Commission, July 2, 2014, No M.7231

EUROPEAN COMMISSION

Judgment

VODAFONE/ ONO

Dear Sir/Madam,

Subject: Case M.7231 - VODAFONE/ ONO

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041

1. On 23 May 2014, the European Commission received the notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Vodafone Group Plc ("Vodafone", UK) acquires within the meaning of Article 3(1)(b) of Council Regulation (EC) No. 139/2004 on the control of concentrations between undertakings (the "Merger Regulation") control of the whole of the undertaking Grupo Corporativo ONO S.A. ("ONO", Spain), by way of purchase of shares. Vodafone is designated hereinafter as the "Notifying Party" and Vodafone and ONO as the "Parties" to the proposed transaction.

1 THE PARTIES

2. Vodafone is the holding company of a group primarily involved in the operation of mobile telecommunications networks and in the provision of mobile telecommunications services, such as mobile voice, messaging and data services. Some of its operating companies also provide fixed voice, fixed internet and/or cable and internet TV ("IPTV") services. Within the EU, Vodafone is active in 12 Member States, including Spain. In Spain, in addition to providing retail mobile telecommunications services and mobile wholesale access and call origination services, Vodafone is active in the provision of fixed voice and broadband internet access services, mainly by using the Telefónica (hereinafter the whole group designated as "Telefónica") fixed access network. Furthermore, in May 2013, Vodafone concluded a co-investment agreement with Orange for the roll-out of two individual and independent fibre to the home ("FTTH") networks in Spain, with the objective of reaching 3 million building units by 30 September 2015. Vodafone does not offer television services in Spain.

3. ONO is a Spanish company that is primarily involved in the supply of television and fixed telecommunications services, such as pay TV, broadband internet and fixed voice services. ONO operates a proprietary cable network in 13 of the 17 Spanish Autonomous Regions. ONO is also active as a mobile virtual network operator ("MVNO") hosted in the mobile network of Telefónica.

2 THE CONCENTRATION

4. Pursuant to the Sale and Purchase Agreement dated 17 March 2014 between Vodafone and ONO, Vodafone will acquire 100% of the shares in ONO through its wholly-owned subsidiary Vodafone Holding Europe S.L.U.

5. Vodafone will thus acquire sole control over ONO within the meaning of Article 3(1)(b) of the Merger Regulation.

6. The Notifying Party submits that the proposed transaction aims at combining Vodafone's and ONO's complementary mobile and fixed networks. More specifically, the integration of the Parties' networks will enable Vodafone to offer a full range of fixed and mobile telecommunications, internet and television services throughout Spain through the integration of ONO's cable network and Vodafone's mobile infrastructure and emerging FTTH network.

7. In addition, the Notifying Party submits that ONO’s cable infrastructure will drive operational savings through the optimisation of the national and regional backbones as well as IT stacks, the possibility to close central offices, replacing asymmetric digital subscriber line ("ADSL") offers (via local loop unbundling ("LLU")) by ultra- fast broadband in some areas and through the usage of ONO’s cable infrastructure to complement existing mobile backhaul. Vodafone also expects that the proposed transaction will provide opportunities for the cross-selling of more services to customers and improved offerings, which would result in enhanced competition and increased customer choice in Spain.

3 EU DIMENSION

8. The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million2 (Vodafone: EUR 51 904 million; ONO: EUR 1 598 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Vodafone: EUR […]; ONO: EUR […]), and only ONO, but not Vodafone, achieves more than two-thirds of its aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4 RELEVANT MARKETS

9. In Spain, the Parties' activities overlap in: (i) the retail supply of fixed internet access services; (ii) the retail supply of fixed voice services; and (iii) the retail supply of mobile telecommunications services to end customers. The Parties offer these services as stand-alone products, as well as in bundles of these services (so-called "multiple play" offers). In addition, Vodafone and/or ONO are present upstream in:

(i) wholesale access and call origination services on mobile networks (Vodafone);

(ii) wholesale fixed call termination services (Vodafone and ONO); (iii) wholesale mobile call termination services (Vodafone and ONO); and (iv) wholesale international roaming services (Vodafone).

4.1 Retail supply of fixed internet access services

10. Internet access services consist of the provision of a fixed telecommunications link enabling customers to access the internet via narrowband ("dial-up") services or broadband services.

4.1.1 Product market definition

11. The Notifying Party submits that there is a single market for the provision of fixed internet access services. According to the Notifying Party, there is no reason to differentiate between broadband and narrowband, since narrowband nowadays represents a negligible proportion of retail internet access services in most Member States, notably in Spain.

12. In addition, the Notifying Party takes the view that the different fixed broadband technologies, such as DSL, cable and fibre, are all part of the same product market. The Notifying Party submits that competition authorities have not traditionally defined separate markets for the retail supply of fixed internet access services by reference to different bandwidth speeds. The Notifying Party argues that market players gradually increase the speed of their commercial offerings as technology allows it and the demand preferences evolve. Thus, the lower speeds tend to disappear as the operators increase the speed of their commercial proposals.3

13. In contrast, it submits that mobile broadband is still subject to inherent technical constraints and that retail customers do not view it as substitutable with fixed broadband. The Notifying Party does not have a strong view as to the possible segmentation between residential / small business customers, and large business customers.

14. In Carphone Warehouse/Tiscali UK, the Commission distinguished between residential / small business customers and large business customers.4 The majority of respondents to the market investigation in the present case confirmed that residential / small business customers and large business customers constitute separate markets.5

15. Moreover, also in the Carphone Warehouse/Tiscali UK case, the Commission concluded that narrowband and broadband internet services belong to separate markets.6 Broadband internet access has three distinguishing features which are not available with narrowband access: (i) the service is always on (that is no dial-up is required); (ii) it is possible to use both voice and data services simultaneously; and (iii) broadband has a faster speed than a dial-up connection. In the same decision, the Commission considered that broadband provided through ADSL technology and cable may belong to the same market but left the precise market definition open.

16. A single competitor indicated that in Spain a distinction between broadband and ultrafast broadband should also be considered.7 The Commission considers that there is a variety of different broadband speeds in the market and that broadband speeds increase, as technologies develop. The Commission notes that the increase in speeds is a sign of evolution of the market, rather than the creation of a new separate market.

17. Furthermore, also in the Carphone Warehouse/Tiscali UK case, the Commission concluded that mobile broadband is more expensive and slower, so it may constitute a separate market.8 The majority of respondents to the market investigation in the present case considered that mobile broadband and fixed internet services are not yet substitutable. Some respondents pointed to differences in speed and quality of the services. Others considered that fixed services have much higher performances, although the tendency in the future is that the differences would narrow. In addition, some respondents considered that there are cultural differences between fixed and mobile broadband. Mobile broadband is used more by younger users whereas fixed internet services are more widely used and universal.9 On this basis, the Commission concludes that to date, mobile broadband services are not yet substitutable to fixed internet services in Spain. However, the Commission considers it possible that in the future the two services may converge.

18. For the purpose of the present decision, the exact product market definition in relation to a sub-segmentation of fixed internet services (for example by customer, technology or speed) can be left open as the proposed transaction does not raise competition concerns under any possible market definition.

4.1.2 Geographic market definition

19. The Notifying Party considers the market to be national in scope, based on the Commission's precedents.10 The Notifying Party submits that aside from regional cable operators (such as Euskatel, S.A. , Telecable de Asturias, S.A.U. and R Cable, S.A.), all competitors (including Telefónica, Orange, Jazztel) operate on the national market. Marketing, commercial and technical services, pricing and bundling of services are directed to the national market. The Notifying Party argues that retail electronic telecommunications markets (which include the fixed internet access market) have been consistently defined as national markets. In Spain most operators compete on a national basis. The Notifying Party concedes that there are a few relevant regional and local operators but even those operators may be able to compete on a national basis either by deploying their own networks or by using the regulated wholesale services available in Spain.

20. The majority of respondents to the market investigation in the present case confirmed that the market for the provision of retail fixed internet services is national in scope and that even telecommunications operators that are part of a wider international group compete on a national basis within the Member States where they are active. The competitive conditions existing in each Member State are very different. Factors such as the number of competitors, disposable income, the degree of competition, costs, population and topography are listed as differentiating parameters by respondents.11

21. As concerns operators such as ONO that provide telecommunications services via a cable network that is restricted to a certain area, the Commission cannot judge in the present case whether they have the ability and incentive to deploy new networks or obtain access to telecommunications services outside of their current network footprint. However, they do interact within that footprint with providers such as Telefónica that operate nationally. ONO itself already operates a cable network in 13 of the 17 Spanish Autonomous Regions. Hence, especially a cable operator as ONO ultimately competes on the basis of nation-wide dynamics.

22. For all these reasons, the Commission concludes that the respective market is national in scope.

4.2 Retail supply of fixed voice services

23. On the market for retail supply of fixed voice services, operators provide fixed voice services to end-customers. In line with previous Commission decisions, fixed voice services include the provision of connection services or access at a fixed location or address to the public telephone network for the purpose of making and receiving calls and related services.12

4.2.1 Product market definition

24. The Notifying Party submits that there is a single market for the provision of fixed voice services. According to the Notifying Party, there is no reason to differentiate between business and residential customers, since most operators provide services to both types of customers and residential packages are also purchased by small offices / home offices businesses (SOHOs) and small and medium enterprises (SMEs). In addition, the Notifying Party takes the view that the relevant market should comprise both domestic and international calls, as well as both fixed line telephony and managed VoIP services. In contrast, the Notifying Party submits that fixed voice services are not substitutable with mobile voice services, even though some consumers may switch from fixed only packages or mobile only voice packages to fixed and mobile multiple play bundles.

25. In Carphone Warehouse/Tiscali UK, the Commission considered that a distinction between local / national and international calls as well as between residential and business customers may not be relevant.13 In Vodafone/Kabel Deutschland, the Commission did not take a definitive view with regard to these possible further segmentations of the retail fixed voice services market. The Commission concluded however that traditional fixed voice services and managed VoIP services are interchangeable within a single market for the retail supply of fixed voice services.14

26. The market investigation in the present case revealed indications that VoIP services and fixed voice services provided through fixed lines are interchangeable (the service is largely the same and the quality of managed VoIP service is improving) and therefore part of the same market.15 According to a respondent, the development of VoIP applications over the last years has increased the comparability between both types of services.

27. As regards the distinction between residential and business customers, the majority of respondents to the market investigation indicated that there is a distinction between residential and business customers.16 One respondent considered that they are two well-distinguished markets and segments with clearly different needs. The degree of competition is different and so is the manner of supplying the service.

28. For the purpose of the present decision, the exact product market definition can be left open as the proposed transaction does not raise competition concerns under any possible market definition.

4.2.2 Geographic market definition

29. The Notifying Party considers the market to be national in scope, based on the Commission's precedents.17

30. The majority of respondents to the market investigation in the present case confirmed that the market for the provision of retail fixed voice services is national in scope and that even telecommunications operators that are part of a wider international group compete on a national basis within the Member States where they are active. The competitive conditions existing in each Member State are very different. Factors such as the number of competitors, disposable income, the degree of competition, costs, population and topography are listed as differentiating parameters by respondents.18

31. The Commission considers the respective market to be national in scope.

4.3 Retail supply of mobile telecommunications services

32. Mobile telecommunications services to end customers include services for national and international voice calls,19 SMS (including MMS and other messages), mobile internet data services and retail international roaming services.20

4.3.1 Product market definition

33. The Notifying Party submits that there is a single market for the provision of mobile telecommunications services to end customers. According to the Notifying Party, it is not appropriate to distinguish services by network technology (2G/GSM, 3G/UMTS and 4G/LTE), by tariff (pre-paid and post-paid contracts), by type of customers (private and business), or by type of service (internet data services, voice and text services).

34. In Hutchison 3G Austria/Orange Austria the Commission considered the aforementioned segmentations, but eventually concluded that there is a single market for the provision of mobile telecommunications services to end customers.21 More recently, in H3G / Telefónica Ireland, the Commission also concluded that there is a single market for the provision of mobile telecommunications services to end customers and that there are no separate markets by types of customers (such as business and residential), by technology (such as 2G, 3G and 4G), by types of service (i.e. voice, mobile broadband and machine to machine), by types of contracts (such as pre-paid and post-paid).22

35. The market investigation in the present case indicated that the provision of retail mobile telecommunications services to private and business customers belongs to the same market. One respondent argued that although there is a difference in consumption and contracts, the range of services offered is largely the same.23

36. The responses of competitors as regards the other possible segmentations of this market were inconclusive. However, the majority of customers and consumer associations considered that the market should not be segmented by contract type or by type of service.24

37. The Commission also considers that although different types of mobile services and different types of customers / contracts have different characteristics, they form part of the same market because of supply-side substitutability. MNOs offering only post-paid services for instance could easily offer pre-paid services and vice versa. Similarly, although consumers may distinguish between mobile broadband, which they purchase for use on their laptop or tablet, and bundles of voice and data services, which they purchase for their mobile phone, the Commission finds that they form part of the same market based on supply-side substitutability. Mobile broadband is offered through the same infrastructure and technology as other mobile telecommunications services. Hence, MNOs could easily switch from offering mobile broadband to offering other mobile telecommunications services, and vice versa.

38. For the purpose of the present decision, the Commission concludes that the market for the provision of mobile telecommunications services to end customers constitutes one single market.

4.3.2 Geographic market definition

39. The Notifying Party considers that the market should be considered national in scope in line with previous Commission's decisions.25

40. The Commission has consistently found that the markets for retail mobile services provided to end consumers are national in scope.26

41. The majority of respondents to the market investigation in the present case confirmed that the market for the provision of retail mobile telecommunications services is national in scope and even telecommunications operators that are part of a wider international group compete on a national basis within the Member States where they are active. The competitive conditions existing in each Member State are very different. Factors such as the number of competitors, disposable income, the degree of competition, costs, population and topography are listed as differentiating parameters by respondents.27

42. The Commission considers the respective market to be national in scope.

4.4 Multiple play packages

43. In Vodafone/Kabel Deutschland28, the Commission found that multiple play offers comprise a bundle of two or more of the following services to end-customers: fixed telephony, fixed internet services, mobile telephony, mobile internet and TV services. Such packaged offers may consist of double, triple, quadruple or even quintuple play offers comprising some or all of the above services.

44. The traditional multiple play offers in Spain have been composed of fixed telephony and broadband access and, to a certain extent, pay TV.

4.4.1 Product market definition

45. The Notifying Party refers to reports from the Spanish competition authority on the evolution in the number of subscribers of the different bundles in Spain. These reports suggest that bundles including mobile telephony and mobile internet access services have increased significantly in terms of number of subscribers following their introduction in 2012, while bundles not including these services have decreased. However, in the Notifying Party's view, customers who subscribe to bundles still account for a relatively low percentage of all customers of fixed and mobile telecommunications services.

46. The Notifying Party submits that the question whether the different types of multiple play offers constitute separate product markets from each of the markets of their components should be left open, in line with the approach taken in previous Commission decisions.29

47. Previous Commission decisions ultimately left open whether there is a market for multiple play services that is separate from the markets for each of the components of the bundles.30

48. The market investigation in the present case has indicated that in Spain triple and quadruple-play services are becoming the norm. One respondent considered that multiple play packages attract the "most valuable customers".31 In particular, customers currently purchase triple and quadruple-play offers combining either (i) fixed telephony, fixed internet / broadband access and TV (only to a limited extent) or (ii) mobile, fixed telephony, fixed internet / broadband access.32 As part of these multiple play offers, consumer associations were of the view that today broadband internet access is to be considered the most relevant service.33 Finally, the majority of competitors indicated that they currently market quadruple play offers and confirmed that such offers are already purchased today and will be increasingly purchased in the near future.34

49. In any event, for the purpose of the present decision, the question whether the different types of multiple play constitute separate relevant markets from each of the markets of their components can be left open, as the proposed transaction does not raise competition concerns under either product market definition.

4.4.2 Geographic market definition

50. In previous decisions, the Commission considered that the possible market for triple play services was national in scope35 but ultimately left the exact geographic market definition open.36

51. As regards the geographic scope of the respective services to be bundled in multiple play offers, in the case at hand, the Commission considered the markets for fixed voice, fixed internet access and mobile telecommunications services to be national in scope. The Commission ultimately left open whether the retail market for TV services is national or regional in scope.37

52. For the purpose of the present decision, the exact geographic market definition can be left open as the proposed transaction does not raise competition concerns under any possible market definition.

4.5 Wholesale market for access and call origination services on mobile networks

53. MNOs provide wholesale access and origination services which enable operators without their own network, MVNOs, to provide their own retail mobile services. There is a wide variety of MVNOs, ranging from MVNOs that have a fully operational proprietary core network and that purchase access to the radio access network of MNOs on the one end, to pure re-sellers of a MNO on the other end.

4.5.1 Product market definition

54. In line with previous Commission decisions, the Notifying Party submits that wholesale access and call origination services, by which MNOs enable MVNOs to provide their own retail mobile services, belong to the same relevant product market.38

55. The majority of respondents to the market investigation in the present case confirmed this product market definition.

56. The Commission considers that the product market should be defined as the wholesale market for mobile access and call origination services.

4.5.2 Geographic market definition

57. In line with previous Commission's decisions, the Notifying Party submits that the relevant geographic scope of the market for wholesale access and call origination on public telephone network is national39.

58. The majority of respondents to the market investigation in the present case confirmed that the geographic market is national.

59. The Commission considers that the relevant geographic market is national.

4.6 Wholesale market for fixed call termination services

60. Call termination is the service provided by a network operator on the supply side to other network operators on the demand side, whereby a call originating in a demand side operator's network is delivered to a user in the supply side operator's network. This service is required by every originating operator, as it is necessary for its customers to be able to communicate with the customers of other networks. Call termination is therefore a wholesale service that is resold or used as an input for the provision of downstream retail telephony services.

4.6.1 Product market definition

61. In line with previous Commission decisions, the Notifying Party submits that wholesale termination on each individual fixed network constitutes a separate relevant product market as a customer on any given network can only be reached by terminating the call on that specific network.40

62. The majority of respondents to the market investigation in the present case confirmed this product market definition.41

63. The Commission considers that there is no substitute for call termination on each individual network since the operator transmitting the outgoing call can reach the intended recipient only through the operator of the network to which the recipient is connected.

64. The Commission considers that, as regards wholesale call termination services, termination on each individual fixed network constitutes a separate product market.

4.6.2 Geographic market definition

65. The Notifying Party considers that the market for call termination services is national in scope.

66. In previous decisions, the Commission considered the geographic market to be national in scope. 42

67. The majority of respondents to the market investigation in the present case confirmed the geographic market as national.43

68. The Commission concludes that the wholesale market for fixed call termination services is national in scope.

4.7 Wholesale market for mobile call termination services

69. When someone calls a mobile phone connected to a different network that call is terminated on the network of the receiving mobile phone. In order for a retail mobile service provider to be able to provide calls to a different network, it must purchase wholesale terminations services on these other networks. This is done through interconnection agreements between the various network operators.

4.7.1 Product market definition

70. The Notifying Party submits that there is no substitute for call termination on each individual network since the operator transmitting the outgoing call can reach the intended recipient only through the network to which the recipient is connected. Accordingly and in line with previous Commission decisions, the Notifying Party submits that wholesale termination on each individual mobile network constitutes a separate relevant product market.44

71. The majority of respondents to the market investigation in the present case confirmed this product market definition.45

72. The Commission considers that there is no substitute for call termination on each individual network since the operator transmitting the outgoing call can reach the intended recipient only through the operator of the network to which the recipient is connected.

73. The Commission concludes, in line with previous decisions, that termination on each individual mobile network constitutes a separate product market.

4.7.2 Geographic market definition

74. In line with previous Commission decisions,46 the Notifying Party submits that the market should be considered national in scope.

75. The majority of respondents to the market investigation in the present case confirmed the geographic market as national.

76. The Commission concludes that the markets for call termination of mobile calls are national.47

4.8 Wholesale market for international roaming

77. For a provider of retail mobile services to be able to provide its end customers with telecommunication services outside their home countries, it enters into wholesale roaming agreements with providers of wholesale international roaming on other national markets. Roaming consists of both terminating calls and originating calls.

78. Retail mobile service providers sometimes have preferred roaming partners in certain countries. This means that the preferred partners' network will be used in the first instance when it has coverage and the mobile user has not manually chosen a different network. A home network will normally have multiple agreements with operators in a particular county in order to provide optimal coverage.

4.8.1 Product market definition

79. In line with previous Commission decisions, the Notifying Party submits that there is a relevant product market for wholesale international roaming services.48

80. Wholesale international roaming services are regulated.49 Mobile network operators must meet all reasonable requests for wholesale roaming access under a reference offer and wholesale changes for the making of regulated roaming services (voice, message and data roaming) are capped.

81. The Commission concludes, in line with previous decisions, that the market for international roaming comprising both terminating calls and originating calls constitutes a separate product market.

4.8.2 Geographic market definition

82. The Notifying Party agrees with previous Commission decisions that the relevant geographic scope of the market for the supply of wholesale international roaming is national.50

83. In previous decisions, the Commission found that the wholesale market for international roaming is national in scope, given that wholesale international agreements can be concluded only with companies which have an operating licence in the relevant country and the licences to provide mobile services are restricted to a national territory.51

84. The Commission concludes that the markets for international roaming are national.

5 COMPETITIVE ASSESSMENT

85. According to the information submitted by the Notifying Party, the proposed transaction gives rise to horizontally affected markets52 for (i) the retail supply of fixed internet access services in Spain; and (ii) the retail supply of mobile telecommunications services to end customers in Spain. In addition, the Parties' combined market share is close to 20% in the market for the retail supply of fixed voice services in Spain in the narrower residential segment in 2013 and was above 20% in 2012. On this basis, this market is also being examined, although it is technically not an affected market.

86. In addition, the proposed transaction gives rise to the following vertically-affected markets in Spain: (i) the wholesale market for access and call origination services on mobile networks (upstream) and the retail market for the supply of mobile telecommunications services (downstream); (ii) the wholesale market for mobile call termination services (upstream) and the retail markets for the supply of fixed call services and the supply of mobile telecommunications services (downstream); (iii) the wholesale market for mobile call termination services (upstream) and the retail markets for the supply of fixed call services and the supply of mobile telecommunications (downstream).

87. Finally, since both Parties offer multiple play packages in Spain, the proposed transaction could potentially give rise to horizontal competition concerns in a possible market for multiple play services. In addition, the proposed transaction could potentially give rise to conglomerate concerns, in relation to foreclosure of inputs (such as mobile or fixed wholesale access services) to competitors wishing to offer multiple play bundles.

5.1 Horizontal assessment

5.1.1 Retail supply of fixed internet access services

88. Both Parties provide fixed internet access services to end customers in Spain. The Parties have a combined market share of 20.6% by revenues (Vodafone 5.4%, ONO 15.2%) and of 20.7% by volume53 (Vodafone 7.9%, ONO 12.7%).54 On the potential sub-segment relating to the provision of fixed internet services to residential customers, the Parties' combined market share is [20-30]% by revenues (Vodafone [5-10]%, ONO [10-20]%) and 22.6% by volume (Vodafone 7.9%, ONO 14.7%).55 By contrast, on the potential sub-segment relating to the provision of fixed internet services to business customers, the Parties' combined market share is below 20% both by revenues and by volume.56

5.1.1.1 The Notifying Party's views

89. The Notifying Party submits that the proposed transaction will not lead to competition concerns on the retail supply of fixed internet access services market in Spain.

90. First, the Notifying Party claims that the Parties' combined market share remains below 25%, which is the threshold under which, according to the Commission's Guidelines on the assessment of horizontal mergers (the "Horizontal Merger Guidelines"),57 a concentration is generally presumed to be compatible with the internal market.

91. Second, the Notifying Party claims that the merged entity will continue to face strong competition from other market players such as Telefónica (43.1% market share by revenues), Jazztel (13.8%) and Orange (13.7%).58 The Spanish market for the retail supply of fixed internet services is characterised by strong competition both in terms of price (with customer loyalty being very low, as shown by high churn rates) and for the improvement and deployment of next generation network ("NGN") infrastructure in order to meet consumer demand for high transmission bandwidth.

92. Third, the Notifying Party claims that Vodafone and ONO are not close competitors in this market. ONO is primarily a provider of fixed telecommunication and pay TV services through its proprietary fixed network. By contrast, Vodafone is an MNO which, despite having recently started to deploy its FTTH network, is currently dependent to a large extent on regulated access to Telefónica's fixed network in order to provide fixed telecommunication services.

5.1.1.2 The Commission's assessment

93. Based on the results of the market investigation, the Commission did not identify competition concerns in relation to the market for retail supply of fixed internet services in Spain.

94. The majority of respondents to the market investigation consider both Vodafone and ONO to be important competitors in the retail supply of fixed internet access services,59 along with other main providers, namely Telefónica, Orange and Jazztel.60 Most respondents view Vodafone and ONO as close competitors on this market.61 However, some respondents pointed out that the Parties' activities are complementary in that, while ONO's main strength lies in its fixed internet network, Vodafone is currently seen first of all as a provider of mobile services.62 While most of the respondents did not regard either Vodafone or ONO as a particularly innovative player, many of them viewed both of them as rather aggressive in terms of pricing, especially due to their attractive multiple play offers that include fixed internet services.63 The majority of respondents considered entry on the market for the retail supply of fixed internet services to be difficult, mainly due to the need for the appropriate infrastructure.64

95. On the other hand, four main providers and a number of smaller competitors will remain active in the market post-merger. According to the respondents to the market investigation, the remaining competitors would be sufficient to preserve competition in the market.65

96. The Commission notes, first, that, within any possible product market segment, the Parties' combined market share will remain below 25%, which, according to the Horizontal Merger Guidelines,66 constitutes a first indication that the proposed transaction is not liable to impede effective competition.

97. Second, following the proposed transaction, a sufficient number of strong alternative providers will remain active on the market and will continue to exercise significant competitive pressure on the merged entity. These providers include the incumbent operator, Telefónica (43.1% market share), Jazztel (13.8%) and Orange (13.7%), as well as smaller competitors.

98. Third, following the proposed transaction, the merged entity will remain the second largest player, that is, will continue to hold the same market position as the one held previously by ONO. The merged entity will continue to be far behind Telefónica in terms of market share and will still face competition from the other providers. In addition, the Commission notes the dynamic nature of competition in this market, due to the planned network roll-outs in Spain.

99. A limited number of respondents raised the concern that, post-merger, Vodafone's position on the market for retail supply of fixed internet access services, in particular in relation to a possible segment for high-speed broadband internet services (above 30 Mbps), would be significantly strengthened, reaching in some Autonomous Regions between [60-70]% and [80-90]% share of the high-speed broadband segment.67

100. First, the Commission takes the view, based on the results of the market investigation, that there are no indications that the national market for retail supply of fixed internet access services should be further segmented by bandwidth speeds.

101. Even if such a high-speed broadband internet segment (above 30 Mbps) were to be considered in Spain, the Commission notes that Vodafone has only recently started offering high-speed access through regulated access to VDSL2 technology. Vodafone's share in this segment ranges between [0-5]% and [5-10]%, depending on the region.68

102. In addition, competition in this segment is highly dynamic as almost all competitors in this market are currently developing their existing networks by rolling out next generation access services. (See below paragraphs 108 and 109.) It is difficult to predict how Vodafone's market share and market position will develop in the next years as against the position of its competitors.

103. Furthermore, in all Spanish Autonomous Communities where the merged entity will be present, it will continue to face competitive pressure from Telefónica. Apart for Telefónica, at least one of the other competitors, such as Orange or Jazztel or the regional fixed services providers will also be present in each region offering high- speed broadband. In other words, there is no Spanish Autonomous Community where the merged entity would be the only choice for customers to have access to high- speed services.

104. The Commission also notes that in highly populated areas such as Madrid or Barcelona, where the FTTH installed accesses outnumber hybrid coaxial cable ("HFC") accesses according to the Comisión Nacional de los Mercados y la Competencia ("CNMC"), ONO's network coverage is relatively low. These are the cities where Telefónica's market share is growing more.69

105. In addition, penetration of high-speed lines is still evolving in Spain. According to the CNMC Fourth Quarter 2013 Report, only around 15% of the lines as at 31st December 2013 had a speed above 20 Mbps. Therefore, the current situation in terms of broadband speeds is rapidly changing.

106. In May 2013, Vodafone concluded a co-investment agreement with Orange for the roll-out of two individual and independent FTTH networks in Spain, with the objective of reaching 3 million building units by 30 September 2015 (1.5 million units for each of Vodafone and Orange). Vodafone and Orange will deploy their FTTH networks in complementary areas and will facilitate mutual access to each other's infrastructure.70

107. According to the Notifying Party, even though the proposed transaction has prompted Vodafone to re-negotiate certain changes in its co-investment agreement with Orange,71 it will not significantly reduce Vodafone's incentive to continue deploying FTTH in Spain (also within the co-investment agreement with Orange) or improving the HFC network of ONO, also in order to compete with Telefónica (who announced that its FTTH deployment will reach 10 million units during 2014).

108. First, the Commission notes that there is intensive network competition in the deployment of NGN infrastructure to meet consumer demand for high transmission bandwidth in Spain. While cable operators such as ONO upgraded their networks a few years ago, other operators are currently undertaking a massive deployment of FTTH networks. These include Telefónica, 72 which, as mentioned above, announced that its FTTH deployment will reach 10 million units during 2014 and 13 million in 2016.73 Telefónica expects to reach 80% of Spain's population in 2016. Thus, Telefónica will have more FTTH accesses than ONO's cable network accesses at the end of this year and, therefore, a better geographical coverage. In addition, Telefónica is upgrading its ADSL customers to its FTTH networks without a price increase and at the same time adding to the commercial proposal pay TV services without a price increase.

109. Furthermore, other operators such as Jazztel are deploying FTTH networks so the degree of competition in high-speed networks in Spain is very intense. Jazztel, pursuant to a co-deployment agreement with Telefónica, has started deploying FTTH with the objective of reaching around 4.5 million households by 2015.74

110. Second, the CNMC appreciates that operators are offering higher transmission bandwidth with lower effective prices (according to the CNMC Geographical Report real prices for transmission above 30 Mbps have decreased between 5% - 10% in 2013 as compared to 2012).75 Also, the CNMC considers that the improvement of VDSL2 access and the deployment of FTTH will increase the number of operators offering speed above 30 Mbps.

111. Without prejudice of regulated access to Telefónica's network,76 post-merger there will be therefore at least four operators deploying NGN at national level (Telefónica, Vodafone, Orange and Jazztel) and three more at regional level (Euskaltel, Telecable and R Cable), all in the context of demand growth of NGN fixed broadband access.

112. Third, as explained above, ONO's network in highly populated areas such as Madrid and Barcelona is not as developed as that of other competitors. Vodafone will thus have an interest to continue the deployment of FTTH in such cities.

113. Given the level of network competition in Spain and on the basis of a balanced assessment of the available evidence, the Commission considers that the proposed transaction is unlikely to significantly affect Vodafone's incentives to continue the deployment of FTTH under the agreement with Orange. In any event, Orange could turn to other fixed operators for co-investment agreements or could invest in FTTH on its own.

114. For these reasons, and taking into account the future FTTH deployments of various competitors as set out above, the Commission considers that it is unlikely that the proposed transaction will give rise to competition concerns on a possible segment for high-speed broadband internet in Spain.

115. In light of the above, the Commission concludes that the proposed transaction would not significantly impede effective competition on the Spanish retail market for fixed internet services, including its possible segments.

5.1.2 Retail supply of fixed voice services

116. The Parties' combined market share is 14.8% by revenues (Vodafone 4.8%, ONO 10.0%) and 19.0% (Vodafone 8.0%, ONO 10.6%)77 by volume.78 On the narrower segment of the provision of fixed voice services to residential customers, the revenue share of the merged entity would amount to [10-20]%,79 with an increment of less than [5-10]%.80 Although the combined market share on this segment share remains […] below 20%, the Commission has included it in its investigation.

5.1.2.1 The Notifying Party's views

117. The Notifying Party submits that the merged entity will continue to face strong competition in particular from Telefónica (by far the market leader with 71.7% by revenues), Jazztel (4.4%) and Orange (2.5%).81 It also submits that Vodafone and ONO are not close competitors in this market; competitors have spare capacity to provide fixed telephony services in case of an increase in price and there are clear asymmetries between Telefónica, Vodafone and other competitors.

5.1.2.2 The Commission's assessment

118. The responses to the market investigation indicated that the Parties are considered important and close competitors.82 The respondents refer to ONO's market shares which establish ONO as a number two competitor on this market. One respondent refers to Vodafone's ability to combine fixed and mobile voice minutes with cheap rates in terms of multiple play services. (The impact on competition in multiple play services is considered below).

119. However, the majority of respondents argued that Vodafone is neither an innovative nor a particularly aggressive competitor.83 Vodafone is mainly seen as a mobile telecommunications services provider, with limited strength in the fixed voice services market. In addition, there are other strong providers in the market, including Telefónica and a sufficient number of alternative providers will remain post-merger on this market. Others argue that Vodafone has been aggressive in the past but has not remained so in the last 3-4 years. On this basis, the market investigation was inconclusive in regard to Vodafone's importance in the market and its closeness in relation to ONO.

120. The Commission did not identify competition concerns in relation to the market for the retail supply of fixed voice services. First, the Commission notes that the Parties' combined market share remains at 14.8% (by revenues) in the overall market for the retail supply of fixed voice services and under 20% even on the narrowest possible market segment, which is the residential segment.

121. Second, a number of alternative providers will remain active on the market, including the incumbent operator Telefónica, Jazztel and Orange. In the overall market for the retail supply of fixed voice services, Telefónica is the undisputed leader, with 71.7% market shares by total revenues and 59.1% by volume (that is by lines). ONO has around 10% by revenues and by volume. Vodafone has 4.8% by revenues and 8% by volume. Jazztel and Orange are very close in terms of market share to Vodafone. Jazztel has 4.4% by revenue and 8.4% by volume. Orange has 2.5% by revenue and 8.5% by volume. There are also several other smaller competitors in the market with market shares of approximately 0% - 3% each, both by revenues and volume. These are R Cable, BT, Euskaltel and Telecable.84

122. On this basis, the Commission considers that following the merger, the merged entity will be the new number two competitor, slightly stronger than ONO currently in terms of market share but still much weaker than Telefónica. In addition, although the merger will eliminate a competitor in the retail fixed voice market, there are a number of other competitors of similar strength in the market (most notably Jazztel and Orange), which could act as alternatives to the merged entity.

123. In light of the analysis above, the Commission concludes that the proposed transaction would not significantly impede effective competition on the market for the retail supply of fixed voice services.

5.1.3 Retail supply of mobile telecommunications services to end customers

124. Both Parties provide mobile telecommunication services to end customers in Spain. While Vodafone acts as a full mobile network operator (MNO), ONO is an MVNO hosted on Telefónica's network. On the Spanish market, there are four active MNOs: Telefónica, Vodafone, Orange and Yoigo.

125. The Parties have a combined market share of [20-30]% by revenues (Vodafone 27.6%, ONO [0-5]%) and [20-30]% by volume85 (Vodafone 23.5%, ONO [0-5]%).86 The increment brought by the proposed transaction is insignificant, below or equal to [0-5]%. On the narrower possible market segment of mobile broadband ("dongles" or "data cards"), the Parties have a higher combined market share, namely [40-50]% by revenues (Vodafone [40-50]%, ONO [0-5]%) and [40-50]% by volume (Vodafone 47.7%, ONO [0-5]%). However, even on this market segment, the increment remains below [0-5]%.87

5.1.3.1 The Notifying Party's views

126. The Notifying Party submits that the proposed transaction will not lead to competition concerns on the retail mobile telecommunications market in Spain

127. First, the horizontal overlap between the Parties remains limited: ONO, through its MVNO business, represents less than [0-5]% market share in terms of revenues and [0-5]% in terms of subscribers.

128. Second, the Notifying Party notes that other strong competitors are active in this market: three MNOs, Telefónica (36.5%), Orange (22.2%) and Yoigo (5.4%),88 as well as a large number of MVNOs (31 active, out of which 9 are full MVNOs and 22 are service providers).

129. Third, the Notifying Party claims that entry by MVNOs on the Spanish market for retail mobile telecommunications has been successful, and this is demonstrated by the number of providers constantly entering the market and their growing retail market share.

130. Fourth, the Notifying Party submits that Vodafone and ONO are not close competitors. It also submits that ONO does not represent an important competitive force in the retail mobile telecommunications services. ONO's mobile telecommunications services are bundled to its fixed telecommunications services in order to defend its customer base in fixed services by attempting to reduce churn in those services.

131. Finally, the Parties submit that the proposed transaction will not have any impact on spectrum rights, as Vodafone would be affected by the regulatory spectrum cap in relation to regional frequency bands in 2600 MHz allocated to ONO in 2011.89 Under the current rules, Vodafone will have to return [information regarding Vodafone's obligation to return spectrum rights following the proposed transaction]90, […].

5.1.3.2 The Commission's assessment

132. Based on the results of the market investigation, the Commission did not identify competition concerns in relation to the market for retail supply of mobile telecommunications to end customers in Spain.

133. The majority of respondents to the market investigation considered that either both Vodafone and ONO, or at least Vodafone91, are important competitors on this market.92 At the same time, the market investigation indicated that the Parties will continue to face significant competitive pressure from other strong suppliers such as Telefónica (Movistar), Orange, Yoigo and Jazztel. 93

134. Most respondents view Vodafone and Ono as close competitors on the market for retail supply of mobile telecommunications.94 In this sense, respondents argued that Vodafone and ONO's offers target the same customers in the residential segment and they are both rather aggressive competitors on this market. However, respondents also pointed out that ONO only provides mobile telecommunications services in relation to its multiple services bundles (which include fixed services) and that Vodafone is a much larger competitor in mobile services. On this basis, the market investigation was inconclusive as regards the closeness of competition between Vodafone and ONO on this market.

135. The majority of respondents to the market investigation indicated that they did not consider ONO an aggressive or innovative competitor.95 While entry on this market was considered to be difficult96, the market investigation showed that a number of providers of retail mobile telecommunications services will remain active on the market. The respondents to the market investigation considered that post-merger there would be a sufficient number of MNOs to ensure that competition would be maintained on the market. One respondent considered that there are more than 30 telephony brands in Spain, "which is more than enough", while another stated that "taking into account the actual number of players in the market, the emergence of a larger one and eventual disappearance of one of them would not imply a relevant change."97

136. First, the Commission notes that the key question in this case is not so much whether Vodafone is an important competitor in this market, but whether the removal of ONO as a MVNO is likely to significantly impede effective competition on this market. ONO acts as a MVNO and its presence on the market is rather reduced ([0- 5]% market share by revenues). The proposed transaction will thus not have an important impact on Vodafone's position in this market. Vodafone will remain the second largest provider of retail mobile telecommunications services, behind Telefónica

137. Second, the combined market share of the Parties by revenues remains below 30% for all possible market segments, with the exception of the possible segment of mobile broadband (in relation to data cards / dongles), where the Parties' combined market share in revenues is [40-50]% (Vodafone [40-50]%, ONO [0-5]%), with the increment brought about by the proposed transaction in this possible segment being insignificant.98

138. Third, after the merger, Vodafone would continue to face strong competition from the three remaining MNOs in Spain, namely Telefonica (36.5%), Orange (22.2%) and Yoigo (5.4%).

139. Moreover, when looking more closely at the position of ONO as a MVNO in Spain, the Commission notes the presence of an important number of MVNOs in the Spanish market (31), out of which 9 are full MVNOs.99 Just between the years 2009 and 2013, 15 MVNOs have entered the market and the large majority of them are active.100 While entry as an MNO may be difficult because of costs associated with acquiring and maintaining spectrum, entry of MVNOs seems to be facilitated by wholesale access obligations imposed on the MNOs.

140. Finally, the review of the Notifying Party's internal documents did not indicate that Vodafone perceived ONO as a particularly important or aggressive competitor on this market.

141. In the light of the above, and in particular given the small increment, as well as the presence of several competitors on this market, the Commission concludes that the proposed transaction would not significantly impede effective competition on the retail mobile telecommunications services market and its possible segments in Spain.

5.2 Vertical assessment

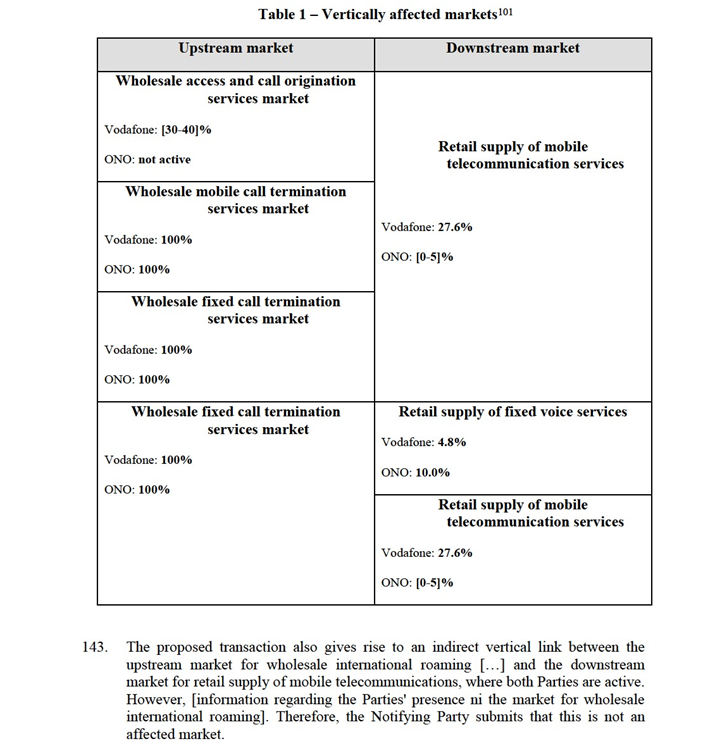

142. The proposed transaction also gives rise to a number of vertically affected markets, as can be seen from the following table.

144 In any event, the Commission considers that given the low increment brought by the proposed transaction in the downstream market, as well as the fact that the upstream market is regulated102 and there are, in any case, several other providers of roaming services, the proposed transaction would not significantly impede effective competition on the wholesale market for international roaming and the retail supply of mobile telecommunication services market.

5.2.1 Wholesale market for access and call origination services on mobile networks – Retail supply of mobile telecommunications services

145. MNOs supply wholesale access and call origination services which enable MVNOs to provide their own retail mobile services. In Spain there are four MNOs, out of which three are currently providing such services (Vodafone, Telefónica and Orange)103. The market for wholesale access and call origination services where only Vodafone, and not ONO, is active ([30-40]% in terms of number of MVNOs and [30-40]% in terms of revenues)104 is upstream of the market for retail supply of mobile telecommunications services where both Parties are active (Vodafone 27.6%, ONO [0-5]% in revenues).

5.2.1.1 The Notifying Party's views

146. The Notifying Party submits that the proposed transaction will not lead to any input or customer foreclosure concerns:

147. First, the merged entity will not have the ability to engage in an input foreclosure strategy as (i) on the upstream wholesale market, regulation in Spain obliges Vodafone, Orange and Telefónica to provide access and call origination services on reasonable terms105 and these conditions are supervised by the CNMC; and (ii) other MNOs are providing these services, such as Telefónica and Orange. The merged entity's incentive is to retain and increase the number of MVNOs in its network, as the wholesale access services provide revenues and improve the use of Vodafone's network capacity. Vodafone estimates that [30-40]% of its network is currently used by MVNOs. This is in comparison to [30-40]% for Telefónica and [30-40]% for Orange. Vodafone notes that this percentage is likely to decrease and thus the corresponding revenue market share is also likely to decrease.106

148. Second, with regard to a possible customer foreclosure scenario, the Notifying Party submits that given the low market share of ONO (under 2% in both revenues and volume) on the downstream retail market and the presence of numerous MVNOs on this market, the proposed transaction would not significantly impede effective competition.

5.2.1.2 The Commission's assessment

149. Based on the results of the market investigation, the Commission did not identify competition concerns pertaining to the relation between the market for wholesale access and call origination services and the market for retail mobile telecommunications services.

150. The market investigation confirmed that Spanish legislation imposes an obligation on Vodafone, Orange and Telefónica to provide wholesale access and call origination services107 on reasonable terms.108 The majority of respondents indicated that while entry on this market may be difficult,109 there are enough providers of such services.110 The large majority of respondents do not consider that the proposed transaction will have any effect on Vodafone's incentives in relation to the provision of such services, and none of the respondents raised any concerns that Vodafone would stop providing such services post-merger.111

151. First, the Commission notes that only Vodafone is present on the upstream market for wholesale access and call origination services and that it was already present on the downstream market for retail mobile telecommunications services. The increment brought by the proposed transaction on the downstream market does not exceed 2% in both revenues and volume.

152. Second, Vodafone will continue to be bound by obligations under the Spanish legislation to offer these services to MVNOs.112

153. Third, the Commission considers, based on the results of the market investigation, that two strong alternative providers, Telefónica and Orange, are present on the market.

154. In light of the analysis above, the Commission concludes the proposed transaction would not significantly impede effective competition on the markets for wholesale access and call origination on the one hand, and retail supply of mobile telecommunications on the other hand.

5.2.2 Wholesale market for mobile call termination services – Retail supply of fixed voice services and retail supply of mobile telecommunications services

155. Vodafone is active on the market for wholesale mobile call termination services on its own network. ONO is also active on this market and provides mobile termination services for its own network.

156. This wholesale market, where the Parties have a 100% market share in their respective networks ("one net-one market" principle) is upstream of the markets for the retail supply of fixed voice services (Vodafone 4.8%, ONO 10%) and retail supply mobile telecommunication services (Vodafone 27.6% , ONO [0-5]%).

5.2.2.1 The Notifying Party's views

157. The Notifying Party submits that any possible competition concerns are excluded from the outset, as the wholesale market for mobile call termination in Spain is subject to regulatory obligations already in place, including price caps and detailed non-discriminatory provisions.113

5.2.2.2 The Commission's assessment

158. The Commission notes, first, that none of the respondents to the market investigation raised any concerns related to vertical issues arising from the transaction on the market for wholesale mobile call termination services on the one hand, and the retail supply of fixed voice services and retail mobile telecommunication services on the other hand.

159. Second, the Commission notes that there are regulatory obligations, including price caps, applying to the wholesale mobile call termination market and that the Parties' combined market share on the downstream market for retail supply of fixed voice services remains under 15% (by revenues). In relation to the downstream market for retail supply of mobile telecommunication services, the Commission notes that the proposed transaction only brings an insignificant increment (less than [0-5]% by revenues).

160. In light of the analysis above, the Commission concludes that the proposed transaction would not significantly impede effective competition on the markets for wholesale fixed call termination services and retail supply of fixed voice services on the one hand, and retail mobile telecommunication services on the other hand.

5.2.3 Wholesale market for fixed call termination services – Retail supply of fixed voice services and retail supply of mobile telecommunications services

161. The wholesale market for fixed call termination services where the Parties have a 100% market share in their respective networks ("one net-one market" principle) is upstream of the markets for the retail supply of fixed voice services (Vodafone 4.8%, ONO 10.0%) and for the retail supply of mobile telecommunication services (Vodafone 27.6% , ONO [0-5]%).

5.2.3.1 The Notifying Party's views

162. The Notifying Party submits that any possible competition concerns are excluded from the outset, as the wholesale market for fixed call termination in Spain is subject to regulatory obligations. Operators such as Vodafone and ONO are obliged to offer call termination services on a non-discriminatory basis and at reasonable prices.114

5.2.3.2 The Commission's assessment

163. The Commission notes, first, that no respondent to the market investigation raised any issues related to vertical competition concerns arising from the proposed transaction on the market for fixed call termination services on the one hand, and the markets for retail supply of fixed voice services and of mobile telecommunications services on the other hand.

164. Second, the Commission notes that there are regulatory obligations applying to the wholesale fixed call termination market and that the Parties' combined market share on the downstream market for retail supply of fixed voice services remains under 15% (by revenues). In relation to the downstream market for retail supply of mobile telecommunication services, the Commission notes that the proposed transaction only brings an insignificant increment (less than [0-5]% by revenues)

165. In light of the analysis above, the Commission concludes that the proposed transaction would not significantly impede effective competition as regards the relation between the market for wholesale fixed call termination services on the one hand, and the markets for retail supply of fixed voice services and retail supply of mobile telecommunication services on the other hand.

5.3 Horizontal and conglomerate effects: Multiple-play packages

166. The Commission has examined whether the proposed transaction would give rise to horizontal competition concerns in a possible market for multiple play services. In addition, as Vodafone's and ONO's services are complementary or at least closely related, the Commission has examined whether the proposed transaction would give rise to conglomerate effects.

167. Both Vodafone and ONO offer bundled products comprising fixed and mobile services. Vodafone has launched multiple play offers comprising fixed telephony, broadband internet access and mobile telephony. Vodafone does not provide pay TV services in Spain. ONO commercialises bundles offering fixed voice services, broadband internet access, pay TV and mobile telephony. The proposed transaction will allow Vodafone to offer multiple play bundles comprising pay TV as well.

168. According to the Commission's Guidelines on the assessment of non-horizontal mergers (the "Non-horizontal Merger Guidelines"),115 conglomerate effects require

(a) the ability to foreclose, (b) the incentives to foreclose and (c) a likelihood that a foreclosure strategy would have a significant detrimental effect on competition and harm consumers. In order to be taken into account, any conglomerate effect must be merger specific. In other words, the conglomerate effect must result from Vodafone's acquisition of ONO.

5.3.1.1 The Notifying Party's views

169. The Notifying Party submits that the merged entity will not have the ability or the incentive to foreclose competitors from making multiple play offers, by denying them access to wholesale mobile services or fixed wholesale services.

170. With regard to the wholesale mobile services, the Notifying Party submits that wholesale mobile access regulation in Spain obliges MNOs to provide wholesale mobile access to competitors which intend to provide retail mobile telecommunications.

171. In relation to both fixed and mobile components, the Notifying Party submits that competitors will have sufficient alternatives post-merger, as Telefónica is subject to wholesale fixed access obligations and other competitors of the Parties such as Orange already offer wholesale services. Therefore, the merged entity will not have the ability to foreclose its competitors in multiple play offers by denying access to wholesale services.

5.3.1.2 The Commission's assessment

Horizontal assessment

172. As regards the possible markets for multiple play services, the Parties' activities currently overlap, as both ONO and Vodafone offer multiple play packages today. Hence the proposed transaction will lead to the elimination of a potential competitor on a possible market for multiple play.

173. The respondents to the market investigation were overwhelmingly of the view that the provision of multiple play services is very important in Spain.116 The majority of respondents argue that bundles are very important in the Spanish telecoms markets. For some respondents, bundles are the only way to compete effectively in the market and represent approximately 50% of new client take up. Some respondents indicate that the ability to offer better multi-play services is the rationale of the proposed transaction. Others comment that it is a necessity to offer bundled services in order to compete with Telefónica and ONO.

174. According to the market investigation responses,117 the Parties are close competitors, in terms of already offering bundled services. Vodafone and ONO are already active in offering multiple play packages. However, they are each strong where the other is weak, with Vodafone being strong in mobile telecommunications and ONO being strong in fixed voice and broadband and pay TV. Thus, the Commission considers that the Parties' activities are largely complementary. One competitor argued that Vodafone is currently not strong in the offering of multiple play services and that the proposed transaction will change Vodafone's position.

175. The market investigation responses show that the proposed transaction would not have a significant effect on competitors and consumers. Although the proposed transaction would remove an important competitor, that is ONO, from the multiple play segment, a number of alternative operators are currently already offering multiple play services, including Telefónica, Jazztel, Pepemobile, Orange and the regional cable operators in northern Spain. As there are different types of multiple play bundles depending on the types of services offered, the Commission does not have separate market shares for bundles. However, the multiple play offerings are calculated as part of the single service offerings, which means that the individual services give a strong indication of the competitive position of each party. The market shares of the individual services indicate that Telefónica is the undisputed leader in the fixed voice, fixed internet and mobile telecommunications retail markets and that there are a number of telecommunications providers who offer multiple play bundles as an alternative to the merged entity.

176. These competitors would act as alternatives to the merged entity. Although a few competitors expressed concerns about the elimination of competition between Vodafone and ONO in relation to multiple play bundles, many competitors and customers argued that a number of suppliers of multiple play offers active in the market would still be in a position to compete with the merged entity.118

177. The Commission considers that the proposed transaction will eliminate a competitor from the multiple play segment. However, there are several competitors to the merged entity which will continue to offer multiple play packages in competition to the merged entity. The merged entity will become a stronger competitor, which will be in a better position to compete with the leading operator, Telefónica. In addition, there are other providers of multiple play services which are alternatives to the merged entity.

178. In light of the analysis above, the Commission concludes that the proposed transaction would not significantly impede effective competition on the possible market for multiple play services.

Conglomerate effects assessment

179. The Commission has also assessed the likely impact of the proposed transaction on the merged entity's ability and incentive to grant its competitors in multiple play services access to the components of these services that it would control.

180. In terms of entry into the multiple play segment, results of the market investigation were mixed, but a number of telecommunications providers indicated that they are interested in offering multiple play services. In terms of a new entrant in the telecoms sector offering multiple play services, some respondents considered that this is very difficult because of barriers to entry and because the sector is already saturated with a number of current operators offering multiple play services.

181. The Commission considers that the merged entity would not have the ability to foreclose competitors from offering elements of fixed or mobile telecommunications services to create multiple play bundles.

182. In relation to wholesale mobile access and origination services, as discussed above, regulation in Spain obliges MNOs to provide access and call origination services on reasonable terms119 and these conditions are supervised by the CNMC. In addition, currently other MNOs such as Telefónica and Orange are providing these services. Therefore, the merged entity would not have the ability to foreclose competitors in multiple play services from obtaining mobile wholesale access.

183. In relation to fixed wholesale access, the Commission notes that the telecommunications incumbent Telefónica is subject to wholesale fixed access regulation, which is supervised by the CNMC. Therefore, the merged entity will not have the ability to foreclose its competitors in multiple play offers by denying access to fixed wholesale services, as competitors have a regulated alternative option.

184. In light of the analysis above, the Commission concludes that the proposed transaction would not significantly impede effective competition on any of the markets for the components of the multiple play offers.

6 CONCLUSION

185. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.04.2008, p. 1).

3 Vodafone, email to the Commission, 23 June 2014.

4 Commission decision COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraphs 26 onwards.

5 See replies to Commission Questionnaire to competitors and business customers and consumer associations of 2 June 2014, question 2.

6 Commission decision COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraph 10.

7 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 2.

8 Commission decision COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraph 20.

9 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 3, and Questionnaire to business customers and customer associations of 3 June 2014 question 3.

10 Commission decision in case COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraph 47.

11 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 11, and Questionnaire to business customers and customer associations of 3 June 2014 question 11.

12 Commission decision in case COMP/M.6584 – Vodafone/Cable&Wireless, paragraph 11.

13 Commission decision in case COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraph 37.

14 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraphs 130-131.

15 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 4, and Questionnaire to business customers and customer associations of 3 June 2014 question 4.

16 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 6, and Questionnaire to business customers and customer associations of 3 June 2014 question 6.

17 Commission decision in case COMP/M.5532 – Carphone Warehouse/Tiscali UK, paragraph 56; Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraph 137.

18 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 11, and Questionnaire to business customers and customer associations of 3 June 2014 question 11.

19 The term international voice calls is used for calls that are made by a domestic user when in its home country, but that terminate at destinations which are abroad such as if the receiving number is a foreign one.

20 Commission decision in case COMP/M.3245 – Vodafone/Singlepoint; Commission decision in case COMP/M. 3530 – Telia Sonera/Orange; Commission decision in case COMP/M. 3916 – T-Mobile Austria/Tele.ring.

21 Commission decision in case COMP/M. 6497 – Hutchison 3G Austria/Orange Austria, paragraph 58.

22 Commission decision in case COMP/M. 6992 – H3G/Telefónica Ireland, paragraph 141 onwards.

23 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 7, and Questionnaire to business customers and customer associations of 3 June 2014 question 7.

24 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, questions 8 and 9, and Questionnaire to business customers and customer associations of 3 June 2014 questions 8 and 9.

25 Commission decision in case COMP/M.5650 – T-Mobile/Orange; Commission decision in case COMP/M. 3916 – T-Mobile Austria/Tele.ring.

26 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraphs 218-219.

27 See replies to Commission Questionnaire to competitors and trade associations of 2 June 2014, question 11, and Questionnaire to business customers and customer associations of 3 June 2014 question 11.

28 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraph 43.

29 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraphs 259-261.

30 Commission decision in case COMP/M.5900 – LGI/KBW, paragraphs 183-186; Commission decision in case COMP/M.5734 – Liberty Global Europe/Unitymedia, paragraphs 43-48 (both for the German market). Commission decision in case COMP/M.6584 – Vodafone/Cable&Wireless, paragraphs 102- 104 (for the UK). However, in the Vodafone/Cable&Wireless decision, the Commission stated with respect to quadruple play that the market investigation had confirmed that "the joint purchasing of mobile and fixed as one package has been the exception rather than the rule".

31 See replies to Commission Questionnaire to competitors of 2 June 2014, question 42.

32 See replies to Commission Questionnaire to competitors of 2 June 2014, question 43.

33 See replies to Commission Questionnaire to business customers and consumer associations of 3 June 2014, question 37.

34 See replies to Commission Questionnaire to competitors of 2 June 2014, questions 44 and 45.

35 Commission decision in case COMP/M.5900 – LGI/KBW, paragraphs 187-189.

36 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraphs 263-265.

37 Commission decision in case COMP/M.6990 – Vodafone/Kabel Deutschland, paragraphs 263-265.

38 Commission decision in case COMP/M.4947 – Vodafone/Tele2 Italy/Tele2 Spain, paragraph 13.