Commission, June 11, 2015, No M.7529

EUROPEAN COMMISSION

Judgment

MOHAWK INDUSTRIES / INTERNATIONAL FLOORING SYSTEMS

Dear Sirs,

Subject: Case M.7529 – Mohawk Industries / International Flooring Systems Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 17 April 2015, the European Commission (‘Commission’) received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043 by which Mohawk Industries Inc. (‘Mohawk’, USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking International Flooring Systems S.A. (‘IFS’, Luxembourg) by way of purchase of shares. Mohawk is hereinafter designated as the ‘Notifying Party’ whereas Mohawk and IFS together are hereinafter designated as the ‘Parties’.

(2) The case was initially notified on 2 March 2015 but subsequently withdrawn on 24 March 2015.

(3) The Parties were informed at the appropriate stage of the procedure that it could not be excluded that the proposed transaction, as originally notified, might raise serious doubts as to its compatibility with the internal market in the potential small- sized MDF panels market in the 500-km catchment areas around the Parties' plants located in Belgium and Northern France. The Notifying Party subsequently submitted commitments on 19 May 2015 designed to eliminate the serious doubts identified by the Commission in accordance with Article 6(2) of the Merger Regulation. After further investigation, and for the reasons stated in Section 5.1.1, the Commission considers that no serious doubts arise on the market for small size MDF panels in the Benelux. The commitments submitted by the Notifying Party are therefore not necessary.

1. THE PARTIES

(4) Mohawk is a US-based publicly-listed company supplying a broad range of flooring products, including carpets, rugs, hardwood, laminate, ceramic tiles, stones and vinyl flooring. It is also active in the production and supply of insulation materials and wood-based panels, such as MDF. The company is active within the EEA mainly through its wholly-owned subsidiary Unilin BVBA (‘Unilin’) that has its production facilities mainly in or close to Belgium.

(5) IFS is a Luxembourg-based holding company of a group of companies active in the production and supply of vinyl flooring, laminate flooring and wood-based panels, in particular raw and coated MDF. IFS' operational headquarters are located in Belgium.

2. THE OPERATION AND THE CONCENTRATION

(6) According to the terms of the share purchase agreement of 13 January 2015, Mohawk will acquire all the issued and outstanding shares in IFS. Mohawk will therefore acquire sole control of IFS. Consequently, the proposed transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million4 (Mohawk EUR 5 533 million; IFS EUR 492 million. Each of them has a Union-wide turnover in excess of EUR 250 million (Mohawk EUR […] million; IFS EUR […] million), but they do not achieve more than two-thirds of their aggregate Union-wide turnover within one and the same Member State. The notified operation therefore has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

4.1. General

(8) The Parties’ activities overlap with respect to (i) fibre boards (MDF/HDF and coated MDF), (ii) flooring materials (laminate flooring and vinyl flooring) and (iii) locking technologies employed in flooring materials.

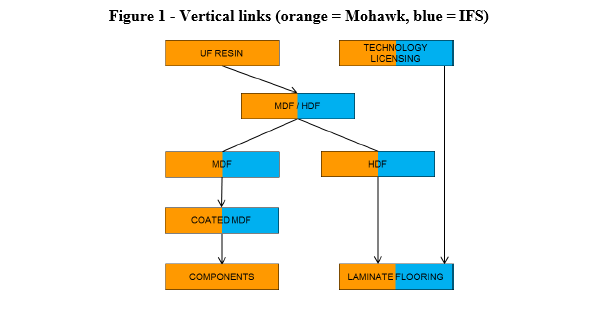

(9) There are vertical links between (i) Mohawk’s UF resins business and the Parties’ fibre board (MDF/HDF) businesses, (ii) the Parties’ raw MDF businesses and their coated MDF businesses, (iii) the Parties’ coated MDF businesses and Mohawk’s components business, (iv) the Parties’ HDF businesses and the Parties’ laminate flooring businesses, and (v) the Parties’ locking technologies businesses and their flooring material businesses. The vertical links are illustrated in Figure 1.

Figure 1 - Vertical links (orange = Mohawk, blue = IFS)

(10) As the proposed transaction does not give rise to horizontally or vertically affected markets concerning components, they are not discussed further in this decision.

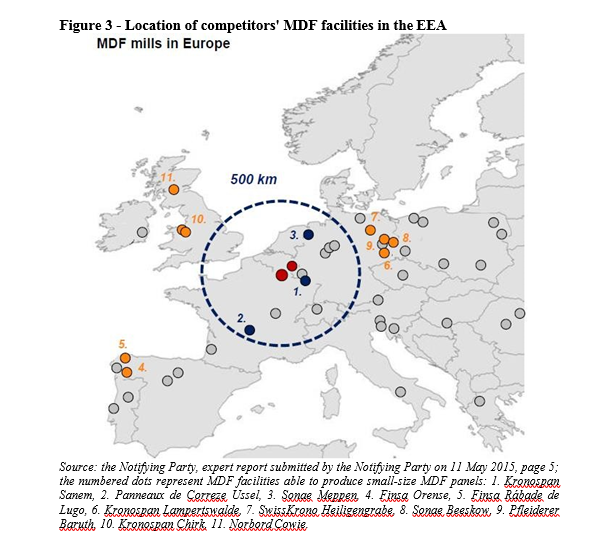

(11) Moreover, only the vertical links between (i) UF resins and fibre boards (MDF/HDF), (ii) (raw) fibre boards and coated MDF and (iii) locking technologies and flooring products give rise to vertically affected markets. Consequently, only those vertical links are discussed in this decision.

4.2. Relevant product markets

4.2.1. UF Resins

(12) UF resins (urea-formaldehyde resins) are used as glue in the panel industry in the production of, for instance fibre boards (MDF/HDF). They also have usages outside the panel industry, including, for example, in textiles and paper. In previous decisions, the Commission has found that UF resins constitute a separate relevant product market, distinct from PF resins (phenol-formaldehyde resins).5 The question of whether the market should be further sub-segmented based on the end- usage of the product has been left open.6

(13) As the proposed transaction does not give rise to competition concerns related to UF resins under the alternative market definitions, it is not necessary to conclude on the exact product market definition concerning UF resins.

4.2.2. Fibre boards (MDF/HDF) MDF and HDF

(14) MDF (Medium Density Fibreboard) and HDF (High Density Fibreboard) are engineered wood products made from compressed wood fibres. MDF and HDF differ in the density of the product, expressed as the ratio between the mass and volume of the product (kg/m3).

(15) Based on indications of existing supply side substitutability, the Commission has previously considered that MDF and HDF could belong to the same relevant product market. However, the product market definition has been ultimately left open.7 The Commission has in previous decision not referred to any specific density threshold to distinguish between MDF and HDF.

(16) The Notifying Party submits that MDF and HDF belong to the same relevant product market as they can be produced on the same production lines and on the basis of the same production process. According to the Notifying Party, the difference between MDF and HDF is usually drawn at the density of 800 kg/m3.

(17) The vast majority of the respondents to the market investigation have confirmed that MDF and HDF only differ in terms of their density. A clear majority considers that the density threshold between MDF and HDF lies within the range of 700–800 kg/m3. Some market participants also referred to certain differences in the surface quality of MDF and HDF.8

(18) Demand-side substitutability between MDF and HDF appears quite limited in light of the replies to the market investigation. Market participants explained that certain applications call for the use of either MDF or HDF due to their weight and density characteristics. Market participants explained that typical applications for HDF include for example flooring products which cannot be made with MDF while typical applications for MDF are the production of furniture and wall panels.9 Moreover, market participants pointed to the fact that HDF is only available up to a certain thickness and that the price differential between the products is so high that an increase of 5–10% of the price of the cheaper product, which is MDF, would not make them switch to HDF.10

(19) In contrast, a degree of supply-side substitutability between MDF and HDF was largely confirmed during the market investigation. The vast majority of the respondents confirmed that MDF and HDF suppliers are usually the same. Even if some suppliers concentrate more on the production of either of the products, the results of the market investigation confirm that MDF and HDF can usually be produced on the same production lines.11 One competitor though noted that if a production line is only specified to make the lower-density MDF, it cannot make HDF even if the opposite was possible.12

Different sizes of MDF

(20) During the market investigation, the Commission’s attention was drawn to a possible differentiation in the market for MDF according to the size of the panels.13

(21) Certain Benelux customers appear to require smaller MDF panels than, e.g. their German or French counterparts. Those sizes, 1220 mm in width, are originally based on foot-measurements (1200 mm equals roughly 4 feet) and are also used in the UK, Ireland and Scandinavia. Other European customers require larger sizes based on the metric measurement system (usually 2070 mm width). In this regard, some market participants from the Benelux have also explained that the market can be roughly divided into (i) large industrial customers that demand or at least are able to use the larger MDF sizes, and (ii) smaller customers in the ‘trading market’ (such as carpenters and do-it-yourself shops) that require the smaller MDF sizes.14

(22) The Notifying Party submits that small and large MDF panels belong to the same product market, in particular because of supply-side substitutability. According to the Notifying Party, there are MDF lines that can produce economically both small and large formats. The smaller-sized MDF panels can be produced economically on fibre board lines that have at least a press width of 2440 mm as that enables an efficient production set-up. The board coming out from the press with a width of 2440 mm can subsequently be sawed into two to achieve the desired product width. According to the Notifying Party, there are more than fourty MDF production lines within the EEA. Eleven of them are able to produce small-sized MDF competitively, that is they have a press width of at least 2440 mm. The Notifying Party argues that switching between the larger and smaller sizes would be done easily and in a timely manner in those presses . The Notifying Party further submits that the unit price for the small and large-sized MDF panels is equal.

(23) Market participants contacted in the market investigation have explained that from a demand-side perspective, the end customers in the Benelux countries require specifically the small-sized panels not only because they are used to them but because (i) the small-sized panels are easier to handle, especially for a person working on his own, and (ii) the customers' facilities (such as machinery and storage) are tailored for small-sized panels. Customers would need to incur investment costs to be able to use the larger sizes. An MDF supplier has explained that over ten years it has tried to promote the larger-sized MDF in the Benelux without success. Therefore, demand-side substitutability appears very limited at least to the extent that a subset of customers are not able to switch to the larger sizes economically and in a timely manner.15

(24) In contrast, the results of the market investigation support the Notifying Party’s submission about a degree of supply-side substitutability due to the ease of switching production between the small-sized and large-sized panels on the same production lines.16 However, as explained by the Notifying Party, such switching appears to be limited to presses with a certain minimum width. In particular, a customer stated that a production line with a press width of 2070 mm will not be able to offer 1220 mm wide panels competitively.17 The results of the market investigation therefore confirm that there appears to be supply-side substitutability for a subset of MDF producers that operate presses of a certain minimum width but not for all MDF producers in the market. Notwithstanding the exact market definitions, the Commission will take into account the fact that switching is feasible for a subset of suppliers in its competitive assessment.

Conclusion

(25) As the proposed transaction does not give rise to competition concerns related to fibre boards under alternative market definitions, it is not necessary to conclude on the exact product market definition concerning fibre boards. The Commission is, in particular, not able to conclude definitively that all small and large-sized MDF panels fall into the same product market and will assess the potential market for small-sized MDF panels separately since the overlap between the Parties' activities is most pronounced on that potential sub-market.

4.2.3. Coated MDF

(26) Coated MDF is (raw) MDF that has been further refined through coating and is thus a higher value product compared to (raw) MDF. Coated MDF is used, for instance in furniture applications.

(27) Various different coating materials and techniques can be used in the production of coated MDF. The Notifying Party submits that such materials and techniques include (i) melamining; (ii) lacquering; (iii) paper foiling; (iv) laminating with HPL (high pressure laminate) or CPL (continuous pressure laminate); and (v) veneering. The Notifying Party submits that it is not necessary to segment the market according to the coating technique.

(28) The Commission has previously left open the question whether the market for MDF should be sub-segmented by coating technique.18As the proposed transaction does not give rise to competition concerns related to coated MDF under the alternative market definitions, it is not necessary to conclude on the exact product market definition concerning coated MDF.

4.2.4. Laminate flooring

(29) Laminate flooring is a type of flooring that traditionally consists of a multiple layer product combining a dense fibreboard core (generally HDF) with a melamine- impregnated paper pattern, a plastic-like wear layer and a melamine under layer. Installed laminate floors typically ‘float’ over the sub-floor on top of a foam or film underlayment, which provides inter alia sound-reducing properties.

Laminate flooring and flooring made from other materials

(30) While the Commission has in an earlier case considered that laminate and wooden flooring could belong to the same relevant market19, in a later case it has considered that they likely belong to different markets even if the question has been left open.20

(31) The Notifying Party argues that laminate flooring constitutes a product market separate from wooden flooring.

(32) The results of the market investigation support the Notifying Party’s argument of laminate flooring being a distinct product market. Even if many respondents explained that laminate flooring is technically substitutable with other materials in all or most applications, many customers also explained that switching was not commercially possible due to, e.g. end-customers’ preferences and the higher prices of alternative flooring materials.21 There is also no or very limited supply- side substitutability because of different production processes and machinery required for the production of different flooring materials.22

(33) The Parties’ internal documents also indicate that […].23 That supports the finding that at least laminate flooring and vinyl flooring belong to different product markets in the EU.

Laminate flooring for residential and for commercial use

(34) The Commission has in an earlier case also suggested that flooring materials for private and commercial use might constitute separate markets.24

(35) The Notifying Party submits that approximately 90% of laminate flooring is sold to residential customers but that differentiation between residential and commercial use is not necessarily instructive because the same products may, at least to certain extent, be used in both applications and because laminate flooring sold through one channel (residential / commercial) might end up being used in the other end-use.

(36) The Commission's market investigation in this case indicates that there is a high level of supply-side substitutability between laminate flooring for commercial and private end-use,25 which would support the finding of a single market encompassing both of those end-uses. However, market participants have also indicated in the market investigation that the technical requirements of products for private and commercial end-use are different and some respondents indicated that this is reflected in the prices.26 Some suppliers seem to concentrate on either of the product types and some suppliers also commented in the market investigation that, despite the technical ability to switch production, they cannot switch immediately between those two types of laminate flooring because the sales channels for commercial and private customers are different.27

Conclusion

(37) As the proposed transaction does not give rise to competition concerns related to laminate flooring under any alternative market definition, it is not necessary to conclude on the exact product market definition concerning laminate flooring.

4.2.5. Vinyl flooring

(38) Vinyl flooring is made from polyvinyl chloride (‘PVC’), and it can come in different formats, such as sheet vinyl or luxury vinyl tiles.

Vinyl flooring and flooring made from other materials

(39) While leaving the exact market definition open, the Commission has previously identified vinyl flooring as one main type of flooring.28

(40) The Notifying Party submits that vinyl flooring constitutes a distinct relevant product market.

(41) The results of the market investigation support the Notifying Party’s submission that vinyl flooring constitutes a market separate from other flooring materials. Even if the majority of respondents explained that vinyl flooring is technically substitutable with other materials in all or most applications, and some customers could consider switching if faced with price increases, many customers also explained that switching was not commercially possible due to, e.g. end-customers’ demands and properties of the product.29 There is also no or very limited supply- side substitutability because of different production processes and machinery required for the production of different flooring materials.30

Sheet vinyl and luxury vinyl tiles ('LVT')

(42) Unlike sheet vinyl, which is sold in sheets, LVT is sold in modular shapes such as squares and rectangles. The Notifying Party explains that while LVT has been in the market since the 1990s, it has recently become more popular and easier to install due to technical improvements in the product. The Notifying Party estimates that LVT is three times more expensive than sheet vinyl.

(43) According to the Notifying Party, it is not necessary, however, to further segment the market into sheet vinyl and LVT. Noting that the Parties' activities only overlap in LVT, it has nonetheless provided market information separately for LVT.

(44) The results of the market investigation do not support the Notifying Party’s submission that sheet vinyl and LVT belong to the same relevant product market. Even if many market participants generally agreed that LVT and sheet vinyl could be used for the same purposes, many customers were not willing to switch between the two.31 There is also no or only limited supply-side substitutability because different production process and machinery is required to produce the two products.32

Vinyl flooring for residential and for commercial use

(45) As regards a potential division between residential and commercial end use, the results of the market investigation were largely similar to those for laminate flooring explained in paragraph (36) although some suppliers explained that supply-side substitutability might be less easy than with laminate flooring.33

Conclusion

(46) As the proposed transaction does not give rise to competition concerns related to vinyl flooring under the alternative market definitions, it is not necessary to conclude on the exact product market definition concerning vinyl flooring.

4.2.6. Locking technologies

(47) Flooring panels, such as laminate or LVT panels, must be connected to each other during the installation process to create a uniform surface of a desired size and shape. That connecting has historically involved gluing the panels together. However, glueless solutions have evolved over time as they provide for easier and faster installation that can be done both by professionals as well as by consumers themselves.

(48) There are a number of different glueless solutions and their variations, many of them patented. The technologies can roughly be divided into two categories: traditional clicking technologies and fold-down technologies.

(49) Traditional clicking technologies are generally based on a special shape of the edge of a flooring panel. According to the Notifying Party, they can further be categorised into angle-angle and angle-snap technologies:

· Angle-angle: panels are angled on both the short and the long side. That means that the floor cannot be installed panel by panel but that it is necessary to lift the previous panel to angle the next panel in.

· Angle-snap: this is a variation of the angle-angle method and requires the panels to be angled on the long-side but to be connected on the short side by shifting and tapping the panel horizontally into the short side of the other panel.

(50) Fold-down technologies allow the flooring panels to be folded vertically together on the short edges. Combined with an angling technology on the long edges of the panel, the vertical locking allows for easier and faster installation that also makes installation on a panel-by-panel basis possible. Fold-down can be achieved with an additional plastic clip inserted in the short edge of a panel during the production process or without such a strip.

(51) According to the Notifying Party, the traditional clicking technologies and the fold- down technologies belong to distinct relevant product markets. In the licensing of such technologies to third parties, the Parties’ activities only overlap with respect to the fold-down technologies where Mohawk (Unilin) is present with its […]* technology while IFS is present with its PressXpress (‘PXP’) technology.

(52) The results of the market investigation have confirmed that glueless locking technologies have taken over the market in some flooring products, such as laminate flooring, and particularly in sales to consumers.34

(53) As to the distinction between traditional clicking and fold-down technologies within glueless technologies, market participants have indicated that the two are substitutable in most applications but that flooring panels employing a fold-down technology are easier and faster to install.35 Nonetheless, while traditional clicking can be used on all edges of a flooring panel, fold-down is typically only used on the short edges of a panel as it would not work optimally in rectangular flooring panels if used on all edges.36 The use of a fold-down technology therefore typically necessitates the use of other types of locking technologies on the same panel as well.

(54) A clear majority of market participants indicated that an extra licence fee is payable by a flooring product manufacturer for the use of fold-down technologies as compared to a flooring product solely employing the traditional clicking technologies.37 Production of flooring panels employing fold-down technologies also typically requires some investment in production technology, particularly if the fold-down technology employed requires the use of a plastic insert in the flooring panel as specific machinery is then needed for placing the inserts into the panels.38

(55) A majority of flooring manufacturer respondents confirmed that they not only can but would consider switching between the technologies if warranted by market conditions such as price increases of products employing one of the technologies.39

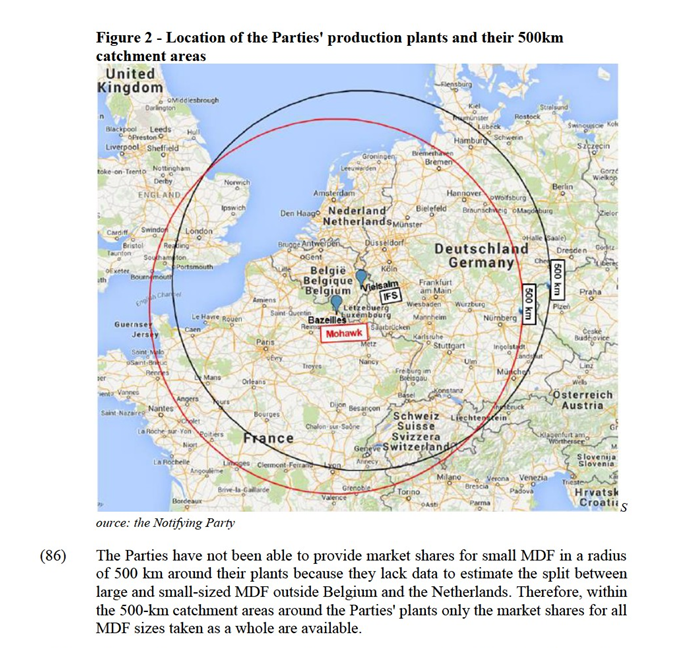

(56) As the proposed transaction does not give rise to competition concerns related to locking technologies under any alternative market definition, it is not, however, necessary to conclude on the exact product market definition concerning locking technologies.

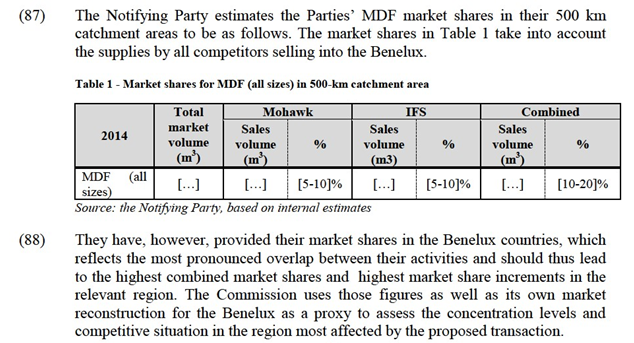

4.3. Relevant geographic markets

4.3.1. UF Resins

(57) In a recent case, which concerned essentially Belgium, the Commission considered that the relevant geographic market for UF resins was cross-border regional, although it left the question ultimately open.40 In an earlier case, the Commission discussed whether the market was national or wider and, noting that UF resins may bbe transported 400–700 km, concluded that Finland was a separate geographic market even if customers in central Europe could source from across borders.41

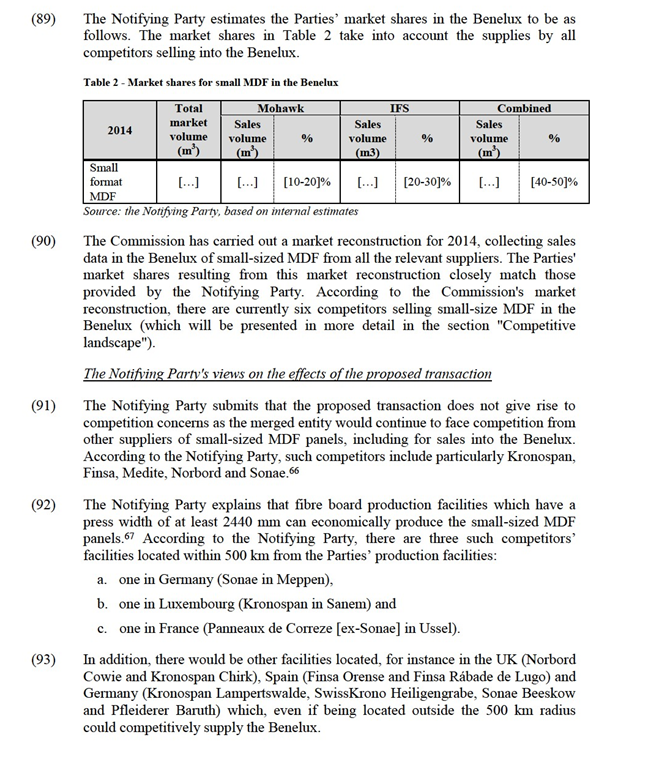

(58) The Notifying Party submits that the relevant geographic market for UF resins is wider than national.

(59) The results of the market investigation support the Notifying Party’s submission in the present case.42

(60) As the proposed transaction does not give rise to competition concerns related to UF resins under the alternative market definitions, it is not necessary to conclude on the exact geographic market definition concerning UF resins.

4.3.2. Fibre boards (MDF/HDF)

(61) The Commission has consistently considered that the relevant geographic market for fibre boards is likely wider than national even if the exact market definition has been left open,43 including in a recent case concerning essentially Belgium44. The Commission has further noted that fibre boards may travel between 500-1000 km.45

(62) The Notifying Party submits that the relevant geographic market for fibre boards is a region between 500–1000 km around the Parties’ production facilities. The Notifying Party further submits that there are no barriers to imports into the various EEA countries and that there are significant cross-border trade flows, some EEA countries also being without a domestic producer and thus relying fully on imports.

(63) The vast majority of the market respondents confirmed that there are no legal barriers to cross-border trade of fibre boards within the EEA, nor legal or commercial barriers to imports to the Benelux countries from other countries of the EEA. This is also supported by the fact that all of the Parties' competitors in the supply of fibre boards (such as Sonae, Norbord, Medite and Finsa) do not have production facilities in the Benelux and have reached a substantial market share in the Benelux through exports from for instance Germany, the UK, Ireland and Spain. In addition, many customers responded that they do not even require their supplier to have sales staff, let alone a production facility, in their own country.46

(64) The delivery distances are dependent on the means of transport with road transport constituting a more expensive means of transport per km than transport by vessel. Nevertheless, according to the respondents to the market investigation, fibre boards would travel a distance of at least 500 km from the production plant. Some market participants even suggested longer sourcing distances.47

(65) On the basis of the Commission precedents and the results of the market investigation, the Commission concludes for the purposes of this decision that the relevant geographic market for fibre boards (MDF/HDF) is larger than national and could be considered as the circular catchment areas drawn with a radius of at least 500 km around the Parties’ production facilities in Vielsalm (Belgium) and Bazeilles (France). As the proposed transaction does not raise competition concerns in the 500-km catchment area, where the overlap between the Parties' activities is most pronounced, it is not necessary for the purposes of the present decision to conclude on the exact geographic market definition concerning MDF/HDF.

4.3.3. Coated MDF

(66) The Commission has in a recent case found indications that the geographic market for coated MDF was at least cross-border regional with a range of 500 km around the relevant production plants.48 In a previous decision, the Commission has considered that the market may even be wider and – in that specific case – cover at least Central Europe.49

(67) The Notifying Party submits that the relevant geographic market for coated MDF concerns a radius of at least 1000 km around the Parties’ production plants.

(68) The results of the market investigation have also confirmed that coated MDF can be sourced and sold across borders up to a distance of at least 500 km. Some market participants even suggested longer sourcing distances.50 While one customer indicated that they require the supplier to have a production facility in their own country, the same customer nonetheless replied that they can source coated MDF across borders.51

(69) The Commission concludes that the relevant geographic market for coated MDF is cross-border regional with a radius of at least 500 km around the relevant production facilities. As the proposed transaction does not raise competition concerns in this area where the overlap between the Parties' activities is most pronounced, it is not necessary for the purposes of this decision to conclude on the exact geographic market definition concerning coated MDF.

4.3.4. Laminate flooring

(70) The Commission has previously considered that the relevant geographic market for laminate flooring is likely EEA-wide but has left the question ultimately open.52

(71) The Notifying Party submits that the relevant geographic market for laminate flooring is EEA-wide. The Notifying Party further notes that the Parties only have one EEA production facility each for laminate flooring and that they supply the whole of the EEA from those facilities.

(72) The results of the market investigation support the Notifying Party’s submission that the relevant geographic market for laminate flooring is EEA-wide. In particular, a clear majority of both customers and competitors considered that laminate flooring can be sourced and purchased across the EEA and no production facility is required in the country of delivery.53

(73) Nonetheless, as the proposed transaction does not give rise to competition concerns related to laminate flooring under the alternative market definitions, it is not necessary to conclude on the exact geographic market definition concerning laminate flooring.

4.3.5. Vinyl flooring

(74) Leaving the exact market definition ultimately open, the Commission has in a number of cases considered that the relevant geographic market for various flooring materials is likely EEA-wide54, but has in an early case assessed vinyl flooring also on a national basis55.

(75) The Notifying Party submits that the relevant geographic market for vinyl flooring is EEA-wide. The Notifying Party further estimates that the majority of LVT sales in the EEA are imported from outside the EEA. While IFS has one production facility in the EEA, the Notifying Party itself does not have a production facility in the EEA although it is currently in the process of constructing one.

(76) The results of the market investigation support the Notifying Party’s submission that the relevant geographic market for vinyl flooring is EEA-wide. In particular, nearly all customers and competitors considered that vinyl flooring can be sourced and purchased across the EEA and no production facility is required in the country of delivery.56 Even if certain competitors referred to some national legislation concerning the technical specifications of the products, that was not reported to affect cross-border trade, such as for instance imports into the Benelux countries from other parts of the EEA.57

(77) A majority, but not all, customers and competitors even considered that they can source and supply vinyl flooring globally.58 However, the Notifying Party, which at present does not have a production facility in the EEA for LVT,59 has notably limited market share there and has decided to invest in an EEA-production facility. This suggests that the market may not be significantly wider than the EEA. Moreover, the Parties’ internal documents suggest that […].60

(78) As the proposed transaction does not give rise to competition concerns related to vinyl flooring under the alternative market definitions, it is not necessary to conclude on the exact geographic market definition concerning vinyl flooring.

4.3.6. Locking technologies

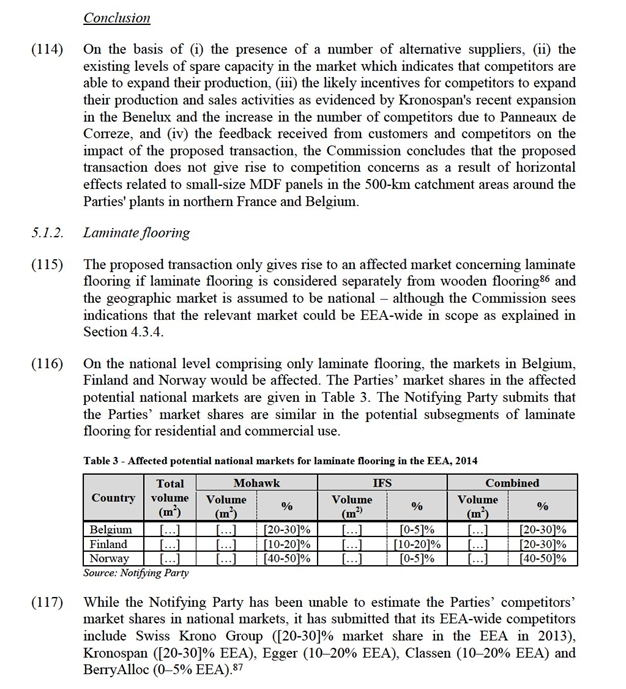

(79) The Notifying Party submits that the geographic market for locking technologies is worldwide or at least EEA-wide. The Notifying Party supports its view by referring to the wide geographic coverage of the patents and licences, and to licensors and licensees being de facto present around the world. Moreover, transport costs play no role.

(80) The results of the market investigation support the Notifying Party’s submission of at least an EEA-wide market. In particular, the relevant patents are generally global and flooring producers also generally replied that they use the licences for worldwide production.61 However, some market participants referred to different patents or pricing mechanisms in different broad geographic areas such as Asia as compared to Europe.62

(81) As the proposed transaction does not give rise to competition concerns related to the licensing of locking technologies for flooring products under the alternative market definitions, it is not necessary to conclude on the exact geographic market definition concerning locking technologies

5. COMPETITIVE ASSESSMENT

5.1. Horizontal effects

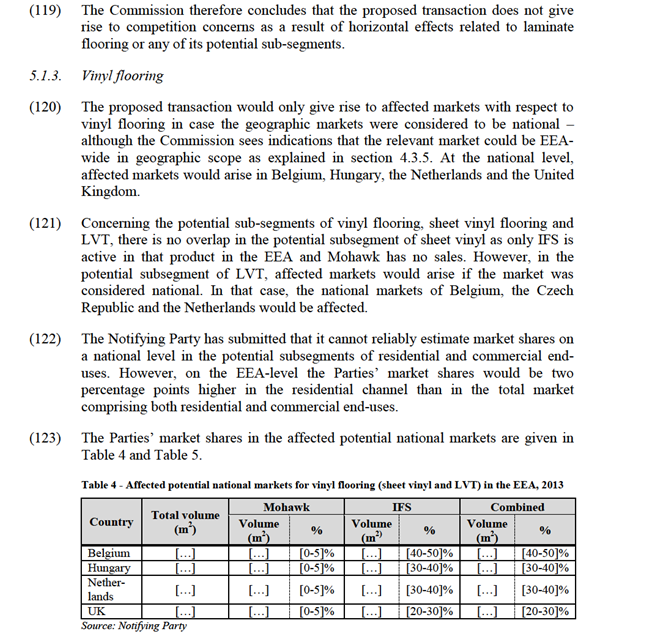

5.1.1. Fibre boards (MDF/HDF)

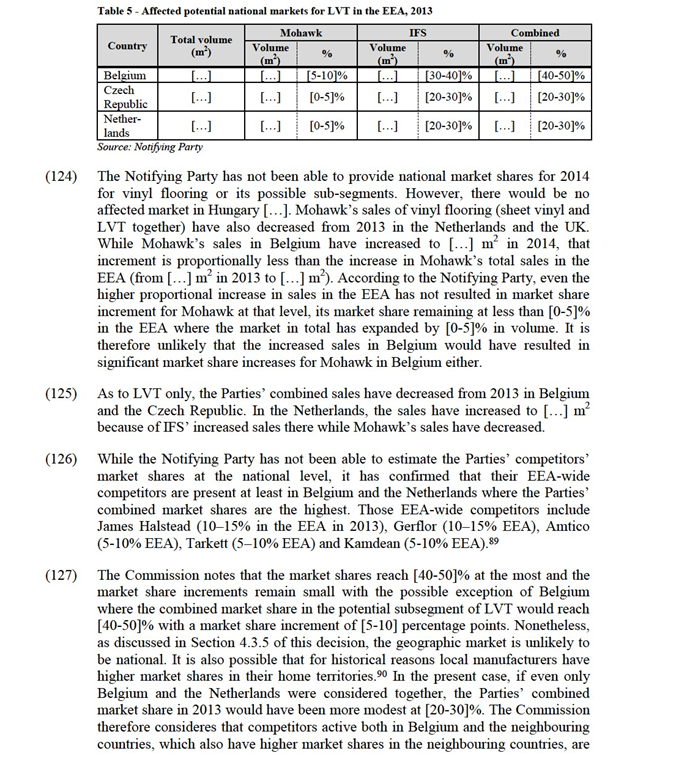

(82) The proposed transaction does not give rise to any horizontally affected markets if MDF and HDF are considered to belong to the same relevant market.

(83) There are also no horizontally affected markets with respect to a potential separate HDF market and with respect to a potential MDF market if all sizes of MDF panels are assessed together.

(84) However, the potential market for the small-size MDF panels63 would give rise to an affected market which will be assessed in more detail in the following sections of this decision.

Concentration levels and market structure

(85) Within 500 km from the Parties’ production facilities, the demand for those small- sized panels is concentrated in the Benelux countries, even if some producers are located outside of those countries. That is illustrated by the Parties' sales figures in the Benelux. Mohawk's small-size MDF sales in the Benelux represent more than [60-70]% of its total sales of small-size MDF boards in the EEA.64 Similarly, IFS' small-size MDF sales in the Benelux represent more than [60-70]% of its total sales of small-size MDF boards in the EEA.65

Figure 3 - Location of competitors' MDF facilities in the EEA

(94) According to the Notifying Party, those suppliers have substantial unutilised capacity, amounting to 100 000 m³ for the three suppliers located up to 500 km from the Parties' plants and amounting to approximately 350 000 m³ for the other competitors.68

(95) The Notifying Party argues further that suppliers having a large network of production plants with overlapping supply areas, such as Kronospan and Sonae, are able to shift production from one facility to another to make capacity available when needed. According to the Notifying Party, that enables for instance Kronospan to increase production of the small-sized panels at its Sanem facility in Luxembourg more than its present idle capacity at that plant as the production of larger-sized MDF panels could be shifted to other facilities still within an economic transport distance.69

Competitive landscape – alternative suppliers

(96) During the course of the market investigation, the Commission has contacted all the producers put forward by the Parties as alternative small-sized MDF suppliers in the EEA.

(97) Sonae is a HDF/MDF producer active in the Benelux region. It operates six plants within the EEA (three in Germany and one in each of Spain, Portugal and France). Sonae mostly supplies the Benelux from its north-western German plant located in Meppen. This plant is able to produce the small-sized MDF panels.70

(98) Kronospan is a HDF/MDF producer active, among other areas, in the Benelux region. Kronospan has nine MDF facilities within the EEA, including an MDF plant in Sanem (Luxembourg) and another in Chirk (UK) able to produce small- size MDF panels. Kronospan has recently invested in a stocking warehouse in Belgium. The warehouse stocks, among other products, small-sized and large-sized MDF panels and supplies Benelux customers71.

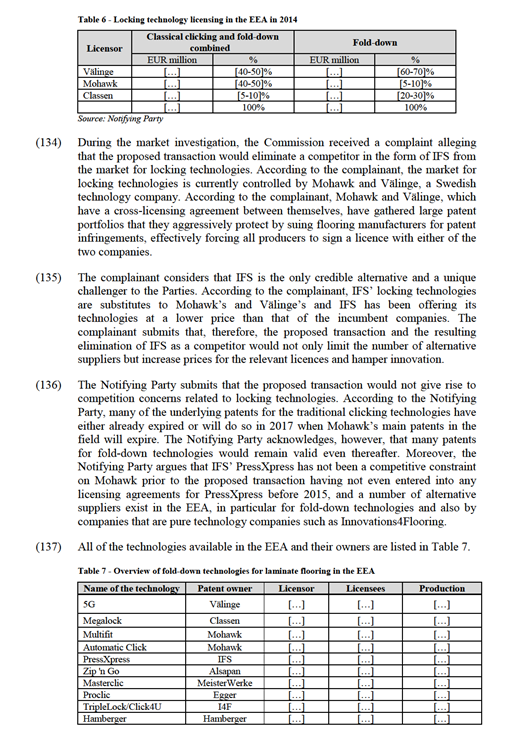

(99) Panneaux de Correze recently purchased in April 2015 a HDF/MDF plant from Sonae located in Ussel in the South of France. This factory is able to supply both small-sized and large-sized MDF panels, including to the Benelux.72

(100) Norbord is an MDF/HDF/OSB producer based in the United Kingdom. Its plant in Cowie/Scotland can supply small-sized MDF to customers in the Benelux, although Norbord's main targeted market is the United Kingdom.73

(101) Finsa is a company active in raw particle board and MDF production and is based in Spain. Finsa sells small-sized and large-sized MDF and other products. It operates a sales office and warehouse in Vlissingen (Netherlands) which it uses for sales to the Benelux and neighbouring countries 74

(102) Medite is an MDF/OSB producer based in Ireland, active also in the Benelux.75 As regards its sales of MDF to the Benelux, Medite appears to specialize in high quality MDF as opposed to standard MDF according to customer reports.

(103) Swiss Krono (with production facilities in eastern Germany, Switzerland and Poland) and Pfleiderer (eastern Germany) are two companies active in HDF/MDF/OSB. Swiss Krono has nearly no sales in the Benelux, however, and Pfleiderer's MDF sales in the Benelux are not significant either since it has chosen to focus on HDF.76

Ability and incentive of competitors to increase small-sized MDF production post- transaction

(104) The Commission has sought to establish whether the competing production facilities would have the capacity and incentive to supply the customers in the 500-km catchment areas around the Parties' plants, and in particular in the Benelux, with small-sized MDF after the proposed transaction.

(105) Based on the results of the market investigation, the Commission considers that there are three alternative suppliers which will in all likelihood have the ability and incentive to increase their small-sized MDF production post-transaction to supply the customers in the 500-km catchment areas around the Parties' plants, and in particular in the Benelux: Kronospan, Sonae and Panneaux de Correze. While the Commission cannot disclose the available spare capacity of the individual suppliers for confidentiality reasons, it suffices to say for the purposes of this decision that altogether, their available spare capacity would amount to more than 70 000 m3. Each of the suppliers would have a reasonable share of the total available spare capacity.

(106) First, the Commission notes that Kronospan made a strategic decision in 2014 to build up its market position in Belgium, including in the sale of small-sized MDF panels. In order to penetrate the Belgian market, Kronospan has decided to invest in a stocking warehouse in Belgium to be able to supply smaller and/or mixed batches to smaller customers (including supplies of small-sized MDF panels) and to ensure just-in-time delivery for its customers. The warehouse is operational since May 2014 and has its own sales team, exclusively dedicated to the Belgian market.77

(107) Market participants confirmed that Kronospan is trying to increase sales within the Benelux countries by means of aggressive pricing. One customer explained that "Kronospan is a particularly aggressive competitor on the market at the moment with low prices. Kronospan wants to win market share in Belgium market (…)". Also the Notifying Party in its internal documents referred to the recent competitive pressure exerted by Kronospan.78

(108) The evidence gathered during the market investigation is not sufficient to establish that Kronospan's quality would be lower than its competitors', given that (i) several market participants are not of that view and (ii) the markets participants complaining about Kronospan's alleged lower quality have not recently sourced any MDF from them.79

(109) Second, Sonae could increase production in Meppen (Germany) to some extent if an increase in demand were to occur. For this purpose, Sonae would take into account possibilities to relocate production of other sizes of panels to other factories.80

(110) Third, Panneaux de Correze is able to supply the Benelux with small-sized MDF, and is targeting the Benelux among other countries.81 Panneaux de Correze has recently entered the market as a new market participant when it acquired the production plant in Ussel previously operated by Sonae. Panneaux de Correze will – as an individual supplier that is not part of a larger network – face different competitive incentives than when the plant was part of the Sonae network. The Commission considers that this increase in the number of competitors will have positive effects on competition for the sale of fibre boards, including for the sale of small-sized MDF panels, in the catchment areas around the Parties' production plants.

Customers' and competitors' views on the effects of the proposed transaction

(111) Although a clear majority of the customers of small-sized MDF in the Benelux considered that the proposed transaction would not have any effect on their companies, some customers did voice concerns as to the impact of the proposed transaction. The Commission has followed-up these concerns with conference calls, in which market participants mainly referred to a potential price increase as a result of the higher market concentration. Some of the market participants also referred to an alleged lack of alternative suppliers and alleged that Kronospan quality was not high enough for it to be considered a good alternative supplier.

(112) In part, the concerns expressed appear to have been based on the perception that the previous acquisition of the company Spano Invest by Mohawk in 2013 ('the 2013 Spano Invest transaction')82 led to price increases of raw particle board in the Benelux. Although the suppliers and customers appear to be similar to a certain extent, the Commission considers it difficult to draw a comparison between the proposed transaction and the 2013 Spano Invest transaction, in particular since the product concerned is not the same. Nevertheless, data on the evolution of raw particle board prices in Belgium, France, Germany and the Netherlands submitted by Mohawk does not indicate a lasting or marked increase in its price of raw particle board in Belgium and the Netherlands relative to the other countries following the 2013 Spano Invest transaction.83

(113) Furthermore,the concerns have not been shared by the majority of customers nor by any of the competitors.84 In particular, other customers sourcing the small-sized panels in the Benelux have stated that they have enough alternative suppliers to turn to, and that this would make a price increase by the merged entity unlikely.85

(118) The Commission notes that the Parties' combined market shares in Belgium and Finland remain modest. As to Norway, the market share increment is notably small and any merger-specific effects on competition can therefore be excluded. Horizontal competition concerns are therzfore unlikely even under this potential narrow geographic market definition. The results of the market investigation support the absence of horizontal competition concerns.

likely to exert competitive pressure also in Belgium. The market shares indicated in Table 4 and Table 5 are therefore likely not indicative of the merged entity’s real market power in Belgium.

(128) The Notifying Party has noted that Mohawk is in the process of constructing an LVT production facility in the EEA. At present, Mohawk has no LVT facility in the EEA.91 The new production facility is planned to become operational in [year]. After becoming operational, the Parties’ combined EEA production capacity for LVT would be approximately [40-50]% of the total LVT capacity in the EEA when considering the present existing production capacity without expansion by competitors. The Notifying Party further estimates that the Parties’ combined market share could increase from [10-20]% in 2014 to [10-20]% in 2016 at the EEA level due to the increased EEA production capacity. The Notifying Party estimates that the total market size would increase from […] m2 in 2013 to […] m2 in 2016, which could curb the Parties’ future market share increases.

(129) The Commission considers that the increase in Mohawk’s production capacity and the subsequent modest estimated increase in the market share does not result in the merged entity’s market position becoming stronger to such an extent that it would give rise to competition concerns. Moreover, two competitors have indicated that they are also planning for capacity increases, one respondent referring to doubling its capacity due to increased demand for LVT.92

(130) Results of the market investigation support the absence of competition concerns related to vinyl flooring. In particular, all customers except one saw no negative effects for vinyl flooring or any of its sub-segments as a result of the proposed transaction.93

(131) The Commission concludes that the proposed transaction does not give rise to competition concerns as a result of horizontal effects related to vinyl flooring or any of its potential sub-segments.

5.1.4. Locking technologies

(132) The Parties are both active in the development of glueless locking technologies employed in flooring products such as laminate flooring and LVT. Both Parties also license IP rights related to those technologies. While Mohawk has been active in the licensing of such rights for many years, IFS has only recently in 2015 entered the market and has so far […] for its fold-down technology PressXpress.94

(133) The Notifying Party’s estimates for market shares in the market for licensing glueless technologies are presented in Table 6. The figures are based on the Notifying Party’s estimates of licence fees collected from third-party licensing, and they show no market share for IFS […].

(138) The results of the market investigation purport that there is only limited competition at present in the market for locking technologies. In particular, market participants have indicated that only Välinge or Mohawk are at present credible licensors of such technologies, and that the use of alternative technologies is at present risky and non-attractive to flooring product manufacturers because of the risk of lengthy patent litigation that may have uncertain outcomes.95

(139) However, the fact that competition may not be functioning optimally at present is not merger-specific. The Commission has therefore sought to clarify whether the proposed acquisition of IFS by Mohawk would give rise to a merger-specific competition concern.

(140) Taking into account the replies to the market investigation, the Commission considers that the proposed transaction would not significantly change the market structure or competitive conditions and would not give rise to merger-specific competition concerns. In particular, the replies of market participants show that IFS has not been exerting any significant actual or potential competitive constraint on Mohawk prior to the transaction and there are some alternative technologies in the market that are, in the view of market participants, at least equally strong options for flooring manufacturers as IFS’ offering.

(141) As to the actual or potential competitive constraint exerted by IFS, market participants have explained that IFS’s technologies, including the PressXpress technology, are subject to patent infringement claims.96 Second, a number of market participants have indicated that in their view, IFS’ technologies also have quality issues which make them unattractive. Market participants commented, for instance, that ‘[PressXpress] we no [sic] not consider to be attractive’, ‘is of minor quality’, ‘Välinge’s 5G technology - - is easier to handle.’, ‘Balterio’s technology would not work with LVT’ and‘Eigene Test und Versuche haben gezeigt, dass andere Fold-down-Systeme eine bessere Performance haben.’97

(142) As to the actual and potential competing suppliers, Innovations4Flooring has confirmed that it has patents related to fold-down locking technologies even if those have been legally contested by Mohawk. Innovations4Flooring has also already licensed the technologies to flooring manufacturers although those manufacturers may at present be put off from coming to the market with products employing those technologies because of risks related to the on-going patent litigation.98

(143) The Commission notes that even if market participants may at present be somewhat hesitant to operate with a new entrant to the market,99 the fact that Innovations4Flooring does not have its own downstream production of physical flooring materials100 may make it even a more suitable technology supplier to flooring material producers than IFS, which is also active in the physical products employing the technologies. Lacking its own downstream production capacity, Innovations4Flooring is also likely motivated to commercialise its technologies through licensing.

(144) In addition, two flooring manufacturers replied in the market investigation that they are working on independent technology solutions. One of those manufacturers indicated that it has already filed for some patents as well.101

(145) Finally, a vast majority of flooring producers did not agree with the complainant in that the proposed transaction would give rise to competition concerns but submitted that the transaction would have no effects concerning the market for locking technologies.102

(146) Therefore, the Commission concludes that the proposed transaction does not give rise to competition concerns as a result of horizontal effects related to locking technologies or any of their potential sub-segments.

5.2. Non-horizontal effects

5.2.1. UF resins and fibre boards

(147) UF resins are used as an input in the production of fibre boards as they are used as glue for bonding the wood elements used in the boards (and other types of wood- based panels).

(148) The vertical relationship between UF resins and fibre boards only give rise to vertically affected markets if considering the potential downstream market for the small-size MDF panels. In that event, the Parties’ combined market share in the downstream market would be around [50-60]% in the Benelux which is the most affected region within the 500-km catchment areas around the Parties' production plants in northern France and Belgium, as explained in section 5.1.1.

(149) It should nonetheless be noted that the UF resins are used similarly in the production of all different sizes of MDF panels and are not specific to the small- sized panels (or even to MDF panels as such). Therefore, the merged entity’s market share in the potential downstream market of small-size MDF panels is not indicative of its market position in the sourcing of UF resins.

(150) Only Mohawk is active in the upstream production of UF resins while IFS is not. Mohawk’s acquisition of its present EEA UF resin capacity was considered in the recent case M.6871 – Mohawk Industries / Spano Invest.

(151) […]. According to the Notifying Party, Mohawk’s market share is [5-10]% in a cross-border merchant market of 400–700 km radius around its production plant in Belgium.

(152) In light of the above, foreclosure concerns are unlikely. That finding is supported by the results of the market investigation in which no market participant raised such concerns.103

(153) Therefore, the Commission concludes that the proposed transaction does not give rise to competition concerns as a result of non-horizontal effects related to the vertical link between UF resins and fibre boards.

5.2.2. Fibre boards and coated MDF

(154) Raw MDF is used as an input in the production of coated MDF.

(155) The vertical relationship between raw MDF and coated MDF only gives rise to vertically affected markets if considering the potential upstream market for the small-size raw MDF panels. In that event, the Parties’ combined market share in the upstream market would be around [50-60]% in the Benelux which is the most affected region within the 500-km catchment areas around the Parties' production plants in northern France and Belgium, as explained in section 5.1.1.

(156) As regards the downstream market for coated MDF, the Parties’ activities only have a practical overlap in Belgium and the Netherlands104. Accordingly, the Notifying Party has only provided market share information for Belgium, the Netherlands and the EEA where the Parties' combined market shares are estimated to be limited at [5-10]% in Belgium (Mohawk [5-10]%, IFS [0-5]%), [10-20]% in the Netherlands (Mohawk: [10-20]%; IFS [0-5]%) and [10-20]% in the EEA (Mohawk [10-20]%, IFS [0-5]%).105

(157) For the reasons explained under Section 5.1.1 of this decision, the proposed transaction does not give rise to competition concerns related to the supply of raw MDF panels, including the potential subsegment of small-sized panels. Competitors active in the downstream markets for coated MDF would continue to have access to alternative suppliers of the upstream raw material, raw MDF, and some of the competitors would in all likelihood be able and have incentive to increase their supply of MDF in case of increased demand from customers. Consequently, input foreclosure concerns are unlikely to occur.

(158) Given that the Parties do not at present source any significant amounts of raw MDF from other suppliers […], customer foreclosure concerns can be excluded.

(159) Therefore, the Commission concludes that the proposed transaction does not give rise to competition concerns as a result of non-horizontal effects related to the vertical link between (raw) fibre boards and coated MDF.

5.2.3. Locking technologies and flooring products

(160) Glue-less locking technologies are used as an input in certain flooring products, particularly in laminate flooring and LVT.

(161) While the merged entity would have a notable market share of up to [40-50]% in the upstream market for locking technologies, the proposed transaction would not, for the reasons explained under Section 5.1.4 of this decision, significantly affect the market structure or competitive conditions in the upstream market. […].106 Mohawk has also until now actively licensed its IP rights to third parties, including its downstream competitors, and it is not likely that the proposed transaction would significantly affect Mohawk’s incentive to continue doing so also post-transaction.

(162) As to customer foreclosure, the Parties are not significant licensees of third-party locking technologies even before the proposed transaction. As to IFS, it only licenses technologies from [company] at present while Mohawk needs a license from [company] to use its [brand] fold-down technology. Even if the merged entity, having also the PressXpress now held by IFS, stopped using [brand] and licensing from [company], the modest market presence of the merged entity in the downstream markets indicates that such a change would not result in Mohawk having the ability to foreclose its suppliers.

(163) Therefore, the Commission concludes that the proposed transaction does not give rise to competition concerns as a result of non-horizontal effects related to the vertical link between locking technologies and flooring products.

6. CONCLUSION

(164) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (‘the Merger Regulation’). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (‘TFEU’) has introduced certain changes, such as the replacement of ‘Community’ by ‘Union’ and ‘common market’ by ‘internal market’. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (‘the EEA Agreement’).

3 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’)

4 Turnover calculated in accordance with Article 5 of the Merger Regulation. M.6871 –

5 Mohawk Industries / Spano Invest, paragraphs 30–31, M.2396 – Industri Kapital / Perstorp (II) – paragraph 26, and M.1813 – Industri Kapital / Nordkem / Dyno, paragraph 30.

6 M.6871 – Mohawk Industries / Spano Invest, paragraphs 30–31, and M.1813 – Industri Kapital / Nordkem / Dyno, paragraph 30.

7 See, e.g. M.6871 – Mohawk Industries / Spano Invest, paragraph 17, M.4165 – Sonae Indústria / Hornitex, paragraph 11, and M.4048 – Sonae Indústria / Tarkett / JV, paragraph 16.

8 Replies to question 6 of Q1 – Questionnaire to MDF/HDF customers and replies to question 8 of Q3

– Questionnaire to competitors.

9 See, e.g. replies to question 8of Q3 – Questionnaire to competitors.

10 See, e.g. replies to question 6 of Q1 – Questionnaire to MDF/HDF customers and replies to question 8 of Q3 – Questionnaire to competitors.

11 See, e.g. replies to question 6 of Q1 – Questionnaire to MDF/HDF customers and replies to question 8 of Q3 – Questionnaire to competitors.

12 Replies to question 8 of Q3 – Questionnaire to competitors.

13 Regarding HDF, the sizes are usually customer specified and not off-the-shelf; confirmed minutes of a call with a customer on 8 April 2015. Therefore the potential distinction between groups of large and small sized panels is not relevant for the assessment of the potential HDF market.

14 See, e.g. responses to the Commission’s requests for information sent to small-sized MDF customers of the Parties on 23 April 2014, confirmed minutes of a call with a customer on 8 April 2015, confirmed minutes of a call with a customer on 26 April 2015; confirmed minutes of a call with a competitor on 20 April 2015 and confirmed minutes of a call with a competitor on 29 April 2015.

15 See, e.g. responses to the Commission’s requests for information sent to small-sized MDF customers of the Parties on 23 April 2014, confirmed minutes of a call with a customer on 8 April 2015, confirmed minutes of a call with a customer on 26 April 2015; confirmed minutes of a call with a competitor on 20 April 2015 and confirmed minutes of a call with a competitor on 29 April 2015.

16 See, e.g. confirmed minutes of a conference call with a competitor on 13 May 2015 and confirmed minutes of a conference call with a competitor on 19 May 2015.

17 See, e.g. confirmed minutes of a conference call with a customer on 8 April 2015.

18 M.6871 – Mohawk Industries / Spano Invest, paragraphs 20–21.

19 M.2051 – Nordic Capital / HIAG / Nybron / Bauwerk, paragraph 10.

20 M.4048 – Sonae Indústria / Tarkett / JV, paragraphs 13–14.

21 Replies to questions 5 and 6 of Q2 – Questionnaire to flooring customers and replies to question 9 of Q3 – Questionnaire to competitors.

22 Replies to question 9 of Q3 – Questionnaire to competitors.

23 See, e.g. document titled ‘IVC management case’, annex 8 to the Form CO.

24 M.1253 – Paribas / JDC / Gerflor, paragraph 7.

25 Replies to question 12 of Q3 – Questionnaire to competitors.

26 Replies to question 9 of Q2 – Questionnaire to flooring customers and replies to question 12 of Q3 – Questionnaire to competitors.

27 Replies to question 12 of Q3 – Questionnaire to competitors.

28 M.1253 – Paribas / JDC / Gerflor, paragraph 7. See also M.4048 – Sonae Indústria / Tarkett / JV, paragraph 13.

29 Replies to questions 5 and 7 of Q2 – Questionnaire to flooring customers and question 10 of Q3 – Questionnaire to competitors.

30 Replies to question 10 of Q3 – Questionnaire to competitors.

31 Replies to question 8 of Q2 – Questionnaire to flooring customers and question 11 of Q3 – Questionnaire to competitors.

32 Replies to question 11 of Q3 – Questionnaire to competitors.

33 Replies to question 10 of Q2 – Questionnaire to flooring customers and replies to question 13 of Q3

– Questionnaire to competitors. *Should read: Multifit.

34 Replies to question 7 of Q4 – Questionnaire to flooring technology owners and licensees.

35 Replies to questions 13 and 14 of Q4 – Questionnaire to flooring technology owners and licensees.

36 Replies to questions 11 and 12 of Q4 – Questionnaire to flooring technology owners and licensees.

37 Replies to questions 13 and 20 of Q4 – Questionnaire to flooring technology owners and licensees.

38 See, e.g. replies to question 16 of Q4 – Questionnaire to flooring technology owners and licensees.

39 Replies to questions 16 to 19 of Q4 – Questionnaire to flooring technology owners and licensees.

40 M.6871 – Mohawk Industries / Spano Invest, paragraph 54.

41 M.1813 – Industri Kapital / Nordkem / Dyno, paragraphs 56, 65 and 68.

42 Replies to question 14 of Q3 – Questionnaire to competitors.

43 M.6871 – Mohawk Industries / Spano Invest, paragraph 44, M.4165 – Sonae Indústria / Hornitex, paragraphs 13–14, and M.4048 – Sonae Industria / Tarkett / JV, paragraphs 20–21.

44 M.6871 – Mohawk Industries / Spano Invest, paragraph 44.

45 M.4165 – Sonae Indústria / Hornitex, paragraphs 13–14.

46 Replies to question 7 of Q1 – Questionnaire to MDF/HDF customers.

47 Replies to questions 7–10 and 13–14 of Q1 – Questionnaire to MDF/HDF customers and questions 15–18 of Q3 – Questionnaire to competitors.

48 M.6871 – Mohawk Industries / Spano Invest, paragraph 46.

49 M.4525 – Kronospan / Constantia, paragraphs 34–35.

50 Replies to questions 7–9 of Q1 – Questionnaire to MDF/HDF customers and questions 15–17 of Q4

– Questionnaire to flooring technology owners and licensees.

51 Replies to questions 7 and 8 of Q1 – Questionnaire to MDF/HDF customers.

52 M.4048 – Sonae Indústria / Tarkett / JV, paragraphs 17–18 and 21, and M.2051 – Nordic Capital

/HIAG / Nybron / Bauwerk, paragraphs 12–13.

53 Replies to questions 12–14 of Q2 – Questionnaire to flooring customers and question 15–18 of Q3 Questionnaire to competitors.

54 M.6871 – Mohawk Industries / Spano Invest, paragraphs 49–50, M.4048 – Sonae Indústria / Tarkett

/ JV, paragraphs 17–18 and 21, M.2051 – M.2051 – Nordic Capital /HIAG / Nybron / Bauwerk, paragraphs 12–13.

55 M.1253 – Paribas / JDC / Gerflor, paragraph 9.

56 Replies to questions 12–14 and 16 of Q2 – Questionnaire to flooring customers and question 15–18 of Q3 – Questionnaire to competitors.

57 Replies to questions 18 of Q3 – Questionnaire to competitors.

58 Replies to question 12 of Q2 – Questionnaire to flooring customers and question 16 of Q3 – Questionnaire to competitors.

59 The Notifying Party does though cut vinyl slabs imported from China into LVT in Belgium.

60 See, e.g. documents ‘IVC management case’ and ‘MHK management case’, annex 8 to the Form CO.

61 Replies to questions 23–26 of Q4 – Questionnaire to flooring technology owners and licensees.

62 See, e.g. confirmed minutes of a call with a flooring manufacturer on 27 March 2015.

63 For the assessment of large-sized panels, the same arguments as for the small-sized MDF panels would be valid – there would be a number of alternative suppliers with the likely ability and incentive to increase production and supply of MDF. Moreover, there are more alternative suppliers in the market for large-sized MDF panels than for small-sized MDF panels as illustrated in the map in Figure 3 of this decision: all the suppliers marked by a grey unnumbered dot are able to supply large-sized panels and a number of them are located within or close to the 500-km catchment areas around the Parties' production plants in northern France and Belgium.

64 See Parties' replies to RFI of 20 May 2015.

65 See Parties' replies to RFI of 20 May 2015.

66 See, e.g, the Notifying Party’s submission of 30 April 2015.

67 See, e.g, the expert report submitted by the Notifying Party on 11 May 2015.

68 See the expert report submitted by the Notifying Party on 11 May 2015, page 6.

69 See the expert report submitted by the Notifying Party on 11 May 2015, page 7.

70 Confirmed minutes of a call with Sonae on 20 April 2015.

71 Confirmed minutes of a call with Kronospan on 29 April 2015.

72 Confirmed minutes of a call with Panneaux de Correze on 21 May 2015 and email of 3 June 2015

73 Confirmed minutes of a call with Norbord on 19 May 2015.

74 Confirmed minutes of a call with Finsa on 12 May 2015.

75 Confirmed minutes of a call with Medite on 20 May 2015.

76 Confirmed minutes of a call with Swiss Krono on 21 May 2015 and of a call with Pfleiderer on 19 May 2015.

77 Confirmed minutes of a call with Kronospan, 29 April 2015.

78 Mohawk's internal document ‘Dico panels: sales & mkt’, 24 March 2015.

79 Confirmed minutes of a call with a customer on 26 May 2015.

80 Confirmed minutes of a call with a competitor on 20 April 2015.

81 Confirmed minutes of a call with Panneaux de Correze on 21 May 2015 and email of 3 June 2015.

82 M.6871 – Mohawk Industries/Spano Invest.

83 See Mohawk's reply to RFI of 20 May 2015.

84 See, e.g. replies to questions 24 and 25 of Q1 – Questionnaire to MDF/HDF customers, replies to questions 36 and 37 of Q3 – Questionnaire to competitors, and responses to the Commission’s requests for information sent to MDF customers purchasing small-sized MDF panels on 23 April 2014.

85 See, e.g. confirmed minutes of a call with a customer on 26 May 2015; responses to the Commission’s requests for information sent to MDF customers purchasing small-sized MDF panels on 23 April 2014.

86 Of the Parties, only Mohawk has limited activities in wooden flooring and the inclusion of wooden flooring in the market definition would only dilute the Parties’ market shares.

87 The market shares are the Notifying Party’s estimate for 2013.

88 Replies to questions 25 and 26 of Q2 – Questionnaire to flooring customers, and replies to questions 36 and 37 of Q3 – Questionnaire to competitors.

89 Market shares are the Notifying Party’s estimates for 2013.

90 Paragraph 29 of the Commission Notice on the definition of relevant market for the purpose of Community competition law (97/C 372/03) highlights the fact that companies might enjoy high market shares in their domestic markets just because of the weight of the past. Hence, high market shares as such do not necessarily mean the markets would be national.

91 Mohawk does though cut vinyl slabs imported from China in Belgium.

92 See, e.g. replies to question 34 of Q3 – Questionnaire to competitors.

93 Replies to questions 25–28 of Q2 – Questionnaire to flooring customers and replies to questions 36-38 of Q3 – Questionnaire to competitors.

94 Parties’ submission of 22 April 2015.

95 See, e.g. replies to question 40 of Q4 – Questionnaire to technology owners and licensees and confirmed minutes of phone calls with market participants on 18 March 2015, 20 March 2015, 27 March 2015 and on 30 March 2015.

96 See, e.g. replies to questions 35 and 36 of Q4 – Questionnaire to technology owners and licensees, and confirmed minutes of phone calls with market participants on 27 March 2015 and 30 March 2015.

97 Replies to questions 35–37 of Q4 – Questionnaire to technology owners and licensees, and confirmed minutes of phone calls with market participants on 27 March 2015; the German quote's translation into English reads ‘Own test and trials have shown that other fold-down systems have a better performance’.

98 See, e.g. confirmed minutes of a phone call with Innovations4Flooring on 30 March 2015. See also replies to question 47 of Q4 – Questionnaire to technology owners and licensees.

99 See, e.g. confirmed minutes of a phone call with a flooring material producer on 27 March 2015.

100 Confirmed minutes of a phone call with Innovations4Flooring on 30 March 2015.

101 Replies to question 46 of Q4 – Questionnaire to technology owners and licensees.

102 Replies to questions 48–50 of Q4 – Questionnaire to technology owners and licensees.

103 Replies to question 36 of Q3 – Questionnaire to competitors. While one competitor indicated competition concerns related to UF resins, they did not substantiate their reply at all.

104 In addition, there is a negligible overlap of a maximum of […] m3 in Italy and Spain. To put it in context, the size of the coated MDF market in Begium is […] m3 and in the Netherlands […] m3.

105 The market shares are the Notifying Party’s estimates for 2013. Should the market be defined according to the individual coating techniques, the Parties’ activities would only overlap with regard to lacquered MDF. Mohawk is also active in the production and sale of melamined MDF but IFS is not active in that coating technique. The Notifying Party submits that the merged entity’s market share, which will in any case be limited, would be lower if the individual coating techniques were considered and would be higher if all coating techniques were considered together as the clear majority of coated MDF sold by Mohawk (or the merged entity) is melamined.

106 See Table 56 of the Form CO, replies to question 29 of Q3 – Questionnaire to competitors and replies to question 28 of Q4 – Questionnaire to technology owners and licensees.