EC, October 2, 2007, No M.4827

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

Rio Tinto/ Alcan

Dear Sir/Madam,

Subject: Case No COMP/M.4827 - Rio Tinto/ Alcan

Notification of 28 August 2007 pursuant to Article 4 of Council Regulation No 139/2004[1]

1. On 28.08.2007, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (" the Merger Regulation") by which the undertaking Rio Tinto pic, belonging to the Rio Tinto Group ("Rio Tinto", UK), acquires control of the whole of the undertaking Alcan Inc ("Alcan", Canada) by way of public bid announced on 21 August 2007.

2. After examination of the notification, the Commission has concluded that the operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market and the EEA agreement.

I. THE PARTIES

3. Rio Tinto is an international mining group, headquartered in London. It combines Rio Tinto pic, listed on the London Stock Exchange, and Rio Tinto Limited, listed on the Australian Securities Exchange. Rio Tinto is engaged in the exploration, mining and processing of mineral resources, such as aluminium, copper, diamonds, energy minerals (coal and uranium), gold, iron ore and other industrial minerals.

4. Alcan is a public company traded on the Toronto, New York, London, Paris (Euronext), Brussels (Euronext) and Swiss Stock Exchanges and it has its head office in Canada. It is involved in the aluminium sector, both in the upstream activities of the value chain (bauxite mining, alumina refining and production of primary aluminium) and in some downstream markets (flexible and specialty aluminium packaging, engineered aluminium products and related research and development).

H. THE OPERATION AND THE CONCENTRATION

5. The notified operation consists of the acquisition of sole control by Rio Tinto, through a public bid announced on 21 August, of Alcan.

6. The present transaction therefore constitutes a concentration pursuant to Article 3(l)(b) of the Merger regulation.

HI. COMMUNITY DIMENSION

7. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 billion[2] (Rio Tinto EUR 20 billion; Alcan EUR 18 billion). Each of them have a Community-wide turnover in excess of EUR 250 million (Rio Tinto EUR [...]; Alcan EUR [...]), but they do not achieve more than two-thirds of their aggregate Community-wide turnover within one and the same Member State. The notified operation therefore has a Community dimension.

IV. COMPETITIVE ASSESSMENT

A. General Introduction

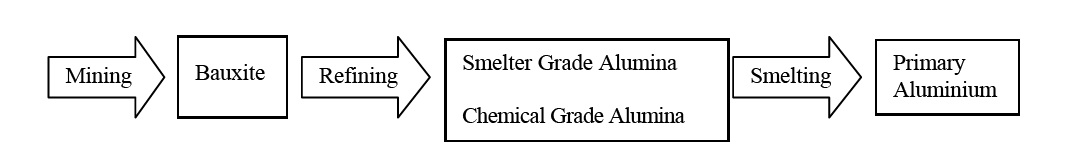

8. The aluminium sector is characterised by a high degree of vertical integration by most of the aluminium producers in the various steps of the aluminium production value chain. The flowchart below summarises the upstream part of the aluminium value chain.

9. The transaction's main effect is on the above upstream markets for aluminium production and, to a lesser extent, in some markets downstream from primary aluminium (Flat Rolled Products or “FRP”) due to the vertical relationships that will be reinforced following the operation (section B).

10. In addition, the Commission has also assessed the impact of the proposed transaction on the market for the licensing of aluminium production technology and the related equipment (section C).

B. Aluminium and aluminium products

I. Relevant Markets

(i) Bauxite

11. Bauxite is a naturally occurring mineral ore which normally contains between 30% and 60% of aluminum and it is used for the production of alumina. It is mined in a number of regions such as South America, Africa, Australia, India and China. It is one of the most common minerals on earth and is widely dispersed in tropical regions.

12. The parties submit that bauxite is a separate relevant product market which is global in scope. These product and geographic market definitions are in line with previous findings of the Commission[3]. The market investigation has confirmed these definitions.

13. A very limited number of the respondents to the market investigation have pointed out that the quality of bauxite may vary. However, they did not suggest that this would lead to the existence of different product markets for the different kinds of bauxite. The question of whether a distinct market exists for high alumina/low iron content bauxite can be, however, left open since, as further described below, the transaction will not have any anti-competitive effects on such kind of bauxite.

(ii) Alumina

14. Alumina is produced by refining bauxite ore. This process basically requires four stages: digestion, clarification, precipitation and calcination.

15. According to the parties, there are two main types of alumina: (i) smelter grade alumina (“SGA") and (ii) chemical grade alumina (CGA), which in turn can be segmented into “commodity hydrate” alumina and “calcined alumina”.

16. While SGA is produced following the four stages described above, commodity hydrate alumina is extracted just after the precipitation process. It is used in the production of a number of chemicals such as aluminium sulphate and chloride, aluminium fluoride or zeolites (detergents and catalysts). Calcined alumina follow the same process as SGA but are however further calcinated. They are used in various applications such as the production of cement, ceramics, refractories or tiles.

17. In one previous decision[4] the Commission considered that commodity hydrate, SGA and calcined alumina (referred to in that case simply as CGA) constituted three separate relevant product markets, although in a subsequent decision[5] the final definitions were left open.

18. For the purposes of the present decision the ultimate definition of the relevant product markets can also be left open since the proposed transaction is not likely to give rise to serious doubts as to its compatibility with the common market or the EEA agreement irrespectively of the definitions retained.

19. With respect to the relevant geographic market, the parties consider that it is world-wide for the three separate relevant product markets described above. In the Alcoa/Reynolds case, commodity alumina was defined as not wider than the EEA. For SGA and calcined alumina, the geographic market was defined by the sales made by the Western refineries, comprising all bauxite refineries except those located in Eastern Europe, CIS6 and China. This distinction was made on the basis of the differences in the quality of the SGA produced ("sandy" SGA produced by the Western refineries versus "floury" SGA produced by the rest of refineries). In the subsequent EN+/Glencore/Sual/UC Rusal case, however, the parties argued that all markets were world-wide, and the final definition was left open. The results of the market investigation point towards the existence of global market for SGA

20. However, for the purposes of the present decision the precise definition of the relevant geographic markets can also be left open since this would not alter the conclusion of the competitive assessment.

(iii) Primary aluminium

21. Primary aluminium is produced from SGA. The parties submit that primary aluminium constitutes a separate relevant product market. The parties consider that secondary aluminium (produced not from SGA but by re-melting and reconverting used aluminium products) exercises a competitive constraint on primary aluminium. However, given that the parties' activities do not overlap on the secondary aluminium segment, the question of whether or not primary and secondary aluminium belong to the same product market can be left open for the purposes of the assessment of the present decision.

22. Primary aluminium can be further segmented according to two main criteria: purity and the form of the final product.

23. Regarding purity, primary aluminium can be segmented into (i) low purity (aluminium content below 99.5%), (ii) standard (aluminium content between 99.5% and 99.9%) and (iii) high purity (aluminium content above 99.9%).

24. In previous decisions[6] the Commission considered that each of the segments of primary aluminium according to their purity constitutes a separate relevant product market. In addition, in one case the Commission even considered a further distinction within the high purity segment for a particular type of primary aluminium (P0404).

25. Given that neither Rio Tinto nor Alcan is active in the production of low purity aluminium, this market will not be discussed further in the present decision. Similarly, given that Alcan does not produce P0404 aluminium, any further segmentation of the high purity aluminium market is not relevant in the present decision.

26. According to its final form, primary aluminium can be distinguished between (i) ingots (for re-melting purposes), (ii) billets (for production of extruded products), (iii) slabs (for production of flat rolled products), (iv) T-bars (for re-melting purposes), (v) wire rod (used to make aluminium wire for applications such as electricity transmission). The Commission has previously left open the question of whether each of them constitutes a separate market8.

27. The majority of the respondents to the market investigation have confirmed the existence of different markets for the different grades and shapes of aluminium products.

28. However, for the purposes of the assessment of the present case it is not necessary to conclude on the precise definition of the relevant product markets listed above since the proposed concentration would not give rise to serious doubts as to its compatibility with the common market or the EEA agreement irrespectively of the market definitions retained.

29. The parties submit that the geographic markets for primary aluminium should be defined as global, which is in line with the previous findings of the Commission9. A large majority of the respondents to the market investigation has confirmed the parties' view. A few respondents to the market investigation have submitted that primary aluminium markets can have a narrower than global geographic dimension due to the existence of i) import duties in the EEA and ii) regional premiums which have to be added to the LME price and which lead to differences in the final aluminium price across the world. However the Commission notes that, notwithstanding the existence of import duties, the import volumes of primary aluminium into the EEA are significant [7]. Moreover, the final price of aluminium is determined to an overwhelming extent by the LME price and, only to a negligible extent, by the regional premiums. On this basis, the Commission considers the primary aluminium markets to be global in scope.

30. One respondent to the Commission's investigation has suggested that the relevant geographic market for slabs is Western Europe (which includes ELI 15, Norway, Iceland, Liechtenstein and Switzerland) as slabs are produced according to customers' specifications and customers need close proximity to their suppliers. As said the Commission considers that the primary aluminium market is global in scope. However, the Commission notes that the proposed operation would have no significant effect on a hypothetical Western European market as Rio Tinto has very limited aluminium production in Western Europe. Its total output was less than [...] tonnes (which accounts for less than [0-5]% of the Western European total production and which represents only a minor increment (less than [5-10]%) to Alcan's Western European production).

(iv) Downstream products

31. Primary aluminium is processed into a wide variety of products including flat rolled products, extrusions and other finished products. Of the parties, only Alcan has operation downstream of primary aluminium. Therefore there are no horizontal overlaps to be considered.

32. Alcan produces from standard purity aluminium the following products: FRP (including: standard FRPs, brazing sheets, food can sheets, beverage can sheets, beverage can end sheets, aereospace FRPs), hard alloy extrusions, soft alloy extrusions. It also produces from high purity primary aluminium: (i) FRP for aerospace applications, (ii) bright sheet and (iii) hard alloy extrusions.

33. Among these products, FRP and extrusions have been considered by the Commission as different product markets.

- Extrusions

34. Extrusions are the second most important category of aluminium semi-finished products after FRPs. Extrusions are formed by pushing aluminium billets through a die. Aluminium extruded products are used in a wide range of applications, including aerospace, automotive, building and construction, and industrial uses. Hard-alloy extrusions are used primarily for applications that require high levels of strength, such as aerospace and other transport applications. Soft-alloy extrusions, on the other hand are used for building and construction, less severe transportation applications, screw machines stock and general applications. The manufacture of hard alloy extrusions differs from soft-alloy extrusions in that, in the case of the former, special heat treatment and other processing is required as well as a higher pressure being required to extrude the billet.

35. In previous Commission decisions[8], two separate markets for aluminium extrusions have been identified: hard-alloy extrusions and soft-alloy extrusions. This decision will discuss only the market for hard-alloy extrusions, since it is the only vertically affected market by the present concentration.

36. Concerning the relevant geographic market, in previous decisions, the Commission has defined the geographic market for hard-alloy extrusions as being EEA-wide[9]. Only the market for aerospace applications has been defined as wider than EEA wide. For the purposes of the present case, the precise definition of the relevant geographic market can be left open since the present transaction would not give rise to serious doubts as to its compatibility with the common market and the EEA agreement irrespective of the definition retained.

- Flat rolled products

37. FRP have been segmented previously by the Commission into various relevant product markets.

38. The transaction will concern the vertical relationships between primary aluminium and the following products:

a. FRP produced from standard purity primary aluminium: (i) beverage can sheet, (ii) beverage can end and (iii) FRP for aerospace applications.

b. FRP produced from high purity primary aluminium: (i) FRP for aerospace applications, (ii) bright sheet.

39. The above FRP markets have been considered as separate relevant product markets by the Commission in a previous decision[10]. For the purposes of the present case, the precise definitions of these markets can be left open since the transaction will not give rise to serious doubts as to its compatibility with the common market or the EEA agreement on any reasonable product market definition.

40. As regards FRPs for aerospace applications, the parties submit that it is not relevant to distinguish within FRPs for aerospace applications those which are made of standard purity aluminium from those which are made of high purity aluminium. However, for the purposes of the present case it is not necessary to ultimately conclude on this issue, given that, according to the parties' best estimates, their market positions arethe same irrespectively of the product market definition retained.

41. The geographic market for the above products has been defined as EEA + Switzerland for beverage sheet and beverage can end, and it has been left open whether it is the EEA or wider for the remaining products[11]. Also in this case the question whether the geographic market is the EEA or wider can be left open since, regardless of the definition retained, the transaction will not give rise to serious doubts as to its compatibility with the common market or the EEA Agreement.

2. Competitive Assessment

Horizontal relationships (i) Bauxite

42. Most of the bauxite ([55-65]%) is used internally by integrated aluminium producers, the remaining ([35-45]%) being sold on the merchant market. The transaction gives rise to a small overlap on the bauxite merchant market, on which the parties would have a theoretical combined market share of around [15-25]% (Rio Tinto [10-20]%, Alcan [5- 10]%). However, [...]the parties estimate that their final combined market share would be around [10-20]%.

43. A limited number of respondents have pointed out that the quality of bauxite may vary and that some alumina refineries may not be able to use all alternative bauxites. However none of them has indicated that the combined entity would be in a position to restrict supplies of a particular type of bauxite to any of its competitors. High grade bauxite, that is bauxite with high alumina and low iron content, represents 19% of the total global bauxite production. The parties' share of this high grade bauxite will be [10- 20]%. All of this is accounted for by Alcan as Rio Tinto has no production of such material. Therefore, the proposed transaction will not bring about any change on the high grade bauxite segment.

44. The parties have only limited interest15 in mines producing high alumina, low iron content bauxites which are the most sought after. Furthermore most recent and planned bauxite development projects are associated with an alumina refinery and therefore the refinery is designed to process the bauxite available locally.

45. Some respondents have pointed out the reduction of the number of players in the market and the anticompetitive effects that the transaction may have in Australia given the consolidation of the mining activities of the parties in that country. However, the Commission considers the relevant geographic market to be global.

46. The bauxite market is very fragmented with a large number of alternative suppliers, the parties' main competitors being Alcoa ([10-20]%), UC Rusal ([5-10]%), CVRD ([5- 10]%), BHP Billiton ([0-5]%) and a substantial number of other smaller players accounting for the remaining [50-60]%. In addition, given the global nature of the bauxite market, the Commission considers highly unlikely that a consolidation of the mining activities in Australia can have any significant anti-competitive effect in the EEA, in particular taking also account of the limited market share of the combined entity at the production level ([5-15]%, Alcan [5-10]% and Rio Tinto [5-10]%)

47. Given (i) the presence of a number of credible alternative competitors on this market, (ii) the limited market share of the combined entity post-transaction and (iii) the fact that the effect on the market of [... ] (representing only [0-5]% of the merchant market size), the transaction does not rise serious doubts as to its compatibility with the common market or the EEA agreement on this market.

(ii) Alumina

48. The parties' activities only overlap in the production of SGA. Alumina producers normally produce, purchase and sell SGA at the same time, but in different geographic locations. The market position of the various players can therefore be assessed either looking at the net supply/demand balance of SGA or looking only at the supplies made by each producer to other parties.

49. If net sales are considered, the theoretical combined market share (without taking into account internalisation of sales post-merger) would be below [5-10]%: Rio Tinto [0-5]% at world-wide level and [5-10]% if Western refineries are considered, [...] Alcan is short of SGA and therefore its purchases are higher than its sales.

50. If only the supplies to third parties are considered, on the basis of parties' estimates of their main competitors' supplies to third parties at a global level[12], the combined entity's market share would be around [15-25]% (Rio Tinto [6-10]%, Alcan [5-15]%). Other players are Alcoa ([25-35]%), BHP Billiton ([5-15]%), Glencore (a trader, [5-15]%), UC Rusal ([10-20]%) and a number of smaller players with market shares below [0- 5]%[13].

51. In terms of production, the combined shares would also be around [5-15]% (Rio Tinto [0-5]%, Alcan [5-10]%) and [10-20]% (Rio Tinto [5-10]%, Alcan [5-15]%) at global and at EEA level respectively. In terms of capacity, the combined shares would also be around [5-15]% (Rio Tinto [0-5]%, Alcan [5-10]%) and [10-20]% (Rio Tinto [5-10]%, Alcan [5-15]%) at global and at EEA level respectively.

52. Given that the combined entity will have a limited position on this market and, at the same time, will have to face the competitive constraint of Alcoa, who appears to be the market leader, as well as of other significant players, the transaction is not likely to give rise to serious doubts as to its compatibility with the common market or the EEA agreement.

(in) Primary aluminium

53. In primary aluminium the parties' activities only overlap on the standard and the high purity aluminium market. For the standard primary aluminium market, which accounts for about 98% of the primary aluminium sales, the combined market share would be around [10-20]% (Rio Tinto [0-5]%, Alcan [5-10]%). Therefore this market is not affected. Moreover, this market is highly fragmented, the parties' main competitors being Alcoa ([5-10]%), Rusal ([10-20]%), Chaleo ([0-5]%), BHP Billiton ([0-5]%).

54. For the high purity primary aluminium merchant market, the parties' combined market share is around [20-30]%, however the increment brought about by the transaction is low (Rio Tinto [15-25]%, Alcan [0-5]%). Other competitors are Dubai ([10-20]%), BHP Billiton ([5-10]%), Century ([10-20]%), Xinjiang Joinworld ([5-10]%) and Sumitomo Chemical ([5-10]%).

55. The parties' estimate that the market shares would be the same if the market is further segmented according to the final shape (ingots, billets, slabs, T-bars and wire rods).

56. Given that the parties will have a limited position on this market and that a number of competitors will remain active post-merger, the transaction is not likely to create competitive concerns in this market.

Vertical relationships

57. On the basis of the market shares provided above, the only vertically affected markets would be the (i) the market for SGA and the market for high purity primary aluminium and (ii) primary aluminium market and some of the markets for flat rolled products further described below. Any other competitive concerns on the vertical relationship between the markets for (i) bauxite and alumina and (ii) alumina and standard primary aluminium can be excluded given that the parties' combined market share would be in any of these markets would not exceed 25%, which does not give rise to vertically affected markets.

(i) alumina and primary aluminium

58. The parties' combined market share in the SGA alumina market would be at most [5- 15]% and would be [20-30]% on the market for third parties' sales of high purity aluminium. The presence of alternative suppliers of SGA in particular Alcoa ([25- 35]%), BHP Billiton ([5-15]%), Glencore (a trader, [5-15]%), UC Rusal ([5-15]%) excludes the risks of input foreclosure. Similarly the fragmentation of the high purity primary aluminium market, excludes risks of customer foreclosure.

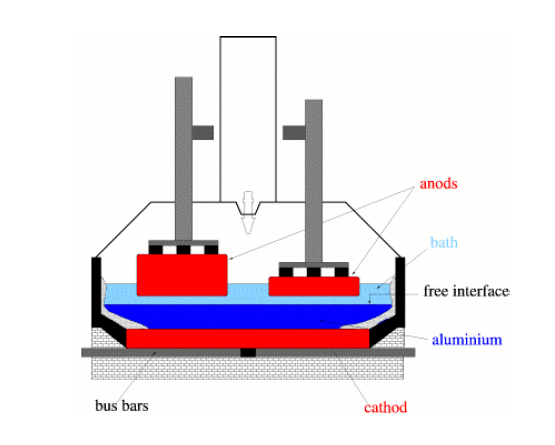

(ii) primary aluminium, FRPs and extrusions

59. Alcan is active in some markets downstream of primary standard aluminium, as described in the table below.

Products | LEA Market share |

STANDARD FRPs | [5-10]% |

BRAZING SHEET | [15-25]% |

FOOD CAN SHEET | [20-30]% |

BEVERAGE CAN SHEET | [35-45]% |

BEVERAGE CAN END SHEET | [30-40]% |

HARD ALLOY EXTRUSIONS | [10-20]% |

SOFT ALLOY EXTRUSIONS | [5-10]% |

| World-wide market share |

FRPs FOR AEROSPACE APPLICATIONS | [25-35]% |

60. On this basis, the upstream market for standard purity aluminium and the downstream markets for i) beverage can sheet, ii) beverage can end sheet, iii) food can sheet and aerospace applications are vertically affected by the present transaction.

61. Alcan is also active in some of the markets downstream of high purity aluminium as described in the table below:

Products | World-wide market share |

AEROSPACE APPLICATIONS | [25-35]% |

Products | LEA market share |

BRIGHT SHEET | [40-50]% |

HARD ALLOY EXTRUSIONS | [10-20]% |

62. On this basis, the upstream market for high purity aluminium and the downstream i) EEA markets for bright sheet, ii) World-wide market for FRPs for aerospace applications and iii) EEA market for hard alloy extrusions are vertically affected by the present transaction.

63. Some of the respondents to the market investigation have voiced some concerns in relation to the possibility that the present transaction could lead to risks of input foreclosure for the suppliers of some of the products mentioned in the table.

64. However the Commission notes that for four of the markets listed above (standard FRPS, brazing sheets, hard alloy extrusions and soft alloy extrusions), which are downstream of the standard aluminium market, Alcan's market share are below 25%. Therefore, given that the combined entity's market share on the upstream market for standard primary aluminium is below 25%, these markets would not be vertically affected by the present transaction.

65. Furthermore, as regards the other markets which are vertically affected by the proposed transaction, the Commission considers that, for the reasons further explained below, the transaction is not likely to give rise to competition concerns at a vertical level.

-vertical relationships between FRP and standard purity aluminium

66. As regards beverage can sheet, the main Alcan's competitors are Alcoa, Hydro Aluminium and Novelis which are all also vertically integrated upstream in the production of standard purity primary aluminium. Furthermore, a significant number of other competitors are active on this market, Alcan's non-integrated competitors would have a wide choice of suppliers of primary standard aluminium. Moreover, Alcan is already an integrated company and, due to Rio Tinto's small market share ([0-5]%) on the upstream standard purity market, the current Alcan's incentives not to supply standard primary aluminium to its downstream competitors will not significantly increase as a result of the present transaction.

67. On this basis, it is unlikely that the transaction will lead to any risk of input foreclosure for the beverage can sheet producers. On the basis of similar considerations, particularly i) the presence of a number of other standard aluminium suppliers and ii) the small increment brought about by the transaction to the parties' shares on the standard primary aluminum market, also risks of input foreclosure for beverage can end sheet producers can be excluded.

68. As regards possible risks of customer foreclosure, the Commission notes that beverage can sheet and beverage can end sheet account together only for about 2% of the total worldwide sales of standard primary aluminium. Moreover, the market for primary aluminium is global. Therefore the combined entity's upstream rivals can find other customers. On this basis, the transaction is not likely to lead to risks of customers foreclosure for the primary aluminium suppliers.

69. As regards food can sheet, the parties' limited market share on both the upstream segment of standard purity aluminium and downstream market for food can sheet and the presence on both such markets of a number of alternative players lead to exclude that the present concentration may cause any risks of input or customer foreclosure.

70. As regards aerospace applications, i) the presence of a number of other standard aluminium suppliers and ii) the small increment brought about by the transaction to the parties' shares on the standard primary aluminum market exclude the risk that the transaction could strengthen the combined entity's ability and incentives to foreclose access to standard primary aluminium to Alcan's competitors on the market for aerospace applications.

71. Similarly, i)the parties' limited share on this market; ii)the presence of other important competitors, namely Alcoa and Aleris, iii) the fact that the demand of standard aluminium for aerospace applications constitutes only a marginal part of the total demand for standard purity aluminium and iv) the fact that Alcan's total demand of standard primary aluminium for all FRP constitutes only a marginal part of the worldwide demand of standard primary aluminium, lead to exclude that the present transaction could increase the risks of customers foreclosure for standard primary aluminium suppliers.

-vertical relationships between high purity aluminium FRP and hard alloy extrusions

72. With respect to bright sheet, Alcan's main competitors are AMAG ([25-35]%) and Alcoa ([15-25]%), both of them are also integrated upstream in the production of high purity primary aluminium. Given the small amount of bright sheet production in the EEA (around [...] kt in the EEA, compared with a production of high purity primary aluminium of [...] kt and sales of [...] kt at worldwide level) and the fact that both Alcoa and AMAG follow a multi-sourcing strategy from other suppliers such as Dubai or BHP Billiton, the transaction is not likely to create input foreclosure risks in this market.

73. The presence of AMAG and Alcoa and the fact that Alcan's demand for high purity aluminium to be used in the production of bright sheet constituted only [5-10]% of the total demand for high purity primary aluminium excludes any risks of customer foreclosure for competing primary aluminium producers that may arise from the present transaction.

74. As regards aerospace applications and hard alloy extrusions, i) the presence of a number of alternative producers on the upstream market for high purity aluminium; ii) the possibility of capacity expansions for such competitors and iii) the small increment ([0- 5]%) brought about by the transaction to Rio Tinto's current share ([15-25]%), excludes any risks of input foreclosure for Alcan's competitors on the downstream market for aerospace application and hard alloy extrusions. Moreover, given Alcan's limited position on the market for aerospace applications and its very limited position on the market for hard alloy extrusions, it is unlikely that the present transaction will lead to risks of customer foreclosure for primary aluminium producers.

C. Technology and equipment

1. Alumina refining technology

75. Alumina refining technology is the technology used to transform bauxite into alumina. The technology is called the "Bayer process", which differs according to the existing qualities of bauxite[14] As explained above, it consists of several stages: digestion, clarification, precipitation, and calcination. Some technology owners possess the full Bayer process technology, whereas other companies specialize in particular steps of the process.

76. In Alcan/Pechiney (II)[15], the Commission found that there was a separate market for the licensing of alumina refining technology to third parties, leaving open the question whether the Bayer process specific to one variant of bauxite (diasporic bauxite) constitutes a relevant product market. The notifying party submits in this case that the relevant product market is the licensing of alumina refining technology, irrespective of the bauxite used. The market investigation suggested that any competitive issue related to alumina refining technology would not be specific to a quality of bauxite or to a step of the alumina refining process so that the competitive assessment is based on the definition of an overall market for the licensing of alumina refining technology.

77. It should also be noted that, consistent with the Commission's practise, "in-house production" (that is, the use of internal smelter cell technology) is not considered as part of the open market. It is however taken into account in the competitive assessment.

78. As for the geographic scope of the market, the notifying party submits that it should be regarded as worldwide in scope. However, in Alcan/Pechiney (II), the Commission considered that it might be appropriate to consider a market for western alumina refining technology refining technology, thereby excluding China and Russia. This alternative market definition does not, however, change the competitive assessment.

Assessment

79. In Alcan/Pechiney (II), the horizontal overlap of the activities of Alcan and Pechiney on the market for alumina refining technology led the Commission to raise serious doubts and Alcan committed to license its alumina refining technologies to third parties until [...].

80. In this case, however, only Alcan is active in the licensing of alumina refining technology with a [50-60]% word-wide market share on the merchant market— considering the added production capacity added from 1995 to 2007[16]—so that risks of input foreclosure were examined by the Commission. This analysis is distinct from the assessment of the risks of non-coordinated effects on the technology licensing market arising from the horizontal overlaps in the Alcan/Pechiney (II) decision.

81. The Commission is of the view that, despite the still strong position of Alcan's technologies, the parties would have limited ability to foreclose their competitors on downstream markets. First, a large number of the major players (Alcoa, Hydro, UC Rusal, BHP Biliton and Chinese producers) have and use their own technology and it seems that only a small proportion of Alcan's competitors could be potentially foreclosed. Second, it is not clear whether Alcan's technology is clearly superior to the extent that it would have a significant impact on the cost structure of alumina producers, and ultimately on the price of alumina. In this respect, as submitted by the parties, [both Rio Tinto and Alcan have refineries or refinery development projects which do not use Alcan's alumina refining technology]. This suggests that Alcan does not own a technology that would prevent its competitors from competing effectively, if Alcan was to decide to stop the effective licensing of the alumina refining technology.

82. The market investigation did not provide evidence that Alcan's activity in the licensing technology would be so decisive as to have an impact on alumina prices. While it is true that some respondents explained that Alcan is the only reliable provider of technology to third parties, others explained that there were other competitive alternatives. Furthermore, no respondents explained how a decision of the new entity to stop the effective licensing of its technology could have an impact on the price of alumina, which appears to be primarily driven by the prices of bauxite, energy and labour costs.

83. As regards the incentive to foreclose as a result of the proposed merger, it is difficult to evaluate to what extent Alcan, pre-merger and under the current market conditions, which have evolved to some extent since the Commission raised serious doubts in Alcan/Pechiney (II), has any incentive to license its technology[17]. Indeed, Alcan is currently obliged to comply with the Alcan/Pechiney (II) decision's commitment to license its alumina refining technology until [...]. For the sake of clarity, it should however be noted that the commitments offered by Alcan in Alcan/Pechiney (II) are automatically carried over and that Rio Tinto will have to comply with these commitments. Consequently, the concern expressed by one respondent that the new entity could immediately change its policy is not grounded as the commitment of the Alcan/Pechiney (II) decision will still be in force and be monitored by the appointed trustee. As regards the period after expiry of that commitment, the likely inability of Alcan, pre-merger, to derive significant strategic advantages in the downstream market for alumina production from a refusal to license or from restrictive licensing terms also suggests that it would have had an incentive to license and that this incentive will not be altered by the greater strength of the merged entity on that downstream market arising from horizontal overlaps with Rio Tinto.

84. In view of the above, input foreclosure that would result in a weakening of the competition on the market for the production of alumina appears unlikely.

2. Smelter cell technology

85. In the Alcan/Pechiney (II) decision’ the Commission defined the market for the licensing of smelter cell technology. Smelter cell technologies are used to transform alumina into aluminium[18].

86. The transformation of smelter grade alumina to aluminium is done by electrolysis: electric current flows from a power generation system through (pre-baked) anodes, a bath of (liquid) alumina, cathodes, and finally goes back to the power generator. With this process, alumina is reduced into aluminium and a layer of aluminium accumulates onto the cathodes situated below the alumina bath (see figure below).

87. One of the crucial factors of differentiation among the available technologies is the intensity of the electrical current they can use. The higher the current, the more efficient and productive the smelter is. However, a higher intensity (or amperage) also creates a stronger magnetic field and therefore magnetic force, which tends to destabilize the overall system. Thus, one of the challenges faced by the industry is to be able to use higher intensity without damaging the smelter cells[19].

88. Some aluminium producers market their technology used to reduce alumina and many market players choose to use the technology of a third party for their production, even if some of them also have their own technology. As a result, as the notifying party submits, there is an open market for the licensing of smelter cell technology.

89. The notifying party explains that the product market includes the following package: patents, and know-how (technical information, including the potlines and potline services, operating procedures and choice of materials) and smelter process; engineering package (flow sheets, specifications, drawings and operating procedures; a nonexclusive, non-transferable licence to construct the smelter and operate the technology to produce aluminium. In particular, the product market does not include the provision of equipment used to build or operate the smelter.

90. It should also be noted that, consistent with the Commission's practice, "in-house production" (that is, the use of internal smelter cell technology) is not considered as part of the open market. It is however taken into account in the competitive assessment.

91. Finally, as regards the geographic scope of the market, the notifying party explains that it is worldwide. This was also the analysis in the Alcan/Pechiney (II) decision. However, it cannot be excluded that at least China could be seen as a different geographic market. Indeed, Alcan, which has a [70-80]% market share outside of China, [has not licensed its technology to Chinese producers]. As a result, it is doubtful that competition conditions in China and outside of China are homogeneous. However, since Chinese producers have used so far their own technology, the geographic market definition has no bearing on the competitive assessment on the merchant market.

Assessment

92. Alcan, with its so-called AP smelter cell technology, has approximately a [70-80]% market share on the licensed smelter projects implemented from 1995 to 2006 both relative to the total number of licensed projects as well as to the total capacity added using a licensed technology. While Rio Tinto does not market its own technology, it produces aluminium and thus, the markets for the licensing of smelter cell technology and aluminium production are affected.

93. In Alcan/Pechiney (II), the Commission considered that the vertical link created by the transaction (Pechiney being a supplier of smelter cell technology to other producers of aluminium) raised serious doubts. The argument of the Commission rested on the fact that, despite the low share of production of the parties in the production of aluminium ([5-10]% for Alcan, [0-5]% for Pechiney), the tripling of Pechiney's customer base was significant enough to give an incentive to the new entity to use Pechiney's dominant position on the market for the licensing of smelter cell technology ([75-85]% market share) and to stop the licensing of Pechiney's supply of smelter cell technology in the hope that the resulting cost increase would elicit an increase in aluminium prices and also curb the investment capacity of competitors. As a result, Alcan committed to license Pechiney's smelter cell technology until [...] (the decision was adopted in September 2003 and Pechiney committed to license its technology for [...] years).

94. For the period going until [...], it should be noted that the new entity will have to comply with the Alcan/Pechiney (II) decision and must license the AP technology. The new entity has therefore no ability to foreclose until [...].

95. For the period starting from [...], the question whether the new merged entity will have the ability and the incentive to foreclose its competitors on the downstream aluminium market through a refusal to license, is not likely to be affected by the envisaged concentration.

96. The proposed concentration does not change in itself the assessment that was performed in the Alcan/Pechiney (II) merger. In fact, the overlap of market shares in the aluminium market being very limited (with only [0-5]% of additional smelting capacity coming from Rio Tinto), it seems highly unlikely that the proposed concentration will substantially change the ability and incentive for Alcan to foreclose the downstream market through a refusal to licence its technology.

97. In view of the above, no competition concerns with respect to input foreclosure which could be causally linked to the proposed concentration are likely to arise in this case.

98. In view of the above, risks of input foreclosure as a result of the proposed concentration appear limited.

3. Anode baking furnace technology

99. Operators of aluminium smelters which use pre-baked anodes technology require prebaked carbon anodes. According to the parties, while the major smelter operators have developed their own anode baking technology in-house, a number of them and other companies licence their anode technology to third parties.

100. There are two anode baking furnace designs: open and closed furnace. In Alcan/Pechiney (II), the Commission left open the question of whether the two designs might have constituted separate markets. As for the parties, they consider that competition exists between the two designs and thus, that they should be part of the same market. It does not however appear to be a question with bearing on the competitive assessment.

101. The notifying party explains that this market is worldwide, which is in line with the Alcan/Pechiney decision.

Assessment

102. Only Alcan is active on this market.

103. The notifying party has not provided market shares but Alcan is one of the major providers of anode baking furnace technologies and one respondent indicated that it believed that Alcan could roughly have a [45-55]% market share, if one considers the projects of the last five years.

104. Thus, the Commission investigated whether the new entity would have the ability and the incentive to foreclose competitors with the provision of anode furnace technology.

105. However, no respondents to the market investigation active in aluminium production expressed specific concerns, and one major producer explained that "during [their] latest evaluation of market technologies, [they] reviewed three technical solutions being licensed"[20]. Riedhammer (which acquired Alcan's anode baking furnace designs in compliance with the commitments of the Alcan/Pechiney (II) case) is reported to be one of the companies marketing actively its technology. Finally, the sales on this market appear to be sporadic (Alcan's sales were limited to [<2] million EUR in 2006). Consequently, input foreclosure as a result of the proposed concentration can be excluded.

106. One respondent explained that the proposed concentration would reduce the number of potential customers of anode furnace technology given that Rio Tinto currently outsources this technology. However, this respondent did not explain how this could result in customer foreclosure and therefore in could result in a significant impediment to competition on the market for aluminium production. This is consistent with the lack of specific concerns expressed by aluminium producers in the market investigation and customer foreclosure as a result of the proposed concentration can be excluded.

107. In view of the above, risks of input or customer foreclosure as a result of the proposed concentration appear limited.

4. Pot tending assemblies

108. Pot tending assemblies (PTAs) are required for all smelters using pre-baked anode technology. The PTA handles all materials in and out of the pot, siphons aluminium from the pot each day, removes spent carbon anodes from the pot, cleans the cavity left behind when the anode is removed, adds a new anode to the pot and bolts it in place to achieve good electrical contact, distributes crushed bath on the anode to protect it from oxidation, and plays an important role in anode beam raising. A wide range of PTAs appear to exist with differing levels of automation and quality, and they are adapted to the smelter cell technology they are used with. Thus, the market is differentiated.

109. Chinese players seem to have only marketed their PTAs in China. However, the question whether the market is worldwide with or without China can be left as it does not change the conclusions of the assessment on the impact of the proposed concentration.

Assessment

110. On the market for the supply of PTAs, Alcan has a [40-50]% world-wide for the period 2001 to 2006 (Rio Tinto makes no sales)[21]. According to the parties, Alcan manufactures technologically advanced PTAs developed for AP technology, together with PTAs for use with other technologies. The other established player on the market is NKM Noell ([25-35]% worldwide market share with China)[22]. Chinese players (Shenyang, Zhuzhou) appear to be able to market their PTAs only in China.

111. In view of Alcan’s market position on the market for the supply of PTAs, the supply of pot tending assemblies and the production of aluminium are vertically affected. However, the incentives to continue the current marketing of Alcan's PTAs appear unchanged as a result of the proposed concentration given that the overlap of market shares on the downstream market for the production of aluminium is very limited ([0- 5]% coming from Rio Tinto[23]). Accordingly, no specific concerns relating to the access to PTAs were expressed in the course of the market investigation[24]. Consequently, input foreclosure effects which could be causally linked to the proposed concentration can be excluded.

112. [...]

113. [...]

114. [...]

115. In view of the above, no competition concerns with respect to input foreclosure as a result of the proposed concentration arise in this case.

5. Conclusion on technology and equipment

116. In light of the foregoing, the Commission is of the view that foreclosure effects resulting from the proposed concentration are limited and thus competition concerns as a result of the proposed concentration can be excluded.

V. CONCLUSION

117. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(l)(b) of Council Regulation (EC) No 139/2004.

1 OIL 24, 29.1.2004 p. 1.

2 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Notice on the calculation of turnover (OJ C66, 2.3.1998, p25).

3 Case IV/ M. 470 - Gencor/Shell and M. 4441 - EN+/Glencore/Sual/UC Rusal .

4 Case M.1693 Alcoa/Reynolds

5 Case M.4441 EN+/Glencore/Sual/UC Rusal

6 Commonwealth of Independent States (CIS), consisting of eleven former Soviet Republics: Armenia,

Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Ukraine, and

Uzbekistan.

7 Cases M.1693 Alcoa/Reynolds and M.4441 EN+/Glencore/Sual/UC Rusal.

8 EN+/Glencore/Sual/UC Rusal.

9 Case IV/ M. 470 - Gencor/Shell and M. 4441 - EN+/Glencore/Sual/UC Rusal. Case M. 1693 - Alcoa/Reynolds Case M.4441 - EN+/Glencore/Sual/U C Rusal Cases M. 1693 - Alcoa/Reynolds and M.4441 - EN+/Glencore/Sual/UC Rusal.

10 According to the James F King Report of 2007, around 55% of the total EEA demand for primary aluminium (6,700 KT) was met by imports (3,600 KT).

11 See inter alia Case M.3225 - ALCAN / PECHINEY

12 Case M.3225 - ALCAN / PECHINEY

13 Case M.3225 - ALCAN / PECHINEY .

14 Case M.3225 - ALCAN / PECHINEY

15 In particular Alcan has a 12% interest in the Trombetas mine in Brazil (which is currently mined) and a 0.9% interest in the mine of Los Piguaos in Venzuela

16 No industry statistics are available at EEA level.

17 These market share data refer to s global market.

18 Gibbsitic bauxites; boehmetic bauxites; diasporic bauxites.

19 M.3225 Alcan/Pechiney (II)

20 This number decreases to [35-45]% by excluding China and Russia.

21 As claimed by Alcan

22 So-called alumina (AfOs) reduction to aluminium (Al)

23 There are other constraints arising from higher amperages such as higher operating temperatures, and enviromnental issues arising from increased emissions.

24 Response to the question 37 of the questionnaire to third parties

25 Figures submitted by Alcan in response to the Commission's question of 14 September 2007.

26 Ibid.

27 Combined market share: [5-15]%

28 See response of competitors to question 39 of the market investigation