Commission, May 19, 2011, No M.6113

EUROPEAN COMMISSION

Judgment

DSM / SINOCHEM / JV

Dear Sir/Madam,

Subject: Case No COMP/M.6113 – DSM / SINOCHEM / JV

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 8 April 2011, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertakings Sinochem Group (Sinochem, China) and Koninklijke DSM N.V. (DSM, Netherlands) enter into a joint venture agreement whereby Sinochem will acquire, within the meaning of Article 3(4) of the Merger Regulation, joint control of the existing anti-infectives business of DSM ("DAI") by way of purchase of shares. DSM and Sinochem are designated hereinafter as the "notifying parties" or "parties to the proposed transaction".

I. THE PARTIES

2. DSM comprises a group of companies active worldwide in the nutrition and pharmaceutical sectors, performance materials and industrial chemicals. DSM's products are used in a wide range of end markets and applications such as human and animal nutrition, cosmetics, pharmaceuticals, automotive and transport, coatings, housing and electrics & electronics.

3. Sinochem is a Chinese State-owned enterprise ("SOE") under the supervision of the Central State-owned Assets Supervision and Administration Commission of the State Council ("Central SASAC"). Sinochem is active in five business segments, namely agriculture, energy, chemical, real estate and finance business units. With very limited exceptions, it does not manufacture beta-lactam semi-synthetic antibiotics or related compounds, the products concerned by the present Decision, but is however a distributor of the associated downstream finished dosage ("FD") products.

4. DAI is active in the field of beta-lactam antibiotics in bulk and other anti-infective products and certain generic pharmaceutical products, mostly intended to be marketed and sold as (upstream) active pharmaceutical ingredients ("API") or as (downstream) FD products.

II. THE OPERATION

5. Under the terms of the transaction, a jointly-owned Chinese company will be established, owned 50% by DSM and 50% by Sinochem, to which all the activities of DAI will be transferred.

III. CONCENTRATION

6. Each of the parties will hold a 50% stake in the joint venture vehicle and neither has any special rights or other means of exercising sole control. The proposed transaction therefore constitutes a concentration with joint control within the meaning of Article 3(4) of the Merger Regulation.

IV. EU DIMENSION

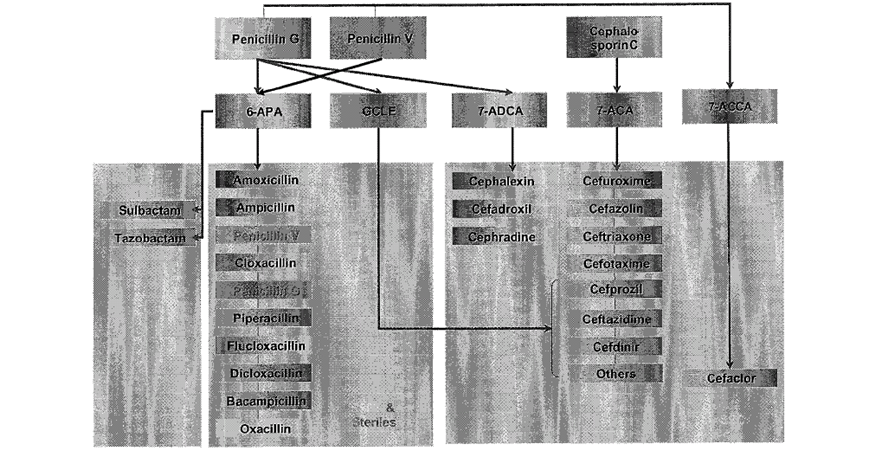

7. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (Sinochem: EUR […] million; DSM: EUR 7 732 million)2. Each of them has an EU-wide turnover in excess of EUR 250 million (Sinochem: EUR […] million; DSM: EUR […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

8. Sinochem is indirectly owned by the Chinese State as 100% of its shares are held by SASAC3, an entity established directly under the supervision of the State Council of the People's Republic of China responsible for oversight and management of SOEs. The question arises of which turnover is attributable to Sinochem pursuant to recital 22 of the Merger Regulation.

9. In order to respect the principle of non-discrimination between the public and private sectors, Recital 224 provides that for public sector undertakings, calculation of the turnover of an undertaking concerned in a concentration needs to take account of undertakings making up an economic unit with an independent power of decision, irrespective of the way in which their capital is held or of the rules of administrative supervision applicable to them.

10. The Commission has in the past considered several concentrations involving undertakings owned by Member States.5 In those cases, the Commission assessed to what extent the companies concerned had an independent power of decision from the State inter alia by looking into the possibility for the State to influence the companies' commercial strategy and the likelihood for the State to in practice coordinate their commercial conduct, either by imposing or facilitating such coordination.

11. In order to assess whether the State has the power to coordinate the commercial conduct of companies, the Commission has previously taken into account factors such as the degree of interlocking directorships between entities owned by the same entity or the existence of adequate safeguards ensuring that commercially sensitive information is not shared between such undertakings.

12. When assessing the chain of control of state-owned companies, the approach is, first, to establish whether the company has an independent power of decision, and, second, if this is not the case, to determine which is the ultimate State entity and which other undertakings owned by this entity need to be considered as one economic entity.

13. In the present case, the ownership of Chinese SOEs lies either with the central government, with regional/municipal governments, or occasionally with other public entities. Sinochem is one of the 129 mostly large SOEs6 financed and owned by the central government. As an undertaking under central government ownership, Sinochem reports to Central SASAC.

14. The Parties submit that Sinochem is an economic unit that has an independent power of decision from the Chinese state. They argue that SASAC's limited statutory powers such as various provisions of the Law of the People's Republic of China on State-Owned Assets of Enterprises or Interim Regulations on Supervision and Management of State- owned Assets of Enterprises prevent it from exercising a decisive influence over Sinochem and that SASAC does not intervene in the strategic decision-making process7(e.g. by approving business plans or budget). They emphasise provisions regarding a separation of ownership from management, operational autonomy of SOEs and a purely supportive role of SASAC which does not interfere in SOEs' production and operation activities, apart from performing the responsibilities of investor. Sinochem submits that SASAC's rights are limited to approving the scope of Sinochem's business activities. Furthermore, Sinochem states that there are no interlocking directorships between Sinochem and other Central or local SASAC owned companies.

15. Nonetheless, the core legislation itself and the associated information outlined on SASAC's website contain a number of provisions which can be read as suggesting that SASAC does in practice have certain powers to involve itself in Sinochem's commercial behaviour in a strategic manner, among others the right to approve mergers or of strategic investment decisions.8 At the same time, a number of external sources suggest9 that commercial decisions of SOEs could be influenced by the Chinese state. It appears from such sources that influence may be exercised through formal channels such as SASAC, but also in less formal ways. Sinochem's and SASAC's own official statements provide certain indications in this regard. For example, Sinochem's Annual Report shows that there is at least a very close cooperation between Sinochem and the Chinese Government.10

16. In light of the above, in the absence of representations by the Chinese State and accompanying evidence, it is not possible to conclude whether or not Sinochem enjoys an independent power of decision in the sense of the Merger Regulation. However, as in China National Bluestar/Elkem11, the issue can be left open, since the Parties achieve the required turnover for EU jurisdiction to apply irrespective of this consideration. The notified operation accordingly has an EU dimension.

V. COMPETITIVE ASSESSMENT

Relevant markets

17. DAI's activities mostly relate to the production and sale of beta-lactam antibiotics. The products can be divided into several main areas: (i) production and sale of raw penicillin G (Pen G), (ii) production and sale of intermediary substances for production of semi- synthetic penicillins and semi-synthetic cephalosporins (6-APA and 7-ADCA respectively), and (iii) production and sales of semi-synthetic penicillins (SSPs) and semi-synthetic cephalosporins (SSCs). These are upstream active pharmaceutical products (APIs) used in the production of various downstream FD anti-infective products. The production chart below depicts the production process from raw penicillin substances to semi-synthetic antibiotics.

Source: Parties' submission

18.The markets in this case are worldwide12 upstream active pharmaceutical ingredient (API) markets for anti-infective products, namely markets related to raw penicillins (Pen G), intermediate products (6-ADA; 7 ADCA), semi-synthetic penicillins (SSPs) APIs and semi-synthetic cephalosporins (SSCs) APIs. These have been established in previous decisional practice13 and were confirmed by the market investigation carried out in this case.

19. Whilst demand for all relevant product groups is derived from the demand for FD products, there is no scope to consider demand side substitutability between different SSP APIs or between different SSC APIs. If a company offers Ampicillin (an SSP) as an FD product to the market, it requires the upstream Ampicillin API and not another one.

20. Therefore, the market investigation primarily examined whether there is sufficient supply-side substitutability between different molecules within SSPs and SSCs to define markets for: (i) all SSP APIs; and (ii) all SSC APIs, or – if not – markets for every single API within each of these categories such as, for example, Ampicillin within the SSP APIs or Cephalexin within the SSC APIs.

21.The market investigation primarily looked at whether companies active in the production of SSC APIs and SSP APIs could quickly and easily switch their production to (i) any other molecule within the respective category, and (ii) the particular molecules currently produced by DAI. The responses showed no difference between (i) and (ii). Most competitors responded that production of SSP APIs or SSC APIs does not imply significant difficulties if a producer is already active in that particular group of antibiotics and that technological switching between various SSP APIs and SSC APIs is relatively easy. Furthermore, although there is often a specialization of different suppliers on certain APIs, suppliers generally offer a wider range of different SSP and/or SSC APIs. The question of whether there would be an incentive to expand their portfolio of SSP APIs or SSC APIs depended in practice on different factors, such as if competitors raised prices by 5-10% and on the ease of obtaining regulatory approvals (which could take 6 months).

22. Most customers buying the products in question responded that they had more than one supplier and could switch if supply conditions were to deteriorate.

23. In light of the above, switching, on the one hand, between the production of different SSC APIs and, on the other, between different SSP APIs, appears to be possible. Therefore, it can be concluded that distinct markets of respectively all SSC molecules and all SSP molecules exist. This is also consistent with the Commission’s previous decisional practice14.

Competitive analysis

24. As referred to above in paragraphs 13 to 15, it cannot be excluded that Sinochem is an economic unit that does not have an independent power of decision from the state. In terms of the results of the market investigation on this issue, most respondents expressed concerns that the proposed joint venture and other Chinese SOEs might have incentives to coordinate behaviour on the markets in question and that such coordination was likely. In some responses, concerns were voiced that this transaction is part of Chinese SOEs' continued attempts to gain more leverage on the markets in question. Overall, the information obtained during the market investigation contains indications that the possibilities for SOEs to act completely independently might be more limited than for private enterprises in the sector in question.

25. That being said, replies from customers based in the EU and from the only Chinese respondent also generally indicated that Chinese suppliers in the market compete with one another, at least to some degree considering that the relevant products are commodities where no major differences in product offering can be expected. Indeed, a coordination of the behaviour of DSM and Chinese SOEs through the proposed joint venture is unlikely given the limited scope of the joint venture.

26. In the following, the competitive analysis of the transaction is presented both in a scenario where Sinochem is deemed to constitute an economic unit with an independent power of decision from the state, and in a scenario where this is not the case and where its market position is taken together with other Chinese SOEs. Whilst this changes the relevant market share situation, it does not alter the conclusion on the competitive analysis as under either scenario, the concentration would not lead to any competition concerns.15

27. The relevant market shares are summarized below.

Table 1: Worldwide volume16 market shares 2010 (%)

| Pen G | 6-APA | 7-ADCA | SSPs | SSCs |

DAI | [0-5] | 0 | [5-10] | [20-30] | [10-20] |

Sinochem | 0 | 0 | 0 | [0-5] | 0 |

DAI + Sinochem | [0-5] | 0 | [5-10] | [20-30] | [10-20] |

DAI + Sinochem + Other Chinese SOEs | [30-40] | [5-10] | [10-20] | [30-40] | [20-30] |

Rest of China – privately owned | [40-50] | [50-60] | [50-60] | [30-40] | [40-50] |

Outside China (world) | [20-30] | [40-50] | [30-40] | [30-40] | [30-40] |

Source: Parties' estimates based on adjusted IMS data.

28. If the competitive situation is assessed on a stand-alone basis with only the activities of DAI and Sinochem taken into account, there are very limited horizontal overlaps, and only in SSPs. According to the parties, Sinochem produces very limited amounts of sultamicillin (a combination of ampicillin and sulbactam) and piperacillin/tazobactam worth EUR […] with an estimated market share of [0-5]% in SSPs, therefore, resulting in a negligible market share and increment.

29. However, there would be more material overlaps in case Sinochem had to be considered as being part of the same economic entity as all Chinese SOEs (according to the information provided to the Commission, the main such SOEs include Harbin Pharmaceutical Group, North China Pharmaceutical Group Corporation and Sinopharm Group Co.). In such a scenario however, the overlaps in any given market remain below the level where serious doubts might arise (with a highest combined market share of [30-40]% for SSPs and [20-30]% for SSCs). The Commission was also able to conclude that a number of competitors to the joint venture exist. These comprise privately-held Chinese companies such as The United Laboratories International Holding Ltd ('Lian Bang') and China Pharmaceutical Group, as well as other companies such as Lupin Ltd, Aurobindo Pharma Ltd, Ranbaxy Laboratories Ltd (all Indian-based), and significant players with their own production facilities established in Europe (such as Antibioticos S.A., ACS Dobfar, Novartis or GlaxoSmithKline).

30. In addition, there is a range of other factors which leads to the conclusion that the proposed transaction does not lead to significant competition concerns.

31. The Parties claim that significant overcapacity exists on the markets in question. This was largely confirmed by the market investigation. The submissions from a majority of competitors point to an overcapacity which is substantial in some instances.17 The market investigation also confirmed that a majority of competitors could raise capacity within 3 months, at least to a certain degree.

32. Furthermore, there are some big producers of ß-lactam FD products such as GlaxoSmithKline which are vertically integrated and fully or partly produce their SSC or SSP APIs in house and which do not therefore appear in the market for intermediate and raw products.

33. Submissions by the Parties and the results of the market investigation confirm that R&D requirements for the products in question are low and that these products no longer enjoy patent protection. Moreover, as confirmed by the market investigation, no significant technical barriers to entry exist once an undertaking is active in the production of SSPs or SSCs. At least in the case of a price increase of 5-10%, market entry or a switch in capacity use is regarded as likely and feasible by competitors and would be requested by customers, a majority of which confirmed in the market investigation that they receive competing bids and benchmark them with their actual supplier. In this regard, as outlined above, the responses to the market investigation clearly confirm that most customers have more than one supplier for technical (technical shortage of supply) and commercial (price increases and other) reasons. Therefore, switching supplier is likely to be feasible should supply conditions deteriorate.

34. Vertical concerns do not arise under either scenario. The analysis of vertical issues can be divided between APIs (including raw and intermediate substances), FD products and FD distribution activities. As regards APIs, Sinochem purchases limited amounts of 6- APA for downstream production of SSPs with market shares below [0-5]%. The combined market share of DAI and other Chinese SOEs remain below [20-30]% for intermediate products (6-APA and 7-ADCA) and SSCs while reaching [30-40]% for SSPs. In relation to the FD segment, DAI does not produce FD anti-infectives and Sinochem does not produce beta-lactam antibiotics. There are significant vertically- integrated competitors in the FD markets, and the market share of other SOEs does not reach [20-30]% globally in these areas. Finally, Sinochem has very limited distribution activities (sales of EUR […] realized worldwide of which EUR […] in the EU per annum).

35. In light of the moderate combined market shares as well as the additional factors outlined above, it can be concluded that even in a scenario where all Chinese SOEs are taken together with DAI, the transaction would not lead to competition concerns.

VI. CONCLUSION

36. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p1).

3 State-owned Assets Supervision and Administration Commission.

4 See also the Jurisdictional Notice §§ 52, 53, 153 and 192-194.

5 See for example COMP/M.5508 Soffin/Hypo Real Estate; COMP/M.5861 Republic of Austria / HYPO GROUP ALPE ADRIA; M.931 Nestle/IVO.

6 So called "Yangqi" (central level enterprises).

7 Cf. in particular, COMP/M.5549 – EDF/Segebel, paragraph 174; COMP/M.5508 SoFFin/Hypo Real Estate.

8 E.g. "SASAC guides and pushes forward the reform and restructuring of state-owned enterprises, advances the establishment of modern enterprise system in SOEs, improves corporate governance, and propels the strategic adjustment of the layout and structure of the state economy" and "SASAC is responsible for the fundamental management of the state-owned assets of enterprises, works out draft laws and regulations on the management of the state-owned assets, establishes related rules and regulations and directs and supervises the management work of local state-owned assets according to law", both at http://www.sasac.gov.cn/n2963340/n2963393/2965120.html.

9 OECD Reviews on a regulatory reform, China: defining the boundary between the market and the State (2009); Barry Naughton, The Chinese economy: Transitions and Growth (MIT press).

10 For example; p. 43: "as the key state-owned enterprise, Sinochem Group is dedicated to serving the greater good of the national political stability, economic development, and social progress". At http://www.sinochem.com/Portals/5/nianbao/2009英文年报.pdf

11 Case COMP/M.6082 China National Bluestar/Elkem.

12 Consistent with the Commission's decisional practice on the geographic scope of API markets.

13 COMP/M.1143 DSM/Gist Brocades, paragraph 9.

14 This case concerned only molecules which are no longer subject to patent protection. It cannot be excluded that narrower markets may exist for molecules still subject to such protection.

15 The Commission also examined whether the Chinese state could influence the behaviour of private Chinese suppliers active in the market - in the present case, this could be excluded.

16 As these are commodity goods, the prices do not vary significantly. Moreover, if an allowance for price variation is made, the market investigation indicates the overall market share picture will generally remain the same.

17 The market investigation pointed to varying degree of overcapacity depending on the product in question. In some instances the Commission was able to conclude that existing overcapacity is not negligible.