Commission, December 20, 2011, No M.6382

EUROPEAN COMMISSION

Judgment

UNIPAPEL/ SPICERS

Dear Sir/Madam,

Subject: Case No COMP/M.6382- Unipapel/ Spicers

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 28 October 2011, the European Commission ("Commission") received notification of a proposed concentration pursuant to Article 4 and following a referral pursuant to Article 4(5) of the Merger Regulation by which the undertaking Unipapel SA ("Unipapel", Spain) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the Spicers Ltd.'s ("Spicers", United Kingdom) business in Continental Europe, ultimately controlled by DS Smith PLC ("DS Smith", United Kingdom), by way of purchase of shares. Unipapel is designated hereinafter as the "Notifying Party", Unipapel and Spicers together as the "Parties".

(1) THE PARTIES

2. Unipapel is a Spanish group active in the wholesale of traditional office supplies, including all consumables and durables required in an office, except for computers. Some of these products are manufactured by Unipapel (in particular, envelopes, filing products and notepads), and some others are acquired from third parties. Furthermore, further to the acquisition of Adimpo in 2009, Unipapel is also active in the wholesale distribution of IT products (mainly printing consumables), with a significant presence in Spain, France, Germany and Italy.

3. Spicers is a pan-European group active in the wholesale of office supplies and to a lesser extent printing consumables in a number of EEA Member States. Spicers is not involved in the manufacture of office supplies business.

(2) THE TRANSACTION

4. On 6 July 2011, Unipapel made a binding offer to D.S. Smith for the purchase of Spicers' European office supplies wholesaling business, which comprises Spicers' business units in: Belgium, France, Germany, Italy, Spain, the Netherlands, Ireland and the United Kingdom. Simultaneously, Unipapel received a binding offer from Becap SPV Ltd. to acquire the Spicers' business units in the United Kingdom and Ireland. As a result, Unipapel will acquire sole control on a lasting basis of only Spicers's business in Belgium, France, Germany, Italy, Spain and the Netherlands ("Spicers CE").

5. This decision only covers the acquisition of sole control of Spicers CE by Unipapel, taking into account that the transaction whereby Unipapel purchases all the European assets of Spicers (the "First Transaction") does not constitute a concentration pursuant to Article 3 of the Merger Regulation.2

6. The above approach results from the fact that the First Transaction will be followed by a subsequent break-up of Spicers which has already been agreed between the different purchasers in a legally binding way. Hence, there is no doubt that the division of Spicers into two separate business units will take place.

7. In view of the above, the proposed transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

(3) EU DIMENSION

8. The transaction does not have an EU dimension within the meaning of Article 1(2) of the Merger Regulation. The aggregate worldwide turnover of all the undertakings concerned is less than EUR 5 000 million. The concentration does not meet either the thresholds laid down in Article 1(3) of the Merger Regulation. The combined aggregate worldwide turnover of all the undertakings concerned is less than EUR 2 500 million.

9. On 16 September 2011, the Notifying Party informed the Commission by means of a reasoned submission that the concentration was capable of being reviewed under the national competition laws of three Member States (France, Italy and Germany) and requested the Commission to examine it pursuant to Article 4(5) of the Merger Regulation.

10. None of the Member States having jurisdiction to examine the concentration raised any objections towards the request for referral within the period laid down by the Merger Regulation. The notified operation is therefore deemed to have an EU dimension according to Article 4(5) of the Merger Regulation.

(4) PROCEDURE

11. After having been informed that based on the initial results of the market investigation it could not be excluded at that stage of the procedure that the transaction might raise serious doubts as to its compatibility with the internal market with regard to the wholesale of traditional office supplies in Spain, on 29 November 2011 the Notifying Party offered commitments with a view to remove possible competition concerns. However, given that the further market investigation demonstrated that the transaction does not raise serious doubts as to its compatibility with the internal market, the commitments were found to be unnecessary.

(5) COMPETITIVE ASSESSMENT

(a) RELEVANT MARKETS

12. The proposed transaction leads to horizontally affected markets in Spain and France. In particular, the market investigations showed some concerns in relation to the market for wholesale of traditional office supplies in Spain. In order to better address these concerns in the competitive assessment, the relevant market definition below is mostly focused on the Spanish market.

– Product Market Definition

· Manufacture of office supplies

13. Unipapel is active in the manufacturing of office supplies, notably (i) envelopes and bags;

(ii) scholar and professional notebooks; and (iii) filing products. Spicers can also be considered as indirectly present on this market as it distributes the products manufactured by third parties under its own brand (DOB products)3.

14. The market for manufacture of office supplies has not been previously analysed as a separate market by the Commission. However the market for manufacture of office supply has been analysed by certain National Competition Authorities.4

15. Indeed, in recent cases the Spanish Competition Authority has considered a market for manufacture and supply of some of office supplies and its further sub-division. In particular, the Spanish Competition Authority looked at the markets for the manufacture and supply of envelopes and manufacture and supply of filing products. As regards the envelopes, the Spanish Competition Authority considered the narrow markets for manufacture and supply of printed and white envelopes taking into account the difference in the demand-side. On the one hand, printed envelopes are sold by manufactures directly to the large end customers in the public or private sector. On the other hand, white envelopes are sold to different distributors such as contract stationers or mass retailers, who can in turn further process these products before selling them to end customers.

16. With regard to the filing products, the Spanish Competition Authority distinguished between several product types, such as binders, lever arch files and index separators, taking into account that these products have different characteristic and prices for the end-consumers.

17. The Notifying Party took note of the above national precedents and proposed to subdivide the market for manufacturing of office supplies into: (i) manufacturing of envelopes; (ii) manufacturing of notebooks; and (iii) manufacturing of filing products.

18. However, for the purposes of this decision it can be left open whether a further segmentation would be necessary, since the Parties position would not change substantially under any alternative market definition.

· Wholesale of office supplies

19. Both Unipapel and Spicers are active in the wholesale of a large range of office supplies.

20. The Notifying Party claims that wholesale of office supplies should be further sub- divided according to the different types of wholesalers into: (i) wholesale of traditional office supplies; and (ii) wholesale of IT products. The main ground of distinction would be, according to the Notifying Party, the fact that wholesalers of IT products do not compete with wholesalers of traditional office supplies.5

21. The majority of the customers confirmed that the wholesale of traditional office supplies and the wholesale of IT products should be considered as separate product markets. Some competitors pointed to the fact that the market could be wider and encompass both traditional office supplies wholesale and IT products wholesale.

22. For the purposes of this decision, the Commission will look into separate product markets for on the one hand wholesale of traditional office supply and on the other hand, wholesale of IT products. However, as it is correct that there is a certain products' overlap between wholesale of traditional office supplies and wholesale of IT products in relation in particular to printing consumables, this product category is dealt with separately below.

(a) Wholesale of traditional office supplies

(i) The products

23. In a previous decision,6 the Commission submitted that the term "office supplies" includes the products which are used in offices. These products are inter alia commercial envelopes; office books and pads, such as memo and refill pads, hard backed manuscript books as well as analysis and duplicate books; cut office paper; writing and graphic supplies, such as pencils, fountain pens, ballpoints, roller-balls, highlighters, markers, fibre/plastic tips, erasers and correction aids; storage and filing products, such as manila and plastic filing, levers arch files, ring, binders and archival filing; electronic office supplies, such as laser and inkjet printer cartridges, desktop appliances, data storage media, fax rolls, transparencies, labels and computer accessories; office desk accessories, such as clear adhesive tapes, repositionable notes, staplers and punches. The Commission at the same time pointed that the distribution of office supplies involves some basic office furniture and small business machines, such as desk top printers, fax machines, calculators, beamers and overhead projectors.

24. In order to describe their activities in this market, the Notifying Party adopted the definition "wholesale of traditional office supplies". Further, the Notifying Party submitted that the wholesale of traditional office supplies mainly consists of the wholesale of traditional office/stationery products (“TOS”), e.g. pens, pencils, notepads, filing products, folders, paper, etc.. Many wholesalers of traditional office supplies have also expanded their traditional activity towards the supply of basic electronic office supplies (“EOS”) such as printer cartridges and data storage as well as business machines (“BM”, e.g. printers and faxes). Lastly, according to the Notifying Party, a small number of wholesalers of traditional office supply are also active in the supply of office furniture (e.g. chairs, desks and filing cabinets).

25. The market investigation confirmed that the wholesale of traditional office supply consists of the categories listed by the Notifying Party. Indeed, most of the competitors to the Parties are active across a number of product categories, in particular TOS and EOS. Some of the competitors are also active within business machines as well as basic office furniture. Therefore, for the purpose of this decision it can be concluded that the wholesale of traditional office supply encompasses all the categories listed above.

(ii) The players

26. According to the Commission's previous decisions, the main types of channels to distribute the traditional office supplies to end users are:

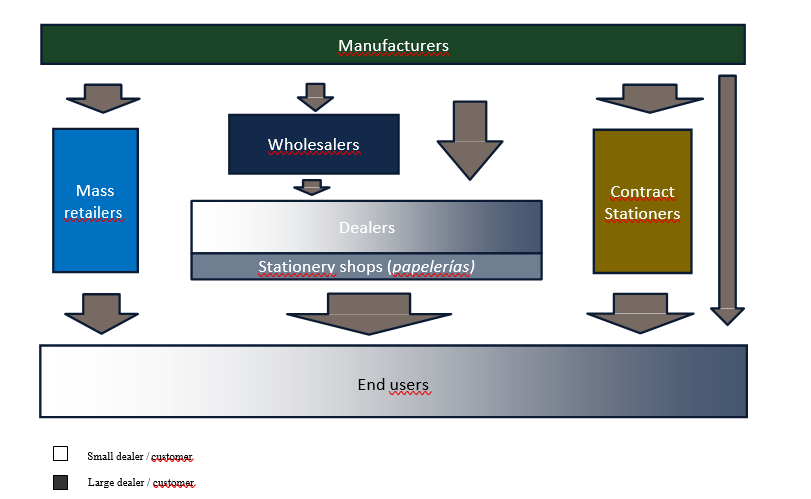

- Contract distributors, which supply office supplies on the basis of framework contracts under which the customers may order supplies whenever the need arises. Two types of contract distributors are often distinguished:

(i) "contract stationers" – i.e. large contract distributors. These distributors can serve large customers with a "one stop shop" catering for all the customer’s needs and they usually operate on a national basis.7 Their clients are mostly large and medium-sized companies and the public sector. Contract stationers usually purchase directly from traditional office supply manufacturers and to some extent also from wholesalers of traditional office supply.

(ii) "dealers" – i.e. regional/local contract distributors.8 Dealers purchase the office supply products from wholesalers and/or manufacturers and sell mainly to medium-sized and small companies. Dealers often form "buyer groups" in order to increase their buyer power. These buyer groups negotiate contracts with wholesalers and/or manufacturers on behalf of all the members of the group.

- Mass retailers, which are large stores devoted to some extent to the sale of office products, and whose prime customer base consists of private persons and some smaller offices. Mass retailers usually purchase their supplies from traditional office supply manufacturers as well as from wholesalers of traditional office supplies.

- Other resellers such as stationary shops and high street stationers. The stationary shops and high street stationers sell traditional office supply to private individuals as well as to small enterprises/offices. The stationary shops and high street stationers usually purchase traditional office supply from wholesalers of traditional office supply. However, to some extent, stationary shops and high street stationers source also from traditional office supply manufacturers.

- Manufacturers of office supplies selling directly to end-users.9

27. The flow chart below represents the structure of the various supply channels.

28. As explained above, the Parties are wholesalers of traditional office supply. They purchase office supply directly from manufacturers in order to re-sell them to dealers and stationary shops (but not to end users).

29. The Commission, in its previous decision,10 found that wholesalers of traditional office supply buy their supply directly from manufacturers. Wholesalers do not, or at least not primarily, sell directly to end-users and concentrate on servicing dealer groups, smaller independent dealers and retailers. They offer a wide range of services to the dealers, including logistical systems whereby orders are fulfilled directly from the wholesaler’s stocks and despatched directly to the end-user.

30. The Notifying Party initially considered that the players active in the wholesale of traditional office supplies comprised: "pure" traditional office wholesaler, buyer groups and specialised office supplies chains, such as dealers operating under a brand name.11

31. However, in the course of market investigation a number of respondents, indicated by the Notifying Party as competitors, explained that they did not perceive themselves as acting at the same level of distribution chain. These respondents presented themselves as customers rather than competitors to the Parties.

32. As a consequence, the Notifying Party provided the market data distinguishing between "pure" traditional office wholesalers, buyer groups and specialized office supply chains. At the same time, the Notifying Party still considered that there were sufficient arguments to sustain that "pure" wholesalers did compete with purchasing groups and with organized chains in order to attract independent dealers and high street specialized retailers.12

33. At the outset, the respondents to the market investigation overwhelmingly pointed to the fact that specialized office supply chains act at a different level of the supply chain than "pure" wholesalers, since they deliver directly to the end customers.

34. The market investigation also revealed significant differences with regard to suppliers, customer base and services offered by wholesalers on the one hand and buyer groups on the other.

35. Many respondents indicated that the players on the market for traditional office wholesale in Spain would be exclusively "pure" traditional office supplies wholesalers, i.e. companies such as the Parties, as well as Comercial del Sur and a number of local wholesalers. In fact, "pure" wholesalers purchase traditional office supplies from manufacturers and sell these products as well as additional services (e.g. websites for online distribution and printing of catalogues) mainly to dealers and buyer groups. In general, wholesalers do not sell to final customers such as individuals or small and medium businesses.

36. On the other hand, buyer groups are groups of dealers which jointly buy office supply from both manufacturers and wholesalers and sell office supplies to medium and small sized final customers (e.g. businesses and schools).13

37. For the purposes of the competitive assessment, the Commission will proceed on the basis of a worst case scenario with a narrow market excluding both specialized office supply chains and buyer groups. However, even in this scenario it would be incorrect to fully ignore the indirect competitive pressure exercised on the Parties in the relevant countries by these other categories of players in the supply chain.

38. In any event the question as to whether buyer groups belong to the same market as "pure" wholesalers of traditional office supplies can be left open since the transaction will not raise serious doubts irrespective of the product market definition adopted.

(b) Wholesale of IT products

39. Only Unipapel, through its subsidiary Adimpo, is active in the wholesale of IT products, namely in the wholesale of printers, accessories and consumables. Spicers CE is not active in the wholesale of IT products, except for printing consumables (see section below).

(i) The products

40. In its previous decisions the Commission explained that the wholesale of IT products include inter alia personal computers (PCs), servers, printers, scanners, storage devices, networking equipment, packaged software and various digital consumer products.14

41. Accordingly, the Notifying Party submits that the wholesale of IT products covers a wide variety of IT products including such as PCs, Laptops, PDAs and accessories, digital imaging tools and accessories, networking and communications, consumer electronics, storage devices and software, printing, accessories and consumables.

42. Overall, the market investigation confirmed the Notifying Party's view regarding the products to be included in a possible market for wholesale of IT product. The vast majority of wholesalers active in IT products are also active in printing consumables, components and peripherals. Many of the respondents to the Commission's investigation are also active across other segments such as PCs, Laptops, PDAs and accessories,15 digital image,16 networking and communications,17 as well as consumer electronics.

(ii) The players

43. The Commission in its previous decision explained that wholesale distribution consists in the supply of a broad range of IT products purchased from many IT manufacturers and software vendors to a large number of re-sellers and retailers, none of which are end- users.18

44. In addition, the Notifying Party submits that there are some forms of specialization within this market. For instance, some wholesalers tend to specialise in certain specific product categories while others supply a wide range of IT products (“broadliners”). However, in the Notifying Party's opinion, there is no need to further subdivide the market since competition strategy, market dynamics as well as the skills and know-how required to be active within each of the category are similar.

45. For the purpose of this decision, the exact product market definition can be left open since the transaction does not raise serious doubts under any alternative market definition.

(c) Wholesale of printing consumables

46. As explained above, Unipapel is active in the wholesale of printing consumables through its subsidiary Adimpo. On the other hand, Spicers CE, as other traditional office supplies wholesalers, is also active in the wholesale of printing consumables, although to a significant lesser extent than Unipapel.

47. The Commission has not, in its previous decisions, considered the market for wholesale of printing consumables.

48. Based on the submission of the Notifying Party, printing consumables consist of products used for printing in the offices, such as cartridges, toners, etc.

49. The Notifying Party claims that the wholesale of printing consumables could include not only the printing consumables traded by IT wholesalers but also printing consumables traded by traditional wholesalers of office supplies.

50. The Commission market investigation confirmed that both wholesalers of traditional office supplies and wholesalers of IT products supply printing consumables. Furthermore, some customers appear to source a number of printing consumables products from both, traditional office supplies wholesalers and IT wholesalers.

51. Accordingly, for the purpose of this decision, the Commission will assess the effects of the transaction on a possible market for printing consumables. However, the exact product market definition can be left open as the transaction does not raise serious doubts under any alternative market definition.

– Geographic Market Definition

· Manufacture of office supplies

52. As explained above, the market for manufacture of office supplies has not been previously assessed by the Commission. In its decisions, the Spanish Competition Authority considered that the market for manufacture and supply of envelopes (including its possible segments for printed and white envelopes) could be seen as EEA or national in scope. Similar approach has been adopted with regards to the market for filing products and possible sub-segments thereof.

53. The Notifying Party submits that relevant geographic markets for each of the markets for manufacturing of envelopes and manufacturing of filing products (and possible segments thereof), as well as manufacturing of notebooks are national in scope.

54. The Notifying Party argues that the above products are usually manufactured on a national basis, because of the idiomatic differences between different Member States.19 Furthermore, customers might have different habits depending on the Member State. The Notifying Party also observes that many customers of the traditional office supplies in question are companies active at national level exclusively.

55. For the purpose of this decision, the exact geographic market definition can be left open since the transaction does not raise serious doubts under any possible market definition.

· Wholesale of office supplies

(a) Wholesale of traditional office supplies

56. In the previous decision with regard to the Dutch market, the Commission stated that the business to business ("b2b") office supply businesses are mostly national in scope due to the fact that significant proportions of the products offered by national office suppliers were specific to the exact national market and the distribution was national in scope.20

57. Accordingly, the Notifying Party submitted that the relevant geographic market for wholesale of traditional office supplies should be considered as national in scope since each country has its own peculiarities in terms of customers' breakdown, relative weight of different routes to market, varying sophistication of the wholesale channel, cultural preferences and competitive dynamics.

58. The market investigation confirmed to large extent the national scope of the relevant geographic market for wholesale of traditional office supplies.21 The marketing and sale activities are organized on a national basis and each country has particular features when it comes to demand for the traditional office supply products.22

59. In any event, for the purpose of this decision the question as to whether the geographic scope of the market is EEA or national can be left open since the transaction does not raise serious doubts under any possible market definition.

(b) Wholesale of IT products

60. The Commission in its previous decisions left open whether the relevant geographic market for the wholesale of the IT products shall be considered national or EEA-wide in scope.23

61. The Notifying Party submits that the wholesale of IT products is organized on a pan- European level since the most relevant players are active in a number of EEA countries. However, on the other hand, the Notifying Party explained that the wholesale channel is organized at a national level because (i) fast delivery plays a key role to customers and

(ii) customers preferences vary in different Member States.

62. The market investigation revealed that the most significant players are active in a number of EEA countries and products do not differ according to the Member State. Some respondents, however, indicate that the geographic market is national in scope because of, for instance, types of delivery preferred by customers based in different Member States.

63. In any event, for the purposes of this decision it can be left open whether the market is national or EEA-wide, since no serious doubts arise under any market definition.

(c) Wholesale of printing consumables

64. As explained above, the Commission did not analyse the market for printing consumables in its previous decisions.

65. The Notifying Party claims that the market for wholesale of printing consumables should be defined as national in scope due to factors such as language differences between Member States, national scope of fast delivery service and the fact that distributors and retailers tend to organize themselves on a national level.

66. The market investigation confirmed that the market for printing consumables is national in scope. This is mainly due to national preferences of the customers and sales forces that are organised by market players at national level.

67. In any event, the precise definition of the relevant geographic market can be left open, as no serious doubts arise under any alternative.

(b) COMPETITIVE ASSESSMENT

68. The proposed transaction gives rise to a limited number of horizontally and vertically affected markets in Spain and France.

69. Unipapel is a manufacturer of a number of traditional office supply products such as envelopes, notebook and filing products in Spain. Further, Unipapel is active in the wholesale of traditional office supplies. Moreover, Unipapel is active through its subsidiary Adimpo in the wholesale of IT products across many Member States, including France, Italy and Germany and to a lesser extent the Netherlands and Belgium. Both wholesale chains of Unipapel (traditional office supply wholesale and IT wholesale) trade printing consumables.

70. Spicers CE can be considered as indirectly present in the manufacture of traditional office supply as it distributes the products manufactured by third parties under its own brand (DOB products). Spicers CE is however mainly active in the wholesale of traditional office supplies in a number of Member States, such as France, Italy, Germany, Spain, Netherlands and Belgium. Spicers CE, through its traditional office supply wholesale channel, also trades to a certain extent printing consumables.

71. Neither Party operates directly as retail distributor. However, both Parties operate their own quasi-franchise systems: Unistar for Unipapel (Spain)24 and Plein Ciel and Calipage for Spicers (France for the former, France, Spain, Germany and Belgium for the latter).25 These quasi-franchise systems group together a number of dealers and high street stationers under particular "retail brand" and offer these groups some additional services such as IT and logistics. The Notifying Party however claims that they do not control these dealers and, moreover, the dealers are not bound by exclusivity agreements with any of the Parties.

72. The transaction does not lead to any affected markets at EEA level. As far as the manufacture of traditional office supplies is concerned, the transaction would not give rise to affected markets as Unipapel currently holds market shares below 5% in the EEA for any segment (envelopes, notebook and filing products).26 Spicers' position in all of these markets at EEA-level is negligible.

73. In none of the markets for the wholesale of traditional office supplies, wholesale of IT products and wholesale of printing consumables, the combined market share of the Parties would not exceed 15% at EEA level. The Parties would not overlap on the market for wholesale of IT products, since only Unipapel is active in that market with market share of approximately [0-5]% in the EEA. On the market for wholesale of traditional office supply in the EEA, the Parties would have combined market shares of [10-20]% (increment of [0-5]% due to Unipapel) whereas on the market for the wholesale of printing consumables the Parties' combined market share would amount to [5-10]% (increment of [0-5]% due to Spicers).

74. The transaction may however lead to affected markets when a geographic market definition limited to national markets is taken into account.

75. At the outset, the proposed transaction could lead to horizontally affected markets in relation to the manufacturing of office supplies in Spain if Spicers DOB sales were to be attributed to Spicers as part of the market for manufacturing of envelopes, notebooks and filing products.

76. Secondly, the market for the wholesale of traditional office supplies would be horizontally affected in Spain, the only country where both Parties have significant presence.

77. Thirdly, the market for wholesale of printing consumables (traded by both traditional office wholesalers and IT wholesalers) is also affected in Spain.

78. Fourthly, because of Unipapel's presence in the upstream markets for manufacture of envelopes, notebook and filing products and the combined entity's presence downstream, the transaction also gives rise to vertically affected markets in Spain and in France.

– Spain

· Horizontally affected markets – Manufacture of traditional office supply (envelopes, notebooks and filing products)

79. The proposed transaction could lead to horizontally affected markets in relation to the manufacture of office supplies in Spain if Spicers' DOB sales were to be attributed to Spicers as part of the market for manufacturing of envelopes, notebooks and filing products.

80. In this regard the Notifying Party explained that Spicers CE is mainly an office supply wholesaler and does not manufacture the products that it commercializes under its own brand. Thus, the Notifying Party is of the opinion that Spicers CE should not be considered as achieving 'manufacturing' sales.

81. However, if the Spicers' DOB sales were to be attributed to Spicers, the merged entity market shares would be as follows.

82. In the market for manufacturing of envelopes, the merged entity's market shares would amount to approximately [30-40]%, with increment of less than [0-5]% due to Spicers. In a possible segment for white envelopes, the combined market shares would amount to around [30-40] %, with increment of less than [5-10]% due to Spicers;27 whereas in the possible segment for special printed envelopes the Parties' combined market share would be in the range of [20-30] %, with increment of less than [5-10]% due to Spicers. In the market for manufacture of notebooks, the market shares of the merged entity would amount to approximately [20-30] %, with increment of less than [0-5]% due to Spicers. Lastly, in the market for the manufacture of filing products, the market shares of the merged entity would amount to approximately [20-30] – [30-40]%, with increment of less than [0-5]% due to Spicers.28

83. The very limited increment added by Spicers' sales of DOB products to Unipapel's market shares does not seem to affect the competitive scenario post-transaction. Furthermore, the merged entity would still face important competitors in each of the segments, such as Grupo Tompla with market share of [30-40] % in the market for manufacturing of envelopes; Enri (Antalis - Lyreco) with market share of around [20-30]% in the market for manufacturing of notebooks; and Esselte with market share of around [20-30] % in the market for manufacturing of filing products.

· Horizontally affected market - Wholesale of traditional office supplies

84. As indicated above, both Unipapel and Spicers CE are active on the Spanish market for the wholesale of traditional office supplies.

85. In a possible market composed by "pure" traditional office supply wholesalers, specialized chains and buyer groups, the market shares of the combined entity would amount to approximately [10-20]%. Post-transaction, the combined entity would face competition from both the large specialized chain Carlin (market shares: [10-20]%) and buyer groups like Serviempresa S.A. ([5-10]%), Disnak ([5-10]%) or ACSS ([5- 10]%), as well as from "pure wholesalers" such as Comercial del Sur ([5-10]%).29

86. The market shares of the Parties and their competitors on the market for wholesale of traditional office supply (including buyer groups) are presented in the table below.

Spanish market for wholesale of traditional office supplies 30 |

Sales 2010 - Value (EUR Mio) |

Market shares (value) |

Unipapel | […] | [5-10]% |

Spicers | […] | [0-5]% |

Combined | […] | [10-20]% |

Carlin | […] | [10-20]% |

Serviempresa | […] | [5-10]% |

Disnak | […] | [5-10]% |

ACCS | […] | [5-10]% |

Settgroup Office | […] | [5-10]% |

Comercial del Sur | […] | [5-10]% |

Folder | […] | [5-10]% |

Other | […] | [30-40]% |

Total | […] | 100% |

Source: Form CO

87. In a possible market for "pure" wholesale of traditional office supply, the Notifying Party submits that their market shares would amount to [30-40]% for Unipapel and [10-20]% for Spicers. The only large competitor would be Comercial del Sur, with market share of [10-20]%.

88. In the course of the market investigation, a number of respondents submitted that the market shares of the Parties would be significantly higher, mentioning market shares of above 60%. The Commission has therefore sought to verify the estimated of the Parties.

89. It was not possible to obtain a comprehensive picture of all potential competitors in the rather fragmented market. Using reasonable estimates, it is, however, possible to assert that in a hypothetical market including only "pure" wholesale of traditional office supplies, the Parties' combined market share will not exceed [40-50]%. In addition to Commercial del Sur, the investigation also identified Makro Paper31 as a significant competitor of comparable size.

90. It is however important to point out that the Commission market reconstruction represents a "worst case scenario", whereby the Commission only took into account companies whose turnover could have been appreciated with a reasonable degree of certainty. The Commission also included in the market a number of local "pure" wholesalers, which constitute a significant constraint on the merging Notifying Party regardless of their relatively small individual size.32 The Commission does not exclude that a potentially high number of additional local wholesalers which have not been taken into account form also part of the market.

91. While a combined market share of [40-50]% appears high, it should be kept in mind that it refers to a very narrow hypothetical market excluding the alternative routes to market such as contract stationers and mass retailers. It must also be seen in the context of the pressure exercised by manufacturers and dealers (possible joined in buyer groups) who can for a large part of their purchases bypass the pure wholesalers (see below).

92. Even under this scenario, post-transaction the merged entity would continue to face competitive pressure from Makro Paper, Comercial del Sur and a number of smaller but competitive local wholesalers.

93. While many respondents to the Commission's market investigation did not see any effects of the transaction, there were also a number of respondents which expressed concerns with regard to the effects of the merger on the Spanish market for the wholesale of traditional office supplies.

94. A number of respondents (mainly dealers and/or buyer groups) explained that the transaction would result in the elimination of one of the three major competitors in the Spanish market for pure traditional office wholesale.

95. Furthermore, some respondents suggested that only "pure" traditional office supplies wholesalers have at present the ability to provide customers such as dealers or contract stationers with delivery in 24 hours. These customers in turn appear to value this service to a considerable extent.

96. A number of respondents also argued that Unipapel and Spicers are the closest competitors in the Spanish market insofar as they are the only wholesalers running a branded retail concept (Unistar for Unipapel and Calipage for Spicers) and providing innovative services to customers such as the possibility to "lease" dedicated web pages to start an online selling activity and direct supply to the dealers’ customers (so called “no- warehouses" or "stockless" dealers).

97. The same respondents pointed to a possible price increase resulting from the transaction. However others predicted a price decrease imposed by the merged entity, which would cause the elimination of some of the smaller competitors.

98. The Commission considers that the above arguments do not show to a sufficient extent that the transaction would raise serious doubts in the market for wholesale of traditional office supplies in Spain.

99. First of all, the market investigation confirmed that a number of alternative suppliers would remain on the market, both at national (Comercial del Sur, Makro Paper and to some extent, Distrisantiago Papeleria) and local level (Almacenez Paez, Anfisa, Commercial don Papel). In particular, a number of respondents to the market investigation explained that they could switch their purchase to the largest competitors of the merged entity, or even to local wholesalers.

100. In this regard the market investigation indicated that local wholesalers are a viable alternative for a large percentage of the Parties' customers. This is because the Parties' customers consist to a large extent of small dealers/high street stationers that have local activities and do not require a wholesaler with a nation-wide presence. These customers already source on a regional basis from the wholesalers present in their geographic area. When purchasing their requirements, these customers consider primarily the wholesalers active in the area where they have developed retail activities rather than giving preference to players that have wholesale operations nation-wide. Consequently, also local wholesalers exercise competitive constraint on the Parties.

101. Furthermore, the market investigation demonstrated that the barriers to expansion in the wholesale of traditional office supply can be overcome by local wholesalers. In recent years, the market has indeed experienced the geographical expansion of a number of players. For instance, Distrisantiago Papeleria, which started as local wholesaler in Galicia, currently has distribution and commercial agents spread all over Spain and supplies customers with its own 7500m2 distribution facility in Santiago de Compostella.

102. Some respondents also confirmed that post transaction the merged entity will not be likely to increase prices. Dealers would indeed have other alternatives such as purchasing their inputs from other wholesalers, namely Comercial del Sur and local wholesalers. The market investigation in fact confirmed that these local wholesalers are spread all over the national territory (at least one local wholesaler every large province) and constitute an important competitive constraint for national wholesalers as well as a suitable sourcing alternative for medium- and small-size dealers. A confirmation of the importance of these local wholesalers comes from the fact that many respondents to the market investigation consider the wholesale market as fragmented; regardless of the presence of a few large companies on the market.

103. Secondly, manufacturers of traditional office supplies appear to constitute a significant competitive constraint versus wholesalers. A large number of customers or potential customers of the Parties are indeed able to source directly from manufacturers. Large dealers and buyer groups currently buy from manufacturers a significant proportion of their requirements (up to [80-90] %, according to the Notifying Party). In the market investigation, manufacturers and buyer groups also confirmed that switching an even higher percentage of purchases to manufacturers would be a plausible reaction to a price increase from the merged entity.

104. In addition, a number of respondents to the market investigation explained that large manufacturers are currently able to deliver their products in many mainland regions even within 24 hours. Thus, time of delivery does not seem to be a decisive element to conclude that manufacturers do not exercise competitive constraints on wholesalers.

105. Switching to manufacturers would however not be possible for small dealers as they would not reach a sufficient volume of orders to make direct purchasing from manufacturing convenient. Nevertheless, some respondents indicated that small dealers would have the possibility to either form a new or join an existing buyer group in order to reach the critical mass of purchases that would be required to order from manufacturers at profitable conditions.

106. In view of the above, it can be therefore concluded that manufacturers of traditional office supplies constitute a significant competitive constraint versus wholesalers.

107. Thirdly, and contrary to a small number of claims from respondents to the market investigation, there seem to be relatively low barriers to entry on the Spanish market for wholesale of traditional office supply. This has been demonstrated by the relatively recent entry of Spicers (in 2003), which in a very short term gained significant market shares and placed itself as the third main wholesaler in Spain. In particular, entry seems to be possible in relatively short periods of time from wholesalers which are currently active in other Member States and already enjoy a certain degree of know-how and expertise.

108. Fourthly, the concerns by some competitors much be seen in the context of the fact that the merged entity may have the possibility to enjoy significant economies of scale and increased buyer power versus manufacturers, which could put it into the position to reduce prices to its customers. A number of respondents to the market investigation indeed suggested that the merger will result in a decrease of prices on the market for wholesale of traditional office supplies. For instance, it has been stated that the merged entity would be able to negotiate better prices on the basis of the higher quantities to be purchased.

109. Lastly, large contract stationers such as Lyreco (turnover in Spain of [...]), Office Depot ([...])33 and Staples ([...])34 seem to provide for an indirect competitive constraint over the Parties. These multinational companies compete with the Parties' main customers (i.e. dealers) for large and medium sized businesses, thereby exercising some influence on the final price to the customer of traditional office supplies.

110. Dealers are also facing competitive pressure from mass retailers such as Carrefour, which are generally considered as a feasible sourcing alternative by small businesses.

111. Any increase in price from the Parties will be likely to be passed on at least partially by the dealers at downstream level, so as to induce the final customers to switch to other suppliers such as contract stationers for large-medium customers or mass retailers for small customers. The merged entity is therefore unlikely to have any incentive to raise prices because that would imply a loss of customers in the long run. The above argument has been confirmed by the Notifying Party in the course of the State of Play Meeting, when the Notifying Party explained that the market strategy of the merged entity would be to remain competitive against the remaining wholesalers whilst assisting dealers to become more competitive versus contract stationers. 35

112. As a result, the Commission concludes that the transaction will not raise serious doubts in the market for wholesale of traditional office supplies in Spain.

· Horizontally affected market – Wholesale of printing consumables

113. According to the Notifying Party, the market share of the merged entity in the Spanish market for the wholesale of printing consumables would amount to approximately [30- 40]% (increment of less than [0-5]% due to Spicers).

114. As illustrated above, the increment due to the concentration between Unipapel's and Spicers' respective businesses is very low and the merged entity would still face a number of competitors such as Techdata (market shares of [10-20]%), Esprinet ([10-20]%), Ingram Micro ([0-5]%) and UFP ([0-5]%).

115. The market positions outlined above have been generally confirmed in the market investigation. Moreover, the majority of respondents to the market investigation were of the opinion that the transaction will not have any negative impact on the market for wholesale of printing consumables.

116. Based on the above, it is concluded that the transaction will not raise serious doubts in the market for wholesale of printing consumables in Spain.

· Vertically affected markets – Manufacture of office supplies / Wholesale of traditional office supplies

117. As explained above, Unipapel manufactures and sells office supplies, notably envelopes, notebooks and filing products to retailers, to direct customers and to office supplies wholesalers, such as Spicers CE.

118. Unipapel's market shares in the manufacture office supplies in Spain were approximately [30-40]% for envelopes,36 [20-30]% for notebooks and [20-30]% for filing products.37 At the downstream level, under the narrowest product market definition, the merged entity would have market share of [40-50]%.

119. In the course of the market investigation, some limited concerns were voiced that the merged entity would make use of its position on both levels of the supply chains to foreclose access to the market for wholesale of traditional office supplies.

120. In spite of the relatively significant market position of the merged entity at both upstream and downstream level, the merger is likely not to lead to any customer foreclosure effects. The combined entity will indeed lack the ability to foreclose access to the customer base of manufacturers of office supplies. Post-transaction, a significant number of wholesalers will remain active on the whole Spanish territory or in a part thereof. Furthermore, as indicated above, manufacturers also currently supply to independent dealers and buyer groups, contract stationers and mass retailers whose market position will not be affected by the proposed acquisition. Manufacturers of office supplies will therefore continue to have an important customer base to supply, regardless of any potential interruption in the orders from Spicers.

121. The market investigation did not show any concern as far as input foreclosure is concerned. In any event, the merged entity will lack any ability to foreclose access to inputs as it will keep on facing competitive pressure in all different markets for the manufacture of office supplies from a number of important players such as Grupo Tompla, Enri (Antalis - Lyreco) and Esselte, which constitute a reliable source of supply for wholesalers.

122. In view of the above, the transaction does not raise serious doubts in relation to the vertical relationship between manufacturing of office supplies and wholesale or traditional office supplies in Spain.

· Conglomerate effects – Wholesale of traditional office supply, wholesale of IT products and wholesale of printing consumables

123. During the market investigation a potential conglomerate issue was raised with respect to the joint sale of traditional office supplies, IT products and printing consumables in Spain.

124. Unipapel is active in the wholesale of IT products and printing consumables through its subsidiary Adimpo.

125. While Spicers in not active in the wholesale of IT products, it is trading as traditional office supplies wholesaler some printing consumables. According to a few respondents to the Commission's market investigation, post-transaction the merged entity would be able to make use of its market position in the market for wholesaling of IT products to leverage its position in the market for wholesale of traditional office supplies by means of a bundled discounts strategy. In particular, the merged entity would be in a position to offer discounts for traditional office supplies conditional to exclusive purchases of IT products.

126. The Commission considers that the concerns above are not justified and that the merger does not lead to serious doubts as far as conglomerate effects in Spain are concerned.

127. At the outset, the merged entity will lack the significant degree of market power in any of the markets concerned. As discussed above, the merged entity will not enjoy such market power in the market where the main overlap between the Parties arises, i.e. the market for wholesale of traditional office supplies. The merged entity will continue to face competition from large and local wholesalers as well as from manufacturers, which would be capable to react to the merged entity's behaviour. Furthermore, the market position of the Parties in the market for the wholesale of IT products in Spain is not significant (combined market shares of [0-5]%). Although the Parties hold relatively larger market shares in the market for wholesale of printing consumables ([30-40]%, with increment of less than [0-5]% due to Spicers), a number of other players such as Techdata ([10-20]%), Esprinet ([10-20]%), Ingram Micro ([5-10]%) and UFP ([5-10]%) would still be active in this market and will preserve their own ability to counter the merged entity's commercial policy. Lastly, none of the products of the Parties appears to be viewed as particularly important by the customers and with few alternatives available on the market.

128. Secondly, customers of traditional office supplies and IT products are not always the same. For instance, stationery shops, which account for approximately […] of Unipapel's sales of traditional office supplies, are usually and mostly buying traditional office supplies exclusively. This is because of the buyer patters of customers of small stationary shops (e.g. private individuals) who do not generally purchase IT supplies together with traditional office products. The merged entity would not therefore be in the position to apply a bundled discount strategy to the whole of its customers' base but only to part of it.

129. Thirdly, Unipapel could in principle already apply a bundled discount strategy because of its relatively important position on both markets for wholesale of traditional office supplies and wholesale of IT products. However, the market investigation did not reveal that Unipapel is currently engaged in such a strategy. Moreover, Unipapel does not currently require any exclusivity when dealing with its customers. For instance, even dealers participating in Unipapel's franchising program Unistar are not obliged to purchase from Unipapel the totality of their requirements.38.

130. Lastly, a number of wholesalers of traditional office supplies already effectuate wholesale of printing consumables and basic IT products such as electronic office supplies (e.g. storage devices).39 The merged entity will not therefore be the only player in the market capable to offer such a portfolio of products to its customers.

131. In view of the above, the proposed acquisition does not lead to serious doubts with regard to conglomerate effects in Spain.

– France

· Vertically affected markets – Manufacture of office supplies / Wholesale of traditional office supplies

132. Unipapel is active in France in the market for the manufacture of envelopes and filing products40 while Spicers is active downstream in the market for wholesale of traditional office supplies.

133. Unipapel's market shares in the manufacture of envelopes and notebooks are lower than 1% in any case.41 The market share of Spicers downstream would be of around [30-40]% in traditional wholesale office supply.

134. The merged entity will continue to face competitive pressure both upstream from major players as Grupo Tompla (envelopes), Hamelin (notebooks) and Esselte (filing products) and downstream market from competitors like Majuscule ([10-20]%), Sacfom ([10- 20]%) and Rouge Papier ([5-10]%).

135. No increment downstream would occur as a result of the transaction and the increments upstream appear to be very minor. The merged entity position on the upstream market will remain almost marginal and therefore the transaction does not seem likely to lead to serious doubts with regard to vertical effects in the French market.

136. This has been confirmed by the market investigation where none of the respondents raised concerns with regards to the competitive situation post-transaction.

137. In view of the above, it is concluded that the transaction will not raise serious doubts with regard to the vertical relationship between the market for manufacture of office supplies and the market for wholesale of traditional office supplies in France.

· Conglomerate effects – Wholesale of traditional office supply, wholesale of IT products and wholesale of printing consumables

138. The transaction may also give rise to potential conglomerate effects in France because of Unipapel's activities in the wholesale of IT products, Spicers' activities in the wholesale of traditional office supplies and the combined activities of the Parties in the wholesale of printing consumables.

139. No concerns were voiced in the course of the market investigation as to the risk that the transaction could give rise to conglomerate effects in France. In any event, the Commission considers that the merger is not likely to lead to any conglomerate effect in the abovementioned markets as the merged entity would lack of any significant market power required to leverage its market position from one market to the other(s).

140. For the reasons above, the transaction is not likely to give rise to conglomerate effects in France in the markets for wholesale of IT products, traditional office supplies and printing consumables.

(6) CONCLUSION

141. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 As stipulated in paragraphs 31 and 32 of the Commission Consolidated Jurisdictional Notice, the first of a series of transactions is not considered as a standalone concentration if a subsequent break-up is agreed in a legally binding way and there is no uncertainty that the second step will take place within a short period of time.

3 See Case T-290/94, Kaysersberg v. Commission of 27 November 1997, para. 172-174.

4 See for instance, the decisions of the Spanish Competition Authority in cases C/0365/11 HB/IBARRA and C/0299/10 MANUFACTURAS TOMPLA, S.A./MAESPA MANIPULADOS, S.L.

5 Form CO, page 32.

6 Case No. COMP/M.2286 – Buhrmann / Samasoffice Supplies, decision of 11 April 2001.

7 Case No. COMP/M.2286 – Buhrmann / Samas Office Supplies, decision of 11 April 2001.

8 Case No. COMP/M.2286 – Buhrmann / Samas Office Supplies, decision of 11 April 2001.

9 The Commission described the channels of office supply distribution in Case No. COMP/M.3108 – Office Depot / Guilbert, decision of 23 May 2003. In this decision the Commission distinguished also the following channels: office superstores, which are large stores devoted to some extent to the sale of office products, and whose prime customer base consists of smaller offices and private persons; mail order companies, who tend to service the smaller offices, offer a broad range of products which can match that of the contract stationers and dealer groups as well as electronic office supplies distributors selling directly to larger end-user offices. These channels are however not significantly present in Spain.

10 Case No. COMP/M.2286 – Buhrmann / Samasoffice Supplies, decision of 11 April 2001.

11 For example the Notifying Party claimed that one of their main competitors are Carlin or Folder, national chains of dealers/high street stationers which operate under (quasi) franchise system in Spain.

12 At a very advanced stage of proceedings the Notifying Party submitted a revised position with regard to the scope of the relevant market. The Notifying Party pointed to the fact that the market for wholesale of traditional office supply would include both manufacturers and "pure" traditional office supply wholesalers. However these submissions have not been substantiated properly. In any event, the Commission takes into account the competitive constraint exercised by the manufacturers in the competitive assessment.

13 Some respondents however confirmed that buyer groups face competition constraints from certain "pure wholesalers" to the extent that buyer groups consider the Parties as their competitors as far as their respective franchising programs (i.e. Unistar and Calipage, see below) are concerned. In this respect, "pure wholesalers" compete with buyer groups for capturing within their franchising programs independent dealers, which could otherwise join buyer groups. In addition, Spicers also runs a buyer group (Carip) which is a direct competitor to the buyer groups formed by independent dealers.

14 Case No COMP/M.5091 - Tech Data / Scribona, decision of 28 April 2008.

15 PDAs (personal digital assistants) are mobile devices that function as personal information managers. PDAs have usually an electronic visual display, enabling it to include a web browser, but some newer models also have audio capabilities, enabling them to be used as mobile phones or portable media players. Many PDAs can access the Internet, intranets or extranets via Wi-Fi or Wireless Wide Area Networks, and some of them employ touch screen technology.

16 This category includes products such as products such as digital cameras and video cameras and all the devices related to camera and video systems.

17 Networking and communications include simple products such as telephones, faxes, modems, proxies and routers, as well as some more complex products including area networks with routers and bridges, local area networking switches, hubs and NICs (network interface controllers).

18 Case No COMP/M.5091 - Tech Data / Scribona, decision of 28 April 2008.

19 According to the Form CO, the majority of the products in question are sold by catalogues and promotion and/or advertising differs according to Member States.

20 Case No. COMP/M.2286 – Buhrmann / Samasoffice Supplies, decision of 11 April 2001.

21 A minority of market respondents pointed to the market being EEA-wide.

22 Some wholesalers are active in Spain on a regional level. However, this would not contradict the national scope of the market, since even players active across the whole national territory deliver their products from one or two storage facilities (e.g. Spicers has storage facilities exclusively in Barcelona and Madrid). In addition, there are low barriers to expansion for existing, regional players as for instance proven by the expansion of Distrisantiago (see below paragraph 101 of the present decision).

23 Case No COMP/M.5091 – Tech Data/ Scribona, decision of 28 April 2008.

24 In Spain, approximately […] dealers/stationers are associated to Unipapel's Unistar program. These dealers/stationers account for approximately EUR […] turnover and operate on the basis of a standard contract which makes them to a large extent independent with regard to their purchases. These dealers/stationers represent a small portion of the Spanish players active in the distribution and retail of traditional office supplies (approximately […] dealers and approximately […] to […] high street stationers).

25 In Spain, approximately […] dealers are associated to Spicers' Calipage program. These dealers represent approximately EUR […] in terms of purchases from Spicers.

26 The Notifying Party submits that Unipapel's market shares on the possible segments for white / special printed envelopes are below 5% in the EEA. Similarly, the Notifying Party submits that Unipapel's market shares in any of the segments of filing products would be below 5% in the EEA.

27 Market shares based on estimations of the Notifying Party for the year 2009.

28 The Notifying Party submits that the market shares for each of the possible segments of the market for manufacture of filing products (i.e. lever arch files, elasto files, suspension files, binders, index separators and others) are below 40% for Unipapel and below 5% for Spicers.

29 Spicers' sales through its buyer group Carip are included in Spicers' sales.

30 Including buyer groups.

31 Makro Paper has been initially regarded by the Notifying Party as a buyer group composed by dealers. In the course of the market investigation, however, the Commission found that Makro Paper is a group of medium-sized local wholesalers which operate under the same brand and commercial structure, making use of the same shared warehousing facilities. Makro Paper is therefore a group of wholesalers from which independent dealers can purchase their requirements. Makro Paper can therefore be considered as acting as a single wholesaler for the purposes of this decision.

32 For the calculation of the turnover of some of "pure" local wholesalers, the Commission relied on the Notifying Party's estimates.

33 [...].

34 [...].

35 Unipapel has recently divested its participation in Ofiservice, a JV with Lyreco which was active in the market for contract stationers. Further to this divestiture the only route to the market of Unipapel is via dealers.

36 In the potential segments for printed envelopes, Unipapel's market shares would be approximately 10- 20%, while in the segment for white envelopes Unipapel's shares would amount to 20-30%. Spicers' market shares are negligible in both segments.

37 Should Spicers' DOB sales be placed in the market for manufacturing of envelopes, notebooks and filing products, the combined market shares would amount to [30-40]% in manufacturing of the envelopes; [20- 30]% in the manufacturing of notebooks; and [20-30] – [30-40]% in the manufacturing of filing products.

38 Purchases from Unipapel represent for these dealers approximately [40-50]% of their total purchases.

39 These are for example: Comercial del Sur, Distrisantiago, Almacenes Paez, Comercial Don Papel, Novedades Marlú, Díaz López, Delio Guerro, Comercial Solis Márquez, Mimbek, Almacenes Rodu, DBP and Almacenes Caype.

40 In France Spicers is also selling distributor own brand of envelopes, notebooks, filing products and some other traditional office supply products; however its sales are minor.

41 The increment added by Spicers in the markets for envelopes and filing products by means of its own branded products manufactured by third parties is less than 1%.