EC, January 8, 2009, No M.5424

COMMISSION OF THE EUROPEAN COMMUNITIES

Judgment

DOW/ ROHM AND HAAS

Dear Sir/Madam,

Subject: Case No COMP/M.5424 – DOW/ ROHM AND HAAS

Notification of 24 November 2008 pursuant to Article 4 of Council Regulation No 139/20041

1. On 24 November 2008, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (‘the EC Merger Regulation’) by which the undertaking The Dow Chemical Company (‘Dow’, United States of America) acquires within the meaning of Article 3(1)(b) of the Council Regulation control of the whole of the undertaking Rohm and Haas Company (‘R&H’, United States of America) by way of purchase of shares.2

I. THE PARTIES

2. Dow is a diversified chemicals company headquartered in the United States of America and is the ultimate parent company of the Dow group of companies, which is active in plastics and chemicals, agricultural sciences, and hydrocarbon and energy products and services.

3. R&H is a specialty chemicals manufacturing company, also headquartered in the United States of America, with activities in the production of performance polymers, specialty chemicals, electronic materials and salt.

II. THE OPERATION AND THE CONCENTRATION

4. On 10 July 2008, Dow and R&H announced the execution of an Agreement and Plan of Merger under which Dow intends to acquire all outstanding shares of R&H common stock. Upon completion of the proposed Transaction, Ramses Acquisition Corp., a wholly-owned subsidiary of Dow incorporated in Delaware for the purposes of acquiring R&H, will merge with and into R&H. R&H will then become a wholly-owned subsidiary of Dow. The notified operation therefore constitutes a concentration within the meaning of Article 3(1)(b) of the EC Merger Regulation.

III. COMMUNITY DIMENSION

5. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (Dow EUR 39,046 million, R&H EUR 6,491 million). Each of them has a Community-wide turnover in excess of EUR 250 million (Dow EUR […], R&H EUR […]), but they do not achieve more than two-thirds of their aggregate Community-wide turnover within one and the same Member State. The notified operation therefore has a Community dimension pursuant to Article 1(2) of the EC Merger Regulation.

IV. COMPETITIVE ASSESSMENT

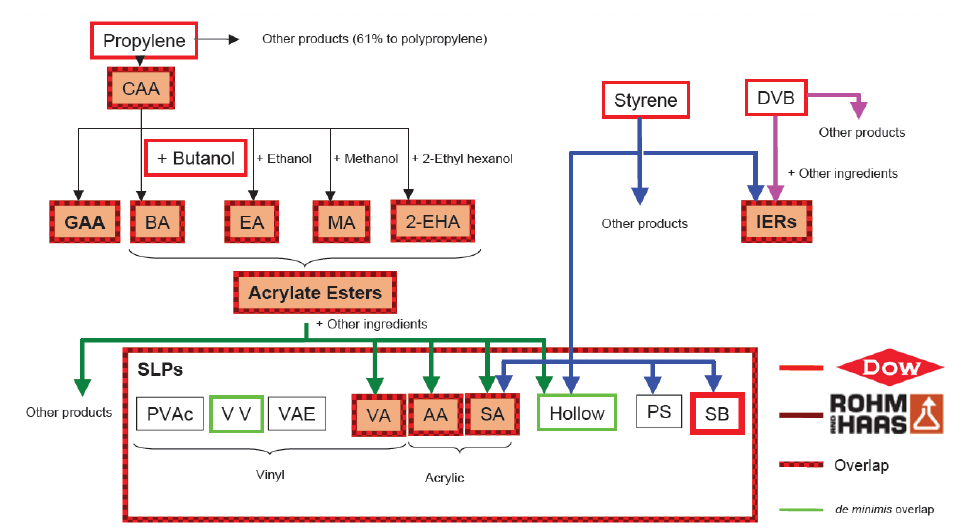

6. The proposed transaction would give rise to a number of horizontal overlaps between the merging parties’ activities most notably in the markets for acrylic acid and its esters (collectively known as the acrylic acid ‘envelope’) and ion exchange resins (‘IERs’). Downstream of the acrylic acid envelope, there are additional overlaps in the manufacture of certain synthetic latex polymers (‘SLP’). These overlaps are shown in the following diagram.

7. The proposed transaction would also give rise to horizontal overlaps in biocides, rheological additives and industrial adhesives and sealants.

8. In terms of vertical relationships, the operation would give rise to affected markets in respect of: divinylbenzene (‘DVB’) and styrene that are upstream of IERs; glacial acrylic acid (‘GAA’) which is upstream of polyacrylates, hydroxyethyl acrylates and […] of rheological additive; and glycidyl methacrylate which is downstream of glacial methacrylic acid (‘GMAA’). There are additional relationships, which do not give rise to affected markets, in respect of a number of other products including propylene which is upstream of crude acrylic acid (‘CAA’) and, depending on the scope of the geographic market, butanol which is upstream of butyl acrylate.

9. The competitive assessment of the notified operation is structured in the following manner. First, the horizontal overlaps arising from the proposed transaction in (i) the acrylic acid envelope, (ii) ion exchange resins, (iii) latexes, (iv) biocides, (v) rheological additives and (vi) industrial adhesives and sealants are discussed. Within the section of the decision dealing with the acrylic acid envelope, the Commission will also assess the vertical relationship arising between butanol and butyl acrylate and propylene and crude acrylic acid. Similarly, the vertical relationships arising between styrene and divinylbenzene, which are upstream of ion exchange resins, will be assessed in the section of the decision concerning ion exchange resins. All remaining vertical relationships arising from the proposed transaction are addressed in a separate section on vertical issues.

1. ACRYLIC ACID ENVELOPE

10. The acrylic acid envelope comprises crude acrylic acid (‘CAA’) and the downstream products glacial acrylic acid (‘GAA’) and acrylate esters (also called ‘acrylic esters’). Acrylic acids and acrylate esters are monomers used in the production of various polymers.3

10.1. Crude acrylic acid

11. Crude acrylic acid (‘CAA’) is an intermediate product that is further processed into either glacial acrylic acid (‘GAA’) or acrylate esters (also called ‘acrylic esters’). CAA is a clear colourless liquid with an acrid odour and is most commonly produced via the catalytic oxidation of propylene. CAA is generally used captively by producers and is not sold on the merchant market. This has been confirmed by the market investigation.4 Therefore, for the purposes of the present case, the question whether CAA would constitute a distinct product market and the scope of the relevant geographic market can be left open. Nonetheless, even though there is no merchant market for CAA, the merging parties’ position in terms of capacity and production is relevant for the competitive assessment of the proposed transaction and is therefore considered below.

12. Dow and R&H both produce CAA in the EEA. Dow operates a CAA production facility at Böhlen, Germany. R&H produces CAA through its interest in StoHaas Monomer GmbH & Co. KG (“StoHaas”),5 a 50/50 joint venture with Stockhausen GmbH & Co. KG (today “Evonik Stockhausen GmbH,” “Stockhausen”), a subsidiary of Evonik Industries AG (companies in the Evonik group, the former Degussa, will hereinafter be referred to as “Evonik”). StoHaas manufactures CAA in Marl, Germany.6 Stockhausen and R&H have […] to StoHaas’ CAA production capacity at Marl.7 […]

13. Outside of the EEA, Dow operates two production facilities in the United States of America at St. Charles, Louisiana (sometimes referred to as the “Taft” plant) and Clear Lake, Texas, U.S.A. R&H operates five CAA production lines at its Deer Park facility in Texas. Three are owned by R&H entirely for its own use and the other two are owned by, but operated by R&H on behalf of, the StoHaas joint venture.8

14. Other EEA manufacturers of CAA are BASF SE (“BASF”), Arkema S.A. (“Arkema”, the 2004 spin-off of Total/Atofina’s chemical business),9 and Hexion Specialty Chemicals (“Hexion”). Beyond the EEA, other manufacturers of CAA include OJSC Acrylat (Russia, “Acrylat”), Sasol Ltd. (South Africa, “Sasol”), Nippon Shokubai KK (Japan, “NSKK”), Formosa Plastics Corporation (Taiwan, “Formosa”), LG Chemical (South Korea, “LG Chem”), Mitsubishi Chemical (Japan, “Mitsubishi”), and a number of other Asian manufacturers.

15. According to the notifying party’s estimates, the global installed production capacity for CAA is approximately [4,000-6,000] kilo tonnes (kt) of which some [1,000-1,500] kt is located in the EEA. At the global level, the merged entity would have a share of approximately [10-20]% of capacity (Dow [5-10]%, R&H [10-20]%).10 On the basis of the notifying party’s estimates, the merged entity would have a share of approximately [10- 20]% of capacity in the EEA (Dow [0-5]%, R&H [5-10]%).

16. On the basis of responses received from CAA manufacturers with production facilities in the EEA (some of which also have facilities outside the EEA) as well as a number of other producers, the notifying party’s estimates for global production capacity appear reasonable even though the figure for one producer (BASF) was significantly over estimated due to the timing of a capacity expansion.11 As far as EEA production capacity is concerned, given the timing of BASF’s capacity expansion, it is apparent that the notifying party has overestimated current production capacity. On the basis of evidence gathered in the market investigation, the merged entity’s share of current EEA capacity would be in the region of [10-20]% (Dow [0-5]%, R&H [10-20]%).

17. It should be noted that as part of the regulatory approval process in the United States of America, the notifying party has expressed its intention to divest its Clear Lake facility in Texas which has the capacity to produce crude acrylic acid, glacial acrylic acid, butyl acrylate and ethyl acrylate.12 Should this divestiture occur, the merged entity’s share of global CAA production capacity, absent other changes, would decrease to approximately [10-20]% (the divestiture would have no effect on capacities located in the EEA).

1.2. Glacial acrylic acid

Relevant product market

18. Glacial acrylic acid is produced by a further purification of CAA either by additional crystallisation or distillation.13 GAA is used in the manufacture of a number of products including super absorbent polymers (‘SAP’), polyacrylates, certain specialty acrylates, certain rheological additives as well as acrylic copolymers for surface coatings, water treatment and textile applications. In terms of demand-side substitution, the investigation confirmed that customers do not consider there are substitutes for GAA in the applications in which it is used.

19. The notifying party submits that GAA is a fungible product that does not differ in terms of chemical composition or purity whether it has been produced by way of crystallisation or distillation. It acknowledges that the precise level of purity of GAA sold can vary according to the customer’s precise requirements with SAP manufacturers, for example, requiring a slightly higher purity. However, all producers are capable in the notifying party's opinion of producing different purities above 99%.

20. The market investigation has broadly confirmed the notifying party’s submission. All GAA manufacturers indicated that there are no significant differences between the GAA produced by different manufacturers. A majority of customers also confirmed that there are no significant differences between the GAA available on the merchant market and that they are able to switch easily between suppliers.14 On the basis of the results of the market investigation, the Commission considers that it is not necessary to make a further segmentation of GAA for the purposes of the competitive assessment.

Relevant geographic market

21. The notifying party submits that the relevant geographic market for GAA is probably EEA- wide though it may be global. It submits that there are limited imports of GAA into the EEA but at the same time it recognises that it is somewhat more difficult and expensive to ship GAA when compared to other products such as acrylate esters as it must be shipped in ISO containers or drums.

22. The market investigation has indicated that customers have a clear preference to source GAA in the region in which they are active, for example Europe, North America or Asia, in view of the logistical demands involved in shipping the product over long distances.15 Moreover, a number of customers indicated that there can be price differences between world regions for GAA, although not within the EEA, because of factors such as feedstock prices, currency fluctuations and regional supply and demand dynamics. The market investigation therefore leads to the conclusion that the scope of the geographic market for GAA is no wider than the EEA. However, in the absence of competition concerns under either definition, the precise scope of the geographic market can be left open.

If dimer levels rise to too high a level, the acrylic acid will no longer be considered to be GAA. Since the formation of dimer is time and temperature dependent, in order to keep dimer levels to a minimum, GAA is typically stored in refrigerated tanks and inventories are kept to a minimum. GAA shipments to customers use transportation modes that reduce the amount of transit time the GAA is left in unrefrigerated conditions, to minimize the risk of dimer formation, and to reduce the risk of polymerization. Accordingly, there are additional costs associated with shipping GAA over very long distances, relative to other monomers such as butyl acrylate.

Competitive assessment

23. In the EEA, Dow produces GAA at its Böhlen facility in Germany.16 R&H does not have a GAA production facility in the EEA17. Stockhausen toll-manufactures GAA for R&H18 at its GAA plant in Marl, pursuant to agreements entered into in connection with the formation of the StoHaas joint venture. […]19

24. In terms of production capacity, the merged entity would have a share of [10-20]% on a global basis (Dow [5-10]%, R&H [5-10]%) and [10-20]% in the EEA (Dow [0-5]%, R&H [10-20]%). Consequently, the increment brought about by the proposed transaction in the EEA in capacity terms is not significant and even at the global level, where the increment is more significant, the merged entity’s share of capacity is not of a magnitude that would give it market power.

25. Other producers of GAA with production capacity in the EEA include BASF, Arkema and Evonik (these companies also have production facilities outside the EEA).20 In addition to these three producers and the merging parties, there are several GAA producers with production facilities outside the EAA including NSKK, Formosa, LG Chem and Mitsubishi and a number of other Asian producers.

26. As noted above, GAA is used in the manufacture of a number of downstream products. According to the notifying party, the most significant downstream application of GAA is the production of SAP though neither of the merging parties is active in the production or sale of SAP. The parties do however use a significant proportion of their GAA production in other downstream applications.21 The market investigation has shown that many other producers including BASF, Arkema, NSKK and Evonik are also integrated downstream in the production of SAP and/or other products.22 As a result, the presence of these companies as well as the merging parties on the merchant market for GAA may depend upon a combination of factors including their GAA production capacity, level of captive use and merchant market demand.

27. On the basis of the results of the market investigation, the merged entity’s share of the EEA merchant market would be [20-30]% (Dow [0-5]%, R&H [20-30]%). The increment resulting from the proposed transaction is not substantial at [0-5]%. On a global basis, the merged entity’s merchant market share would be [10-20]% (Dow [5-10]%, R&H [10- 20]%).23

28. The merged entity would continue to face competition from a number of other producers with production facilities in the EEA including Arkema with a merchant market share of (25-35%), BASF (15-25%) and Hexion (5-10%). The market investigation has also shown that other producers are present on the merchant market with an aggregate share of approximately [20-30]%.

29. In the market investigation, a number of respondents expressed concern that the proposed transaction would lead to a reduction in the number of potential suppliers and that prices could rise as a result.24 However, given the presence of alternative suppliers on the merchant market, some with market shares greater that the merging parties, the fact that the GAA produced by different manufacturers is interchangeable and indications in the market investigation of excess capacities both within the EEA and beyond, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the common market.

1.3. Acrylate esters – horizontal issues

30. Other than GAA, the primary use for CAA is as a raw material in the production of the following acrylate esters: butyl acrylate, ethyl acrylate, methyl acrylate and 2-ethylhexyl acrylate. These esters are produced in a condensation reaction (known as esterification) between CAA and an alcohol.25 Acrylate esters impart colour stability and clarity, heat and ageing resistance, weather resistance, low temperature flexibility and/or other qualities to the polymeric materials in which they are used. The main end uses of these polymers include the production of coatings, adhesives and sealants, paper, polymer additives, textiles and inks.

31. The notifying party submits that it can be left open whether these ‘commodity’ acrylates (butyl acrylate, ethyl acrylate, methyl acrylate and 2-ethylhexyl acrylate) form part of one single product market or each represents a distinct product market as the proposed transaction would not raise competitive concerns even if each of these acrylate esters were to be assessed separately. It submits that there is a certain degree of demand-side substitution between these acrylate esters as they are economic substitutes in a number of applications. In addition, it submits that from the supply-side perspective, most suppliers of acrylate esters are active in the production and/or sale of multiple acrylates and can adjust the allocation of CAA between their respective acrylate facilities according to the demand for each acrylate. According to the notifying party, several suppliers have ‘swing plants’ which can be used to produce more than one acrylate ester.26 It notes that the Commission has considered in a number of decisions that the opportunity to produce two or more non-identical products in a swing plant is a significant indicator that the products concerned form part of the same product market.

32. Acrylate esters have been discussed in three Commission decisions. In Degussa/Laporte, the Commission concluded that four types of hydroxyl acrylates/monomers (i.e. acrylates made from GAA or methacrylic acid rather than CAA) constituted one single product market.28 In Celanese/Clariant Emulsions Business, the Commission left open whether each monomer considered in that case – including acrylate monomers – constituted a separate product market.29 In Celanese/Degussa/JV (European Oxo-Chemicals) however, the Commission indicated that butyl acrylate and 2-ethylhexyl acrylate were separate product markets. Methyl acrylate and ethyl acrylate were not specifically discussed in any of these decisions.30

33. The market investigation in the present case has not supported the notifying party’s submission that acrylate esters form part of a single product market. In terms of demand-side substitution between the various acrylate esters concerned by the present decision, the majority of respondents indicated that a small but significant, non- transitory increase in the price of a particular ester would not lead them to switch to another acrylate ester, or indeed any other product, for the same end-use. These customers value each acrylate ester for the particular qualities and properties they provide in the applications in which they are used.31 In terms of supply-side substitution, although the market investigation has confirmed that many suppliers of acrylate esters are indeed active in the production and/or sale of more than one type of acrylate ester, it has not been able to confirm the widespread presence of swing plants in the industry. In any event, as these plants are typically for heavy esters (butyl acrylate/2- ethylhexyl acrylate) or light esters (methyl acrylate/ethyl acrylate), they would not support the conclusion that there is sufficient supply-side substitution between all esters (i.e. heavy and light) such that they would form part of the same relevant product market. For these reasons, the Commission considers that for the purposes of the present case, each acrylate ester should be considered as representing a separate product market.

34. In terms of the scope of the geographic market the notifying party submits that the relevant geographic market for the acrylates concerned by the present decision is global. It submits that they are commodity products that are traded globally, transport costs are not significant and there are substantial imports into the EEA. It submits that the pricing of monomers follows global trends and that a 5-10% price increase in one region would lead to increased product flows from other regions and/or decreased product flows out of the region in which the initial price increase was observed. The market investigation has provided some support for the notifying party's claims. For the reasons noted below, however, the geographic market definition can be left open in the present case.

1.3.1. Butyl acrylate

Relevant product market

35. Butyl acrylate is produced through the esterification of an alcohol known as butanol (or n- butyl alcohol) and CAA. It is used as a raw material in the production of emulsion polymers (which are in turn used in the production of paints, coatings, adhesives and other products), inks, engineered plastics and lubricating oil additives. Butyl acrylate is the largest volume acrylate ester produced from CAA. As stated above, the notifying party submits that the question of market definition for acrylate esters including butyl acrylate can be left open as the proposed transaction would not raise concerns even if each acrylate ester were considered to constitute a separate product market.

36. In a previous decision in which butyl acrylate was considered (Celanese/Degussa/JV (European Oxo Chemicals)), the Commission found that butyl acrylate constituted a separate product market. This conclusion has been supported by the market investigation in the present case which has shown that in most applications there is no demand-side substitution between butyl acrylate and other acrylate esters or indeed between butyl acrylate and other chemical products.

Relevant geographic market

37. As noted previously, the notifying party submits that the relevant geographic market for butyl acrylate, as for the other acrylates concerned by the present decision, is global. In Celanese/Degussa/JV (European Oxo Chemicals) the Commission assessed the transaction on the basis of an EEA-wide market for butyl acrylate noting that the level of imports at that time was not significant.

38. Respondents to the market investigation in the present case have confirmed that butyl acrylate and the other acrylate esters concerned by the present decision are commodity products that are traded on a global basis and do not vary between suppliers in terms of chemical properties. Notwithstanding this fact, however, the majority of respondents also observed that there are price differences between Europe and other world regions (although not within Europe) due to factors such as raw material costs, regional supply and demand factors and exchange rate movements. This would tend to indicate that the market is no broader than EEA-wide. Nevertheless, as the proposed transaction would not give rise to competition concerns even on the narrow basis of an EEA-wide market, the precise scope of the geographic market can be left open.

Competitive assessment

39. Dow manufactures butyl acrylate at its Böhlen facilty in Germany and at two locations in the United States of America.32 Dow consumes about [...] of its butyl acrylate captively in its downstream polymer latex business. R&H produces butyl acrylate at Marl in Germany and at its Deer Park plant in the United States of America. R&H also uses […] of its butyl acrylate production captively in its downstream polymers business.

40. On the basis of the results of the market investigation, the merged entity’s share of the EEA merchant market would be [30-40]% (Dow [10-20]%, R&H [20-30]%).33 In the EEA, the merged entity would continue to face competitive pressure from other suppliers some of which compete by selling imported butyl acrylate. In terms of merchant market sales, these other competitors are Arkema (10-20%), BASF (5-15%), Acrylat (5-15%), Sasol (5-15%) as well as a number of other suppliers with an aggregate market share of approximately [20-30]%.

41. A number of respondents to the market investigation expressed the concern that the proposed transaction could reduce competition as it would combine two companies with significant production capacities and a strong presence on the merchant market. As noted previously in connection with glacial acrylic acid, some of these concerns emphasised the effects of the proposed transaction in North America rather than the EEA.

42. On the basis of evidence gathered in the market investigation, the merged entity’s share of production capacity for butyl acrylate would be in the region of [20-30]% at a global level (Dow [5-10]%, R&H [10-20]%) and [20-30]% in the EEA (Dow [10-20]%, R&H [10-20]%). If the potential divestment of Dow’s Clear Lake plant is taken into consideration, the merged entity’s share of global capacity would decrease to approximately [10-20]% (there would be no effect on capacity in the EEA).

43. Moreover, the merged entity would continue to face competition from a number of other producers both at a global and EEA level. In the case of the EEA, these competitors include BASF, Arkema, Acrylat, Sasol and Hexion. BASF, which already holds the leading position in terms of production capacity in the EEA, has announced plans to increase its production capacity for butyl acrylate.

44. In light of the above considerations, it is concluded that the proposed transaction does not raise serious doubts as to its compatibility with the common market in the market for butyl acrylate.

1.3.2. Ethyl acrylate

Relevant product market

45. Ethyl acrylate is produced through the esterification of ethanol and CAA. It is primarily used in the production of polymer latexes that are in turn used for plastic sheet, textiles (such as carpet backing and industrial drape backliners), and coatings and adhesives (especially pressure sensitive adhesives).

46. The notifying party submits that the question of market definition for acrylate esters including ethyl acrylate can be left open as the proposed transaction would not raise concerns even if each acrylate ester were considered to constitute a separate product market.

47. However, in light of the reasons noted above in paragraph 33 with respect to demand-side and supply-side considerations, the Commission has concluded that ethyl acrylate constitutes a distinct product market.

Relevant geographic market

48. As noted previously, the notifying party submits that the relevant geographic market for ethyl acrylate, as for the other acrylates concerned by the present decision, is global.

49. Respondents to the market investigation in the present case have confirmed that ethyl acrylate and the other acrylate esters concerned by the present decision are commodity products that are traded on a global basis and do not vary between suppliers in terms of chemical properties. Notwithstanding this fact, however, the majority of respondents also observed that there are price differences between Europe and other world regions (although not within Europe) due to factors such as raw material costs, regional supply and demand factors and exchange rate movements. This would tend to indicate that the market is no broader than EEA-wide. Nevertheless, as the proposed transaction would not give rise to competition concerns even on the narrow basis of an EEA-wide market, the precise scope of the geographic market can be left open.

Competitive assessment

50. Neither Dow nor R&H produces ethyl acrylate in the EEA. […]

51. On the basis of the results of the market investigation, the merged entity’s share of the EEA merchant market would be [30-40]% (Dow [10-20]%, R&H [10-20]%).34 In the EEA, the merged entity would continue to face competitive pressure from other suppliers some of which compete by selling imported ethyl acrylate. These competitors include Arkema (20-30%), Sasol (5-15%), Hexion (5-15%), BASF (0-10%) Acrylat (0- 10%), as well as a number of other suppliers with an aggregate market share of approximately [20-30]%.

52. On the basis of evidence gathered in the market investigation, the merged entity’s share of production capacity for ethyl acrylate would be in the region of [30-40]% at a global level (Dow [10-20]%, R&H [10-20]%) and 0% in the EEA (as neither party produces the product in the region). If the potential divestment of Dow’s Clear Lake plant is taken into consideration, the merged entity’s share of global capacity would decrease to approximately [20-30]%.

53. As has been confirmed by the market investigation, ethyl acrylate is an undifferentiated commodity product. Customers would therefore be able to switch relatively easily and with little cost to alternative suppliers in the event that the merged entity was to try and impose a price increase on its customers. The ability to switch is further supported by responses from the majority of customers in the market investigation which have confirmed that ethyl acrylate is in sufficient supply on the merchant market.

54. In light of the above considerations, it is concluded that the proposed transaction does not raise serious doubts as to its compatibility with the common market in the market for ethyl acrylate.

1.3.3. Methyl acrylate

Relevant product market

55. Methyl acrylate is produced through the esterification of methanol and CAA. It is used for similar applications as other acrylate esters as well as in polymers for use in barrier applications.

56. The notifying party submits that the question of market definition for acrylate esters including methyl acrylate can be left open as the proposed transaction would not raise concerns even if each acrylate ester were considered to constitute a separate product market.

57. However, in light of the reasons noted above in paragraph 33 with respect to demand-side and supply-side considerations, the Commission has concluded that methyl acrylate constitutes a distinct product market.

Relevant geographic market

58. As noted previously, the notifying party submits that the relevant geographic market for methyl acrylate, as for the other acrylates concerned by the present decision, is global.

59. Respondents to the market investigation in the present case have confirmed that methyl acrylate and the other acrylate esters concerned by the present decision are commodity products that are traded on global basis and do not vary between suppliers in terms of chemical properties. Notwithstanding this fact, however, the majority of respondents also observed that there are price differences between Europe and other world regions (although not within Europe) due to factors such as raw material costs, regional supply and demand factors and exchange rate movements. This would tend to indicate that the market is no broader than EEA-wide. Nevertheless, as the proposed transaction would not give rise to competition concerns even on the narrow basis of an EEA-wide market, the precise scope of the geographic market can be left open.

Competitive assessment

60. R&H does not produce methyl acrylate anywhere in the world. Its limited presence on the merchant market, both at an EEA and global level, derives from […]. Dow also lacks production capacity for methyl acrylate in the EEA. […]

61. On the basis of the results of the market investigation, the proposed transaction would not give rise to an affected market if the market is considered to be no broader than the EEA. On this basis, the merged entity’s market share would only be [5-10]% (Dow [5- 10]%, R&H [0-5]%). Given the relatively limited market position of the merged entity in the EAA, the small increment of [0-5]% arising from the proposed transaction and the presence of other competitors including the market leader BASF, Arkema, Acrylat and Hexion, the notified operation does not give rise to serious doubts as to its compatibility with the common market.

62. In a similar fashion, the proposed transaction does not give rise to serious doubts if the scope of the geographic market is considered to be global. On this basis, the merged entity’s share of the merchant market would be approximately [10-20]% (Dow [10-20]%, R&H [0- 5]%). The increment that would result from the proposed transaction is negligible and the merged entity would continue to face competition from a number of other suppliers including the market leader BASF, Formosa, Arkema, NSKK and others. Furthermore, as R&H does not produce methyl acrylate anywhere in the world, the proposed transaction would not add to Dow’s existing share of global production capacity of approximately [10- 20]%.

63. In light of the above considerations, it is concluded that the proposed transaction does not raise serious doubts as to its compatibility with the common market in the market for methyl acrylate.

1.3.4. 2-Ethylhexyl acrylate

Relevant product market

64. 2-ethylhexyl acrylate is produced through the esterification of 2-ethyl hexanol and CAA. It is used in applications similar to those that employ other acrylate esters.

65. The notifying party submits that the question of market definition for acrylate esters including 2-ethylhexyl acrylate can be left open as the proposed transaction would not raise concerns even if each acrylate ester were considered to constitute a separate product market.

66. In a previous decision in which 2-ethylhexyl acrylate was considered (Celanese/Degussa/JV (European Oxo Chemicals)), the Commission found that 2- ethylhexyl acrylate constituted a separate product market.

67. This finding has been confirmed by the market investigation in the present case and in light of the reasons noted above in paragraph 33 with respect to demand-side and supply-side considerations, the Commission has concluded that 2-ethylhexyl acrylate constitutes a distinct product market.

Relevant geographic market

68. As noted previously, the notifying party submits that the relevant geographic market for 2- ethylhexyl acrylate, as for the other acrylates concerned by the present decision, is global. In Celanese/Degussa/JV (European Oxo Chemicals) the Commission assessed the transaction on the basis of an EEA-wide market for 2-ethylhexyl acrylate noting that there were no barriers to trade within the region and that imports were not significant.

69. Respondents to the market investigation in the present case have confirmed that 2- ethylhexyl acrylate and the other acrylate esters concerned by the present decision are commodity products that are traded on global basis and do not vary between suppliers in terms of chemical properties. Notwithstanding this fact, however, the majority of respondents also observed that there are price differences between Europe and other world regions (although not within Europe) due to factors such as raw material costs, regional supply and demand factors and exchange rate movements. This would tend to indicate that the market is no broader than EEA-wide. Nevertheless, as the proposed transaction would not give rise to competition concerns even on the narrow basis of an EEA-wide market, the precise scope of the geographic market can be left open.

Competitive assessment

70. Neither Dow nor R&H produces 2-ethylhexyl acrylate anywhere in the world. As such, the merging parties’ presence on the merchant market derives from […]

71. On the basis of the results of the market investigation, the merged entity’s share of the EEA merchant market would be approximately [20-30]% (Dow [10-20]%, R&H [10- 20]%).35 In the EEA, the merged entity would continue to face competitive pressure from other suppliers including BASF, Arkema and Hexion, all of which have production capacities in the region.

72. A number of respondents to the market investigation indicated that 2-ethylhexyl acrylate has on occasion been in short supply on the merchant market. It was even suggested by one respondent that this shortage could be exacerbated in future if Dow, which was considered to be a producer of 2-ethylhexyl acrylate by this respondent, were to supply R&H in the future and therefore reduce its sales on the merchant market. The market investigation indicated that past shortages on the merchant market appear to have been the result of a lack of availability of the oxo-alcohol (2-ethyl hexanol) which is used together with crude acrylic acid to produce the ester concerned. It should be recalled that neither Dow nor R&H is active in the production of 2-ethylhexyl acrylate in the EEA. Indeed, R&H has no production of 2-ethylhexyl acrylate anywhere in the world […] Consequently, any concerns relating to the future behaviour of the merged entity as a producer of 2-ethylhexyl acrylate are unfounded. Moreover, neither Dow nor R&H is backward integrated into the production of 2-ethyl hexanol. For these reasons, the Commission considers that the product shortage cannot be attributed to the merging parties and the structural change brought about by the proposed transaction on the merchant market for 2-ethylhexyl acrylate is not significant given that the merged entity will have no activity either in the production of 2-ethyl hexanol or 2-ethylhexyl acrylate.

As a final point, the market investigation also confirmed that one EEA producer (Arkema) intends to expand its production capacity for 2-EHA by 50 kt during the course of 2009.36 This capacity expansion is significant when compared to the current level of capacity in the EEA and the size of the EEA merchant market which, according to the results of the market investigation, is in the region of [80-100] kt.

73. In light of the above considerations, it is concluded that the proposed transaction does not raise serious doubts as to its compatibility with the common market in the market for 2-ethylhexyl acrylate.

1.3.5. Other concerns raised in the market investigation relating to the acrylic acid envelope

74. During the course of the market investigation, the concern was expressed that the proposed transaction could reduce the degree of competition in acrylate esters and downstream polymer applications. It was suggested that the interests of the relatively few players active on the market for these products on a global basis, which would be reduced by the transaction, were closely aligned. It was also suggested that the pricing power of these companies, which are active at many points in the value chain, would increase as a result of the proposed transaction. It was said that the production of alcohols that are upstream of acrylate esters (butanol, ethanol, methanol and 2-ethyl hexanol) was dominated by relatively few companies including Dow and that as a result they could hinder the expansion of acrylate production by creating a tighter supply of these raw materials.

75. The Commission examined these claims but considers that the proposed transaction will not result in a significant lessening of competition as has been suggested. In the first place, the degree to which the companies concerned are vertically integrated and the products and markets in which they are active is not symmetrical. For example, whereas Dow and R&H are both active in the production of glacial acrylic acid, they are not active in the downstream application of super absorbent polymers unlike a number of other glacial acrylic acid producers such as BASF, NSKK and Evonik. In addition, the production capacities, level of captive demand and presence on the merchant market of these producers in the markets under consideration is not similar and may vary over time. Taken together, these factors are not indicative of markets where coordination is likely to emerge.

76. At the same time, Dow’s backward integration into the alcohols necessary for the production of acrylate esters is not as extensive as has been suggested. In actual fact, Dow is only active in one of these alcohols (butanol) and for the reasons described in the following section, the Commission has concluded that the proposed transaction does not raise concerns in this market. R&H does not produce any of the alcohols that are upstream of the acrylate esters concerned by the present decision. As a consequence, it cannot be said that the change brought about by the proposed transaction in this regard is significant.

77. In view of the above considerations, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the common market in the products encompassed by the acrylic acid envelope and applications that are downstream of this envelope.

1.4. Vertical issues

1.4.1. – Butanol and butyl acrylate

78. Butanol is one of the main raw materials used in the production of butyl acrylate which has itself been defined above under section 1.3.1 as a relevant product market. Butanol is a downstream product of propylene and syngas (hydrogen and carbon monoxide). Together, propylene and syngas can be used to produce butylaldehyde (also called butyraldehyde).37 Butanol is produced by the catalytic hydration of butylaldehyde. Dow, but not R&H is active in the production of butanol.

79. Butanol has been considered in a number of previous Commission decisions including Celanese/Degussa/JV (European Oxo Chemicals) where the Commission defined butanol as a relevant product market but left open the question whether there are separate product markets for the two types of butanol: n-butanol (made from n- butylaldehyde) and iso-butanol (primarily made from iso-butylaldehyde, but also produced in limited quantities when producing n-butanol).38 In Celanese/Degussa/JV (European Oxo Chemicals), the Commission considered the geographic market for butanol to be EEA-wide.39

80. The notifying party submits that butyl acrylate can only be produced with n-butanol. Consequently, there is no vertical link between iso-butanol and butyl acrylate. The notifying party further submits that the geographic market for butanol is at least EEA- wide if not broader. Nevertheless, for the purposes of the present case it is not necessary to reach a conclusion on the relevant product and geographic markets as the proposed transaction would not give rise to competition concerns even assuming that n-butanol constitutes the relevant product market.

81. As Dow's share of the merchant market for butanol is less than 25% at an EEA-wide and global level ([0-5]% and [10-20]% respectively)40, the proposed transaction would only give rise to a vertically affected market if the scope of the geographic market for butyl acrylate were considered to be no broader than EEA-wide as the merged entity would have a market share of [30-40]%: Dow [10-20]%, R&H [20-30]%. Even if this were the case, it is not considered that the transaction would give rise to anti-competitive effects in terms of input or customer foreclosure for the following reasons.

82. In terms of input foreclosure, Dow’s share of the merchant market for butanol in the EEA is limited at less than [0-5]%. There are at least four other suppliers of butanol to the EEA merchant market, Perstorp, Oxea, ZAK and BASF, each of which has a greater share of the merchant market than Dow and butanol production facilities in the EEA whereas Dow does not. In terms of production capacity, although Dow has no butanol production facilities in the EEA, it is one of the largest producers of butanol on a global scale with [10-20]% of installed capacity. However, this figure is not reflective of its merchant market position as it consumes […] of its butanol output internally for the production of […].Moreover, it expects its share of global capacity to decline in the near future as other producers enter the market. Finally, Dow does not sell butanol to butyl acrylate producers anywhere in the world with the exception of […].

83. In terms of customer foreclosure, it should be noted that R&H […] purchases […] of its total butanol requirements (approximately […]%) from […].41 R&H's purchases of butanol from firms other than […], namely […] in the EEA and […] in North America, represent approximately [10-20]% of the EEA butanol merchant market and less than [0-5]% of the worldwide butanol merchant market. […]

84. In the market investigation, one producer raised the concern that the proposed transaction could increase the competitive disadvantage of those producers of butyl acrylate that are not backward integrated in the production of n-butanol as they would have to purchase butanol on the merchant market at a higher cost than their vertically integrated competitors.

85. On the basis of the evidence gathered in the market investigation, the Commission considers that the proposed transaction does not raise concerns in respect of the vertical relationship between butanol and butyl acrylate. First, it should be noted that although butyl acrylate is the main downstream application in which butanol is used, there are a number of other applications including glycol ethers, butyl acetate and solvents where the aggregate demand for butanol is as significant as it is for butyl acrylate. Therefore, even if the merged entity were to meet its entire butanol requirement internally, there would still be a sufficient customer base for other butanol producers not only in terms of other non-integrated butyl acrylate producers such as Hexion, Acrylat and NSKK but also in other downstream applications. This fact was confirmed by a second butanol producer in the market investigation as well as by the butanol producer mentioned above which also acknowledged that a greater degree of vertical integration between R&H and Dow would not significantly change the butanol merchant market. Second, the change in the structure of the market arising from the proposed transaction is relatively modest as Dow and a number of its competitors in butyl acrylate, including BASF and Arkema, are already backward integrated into the production of butanol […]. In any event, given the merged entity’s share of production capacity and merchant market sales, it cannot be said to have market power in the production and sale of butanol regardless of the geographic market considered. Finally, the merger would not add any increment to Dow's pre-existing butanol production.

86. In light of the above considerations, the Commission considers that the proposed transaction would not give rise to foreclosure concerns either in respect of input foreclosure or customer foreclosure in these markets.

1.4.2. Propylene and crude acrylic acid

87. Propylene is a gaseous olefin used as a raw material for the production of a number of important basic petrochemical products including the thermoplastic polypropylene, which consumes approximately 61% of all propylene, propylene oxide (“PO”), acrylonitrile (“ACN”), OXO alcohols (such as butanol), cumene, CAA, and other products.

88. CAA is most commonly produced from propylene and oxygen by a two-stage oxidation of propylene. CAA is an intermediate product that is further processed into either GAA or acrylate esters.42 Downstream products from CAA (and thus indirectly vertically- related to propylene) include GAA and acrylate esters, such as butyl acrylate.

89. Dow is active in the production and sale of propylene […]. R&H does not produce or sell propylene anywhere in the world. R&H does not purchase propylene in the EEA and does not purchase from Dow anywhere in the world. Dow produces CAA in the EEA but R&H has no CAA production apart from the production of its 50/50 Joint venture with Stockhausen, StoHaas (see supra). CAA is not sold on the merchant market but rather consumed captively. The only downstream product produced by both parties in the EEA is the acrylate ester, butyl acrylate.

Relevant product and geographic markets

90. Propylene has been treated as a distinct product market in previous Commission's decisions.43 The market test did not contradict this finding. The Commission has not found it necessary to delineate the precise scope of the geographic market for propylene in the previous decisions, but has suggested that the market was at least Western European and possible EEA-wide. However, there is no need to determine the precise geographic market for propylene, as the transaction does not raise any serious doubts about the supply of propylene, irrespective of the market definition.

91. For the reasons discussed above under section 1.1, CAA is not a relevant product market as there is essentially no merchant market. Therefore, both the product and geographic market definition can be left open.

Competitive assessment

92. Dow’s propylene activities focus on production for internal consumption, and as a result its share of the merchant market is well below 25% in the EEA. R&H is not active in the production or sale of propylene anywhere in the world […].

93. The combined entity will not have the ability to raise downstream producers’ costs by restricting or foreclosing access to propylene, as it lacks market power to do so. Furthermore, there will still be several competitors on the market such as Polimeri, Shell, BP and Total. Downstream propylene consumers, including those CAA producers which are not backward integrated in the production of propylene, have several options for their propylene supply, including purchasing propylene directly from manufacturers or from traders.

94. The combined entity will not have the ability to foreclose other propylene producers’ access to customers in the downstream production of CAA by reducing its purchases of propylene from the combined entity’s upstream propylene competitors. This is because most propylene is sold for consumption in the production of products other than CAA. The propylene requirements of the StoHaas JV do not represent a sufficiently large proportion of propylene purchases from third party suppliers to enable the merged entity to impede effective competition on the market for propylene. […] In CAA, the parties do not sell on the merchant market and their share of capacity is limited at [10-20]%.

95. Therefore, the transaction does not raise any serious doubts as to its compatibility with the common market regarding the markets for propylene and its downstream products CAA and acrylate esters.

2. ION EXCHANGE RESINS

2.1. Horizontal assessment

96. Both Dow and R&H are major producers of ion exchange resins (‘IER’ or ‘IERs’), although this activity has a relatively minor importance compared to their overall business.44

Relevant product market

97. IERs are small plastic resin beads (between 0.3 and 1.2 mm) containing ions with a positive or negative electric charge. IERs are used primarily at industrial scale for the purification of liquids. IERs can remove or separate soluble impurities that cannot be filtered out. The resins charged with a particular electrically charged ion use ionic attraction to selectively remove soluble impurities from liquids (such as calcium from water), whereas the ions contained in the liquid and in the resin bead are being 'exchanged'. IERs have to be regenerated over time by replacing the impurity ions with the type of ions originally loaded into the resin. As a result of this regeneration, IERs may be reused multiple times, with a total lifespan up to 10 years (but typically shorter than that). IERs are used in a wide range of applications including water softening in households, industrial water treatment, the pharmaceutical industry and in nuclear power plants.

98. IERs are produced in different stages. First a copolymer bead is produced by reacting divinylbenzene (‘DVB’) together with styrene (or sometimes with methyl acrylate). These copolymer beads are then functionalized by adding an ion (there are many ions used according to the intended use) containing an electric change to attract the impurity ions and remove them from the liquid. IERs are typically produced in batches and they are very differentiated products – apart from different ions loaded into the resins (which either belong to the group of anionic or cationic ions45), IERs are produced in different sizes, different forms of resins (gel or macroporous), the resins can be based on different chemistry (styrene or acrylic), and the IERs may be acidic (strong or weak) or basic (strong or weak).

99. Absent any Commission precedents in this area, the parties in this case submit that the relevant market is the supply of IERs, although they suggest that alternative technologies used to remove soluble impurities from liquids may be viewed as substitutable from the customers’ perspective.

IERs and alternative technologies

100. The market investigation confirmed that certain alternative technologies, in particular reverse osmosis (an alternative technology based on membranes), is to some extent interchangeable with IERs and that some switching by customers between IERs and reverse osmosis occurred in the past.46 Generally, it was observed that reverse osmosis, replaced IER in some projects in the past, but the situation seems to have stabilized in recent years. In any event, despite a certain competitive pressure exercised by reverse osmosis on IERs47, the investigation points to several elements which lead to the conclusion that the two applications are not as close as to constitute one single relevant product market.

101. From the demand perspective, it is noted that each of these two alternative technologies has its field of application where it is best suited and the overlapping areas where both technologies can be used alternatively seem to be limited, without there being substitutability in general between the two applications. Reverse osmosis seems to overlap with IERs mostly in the area of industrial water treatment, such as for water demineralisation, but often there will be no substitutability as the use of one or other technology may depend on the size of the project48 and it is also determined by a mix of factors relating to both the feed water characteristics and specifications of the pure water.49 Therefore, the technical substitutability has to be evaluated on a project-by-project basis and even within industrial water treatment area, substitution is not technically possible for a significant part of the projects50 and it is not a technically viable alternative for many further applications.

102. Further, it is observed that in those situations where these two technologies are technically substitutable for a particular purification need, customers tend to compare the price of reverse osmosis and IERs and in general try to optimize their costs. However, a small but significant permanent increase in the range of 5-10% of IER prices would likely not trigger significant switching to reverse osmosis, as demonstrated by the customer replies within the investigation.51 In fact, one important customer explained that when looking at the total system costs of a water solution system, IER or reverse osmosis represents only a relatively minor part ([0-10]%) of these total costs, so a relative price increase of a magnitude of 5-10% would translate into less than [0-5]% of the total system costs; that does not make a large difference on the total costs and may not alone trigger a lot of switching.52 Another customer explains that "a price increase of 5-10% on IER would not effect the selection of technology very much. Main parameter is operating costs and other requirements (e.g. chemical-free operation)".53 As regards operating costs, it is noted that IERs for example produce less water losses, and that the volumes of effluent water from the purification process are different when comparing the two alternative systems. Generally, rather than a mere reaction to a relative price increase of the material (IERs or reverse osmosis), it seems that the choice between alternative technologies is more a technical one. Customers therefore generally do not consider those technologies as perfect substitutes between which they would switch in case of a SSNIP of a magnitude of 5-10%.

103. On the supply-side, it is noted that reverse osmosis is a completely different production process, making any hypothetical production switching unrealistic. It should be noted that out of all IER suppliers, only one producer (Dow) is active in both reverse osmosis and IERs, whereas all others either produce one or another solution, but never both at the same time. The competitive landscape and interaction on the supply side of the market thus necessarily differs for IERs and reverse osmosis.

104. Based on the above, it is thus concluded that the results of the market investigation support the view that the market for IER is not as wide as to encompass alternative technologies and in particular reverse osmosis, even though some competitive pressure from reverse osmosis is observed at some edges of the market.

Segmentation of IER market according to end-use application areas

105. The parties submit that IERs comprise a single product market and should not be further narrowed down according to end-use application segments. In the parties’ view, despite the fact that a wide range of IERs are used in various applications, there is a considerable degree of supply-side substitutability between IERs produced for different end-uses and all major competitors are active across segments.

106. As a preliminary remark, it has to be noted that IER producers questioned during the investigation internally do not use the same end-use segmentation54 (and even if they do, sometimes they define the same segments differently55), which indicates that there is no common alignment in the industry on the precise application segments. However, as end-use segmentation was suggested by a complainant in this case arguing that the parties’ position would be particularly strong in some segments or even sub-segments (mainly in high-end application segments such as ultra-pure water, nuclear and the pharmaceutical segment), the Commission carefully analysed the transaction also with regard to these specific segments of the IER market.

107. The parties consider that the principal basis of a segmentation of the IER market would be between (1) water applications (i.e, where impurities are separated from water so that the water can be used for its intended purpose) and (2) non-water applications (i.e., where IERs are used to separate ions from non-water liquids). These two categories may be further segmented as follows: water applications into (i) residential water applications and (ii) industrial water applications (which inter alia also includes ultra- pure water and nuclear applications); and non-water applications into (i) food/beverage- related applications; (ii) pharmaceutical and medical applications; and (iii) industrial processing applications (which inter alia also includes catalysis and chemical processing applications). As stated above, there are slightly different perceptions of competitors about the precise segments. However, it seems to be common in the industry to refer to end-use application segments suggesting that it is not unreasonable from a business perspective to distinguish end-use segments of the IER market as proposed by the parties, with more or less details as regards further sub-segmentation. On the basis of the market investigation, it is however considered that these segments are rather unlikely to constitute separate product markets.

108. From a demand side, as IERs used in a particular segment are usually tailor-made to best suit the needs of that customer segment or indeed a particular application within that segment, they are typically not substitutable for another specific need. As such, in the context of a differentiated product such as IER, a closer look at the supply-side characteristics of the market appears more meaningful in relation to the relevant product market definition.

109. The market investigation points out that all major established IER producers (Dow, R&H, Lanxess, Purolite, Mitsubishi) are indeed active across application segments, although their presence and focus on certain areas varies (partly due to historical or strategic reasons), and it seems that they are all capable of producing IERs suited for all segments.56 The investigation also suggests that there would be no particular reasons why these established producers would not be able to develop and expand further in a particular segment should an opportunity arise and it would prove to be more commercially attractive than serving another segment.57

110. On the production side, the main limitation to switching between different IERs relates to the different chemical processes that may be involved in the production process, i.e. anionic or cationic resins. It is indeed common in the industry to use dedicated production facilities for cationic and for anionic resins. However, this distinction only refers to the second stage of the production process, namely the functionalisation of the resins with a particular ion, whereas the first production step (of creating the copolymer beads) can be common for both anionic and cationic resins and thus a certain degree of substitution can take place there. Further production switching bottlenecks were pointed out by one producer in the first production step, such as dedicated equipment for producing gel-type and macro-porous type of resins.58 However, it is important to note that there is usually a mix of different resins comprising both anionic and cationic resins (and similarly, both gel and macro-porous resins, etc.) offered and used across and within most application segments. In other words, the different types of IERs (which accordingly need different production equipment for a particular production step, as explained above) are not at all specific to a particular application segment. All established IER producers offer all of these types of IERs. Accordingly, subject to some very specific types of resins, switching production of IERs used in different end-use applications seems generally feasible, in particular as IERs are produced in batches.59

111. The investigation however also indicates that some specialized IERs (used in nuclear, ultra-pure water and pharmaceutical segments) require more sensitive production processes. Some special equipment is needed to produce these IERs (such as a 'clean room') to comply with stricter requirements, so dedicated production lines are used. Therefore, production switching from IERs used in less demanding applications to these more sensitive IERs would not be as quick as within the other segments and requires some further investment. It seems however that all major players do possess the know-how and technology to produce these types of IERs. Even if this switching would require some time and money, it seems that if production of these special resins would be attractive commercially, producers would be ready to switch, as is demonstrated by Mitsubishi which is currently not producing ultra-pure and nuclear resins in Europe but explains that "if the sales of UPW and/or nuclear IERs in Europe would become commercially attractive for Mitsubishi, the company would certainly be able to make the necessary investments and switch the production to IERs which would be more profitable to sell."60 Finex, a niche European producer active in the production of inter alia nuclear IERs even considers, from a production point of view, the ultra-pure water IERs as "more a commodity product than a high-end product despite the purity requirements".61 Apart from differences in production as discussed above, some segments (such as IERs for the pharmaceutical industry and for drinking water) require more regulatory approvals for IERs or qualification of suppliers by the customers (for sensitive nuclear uses for example), and customers would be more stringent about the quality assurances and track-record of the suppliers. However, all main established IER producers are already active across segments including the production of the more specialized and more sensitive IERs.

112. Based on the arguments as set out before, the Commission considers that no separate markets need to be defined for different end-use application segments. However, the Commission carefully analysed the likely impact of the concentration on the segments claimed to be most affected and found out that the merger would not lead to serious doubts even within these particular market segments. Therefore, the question whether the relevant product market is IER or narrower according to end-use application segments may ultimately be left open in this case.

Relevant geographic market

113. The parties submit that the relevant geographic market for the supply of IERs is global, since these products are supplied globally from a few plants worldwide, transportation costs are relatively low and there are important cross-regional trade flows and that IERs are often purchased internationally by clients.

114. These elements are largely confirmed by the market investigation. In fact, all major competitors agree that IERs are supplied globally into all regions from plants across the world62, and that transportation costs (which usually are below 5%) are not a barrier to trade. As regards trade flows, it is noted that according to parties’ estimates about [30- 40]% of EEA consumption of IERs was imported in 2007, predominantly from China.63

Most competitors also agree with the parties that a significant part of business is done with customers operating globally (such as large OEMs or service companies) which purchase IERs internationally.64 In fact, some large OEMs questioned during the investigation explained that they indeed have global contracts with their preferred suppliers. Other customers, which do not have worldwide operations, may prefer to source locally.

115. IER customers consistently stressed the importance of a local presence for an IER supplier in terms of sales and technical support.65 It was explained that this is relevant mostly at the beginning of the selection procedure for a project when IER suppliers have to do a number of testing, analysis and process design operations and thus a more intense contact is necessary. As concerns after sales services during the operation phase, customers generally do not require technical assistance from the supplier apart from the ‘renewal’ of resins which is done once every few years. Even though the main suppliers maintain their own offices worldwide, it seems that a local presence in terms of technical support can be ensured by dedicated distributors, which is also demonstrated by […]66. It seems irrelevant whether this technical support would be provided by a distributor or the supplier itself67, and establishing such a local presence was not referred to by any competitor as a barrier to enter a particular region. In fact, when asked whether there would be any specific barriers to sell IERs in a particular region of the world, all major competitors replied that there would be none, except for one remarking that for certain applications (such as food or drinking water) regulatory approvals are necessary at a national level in some countries.

116. Also, it has to be noted that some regional approaches in terms of pricing were reported by customers. For example, it was reported by one internationally operating OEM that prices differ across world regions even if they have a worldwide contract with a global price cap with their suppliers – prices were reported to be higher in USD regions compared to Europe, whilst this difference would mainly be attributable to currency exchange rates.

117. When looking at the presence of the main IER suppliers, all of them are active in all world regions and can be considered true global players, however their strength varies across the regions. According to parties' estimates of market shares by world regions, Dow has a relatively stronger position in North America, Mitsubishi primarily focuses on Asia, both Lanxess and Purolite are stronger in Europe and North America than in Asia. In Asia, there is a significantly higher presence of Indian and Chinese IER suppliers than in other regions. Thus, the competition landscape differs across regions to some extent but is generally not significantly different when looking at a global and EEA-wide level. In particular, the parties’ market shares on worldwide and EEA-wide levels of the IER market are within relatively similar ranges.

118. However, given that the competition assessment would not materially differ on the EEA-wide and worldwide market and the operation does not lead to serious doubts as to its compatibility with the common market under either market definition, the geographic scope of the market may ultimately be left open.

Competitive assessment

Overview of the main players and market shares

119. R&H is the market leader in IERs at a worldwide level and has a significant position in the EEA alongside Lanxess (formerly owned by Bayer). R&H is present across the whole range of IERs and specially focused on more value-added specialized applications. Other important suppliers include Purolite and Dow which are about the same size in terms of market share. Mitsubishi is an IER provider with a reputed track- record, especially for high-end applications but focuses primarily on Asian customers. Other Asian producers (from India and China), on the other hand, are present in commodity applications, also in the EEA. However, customers contacted in the market investigation do not currently see these Indian and Chinese producers as sufficiently reliable and experienced at the present time for high-end applications.

120. The market shares on both worldwide and EEA levels in value and volume are presented in the table below.

Table 1: Market shares for Ion Exchange Resins 2007

SUPPLIER | WORLDWIDE | EEA | ||

SHARE (BY VOLUME) | SHARE (BY VALUE) | SHARE (BY VOLUME) | SHARE (BY VALUE) | |

Dow | 10-20% | 10-20 % | 10-20% | 10-20% |

R&H | 10-20% | 25 -35 % | 20-30% | 30-40% |

Dow + R&H | 30-40% | 40 - 50% | 30-40% | 40-50% |

Lanxess | 10-20% | 10 – 20 % | 30-40% | 30-40% |

Purolite | 10-20 % | 10-20 % | 10-20% | 10-20% |

Mitsubishi | 0-5% | 5-10 % | 0-5% | 0-5% |

Other | 30-40 % | 10-20% | 10-20% | 5-10% |

Source: parties' estimates and market reconstruction

121. As can be seen from the table above, the parties' combined share by volume would be in the range of 30-40%, and in value it would be 40-50% both worldwide and EEA- wide.

122. The Commission conducted an extensive market investigation in this case, contacting all major competitors and a significant number of customers representing a very large part of both parties’ customer base across the spectrum of the IER market,.68

123. The results of the market investigation clearly confirm that the marketplace would not be changed substantially by the merger so as to lead to a significant lessening of competition as Dow is not a particularly close competitor of R&H, and as post-merger there will remain a sufficient degree of competition from other strong suppliers capable of expanding their activities, particularly with the support of large and strong customers.

Parties are not close competitors

124. The investigation confirmed that the parties are not seen as the closest competitors in the IER market, but that their IER businesses would be rather complementary. As noted by one important competitor, "There is not a large impact on competition caused by the merger as Dow and R&H have a rather complementary business in IER. Dow is more focused on large volumes bulk commodity products. R&H is also present on the commodity segments but is also focused on the specialized resins."69 Although both parties compete partly in the same areas, this overall perception that the focuses and strengths of their business are rather complementary is shared by a number customers. 70 This is consistent with the submissions of the parties who explain that Dow is rather focused on more bulky business (where all competitors are well active), whereas R&H is present across the spectrum but has a particular focus on speciality business.

125. The market investigation also pointed out that customers predominantly see Lanxess as the closest competitor to R&H71, citing reasons such as its comparable product range and quality. This is consistent with the own assessment of Lanxess, which explains in its answer that "When looking at the overall IER market, we consider ourselves to be Rohm & Haas' closest competitor as we are no.2 in terms of market share and because Lanxess and Rohm & Haas are the only suppliers which offer the full range of IERs."72 Dow does not appear to be seen by customers as a very close competitor of R&H and only ranked after Purolite as the closest competitor to R&H. There is thus a consistent pattern in replies clearly pointing to the fact that Dow is not a particularly close competitor to R&H.

126. Apart from qualitative evidence, the different focus is also clearly evidenced by the significant difference in market shares by volume and by value attributable to R&H which focuses on activities in the higher end of the market with higher value-added products (R&H has worldwide market shares of 10-20% in volume and 25-35% in value). On the contrary, there are no such large differences in value and volume market shares in case of Dow.

127. These elements pointing to a conclusion that Dow and R&H are not competing very closely has been complemented by a bidding analysis of data submitted by R&H. On 17 September 2008, R&H submitted data on [>300] new or existing projects that R&H lost or did not get, due to […], between […] and […] and between […] and […].73 […]. Of the [>300 ] lost projects described, […] ([20-30]%) do not identify an alternative supplier. For the other […], Dow is identified […] times as a potential competing supplier. Thus, according to the R&H submission, Dow and R&H competed only on [0- 10]% of all R&H lost business ([5-15]% in value terms), which corresponds to [0-10]% of all R&H business with at least one identified competing supplier ([5-15]% in value terms). In other terms, despite the inherent bias that could be attached to the restriction of the analysis to lost business, there is no indication in the database submitted by R&H that would contradict the conclusion reached above regarding a rather limited competitive interaction between the parties.74

The merger will not lead to a significant loss of a major competitive force

128. As was elaborated above, pre-merger Dow was not a particularly close competitor to R&H and in any event not its closest competitor. It terms of pricing, Dow is often referred by customers as being relatively higher pricing for similar comparable products of its competitors and it seems that Dow was not expanding aggressively on the market by offering low prices. It is evident from Dow's internal business documents that […]On the other hand, internal documents of Dow rather consider […] as the player with its pricing policy being most aggressive towards its competitors, and […] as the player with an interest to win more volumes and thus seeking to expand business.$

129. The market investigation also shows that Purolite was referred to by many market participants as the most price competitive, offering lower prices in order to win business.75 Lanxess publically announced a significant capacity expansion, building a new IER plant in India with significant new capacity which it wants to have operational in 2010, so it may be expected that Lanxess will also try to actively win new business.76 […] In terms of innovation, there are no indications that Dow would be the main innovator on the IER market.

130. Therefore, it seems that the disappearance of Dow would not lead to the significant loss of a major competitive force which was pre-merger fundamental to constrain R&H and to stimulate competition. Rather, it seems that the remaining players Lanxess and Purolite, together with Mitsubishi and a number of smaller competitors will continue to exercise a considerable competitive pressure on the merged entity.

There will remain a number of strong competitors capable to expand

131. The market investigation indeed confirms that post-merger, there will still be a critical number of strong competitors to the merged entity capable and having a strong incentive to compete vigorously on the market.

132. Lanxess is the strongest competitor to the parties and can now be seen as the challenger to R&H. It has a 10-20% worldwide market share and a very strong position with a share of 30-40% within the EEA. Lanxess is considered as the closest competitor to R&H in terms of product offering, covering the whole range of IERs. It enjoys a strong track-record of projects and quality recognition on the market. Lanxess currently operates two IER plants in Germany, where it recently completed some capacity expansions increasing its capacity by 10%77. More importantly, as noted above, Lanxess is currently constructing a new IER plant in India which will increase its production capacities significantly and which is expected to be operational in 2010 and Lanxess will thus have every incentive to utilise this new capacity by winning new customer orders.

133. Purolite is another strong IER producer based in the US, with production plants in the US, China and Romania. It has a market share of 10-20% on both a worldwide and EEA-wide level. Purolite confirms that it has a complete line of ion exchange resins78 and it is interesting to note how Purolite itself explains its way to the market: "Purolite has built its business on the basis that customers switch suppliers. As the latest entrant into the ion exchange resin business, we have taken a lot of business from our competitors because we have been able to convince the customers that we can provide a better service, product or value than the competitor."79 As explained above, Purolite is seen by many customers as a player with a low pricing policy. Even if some customers refer to a slightly lower reputation of Purolite, other customers confirmed that they view Purolite's product as good quality and some important customers were able to grow business with Purolite significantly in the very recent years.80