Commission, December 15, 2010, No M.6007

EUROPEAN COMMISSION

Judgment

NOKIA SIEMENS NETWORKS/ MOTOROLA NETWORK BUSINESS

Dear Sir/Madam,

Subject: Case No COMP/M.6007 – Nokia Siemens Networks/ Motorola Network Business

Notification of 11 November 2010 pursuant to Article 4 of Council Regulation No 139/20041

1. On 11 November 2010, the European Commission received a notification of a proposed concentration pursuant to Article 4 and following a referral pursuant to Article 4(5) of the Merger Regulation by which the undertaking Nokia Siemens Networks B.V. ("NSN", The Netherlands), controlled by Nokia Corporation (Finland), acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the majority of Motorola, Inc.'s public wireless network business (Motorola Network Business, "MNB", US) by way of purchase of assets.

I. THE PARTIES

2. NSN provides mobile and fixed network infrastructure, communications and networks service platforms, as well as professional services to operators and service providers. NSN is one of the three business groups of Nokia, together with the Devices & Services and NAVTEQ business groups.

3. MNB designs, manufactures, sells, installs and services wireless access systems, including cellular infrastructure systems and wireless broadband systems, to wireless services providers.

II. THE OPERATION AND CONCENTRATION

4. The envisaged transaction concerns the acquisition of sole control by NSN of MNB by way of purchase of assets.

5. The operation therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

6. This operation does not have an EU dimension within the meaning of Article 1 of the Merger Regulation because MNB's total EU turnover for the year 2009 is only EUR […] million and MNB does not achieve a turnover of at least EUR 25 million in at least three EU Member States2.

7. However, on 14 October 2010, the notifying party informed the Commission in a reasoned submission that the concentration was capable of being reviewed under the national competition laws of at least three Member States (Austria, Bulgaria, Ireland, Italy, Lithuania, Portugal, Slovak Republic, Spain, and the UK) and requested the Commission to examine it. None of the Member States that were competent to examine the concentration indicated its disagreement with the request for referral within the period laid down by the Merger Regulation. Besides, none of the undertakings concerned achieves more than two-thirds of its aggregate EU-wide turnover within one Member State. The case is therefore deemed to have a Community dimension according to Article 4(5) of the Merger Regulation.

IV. COMPETITIVE ASSESSMENT

(1) Market definition

Product market definition

8. The proposed transaction concerns the mobile telecommunications equipment sector.

9. Within mobile telecommunications equipment, the parties' activities overlap in the following product segments: (i) public wireless network equipment infrastructure, and in particular the Radio Access Networks ("RAN"), Core Network Systems ("CNS"), and Operation Support Systems ("OSS")/Business Support Systems ("BSS") segments and (ii) associated network infrastructure services, and in particular Deployment, Delivery and Installation services ("DDI"), Maintenance and Care services ("M&C") and Managed services for mobile networks.

(a) Public wireless network equipment infrastructure

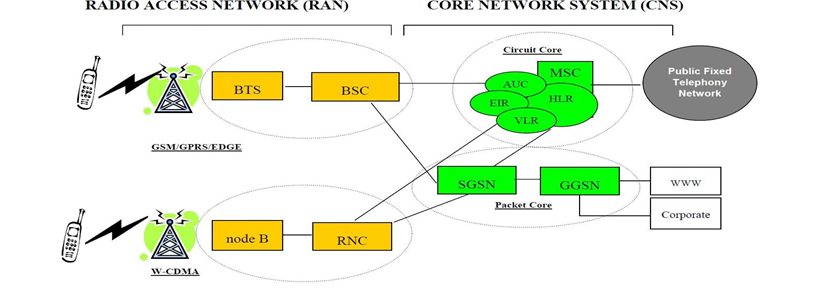

10. The parties submit that regardless of the technology used3, mobile network equipment has two principal components as presented below: (i) the RAN, which performs the radio functions of the mobile network and (ii) the CNS, which manages information flows within the mobile network, providing call control and security functions such as location updating and authentication.

11. In addition, in order to ensure the proper technical and commercial operation of the network, operations and business support software (OSS/BSS) is required. OSS is a software that enables mobile network operators to manage, monitor and control network operations and services; BSS is a software that enables mobile service to carry out business related functions such as billing, charging and subscriber management functions.

12. In its decision in case COMP/M.4297 - Nokia/Siemens the Commission concluded that RAN elements and CNS elements constitute separate product markets. Moreover, the Commission concluded that within the overall market for RAN, a distinction should be made according to technology and particularly that CDMA technology, GSM/GPRS/EDGE technology and WCDMA technology constitute separate markets4. In the same decision the Commission also considered that OSS and BSS could be separate markets but ultimately left the definition open5.

13. While the vast majority of the respondents to the market investigation confirmed that the Commission’s findings in the Nokia/Siemens decision are still relevant, some have claimed that with regard to RAN the industry is experiencing some convergence in technology and that in the future the distinction between CDMA, GSM/GPRS/EDGE and WCDMA technology might no longer be relevant.

14. In the present case the precise product market definition can be left open as under all possible product market definitions competition concerns are unlikely to arise.

(b) Associated network infrastructure services

15. The notifying party submits that these services can be classified in the following categories: (i) DDI services, which typically comprise the support services that are required from the preliminary planning phase to the activation of the network, (ii) M&C services, which typically comprise preventive and reactive services designed to maintain consistent network functionality and related software and hardware services, and (iii) Managed services, which allow an operator to outsource certain tasks, including network-related technical activities, to the service provider.

16. In its decision Nokia/Siemens, the Commission noted that DDI and M&C services are likely to form part of the broader market for the supply of network equipment. The Commission also looked at DDI and M&C services separately and combined as a market segment within mobile services. On the other hand, managed services are often delivered separately by telecom players and could therefore constitute a separate product market6.

17. The market investigation confirmed that the Commission findings in the Nokia/Siemens decision are still relevant.

18. In the present case the precise product market can be left open as under all possible product market definitions competition concerns are unlikely to arise.

Geographic market definition

19. In Nokia/Siemens7 the Commission found that the markets for mobile network infrastructure equipment and associated mobile services are global or at least EEA-wide. However, the Commission ultimately left open the exact scope of the relevant geographic markets.

20. The market investigation confirmed that the scope of the geographic markets in exam is at least EEA-wide, if not global, mostly due to the international standardisation of mobile telecommunication networks equipment and related services, the fact that contracts are concluded on a global basis and the limited regional variations in cost and price.

21. In the present case the precise definition of the geographic market can be left open as under all possible geographic market definitions competition concerns are unlikely to arise.

(2) Competitive assessment

22. The activities of NSN and MNB overlap horizontally in the mobile network infrastructure equipment sector and the associated network infrastructure equipment services. There are no vertical relationships between their activities.

23. According to the information provided by the notifying party, the combined market shares of the combined entity post-transaction will be above 15% in the markets for (i) RAN equipment, including the narrower GSM/GPRS/EDGE RAN and WCDMA RAN equipment segments; and (ii) network infrastructure equipment services, including the narrower DDI and M&C.

24. As regards all RAN infrastructure equipment, the parties would have a combined market share of [30-40]% in the EEA (NSN [30-40]%, MNB [0-5]%) and [20-30]%worldwide (NSN [10-20]%, MNB [5-10]%).

25. On the narrower segments of GSM/GPRS/EDGE RAN and WCDMA RAN, the table below shows the market shares of the parties and their main competitors.

Table 1: Mobile Network Infrastructure Equipment

| GSM/GPRS/EDGE RAN | WCDMA RAN | ||

EEA | worldwide | EEA | worldwide | |

NSN | [30-40]% | [20-30]% | [30-40]% | [20-30]% |

MNB | [0-5]% | [5-10]% | [0-5]% | [0-5]% |

Combined | [20-30]% | [20-30]% | [30-40]% | [20-30]% |

Ericsson | [30-40]% | [30-40]% | [30-40]% | [30-40]% |

Alcatel/Lucent | [10-20]% | [10-20]% | [10-20]% | [5-10]% |

Huawei | [5-10]% | [10-20]% | [10-20]% | [10-20]% |

ZTE | [0-5]% | [5-10]% | [0-5]% | [0-5]% |

Others | [5-10]% | [5-10]% | [0-5]% | [10-20]% |

Source: Nokia’s and MNB’s sales are actual sales for fiscal year 2009. The market size estimates are based on NSN internal estimates.

26. As regards all network infrastructure equipment services, including both fixed and mobile services, the parties would have a combined market share of [20-30]% in the EEA (NSN- [20-30]%, MNB-[0-5]%) and [20-30]% worldwide (NSN-[10-20]%, MNB-[0-5]%).

27. On the narrower market segments of DDI services and M&C services, the table below shows the market shares of the parties and their main competitors.

Table 2: Associated Network Infrastructure Equipment Services (including both fixed and mobile services)

| DDI services | M & C services | ||

EEA | worldwide | EEA | worldwide | |

NSN | [30-40]% | [20-30]% | [20-30]% | [10-20]% |

MNB | [0-5]% | [0-5]% | [0-5]% | [5-10]% |

Combined | [30-40]% | [20-30]% | [20-30]% | [20-30]% |

Ericsson | [10-20]% | [10-20]% | [10-20]% | [20-30]% |

Alcatel-Lucent | [10-20]% | [5-10]% | [20-30]% | [10-20]% |

Huawei | [0-5]% | [10-20]% | [5-10]% | [10-20]% |

NEC | [0-5]% | [0-5]% | [0-5]% | [5-10]% |

Others* | [30-40]% | [30-40]% | [30-40]% | [30-40]% |

Source: MNB’s sales are actual sales for fiscal year 2009. NSN’s mobile services sales and shares are NSN’s rough estimates.

* The “Others” category includes several IT-related firms including IBM, Accenture, Lemcon Networks, Leadcom, Mycom, DMN Installations, Bovis Lend Lease and others.

28. The notifying party submits that NSN and MNB are not close competitors, due to their complementary product portfolios and different geographic coverage. MNB is predominantly active in CDMA8 and WiMAX9, and the vast majority of MNB’s customer base is in the US and Japan. NSN is not active in CDMA or WiMAX. Moreover, the submitted bidding data demonstrates that MNB has not been very successful in winning bid competitions for public wireless network infrastructure in the EEA10.

29. The notifying party also submits that the merged entity will still face a number of strong competitors such as Ericsson and Alcatel-Lucent, with estimated market shares in all the relevant market segments, which are comparable to or higher than the combined entity's. Two of the other main competitors are the two most recent market entrants Huawei and ZTE. Both of these players have won leading mobile network equipment competitions for 2G, 3G and 4G equipment and have significantly expanded their share over the last 5 years both in the EEA and on a global basis. Furthermore, the notifying party submits that there are several significant competitors such as Samsung, NEC, Fujitsu, Cisco systems that are active on a global basis without a significant EEA presence that could easily expand into the EEA.

30. Finally, according to the notifying party, the combined entity would continue to be competitively constrained by its customers - mobile network operators such as Vodafone, Orange, T-Mobile, Telefónica, China Mobile, who are sophisticated buyers that construct detailed, multi-stage procurement processes on a worldwide basis in order to extract the best possible terms from vendors.

Results from the market investigation

31. At first, it should be noted that the vast majority of respondents did not express any objections against the proposed transaction. One customer (operator) and two competitors expressed some concerns in relation to a stronger market position of the combined entity. However, for the reasons set out in the following paragraphs, the markets in issue will remain competitive post-transaction.

32. The majority of the respondents confirmed the notifying party’s claim that the NSN and MNB are not close competitors as their product portfolios are complementary and MNB’s presence in the EEA is limited.

33. With regard to the combined market shares post-transaction in those markets where NSN's and MNB's activities overlap, the figures in tables 1 and 2 above indicate that in the EEA the increment brought about by the transaction will be negligible as it will be below [0- 5]% in all the markets concerned.

34. Moreover, the market investigation confirmed that the relevant markets are bidding markets. As previously indicated by the Commission11, this implies that the market shares of the parties do not necessarily give indication of the market power that the merged entity will obtain post-merger.

35. The market investigation indicated that customers, who are big mobile network operators, are sophisticated buyers that acquire network equipment through tender procedures launched every 3 to 5 years both for newly installed equipment (a greenfield operation) and for subsequent upgrades and updates (brownfield operations). These tender procedures involve multiple vendors and selection criteria are price and technology offered. Moreover, most of the customers have different suppliers for the same generation of network equipment.

36. The market investigation also showed that contracts usually have a duration of 3 to 5 years, as that is the time required to develop and roll-out a network. However, the price for the overall network equipment and its installation is usually agreed upon in advance for the whole contract duration. Moreover, at the termination of the contract, an operator would usually launch a new tender and would therefore be free to choose a new network equipment supplier.

37. On top of such purchasing patterns that maintain pressure on all vendors to offer competitive and cost effective solutions, the market investigation also confirmed that post-merger the combined entity will continue to face several effective competitors, such as Alcatel-Lucent and Huawei, with Ericsson being the market leader in GSM/GPRS/EDGE RAN.

38. Finally, some respondents to the market investigation also revealed that due to the steep increase in data traffic in the past years and the pressure by mobile network operators, prices for mobile network equipment have been steadily decreasing.

39. Based on the above it can be concluded that the proposed concentration does not raise serious doubts as to its compatibility with the internal market.

V. CONCLUSION

40. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 In 2009 NSN had a worldwide turnover of EUR 41,000 million and an EU-wide turnover of EUR […] million. In 2009 MNB had a worldwide turnover of EUR […] million and an EU-wide turnover of EUR […] million.

3 Mobile network equipment can be grouped into technology generations, with each subsequent generation increasing both transmission capacity and technological capability. Equipment generations can be classified into 2/2.5G, 3G and 4G products.

4 Commission decision of 13 November 2006 in Case COMP/M. 4297 – Nokia / Siemens, para. 26 and following.

5 Commission decision of 13 November 2006 in Case COMP/M. 4297 – Nokia / Siemens, para. 24 and following.

6 Commission decision of 13 November 2006 in Case COMP/M. 4297 – Nokia / Siemens, para. 44-46.

7 Commission decision of 13 November 2006 in Case COMP/M. 4297 – Nokia / Siemens, para. 47-48 and 52-53.

8 Code Division Multiple Access (CDMA) is a 2G technology standard that scrambles and reassembles speech and data bits by assigning a unique correlating code to each transmitter. It is used in the Americas and parts of Asia.

9 Worldwide Interoperability for Microwave Access (WiMAX) is a long-range wireless networking standard supported by the WiMAX Forum. WiMAX allows high-speed Internet access from mobile devices such as handsets, laptops, personal music players and cameras.

10 Since 2009 MNB has not won any bid competitions the supply of mobile network equipment in the EEA.

11 See Commission decision of 13 December 2000 in Case COMP/M.1940 Framatome / Siemens / Cogem / JV, Commission decision of 20 July 2005 in Case COMP/M3653 Siemens / VA Tech and Commission decision of 10 July 2003 in Case COMP/M.3148 Siemens / Alstom Gas and Steam Turbines.