Commission, November 22, 2010, No M.5930

EUROPEAN COMMISSION

Judgment

JCI / MICHEL THIERRY GROUP

Dear Sir/Madam,

Subject: Case No COMP/M. 5930 - JCI / MICHEL THIERRY GROUP Notification of 15 October 2010 pursuant to Article 4 of Council Regulation (EC) No 139/2004[1]

1. On 15 October 2010, following a referral pursuant to Article 4(5) of the Merger Regulation the European Commission received a notification of a proposed concentration by which the undertaking Johnson Controls, Inc. ("JCI", USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of Michel Thierry Group S.A ("MTG", France) by way of purchase of shares.

I. THE PARTIES

2. JCI is active in the areas of automotive systems, facility management and control systems and services. JCI's stocks are traded on the New York Stock Exchange.

3. The automotive business of JCI includes the manufacturing of seating and interior systems for light vehicles including passenger cars and light trucks. The products include automotive seating, overhead systems, instrument panels, door panels and interior electronics. These products and systems are sold to the automotive original equipment market.

4. MTG is a supplier of automotive textiles2 used in car seats and other interior parts such as headliners/overhead systems or door panels. MTG generates the significant majority of its

global revenues from the production of textiles for car seats ([…]% of[2] its sales in 2009 in the EU, the rest being sales of textiles for door panels).

5. In addition, MTG's textiles can be used for other interior parts such as sun visors or headliners/overhead systems. In 2010, MTG started to manufacture […] textiles for […].

II. CONCENTRATION

6. JCI intends to purchase all shares of the MTG. The proposed transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

7. The concentration does not have an EU dimension within the meaning of Article 1(2) of the Merger Regulation. The aggregate worldwide turnover of all the undertakings concerned is more than EUR 5 000 million[3] (JCI: 21 063 EUR million, MTG: […] EUR million). However, only one of the undertakings concerned has an aggregate EU-wide turnover of more than EUR 250 million (JCI: […] EUR million, MTG: EUR […] million). The concentration also does not meet the thresholds laid down in Article 1(3) of the Merger Regulation.

8. The transaction would have required notification in more than three Member States, namely in seven Member States: Austria, the Czech Republic, France, Germany, Greece, Romania, and Slovakia.

9. On 20 August 2010, the Commission received a referral request pursuant to Article 4(5) of the Merger Regulation. None of the Member States concerned objected to the request for referral. As a consequence, the concentration shall be deemed to have an EU dimension and shall be notified to the Commission.

IV. COMPETITIVE ASSESSMENT

10. The target's activities in automotive textiles and automotive leather (upstream) and JCI's activities in a number of car components that utilise automotive textiles (downstream) are vertically linked. The planned transaction would have the result that the acquirer, JCI would integrate vertically with one of its main suppliers of automotive textiles and leather.

11. There is a very minor current horizontal overlap, as MTG has started producing […] (already supplied by JCI) in […]; however, this will not be analysed further as the total production capacity of MTG is very insignificant[4].

IV.1. RELEVANT PRODUCT MARKETS

12. The parties are suppliers to Original Equipment Manufacturers ("OEM") or, in the case of the target, their Tier 1 (direct) suppliers in the automotive industry. They do not supply the automotive after market with these products.

IV.1.1.1.Automotive textiles (upstream market)

13. The Commission has not yet dealt with automotive textiles in previous decisions. The technical characteristics of automotive textiles differ significantly from those of other textiles (e.g. furniture, clothing), in particular regarding their requirements as to abrasion, flame resistance and easy cleaning. In view of the importance of the textile design for vehicles' overall interior design, car manufacturers work directly with the textile producers, determine the fabric on the basis of the designs submitted by the textile producer and agree with the latter on the price.

14. The parties therefore submit that automotive textiles constitute a product market separate from other textile markets. The parties furthermore submit that all types of automotive textiles form part of one single market for automotive textiles and that a further subdivision into textiles for light vehicles/cars (light commercial vehicles, "LCVs") and for heavy vehicles/trucks as well as into textiles for the different interior components and systems is not justified since all textiles produced by MTG and its competitors can be used for light and heavy vehicles and for the different interior parts such as seats, seat components, door panels or headliners.

15. The market investigation carried out by the Commission clearly confirmed the parties' view that automotive textiles constitute a separate market from other textile markets and that no differentiation is to be made between textiles for light and heavy vehicles.[5]However, the concrete delimitation can be left open as even if only light vehicles are considered (the parties do not supply parts or textiles for heavy vehicles), no competition concerns arise.

16. The market investigation provided mixed results as to the question whether textiles used for certain interior car parts belong to the same market. In particular, textiles for car seats and textiles for door panels are very similar and car manufacturers typically choose textiles of the same design for the seats and the lining of the car’s door panels in order to ensure a uniform look and feel. The main difference between textiles for car seats and textiles for door panels is that the latter require a higher degree of elasticity. Where car manufacturers choose textiles with the same textile design for the car seats and the door panels (which is mostly the case), the textiles for both parts are sourced from the same supplier.

17. The textiles for both applications can be produced on the same machines with the same raw material and using the same processes and their manufacture requires the same expertise. All major manufacturers (including MTG, Aunde, Trèves and Eybl) produce both textiles for seats and for door panels. Consequently, the majority of competitors and a number of OEMs stated that the relevant market is comprised of all textiles independent of their specific use. The competitors submit that given a similar product range and a quite high supply side substitutability, mainly all suppliers of automotive textiles compete with each other in all segments

18. However, a narrow majority of the OEM and some competitors stated that the (usually woven) textiles for seats, seat covers and head rests on the one hand and (knitted) textiles for other interior components (e.g. door panels) constitute different product markets.

19. For the purpose of the present decision, the concrete market definition can be left open as no competition concerns would arise on the basis of a narrower market definition, i.e. the further segmentation of automotive textiles according to their usage for different categories of interior parts.

IV.1.1.2.Automotive leather (upstream market)

20. The Commission has not yet dealt with automotive leather in previous decisions. The parties submit that automotive leather constitutes a separate market from automotive textiles because the process to manufacture leather is entirely different and requires significant investment and time to build the industrial capacity. Consequently, the suppliers generally differ and textile manufacturers, with the exception of MTG (via its JV with the Italian manufacturer) and one competitor, do not produce automotive leather. The market investigation confirmed this view. No evidence was found to further subsegment that market.

IV.1.1.3.Car seats, automotive seat covers, head rests, arm rests[6](downstream markets)

21. JCI produces seat covers, arm rests and head rests that are attached to the seats. It also manufacturers complete seats which is principally an assembly activity: car manufacturers usually source the different components separately and the seat manufacturer assembles the parts – sourced to a significant extent from third parties - close to the car factory. The Commission in previous decisions[7] has left open whether the individual components or the complete seat constitute the relevant product market. For the purpose of this decision, it can be also left open whether the individual components requiring textiles (seat covers, head rests and, with respect to rear seats, also arm rests) or the complete seat comprising these components constitute the relevant component market(s) downstream, since the operation does not raise serious doubts as to its compatibility with the internal market under any of the alternative definitions.

IV.1.1.4.Sun visors, headliners and overhead systems (downstream markets)

22. Headliners form the interior covering of the roof of a car. An overhead system is the layer of plastic covered with the textile and combining other roof components including headliners and sun visors. The production of overhead systems – sometimes also referred to as headliners – is mainly an assembly activity mostly carried out by the car manufacturers who choose the suppliers of the different components including, for instance, sun visors. The Commission in previous decisions has left open whether there is a single market for overhead systems or whether the individual components form separate product markets,[8] but also considered individual components such as sun visors as relevant product markets in their own right.[9] In the present case, the exact market definition can be left open as the operation does not raise serious doubts under any of the alternative definitions.

IV.1.1.5.Door panels (downstream market)

23. A door panel is the interior trim of a door, made of plastic and often covered by fabric. Suppliers usually provide the OEMs with complete door panels that are manufactured and sold as a single unit. For this reason and in line with previous Commission decisions[10] door panels are considered to constitute a relevant product market for the purpose of this decision.

IV.1.1.6.Floor consoles (downstream market)

24. A floor console is the part which covers the floor of the interior of a vehicle. It reaches from the instrument panel to the rear seats in the middle of the vehicle. In the front of a car they may contain arm rests covered by textiles and controls for operating the vehicles. Floor consoles are sourced by the OEMs for each car model as a whole in tender procedures. For this reason and in line with previous Commission decisions[11], floor consoles are considered to constitute a relevant product market for the purpose of this decision.

IV.2. RELEVANT GEOGRAPHIC MARKETS

25. In line with the Commission's previous decisions[12] concerning OEM markets for automotive components, the parties have submitted that the geographic scope of all possible product markets is at least EEA-wide. The market investigation has confirmed this approach. Many replies even suggested a worldwide scope at least of the component (not textile) markets in view of the the sourcing of the OEMs and their organisation of bids.[13] If OEMs decide to produce a new vehicle model, they often ask suppliers to participate in a tender for the respective automotive components on a worldwide basis whereas the assembly of the different components to form, for instance, a seat is carried out near the OEM plants. The worldwide sourcing applies in particular to smaller components manufactured by tier 2 or 3 suppliers but it depends also on the type of the component and the sourcing or tendering model of the various OEMs. However, as in previous decisions, it is also not necessary for the present case to define the geographic scope exactly since even on the basis of narrow markets – EEA-wide – the transaction does not raise serious doubts as to its compatibility with the internal market.

IV.3. VERTICAL EFFECTS OF THE TRANSACTION

IV.3.1. Introduction

26. As a result of the planned transaction, JCI will vertically integrate with one of its textiles suppliers. The assessment therefore concerns the vertical effects between automotive textiles on the one hand and the automotive components which require textiles on the other.

27. As mentioned above, MTG generates a significant majority of its revenues through the manufacture and sale of automotive textiles, most of these sales resulting from the production of textiles for car seats (over […]% of its sales). The remaining part of MTG's automotive textiles sales resulted from door panels and […].

28. MTG also produces automotive leather. However, in view of their minor sales that account for [0-5]% of the automotive leather market in the EEA and that are exclusively supplied to […] through a […] joint venture with the company Italian Leather Group, the following assessment does not further analyse automotive leather.

29. JCI produces seat covers, head rests and – with respect to rear seats - arm rests for car seats. It also assembles sun visors, headliners/overhead systems and door panels, and produces floor consoles (to the extent they include arm rests). However, in view of JCI’s modest market shares ([5-10]% for floor consoles) in the EEA, the assessment does not further analyse floor consoles.

30. Consequently, the following will focus on the vertical effects between automotive textiles as a whole, textiles for seat components or textiles for other interior components such as headliners, overhead systems or sun visors (upstream markets) and the respective interior parts (downstream markets) as these are potentially affected markets.

31. As neither MTG nor JCI sell automotive textiles or interior car components for heavy trucks[14], the assessment is based on the textiles/components for light vehicles as the narrowest possible market.

IV.3.2. Upstream markets

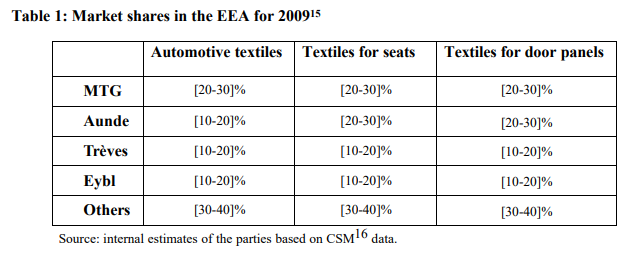

32. The parties submitted MTG's market shares for overall automotive textiles, textiles for car seats and for door panels. They are outlined in the table below.

33. On the basis of an overall automotive textiles market, MTG's market share is below [2030]%. MTG's market share for the market of automotive textiles other than for seats is well below the [20-30]% specified in the table above as MTG does not produce textiles for other products than car seat components and door panels, indeed it would be around approximately [5-10]%. Thus, if two different automotive textile markets were considered – one for textiles for automotive seats (seat covers, head rests, arm rests) and one for the textiles for other interior parts – the only affected upstream market is the one for automotive seat textiles. However, if door panels are considered to be part of a wider automotive textile market for interior parts not related to seats (floor consoles, overhead systems/headliners/sun visors), where MTG's market position is weaker.

IV.3.3. Downstream markets

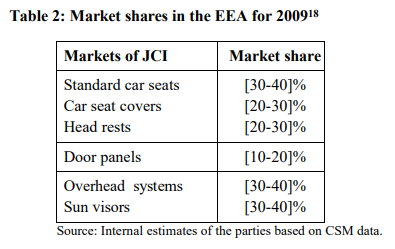

34. JCI produces car seats and the respective seat covers, head rests, door panels, overhead systems, headliners, sun visors and floor consoles (to the extent they include arm rests). The following table gives an overview of JCI's market shares in the (potentially) affected downstream markets as submitted by the parties[17]:

35. Downstream, the main affected market(s) concern car seats (including or excluding seat covers and head rests). In the market for complete car seats, JCI currently has an estimated market share of [30-40]% according to the parties' information. Textiles for car seats, i.e. for seat covers and head rests, are also by far the main textile type for MTG (over […]% of its total production) and where it achieves a market share of [20-30]%. In view of the fact that MTG's textiles can in principle be used also for the other components (and that it already started to produce headliners and sun visors), these can also be regarded as affected markets. In view of JCI's market share of [10-20]% for door panels and MTG's modest market share (as described above), door panels are not considered furthermore.

IV.3.4. Safe harbours

36. In all markets other than that for standard car seats, overhead systems and sunvisors, the parties' market shares are below 30% with post merger HHIs below 2000 and therefore within the safe-harbour identified in the Commission's guidelines on the assessment of non-horizontal mergers[19].

IV.3.5. No input foreclosure

IV.3.5.1.Car seat assemblers, seat cover and headrest manufacturers

37. As regards standard car seats, JCI's position on a potential (EEA-wide) market for standard car seats is [30-40]%, whilst it is [20-30]% when considering seat covers and [20-30]% when considering head rests, respectively. As seen in Table 1, MTG, on the other hand, has a [20-30]% market share on a potential upstream market of automotive textiles for seats. Given that the textiles that are used for seat covers and head rests are covered with the same material as the seats in order to ensure a uniform look and feel of the car's interior, these will be analysed together below.

38. The parties state, as regards potential input foreclosure of downstream competitors, that there are a number of credible alternative sources to MTG in the marketplace and that in any event all of the demand for fabrics for car seats is sourced directly by the OEMs, and therefore neither MTG is free to select its seat cover manufacturer, nor can JCI freely choose its fabric manufacturers. The parties also submit that already today, MTG supplies approximately [20-30]% of its sales in the EU to JCI, and that therefore supplying only JCI would lead to it losing [70-80]% of its EU revenues. Furthermore, it would not, in any event, be able to adopt such a strategy given the OEMs' significant buyer power as regards their inputs and hence that OEMs would not tolerate a refusal of MTG to supply seat cover manufacturers selected by them.

39. The market investigation has shown that following the transaction, JCI has neither the ability nor the incentive to foreclose its downstream competitors, for the following reasons.

40. MTG has strong competitors and credible alternatives to its supplies. Aunde is an almost equally strong competitor to MTG for automotive textiles as a whole and for car seat textiles specifically. Other competitors include Trèves and Eybl with 10-20% market shares each in automotive textiles and textiles for car seats. These three competitors of MTG are already vertically integrated companies producing both the textiles and manufacturing seat covers.

41. The market investigation has also confirmed the statements made by the parties that there are no capacity constraints in automotive textiles. It was also confirmed that MTG is not considered in the marketplace, by either customers (including OEMs and Tier 1 and Tier 2 suppliers), to hold a specific competitive advantage via any technology or know-how over its automotive textile competitors.

42. Further, the market investigation has confirmed that it is the OEM which in the vast majority of cases chooses the textiles supplier for the seat, and not the Tier 1 or Tier 2 component manufacturer. This is clearly the case with MTG where, should one include those contracts relating to pricing, design and other contractual conditions negotiated directly with the OEMs, these would account for all of its top 5 customers, representing the vast majority of its sales[20]. All customers in the market investigation stated they could relatively easily switch suppliers in response to an increase in price by JCI post merger, both for automotive textiles as well as for the related interior car components.

43. As regards the linked potential downstream market of car seats, the market investigation has also largely confirmed that it is the OEM which chooses the seat cover and head rest manufacturer, and that therefore the car seat assemblers have little margin of choice as to the producers of individual components of the seats (such as the seat covers). Therefore, this transaction will not affect to any relevant extent the conditions of supply of JCI's competitors downstream and the transaction does not raise serious doubts as to its compatibility with the internal market and the EEA Agreement in this respect.

IV.3.5.2.Manufacturers of overhead systems/headliners and sun visors

44. JCI's position on a potential (EEA-wide) market for the assembly of overhead systems is [30-40]%, whilst it is [30-40]% when considering sun visors. Anyway, about [80-90]% of all overhead systems for cars produced in the EEA are assembled in-house by the OEMs themselves. As to headliners, JCI has a market share of [5-10]% according to the parties

and 10-20% according to the market investigation. The largest competitor is, according to the parties, Grupo Antolin with a market share of [30-40]%, followed by British Vita/Tramico with 12%. Regarding sunvisors, the parties submit a market share of [3040]%. This market share seems to be overestimated according to estimates by some of the main competitors. Among those competitors there are Magna, Grupo Antolin and Saturno.

45. Thus – and as mentioned above in recital 40 – MTG has strong competitors and credible alternatives to its supplies of automotive textiles as there is spare capacity in the market (see recital 41). It is also the OEMs that play a determinative role on the choice of supplier of textiles for these interior car components as well the negotiation of price and other conditions. Therefore, the transaction will not affect to any relevant extent the conditions of supply of JCI's competitors downstream.

46. Under the given conditions, the merged entity will have neither the ability nor the incentive to foreclose non-integrated suppliers of interior components or systems from access to automotive textiles (input foreclosure) from which would result any serious doubts as to its compatibility with the internal market and the EEA Agreement.

IV.3.6. No customer foreclosure

47. Concerning customer foreclosure, the parties argue that the OEMs' buyer power will not offer JCI the ability to reduce purchases from competitors of MTG in the case of textiles for car seats as the fabric supplier is selected by the car manufacturer, and in the case of textiles for other car interiors, OEMs' purchasing policy also does not permit freedom of choice of supplier by the Tier 1 operators. According to the parties, a refusal of JCI to purchase fabrics from a third party supplier or an attempt to purchase them at less favourable conditions would not be tolerated by the OEMs and could even lead to retaliatory action that would damage significantly JCI’s automotive supply business. In any event, they consider that there would be sufficient alternative buyers to which MTG’s competitors could sell their products and that JCI does not have significant market power in the potential downstream markets.

48. Indeed, one of the main arguments of the parties relies on their dependence on their customers, i.e. the OEMs, which would not allow them to raise prices or act in any anticompetitive way. According to the notification, OEMs may set requirements for the interior parts manufacturers also as regards the identity of their sub-suppliers. Moreover, they state that contracts for this type of product are normally awarded on the basis of tendering procedures (where quotations are asked from potential suppliers). Once a new car model is launched, textiles are put up for tender by the OEM. The contracts usually last for 3-4 years but the OEMs have the possibility to re-tender or change textiles within the life-span of a car model so that textiles manufacturers may lose a contract (which, for instance, has already happened to MTG). This must be considered when assessing the market shares as indicators of market power and the number of competitors needed to ensure effective competition.

49. As regards the possibility of customer foreclosure, the market investigation has shown that following the transaction, JCI has neither the ability nor the incentive to foreclose MTG's competitors' access to downstream markets for the following reasons.

IV.3.6.1.Suppliers of automotive textile for car seats

50. JCI's competitors for complete car seats and seat covers include Lear and Faurecia (controlled by PSA) with market shares in car seats of [20-30]% and [20-30]% according to the parties, and in seat covers of [10-20]% and [10-20]% respectively (another company, Prevent, achieves [10-20]% in seat covers). Regarding head rests, Grammer is the strongest competitor ([20-30]%) with meaningful presence also from Trèves ([1020]%) and Lear ([5-10]%).

51. The market investigation demonstrated that JCI is not considered to hold any specific competitive advantages in these interior car components or systems, and confirmed that the industry has available spare capacity. Therefore, there exist sufficient alternative buyers to which MTG’s competitors could sell their products.

52. Furthermore, it is the OEM that chooses not only the textiles and the interior car seat components for a given car model. Moreover, car manufacturers also produce car components such as car seats in-house. This means that JCI is not free to choose its supplier of automotive textiles for seat covers and head rests and therefore does not have the ability to foreclose access to MTG's competitors to a sufficient customer base.

53. The important role played by the OEMs in the choice of textile supplier also means that a refusal by JCI to purchase fabrics from a manufacturer chosen by the OEMs might result in it losing its bid for a tender for the supply of a car seat component, which might lead to JCI losing business on these downstream markets.

54. As regards the possibility of customer foreclosure of the automotive textile manufacturers, the market investigation has generally confirmed that following the transaction, JCI has neither the ability nor the incentive to do so. As a general note, most of the competitors on the upstream markets did not raise any concerns.[21] remained. It should be noted that none of the OEMs covered by the market investigation expressed objections to the transaction.

55. In light of the above, the merged parties will not have the ability or the incentive to foreclose non-integrated textile manufacturers from access to manufacturers of interior components or systems from which would result any serious doubts as to its compatibility with the internal market and the EEA Agreement.

IV.3.6.2.Suppliers of automotive textile for sun visors and overhead systems

56. Specifically for overhead systems, according to the notification, [80-90]% of all overhead systems for cars produced in the EEA are assembled in-house by the OEMs themselves. This may be explained by the fact that the production of these systems is essentially an assembly activity, and therefore needs to be located very close to the car production line. JCI's largest competitor in the non-captive overhead systems market is, according to the parties, Grupo Antolin with a market share of [30-40]% (followed by British Vita with [10-20]%).

57. For sunvisors, the tender procedures are organised by the OEMs for various car models and not just one, as they are technically simpler components. As is the case for the other car components described above, these are in the vast majority of cases directly chosen by the OEMs through tender procedures. As in overhead systems, Grupo Antolin is the strongest competitor regarding sun visors with [20-30]%, Saturno has [10-20]% and Magna [10-20]%.

58. The market investigation did not reveal any specific competitive advantages retained by JCI in these interior car components or systems, and also confirmed that the industry has available spare capacity to produce and/or assemble these products/systems. Therefore, there exist sufficient alternative buyers to which MTG’s competitors could sell their products (even if via the direction of the OEMs). Finally, no substantiated concerns were raised in the market investigation regarding the transaction, either from competitors or from OEMs.

59. Given in particular the important role of OEMs as regards the choice of both automotive textiles and interior car parts such as overhead systems and sunvisors, the merged parties will not have the ability or the incentive to foreclose non-integrated textile manufacturers from access to manufacturers of these interior car components or systems and from which would result any serious doubts as to its compatibility with the internal market and the EEA Agreement.

V. CONCLUSION

60. For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the functioning of the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 Through a […] joint venture with the company Italian Leather Group, MTG also produces automotive leather for […](car seats and door panels).

3 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p1).

4 The total production capacity of MTG accounts for only [0-5]% of total number of seats produced in the EEA.

5 This does not mean that this holds for all automotive markets – the Commission has in previous decisions also distinguished between components for LCVs and for heavy vehicles (COMP/M. 2832 – General Motors/Daewoo; COMP/M.5250 - Porsche/Volkswagen).

6 Arm rests only form part of the seat for rear seats; according to the parties, front arm rests form part of floor consoles.

7 IV/M.666 – Johnson Controls/Roth Frères; IV/M. 937 – Lear/Keiper; IV/M.1093 - Ecia/Bertrand Faure.

8 IV/M.1518 – Lear/United Technologies.

9 IV/M.1196 – Johnson Controls / Becker.

10 IV/M.666 - Johnson Controls/Roth Frères; COMP/M. 1563 - Ford /Plastic Omnium; IV/M.1196 – Johnson Controls / Becker.

11 COMP/M. 1563 - Ford /Plastic Omnium:

12 COMP/M. 1563 - Ford /Plastic Omnium; COMP/M. 5799 – Faurecia/Plastal .

13 See also COMP/M. 1563 - Ford /Plastic Omnium; COMP/M. 5799 – Faurecia/Plastal.

14 MTG has very residual sales to heavy vehicles.

15 The data are based on volume. The parties consider that the market shares in volume and in value would be very similar or identical as its product mix is very similar to the overall product mix in the EEA. The market investigation has broadly confirmed these estimates.

16 CSM is an automotive market forecasting service agency often used by the industry.

17 This includes, apart from MTG's market shares in overall textiles and in potential textile submarkets, all component markets/submarkets where JCI has a market share over or around [20-30]% (plus door panels in view of MTG's market share close to [20-30]%).

18 Data in volume. The parties consider that the market shares in volume and in value would be very similar or identical as its product mix is very similar to the overall product mix in the EEA. The market investigation has broadly confirmed the accuracy of these figures.

19 Paragraph 25 of the Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations betweem undertakings, OJ C 265/6, 18.10.2008.

20 […]% in 2009 according to the notification.

21 One competitor of the (potential) upstream market referred in its answers that JCI will have a strong market position after the transaction without specifying its answers further.