Commission, July 2, 2012, No M.6535

EUROPEAN COMMISSION

Judgment

GLORY/ TALARIS TOPCO

Dear Sir/Madam,

Subject: Case No COMP/M.6535 – GLORY/ TALARIS TOPCO

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 30 May 2012, the European Commission received notification of a proposed concentration pursuant to Article 4 and following a referral pursuant to Article 4(5) of the Merger Regulation by which the undertaking GLORY Ltd. ("GLORY", Japan) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking Talaris Topco Ltd. ("Talaris", United Kingdom) by way of purchase of shares.2 GLORY and Talaris are designated hereinafter as "the Parties".

I. THE PARTIES

2. GLORY is a Japanese company active in the development and manufacture of money handling machines, cash management systems, vending machines and coin operated lockers for customers in the financial, retail and leisure sectors

3. UK-based company Talaris is active in the development and manufacture of cash management products mainly for customers in the financial sector and the provision of associated services.3 Talaris is currently controlled by the private equity firm Carlyle which acquired the business in 2008 when it was spun out of De La Rue.4

II. THE OPERATION

4. On 14 February 2012, GLORY announced that it had made a binding offer to acquire all of the voting securities in Talaris. Following the receipt of relevant consents from the employee works council in France, the Parties signed a Sales and Purchase Agreement to this effect on 23 February 2012. GLORY will therefore acquire sole control over Talaris and the notified operation constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

5. The concentration does not meet the jurisdictional thresholds of Article 1 of the Merger Regulation as the Parties' combined worldwide turnover is less than EUR 2 500 million (GLORY: EUR 1 223 million; Talaris: EUR 370 million).5 However, on 26 March 2012, GLORY submitted a reasoned submission under Article 4(5) of the Merger Regulation that the transaction should be examined by the Commission because it was capable of being reviewed under the national competition laws of three Member States, namely Germany, Spain and Portugal. As none of the Member States competent to review the proposed transaction objected within 15 working days of having received the reasoned submission, the concentration is deemed to have a Union dimension.

IV. MARKET DEFINITION

6. The Parties' principle activity is the manufacture and supply of automated cash handling products. These comprise customer-operated ATMs, teller-assist ATMs, banknote handling products and coin handling products, each of which is described in more detail in the following section.

IV.1. Product descriptions

IV.1.1. Customer-operated ATMs

7. Customer-operated ATMs are self-service units which automate certain cash handling functions traditionally performed by bank tellers. While some ATMs only dispense banknotes ("ATM Dispensers"), the latest ATM models also accept deposits from customers, check, sort, authenticate and store banknotes while other ATM models are also able to recycle cash ("ATM-Rs").

Figure 1 Example of a Talaris ATM-R. Source: Form CO

8. In this context, recycling means the ability to receive a banknote, verify it for fitness and authenticity and return the same note back to the teller or customer. ATM-Rs, Teller-assist Cash Recyclers ("TCRs"), and banknote sorters are cash handling products including a recycling function. According to regulation by the European Central Bank ("ECB"), where a company chooses such automated recycling system in the Eurozone, it must use a product approved by a National Central Bank.6 Alternatively, the collected cash has to be checked by trained staff or be delivered to specialised cash-in-transit companies using approved cash handling products. Euro coins however do not fall under the ECB Regulation.

9. Equivalent National Bank Certification procedures exist in the Czech Republic and Hungary with only minor differences in the costs and the term of validity of certifications. According to the Parties, in practice customers in the EEA require all automated cash handling products to be of a standard equivalent to those of the ECB.

IV.1.2. Teller-assist ATMs

10. Teller-assist ATMs are mechanically similar to customer-operated ATMs, but are installed under the teller’s counter or at other teller locations. Teller-assist ATMs are used by bank staff rather than customers directly. They include Teller Cash Dispensers ("TCDs"), which store cash of various denominations in a secure unit and dispense cash as required, and TCRs, which in addition are capable of recycling banknotes.

Figure 2 Example of a GLORY TCR. Source: Form CO

IV.1.3. Banknote handling products

11. Banknote handling products comprise banknote counters and banknote sorters. Banknote counters are designed to count loose or bundled banknotes. They can range from low-cost basic weighing scales to more sophisticated devices capable of accurately counting large volumes of strapped notes. Banknote sorters are used to sort or differentiate denominations of cash and to recycle banknotes, i.e. to check them for fitness and authenticity.

Figure 3 Example of a GLORY banknote sorter. Source: Form CO

IV.1.4. Coin handling products

12. Coin handling products perform many of the same functions for coins as banknote handling products do for banknotes. Coin counters are used to count single denominations of coins at a time and generally cannot sort between different denominations of coins. Coin sorters are capable of counting and sorting mixed amounts of coins of various denominations into separate compartments. In addition, coin sorters authenticate coins filtering out counterfeits or othercurrency coins. Coin wrappers count coins and enclose them in paper tubes, with each tube consisting of a specific number of coins allowing for easy transportation.7 Coin deposit units are self-service units that allow customers to deposit large amounts of coins securely. The coins are sorted and counterfeits detected, while foreign objects are filtered out.

Figure 4 Example of a Talaris coin sorter. Source: Form CO

IV.2. Product market definitions

IV.2.1. Overall market for automated cash handling products

13. The Parties submit that the relevant product market is the supply of all types of automated cash handling products predominantly to the financial sector excluding sales of ATMs to retail and cash-in-transit companies. This market would include the supply of customer-operated ATMs, teller-assist ATMs, banknote handling products as well as the various types of coin handling product described in section IV.1.4 above.

14. The Parties argue that these products are functionally similar and largely substitutable. According to GLORY, they all serve to improve the efficiency of a financial institution’s retail branch network by reducing staff numbers required and reducing teller time spent on cash handling. Moreover, GLORY submits that all of the products improve security by reducing the amount of time that cash is in open circulation within the branch. Furthermore, GLORY argues that customer-operated ATM-Rs, TCRs and banknote sorters with recycling functions are each capable of complying with the ECB cash recycling regulations described in recital 8 above.

15. The Commission has in the past identified two distinct markets for (i) financial workstations comprising ATMs and cash dispensing machines used by the financial sector and (ii) retail workstations comprising cash registers and electronic credit or debit systems such as point-of-sale or electronic cash registers used in the retail, hotel and restaurant businesses.8 However, these precedents do not mention smaller cash handling products such as banknote and coin handling products specifically. In a more recent decision, the Commission left open the precise product market definition for financial and retail workstations.9

16. The Commission considers, on the basis of the market investigation, that in the present case, retail workstations might constitute a product market that is distinct from type of automated cash handling products deployed by financial institutions. Both customers and competitors point to the differences in purpose of the respective cash handling transactions, in volumes handled, in the legal and compliance frameworks, in technology, in operational risk patters and distribution channels.

17. As neither of the Parties is active in the sale of retail workstations as described in recital 15 above, the question whether financial workstations and retail workstations should be considered separately or as part of the same product market can be left open as this would not significantly affect the competitive assessment of the notified operation. The remainder of this Decision will therefore consider only automated cash handling products as described in section IV.1 above as this is the area of overlap between the Parties' activities.

IV.2.2. Segmentation by cash handling product

18. The Parties do not consider it appropriate to further segment the market of automated cash handling products sold to customers in the financial sector according to the different types of cash handling products because of demand-side substitutability considerations as described in recital 14 above. In addition they submit that there is a high degree of supply-side substitutability especially between the manufacturing of customer and teller-operated ATMs because of the use of similar technology and the use of the same distribution channels. They further submit that producers of ATMs can extend their production to banknote handling products within 12 months and without incurring significant costs.

19. The Commission has not considered a further sub-segmentation of the market for financial workstations in previous decisions.10 However, there are a number of differences between the cash handling products in question as far as their functionality and end-use, physical characteristics, prices, and method of production are concerned.

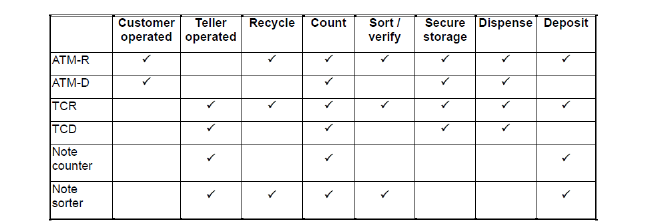

20. The different functionalities of ATMs and banknote handling products are illustrated in Table 1 below:

Table 1 Functionality of automated cash handling products. Source: paragraph 6.54 Form CO

21. In particular, while customer-operated ATMs target the public, teller-assist ATMs are operated by trained bank staff. In addition, only ATMs are integrated into the customers' IT systems requiring the use of IT integration services while banknote and coin handling units operate on a stand-alone basis. Moreover, ATMs are primarily aimed at the financial sector while banknote and coin handling products are also sold to customers in other sectors such as cash-in-transit and retail companies to a non- negligible extent.11

22. Furthermore, the automated cash handling products differ in their degree of technical sophistication and consequently in their sales price.12 The Parties submit that the design life of ATMs is similar at approximately 7 years while banknote and coin handling products have a design life of approximately 5 years. Accordingly, due to differences in purchasing and replacement costs, only ATMs are regularly serviced and maintained while banknote and coin handling systems are replaced rather than repaired or serviced.

23. The results of the market investigation also appear to support a segmentation of the market by type of cash handling product. In particular, customers seem to have set preferences for the purchase of a specific type of cash handling product, depending on their overall business and, in particular, bank branch strategy. The Commission considers that, on the basis of the market investigation, there is a low degree of flexibility on the part of customers to switch between different types of cash handling products.

24. Likewise, some competitors have explained that supply-side substitutability is limited due to differences in the production process and technology. Looking at the results of the market investigation, the Commission acknowledges that switching between the production of different types of cash handling products can require considerable preparation time and investments. However, the same results of the market investigation brought the Commission to consider that flexibility is higher between the production of different types of customer-operated ATMs (i.e. between ATM- Dispensers and ATMRs), teller-operated ATMs (i.e. between TCDs and TCRs), banknote handling products (i.e. between banknote sorters and banknote counters) and coin handling products (i.e. between coin counters, coin sorters, coin wrappers and coin deposit units).

25. In any event, for the purpose of this Decision the exact product market definition can be left open as the transaction does not raise serious doubts under any alternative product market definition.

IV.3. Geographic market definition

26. The Parties submit that the geographic market for cash handling products and possible sub-segments is EEA-wide or at least EU-wide in scope. They argue that the principal suppliers are active across the EEA either directly or through distributors and that these suppliers generally set their prices at the EEA level. Moreover, they argue that manufacturing is global and there is substantial cross-border trade of cash handling products in the EEA. They further submit that there are no customer preferences for local manufacturers and that certain customers operate on a pan-European basis. In addition, they stress that the ECB has introduced common standards in the eurozone that most automated cash handling products must meet.

27. The Commission has previously found the geographic market for financial workstations to be Community-wide in scope.13 The Commission found that customers did not limit their choice to national manufacturers, that all major suppliers were present in all national markets and that there was substantial cross-border trade while national buying preferences were absent.

28. The majority of respondents to the Commission's request for information in the present case confirmed that the market for automated cash handling products is EEA-wide in scope due to the presence of competitors that are active across a number of Member States and common regulatory standards such as those set by the ECB. Whilst some market players even indicated that due to similar demand and supply factors and the presence of global suppliers, the market should be defined as global in scope, a minority expressed the opinion that the market for automated cash handling products and its potential sub-segments could possibly be defined as national in scope due to differences in certain national regulations.

29. In view of these sometimes contradictory opinions, the Commission therefore considered whether there had been any developments since the adoption of its previous decisions concerning financial workstations that could put in question its earlier findings that the market was Community-wide in scope. As part of this assessment, the factors relevant to the definition of the geographic market as specified in the relevant Commission Notice on market definition were taken into account.14

30. The suppliers of automated cash handling products in the EEA are generally multinational companies present across the EEA. As a result, the Parties compete with the same leading automated cash handling product suppliers for all significant European contracts. Manufacturing in the industry is global with most suppliers manufacturing their products in centralized production facilities, including increasingly in Asian locations, before shipping their products to customers based all over the world.15 There are accordingly already significant imports into the EEA mostly originating from Asian countries and representing 68% of the sales of automated cash handling products in the EEA in 2010.16 Furthermore, in light of the results of the market investigation, the Commission considers that market players expect Asian imports into the EU, especially from China and South Korea, to grow further over the next years. In this regards, it is to be noted that while transport costs vary according to the distance travelled and the weight of the product, suppliers contacted in the market investigation estimate transport costs in general do not exceed 5% of the final sales price.

31. Whilst a number of respondents to the Commission's requests for information indicated that prices for automated cash handling products may vary between Member States, based on the results of the market investigation, the Commission did not find evidence supporting a distinct pattern of price differences between certain areas or Member States within the EEA. In this regard, the majority of customers contacted in the market investigation also replied that they would consider purchasing from a supplier based in another Member State if local suppliers were to raise prices by about 5-10%. This view on demand characteristics was shared by the vast majority of competitors contacted in the market investigation.

32. The Commission considers that from the results of the market investigation, it appears that selling through a local presence, be it through a local direct sales office, a local distributor or partnerships with a local producer, is important in the industry. This is due to the fact that automated cash handling machines need to be installed at the buyer's premises and that customers value having access to a fast and reliable after-sales service and maintenance network.

33. However, the Parties estimate that there are on average five distributors active in each of the EEA Member States17 and most suppliers of cash handling products in the EEA already have access to these local distributors. Furthermore, since there are a significant number of distributors, costs for establishing a new distribution relationship are limited.18 The use of distributors is thus a quick and effective way for suppliers to market their products in different geographic areas.

34. Moreover, based on the results of the market investigation, the Commission also acknowledges that customers do not have specific preferences for local manufacturers as long as their needs for installation and after-sales services and maintenance are met through local distributors.19

35. Moreover, different suppliers' automated cash handling products are generally able to process different currencies based on the same hardware. Customization only concerns the use of currency-specific "pattern set" software which is uploaded to the product according to its intended use. According to the Parties, the cost of creating "pattern set" software is low at approximately [less than EUR 2000] per currency and the process typically takes [less than one month]. Accordingly, customization of cash handling products to the processing of different currencies does not seem to constitute a significant barrier to trade within the EEA.

36. In view of the above and in line with the Commission's previous findings20, the Commission concludes that the scope of the geographic market for automated cash handling products and any potential sub-segments according to the type of automated cash handling product is EEA-wide or at least EU-wide in scope.

V. COMPETITIVE ASSESSMENT

37. The proposed transaction does not give rise to an affected market at EEA or EU-wide level if the product market is considered to include all the various types of automated cash handling products as the Parties' combined market shares do not exceed 15%.21 The proposed transaction does however gives rise to horizontal overlaps between the Parties' activities and in some instances affected markets at EEA and EU-level if separate product markets are considered for each type of cash handling product (that is to say TCRs, banknote counters, banknote sorters, coin counters, coin sorters and coin deposit units).

V.1. TCRs

38. The horizontal overlap between the Parties' activities gives rise to an affected market in relation to TCRs22 with the merged entity having a combined market share of [50-60]%23 in the EEA and the EU (GLORY: [10-20]%; Talaris: [40-50]%). However, the TCR market is a bidding market and consequently market shares in themselves are not indicative of market power and actual competitive conditions in the market. Due to the bidding procedures market shares fluctuate according to whether significant contracts are won or lost in any given year.24

39. Moreover, the Commission's analysis of tender data confirmed that the major TCR suppliers will continue to compete in tenders in the future, including in geographical areas where the Parties have an established market presence. Market players contacted in the market investigation have also indicated that the TCRs offered by all competitors in the market are of comparable quality and performance levels. Accordingly, all competitors are able to compete in different tenders across the EEA and do so on a regular basis.

40. The Parties' main competitors in the TCR segment in the EEA25 include three competitors with comparable market shares to GLORY, namely CTS Cashpro ([10-20]%), CIMA ([10-20]%) and Wincor Nixdorf ([10-20]%). There are also a number of other competitors, including Fujitsu ([0-5]%) and NCR ([0-5]%) though the combined market shares of these suppliers is currently less than [0-5]%.

41. CTS Cashpro is the world's largest manufacturer of TCRs with activities in 18 EEA Member States.26 CIMA is an Italian company focussing on the sale of TCRs. The company entered into an exclusive licensing agreement with NCR in 2007 according to which NCR manufactures CIMA TCRs and sells them under the NCR brand. NCR is one of the world's leading suppliers of automated cash handling products and the largest supplier of customer-operated ATMs worldwide and in the EEA. Wincor Nixdorf is a leading provider of IT solutions and services to retailers and retail banking. The company is the second largest providers of ATMs worldwide and in the EEA.

42. Accordingly, the Parties' competitors are strong players both in terms of financial power and innovation. This is also evidenced by their ability to grow their market shares. Wincor Nixdorf and CIMA have been successful in strengthening their market position by winning tenders over the past three years, gaining [5-10]% and [5-10]% of market share respectively since 2009.

43. The Commission considers that the results of the market investigation do not seem to confirm the Parties' claim that new players – either already active in banknote handling systems or in customer-operated ATMs – could readily enter the TCR segment. In particular, competitors contacted in the market investigation pointed out that market entry required investments in developing TCR storage modules that differ from ATM or banknote handling modules in size and technology.27

44. Nevertheless, Cespro, a competitor primarily active in the manufacturing of semi- automated safes, has recently entered the TCR segment, indicating that market entry is attractive and feasible. This is supported by the fact that the European TCR market is forecast to grow considerably over the next years. The RBR reports that [discussion of growth in the TCR market] […].28 […].29

45. Consequently, a number of market players contacted in the market investigation expect TCR imports into the EEA by Asian manufacturers to grow in the future.30 A TCR competitor specifically explained that Asian TCR manufacturers are currently looking into investments in the European market and are expected to enter the market over the next five years.

46. Overall, end customers contacted in the market investigation have not raised substantiated concerns with respect to the TCR segment. In contrast, a number of TCR customers anticipate that the proposed transaction will have beneficial effects on their business. This relates, in particular, to the enhanced power of the merged entity to innovate, to offer an extended product range and to meet customers' service requirements through an extended service network.

47. Demand for TCRs in the EEA is concentrated in a relatively small number of financial institutions.31 After testing TCRs of different suppliers in a pilot phase, financial institutions regularly launch tenders32 setting out the volume required, the specification of the units, the warranty requirements and the length of any after-sales servicing and maintenance. On the basis of the market investigation, the Commission notices that customers consider quality, reliability and price of the products as more important factors in their purchasing decision than the existing customer relationships of a supplier.33 Moreover, based on the results of the market investigation, it also notices that a large part of customers multi-source their TCR purchases.

48. Due to the economic strength of financial customers and the use of tender processes, the vast majority of TCR end customers contacted in the market investigation indicated they were not dependent on the Parties for the supply of TCRs. The market investigation also confirmed that the vast majority of end customers do not expect the Parties' negotiation power to increase in relation to them following the transaction.

49. Therefore, there are a number of important competitors which will remain active in bidding for tenders in the market and continue to exert a competitive constraint on the merged entity. Market entry by European and Asian manufacturers in the growing TCR segment remains attractive and feasible. There is significant buyer power of the merged entity's customers who are sophisticated, financial institutions and which have not raised any substantiated concerns relating to the proposed transaction. The Commission thus concludes that the transaction does not raise serious doubts as to its compatibility with the internal market even if the TCR segment were considered to constitute a separate product market.

V.2. Banknote handling products

50. The proposed transaction also gives rise to affected markets with respect to banknote handling products, notably banknote counters and banknote sorters.34

V.2.1. Banknote counters

51. If the product market is further sub-segmented, the Parties' combined market share for banknote counters is [20-30]% in the EEA (GLORY: [10-20]%; Talaris: [5-10]%) and [20-30]% in the EU (GLORY: [10-20]%; Talaris: [5-10]%). Competitors at the EEA level35 include VIP Buic ([10-20]%), Magner ([5-10]%) and Scan Coin ([5-10]%). In addition, there are a large number of smaller players, including Asian importers, accounting for approximately [30-40]% of the market.36

52. The Parties' market shares in banknote counters have declined since 2009, falling from [30-40]% in 2009 to [20-30]% in 2011, due to […]. In terms of units sold Talaris' sales have […] since 2009.

53. Banknote counters are generally low-cost pieces of hardware. Due to this fact, together with the relatively easy access to distribution networks as explained in recital 33 above, the market investigation has not identified significant barriers to market entry in the banknote counter segment.

54. Furthermore, market participants have not raised substantiated concerns in the market investigation. In contrast, some end customers highlight the large number of available suppliers in the EEA market. Moreover, some customers expect beneficial effects from the proposed transaction, in particular relating to research and development investments. In particular, some end users submit that the newly created entity will be able offer better banknote handling products and services.

V.2.2. Banknote sorters

55. As regards banknote sorters, the Parties have a combined market share of [20-30]% in the EEA and in the EU (GLORY: [10-20]%; Talaris: [5-10]%). Competitors at the EEA level37 include Kisan ([30-40]%), Giesecke & Devrient ([10-20]%) and Laurel ([5-10]%).There is an additional number of smaller players, including Asian importers, accounting for approximately [10-20]% of the market.

56. Talaris' market share in banknote sorters has only recently exceeded [5-10]% in the EEA. Until 2010, Talaris' market share was less than [0-5]% ([0-5]% in 2010 and [0-5]% in 2011).

57. Market players contacted in the market investigation have not raised substantiated concerns with respect to banknote sorters. However, some end customers specifically mentioned that the merged entity will be able to provide customers with more competitive solutions. Moreover, some end users consider that the proposed transaction might lead to price decreases in the banknote sorting segment.

58. In sum, the combined market share of the Parties in the two potential banknote handling sub-markets are below or only slightly above 25%, the threshold identified by the Commission to indicate that a concentration is not liable to impede effective competition.38 There are a number of strong competitors able to supply both types of products in the EEA and market players have not raised substantiated concerns. Accordingly, even under a narrow product market definition differentiating between the different types of banknote handling products, the transaction does not raise serious doubts as to its compatibility with the internal market.

V.3. Coin handling products

59. With respect to coin handling products, the transaction does not give rise to an affected market as the Parties' combined market share is [10-20]% in the EEA (GLORY: [5-10]%; Talaris: [0-5]%) and [10-20]% in the EU (GLORY: [10-20]%; Talaris: [0-5]%). Talaris' business activities in the coin handling segment are […] with sales of [...] EUR […] in the EEA in 2011. The Parties' competitors at the EEA level are Scan Coin ([30-40]%), Laurel ([10-20]%), Pro Coin ([5-10]%), CT Coin ([0-5]%) and a number of other smaller players ([20-30]% combined) including Asian importers.39

60. Even if the market were further sub-segmented into the markets for coin counters, coin sorters, coin wrappers and coin deposit units the assessment would not change materially. The Parties' market shares in the EEA40 are set out in Table 3 below:

| Coin counters | Coin sorters | Coin deposit systems |

GLORY | [10-20]% | [10-20]% | [0-5]% |

Talaris | [0-5]% | [5-10]% | [0-5]% |

Combined | [10-20]% | [10-20]% | [0-5]% |

Table 3 Market shares in coin handling product sub-segments. Source: Parties' estimates in response to the Commission's Request for Information of 19 June 2012.

61. In the affected market for coin counters, the increment at the EEA level due to the acquisition of Talaris is limited at [0-5]%, equivalent to a Talaris turnover of EUR […] in 2011. The merged entity will continue to face competition from Scan Coin ([30-40]%), Pro coin ([20-30]%), CT Coin ([5-10]%) and a number of smaller competitors (together [20-30]%).

62. In the market for coin sorters at the EEA level, the merged entity will become the number three supplier behind Scan Coin ([30-40]%) and Pro coin ([20-30]%). Other competitors include CT Coin ([5-10]%) and Laurel ([5-10]%) with a number of smaller competitors together accounting for a market share of [10-20]%.

63. In light of the above, and in the absence of any concerns on the part of the Parties' customers and competitors contacted in the market investigation, it is concluded that the proposed transaction does not raise serious doubts as to its compatibility with the internal market with regards to coin handling products.

VI. CONCLUSION

64. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Publication in the Official Journal of the European Union No C 161, 07.06.2012, p. 26.

3 Talaris derives approximately [40-60%] of its EEA revenues from sales of cash handling products and [40- 60%] from servicing of its installed base in the eight EEA Member States where it has a direct sales presence (Belgium, France, Germany, Luxembourg, the Netherlands, Portugal, Spain and the United Kingdom). In contrast, GLORY only services automated cash handling products in Belgium, France, Germany and Italy and achieved a […] service turnover of EUR […], equivalent to […]% of its EEA- wide turnover, in 2011. Moreover, Talaris' service turnover related almost exclusively to its own installed base while GLORY only offers services for its own installed base and does not offer maintenance services for third party products. Accordingly, the Parties did not compete for after-sales services and maintenance prior to the notified operation. Consequently, and in light of the fact that market participants have not raised substantiated concerns with respect to after-sales servicing and maintenance, these services are not considered further in this Decision.

4 Case No COMP/M.5248 Carlyle/De La Rue Cash Systems Business, 28.7.2008.

5 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

6 Decision of the European Central Bank of 16 September 2010 on the authenticity and fitness checking and recirculation of euro banknotes (ECB/2010/14), Official Journal L 267, 9 October 2010, p. 1-20; see also Council Regulation (EC) No 44/2009 of 18 December 2008 amending Regulation (EC) No 1338/2001 laying down measures necessary for the protection of the euro against counterfeiting, Official Journal L 17, 22 January 2009, p. 1-3. The common test procedures provide for regular annual testing of the various types of banknote handling machine, as well as additional ad hoc retesting upon invitation, cf. the description of the certification procedure on the ECB's website, http://www.ecb.int/euro/cashhand/recycling/procedure/html/index.en.html (retrieved on 20 June 2012). Test results are published on the ECB website, http://www.ecb.int/euro/cashhand/recycling/ tested/html/index.en.html (retrieved on 20 June 2012).

7 While GLORY sells a range of coin wrappers, Talaris does not sell this product.

8 Case IV/M.050 AT&T/NCR, 18 January 1991, recital 12 and Case IV/JV.22 Fujitsu/Siemens, 30 September 1999, recital 42. This distinction was mentioned but not analysed in further detail in Case IV/M.057 Digital/Kienzle, 22 February 1991, recital 10 and Case IV/M.129 Digital/Philips, 2 September 1991, recital 9.

9 Case No COMP/M.3437 - KKR / VENDEX, 15 June 2004, recital 14.

10 See footnotes 8 and 9 above.

11 GLORY estimates that […] of its sales are to financial institutions while […] are made to cash centres operated by cash-in-transit companies. Its remaining sales are to the retail sector ([…]%) and other customers such as casinos. Talaris estimates that […] of its TCR sales were made to financial institutions. Regarding banknote and coin handling products, […]% and […]% of Talaris' sales were made to financial institutions respectively with the remaining sales going to the retail and gaming sectors. Talaris does not sell its products to cash centres.

12 The Parties' average sales price for TCRs ranges between EUR […] and EUR […]. In contrast, average banknote counters' prices range between EUR […] and EUR […] and average banknote sorters' prices range between EUR […] and EUR […]. The Parties' average prices for coin handling products range between EUR […] and […].

13 Case IV/M.050 – AT&T/NCR, 18 January 1991, recital 13 and Case IV/JV.22 Fujitsu/Siemens, 30 September 1999, recital 48.

14 Commission Notice on the definition of the relevant market for the purposes of Community competition law, OJ C 372, 9.12.1997, p. 5.

15 For example, […] of GLORY’s products are manufactured at its facilities in Japan, China and the Philippines. In Europe, GLORY […]. Talaris manufactures […] of its products through the use of outsourced contractors, primarily based in Asia. In Europe, […].

16 According to the Parties, imports accounted for 62% of customer-operated ATM sales, 54% of TCR sales and 100% of the sales of banknote and coin handling products in the EEA in 2010.

17 According to the Parties, between two and nine different distributors are active in each EEA Member State.

18 According to the Parties, the cost of setting up a new distribution arrangement for an additional product in a jurisdiction where a supplier has an established distributor is [less than 75 000]. Where a supplier does not have a historical or existing relationship with a distributor, the cost of setting up such a distribution network is estimated by the Parties at [less than 150 000]. In both cases, actual costs within this range depend on the product range to be sold and the level of training and travel required.

19 This is confirmed by the Retail Banking Research ("RBR") Report on teller-assist ATMs, which [discusses the significance of potential inhibitors for customers purchasing teller-assist ATMs] p. 20.

20 See footnote 13 above.

21 The Parties' combined market share for all types of automated cash handling products is [5-10]% in the EEA (GLORY: [0-5]%; Talaris: [5-10]%) and [5-10]% in the EU (GLORY: [0-5]%; Talaris: [5-10]%).

22 The Parties' activities overlap specifically in the supply of TCRs to financial institutions as Talaris does not supply TCRs to retailers. Accordingly, only the supply of TCRs to financial institutions will be considered in this Decision.

23 Market shares are based on value. Since the assessment does not change materially if market shares based on value are taken into account, only market shares based on value will be further considered in this Decision.

24 This is illustrated by the fact that GLORY's market share has declined over the past three years from [20-30]% in 2009, while Talaris market share has increased from [20-30]% in 2009.

25 The competitive situation is very similar at the EU level. Competitors' market shares in the EU are [10-20]% for CTS Cashpro, [10-20]% for CIMA and [10-20]% for Wincor Nixdorf.

26 See the company's website at http://cashpro.ctsgroup.it/ (retrieved on 21 June 2012).

27 According to these competitors, for example, TCRs use a "drum" cash recycling technology while ATM- Rs use a "cassette" cash recycling technology.

28 RBR Report "Global Teller Assists Units 2011", p. 40 and 41; see also p. 24 for the global growth rate in sales of […]%.

29 Ibid, p. 2.

30 According to the Parties, the following Asian competitors currently produce and market TCRs in Asia: Hitachi Omron, OKI Electric Industry, GRG Banking and Nautilus Hyosung. Out of these Hitachi, GRG and Nautilus are already active in the sale of other automated cash handling products in the EEA.

31 According to the RBR Report "Global Teller Assists Units 2011", 15 European banks account for […]% of TCRs deployed in the EEA, p. 11.

32 The Parties estimate that 90-95% of the TCR contracts in the EEA are tendered and that this includes all of the significant TCR contracts launched by larger financial institutions in the EEA. According to the Parties, these tenders are increasingly conducted through electronic auctions ("e-auctions") in which suppliers bid via an online portal. The Parties estimate that around 40% of tenders are currently conducted on the basis of e-auctions.

33 Similarly, the RBR Report "Global Teller Assists Units 2011" [discussion of the importance of an existing relationship with a supplier as a vendor selection criterion in the international teller-assist ATM business], p. 23.

34 The banknote handling product segment includes sales to both financial institutions and retail customers as the same products are sold to these customer groups without any need of adaptation or customization. The Parties' combined market share in a potential market for banknote handling products is [20-30]% in the EEA (GLORY: [10-20]%; Talaris: [5-10]%).

35 The competitive situation is very similar at the EU level. Competitors' market shares in the EU are [10-20]% for VIP Buic, [5-10]% for Magner and [5-10]% for Scan Coin with smaller players also accounting for approximately [30-40]% of the EU-wide market.

36 According to the Parties, these suppliers comprise more than 60 smaller companies supplying banknote counters in the EEA.

37 The competitive situation is very similar at the EU level. Competitors' market shares in the EU are [30-40]% for Kisan, [10-20]% for Giesecke & Devrient and [5-10]% for Laurel with smaller players also accounting for approximately [10-20]% of the EU-wide market.

38 Cf. paragraph 32 of the Merger Regulation and paragraph 18 of the Commission's Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings, OJ C 31, 5.2.2004, p. 5.

39 The competitive situation is very similar at the EU level. Competitors' market shares in the EU are [30-40]% for Scan Coin, [10-20]% for Laurel, [5-10]% for Pro coin, [0-5]% for CT Coin and [20-30]% for a number of smaller competitors.

40 There are no substantial differences in market shares at the EU level.