Commission, June 20, 2015, No M.7523

EUROPEAN COMMISSION

Judgment

CMA CGM/ OPDR

Dear Sir/Madam,

Subject: Case M.7523 – CMA CGM/ OPDR

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 22 May 2015, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertak- ing CMA CGM SA ("CMA CGM", France), controlled by Merit Corporation (Leba- non), Yildirim holding (Turkey) and Caisse des Dépôts et Consignations (France) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking Oldenburg-Portugiesische Dampfschiffs-Rhederei ("OPDR", Germany), controlled by Bernhard Schulte GmbH & Co. KG (Germany) by way of purchase of shares ("the Transaction").3 (CMA CGM and OPDR are des- ignated hereinafter as "Parties".)

I. THE PARTIES

(2) CMA CGM is the parent company of an international group of companies engaged in containerised liner shipping and port terminal management. CMA CGM is the world's third largest container shipping company and offers a complete range of ac- tivities including shipping, reefer transport (i.e. transport of refrigerated goods), han- dling facilities in port and freight transport, and logistics on land. Mainly through its subsidiary MacAndrews, CMA CGM is also active in intra-European short-sea ship- ping.

(3) CMA CGM is currently jointly controlled by Merit Corporation (Lebanon), the hold- ing company first created by CMA CGM's founder Mr Jacques R. Saadé, Yildirim Holding (Turkey), a joint stock company active in coal and metal, fertiliser produc- tion and sale, mining and ferroalloys, shipping and ship building and port manage- ment, and BPIfrance Participations (France), an investment fund controlled by the French public group Caisse des Dépôts et Consignations that acquires shareholdings in various sectors and especially in environmental services, telecommunications, construction, infrastructure, hotels, industry etc.

(4) OPDR is a Germany-based shipping company fully owned by the Bernhard Schulte group. OPDR is specialised in short-sea traffic providing a door-to-door service con- necting Northern Europe, the Canary Islands, the Iberian Peninsula (hereinafter also referred to as "Iberia") and North Africa.

II. THE OPERATION AND THE CONCENTRATION

(5) Through the Transaction CMA CGM intends to acquire via a share deal sole control of OPDR. Upon closing, CMA CGM will own and control all assets required to op- erate the OPDR business, including a 100% shareholding of the subsidiaries OPDR Germany GmbH, OPDR Netherlands B.V., OPDR Iberia S.L.U., OPDR Iberia Unipessoal Lda., OPDR Road S.L.U., OPDR Maroc Sarlau and OPDR UK Limited.

(6) It should be noted that the scope of the Transaction [CONFIDENTIAL - Information related to the scope of the Transaction]4 5.6

(7) It follows from the above that the Transaction is a concentration within the meaning of the Merger Regulation.

III. EU DIMENSION

(8) The Transaction was referred to the Commission under Article 4(5) of the Merger Regulation and is therefore deemed to have an EU dimension. The Transaction orig- inally exceeded the filing thresholds in Germany, Austria, Portugal, Spain and Cy- prus. Moreover, the case fulfilled the UK jurisdictional thresholds and was thus eli- gible for voluntary notification to the CMA.

IV. ACTIVITIES OF THE PARTIES

A. OPDR

(9) OPDR is a relatively small operator with an annual turnover of EUR [below 250 mil- lion] in 2013, specialised in short-sea container shipping, and active in more than 30 countries across Europe and North Africa and mainly active in the following coun- tries: Spain, Portugal, Morocco, UK, Belgium, the Netherlands, and Germany. More than […]% of its volumes are traded on the trades between Iberia, the UK, Benelux, Germany, and Morocco. OPDR's fleet is composed of ten ships – […] of which are currently chartered – for a total nominal capacity slightly under 7000 TEUs,7 making it the ninth largest player in Europe in terms of nominal cacapity.8

(10) OPDR offers both pure short-sea transport and door-to-door transport to its custom- ers. Door-to-door requires the provision of the "extra mile" or "last leg" of land transport to the final place of destination, as a complement to sea transport. OPDR normally only offers door-to-door when such activity includes at least one leg of sea transport, i.e. road transport is normally not provided by OPDR independently from sea transport.9

(11) The proportion of door-to-door services in comparison to the total volumes trans- ported by OPDR has increased over the last years. Indeed, for OPDR, door-to-door services have increased by […] percentage points between 2012 and 2013 (from […]% to […]% overall) and by […] percentage points between 2013 and 2014 (from […]% to […]% overall).

(12) In principle, OPDR does not itself operate trucks, trailers, trains or barges. Trucks, trailers and spaces on barges are contracted from third-party service providers. OPDR does not operate its own warehouses with regard to its short-sea container shipping activities.10

(13) OPDR is also marginally active in Ro-Ro shipping, exclusively via its subsidiary OPDR Canarias S.A., and on the route from Spain (Seville) to the Canary Islands.

B. CMA CGM

(14) The CMA CGM Group, directly and via its specialised subsidiary MacAndrews, also provides short-sea container shipping services within Europe. It is active mainly in the following countries across Europe: UK, Ireland, Spain, Portugal, France, the Netherlands, Scandinavia, Poland and the Baltic States. CMA CGM and its subsidi- ary Comanav also operate a line from Morocco, mainly to Spain, France, Belgium, and the Netherlands . Based on nominal capacity, CMA CGM is number three in Eu- rope.11

(15) As OPDR, the CMA CGM Group also provides door-to-door traffic to its customers, providing the "last leg" or the "extra mile" of land transport. As for OPDR, the pro- portion of door-to-door services provided by the CMA CGM Group has increased over the last years as part of its short-sea activities. Indeed, [as the business has de- veloped with direct manufacturing contracts], so has the door-to-door provision of services. As a result, for MacAndrews, door-to-door services have increased by […]% between 2011 and 2012 (from […]% to […]% overall) and by […]% between 2012 and 2013 (from […]% to […]% overall).

(16) The CMA CGM Group also contracts third parties to provide its customers with the "last leg" or "extra mile", as it does not own or operate trucks or trains, with one exception: the CMA CGM Group, via its subsidiary Greenmodal Transport, is active in inland transportation essentially in France, and marginally in Belgium, Germany and the Netherlands. Greenmodal Transport provides such inland transportation services both, internally, to the CMA CGM Group, and, externally, to third-party carriers. It should however be noted that OPDR does not currently purchase services of inland transportation from Greenmodal Transport.

(17) The CMA CGM Group also provides Ro-Ro shipping services from the south of France to the Maghreb. It does not operate between Spain and the Canary Islands nor on any substitutable line.

(18) The CMA CGM Group, via its subsidiaries CMA Terminals and Terminal Link, is also active on the market for container and Ro-Ro terminal services, where OPDR is active on the demand-side.

(19) The CMA CGM Group, through its wholly-owned subsidiary CMA CGM Logistics ("CCLog"), has a minor activity in freight forwarding in Europe.

V. MARKET DEFINITION

(20) The Parties submit that their activities mainly overlap on the markets for intra-European door-to-door transport. Both Parties also provide stand-alone short-sea container shipping. Moreover, they identify vertical relationships between their shipping and transport activity and CMA CGM's activity as a provider of freight forwarding services and a ter- minal services' operator.

(21) According to the Parties, even though they are both active in the market for Ro-Ro shipping,12 they do not overlap on any trade.13 Similarly, although CMA CGM con- trols some Ro-Ro terminals, these are not located on a trade on which OPDR is ac- tive.14 Ro-Ro Services as well as Ro-Ro terminal services will therefore not be dis- cussed any further in this Decision.

(22) In addition, even though both Parties offer inland transportation services (not neces- sarily linked to their door-to-door activities, which are usually sub-contracted) through specialised subsidiaries, they do so in different geographic markets and thus do not overlap in their activity.15 Inland transportation services will therefore not be discussed further in this Decision.

A. Intra-European door-to-door multimodal transport services

1. Product market

(23) The Parties submit that their business is mainly and increasingly a door-to-door con- tainer transport service that is in direct competition with providers of other modes of transport, especially transport by truck, but also by rail and inland waterway barges that can also offer door-to-door services.16 The Parties supply such services by tak- ing care, in addition to the sea leg of a service, of the transportation of the goods to/from the harbour using trucks, trains, etc. from their place of origin to their final destination. MacAndrews, CMA CGM's subsidiary specialised in intra-European short-sea shipping, estimates that on its Spain to UK activities, […]% to […]% of its cargo is handled on a door-to-door basis, while OPDR's figures amount to up to […]% to […]% on the same route.17 More generally, CMA CGM estimates that on 21 of the 40 country pairs, in which its activity overlaps with that of OPDR, more than […]% of its cargo is handled on a door-to-door basis; this ratio even goes as high as […]% on eight of these country pairs.18

(24) Door-to-door transport services consist in taking up cargo at an agreed point and de- livering it to another agreed point. Customers decide where the point of loading and point of delivery are situated and transport services providers adapt to this. As the cargo is containerised, it can travel on vessels, trucks, trains and barges. CMA CGM claims that customers take three factors into account when selecting a supplier for their transport needs: frequency of departures, transit time and price. While short sea shipping is usually the cheapest mode, trucks are faster and often offer a higher fre- quency of departures, which often makes it a preferable choice for perishable goods. Transport by train and barges usually needs to be complemented by trucking in order to offer a door-to-door transport service, and barges play a role only in certain areas of Europe. Despite these differentiating factors, CMA CGM claims that, from a cus- tomer’s perpective, in-land and sea transport are substitutable. Consequently, CMA CGM claims that the relevant product market is the market for door-to-door multi- modal transport services.

(25) This view has been confirmed by market participants. Large majorities among all groups of respondents to the Commission's market investigation have stated that there is predominantly a door-to-door transport market that encompasses all modes of transport,19 in which all transport operators, irrespective of the mode of transport they use,20 fully compete against each other21 and that this market should not be fur- ther subdivided or segmented.22

(26) The Commission has not yet defined a door-to-door transport market in merger cases and has left open whether short-sea container shipping services compete with other forms of transport.23 The Commission has, however, accepted a market for unitised transport in which maritime services compete with other modes used for door-to- door services in antitrust cases.24 Given that containerised cargo can easily be trans- ported on trucks, there indeed seems to be a high degree of substitutability between sea transport and truck transport.25 In the intra-European market, customers who would consider maritime transportation can often also opt for transport by truck. Likewise, sea transport may often be an option for customers of truck transportation services (depending on their needs in terms of frequency and flexibility).

(27) The market investigation has shown that truck operators are often viewed as a substi- tute service to rail and ship operators.26 In order to compete more effectively, vessel and rail operators increasingly provide "door-to-door" services, sometimes on virtu- ally all their cargo on a given trade.

(28) As concerns the different modes of transport, some differences exist. While trucks can reach any given point accessible by road (or potentially by means of ferry), i.e. virtually any loading and delivery point chosen by the customer, rail or ship carriers need to arrange for the first/last mile to be performed by trucks if the point of origin or destination is not accessible by ship or train. Ship and train operators do this either by subcontracting the first/last mile of the journey to a truck company or by internal- ising these operations (i.e. by operating their own trucks). Similarly, truck operators may need to subcontract with vessel operators in order to reach areas in the UK, Mo- rocco, etc.

(29) Moreover, trucks may offer greater flexibility than ships or trains because they are independent of fixed schedules and can reach any point connected by road. The mar- ket investigation also showed, however, that transport by truck can be substantially more expensive than transport by ship or rail.27 Price as well as frequency and travel duration may therefore be the main differentiating criteria from a customer's per- spective between door-to-door services by a truck operator or door-to-door service by a train/ship operator (if both are available for a given route).28

(30) From a demand-side perspective, it might therefore not matter so much how exactly the transport of the freight is being carried out, as long as the customers' needs in terms of price, frequency, capacity and transport duration are met. Not all customers are completely indifferent as to the mode of transport used, because they may be price sensitive, want to reduce their carbon footprint or need a high degree of flexi- bility. However, there appears to still be a large number of customers, for which all operators, irrespective of the mode of transport employed, are an alternative option.

(31) As transport operators often need to combine different modes of transport in order to provide a full door-to-door service, it appears that sea vessel operators, truck, rail and barge companies offering door-to-door transport ultimately compete on the pro- vision of multimodal transport services. Therefore, the Commission concludes that there is a market for door-to-door transport services, including all modes of transpor- tation.

1. Geographic market

(32) The Parties claim29 that the geographic delineation of such a door-to-door multimod- al transport market should be defined on a country-by-country basis (e.g. Spain to Ireland).

(33) In this respect, the Parties suggest that the narrowest relevant geographic market def- inition for intra-Europe transportation services is composed by pairs of countries and provide market share data on this basis. Moreover, in analogy to short-sea container shipping services,30 the Parties have distinguished between the directions of the trade flows (Spain to Ireland may therefore be a different market from Ireland to Spain) and have provided market share data on that basis.

(34) The Commission has not yet considered the geographic scope of a market for intra- European door-to-door transport services.

(35) The market investigation proved inconclusive in this regard. While large majorities of all groups of respondents have indicated that they believed the intra-European door-to-door transport market should be looked at in terms of trades (in this case, aggregated country pairs, e.g. Iberia to British Isles, etc.),31 equally large majorities of all groups of respondents in turn stated that they purchased these services either at national or at the EEA-level.32

(36) As no competition concerns arise on the country-by-country pair approach, which is the narrowest conceivable market definition, the Commission considers that for the purpose of this Decision it can be left open whether the market should be defined on a country-by-country or a trade basis. The assessment will therefore be carried out on a country pair basis and examine the different directions of the trade flows seper- ately.

1. Conclusion

(37) In view of the above, the Commission concludes that there is a market for door-to- door transport services, in which providers compete for the same customers irrespec- tive of the specific mode or modes of transportation. The geographic scope of the market may at its narrowest be defined as consisting of country pairs, but may be larger in scope. As however this would not alter the present assessment, the exact scope of the geographic market can be left open.

B. Short-sea container shipping

1. Product market

(38) The Parties argue that they overlap horizontally only on the market for intra- European transport services of which short-sea (coastal trade) container shipping services may be a subsegment.33 However, given that the Parties are short-sea con- tainer shipping providers, that they still carry out a substantial part of their business on a port-to-port basis for customers not demanding door-to-door services, and that the Commission has in the past defined a separate market for short-sea container shipping, this market has been included in the market investigation.

(39) In its decisional practice,34 the Commission has analysed cases involving short-sea container shipping, which can potentially be distinguished

(a) from deep sea container shipping (i.e. deep sea shipping);

(b) from bulk shipping (i.e. non-containerised shipping); and

(c) from Ro-Ro35 shipping.

(40) Further possible delineations can be made between liner (scheduled services) and charter, tramp or specialised transport services (ad hoc services), as well as reefer and non-reefer services (i.e. refrigerated or not). According to the Commission's case practice, in trades with a share of reefer containers in relation to all containerised cargo below 10% in both directions, transport in reefer containers is not assessed separately, but as part of the overall market for container liner shipping services.36

(41) In the Commission's market investigation, a majority of respondents indicated that short-sea container shipping should be distinguished from other modes of transport as a separate market in spite of their overall acceptance of a door-to-door multimodal transport services market.37 While competitors were rather split on the question, cus- tomers overwhelmingly supported the idea of a separate market; freight forwarders did not think that short-sea container shipping was a separate market.

(42) As regards the type of cargo transported, majorities among all groups of respondents were of the opinion that container shipping should be distinguished from a market for the transport of wheeled cargo (Ro-Ro vessels) or for bulk cargo.38

(43) In the same vein,39 large majorities among all groups of respondents said that cus- tomers would not switch to bulk cargo vessels, should prices for short-sea container shipping rise by 5–10% for a steady period of time. Short-sea competitors and freight forwarders considered that customers would switch to Ro-Ro vessels should prices for short-sea container shipping rise by 5–10% for a steady period of time; a majority of customers however rejected this.

(44) Large majorities of all groups of respondents asserted that liner shipping should be distinguished from the provision of non-regular, not pre-scheduled services (e.g. charter, tramp, specialised transport).40

(45) Large majorities of all groups of respondents also claimed that deep sea container vessels on routes connecting European costal harbours can in principle be a viable alternative to short-sea container services provided by specialised short-sea container vessels (in terms of price, availability, duration, frequency, ports of call, etc.).41 However, a majority of all respondents stated that the competitive constraint exer- cised by deep sea vessels was limited and that it depended on the characteristics of the service and the specific trade.

(46) The market investigation yielded mixed results concerning the definition of a nar- rower market for the transport of refrigerated goods (reefer).42 A majority of all re- spondents (with a majority of freight forwarders dissenting) accepted that the transport of reefer goods should not be considered as constituting a separate market from that for the transport of dry (non-refrigerated) goods in intra-European short sea container shipping.43

(47) The Commission considers that the market investigation has shown that there may still be a separate short-sea container shipping services market independent from an all-encompassing door-to-door transport services market. Indeed, not all customers wish to purchase door-to-door transport services because they are themselves capa- ble of ensuring the first and/or the last leg of their goods' journey. Other customers may have a preference for short-sea shipping because of its lower price, the regulari- ty of the service or because they want to improve their carbon footprint.

(48) While it seems to transpire from the results of the market investigation that short-sea container shipping providers do compete with providers of transport services using other modes of transport to a certain extent, there may not be full substitutability on every level. The competitive effects of the Transaction will therefore also have to be analysed on this narrower market.

(49) As concerns the exact market delineation, there seems to be sufficient evidence to conclude that non-scheduled services are not part of the short sea container shipping market, as the regularity of short sea services emerges as a distinctive characteristic of this market from the market investigation. Bulk vessels can also safely be exclud- ed from the assessment (even more so as the Parties do not operate any bulk vessels at all).

(50) Although Ro-Ro shipping found some support in the market investigation as a poten- tial substitute for short-sea shipping, its inclusion or not in the market would not af- fect the competitive assessment of the Transaction and can therefore be left open.

(51) Deep sea container shipping services on the other hand may exert a significant com- petitive pressure on short sea container shipping services. Given that the extent to which they do so depends on the specific trade, they will be taken into account or not in the competitive assessment of the respective trades.

(52) Finally, the question of whether reefer and dry transport services are part of the same market, and if so whether only reefer containers or also bulk reefer vessels44 should be included, can be left open because the assessment of the Transaction would not change materially either way.

2. Geographic market

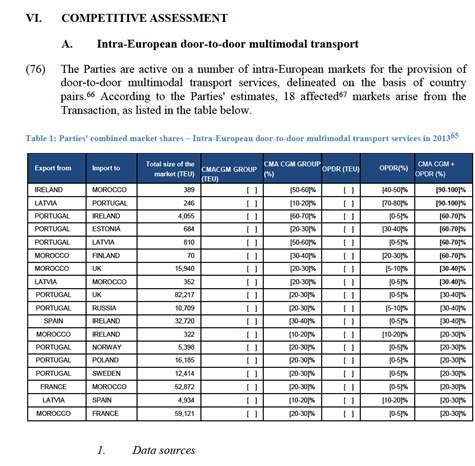

(53) In terms of the geographic size of the container shipping market, the Commission considered in its past practice a distinction on the basis of single trades, defined by the range of ports which are served at both ends of the service.45 Regarding short-sea unitised freight services, also encompassing short-sea container shipping, the Com- mission concluded in its past practice that such a market could be defined on the ba- sis of geographic corridors, ultimately leaving the exact market definition open.46

(54) In case M.7268 – CSAV / Hapag Lloyd, a case concerning deep sea container ship- ping, the Commission further distinguished between the legs of each trade.47 A "leg of trade" is defined as one of the two directions of a trade (e.g. on the trade connect- ing Northern Europe to North America and back, Northern Europe–North America is the first leg and North America–Northern Europe is the second leg). Given that the market conditions on the two directions of a trade can be significantly different, in particular in the case of trade imbalances or different characteristics of the products shipped, the Commission concluded that each leg constitutes a separate market.

(55) The Parties followed these precedents and provided market share data for their mari- time-only services (i.e. short-sea container shipping services) on the basis of geo- graphic corridors (i.e. trades), separate for each leg of trade.

(56) More specifically, the Parties submit that they are active on trades (or corridors) linking the Iberian peninsula and Morocco with the British Isles and Northern Eu- rope. The Parties define these trades as consisting of Spain and Portugal for Iberia, of the UK and Ireland for the British Isles and of Germany and Benelux for Northern Europe.48

(57) In the Commission's market investigation, large majorities of all groups of respond- ents have confirmed that for the present Transaction, geographic markets should be defined on the basis of trades (or corridors)49 and have indicated that short-sea con- tainer shipping services should not be looked at as being port-to-port only because shipping companies can serve a range of ports at both ends of a service.50

(58) Large majorities of all groups of respondents to the market investigation also consid- ered that transportation of cargo from point A to point B (the first leg of a trade) is a different market from the transportation of cargo from point B to point A (the second leg of a trade).51 In the Commission's market investigation the Parties' proposed de- lineation of trades (or corridors) was largely confirmed by competitors and freight forwarders, while customers tended to define trades as consisting of single countries only (with the exception of the Northern Europe end of trade whose proposed com- position was also endorsed by a majority of customers).52

(59) The Commission considers that in line with previous decisions and with the results of the market investigation, for the purpose of the assessment of the Transaction, the relevant geographic market should be delineated on the basis of single trades, de- fined by the range of ports which are called at both ends of the service.

(60) In conformity with previous decisions and the results of the market investigation, the Commission will consider each leg of trade separately. Since no competition concerns arise on the basis of leg of trades, it can be left open if each leg of trade forms a separate product market or not.

(61) As to the specific scope of the trades on which the Parties are active, the Commis- sion will carry out its assessment on the trades as proposed by the Parties. Given however that the Parties have also provided market shares on the more granular level for Spain and Portugal where the Parties' positions appear particulary strong, and given that the Transaction does not raise competition concerns on either level, the exact scope of the markets can remain open.

3. Conclusion

(62) The Commission concludes that for the purpose of the assessment of the Transaction a market for short-sea container shipping services, which to the extent outlined above is exposed to competitive pressure from other modes of transportation, should be considered. The geographic scope of this market is delineated on the basis of sin- gle trades, defined by the range of ports which are served at both ends of the service.

C. Container terminal services

(63) In previous Commission decisions,53 the provision of container stevedoring services by terminal operators has been defined as involving the loading, unloading, storage, and land-side handling for inland transportation of containerised cargo.

(64) With respect to deep-sea traffic, a delineation of container terminal throughput has been envisaged as follows:

(a) hinterland traffic, that is containers transported directly onto/from a container vessel from/to the hinterland (via barge, truck or train), and

(b) transhipment traffic, that is, containers destined for onward transportation to other ports. Transhipment traffic involves both feeder movements and relay movements.

(65) The relevant geographical dimension of stevedoring services is in its broadest scope regions, such as Northern Europe (for transhipment traffic); and in its narrowest pos- sible scope the catchment area of the ports in a certain range, such as Hamburg– Antwerp (for hinterland traffic) or possibly even narrowed down to comprising ports of a single Member State (such as Germany) only.54 The Commission however left open the precise definition of the geographic market.

(66) The Parties agree with the Commission's market definition but submit that for the assessment of the Transaction the distinction between hinterland traffic and tran- shipment traffic plays no role.55

(67) Given however that no competition concerns arise under any plausible market defini- tion, the exact market definition can remain open.

D. Freight forwarding

(68) The Parties submit that freight forwarding relates to the organisation of transporta- tion of items on behalf of customers but without taking on the actual transportation which is usually subcontracted to one or more third parties. The Parties submit that the market is at least national in size.56

(69) The Parties also argue57 that the market for freight forwarding is different from door- to-door intermodal transportation. The main difference between freight forwarding services and transport operators offering door-to-door services according to the Par- ties is that freight forwarders do not own transportation means or operate transport services, whereas transport operators do.

(70) The Commission has defined freight forwarding as "the organisation of transporta- tion of items (possibly including activities such as customs clearance, warehousing, ground services, etc.) on behalf of customers according to their needs".58 The Com- mission has so far left open if the freight forwarding market is national or larger.59

(71) However, the results of the market investigation proved inconclusive as to the ques- tion of whether the transport of goods should be looked at as strictly separate from freight forwarding services.60 Moreover, large majorities of the Parties' short-sea competitors as well as freight forwarders rejected the assertion that the use of own means of transport, i.e. a fleet of trucks or vessels, was determinant of whether a supplier of transport solutions should be considered a freight forwarder, a door-to- door shipper or a transport company.61

(72) The Commission considers that, given that door-to-door multimodal transport pro- viders take care of the organisation of the whole journey of the transported goods, they appear to be offering comparable services and thus to a substantial degree also compete with freight forwarders, which equally take care of the organisation of the whole journey of the goods to be transported. Different from what the Parties argue, the ownership of means of transport is not the decisive criterion to draw a line be- tween door-to-door transport providers and freight forwarders.62 The market investi- gation showed that not only do market participants dismiss this criterion but also that there are many examples of freight forwarders that own their own means of transpor- tation.

(73) While the Commission has in past cases63 indicated that "freight transport services constitute an input to freight forwarding services" and that "freight forwarding pro- viders offer a service to customers, which is often sub-contracted to the transport carrier", the market investigation has shown that the distinction between freight for- warding and transport services has increasingly become blurred. While freight for- warders as organisers of the transporation itinerary have taken on the execution of transport services themselves, transport providers more and more offer organisation services in addition to their own transportation services.64

(74) However, given that the proposed concentration would lead only to an affected mar- ket due to a vertical relationship, as one of the parties, CMA CGM has a dedicated freight forwarding subsidiary called CCLog, irrespective of the market definition, the Transaction will not lead to any appreciable impact on the competitive condi- tions. Therefore, it is not necessary to define the exact delineation between freight forwarding services and door-to-door multimodal transport services.

(75) In view of the above and in line with previous desions, the geographic maket for freight forwarding is considered as national or wider. However, the exact geographic definition can be left open since the Transaction would not raise serious doubts as to its compatibility with the internal market under any possible market definition as re- gards freight forwarding.

(77) The Parties submit that there are some limitationsas to the availability of data related to intra-Europe shipping. The main source is Eurostat, which however gathers data in tons and not on the basis of TEUs, the standardised measurement for freight containers.68 Moreover, the Eurostat data appear to jot always capture small volumes69 and occasionaly include significant inconsistencies between the volumes reported as having being shipped by a country A to a country B and thise reported received by country B from country A.70 The information on volumes shipped, mar- ket shares and capacity submitted by the Parties is based on a study realised by a consultancy taking into account data from Eurostat, the World Cargo Database and the container shipping database.71

(78) The market investigation confirmed the difficulty in collecting reliable data. The Commission did not engage in a market reconstruction, however it asked competi- tors to indicate the volumes they shipped. Competitors did not always confirm the Parties' submission, which appear at times to have sometimes overestimated compet- itors' volumes and thus somewhat inflated their respective market shares,72 whereas at other times competitors' volumes were underestimated resulting in lower market shares. Lastly, the Parties appear to consistently estimate the different markets' size as larger than their competitors; on the other hand, their competitors' estimates often suggest market sizes that in some instances would be lower than the Parties' actual volumes shipped.

(79) Therefore, although the market shares provided by the Parties are indicative of the structure and dynamics within the different markets, they should for the purpose of the present analysis be viewed critically and against the background of the additional information on volumes shipped and more broadly on the functioning of the market.

2. The Parties' view

(80) The Parties explain that in many of these markets, the volumes shipped are rather limited. As a result, when sea carriers serve these country pairs, they usually do not establish regular direct services. Instead, the Parties and other sea carriers serve these markets indirectly through transhipment, by shipping the cargo to one of their hubs through one of their regular services and from then on transferring it to one of their other services or slot chartering on other carriers' vessels to complete the service. Of all services listed in Table 1 above, only Portugal–UK is served directly by both Par- ties.

(81) Such services are introduced in view of accommodating specific customers' needs. The Parties argue that when a new request for shipping arises, they compete with providers of land transport as well as with sea carriers offering door-to-door services and to some extent also with freight forwarders. The latter could easily set up a ser- vice replicating that of the Parties combining their regular services with slot charter- ing and ensuring the delivery of the cargo. The information provided on capacity by the Parties further confirms that, should a sea carrier decide to replicate such service, there would be carriers other than the Parties able to take on such cargo.73

(82) The Parties further submit that this diversity of the services provided in the above coutry pairs does not allow for gathering reliable data on the total volumes shipped on these markets.

(83) Lastly, the Parties point out that in most of these country pairs, the increment of the Transaction is particularly low; it is therefore rather unlikely that competition con- cerns would arise.

(84) More specifically, the Parties submit that in twelve country pairs, their aggregate market share is below [30-40]%.74 Moreover, only in four of these twelve country pairs the increment of the Transaction exceeds 5%, namely in Morocco–UK, Portu- gal–Russia, Morocco–Ireland and Latvia–Spain.75

(85) Of the six country pairs, where the Parties' market shares exceed [60-70]%, the in- crement is below [0-5]% in two according to the figures provided by the Parties, namely in Portugal–Ireland, where the share of OPDR is [0-5]% and corresponds to […] TEUs and in Portugal–Latvia, where OPDR ships […] TEUs, amounting to [0- 5]% of the indicated total market. OPDR services these country pairs by shipping the cargo on one of its vessels from Portugal to the Netherlands and then slot charters on other carrier's vessels serving Ireland and Latvia respectively.76 This market is there- fore not regularly served by the Parties and many sea carriers and other transport op- erators active in the EEA would be in the position of taking on such low volumes post-Transaction and setting up a service similar to that of OPDR.

(86) In the remaining four markets, in which the Parties appear to have high market shares, the indicated size of the total market is below 700 TEUs, hence corresponds to less than an average short-sea vessel. These country pairs are Ireland–Morocco, Latvia–Portugal, Portugal–Estonia and Morocco–Finland; in two of those one end of the country pair is outside the EEA and the volumes shipped appear to be marginal.

(87) Therefore the Parties argue that the Transaction is unlikely to raise any competition concerns.

3. Commission's assessment

(88) The Commission's market investigation has confirmed that the Transaction is unlike- ly to raise competition concerns in any of the affected markets. Already based on the volume figures provided by the Parties the large majority of markets would be un- problematic because the increment brought about by OPDR in terms of actual con- tainers shipped is marginal77 or one end of an already small volume country-pair is outside the EEA, making the country-pair a non-substantial part of the Internal Mar- ket.78

(89) This leaves the following seven country pairs for a closer examination: Latvia– Portugal, Portugal–Estonia,79 Morocco–UK, Portugal–UK, Portugal–Russia, Spain– Ireland and Latvia–Spain.

(90) An assessment based on market shares, however, proved to be somewhat difficult, as the replies to the market investigation demonstrated that the volume data provided by the Parties did not hold up in every instance. The volume data collected from short sea competitors differed in many instances from the data reported by the Par- ties. Furthermore, even if the data collected from sea shipping operators are taken in- to account, it could not suffice to provide a full overview of the market and the vari- ous carriers' market shares because it would be omitting the cargo transported only by road and/or rail.

(91) As the Parties have in many instances underestimated the volumes shipped by their short sea competitors and therefore also the total market size, they consequently overestimated their own market share. In particular on the six markets in which the Parties submitted that their aggregate market share exceeded 60%, the market inves- tigation indicated that volumes shipped by other sea carriers were sometimes consid- erably higher, leading to an increase of the estimated total market and lowering the combined market share as indicated by the Parties.80

(92) However, there are also some markets where the Parties overestimated the volumes of competing short sea container shipping companies. Nevertheless, the corrected market shares for those country pairs do not, when put into context, lead to competi- tion concerns on any of these seven routes.

(93) Firstly, on Latvia–Portugal the Parties' combined market share appears to be much lower (it appears to be about [30-40]% in total only) since five other sea carriers in- dicated to be serving this country pair.81 As this country pair may also be reached completely by land it is furthermore probable that trucking companies or other transport operators have shipped volumes not accounted for in the Parties' data. OPDR does not serve Latvia directly, MacAndrews also charters slots on third carri- ers' vessels from Latvia to Rotterdam and then tranships on its own vessels and CMA CGM trainships in Nothern Europe between own vessels.82 Competition con- cerns on this country pair are therefore unlikely.

(94) Secondly, in the case of Portugal–Estonia, the Parties appear to have overestimated their competitors' volumes and subsequently also the size of the total market, result- ing in a slight underestimation of their own market share. However, two other short- sea competitors not mentioned by the Parties stated having had some volumes during the market investigation;83 additional shipments by land transport operators may also have been omitted in the data provided by the Parties. Here as well OPDR and MacAndrews charter slots on the leg connecting the Netherlands to Estonia and CMA CGM tranships in Nothern Europe. OPDR's monthly volumes in this market range from [less than 100] TEUs; it is therefore clear that most competitors would be in the position of taking on such volumes by setting up a service as OPDR did, if demand arose.84 Competition concerns on this country pair are therefore unlikely.

(95) On Latvia–Spain and Morocco–UK the Parties have equally underestimated their market shares. These country pairs are served by OPDR and CMA CGM through transhipment in Northern Europe. Similar services could therefore be offered also by other carriers serving one of the two ends of the country pair and a European hub, from which third party carriers take over the containers and transport them to the second country. Indeed, the market investigation revealed that a number of other sea carriers have been active on these country pairs.85 Given the size and experience of some of these carriers, it can be concluded that they would be in a position to offer services comparable to that of the Parties, as soon as demand arises.

(96) In the three remaining markets, namely in Portugal–UK, Portugal–Russia, and Spain–Ireland, the Parties' combined market share also appears to be potentially higher than indicated, but still below [60-70]% on a pure short sea shipping basis, which is an upper bound as transportation by truck has not been included in this fig- ure. In any event, the increment of the Transaction would be low or moderate (below 10% even when taking into account only the volumes reported by short-sea competi- tors). These country pairs are served by OPDR and CMA CGM through tranship- ment in Northern Europe, i.e. indirectly. Similar services could therefore be offered also by other carriers serving one of the two ends of the country pair and a European hub, on which services connecting the second country call. Indeed, the market inves- tigation revealed that a number of other sea carriers have been active on these coun- try pairs. Given the size and experience of some of these carriers, it can be concluded that they would be in the position to offer services comparable to that of the Parties, as soon as demand arises.

(97) A minority of respondents had concerns about the transaction in particular in relation to the Portugal–UK and Spain–UK country pairs but did not provide convincing rea- sons to substantiate their concerns. The clear majority of customers and competitors however did not identify competition concerns on all or a selection of the country pairs.86

(98) In light of the above considerations, and despite the Parties' apparent high combined market share, the Transaction is not expected to raise competition concerns on any of the affected country pairs.

B. Short-sea container shipping

1. The Parties' view

(99) The Parties submit that their short-sea container shipping activities overlap on six legs of trade, namely (i) from/to Northern Europe to/from Iberia, (ii) from/to Iberia to/from British Isles and (iii) from/to Northern Europe to/from Morocco. Of the six legs of trade, the Parties' overlap would give rise to three affected markets in the case of Iberia to British Isles, British Isles to Iberia and Northern Europe to Iberia.87

(100) The parties stress the complementarity of the merging firms on the short-sea ship- ping market, which would eventually benefit the customers. The parties emphasise that the merger will help reducing fixed costs (for container leasing, chartering costs, bunker – following new European regulation on fuel, etc.) and therefore the market price.88 The merger would also create operational synergies. Indeed, the capacity of OPDR ships northbound and Mac Andrews ships southbound in the Iberia–British Isles trade is overall low, while the capacity of OPDR ships southbound is rather high. Therefore, the merged entity would increase the overall capacity of ships, no- tably on the services between South Spain, Bilbao and the Canary Islands. This would lead to efficiency gains.

2. Analytical framework

a) Consortia

(101) The Parties have entered into a number of vessel sharing agreements/consortia with other sea carriers in intra-Europe trades. The Commission has considered in its past practice that such consortia may enable participating carriers to exert some influence over a part of the market greater than their actual market share, since consortia part- ners decide jointly on capacity, schedule, ports of call and are thus able to influence operational decisions of all consortia members. To reflect all volumes over which carriers have a certain degree of influence, the Commission based its assessment on the aggregate shares of these carriers' consortia, calculated as the combined share of all consortium members, acknowledging however that there is still a degree of com- petition between members of a consortium.89

(102) The impact of consortia on the respective markets will be taken into account in as- sessing the effects of the Transaction. The role of consortia in deep-sea container shipping appears however to be much more significant than in the case of intra- European short-sea shipping. This is due to the fact that deep-sea shipping services require much greater scale and are usually offered through the employment of much greater vessels, making cooperation among carriers crucial for achieving the neces- sary scale and continuing serving certain trades. In intra-Europe short-sea shipping, the vessels employed are smaller and the volumes shipped lower.90 Carriers usually offer independent services and slot charter on other operators' vessels; only more rarely they engage in cooperation in the form of consortia. Indeed, the Parties submit that, other than their own, no other consortia currently operate on the six overlapping intra-European short-sea trades.91

b) Competition by other modes of transport

(103) As already indicated in the section on market definition above,92 the Parties argue that the market should not be limited to short-sea shipping only, but include all con- tainer shipping activities, irrespective of the mode of transport used, in order to re- flect their activity, which is organised on a door-to-door basis. The Commission notes that it results from the market investigation, even when considering the impact of the Transaction on the narrowest segment of such a market, namely on intra- Europe short-sea shipping markets, that other modes of transport, as well as freight forwarders, indeed exert competitive pressure. This will therefore be taken into ac- count.

(104) Respondents to the market investigation confirmed that deep-sea vessels calling at European ports would constitute an alternative for customers of short-sea carriers on some trades. In addition, certain respondents identified trucks as the Parties' closest competitors on some trades. Lastly, in relation to customers' ability to switch, re- spondents to the market investigation seemed to consider switching to a different mode of transport slightly more difficult than to a different short-sea carrier, while confirming however that this would indeed constitute an alternative option.

c) Reefer market

(105) The transport of reefer containers accounted for more than 10% of the total container trade along all six legs where the Parties' activities overlap. In a narrower market definition for reefer container shipping only, the Parties' combined market shares would lead to the same affected markets as for the overall short-sea container ship- ping cargo (dry and reefer) as indicated in recital 1, namely Iberia to British Isles, British Isles to Iberia and North Europe to Iberia.

(106) Within each one of the affected markets, the Parties' combined market shares for reefer container shipping are within the same range as for the overall container ship- ping cargo (dry and reefer). Most of the main competitors are also active in the reef- er market, and the competitive assessment for overall cargo (dry and reefer) is there- fore applicable to reefer container cargo. In addition, none of the respondents to the market investigation has raised any substantiated concern as regards the effects of the Transaction over the reefer market. The reefer cargo is therefore not further dealt with separately in the competitive assessment.93

d) Barriers to entry

(107) The Parties further suggest that barriers to entry are very low in this market.94 As a result, any competitor or other logistics operator could easily start offering new or expand its current services if there is sufficient demand. The Parties argue that there is no need for carriers to start operating own vessels, instead they may start serving a trade through slot chartering or consortia with other carriers and choose to employ own vessels only at a later stage.

(108) The market investigation confirmed this finding, as competitors listed overcapacity, low profitability and costs as the main barriers to entry, specifying however that these costs are significantly lower in case of expansion.95 In terms of time, competi- tors consider that entry or expansion could be achieved within 3 to 12 months.96 Lastly, the market investigation indicated that customers may have the ability to en- tice a competitor to enter or expand its services on certain markets, e.g. by adding ports of call on their current rotation, as the majority of responding competitors con- firmed that they have been enticed by customers to offer new or expanded services in the past.97

(109) The Commission therefore considers that barriers to entry appear to be rather low and that entry could take place within a relatively short time frame. Given that at least some customers have buyer power and could entice entry and given that there appears to be a lot of unused capacity in short-sea container shipping, even potential entry is likely to exert competitive pressure on prices on a given trade.

e) Switching costs

(110) The Parties argue that switching is very easy and does not entail any costs for cus- tomers.98

(111) The vast majority of customers and freight forwarders responding to the market in- vestigation indicated that they purchase short-sea container liner shipping services from several suppliers; the most popular answer being that they contract with more than four suppliers. Several respondents indicated that they choose to multisource in order to ensure that they profit from the competition among their suppliers.99 Cus- tomers therefore appear to already have established relationships with a number of carriers and to be systematically comparing services and prices.

(112) When asked about how easy it is to switch from one sea carrier to another, the ma- jority of respondents assessed it as somewhat or very easy. A few customers indicat- ed that the time to switch would extend to the contract termination deadline usually covering 2–3 months; the majority of respondents however commented that switch- ing is a matter of a few days, on condition that the customer bears the cost of the change of schedule.100 The market investigation was rather inconclusive as to wheth- er switching into a different mode of transport would also be easy; those considering this more difficult identified cost as the main reason.

(113) The Commission considers that frequent switching between short-sea container shipping providers is a rather customary feature of the industry and takes place with- in relatively short time frames. Switching costs do not appear to be prohibitively high.

3. Iberia to British Isles

a) The Parties' view

(114) The Parties submit that this trade comprises the UK and Ireland on one end and Spain and Portugal on the other.101 According to the Parties' estimate, CMA CGM (including MacAndrews) has a market share of [50-60]% and OPDR of [5-10]%, leading to a combined market share of [60-70]% on this trade.102 In addition, MacAndrews is in a consortium with DSL on this trade, as well as in a consortium with Samskip, which is active on this and the Iberia-Northern Europe trade. The market share corresponding to the Parties and their consortia would, according to the Parties, amount to [70-80]% on the Iberia-British Isles trade.103 Should Spain and Portugal be looked at individually, and the British Isles be split as well into Ireland and the UK, the Parties' market shares would amount to [50-60]% on a potential Por- tugal to UK trade and to [60-70]% on a potential Spain to UK trade, and no overlap would occur on the trades to Ireland.104

(115) The Parties argue that despite these market shares the concentration does not lead to any competition issues. First, the Parties point out that they face significant competi- tive pressure from providers of other modes of transport, such as Ro-Ro vessels, trucks, deep sea vessels etc. According to their estimate, their combined market share would be below [20-30]% and the Transaction's increment less than [0-5]% on a broader market including all modes of transport.105

(116) Second, the Parties' main competitor on this trade is the MSC Group with its special- ised short-sea subsidiary WEC (and to a lesser extent also under its main brand MSC itself) having an aggregate share of 11%. SeaGo (Maersk's short-sea subsidiary) and Borchard Lines are also active on this trade, as is the deep-sea carrier K-Line.

(117) Lastly, the Parties submit that there is sufficient capacity on this trade, as the vessels they employ amount to less than [20-30]% of the total available short-sea shipping capacity.106 Customers would therefore have several alternatives to the Parties post- Transaction, not only among short-sea carriers, but also among providers of services of other modes of transport.

b) Commission's assessment

(118) The market investigation indicated that the Parties had slightly overestimated com- petitors' market shares on this trade, although the discrepancy would account for on- ly 1 640 TEUs, corresponding to less than 1% of the total trade. The market investi- gation has revealed that, under the most conservative calculation, the Parties' com- bined market share would be [60-70]% ([70-80]% with consortia). The increment of the Transaction would however not exceed [5-10]%, even under the most conserva- tive estimation.107

(119)The information provided by the Parties on capacity reflects the total capacity of all vessels serving the Iberia-British Isles trade. It therefore provides an overview of the activity on the trade, but however does not fully correspond to the capacity actually used on the trade, given that several carriers combine their services on this trade with other services, carrying cargo destined for ports in other ends of trade, which are served on the same rotation (e.g. in Northern Europe, Mediterranean, etc.).108

(120) According to the information provided by the Parties there are 20 services by nine different sea carriers established on this trade (10 of which operated by sea carriers different from the Parties) 109 among which Borchard, X-Press Feeder, SeaGo Line, WEC Lines, as well as Hamburg Süd, Hapag-Lloyd, K-Line, and MSC.110 Even if not all of the above currently carry significant volumes, they regularly call at ports on both ends of this trade, and would therefore be in the position of easily taking on additional volumes, should there be an increase in demand. The vast majority of re-spondents to the market investigation also consider that capacity meets or exceeds demand on this trade.111

(121) Further, the market investigation showed, also in relation to this trade, that barriers to entry are low.112 In particular, a customer indicated that after the economic crisis of 2009–2010 when truck capacity became scarce and land transport rates increased significantly, new entry and expansion of incumbents' services was witnessed among short-sea carriers on this trade.113 Moreover, competitors explained that they regular- ly monitor this trade. Four of the Parties' close competitors confirmed that they are already considering entering or expanding their services between Iberia and British Isles and would continue to do so also post-Transaction.114

(122) In addition, according to the Parties submissions, short-sea shipping represents ap- proximately […]% of the total volumes shipped on this trade.115 The majority of di- rect customers and freight forwarders also took the view that trucks, Ro-Ro and deep-sea vessels exert strong competitive constraint on short-sea carriers.116 The vast majority of competitors also shared the same view, identifying competition from trucks as strongest, followed by Ro-Ro and deep sea vessels.117

(123) Lastly, when asked whether the Transaction is likely to have a negative impact on competition on this trade, the majority of the respondents did not identify such risk.118 Rather, a majority of customers (freight forwarders that buy services from ei- ther or both Parties included) consider that sufficient competitors or potential entry exist on the six trades, Iberia to British Isles included.119

(124) In view of the above considerations and in particular the fact that several competitors appear to consider entry, the Commission concludes that the Transaction does not lead to serious doubts as to its compatibility with the internal market on a market for the provision of short-sea transport services in the Iberia–British Isles trade.

4. British Isles to Iberia

a) The Parties' view

(125) The Parties submit that CMA CGM (including MacAndrews) has a market share of [40-50]% and OPDR of [5-10]%, leading to a combined market share of [50-60]% on this trade in 2013. In addition, MacAndrews' consortia with DSL and Samskip operating northbound on this trade are also serving the southbound leg. The market share corresponding to the Parties and their consortia would, according to the Par- ties, amount to [70-80]% on the British Isles−Iberia trade.120 Should Spain and Por- tugal be looked at individually, and the British Isles be split as well into Ireland and UK, the Parties' market shares would amount to [50-60]% on a potential UK to Por- tugal trade and to [50-60]% on a potential UK to Spain trade,121, and no overlap would occur on trades to Ireland.

(126) The Parties argue that the concentration does not lead to any competition issues. First, the Parties point out that they face significant competitive pressure from pro- viders of other modes of transport, such as Ro-Ro vessels, trucks, deep sea vessels etc. According to their estimate, their combined market share would be below [10- 20]% and the Transaction's increment less than [0-5]% on a broader market includ- ing all modes of transport.122

(127) Second, the Parties argue that there are many actual competitors on this trade, in- cluding Borchard Lines and K-Line. Since their total capacity on the trade amounts, as already mentioned in recital (117) above, to less than [20-30]% in terms of short- sea shipping and to [5-10]% if capacity on deep-sea vessels is also considered, the Parties submit that customers could choose among several sea carriers on this trade.

b) Commission's assessment

(128) The market investigation indicated that the Parties had overestimated competitors' market shares and the total size of the market in this trade. Given the rather small size of this leg of trade, such overestimation would impact on the Parties' market shares, which would, under the most conservative calculation, amount to [70-80]% and to [80-90]% with consortia; the increment of the Transaction would however not exceed [10-20]%, even under the most conservative estimate.123

(129) Despite the high combined market share of the Parties on this trade however, the ma- jority of respondents to the market investigation did not identify potential competi- tion problems in this trade.124

(130) First, nearly all respondents to the market investigation stated that there is overca- pacity on this market.125 The size of the market (less than 60 000 TEUs) is only ap- proximately a fourth of the volumes shipped northbound.126 This imbalance of shipments results from the fact that the British Isles are an import and not an export mar- ket in relation to the Iberian peninsula. To cope with this imbalance, one competitor stated that although it is active on the Iberia-British Isles trade, it chose to not serve the southbound leg, but to instead continue by serving a different trade and thus re- turn to Iberia after a larger rotation to increase its efficiency.127 Another competitor explained that although it operates southbound between British Isles and Iberia, it mainly returns empty containers to be used again on the northbound leg. Therefore, it has almost "unlimited capacity" that would allow it to accommodate additional cargo, should demand increase, without any change to the current service or vessels employed.128

(131) Second, the Parties submit that there are 21 services by nine different sea carriers established on this trade (11 of which operated by sea carriers different from the Par- ties), as almost all carriers providing the northbound service return to Iberia, often however after calling on ports belonging to different ends of trade.129 Even if not all of these carriers currently transfer significant volumes, they would be in a position to take on additional cargo, if there is an increase in demand. The Parties' competitors on this leg include Borchard, WEC Lines and SeaGo, as well as their two consortia partners that also compete with the Parties, at least concerning prices. Moreover, in this case as well, short-sea container shipping constitutes only one of the available options of shipping goods from the British Isles to Iberia; Ro-Ro vessels, deep-sea vessels, as well as trucks and rail have been identified by customers and competitors as alternative possibilities.130

(132) Third, as already mentioned in recital (107), the market investigation showed that barriers to entry are low on intra-European short-sea shipping markets.131 Therefore, should demand rise, carriers would be in the position of expanding their current ser- vices, adjusting their rotation to include this leg of the trade or enter for the first time, as they currently specifically prioritise other legs due to the reduced volumes shipped between the British Isles and Iberia.

(133) In view of the above considerations and in particular the overcapacity and low utili- sation rates on this leg of trade, and in line with the results from the responses to the market investigation, the Commission concludes that the Transaction does not lead to serious doubts as to its compatibility with the internal market on a market for the provision of short-sea transport services in the Iberia–British Isles market.

5. Northern Europe to Iberia

a) The Parties' view

(134) The Parties submit that this trade comprises Belgium, Netherlands and Germany on one end and Spain and Portugal on the other. According to the Parties' estimate CMA CGM (including MacAndrews) has a market share of [5-10]% and OPDR of [10-20]%, leading to a combined market share of [20-30]% on this trade. In addition, MacAndrews' consortium with Samskip is also active on this trade. The aggregate market share of the Parties and the consortium would, according to the Parties, amount to approximately [20-30]% on the Northern Europe–Iberia trade.132

(135) The Parties argue that despite these market shares the concentration does not lead to any competition issues. First, the Parties point out that on this trade, competition by trucks is particularly strong, as the whole journey may be made by road. According to their estimate, their combined market share would be below [0-5]% and the Transaction's increment less than [0-5]% on a broader market including all modes of transport.133

(136) Second, the Parties argue that the market is only "slightly affected" and that this is only due to the sharp decrease in size of this leg of trade, which contracted by ap- proximately 15% from 2012 to 2013, rather than the Parties' performance. Other sea carriers active on this trade are WEC Lines with a market share of 10–15%, as well as K-Line, Cosco and Cobelfret with market shares between 5% and 10%. Further, the Parties claim that their capacity corresponds to approximately 10% of the total capacity on the trade, excluding deep-sea services.134 Customers would therefore be able to choose among different providers in the short-sea shipping sector, as well as providers of services of other modes of transport.

b) Commission's assessment

(137) The market investigation was somewhat inconclusive as to the volumes shipped by competitors on this trade. The data provided by some competitors with volumes shipped from Northern Europe to Iberia seem to include cargo shipped from ports beyond the catchment area where the Parties operate in Northern Europe.135 In any event, the vast majority of respondents to the market investigation did not identify potential competition problems in this trade and the Parties' moderate market shares indicate that there is sufficient competition on this trade.136

(138) Nine further sea carriers, active in both short-sea shipping, like SeaGo Lines, WEC Lines, X-Press Feeder and deep-sea shipping, such as Evergreen, K-Line, Hapag- Lloyd, MSC reported having shipped volumes on this trade during the market investigation. Even if some shipped only marginal quantities, the fact that they are servingthis trade indicates that they would be in the position of taking on additional cargo in case of increase in demand. The Parties also submit that there are 17 services established on this market, which could also accommodate any increased services re- quest.137

(139) Further, sea shipping could be replaced by land transport on this leg of trade as well, as trucks, trains and Ro-Ro vessels have been identified by customers and competi- tors as alternative possibilities.138 In addition, on this market as well, the market in- vestigation did not indicate lack of capacity; instead the vast majority of respondents consider that capacity either meets or exceeds demand on this leg.139 Lastly, no spe- cific barriers to entry were identified on this market during the market investigation. Therefore, carriers could expand their current services or start offering new ones, should demand rise on this market. Moreover, a large majority of all respondents considers that sufficient competition or potential entry /expansion exists on this trade post transaction. 140

(140) In view of the above considerations, the Commission concludes that the Transaction does not lead to serious doubts as to its compatibility with the internal market on a market for the provision of short-sea transport services on the Northern Europe– Iberia market.

c) Conclusion

(141) In light of the above considerations, despite the high market shares on two of the above mentioned markets and against the background of the results of the market in- vestigation, there seems to be sufficient actual and potential competition to defeat any attempt by the merged entity to raise prices.

C. Vertical relationships

(142) The CMA CGM Group offers services that are vertically related to the container short-sea shipping business and the door-to-door multimodal transport. In particular, CMA offers freight forwarding services and container terminal services.

(143) The Transaction would create vertical links between the Parties' operations (i) in the market for container short-sea shipping and door-to-door multimodal transport ser- vices on the one hand, and the market for freight forwarding services on the other hand; as well as (ii) in the market for container short-sea shipping and the market for container terminal services.

1. Freight forwarding services

(144) Short-sea shipping services and possibly door-to-door multimodal transport may be a necessary input to freight forwarding services. Freight forwarders are actually among the most important customers of short-sea container liner shipping companies, to which they subcontract transport of cargo.

(145) The CMA CGM Group, through its wholly-owned subsidiary CCLog, provides freight forwarding services. CCLog offers all complementary services needed in the transport and logistics chain such as customs clearance, freight forwarding, packag- ing or storage. CCLog’s agency network covers 28 countries over the world (China, France, UK, Netherlands, Belgium, Germany, Canada, USA, Vietnam, Malaysia, In- donesia, Lebanon, India, Sri Lanka, Australia, Egypt, Jordan, Bangladesh, Russia, Turkey, South Africa, Brazil, Poland, Italy, Morocco, Spain, Thailand and Namibia), Europe representing around […]% of its worldwide turnover, and France being by far the most important country with […]%.

(146) On the basis of the combined market shares of the Parties, the Transaction would create verticaly affected markets in excess of 30% between the provision of freight forwarding services via CCLOG and the Parties' activities in the market of (i) door- to-door multimodal transport services and (ii) short-sea container shipping. Namely on the following country pairs and legs of trade:

· "Spain to Ireland", "Morocco to UK" and "Portugal to UK", in the country pair approach; and

· "Iberia to British Isles" and "British Isles to Iberia" in the geographic corri- dor approach.

a) The Parties' view

(147) The Parties submit that these vertical links will not lead to any competition concern because (i) the market share of CCLOG in any of the abovementioned countries is well below [0-5]%, and (ii) the market share of OPDR for freight sea services in any of these countries is low.

b) Commission's assessment

(148) The Commission considers that, given the low market share of CCLOG in freight forwarding, irrespective of any market segmentation, it is unlikely that the merged entity would have the ability or incentive to foreclose accesss to a sufficient custom- er base to its actual or potential freight forwarding rivals in the upstream markets for short-sea shipping or door-to-door multimodal transport services. Likewise, due to the low market share of CCLOG, it is unlikely that other freight forwarders would be foreclosed from access to short-sea container shipping services by the Parties on any trade.

c) Conclusion

(149) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the ver- tical relationship between the activities of the Parties in the markets for short-sea container liner shipping and door-to-door multimodal transport services on the one hand, and the market for freight forwarding services on the other hand.

2. Container terminal services

(150) Terminal services have consistently been considered as an upstream market to the provision of short-sea shipping services.141

(151) The CMA CGM Group holds [CONFIDENTIAL] stakes in eight terminals in Eu- rope and a further one in Morocco:

· Intramar (Marseille – France),

· Antwerp Gateway (Antwerp – Belgium),

· Générale de Manutention Portuaire (Le Havre – France),

· Terminal des Flandres SAS (Dunkirk – France),

· Terminal du Grand Ouest (Montoir de Bretagne – France),

· Eurofos (Fos – France),

· Marseille Manutention (Marseille – France),

· Malta Freeport Terminals (Marsaxlokk – Malta), and

· Somaport (Casablanca – Morocco).

(152) In addition, the CMA CGM Group also holds [CONFIDENTIAL] stakes in the ter- minals Rotterdam World Gateway (Rotterdam – the Netherlands), Container Han- dling Zeebrugge (Zeebrugge – Belgium) and Eurogate Tanger (Tangiers – Moroc- co).

(153) The Transaction would therefore create vertical links between the Parties' operations in the market for short-sea shipping services and the upstream market for container terminal services.

(154) Given the current ports of call of OPDR and the terminals [CONFIDENTIAL] CMA CGM, the Transaction may give rise to a vertical overlap in the region of Antwerp (Antwerp Gateway) and Morocco (Somaport).

(155) In 2013, the total volume handled by the CMA CGM Group accounted for a [10- 20]% market share for container terminal services in the region of Antwerp. Equally, Somaport accounted for a [5-10]% market share for container terminal services in the Casablanca–Tangiers range.

a) The Parties' view

(156) As regards the container terminal services provided by the CMA CGM Group in Antwerp/Zeebrugge, the Parties submit that there is no trade to/from a region includ- ing Belgium on which the Parties together have a combined market share in excess of 30%.

(157) As regards the container terminal services provided by the CMA CGM Group in Morocco (Somaport), the Parties submit that OPDR already has all its volumes han- dled in Casablanca by Somaport, and that their volumes represented less than [0-5]% of the overall volumes handled in the Casablanca–Tangiers range in 2013. 142

(158) Therefore, the Parties argue, the Transaction will not lead to any competition con- cerns regarding these vertically related markets.

b) Commission's assessment

(159) When asked about the impact of the Transaction to the vertically related market for the provision of container terminal services, a majority of competitors, customers and freight forwarders have stated that the Transaction would not have a negative ef- fect on any of the relevant trades.143

(160) The Commission considers that the merged entity would not have the ability to en- gage in any foreclosure strategy on the market of container terminal services.

(161) First, it is unlikely that the merged entity would stop providing port terminal services to competing liner shipping companies in Antwerp or in Morocco, since the market share for port terminal services by the parties is low and there are enough alternative providers offering port terminal services.

(162) Second, it is unlikely that competitors in the market for container terminal services where the Parties offer such activities (see recital (151)) would be foreclosed from access to a significant customer base, since the Parties represent a limited share of the demand for container terminal services both in North-Western Europe and in Morocco.

c) Conclusion

(163) In light of the above, the Commission concludes that the Transaction would not raise serious doubts as to its compatitibility with the internal market with respect to the vertical relationship between the activities of the Parties in the market for short-sea container liner shipping services and in the market for container terminal services.

VII. CONCLUSION

(164) For the above reasons, the European Commission has decided not to oppose the noti- fied operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replace- ment of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p.3 ("the EEA Agreement").

3 Publication in the Official Journal of the European Union No C 179, 2.6.2015, p. 11.

4 "TEU" stands for the 'twenty-foot equivalent unit' used to describe the capacity of one ship container.

5 The ConRo vessel is a hybrid of a Roll on-Roll off vessel (see footnote 12) and a container ship.

6 Form CO, paragraphs 43 and following, Share Purchase Agreement related to the Shares in Olden- burg-Portugiesische Dampfschiffs-Rhederei GmbH & Co. KG, its General Partner including certain parts of the business of OPDR Canarias S.A., signed by Bernhard Schulte GmbH & Co KG and CMA CGM S.A. of 20 November 2014, Annex 2 to the Form CO.

7 Form CO, paragraphs 95 and following.

8 Form CO, paragraph 94.

9 OPDR recently created a subsidiary dedicated to road transport called OPDR Road Spain. It just start- ed its operation in 2014 and carries cargo in Spain, on land. However, its activity is marginal com- pared to OPDR's total turnover (less than [0-5]%). OPDR Road Spain offers road transport services independently from short-sea shipping. OPDR does not provide inland transportation services sepa- rately from their container short-sea shipping activities other than through OPDR Road Spain; Form CO, footnote 24.

10 Form CO, paragraph 112.

11 Form CO, paragraph 91.

12 "Roll on-roll off"' shipping corresponds to the transport of wheeled cargo (lorries, cars, etc.) on ships.