EC, July 28, 2008, No M.5188

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

Mars/ Wrigley

Dear Sir/Madam,

Subject: Case No COMP/M.5188 – Mars/ Wrigley

Notification of 20/06/2008 pursuant to Article 4 of Council Regulation No 139/20041

1. On 20.06.2008, the Commission received a notification of a proposed concentration by which the undertaking Mars Incorporated ("Mars", USA) acquires sole control of the whole of Wm. Wrigley Jr. Company (“Wrigley”) by way of purchase of shares.

I. THE PARTIES

2. Mars is a family-owned company. It is active in confectionery, food and pet care products. Its confectionery business comprises chocolate confectionery and to a smaller extent sugar confectionery.

3. Wrigley is a US-based multinational company active in gum and sugar confectionery. It is listed on the New York and the Chicago stock exchanges. Wrigley’s principal products are gum and hard candy.

II. CONCENTRATION

4. Mars intends to acquire a controlling equity interest of 80.7% in Wrigley. Berkshire Hathaway which is amongst others financing the transaction will acquire a minority interest of 19.3% in Wrigley. Berkshire Hathaway will not have rights that could confer joint control over Wrigley. At closing, Mars will transfer its worldwide sugar confectionery business to Wrigley. Mars intends to keep Wrigley as a stand-alone entity post closing.

III. COMMUNITY DIMENSION

5. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 billion (Mars: EUR 15.544 billion, Wrigley: EUR 3.932 billion).2 Each of them have a Community-wide turnover in excess of EUR 250 million (Mars: EUR […] million, Wrigley: EUR […] million), and they do not achieve more than two-thirds of their aggregate Community-wide turnover within one and the same Member State. The notified operation therefore has a Community dimension.

IV. RELEVANT MARKETS

6. The proposed concentration concerns the production of chocolate confectionery, sugar confectionery and gum.

A) Relevant product markets

7. The parties submit that the relevant product markets are chocolate and non-chocolate confectionery. However, the parties provided market share information also on the following confectionery segments:

- Chocolate confectionery;

- gum;

- Sugar confectionery.

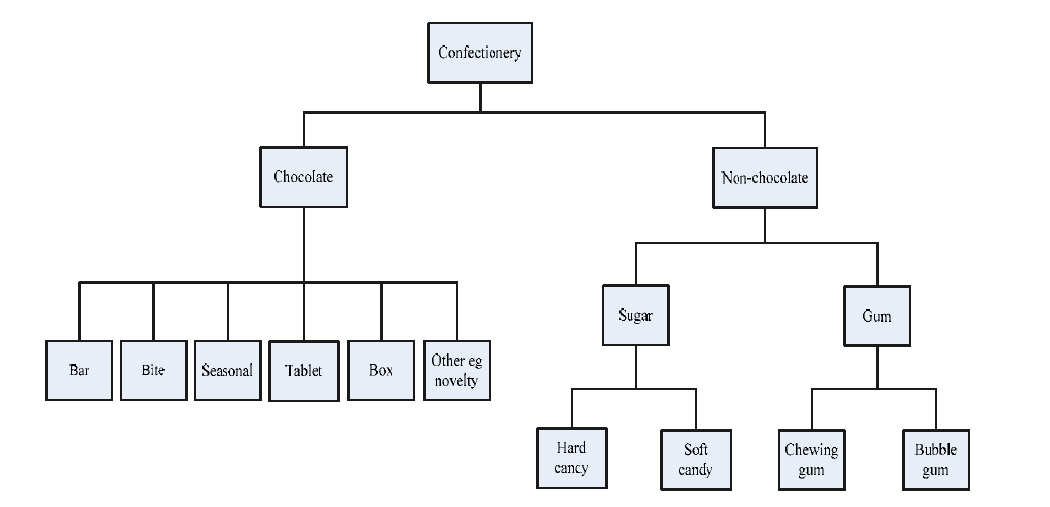

8. According to the parties the confectionery industry can be sub-divided as follows:

9. In the parties' view, non-chocolate confectionery products such as gum and sugar confectionery are not substitutes for chocolate. Chocolate is consumed for hunger satisfaction or indulgence purposes, whereas gum and sugar confectionery are not. They are consumed for enjoyment and, in some cases, such as pastilles and hard candy, oral hygiene or breath freshening.

10. The parties, in particular Wrigley, believe that gum cannot be considered a separate product market from sugar confectionery given the high degree of substitutability between gum products on the one hand and sugar confectionery on the other. As noted above, gum and sugar confectionery products include a wide variety of impulse products that are consumed not to satisfy a sensation of hunger but rather for pure enjoyment or (in the case of certain gum and sugar confectionery products) reasons of oral hygiene, such as plaque reduction or breath freshening.

11. Regarding supply side substitutability, chocolate and non-chocolate confectionery are not substitutable as they are manufactured in different production lines and it is not possible to switch production in the short term and without incurring significant cost.

12. In previous decisions the Commission has considered that the market for confectionery could be subdivided into separate markets for (i) sugar confectionery and (ii) chocolate confectionery.3 However, the Commission left the market definition open.

13. The Commission's market investigation has shown that the majority of respondents agree with a sub-division of the confectionery market into three segments, i.e. chocolate confectionery, gum and sugar confectionery.

14. For the purposes of deciding the present case it can be left open how exactly the product markets should be defined since competition concerns do not arise under any alternative product market definition.

B) Relevant geographic markets

15. The parties acknowledge that the geographic markets are national.

16. In previous decisions4 the Commission concluded that the relevant geographic market for chocolate and non-chocolate confectionery was national. The results of the market investigation also indicated national markets. However, the geographic market definition can be left open.

V. COMPETITIVE ASSESSMENT

17. The parties' activities only overlap in sugar confectionery products. Wrigley is not active in chocolate markets and Mars is not active in gum markets. There are no vertical relationships.

Horizontal effects

18. If the market was divided into three separate markets, i.e. chocolate confectionery, sugar confectionery and gum the transaction would lead only to one affected market in the meaning of the ECMR. The parties would have a combined market share of [10-20]% only in the market for sugar confectionery in Latvia. In all other markets, where both parties are active, their market share would be lower. In the markets for sugar confectionery where Wrigley has a higher market share (Bulgaria: [20-30]%, Romania: [25-35]%, Slovenia: [10-20]%), Mars is not active. Based on these limited market shares the concentration is unlikely to give rise to competition problems in the market for sugar confectionery.

20. On the possible market of non-chocolate confectionery as opposed to chocolate confectionery, the proposed transaction would lead to combined market shares of over 30% in a number of geographic markets due to Wrigley's strong position in gum (Austria: [30-40]%+ [0-5]%, Czech Republic: [30-40]% + [0-5]%, Estonia: [40-50]%+ [0-5]%, Ireland: [25-35]% + [0-5]%, Latvia: [35-45]% + [0-5]%, Lithuania: [35-45]% + [0-5]%, Slovakia: [30-40]%+ [0-5]%). However, the market share increment contributed by Mars is small (mostly an increase of [0-5]%). The highest market share of Mars in this segment is in the UK ([0-10]%), however the combined market share here would be only [20-30]%.

21. The parties claim that the merged entity would face significant competitors on all these markets, such as Cadbury, Nestle, Hershey, Kraft Foods, Ferrero, Lindt, Perfetti Van Melle, etc. The market investigation showed that in the UK and Ireland especially (where the market shares of Mars, though modest, are higher than in other countries) there are several credible competitors remaining in the non-chocolate confectionery market (for example Cadbury, Perfetti van Melle, Nestle, Haribo and Swizzels Matlow).

22. Given the limited market shares of Mars, it does not appear that Mars has exercised a significant competitive constraint on Wrigley in these markets. The concentration is, therefore, unlikely to give rise to competition concerns in the market for non-chocolate.

Potential competition

23. According to the information provided by the parties, Mars tried to enter the EEA gum market in 2004. It did so by extending its pre-existing sugar confectionery "Skittles" brand into bubble gum5. Skittles bubble gum was launched in 2004, by way of a test in a limited number of UK retailers. However, according to Mars, consumer demand was very low, and sales already began to decline by the end of that same year. Total sales in 2004 amounted to EUR […]. The test proved to be unsuccessful, and the product was finally discontinued in the UK in 20056.

24. In light of these facts the Commission has considered whether Mars could exercise a competitive constraint on Wrigley in the gum market as a potential competitor.

25. For a merger with a potential competitor to have significant anti-competitive effects, two requirements must be met: (1) the potential competitor must already exert a significant constraining influence or there must be a significant likelihood that it would grow into an effective competitive force and (2) there must not be a sufficient number of other competitors, which could maintain sufficient competitive pressure after the merger.7 Neither condition appears to be met in the present case.

26. On the one hand, Mars submits that it abandoned all plans to enter the EEA gum market following the failed attempt. It submits internal documents to this effect, which show that the decision was made by Mars to discontinue its gum-related activity in the EEA. Mars has not identified any other internal document that assessed the gum market and possible entry into the gum market by Mars.

27. Furthermore, there are a number of actual competitors in the gum markets within the EEA such as Cadbury, Leaf and Perfetti Van Melle and more recent entrants such as GlaxoSmithKline, Nestle/Colgate-Palmolive and Lofthouse/Fisherman's Friends. The parties also list a number of other potential entrants into the European markets, such as Hershey and Lotte which are active in gum outside the EEA.

28. In light of i) the lack of evidence that Mars has plans to re-enter the gum market, ii) the fact that its entry was unsuccessful and iii) the fact that even if Mars would constitute a potential competitor (now or at least in the near future) it is unlikely that it would exert a more significant constraining influence on Wrigley in gum markets than other actual or potential competitors.

Conglomerate effects

29. The Commission further investigated whether the combination of the two companies could give rise to competition concerns by way of conglomerate effects, given that chocolate, sugar confectionery and gum may all be considered as impulse products.

30. Wrigley enjoys very high market shares in gum in several Member States in the EEA ([90-100] %). However, the market shares of Mars in chocolate are considerably lower.

Mars only exceeds a market share of 30% in Cyprus ([30-40]%) and the Netherlands ([30-40]%), but in these countries Wrigley has smaller market shares (Cyprus [25-35]%, the Netherlands [0-10]%). Mars' share is below 25% in all other countries except for the UK ([20-30]%), where Wrigley's accounts for [80-90]%. Whether the combination of the two companies could give rise to competition concerns would depend on Wrigley's ability to leverage its market position in the gum market into the chocolate market and/or the sugar confectionery market and whether the concentration could thereby harm consumers through foreclosure in the chocolate and/or sugar-confectionery market following the merger.

31. Conglomerate effects can in particular arise where the merging companies are active in closely related markets, e.g. where the merger involves suppliers of complementary products or of products which belong to a range of products that is generally purchased by the same set of customers for the same end use.8

32. The risk that the new entity would be able to leverage its market position in the gum markets into sugar confectionery seems low. The market share increment added by Mars in most national sugar confectionery markets is very small ([0-5]%), so that the situation post-merger does not significantly change compared to the current situation. Moreover, in the two countries where Mars has higher market shares in sugar confectionery than Wrigley (Mars has in the UK [0-10]% and in Ireland [0-10]%), Wrigley’s market shares in sugar confectionery are very small ([0-5]%). This indicates that Wrigley has so far not been able to leverage its strong position in gums into the respective national sugar confectionery markets.

33. Regarding the risk that the new entity would be able to leverage its market position in the gum markets into chocolate confectionery, the parties submit that neither of these two criteria is fulfilled in the combination of Mars and Wrigley because:

- it does not involve suppliers of complementary products; chocolate and gum are not complementary within the meaning of the Commission's Guidelines. The Commission itself in its Guidelines defines products as being “complementary” “when they are worth more to a customer when used or consumed together than when used or consumed separately.”9 This is not the case for chocolate and gum; and

- it does not involve products which, although they are purchased by the same customers (retailers and wholesalers), are purchased for the same end use; chocolate and gum are used for different purposes by the end consumer. Consumers do not purchase chocolate and gum for the same end uses. Chocolate is consumed for hunger satisfaction or indulgence purposes. Gum is consumed for enjoyment and oral hygiene or breath freshening.

34. The market investigation largely confirmed that chocolate and gum are not complementary. Responses showed that the volume of sales of chocolate is not influenced by the volume of sales of gum and vice versa. Similarly, even though the products might be bought by the same customers they are not typically bought together and they are certainly not used together. According to most retailers, gum and chocolate are neither bought together, nor bought by the same customers, nor used together. In general, most customers have not expressed concerns with the merger.

35. Several competitors mentioned, however, that gum and chocolate were bought by the same customers on the basis that they could both be considered as impulse and/or snack products which are sold in the "hot-zones"/ impulse buying areas in grocery stores (typically close to the cash desks).Although a number of competitors have commented on the combination of two players that are significant in their own respective segments of the confectionery sector, the specific concern that was raised by several competitors also pointed to these "hot-zones"/ impulse buying areas in grocery stores. Some competitors indicated that the parties would enjoy a very strong position in these check- out zones/impulse areas of grocery shops following the merger. One competitor raised the concern that the parties might be able to demand exclusivity for this area post- merger.

36. Based on data provided by the parties, however, it appears that the check-out area within a store is generally not a key sales area for chocolate products even within sales through grocery channels. Apart from a few countries such as […] where Mars' market shares are very low, Mars sells the majority of its products via the aisle. Although the checkout-zone is the key selling area for gum, the concentration does not change the situation to this effect as it is Wrigley, not Mars, which is already a very strong player here.

37. Based on i) the lack of compelling indications that chocolate and gum are closely related markets, ii) the lack of concern from customers and iii) evidence provided by the parties pointing to the limited importance of the checkout-zone for chocolate products, it does not appear likely that […] could lead to competition problems in the respective chocolate markets.

VI. CONCLUSION

38. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of Council Regulation (EC) No 139/2004.

1 OJ L 24, 29.1.2004 p. 1.

2 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Notice

on the calculation of turnover (OJ C66, 2.3.1998, p.25).

3 Case COMP/M.4293 – Nordic Capital Fund VI/ ICA Meny, of 8 September 2006, para. 11; Case M.2072

- Philip Morris/Nabisco, Commission decision of 16 October 2000.

4 See e.g. COMP/M.4824 Kraft/Danone Biscuits, para. 19; COMP/M.2072 Philipp Morris/Nabisco, para.17.

5 […]

6 […]

7 Guidelines on the assessment of horizontal mergers, [2004] C 31/5, para. 60.

8 Guidelines on the assessment of non-horizontal merger, para. 91.

9 See Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentration between undertakings (“Non-Horizontal Merger Guidelines”), footnote 10.