EC, July 25, 2008, No M.5197

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

HP/ EDS

Dear Sir/Madam,

Subject: Case No COMP/M.5197 – HP/ EDS

Notification of 19/06/2008 pursuant to Article 4 of Council Regulation No 139/20041

1. On 19/06/2008, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the "EC Merger Regulation") by which the Hewlett-Packard Company ("HP", USA) acquires within the meaning of Article 3(1)(b) of the Council Regulation control of the whole of Electronic Data Systems Corporation ("EDS", USA) by way purchase of shares. HP and EDS are together referred to below as "the parties".

I. THE PARTIES

2. HP is a global information technology company with a broad portfolio of hardware, services and software, which it provides to consumers, businesses and institutions globally.

3. EDS is a global information technology services company supplying business solutions. It provides a range of IT outsourcing and business processing outsourcing services to businesses globally.

II. THE OPERATION

4. On 13 May 2008, HP and MergerCo, a Delaware corporation formed and currently wholly owned by HP, entered into an Agreement to merge MergerCo with EDS, the latter continuing as the surviving entity. After the merger, EDS will be a wholly owned subsidiary of HP. The operation constitutes a concentration within the meaning of Article 3(1)b of the EC Merger Regulation.

IV. COMMUNITY DIMENSION

5. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 billion2. Each of them have a Community-wide turnover in excess of EUR 250 million, and they do not achieve more than two-thirds of their aggregate Community-wide turnover within one and the same Member State. Therefore the notified operation has a Community dimension within the meaning of Article 1(2) of the EC Merger Regulation3.

V. COMPETITIVE ASSESSMENT

I. RELEVANT MARKETS

Product market

6. According to the notifying party, the relevant product market encompasses all IT services. This market includes the provision of several types of services such as IT Management (outsourcing of infrastructure and/or applications), consultancy, operational support, applications and delivery.

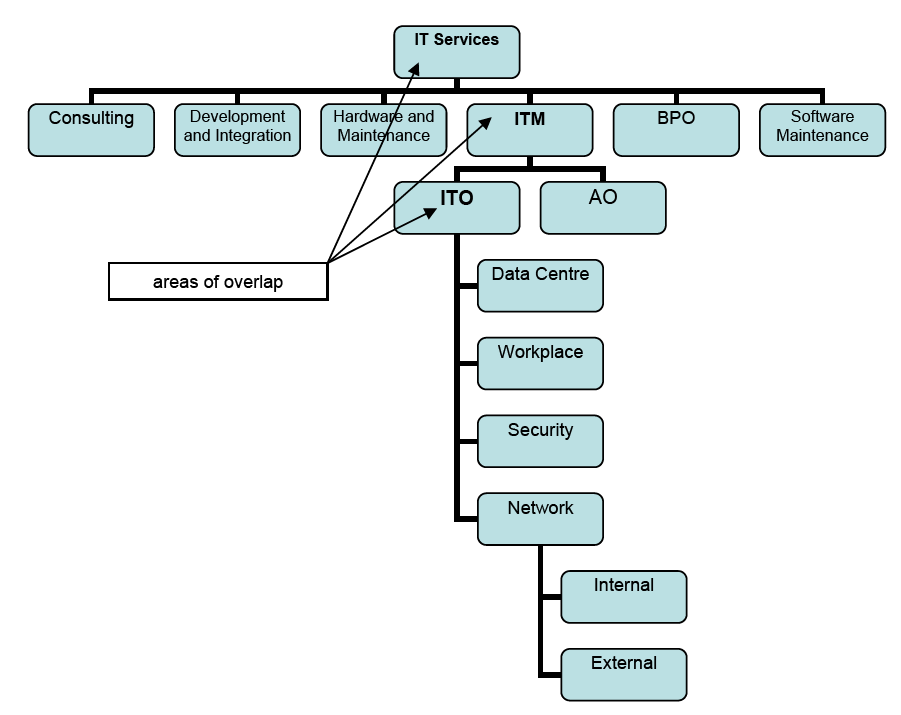

7. Industry analysts, such as Gartner, sub-divide the market in six categories: a) consulting services, b) development and integration services, c) hardware and maintenance services, d) IT management (outsourcing), e) business process outsourcing (BPO) and f) software maintenance services. IT Management can be further sub-divided into Infrastructure Outsourcing (ITO) and Applications Outsourcing (AO). Figure 1 illustrates these categories.

Figure. 1

8. In previous decisions, the Commission considered the possibility of sub-dividing the market for IT services in a way similar to Gartner by identifying seven service categories4: (i) hardware maintenance; (ii) software maintenance and support; (iii) IT and business consulting; (iv) software development and integration; (v) IT management services ("ITM"); (vi) business management services; and (vii) education and training. Furthermore, the Commission also considered a further sub-division of the ITM segment into Application Outsourcing and IT Outsourcing5. However, in each of these cases the exact definition of the market was left open.

9. The notifying party argues that these service categories do not constitute separate markets because of i) the ability of many customers to purchase all of their IT services from a single provider, ii) the fact that all major players in global IT services are active in all or most segments of IT services, and iii) the high degree of supply-side substitutability in the provision of these services.

10. In IBM/PWC Consulting6, the Commission referred to a possible delineation of the IT services market along "verticals", i.e. according to type of industry in which the customer is active. The notifying party does not consider this delineation to be appropriate. In fact, whilst certain customers may have specific requirements, most service providers operate across a large number of verticals, suggesting a significant degree of supply-side substitutability.

11. In some cases, the Commission also considered the possibility of making a distinction between the supply of IT services to large corporations and SMEs7, a subdivision which the notifying party considers to be inappropriate in view of the similarity of services provided to small and large customers. SMEs and larger customers are also supplied by the same service providers.

Market investigation

12. The results of the market investigation show that the majority of the respondents acknowledge the possibility of considering different segments of the market for IT services to be separate relevant markets. Both competitors and customers agree in their vast majority with the proposed sub-division of IT services into the six segments identified by Gartner: a) consulting services, b) development and integration services, c) hardware and maintenance services, d) IT management (outsourcing), e) business process outsourcing (BPO) and f) software maintenance services. This division is in line with the previous Commission precedents8. As for the potential sub-division of the ITM segment into AO and ITO services, the result of the investigation was balanced with a slim majority of respondents maintaining that there are separate markets for ITO and AO. However, 20 out of 27 customers who replied to the market investigation purchase ITO and AO from the same suppliers.

13. With regard to sub-division of the market for IT services along different "verticals", bidding data obtained from the parties suggest that most service providers operate across each or a large number of "verticals", indicating a significant degree of supply-side substitutability.

14. Similarly, with regard to the possible sub-division of the IT services market according to the size of the customers, the results of the market investigation confirmed a significant scope for supply side substitutability, but were not conclusive on the point.

15. Nevertheless, the question whether IT services, for the purposes of defining the relevant market, should be sub-divided by segments (including further sub-division of ITM into AO and ITO), verticals or by customer size can be left open, because the concentration does not raise competition concerns under any possible definition of the relevant market.

Geographic market

16. The notifying party submits that the relevant geographic market for assessing the impact of the transaction on competition in the market for IT services is world-wide or at least EEA-wide in scope. In previous decisions, the Commission has indicated that the IT services market has increasingly shown a strong trend towards internationalisation of supply and demand, but left the exact geographic scope open9.

17. The market investigation showed that IT services and their narrower segments are considered to be worldwide by the vast majority of the respondents, while a minority of the respondents suggested that the ITM market could have an EEA-wide scope.

18. In any case the question whether the market for IT, ITM and the other possible sub- segments are EEA wide or worldwide in scope can be left open, because the concentration does not raise any competition concern under any possible definition.

II. ASSESSMENT

A. HORIZONTAL ISSUES

IT Services

19. Both parties are active in IT services. HP’s portfolio of IT services includes hardware and software support, consulting and integration and outsourcing services10. EDS is a supplier of IT services in all IT services areas except hardware and maintenance services. Both parties' clients are active in a variety of different sectors11.

20. According to the notifying party, the concentration will not give rise to affected markets either on a global or EEA-wide basis. The notifying party provided market share data for the IT services market as a whole as well as its different segments (by type of service) and verticals (by type of customer) as defined by Gartner.

21. The overlap between the parties on an overall IT services market is limited both on a worldwide and an EEA level; their combined market share in 2006 is [5-10%] at a worldwide level and [5-10%] at an EEA level and has been decreasing between 2004 and 200612. Such a wide market for IT services would be highly fragmented. The leader both in the EEA and globally would be IBM with a market share of around [5-10%]. The next largest competitors (e.g. Fujitsu, Accenture, Capgemini, T-Systems) would have market shares of between [0-5%] and [0-5%] both on a worldwide and an EEA level. Many of these, especially IBM, are active across all or several sub-segments of IT services.

22. Further, on the basis of the information provided by the notifying party, the respective business focus of HP and EDS is different. Being mainly a hardware producer, HP’s primary focus is hardware and maintenance services13, where [the majority] of its IT services revenues are generated. EDS does not have significant business in this sector. Furthermore, HP has limited capability in IT Management services where EDS has a broad offering.

23. Against this background, it can be concluded that the concentration does not raise any competition concerns in the overall market for IT services. As the results of the market investigation showed that the only significant overlap occurs in a market confined to ITM only, the following section will address this aspect.

IT Management

24. If a narrower definition of the relevant product market based on the sub-segments of IT services is considered, the only significant overlap between the parties is in the ITM segment. However, also on the basis of this narrower definition of the relevant market, the concentration would not give rise to affected markets.

25. The parties’ combined market share in ITM in 2006 is [5-10%] at a worldwide level and [10-20%] in the EEA. Like the overall market for IT services, this segment is fragmented. The market leader is IBM with a market share of [10-20%] globally and [10-20%] at an EEA level. The next largest competitors (e.g. Fujitsu, Capgemini, CSC and T-Systems) have market shares between [5-10%] and [0-5%] at both worldwide and EEA level.

26. The parties consider that their respective business focus in this segment is different. As noted, ITM can be subdivided into Infrastructure Outsourcing (ITO) and Applications Outsourcing (AO). HP has negligible activities in the AO sub-segment, where EDS has a strong presence. Further, HP’s activities in the ITO sub-segment is confined to the provision of services inside individual data centres, while EDS has developed an external network which can connect data centres globally. HP also submits that the client base of the parties to the concentration does not overlap significantly both as regards individual customers and vertical categories.

27. There is no third party data regarding the market shares in the two sub-segments of ITM; ITO and AO. On the basis of internal presentations to HP's board submitted by the notifying party, it can be estimated that the worldwide combined market share for ITO in 2007 would be [5-10%], with IBM being the market leader with around [10-20%]. CSC, Fujitsu, BT, NTT and T- Systems would be the closest competitors with market shares between [0-5%] and [0-5%]. As for AO, even if EDS is the market leader with a market share of around [20-30%], HP's post-merger increment would be only around [0- 5%]14.

28. The majority of respondents to the market investigation consider that HP and EDS compete in the overall ITM market. However, some of the respondents have specified that the parties only compete in some areas of ITM, namely the ITO sub-segment. This is consistent with the information provided by the notifying party, according to which HP has very limited AO activities. The activities of HP and EDS overlap in the ITO sub- segment where both parties provide some data centre, internal network, workplace and security services. The parties submit that these types of services are also provided by many other competitors including IBM, Accenture, T-Systems, ATOS Origin, CSC and Getronics.

29. On the basis of the bidding data provided by the parties to the concentration15, it can be concluded that even in the narrower ITM segment the parties are not the most important competitors. Out of [300-400] bids for the supply of ITM services, in which EDS participated in the last 3 years, IBM was its direct competitor in […] bids (~[30-40%]), Accenture and HP in […] bids each (~[10-20%]), ATOS Origin in […] bids (~[0-10%]), Cap Gemini and T-Systems in […] cases each (~[0-10%]) followed by others. Out of [0- 100] EMEA bids which HP fully tendered for over the last three years, EDS was a competitor only in […] cases (~[0-10%]). IBM was HP's competitor in […] cases (~[30- 40%]), T-Systems in […] cases (~[10-20%]), Fujitsu in […] cases (~[0-10%]) followed by Accenture and ATOS Origin in […] cases (~[0-10%]) and CSC in […] cases (~[0- 10%]).

30. In the market investigation, customers confirmed that they can purchase ITM services from several suppliers other than the parties, including IBM, ATOS Origin, Capgemini, T-Systems, Accenture and CSC, as well as a number of smaller players active locally or regionally. The investigation also showed that the majority of customers are able to "insource" their ITM needs, which constitutes an additional competitive constraint on the combined entity.

31. It can also be noted that several customers and competitors pointed to the positive effects of the merger in the ITM segment, in particular referring to economies of scale, increased innovation and reduction of prices. Some customers also expect the merged company to offer improved quality of service in the ITM segment.

32. On the basis of the above, it can therefore be concluded that the concentration does not raise competition concerns in the market for ITM services or in any of the ITO or AO sub-segments.

Large companies versus SMEs

33. No independent data are available to determine the market shares of the parties in relation to the possible sub-division of the market between large and small customers. Since the parties to the concentration are active primarily in the provision of services to large customers, and because smaller customers can purchase IT services from smaller, regional suppliers, any potential concerns would be limited to the segment of large companies. The bidding data provided by the parties, which includes only bids larger than 25 million Euros, demonstrates that the concentration would not be likely to raise concerns even if the relevant market would only include the larger companies. The parties are not the most important competitors in the ITM services also if the market is confined to sales to large customers only.

34. Against this background, the concentration would not give rise to competition concerns also under this market definition.

"Verticals"

35. The notifying party submits that the concentration would not give rise to affected markets even if assessed on the basis of individual vertical segments. There are no significant overlaps in the parties' activities in any vertical of the IT services market. Whereas HP is stronger in healthcare and general services, EDS is particularly strong in agriculture, mining and construction as well as in the national government sector. According to Gartner data, the parties' combined market share in the different "verticals" in the EEA is [10-20%] or lower in the year 2006. Such markets are very fragmented, IBM being a market leader with a market share between [5-10%] and [10-20%] in half of the categories. Several globally active competitors such as T-Systems, Siemens, Accenture, Capgemini and Atos Origin have leading positions or market shares of [less than or around] 10% in each category16. Bidding data provided by the notifying party also confirm that most bidders participate in bids across several different verticals.

36. Against this background, the concentration would not give rise to competition concerns also under this market definition.

B. NON-HORIZONTAL ISSUES

37. Given HP's significant activities in the market for supply of IT hardware systems and products (in particular storage solutions and servers) as well as some activity in the market for supply of software,17 it could be considered that the concentration has a non- horizontal aspect in as much as these products are necessary components which are integrated into new or existing IT systems in order to implement an overall IT solution.

38. The notifying party contends that the concentration will not give rise to foreclosure concerns, in particular because of HP's lack of market power in any server and storage solutions or software markets as well as any IT services market. In addition, it submits that customers in the market for IT services have substantial power over the sourcing process of IT software and hardware. It therefore concludes that the merged company would lack the ability to leverage its position in the IT services market into the software and hardware markets.

39. Furthermore, the notifying party considers that, since it is already active in IT services, the concentration would not change its incentive to sell third party software and hardware to its IT service customers. Finally, it also considers that, even assuming that it would have the ability and incentive to engage in such a levering strategy, the effect on HP's software and hardware sales would be minimal.

40. The market investigation has revealed that while several customers purchase software and hardware from or through their IT services providers, their choice of software and hardware vendor is made independently from the choice of IT services supplier. Customer choice is determined by factors such as existing infrastructure and infrastructure needs, performance, quality and cost. Hence it appears that, even assuming that the merged entity had the incentive and were to attempt to give preference to its own software or hardware solutions when serving its IT service customers, it would lack the ability to do so, given that customers retain a high degree of discretion in the choice of hardware.

41. Furthermore, a large majority of respondents to the markets investigation expressed no substantiated concerns with regard to the effects of the merger in relation to the hardware or software markets.

42. Against this background, it can be concluded that the concentration does not raise competition concerns even as regards its possible non-horizontal dimension.

VI. CONCLUSION

43. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of Council Regulation (EC) No 139/2004.

1 OJ L 24, 29.1.2004 p. 1.

2 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Notice

on the calculation of turnover (OJ C66, 2.3.1998, p25).

3 Combined aggregate worldwide turnover exceeding € 5 000 million (HP € 77 576 million, EDS € 16 150

million); each of HP and EDS achieved a Community-wide turnover exceeding € 250 million (HP € […]

EDS € […]). None of the companies achieves more than two thirds of its Community-wide turnover in

one and the same Member State.

4 See e.g. Case No COMP/M.2478 - IBM Italia/Business Solutions/JV (dated 29 June 2001); Case No

COMP/M.1901 - Cap Gemini/Ernst & Young (dated 17 May 2000); Case No IV/M.1561 –

Getronics/Wang (dated 15 June 1999); Case No IV/M.2609 – HP/Compaq (dated 31 January 2002); and

Case No IV/M.3398 – HP/Triaton (dated 26 March 2004).

5 See Case No COMP/M.2478 - IBM Italia/Business Solutions/JV.

6 Case No COMP/M.2946 – IBM/PWC Consulting and case No COMP/M.3398 – Hewlett Packard /Triaton.

7 Case No IV/M.3398 – HP/Triaton; Case No COMP/M.2478 - IBM Italia/Business Solutions/JV. The

concept of medium-sized, small and micro enterprise is defined in Recommendation 2003/361/EC

regarding the SME definition which replaced Recommendation 96/280/EC as from 1 January 2005. See

http://ec.europa.eu/enterprise/enterprise_policy/sme_definition/index_en.htm .

8 Gartner provides data on six sub-segments of IT services: Consulting Services, Development and

Integration Services, Hardware and maintenance Services, IT Management, Process Management and

Software Maintenance Services. Compared to the segmentation used by the Commission Gartner does not

provide data for education and training which is included in the “consulting” segment and business

management services are included in the “process management” segment.

9 Cases IBM Italia/Business Solutions/JV at para 28; Cap Gemini/Ernst & Young at para 11; HP/Compaq at

para 26; and HP/Triaton at para 10.

10 HP markets its IT services to particular industries such as communications, media and entertainment,

manufacturing and distribution, financial services, health and life sciences and the public sector.

11 “Verticals” include manufacturing, financial services, healthcare, communications, energy, transportation

and consumer and retail industries. EDS has a particular focus in the Government vertical in the United

States and the UK.

12 Source: Gartner.

13 In line with its traditional base in IT products.

14 Calculations based on figures provided by the notifying party in Annex 5.4J, page 8.

15 Both parties provided data on won, lost and abandoned bids for contracts of value >€ 25 million, for the years 2006/2007/2008 for ITM in the EEA.

16 According to Gartner IT services market shares in the EEA of August 2007, the market leaders in each

category are the following: a) communications – T-Systems, [10-20%] b) discrete manufacturing –

Siemens ,[5-10%] c) financial services – IBM, [10-20%] d) healthcare – HP, [5-10%] (combined market

share with EDS is [5-10%]) e) local and regional government – IBM, [5-10%] f) national and

international government – Capgemini – [5-10%] (combined market share HP+EDS , [5-10%]) g) process

manufacturing – IBM, [10-20%] h) process manufacturing – IBM, [5-10%] i) services – HP, [5-10%]

(combined market share with EDS [5-10%]) j) transportation – IBM, [10-20%] k) utilities – Capgemini –

[10-20%] l) wholesale trade – IBM – [10-20%].

17 HP has a market share of [25-35%] in all servers and [15-25%] in all storage, with a higher share of

narrower segments.