Commission, December 20, 2011, No M.6380

EUROPEAN COMMISSION

Judgment

BRIDGEPOINT / INFRONT SPORTS & MEDIA

Dear Sir/Madam,

Subject: Case No COMP/M.6380 – Bridgepoint / Infront Sports and Media Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 15.11.2011, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the "Merger Regulation") by which the undertaking Bridgepoint Capital Group Limited (''Bridgepoint'', United Kingdom) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the undertaking Infront Sports & Media AG ("Infront", Switzerland) by way of acquisition of shares2.

I. THE PARTIES

2. Bridgepoint provides private equity to established companies in a broad range of sectors (including business services, consumer, financial services, healthcare, industrials and media) to fund buy-outs, buy-ins, growth and public-to-private transactions. Bridgepoint controls, inter alia, the Spanish company Dorna, which is active in the organization and management of motorcycle racing championships, notably the FIM Road Racing World Championship Grand Prix, known as "MotoGP".

3. Infront is a global sports marketing group offering specialized services (rights distribution, host broadcasting, media and program production, event operations, brand development, marketing and sponsorship) and holding a portfolio of sports media and marketing rights. Infront holds, inter alia, the rights to organize and manage certain motorcycle racing events known as the Superbike World Championship ("Superbike").

II. THE OPERATION AND THE CONCENTRATION

4. The transaction consists in the acquisition by Bridgepoint, through a Swiss special purpose vehicle, Swissco, of 100% of the share capital of Infront. Swissco will be held by a Luxembourg special purpose vehicle, Luxco which will be in turn held by Bridgepoint Europe IV Investments (a fund controlled by Bridgepoint) and members of the management team of Infront. Following the completion of the transaction, Bridgepoint will hold […]% of the share capital and voting rights of Luxco, while members of the management team of Infront will hold […]% of Luxco's share capital and voting rights. Post-transaction, Bridgepoint will exercise full control over Luxco, and ultimately over Infront.

5. The operation therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

6. The undertakings concerned had a combined aggregate worldwide turnover of more than EUR 5 000 million3 in 2010 (Bridgepoint: EUR […] million, Infront: EUR […] million). They had a combined aggregate EU-wide turnover of more than EUR 250 million each in 2010 (Bridgepoint: EUR […] million, Infront: EUR […] million). Bridgepoint and Infront did not generate more than two-thirds of their respective EU-wide turnovers within the same Member State in 2010. The notified operation therefore has an EU dimension.

IV. ASSESSMENT

IV.1. Relevant markets

7. Both undertakings are active in the organisation of motorcycle racing sport events. Bridgepoint, through its Spanish subsidiary Dorna, holds the worldwide concession from the FIM (Fédération Internationale de Motocyclisme) to organize and manage MotoGP until […]. Dorna also manages the commercial rights to the Spanish Road Racing Championship ("CEV"), and of the "European Championship", a single race that takes place in Spain once a year. MotoGP, however, accounts for more than 95% of Dorna’s revenues. MotoGP is an international motorcycle series that is held on-road and on-circuit. It was established by FIM in 1949 and is the oldest motorsports championship in the world. The motorcycles used in MotoGP are specifically manufactured prototypes. There are three classes within MotoGP: 125cc, Moto2 class 600cc engines, MotoGP class 800cc engines. MotoGP consists of up to 18 annual races which take place at different sites around the world.

8. Infront holds the FIM license to organize and manage the Superbike until […]. Superbike is an international motorcycle series that is held on-road and on-circuit. It is a road racing world championship using production-based motorcycles. Superbike consists of up to 13 annual race weekends that take place at different sites around the world. Infront also exploits the media and marketing rights for a number of sport events in the EEA, including football, volleyball and certain winter sports (e.g., ski and ice hockey).

IV.1.1. Product markets

9. The Commission has examined in its previous decision CVC/SLEC4 the sector of the management of international motorsport events.5 It found that each type of market participant who deals with organizers/managers of international motor sports has specific demand parameters, and therefore the relationships of such organizers/managers with each of those participants are in separate product markets. The Commission identified the following main market participants: (1) motor sport regulators; (2) teams/manufacturers; (3) circuit owners/local promoters; (4) advertisers; and (5) television broadcasters.

IV.1.1.1. Motor sport regulators

10. The two main worldwide official regulators of motorsports events are FIM for motorcycle sports and FIA (Fédération Internationale de l'Automobile) for motorcar sports. FIM and FIA regulate the motor sport activities for which they are competent and award to third parties, such as Dorna, Infront and other international sport event managers/organisers, the necessary concessions for the organisation and managements of these activities.

11. In CVC/SLEC, the Commission considered that since FIM and FIA, and their respective national federations, focus on different parts of motor sport (i.e., respectively, motorcycle and motorcar sports), they are to be considered as active on separate product markets.

12. The notifying party did not dispute this finding. The Commission therefore takes the view that the market for the award of the concessions for the organisation and management of the motorsport events for which FIM is competent constitutes a separate relevant product market.

IV.1.1.2. Teams/manufacturers

13. In CVC/SLEC, the Commission considered that motorcycle and motorcar sports are not substitutable for teams and manufacturers.

14. The notifying party submits that the motorcycle sports market should be segmented further and that MotoGP and Superbike belong to separate product markets. According to the notifying party, for teams/manufacturers, there are certain important differences between MotoGP and Superbike which make the two events not substitutable, including the fact that:

(i) MotoGP and Superbike feature different machines (more expensive prototypes for MotoGP versus production motorcycles for Superbike);

(ii) MotoGP and Superbike do not target the same types of teams or manufacturers. MotoGP features a strong and direct involvement by many of the largest manufacturers worldwide through so-called "factory" teams, with yearly budgets of EUR 20-30 million, while Superbike has more limited direct manufacturer involvement and mainly features so-called "privateer" teams (who lease motorbikes from the major manufacturers) , with significantly lower budgets (around EUR 5-10 million); and

(iii) Teams/manufacturers do not pay a fee to compete in MotoGP, while they do for Superbike.

15. The results of the market investigation on this issue were not conclusive. Some of the respondents confirmed the parties' arguments on the existence of differences between the two competitions in terms of machines used, teams involved and budget.6 Four teams also indicated that MotoGP, as the highest level in motorcycle sport, cannot be compared to Superbike as a marketing channel for a manufacturer to build their brand.7 Other teams, however, explained that the performances of the motorbikes involved in the two competitions, and the skills required to handle such motorbikes, were comparable.8 Another team also explained that both series are demonstrating the leading edge of motorcycle performance technology.9 Finally, four teams submitted that it cannot be argued that MotoGP is a "factory team" competition, while Superbike is a "private team" competition, as both series include a number of factory teams and privateer teams.10

16. In any event, for the purpose of the assessment of the present transaction, the Commission considers that the question of whether MotoGP and Superbike belong to separate product markets within the organisation of international motorcycle sport events with respect to teams/manufacturers can be left open, as the transaction does not raise any serious doubts even if the two events were deemed to be part of the same market.

IV.1.1.3. Circuit owners/local promoters

17. In CVC/SLEC, the Commission left open the question of whether from a circuit owner/local promoter's perspective there are separate product markets for circuits suitable for Moto GP and Formula One.

18. The notifying party submits that there exist separate product markets for circuits suitable to host each of Moto GP and Superbike. According to the notifying party, for circuit owners/local promoters, there are a number of important differences between MotoGP and Superbike, which make the two events not substitutable, including the fact that:

(i) The safety and infrastructure requirements for the circuits to host the two events are different;

(ii) The fees charged to a circuit to host a MotoGP are much more significant (around […] times higher) than the fees charged to host Superbike; and

(iii) The attendance for MotoGP races is much higher than the one for Superbike ([…] million versus […] spectators in 2010).

19. The notifying party also submits that an analysis of the evolution of the calendar of the 58 circuits around the world which have hosted at least one of Formula One, MotoGP or Superbike event over the last 15 years clearly supports the conclusion that there is no substitutability between MotoGP and Superbike from a circuit owner's perspective. This reflects the fact that, according to the notifying party, this analysis shows that: (1) circuit owner's decisions to host MotoGP or Superbike are not connected; and (2) a circuit owner, which stops hosting MotoGP, very rarely replaces it with Superbike and vice- versa.

20. The notifying party further submits that there is no motorbike event which can be directly compared to MotoGP in terms of ability to attract audience and spectators on a worldwide basis. The closest alternative to MotoGP would indeed be Formula One. Superbike is a tier 2 event, with a more limited ability to attract audience and spectators and competes more closely with other minor sport event, such as certain national series, car endurance events, Formula 3 and many others.

21. The results of the market investigation by and large appear to support the notifying party's arguments.

22. Five circuit owners replied that, within motorcycle sport events, MotoGP and Superbike belong to separate product markets (while three replied that they belong to the same product market).11 The above five respondents also indicated that MotoGP belongs to a tier 1/first class type of events, while Superbike belongs to a tier 2/second class type of events.12 They also explained that MotoGP is the equivalent to Formula One in that it attracts the general public, while Superbike is more targeted to true motorbike enthusiasts (three other circuits, however, explained that the target group for both events is generally the same, i.e., motorbike fans).13

23. The market investigation also confirmed that the safety and infrastructure requirements for a circuit to host each of Moto GP and Superbike are different and that a different type of license granted by FIM (respectively, type A and type B) is required to host each of Moto GP and Superbike.14

24. Further, all circuit owners, who replied to the market investigation, confirmed that the attendance for MotoGP races is much higher than the one for Superbike.15 Figures obtained from circuit owners during the market investigation also confirmed that the fees they pay to organise MotoGP (because of its higher TV and media coverage, spectator attendance and number of official teams participating) are significantly higher than the fees they pay to organise Superbike.16

25. In any event, for the purpose of the assessment of the present transaction, the Commission considers that the question whether Moto GP and Superbike belong to separate relevant product markets from the perspective of circuit owners/local promoters can be left open, as the transaction does not raise any serious doubts even if the two events were deemed to be part of the same market.

IV.1.1.4. Advertisers

26. The decision in case CVC/SLEC, did not define the relevant product market from the advertisers' perspective because the transaction for that case did not generate overlapping activities in this sector.

27. The notifying party submits that the relevant product market includes all types of advertising/sponsoring activities, since companies wishing to promote their products can choose any type of advertising strategy and (motor-)sports advertising/sponsorship is only one channel amongst others, including direct advertising, print and press, Internet, etc.

28. The results of the market investigation were inconclusive as to the exact scope of the relevant product market.

29. Only one of the 14 respondents indicated that, in case of a 5-10% increase in the price to place ads and/or to engage in sponsorship in relation to MotoGP or Superbike, it would switch (part of) its advertising budget to, respectively, Superbike and MotoGP. The same market participant, however, indicated that engaging in advertising activities in connection with MotoGP and/or Superbike is not essential for it to reach certain categories of customers and/or to attract certain specific categories of customers.17 Only one respondent indicated that both MotoGP and Superbike are ''must have'' events from an advertiser's perspective18. All other market participants replied that, in case of a 5- 10% increase in the price to place ads and/or to engage in sponsorship in relation to MotoGP or Superbike, they would switch (part of) their advertising/sponsorship budget to other motor or non-motor sport events and/or to non-sport events.19

30. In any event, for the purpose of the assessment of the present transaction, the Commission considers that the exact scope of the relevant product market, i.e., whether engaging in advertising and/or sponsorship activities in relation to MotoGP and Superbike belong to the same relevant product market and/or whether such market also includes other (motor)sport or non-sport events, can be left open, as the transaction does not raise to any serious doubts even under the narrowest possible product market definition including both MotoGP and Superbike (i.e., advertising/sponsorship in relation to motor sport events).20

IV.1.1.5. TV broadcasters

31. In past decisions, the Commission has identified separate product markets within the licensing of TV broadcasting rights to sport events, including separate product markets for major sport events and other (minor) sport events21 and, within the market for major sport events, a separate market for major regular sport events (further split between regular football and other major sport events) and major irregular sport events.22 The Commission also identified separate product markets for the licensing of pay-TV and Free-To-Air ("FTA") broadcasting rights for sports events.

32. The notifying party submits that Superbike is a non-major (regular) sport event in any Member States, mainly because of: (1) the low levels of fees paid for Superbike by comparison to MotoGP; (2) the low television audience achieved by Superbike throughout the EEA; and (3) the limited presence of Superbike in broadcasters' listings. As regards MotoGP, the notifying party submits that MotoGP is a major (regular) event in Spain, Italy, and the Czech Republic, and a minor sport event in the other Member States.

33. The market investigation by and large confirmed the notifying party's submission. The majority of the respondents confirmed that MotoGP is to be considered as major sport event in some Member States, including, in particular, Italy and Spain, and a non-major sport event in other Member States, such as UK, Germany and Portugal23. None of the respondents indicated that Superbike should be considered as a major sport event.24 The majority of the respondents further indicated that: (1) in those Member States where MotoGP does not constitute a major sport event, if TV broadcasting licensing fees for Moto GP were to increase by 5-10%, they would likely replace Moto GP with sport events other than Superbike or even with non-sport events;25 and (2) if TV broadcasting licensing fees for Superbike were to increase by 5-10%, they would likely replace Superbike with sport events other than MotoGP or even with non-sport events.26

34. As regards the possible segmentation between pay-TV and FTA broadcasting rights, the notifying party submits that, based on this segmentation, the parties' activities would only overlap in France and the UK (where both MotoGP and Superbike are currently broadcast on pay-TV) and in Italy (where both events are currently broadcast on FTA TV).

35. For the purpose of the assessment of the present transaction, the Commission can therefore conclude that Superbike does not constitute a major sport event in the EEA, while the question of whether MotoGP constitutes a major sport event in the EEA and/or in the various Member States can be left open. The transaction indeed does not raise any serious doubts irrespective from the fact that Moto GP is considered as a major or a minor sport event. The question of whether the licensing of pay-TV and FTA TV broadcasting rights for sports events constitute separate relevant product markets can equally be left open as the transaction would not raise any serious doubts under either market segmentation.

IV.1.2. Geographic markets

IV.1.2.1. Motor sport regulators

36. In CVC/SLEC, the Commission did not take a view on the geographic scope of the market from FIM's perspective.

37. The notifying party did not take a position on this issue either.

38. For the purpose of the assessment of the present transaction, since competition for the acquisition of the concessions to organise MotoGP and Superbike take place at a global level, the geographic scope of the market for the organisation of FIM international motor sport events can be considered as being worldwide.

IV.1.2.2. Teams/manufacturers

39. In CVC/SLEC, the Commission did not take a view on the geographic scope of the market from the teams/manufacturers' perspective.

40. The notifying party submits that that the relevant market is at least EEA-wide since international motorsport series target teams/manufacturers from around the world, which must also be capable to participate in races on different continents.

41. The Commission considers that geographic scope of the product market is probably at least EEA-wide, for the reasons provided by the notifying party. However, for the purpose of the assessment of the present transaction, the geographic scope of the market can be left open, as the transaction does not raise any serious doubts under any relevant geographic market definition.

IV.1.2.3. Circuit owners/local promoters

42. In CVC/SLEC, the Commission considered that, from the circuit owners/local promoters' perspective, the relevant market is at least EEA-wide, as these operators promote both national and international series and events.

43. The notifying party agrees with this market definition and the market investigation confirmed this conclusion.27

44. For the purpose of the present transaction, it can therefore be concluded that the geographic scope of the market is at least EEA-wide.

IV.1.2.4. Advertisers

45. In CVC/SLEC, the Commission did not define the geographic scope of the relevant market from the advertisers' perspective.

46. The notifying party submits that the relevant market is at least EEA-wide, since: (1) customers typically purchase advertising at MotoGP and Superbike events on the basis of single contracts which may include all races; (2) even where they purchase advertising for a single event, the fact that MotoGP and Superbike are broadcast worldwide means that sponsors and advertisers are achieving worldwide publicity from their advertising/sponsorship activities; and (3) the companies who advertise at such events tend to be large multi-nationals.

47. The market investigation was inconclusive as to exact scope of the relevant geographic market. Out of seven respondents, four indicated that the market is national, while three took the view that the market is EEA-wide or even broader.28

48. In any event, for the purpose of the assessment of the present transaction, the geographic scope of the market can be left open, as the transaction does not raise any serious doubts under any relevant geographic market definition.

IV.1.2.5. TV broadcasters

49. The Commission has in the past considered that the various markets for the licensing of TV rights to sport events are national in scope, or at most, correspond to homogeneous linguistic areas.

50. The notifying party submits that this market is at least EEA-wide, since: (1) customers purchase TV rights to MotoGP and Superbike events on the basis of single contracts that cover all the territories in which the customer wishes to broadcast; (2) the companies who seek to advertise at such events tend to be large multi-nationals; and (3) the events at hand are cross-border events broadcasted in many countries.

51. The majority of the respondents to the market investigation confirmed that the relevant market is national in scope or, at most, covers homogeneous linguistic areas.29

52. For the purpose of the present transaction, it can therefore be concluded that the geographic scope of the market is national / or covers homogeneous linguistic areas.

IV.2. Competitive assessment

53. The transaction will give rise to horizontal overlaps between the parties' motorsport activities with respect to each of motor sport regulators (namely FIM), advertisers and TV broadcasters.

54. Also, depending on the definition of the relevant product markets, the transaction may give rise to horizontal overlaps or to a conglomerate relation between the parties' motorsport activities with respect to teams/manufacturers, circuit owners/local promoters and advertisers.

55. Further, the transaction will also give rise to a conglomerate relation between the parties' activities with respect to TV broadcasters.

IV.2.1. Motor sport regulators

56. The transaction gives rise to a horizontal overlap between the parties' activities with respect to FIM.

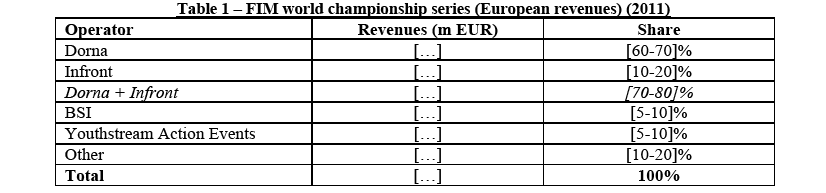

57. Based on the notifying party's own estimates (reported in Table 1 below), post transaction, the merged entity would hold a market share of around [70-80]% with respect to worldwide FIM events. The market share increase deriving from the transaction (corresponding to Infront's current share) would be [10-20]%.

|

58. Despite the high post merger combined market shares, the Commission takes the view that the transaction will not have any material anticompetitive impact in the relevant market for a number of reasons, including the fact that:

(i) The market share increment deriving from the transaction is limited since Infront is a small player on the relevant market;

(ii) A number of other players comparable to Infront will remain active on the market after the merger;

(iii) In the short term, the transaction could not have any competitive impact since: (1) Dorna already holds the rights to organize MotoGP until […]; (2) Infront already holds the rights to organize Superbike until […]; and (3) the relevant concession agreements will not be affected by the transaction and should therefore continue to run until their natural expiry date; and

(iv) In the long term, the transaction would also have a limited competitive impact since FIM awards the rights to organise and manage the sport events it regulates through open tenders, to which other players than the merged entity, including, but not limited to, operators who are currently active in the organisation of other motor and non-motor sport events, would have the ability to participate.

59. The market investigation confirmed that the transaction will not give rise to competition concerns. In particular, FIM confirmed that the transaction will not have any competitive impact for as long as the existing concession agreements for the organisation and management of both Moto GP and Superbike remain in place and that these agreements will not be affected by the merger.30 FIM - the only customer in the relevant market – also did not express any concerns as to the possible impact of the transaction in the long term. To the contrary, FIM submitted that the transaction would be pro-competitive in that it would ensure a long-term future for Superbike.31 Furthermore, the market investigation identified market players such as Formula 1, IMG, Eurosport Events and Lagardere/Sportfive as viable competitors to the merged entity going forward.

60. In light of the above, the Commission considers that the notified operation does not raise serious doubts as to the compatibility with the internal market vis-à-vis motorsport regulators, namely FIM.

IV.2.2. Teams/manufacturers

61. If MotoGP and Superbike are considered to belong to the same relevant product market with respect to teams/manufacturers, the transaction will give rise to a horizontal overlap between the parties' activities. Conversely, if the two events are considered as belonging to separate relevant product markets, the transaction will give rise to a conglomerate relationship between the parties.

62. The market investigation therefore verified whether, as a result of the transaction, the merged entity would have the ability and the incentive to: (1) raise the fees currently paid by team/manufacturers to participate in Superbike and/or to start charging team/manufacturers to participate in MotoGP (horizontal overlap); or (2) condition a team/manufacturer's participation in one event to the same team/manufacturer also participating in the other event (conglomerate relation).

63. Horizontal overlap. In response to the market investigation, a large majority of teams did not raise concerns related to the possibility that the merged entity would be able to increase its fees towards teams/manufacturers post-transaction. This reflects the fact, among other things, that a number of teams already face financial difficulties and are currently at the limit of what they can spend to participate in this type of events. A further increase in fees (or the fact of starting to charge fees) may force teams to pull out from either competition, which, in turn, would reduce the interest of the public in the competition, and/or to switch to other motorcycle events.32

64. Conglomerate analysis. A large majority of teams did not raise concerns related to the possibility that holding the rights to organize both MotoGP and Superbike would allow the merged entity to condition participation in either MotoGP or SuperBike to a team/manufacturer also participating in the other event.33 This is because, as several teams explained, the teams participating in both championships are different, and they would not, for commercial and - especially for privateer teams - for financial reasons, participate in both competitions (which further confirms that the two events are not close substitutes from the teams/manufacturers' perspective).

65. In light of the analysis above, the Commission considers that the notified operation does not raise serious doubts as to the compatibility with the internal market vis-à-vis teams/manufacturers.

IV.2.3. Circuit owners/local promoters

66. If MotoGP and Superbike are considered part of the same relevant product market with respect to circuit owners/local promoters, the transaction will give rise to a horizontal overlap between the parties' activities. Conversely, if the two events are considered as belonging to separate relevant product markets, the transaction will give rise to a conglomerate relationship between the parties.

67. Horizontal overlap. The notifying party submits that, if the Commission were to consider that MotoGP and Superbike belong to the same relevant product market from the circuit owners/local promoters' perspective, the transaction should not raise competition concerns for a number of reasons, including the fact that:

(i) The total revenues of circuit owners/local promoters deriving from the organisation of MotoGP and Superbike races is limited (less than 15% for MotoGP and 3% for Superbike for four representative circuits analysed in a study submitted by the parties), which means that circuits do not have to rely on the organization of MotoGP or Superbike for their viability and have a wide range of alternative sources of revenues;

(ii) MotoGP and Superbike only share a limited number of circuits for the organisation of their championships (in 2010 only 5 circuits have hosted both championships);

(iii) MotoGP and Superbike are not close substitutes since, for many circuits (in particular the circuits that are currently hosting a Superbike race), the necessary investments (mainly safety investments and larger hosting fees to start hosting MotoGP) would exceed by far the additional revenues that may result from upgrading to MotoGP; and

(iv) There are sufficient circuits in the EEA to host competing motor sports events (around 40) and MotoGP or Superbike events normally takes maximum five days, meaning that there remain sufficient time slots available for the organization of other motor sports events.

68. The results of the market investigation did not entirely confirm the first argument of the notifying party, i.e., it showed that the total revenues of circuit owners/local promoters deriving from the organization of Superbike and MotoGP races is higher than indicated by the notifying party.34

69. Nevertheless, the large majority of circuit owners explained that they were not concerned by the transaction.35 Two circuit owners even explained that having one company owning the rights to organise both championships may in fact be beneficial, as it would enable them to realise synergies and cost savings.

70. As regards the possibility that the transaction may lead to the merged entity charging higher fees for the organization of a MotoGP and/or SuperBike event post-transaction, a majority of circuit owners did not believe that the merged entity would have the ability to engage in such practice.36 Three circuit owners explained that they would not host these events if it no longer made financial sense following a fee increase, and two other circuits explained that in the current difficult economic conditions, many circuits may not be able to afford paying higher participation fees, and that the organisers of MotoGP and Superbike need to host races in Europe, where the sport is followed by viewers, and hence sponsors/advertisers and TV broadcasters.

71. In addition, MotoGP and Superbike do not appear to be close substitutes from the circuit owners/local promoters' perspective. Figures provided by the notifying party show that circuit owners have "replaced" MotoGP with Superbike (or viceversa) only twice (once in the EU) in the past 15 years. As a result, even if the merging parties were to increase the fees paid by circuits to host a MotoGP competition, it is unlikely that these circuits would replace MotoGP with Superbike. This is because, according to the notifying party, Superbike is not a substitute for MotoGP in terms of its ability to attract significant audiences and numbers of spectators.

72. Similarly, if the merging parties were to increase fees paid by circuits to host a Superbike competition, then these circuits would likely not "replace" Superbike with MotoGP, but with other events, such as national motorbike series, motorcycle or car endurance, Formula 3, the Renault World Series, the World Touring Car Championship, truck racing events or even concerts or other large events such as e.g. the Rock am Ring in Nurburgring in Germany.

73. Conglomerate analysis. As regards the merged entity's ability and incentive to conditioning the granting of one event to a circuit to the same circuit also accepting to host the other event, the notifying party submits that:

(i) Since circuits do not depend on MotoGP and/or Superbike to operate as they have a range of alternative sources of income, the merged entity will not enjoy any appreciable degree of market power post transaction;

(ii) The merged entity would have little incentive in engaging in a tying strategy with respect to MotoGP and Superbike since there are only a limited number of circuits who can actually host both events (12 in the EU). Given the much larger number of circuits which could host Superbike (around 40 in the EU), the merged entity would rather have the incentive to pit these circuits against each other to obtain better conditions for Superbike; and

(iii) In any event, even if the merged entity had the ability and incentive to engage in any such tying strategy, it is unlikely that this conduct would have any significant impact on market participants, as MotoGP circuits have strong negotiating power and, for the other circuits Superbike only constitutes a limited source of revenues. There would also not be any foreclosure effects vis-à-vis organisers of other motor sport events, given the large number of available circuits in the EU (around 40).

74. The respondents to the market investigation were not concerned by the possibility that the merged entity may condition the granting of one event to a circuit to the same circuit also accepting to host the other event. Two circuits explained that it was very unlikely that the new entity would be able to condition the acceptance of a circuit as part of the MotoGP calendar to the same circuit also hosting a SuperBike race, as there are in practice very few circuits which are able to host both events for technical / safety reasons.37 Furthermore, one circuit owner explained that since motorbike manufacturers taking part as racing teams in either Superbike or MotoGP have an interest in these races taking place in as many countries as possible where they sell their bikes, they would likely oppose such practice.

75. In light of the analysis above, the Commission considers that the notified operation does not raise serious doubts as to the compatibility with the internal market vis-à-vis circuit owners/local promoters.

IV.2.4. Advertisers

76. The transaction will give to rise to a horizontal overlap between the parties' activities in the market for the sale of advertising/sponsorship in relation to (motor)sport events. Moreover, if separate relevant product markets were to be identified for the sale of advertising/sponsorship in relation to, respectively, motorsport and other sport events, the transaction would also give rise to a conglomerate relation between MotoGP/Superbike and Infront's non-motorsport activities.

77. Horizontal overlap. The notifying party submits that the overlap between the parties' activities in this market is very limited, as they only have one common customer, Tissot. The notifying party also submits that the parties' combined shares are also very limited regardless of the product market definition adopted. In more detail, the notifying party estimates that the parties' combined share of the EEA market for sports advertising/sponsorship is less than [0-5]%. At the national level, the notifying party estimates that the parties' combined share of this market is below [10-20]% in each of France, Germany, Italy, Spain and the United Kingdom, and below [5-10]% in the other EEA countries.

78. If the product market were to be narrowed down to advertising/sponsorship in relation to motor sport events, the notifying party estimates that the parties combined share would be below [10-20]% at the EEA level and below [10-20]% at the national level.

79. The Commission investigated whether, post transaction, the merged entity would have the ability and incentive to raise prices for the sale of advertising space/sponsoring for its motorsport events. The vast majority of respondents to the market investigation did not raise any concerns related to a possible combination of the parties' motorsport advertising activities.38

80. Conglomerate analysis. The notifying party submits that the transaction will not give rise to any conglomerate competition concerns given: (1) the parties' limited share in the sale of advertising/sponsorship for motorsport events; (2) the fact that advertisers hold a strong negotiating power; and (3) the fact that, if it were to engage in any tying/bundling strategy, the merged entity would risk losing a large number of customers, i.e., all those customers not interested in purchasing the bundle.

81. The Commission investigated whether, post transaction, the merged entity would have the ability and incentive to condition the sale of advertising space/sponsoring for MotoGP/Superbike and the other sport rights exploited by Infront. However, the majority of respondents did not express any concerns in this regard.39

82. In light of the low market shares of the parties and of the absence of concerns raised during the market investigation, the Commission considers that the notified operation does not raise serious doubts as to the compatibility with the internal market vis-à-vis advertisers.

IV.2.5. TV broadcasters

83. The transaction will give rise to a horizontal overlap between the parties' activities in those Member States where both MotoGP and Superbike do not constitute major sport events (namely all EEA Member States other than Italy, Spain and, perhaps, the Czech Republic), as well as in those Member States where both events are broadcast on pay- TV (France and the UK) or on FTA TV (Italy).

84. The transaction will also give rise to a conglomerate relation between MotoGP and Superbike in those Member States where the two events belong to separate product markets (namely, Italy, Spain and, possibly, the Czech Republic), as well as between MotoGP and/or Superbike and all the other sport events exploited by Infront across the EEA.

85. Horizontal overlap. Since Superbike cannot be considered as a major sport event, the parties' activities only overlap in those Member States where Moto GP also does not constitute a major sport event (i.e., all EEA Member States other than Italy, Spain and, possibly, Czech Republic). However, the notifying party submits that the parties' combined share of the market for the licensing of TV broadcasting rights for minor sport events in all these Member States would be below [5-10]%.

86. The notifying party also submits that, even if the relevant market were to be segmented between the licensing of pay-TV and FTA broadcasting rights for sport events, the activities of the parties would overlap only in France and in the UK, where MotoGP and Superbike are currently broadcast by the Pay-TV channel Eurosport, and in Italy, where MotoGP and Superbike are currently broadcast by, respectively, FTA channels Reti and La 7. In France and the UK, the parties' share in the market for the licensing of broadcasting rights for pay-TV sport events would be well below [5-10]%,40 while in Italy, the parties' share in the market for the licensing of broadcasting rights for FTA TV sport events would be around [5-10]%.

87. The vast majority of respondents to the market investigation did not raise any concerns about the horizontal overlap between the parties' activities in the licensing of TV broadcasting rights for MotoGP and Superbike.41

88. Conglomerate analysis. Some of the respondents to the market investigation raised the possible concern that the transaction could lead to the merged entity tying/bundling the MotoGP and Superbike TV broadcasting rights in those Member States where MotoGP constitutes a major sport event. They did not, however, provide arguments to support their claim.42

89. The Commission considers this concern to be unfounded for a number of reasons, including the fact that: (1) holding the TV broadcasting rights for MotoGP does not appear to confer to the merged entity any significant degree of market power given the presence of equally or even more attractive sport events from a TV broadcaster's perspective; (2) there are alternative major sport events with a much greater impact than MotoGP (even in Italy, Spain and the Czech Republic, MotoGP represents less than [5- 10]% of the market for major sport events); (3) TV broadcasters appear to hold a strong negotiating power; and (4) TV broadcasters would likely not be interested in purchasing the rights for both events, as they both take place during weekends from April to October, which would mean for broadcasters to show a motorbike race (and sometimes both MotoGP and Superbike) every weekend during this period (the majority of TV broadcasters currently do not show both events).

90. The notifying party also submits that the transaction will not give rise to any conglomerate competition concerns following a possible tying/bundling of MotoGP and/or Superbike TV broadcasting rights with the other sport broadcasting rights exploited by Infront since, among other things, the relevant sport events take place at different periods of the year, have a different duration and the contract for the licensing of the relevant TV broadcasting rights also have a different duration, thus making it difficult for the merged entity to package them into a bundle. Moreover, to date, Infront has never bundled the TV broadcasting rights for Superbike with other TV rights in its portfolio.

91. The Commission considers that conglomerate concerns are indeed unfounded for a number of reasons:

(i) First, post transaction, the merged entity would continue to face strong competition from other licensors with comparable portfolios of sport events, including IMG, Lagardere/Sportfive, Octagon, WMG, Kentaro and others;

(ii) Second, the majority of the sport rights held by the merged entity are not particularly important events by broadcasters from a TV broadcaster's perspective;43

(iii) Third, even if the merged entity were to hold rights in relation to events that may be considered as important for TV broadcasters (e.g., football rights in Italy), post transaction it would not have the ability to bundle these rights with other sport rights it exploits (including MotoGP and Superbike) in light of the fact that the relevant football rights are currently sold through exclusive tenders (i.e., tenders only covering these rights) and there is no reason to believe that this practice will change in the future as it appears to be the most profit-maximising for the right holder. Moreover, the tender process for football rights in Italy took place in 2011 and the relevant rights are assigned until the 2014/2016 season;

(iv) Fourth, the merged entity would have no incentive to bundle/tie the TV rights for MotoGP and other sport events since TV broadcasters would most likely not be interested in buying these packages. Conversely, the merged entity would have an incentive to sell TV sport rights separately in order to pit the largest number of purchasers against each other and obtain the best price for these rights;

(v) Fifth, since there are many alternatives to MotoGP and to the sport events held by Infront, the merged entity would have no incentive to bundle MotoGP and some other sport events since such a strategy would not allow it to raise prices (TV broadcasters would replace MotoGP and Superbike with other comparable sport events) or to foreclose rivals (there are hundreds of TV broadcasters and a tying/bundling strategy could not allow a significant reduction of sales prospects for rivals); and

(vi) Sixth, Infront has never engaged in tying/bundling of TV rights in respect of different competitions it owns/commercializes vis-à-vis TV broadcasters, which constitutes further evidence of the absence of incentive for the merged entity to adopt a bundling/tying strategy following the transaction.

92. As a result, it is concluded that the merged entity would likely not have the ability and/or the incentive to implement a tying/bundling strategy with respect to the licensing of the TV broadcasting rights in relation to the sport events in its portfolio and, in any event, any such strategy would likely not have any anti-competitive effects.

93. In light of the analysis above, the Commission considers that the notified operation does not raise serious doubts as to the compatibility with the internal market with regard to the organisation of motorcycle sport races with respect to TV broadcasters.

V. CONCLUSION

94. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Publication in the Official Journal of the European Union No C 343, 23.11.2011, p.19

3 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Notice on the calculation of turnover (OJ C66, 2.3.1998, p25).

4 Commission decision of 20 March 2006 in Case COMP/M.4066 CVC/SLEC.

5 In this respect “motorsport” is understood to include both motorcycle related sports and motorcar related sports.

6 Questionnaire to teams/manufacturers of 16 November 2011, questions 9 and 10.

7 Questionnaire to teams/manufacturers of 16 November 2011, questions 15 and 16.

8 Questionnaire to teams/manufacturers of 16 November 2011, questions 10 and 11.

9 Questionnaire to teams/manufacturers of 16 November 2011, questions 15 and 16.

10 Questionnaire to teams/manufacturers of 16 November 2011, question 17.

11 Questionnaire to circuit owners/local promoters of 16 November 2011, question 15.

12 Questionnaire to circuit owners/local promoters of 16 November 2011, question 19.

13 Questionnaire to circuit owners/local promoters of 16 November 2011, question 15.1.

14 Questionnaire to circuit owners/local promoters of 16 November 2011, question 6.

15 Questionnaire to circuit owners/local promoters of 16 November 2011, question 10.

16 Questionnaire to circuit owners/local promoters of 16 November 2011, questions 9 and 17.

17 Questionnaire to sponsors/advertisers of 16 November 2011, questions 5.3 and 6.

18 Questionnaire to sponsors/advertisers of 16 November 2011, question 6.

19 Questionnaire to sponsors/advertisers of 16 November 2011, question 4.

20 The Commission, in line with the majority of respondents to the market investigation, takes the view that a narrower product market for motorcycle sport advertising is not warranted since, among other things, (1) advertisers/sponsors do not necessarily focus on a specific sport; and (2) Superbike or MotoGP do not attract specific categories of products or industries, and therefore, considers that it is not necessary to assess the possible impact of the transaction on such a product market.

21 Major sport events are considered to be a vital input for TV channels, unlike non-major sport events for which TV operators decide whether to broadcast an event at a given time based on available opportunities, but do not focus on a particular sport event.

22 Commission decision of 20 March 2006 in Case COMP/M.4066 CVC/SLEC.

23 Questionnaire to TV Broadcasters of 16 November 2011, question 13.

24 Questionnaire to TV Broadcasters of 16 November 2011, question 13.

25 Questionnaire to TV Broadcasters of 16 November 2011, questions 8, 9 and 10.

26 Questionnaire to TV Broadcasters of 16 November 2011, questions 9 and 11.

27 Questionnaire to circuit owners/local promoters of 16 November 2011, question 21.

28 Questionnaire to sponsors/advertisers of 16 November 2011, question 9.1.

29 Questionnaire to TV broadcasters of 16 November 2011, question 16.

30 Questionnaire to sport event organisers, question 9 and questionnaire to FIM, questions 11 and 12.

31 Questionnaire to FIM, questions 14.1 and 14.2.

32 Questionnaire to teams/manufacturers of 16 November 2011, questions 18, 19 and 22.

33 Questionnaire to teams/manufacturers of 16 November 2011, question 24.

34 Questionnaire to circuit owners/local promoters of 16 November 2011, question 1.

35 Questionnaire to circuit owners/local promoters of 16 November 2011, question 26.

36 Questionnaire to circuit owners/local promoters of 16 November 2011, question 26.1.

37 Questionnaire to circuit owners/local promoters of 16 November 2011, question 26.1.

38 Questionnaire to sponsors/advertisers of 16 November 2011, questions 13.1 and 13.2.

39 Questionnaire to sponsors/advertisers of 16 November 2011, question 16.

40 For completeness, it is noted that, if the relevant market were to be further segmented and a narrow market for the licensing of pay-TV broadcasting rights for minor sport events were to be identified, the transaction would still not raise any competition concerns given the wide variety of alternative minor sport events (other than MotoGP and Superbike) available to pay-TV broadcasters.

41 Questionnaire to TV broadcasters of 16 November 2011, question 18.

42 Questionnaire to TV broadcasters of 16 November 2011, question 19.

43 The main TV sports rights held by Infront in Europe are the following: (i) football Serie A, Serie B, TIM Cup and TIM Supercup in Italy; (ii) home matches of football national teams for the qualification of UEFA Euro 2012 and 2014 FIFA World Cup for Liechtenstein, Malta, Romania, and San Marino; (iii) handball bi-annual EHF Euro Championship, (iv) volleyball bi-annual CEV European Championship; (v) FIS Alpine Ski and Nordic World Cup races, (vi) International Ice Hockey Federation World Championship,(i) Bobsleigh and Skeleton World Championships, (viii) Curling World Championship, and (ix) Superbike.