Commission, August 8, 2011, No M.6316

EUROPEAN COMMISSION

Judgment

AURUBIS/ LUVATA ROLLED PRODUCTS

Dear Sir/Madam,

Subject: Case No COMP/M.6316 - AURUBIS/ LUVATA ROLLED PRODUCTS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 1 July 2011, the European Commission received a notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Aurubis AG (Aurubis, Germany) acquires control over certain assets and legal entities which are currently owned by Luvata Espoo Oy (Luvata, Finland), and which constitute Luvata’s “Rolled Products Division” (LRP)2. Aurubis and LRP are designated hereinafter as "the Parties".

I. THE PARTIES AND THE OPERATION

2. Aurubis is one of the main copper producers in Europe.3 It has about 4,800 employees and production sites in seven European countries. The core business of Aurubis is the production of marketable cathodes. These are processed into wire rod and shapes, and – on a level further downstream - into rolled products for industrial use. The production and sales activities also include precious metals and a number of other products, such as sulphuric acid and iron silicate.

3. Luvata – the seller – supplies metals and offers solutions, services, components and materials for manufacturing and construction and employs 7,000 staff in 18 countries.

4. The target of the proposed transaction, LRP, is one of the four divisions of Luvata and manufactures thin rolled products from copper and copper alloy for industrial use. It has manufacturing facilities in Europe (Finspang in Sweden, Pori in Finland and Zutphen in the Netherlands) and the US, as well as sales offices in Europe, the US and Asia. LRP's oxygen-free (OF-Cu) copper foundry in Pori is not part of the transaction.4

5. On 29 April 2011, Aurubis and Luvata signed a share sale and purchase agreement which concerns the sale of 100% of the shares in Luvata Sweden ("the Main Agreement"). Several additional share purchase and asset transfer agreements regarding the acquisition of the remaining target companies and the target assets by Aurubis have been attached as exhibits to the Main Agreement.

6. Aurubis will therefore acquire sole control over LRP and the proposed transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.5

II. EU DIMENSION

7. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5,000 million6 (Aurubis: EUR […]; LRP: EUR […]). Each of them has an EU-wide turnover in excess of EUR 250 million (Aurubis: EUR […]; LRP: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

III. COMPETITIVE ASSESSMENT

Production chain of copper

8. Copper is a natural product gained from copper ore. Copper ore contains only a low concentration of copper (below 5% copper content). After extraction from the copper mine, it is enriched in processing facilities into copper concentrates (25–40% copper content). Both copper concentrate and copper scrap (recycled copper material) are converted into anodes which are used to produce copper cathodes (flat pieces produced in various grades) in an electrolytic process in a copper tank house.7

9. Copper cathodes are then further processed by smelting and casting into semi finished products such as (i) copper rods and (ii) shapes. Copper rod is the main feed stock for power cables, installation cables and communication cables and wires.8 Copper shapes, which are either billets9 or cakes10, are just intermediate products, further processed into other products: billets are transformed into tubes, bars and profiles, whereas cakes are the feedstock for pre-rolled strip11, which is then further rolled down into rolled products.12

10. Rolled copper products are available in different forms: plates, sheets and strip. The products are also available in different dimensions and alloy compositions and qualities depending on final use. Customers of rolled products manufacture, e.g., electric motors, cables, microchips and transformers (because of the high electrical conductivity of copper), air-conditioning, heat exchangers, kitchen equipment and brake pads (because of the high thermal conductivity) and sanitary equipment, tubes, roofs and facades, coins (because of the high reliability).

11. The table below summarises the activities of the Parties in the different steps in the production process. In addition, Aurubis and LRP source scrap13 as an intake for their copper products (Aurubis also buys copper concentrate).

Table 1: Positions of the Parties in the copper production chain

Product | Aurubis | LRP | |

Production of copper cathodes | u |

| |

By-products | sulphuric acid | u |

|

iron silicate | u |

| |

precious metals | u |

| |

Copper shapes | u | u | |

Copper rod | u |

| |

Bars and profiles | u |

| |

Pre-rolled strip | u14 | u15 | |

Rolled products | u | u | |

Source: Form CO, p51 and 52.

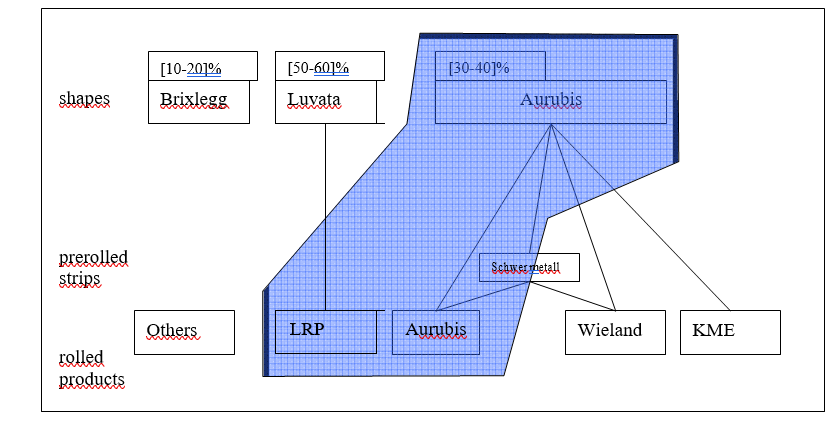

12. However, although Aurubis is indeed a vertically integrated copper producer, it mainly focuses on the markets upstream of rolled products. These activities include Aurubis' participation in Schwermetall, a 50/50 Joint Venture with Wieland. On the other hand, LRP is primarily a copper rolled product manufacturer, and rather absent from the upstream markets.

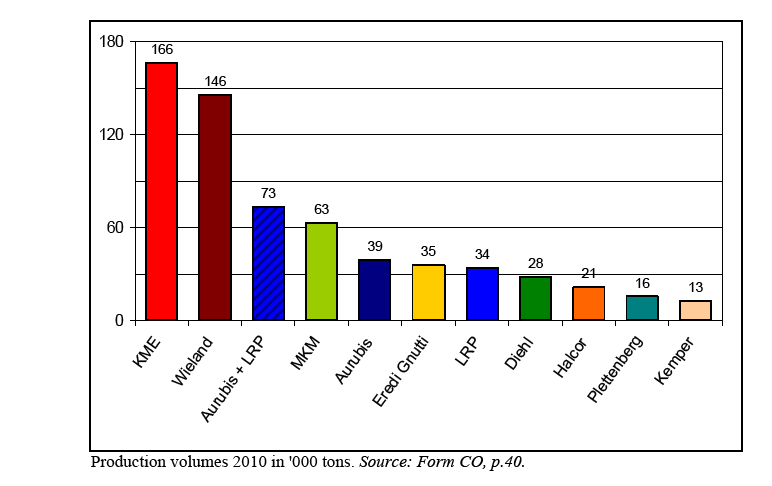

13. The Parties' main competitors for rolled products are also vertically integrated companies such as KME and Wieland. The table below provides an illustration of different actors position on the downstream market for rolled products made of copper only or copper alloy:

Chart 1: Main rolled products manufacturers in Europe

1. RELEVANT MARKETS

14. The Parties' activities mainly overlap in relation to the manufacturing of copper rolled products. Overlaps also arise with respect to the production of certain intermediate products which are upstream of rolled products, copper shapes and pre-rolled strip. However, LRP's shapes and pre-rolled strips are exclusively used in-house (with the exception of some shapes – only billets - which are sold to a single external customer). With respect to copper cathodes, only Aurubis produces and sells cathodes. However, a vertical link arises as LRP sources cathodes for the production of copper shapes, although not from Aurubis.

15. The markets affected by the transaction therefore concerns the following products (i) copper cathodes, (ii) copper shapes, (iii) pre-rolled strip and (iv) rolled products.

(i) Copper cathodes

16. Copper cathodes are the base input for the production of copper shapes. Copper cathodes that comply with the London Metal Exchange (LME)16 standard of so called "grade A" cathodes must have a copper content of at least 99.9935% and a defined maximum level of the various impurities such as silver, lead, phosphorus and other precious metals. All non-LME certified cathodes or "off-grade" copper cathodes may have copper content below LME-certified cathodes or a combination of impurities that does not comply with the standard set by the LME. Aurubis does not sell any off- grade cathodes.

17. In previous cases17, the question whether LME-grade and off-grade cathodes constitute a single product market or are rather to be distinguished was left open. The question can also be left open in the present case, as the transaction does not give rise to any competition concerns irrespective of the precise product market definition (i.e. an overall copper cathodes market or a narrower LME-grade cathodes market).

18. With respect to the geographical market definition, the Commission concluded in case Norddeutsche Affinerie/Cumerio18 that the geographic scope of the copper cathodes market is world-wide. The market investigation conducted in the present case did not bring to light any strong indication contradicting these previous findings. However, the question of the precise market definition can be left open in the present case, as no competition concerns arise.

(ii) Copper shapes and OF-Cu shapes (i.e. cakes and billets)

19. Copper shapes are a purely intermediate product for the production of rolled products. Copper shapes can be of two types (i.e. billets and cakes, as mentioned above) and may have a different content of copper and impurities. Depending on the copper content and the content of impurities, shapes of different grades and alloy can be distinguished, in particular oxygen free copper shapes (hereinafter "OF-Cu shapes") and oxygen bearing-shapes.

20. The Commission already considered the question of the market definition for copper shapes in case Norddeutsche Affinerie/Cumerio.19 The Commission investigated the possible subdivisions of the copper shapes market from both demand-side and supply-side points of view. Although the market investigation showed that there is no demand-side substitutability between billets and cakes and that it may not be possible for every copper producer or processor to easily switch between the production of cakes and billets on the same production line, or to switch easily between all sizes or weights of cakes and billets, the Commission concluded that the possibility and likelihood of such switching characterises the market situation in general. Finally the Commission concluded that copper shapes constituted a single distinct product market regardless of whether they are cakes or billets as well as regardless of the specific qualities of copper. The market investigation conducted by the Commission in the present case did not bring to light any indications substantially contradicting the previous findings.20

21. The question whether it would be necessary to identify a separate market for OF-Cu shapes has also been considered by the Commission in case Norddeutsche Affinerie/Cumerio.21 It pointed out that OF-Cu shapes are indispensable for some applications such as underwater cables and cable strips made of copper or are used for special applications in electronics, telecommunications, and high energy physics, where high electrical and thermal conductivity are needed. It has been also highlighted that OF-Cu qualities of shapes can only be produced in special dedicated production lines because of the requirement of a protected atmosphere. However the Commission ultimately decided to finally leave the question open.

22. The German Bundeskartellamt identified a separate market for OF-Cu shapes.22 The market investigation conducted by the Commission in the present case rather supports such a finding. Indeed, only very few companies are able to produce OF-Cu shapes and the market investigation does not support the notifying party's submission that it is no longer necessary to produce OF-Cu shapes on dedicated production lines because of technology advances. In particular, continuous casting lines can be used to cast OF-Cu shapes as well as other copper grades only by introducing a separate furnace which is exchanged prior to starting an OF-Cu campaign. The market investigation conducted in the present case revealed that only a minority of respondents share the Notifying party's position23.

23. However, the question of the precise market definition for copper shapes can be left open, as the transaction does not lead to competition concerns under any plausible market definition.

24. Previously the Commission concluded that the relevant geographic market for copper shapes is the EEA-wide market.24 The German Bundeskartellamt also found an EEA- wide market for oxygen-free copper shapes.25 While the market investigation conducted by the Commission in the present case indicates that shapes can be economically transported worldwide, it also shows that only few manufacturers supply shapes outside the EEA (and in any case, bellow [0-5]% of their production).26 Therefore, the competitive assessment of the present case will be conducted on the basis of an EEA-wide market definition.

(iii) Pre-rolled strip

25. Pre-rolled strip is an intermediate product which is usually produced in-house by manufacturers of rolled products. The vast majority of the pre-rolled strip is destined for captive use. LRP is not active on the merchant market for pre-rolled strip – neither as a supplier nor as a customer.

26. Pre-rolled strip is available in copper and in copper alloys depending on the cakes used in the production process. Since pre-rolled strip is merely another intermediate product one step down the production chain from copper cakes and takes on the qualities of its input material, the notifying party submits that pre-rolled strip forms one single product market. In any event, in the absence of any overlap between Aurubis and LRP in the merchant market, the question of the precise product market definition can le left open.

27. In Norddeutsche Affinerie/Cumerio, the Commission considered that, in the absence of any overlap between the Parties, it is not necessary to decide the exact geographic extension, either EEA or worldwide, of the markets for the various semi-finished copper products downstream of copper shapes. For the purpose of the competitive assessment in the present case, only the EEA market position of Aurubis would be considered.

(iv) Rolled products

28. The proposed transaction primarily concerns the production and sale of rolled products, which can be used for various end-products such as roofing copper, boiler strip, heat exchangers strip etc. Rolled products made from OF-Cu are used in various applications where high electrical and thermal conductivity are needed.

29. Aurubis submits that the relevant market includes at least all rolled products made of copper and copper alloys given that: (a) from a supply-side perspective, most manufacturers are able to offer all different types of rolled products e.g. in all sizes and all alloy compositions; (b) from a demand-side perspective, depending on the application in which the copper products may be used, alternative materials also constitute a competitive constraint (e.g. aluminium, steel, plastic).

30. Previously, in Norddeutsche Affinerie/Cumerio, the Commission left open whether the downstream semi-finished copper products constitute a few or numerous distinct markets on the basis of their use in different applications, the most important of which being electrical engineering and the electronics industry (appliances, air conditioning and circuit boards); the construction industry (plumbing and roofing); telecommunications (cables); automotive industry (radiators); machine construction (motors). The Commission also analysed the possible substitutability of semi-finished copper products by other materials and underlined that the exact extent to which copper can be replaced by other materials depends on the characteristics of copper, mainly with regard to electrical conductivity and processing characteristics. Even if copper may easily be substituted by other materials for certain finished products such as plumbing tubes or telecommunication cables, for other finished products, for which the characteristics of copper are essential, possibilities for substitution are far more limited (i.e. the applications of copper in the electrical engineering and the electronic industry are less subject to substitution pressure from alternative materials).

31. The market investigation in the present case has shown that supply-side substitutability may not be as easy as put forward by the notifying party. It also provides strong indications that a segmentation of the market distinguishing by application27 may be appropriate.28 Participants to the market investigation also pointed out that for some applications (e.g. electrical applications, solar industry, electronic devices), customers request OF-Cu rolled product.29 However, for the purpose of the present case, the question of the precise market definition can be left open as the transaction does not raise competition concerns under any plausible market definition. As regards the question of the substitutability of copper rolled products by other materials, the present market investigation supports the previous findings that, for certain applications, alternative materials can be used.30 Therefore, the competitive pressure alternative products may exert on the rolled copper manufacturers will be further considered in the competitive assessment.

32. In line with Commission's conclusion in the Norddeutsche Affinerie/Cumerio (although the precise definition was left open) Aurubis submits that the geographic scope of markets for semi-finished copper products is at least EEA-wide. The market investigation in the present case confirmed that rolled products can be economically transported within the EEA. The percentage of the rolled products exported outside EEA varies between less then 5% to almost 25% for some manufacturers. On the other side, only few customers of rolled products pursue geographical multisourcing strategy (i.e. EEA, US, Asia etc). Therefore, the competitive assessment of the present case will be conducted on the basis of an EEA-wide market definition.

2. PRELIMINARY COMPETITIVE ASSESSMENT

A. HORIZONTAL ASSESSMENT

33. The Transaction leads to horizontally affected markets with respect to: (i) copper shapes; (ii) pre-rolled strip; and (iii) rolled copper products.

(i) Copper shapes

34. The overall production of copper shapes in the EEA is rather fragmented, as can be seen from the table below. The transaction would thus only lead to a combined market share in shapes production of [10-20]%. However, most producers only make shapes for internal use while a few suppliers sell them to third Parties. Aurubis, which only has limited activities downstream, is the main supplier of shapes to third Parties. For this reason the transaction would lead to a combined market share on the merchant market in the EEA of [60-70]% with an increment of [5-10]%.

Table 2: Market share data for Shapes, EEA.

| Volume (in tons) | Shares (in %) | ||

2010 | 2010 | |||

Production | Sales | Production | Sales | |

Aurubis | […] | […] | [10-20]% | [50-60]% |

– thereof Aurubis w/o Schwermetall | […] | […] | [5-10]% | [50-60]% |

– thereof Schwermetall | […] | […] | [5-10]% | [0-5]% |

Luvata Rolled Products | […] | […] | [0-5]% | [5-10]% |

Combined | […] | […] | [10-20]% | [60-70]% |

Luvata Rest * | […] | […] | [0-5]% | [0-5]% |

KME | […] | - | [20-30]% | - |

Wieland | […] | - | [10-20]% | - |

Carlo Gnutti | […] | - | [10-20]% | - |

Halcor | […] | - | [5-10]% | - |

Diehl | […] | - | [5-10]% | - |

Brixlegg | […] | […] | [0-5]% | [20-30]% |

Almag | […] | - | [0-5]% | - |

Eredi Gnutti | […] | - | [0-5]% | - |

MKM | […] | - | [0-5]% | - |

Swissmetall | […] | - | [0-5]% | - |

Silmet | […] | - | [0-5]% | - |

Lafarga Lacambra | […] | […] | [0-5]% | [5-10]% |

Mueller Europe | […] | - | [0-5]% | - |

Hutmen | […] | - | [0-5]% | - |

KGHM | […] | […] | [0-5]% | [5-10]% |

Fonderie Le Palais | […] | […] | [0-5]% | [5-10% |

Others | […] | - | [0-5]% | - |

Total market | […] | […] | 100% | 100% |

Note: * Luvata Rest refers to the OF-Cu foundry which is not part of the transaction. Source: Reply to the Commission' RFI of 12 July 2011, Annex 1(1).

35. Pre-merger, the competitive pressure exercised by Luvata on Aurubis in the market for shapes was limited. The [5-10]% increment stemming from LRP is related to one particular customer, which is located in Pori on the same site as the Luvata foundries. This customer is buying only billets. Were a market for billets shapes to be considered31, the Parties would hold a market share of [40-50]% (Aurubis [30-40]%, LRP [10-20]%). The second biggest manufacturer would be Brixlegg, with a market share of [30-40]%. Several other competitors are also present, such as KGHM ([5- 10]%), Lafarga ([5-10]%) as well as Fonderie Le Palais ([5-10]%).

Table 3: Market share data for Billets, EEA.

| Volume (in tons) | Shares (in %) | ||

2010 | 2010 | |||

Production | Sales | Production | Sales | |

Aurubis | […] | […] | [0-5]% | [30-40]% |

– thereof Aurubis w/o Schwermetall | […] | [...] | [0-5]% | [30-40]% |

– thereof Schwermetall | - | - | - | - |

Luvata Rolled Products | […] | […] | [0-5]% | [20-30]% |

Combined | […] | […] | [5-10]% | [40-50]% |

Luvata Rest * | […] | […] | [0-5]% | [0-5]% |

KME | […] | - | [20-30]% | - |

Wieland | […] | - | [5-10]% | - |

Carlo Gnutti | […] | - | [20-30]% | - |

Halcor | […] | - | [5-10]% | - |

Diehl | […] | - | [5-10]% | - |

Brixlegg | […] | […] | [5-10]% | [30-40]% |

Almag | […] | - | [5-10]% | - |

Eredi Gnutti | […] | - | [0-5]% | - |

MKM | […] | - | [0-5]% | - |

Swissmetall | […] | - | [0-5]% | - |

Silmet | […] | - | [0-5]% | - |

Lafarga Lacambra | […] | […] | [0-5]% | [5-10]% |

Mueller Europe | […] | - | [0-5]% | - |

Hutmen | […] | - | [0-5]% | - |

KGHM | […] | […] | [0-5]% | [5-10]% |

Fonderie Le Palais | […] | [..] | [0-5]% | [5-10]% |

Others | […] | - | [0-5]% | - |

Total market | […] | […] | 100% | 100% |

Note: * Luvata Rest refers to the OF-Cu foundry which is not part of the transaction. Source: Reply to the Commission' RFI of 12 July 2011, Annex 1(3).

36. During the market investigation, one customer raised concerns with respect to the fact that the transaction will eliminate its only alternative supplier and that sourcing from other alternatives like Brixlegg is likely to be unattractive because of higher transport costs. This customer currently sources its entire needs of deoxidized high phosphorous copper (DHP) billets necessary for its tubes production from Luvata and it usually uses the offer from Aurubis as the alternative when negotiating prices with Luvata.

37. However, this customer, which ships its industrial tubes to the entire EEA, does not exclude looking for alternative suppliers in China, or Istanbul, Turkey, although it fears that this will translate into a higher price for its end-products (i.e. tubes) in a context where it is facing competition from tube producers from the UK and Germany32.

38. The Commission investigated whether changing suppliers will translate into higher transport cost and, eventually, into higher prices for this customer's end-products. The notifying party's provided an estimate of total costs for sourcing DHP billets from Aurubis (Hamburg) or Luvata to the place this customer is located. These are rather similar […]33. Freight costs, including working capital costs, represent roughly 1.5% of the final price.

39. The impact of sourcing from Brixlegg instead of Pori results mainly from the increased distance. Brixlegg is located in Austria, and the distance to ship to Pori is 55% higher when sourcing from Brixlegg than when sourcing from Aurubis in Hamburg. Knowing that, freight costs (including working capital costs) represent roughly 1.5% of the final price of billets, it can be expected that the increase in the final price (assuming that the increase in freight costs is entirely passed on) would be 0.825% (i.e. 55% of 1.5%). This increase would therefore be limited.

40. As a result, it is likely that this customer could credibly use the threat of switching to Brixlegg in order to retain similar sourcing conditions from the plant of the merged entity in Pori. In addition, were this customer to switch to Brixlegg, the price increase would be limited to 2.3%, close to the 1.5% price increase that would result from sourcing from Hamburg, the alternative previously used by this customer to exercise pressure on Luvata.

41. In addition, the harm to customers will be further limited by the fact that this customer's sales will compete with products manufactured using the much larger pool of in-house production of billets shown in Table 3.

OF-CU shapes

42. As mentioned earlier, very few suppliers are able to produce OF copper shapes. Luvata accounts for [50-60]% of the production and [5-10]% of the (non-captive) sales of OF-Cu shapes in the EEA Aurubis accounts for [30-40]% of the production and [60-70]% of the sales of OF-Cu shapes in the EEA. Given that no overlap arises from the transaction in relation to OF-Cu shapes (as mentioned above, Luvata's oxygen free foundry in Pori in not part from the transaction), this will not be further considered within the horizontal assessment of the case.

Table 4: Market share data of OF-CU shapes, EEA

| Volume (in tons) | Shares (in %) | ||||

Capacity | Production | Sales | Capacity | Production | Sales | |

Aurubis | […] | […] | …] | [50-60]% | [30-40]% | [60-70]% |

Luvata | […] | […] | […] | [30-40]% | [50-60]% | [5-10]% |

Brixlegg | […] | […] | […] | [10-20]% | [10-20]% | [30-40]% |

Total market | […] | […] | […] | 100% | 100% | 100% |

Source: Reply to the Commission' RFI of 15 June, Annex1.

(ii) Pre-rolled strip

43. The transaction leads to a combined market share in the EEA (including captive production) of [20-30]% in pre-rolled strip with an increment of [10-20]% (Aurubis [10-20]%, LRP [10-20]%). Other large competitors in the market are KME holding [20-30]%, Wieland with [10-20]% and MKM with [10-20]% leaving several other smaller players with [10-20]%. However since Aurubis' [10-20]% share is made up of 100% of sales and production of Schwermetall (Aurubis' joint venture with Wieland) this overstates Aurubis' share (otherwise the combined share would be [20- 30]%)34 compared to if sales were equally allocated between the joint venture parents. On the merchant market, the transaction does not lead to any overlap.

(iii) Rolled products

44. On the basis of a market definition encompassing all copper rolled products, the Parties’ combined market share is below 15% in the EEA. Their combined market share exceeds 15% in the segment for rolled products made out of pure copper where they will have a combined share of [10-20]% ([5-10]% each, as illustrated in the table bellow).35 There are several other competitors, the strongest of whom is KME with [30-40]% followed by MKM with [10-20]%, Wieland with [10-20]% and several other smaller competitors holding the remaining [10-20]%.

Table 5: Sales of rolled products. Copper only, 2010.

| Sales (in tons) | Shares (in %) |

Aurubis | […] | [5-10]% |

LRP | […] | [5-10]% |

Combined | […] | [10-20]% |

KME | […] | [30-40]% |

MKM | […] | [10-20]% |

Wieland | […] | [10-20]% |

Eredi Gnutti / Ilnor | […] | [5-10]% |

Halcor | […] | [5-10]% |

Diehl | […] | [0-5]% |

Med Povrly | […] | [0-5]% |

Walcownia | […] | [0-5]% |

Kemper | […] | [0-5]% |

Schlenk | […] | [0-5]% |

Schreiber | […] | [0-5]% |

Messingwerk Plettenberg | […] | [0-5]% |

Hutmen | - | - |

Total market | […] | 100% |

Source: Form CO, Annex 7.3(b)(I).

45. A potential further distinction of rolled product, according to different applications they may be used for, would lead to the following affected markets36: rolled products for electrical industry (combined market share of [20-30]%), rolled products for building & construction (only for other applications than architectural37, combined market shares of [10-20]%) and distribution (i.e. rolled products sold to slitting centers – combined market share of [20-30]%). Post-transaction, the combined entity will continue to face competition from several other producers such as Wieland and KME. The table below illustrates the Parties and their main competitors' market position:

Table 6: Sales of rolled products by applications, 2010

| Electrical industry | Building& construction (only for other applications then architectural) | Distribution |

Aurubis | [10-20]% | [5-10]% | [10-20]% |

LRP | [5-10]% | [10-20]% | [10-20]% |

Combined | [20-30]% | [10-20]% | [20-30]% |

Wieland | [30-40]% | [30-40]% | [20-30]% |

KME | [20-30]% | [20-30]% | [20-30]% |

MKM | [10-20]% | [10-20]% | [5-10]% |

Source: Form CO, Annex 7.3.e(i), Annex 7.3.d(i), Annex 7.3.f(i).

46. On a potential market for OF-Cu rolled products, the Parties' hold a combined market share of [60-70]%, with an increment of [5-10]% (LRP). Considering a further segmentation by application, the Parties activities overlap with a significant extent only with respect to OF-Cu rolled products for electrical industry (Aurubis holds a market share of [10-20]%, while LRP accounts for [50-60]% of the market).38 The Parties main competitors are KME ([20-30]% of market share on a potential overall market for OF-Cu rolled products, and [10-20]% if considering only the OF-Cu rolled products for electrical industry), and Wieland ([10-20]% of market share on a potential overall market for OF-Cu rolled products, and [10-20]% if considering only the OF-Cu rolled products for electrical industry).

Table 7: Sales of OF-CU based rolled products by product category, 2010

|

All products |

Cables | Electrical Industry |

B&C others | General Engineering |

Distribution | ||||||

tons | % | tons | % | tons | % | tons | % | tons | % | tons | % | |

Aurubis | […] | [5-10]% | - | - | […] | [10-20]% | - | - | […] | [0-5]% | […] | [0-5]% |

LRP | […] | [50-60]% | […] | [50-60]% | […] | [50-60]% | […] | [50-60]% | […] | [40-50]% | […] | [80-90]% |

Comb. | […] | [60-70]% | […] | [50-60]% | […] | [70-80]% | […] | [50-60]% | […] | [40-50]% | […] | [80- 90]% |

KME | […] | [20-30]% | […] | [20-30]% | […] | [10-20]% | […] | [30-40]% | […] | [30-40]% | […] | [10-20]% |

Wieland | […] | [10-20]% | […] | [20-30]% | […] | [10-20]% | […] | [10-20]% | […] | [10-20]% | […] | [5-10]% |

MKM | […] | [0-5]% | - | - | - | - | - | - | […] | [5-10]% | - | - |

Schreiber | […] | [0-5]% | - | - | - | - | - | - | […] | [0-5]% | - | - |

Schlenk | […] | [0-5]% | - | - | - | - | - | - | […] | [0-5]% | - | - |

Diehl | […] | [0-5]% | - | - | […] | [0-5]% | - | - | - | - | - | - |

Others | […] | [0-5]% | […] | [0-5]% | […] | [0-5]% | […] | [0-5]% | […] | [0-5]% | […] | [0-5]% |

Total | […] | 100% | […] | 100% | […] | 100% | […] | 100% | […] | 100% | […] | 100% |

Source: Form CO, Annex 7.3.m(I).

47. Even if the degree of concentration of these potential markets is not negligible, the market investigation confirmed that manufactures of OF-Cu rolled products use the same production line to manufacture OF and non-OF rolled products39. This and the fact that, as it will be further demonstrated, the transaction do not affect competitors access to the necessary raw materials for producing OF-Cu rolled products, allows to conclude that the transaction will not lead to negative effects with respect to OF-Cu rolled products. These conclusion is reinforced by (i) the existence of alternative products that customers of OF-Cu rolled products could use instead, at least for some applications40; (ii) the fact that some customers considers outside EEA OF-Cu rolled products as potential suppliers and (iii) the majority of customers do not expect any effect on prices for OF-Cu rolled products as a consequence of the proposed transaction.

B. VERTICAL LINKS

48. As indicated in the Table 1, both Parties are active at different stages of the production chain of rolled products. However, the proposed transaction only give rise to a limited number of vertically affected markets: (i) Aurubis sells copper cathodes, which are used downstream for the production of copper shapes and pre-rolled strips, where both Parties are active; (ii) copper shapes and pre-rolled strips are further down used for the production of copper rolled products41.

49. According to the Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings42 (hereinafter the "Non-Horizontal Merger Guidelines"), a merger is said to result in foreclosure where actual or potential rivals’ access to supplies (input foreclosure) or markets (customer foreclosure) is hampered or eliminated as a result of the merger, thereby reducing these companies’ ability and/or incentive to compete. Such foreclosure is regarded as anti-competitive where the merging parties – and, possibly, some of its competitors as well – are as a result able to profitably increase the price charged to consumers.

50. In assessing the likelihood of such an anti-competitive input foreclosure scenario, it is necessary to examine whether the new entity would have the ability after the merger to foreclose access to supplies or input, whether it would have the incentive to do so and whether a foreclosure strategy would have a significant detrimental effect in the downstream market (in the case of input foreclosure) or the upstream market (in the case of customer foreclosure). This analysis is carried out in the following recitals.

(i) Copper cathodes used as an input for the production of copper shapes and pre-rolled strips

Input foreclosure

51. With respect to copper cathodes, only Aurubis produces and sells cathodes. Aurubis' market share on the worlwide market for copper cathodes is limited regardless of whether captive sales are included or exluded and whether a distinction is made between LME-grade and off-grade cathodes. Aurubis does not sell any off-grade cathodes. In the LME grade segment, its market share remains below [10-20]% including or excluding captive sales. The main competitors of Aurubis for cathodes are Corporación Nacional del Cobre de Chile (respectively [5-10]% including captive use, and [30-40]% excluding captive use), Freeport-McMoRan Copper & Gold Inc. (resp. [5-10]% and [5-10]%), Jiangxi (resp. [5-10]% and [10-20]%) and Xstrata plc (resp. [0-5]% and [10-20]%).

Table 8: Production and sales of cathodes, 2010

Worldwide | Market size (tons) | Market Shares | ||

Aurubis | LRP | Combined | ||

Overall production (incl. captive use) | […] | [5-10]% | – | [5-10]% |

Overall sales (excl. captive use) | […] | [0-5]% | – | [0-5]% |

LME-grade production (incl. captive use) | […] | [5-10]% | – | [5-10]% |

LME-grade sales (excl. captive use) | […] | [0-5]% | – | [0-5]% |

Source: Form CO, p.76.

52. On the basis of its limited market share in the market for copper cathodes and its potential subsegments, it is unlikely that Aurubis would have the ability to carry successfully an input foreclosure strategy. Should Aurubis try to foreclose its competitors in the downstream market for shapes, these competitors could switch to other suppliers of copper cathodes (given that cathodes are standardised commodities, there are no switching costs for customers when changing from one supplier). In addition, shapes producers can also use copper scrap for direct use instead of cathodes as an input material for their production. The market investigation has confirmed that customers of cathodes for the production of shapes are not concerned about the impact of the transaction in relation to the supply of cathodes43

Customer foreclosure

53. LRP sources cathodes for the production of copper shapes and pre-rolled strips44. LRP's main suppliers of cathodes are Xstrata and Boliden. LRP purchases […] tons of copper cathodes (including […] tons of LME-grade cathodes), i.e. [0-5] % of the production of shapes sold on the merchant market (and [0-5]% of the production of LME-grade cathodes sold on the merchant market)45. In addition the LRP's market shares in the downstream market of shapes ([0-5]% including captive use, [5-10]% on the merchant market) or pre-rolled strips ([10-20]% including captive use, LRP is selling on the merchant market) are limited. It is therefore highly unlikely that the merged entity would have the ability to foreclose Aurubis's competitors upstream post-merger by reducing its purchases of cathodes46.

(ii) Copper shapes and pre-rolled strips used in the downstream market for the manufacture of rolled products

54. As explained in paragraphs 44 and 45, the Parties' combined market share remains at or below [20-30]% in the market for rolled products and its subsegments with the exception of the potential segment for OF-CU rolled products. Several competitors are active on the market for copper rolled products such as KME ([30-40]%), MKM ([10-20]%), Wieland ([10-20]%) and several other smaller competitors holding the remaining [10-20]%. As a result it appears unlikely that the merged entity would have the ability to foreclose its competitors upstream post-merger by reducing its purchases of non OF-CU copper shapes and pre-rolled strips.

55. In the merchant market for pre-rolled strips, LRP is not active and Aurubis sells only through Schwermetall, its JV with Wieland, which holds a [90-100]% market share in the EEA. In the merchant market for shapes, the Parties hold a [60-70]% market share in the EEA. However, the proposed transaction does not bring a substantial change to the situation pre-merger as the only additions in sales on the merchant markets for pre-rolled strips and shapes is linked to LRP's sales of shapes to one individual customer. which manufactures copper tubes - a market in which the merged entity will not be active even after the transaction47. As this customer is not a downstream competitor of the merged entity, the transaction does not bring about risks of input foreclosure (i.e. of an attempt by the merged entity to raise the costs of downstream rivals48) in relation to the supply of shapes and pre-rolled strips.

OF-CU shapes and pre-rolled strips used in the downstream market for the manufacture of OF-CU rolled products

56. In Europe, only three companies produce oxygen free copper shapes, for which demand is limited: Luvata, Aurubis and Brixlegg.

57. To avoid a direct horizontal overlap, the Parties have carved out Luvata's oxygen free foundry from the transaction. While the Parties avoid a horizontal overlap upstream (shapes) there will be a horizontal overlap downstream in OF-Cu rolled products leading to a combined market share of [60-70]%. In addition vertically integrated Aurubis is the main supplier of OF-CU shapes to third Parties – see Chart 2.

Chart 2: Vertical link in relation to the markets for shapes, pre-rolled strips and rolled products

Customer foreclosure

58. Following the transaction, LRP, which was previously purchasing OF-CU shapes internally (i.e. from Luvata), will become part of Aurubis. The proposed transaction therefore does not restrict access to a sufficient customer base for Brixlegg, which was not selling to LRP pre-merger. Regarding Luvata's OF-Cu foundry, it is currently being used by the Special Products Division of Luvata (LSP) – which is not part of the Transaction –, LRP and one customer. The Parties have also signed a […] contract on the supply of […]tons OF-Cu shapes to LRP, which is based on current supply volumes. In 2010, Luvata Pori was producing […] tons of OF-CU shapes, out of which […] tons were used for internal consumption, […] tons were delivered to LRP and another […] tons were sold to an independent customer49. The contract signed by the Parties therefore guarantees that the demand addressed by LRP to Luvata Pori will be maintained at the same level for at least […].

59. It is therefore unlikely that the merged entity would have the ability to foreclose Aurubis's competitors upstream post-merger by reducing its purchases of OF-CU shapes.

Input foreclosure

60. The question also arises whether the merged entity would be able to raise (downstream) rivals costs by raising it prices (upstream) for OF-CU shapes and as a result provoke an overall increase in price for rolled products based on oxygen free copper, a concern that was voiced by some rolled products manufacturers.

61. The notifying party argues that post-merger, OF-Cu shapes will be readily and easily available for any third Parties from the carved out foundry in Pori as according to the notifying party, Luvata Pori will have spare OF-Cu capacity of […] tons for additional internal consumption and sales to third Parties.50

62. The market investigation showed that a majority of customers of OF-CU shapes and pre-rolled strips were not concerned about the impact of the transaction.51 The market investigation also provided several additional elements that cast doubts on the ability of Aurubis to raise rivals costs in the downstream market for OF-CU rolled products:

a. OF-CU competitors have sufficient supply possibilities post-transaction for OF-Cu shapes

63. Wieland, an important competitor in OF-Cu rolled products, is able to source OF-Cu pre-rolled strips through its JV with Aurubis Schwermetall. In addition, two alternative suppliers of OF-Cu-shapes in addition to Aurubis will be able to supply the EEA-market: Brixlegg in Austria for OF-Cu billets and cakes, and Luvata's OF- Cu foundry in Finland that is not part of the transaction52. Pre-merger Luvata was not considered as a potential alternative since it was a vertically integrated competitor in the downstream market for OF-Cu rolled products and therefore had no incentive to supply its competitors. However, post-transaction this vertical link does not exist anymore and Luvata has sizeable spare capacity. Based on an analysis of the price and cost information provided by the notifying party, it appears that Aurubis' prices are already so high that Luvata should be able to supply for instance KME, cover the transport cost and still make a margin compared to the cost of producing the cakes53. In addition, an internal document of Luvata shows that, when negotiating […] agreement, Luvata considered that Aurubis Hamburg was a credible alternative and therefore exercised a competitive constraint54. Conversely, this indicates that Luvata's production in Pori would be a credible alternative for Aurubis' production in Hamburg. This alternative is thus likely to provide a constraint on Aurubis' ability to further increase its prices of OF-Cu shapes to its customers.

b. OF-Cu rolled products customers have the ability to switch to other non-OF- Cu rolled products or to other non-EEA suppliers in case of a price increase post-transaction:

64. Competitors indicate that OF-Cu rolled products can be technically substituted by other types of copper such as SE-Cu.55 One competitor even indicated that it forced successfully its customers requesting OF-Cu to switch to SE-Cu, which he considers as the standard oxygen free copper.56 In his view, any increase in the price of OF-Cu rolled products would trigger a switch to other types of copper such as SE-Cu.

65. It therefore appears unlikely that the merged entity will be able to raise (downstream) rivals costs by raising prices (upstream) for OF-CU shapes and as a result provoke an overall increase in price for rolled products based on oxygen free copper.

66. In addition, even in the unlikely scenario under which the merged entity would be able to raise downstream rivals costs, the effect of such foreclosure strategy would be limited by competition downstream. Indeed several competitors in OF-CU rolled products indicate that, were both Aurubis and Luvata to increase the price of OF-CU rolled products by 5-10%, customers would consider alternative suppliers for OF-CU RP from outside the EEA, in particular from Asia and the US.57.

IV. CONCLUSION

67. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Publication in the Official Journal of the European Union No C 203, 09.07.2011, p.22.

3 Aurubis was previously known as Norddeutsche Affinerie AG. Following an in depth investigation by the Commission, it acquired the Belgian company Cumerio S.A. in 2008 - see Commission decision of 23.01.2008, case COMP/M.4781 – Norddeutsche Affinerie/Cumerio.

4 As regards Pori, only one – the deoxidized high phosphorus copper (DHP) foundry - of the five copper and copper alloy foundries is acquired by Aurubis. Form CO, p. 18.

5 The same transaction was initially notified on 16.06.2011, but the Notifying Party decided to withdraw the notification. When discussing the results of the market investigation conducted by the Commission in order to assess the impact of the proposed transaction, reference will be done to either the questionnaires sent out in the context of the first notification under the case number COMP/M.6251 (hereinafter referred to as "Commission RFI case COMP/M.6251") or the questionnaires sent out following the renotification on the proposed transaction under the case number COMP/M.6316 (hereinafter refer to as "Commission RFI case COMP/M.6316").

6 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p1).

7 The production of copper cathodes also brings about certain by-products: sulphuric acid, iron silicate and anode slimes, containing precious metals such as gold, silver and platinum. The transaction does not lead to any overlap with respect to copper by-products.

8 Copper rod can also be further processed into drawn and shaped wires, profiles and nuggets (i.e. copper rod chopped to certain dimensions, according to customer' requirements).

9 Copper shapes with a circular section, with a diameter varying from 100–800 mm.

10 Copper shapes with a rectangular section and weight up to 25 tons per cake.

11 Pre-rolled strips are thin strands of copper produced from copper cakes by a hot and cold rolling process. They are the feedstock for the production of rolled products. Pre-rolled strip is produced as follows: Cakes (which have a thickness of 180–335 mm) are “rolled thin” in a hot rolling mill to a thickness of 16–18 mm. The next processing stages are milling and cold rolling where the hot rolled material is rolled down even further to a thickness of 1.5–5 mm. On average, pre-rolled strip has a thickness of 2.5–3.5 mm.

12 Several production processes exists for the production of rolled products from primary copper. The traditional process involves the casting of shapes, while newer production technologies (vertical strip casting (VSC) and direct casting) dispense with the casting of shapes as an intermediate product.

13 Both Parties source copper scrap as an intake for their copper products. In case Norddeutsche Affinerie/Cumerio, the Commission concluded, in line with its previous practice, that a distinct product market for copper scrap exists and it is world-wide in scope. In the present case, the question of the precise product market definition with respect to copper scrap can be left open, as the transaction does not lead to affected markets even on the narrowest plausible market definition (i.e.EEA-wide market for copper scrap, or even considering a further segmentation of the copper scrap between "high quality" scrap, which can be processed into shapes without prior electrical refining, and scrap for refining). The Parties' share of demand for cooper scrap is as following: (a) scrap for refining: only Aurubis, [10-20]%; (b) scrap for direct use: Aurubis [0-5]%, LRP [0-5]%; (c) overall scrap: Aurubis [5-10]%, LRP [0-5]%. Therefore, copper scrap will no longer be considered in the present decision.

14 Through its 50/50 joint venture with Wieland, Schwermetall.

15 LRP's production of pre-rolled strip is exclusively used in-house.

16 The London Metal Exchange (LME) is the world’s most important trading market for copper. The “LME price” is thus also referred to as “world copper price”. The price of all downstream copper products are equally based on this LME copper price.

17 COMP/M.4505 Freeport-McMoran Copper & Gold / Phelps Dodge Corporation, 20 February 2007; COMP/M.4781 Norddeutsche Affinerie/Cumerio, 23.01.2008.

18 COMP/M.4781 Norddeutsche Affinerie/Cumerio, 23.01.2008.

19 COMP/M.4781 Norddeutsche Affinerie/Cumerio, 23.01.2008.

20 Questionnaires to competitors "Copper shapes", Commission RFI case COMP/M.6251.

21 COMP/M.4781 Norddeutsche Affinerie/Cumerio, 23.01.2008.

22 A-TEC/Norddeutsche Affinerie Decision of 27.02.2008, case B5-198/07.

23 Questionnaires to competitors "Oxigen Free Rolled Copper Products", Commission RFI case COMP/M.6316.

24 COMP/M.4781 Norddeutsche Affinerie/Cumerio, 23.01.2008.

25 A-TEC/Norddeutsche Affinerie Decision of 27.02.2008, case B5-198/07.

26 Questionnaires to competitors "Copper shapes", Commission RFI case COMP/M.6251.

27 In line with LRP's customer of rolled product segmentation, the following applications have been considered: engine cooling, building & construction, architectural (roofing, guttering and façade products), building & construction, others (all other building and construction applications such as boilers, lightning arresters, heat exchangers etc. This also includes copper products for solar thermal applications and the wind industry), electronic devices, electrical industry, cable, ordnance (ammunition - case cups, bullets jackets, bullets and cartridges), general engineering (other industrial applications, such as frame joint, flat washers, musical instruments, decorative products, fasteners, zippers, eyelets and rivets for clothing) and "distribution" (copper rolled products sold to slitting centres which stock master coils of various thicknesses and alloy compositions and subsequently cut them according to the requirements of their customers. The end use of these products is generally not known to the producing rolling mills). Categorisation according to application seems to be widely used in the industry (Questionnaires to competitors "Copper rolled products", Commission RFI case COMP/M.6251).

28 Questionnaires to competitors "Oxigen Free Rolled Copper Products", Commission RFI case COMP/M.6316.

29 Ibid.

30 Questionnaires to customers "Oxigen Free Rolled Copper Products", Commission RFI case COMP/M.6316.

31 Where a separate market for cakes to be considered, the transaction would not lead to an overlap on the merchant market, where only Aurubis is active.

32 Non-confidential minutes of the conference call with one third party, 11 July 2011.

33 See Annex 5, Reply of the notifying party's to the Commission's request for information of 12 July ("Comparison of billet costs for delivery in Pori").

34 And understates Wieland's (otherwise [20-30]%).

35 If considering only the rolled products made out of copper alloys, the Parties hold a combined market share of [5-10]% (Aurubis [5-10]%; LRP [0-5]%).

36 The Parties will hold a significant market share on a potential market for "engine cooling" applications ([70-80]%) but no overlap arise from the transaction as Aurubis is not active in this field.

37 As mentioned above, when considering a potential market segmentation by application, a distinction has been made between "building &construction, architectural" which refers to copper rolled products used for roofing, guttering and façade products and "building & construction, others", which includes all other building and construction applications such as boilers, lightning arresters, heat exchangers etc. as well as copper products for solar application and the wind industry.

38 Aurubis market presence is very limited on a potential market for OF-Cu rolled products for general engineering applications (on a market estimated at […] tons, Aurubis sold […] tons of products in 2010; LRP holds a market share of [40-50]%), as well as on a potential market for "distribution" (Aurubis sold in 2010 […] tons to slitting centres, holding a market share of [0-5]%; LRP's market share amounts to [80-90]%), or "cables" (Aurubis sold in 2010 […] tons, holding a market share of less than [0-5]%; LRP's market share amounts to [70-80]%). No overlaps arise in relation to OF-Cu rolled products for other applications (i.e. in the segments for respectively ("building & construction, others", "engine cooling", "building & construction, architectural", "electronic devices", "ordnance".

39 Questionnaires to competitors "Oxygen Free Rolled Copper Products", Commission RFI case COMP/M.6316.

40 Questionnaires to customers "Oxygen Free Rolled Products", Commission RFI case COMP/M.6316.

41 There is no vertical overlap between the Parties' activities in the upstream market for copper shapes and the downstream market for pre-rolled strips as LRP is not active on the merchant market for pre-rolled strips.

42 OJ C 265, 18.10.2008, p. 10, paragraph 29.

42 Questionnaires to competitors "Copper shapes", Commission RFI case COMP/M.6251.

43 Questionnaires to competitors "Copper shapes", Commission RFI case COMP/M.6251.

44 The so-called Vertical Strip Casting ("VSC") technology used by LRP in some of its plants does not involve intermediate products such as shapes. VSC combines casting, milling and rolling in one continuous process for the production of pre-rolled strip.

45 Notifying party's reply to the Commission's request for information of 27 July 2011.

46 According to the Non-Horizontal Merger Guidelines, for customer foreclosure to be a concern, the vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market.

47 Form CO, p. 95.

48 Cf. in particular paragraphs 30 and 31 of the Non-Horizontal Merger Guidelines.

49 Form CO, p. 19.

50 The overall estimated capacity of Luvata's OF-Cu foundry in Pori is […] tons. The Parties have entered into a non-compete contract for the Luvata foundry, but OF-Cu shapes are specifically excluded from it: see Form CO, Annex 5.1.e.

51 Questionnaires to competitors "Oxygen Free Rolled Products", Commission RFI case COMP/M.6316. 6 out of 9 companies active in the supply of OF-CU rolled products did not express concerns.

52 One competitor in OF-CU rolled products also indicates that the Japanese Hitachi Cable company could supply OF-CU shapes. Questionnaires to competitors "Oxygen Free Rolled Products", Commission RFI case COMP/M.6316.

53 Notifying party's reply to the request for information sent by the Commission on 12 July 2011.

54 Form CO, Annex 5.4.s - E-Mail from […]

55 Questionnaires to competitors "Oxygen Free Rolled Products", Commission RFI case COMP/M.6316.

56 Questionnaire to competitors "Oxygen Free Rolled Products", Commission RFI case COMP/M.6316.

57 Ibid.