EC, August 2, 2007, No M.4737

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

Sabic / GE Plastics

Dear Sir/Madam,

Subject: Case No COMP/M.4737 – Sabic / GE Plastics

Notification of 29/06/2007 pursuant to Article 4 of Council Regulation No 139/20041

1. On 29/06/2007, the Commission received a notification of a proposed concentration by which the undertaking Sabic Europe B.V. (The Netherlands), controlled by Sabic Corporation ("Sabic", Saudi-Arabia), acquires within the meaning of Article 3(1)(b) of the Council Regulation control of parts of the undertaking General Electric Company ("GE", USA), namely those legal entities and assets forming GE's plastics business ("GE Plastics") by way of purchase of assets and shares.

I. THE PARTIES

2. Sabic is an international industrial group that is primarily active in the production and sale of basic chemicals, intermediates, polymers (also referred to as plastics), fertilisers and, to some extent, metals.

3. GE Plastics, presently part of GE’s “GE Industrial” business division is a manufacturer and distributor of plastics, notably higher value added performance engineering thermoplastics, including blends and compounds thereof, sheets and films manufactured from some of these products (principally polycarbonate). GE Plastics and Sabic are referred together hereinafter as "the Parties".

II. THE OPERATION

4. According to the "Stock and Asset Sale Agreement", dated 21 May 2007, Sabic will acquire all shares and assets forming GE Plastics and will therefore acquire sole control over GE Plastics. The operation thus constitutes a concentration within the meaning of Article 3.1(b) of the ECMR. The parties have a combined worldwide turnover of more than €5,000 million and the individual Community-wide turnover for each of at least two of the undertakings concerned exceeds €250 million. Neither Sabic nor GE Plastics have achieved two-thirds of their aggregate Community-wide turnover within one and the same Member State. The notified operation therefore has a Community dimension.

III. RELEVANT MARKETS

5. The proposed transaction concerns the production and sale of basic chemicals, polymers and engineering plastics.

A Relevant product markets

6. There is only a limited number of "overlap" products which GE Plastics and Sabic both produce. Most of the technically affected markets concern a potential "vertical" supply relationship between Sabic and GE Plastics, since many of the raw materials ("inputs") currently sold by Sabic can be used for the production of plastics produced by GE Plastics.

1. Horizontally overlapping products

7. Sabic and GE Plastics both produce a limited number of basic chemicals, intermediate products and plastics (also referred to as “polymers”), in particular styrene and polypropylene compounds, which both Parties produce in Europe.

8. Styrene is an intermediate chemical product used as monomer for the production of polystyrene and as co-monomer in the production of a number of plastics and synthetic rubbers2. The parties submit that styrene constitutes product market of its own due to its physical characteristics and the absence of substitutes for its specific applications. This view is consistent with the Commission’s previous practice3 and was supported by the Commission's market investigation. The precise definition of the market can, however, be left open, since the transaction does not lead to anti- competitive effects in the styrene markets under either definition.

9. The Parties further propose to define a separate product market for polypropylene ("PP") compounds. PP compounds are made from PP resins, additives and one or more fillers such as glass fibre or minerals. The parties submit that the market for PP compounds should be analysed separately from the market(s) for PP resins, but that the different types of PP compounds are part of the same product market, since they are substitutable for the same uses and compounders can generally produce a wide range of PP compounds. The Commission has in previous decisions left open the question whether there is a separate market for PP compounds for specific applications, such as PP compounds for automotive applications4. Although a significant number of respondents to the Commission's market investigation has supported the definition of a separate PP market for automotive applications, the precise market definition can ultimately be left open for the purpose of this decision, since the notified transaction will not lead to competition concerns under any alternative product market definition.

10. Both Parties are also active to a limited extent in the production of a number of other chemicals such as polystyrene, ethylene propylene, pygas, toluene, crude C4, benzene and ethyl benzene. However, since none of these activities would give rise to a technically affected market even under the narrowest possible market definition, these markets can be disregarded for the analysis of the horizontal relationship between the Parties in this decision.

11. The Commission has also analysed potential anti-competitive effects in the market for polycarbonate ("PC"). PC is a thermoplastic derived from bisphenol A (BPA) and used in applications such as optical media construction, transportation or automotive. The parties submitted that neither polycarbonate blends nor polycarbonate compounds constitute separate product markets. The Commission, in a previous decision, considered defining a separate market for PC and even for PC compounds5. For the purpose of the present decision, it can be left open, whether PC forms part of a wider market for "engineering plastics", whether a separate PC market, a narrower "PC compounds" market or even narrower markets should (e.g. for specific PC compounds or PC blends, for PC films etc.) be defined, since no competition problems would arise under either delineation.

Vertically linked product markets

12. The parties have indicated the upstream and downstream markets where the merging parties’ activities are potentially vertically "linked", i.e. where Sabic produces an input that is also used by GE Plastics. Such a vertical relationship can inter alia be found for styrene and the downstream products produced thereof (Acrylonitrile Butadiene Styrene ("ABS"), polystyrene and Acrylic Styrene Acrylonitrile ("ASA")), for butadiene and its downstream products (notably ABS); for polypropylene (PP) resins and the downstream product PP compounds; PET and the downstream products PC and polybutylene terephthalate (PBT) compounds; for polyvinyl chloride (PVC) and the downstream compounds for use in polymer compounding; for polyethylene (PE), used in a number of different grades of compounds of other polymers and for propane which is used for the production of ethylene.

13. The market definition for these products proposed by the parties appears to be generally consistent with the Commission’s approach to these markets in previous decisions6. However, since neither Sabic nor GE Plactics has a market share of more than 25% on the above mentioned up- or downstream markets, none of these vertical relationships would give rise to technically affected markets, and these markets will not be further analysed in this decision.

14. GE Plastics does, however, hold more than 25% on some of the downstream markets for certain plastics, namely on the markets for polyphenylene ether ("PPE"), polyetherimide ("PEI") and PC/PC compounds. These vertical relationships therefore give technically rise to affected markets, since Sabic is active in the production of a related upstream product (methanol, polystyrene and benzene).

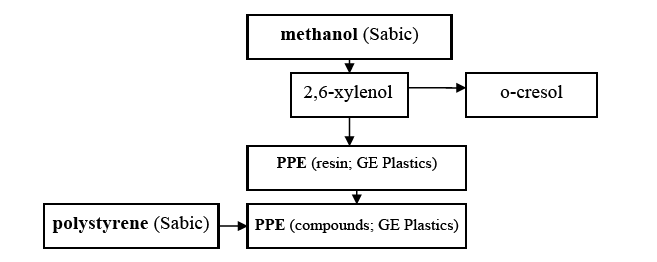

PPE and the (indirect) upstream markets methanol/polystyrene

15. The vertical relationship between methanol (produced by Sabic), 2,6-xylenol, o- cresol, polystyrene and PPE resin/compounds (produced by GE Plastics) is illustrated in the following diagram:

16. As regards the "upstream" product methanol, the parties submit that it constitutes a distinct product market due to its physical characteristics and the absence of substitutes for its specific uses, and that the market should not be further sub-divided. This view is consistent with the Commission’s previous decision practice7. The Parties also propose to define a separate market for polystyrene, which was largely supported by the market investigation.

17. The end-product PPE is an engineering thermoplastic, used in a number of industries, including motor vehicles, electrical/electronics products or telecommunications products. The parties submit that PPE constitutes a separate product market which should not be further sub-segmented. Although some respondents to the Commission's market investigation have proposed to define narrower markets such as PPE for automotive applications, the precise market definition can be left open for the purpose of this decision, since the transaction would not lead to vertical competition concerns under any alternative market definition.

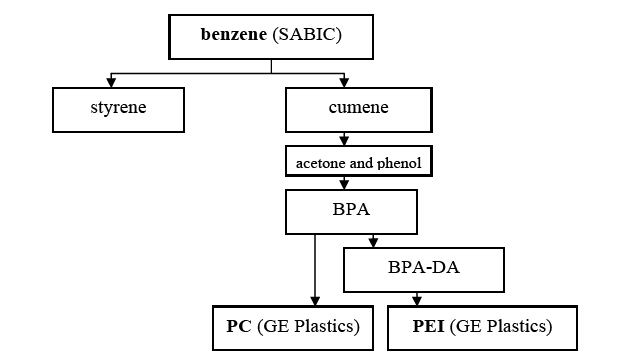

PEI, PC and the (indirect) upstream market benzene

18. Sabic also produces benzene, which can be used as an input for the production of PEI and PC markets, as shown in the chart below.

19. Benzene is an aromatic chemical used in the manufacture of cyclohexane (for nylon), ethylbenzene (for styrene), cumene (for phenol and acetone and, ultimately, polycarbonate, PEI and PPE) and synthetic detergents8. The parties submit that benzene is a distinct product market due to its physical characteristics and the absence of substitutes for its specific uses. This is consistent with the Commission’s previous practice9 and was supported by the Commission's market investigation10.

20. The end product polyetherimide (PEI), for which GE Plastics is the only producer world-wide, is a plastic which presents heat resistance, high strength, high modulus and broad chemical resistance. It is used in applications such as electrical, automotive, telecommunications, aerospace or healthcare. The parties suggest that the product market definition may be wider than PEI, encompassing other engineering plastics. Although some respondents to the Commission's market investigation supported a wider market, the precise market definition can ultimately be left open, since the transaction will not lead to competition concerns under any alternative product market definition11.

B Relevant geographic markets

21. The parties submit that all horizontally and vertically affected markets are at least EEA-wide in scope. The Commission has previously dealt with a number of the products concerned by the transaction, such as methanol12, styrene13, ethylene14, butadiene15, polypropylene16, pygas17, ethylene, polyethylene, propylene18, toluene19, crude C420 and benzene21 and in most cases defined EEA-wide or even larger markets.

22. The Commission's market investigation has largely confirmed that the affected markets affected by this transaction are at least European-wide. The exact definition of the geographic scope of the affected markets, however, can be left open, since the transaction does not give rise to any competition concerns, regardless of whether these markets were to be defined world-wide or European-wide.

IV. COMPETITIVE ASSESSMENT

23. As set out above, the transaction concerns the acquisition of a plastics supplier specialised in high value plastics (GE Plastics) by a commodity plastics supplier (Sabic). The Commission's market investigation has confirmed that the product portfolios of the two Parties are to a large extent complementary and that Sabic's acquisition of GE Plastics will also not enable the merged entity to foreclose access to important inputs or to downstream markets.

Horizontal issues

24. The market investigation has confirmed that, at present, the transaction does not result in any competitive overlap that would give rise to technically affected markets, with all combined market shares being below 15%, even on the narrowest possible definition.

25. As concerns in particular a hypothetical market for PP for automotive applications, the parties’ combined market share would remain below [5-15]% in a Western European market, with a very limited share of below [0-5]% for GE Plastics. On a world-wide level, the market share would even be lower.

26. The only more important potential horizontal overlap between the Parties' activities concerns the market for PC. Although at present only GE Plastics is active in the production of PC, Sabic has announced plans to start the production of PC in Asia within the next three years. Sabic has indeed acquired a controlling share of 35% in the Saudi Kayan Petrochemical Company ("Saudi Kayan") and intends to produce PC resins […] in a petrochemicals complex in Saudi-Arabia with an annual capacity of [...]kt. of PC (expected world-wide capacity in 2010: 4598 kt.). The construction of the plant has not yet begun. According to the Parties, the production site will start its commercial operations only in 2010, and the Parties indicated that further delays are well possible. Sabic has indicated that it cannot be expected that the plant will be fully operational already in 2010, since it may well take some more years until the plant is reaching its full capacity. Nevertheless, since the Commission is required to carry out a prospective analysis of the effects of the transaction, it has also investigated whether competition concerns can be expected on the market for PC or PC compounds in the near future.

27. GE Plastics has a significant market share for PC both on a world-wide level today, where GE Plastic is currently the second strongest producer with a market share of [25-35]%, closely behind Bayer, holding a market share of [25-35]% (sales value 2006). GE and Bayer face competition from a number of other competitors, namely the Japanese companies Teijin Limited ("Teijin") and Mitsubishi Engineering Plastics ("Mitsubishi"), both accounting for around [10-20]% of world-wide sales, and Dow Chemical, accounting for around [5-10]% of the world market22, as well as from other smaller competitors.

28. The Commission has concluded that the hypothetical future overlap in the field of PC is not likely to give rise to a significant impediment of competition, even if a world- wide market were to be considered, for the following reasons:

29. First, it has to be noted that the potential future overlap between GE's and Sabic's activities in the PC market will not materialise before 2010 or even later. It therefore reaches the very limits of the timeframe for which the Commission can at all carry out a prospective analysis of dynamic competition in the market. Second, the Commission's market investigation showed that not only Sabic, but a number of different competitors (except GE Plastics) are planning to bring additional PC capacity to the market in the next years. It is estimated that Sabic's investment constitutes only [20-30]% of the additional capacity coming on the market until 2011 through capacity extensions of all existing competitors. Competitors have confirmed that no capacity constraints are expected for the future. In such a scenario, the merged entity's market share is not likely to increase significantly, but is estimated to remain stable at around [25-35]%23. Third, Sabic and GE Plastics would not be the closest competitors for PC absent the merger, since GE Plastics is specialised on more sophisticated PC applications, while Sabic will only produce "basic" PC resins, at a much smaller scale and with a different regional focus than GE Plastics.

30. The Commission's market investigation has confirmed that the markets for PC will remain competitive in future. No PC customer has raised concerns with respect to the merged entity's future capacity increase, and all third parties have confirmed that customers would still have the choice between a number of strong suppliers for PC, PC compounds/blends and other PC types to whom they could turn should the merged entity decide to increase prices or decrease capacity24.

Vertical issues

31. Sabic is currently not a significant supplier to GE Plastics. Indeed, GE Plastics currently purchases only a relatively small number of raw materials from Sabic outside Europe. In Europe, there are, according to the Parties, virtually no supplies from Sabic to GE Plastics today. However, the transaction will allow the merged entity to deepen GE Plastics' vertical integration. It provides GE Plastics, specialised in more sophisticated engineering plastics, with the opportunity to source more raw materials from Sabic, specialised in the supply of commodity chemicals and plastics, many of which can be used as an input for the production of engineering plastics. The Commission has therefore analysed whether Sabic or GE Plastics hold a position on any up- or downstream market that could allow them to foreclose competitors from important inputs or from important downstream customers to the detriment of competition in these markets.

32. The market investigation has confirmed that the competitive structure would not be harmed in these markets as a result of the transaction, because, one the one hand, Sabic does not hold significant market shares for any raw material that can be used by GE Plastics, and, on the other hand, GE Plastic is not a particularly important customer for any of the raw materials supplied by Sabic. The investigation also showed that the potential vertical links between the parties are often indirect, that other suppliers are present at different intermediary stages of the value chain and that the respective end products can often be produced with other raw materials than those supplied by Sabic.

Sabic does not have an important position on any upstream market

33. According to the Parties, Sabic does not hold a market share of above 25% for any potential "upstream" product which can potentially be used by GE Plastics, even on the narrowest conceivable market definition. The market investigation has confirmed that there is a sufficient number of other strong suppliers for all raw materials which can be used by GE Plastics. Although some competitors mentioned that the merger might create certain disadvantages for them, e.g. because the merged entity could benefit from financial advantages through its vertical integration and since the merged entity might change the commercial terms of some existing supply agreements, no third party claimed that Sabic could use its market power to foreclose customers from the access to an important input in an anti-competitive manner. Almost all third parties confirmed that Sabic does currently not have a particularly important position as supplier and that they could turn to other suppliers without major difficulties in case of a price increase.

34. The Commission has nevertheless analysed more in detail the vertical relationships in those markets in which GE Plastics holds a relatively strong position, namely PPE, PC and PEI:

Effects on the methanol/polystyrene market (PPE production)

35. GE has [70-80]% market share in the PPE resins market and would have a [80-90]% market share in a PPE compound market25. However, the (indirect) vertical link with Sabic's methanol production is not likely to give rise to any competition concerns, since methanol is a commodity that is used for a large number of other applications than PPE and available from many producers world-wide. Sabic accounts only for [0- 5]% of the EEA-wide methanol market in terms of sales. Its methanol capacity accounts for [5-10]% of the world-wide market26. Both on a European-wide and on a world-wide level, the merged entity will face a number of strong competitors such as Mider ([20-30]% of world wide capacity), BASF ([10-20]%) and Shell/DEA ([10- 20]%). Despite its strong position in PPE, GE Plastics purchases just insignificant methanol quantities in the merchant market (amounting to [<1]% of global, and [<1]% of total EEA, methanol purchases).

Effects on the benzene market (PEI and PC production)

36. As set out above, GE is currently the only producer of PEI world-wide. In the PC market GE Plastics is the second important player, with a market share of around [25- 45]%, depending on the geographic market definition. The current market leader in PC in terms of sales is Bayer.

37. One (indirect) input for PEI and PC is benzene. Sabic has a limited presence in the benzene market, with a market share of around [5-10]% (capacity, 2006) in the EEA and approx [5-10]% world-wide, facing competition from strong competitors such as Shell ([10-20]%), Dow ([10-20]%) and Total ([5-10]%). GE Plastics [is not] a key customer for any benzene producer world-wide. GE Plastic's purchases of benzene account not even for 1% of all benzene sales world-wide.

38. It can thus be concluded that the transaction does not give rise to any risk of input or customer foreclosure.

V. CONCLUSION

39. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of Council Regulation (EC) No 139/2004.

1 OJ L 24, 29.1.2004 p. 1.

2 See e.g. cases no. IV/M.1078 - BP/HULS and COMP/M.3578 - BP/NOVA.

3 Idem.

4 Case COMP/M.3733 – Dow/DDE. Case No. COMP/1751 - Shell/BASF/JV - Project Nicole.

5 Case COMP/M.1814 – Bayer/Röhm/Makroform, Article 6(1)(b) decision of 17 April 2000, paras 10 – 13.

6 Case No. IV/M.3642 - Carlyle/Advent/HT TROPLAST JV; Case No. COMP/M.3543 - PKN

Orlen/Unipetro Case No. IV/M.1469 - Solvay/BASF; Case No. IV/M.284 - Hoechst/Wacker; and Case

No. IV/M.475 - Shell Chimie/Elf Atochem No COMP/M.4041 - Basell/Societe du Craqueur de l'Aubette;

Case No. COMP/M.3733 - Dow/DDE; Case No. IV/M.2806 - SABIC/DSM Petrochemicals; Case No.

COMP/M.2533 - BP/E.ON; Case COMP/M.2389 Shell/DEA; Case No. COMP/M.2297 - BP Chemicals/Solvay (PP); Case No. COMP/M.2299 - BP Chemicals/Solvay/HDPE JV; Case No. IV/M.2345

- Deutsche BP/Erdolchemie; No IV/M.2192 - 3* SmithKline Beecham/Block Drug; Case No.

COMP/M.2092 - Repsol Quimica/Borealis/JV; Case No. COMP/M.1966 - Phillips/Chevron/JV; Case

COMP/M.1671 - Dow Chemical/Union Carbide; No COMP/M.1663 - Alcan/Alusuisse; Case No.

IV/M.1163- Borealis/IPIC/OMV/PDC; Case No. IV/M.1293 - BP/AMOCO; Case No. IV/M.1041 -

BASF/Shell (II); Case No. IV/M.734 - Melitta/Dow-Newco; Case No. IV/M.708 - Exxon/DSM; Case No.

COMP/M.269 - Shell/Montecatini; Case No. IV/M.591 - Dow/BUNA; Case No. IV/M.550 - Union

Carbide/Enichem; and Case No. IV/M.361 - Neste/Statoil.

7 See e.g. case COMP/M. 1813 Industri Kapital/(Nordkem)/Dyno and case COMP/M. 331 – Fletcher

Challenge/Methanex.

8 Case No. IV/M.3288 - TNK-BP/SIBNEFT/SLAVNEFT JV.

9 Case No. IV/M.2806 - SABIC/DSM Petrochemicals; Case No. IV/M.3288 - TNK-

BP/SIBNEFT/SLAVNEFT JV; Case No. IV/M.2681 - Conoco/Phillips Petroleum; Case No. IV/M.2345 -

Deutsche BP/Erdolchemie; and Case No. IV/M.1859 - ENI/GALP.

10 It may be noted that Sabic also produces caustic soda, which is used by GE Plastics in the production

process as a medium for its polymerisation. Sabic's global market share for caustic soda is, however,

below 1%. This market is therefore disregarded for the purpose of this decision.

11 It may be noted that, due to the variability of the production process of different plastics, there are also

other potential vertical links between the Parties' activities. However, since the activities of Sabic and the

importance of GE Plastics as a customer for these products are insignificant, these relationships do not

need to be set out in detail for the purpose of this decision.

12 The Commission considered that, although methanol is internationally traded as a commodity (as it can be profitably transported over long distances) the market is not worldwide in scope as conditions of

competition vary between the three main demand areas of the world (Western Europe, North America and

Asia), principally due to differences in demand patterns and significant import duties in each region, see

Case COMP/M. 1813 Industri Kapital/(Nordkem)/Dyno and Case COMP/M. 331 – Fletcher

Challenge/Methanex.

13 The Commission considered the market for styrene EEA-wide or worldwide, see case No. COMP/M.3578

- BP/ Case No. IV/M.1078 - BP/HULS.

14 Case No. COMP/M.4094 - Ineos/BP Dormagen, the Commission noted (para. 29) that its investigation

“was inconclusive as to whether the geographic market is the EEA or the geographic area covered by the

pipeline network”. In other cases the Commission was of the opinion that the geographic market is

determined by the relevant pipeline network: Case No. COMP/M.4041 - Basell/Societe du Craqueur de

l'Aubette; Case No. COMP/M.3733 - Dow/DDE; Case No. IV/M.2806 - SABIC/DSM Petrochemicals;

Case No. COMP/M.2533 - BP/E.ON; Case No. COMP/M.2389 - Shell/DEA.

15 See e.g. for butadiene Case COMP/M. 4041 - Basell / Craqueur de l'Aubette.

16 Case COMP/M.3733 – Dow/DDE. Case No. COMP/1751 - Shell/BASF/JV - Project Nicole.

17 Case No. COMP/M.4041 - Basell/Societe du Craqueur de l'Aubette.

18 Case No. COMP/M.4041 - Basell/Societe du Craqueur de l'Aubette; Case No. IV/M.3110 - OMV/BP

(Southern Germany Package); Case No. IV/M.2806 - SABIC/DSM Petrochemicals; Case No.

Comp/M.2345 - Deutsche BP/Erdolchemie; Case COMP/M.2092 - Repsol Quimica/Borealis; and Case

IV/M.361 - Neste/Statoil.

19 Case No. COMP/M. 2389 – Shell/DEA.

20 Case No. COMP/M.4041 - Basell/Societe du Craqueur de l'Aubette and Case No. M.2806 - SABIC/DSM

Petrochemicals.

21 Case No. IV/M.3288 - TNK-BP/SIBNEFT/SLAVNEFT JV; Case No. IV/M.2806 - SABIC/DSM

Petrochemicals; Case No. IV/M.2681 - Conoco/Phillips Petroleum; Case No. IV/M.2345 - Deutsche

BP/Erdolchemie; and Case No. IV/M.1859 - ENI/GALP.

22 On a European-wide level, Bayer would hold [40-50]% of the market, followed by GE Plastics ([35-

45]%), Dow Chemical ([5-10]%), Teijin ([0-5]%) and Mitsubishi ([0-5]%).

23 The Parties submit even that the market share is likely to decrease, […].

24 It may be noted that one respondent to the Commission's market test expressed concerns with respect to a potential market for PPE for automotive applications. This respondent raised the issue of a possible entry of Sabic to this market, had the transaction not been undertaken. However, the parties have duly

confirmed that prior to the transaction, Sabic had not undertaken any move to enter this market […].

25 A PPE compound is a blend of PPE resins and polystyrene.

26 Sabic has no methanol production in Europe.