EC, October 31, 2008, No M.5338

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

Barclays/ Investcorp/ N&W Global Vending

Dear Sir/Madam,

Subject: Case No COMP/M.5338 - Barclays/ Investcorp/ N&W Global Vending

Notification of 26 September 2008 pursuant to Article 4 of Council Regulation No 139/2004[1] [2]

(1) On 26 September 2008, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 ("the EC Merger Regulation") by which the undertakings Barclays Private Equity S.p.A. ("Barclays", Italy) and Investcorp Investment Holdings Ltd. ("Investcorp", United Kingdom) acquires within the meaning of Article 3(l)(b) of the EC Merger Regulation joint control of the undertaking N&W Global Vending S.p.a. ("N&W Global Vending" Italy) by way of purchase of shares.

I. THE PARTIES

(2) Both acquirers, Barclays and Investcorp, are international investment companies and financial service providers. Investcorp acts as a principal and as an intermediary in international investment transactions. Investcorp group specialises in facilitating the flow of capital from its clients in the Arabian Gulf into investments in the United States and Western Europe. Barclays is a global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services. Barclays operates in over 60 countries on a worldwide basis.

(3) The target, N&W Global Vending, is a leading manufacturer of food and beverage vending machines, having its principal sales in some Western European countries but also present in Eastern Europe.2

H. THE CONCENTRATION

(4) Based on the sale and purchase agreement signed on 19 September 2008, the two acquirers will own 100% of the shares of N&W Global Vending via an acquisition vehicle. The Board of that acquisition vehicle will consist of five members, two of which will be appointed by each of Barclays and Investcorp, whereas the fifth member will be appointed jointly. Resolutions shall only be taken with the favourable vote of at least one Board member nominated by each of the acquirers. As a result, both Barclays and Investcorp have a right of negative veto over all decisions of the acquisition vehicle that will acquire control of N&W.

(5) For the above reasons, the proposed transaction qualifies as a concentration within the meaning of Article 3(l)b of the EC Merger Regulation, whereby Barclays and Investcorp will acquire joint control over N&W Global Vending.

HI. COMMUNITY DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 billion[3] (Investcorp: [...]; Barclays: [...]; N&W Global Vending: [...]). Each of them have a Community-wide turnover in excess of EUR 250 million (Investcorp: [...]; Barclays: [...]; N&W Global Vending: [...]). [...] generated more than two-thirds of its Community-wide turnover in the United Kingdom in 2007. However, neither [...] nor [...] generated two-thirds of their Community-wide turnover in the United Kingdom in 2007.

(7) For the above reasons, the proposed concentration has a Community dimension, in accordance with the thresholds set out in Article 1(2) of the EC Merger Regulation.

IV. COMPETITIVE ASSESSMENT

1. Relevant product market

(8) Neither of the acquirers is engaged in the same business activities as the target, namely production of drink and food distribution machines (vending machines, beverage machines designed for use in hotels, restaurants and cafeterias ("HoReCa") and coffee machines used in offices).

(9) One of the acquirers, Investcorp, owns a company, Ceme, producing fluid control components, two of which, solenoid valves and solenoid pumps are (or can be) input products for hot beverage distribution machines. Therefore the transaction raises vertical issues with respect to solenoid valves and solenoid pumps on the one hand and beverage distribution machines (namely beverage vending machines, beverage machines used in HoReCa and office coffee machines) on the other.

1.1 The market for food and drink distribution machines

(10) There are three main types of food and drink distribution machines: vending machines, beverage machines used in HoReCa and office coffee machines. The first category is vending machines. Vending machines are large automatic machines that dispense a wide variety of products, including drinks and snacks. They include some form of automatic payment mechanism, and can be placed in a wide variety of locations (such as offices, factories, universities, sports centres, shopping centres, airports and railway stations). Within vending machines there are three category of products by reference to the product(s) that they dispense, namely hot and cold beverages ("H&C), snacks and food ("S&F") and cans and bottles ("C&B"). The second category of food and drink distribution machines is beverage machines for HoReCa sector ("hotels, restaurants, catering") which are not equipped with a payment system and have medium capacity. The third category of food and drink distribution machines is small capacity machines without payment system designed for office coffee supply.

(11) According to the notifying parties, these three types of machines (vending machines, beverage machines for HoReCa sector and office coffee machines), and as all vending machine sub-types, would constitute one single product market. In their view, in most cases, vending machine customers seek to source snack, food and beverage machines from the same supplier, largely to take advantage of the maintenance and service efficiencies that this affords. Additionally, distinguishing between types of vending machines by reference to the products dispensed is becoming increasingly difficult, as successive generations of machines increasingly supply both food and beverages. Finally, the notifying parties also claim supply-side substitution among beverage and food distribution machines indicating that nowadays all suppliers are able to deliver the three types of vending machines. Furthermore, there is a high level of supply-side substitutability between beverage machines whether vending machines, machines used in HoReCa or office coffee machines.4

(12) The information obtained during the market investigation does not support these views. At least in the three beverage distribution machine categories (vending-, HoReCa and office machines), both, the largest suppliers and their market position and the largest customer groups are clearly different, as are the trends in the markets. A number of respondents during the market investigation indicated that they do not produce all of these machines. N&W Global Vending itself has a strong position as a vending machine supplier, whereas its market position for beverage machines for HoReCa and office coffee machines is much weaker. The question whether these three categories belong to one market can be left open for the assessment of this transaction, as no competition problem would arise even in case of the narrowest market definition.

(13) When it comes to vending machine subcategories (namely hot and cold beverages ("H&C), snacks and food ("S&F") and cans and bottles ("C&B"), the question whether these categories belong to one market can be left open for the assessment of this transaction, as only hot and cold beverage machines use solenoid pumps and valves, therefore vertical relations only occur with respect to these beverage vending machines.

Market for solenoid pumps and valves

(14) Solenoid pumps are primarily used to pump precise volumes of fluid into higher- pressure boilers or heat exchangers. They are called solenoid because the mechanical pump uses electricity to operate. The parties claim that solenoid pumps are essentially commoditised components that are produced to standard specifications and are supplied in bulk.

(15) Solenoid valves are controlled by electrical signals, and regulate the flow of liquids in a broad range of applications, including coffee and other drinks machines, steam generators and gas boilers. (Besides standard solenoid valves, there is a range of specialised solenoid valves (i.e. Teflon, cryogenic, dri and inert instrument class valves used for specific applications.)

(16) Both solenoid pumps and valves are components used for espresso and filter coffee machines, hot and cold beverage vending machines, HoReCa and office coffee machines. In addition, they are used in a wide range of other applications, including household steam and cleaning products, heating, ventilation, air conditioning and a range of industrial applications. Beverage distribution machine manufacturers typically source these components from third party suppliers and assemble the machines.

(17) The notifying parties claim that solenoid pumps and valves used for beverage distribution machines are standardised using the same core materials and technology, the only difference being the pressure and the flow rate of these products. The notifying parties add that although the different models are of various performance and technical parameters, there is also little difference among the models in terms of price5 of these products used for beverage distribution machines.

(18) The market investigation showed that solenoid pumps used for beverage distribution machines (whether vending machines, machines used in HoReCa or office coffee machines) apply similar pumps, however solenoid pumps of other specific applications may be different. Also, for instance there are special pumps used for larger beverage distribution machines which are however not produced by Ceme. Producers tend to buy solenoid pumps from specialised manufacturers for specific applications. Beverage distribution machine producers usually look for big quantities and relatively low-priced pumps, typically those produced by Ceme.

(19) Given that the assessment concerns the vertical link between beverage distribution machine producers with a focus on hot and cold beverage vending machines (as well as machines used in HoReCa and office coffee machines) and the solenoid pumps and valves used for these applications, the question whether all solenoid pumps and valves belong to the same market can be left open.6

2. Relevant geographic market

2.1 The market for food and drink distribution machines

(20) The notifying parties claim that the geographic scope of the market for the design and production of vending, HoReCa and office coffee machines is at least EEA-wide in scope as (1) the same machines are used across Europe; (2) machine designers and producers supply European demand from production facilities located in a small number of countries; and (3) the largest customers operate Europe-wide.

(21) There are however a number of elements pointing towards national markets. First of all, both customers and suppliers are rather national players. Concerning customers, the notifying parties estimate that approximately 20% of sales are made to European-wide operators and several other customers operate in more than one Member State. When it comes to HoReCa and offices machines, customers are often even local. The parties themselves consider N&W Global Vending in their internal document as "the only true European player".[4] Yet N&W Global Vending itself focuses on a limited number of Member States whereas it is completely absent in others. Secondly, given that regular maintenance by the seller of these machines is crucial for customers, producers need to have a national sales force and/or appointed distributors in order to be able to sell the machines in a Member State.

(22) However for the assessment of the present transaction, the question whether markets are EEA-wide or national may be left open.

2.2 The market for solenoid pumps and valves

(23) As to the geographic markets for solenoid pumps and valves used for beverage distribution machines, the notifying parties consider these markets to be global in scope,8 as pumps and valves are small and light, are easy and inexpensive to transport and are shipped increasingly globally.

(24) The market investigation does not support such a wide geographic market definition. Although, transportation cost is not material, solenoid pumps are overwhelmingly supplied by European manufacturers; Asian imports are today hardly present on the market (the notifying parties estimate the level of imports into the ELI to be 5% only). Within Europe, the geographic location of the manufacturer is not an important selection aspect. In fact, customers located in different countries do and/or would easily turn to manufacturers located in other countries. In any event, for the assessment of the present transaction, the question of whether the market is national or EEA-wide may be left open.

3. Competitive assessment

3.1 The market positions ofN&W Global Vending and its competitors

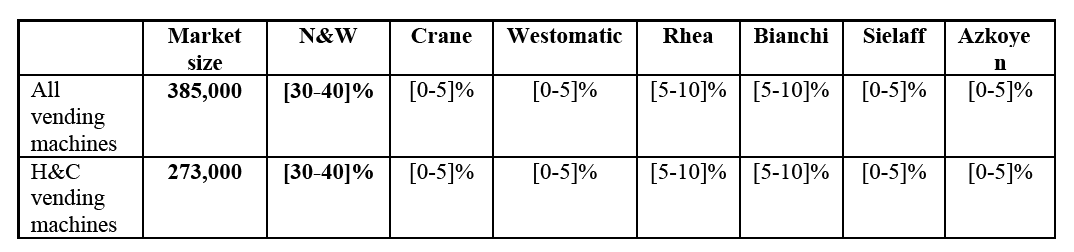

(25) At the EEA level, the share of supply of N&W Global Vending for all beverage distribution machines (for all vending machines, HoReCa machines and office coffee machines OCS) is estimated to be [10-20]%, specifically for vending machines its share is approximately [30-40]%, while its share of supply for each HoReCa and office coffee machines only is approximately [5-10]%.[5] [6] For both, HoReCa and office coffee machines N&W Global Vending's share of supply would not exceed 25% on any possible geographic market. The table below shows the market position ofN&W Global Vending and its competitors in the market for all beverage and food vending machines and specifically in the market for hot and cold beverage vending machines in the EEA.

Vending machine shares of supply in the EEA (based on volumes) - 200710

(26) At national level, the share of supply of N&W Global Vending for hot and cold beverage vending machines only is the following:

Hot and cold beverage vending machine share of supply (based on volumes) in 2007 at Member State level[8]

| N&W | Bianchi | Saeco | Rhea | Crane | Sielaff | Azkoyen | Westomatic | Coffee Queen | Etna | Bravilor |

Italy | [60-70]% | [20-30]% | [5- 10]% | [5- 10]% | — | — | “ | — | “ | — | ““ |

France | [40-50]% | [10-20]% | [10- 20]% | [20- 30]% |

|

|

|

|

|

|

|

Spain & Portugal | [40-50]% | [10-20]% | [10- 20]% | — | ““ | ““ | [20- 30]% | ““ | — | ““ | ““ |

Ireland | [40-50]% |

|

|

| 30% |

|

| [10- 20] % |

|

|

|

Denmark | [60-70]% | [5-10]% |

|

|

| 5% |

|

| [10- 20]% |

|

|

Finland | [20-30]% | [5-10]% |

|

|

| 5% |

|

| [20- 30]% |

|

|

Sweden | [30-40]% | [5-10]% |

|

|

| 5% |

|

| [20- 30]% |

|

|

Norway | [30-40]% | [5-10]% |

|

|

| 5% |

|

| [20- 30]% |

|

|

Belgium | [20-30]% | [10-20]% | ““ | [10- 20]% | ““ | ““ | — | ““ | — | [10- 20]% | [10- 20]% |

Netherlands | [30-40]% | [10-20]% | - | [10- | - | - | - | - | - | [10- | [10- |

|

|

|

| 20]% |

|

|

|

|

| 20]% | 20]% |

Poland | [30-40]% | [20-30]% | — | [20- 30]% | — | — | “ | — | “ | — | ““ |

Slovakia | [30-40]% | [20-30]% | ““ | [20- 30]% | ““ | ““ | — | ““ | — | ““ | ““ |

Hungary | [20-30]% | [20-30]% | — | [20- 30]% | — | — | “ | — | “ | — | ““ |

Greece | [40-50]% | [20-30]% | — | [20- 30]% | — | — | “ | — | “ | — | ““ |

The market positions of Ceme and its competitors

(27) The notifying parties provided market share data for solenoid pumps used in beverage vending, HoReCa and office coffee machines in Europe.12 As the table below shows, Ceme is the strongest supplier in Europe. Shares of supply of solenoid pumps used for hot and cold beverage vending machines, beverage machines for HoReCa and office coffee machines in the EEA in 2007 (based on volumes)[9] Looking at national level, Ceme estimates that its supply share corresponds to its European supply share, although it notes that N&W and a number of material coffee machine producing customers are headquartered in Italy.

Supplier | Europe |

Ceme | [40-50]% |

Invensys | 15-25% |

Olab | [10-20]% |

Ode (Defend) | [10-20]% |

Gotec | 0-5% |

Fluidotech | 0-5% |

Chinese companies | 0-5% |

Total market size | 1.9 million pumps |

(28) Concerning solenoid valves, Ceme is not a strong player, the supply share of of the company at European level remains below [0-5]%.

Shares of supply of solenoid valves used for hot and cold beverage vending machines, beverage machines for HoReCa and office coffee machines in the EEA in 2007 (based on volumes)14

|

3.2 Input foreclosure

(29) Looking at the market position of the parties and their competitors, foreclosure with respect to beverage machines for HoReCa and for office coffee machines is unlikely to occur as N&W Global Vending, contrary to the vending machine markets, does not hold a considerable market position with respect to HoReCa and office coffee machines either at EEA or at national level. As stated above the companies even at national level would remain below 15% in both segments.

(30) Additionally, Ceme is not a considerable solenoid valve supplier, in particular the company does not supply any vending machine producer.

(31) Ceme, besides N&W Global Vending, supplies solenoid pumps to a number of N&W Global Vending’s competitors which are mainly smaller players on the market, ([...]). In addition, N&W Global Vending holds a considerable market position in the market for hot and cold beverage vending machines. Therefore the current assessment focuses on the potential for lessening of competition in the market for hot and cold beverage machines (downstream) through increased price and/or degraded quality on the solenoid pumps (upstream). (It should be noted that pumps supplied by Ceme are only used for hot and cold vending machines equipped with brewing technology which represents about 55% of all hot and cold vending machines sold in Europe in 2007.[10] [11])

(32) The merged entity is unlikely to be able to foreclose its competitors on the vending machines market. First, the price of a solenoid pump constitutes a negligible fraction of the lifetime cost of a vending machine (far less than 1%). Solenoid pump is a low- cost input (EUR 3-5) compared to the price of a final vending machine (ranging from EUR 800 to 4200[12]) therefore machine producers and final consumers purchasing beverages from these machines are unlikely to be affected even by a potential price increase. In that respect the notifying parties submit that recent interviews of vending, HoReCa and office coffee machine customers indicate that price is only the fifth most important factor for customers when selecting machines.17 Customers consider the profitability of vending machines to be more important than their price per se.18

(33) Secondly, solenoid pumps used for beverage vending machines, as outlined above, are standard products similar or even identical to those used in other applications for HoReCa, office and domestic coffee machines, steam cleaning and steam ironing applications which according to the market investigation do not require any specific additional know-how. Solenoid pumps are supplied by a number of companies (including Ceme, Invensys, Olab, Ode (Defend), Gotec, Fluidotech). Taking into account the companies supplying solenoid pumps to all these applications there is a sufficient number of at least potential alternative suppliers to Ceme which do or could supply hot and cold beverage vending machine producers.

(34) Thirdly, a targeted input foreclosure vis-a-vis downstream competitors would be difficult. Buyers are often multi-product firms which source similar pumps for a number of applications without specifying the end-use of the product. The notifying parties explain also that Ceme supplies these pumps not only directly to original equipment manufacturers (often present in a number of the above-listed applications and buying pumps without identifying the actual end-application) but also to subcontractors and distributors, making discrimination of vending machine suppliers difficult.[13]

(35) In principle the merged entity could have an incentive to foreclose since the margins upstream in the pump business are slim (or at least much lower than on the vending machines market) and hence little profit would be sacrificed through a price increase or an outright refusal to supply solenoid pumps. However, due to lack of ability to foreclose, in particular due to the low input cost solenoid pumps represent such incentive, even if present, is unlikely to lead to the lessening of competition on the downstream market. It should be also noted that Ceme is owned only by one of the acquirers, and the two companies have different management teams, therefore the incentive for a foreclosure strategy is further reduced.

(36) Given the above, it is not likely that the transaction leads to a risk of input foreclosure and that Ceme might raise costs of other vending machine suppliers.

3.3 Customer foreclosure

(37) Ceme is already today the sole solenoid pump supplier of N&W Global Vending. Given N&W Global Vending’s limited position as a customer of solenoid valves and pumps compared to the existence of the number of various application of these products (which are not related to vending, HoReCa and office coffee machines) and also the number of other hot and cold beverage machine producers and the limited part of income Ceme generates[14] with these sales, customer foreclosure appears to be an unlikely scenario following the transaction.

(38) In light of the above considerations, the Commission concludes that the proposed concentration does not raise serious doubts as to its compatibility with the common market.

V. CONCLUSION

(39) For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the common market and with the EEA Agreement. This decision is adopted in application of Article 6(l)(b) of the EC Merger Regulation.

1 OJ L 24, 29.1.2004 p. 1

2 N&W Global Vending Mainly is active in Italy, France, Spain and Portugal, Ireland, Denmark, Finnland,

Sweden, Norway, Belgium, the Netherlands, Greece Poland, Slovakia and Hungary.

3 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Notice

on the calculation of turnover (OJ C66, 2.3.1998, p25)

4 According to the notifying parties, in addition to N&W Global, Saeco/Gaggia, Melitta, CMA, Brasilla, WMF/Schaerer and Franke / Bremer, produce both HoReCa and office coffee machines.

5 The price ranges between EUR 3-5.

6 For the purpose of the competitive assessment only solenoid pumps and valves used for beverage vending machines, beverage machines used in HoReCa and office coffee machines will be considered.

7 Internal document, "N&W IC Discussion Materials Introduction and Critical issues" of 14 July 2008. p. 1. (emphases added)

8 Answer of 21 October 2008 of the notifying parties to Article 11 letter of the Commission.

9 N&W estimates that the total European market size in 2007 for all vending machines (including HoReCa

and OCS machines) was 1.81 billion. Of this, 0.97 billion was generated through the supply of

HoReCa machines and 0.1 billion through the supply of OCS machines.

10 Source: Form CO, best estimates of the parties.

11 Source: Answer to Article 11 request of 6 October 2008, best estimates of the parties.

12 Ceme estimates that approximately 1.9 million solenoid pumps were used in H&C vending, HoReCa and

OCS machines in Europe in 2007.

13 Source Form CO, best estimates of the parties.

14 Source Form CO, best estimates of the parties.

15 Source: European Vending Association, submission of the notifying parties of 27 October 2008.

16 Source: notifying parties, e-mail of 23/10/2008 12:41.

17 The most important factor is machine quality and reliability, followed by the ease and cost of machine

maintenance, quality of the machines output and the range of products that the machine can dispense.

The level and quality of service and support is considered to be as important as price.

18 Profitability can be maximised in a number of ways, including: the supply of premium or higher quality

products (e.g., espresso coffee), the use of remote monitoring technology to ensure that machines are

kept fully stocked, the use of remote dynamic pricing that allows rapid and targeted re-pricing of

products in response to demand fluctuations, and reductions in maintenance and service requirements

through increased reliability. For example, machines that allow customers to maintain the quality of a

broad range of products, and provide a higher throughput, provide better operational and financial

performance.

19 Source: European Vending Association, submission of the notifying parties of 27 October 2008.

20 Less than [0-5]% of Ceme’s income comes from the supply of solenoid pumps to producers of hot and

cold beverage vending machines, beverage machines for HoReCa and office coffee machines, and less

than [0-5]% of its total revenues through the supply of solenoid valves for use in these machines