Commission, February 6, 2011, No M.6411

EUROPEAN COMMISSION

Judgment

ADVENT / MAXAM

Dear Sir/Madam,

Subject: Case No COMP/M.6411 - ADVENT/MAXAM

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 22.12.2011, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Advent International Corporation (“Advent”, United States) acquires within the meaning of Article 3(1)(b) of the Merger Regulation joint control of the undertaking MaxamCorp Holding, S.L. (“Maxam”, Spain) by way of purchase of shares.2 Advent and Maxam are referred to hereinafter as the “Parties”. Advent is referred to as the “Notifying Party”.

I. THE PARTIES

2. Advent is a global financial services company that is present in more than 70 countries throughout the world, with investments in several types of markets in a diverse portfolio that includes pharmaceutical, software, drilling, postal services and insurance companies, among others. Advent manages or advises together with a number of general partners3 a number of investment funds (the "Advent Entities"). Advent controls H.C. Starck GmbH (“Starck”) which is active mainly in refractory metals and advanced ceramics and OXEA S.a.r.l. (“Oxea”), which primarily produces chemicals.

3. Maxam is the head of a diversified group of companies which consists of the following divisions: (i) Maxam Civil Explosives which develops, manufactures and commercializes a wide range of packaged and bulk explosives, initiating systems, exploders and measuring equipment; (ii) Maxam Outdoors which develops, manufactures and commercializes hunting and sport cartridges and necessary components: gunpowder, primers and shell cases and also manufactures recreational pyrotechnic products; (iii) Maxam Defence (Expal Systems S.A. (“Expal”) is the head of Maxam's defence business) which develops, manufactures and commercialises a wide range of products for military use including ammunition, weapon systems, energetics and systems and technology; (iv) Maxam Chem (Maxam Chem S.L. is the head of the chemical division) which develops, manufactures and commercialises certain chemical products and (v) Maxam Energy which develops a series of projects based on renewable energies. Maxam also holds […]% of the share capital in Cetpro Ltd. (“Cetpro”), a joint venture with Yara International ASA (“Yara”). Cetpro is active in the production and supply of cetane number improvers for diesel fuel.

II. THE OPERATION

4. The transaction consists of a share purchase by Advent of 49.99% of Maxam's shares. The remaining shares in Maxam (50.01%) will be held by a number of natural persons collectively referred to as “the TDA Group”.

5. The Advent Entities and the TDA Group have concluded a shareholders agreement ("SHA") which provides that some reserved matters require consent by both the Advent Entities and the TDA Group.4 These matters include […], the approval or amendment of the business plan, the annual budget and the financial projections of Maxam, the approval of certain investments or the establishment of a management body other than the board.

6. The TDA Group comprises, directly or indirectly, approximately […] natural persons who are legally bound to always exercise collectively and jointly (as opposed to individually) their respective individual voting rights in Maxam.5 According to the Commission's Consolidated Jurisdictional Notice (paragraphs 151 and 152), natural persons cannot be considered as “undertakings concerned” in the sense of the Merger Regulation if they do not carry out further economic activities or control one or more other economic undertakings. The TDA Group includes Maxam’s current managers, technical experts, other employees and individual co-investors who do not currently hold control of any other economic undertaking. The TDA Group cannot therefore be considered as an undertaking concerned in the sense of the Jurisdictional Notice.

7. As a result of the above, post-transaction Advent and the TDA Group will acquire joint control of Maxam. However, only Advent can be considered an undertaking concerned in the sense of the Jurisdictional Notice and be therefore viewed as notifying party.

III. CONCENTRATION

8. The proposed transaction will result in Advent acquiring joint control over Maxam, together with the TDA Group. In light of the above, the notified operation constitutes a concentration within the meaning of Article 3(1) of the Merger Regulation.

IV. EU DIMENSION

9. The Parties have a combined aggregate worldwide turnover of more than EUR 5 000 million (Advent: EUR […]; Maxam: EUR […]).6 Each of them has an EU-wide turnover in excess of EUR 250 million (Advent: […], Maxam: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

V. COMPETITIVE ASSESSMENT

10. Advent and Maxam are both active in the manufacture of inputs for the manufacture of propellants in the EEA, a possible market comprising the manufacture of products such as nitrocellulose, ammonium perchlorate, nitrofilm or rubber thermal protection. However, this horizontal overlap does not result in an affected market within the meaning of Section 6, III, (a) of the Form CO attached as Annex I to the Implementing Regulation7 and will not be further discussed in this decision.

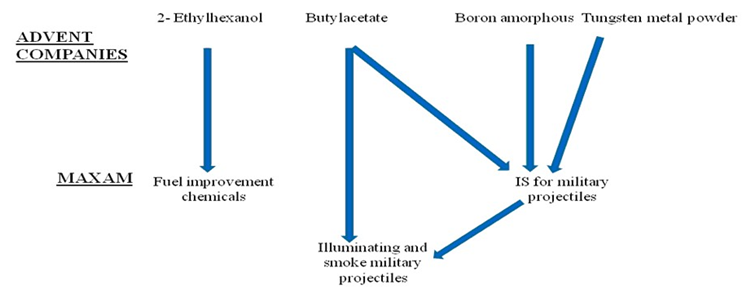

11. The transaction however gives rise to a number of vertically affected markets because of certain vertical relationships between the activities of companies part of the Advent group on the one hand (i.e. Oxea and Starck) and Maxam on the other. These are illustrated by the diagram below.

A. RELEVANT MARKETS

(i) 2-EH / 2-EHN

2-EH - product market

12. Advent, through Oxea is active in the production and supply of 2-Ethylhexanol (“2-EH”).

13. 2-EH is a downstream product of n-butyric aldehyde, an oxo-alcohol used as an intermediate product in a number of industrial uses, such as plasticisers synthetic fabrics, solvents, lubricants and the production of fuel improvement chemicals (2-Ethylhexylnitrate, “2-EHN”).

14. In a previous decision8 the Commission defined 2-EH as a distinct relevant product market given that 2-EH is only partly substitutable, that conversion costs are considerable and, above all, that prices of potential substitutes behave very differently.

15. The Notifying Party confirms that although 2-EH can be partially substituted by polyalcohols (such as iso-nonylalcohol, iso-decylalcohol and propylheptanol), conversion costs and price differences exist, in particular vis-à-vis iso-nonylalcohol, the main substitutive product.

16. Most respondents to the market investigation confirmed that 2-EH cannot be replaced by other products for a large number of its applications. In particular, there is no economically feasible alternative to 2-EH for its use as input in the production of 2- EHN. As regards supply side substitutability, 2-EH is manufactured in multi-purposes plants for the production of oxo-alcohols. Although there is a certain flexibility to swing between the production of 2-EH and butanol, switching large volumes may

imply serious constraints. One of the biggest differences between the two oxo-alcohol units lies in the distillation piece used to purify the products. A decision to increase significantly the output of 2-EH would require investments in the order of several EUR million and a minimum time period of one year.

17. In light of the above, it can be concluded that there is no reason to depart from the Commission’s previous conclusion on market definition. For the purposes of this decision, 2-EH shall be therefore considereda separate product market.

2-EH -geographic market

18. In the Celanese / Degussa /JV decision, the Commission considered the market for 2- EH to be EEA-wide9 because 2-EH could be carried by all means of transport (road, sea or rail tankers) and because, in order to keep transport costs as low as possible and to be able to supply more distant customers, EEA suppliers typically had storage tanks across the EEA.10

19. The Notifying Party argues that the scope of the market is at least EEA-wide but may be also considered worldwide. 2-EH is a commodity which is traded worldwide and approximately […] of Oxea’s sales consists of exports outside the EEA. Transport costs do not justify a narrower market definition than EEA wide as Oxea's transport costs vary from approximately [0-5]% to [5-10]% (an average of [0-5]%) across the EEA.

20. The majority of respondents to the market investigation indicated that transport costs between different regions and Member States are relatively significant. Furthermore, it has been indicated that closeness to the final customer could represent an important advantage for 2-EH suppliers. However, the same respondents confirmed that they multi-source from different Member States and that there are no regulatory barriers between Member States. At the same time, prices do not differ significantly across EEA Member States.

21. In view of the arguments above, and in particular the relatively low impact of transport costs on the trade of 2-EH between different EEA Member States, it can be concluded that there is no reason to depart from the Commission’s previous definition of the market as EEA-wide.

2-EHN - product market

22. Maxam through Cetpro, is active in the production and supply of 2-EHN, a specific type of fuel improvement chemical belonging to the group of cetane number improvers for diesel fuel.

23. Fuel improvement chemicals are chemical substances that are added in small amounts to diesel or gasoline in order to enhance the quality or performance of the fuel manufactured for the automotive industry.11 Cetane number improvers have the specific function of enhancing the performance of diesel fuels by reducing the time elapsing between injection and ignition of the fuel.

24. In a previous decision,12 the Commission indicated that results from the market investigation pointed to the existence of a single market for all gasoline additives. The Commission nonetheless left the market definition open. In a more recent decision, the Commission considered a possible separate market for 2-EHN, without reaching an explicit conclusion as to the scope of the product market.13

25. The Notifying Party maintains that fuel improvement chemicals comprise a range of products that modify different properties of fuels. Typically, these chemicals can be added as standalone products or as packages containing different improvement chemicals. The Notifying Party considers that the existence of a single market for fuel improvement chemicals cannot be excluded, because these chemicals all serve the same purpose of improving the quality and properties of fuels and are acquired by the same purchasers (i.e. oil companies and refineries). Nevertheless, the specific functions performed by each chemical are different and it could therefore be argued that they are not substitutable products. Hence, each fuel improvement chemical would belong to a distinct product market (e.g., oxidation stability improvers, sulphur levels improvers, lubricity stability improvers, etc.).

26. A large majority of respondents to the market investigation indicated that other products including other fuel additives are not full substitutes for 2-EHN as this is the most wide-spread and relatively inexpensive cetane number improver and customers cannot switch between 2-EHN and other products.

27. In view of the above, it appears that there are strong indications that 2-EHN constitutes a separate product market. However, the market definition can be left open for the purposes of this decision as none of the Parties is involved in the production of fuel improvement chemicals other than 2-EHN and no serious doubts arise even under the narrowest market definition as a result of the proposed transaction.

2-EHN - geographic market

28. The Notifying Party submits that the market for fuel improvement chemicals can be considered worldwide in scope since 2-EHN is sold as a commodity, manufactured in different facilities around the globe, and typically exported either to the refineries or to the ports where fuel cargos arrive. However there are no significant imports of 2-EHN into the EEA because the EEA is the main diesel market in the world and the majority of the installed production capacity of 2-EHN worldwide is within the EEA.14 Therefore the Notifying Party argues that the geographic scope of a market for 2-EHN is at least EEA-wide.

29. The majority of respondents to the Commission's market investigation indicated that there are no significant price differences or regulatory barriers between EEA Member States and that customers adopt multi-sourcing strategies from different Member States. However, closeness to production facilities is considered as an important advantage by most customers. A number of respondents also indicated that transport costs are significant.

30. In any event, the question as to whether the market for 2-EHN is worldwide or EEA- wide can be left open as no serious doubts arise even under the narrowest market definition as a result of the proposed transaction.

(ii) Boron amorphous / initiating systems for military applications / illuminating and smoke military projectiles

Boron amorphous - product market

31. Advent through Starck manufactures and supplies boron amorphous.

32. Boron amorphous is a chemical product with a variety of industrial applications, including the manufacture of airbags, igniters, pyrotechnics, refractory additives and welding & brazing fluxes. The main industrial use of boron amorphous is the manufacture of airbags. The Notifying Party notes that a less common industrial application is the manufacture of certain military products such as military initiating systems which are incorporated into illuminating and smoke military projectiles. The Notifying Party submits that boron amorphous could potentially be substituted for other elements such as aluminium or iron oxide in the manufacture of those military products.

33. The Commission's market investigation was not conclusive with respect to the product market definition for boron amorphous. In any event, it is not necessary to conclude on the relevant product market definition for the purposes of this decision as no serious doubts arise even under the narrowest definition of boron amorphous as a separate market as a result of the proposed transaction.

Boron amorphous - geographic market

34. The Notifying Party submits that the scope of the geographic market is world-wide since sellers of boron amorphous are active on a global scale and serve customers located all over the world. Transport costs are very low and a number of independent trading companies exist. Suppliers are located in very different regions of the world (Europe, the US, Japan, China, Russia and India). In fact, Maxam itself purchases its boron amorphous requirements directly from […] (instead of EU suppliers such as Starck).

35. The market investigation did not contradict the Notifying Party's arguments in this respect. In any event, it is not necessary to conclude on the relevant geographic market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

Initiating systems for military applications - product market

36. Maxam through Expal manufactures initiating systems (“IS”) for military applications, notably projectiles.

37. IS are devices used to detonate civil and military explosives in a predictable, reliable and safe manner. The vertical relation in question concerns only a specific type of IS produced by Maxam and used for the detonation of military projectiles. The Notifying Party’s position is that these IS constitute a separate product market as they are only used for military applications and they are different from IS for the detonation of explosives.

38. The majority of the respondents to the market investigation do not believe that there is any other product or type of IS that is substitutable with IS for projectiles. Technologies used for alternative IS appear to be different and potential substitutes do not appear to match end-users' specifications without a re-design of the end-product.

39. In any event, it is not necessary to conclude on the relevant product market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

Initiating systems for military applications - geographic market

40. In the Orica / Dyno decision the Commission considered that the relevant geographic market for the wholesale of civil IS could be defined as EEA-wide.15 The Notifying Party argues that the geographic scope of the market for IS for military projectiles should also be considered at least as EEA-wide.

41. The market investigation confirmed the Notifying Party's view. The majority of the respondents to the market investigation argued that on the one hand the transport costs are high, but on the other the price differences are not significant across the EEA. Whilst possible regulatory barriers regarding the import and export of IS for military projectiles exist, some suppliers are active on a worldwide basis.

42. In any event, it is not necessary to conclude on the relevant geographic market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

Illuminating and smoke military projectiles - product market

43. Maxam through Expal manufactures illuminating and smoke military projectiles.

44. Illuminating and smoke military projectiles are designed to illuminate or signal on the battlefield at night or during periods of reduced visibility through the use of light or smoke.

45. According to the Notifying Party, military equipment such as illuminating and smoke military projectiles typically belongs to different product markets than civil equipment given that the ultimate customers in military markets are the Ministries of Defence or international military organizations which exercise strict control over the quality and safety of the products. Within military equipment, illuminating and smoke projectiles have a different use (i.e. illuminate/signal or hide) than other military projectiles (typically used for inflicting damage). Therefore, it could be argued that illuminating and smoke military projectiles belong to a separate product market from projectiles designed to inflict damage.

46. In any event, it is not necessary to come to a final conclusion on the relevant product market for the purpose of this decision as under all alternative market definitions no serious doubts arise as a result of the proposed transaction.

Illuminating and smoke military projectiles – geographic market

47. In absence of Commission precedents discussing the geographic scope of the market, the Notifying Party considers that the market for illuminating and smoke military projectiles should be EEA-wide in scope. This position is based on the fact that customers (mainly Ministries of Defence of the Member States) source their requirements on a pan-European basis.

48. In any event, it is not necessary to conclude on the relevant geographic market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

(iii) Tungsten metal powder / IS for military projectiles / illuminating and smoke military projectiles

Tungsten metal powder - product market

49. Advent through Starck manufactures and supplies tungsten metal powder.

50. Tungsten, also referred to as wolframium (W), is a hard brittle corrosion-resistant metallic element having the highest melting point of any metal. Tungsten is processed to manufacture several intermediate products such as ammonium paratungsten (APT), tungsten oxide (WO3), tungsten metal powder (WMP) and tungsten carbide (WC).

51. Given the absence of Commission precedents defining the market for tungsten products, the Parties have adopted a conservative approach and have provided information on the basis of the narrowest possible market definition (i.e. tungsten metal powder).

52. Respondents to the market investigation considered that although there may be substitutes for tungsten metal powder in the production of certain products, there is no overall substitute for tungsten metal powder due to its specific characteristics. Therefore customers cannot switch easily to other products.

53. In any event, it is not necessary to conclude on the relevant product market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

Tungsten metal powder - geographic market

54. Although the Commission has not dealt with tungsten metal powder in the past, in a previous decision it has been concluded that platinum group metals which can be considered high value metals such as tungsten metal powder form part of a worldwide market.16 In another decision, the Commission left open the geographic market definition for the supply of other high value metals such as zinc concentrate and zinc metal but found that there were indications pointing at an EEA-wide market.17

55. The Notifying Party’s position is that the geographic scope of the market for tungsten metal powder is world-wide, since it is a high value commodity traded and consumed globally.

56. The market investigation confirmed the view of the Notifying Party only to a certain extent. Whilst respondents confirmed that transport costs do not play a major role in the supply of tungsten metal powder and that the same suppliers are active on a worldwide basis, there appear to be significant differences with regard to prices in different geographic areas.

57. In any event, it is not necessary to conclude on the relevant geographic market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

(iv) Butyl acetate / IS for military projectiles / illuminating and smoke military projectiles

Butyl acetate - product market

58. Advent through Oxea manufactures and supplies butyl acetate.

59. Butyl acetate is mainly used as a solvent. It is usually included in varnish kits, as a co- solvent in low-solvent varnishes with high solid concentrations. It dissolves substances such as fats, oils, cellulose nitrate and both natural and synthetic resins.

60. In previous decisions,18 the Commission has defined the butyl acetate market as distinct from other chemical products in view of its specific applications, considering that there are no substitute products that can replace butyl acetate in all circumstances. The Notifying Party agrees with this conclusion.

61. Some respondents to the market investigation confirmed the conclusion of the Commission in previous cases that butyl acetate should be regarded as one single product market though one respondent stated that there is only partial substitutability of butyl acetate for some applications.

62. In any event, it is not necessary to conclude on the relevant product market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

Butyl acetate – geographic market

63. The Notifying Party considers the market for butyl acetate as EEA-wide in scope, in accordance with the conclusion in Celanese / Degussa / JV, where the Commission found that the market for butyl acetate covered the whole of the EEA.19 Similar to 2- EH or many other chemical products sold as commodities, butyl acetate can be carried by all means of transport while freight costs are not sufficiently high to alter competitive dynamics.

64. The market investigation overall confirmed the views of the Notifying Party, although one producer indicated that transportation costs for butyl acetate are relatively significant.

65. In any event, it is not necessary to conclude on the relevant geographic market definition for the purposes of this decision as no serious doubts arise under any alternative market definition as a result of the proposed transaction.

B. COMPETITIVE ASSESSMENT

(i) 2-EH / 2-EHN

66. A vertical relationship between the Parties exists insofar as Advent through Oxea sells 2-EH and Maxam through Cetpro, a […] joint venture between Maxam and Yara, purchases 2-EH in order to produce 2-EHN.

67. Oxea holds a market share of [50-60]% in the market for 2-EH in the EEA. It faces competition from large companies such as Perstop ([10-20]%), Oxochimie (a joint venture between Arkema and Ineos, [10-20]%) and ZAK ([5-10]%), which all have manufacturing facilities in the EEA.

Table 1: Sales and market shares for the supply of 2-EH in the EEA in 2011 Source: Form CO

Company | EEA market | |

Volume (T) | Market share | |

Oxea | […] | [50-60]% |

Perstorp | […] | [10-20]% |

Oxochimie | […] | [10-20]% |

ZAK | […] | [5-10]% |

Others and Imports | […] | [10-20]% |

Total market size | 273 000 | 100% |

68. In the downstream market for 2-EHN, Cetpro's market shares amount to [10-20]% worldwide and [20-30]% in the EEA. At EEA level Cetpro faces competition from important players such as the market leader Eurenco (market share of [30-40]%), EPC ([20-30]%) and Nitroerg ([10-20]%).

Table 2: Sales and market shares for the supply of 2-EHN in the EEA in 2011 Source: Form CO

Company | EEA market | |

Volume (T) | Market share | |

Cetpro | […] | [20-30]% |

Eurenco | […] | [30-40]% |

EPC | […] | [20-30]% |

Nitroerg | […] | [10-20]% |

Total market size | 90 000 | 100% |

Customer foreclosure

69. A number of respondents to the Commission's market investigation argued that the merged entity could foreclose access to Cetpro by Oxea's competitors in the upstream market for 2-EH.

70. Such customer foreclosure is unlikely to materialise. First, the transaction will not bring any substantial change to the existing supply relationship between Oxea and Cetpro. In 2010, Cetpro sourced approximately […] tonnes of 2-EH for its production of 2-EHN, accounting for approximately [5-10]% of the overall EEA 2-EH market in the same year (approximately 279 000 tonnes). The main supplier of Maxam in the past years has always been Oxea with approximately […] tonnes sold in 2010, which represents [70-80]% of Cetpro's purchases in the same year. The remaining part of Cetpro's purchases of 2-EH were made from […] and […]. The volumes which could in principle be object of a customer foreclosure strategy appear therefore to be very limited as they represent only approximately [0-5]% of the EEA market for 2-EH and [0-5]% of the EEA installed production capacity.

71. Second, in order for Advent to require Cetpro to buy 2-EH exclusively from Oxea, it would need the consent of both the TDA shareholders (within Maxam) and Yara (within Cetpro). It cannot be assumed that the interests of the TDA shareholders and Yara will be aligned to those of Advent, as these shareholders will not gain any substantial benefit from Cetpro dealing exclusively with Oxea. On the contrary, it appears likely that both the TDA shareholders and Yara will have a strong interest in Cetpro continuing to (i) multi-source 2-EH in order to ensure security of supplies, and (ii) purchase 2-EH from the lowest cost supplier possible, which will not necessarily be Oxea.

72. Finally, the production of 2-EHN is not the main application for 2-EH, accounting for approximately 21% of the 2-EH market in 2011. The primary application for 2-EH is currently represented by 2-EH acrylate with 27% of the whole market, followed by the production of plasticisers, which accounts for approximately 23% of the total EEA market.20 Data provided by the Parties and confirmed in the course of the market investigation also shows that demand from outside the EEA has been constantly increasing in recent years.21 Even if Cetpro were to cut its purchases of 2-EH from Oxea’s rivals, these 2-EH producers will continue to have a wide range of important alternatives in terms of potential customers, both inside and outside the EEA.

73. In light of the above, it can be concluded that the proposed transaction does not raise serious doubts in relation to customer foreclosure with regard to the vertical relationship between 2-EH and 2-EHN.

Input foreclosure

74. With a market share of [50-60]% and total sales in the EEA of approximately […] tonnes in 2011, Oxea is the largest 2-EH producer in the EEA. As mentioned above, there is a consolidated supply relationship between Oxea and Cetpro. Oxea is not however the main 2-EH supplier of Cetpro’s competitors, which appear to source the majority of their individual requirements from Oxea’s competitors, seemingly with a strong preference for their respective geographically closest supplier. In 2011, two producers of 2-EHN purchased from Oxea relatively small quantities of 2-EH (respectively […] and […] tonnes, equal to only […]% and […]%; of their respective requirements). A third competitor has not purchased any 2-EH from Oxea for the past 5 years

75. Regardless of Oxea's relatively low sales to Cetpro’s competitors, some respondents expressed concerns with regard to Oxea’s alleged importance as an actual or potential supplier of 2-EH. Oxea is viewed as an important player because of its large capacity, strategic location at the heart of continental Europe (Oberhausen, Germany) and the alleged effects on the price of 2-EH that a potential cut in Oxea’s supplies to the free market would have.22 It also appears that a number of Cetpro’s competitors make use of Oxea as a reference supplier in negotiations with their main suppliers. Concerns have been therefore voiced with regard to the possibility that post-transaction Oxea could engage in an input foreclosure strategy by means of price discrimination or termination of supplies in order to raise Cetpro’s rivals costs.

76. By contrast, a number of respondents to the market investigation stated that post- transaction Cetpro would become a more efficient competitor and that the price of 2- EHN could decrease. Cetpro may gain preferential access to 2-EH, which accounts for [80-90]% of the production costs for 2-EHN. According to one respondent, this cost advantage vis-à-vis competitors would be reinforced because of the existing partial integration of Cetpro (through Yara) in the upstream market for nitric acid (the second most important input for the production of 2-EHN).

77. The Commission's first phase investigation has shown that serious doubts with regard to input foreclosure can be excluded as the risk that Oxea will have the ability and the incentive to foreclose access to 2-EH by 2-EHN manufacturers is remote and such a foreclosure would in any event be unlikely to have an effect on competition ultimately resulting in harm for consumers.

Ability for Oxea to engage in input foreclosure

78. First, Oxea’s strategic position, although relevant to the competition assessment, should not be exaggerated. Although transport costs appear to be relatively important (up to [5-10]% of the final price within the EEA for deliveries from Oxeas's plant in Oberhausen, Germany), they do not in practice appear to constitute an obstacle to trade within the EEA. The market investigation indicated that all 2-EHN producers are multi-sourcing 2-EH across Europe as far as Poland (from Zak) and Sweden (from Perstorp). Evidence found in the market investigation suggests that suppliers in relatively remote geographic location are able to compensate for higher transport costs by offering cheaper prices.

79. Second, Oxea is not the main supplier of 2-EH to Cetpro’s competitors and the volume that could in principle be object of foreclosure appears to be relatively limited. It is in fact very likely that any cut in Oxea’s supplies would be compensated by an increase in supplies by one of Oxea’s competitors. Although most 2-EH producers are currently operating close to full capacity, one appears able to increase its output in a short time frame by redirecting production from captive use.

80. The market investigation also confirmed a strong preference for European 2-EH producers to target European demand first and repatriate their exports into the EEA when possible. EEA firms currently export a significant part of their production (approximately 30% of total output), in particular to North America, the Middle East and Africa.23 Generally, market players however prefer to rely on sales opportunities within the EEA because these constitute a more stable and predictable source of income, whilst the possibility to export towards Asia or North America is generally depending on a number of factors such as difference in the price of propylene (the main input for the production of 2-EH) in these geographic areas. It therefore seems unlikely that Oxea would stop supplying Cetpro’s competitors based in the EEA. Furthermore, capacity utilisation remaining constant, it appears plausible that 2-EH manufacturers would repatriate part of their exports in order to supply Cetpro’s rivals, in such a way offsetting any effect of a possible foreclosure strategy by Oxea.

81. Moreover, the market investigation showed that demand in the upstream 2-EH market for use in plasticisers is decreasing as a result of safety concerns related to the use of plasticisers. In recent years a number of substitute products for 2-EH have been developed for each of its industrial applications, diminishing demand for 2-EH from the plasticiser market and decreasing the overall sales of 2-EH within the EEA. 2-EH suppliers thus need to ensure that their supplies are re-directed from the plasticiser market to other applications such as 2-EH acrylate and 2-EHN. As a result, the bargaining position of 2-EHN manufacturers vis-à-vis 2-EH producers has been strengthened, making unlikely that 2-EH suppliers will be able to charge higher prices to 2-EHN manufacturers.24

82. Finally, the amount of imports into the EEA has trebled in the last few years. In particular, imports from Russia and the Middle-East appear to play an increasing role in the EEA 2-EH market. Although at present 2-EHN producers do not appear to source from non-EEA suppliers yet, there is evidence that in recent years both Cetpro and one of its rivals showed interest in purchasing from […], a 2-EH producer based in […], to the extent that Cetpro signed a contract with […] which foresees the beginning of supplies in 2012.

83. In view of the above, the risk that Advent through Oxea will have the ability to raise Cetpro’s rivals’ costs by foreclosing access to 2-EH appears remote.

Incentives for Oxea to engage in input foreclosure

84. As regards incentives to foreclose access to 2-EH, post-transaction Advent will hold 49.9% of Maxam's share capital. In turn, Maxam holds […]% of Cetpro’s share capital. Advent will therefore only capture approximately […]% of Cetpro’s profit. On the contrary, Advent holds 92% of Oxea’s share capital. If Advent were to forego 2-EH sales in order to benefit Cetpro, Advent would have to recover at Cetpro level approximately […] times the profit lost upstream in order for the overall strategy to be profitable.

85. In 2011, two of Cetpro's competitors purchased approximately EUR […] from Oxea, accounting for approximately [10-20]% of Oxea’s EEA sales. As indicated above, Advent will not be able on a standalone basis to force Cetpro to purchase exclusively from Oxea. Furthermore, Cetpro is currently operating at approximately [80-90]% of its total capacity and cannot therefore significantly expand its output. As a result, Oxea will not be able to count on Cetpro to re-absorb the volumes of 2-EH previously supplied to Cetpro's competitors and would simply have to withdraw these sales from the market. This would not only result in potential losses of up to EUR […], but also in a decrease of its capacity utilisation and a consequent reduction of profitability for its overall production of 2-EH because of the proportional increase of allocated fixed costs per unit.25

86. In 2011, Cetpro’s sales amounted to approximately EUR […]. As indicated above, because of capacity constraints, Cetpro would only be able to expand its current output to a limited extent in order to increase its present [20-30]% market share. Any significant increase in the merged entity’s gains will therefore have to result from an increase in prices for 2-EHN. As margins at the downstream level do not significantly differ from margins upstream, it appears extremely unlikely that the merged entity would be able to charge increased prices in such a way as to recover downstream approximately four times the losses suffered upstream.

Effects on competition

87. Even assuming that the merged entity would have the ability and the incentive to foreclose access to 2-EH to Cetpro’s competitors, it is unlikely that this strategy would have any effect on competition.

88. First, the price of 2-EHN appears to be significantly influenced by demand and capacity available in the market. Any potential increase in the price of 2-EHN would be most likely offset by recent increases in capacity by two producers of 2-EHN as well as by a planned increase in capacity by […].26

89. Second, almost all sales of 2-EHN are made to petrochemical companies and large distributors that supply petrochemical companies. Most of these companies have a product portfolio which includes propylene, the main raw material for the production of 2-EH. As the price of 2-EHN is indirectly influenced to a significant extent by the price of propylene, petrochemical companies are aware of the market trends of the input and the costs incurred in by 2-EHN producers. That provides them with sufficient bargaining power to contrast any unreasonable increase in the price of 2-EHN.

90. Petrochemical companies also tend to rely on tenders in order to purchase their requirements at convenient prices. These tenders are increasingly made under strict conditions and procedures imposed by these companies. Moreover, refineries belonging to the same group source their requirements through a single purchasing department which concentrates all the orders coming from many refineries located in different countries. These factors significantly reduce the suppliers’ bargaining power.

91. In light of the above, it can be concluded that the proposed transaction does not raise serious doubts in relation to input foreclosure with regard to the vertical relationship between 2-EH and 2-EHN.

(ii) Boron amorphous / initiating systems for military applications / illuminating and smoke military projectiles

92. A vertical relationship exists insofar as Advent (through Starck) manufactures boron amorphous and Maxam uses the product as an input for the manufacture of certain IS for military projectiles, which are further incorporated into illuminating military projectiles.

93. Advent's market share of boron amorphous is [30-40]% at world-wide level with a [90-100]% share by value at EEA level ([90-100]% by volume). Maxam has very limited market shares under any possible market definition in the downstream market for IS for military projectiles: below [0-5]% in the EEA and below [0-5]% worldwide. Maxam's shares in the EEA downstream market for illuminating and smoke military projectiles are below [0-5]% and below [5-10]% in illuminating military projectiles and smoke military projectiles respectively.

94. One respondent to the market investigation raised the possibility that prices for boron amorphous may rise as a result of the transaction. The overall results of the market investigation however did not confirm the likelihood that such concern may materialise.

95. At the outset, IS for military projectiles and illuminating and smoke military projectiles are by no means the only products manufactured using boron amorphous as an input. Aside from these products, boron amorphous can be used for a variety of industrial applications, such as the manufacture of airbags, igniters, pyrotechnics, refractory additives and welding and brazing fluxes. Furthermore, the proportion of boron amorphous used in the manufacturing process of illuminating and smoke projectiles is extremely small (i.e. around [0-5] %or less of the total input costs). In fact, Maxam’s current demand for boron amorphous is de minimis (approximately EUR […] per year). As a result, no risk of customer foreclosure could possibly arise.

96. As regards input foreclosure, none of Maxam’s main competitors in the downstream markets for IS for military projectiles and illuminating and smoke projectiles markets is an important customer of Starck. In fact, the majority of Maxam's competitors on the downstream market do not use boron amorphous for the manufacture of IS for military projectiles and illuminating and smoke military projectiles.

97. In view of the above and the general lack of concerns raised in the course of the market investigation, the Commission considers that the proposed transaction does not raise serious doubts with regard to the vertical relationship between boron amorphous on the one hand and IS for military projectiles and illuminating and smoke projectiles on the other.

(iii) Tungsten metal powder / IS for military projectiles / illuminating and smoke military projectiles

98. A vertical relationship exists as Advent (through Starck) manufactures tungsten metal powder and Maxam uses this product as an input for the manufacture of certain IS for military projectiles, which are further incorporated into illuminating military projectiles.

99. In 2010, Starck’s market share at EEA level amounted to [20-30]%, the other major players in the market being GTP (market share of [30-40]%) and WBH ([10-20]%). In the downstream markets (i.e. IS for military projectiles and illuminating and smoke military projectiles) Maxam's market shares amounted to less than [0-5]% at EEA level.

100. In each of 2010 and 2011, Maxam's purchases of tungsten metal powder amounted to less than EUR […]. Furthermore, none of Maxam's main competitors in the downstream markets is a major customer of Stark.

101. In view of the above and the general absence of concerns raised in the course of the market investigation,27 the Commission considers that there are no serious doubts with regard to the vertical relationship between tungsten metal powder on the one hand and IS for military projectiles and illuminating and smoke projectiles on the other.

(iv) Butyl acetate / IS for military projectiles / illuminating and smoke military projectiles

102. A vertical relationship exists insofar as Advent (through Oxea) manufactures butyl acetate and Maxam (through Expal) uses the product as an input for manufacturing IS for military projectiles, which are further incorporated into illuminating military projectiles. Butyl acetate is also used as a separate input in illuminating military projectiles.

103. Oxea’s EEA market share in the upstream market is around [30-40]% at EEA level with three other players, namely BASF, Oxochimie and Celanese holding comparable market shares of [20-30]%, [20-30]% and [10-20]% respectively. In addition, Maxam’s market shares in the downstream markets are below [0-5]% at EEA level. None of Maxam’s main competitors downstream (i.e., Chemring, BAE Systems, NAMMO or Rheinmetall) is a major customer of Oxea.

104. One of the respondents to the Commission's market investigation voiced some general observations in relation to possible competition concerns deriving from the vertical integration between Oxea and Maxam with respect to butyl acetate.

105. Butyl acetate is mainly used as a solvent for coatings and paints. The market investigation showed that Oxea is already active in this segment. Thus, one of the merging parties is already partially vertically integrated and the structural change brought about by the merger will not modify substantially the ability or incentives for Oxea to engage in input or customer foreclosure.

106. Furthermore, butyl acetate is only used by Maxam for the manufacture of a specific product of illuminating projectiles. Butyl acetate’s contribution to the total manufacturing costs of this product is marginal (less than [0-5]% of the total input costs). Maxam's purchases of butyl acetate are therefore very sporadic. For instance, Maxam did not purchase any butyl acetate in the last […].

107. In view of the above, the Commission considers that the proposed transaction does not raise serious doubts with regard to the vertical relationship between butyl acetate on the one hand and IS for military projectiles and illuminating and smoke projectiles on the other.

VI. CONCLUSION

108. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Publication in the Official Journal of the European Union No C 7, 10.01.2012, p. 9.

3 […].

4 According to Clause […], the Advent Entities and the TDA Group have the right to appoint 5 Board members each. The Executive Committee (on which the Board may delegate powers) shall be composed of 6 members, each collective shareholder (i.e., the Advent Entities and the TDA Group) appointing 3 (Clause […]). Further, Clause […] requires that at least 9 of the 10 members of the Board vote in favor of the resolution.

5 Clause […] of the SHA involves a pooling agreement (in the sense of paragraph 75 of the Commission Consolidated Jurisdictional Notice) among the natural persons comprised in the TDA Group regarding their individual voting rights. The implication is that, in terms of the exercise of voting rights, Maxam will only have two effective shareholders: the TDA Group (which will be itself a “voting block” as per Clause […]) and the Advent Entities.

6 Turnover calculated in accordance with Article 5 of the Merger Regulation.

7 Commission Regulation (EC) No 802/2004 of 7 April 2004 implementing Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings, OJ L 133 , 30.4.2004, p. 1.

8 Commission Decision of 11 June 2003 in case COMP/M.3056 Celanese / Degussa / JV, paragraph 118 et seq.

9 Commission Decision of 11 June 2003 in case COMP/M.3056 Celanese / Degussa / JV, paragraph 126.

10 Commission Decision of 11 June 2003 in case COMP/M.3056 Celanese / Degussa / JV, paragraph 124.

11 Commission Decisions of 30 November 2010 in case COMP/M.5927 Basf /Cognis, paragraph 111 et seq., and of 18 June 2002 in case COMP/M.2806 Sabic / DSM Petrochemicals, paragraph 10

12 Commission Decision of 18 June 2002 in case COMP/M.2806 Sabic / DSM Petrochemicals, paragraph 10.

13 Commission Decision of 21 September 2007 in case COMP/M.4730 Yara / Kemira GrowHow, paragraph 123.

14 Maxam's 2-EHN is manufactured through Cetpro in Belgium, Exchem has its facility in the UK, Eurenco is in the south of France and Nitroerg is based in the south of Poland.

15 Commission Decision of 23 May 2006 in case COMP/M. 4151 Orica / Dyno, paragraph 39.

16 Commission Decisions of 24 April 1996 in case IV/M.619 - Gencor/Lonrho, paragraph 72.

17 Commission Decisions in case COMP/M.4256 Xstrata / Falconbridge, paragraph 19: "While the market investigation confirmed that zinc concentrates are extensively traded on a global basis, it appears that the geographical dimension of the market for the supply of zinc metal may have a narrower geographic dimension (EEA-wide)".

18 Commission Decision of 11 June 2003 in case COMP/M.3056 Celanese / Degussa / JV, paragraph 147 et seq.

19 Commission Decision of 11 June 2003 in case COMP/M.3056 Celanese / Degussa / JV, paragraph 149. The Commission however stressed that imports from outside the EEA play an important role in the market.

20 Source: Oxea's estimates.

21 In 2010, Oxea’s exports of 2-EH represented approximately [40-50]% of its total sales of 2-EH.

22 Data concerning the evolution of 2-EH price has however only showed a relatively weak relationship between the price of 2-EH and the exit of capacity from the market in the past 10 years, the price of 2- EH being mainly influenced by the price of its main input, propylene.

23 Form CO, pagaragraph 154.

24 The market investigation showed that 2-EHN producers rank among the top 3 customers for at least 3 of the 4 main 2-EH producer active in the EEA.

25 The market investigation confirmed that fixed costs play a very important role in the 2-EH business and that running production plants as close as possible to full capacity is a key requirement for operating profitably.

26 […].

27 One of the respondents to the Commission market investigation argued that the transaction may result in an increase in prices for tungsten metal powder. That respondent does not however use tungsten metal powder as an input for the production of IS for military projectiles or illuminating military projectiles but rather for the production of tank ammunitions, namely kinetic penetrators. These concerns are therefore not merger specific as the latter product is not part of Maxam's portfolio.