Commission, July 23, 2012, No M.6568

EUROPEAN COMMISSION

Judgment

CISCO SYSTEMS / NDS GROUP

Subject: Case No COMP/M.6568 Cisco/NDS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 18 June 2012, the European Commission received notification of a proposed concentration pursuant to Article 4 of Merger Regulation by which Cisco Systems, Inc. (“Cisco”, USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of NDS Group Limited (“NDS”, UK), by way of purchase of shares. Cisco is hereinafter designated as the "Notifying Party". Cisco and NDS are hereinafter designated as the “parties”.

I. THE PARTIES

2. Cisco is active in the development and sale of networking products for the Internet. It develops a wide range of products and services, including switches used in local and wide area networks, routers, enterprise unified communications, network and content security systems, digital set-top boxes (“STBs”) and digital media technology products.

3. NDS supplies digital technology and services to digital pay-TV service and content providers. It offers solutions for satellite, cable, terrestrial, Internet Protocol television ("IPTV"2), mobile devices and hybrid TV systems. NDS’ services are used to manage subscriber access to pay-TV content and enable the viewer to choose, navigate, store and interact with such content. NDS is currently jointly controlled by Permira Advisers LLP (“Permira”) and News Corporation (“News Corp”), which own 51% and 49% of NDS’ share capital respectively.

II. THE OPERATION AND THE CONCENTRATION

4. On 15 March 2012, Cisco entered into a Share Transfer Agreement pursuant to which it will acquire indirectly, through a set of interlinked transactions, all of the outstanding share capital of NDS from Permira and News Corp. After completion of the notified concentration, Cisco will have sole control over the whole of NDS.

5. The notified operation therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

6. The undertakings concerned had a combined aggregate worldwide turnover of more than EUR 5 000 million3 (Cisco: EUR 31 800 million, NDS: EUR 701 million) in the last financial year. Each of them has an EU-wide turnover in excess of EUR 250 million (Cisco: EUR […] million, NDS: EUR […] million), and both do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

7. The notified operation therefore has an EU dimension according to Article 1(2) of the Merger Regulation.

IV. COMPETITIVE ASSESSMENT

IV.1. Relevant markets

8. The notified operation concerns the pay-TV sector. Cisco and NDS both provide products and solutions to pay-TV service providers.

IV.1.1. Product markets

9. Pay-TV service providers, which in the EEA include satellite, cable, terrestrial and IPTV service providers, rely on a variety of hardware and software solutions ("pay-TV technical services") to securely and reliably deliver digital video content to consumers.

10. In addition to traditional delivery over a managed network4 to a STB connected to a television set, pay-TV service providers increasingly demand solutions that allow video content to be sent to a variety of unmanaged devices i.e. devices not controlled by the pay-TV service provider (personal computers, tablets, smart phones etc), and over a variety of other networks (e.g. the Internet, mobile wireless networks). These solutions allow multi-screen and remote access to the services purchased by subscribers.

11. Pay-TV technical services typically consist of both hardware products (STBs, unified gateways5) and software components.6 Such software components include:

- Conditional access systems ("CAS"). These are needed to limit access to pay-TV services to paying subscribers. CAS traditionally includes software components in the head-end7 as well as software and hardware components in the STB. CAS uses a combination of scrambling, encryption and decryption to prevent unauthorised access to television signals.8 CAS may also either include smart cards containing specialised microprocessors or be deployed in card-less solutions, in which case the microprocessor is one of a number of media processor chips that contains specialised security codes.

- Digital rights management (“DRM”) software. DRM software protects the rights and business rules of licensors for individual items of content. It is used to grant authorised users access: (i) to individual items of paid-for video content; (ii) to downloaded content; (iii) on multiple (in type and number) devices; and (iv) in a way that allows the service provider to control and monitor the usage of the content. It does not, however, result in the encryption of the communication channel itself. Pay-TV service providers use DRM software to supplement their core subscription-based service offering by enabling access control of content on other (unmanaged) devices according to the licensing conditions agreed with content providers. Contrary to CAS, DRM does not require specialised hardware.

- Middleware software. Middleware is a layer of software residing in a STB. It typically controls a number of functions in the STB, including the hard drive file management. It also facilitates the operation of separate application software that provides additional functionality to subscribers and service providers, including electronic programme guides (“EPG”), digital video recording (“DVR”) and other interactive applications.

- Application software. The two main types of application software are DVR, allowing the recording of programmes, and EPG, providing pay-TV users with continuously updated menus that display current and upcoming programming or scheduling information.9

- Content management systems ("CMS"). These systems allow video service providers to edit, modify, and transmit digital media content.

- Home provisioning software ("HPS"). HPS allows pay-TV operators to remotely configure, update, monitor and troubleshoot different customer premises equipment, including STBs.

12. In recent decisions, the Commission has considered whether certain hardware and software components of pay-TV technical services (in particular, CAS, middleware and STBs) constitute separate product markets.

13. In News Corp/Premiere, the Commission found that within the broader category of pay- TV technical services, CAS constitutes a separate product market. It based this consideration on the strategic importance of the choice of CAS for pay-TV service providers and the subsequent expense and technical difficulties for pay-TV service providers when switching CAS. In the same decision, the Commission left open whether the provision of middleware constitutes a separate market.10

14. In News Corp/BSkyB, the Commission noted that, from a supply-side perspective, it is not necessary for providers of pay-TV technical services to offer all three components of a traditional conditional access product (CAS, middleware and STBs) in order to be able to compete and that therefore it could not be excluded that these components constitute three separate product markets. 11

15. The Notifying Party submits that for the purpose of the present case, the question of whether different pay-TV technical services products constitute separate markets can be left open as on any plausible product market definition, the notified transaction does not give rise to competition concerns.

16. A majority of the respondents to the market investigation indicated that the market for pay-TV technical services should be sub-divided into separate markets, based on underlying hardware and software components (STBs, CAS, DRM, middleware software, application software, CMS and HPS).12 First, each of the hardware and software components has a different functionality and customers cannot switch between the different components. Second, from a supply-side perspective, suppliers and the competitive landscape in each of the hardware and software component segments differ. Suppliers of STBs do not typically offer CAS, middleware or application software, whereas suppliers of pay-TV software components do not typically offer STBs. Third, the prices and pricing models of different hardware and software components vary significantly.

17. In line with the considerations set out in past decisions and the responses to the market investigation in this case, the Commission considers that CAS, middleware and STBs constitute separate relevant product markets, due to the lack of sufficient demand-side and supply-side substitutability between the three components of a traditional conditional access product.

18. As for other software components that are part of pay-TV technical services (notably DRM, application software and its sub-segments, DVR and EPG, CMS and HPS), it can be left open for the purposes of the present decision whether they constitute a single or separate product markets since on these segments, the concentration does not raise serious doubts under any plausible product market definition.

IV.1.2. Geographic markets

19. In previous decisions, the Commission has contemplated, but ultimately left open, whether the relevant geographic market for the provision of pay-TV technical services is at least EEA-wide, if not worldwide in scope.13

20. The Notifying Party submits that the relevant geographic market is at least EEA-wide, if not worldwide in scope, although that definition can be left open as on any geographic market definition, the proposed transaction does not give rise to competition concerns.

21. Respondents to the market investigation generally confirmed the Notifying Party's submissions. Several respondents also pointed out the importance of different technical standards between various regions, which necessitates a certain level of customisation of CAS, middleware and STB components.14

22. Since the concentration does not raise serious doubts under any plausible approach on these segments, the exact geographic market definition can be left open for the purposes of this decision.

IV.2. Competitive assessment

IV.2.1. Horizontal assessment

23. The following table provides an estimate of the 2011 market shares of the parties in the various markets/segments:

Table 1: Market shares in 2011

|

|

EEA (in volume) |

Worldwide (in volume) | ||

Cisco | NDS | Cisco | NDS | ||

STB |

| [10-20]% | - | [5-10]% | - |

CAS |

| - | [20-30]% | [0-5]% | [20-30]% |

Middleware |

| - | [20-30]% | [0-5]% | [20-30]% |

DRM |

| - | < 10% | - | < 10% |

Application software | DVR | - | [30-40]% | - | [30-40]% |

EPG | - | [20-30]% | < [0-5]% | [20-30]% | |

CMS |

| [0-5]% | - | < 15% | - |

HPS |

| < 5% | < 10% | < 5% | < 5% |

Source: Screen Digest 2010, Infonetics 2012 and parties.

IV.2.1.1. STB, CAS and middleware

24. Within the EEA, the activities of the parties do not overlap in the STB, CAS and middleware markets as Cisco is not active in the sale of CAS and middleware and NDS does not manufacture or sell STBs.

25. At worldwide level, the activities of the parties overlap in the CAS and middleware markets and the merged entity will become the market leader in these markets (2011 market shares of [20-30]% in CAS and [20-30]% in middleware).

26. However, this overlap between the worldwide activities of the parties on the worldwide CAS and middleware markets does not give rise to serious doubts as to the compatibility of the concentration with the internal market.

27. First, the increments in market shares resulting from the transaction in both the worldwide market for CAS and the worldwide market for middleware are limited to [0- 5]%.

28. Second, respondents to the market investigation indicated that a number of competitors will continue to compete with the merged entity in both worldwide markets.15 The Nagra/Kudelski group ([10-20]% market share in 2011), Motorola Mobility (now owned by Google, [10-20]%), Irdeto ([10-20]%) and Conax ([5-10]%) are competitors in CAS at worldwide level while OpenTV/Kudelski group ([10-20]%) and TVWorks ([10-20]%) are competitors in middleware at worldwide level. There are also a number of other competitors with smaller worldwide market shares, including Microsoft ([0-5]%) and Irdeto ([0-5]%), as well as new entrants in the past five years16 including Wyplay, Ericsson and SoftAtHome.

29. Third, respondents to the market investigation indicated that Cisco and NDS are not particularly close competitors in CAS and middleware.17

30. For the above reasons, the Commission considers that the notified transaction does not raise serious doubts as to its compatibility with the internal market regarding both the EEA and worldwide CAS and middleware markets.

IV.2.1.2. Other pay-TV technical services software products (i) DRM and application software

31. Within the EEA, Cisco is not active in the DRM and application software (EPG and DVR) markets/segments.

32. At worldwide level, only NDS is active in DRM. As for application software, NDS has a worldwide market share of [20-30]% for EPG software and [30-40]% for DVR software,18 while Cisco has a share of less than 1% for EPG software and no market share for DVR software.19

33. Given the absence of horizontal overlap between the activities of the parties in DRM and the limited horizontal overlap of the activities of the parties in the worldwide markets/segments for application software/EPG/DVR, the Commission considers that the notified transaction does not raise serious doubts as to its compatibility with the internal market regarding the EEA and worldwide markets/segments for both DRM and application software/EPG/DVR.

(ii) CMS and HPS

34. There are limited horizontal overlaps between the activities of the parties in the EEA and worldwide markets/segments for CMS and HPS.

35. In CMS, the Notifying Party estimates that the combined 2011 market share of the parties was below [0-5]% in the EEA (Cisco [0-5]%, NDS [0-5]%)20 and below [10- 20]% worldwide.

36. Similarly, in HPS, the Notifying Party estimates the combined 2011 market share of the parties was below 15% in the EEA and below 10% worldwide (Cisco below 5%, NDS below 5%). Moreover, the overlap within the EEA concerns products that are not close competitors given that Cisco's sales are currently limited to its product “BAC for Cable” which does not use the TR-069 standard, whereas NDS' software Panorama does use this standard.

37. Given these limited horizontal overlaps, the Commission considers that the notified transaction does not raise serious doubts as to its compatibility with the internal market regarding the EEA and worldwide markets/segments in both CMS and HPS.

(iii) Conclusion on other pay-TV technical services software products

38. Given that the proposed transaction does not result in any significant horizontal overlaps in any of the sub-segments of other pay-TV technical services software products, the Commission considers that the notified transaction does not raise serious doubts as to its compatibility with the internal market in relation to any of these sub-segments.

IV.2.2. Non-horizontal assessment

IV.2.2.1. Relationship between markets/segments

39. NDS is active in the markets for CAS and middleware and the markets/segments for DRM, application software and HPS. These neighbouring markets/segments are closely related markets/segments to the STB market in which Cisco is active.

40. The individual elements of pay-TV technical services infrastructures sold to EEA pay- TV service providers are generally compatible with each other and can be combined under a “mix and match” approach. While the components do not display plug-and-play compatibility, they are commonly made compatible by means of product integration. The scope of the integration work that is required depends not only on the product specifications of the STBs, CAS, middleware and/or application software of each supplier, but also on the existing technical environment and the features that a pay-TV service provider chooses to include.

41. In the EEA, pay-TV service providers mostly source the products they need for their pay-TV technical services infrastructure directly from suppliers of STBs, CAS, middleware, application software, and HPS. As a result, no payments are typically made between pay-TV technical service providers of the various products, subject to the following two exceptions.

42. First, when a STB supplier integrates a CAS from a CAS supplier, it must submit the integrated result for certification by the CAS supplier. This ensures that the CAS functions properly with the STB model in question as a CAS supplier may be required to offer contractual assurances to pay-TV operators, which may be backed with financial commitments, that the CAS will withstand “cracking” efforts. A CAS provider typically charges a one-time payment for certifying its CAS ("integration fee"). This integration fee can range between USD […] and USD […] depending on the complexity of the integration project and number of integrated components (CAS, middleware etc). The amount charged does not depend on the number of STBs ordered by a pay-TV service provider.

43. Second, for a CAS to function, a STB supplier must install on its STBs specific software provided by the CAS supplier. In most instances,21 NDS requests from a STB supplier a

software license fee ("verifier fee") for its CAS software in addition to the CAS-related fees charged directly to pay-TV service providers. This verifier fee is calculated per STB unit and may vary, depending on the volume of cumulatively deployed STBs. The verifier license fees are usually specified in agreements that NDS signs with each STB vendor of a particular pay-TV service provider.

44. The Notifying Party submits that the verifier fee is the same for any STB provider (independent of model or manufacturer) used by a particular pay-TV service provider. NDS does not charge similar fees to STB providers with regard to its middleware, its application software (EPG and DVR) and its HPS.

45. The Notifying Party also submits that while in most instances, verifier fees are paid to software providers by STB providers, STB providers then cross-charge pay-TV service providers for such fees. The market investigation confirmed that this is typically the case, although some pay-TV service providers prefer to directly negotiate with, and pay these fees to, software providers.22

46. Against this backdrop, the Commission considers that, given that STB providers and providers of pay-TV technical services software products are not in a supplier/retailer relationship but rather supply the same customers (pay-TV service providers), the relationship between the CAS and STB markets is better viewed as conglomerate in nature.23

47. In any event, the Commission’s assessment of the possible non-horizontal issues raised by the proposed transaction is the same, regardless of whether the relationship between the activities of Cisco and NDS is qualified as vertical or conglomerate.

IV.2.2.2. Market shares

48. According to the Non-Horizontal Merger Guidelines, vertical and conglomerate mergers are unlikely to pose a threat to effective competition where the post-merger market share of the new entity in each of the markets concerned is below 30%.24

49. In this case, the post-transaction market share of the merged entity in each of the potential markets concerned is below 30%, except in the market/sub-segment of DVR software, which is part of the broader market/segment of application software. In 2011, NDS accounted for respectively [30-40]% and [30-40]% of the EEA and worldwide markets for DVR software.

50. Notwithstanding these market shares, the Commission considers that the transaction does not raise serious doubts with respect to the DVR segment/market.

51. First, DVR software is not indispensable for STBs, as can be seen by the fact that DVR software is not present in the majority of STBs.25

52. Second, while NDS does not sell its DVR software product, xTV, separately from its CAS, a number of competitors offer DVR software on a stand-alone basis (not linked to their CAS) and mixing-and-matching is possible. These suppliers include Nagra (Kudelski), with an estimated market share of 30-35% in the EEA, and 15-30% worldwide, and TiVo, with an estimated market share of up to 5% in the EEA and 5- 10% worldwide. STB manufacturers including Netgem, ADB, Kaon and Pace also offer DVR software. As a result, post-merger, a number of DVR suppliers that are either not integrated or integrated with other pay-TV technical services products26 will continue to be active in the DVR market/segment.

53. Third, respondents to the market investigation did not raise any concerns with respect to DVR software or application software.

IV.2.2.3. Foreclosure concerns with respect to the merged entity's position in CAS and middleware

54. Respondents to the market investigation raised three concerns resulting from the relationship between the CAS and middleware markets in which NDS is active and the STB market in which Cisco is active.

55. The first issue raised concerns whether the merged entity may restrict the compatibility of NDS’ software products for STBs with the products sold by STB suppliers that compete with Cisco. The second issue raised concerns whether the merged entity may raise the costs of STB suppliers that compete with Cisco by charging them higher license fees for NDS’ software (fees that are then cross-charged to pay-TV service providers). The third issue raised concerns the question whether the merged entity may provide its customers with “bundled”, pre-integrated offerings at a particularly attractive price that competitors will not be able to match, thereby marginalising those competitors that supply only one or some of the components.

56. As noted in recital 48 above, it is unlikely that a conglomerate merger will pose a threat to effective competition in a situation where the post-merger market share of the merged entity in the markets concerned is below 30%.

57. Notwithstanding the fact that the post-transaction market shares of the merged entity are below 30% in the CAS, middleware and STB markets, the Commission has analysed the three conglomerate concerns raised by respondents to the market investigation with respect to the framework set out in the Non-Horizontal Merger Guidelines, namely whether: (i) the merged entity will have the ability to foreclose its rivals; (ii) the merged entity will have the economic incentives to do so; and (iii) a foreclosure strategy will have a significant detrimental effect on competition, thus causing harm to consumers.27

(i) Assessment of a foreclosure strategy of STB competitors based on degraded compatibility and/or the raising of the costs of rivals

58. Certain STB suppliers that responded to the market investigation claimed that, post- transaction, the merged entity will have the ability and incentive: (i) to restrict the compatibility of STB suppliers with NDS' CAS and/or middleware; (ii) to delay the provision of technical information relating to new NDS software versions/features to competing STBs; (iii) to slow down certification of competing STBs; and/or (iv) to raise the costs of competing STB suppliers by charging higher software license fees for NDS’ software. By using one or a combination of these strategies, the merged entity – as a major pay-TV CAS and/or middleware provider - will be able to "steer" pay-TV operators into purchasing Cisco's STBs. Moreover, the merged entity will not risk losing business with regard to CAS and/or middleware, as switching costs for pay-TV service providers are high.

Ability of the merged entity to foreclose

The Notifying Party's view

59. The Notifying Party submits, first, that the merged entity will lack the ability to foreclose rival STB suppliers because its 2011 share (by volume) of the EEA-wide and worldwide CAS markets was respectively only [20-30]% and [20-30]%. The same applies with regard to the middleware market, where the merged entity had a 2011 EEA-wide and worldwide share (by volume) of respectively [20-30]% and [20-30]%. As for the STB market, Cisco's 2011 share was [10-20]% in the EEA and [5-10]% worldwide.

60. Second, the Notifying Party notes that no significant integration work is required to achieve compatibility between middleware and STBs in the case of NDS' software.28

61. Third, the Notifying Party notes that pay-TV operators will not tolerate any foreclosure strategy and enjoy countervailing buyer power that will allow them to react to interoperability issues or price increases. For instance, NDS' top three customers account for more than […] of its revenues.

62. Fourth, with respect to pay-TV providers that already use NDS' CAS and/or middleware, the Notifying Party contends that the merged entity will lack the ability to foreclose as a CAS supplier is normally contractually obliged to facilitate and support the integration of different STB suppliers over time. In that regard, NDS' CAS agreements with pay-TV operators (accounting for [the vast majority] of NDS’ EEA business) contain contractual clauses that require NDS to facilitate integration of STBs chosen by pay-TV service providers. Given that pay-TV operators, have, and will continue to have, a strong preference for the “mixing and matching” of different suppliers within the STB stack, these service providers can be expected to rigorously enforce such contractual provisions.

63. Fifth, with respect to the possibility for pay-TV service providers to switch pay-TV technical service suppliers, in particular with respect to CAS, the Notifying Party acknowledges that the time and expense associated with replacing CAS (once a given CAS has been implemented) may discourage pay-TV service operators from switching CAS vendors. Such switching can take six to twelve months, creates a financial risk that certain customers may change pay-TV service providers in the context of the change of the smart card (risk of "churn") and will lead to a number of costs, including the shipping of smart cards and/or the replacement of older STBs that do support the new CAS.29

64. At the same time, the Notifying Party submits that, in order to avoid the risk of increased churn while enabling the possible switching of CAS at least with respect to newly deployed STBs, pay-TV service providers that have implemented a Digital Video Broadcasting ("DVB")-compliant version of CAS (which includes all EEA pay-TV service providers) have the option to "cap" the usage of their existing CAS and run in parallel a new CAS through a technique called “Simulcrypt”. However, the Notifying Party recognises that pay-TV service providers generally do not view Simulcrypt as a long-term solution due both to significant additional costs of simultaneously running two CAS systems and the fact that Simulcrypt exposes both simultaneously running CAS systems to the security vulnerabilities of each of those CAS.

Respondents to the market investigation

65. Respondents to the market investigation made a number of points.

66. First, for a CAS or middleware provider to have the ability to "steer" pay-TV operators into purchasing certain STBs, that provider needs to play a central role in the selection process for new STB suppliers (prior to signing an agreement). However, all but one pay-TV operator indicated that they have never selected a different STB supplier then initially considered because of advice provided by their CAS and/or middleware provider.30

67. Second, a large majority of pay-TV service providers stated that their chosen CAS and/or middleware providers are contractually required to undertake all necessary technical integration work to achieve compatibility of software with the STB models chosen by them.31

68. Third, respondents to the market investigation indicated that “mixing-and-matching” of pay-TV technical services products from different suppliers constitutes a characteristic feature in the EEA, where pay-TV technical service providers often purchase pay-TV technical services products from different suppliers. In particular, a large majority of pay-TV operators indicated that they prefer, and will continue to prefer in the future, to purchase the various elements of a STB stack (STBs, CAS, DRM, middleware and application software) from different suppliers.32

69. Fourth, several respondents to the market investigation, including a STB provider that raised conglomerate concerns, noted that while some smaller pay-TV service providers may prefer a pre-integrated offer due to faster time to market and potential cost advantages, the dangers associated with a closed ecosystem and greater vendor lock-in mean that larger pay-TV service providers will continue to prefer an open mix-and match approach in order to maintain their bargaining power.

70. Fifth, a large majority of pay-TV operators considered that, in order to be able to effectively compete in the market for pay-TV technical services in the future, a provider of pay-TV technical services does not need to offer a complete and integrated technical services solution.33

71. Sixth, regarding the ability of the merged entity to raise prices, pay-TV service providers responding to the market investigation noted that the integration and verifier fees cannot be changed during the contractual period.34 In addition, regarding a hypothetical small but substantial non-transitory increase in price (“SSNIP”) after the expiration of contractual terms, pay-TV service providers noted that they could negotiate with the software provider and seek to decrease any increase in fees payable indirectly or directly by them.35

72. Seventh, with respect to the possibility of switching CAS, a large majority of pay-TV service providers recognised that replacing the CAS is complex, disruptive, needs a lot of time and is not really an option even in the case of a SSNIP.36 The few responding pay-TV service providers that have actually switched CAS provider in the past 5 years confirmed that the time needed was 9 to 12 months.37

73. At the same time, a number of large pay-TV service providers, as well as some pay-TV technical service providers noted the possibility to run two CAS via Simulcrypt and some pay-TV service providers stated that they already do run two CAS via Simulcrypt, even though this adds substantial costs. In addition, some pay-TV operators stated that, in the event of a SSNIP, they would choose a switching strategy of "capping" whereby they would keep the existing CAS for legacy STBs, add Simulcrypt with a new CAS (and a new generation of compatible STBs) and reduce STBs with the legacy CAS over time (thereby reducing the CAS-related license fees38 payable to the legacy CAS provider).

74. Finally, regarding the replacement of middleware in STBs, on the one hand, roughly half of the pay-TV service providers that responded to the market investigation indicated that while complex and needing some time, such switching would be a real option in case of a SSNIP,39 particularly with respect to the launch of a new generation of STBs.40 Indeed, a number of pay-TV service providers indicated that they have switched middleware in the past 5 years and that the time needed to complete such a switch varied from anywhere between 6 months and 2 years.41 On the other hand, a majority of pay-TV

technical services providers that responded to the market investigation did not view the switching of middleware as a realistic option for pay-TV service providers in the event of a SSNIP.42

The Commission's assessment

75. The Commission considers that, for a number of reasons, the merged entity will not have the ability to foreclose rival STB suppliers from supplying pay-TV service providers.

76. First, it is unlikely that the merged entity will pose a threat to effective competition as its post-transaction market shares in the CAS, middleware and STB markets are below 30%.

77. Second, if a pay-TV service provider would consider starting to use NDS’ CAS or middleware and would be concerned that the merged entity would not facilitate the integration of STBs of different suppliers with the merged entity's CAS or middleware and/or raise fees indirectly payable by them, it would have a number options. It could refrain from purchasing CAS or middleware from the merged entity and instead purchase a product from a competing supplier. It could also attempt to negotiate the appropriate contractual safeguards to ensure that the merged entity will facilitate integration (as a number of pay-TV operators have successfully done with NDS).

78. Third, in a situation where a pay-TV operator uses NDS’ CAS or middleware and a specific STB model is already deployed on that system, notwithstanding the fact that it may be technically possible for the merged entity to limit or restrict the compatibility of STBs with CAS and middleware, and to increase the integration and verifier fees if contractual terms expire, the ability of the merged entity to foreclose will be limited in two ways: (i) it will be limited to the market segment where the pay-TV service providers already use NDS' CAS and/or middleware; and (ii) it will be limited to new STBs, given that the merged entity has no technical or commercial means either to affect already deployed STBs of that model or to prevent a pay-TV service provider from adding additional STBs of that specific model to its system.

79. Fourth, while switching to a competing CAS solution is a major decision and switching costs for CAS and (to a lesser extent) middleware are relatively high once a CAS and middleware is integrated with STBs and are deployed at the premises of end-consumers, the ability of the merged entity to foreclose is likely to be reduced for newly deployed STBs for several reasons: (i) as confirmed by several examples, pay-TV service providers are likely to choose the "capping" option and deploy a parallel CAS for newly deployed STBs; (ii) it is relatively straightforward for pay-TV service providers to deploy a new middleware system for new STBs. Pay-TV service providers will therefore be able to threaten both their CAS providers with switching with respect to new STBs that they will deploy, and their middleware provider (given less technical complexity and cost). They will also be able to threaten to limit future sales to both groups of providers (since the majority of software costs are volume-based).43

80. Fifth, while a majority of pay-TV technical services providers that responded to the market investigation indicated that they did not consider the switching of middleware as a realistic option for pay-TV operators in the event of a SSNIP, these replies are based to a large extent on the fact that these respondents considered that middleware would need to be replaced on STBs already deployed by a pay-TV service provider at the premises of end customers. However, as explained in paragraph 74 above, a majority of pay-TV service providers that responded to the market investigation clarified that switching is comparatively straightforward with respect to newly deployed STBs as a number of operational and technical risks can be discarded. Since a pay-TV service provider launches a new generation of STBs every two to three years, it is therefore possible for NDS' middleware customers to switch to alternative middleware within this timeframe, something which is likely to constitute a sufficient constraint on the merged entity.

81. Finally, the vast majority of pay-TV service providers did not express any concern with respect to the transaction.

Incentives of the merged entity to foreclose

The Notifying Party's view

82. The Notifying Party submits that in order to maximise its chances of winning a contract, a CAS or middleware supplier has a strong incentive to ensure compatibility with a wide range of STBs, so as to give pay-TV service providers the maximum degree of flexibility in relation to their choice of STBs. For example, while certain pay-TV service providers source both CAS and middleware from NDS, others source CAS from NDS and middleware from a different supplier, thereby requiring NDS to achieve compatibility with that specific middleware product. The Notifying Party is not aware of any supplier that has, or would, systematically restrict the compatibility of its STBs, middleware, application software and CAS.44 Currently, NDS’ CAS is compatible with more than 200 different STB models made by over 50 STB manufacturers.

83. Furthermore, to the extent that switching CAS may be difficult, thereby reducing the likelihood that NDS may lose CAS business from pay-TV service providers, the Notifying Party submits that the merged entity will still not have an incentive to foreclose because such a strategy will damage its reputation, thus hampering its chances of securing new sales from other pay-TV service providers (given their widespread preference for a non-integrated model).

Respondents to the market investigation

84. A large majority of responding pay-TV operators agreed with the Notifying Party’s claim that CAS and/or middleware software providers have a strong incentive to achieve compatibility with a wide number of STB products from different suppliers in order give pay-TV service providers the maximum degree of flexibility in relation to their choice of STBs.45

85. In addition, one large pay-TV service provider noted that major pay-TV service providers calculate the overall cost of ownership (including lifecycle costs associated with the product, the supply chain and refurbishments) in relation to each of the pay-TV technical services products supplied by vendors. As a result, a low-cost CAS provider that partners up with only one or two high cost STB vendors is likely to have a higher overall lifecycle cost of ownership than a medium-cost CAS provider that partners up with more STB vendors (as the more STB vendors there are competing for a given CAS account, the more this is likely to increase competition and result in lower prices for STBs). It is therefore in the interests of CAS and middleware suppliers to ensure compatibility with a high number of STB products.

The Commission's assessment

86. For the reasons indicated by the Notifying Party, and supported by pay-TV service providers that responded to the market investigation, the Commission considers it unlikely that the merged entity will have the incentive to degrade the compatibility of NDS’ pay-TV software with STBs other than those of Cisco's, or to raise rivals' costs.

Effect on competition of the foreclosure strategy

The Notifying Party's view

87. The Notifying Party submits that even if it would have the ability and incentive to foreclose STB competitors by degrading compatibility or raising the costs of its rivals, such a strategy would not have a detrimental effect on competition.

88. In support of its submission, the Notifying Party provided data showing that in 2011, sales by competing STB suppliers to pay-TV customers of STBs using NDS’ CAS represented only [less than 10]% of total EMEA sales.

89. In addition, based on 2011 shipment figures, the EEA market share that would be subject to foreclosure would amount to only [10-20]%.46 The main reason for this limited share that would be subject to foreclosure, when compared to NDS' higher market share in CAS, is that NDS' two largest EEA customers are BskyB and Sky Italia, both satellite pay-TV operators that self-supply STBs from Amstrad, which itself is not active in the merchant market. Accordingly, even if BSkyB and Sky Italia were to source STBs from Cisco in the future (which is unlikely, given that Amstrad is a BSkyB subsidiary), this would not affect any other market supplier of STBs. Accordingly, sales to BSkyB and Sky Italia should be disregarded when assessing how any foreclosure strategy by the merged entity may affect other STB suppliers.

90. The Notifying Party further submits that pay-TV service providers that follow a dual- sourcing strategy for the purchase of their STB requirements may generally try to evenly split their orders between suppliers, provided they are sourcing comparable STB models from each of their supplier. However, commercial or technical considerations may, in practice, lead certain pay-TV service providers to favour one supplier who may be awarded a greater share of sales.

Respondents to the market investigation

91. Respondents to the market investigation indicated that a majority of pay-TV service providers pursue a dual- or multi-sourcing strategy when they purchase STBs in order to ensure security of supply and, given that switching to another STB product would take some time, to gain commercial leverage over their STB suppliers.47

92. While there is no uniformity regarding how STB purchases are split amongst STB suppliers, a number of pay-TV service providers indicated that they aim for a 50%/50% split, market conditions permitting.

The Commission's assessment

93. The Commission considers that the effects of any foreclosure strategy by the merged entity are likely to be limited.

94. First, as indicated by the Notifying Party, only a limited market share in the EEA would be subject to potential foreclosure.

95. Second, as indicated by respondents to the market investigation, the effects of such potential foreclosure would be reduced, given the preference of many pay-TV service providers for dual- and/or multi-sourcing of STBs.

Conclusion

96. For the above mentioned reasons, the Commission concludes that the merged entity is unlikely to have the ability and incentive to foreclose rival STB suppliers by degrading the compatibility of its CAS and/or middleware with their STBs and/or raising their costs. The foreseeable effects of such a strategy would also, in any event, likely be limited. (ii) Assessment of a foreclosure strategy of STB and pay-TV software competitors based on mixed bundling

97. The prevailing business models used by pay-TV service providers to currently procure software that is loaded on to STBs can be characterised as either bundled software or individual component deals.

98. In the case of bundled software deals, a number of software components are licensed to pay-TV service providers for a per-STB license fee, plus an annual maintenance fee.

99. In the case of individual component deals, the two typical business models are as follows:

a. for CAS: the sale of the smart card, the licensing of the software that is deployed in the STB, and an annual per-subscriber security maintenance fee;

b. for middleware, EPG and DVR: a one-off per STB license fee and one-off license fees for the various head-end software components.

100. Certain STB suppliers and certain pay-TV software suppliers that responded to the market investigation claimed that the merged entity will be able to offer pay-TV customers a bundle consisting of Cisco’s STBs and NDS’ pay-TV software (CAS, middleware, and other software) (“the STB bundling strategy”). The merged entity will be able to offer this bundle at a price that competitors will not be able to match, thereby marginalising non-integrated players and single-product companies.

101. A very limited number of respondents to the market investigation also expressed concerns about the ability and incentives of the merged entity to offer pay-TV service providers, that are also customers of network equipment, with a bundle consisting of Cisco's network equipment (e.g. routers, switches) and Cisco's STBs and NDS’ pay- TV software (“the network equipment bundling strategy”).

102. In response to these latter concerns, the Notifying Party puts forward four main arguments. First, except for limited sales expenses (travel costs, costs of communicating with customers, minor efficiencies relating to order placement, order processing and follow-up, invoicing), no other cost savings would arise as a result of a network equipment bundling strategy.48 Second, Cisco has never previously bundled or tied products in relation to the sale of either its STBs or of its routers, switches and other network equipment. Third, satellite pay-TV service providers, which account for a large part of NDS' sales, purchase network equipment only to a very limited extent. Fourth, procurement and sales of STBs and network equipment are handled by different units within both operators of pay-TV services and Cisco, and follow different procurement cycles.

103. The Commission considers that the concerns raised regarding the network equipment bundling strategy can be dismissed at the outset as the network equipment market(s) are not closely related to the pay-TV technical services markets and because the Notifying Party's arguments put forward in response to these concerns are convincing.

104. The Commission has therefore focused its assessment on a possible STB bundling strategy by the merged entity.

Ability of the merged entity to foreclose

The Notifying Party's view

105. The Notifying Party submits that it will not have the ability to foreclose its competitors through a STB bundling strategy.

106. First, it argues that the transaction will not create any meaningful scope for cost synergies with regard to the supply of STBs and pay-TV software,49 as the only cost element specifically relating to the relationship between STBs and pay-TV software is the one-off integration fee of a new STB model that pay-TV service providers directly or indirectly pay for the integration of a new STB model with the CAS.

107. Second, the Notifying Party submits that if the merged entity were to waive this integration fee, it would not be able to recover the real cost that the CAS vendor incurs to assure its customers (which in turn assume contractual obligations to protect content owners' content using state-of-the-art service protection) that the CAS will be secure on a particular STB model.

108. Third, a number of competing STB suppliers is already, today, able to match the merged entity’s product offering and offer a complete stack. Such suppliers notably include Pace50 and Motorola Mobility (recently acquired by Google).51 As for STB suppliers which are currently unable to match the merged entity’s product offering, several lack only one component of a complete stack and have numerous alternatives available to source the element that they lack.

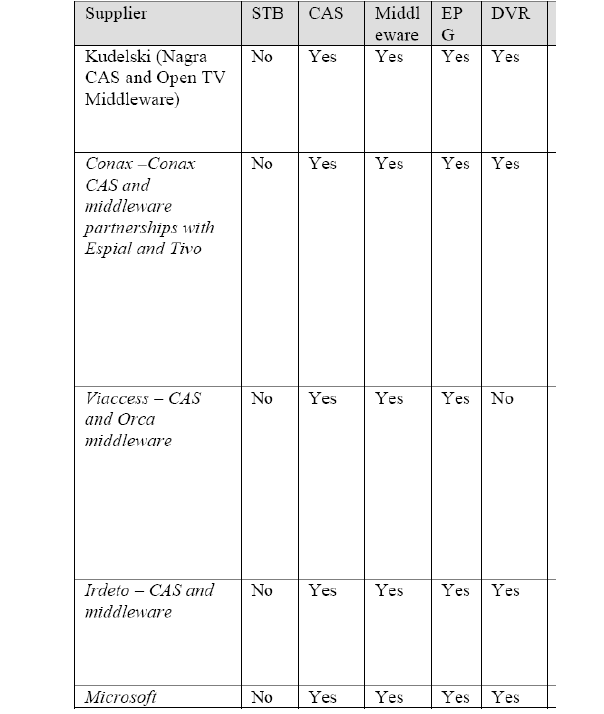

Table 2: CAS vendors offering a wide range of STB stack options

Source: Notifying party.

Respondents to the market investigation

109. Respondents to the market investigation confirmed that Motorola/Google and Pace are able to offer a product offering broadly similar to that of the merged entity. Respondents also mentioned Nagra (Kudelski), Microsoft, Ericsson, Huawei, and Technicolor, albeit that the latter three companies currently lack a CAS product.52

The Commission's assessment

110. The Commission considers that there are a number of reasons why the merged entity will not have the ability to foreclose competitors via a STB bundling strategy.

111. First, it is unlikely that the merged entity will pose a threat to effective competition as its post-transaction market shares in the CAS, middleware and STB markets are below 30%.

112. Second, sufficient competitors already have a broad offering of pay-TV technical services and will thus be able to adopt effective and timely counter-strategies by combining their offers in order to defeat any bundled offer by the merged entity.53

Incentives of the merged entity to foreclose

The Notifying Party's view

113. The Notifying Party submits, first, that it will not be rational for Cisco to discount the price of NDS’ CAS, middleware or DRM in order to secure additional STB sales, as Cisco’s margin on the sale of STBs is lower than NDS’ estimated margin on the sale of software products.

114. Second, if the merged entity were to decrease the price of NDS’ CAS, middleware or DRM so as to entice a customer to purchase STBs from Cisco, the merged entity will have no possibility to subsequently increase that price in future, should the customer subsequently choose a non-Cisco STB when it launches its next generation of STBs.

115. Third, the margins Cisco achieves on STB sales are in decline and Cisco has limited scope to further reduce costs, because it has outsourced the entire production of STBs to third parties. Accordingly, there is no meaningful possibility for Cisco to further discount the price of STBs without incurring losses.

Respondents to the market investigation

116. Respondents to the market investigation were silent with respect to the Notifying Party's arguments. They also did not raise any additional points.

The Commission's assessment

117. The Commission considers that the arguments put forward by the Notifying Party are convincing and that the merged entity is likely to lack the incentive to engage in foreclosure via the STB bundling strategy. In particular, an analysis of internal Cisco documents concerning the future business plan for the merged pay-TV technical services business confirms that Cisco’s margin on the sale of STBs (approximately […]%) is lower than NDS’ estimated margin on the sale of software products (approximately […]%).54

Effect on competition of the STB bundling strategy

The Notifying Party's view

118. The Notifying Party submits that even if it would have the ability and incentive to foreclose competition via a STB bundling strategy, the effect of such a strategy on the STB market would be insignificant. This is because even if the merged entity were to waive the integration fee, this would have only a small impact on the overall cost for Cisco’s STBs (1% or less of the total STB hardware cost in small scale pay-TV systems).

Respondents to the market investigation

119. Respondents to the market investigation indicated that pre-integrated pay-TV technical services solutions comprising STB and pay-TV software have a number of advantages, including lower transaction costs due to a single point of contact, smoothness of technical integration, lower technical risks, clearer responsibilities for, and tracking of, technical failures, speed of deployment, and potentially reduced costs (at least initially).

120. In addition, a STB supplier and a software supplier, both which had raised the concern regarding a STB bundling strategy by the merged entity, claimed that for a “greenfield” pay-TV provider with no existing pay-TV infrastructure, a pre-integrated solution of STBs and pay-TV software would be of higher quality, be cheaper, involve less risk concerning integration and be faster to market.55

121. Finally, a limited number of respondents to the market investigation noted that since, post transaction, NDS will no longer be affiliated with the News Corp group of companies, this will make it more likely that NDS' competitors will be able to win business from NDS’ two largest customers, Sky Italia and BskyB.

The Commission's assessment

122. The Commission considers that the foreseeable effects of the STB bundling strategy are likely to be limited. This is because few, if any, greenfield services are expected to be launched in the next few years in the EEA (see footnote 55 above). As a result, it is unlikely that any EEA pay-TV service provider will be interested in purchasing a pre- integrated product. Instead, EEA pay-TV service providers are likely to continue to upgrade individual components within their STB stack.

123. In addition, as indicated by some of the respondents to the market investigation, a STB bundling strategy, if it meets real demand, may actually lead to efficiencies. Coupled with the lack of significant market power of the merged entity, the effect of a STB bundling strategy by the merged entity may therefore actually even have pro- competitive effects.

Conclusion

124. For the above mentioned reasons, the Commission considers that the merged entity is unlikely to have the ability and incentives to foreclose rival STB suppliers and rival pay-TV software suppliers via a mixed bundling strategy. In addition, the foreseeable effects of such strategy would also, in any event, likely be limited.

V. CONCLUSION

125. For the above reasons, the Commission considers that the notified operation does not raise serious doubts as to its compatibility with the internal market.

126. It has therefore decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 IPTV is a system through which television services are delivered using the internet protocol suite over a packet-switched network such as the Internet.

3 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

4 The network is called "managed" because the service provider controls the backbone, core and delivery, therefore guaranteeing digital rights integrity to content owners and quality of service to content aggregators and subscribers. By contrast, the Internet is an example of an "unmanaged" network.

5 Unified gateways (not to be confused with NDS' next-generation high-end middleware software product called Unified Gateway) are emerging hardware devices that combine in the same device the functionalities of STBs with those of a broadband gateway, broadband modem, router and/or wireless access point. The Notifying Party submits that most STB suppliers are currently developing unified gateways and that, over time, unified gateways are expected to displace high-end STBs in the more developed customer regions. However, as in the EEA, they are only beginning to be deployed by a limited number of pay-TV service providers, they will not be considered further by this decision.

6 Certain integration services are also required when a given pay-TV technical services software or hardware product is integrated with an existing or new pay-TV technical services product from another supplier. The Notifying Party submits that these services are provided either by a supplier of software and hardware products, a third party or the pay-TV service provider’s internal IT staff. As Cisco and NDS do not offer integration services separately from the sale of pay-TV technical services products, these integration services will not be considered further by this decision.

7 In this decision, the term “head-end” refers to the location at which a pay-TV service provider receives video content from content providers (cable programmers, broadcast networks or stations) and processes, secures, and delivers that content over a pay-TV service provider’s network.

8 The data stream is scrambled at the head-end with a secret, automatically generated key - the authorisation code - that normally changes several times per minute. Encryption is used to protect the authorisation code during transmission from the service provider to the subscriber’s STB. Once it is confirmed that the authorisation code is valid, the secure embedded microprocessor or the smart card unscrambles the data and returns it to the receiver. If the authorisation code is invalid, corrupted or otherwise unacceptable, the content remains scrambled. The authorisation is sent to the STB in the form of a specific message to each device, as identified by the smart card or embedded secure microprocessor.

9 Other types of application software include gaming software and software enabling the viewing of sporting events from different camera angles.

10 Case COMP/M.5121 - News Corp/Premiere, decision of 25 June 2008, recital 46.

11 Case COMP/M.5932 News Corp/BskyB, decision of 21 December 2010, recital 112. In past decisions, the Commission has also contemplated, but ultimately left open, whether STBs constitute a separate relevant product market. See Case M.1978 Telecom Italia/News Television/Stream, decision of 29 June 2000, recital 17; and Case COMP/M.4063 Cisco/Scientific Atlanta, decision of 22 February 2006, recitals 10 to 20.

12 See responses to questions 8 and 9 of the questionnaire to pay-TV service providers of 19 June 2012, responses to questions 7 and 8 of the questionnaire to STB providers of 19 June 2012 and responses to questions 7 and 8 of the questionnaire to pay-TV software providers of 19 June 2012

13 Case COMP/M.5121 News Corp/Premiere, decision of 25 June 2008, recitals 47-48; Case COMP/M.5932 News Corp/BSkyB, decision of 21 December 2010, recital 113.

14 See responses to questions 15, 16, 17, and 18 of the questionnaire to pay-TV service providers of 19 June 2012, responses to questions 14, 15, 16, and 17 of the questionnaire to STB providers of 19 June 2012 and responses to questions 14, 15, 16, and 17 of the questionnaire to pay-TV software providers of 19 June 2012.

15 See responses to question 55 of the questionnaire to pay-TV service providers of 19 June 2012, responses to question 42 of the questionnaire to STB providers of 19 June 2012 and responses to question 43 of the questionnaire to pay-TV software providers of 19 June 2012.

16 See responses to question 35 of the questionnaire to pay-TV service providers of 19 June 2012, responses to question 29 of the questionnaire to STB providers of 19 June 2012 and responses to question 29 of the questionnaire to pay-TV software providers of 19 June 2012.

17 See responses to questions 29 to 32 of the questionnaire to pay-TV service providers of 19 June 2012, responses to questions 23 to 26 of the questionnaire to STB providers of 19 June 2012 and responses to questions 23 to 26 of the questionnaire to pay-TV software providers of 19 June 2012.

18 As noted in recital 11, EPG and DVR are by far the most commonly deployed applications. NDS estimates that all STBs sold today include an EPG and, depending upon the country concerned, up to 40% have DVR capabilities.

19 Regarding EPG, Cisco currently does not offer EPG as a standalone product, but only as part of one of its middleware products (Voyager Vantage), which has very limited sales. Previously, it offered a product called SARA, which it no longer develops and which today is deployed only in a small quantity of legacy STBs by a limited number of pay-TV operators outside of the EEA. As for DVR, Cisco offers STB models only with embedded low level DVR software that is designed to interface with another vendor’s DVR control software. It is thus not normally used as the only DVR software functionality on a system. Cisco does not therefore currently offer a full functional DVR software separately from its middleware product, Voyager Vantage.

20 NDS currently does not have a CMS offering but it is planning to deploy a solution currently under development for its [customer] (which will be proprietary to [customer]). Once this solution is deployed by [customer], its EEA-wide market share will be around [0-5]% in the EEA. The Notifying Party is not aware of any third party market share estimates for CMS on a worldwide basis but estimates that its worldwide share of supply of CMS solutions is in any event below [10-20]%.

21 […]

22 See responses to question 48 of the questionnaire to pay-TV service providers of 19 June 2012.

23 See Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Mergers Guidelines"), OJ C 265/6, 18.10.2008, paragraph 91: "[c]onglomerate mergers are mergers between firms that are in a relationship which is neither purely horizontal (as competitors in the same relevant market) nor vertical (as supplier and customer)."

24 Non-Horizontal Mergers Guidelines, paragraph 25.

25 As noted in footnote 18 above, NDS estimates that, depending upon the country concerned, up to 40% of STBs have DVR capabilities.

26 The Notifying Party further submits that major technology trends for DVR software are the extension, via remote DVR scheduling, of traditional DVR services and the enabling of DVR services (pause live TV and recording) in the cloud. Neither Cisco nor NDS are currently developing DVR software with such features.

27 Non-Horizontal Mergers Guidelines, paragraph 94.

28 This is because NDS has developed a Driver Layer Interface (“DLI”), a software containing interoperability instructions that, once installed in a STB, allows the operation of the middleware.

29 The Notifying Party notes that the primary reason for switching from one CAS to another is security issues, as confirmed by a number of recent examples in the EEA.

30 See responses to question 40 of the questionnaire to pay-TV service providers of 19 June 2012.

31 See responses to question 47 of the questionnaire to pay-TV service providers of 19 June 2012.

32 See responses to question 27 of the questionnaire to pay-TV service providers of 19 June 2012.

33 See responses to question 28 of the questionnaire to pay-TV service providers of 19 June 2012.

34 See responses to question 48 of the questionnaire to pay-TV service providers of 19 June 2012.

35 Ibid.

36 See responses to question 24 of the questionnaire to pay-TV service providers of 19 June 2012. Pay- TV technical services providers also largely confirmed this view (see responses to question 19 of the questionnaire to STB providers of 19 June 2012 and responses to question 19 of the questionnaire to pay-TV software providers of 19 June 2012).

37 See responses to question 19 of the questionnaire to pay-TV service providers of 19 June 2012.

38 Notably the one-off per-STB license fee for each newly deployed STB plus an annual maintenance fee based on the volume of active STBs. The annual maintenance fee includes the right to receive upgrades and the right to receive a replacement CAS if the initial CAS is “cracked”.

39 See responses to question 25 of the questionnaire to pay-TV service providers of 19 June 2012.

40 According to the Notifying Party, new STB models are introduced on average every two to three years.

41 See responses to question 19 of the questionnaire to pay-TV service providers of 19 June 2012.

42 See responses to question 20 of the questionnaire to STB providers of 19 June 2012 and responses to question 20 of the questionnaire to pay-TV software providers of 19 June 2012.

43 See footnote 38 above.

44 According to the Notifying Party, the only exceptions may be: (i) Microsoft, active mainly in IPTV and which offers its CAS and middleware only in combination as part of Microsoft’s Mediaroom solution); (ii) Netgem; and (iii) Technicolor, both which do not allow third party STB suppliers to integrate with their respective middleware and application software.

45 See responses to question 46 of the questionnaire to pay-TV service providers of 19 June 2012.

46 This figure is based on a division of the STB units sold to pay-TV operators that use NDS’ CAS without Amstrad ([…] by the total sales of STB units in Europe/EMEA excluding Amstrad […].

47 See responses to question 37 of the questionnaire to pay-TV service providers of 19 June 2012.

48 The Notifying Party notes that even such negligible savings are hypothetical since Cisco plans to keep the NDS software product business organisationally and functionally separate from Cisco’s STB business. This is confirmed by internal Cisco documents.

49 The Notifying Party submits that only this scenario is relevant given that any bundle between various pay-TV software components is not merger-specific.

50 Pace offers STBs, CAS (having acquired Latens’ CAS business), middleware, EPG functionality, DVR hardware with rudimentary DVR software (similar to Cisco’s) and (through its acquisition of 2Wire) industry-leading home provisioning software.

51 Motorola Mobility offers STBs, CAS, middleware, EPG and DVR software, although Motorola Mobility is currently not very active in the EEA in the CAS and middleware markets.

52 See responses to question 33 of the questionnaire to pay-TV service providers of 19 June 2012, responses to question 27 of the questionnaire to STB providers of 19 June 2012 and responses to question 27 of the questionnaire to pay-TV software providers of 19 June 2012.

53 See Non-Horizontal Merger guidelines, paragraph 103.

54 See [Cisco internal pre-acquisition briefing document], Cisco March 2012.

55 It should be noted in this context, as submitted by the Notifying Party, that no completely new "greenfield" services have been launched in the EEA and other developed countries since the deployment of IPTV networks by telecommunication companies in the mid-2000s.