Commission, October 26, 2010, No M.5902

EUROPEAN COMMISSION

Judgment

LWM/ RWI/ F&F

Dear Sir/Madam,

Subject: Case No COMP/M.5902 – LWM/ RWI/ F&F Notification of 21 September 2010 pursuant to Article 4 of Council Regulation No 139/2004[1]

1. On 21/09/2010, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) 139/2004[2] ("the Merger Regulation") by which Lamb-Weston/Meijer V.O.F. ("LWM", the Netherlands) and Raiffeisen Ware Austria International Holding GmbH ("RWI", Austria), controlled by RWA Raiffeisen Ware Austria AG ("RWA", Austria)[3], acquire within the meaning of Article 3(1)(b) of the Merger Regulation joint control over Frisch & Frost Nahrungsmittel-Gesellschaft m.b.H. ("F&F", Austria), by way of purchase of shares. F&F is currently controlled by

RWA.

I. THE PARTIES AND THE OPERATION

2. LWM focuses on the production and distribution of deep-frozen potato products and appetizers and is mainly active in the Netherlands, France, Germany, the United Kingdom, Spain and Italy. LWM's customers are retailers, distributors and companies in the food services sector, such as caterers.

3. RWI is a holding company with no business activity of its own, ultimately jointly controlled by BayWa/RWA group. BayWa/RWA group, that currently controls F&F through RWI, is an international trading and services organization active in the wholesale and retail sale of agricultural products and commodities as well as consumer products mainly in Austria, Hungary, Germany, Slovakia, Slovenia and the Czech Republic.

4. F&F is active in the manufacture and trade of deep-frozen potato and dough products, in particular fries, potato croquettes and hash browns. F&F supplies retailers, distributors as well as the food service sector in Austria and also has a limited presence in some Member States in Central and South-Eastern Europe.

5. The proposed operation concerns the acquisition by LWM of approximately [70-80%] of the share capital in F&F. LWM, RWI and F&F shall enter into a Shareholders Agreement relating to F&F with a view of governing the terms of the investment and their future co-operation in relation to F&F. Upon completion of the transaction, LWM will hold [70-80%] of the shares and RWI will hold the remaining [20-30%]. The corporate governance rules of the joint-venture will confer joint control by both parents over F&F. In particular, decisions regarding […][4].

6. The proposed transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

II. UNION DIMENSION

7. The undertakings concerned have a combined aggregate world-wide turnover for 2009 of more than EUR 5 000 million[5] (LWM: EUR 9 646 million, RWI: EUR 7 203 million, F&F EUR 68 million). Each of at least two of them has EU-wide turnover for 2009 in excess of EUR 250 million (LWM: EUR […] million, RWI: EUR […] million) without achieving more than two-thirds of their EU-wide turnover within one and the same Member State.

8. The concentration therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

III. COMPETITIVE ASSESSMENT

9. The proposed concentration concerns the production and distribution of frozen and chilled potato products, frozen vegetable products as well as sweet and savoury dough products for the food sector, fast food chains and the retail sector.

10. The activities of LWM and F&F overlap in the area of production and sale of deep-frozen potato products dedicated to both the retail sector and the food service sector. [6]

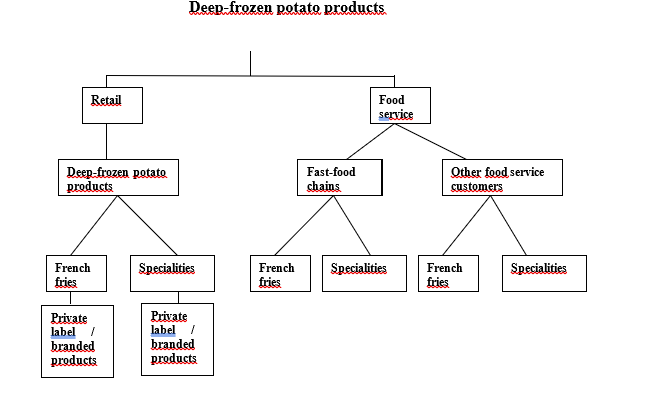

11. The chart below illustrates the potential segmentations of the market for the supply of deep-frozen potato products.

12. In the retail channel, the proposed transaction leads to horizontally affected markets in Austria only. In the food service sector, the proposed transaction gives rise to affected markets both at the EEA and national levels with significant combined market shares in Austria and in Italy.

A. Relevant product market

13. The activities of LWM and F&F overlap in the area of deep-frozen potato products. The category of deep-frozen potato products comprises a number of different products and product varieties which could be divided broadly into French fries and specialities. Specialities usually have different shapes (e.g. cubes or twisters), special coatings and/or structures and include, inter alia, wedges, croquettes, hash browns, cubes, potato slices and roast potatoes.

14. In past decisions in the food sector, the Commission distinguished the production and sale of food products dedicated to the retail sector from the production and sale of food products dedicated to the food service sector.[7] The notifying parties (hereinafter "the Parties") submit that the Commission should not depart from its past decisional practice given that the food service distribution channels have important features which distinguish them from the retail distribution channels.

13. The market investigation unanimously confirmed the parties' view and the previous Commission market delineation. The main arguments put forward by respondents to distinguish the production and sales to the retail sector from the production and sales to the food service sector are the different customers and their needs (retailers for the retail sector and wholesalers or end users for the food service sector), as well as different packaging (including size), the quality, and the prices of the products. Suppliers have usually a separate sales force and different brands for the retail and the food service sector.

14. In the Orkla/Chips decision[8], the Commission concluded that the category of frozen potato products included all side dishes based on potatoes without further segmentation. However, the Commission stressed the fact that its conclusions were only relevant for the purposes of the case as the consumption habits for frozen potato products appeared to vary between Member States. In the following paragraphs, potential markets are discussed separately for retail and food service sectors.

1. The retail sector

17. The Parties submit that in the retail channel the relevant market for deep-frozen potato products should include both French fries and the different specialities. The Parties explain that from the demand side, retailers usually stock a range of deep-frozen potato products, including not only French fries but also specialities, which compete for the same shelf space. From the point of view of end-consumers, French fries would basically fulfil the same function as other deep-frozen potato products, i.e. being a side dish. As regards the supply side, the majority of companies producing deep-frozen potato products would offer a wide range of these products including French fries and other specialities. The Parties also state that French fries and other deep-frozen potato products involve an almost identical or at the very least very similar production process, which implies that producers of French fries can easily switch to the production of other deep-frozen potato products and vice versa.

18. The arguments put forward by the Parties were not clearly supported by the market investigation. The vast majority of retailers indicated that French fries and specialities are not substitutable products in particular due to price difference (specialities tend to be more expensive due to the coating applied to the product) and customers' preferences. Despite confirming some degree of supply-side substitutability, the majority of respondents did not confirm the existence of an overall market for deepfrozen potato products including French fries and specialities.

19. In past decisions, the Commission also considered whether frozen and chilled foods belong to the same product market[9] and either left the product market definition open or indicated that, though not being part of the same market, chilled foods exercise some competitive constraint on frozen food and vice versa[10]. In the present case, the Parties submit that it is not appropriate to include deep-frozen potato products in the same product market, although there may be a certain degree of competitive constraint exercised by chilled products. Moreover they explain that there is no overlap between the Parties as LWM does not sell chilled potato products. Therefore for the purpose of the present case, the competitive assessment will be based on the narrowest market definition proposed by the Parties (i.e. supply of deep-frozen potato products).

20. In line with the Commission's past decisional practice[11], the Parties further explain that private label and branded products should be included in the same market. In the Orkla/Chips decision[12], the Commission concluded that frozen potato products are close to commodity products for which price is a more important competitive factor than brand.

21. According to the Parties, the level of product differentiation is comparatively low. The Parties also argue that all major retailers offer private label deep-frozen potato products and there would be no significant differences as regards the quality of own label and branded deep-frozen potato products. Though the price range for private label products is typically somewhat lower than for branded products[13], the Parties note that private label products effectively restrict the price at which branded products can be sold. This is due to the fact that there is a ceiling on how much more customers are willing to pay for a branded product compared to private label. This effect would be particularly strong for a commodity product such as deep-frozen potato product. Private label products would account for a significant share of sales of deep-frozen potato products to the retail sector. The Parties argue that end-consumers increasingly switch to own label products[14].

22. The vast majority of the retailers responding to the market investigation considered private-label and branded deep-frozen potatoes as similar products in terms of quality and packaging. In the event of a small and permanent price increase, these respondents almost unanimously indicated that end-customers would switch from producer branded products to private label. According to these respondents, demand is mainly driven by price as there are no specific differences between private label and branded products.

Conclusion

23. For the purpose of the present transaction, the question whether (i) deep-frozen potato products for the retail sector should include both French fries and the different specialities and (ii) private label and branded products should be included in the same product market can be left open as under any alternative market definition the proposed transaction does not give rise to any competition concerns.

2. The food service sector

24. In previous decisions, the Commission concluded that the food service sector comprises the supply to out-of-home eating (e.g. hotels, restaurants, fast-foods and pizzeria outlets, sandwich shops) and institutional catering (factory and office canteens, hospitals, schools etc.)[15]. The Parties propose to distinguish between the supply of fast food chains and the supply of the food service sector in general. In this respect, the Parties supply two groups of customers in the food service sector: (i) fast food chains and (ii) wholesalers and Cash & Carry operators. With the exception of the supply to fast food chains, the Parties do not sell directly to out-of-home eating and institutional catering outlets. Rather, the out-of-home eating and institutional catering sectors are supplied by means of sales to wholesalers and Cash & Carry operators which in turn sell the products to out-of-home and institutional facilities.

25. According to the Parties, the supply of deep-frozen potato products to fast food chains would have important features which distinguish it from the supply of other out-ofhome and institutional catering outlets. In particular, products for fast food chains would need to meet very high and strict quality requirements as regards their preparation and size. For example, French fries supplied to fast food chains need to have a certain length and to be fried in certain oils. Moreover, some fast food chains also require their French fries to have a special coating. These requirements would be satisfied by a limited number of producers.

26. The market investigation broadly confirmed the definition adopted by the Commission in previous decisions (i.e. food service sector differentiated into the supply to out-ofhome eating and institutional catering). However, several respondents to the market investigation agree with the argument put forward by the Parties that deep-frozen potato products in the food service sector are supplied to different groups of customers such as (i) fast food chains and (ii) wholesalers and Cash & Carry operators. In particular, they confirmed that the supply of fast food chains differs from the supply of other out-ofhome eating and institutional catering outlet due to the higher and stricter quality requirements as regards the preparation (different color and material as well as consistency) and size notably targeted at facilitating the high speed of operation in the restaurants.

27. While in the retail sector the Parties consider that a further segmentation of the product category of deep-frozen potato products may not be considered appropriate due to demand-side and supply-side substitutability, they submit that this may not be the case in the food service sector. The Parties indeed argue that the substitutability between French fries and other frozen potato products from the demand side is more limited in the food-service sector. This would apply in particular to fast food chains.

28. According to the Parties, for fast food chains, French fries would be a "must have" product as they generate a substantial amount of their turnover with the sale of French fries. While fast food chains may also offer other potato products, these rather supplement their product range and are not considered as a necessity. Most fast food chains sell other deep-frozen potato products only as limited time offers. As regards other food service customers, the degree of demand side substitutability would be higher than with fast food chains. As in the retail sector, wholesalers and Cash & Carry operators usually stock a range of deep-frozen potato products. Thus, they do not limit themselves to French fries but also offer different specialities in their portfolio. However, French fries would still remain a must stock item as a number of dishes would be traditionally served with French fries in restaurants and canteens.

29. The market investigation provided indications that French fries should be considered a separate market; however it is not conclusive on this point. The majority of the respondents indicated that French fries (in particular for fast-food chains) are a distinct market on the ground that it requires a higher quality potato and more careful processing. Some respondents indicated that there are significant differences in price between French fries and specialities as specialities require more manufacturing processes. Nevertheless, several respondents suggested French-fries to be part of an overall deepfrozen potato market.

30. For the purpose of the assessment of the present transaction, the question whether (i) the supply to fast-food chains should be distinguished from the supply to other out-ofhome and institutional catering outlets and (ii) French fries should be considered a separate market in the food sector can be left open, given that the proposed transaction does not raise any competition concerns under any alternative market definition.

B. Relevant geographic market

1. The retail sector

31. In past decisions, the Commission considered the relevant geographic market definition for food products to be national based on the following considerations: differences as regards the tastes of consumers and their consumption pattern, national sales channels, negotiations of supply contracts on national level, pricing on a national level, national distribution and logistics, different brands in different Member States and a considerable degree of divergence in the shares of the relevant suppliers in the different Member States.[16]

32. The Parties submit however that the market is wider than national, possibly EEA-wide, and should at least be considered as comprising neighbouring Member States, e.g Austria and Germany or the Benelux countries and France.

33. The Parties point out that over the past few years there would have been a significant trend towards harmonization and Europeanization as regard the supply of deep-frozen potato products to the retail sector: large retailers have broadened the range of their activities from a national to a pan-European scope and have centralized sourcing departments; there is a process of harmonization as regards the standards that apply to the composition, production and labelling of consumer foods at EU-level; there are no or only very limited differences in consumer tastes and suppliers sell the same products, i.e. without a change in the recipe, in a number of Member States; a number of suppliers of deep-frozen potato products are established on a pan-European basis[17] and sell under the same brand name in several European countries; eventually products are sold from a limited number of production facilities throughout the whole EEA or at least in a number of Member States.

2. The food service sector

34. As regards the food service sector, the Parties submit that the relevant geographic market is wider than national, possibly EEA-wide and should at least comprise neighbouring Member States such as Austria and Germany. The Parties argue the following: the most significant customers (wholesalers and Cash & Carry operators) are active in several Member States and large international fast food chains have a centralised sourcing strategy; there are no significant differences in tastes as regards deep-frozen potato products in the different Member States and the products supplied are therefore the same. A number of suppliers, including LWM, are active on a panEuropean basis and an increasing number of suppliers have a centralised sales force.

35. Though the Commission has confirmed in the Unilever/Bestfoods decision tendencies towards a widening in the scope of the food service markets in the EEA, it concluded in several occasions that both from a demand side and s supply-side perspective food service markets remain predominantly national.[18] This assessment was mainly based on differences as regards the tastes of consumers and their consumption patterns, national sales channels, negotiations of supply contracts on national level, national distribution and logistics and different brands in different Member States.

3. Conclusion

36. The market investigation confirmed a growing trend towards harmonization and Europeanization as regard the supply of deep-frozen potato products in the retail sector and the food service sector. However, the majority of customers and competitors pointed to significant differences among Member States, notably as regards pricing, consumers' consumption habits, brands, organisation of sales and shares of the relevant suppliers.

37. For the purpose of the assessment of the present transaction, the exact definition of the relevant geographic market for food products in the retail sector and in the food service sector can be left open, given that the proposed transaction does not raise any competition concerns under any alternative market definition.

C. Assessment

38. When considering all possible sub-segmentations of the overall market for the production and sale of deep-frozen potato products, the proposed transaction would result in several affected markets both at the EEA and national level, especially with regard to the supply of French fries to fast-food chains. These are considered separately below. It can however already be noted that the market investigation carried out by the Commission has however showed that the proposed transaction would not raise competition concerns on any market for deep-frozen potato products or any alternative sub-segmentation thereof. The vast majority of respondents to the market investigation, both competitors and customers, have not expressed any concerns as regards the competitive effects of the proposed transaction; on the contrary some customers indicated that they see this transaction as a positive event as the Parties will be able to offer post-merger an enlarged portfolio of products.[19]

1. The retail sector

39. At the EEA level, the combined market shares of LWM and F&F do not give rise to any affected markets on any of the potential retail market.[20]

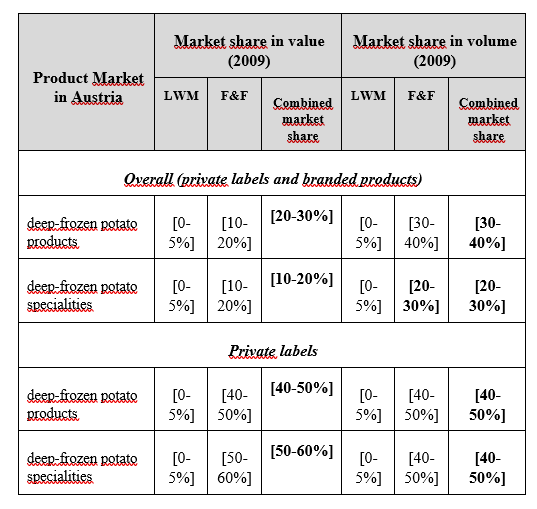

40. At the national level[21], the potential market for the supply of deep-frozen potato products to the retail sector in Austria[22] would be affected, with combined market shares of at most [20-30%]% in value and [30-40%] in volume with limited increments brought by LWM (below [0-5%]% and [5-10%] in value and volume respectively). There is no overlap in a potential segment of deep-frozen French fries for the retail sector in Austria as LWM has no sales of French fries to the retail sector in that Member State.

41. Considering separate product markets for branded and private labels in Austria, the combined share of the Parties as regards the supply of private label deep-frozen potato products and specialities to the retail sector would be at most [50-60%] in value and [4050%] in volume although the increments brought by LWM remain rather low (below [0-5%] in value and volume respectively). In the categories of branded products only, there would be no affected market in Austria.[23]

39. The transaction does not significantly change the market structure in the retail channel in Austria as the market share of LWM in the deep-frozen potato products, or any potential sub-segments, is low (in any case below [0-5%]). No retail customer active in Austria has expressed any concerns as regards the competitive effects of the proposed transaction and a significant number have attributed the absence of impact in Austria to the low presence of LWM in the country.

40. Furthermore, the respondents to the market investigation confirmed that LWM and F&F will not be able to exercise market power in the Austrian market for the following reasons: (i) the presence of a number of well-established pan-European competitors, such as Iglo and McCain, which have higher market shares than the Parties (in the supply of deepfrozen potato products Iglo has a [30-40%] market share in value and McCain [20-30%] in value; in the supply of deep-frozen potato specialities Iglo has a [30-40%] market share in value and McCain [20-30%] in value) and more generally the important number of alternative suppliers on the market[24] and (ii) the low level of switching costs for customers.

41. As regards specifically private label products, LWM has only very limited sales in Austria and the market share of F&F in 2009 accounted for […][25].

42. The market investigation confirmed that the retailers selling private labels do not consider that the transaction will create anti-competitive effects. Besides, several of respondents, whether retailers or competitors, have indicated that an important number of suppliers are active on the market, notably 11er, AVIKO, Agrafrost and Wernsing.

2. The food service sector

46. In the food service sector, the transaction would lead to a number of affected markets both at the EEA level and at the national level. As an introductory remark to the assessment of the impact of the transaction in the food service sector, it has to be underlined that no customer active in the food service sector has expressed any concerns as regards as regards the competitive effects of the proposed transaction.

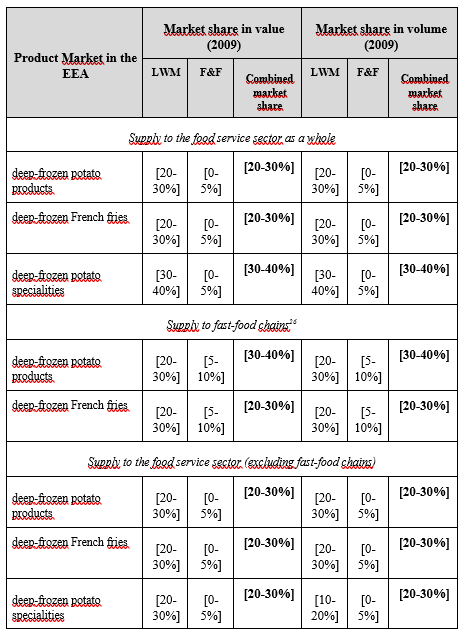

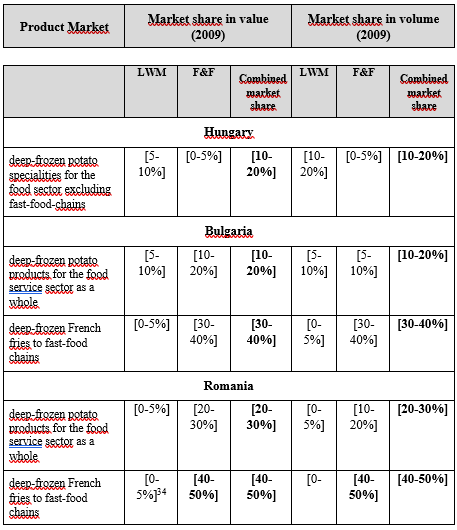

a) Affected markets at the EEA level

47. Considering an EEA wide market, and considering the narrowest possible product market definitions, 8 markets would be affected by the transaction in the supply of deep-frozen potato products to the food service sector with combined market shares ranging between [20-30%] and [30-40%] in value. Increments brought by the transaction in these markets would be rather small (at most [5-10%] in value).

48. Contrary to LWM that is active as regards the supply of deep-frozen potato specialities to fast food chains in the EEA, F&F does not offer specialities to fast food chains on a regular basis and only occasionally supplies deep-frozen potato specialities for campaigns or promotions. In 2009, F&F did not have any sales of deep-frozen specialities to fast-foods in the EEA.

49. The market investigation confirmed that post-transaction it is unlikely that LWM and F&F will be able to exercise market power on the supply of deep-frozen potato products or any sub-segmented markets at the EEA level for a number of reasons that apply both for the supply to fast-food chains and the supply to the food service sector (excluding fast-food chains).

50. First, there are several well-established competitors active in the supply of deep-frozen potato products to the food-sector, notably McCain, AVIKO, Farm Frites, PinguinLutosa, and Agrafrost. McCain is the strongest supplier with a market share of [30-40%] in value on the market for the supply of deep-frozen potato products for the food service sector as a whole in the EEA. Post-merger McCain will remain market leader in all the potential markets described in the table above except in the market for the supply of deep-frozen French fries to the food service sector (excluding fast food) where LWM is already market leader (and F&F has only a [0-5%] market share in value). McCain is notably by far the strongest supplier of potato products to fast-food chains in the EEA with a [40-50%] market share in value.

51. Secondly, the vast majority of competitors have confirmed the Parties' submission that barriers to entry are limited by indicating either that there are no barriers to entry or that they mainly consist in the establishment of long-term relationships with customers.

52. Thirdly, the vast majority of competitors have indicated that they have lost and/or won customers in the food service sector over the last 2-3 years which shows that the market is dynamic.

53. As regards specifically the supply to fast-food chains and in particular the supply of French fries (as there is no overlap for specialities), the number of customers is limited and in particular [...] customers [...] account for the vast majority of sales. [...]. The market investigation [...] has confirmed that fast-food chains pursue a multi-sourcing strategy and are able to switch their suppliers. This is illustrated by the fact that [...].[27]

54. Finally, as regards the markets for the supply to the food service sector excluding fastfoods, the increments brought by F&F are negligible under all possible market definitions ([0-5%] at most in value). As a result, the proposed transaction will not significantly change the market structure.

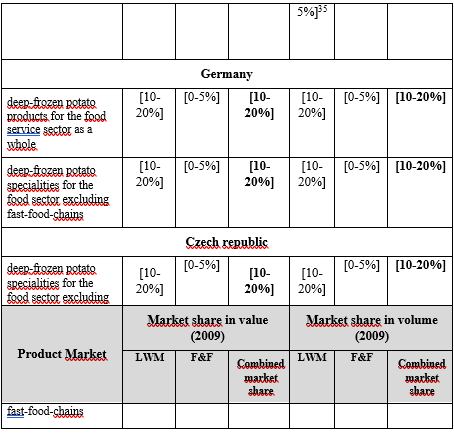

b) Affected markets at national level

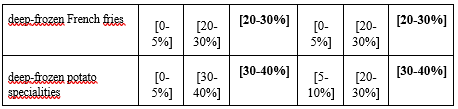

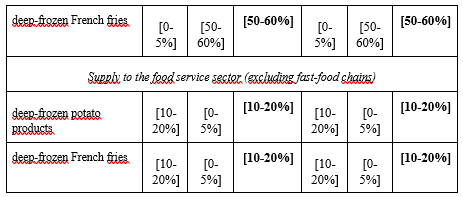

55. Considering national-wide markets and the narrowest possible product market definitions, the proposed transaction would result in a number of affected markets with in some cases significant combined market shares in Austria and in Italy. This is the case notably for the supply of deep-frozen potato products to the food service channel and possible narrower markets based on 2009 figures. In addition, a number of markets for the supply of deep-frozen potato products to the food service would be affected in Bulgaria, Germany, Hungary and Romania, with however relatively low markets shares and/or small increments.[28]

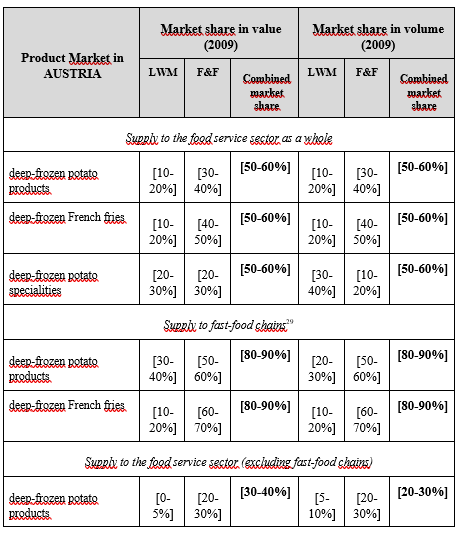

Austria

56.In Austria, the combined market shares of the Parties based on 2009 figures would be significant in a number of markets (between [20-30%] and [80-90%] in value), in particular in the supply to fast-food chains, with the two highest combined markets shares being in the supply of deep-frozen potato products for fast-food chains ([8090%] in value, increment of [30-40%] in value) and the supply of deep-frozen French fries for fast-food chains ([80-90%] in value, increment of approximately [10-20%] in value).

57. As regards the supply to the food sector as whole, the Parties combined market share in value in 2009 is [50-60%] for deep-frozen potato products, [50-60%] for deep-frozen French fries and [50-60%] for deep-frozen potato specialties. Post-merger, alternative well-established competitors will remain active in all three sub-segmented markets such as 11er ([10-20%] in deep-frozen potato products, [10-20%] in deep-frozen French fries and [10-20%] in deep-frozen potato specialties, Farm Frites ([5-10%] in deep-frozen potato products, [5-10%] in deep-frozen French fries and [5-10%] in deep-frozen potato specialities) and McCain ([5-10%] in deep-frozen products, [0-5%] in deep-frozen French fries and [10-20%] in deep-frozen potato specialities).

58. As regards the supply to fast-food chains, the Parties combined market share in value in 2009 is [80-90%] for deep-frozen potato products and [80-90%] for deep-frozen French fries.

59. The high market shares of the Parties in 2009 in Austria (and in Italy as indicated below) result from the sales of the Parties to […], namely […], which account for a large share of total demand of deep-frozen potato products for fast-food chains in Austria (as well in Italy and all other Member States). [30]

60. However, the market shares of suppliers as regards sales to fast-food chains may vary significantly depending on their ability to win or renew contracts with customers and the duration of these contracts. The volatility of market shares as regards the supply to fast-food chains can be illustrated by the fact that […][31].

61. The limited duration of contracts with fast-food chains (from one up to three years) also clearly indicates that customers do not encounter difficulties in switching suppliers. […]

62. As regards the supply to the food service sector (excluding fast-food chains), the Parties combined market share in value in 2009 is [30-40%] for deep-frozen potato products, [20-30%] for deep-frozen French fries and [30-40%] for deep-frozen potato specialties. Post-merger, several well-established competitors will remain active in the market such as 11er ([20-30%] in deep-frozen potato products, [20-30%] in deep-frozen French fries and [20-30%] in deep-frozen potato specialties), Farm Frites ([10-20%] in deep-frozen potato products, [10-20%] in deep-frozen French fries and [10-20%] in deep-frozen potato specialities) and McCain ([10-20%] in deep-frozen products, [5-10%] in deepfrozen French fries and [10-20%] in deep-frozen potato specialities). Further, LWM's market shares are limited in all the potential markets ([0-5%] in deep-frozen potato products, [0-5%] in deep-frozen French fries and [0-5%] in deep-frozen specialities) and therefore the proposed transaction will not significantly affect the market structure.

63. The market investigation has confirmed that the customers in the food service sector in Austria (whether fast-food chains or other customers) consider that there is a sufficient number of alternative suppliers active on the market as indicated above. With regard the supply to fast-food chains, one customer even underlined that "there is a lot of capacity in Europe". Furthermore, the vast majority of competitors active in both supply to fastfood chains and other customers have confirmed the Parties' submission that barriers to entry are limited by indicating either that there are no barriers to entry or that they mainly consist in the establishment of long-term relationships with customers.

Italy

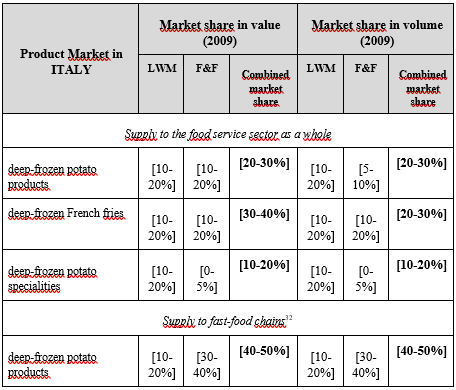

64. In Italy, the merged entity would post-transaction hold market shares between [10-20%] and [50-60%] in value. In particular in the supply to fast-food chains, the highest market share is in the supply of deep-frozen French fries for fast-food chains ([50-60%] in value, increment of [0-5%] in value).

65. As regards the supply to the food service as whole, the Parties combined market share in value in 2009 is [20-30%] for deep-frozen potato products, [30-40%] for deep-frozen French fries and [10-20%] for deep-frozen potato specialties. Post-merger, alternative well-established competitors will remain active in all three segmented markets such as McCain ([30-40%] in deep-frozen potato products, [30-40%] in deep-frozen French fries and [30-40%] in deep-frozen potato specialties), Aviko ([5-10%] in deep-frozen potato products, [10-20%] in deep-frozen French fries and [0-5%] in deep-frozen potato specialities) and Farm Frites ([0-5%] in deep-frozen products, [0-5%] in deep-frozen French fries and [0-5%] in deep-frozen potato specialities).

66. As regards the supply to fast-food chains, the Parties combined market share in value in 2009 is [40-50%] for deep-frozen potato products, [50-60%] for deep-frozen French fries. […][33]

67. However, the Parties will still face competitive pressure of significant competitors, notably McCain which has approximately [20-30%] market share in value in the supply of deep-frozen potatoes to fast-food chains and in the potential market for deep-frozen French fries to fast-food chains.

68. In addition, the increment brought by LWM is de minimis ([0-5%] in value) while there is no overlap between the Parties in any case for the supply of specialities to fast-food chains.

69. As regards the supply to the food service sector (excluding fast-food), the Parties combined market share in value in 2009 is [10-20%] for deep-frozen potato products, and [10-20%] for deep-frozen French fries. F&F's market shares are negligible in both sub-segments ([0-5%] in value) and therefore the proposed transaction will not significantly affect the market structure. Mc Cain will continue to be by far the market leader with approximately [30-40%] market share in value in the supply of deep-frozen potatoes and a [40-50%] market share in value in the supply of deep-frozen French fries.

70. The market investigation has confirmed that the customers in the food service sector in Italy (whether fast-food chains or other customers) consider that there is a sufficient number of alternative suppliers active on the market as indicated above. Furthermore, as regards specifically Italy the vast majority of competitors have confirmed the Parties' submission that barriers to entry are limited by indicating either that there are no barriers to entry or that they mainly consist in the establishment of long-term relationships with customers.

Hungary, Bulgaria, Romania, Germany and the Czech Republic

71. A number of other national markets for the supply of deep-frozen potato products to the food service would be affected in addition to Austria and Italy: Bulgaria, Germany, Hungary, Romania and the Czech Republic, with however relatively low markets shares and/or small or minimal increments.

71. Based on the market structure above, the Commission has concluded that the proposed transaction does not raise competition concerns on any market for the supply of deepfrozen potato products or any alternative sub-segmentation thereof.

VII. CONCLUSION

73. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 OJ L 24, 29.1.2004 p. 1.

3 RWA is ultimately jointly controlled by BayWa AG (Germany) and RWA Raiffeisen Ware Austria Handel und Vermögensverwaltung eGen (Austria) (the companies controlling RWI are hereinafter referred to as "BayWa/RWA group").

4 […].

5 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p.1).

6 Neither LWM nor F&F have any significant upstream (eg potato breeding) or downstream activities.

7Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips; Commission decision of 23 February 2001, Case No COMP/M.2302 – Heinz/CSM; Commission decision of 28 September 2000, Case No COMP/M.1990 – Unilever/Bestfoods.

8 Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips.

9 Commission decision of 6 March 1999, Case No COMP/M. 1740 – Heinz/United Biscuits Frozen and chilled foods.

10 Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips.

11 Commission decision of 6 March 1999, Case No COMP/M. 1740 - Heinz/United Biscuits Frozen and chilled foods.

12 Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips.

13 According to the Parties, prices for private label deep-frozen potato products range between EUR […] and EUR […] per kg depending on the type of product and its quality. Prices for branded deep-frozen potato products range from EUR […] to EUR […] per kg depending on the type of product and its quality.

14 According to estimates of the notifying Parties, private label products currently account for a share of approximately [40-50%] of total sales of deep-frozen potato products by retailers in the EEA (on an average basis).

15Commission decision of 28 September 2000, Case No COMP/M. 1990 – Unilever/Bestfoods.

16 Commission decision of 17 December 2008, Case No COMP/M.5046 – Friesland Foods / Campina ; Commission decision of 9 November 2007, Case No COMP/M. 4824 – Kraft/Danone Biscuits ; Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips ; Commission decision of 28 September 2000, Case No COMP/M. 1990 – Unilever/Bestfoods.

17 LWM, McCain, AVIKO, Farm Frites and PinguinLutosa.

18 Commission decision of 17 December 2008, Case No COMP/M.5046 – Friesland Foods / Campina ; Commission decision of 28 September 2000, Case No COMP/M. 1990 – Unilever/Bestfoods ; Commission decision of 3 March 2005, Case No COMP/M.3658 – Orkla/Chips.

19 Several respondents have underlined that F&F offers high quality typical Austrian products that LWM does not supply and that LWM is well-know for its innovative products.

20 At the EEA level, the combined market shares of the Parties for deep-frozen potato products, French fries and specialities are respectively of [0-5%], [0-5%] and [5-10%] (with increments brought by F&F of respectively [0-5%], [0-5%] and [0-5%]). For private label products only, the combined market shares of the Parties for deep-frozen potato products, French fries and specialities are respectively of [0-5%], [05%]and [5-10%] (with increments brought by F&F of respectively [0-5%], [0-5%]and [0-5%]). For branded products only, the combined market shares of the Parties for deep-frozen potato products, French fries and specialities are respectively of [0-5%], [0-5%]and [0-5%] (with increments brought by F&F of [0-5%] in all markets).

21 The market shares of F&F in the retail sector are higher in volume than in value. This is due to the fact that […].

22 In addition to Austria, the notifying Parties have overlapping activities as regards the supply of deepfrozen potato products to the retail sector in Bulgaria, Germany and Romania. The notifying Parties’ combined market shares as regards the supply of deep-frozen potato products to the retail sector in all the above mentioned Member States are however clearly below 15% whatever the market definition retained.

23 For branded products only, in Austria the combined market shares of the Parties for deep-frozen potato products and specialities are respectively of [10-20%] (with increments brought by LWM of [0-5%]) and [5-10%] (with increment brought by F&F of [0-5%]).

24The market investigation underlined that the competitors considered as suitable alternatives are in the supply to the retail sector in Austria are notably McCain, 11er, Iglo, Agristo, Agrafrost, Aviko, Elfer, Schne-frost, Wernsing and Clareabout.

25Pursuant to an annual tender procedure which is the standard practice in the industry for private label products

26 As mentioned above F&F in any case does not supply specialities to fast-foods in the EEA.

27 See Annex 6.C.II.a […].

28 The Parties' activities also overlap in the supply of deep-frozen potato products, or possible subsegmented markets also overlap in Slovakia and in Slovenia. The combined market shares of the Parties in these markets remain however below 15%.

29 As mentioned above F&F in any case does not supply specialities to fast-foods in the EEA.

30 […].

31 See paragraph 15 of the "Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings" (2004/C 31/03) stating that current market shares may be adjusted to reflect reasonably certain future changes, for instance in the light of exit, entry or expansion.

32 As mentioned above F&F in any case does not supply specialities to fast-foods in the EEA.

33 […].

34 The increment brought by LWM approaches zero (with sales for LWM of […]).

35 The increment brought by LWM approaches zero (with sales for LWM of […]).