EC, October 8, 2007, No M.4871

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

KPN/ GETRONICS

Dear Sir/Madam,

Subject: Case No COMP/M.4871 - KPN/ GETRONICS

Notification of 03/09/2007 pursuant to Article 4 of Council Regulation No 139/2004[1] [2]

1. On 03 September 2007, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC Merger Regulation) No 139/2004 by which the undertaking Koninklijke KPN N.V. ("KPN", The Netherlands), acquires within the meaning of Article 3(l)(b) of the Council Regulation control of the whole of the undertaking Getronics N.V. ("Getronics", The Netherlands) by way of purchase of shares.

1. THE PARTIES

2. KPN's main activities are the provision of fixed telephony and broadband internet access over its fixed telecommunication infrastructure in the Netherlands. KPN also provides mobile telephony to personal customers over its mobile networks in the Netherlands, Germany and Belgium. For business customers, KPN provides a range of services, from voice, internet and data services to fully-managed outsourced ICT (like contact centre solutions and customer relationship management) solutions.

3. Getronics is an international provider of ICT services. The company has direct presence in 25 countries although it is principally active in the Netherlands. The core business of Getronics can be divided into (i) workspace management services; (ii) application integration and management services; and (hi) consulting and transformation services.

II. THE OPERATION

4. On 29 July 2007 KPN and Getronics concluded a Merger Protocol, pursuant to which KPN announced on 30 July 2007 its public offer, in cash, on all the outstanding shares and bonds in the capital of Getronics2. The parties expect to close the transaction by mid October 2007. As a consequence KPN will acquire sole control over Getronics.

HI. COMMUNITY DIMENSION

5. The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 billion (KPN: EUR 12.057 billion; Getronics: EUR 2.629 billion). The aggregate Community-wide turnover of each of these two undertakings concerned is more than EUR 250 million (KPN: EUR [...] million; Getronics: EUR [...] million) for 2005. Neither KPN nor Getronics achieve more than two thirds of their Community wide turnover in any Member State. The notified transaction therefore has a Community dimension under Art 1(2) of the Merger Regulation.

IV. COMPETITIVE ASSESSMENT

Market definition

6. The proposed transaction principally relates to the provision of IT services in the Netherlands. The activities of the parties overlap notably in the development and integration services and IT management services. There is also a limited overlap of the activities of the parties in the supply of networking equipment for telecommunication infrastructure.

Relevant product market

7. In former decisions on the IT services sector, the Commission left open the exact delineation of the market[3]. Various market segmentations were analysed based on service categories ((i) hardware maintenance, (ii) software maintenance and support, (iii) consulting; (iv) development integration, (v) IT management services, (vi) business management services, and (vii) education and training ), or based on the possibility of sub-dividing the IT services market on an industry basis (such as financial services, transport manufacturing, government etc.), or based on the distinction between the supply of IT services to large corporations and to smaller organisations. However, for the purpose of these cases it was not necessary to adopt a definitive definition of the product market.

8. In the present case, the notifying parties submit that the exact market definition can be left open, as they consider that market shares, at any given market definition, are not deemed to give rise to a significant impediment of competition. However, for the sake of market analysis, the notifying parties submit that the market for IT services can be delineated along the following market segments ("Gartner market definition"): (i) Hardware maintenance & support; (ii) Software support; (iii) Consulting; (iv) Development & integration; (v) IT management; and (vi) Process management. All these market segments can in addition be further disaggregated (i.e. the segment (iv) Development and integration can be further subdivided into Application development, Developments, and Integration).

9. Within the market investigation, both customers and competitors have agreed that this market definition correctly reflects the market for IT services. However, several competitors also suggested that this market segmentation was not the only one to adequately qualify the market for IT services. For instance, several competitors suggested delineating the market along Infrastructure management, Application management, and End user management. Nevertheless, whatever the alternative market definition proposed, competitors and customers agreed that the most disaggregated levels of market segments as proposed by the notifying parties could all be included in a larger market segment under any alternative market definition. Therefore, examining the competitive situation at the most disaggregated level guarantees that the analysis will cover any alternative market definition.

10. The market investigation has also confirmed that some independent competitors focus on specific sub-market segments, and that some customers distinguish such segments when launching call for tenders. Nevertheless, the largest IT service providers (a.o. GapGemini, Atos Origin, IBM) propose all, or almost all, IT services to their customers.

11. For the sake of completeness, market information was in addition provided by the notifying parties along a second possible market segmentation on the basis of segmentation by platform ("Platform market definition": Desktop/client; Server/Host; Corporate premise equipment; Local Area Network "LAN"; Public Network; Wide Area Network "WAN").

12. However the exact product market definition may be left open, since in all alternative market definitions the operation does not raise competition concerns. The supply of networking equipment for telecommunication infrastructure can be considered as a separate product market.

Relevant geographic market

13. In former decisions on the IT services market, the Commission left open the exact geographic definition of the market[4]. The Commission noted the continuing internationalisation of IT services, however also noting that customers continue to value the supplier’s ability to provide products and services tailored to local cultural, language and business particularities.

14. These conclusions have been confirmed within the market investigation. In addition both customers and competitors have pointed out that the market for IT services presents the characteristics of both EEA and national markets. A number of local competitors have principally developed a national presence and limit their offers to customers in one country, whereas the largest competitors are international firms often proposing contracts to their customers covering locations in different countries[5]. All customers have also indicated that they require a strong local presence for some IT services when interactions with staff is frequent, whereas they easily accept that their IT service provider locate their helpdesk in other countries for other IT services.

15. More generally, the possibility of national market for the Netherlands cannot be excluded in this case. However the exact geographic market definition may be left open, since in all alternative market definitions the operation does not raise competition concerns.

Competitive assessment

16. KPN is the Dutch incumbent telecommunication operator and as such operates the fixed telecommunication infrastructure in the Netherlands. KPN also provides mobile communication to its customers in several countries. Getronics is not active in these sectors.

17. KPN and Getronics both provide IT services in the Netherlands. Only Getronics provides IT services outside of the Netherlands. Therefore the two undertakings have overlapping activities in the IT services in the Netherlands only.

18. Along a market including all IT services, the market shares of the newly formed entity would not raise any competition concern, whatever the geographic market definition. The competitive analysis will therefore be conducted at the level of the Gartner market definition and the Platform market definition.

| IT Services market - EEA | IT Services market - The Netherlands | ||

Name | Value in M€ | % | Value in M€ | % |

Getronics | [...] | [0-10] | [...] | [0-10] |

KPN | [...] | [0-10] | [...] | [0-10] |

KPN/Get ronics | [...] | [0-10] | [...] | [10-20] |

Source: Notifying parties |

Competitive assessment under the Gartner market definition

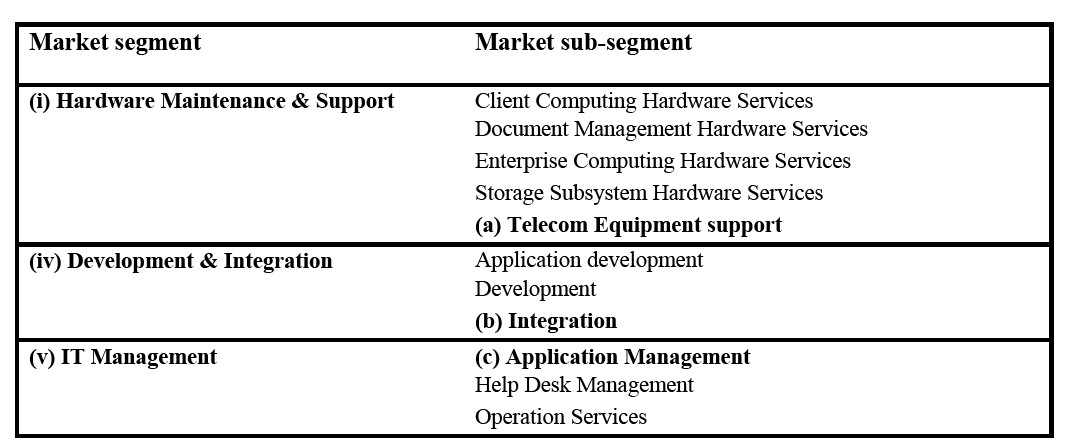

19. Getronics is active in all of the market segments mentioned under the Gartner market definition, with the exception of "Process Management". The parties submit that KPN is only active in several sub-segments of the above mentioned segments, namely:

(a) Telecom Equipment Support (in Hardware maintenance & support)

(b) Integration (in Development & integration)

(c) Application Management (in IT Management)

20. For the sake of completeness the parties have proposed the following definition for the markets and sub-markets for IT services along the Gartner market definition (the table only includes markets where KPN and Getronics overlap):

(For instance only Getronics is active in the "Client Computing Hardware Services" sub-segment)

21. The notifying parties submit that market shares of the parties at the level of market segment are below [10-20]% and as such the concentration will not give rise to a significant impediment of effective competition. In addition the increase of market share in the IT management segment is inferior to [<5]%.

| (i) Hardware Maintenance & Support | (iv) Development & Integration | (v) IT Management | |||

Name | Value in M€ | % | Value in M€ | % | Value in M€ | % |

Getronics | [...] | [0-10] | [...] | [0-10] | [...] | [10-20] |

KPN | [...] | [0-10] | [...] | [0-10] | [...] | [0-10] |

KPN/Getronics | [...] | [10-20] | [...] | [10-20] | [...] | [20-30] |

Source: Notifying parties |

22. To fully capture the competitive situation, the Commission asked the notifying parties to provide their best estimates of market shares at the level of the 3 market sub-segments where both KPN and Getronics are present. In the (iv)-(b) Integration and (v)-(c) Application management sub-segments, the market shares are as high as [40-50]% and [30- 40]%. However the notifying parties submit that KPN and Getronics are not close competitors in these two areas as illustrated by the limited increment due to the concentration. In addition, the notifying parties submit that competition is intense in the market for IT services as a whole and that any attempt to increase prices by the merged entity KPN/Getronics in any of these sub-segments would immediately be used as an opportunity from competitors to better penetrate these sub-segments.

| (i) -(a) Telecom Equipment support[6] | (iv) - (b) Integration | (v) - (c) Application Management | |||

Name | Value in M€ | % | Value in M€ | % | Value in M€ | % |

Getronics | [...] | [0-10] | [...] | [0-10] | [...] | [20-30] |

KPN | [...] | [10-20] | [...] | [30-40] | [...] | [0-10] |

KPN/Getronics | [...] | [10-20] | [...] | [40-50] | [...] | [30-40] |

Source: Notifying parties |

23. Several large competitors (like Atos Origin, IBM, CapGemini) are notably active in all market segments. These competitors are especially well represented in the market segments (iv) Development & integration and (v) IT management where they each have market shares around 10%. Although in these segments KPN/Getronics will be the clear leader, these large competitors constitute credible alternatives for customers and guarantee a strong level of competition. They could especially immediately react to any attempt by the merged entity KPN/Getronics to increase prices in the sub-segments (iv)-(b) Integration and (v)-(c) Application management.

24. The market investigation has indeed confirmed that there is a sufficient level of competition in the market for IT services and that all large competitors have activities in all segments and sub-segments. A large majority of customers and competitors has reported that they do not fear any increase of market power of the merged entity KPN/Getronics. Customers notably submit that IT services are generally contracted for a fixed period (generally four or five years) during which price increase is capped by contractual provisions. When contracts are renewed, the market investigation has confirmed that competition among IT service providers is strong, and will remain so post-merger. According to the market investigation, switching costs, although these are not completely negligible if a new IT service provider is selected, do not constitute a limitation to the fluidity of this market.

25. It is therefore assumed that under the Gartner market definition, the concentration does not give rise to any significant impediment of effective competition.

Competitive assessment under the Platform market definition

26. Under the Platform market definition, both KPN and Getronics are active in all different sub-markets. However in no market under this definition, the merged entity KPN/Getronics would reach a market share higher than 25% (Desktop/client: [20-30]%; Server/Host: [10- 20]%; Corporate premise equipment: [0-10]%; LAN: [10-20]%; Public Network: [10- 20]%; WAN: [10-20]%). As highlighted in the competitive analysis under the Gartner market definition above, there is sufficient competition in the market for IT services. No competition concern was raised during the market investigation. It can therefore be assumed that the concentration does not give rise to any significant impediment of effective competition under the Platform market definition.

Vertical integration

27. Some customers purchase integrated IT solutions, notably including WAN, allowing IT systems to be operated simultaneously in different geographical locations. In order to offer such a service, an IT service provider must generally purchase communication capacity from a telecommunication company, generally under the form of a leased line between locations to be connected. Against this background, a vertical relationship between IT Services providers such as Getronics and telecommunication providers such as KPN exists in the market for IT services. In addition, the notifying parties suggest that there exists a convergence trend among customers between the purchasing of IT services and the purchasing of telecommunication capacity.

28. One competitor has notably submitted that the merged entity KPN/Getronics will be in a position to use its incumbent position in the telecommunication area to sponsor its other IT services activities, therefore increasing price pressure for pure IT services competitors. However, all customers have confirmed that they purchase IT and telecommunication services separately, therefore limiting the foreclosure impact of a bundled offer from KPN/Getronics combining IT and telecommunication services. In addition, several customers spontaneously submitted that a number of competitors are currently developing bundled offers that could compete with KPN/Getronics offers.

29. Such vertical integration does not give rise to competition problems as sufficient alternatives exist to acquire telecommunication capacity in the Netherlands (telecommunication operators such as [...], cable operators, DSL operators). Getronics notably subcontracts [90-100]% of its WAN telecommunication related services to [...] and [0-10]% to KPN, clearly illustrating that KPN, although the incumbent telecommunication operator, would not have the ability to foreclose Getronics competitors willing to propose WAN related IT services.

30. More generally, competitors and customers have submitted that proposing bundled offers including IT and telecommunication services would be an advantage for KPN/Getronics, however not to such an extent as to give rise to a significant impediment of effective competition in the market for IT services.

Supply of networking equipment for telecommunication infrastructure

31. Getronics only has a marginal activity in the market for supply of networking equipment for telecommunication infrastructure (less than [<5]%, even at the narrowest market definition). The concentration therefore does not give rise to any significant impediment of effective competition on this market.

V. CONCLUSION

32. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(l)(b) of Council Regulation (EC) No 139/2004.

1 OIL 24, 29.1.2004 p. 1.

2 KPN has already acquired a shareholding in Getronics through a series of share purchases. KPN currently

owns up to 29,9% of the outstanding ordinary shares in Getronics.

3 COMP/M.3571 IBM/ Maerskdata / DMData; COMP/M. 3995 Belgacom/Telindus.

4 COMP/M.3571 IBM/ Maerskdata / DMData; COMP/M. 3995 Belgacom/Telindus.

5 For instance, one large customer submitted that 70% of its IT service contracts (in value) are signed with international IT service providers, and 30% are signed with local/national IT service providers.

6 For the sake of completeness, it should be noted that the sub-market "Telecom Equipment support" comprises two distinct categories of services, namely "Enterprise Equipment Services" and "Infrastructure". As neither KPN, nor Getronics are present in the "Infrastructure" area, the sub-market "Telecom Equipment support" in this table is limited to the "Enterprise Equipment Services" area.