Commission, October 19, 2011, No M.6106

EUROPEAN COMMISSION

Judgment

Caterpillar/MWM

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings1, and in particular Article 8(1) thereof,

Having regard to the Commission's decision of 5 May 2011 to initiate proceedings in this case, Having regard to the opinion of the Advisory Committee on Concentrations,

Having regard to the final report of the Hearing Officer in this case, Whereas:

(1) On 14 March 2011, the Commission received a notification of a proposed concentration pursuant to Article 4 of Regulation (EC) No 139/2004 (the "Merger Regulation") by which Caterpillar Inc. ("CAT", USA) acquires within the meaning of Article 3(1)(b) of that Regulation indirect sole control of MWM Holding GmbH ("MWM", Germany) by way of a purchase of shares. CAT and MWM are hereinafter referred to as the "Parties".

1. THE PARTIES

(2) CAT is the ultimate parent company of a global diversified group that is, inter alia, active in the provision of machinery, engines and financial products. It manufactures and sells engines and machinery for a large number of applications (such as marine, petroleum, industrial, agricultural), including gas and diesel fuelled engines and machinery for electric power generation systems. Among such electric power generation systems, CAT manufactures and sells (via its distribution network) "gensets". Gensets (short for engine 'generator sets' for power generation) are electricity generating devices that have as their main components a reciprocating (namely piston) engine and an electricity generating device. Gensets can be powered by various types of fuels, including diesel, natural gas and gas from other sources (non-natural gas).

(3) MWM and its subsidiaries produce and sell products, services and technologies for decentralised energy supply using gas and diesel reciprocating engines. MWM sells gensets, co-generation (heat and power) and related products.

(4) Although the Parties are active in a large variety of products, the Commission's Phase I and Phase II market investigations and this Decision focus on "gensets".

2. THE OPERATION AND THE CONCENTRATION

(5) Pursuant to the Share Purchase Agreement of 21 October 2010 between the Parties, CAT, indirectly through its wholly-owned subsidiary, Caterpillar Investment GmbH & Co. KG., will acquire all shares in MWM and, consequently, MWM will become a wholly-owned subsidiary of CAT. It follows that the proposed concentration concerns the acquisition of sole control of MWM by CAT and, thus, the proposed concentration is a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(6) The proposed concentration does not have a Union dimension but was notifiable in Germany, Austria and Slovakia. Germany requested that the Commission examine the proposed concentration pursuant to Article 22(1) of the Merger Regulation. That request was joined by Austria and Slovakia. The Commission decided to examine the proposed concentration since the legal requirements for a referral were met. It was appropriate to refer the proposed concentration as the potentially affected markets are at least EEA-wide and the potential competition concerns would be better addressed at the Union level.

4. THE PROCEDURE

(7) On 14 March 2011, the Commission received a notification of the proposed concentration pursuant to Article 22(3) of the Merger Regulation, as referred to in recital 6 of this Decision.

(8) On 25 March 2011, the Commission received a complaint from a third party in response to a questionnaire regarding the proposed concentration (the "Third Party"). The Third Party subsequently made several submissions in the procedure. Several other respondents raised similar concerns during the Phase I market investigation2.

(9) On 6 April 2011, a state of play meeting took place with Commission officials where the Parties were informed of the Commission's competition concerns resulting from its Phase I market investigation and in particular:

(a) Unilateral effects were deemed to arise from the proposed concentration in view of the combined entity's high market shares in several of the power output ranges and geographical markets3;

(b) Coordinated effects were deemed to result from the fact that the proposed concentration would reduce the number of competitors from three to two. Post- concentration, only General Electric Company ("GE", USA) would seem to remain a credible competitor, as other market players appeared to play only a marginal role. Also, MWM seemed to be the strongest competitor pre- concentration to both CAT and GE and consequently, it could not be excluded that the absorption of MWM by CAT would significantly reduce competition.

(c) The proposed concentration would allegedly lead to foreclosure. The combined entity would have both the ability and incentive to foreclose its competitors in the downstream markets, in particular so-called packagers. Packagers are market participants that either: (i) purchase bare gas engines and a complete genset that is sold to final customers, normally with various other ancillary equipment and services; or (ii) purchase a complete genset that is subsequently resold with accompanying equipment and services to final customers.

(10) On 12 April 2011, the Parties proposed a remedy (the "Phase I Remedy"). By the Phase I Remedy, the Parties proposed to commit to [extend certain agreements in the EEA]* after the closing of the proposed concentration. According to the Parties, such a commitment would be sufficient to remove the competition concern regarding input foreclosure as expressed by the Commission. The Parties did not submit any proposals for remedies that would alleviate the Commission's concerns with regard to the potential horizontal effects (neither unilateral nor coordinated) of the proposed concentration because, according to the Parties, these are not warranted.

(11) According to paragraph 81 of the Commission notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004: "Commitments in phase I can only be accepted where the competition problem is readily identifiable and can easily be remedied. The competition problem therefore needs to be so straightforward and the remedies so clear-cut that it is not necessary to enter into an in-depth investigation and that the commitments are sufficient to clearly rule out ‘serious doubts’ within the meaning of Article 6(1)(c) of the Merger Regulation".4

of the Phase I Q3 Questionnaire to distributors; see responses to questions 44 and 45 of the Phase I Q4 Questionnaire to customers.

(12) The Parties themselves made it clear that: "the object of the [offered] commitment is to remove the potential foreclosure concerns the Commission has preliminarily found in the investigation"5. Consequently, the Phase I Remedy addressed only one of the Commission's initial concerns. It did not address, in particular, the Commission's concerns related to horizontal (both unilateral and coordinated) effects. Therefore, it was considered unnecessary to assess whether the offered commitment was suitable to remove the potential foreclosure concerns of the Commission.

(13) On 5 May 2011, the Commission adopted a decision pursuant to Article 6(1)(c) of the Merger Regulation (the "6(1)(c) Decision") which found that the proposed concentration raises serious doubts as to its compatibility with the internal market and with the functioning of the EEA Agreement in relation to the potential market for gas gensets with a power output range between 0.5MW and 5MW and its possible segments for power output ranges between 1.5-2MW and between 2- 2.5MW. The serious doubts raised in the 6(1)(c) Decision related to horizontal (unilateral) effects. As regards the coordinated and vertical effects, in particular input foreclosure, the 6(1)(c) Decision considered that they needed to be further investigated.

(14) On 25 to 31 May 2011, inspections pursuant to Article 13(4) of the Merger Regulation took place at the premises of CAT in the United Kingdom and of MWM in Germany, and were continued at the Commission's premises in Brussels. Those inspections were warranted as the Commission had indications that the Parties may have:

(a) provided misleading information to the Commission in response to requests for information by the Commission, pursuant to Article 11 of Merger Regulation;

(b) provided misleading information to the Commission in the notification of the proposed concentration, which would impede the Commission to effectively exercise the control of a concentration between undertakings and/or have withheld from the Commission information relevant to the competitive assessment in this case;

(c) implemented the notified concentration before it has been cleared by the Commission in contravention of Article 7(1) of the Merger Regulation.

(15) During the Phase I and Phase II market investigations, the Commission also adopted three Decisions pursuant to Article 11(3) of the Merger Regulation (the "Article 11(3) Decisions"):

(a) On 29 March 2011, an Article 11(3) Decision was addressed to International Engines Statistics Group ("IESG") mainly concerning market share data. IESG is an industry organisation that produces market statistics data regarding, inter alia, gas and diesel engines and gensets6;

(b) On 14 June 2011, an Article 11(3) Decision was addressed to CAT concerning bidding data critical for the market definition analysis, originally requested on 17 May 2011. Pursuant to Article 10(4) of the Merger Regulation, the time limits referred to in Article 10(3) of the Merger Regulation were suspended until the receipt of complete and correct information. On 23 June 2011, the Commission reduced the scope of its request for information. That suspension was lifted on 8 July 2011.

(c) On 22 June 2011, an Article 11(3) Decision was addressed to GE concerning bidding data critical for the market definition analysis, originally requested on 20 May 2011 and for which no complete answer had been received in the meantime.

(16) The meeting of the Advisory Committee took place on 4 October 2011.

5. COMPATIBILITY WITH THE INTERNAL MARKET AND THE EEA AGREEMENT

5.1. Introduction

(17) This Decision assesses the concerns raised by the Commission in its 6(1)(c) Decision related to horizontal (unilateral as well as coordinated) effects and vertical effects, in particular input foreclosure, with regard to gas gensets, in the light of the results of the Phase II market investigation.

(18) A genset is a device that recombines a reciprocating (that is to say, piston) engine with various ancillary equipment, such as an electricity generator, a switching gear, a turbocharger and possibly other equipment (at the customer's option) to form a stand alone electricity generator device. The engine7 is one of the most significant components of a gas genset, also because the engine's design and characteristics are crucial determinants of the efficiency, output and emissions of the genset.

(19) According to the Parties, the relevant product market includes all gas gensets. The Parties' view is that neither power ranges nor engine speed are meaningful elements to delineate the relevant product market8. The Commission has carefully investigated possible segmentations by power bands (both in terms of genset size and in terms of size of projects served by those gensets) and speed, as discussed in recitals 41 to 51 of Section 5.2.1.4, recitals 55 to 62 of Section 5.2.1.5 and recitals 63 to 71 of Section 5.2.1.6.

5.2. Horizontal overlaps: gas gensets

5.2.1. Product Market

5.2.1.1. Diesel fuelled gensets versus gas fuelled gensets

(20) The Commission has analyzed gensets in past Decisions and has considered gas and diesel gensets as two possible distinct relevant product markets, but it did not reach a definitive conclusion in that respect9.

(21) The Parties agree that a distinction should be made between diesel and gas fuelled gensets10.

(22) In this case, the Phase I and Phase II market investigations11 have generally confirmed that it is possible to distinguish between markets for diesel gensets and for gas gensets. Even though diesel gensets can be assembled on the same production lines as gas gensets, they constitute a different market from gas gensets.

(23) Firstly and most importantly, diesel gensets are particularly suitable for standby applications, as an emergency source of power, while gas gensets are more efficiently used as a continuous source of power, and an alternative to the power grid. Using diesel gensets as a continuous source would be sub-optimal, for example, in terms of fuel cost (diesel is more expensive than gas, and fuel represents up to 70% of the total cost for operating a genset), but could be justified in situations where the gas network or other gas sources (that is to say, no natural gas) are not accessible.

(24) In addition, environmental issues play a role in favour of gas gensets, as diesel gensets are characterised by higher CO2 emissions with respect to gas gensets of comparable power.

(25) As a result of the limitations in substitutability from the demand side, it should be concluded that diesel gensets and gas gensets constitute separate product markets for the purposes of this Decision.

5.2.1.2. Natural gas and non-natural gas gensets are part of the same relevant market

(26) Natural gas is a fossil fuel (that is to say, it is extracted from nature) constituting a combustible mixture of hydrocarbon gases. Non-natural gas is not a fossil fuel but is produced artificially. It is formed primarily of methane (70% to 90%) and can also include ethane, propane, butane and pentane. Examples of non-natural gas are coal mine and coal bed gases, flare gas, biogas (such as fermentation, landfill and sewage gas) and also gases with high contents of hydrogen such as pyrolysis gas, coke oven gas and others. Both natural and non-natural types of gas can be used to fuel gensets.

(27) In previous Decisions12, a potential product market definition was considered for gas reciprocating engines by type of input used (that is to say, natural versus non-natural gas). However, the precise market delineation was ultimately left open.

(28) The Parties consider that no distinction should be made, from a supply side point of view, as there is hardly any difference in the manufacturing process for natural gas and non-natural gas gensets13. The two types of gensets can be produced using the same production lines. As a result, manufacturers can easily switch production between the two products. The Parties argue that there are only marginal differences that relate to adjustments in electronic control and cooling systems. There are also some changes in the mechanical hardware, which ensure the appropriate treatment of the different types of gases, gas efficiency, gas variability and potential impurities. In particular, the required investment for a manufacturer of natural gas gensets14 in order to develop the appropriate non-natural gas technology and know-how may involve a cost of between EUR […]* to […]* million (including research and field tests). That would involve the adaptation of approximately [5-10]*% of the parts of the existing natural gas engine and an increase of production cost of around [0-5]*%.

(29) From a demand side, the Parties argue that gas gensets can be fuelled, depending on availability, with natural gas or with non-natural gas. Any gas genset can run on either natural gas or non-natural gas, conditional on making some minor modifications, mainly regarding the cleaning of the gas, not only in order to optimise the functioning of the gas genset but also to avoid an abnormal deterioration of the genset15. This implies that switching from natural gas to non-natural gas only requires interventions, the cost of which can, however, be balanced by future savings, such as in fuel costs. Furthermore, even the availability of non-natural gas does not necessarily lead to choose a genset fuelled by non-natural gas. Such a choice can also be affected by technical risks relating to the extraction and the processing of non-natural gas, the relative process and other financial incentives, for example to the use of non-natural gas.

(30) The Phase I market investigation16 confirmed that, from a supply side perspective, minor changes in the production process are needed in order to manufacture a natural or a non-natural type of gas genset. The Phase I investigation was not conclusive on whether natural and non-natural gas gensets are substitutable from a demand side view point.

(31) In the Phase II market investigation, the majority of the respondents considered that limited technical modifications suffice to convert an engine running on natural gas to non-natural gas17. The main components which need to be replaced in the engine are parts of the fuel system. A higher gas flow is required and thus, valves and other fuel system components need to be enlarged. In addition, non-natural gases may have contaminants which can damage the engine components. In that case, certain elements need to be made from different materials.

(32) Most of the manufacturers indicated that the cost of those adjustments is low, around 5% of the cost of the genset18. Some respondents also indicated that no extra time or only a number of hours, at most a few days, are necessary to convert a natural gas engine to a non-natural gas one19.

(33) From a demand perspective, the Phase II market investigation revealed20 that competition between natural and non-natural gas gensets takes place ex-ante. Both natural and non-natural gas gensets cover similar needs and have comparable performance. Therefore, customers' choice depends on the availability of the fuel, and the overall price of the gensets (including the fuel cost). When both types of gas are available, both non-natural and natural gas gensets are close substitutes. In that case, the purchase decision will depend on the relative cost of the fuels available, which fluctuates depending on the supply/demand conditions.

(34) In view of the high degree of substitutability, it should be concluded that gensets fuelled by natural and non-natural gas are part of the same product market.

5.2.1.3. Possible distinction segmentation along engine speed and power: the precedents

(35) In previous Decisions21 the potential segmentations of the market for reciprocating engines used for power generation or gensets, whether gas or diesel, by speed and by power output, was considered but the precise market delineations were ultimately left open. In particular, in a previous Decision concerning diesel gensets, the Parties had suggested that the market of gensets could be divided by power bands22.

(36) In M.6039 GE/Dresser, the market investigation suggested that the market for gas gensets could be divided into different segments according to the power output of engines and according to different speeds of engines (high speed above 1000rpm, and medium speed between 500 and 1000rpm, typically 750 rpm). The market investigation in GE/Dresser also suggested that: “there is a certain degree of substitutability between engines of different outputs, especially in light of the fact that customers take into account several factors in order to choose an engine that best suits their needs and in practice this is something that competitors competing for a project would model individually for a given customer. It also appears that boundaries between different output ranges and speeds tend to change over time as technology and efficiency improves”. However, a conclusion on that point was not reached in that Decision, as the market definition was left open23.

(37) Differences in engine speed were also investigated in M.6172 Daimler/ Rolls-Royce/ Tognum/ Bergen, but the product market definition was left open, since the transaction did not lead to competition concerns, regardless of the product market definition considered. In that Decision, it was found that: “A significant criterion applied by customers in engine selection is engine speed. The speed of an engine depends on the bore and stroke length of the engine cylinders, but all the parameters may be adjusted by the engine designer in order to optimise a design for a particular application. For a given size of cylinder, increasing the engine speed will increase the power of the engine24. Additionally, as cylinder sizes increase, more time is required per piston stroke to ensure complete combustion occurs. The efficiency losses associated with incomplete combustion will also limit the degree to which engine speed can be increased”25.

(38) It was also found in that case that the costs of making those design changes are substantial and, in particular, the genset manufacturer Rolls-Royce's Bergen business ("Bergen", Norway) has not been successful at making high speed engines, while Tognum AG ("Tognum", Germany) has not been successful at making medium speed engines. However, the market definition was left open in relation to the speed of the engine.

5.2.1.4. Distinction based on the engine speed of the genset

(39) The industry association IESG, in charge of the collection and reporting of sales data, introduced in 2009 (in agreement with its stakeholders) a clear distinction between high- and medium-speed engines for power generation, setting the dividing line at the level of 1000rpm, on top of the pre-existing distinction in power classes. Without prejudging whether or not such market segmentation should be accepted in this Decision, that evolution in the practices of the industry association signals the relevance of that dimension of analysis.

Adjustments of the engine speed involve increasing the length of the piston stroke by re-designing the crankshaft to increase the volumetric displacement between full compression and full extension of the combustion chamber. Increasing the stroke length will increase the power of the engine. Small increases in bore size can be achieved by machining out the cylinder block to increase the diameter of each cylinder and installing a piston with a larger head. Increasing the bore size in this way is relatively inexpensive but will increase the long term maintenance burden as the engine will suffer from increased wear and tear. Large changes of bore size will require a completely new engine block.

(40) In this case, the Parties’ view is that: “there is no meaningful segmentation by engine speed of the market for gas gensets/reciprocating engines at the power output levels relevant in this transaction”26, as gensets with different speeds would compete against each other without significant difficulties.

(41) The majority of respondents in the Phase II market investigation estimate that, from the demand side, fuel costs account for around 70% of total costs (purchasing and operation costs) over the running life of a genset, which explains why electrical efficiency is the most important factor which customers take into account when they purchase a genset. This is in line with the Parties' contentions.

(42) Concerning this essential product characteristic, the Phase II market investigation27 also revealed that medium-speed gas engines for power generation typically have a higher electrical efficiency (up to 45 to 48%), a level which even the most efficient high-speed engines currently do not match (typically only up to 45%, but usually lower). As a result, fuel costs for operating medium-speed gensets are significantly lower for the same amount of power delivered. Medium-speed gensets are also characterised by lower maintenance costs and longer running lives (80-100.000 hours versus 40-60.000 typically for high-speed engines).

(43) On the other hand, medium-speed gensets are characterised by higher fixed costs. They are more expensive to buy and have higher installation costs due to much heavier engineering work. In particular, the acquisition price per MW of nominal power is about 50% higher for medium-speed gensets than for high-speed gensets.

(44) That clearly indicates that while the fixed costs related to a medium-speed gensets are much higher than the fixed costs for high-speed gensets, at the same time variable costs are lower for medium-speed as compared to high-speed engines.

(45) The more detailed information revealed by the Phase II market investigation, as compared to the Phase I market investigation, has allowed the Commission to establish a certain degree of continuity in the trade off between high-speed and medium-speed gensets in the presence of which a possible segmentation along the engine speed dimension appears much less clear cut than it was at the end of Phase I market investigation.

(46) The bidding data collected during the Phase II market investigation show that medium-speed gensets do not compete for projects of a size below 2.5MW, but that high-speed multiple-genset installations can to some extent compete with larger-capacity medium-speed gensets for large projects (for example, of 5-10MW).

(47) No sales of medium-speed gas gensets with capacities below 2.5MW were recorded in the last five years worldwide. Rolls-Royce/Bergen and Wärtsilä, who produce only medium-speed gensets, appear marginally as competitors in bids for projects up to 5MW that could be served by manufacturers of high-speed engines with single or multiple-genset installations. They are present (and not successful) in only [5-10]% of the bids for projects with a power output between 2.5 MW and 5MW28.

(48) In their submissions, the Parties did not mention manufacturers of medium-speed engines such as Wärtsilä (Finland) or Rolls-Royce/Bergen among the "credible competitors" in their analysis of competitive constraints in the market or in their assessment of closeness of competition29.

(49) On the other hand, the presence of successful bids for large projects based on multiple high-speed gensets points in the direction of high-speed gensets of smaller (individual) size being competitive against medium-speed gensets of larger (individual) size30.

(50) It follows that the product characteristics give rise to a certain continuity in the trade off between high-speed and medium-speed gensets (in terms of fixed and variable costs) and that offers with multiple smaller high-speed gensets appear to be able to successfully compete with larger medium-speed gensets for large projects.

(51) In light of those considerations, there is no clear cut delineation between high-speed and medium-speed gas gensets. In this case, the market definition may be left open in that respect, as the competitive assessment would not change under any of the alternative definitions.

5.2.1.5. Distinction based on the power of the genset: gensets with a power lower than 0.5MW

(52) The electrical power output of a genset is approximately 2 to 3% less than the mechanical power output of the reciprocating engine with which it is powered. The figures referred to in recitals 54-62 make reference to the electrical power of the genset.

(53) The Parties’ view on a potential segmentation of the gas genset market by ranges of power output is that this would not reflect the market reality and be at odds with the Commission’s decisional practice. From a demand-side perspective, the Parties argue that customers can chose between a single genset and offers for several gensets that can together supply the same amount of total power ("multiple genset offers") and point to bidding data which they submitted in support of this conclusion. From a supply-side perspective, the Parties contend, on the one hand, that genset manufacturers may upgrade or downgrade products to achieve different power outputs and, on the other hand, that in a given power range, it is easy for suppliers to offer a range of power outputs with engines which derive from the same product family.

(54) Concerning gensets with a power below 0.5MW, the Parties’ view is that such gensets do compete effectively with gensets with a higher power output in the form of multiple genset offers. The Parties submit that information from CAT's distributors suggests that [40-50]*% of gensets are offered as part of multiple genset installations, a figure which goes up to [60-70]*% in some situations such as the one considered by the Parties in the bidding data submission related to Denmark31. Apart from bidding data results, the Parties also stress that gensets may be run not at full capacity but at partial loads.

(55) The Phase II market investigation has indicated that, in general, from a demand-side perspective consumer demand materialises in the form of projects for which manufacturers, but mainly distributors and packagers, submit bids, with certain power and other requirements, not in terms of a number of gensets.32 As a result, the importance of multiple genset offers, as opposed to single genset offers, can provide an indication of the degree of "upwards" substitutability (that is to say, multiple gensets of lower power size can compete with single gensets of larger power size).

(56) As to upward substitution, namely, the substitutability of larger gensets with multiple 0.5MW gensets, the aggregate results of the bidding data used in the Phase II market investigation indicate that offers with multiple gensets having a power below 0.5MW account for less than [0-5]% of the projects for which a power above 0.5MW is required (and [0-5]*% considering only the bidding data provided by CAT distributors).

(57) The Phase II market investigation33 also showed that, in general, substitutability in this market takes place only very marginally "downwards", that is to say, with a gas genset of a given capacity substituting for a (single) genset of lower capacity. Even though gensets can in theory be operated at half-load, the majority of respondents say that they operate gensets at full capacity, which also makes sense from an economic point of view as gensets reach their optimal fuel efficiency when they run on full load.

(58) As to downward substitution, gensets with a power above 0.5MW do not appear to represent a credible competitive threat for gensets with a power below 0.5MW.

(59) The majority of respondents in the Phase II market investigation34 confirm that gensets with a power below 0.5MW generally have a shorter running life, a lower electric efficiency, but seem to have higher acquisition costs per MW than gensets with larger power outputs.

(60) It must also be stressed that the supply side of gas gensets with a power below 0.5MW is substantially different from that for gensets with larger power. Since gas gensets with power lower than 0.5MW are often derived from truck motors, the suppliers of these gensets are different from those manufacturing gensets with larger capacities. Important suppliers of smaller 0.5MW gensets are MAN AG ("MAN", Germany) and Scania AB ("Scania", Sweden) and, to a smaller extent, Fiat S.p.A. ("Fiat", Italy) and Deutz AG ("Deutz", Germany). These companies are insignificant, or even completely absent, in the supply of larger gas gensets.

(61) In view of those elements, it should be concluded on the basis of the limitations in demand-side substitutability that high-speed gas gensets with a power below 0.5MW and high speed gas gensets with a power above 0.5MW are part of different product markets.35

(62) That conclusion is not contradicted by the Parties' assertion that some market players have a portfolio of products covering power classes both below and above 0.5MW, as market players may be active in different product markets.

5.2.1.6. Distinction based on the power of the genset: gensets with a power higher than 0.5MW

(63) Concerning the size classes of 0.5MW and above, the market data for the last five years collected in the Phase II market investigation brings to light the following facts.

(64) Firstly, there are no sales worldwide of high-speed gensets with a power above 5MW. Secondly, only GE sold high-speed gas gensets with a power above 2.5MW. Thirdly, there are no sales of medium-speed gensets with a power below 2.5MW in the past five years. Such elements suggest a potential market delineation from a supply-side perspective below and above 2.5MW.

(65) However, from a demand-side perspective, customer projects requiring a power above 5MW may choose between acquiring single medium-speed gensets or a combination of smaller-sized high-speed gensets.

(66) In addition, evidence from the bidding data submitted by the Parties at the Commission's request suggests that competition by multiple-genset installations based on smaller gensets can successfully compete with single more powerful gensets also in smaller power ranges, although this is very limited in the lower power ranges but increases with project size. For example, multiple-genset bids account for fewer than 5% of the bids for projects with a power between 0.5MW and 0.75MW36. Conversely, the same dataset indicates that only about a third of the bids for projects with a required power output between 2.5MW and 5MW are with single gensets.

(67) This demand-side substitutability suggests that a segmentation according to project size (in terms of total power of the installation) possibly including multiple gensets would be more in line with customers requirements than a market segmentation based on the power of the individual genset offered or the speed of the engine.

(68) However, information on project size is only available in the bidding data set. It may be argued that sales through tenders represent only a small part of the overall sales of gensets in the market. Nevertheless, the bidding database appears to be a sufficiently representative sample. The distribution of total gensets sales of the Parties and their competitors, as reported to the Commission, is similar to the one of their sales (that is to say, won contracts) in the bidding database. More precisely, according to the Commission's market reconstruction based on total sales (in power) provided by the Parties and the competitors, CAT would have approximately [10-20%] of the market, whereas MWM around [20-30%]. Based on total power of all bids won by the Parties, CAT would have again approximately [10-20]*%, and MWM would have approximately [20-30]*%. As the market shares are similar, the bidding data may be used to draw conclusions.

(69) The bidding data set, including information submitted by the Parties and their competitors, shows substitutability between gensets of a given capacity and offers based on installations, including multiple gensets of lower capacity. Furthermore, the pattern is of an increasing degree of substitutability the larger the projects considered.

(70) In the same data set, statistics further support demand substitution between single and multiple gensets. In particular, within the 1.5-2.0MW power range, [30-40%] of gensets are sold as part of multiple genset projects, and [30-40%] of projects with this power range are served with multiple genset bids37. These figures increase with the total power output of the project, that is to say, the degree of substitution becomes higher in higher power bands. The proportion of tenders won by suppliers offering multiple gensets is sufficient to effectively constrain suppliers of single gensets. Consequently, a delineation according to the power output appears inappropriate because there is substitution from the other power ranges segments through the multiple offers.

(71) That shows that while a significant degree of substitution exists between multiple genset offers and larger single genset offers (and especially so for larger projects), the number of gensets that can be pooled together in the same installation is rarely large. This indicates that, given the capacity of the largest existing high-speed gensets, it would be possible to consider that an upper bound exists in the size of projects that can be served with multiple high-speed gas gensets, but it is at the same time not possible to precisely define where that upper bound is located and, correspondingly, the point from which medium-speed gensets would be shielded from competition by these multiple genset installations. In any event, it is not necessary to establish where this upper bound is located, as it will not affect the competitive assessment of this case. In view of those elements, the product market may be defined as the market for gensets with a power above 0.5MW.

5.2.2. Geographic scope of gas genset market

(72) In line with the findings of previous Decisions,38 the Parties submit that the relevant geographic market for gas gensets is at least EEA-wide in scope, and probably global.

(73) The Parties argue that: (i) technical requirements relating to gensets, customer preferences, price and environmental requirements are similar in the EEA, and even globally; (ii) there are no legal, regulatory or technical barriers to trade that would impede worldwide trade flows; and (iii) transport costs are minor in comparison to the cost of manufacturing costs or sales prices ([0-5]*% to [5-10]*% depending on the size of the genset).39

(74) The Phase II market investigation confirms the Parties' contention. Brands are marketed on a worldwide basis and genset manufacturers appear to have worldwide structures to commercialise their products. There are no regulatory or tariff barriers preventing exports outside the EEA.40 Gas gensets are imported from non-EEA countries that share safety and environmental standards set by their national laws. As regards price differences, the majority of gas genset manufacturers other than the Parties responded that their prices apply equally worldwide or that price changes, if any, do not exceed 10%.41 According to most respondents, genset imports from outside the EEA are very significant42 and customers usually source gas gensets globally.43 Finally, the majority of the respondents considered the gas genset market to be worldwide.44

(75) Nonetheless, gas gensets are channelled to end users through distributors, which usually operate on their respective national territories and are sometimes linked to gas genset manufacturers by contracts containing territorial exclusivity clauses.45

(76) In any event, the geographic market definition may ultimately be left open since the proposed concentration would not impede competition under both EEA-wide or worldwide market definitions.

5.3. Non-coordinated effects for gas gensets > 0.5MW

(77) The proposed concentration gives rise to an horizontal overlap in the market for high-speed gas gensets above 0.5MW, as the Parties are both active in this power range. According to the Parties' submission, their combined market shares below

(78) The Phase II market investigation has allowed the Commission to reconstruct the market of gas gensets above 0.5MW. The market presence of the various competitors is therefore more precise than in the Phase I market investigation, where the size of certain competitors could not be captured with sufficient accuracy (in particular Cummins Inc. ("Cummins", UK) and Guascor Group ("Guascor", Spain)).

(79) It should also be emphasised that, besides the larger producers listed in Tables 1, 2 and 3 of recitals 80, 84 and 89, there are also a certain number of smaller ones. Therefore, the figures in those tables are, to a certain extent, overestimated.

5.3.1. Market share analysis

5.3.1.1. Analysis from a project perspective

(80) Tables 1 and 2 of recitals 82 and 84 result from the market reconstruction obtained from the Phase II market investigation. It is based on sales data in volumes (in terms of nominal power of gensets / bare engines47 and not in units, contrary to the data collected by IESG) submitted by genset manufacturers pursuant to the Commission's data request dated 20 May 2011.

(81) As discussed in Section 5.2.1.6, it is appropriate to consider power bands within the market for gensets. However, power bands could be defined along two dimensions, that is to say, considering either the project size or the genset size. While genset size corresponds to a supply-side perspective and is logically reflected in sales data, the demand-side perspective reflected by the project size better corresponds to the way competition seems to takes place in this market, that is to say, at the level of projects, where a project of a given size can be served by a single genset or by an appropriate combination of multiple gensets (and in certain cases multiple high-speed gensets can compete with larger single medium-speed gensets).

(82) As no further subdivision by size class needs to be considered in either a genset size or a project size dimension, market shares in terms of gas genset size above 0.5MW correspond with market shares when assessed on a project dimension. Tables 1 and 2 of recitals 82 and 84 therefore correspond most closely to the market definition adopted in this case, a market in which competition is defined in terms of projects. Nonetheless, an alternative analysis by gas genset size-classes will also be considered in recitals 89-94 of Section 5.3.1.2.

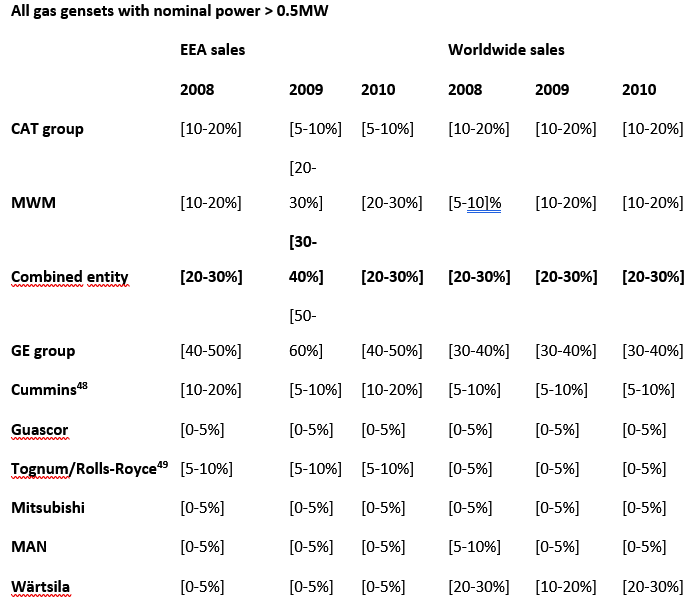

Table 1: EEA and worldwide market shares for gas gensets (volume in MW)

Source: Reconstruction of the market based on Phase II market investigation results.

(83) Table 1 of recital 82 shows that in the market for gas genset projects > 0.5MW, the market share of CAT is decreasing while the market share of MWM is increasing. The decrease of CAT is slightly more significant at the worldwide level (from [10-20%] in 2008 to [10-20%] in 2010) while the increase of MWM is more pronounced in the EEA (from [10-20%] in 2008 to [20-30%] in 2010). As a result, the combined market share is moderately increasing in the EEA (from [20-30%] in 2008 to [20-30%] in 2010) and decreasing worldwide (from [20-30%] in 2008 to [20-30%] in 2010).

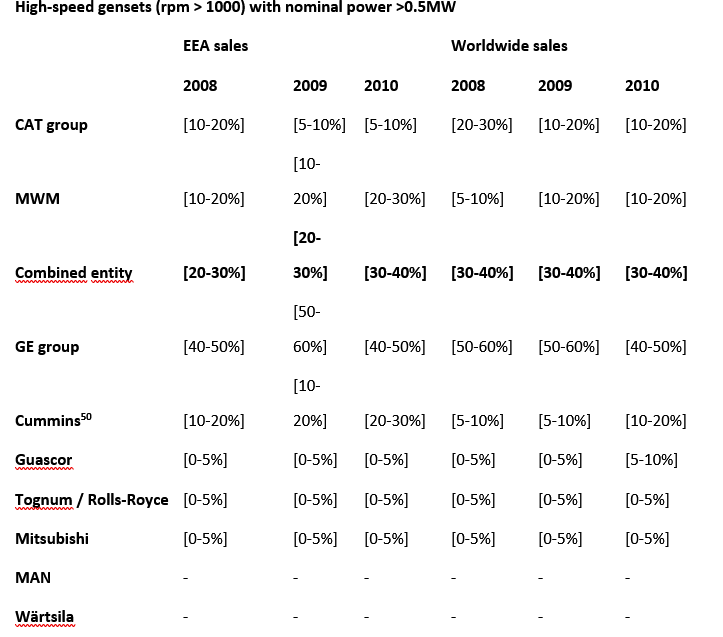

(84) Table 2 below presents the same market reconstruction, but focusing only on high-speed genset projects, as opposed to the table in recital 82 that also includes genset of lower speeds (that is to say, below 1000rpm).

Table 2: EEA and worldwide market shares for high-speed gas gensets (volume in MW)

Source: Reconstruction of the market based on Phase II market investigation results.

(85) Table 2 of recital 84 shows that in a market for gas genset projects >0.5MW that only includes high-speed gas gensets, the market share of CAT is decreasing while the market share of MWM is increasing. The decrease of CAT is slightly more significant at the worldwide level (from [20-30%] in 2008 to [10-20%] in 2010) while the increase of MWM is slightly more pronounced in the EEA (from [10-20%] in 2008 to [20-30%] in 2010). As a result, the combined market share is moderately increasing in the EEA (from [20-30%] in 2008 to [30-40%] in 2010) and decreasing worldwide (from [30- 40%] in 2008 to [30-40%] in 2010).

(86) A comparison between Tables 1 and 2 of recitals 82 and 84 demonstrates that the developments of the Parties' individual and combined market shares for genset projects

>0.5MW, as well as those of their competitors, is only marginally different when a market is considered that includes only high-speed gensets, or whether such a market includes also lower immaterial for the competitive assessment if the market definition is left open on that point.

5.3.1.2. Gas gensets > 0.5 MW from a sales data perspective (narrow power bands)

(87) The data obtained during the Phase II market investigation allows a complete market reconstruction by power segments only along the genset size dimension, while only a partial reconstruction is possible along the alternative, project size dimension (using the bidding data where information on genset size and overall project size could be matched). The bidding data, however, only represents part of the total sales and, as provided by the respondents during the Phase II market investigation, only covers EEA projects.

(88) The analysis in recitals 89-94 nonetheless presents the market reconstruction by segment along the genset size dimension, despite the fact that as discussed earlier (in Section 5.2.1.6) this is not the most appropriate way to look at market segmentation and needs to be qualified.

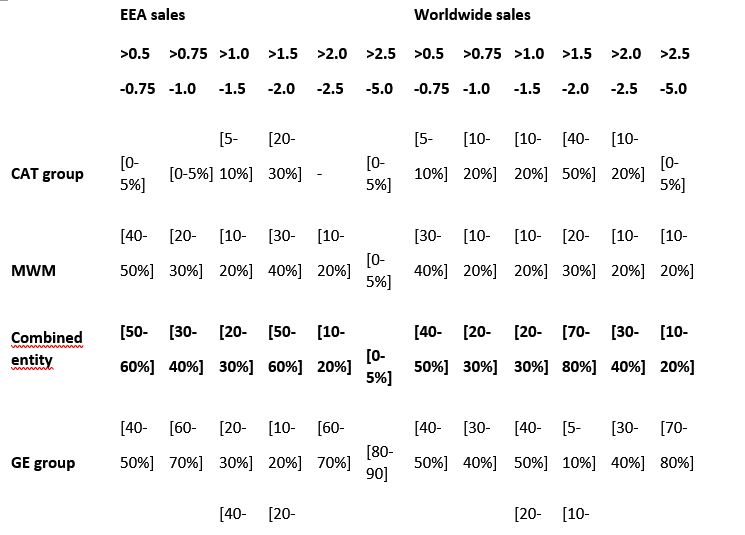

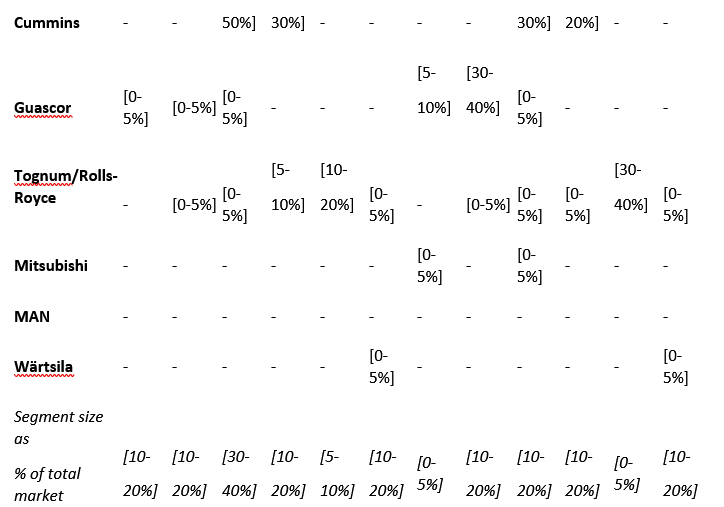

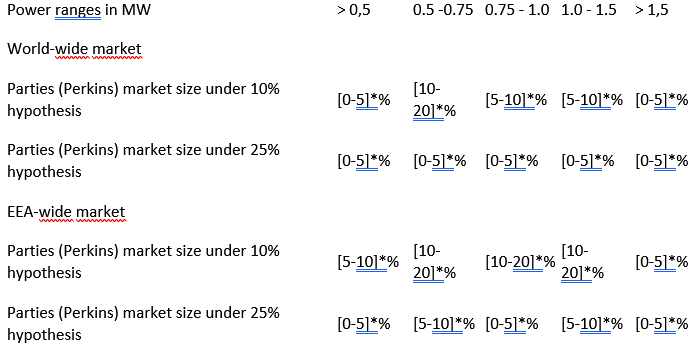

(89) Table 3 below presents the market reconstruction by genset power bands as used by IESG. However, the Parties contest the relevance of a segmentation of gas gensets for power generation on the basis of IESG power output bands as being highly artificial and narrow51.

Table 3: EEA and WW market shares for gas gensets by power band (in MW, 2010, all speeds)

Source: Reconstruction of the market based on the Phase II market investigation

(90) Considering that table of gas genset power bands, the Parties would have non- marginal overlaps only in the power range between 0.5MW and 2.5MW. In those power bands (other than the 1.5-2MW), CAT's market shares would always be below [10%]* in the EEA and [20%]* globally. The Parties' cumulative market share appears particularly high and with a very significant overlap only in the segment 1.5- 2MW. On first view, it therefore appears that also under the alternative perspective of gensets by power bands, no competition concerns arise except maybe in the segment 1.5-2MW.

(91) However, the high market shares in both the EEA and global markets for gensets in the power band 1.5-2MW must be considered in the light of the information collected during the Phase II market investigation concerning the size of the projects served by 1.5-2MW gensets. It appears that a significant part of the gensets belonging to that power range are combined into multiple offers for larger projects. More precisely, more than half of the projects in the 2.0-2.5 MW class are supplied with 1.5-2.0 MW gensets. As a result, the prima facie indication resulting from the Parties showing a combined market share of [50-60%] in the (high-speed) genset power band 1.5-2MW in the EEA is considerably diluted once considered in terms of project size.

(92) Furthermore, as shown in Table 3 of recital 89, it should be emphasised that the 1.5- 2MW segment represents only about [10-20%] of the total gas gensets market (both in the EEA and worldwide) and that, in neighbouring power bands, CAT is significantly weaker or even absent (for example, as in the 2-5MW segment in the EEA).

(93) The relatively stronger presence in the particular 1.5-2MW genset power band can be fully attributed to two specific engine models manufactured by CAT (the […]* and […]* models) that are considered in the industry as particularly reliable.

(94) That finding corresponds at least in part to what is represented in Table 4 below. In its category, CAT's […]* model (the only one represented in Table 4 where the […]* is not reported) faces the "best-in-class" MWM's […]* model, while GE's […]* model appears to be less competitive than GE's models in other categories. This seems to justify, in addition to the perception of the […]* model as reliable, as already referred to in recital 93, the relative strength of CAT in this segment as compared to neighbouring segments where both GE and MWM (contrary to CAT) are perceived as "best-in-class".

Table 4: A snapshot of the "best-in-class" engines by CAT, MWM and GE

[Table 4 shows a comparison of gas gensets by CAT, MWM's and GE per KW band, showing their relative competitiveness and product gaps of the three manufacturers.]*

Source: CAT internal documents. Yellow: competitive engine; green: 'best in the class' engine, and red: gap or non competitive engine.

(95) As shown in Table 4 of recital 94, MWM has a […]* complete portfolio of successful models, spanning over […]* power bands. That explains MWM's strength (as compared to CAT) in all power bands. [Specific analysis of MWM's product portfolio compared to CAT in all power bands and with GE's portfolio, in particular in relation to the 1-1.5MW and 2-2.5MW genset power bands]*. MWM presence remains below [20-30%] in most power bands, with the exception of the 0.5- 0.75MW ([40-50%] in the EEA in 2010) and 1.5-2MW ([30-40%] in the EEA in 2010). However, those relatively high market shares in some particular genset power bands are of less importance considering that MWM's market share remains below [20-30%] in the broader product market (that is to say, considering high-speed gas gensets in the EEA as shown in Table 2 of recital 84).

(96) The partial representation provided in Table 4 of recital 94 does not do justice to the fact that, in all genset power bands, strong competitors will remain in the market in addition to the market leader GE, namely Cummins as well as Tognum and Guascor. As discussed in detail in the Sections on research and development ("R&D") competition and potential entrants, Tognum, Guascor and also MAN have been or are being acquired by large companies (Tognum by Daimler and Rolls-Royce, Guascor by Dresser Rand, MAN by Volkswagen) with know-how and financial means likely to further boost their capacity to compete with the combined entity that would result from the proposed concentration.

(97) Finally, none of the genset customers that replied to the Phase II market investigation expressed any significant concern as regards the horizontal overlap in the 1.5-2MW power band. Also, none of the respondents attributed the combined entity with a

particular capability referred to the 1.5-2MW power band that no other supplier would be able to match or compete with.

(98) It should therefore be concluded that the proposed concentration would not significantly strengthen the position of the combined entity in any of the bands referred to Table 3 of recital 89 for the following reasons: (i) the power band where the overlap is significant (1.5-2MW) represents a minor part of the overall genset market; (ii) that power band is defined in terms of genset power and, once considering the more appropriate dimension of project size, it appears that a significant part of gensets recorded in this power band actually serves projects of a larger size; and (iii) strong and equally capable competitors remain in the market (to some degree further strengthened in their capability to compete in R&D by the on-going consolidation process in the industry).

5.3.2. The Parties are not close competitors

(99) Paragraph 28 of the Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings52 states that: "…The merging firms' incentive to raise prices is more likely to be constrained when rival firms produce close substitutes to the products of the merging firms than when they offer less close substitutes. It is therefore less likely that a merger will significantly impede effective competition, in particular through the creation or strengthening of a dominant position, when there is a high degree of substitutability between the products of the merging firms and those supplied by rival producers."

(100) The Parties claim that CAT and MWM are not close competitors, supporting that claim with submissions based on bidding data. Also, the Parties claim that CAT and MWM are not close competitors in terms of technology, R&D efforts and market positioning.

5.3.2.1. Quantitative analysis

(101) The Parties separately provided bidding data for the period from 2006 to 2010 pursuant to the Commission's requests for information during the Phase II market investigation.53 These data have been analysed by the Commission and the conclusions for the data of CAT and MWM are set out in the following recitals.

(102) Based on the bidding data received from the Parties, CAT's distributors and packagers faced a bid from more than [0-5]* genset competitor in [0-5]* out of [0- 5]* cases. For bids where there was more than one competitor, the data provided shows that GE is the competitor most often encountered by CAT, with GE appearing in […]*% of the bids, whereas MWM is present in only […]*% of the bids in which CAT was present. Tognum ([…]*%), Cummins ([…]*%) and Guascor ([…]*%) are also facing CAT's distributors and packagers in a significant number of bids.

(103) The bidding data reveals that CAT has a limited range of gas gensets with its two most successful products ([…]* and […]* models both falling within the 1.5-2MW power range). Just [below 50%]* of CAT's distributors and packagers bids were for projects within that range.

(104) Even in the 1.5-2MW power range where CAT is relatively stronger, the Parties are not close competitors. In particular, in that segment the presence of competitors other than GE and MWM is even more relevant. More precisely, Tognum was present in […]*% of the bids in that segment and Cummins in […]*%.

(105) When CAT's distributors and packagers lost a bid, the winning bidder54 was GE in […]*% of the cases, while MWM was the winner in […]*% of the bids lost by CAT. In addition, CAT's distributors and packagers lost projects on a regular basis against Cummins (in […]*% of the cases), Tognum ([…]*%) and on multiple occasions to Guascor and others. In the 1.5-2.5MW power range55, the percentage of bids where Cummins won was even more significant, reaching […]*%, while MWM won in […]*% of the bids lost by CAT distributors.

(106) Therefore, it should be concluded from CAT's bidding data that the Parties are not close competitors in the overall market for gas gensets and that GE is by far the most important constraint to the combined entity. Additionally, there are also other relevant competitors, such as Tognum, Cummins and Guascor among others, which are closer to CAT than MWM. Even in the power range where CAT is stronger (that is to say, 1.5-2MW), the bidding data analysis reveals that MWM and CAT are not close competitors.

Quantitative analysis on MWM bidding data in the EEA

(107) Based on the bidding data submitted by the Parties, MWM almost always faced a bid from more than one genset manufacturer. In bids where CAT was competing against MWM, GE was present as a competitor alongside CAT in a large majority of cases ([…]*% overall and […]*% in the 1.5-2.5MW segment), while MTU/Tognum was also present in a substantial proportion of cases ([…]*% and […]*% respectively).

conduct the analysis in this case. That information was provided in the larger datasets compiled after Commission's indications in the Phase II market investigation.

(108) A close analysis on the data submitted by the Parties demonstrates that GE is undeniably the most important competitive constraint on MWM, both across all project sizes and specifically in the 1.5-2.5MW power range. GE is by far the competitor that MWM faces most frequently, across all power output segments (in […]*% of bids overall and in […]*% of bids in the 1.5-2.5 MW segment). CAT is encountered much less frequently ([…]*% and […]*% respectively) and to a similar extent as Tognum ([…]*% and […]*% respectively). Cummins also appears to have a role in competing against MWM, being present in […]*% of the bids overall and in […]*% of the bids in the specific 1.5-2.5MW power range.

(109) In bids that MWM lost to a competitor, GE was again the most frequent winning bidder ([…]*% overall), with CAT ([…]*% overall) and Tognum ([…]*% overall) winning infrequently. Cummins won in […]*% of the bids.

(110) Analogous results are observed in the 1.5-2.5MW power range. GE won in […]*% of MWM’s lost bids, CAT in […]*%, Tognum in […]*%, while Cummins, with […]*%, won against MWM more frequently than either CAT or Tognum.

(111) The above quantitative evidence supports the conclusions from the Phase II market investigation showing that GE and MWM are technology leaders in the relevant market and, therefore, closer competitors than CAT and MWM.

(112) Furthermore, the proposed concentration cannot reasonably be characterised as a "3 to 2" transaction on any of the suggested product markets based on the quantitative analysis of the bidding data submitted by the Parties. Tognum is consistently equally important as a competitor to MWM as CAT, and this applies both in the overall market and in the specific 1.5-2.5MW power range. It is not surprising that Tognum appears significantly in the MWM database given that both companies are German. This shows that CAT is not a strong competitor to MWM in the area where the latter has its highest influence. Cummins also plays a significant role in the market and exerts a competitive constraint on both MWM and CAT, being as or more important than CAT both in the overall market and in the specific 1.5-2.5MW power range.

(113) Consequently, it should be concluded from MWM's bidding data that the Parties are not close competitors. MWM and GE are closer competitors than MWM and CAT; and Tognum and Cummins represent stronger competitive constraints to MWM than CAT.

5.3.2.2. Qualitative analysis Difference in R&D efforts/innovation

(114) Paragraph 38 of the Horizontal Merger Guidelines states the following: "(…) effective competition may be significantly impeded by a merger between two important innovators, for instance between two companies with ‘pipeline’ products related to a specific product market. Similarly, a firm with a relatively small market share may nevertheless be an important competitive force if it has promising pipeline products."

(115) Investment in R&D is of strategic importance in the gas gensets industry. As the buying decision by customers depends on the lifecycle cost analysis (driven not only

by purchase price of the genset but also by its energy efficiency, maintenance costs and other cost considerations), R&D efforts are very important to ensure the competitiveness of a company. In addition, the market demands engines/gensets to be increasingly more efficient, generate more power, and at the same time have a lower environmental impact, which requires that all competitors constantly develop new products or optimise the products they offer.56

(116) For instance, in July 2010, GE Jenbacher opened a new competence centre for gas engine technology in Germany. In May 2011, Cummins announced the opening of Cummins Oil and Gas Centre of Excellence in Houston, Texas, the USA.

(117) As submitted by the Parties, in the late 1990’s, CAT was a market leader in the gas genset market. However, during recent years, its products have become less competitive due to a lack of R&D investments. This is because CAT was historically rather specialised in diesel gensets and had no strategic focus in gas gensets. Also, during the last decade CAT chose to update its diesel gensets to comply with new emissions standards, and thus, allocated […]* R&D efforts to its diesel gensets.

(118) MWM, on the other hand, has not focused on diesel gensets. Following its acquisition by 3i Group plc ("3i", UK) in 2008, capital investments were made to improve and intensify the R&D efforts, inter alia. Whilst CAT spent approximately […]*% of its annual turnover in 2009 in R&D efforts for the gas gensets, MWM invested approximately […]*% of its annual turnover in the last financial year 2009 to 2010. Therefore, MWM has concentrated its R&D spending on the development of its gas gensets, which has allowed MWM to have a complete product line from 0.4MW to 4.3MW with 'best in class' technology and fuel efficiency gas gensets at present. MWM is a supplier of highly efficient and environmentally friendly systems for power generation, focused on high efficiency products and state-of-the-art natural and non-natural gas gensets. This is supported by the Parties internal documents.

(119) CAT's internal documents, as depicted in Table 4 set out in recital 94, show CAT's own perception of its own gas gensets in comparison to MWM's and GE's gas gensets. In the power range from […]*MW, MWM's engines/gensets are perceived as the most efficient of the market. GE, in turn, is seen as having highly efficient gensets in the power bands […]*MW and […]*MW. By contrast, CAT's gensets are […]* and its portfolio does not cover […]* power ranges. CAT further states that […]* in the power band where its gensets are more successful (that is to say, […]*MW), this is due to the reliability of […]* models, […]*.

(120) The results of the Phase II market investigation confirm that perception, as well as the conclusions concerning closeness of competition (see Section 5.3.2). Competitors, customers, consultants and distributors stress the competitive nature of innovation (and, in particular, energy efficiency, see recitals (122) to (131) in this industry and generally do not consider MWM and CAT as close competitors as regards innovation. MWM is considered to be more efficient and innovative, more similar to GE, while CAT is lagging behind, though its engines are considered reliable.57

(121) Based on those findings, it should be concluded that the Parties are not close competitors as regards innovation.

Differences of the electrical efficiency

(122) According to the Parties, the electrical efficiency of a gas genset is the most important factor that customers consider when purchasing a gas genset. Fuel costs represent [80-90]* to [90-100]*% of operating costs, and roughly [60-70]*% of the lifetime ownership and operation costs of a gas genset. Low electrical efficiency leads to high fuel consumption and thus to higher costs. Thus, the differences in electrical efficiency between CAT's and MWM's gas gensets result in […]* differences regarding the cost of fuel. These arguments have been broadly endorsed by the respondents to the Phase II market investigation: "The most important [costs] are the life time costs and they are determined by electrical efficiency."58

(123) The Parties submit there are […]* gaps between the efficiency of the gas genset models of the two companies. Both non-natural and natural gas gensets of CAT have […]* lower electrical efficiency than the closest corresponding MWM products. The electrical efficiency of MWM's products is much closer to that of GE's products. In that sense, it should be noted that the vast majority of customers responding to the Phase II market investigation indicate that technology related product characteristics as the most determinant element in their purchase decisions.59

(124) The diagrams below illustrate the different levels of electrical efficiency of existing natural gas gensets for the Parties and their competitors. An indispensable preliminary caveat concerns Cummins, whose competitive strength is not fully reflected (if at all) in these diagrams, which are based on publicly available information on electrical efficiency data. There is, however, only one natural gas model manufactured by Cummins for which public information is available (and it is the only one included in the diagram below).

Figure 1: Electrical efficiency in natural gas gensets

[Figure 1 reflects the electrical efficiency of the different natural gas gensets models of the Parties and their main competitors, such as Cummins, GE, Guascor, MAN, MTU, Wärtsila and Waukesha, in relation to electrical power (between 0 and 4.4MW). Figure 1 shows that GE and MWM products are more efficient than CAT's.]*

Source: Parties' submission

(125) In the market for gas gensets >0.5MW, CAT's gensets have efficiency rates ranging from 37% to 42%, whereas MWM constantly sells products of better efficiency. All MWM's products range above an efficiency of 42%. Moreover, the efficiency rates of MWM's gensets are rather uniform, meaning that there are no huge gaps between their most and least efficient products.

(126) The diagram set out in recital 124 also shows two main groups of competitors. The first group consists of GE and MWM, who offer a broad range of highly efficient gensets. Nearly all products of these manufacturers have efficiency rates between [30-50]*%. The second group is composed by CAT/Perkins, Tognum/MTU and Guascor, whose gensets have an electrical efficiency between [25-45]*%. On average, these manufacturers' gensets' efficiency is […]* lower than the efficiency of GE's and MWM's natural gas gensets. Even in the power range where CAT has its most efficient gas gensets (that is to say, […]*MW), and thus its presence in the market is stronger, both MWM and GE have more efficient gas gensets.

(127) Those differences in electrical efficiency between CAT's and MWM's gensets become even more evident when considering non-natural gas gensets.

Figure 2: Electrical efficiency in non-natural gas gensets

[Figure 2 reflects the electrical efficiency of the different non-natural gas gensets models of the Parties and their main competitors, such as GE, Guascor, MAN and MTU, in relation to electrical power (between 0 and 4.4MW). Figure 2 shows that GE and MWM products are more efficient than CAT's.]*

Source: Parties' submission

(128) CAT offers only a […]* limited number of non-natural gas gensets, although non- natural gas gensets represented approximately [30-40]*% of the EEA market in 2010. Compared to MWM's non-natural gas gensets, CAT's gensets are […]*% less efficient, whilst GE offers products that are much closer to MWM's electrical efficiency's standards. This results in […]* additional fuel demand for customers using CAT's gensets.

(129) In that regard, the Parties submit that the ability to adjust a genset’s performance to the ambient conditions also has an impact on efficiency. [Some suppliers, competitors of CAT, are able to adjust their gensets to meet the customers' requirements in terms of altitude, temperature or humidity. The lack of customization can have a negative effect on optimizing the genset's performance and efficiency]*. This leads to efficiency losses so that in these circumstances the efficiency gaps become even larger.

(130) Furthermore, as it appears from the diagram set out in recital 127, GE and MWM offer non-natural gas gensets with [high]* efficiency in the market, whereas CAT offers non-natural gas gensets with [lower]* electrical efficiency, […]* below Guascor, MAN and Tognum/MTU.

(131) The Phase II market investigation has also largely confirmed that consultants, distributors and packagers consider MWM as offering technologically superior products than CAT in terms of electrical efficiency.60 Only for customers, a roughly equal number of responses from customers could be found in favour of each company.61

(132) Accordingly, it should be concluded that MWM and CAT are not close competitors as far as electrical efficiency is concerned.

Differences in overhaul time

(133) Overhaul time is the period of time needed when a genset must be shut-down for significant repairs and maintenance. The overhaul times of CAT's and MWM's gensets are quite different and this difference applies almost equally to all power band ranges. MWM's products usually only require a full inspection and overhaul after a runtime of […]* hours. CAT generally already recommends a full inspection and overhaul for its products after a runtime of […]* hours. It follows that, if a gas genset is operated continuously, a CAT customer needs an overhaul […]* earlier than a MWM customer. In monetary terms, this can make a substantial difference for customers as the costs for a complete overhaul can run up to two thirds of the initial costs of a genset, in addition to the lost electrical output during the shut-down time of the genset.

(134) The Phase II market investigation partially endorses the Parties' arguments referred to in recital 133. The majority of the competitors62 that replied to the Phase II market investigation mention both CAT and MWM as having low maintenance costs and short downtime. However, none of them are marked as market leaders in that respect. On the other hand, customers submit that CAT's gensets are "old-fashioned and expensive to maintain"63. Distributors credit CAT with being good at engine reliability and maintenance needs. That seems to stem from the "old"64 or "more conservative"65 technology CAT uses: "low technology – simple engines – easy maintenance"66. Still, distributors see MWM as having better technology which includes a "very sophisticated and functional control system",67 reducing maintenance costs.

Different positioning of the Parties in the market

(135) According to the Parties, the activities and the positioning of CAT and MWM differ significantly. MWM almost exclusively manufactures and sells gas gensets, whereas CAT's business activities cover a much broader area. Within power generation, CAT has focused its activities on diesel gensets rather than on gas gensets. Diesel gensets represented [5-10]*% of CAT's total turnover in 2009, while gas gensets amounted to [0-5]*%.

(136) The different activities of the Parties have the effect that their brands are perceived entirely differently. CAT's brand recognition results primarily from its long-standing activities in earth-moving and mining equipment, as well as its diesel engines/gensets. CAT's gas gensets, however, are [less]* known and are perceived as being [less]* efficient. By contrast, MWM is a well known brand for gas gensets, with the reputation of offering tailor-made, reliable gas gensets with a good price performance. Those differences in perception between the Parties’ respective gas gensets are also in line with the objective differences in efficiency and innovativeness, as set out in recitals 114-121 and 122-132. As a result, customers […]* of gas gensets are likely to have a preference for MWM’s products over those of CAT.

(137) Moreover, the Parties underline the complementarity of the proposed concentration as regards their business portfolio and their geographic scope. The gas genset product portfolios of CAT and MWM differ significantly in terms of fuel used (natural gas/non-natural gas). With respect to non-natural gas gensets above 0.5MW, CAT only offers three models68, while MWM offers seven69.

(138) The geographic focus of both companies is also different. CAT has a stronger presence on a worldwide level, but a weak one on an EEA basis. MWM, on the contrary, is strong in the EEA but with limited distribution presence in the rest of the world.

(139) The Phase II market investigation reveals that CAT has a reputation of being "solid" and "expensive"70, while MWM is seen as having a more aggressive price policy, especially concerning rebates. The overall image is of CAT offering lower, simpler technology than MWM, with MWM being "good and getting better"71. Competitors share the same views72. CAT is regarded as being a global player, with a diversified portfolio in different end applications and heavy equipment, but lagging behind the main competitors in the gas genset market. MWM is considered as an aggressive and dynamic player that has been successful in building brand recognition in a short period of time and launching competitive and innovative products in the market for gas gensets.

(140) Taking those elements into account, it should be concluded that MWM and CAT are not close competitors as regards their positioning in the gas genset market.

5.3.3. Potential entrants

(141) The Parties consider that several new entrants on the market and potential new entrants will constrain the combined entity's competitive behaviour. In that sense, paragraph 68 of the Horizontal Merger Guidelines states that: "When entering a market is sufficiently easy, a merger is unlikely to pose any significant anti- competitive risk.(…) For entry to be considered a sufficient competitive constraint on the merging parties, it must be shown to be likely, timely and sufficient to deter or defeat any potential anti-competitive effects of the merger."

(142) The Parties estimate that the gas gensets market will grow at approximately [10- 20]*% per year from 2011 to 2020, which is a very significant rate. Market drivers for growth are population growth, environmental concerns with constraints on carbon emissions, and crude oil prices. In particular, population growth and increased electricity demand per capita is causing an upwards pressure on demand for electrical energy. In addition, there is and will be continued pressure to meet the demand for more electrical energy using technologies that generate electricity in a more fuel efficient way, emit less carbon per unit of power and do not rely on liquid hydrocarbon fuels. Taking those matters into account, the Parties believe that growth in demand for gas gensets will rapidly increase over the coming years. That means that there is space to accommodate the growth of existing players, as well as new entrants to the market for gas gensets.

(143) In that respect, both the Phase I and II market investigations confirmed that the market for gas gensets is growing rapidly. In particular, an annual growth of between 10 to 15% in the coming years is expected and will continue in the future due to environmental reasons, as well as an increase in the market demand, inter alia73. As a consequence, many respondents to the Phase II market investigation indicated that Asian (namely Chinese and Korean) players could enter the EEA market74 in the near future.

(144) According to the Parties, there are also no significant barriers to entry, in particular for manufacturers that are already present in the diesel genset market. It should be emphasised that all gensets are derived from diesel gensets. Most of the current gas gensets manufacturers are also diesel gensets manufacturers, such as GE, CAT, Cummins, Guascor or Mitsubishi. Tognum is the most recent example of a diesel supplier who has entered the gas market in the EEA.

(145) The Parties point out that an important element for a successful gas genset is the access to a technologically competitive bare engine, in particular as far as the control system of the engine is concerned. This is the reason why most gas gensets suppliers are vertically integrated, since that allows control of product development, production costs and system integration.

(146) However, the Parties argue that the lack of a proprietary gas engine is not an obstacle for market entry. In the past, suppliers have either developed their own engine/control systems, or purchased engines/control systems from third parties or adapted diesel engines to gas gensets. Based on the experience of MWM, in order to launch a 0.5MW gas bare engine, a diesel manufacturer would need to invest approximately EUR […]* million to market a gas engine developed from an existing diesel engine.75

(147) Potential competitors who are not active in diesel engines/gensets can also enter into the market by acquiring know-how regarding the gas engine from third parties. AVL, Austria, sells advanced control systems or know-how in relation to control systems to gas or diesel engine manufacturers. Bosch and Ricardo are other examples of such companies.

(148) Packagers can also enter the gas genset market by sourcing the engine from existing gas bare engine suppliers, such as Cummins or Guascor in the EEA. Packagers acquire a significant amount of know-how on the engines and gensets they acquire from manufacturers and also have the expert personnel for sales and marketing, as well as knowledge about the final customers, and supply maintenance and spare parts. An example of a recent entry is packager 2G Energietechnik GmbH who has entered the gas genset manufacturing market. 2G has developed its own gas engine line with power outputs below 0.4MW, based on MAN engines.

(149) Furthermore, the Parties stress that the availability of a company's own sales network as such is not a necessary requirement to become a successful supplier, as proven by the example of MWM. MWM has effectively developed its sales network in only a few years. Thus, a new entrant can successfully supply its gensets via independent distributors or packagers, without being forced to set up its own distribution network.

(150) In addition, many respondents to the Phase II market investigation point to the fact that new developments are constant in the market, and that competitors need to regularly launch new or improved products. Numerous examples are given in that regard, including the main innovations brought about in recent years, such as the current pipeline products and R&D efforts carried out by manufacturers.76 As a consequence, the market for gas gensets is highly dynamic and competitive, enabling recent entrants (such as MWM or Tognum) to increase its market share in a short period of time, and vice versa, making manufacturers that do not invest in R&D obsolete ([…]*). It also explains the fluctuation of the market shares for the main competitors in the gas genset market, both on a global and EEA basis and provides an indication that historic market shares are an insufficient proxy for market power.

(151) Additionally, the Phase II market investigation shows that entering the gas genset market is not as costly as suggested by respondents to the Phase I market investigation77. Firstly, to develop a distribution network is feasible in a short period of time. It is not necessary for a company to have its own distribution network, a newcomer can supply its products through highly sophisticated independent distributors or packagers, who have the market knowledge and have access to a wide customer base.

(152) Furthermore, as confirmed by the Phase I and II market investigations, to develop a new gas genset from scratch requires significant costs and time. However, to develop a gas genset from an existing genset significantly reduces time and expenses.78 For that reason, it is feasible for a player already offering a gas genset of a given size, to start offering a gas genset with different capacities. In the market for gas gensets