Commission, September 22, 2010, No M.5933

EUROPEAN COMMISSION

Judgment

MARFRIG/ KEYSTONE

Dear Sir/Madam,

Subject:Case No COMP/M.5933 - MARFRIG/ KEYSTONE Notification of 18/08/2010 pursuant to Article 4 of Council Regulation No 139/2004[1]

1. On 18/08/2010 the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004[2] by which the Marfrig Alimentos S.A. ("Marfrig", Brazil) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of Keystone Foods Intermediate LLC ("Keystone", the USA), which is ultimately controlled by LBG Keystone LLC ("LBG Keystone", the USA) by way of purchase of shares.

I. THE PARTIES

2. Marfrig is active in the supply of fresh and processed meat and other food as well as in the manufacture of leather products.

3. Keystone is active in the supply of meat and other products for the foodservice channel; contract logistics for food services and food retail industries and freight forwarding.

II. THE OPERATION

4. Marfrig intends to acquire all shares of Keystone. As a result, after completion of the proposed transaction, Marfrig will acquire sole control over Keystone within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

5. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 billion[3] (Marfrig: EUR 3.182 billion, Keystone: EUR 4.607 billion). Each of them has an EU-wide turnover in excess of EUR 250 million (Marfrig: EUR 1.423 billion, Keystone: EUR 1.766 billion), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

IV. MARKET DEFINITION

6. The proposed transaction concerns the following markets:

i) Supply of processed meat products – horizontal overlap, ii) Supply of primary meat - contract logistics for food services – vertical link, iii) Supply of primary meat - freight forwarding services – vertical link, iv) Supply of processed meat - contract logistics for food services – vertical link, v) Supply of processed meat - freight forwarding services – vertical link.

RELEVANT MARKETS

Supply of processed meat products

Product market

7. The supply of processed meat comprises meat from mammals or birds combined with external ingredients such as salt or spices and which can be raw, dried, smoked and cooked.[4]

Species

8. The Commission has considered that there are distinct product markets for processed poultry, processed beef and processed pork[5].

9. The parties submit that defining separate markets for individual species would not reflect actual market conditions. In their view, most end consumers would consider processed meat products from different species as substitutable and would choose a specific meat product depending on their catering needs rather than on the type of meat from which the product is made.

Customer segmentation

10. The Commission has further considered additional possible segmentations according to customer type, i.e. sales to (i) retailers and (ii) caterers, but ultimately left the market definition open[6].

11. The parties note that products supplied are similar irrespective of the distribution channel through which they are supplied. Products sold to both the food-services and retailer sectors are manufactured in the same way and on the same production lines. The main difference between the products destined for the food-services and retailer sectors is the packaging used. Products for the food-service sector are typically packaged in larger bulk sizes than those supplied to the retail sector.

Product type

12. The Commission has also considered further segmentations by product type, namely i) raw cured products, ii) processed meat for cold consumption, iii) canned meat, iv) cooked sausages, v) pâtés and pies, and vi) ready prepared dishes and components for such ("convenience products"). Again the Commission ultimately left the market definition open[7].

13. Ready prepared dishes, in previous decisions labeled "convenience products" or "ready prepared dishes and components for such", have been defined by the Commission as "a fully or partially prepared dish or packaged food that can be prepared quickly and easily, deep frozen or fresh"[8]. The Commission considered the sub-segmentation to a narrower market that includes only meat convenience food products which consist of at least 90% meat content, excluding pre-packed unprocessed meat and unprocessed minced meat, but left the exact product definition open.[9]

14. The parties submit that processed meat products belong to a single market which should not be further broken down by product type.

Conclusion on the product market definition

15. For the purpose of the proposed transaction, the precise market definitions can be left open, as since any alternative delineation, it would not raise any competition concerns.

Geographic market

16. In previous decisions the Commission left open whether the geographic market for the processed meat products is EEA-wide or national and whether the potential submarket of convenience products is EU-wide or national in scope[10].

17. The parties submit that markets for processed meat products are at least EEA-wide. The country of origin is not a particularly important characteristic of the product for consumers and it is even used less as a marketing tool than is the case in the supply of primary products.

18. There exist significant trade flows within the EEA and globally. Many of the processed meat products to be found on supermarket shelves and restaurants originate from outside the EEA. Main retailers across the EEA source their private label products from outside. A significant proportion of processed chicken products sold into the EEA originates from low cost production centres based outside the EEA. In fact, the parties import processed poultry and beef into the EU from Thailand and Brazil.

Conclusion on the geographic market definition

19. Nevertheless, it is not necessary in the present case to precisely define the market since the proposed concentration is unlikely to raise concerns under any geographic market definition

Supply of primary meat products

Product market

20. According to Commission precedents, primary meat includes both fresh and frozen meat (including minced meat) which is not further processed[11].

Species

21. In previous decisions, the Commission has determined that separate product markets can be distinguished for the sale of primary poultry, beef and pork, respectively[12]. Moreover, the Commission considered whether a potential market for primary poultry products would have to be further subdivided into separate markets for chicken meat, turkey meat, or boneless chicken breast meat, ultimately leaving the question open[13].

Fresh/frozen

22. Primary meat of all species encompasses both fresh and frozen meat, including meat supplied frozen for transport and then defrosted prior to sale to be consumed as a fresh or chilled product[14]. In the Marfrig Alimentos/Seara merger case the Commission has considered a potential further segmentation between fresh and frozen primary meat, without taking a final decision[15]. In previous cases, the Commission did not consider whether frozen (possibly including formerly frozen) should be distinguished from fresh (including chilled) products[16].

23. The parties submit that both fresh and frozen meat belong to the same product market, as, in their view, from a consumer perspective, frozen meat products are largely substitutable with fresh meat products.

Customer segmentation

24. The Commission has further considered additional possible segmentations according to sales to (i) retailers (ii) caterers and (iii) industrial processors (who transform the meat into processed meat products, which is then sold to the retail market or the catering market as processed meat)[17]. In some other decisions, the Commission considered this segmentation, but has left the question open[18].

25. The parties submit that whilst there may be some differences between the requirements of different customer types (e.g. in relation to quality of the cuts, packaging and speed of delivery[19]), products have to meet the same veterinary and hygiene requirements irrespective of the customer to which they are sold. Moreover, suppliers typically supply across customer types and it is straightforward for them to switch to supply customers in different segments. Indeed, given the role of traders in the market, it is often unclear into which channel any given consignment of primary meat will be sold[20].

Conclusion on the product market definition

26. However, it makes no difference whether it is considered the market for the supply of primary meat altogether or any subdivision thereof, since under any product market delineation Marfrig's market shares (Keystone not being active) would not be higher than 25%. Therefore, the precise product market definition can be left open since no competition concerns arise under any possible delineation.

Geographic market

27. In previous decisions[21], the Commission considered the retail market for primary meat, i.e. the market for the sale of fresh meat to super- and hypermarkets to be national in scope while the markets for the sale of fresh meat to caterers and industrial processors were considered to be possibly wider than national.

28. The parties submit that the geographic scope of this market would be EEA- or worldwide.

Conclusion on the geographic market definition

29. For the purpose of this transaction the precise geographic market definition can be left open, since no competition concerns would arise under any reasonable geographic market definition.

Contract logistics for food services Product market

30. In relation to Keystone’s activities in the segments of (i) contract logistics for the food services and the food retail industries and (ii) freight forwarding services, the Commission has in the past determined separate markets for contract logistics and freight forwarding[22].

31. Contract logistics are part of the supply chain process that plans, implements and controls the efficient, effective flow and storage of goods, services and related information from the point of origin to the point of consumption in order to meet customers’ requirements. The main elements of contract logistics are the provision of warehousing and transportation services, with the focal point being the management of the flow of goods for customers[23].

Conclusion on the product market definition

32. For the case at hand, the exact market definition can be left open since there would be no competition concerns regardless of the product market delineation.

Geographic market

33. The Commission has previously left open whether the relevant geographic market for contract logistics services was national or larger (pan-European or international)[24].

Conclusion on the geographic market definition

34. The exact market definition can be left open for geographic markets since no competition concerns would arise under every possible market definition.

Freight forwarding services

Product market

35. As mentioned in paragraph 30, the Commission has in the past determined separate markets for freight forwarding services[25].

36. Freight forwarding is the organization of transport items (possibly including ancillary activities such as customs clearance, warehousing, ground services etc.) on behalf of customers according to their needs[26]. The Commission in the past further subdivided the market into i) domestic and cross border freight forwarding; ii) land, air and sea freight forwarding; and iii) express and standard freight forwarding[27].

Conclusion on the product market definition

37. For this case the exact market definition can be left open for all product markets since there would be no competition concerns regardless of the product market delineation.

Geographic market

38. The Commission has previously left open whether the relevant geographic market for freight forwarding was national or EEA-wide[28].

Conclusion on the geographic market definition

39. The exact market definition can be left open for geographic markets since no competition concerns would arise under every possible market definition.

V. COMPETITIVE ASSESSMENT

HORIZONTAL OVERLAPS

40. Both parties are active in the EEA in the market of "processed beef products" and in the market of "processed poultry products".

Processed beef

At EEA level

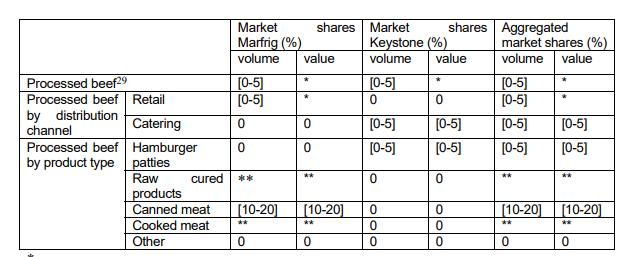

41. The table below shows the parties market shares in the supply of processed beef in the EEA.

* Estimates only available for the total market size by volume, not value. However, the Parties hold that their market shares would not significantly alter on a value basis. **The parties do not have any market intelligence on the market size and the market share for raw cured products, cooked meat and other processed beef products. Since the activities of Marfrig in relation to raw cured products and cooked meat are minor and Keystone is not active at all in these sub-segments, no competition concerns will arise.

42. It is clear from the table, incomplete though it is, that the parties' activities are largely complementary and that there is no overlap whether the market is divided by type of processed beef or by distribution channel At EEA-level, the combined share for processed beef will be lower than the highest market share recorded for an individual segment, Marfrig's market share of [10-20]% in canned meat.

At national level

43. At national level the parties' activities only overlap in the market of processed beef products in the national markets of Belgium, France, Italy and Spain. However, on these markets the estimated combined market shares are below 10%.[29]

44. On the narrower segmentation per product type and per consumer type, there are overlaps in the parties' activities in the market of supply for catering in the national markets of Belgium, France and Italy. However, on these markets the combined market shares are below 10% (Belgium: [5-10]%, France: [5-10]%, Italy: [0-5]%).

Conclusion

45. Based on the above, it can be concluded that the proposed transaction will not give raise to any significant impediment to effective competition with respect to the market for the processed beef under any product and geographic market definition.

Processed poultry

At EEA-level

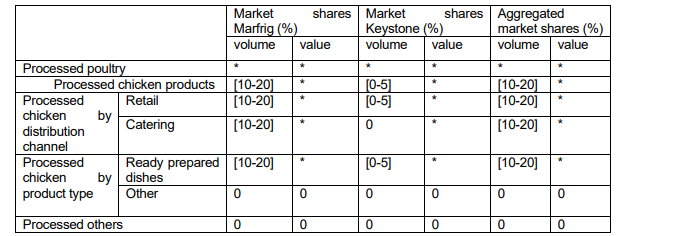

46. At EEA level, the parties' activities overlap in the market of processed chicken products, their aggregated market share being [0-5]%.

47. In the narrower markets of processed chicken products per product type, the parties' activities overlap only in the market of ready prepared dishes. However this is not an affected market, as the parties' combined market shares are estimated to be below 15%.

48. In the narrower markets of processed chicken products per consumer type, the parties' activities overlap in the market of i) supply to retail and ii) supply to catering, however, these markets are not affected, as both estimated, combined market shares are below [510]% (supply to retail: [0-5]%, supply to catering: [0-5]%).

At national level

49. At national level the parties' activities only overlap in the market of processed chicken products in the national markets of Finland, Germany, the Netherlands, and the United Kingdom. However, except for the UK, the markets are not affected, as the estimated combined market shares are below [5-10]% (Finland: [0-5]%, Germany: [0-5]%, the Netherlands: [0-5]%).

50. In the United Kingdom, the parties' combined market share in the market of processed chicken products slightly exceeds 15% however, as it can be seen in the table below, Keystone's increment is negligible ([0-5]%).

51. In the narrower markets of processed chicken products per product type of processed chicken products, the parties' activities overlap in the market of ready prepared dishes in the national markets of Finland, Germany, the Netherlands and the United Kingdom. However, except for the United Kingdom, these markets are not affected, as the parties' combined market share is below 15%.[30]

52. In the United Kingdom, the parties' combined market share in the market of ready prepared dishes is [10-20]%, however, as it can be seen in the table below, Keystone's increment is negligible ([0-5]%).

53. In the narrower markets of processed chicken products per consumer type, the parties' activities overlap i) in the market of supply to catering in the national markets of Germany and the Netherlands and ii) in the supply to retail in the national market of the United Kingdom.

54. The national markets of Germany and the Netherlands would not be affected markets as the combined market shares are well below 15% (Germany: [0-5]%, the Netherlands: [5-10]%)

55. In the United Kingdom, the market of supply of processed chicken products to retail, the parties' combined market share is [10-20]%, however, as it can be seen in the table below, Keystone's increment is negligible ([0-5]%).

The following table shows parties' market shares in the supply of poultry meat in the UK.

* Since the parties cannot estimate the total market size, they also cannot estimate their market shares, which would need to be based on their sales in proportion to the overall market size.

Conclusion

57. Based on the above, it can be concluded that the proposed transaction will not give raise to any significant impediment to effective competition with respect to the market for the supply of processed poultry under any product and geographic market definition.

VERTICAL RELATIONSHIPS

Supply of primary meat (upstream) - Contract logistics for food services (downstream),

58. Keystone does not supply primary meat in the EEA. Marfrig's market shares in the upstream market of supply of primary meat are below [5-10]% on EEA-wide and below 25% on all the relevant national markets.

59. Only Keystone provides contract logistics in the EEA. At EEA level, the market shares of Keystone are minimal ([0-5]%). At national level Keystone's shares are below 25%.

60. It is unlikely that the combined entity would be in a position, after the transaction, to raise prices to or to foreclose rivals upstream with such a low market share downstream.

61. Conversely, if Marfrig, after the merger, would only use Keystone's logistic network, this would not significantly change the structure of the market. The reason for this is that logistic competitors downstream would still have more than 75% of the deliveries of primary meat after the transaction.

Conclusion

62. Given the above, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the internal market with regard to the vertical link described above.

Supply of primary meat (upstream) - freight forwarding services (downstream)

63. Keystone does not supply primary meat in the EEA. Marfrig's market shares in the upstream market of supply of primary meat are below [5-10]% on EEA-wide and below 25% on the relevant national markets.

64. Only Keystone provides freight forwarding services in the EEA. At EEA level, the market shares of Keystone are minimal ([0-5]%). At national level Keystone's share is always below 25%.

65. It is unlikely that the combined entity would be in a position, after the transaction, to raise prices to or to foreclose rivals upstream with such a low market share downstream.

66. Conversely, if Marfrig, after the merger, would only use Keystone's freight forwarding network, this would not significantly change the structure of the market. The reason for this is that logistic competitors downstream would still have more than 75% of the deliveries of primary meat after the transaction.

Conclusion

67. Given the above, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the internal market with regard to this vertical relationship

Supply of processed meat (upstream) - Contract logistics for food services (downstream)

68. The aggregated market shares of the parties in the upstream market of supply of processed meat are below 25% for the narrowest product and geographic market definitions.

69. Marfrig does not provide contract logistics in the EEA. At EEA level, the market shares of Keystone are minimal ([0-5]%). At national level Keystone's shares are below 25%.

70. It is unlikely that the combined entity would be in a position, after the transaction, to raise prices to or to foreclose rivals upstream with such a low market share downstream.

71. Conversely, if Marfrig, after the merger, would only use Keystone's logistic network, this would not significantly change the structure of the market. The reason for this is that competitors downstream would still have more than 75% of the market in processed meat after the transaction.

Conclusion

72. Given the above, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the internal market with regard to the vertical link described above.

Supply of processed meat (upstream) - freight forwarding services (downstream).

73. The aggregated market shares of the parties in the upstream market of supply of processed meat are below 25% under the narrowest product and geographic market definition.

74. Marfrig does not provide freight forwarding services in the EEA. At EEA level, the market shares of Keystone are minimal ([0-5]%). At national level Keystone's share are below 25% in every Member State.

75. It is unlikely that the combined entity would be in a position, after the transaction, to raise prices to or to foreclose rivals upstream with such a low market share downstream.

76. Conversely, if Marfrig, after the merger, would only use Keystone's freight forwarding network, this would not significantly change the structure of the market. The reason for this is that competitors downstream would still have more than 75% of the market in processed meat after the transaction.

Conclusion

77. Given the above, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the internal market with regard to the said vertical relationship.

VI. CONCLUSION

78. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

[1] OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 OJ L 24, 29.1.2004, p. 1 (the "Merger Regulation").

3Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p1).

4 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 13.

5 Case COMP/M.3401 – Danish Crown/Flagship Foods, paragraph 13. 0

6 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 14.

7 Case COMP/M.3337 – Best Agrifund/Nordfleisch, paragraph 40; Case COMP/M.3401 – Danish Crown/Flagship Foods, paragraph 16; Case COMP/M.3605 – Sovion/HMG, paragraph 88; Case COMP/M.5558 – Nutreco/Cargill, paragraph 17.

8 Case COMP/M.3337 – Best Agrifund/Nordfleisch, paragraphs 51-52.

9 Case COMP/M.3337 – Best Agrifund/Nordfleisch, paragraph 51.

10 Cases COMP/M.5705 – Marfrig Alimentos/Seara, para. 18; COMP/M.3337 – Best Agrifund/Nordfleisch paragraphs. 43-46, 53;

11 Case COMP/M.3337 Best Agrifund/Nordfleisch, paragraph 23.

12 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 10; Case COMP/M.3476 – Cargill/Seara, paragraph 10.

13 Case COMP/M.5705–Marfrig Alimentos/Seara, paragraph 10; Case COMP/M.3476–Cargill/Seara, paragraph 10.

14 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 8.

15 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 8.

16 Case COMP/M.3337 – Best Agrifund/Nordfleisch, paragraph 23.

17 Case COMP/M.3337 – Best Agrifund/Nordfleisch paragraph 24.

18 Case COMP/M.5705 – Marfrig Alimentos/Seara, paragraph 9; Case COMP/M.3476–Cargill/Seara, paragraph 11.

19 Case COMP/M.3401 – Danish Crown/Flagship Foods, paragraph 17.

20 Meat traders generally use their market knowledge and contacts to obtain orders from their known customers and then source the product (at a small margin) from around the globe.

21 Case COMP/M.5322 – Marfrig/OSI Group Companies, paragraph 20.

22 Case COMP/M.3971 – Deutsche Post/Excel, paragraph 15.

23 Case COMP/M.3971 – Deutsche Post/Excel, paragraph 14.

24 Case COMP/M.3492 – Excel/Tibbett, paragraphs 17, 18.

25 Case COMP/M.3971 – Deutsche Post/Excel, paragraph 15.

26 Case COMP/M.5450 – Kühne/HGV/TUI/HAPAG-LLOYD, paragraph 18.

27 Case COMP/M.5450 – Kühne/HGV/TUI/HAPAG-LLOYD, paragraph 18; Case COMP/M.3971 –

Deutsche Post/Excel, paragraphs 10, 13.

28 Case COMP/M.3492 – Excel/Tibbett, paragraphs 17, 18.

29 The parties point out that their estimates of the total market size of the processed beef segment and its sub-segments represent the parties' best estimate. However, due to the limited activities of the parties in these segments, the market intelligence available to the parties is limited accordingly. Keystone, who estimated the size of the processed beef for catering segment, is active for […] in this segment. Marfrig's production facilities and main activities are in South America. Marfrig's estimate of the size of the processed beef for retail segment is based on market intelligence on production, export and import volumes in the EEA and data on the break down of beef production in the UK, according to which 39% of all beef production are sold as processed beef to retail.

30 The parties were unable to provide market shares, but stated that the combined market shares are below 10%.

31 Idem.