Commission, October 3, 2014, No M.7277

EUROPEAN COMMISSION

Judgment

ELI LILLY/ NOVARTIS ANIMAL HEALTH

Dear Sir / Madam,

Subject: Case M.7277 – Eli Lilly/ Novartis Animal Health

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139 / 20041

(1) On 29 August 2014, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking Eli Lilly and Company ("Eli Lilly", United States) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking Novartis Animal Health ("NAH", Switzerland) by way of purchase of shares and assets.2 Eli Lilly and NAH are collectively referred to as the "Parties".

1. THE PARTIES

(2) Eli Lilly is a publicly listed company whose common stock is traded on the New York Stock Exchange. It is active in the discovery, development, manufacture and sale of a range of pharmaceutical products for humans and animals. The main areas in which it is active are: neuroscience, endocrinology, oncology, cardiovascular, animal health, and the treatment of staphylococcal and bacterial infections.

(3) NAH is a publicly listed company whose common stock is traded on the New York and the Swiss Stock Exchanges. It is active in the discovery, manufacturing, development and sale of animal health products to prevent and treat diseases in companion animals, production animals and farmed fish.

2. THE OPERATION

(4) The transaction consists of the acquisition of sole control over NAH by Eli Lilly, via a stock and asset purchase agreement dated April 22, 2014. The business will be integrated into Eli Lilly’s animal health business, Elanco Animal Health (“Elanco”).

(5) Consequently, the Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 2 500 million [Eli Lilly EUR […]; NAH EUR […]]. In each of at least three Member States, the combined aggregate turnover is more than EUR 100 million [in the United Kingdom: Eli Lilly EUR […]; NAH EUR […]; in Germany: Eli Lilly EUR […]; NAH EUR […]; in France: Eli Lilly EUR […]; NAH EUR […]]. Finally, the aggregate Community-wide turnover of each of them is more than EUR 100 million [Eli Lilly EUR […]; NAH EUR […]]. Neither of them achieves more than two-thirds of their aggregate EU-wide turnover in one and the same Member State.

(7) The notified operation therefore has an EU dimension within the meaning of Article 1(3) of the Merger Regulation.

4. COMPETITIVE ASSESSMENT

4.1. Product market definition

4.1.1. Introduction

(8) Like the human health industry, the animal health industry is heavily regulated at the EEA and national level. Veterinary products cannot be marketed in the EEA without a prior marketing authorisation. The commercialisation of animal health pharmaceuticals in the EEA requires obtainment of a marketing authorisation. Depending on the type of the product, marketing authorisations for animal health products in the EEA can be obtained centrally from the EMA or nationally from the competent authorities in each Member State through the decentralised, mutual recognition or the national procédures.

(9) Generics are the identical copies of the innovative treatments which enter the market after the patent protections afforded to the original developer have expired. Generic producers are only required to demonstrate that their product is an identical version of the original product in respect to composition (same qualitative and quantitative composition in active substances) and the formulation (the same pharmaceutical form), so as to demonstrate bioequivalence with the reference product. Therefore, generics are assumed to be identical in dose, strength, route of administration, safety, efficacy and intended use and can be launched as soon as the original product become off-patent. Most of the products in the affected markets are off-patent.

(10) There are significant barriers to entry in the animal health markets, with varying degrees on a case by case basis. A distinction can be made between barriers to entry into a new product market and barriers to geographic entry (entry with an existing and already registered product in a new geographic market). Barriers vary depending on the markets concerned (size of the market, demand for the product and expected evolution, competitive environment).

(11) In animal health cases, the Commission factored into its competition assessment pipeline products in full development stage.3 Therefore, also in this case, the Commission has taken into account the pipeline products of the Parties which reached this development phase.

(12) In previous cases, the Commission has divided animal health products into three core areas, namely: (i) biologicals (vaccines); (ii) pharmaceuticals; and (iii) medicinal feed additives.4 In the present case, the Parties' activities overlap only in pharmaceuticals.

(13) Pharmaceuticals encompass a wide group of products that contain a variety of active substances to prevent or treat a large range of animal diseases and disorders. In its previous decisions, the Commission considered that pharmaceuticals for animal usage should be split into parasiticides, antimicrobials, endocrine treatments, anti- inflammation and analgesic pharmaceuticals.5

(14) Furthermore, the Commission considered that the most important factors to be taken into account when defining relevant product markets in the area of animal health pharmaceuticals are the following:6

(i.) Animal species: Although many pharmaceuticals are multi-species, some are effective only for a particular species or group of species (such as companion animals). In this regard the Commission has considered that animal health products are mainly produced for the following main groups of animals:7 (a) Ruminants (cattle, sheep and goats); (b) Swine; (c) Poultry (chickens and turkeys); (d) Equine (horses); (e) Companion animals (cats and dogs) and (f)

Aquaculture animals (farmed fish).8

(ii.) Active ingredient: In some cases the active substance is the main determinant for the product market definition, e.g. in antibiotics, because the same active substance is effective against the whole range of pathologies.

(iii.) Target pathology / scope of effectiveness: Pathology is often at the core of the market definition. However, in some instances it is impossible to limit market demarcation to very narrowly defined pathologies.

(iv.) Mode of administration: Most animal health pharmaceuticals are injectable (especially for production animals). For companion animals a large number of pharmaceuticals are administered orally (tablets, pastes and granules). There is a large number of additional modes of administration such as intra-mammary products for mastitis treatment in cows, anti-parasitic collars or spot-on drops for companion animals, etc.

(v.) Duration of efficacy: Farmers may demand products that remain active for long periods of time, usually for preventive purposes, e.g. anti-parasitic products or long-acting preventive antibiotics.

(vi.) Duration of the withdrawal period: For production animals, the withdrawal period - i.e. the period after treatment during which an animal's meat or milk is deemed unsuitable for human consumption – is of large economic importance.

(15) In the present case, the Parties' activities overlap in parasiticides and antimicrobials for both companion animals and production animals (comprising ruminants, swine, and poultry).

4.1.2. Parasiticides for companion animals

(16) Parasiticides are used to kill or prevent parasites from infesting the animal, whether internally (e.g. worms) or on the body (e.g. fleas and ticks). Within parasiticides, there are different products against multi-celled parasites (such as fleas and worms) and anti-coccidial treatments which act against single celled parasites. As the Parties are not active in anti-coccidials, this segment will not be further considered.

(17) As regards multi-celled parasiticides, the Commission previously considered three main types of parasiticides: (i) ectoparasiticides, used to control external parasites such as fleas, ticks, etc, (ii) endoparasiticides, used to control internal parasites such as gastro-intestinal roundworms and tapeworms, lungworms, liver flukes, protozoa, etc. and (iii) endectocides, used to treat both external and internal parasites.9 In Schering Plough / Organon Biosciences,10 the Commission analysed a possible alternative market comprising both endectocides and endoparasiticides. Also, in Pfizer / Wyeth11, the Commission analysed endoparasiticides and endectocides together but also separately, as the market investigation in that case indicated that these two segments are not always substitutable. In all these decisions the Commission left the market definition for parasiticides open.

(18) The Commission has so far not further segmented the market based on species (except for horses) mode of administration, disease or distribution method for these three markets. However, in Pfizer / Wyeth, the market investigation showed that products for the treatment of heartworms are not substitutable with products that treat other internal parasites such as gastro-intestinal parasites and the Commission considered heartworm as a separate segment12 but ultimately left the market definition open.

4.1.2.1. The views of the Notifying Party

(19) The Notifying Party submits that endectocides compete with both endoparasiticides and ectoparasiticides as they combine active ingredients for both internal and external parasites and are equally effective. Moreover, the Notifying Party considers that the price of the endectocides is not significantly higher than the price of single molecule products. On the supply side, the Notifying Party submits that there is significant substitution between endectocides on the one hand and ectoparasiticides and endoparasiticides on the other side as the endectocides combine the active ingredients of them both. Additionally, all major suppliers produce all three types of parasiticides.

(20) The Notifying Party considers that any further segmentation of the parasiticides market for companion animals would not be appropriate. However, it recognises that heartworm is a serious concern for certain southern European countries (mainly Italy, Spain and Portugal) and has become widely recognised as such. Nevertheless, it argues that there is no reason to consider that heartworm constitutes a separate market.

(21) As regards the difference in the distribution method, the Notifying Party submits that both the vet channel and the over-the-counter ("OTC") channels impose competitive constraints on each other and therefore one single market should be considered.

(22) Additionally, in relation to the mode of administration, the Notifying Party submits that segmenting parasiticides by mode of administration would not be in line with the Commission’s decisional practice which has considered that the various modes of administration in parasiticides for companion animals are interchangeable and thus compete with each other.

4.1.2.2. The results of the market investigation and the Commission's assessment

(23) As regards substitutability between ectoparasiticides, endoparasiticides and endectocides, the results of the market investigation were mixed and revealed that it depends very much on the customers' preferences, the disease and the particular characteristics of the animals that are being treated.13 From the demand side, the customers' participating in the market investigation submitted that they would not switch from endoparasiticides or ectoparasiticides products to endectocides products as a reaction to a permanent price increase of 10% of the former ones.14 However, customers who want to treat both internal and external parasites at the same time would choose a combined active ingredient product (endectocide).

(24) There is therefore a certain degree of substitution between ecto / endecto products and between endo / endecto products that the Commission will take into account in the competitive assessment. However, in this specific case the market definition can be left open as the transaction does not give raise to competition concerns neither in the segments of ectoparasiticides, endoparasiticides and endectocides, nor in the hypothetical segments comprising endo / endecto parasiticides and ecto / endecto parasiticides.

(25) As regards other alternative market definitions, a large majority of respondents to the market investigation submitted that, similarly to the Notifying Party's views, the channel of distribution (OTC or vet channel) plays a role only from a marketing strategy's point of view, rather than from a competitive point of view.15 Based on these results, the Commission concludes that the OTC and the vet channels do not constitute separate segments.

(26) As regards heartworms, the majority of the respondents to the market investigation submitted that there is a separate market for heartworm products, including both treatment and prevention products.16 This is due to the fact heartworm is an endoparasitic worm that primarily resides in the heart of dogs (and to a lesser extent of cats) and cannot be treated with intestinal tablets used to treat other types of worms. This creates the need for specific treatment.17 The Commission considers, based on the results of the market investigation, that heartworm products constitute a separate market.

(27) As regards a possible segmentation of parasiticides between injectable, topical and oral products, the respondents to the market investigation indicated that the distinction between oral / topical on the one side and injectable products on the other side is particularly relevant for ecto / endecto products. One supplier mentioned that "oral and topical products are usually administered by pet owners, whereas injectable products are usually administered by veterinarians" and that "twice-a- year injection administered by a veterinarian is a very different prospect than a

monthly owner-administered treatment".18 Therefore, oral and topical ecto / endecto products could constitute a separate segment altogether.19 The Commission will take into consideration such a possible segmentation in the competitive assessment. However, in this specific case the market definition can be left open as the transaction does not give rise to competition under any plausible product market definition.

4.1.2.3. Conclusion

(28) In the present case, the Commission considers that heartworm products constitute a separate market. As regards other parasiticides for companion animals, the precise market definition can be left open in this specific case as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

4.1.3. Otitis externa for companion animals

(29) Otitis extern is an inflammation of the external ear canal. It is not a disease in itself but rather a symptom of some other diseases, such as an infection.

(30) According to the Commission’s past decisional practice,20 otitis pharmaceuticals are considered as a separate market.

4.1.3.1. The views of the Notifying Party

(31) The Notifying Party agrees with the product market definition previously defined by the Commission, namely that otitis externa constitutes a separate market, without the need to further segment it based on any other criteria.

4.1.3.2. The results of the market investigation and the Commission's assessment

(32) Based on the fact that products that treat otitis externa have very specific indications and formulations compared to products indicated for general or skin infections, the respondent suppliers to the market investigation submitted that otitis externa is a separate market, as previously defined by the Commission.21

(33) As regards the mode of administration, the respondents to the market investigation have also submitted that the otitis externa market is mainly a topical market and that oral and injectable products are rarely used.22 In the present case, whether the market can be segmented by mode of administration is a question that can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

4.1.3.3. Conclusion

(34) In the present case the precise product market definition for otitis externa can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

4.1.4. Antimicrobials for production animals

(35) Antimicrobials are pharmaceutical products that destroy or prevent the growth of microbes such as bacteria, mycoplasma (pathogens that clack cell walls) or fungi and thus treat diseases associated with them.

(36) In previous decisions,23 the Commission considered that the market definition of antimicrobials has been driven by: (i) the mode of administration (ii) the chemical class and (iii) the animal's size. As regards the mode of administration, the Commission has in the past recognised that, based on the market investigation results in those cases, there is limited substitution between injectable and oral products as they are used for different situations, in different ways.24 In relation to the chemical class, the following main categories were singled out: sulphanomides, penicillins, cephalosporins, tetracyclines, etc. Finally, in relation to the size of the animals or animal species, the Commission has analysed this market based on a separation between large animals, comprising production animals and companion animals (without any further segmentation by particular species).25

4.1.4.1. The views of the Notifying Party

(37) The Notifying Party submits that there is no need to further segment the market for antimicrobials based on mode of administration as farmers can use all products interchangeably. Furthermore, the Notifying Party indicates that Parties' products each have several modes of administration. Likewise, a further distinction based on species of production animals is not relevant, as most of the antimicrobials, in particular those administered orally, are indicated for a wide variety of species. However, the Notifying Party has provided data for each species separately and for each different administration mode.

(38) The results of the market investigation and the Commission's assessment

(39) Based on the market investigation results, the Commission considers that antimicrobials for production animals might be further segmented taking into account (i) the active ingredient,26 (ii) mode of administration and (iii) different species.

(40) As regards the mode of administration, and in line with previous Commission's decisions, the large majority of the respondents to the market investigation submitted that injectable products are often very different from oral formulations from the point of view of efficiency, prices, easiness of administration, duration of action and targeted pathology.27 Moreover, looking at a further possible segmentation of the oral products into pre-mixes and solubles, the respondents to the market investigation mostly from the demand side submitted that these products might not always be fully substitutable. This is mainly due to the differences in the easiness of administration or the differences in the equipment of the farmers, the speed of administration and in some countries, due to the legislative or regulatory framework (in countries like Denmark for example).28

(41) Furthermore, the respondent customers to the market investigation submitted that they would not switch from pre-mixes antimicrobials to soluble products in case of a permanent price increase of 5-10% of the pre-mix antimicrobials.29 However, for the purpose of this decision, a further segmentation of the market by mode of administration into injectable, and oral products (and within oral products a further segmentation between pre-mix and soluble products) can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

(42) Finally, when it comes to different species of production animals, the market investigation showed mixed results. One supplier mentioned that at least the major species should be taken into account, mentioning swine, poultry, cattle and farm rabbits.30 However, the Commission notes that there are several products indicated for two or even three different species. Moreover the Centre Européen d’Etude pour la Santé Animale (CEESA)31 does not collect data per species. However, for the purpose of this decision, a further segmentation of the market by species can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

4.1.4.2. Conclusion

(43) In the present case, the precise product market definition for antimicrobials for production animals can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

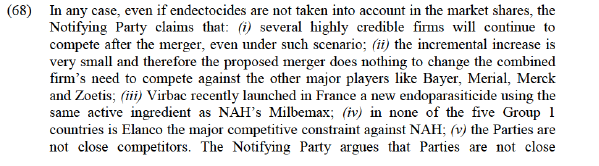

4.1.5. Parasiticides for production animals

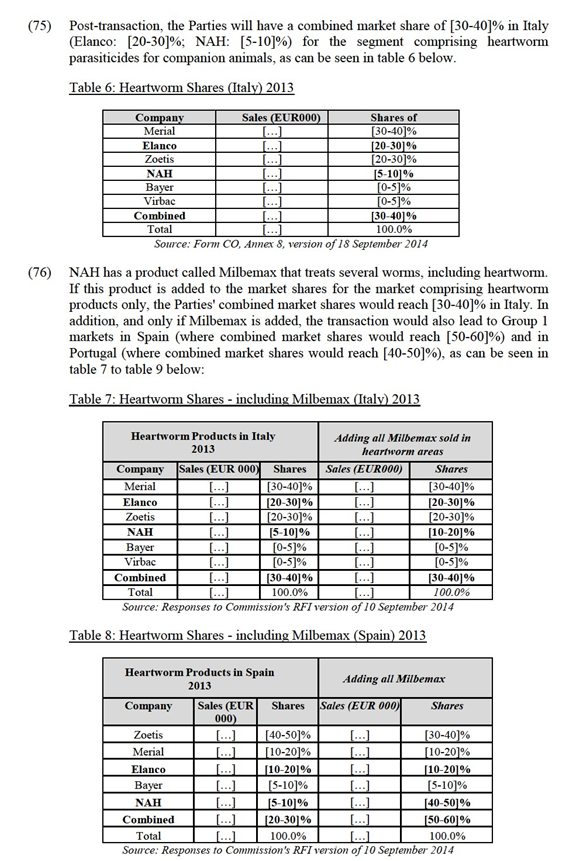

(44) The Commission precedents referred to in Section 4.1.2 concerning parasiticides for companion animals are also relevant for production animals. The Commission's investigation and assessment focuses on endoparasiticides and endectocides only as Elanco is not active in ectoparasiticides. Therefore, ectoparasiticides are not considered further.

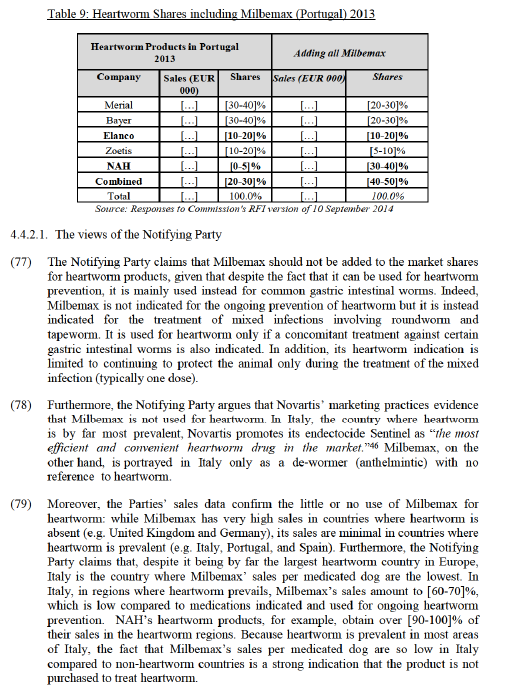

4.1.5.1. The views of the Notifying Party

(45) Firstly, similarly to companion animals, the Notifying Party considers that most endoparasiticides compete with endectocides as customers use them interchangeably to treat internal worms in production animals, with no significant difference in effectiveness, duration, or withdrawal period.

(46) Secondly, the Notifying Party argues that the suppliers of endoparasiticides typically price their products below the price of endectocides to maintain competitiveness.

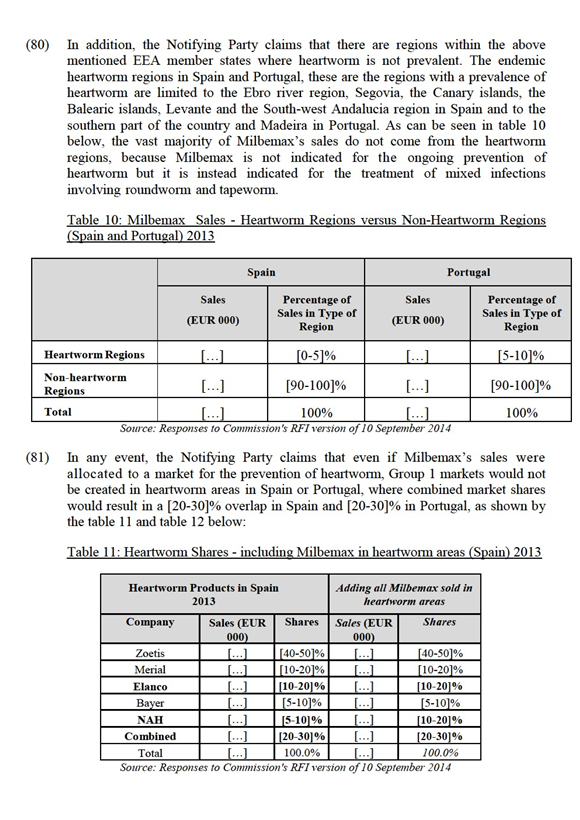

(47) Finally, the Notifying Party does not consider appropriate to differentiate the parasiticides for production animals by species, since many of the Parties' products are indicated for several species, or by any other criteria.

4.1.5.2. The results of the market investigation and the Commission's assessment

(48) As regards the substitutability between endectocides and endoparasiticides, the results from the market investigation were mixed. One supplier explained that "giving the sliding scale between targeted Parasiticides on the one hand and broad- coverage products in the other hand, it is difficult to delineate precise borders of each of these segments".32 Additionally, while one supplier indicated that endoparasiticides and endectocides are different from the point of view of price, duration of action and withdrawal time, other supplier mentioned that "it is common for endectocide compounds to be used interchangeably with endoparasiticides for the treatment of internal parasiticides when in single active and multiple active formulations".33 From the supply side, switching from one segment to another is not an easy process and could take up to even five to eight years.34 On this basis, there are arguments to suggest that endoparasiticides and endectocides may constitute separate markets. However, taking into account the degree of substitutability between endo / endecto products, the Commission considers that product market for parasiticides for production animals could also be segmented along these lines. In any case, the Commission considers that the market definition for endoparasiticides, endectocides or endo / endectocides can be left open as the proposed transaction does not give rise to competition concerns under any plausible product market definition.

(49) As regards the mode of administration, the market investigation results were inconclusive, indicating that a more appropriate delineation should be done according to the spectrum of activity, segmenting the market into flukes and nematodes.35 However, for the purposes of the present case, a further split of the market into flukicides and nematodicides can be left open as the proposed transaction does not give rise to competition concerns under any plausible product market definition.

(50) Additionally, respondents to the market investigation indicated that a separation by species should also be taken into account. However, they have also submitted that some products are suited for several species and that for example cattle and sheep could equally be considered one segment, as argued by the Notifying Party. In this regard, one supplier mentioned that even though "some formulations might be mode adopted for sheep […], sheep and cattle products are the same".36 However, for the purposes of the present case, a further split of the market by different species can be left open as the proposed transaction does not give rise to competition concerns under any plausible product market definition.

4.1.5.3. Conclusion

(51) In the present case, the precise product market definition for endoparasicitides and endectocides, but also the alternative segment endo / endecto can be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

(52) Moreover, as regards the segmentation of market for species can also be left open as the proposed transaction does not raise serious doubts as to its compatibility with the internal market with respect to any plausible product market definition.

4.2. Geographic market definition

(53) In previous decisions, the Commission has consistently considered that relevant geographic markets in the animal health sector have a national dimension.37 Although the animal health regulation has been harmonised to a certain extent at the EU level and although there are certain procedures which operate on a pan-EEA level, the existence of national regulatory authorities that can impose certain national recommendations or prohibitions depending on the specific situation in each country,38 distribution systems and national preferences indicates that the markets for animal pharmaceuticals are still national.

4.2.1.1. The views of the Notifying Party

(54) The Notifying Party submits that animal health products are subject to national and mutual recognition registration systems which require products to be sold according to indications and uses prescribed by national registration and approval requirements. The sales of pharmaceuticals for animal use are thus influenced by different regulatory regimes concerning administrative procedures and approval requirements (i.e. national marketing authorizations).

(55) However, the Notifying Party also submits that there is a growing trend towards competition across borders due to the recent regulatory changes (EU centralised registration procedure for new products) and to the presence of large multinational players across several Member States with a similar or identical product portfolio.

4.2.1.2. The results of the market investigation and the Commission's assessment

(56) The respondents to the market investigation have indicated that the sale of animal health products is governed by the laws and regulations specific to each country in which animal health products are sold,39 although there has also been mentioned that the registrations requirements are now more and more uniform across the EEA.40 Moreover, one supplier mentioned that there is a growing trend to source parasiticides via the internet, rather than by the classic distribution channels, which could also indicate a much wider geographic market definition. However, the same respondent also mentioned that the different national legislation and registration status of products, the prevalence of certain diseases in certain areas speak in favour of national markets.41 Indeed, the legislation in some countries (for example in Denmark) as regards the usage of antimicrobials in the food of the production animals influences the sales of certain products and their formulations.

(57) Several respondents to the market investigation from the supply side submitted that distribution and prices remain at national level, thus speaking in favour of national markets. In relation to the distribution system, it seems that in some countries it is made directly through vets, while in other countries pharmaceuticals these are sold via wholesalers and then to pharmacies.42

(58) Based on the results of the market investigation, the Commission concludes that the markets analysed in this case are national in scope.

4.3. Competitive Assessment

(59) The Notifying Party has based its competitive assessment on the filtering system used by the Commission in cases concerning pharmaceutical products for humans and animals, as well as medical devices.43 Based on this methodology, animal health pharmaceutical markets are analysed according to three categories:

a. Group 1: where the Parties’ combined market share exceeds 35% and the increment exceeds 1%;

b. Group 2: where the Parties’ combined market share exceeds 35% but the increment is less than 1%;

c. Group 3: The Parties’ combined market share is between 20% and 35%.

(60) The markets which fall within Group 2 because the Parties' combined market shares exceeded 35% and the increment does not exceed 1% are the following:44 (i) for companion animals: the market for endoparasiticides in the Netherlands, Poland and the United Kingdom and the market of otitis externa in the Netherlands; (ii) for production animals: the market of nematodicides for sheep in Belgium. Given the small increment and the fact that no concerns have been raised by customers and competitors in the course of the market investigation, the Commission concludes that the transaction does not raise serious doubts as to its compatibility with the internal market in respect of these possible markets.

(61) The markets which fall within Group 3 because the Parties' combined market shares did not exceed 35% are the following:

a. Parasiticides for companion animals: the market of endoparasiticides in Austria, Germany, Italy and Portugal; the market for endo/endecto in Belgium, France, Greece and Ireland; the market for otitis externa in the Czech Republic, in France and Poland; the market for heartworm treatment in Portugal and Spain;

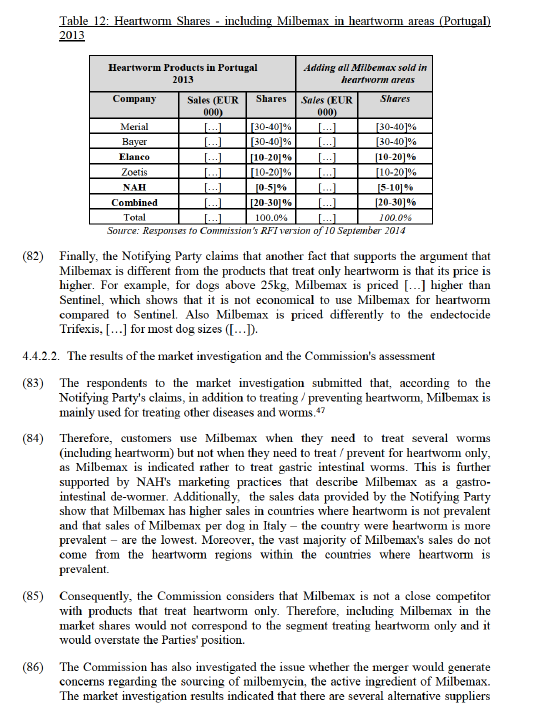

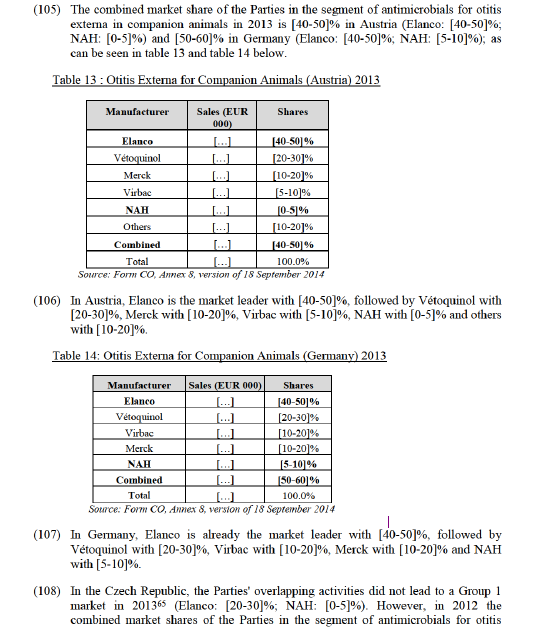

b. Antimicrobials for production animals: the market of aminoglycoside antimicrobials for production animals in Ireland and the United Kingdom; the market for injectable antimicrobials for cattle in the United Kingdom; the market for oral antimicrobials for swine in the Czech Republic, Denmark, Greece, Hungary and Poland; the market for oral antimicrobials for cattle in the Netherlands; the market for oral antimicrobials for poultry in the Netherlands, Poland, Portugal and the United Kingdom; the market of oral antimicrobials for swine (premix-only) in the Czech Republic, Greece, Hungary, Poland, Portugal and Spain; the market for oral antimicrobials for swine (soluble) in the Czech Republic, Denmark, Greece, the Netherlands, Poland and the United Kingdom; the market for oral antimicrobials for cattle (soluble) in the Netherlands, the market for oral antimicrobials for poultry (soluble) in the Netherlands, Poland, Portugal and the United Kingdom;

c. Parasiticides for production animals: the market for endoparasiticides for cattle and sheep combined in Ireland and the Netherlands; the market for endoparasiticides for cattle in Ireland and the United Kingdom; the market for endoparasiticides for sheep in Germany, Ireland and Spain; the market for endoparasiticides and endectocides for cattle and sheep combined in the United Kingdom; the market for endoparasiticides and endectocides for sheep in Ireland and the Netherlands; the market for nematodicides for cattle and sheep combined in the United Kingdom; the market for nematodicides for sheep in the Netherlands; the market for flukicides for cattle and sheep combined in Ireland; the market for flukicides for cattle in Germany and Ireland; and the market for flukicides for sheep in Ireland and Spain.

(62) As regards the Group 3 markets mentioned in paragraph (61), the Commission's market investigation and assessment did not reveal that the Parties were […] innovators or held […] pipeline products in any of these markets. The increment in market share in these markets is often not important and the combined entity will still face significant competition from a number of other competitors. Furthermore, no substantiated concerns have been raised by customers in the course of the market investigation as regards these markets. Consequently, the Commission concludes that the transaction is unlikely to raise serious doubts as to its compatibility with the internal market on these markets.

(63) The following sections focus on the markets that fall within Group 1 and on which the Commission has focused its investigation.

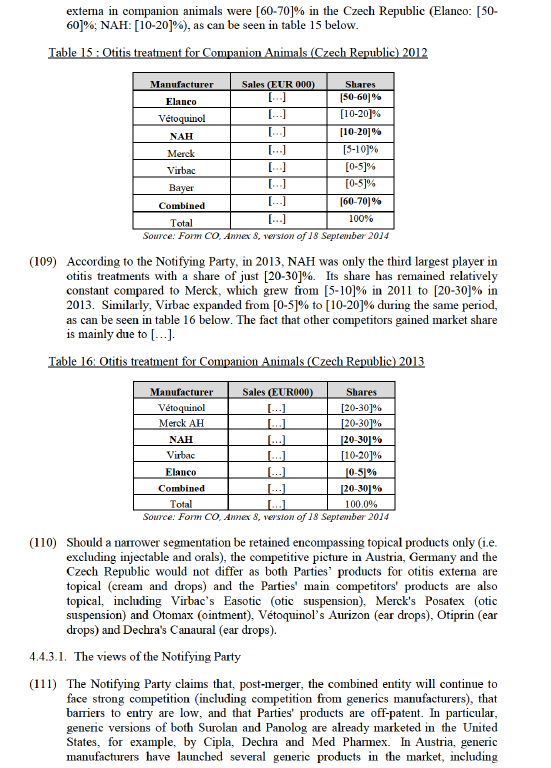

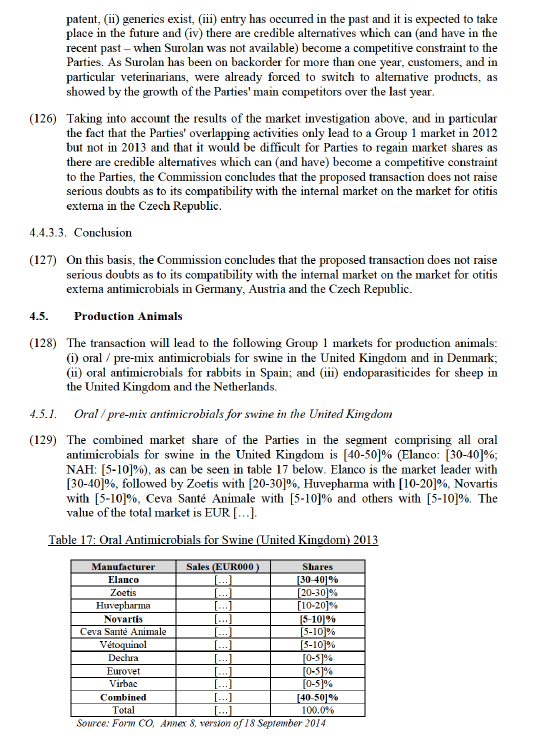

4.4. Companion Animals

(64) The transaction will lead to the following Group 1 markets for companion animals:

(i) endoparasiticides in Belgium, France, Greece, Ireland, Spain and the Netherlands;

(ii) heartworm parasiticides in Italy, Spain and Portugal; and (iii) otitis externa in Germany, Austria and the Czech Republic.

4.4.1. Endoparasiticides in Belgium, France, Greece, Ireland, Spain and the Netherlands

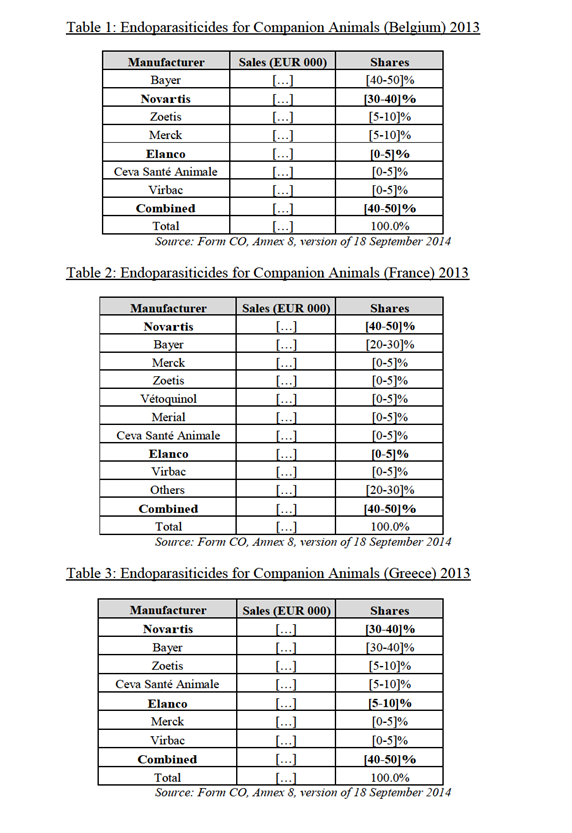

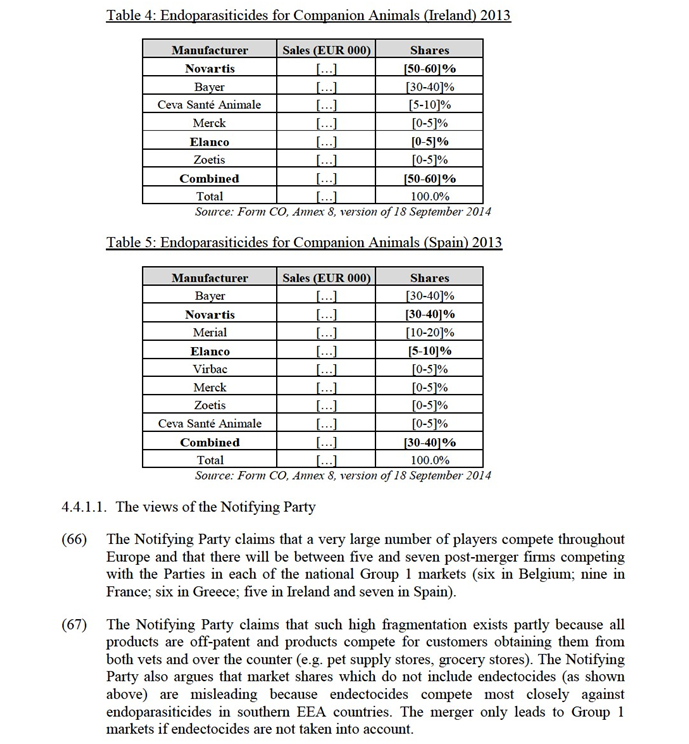

(65) As shown in table 1 to table 5 below, the combined market shares of the Parties in the segment comprising all endoparasiticides (excluding endectocides) for companion animals are [40-50]% in Belgium (Elanco: [0-5]%; NAH: [30-40]%); [40-50]% in France (Elanco: [0-5]%; NAH: [40-50]%); [40-50]% in Greece (Elanco: [5-10]%; NAH: [30-40]%), [50-60]% in Ireland (Elanco: [0-5]%; NAH: [50-60]%), and [30-40]% in Spain (Elanco: [5-10]%; NAH: [30-40]%).

competitors in particular given that (a) Milbemax (NAH) is a general wormer used for gastro-intestinal worms, while Guardian (Elanco) is effective only against heartworm45, (b) the vast majority of Elanco’s endoparasiticides sales are via the injectable version of Guardian while none of NAH’s products is injectable and (c) the Parties' products contain different active ingredients, which the parties purchase from different sources.

4.4.1.2. The Commission's assessment

(69) In France, Belgium and Ireland the increment brought by Elanco is very small and in any case below [0-5]% ([0-5]% in Belgium, [0-5]% in France and [0-5]% in Ireland). In Greece and Spain, despite the increment being a bit higher, Elanco remains a small player, with a market share of [5-10]% in Greece and [5-10]% in Spain.

(70) In addition, it is important to take into account that the market shares referred to in the precedent paragraph do not include endectocides, whilst, as better described in the market definition section, the results of the market investigation were mixed regarding the question whether there is substitutability between ectoparasiticides, endoparasiticides and endectocides.

(71) In any case, and even for endoparasiticides only, several competitors will remain active post-merger in all of the above-mentioned Group 1 countries. In particular, the merging Party will face competition from Bayer which is the market leader in Belgium and Spain (with [40-50]% and [30-40]% market share respectively) and a strong competitor in France ([20-30]%), Greece ([30-40]%) and Ireland ([30-40]%).

(72) Given the above and in particular taking into account that the increment brought about by the merger is small and that other competitors remain in the market post- merger, the Commission considers that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for endoparasiticides for companion animals in Belgium, France, Ireland, Greece and Spain.

4.4.1.3. Conclusion

(73) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for endoparasiticides in Belgium, France, Greece, Ireland, Spain and the Netherlands.

4.4.2. Heartworm parasiticides for companion animals in Italy, Spain and Portugal

(74) Heartworm is prevalent only in south Europe. Therefore, the Parties' activities overlap in Italy, Spain and Portugal.

for heartworm products in Italy. In particular, four respondents from the supply side stated they source different active ingredients from third party suppliers.48

(87) In any event, even if Milbemax sales in heartworm areas were to be allocated to a market for the prevention of heartworm, Parties' combined market shares would be [20-30]% and [20-30]% in Spain and Portugal respectively, therefore not representing a Group 1 markets in those countries.

(88) As to Italy, as it can be seen in table 7 the allocation of Milbemax sales in heartworm areas in Italy for the prevention of heartworm, allocating Milbemax sales would not change significantly market shares of the Parties. Indeed, the result only marginally increases NAH’s share (from [5-10]% to [10-20]%) and the combined share (from [30-40]% to [30-40]%). The Group 1 country in Italy would therefore remain.

(89) Consequently, market shares which will be taken into account for this segment will not include Milbemax, leaving only Italy as a Group 1 country, which is further analysed.

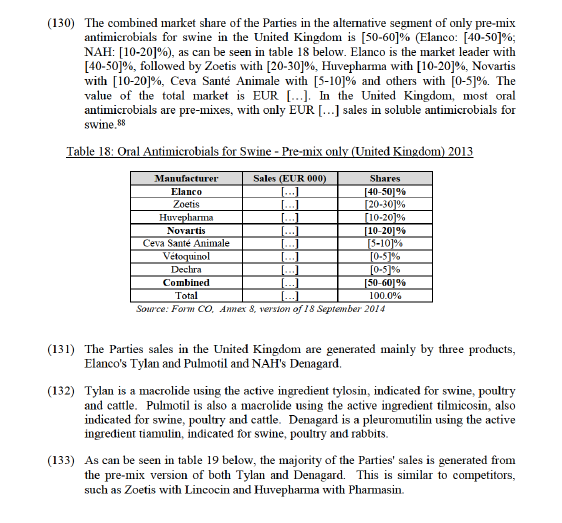

(90) In Italy, the market leader is Merial with [30-40]% with its Heartguard product. Currently, Elanco (Guardian and the soon-to-be-launched Trifexis) is number two with [20-30]%, followed by Zoetis (Revolution / Stronghold) with [20-30]%, NAH (Milbemax and Sentinel) with [5-10]%, and Bayer (Advantage / Advocate) with [0- 5]%. It is important to note that Elanco is launching a product called Trifexis, which is similar to NAH's Sentinel.

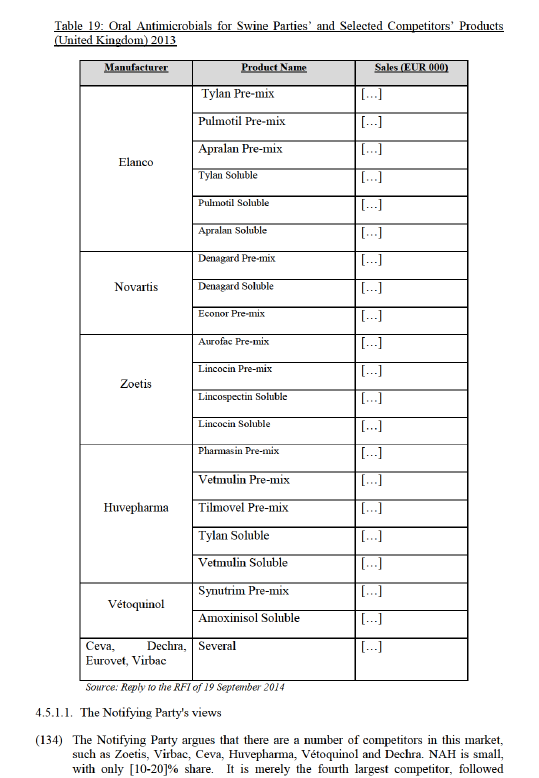

4.4.2.3. The views of the Notifying Party

(91) The Notifying Party argues that there is a large number of strong players in Italy, including Merial ( which remains the largest competitor post-merger), Zoetis and Bayer.

(92) The Notifying Party also argues that in addition to these competing products, new entry has occurred lately, namely in 2013, when Bayer has added new indications for its endectocide Advocate to ensure that heartworm is covered and when Virbac’s Filarive has been launched in Italy in the first quarter of 2011.

(93) The Notifying Party also claims that new entry is imminent and further precludes any competitive concern: Merck49 and Merial50 are introducing new endectocides to offer yet additional alternatives for heartworm prevention.

(94) The Notifying Party also argues that Elanco and NAH are not particularly close competitors. On the contrary, Elanco’s heartworm product, Guardian, is the only such drug in Europe administered by injection. Unlike NAH’s tablets, Guardian is administered by the vet and only once, to protect the animal for the entire season. This avoids the uncertainties of consistent compliance by pet owners. In contrast, the tablets and topical solutions offered by NAH and the other players are applied by pet owners for the animal’s lifetime, a significant differentiating feature affecting customer preferences.

4.4.2.4. The results of the market investigation and the Commission's assessment

(95) The market investigation respondents confirmed the Notifying Parties' claims that Merial is the market leader for products in oral form. The market investigation also provided indications that Elanco is important in products in injectable form.51

(96) However, contrary to the Notifying Party's arguments, the majority of respondents to the market investigation submitted that the Parties are close competitors on this market.52 In addition, some respondents from the supply side to the market investigation expressed concerns that the transaction will have an impact on the availability of heartworm products.53 One respondent expressed concerns that post- merger the Parties would have a dominant position on this market.54 However, from the demand side, the market investigation showed indications that the transaction will have no impact on the availability of heartworm products in Italy, nor will it lead to higher prices.55

(97) The majority of respondents to the market investigation submitted that there are alternative suppliers for heartworm products in Italy56 and that customers multi- source.57 The market investigation also provided indications that, in case the Parties' were to raise their prices, customers would switch to other competing products. 58

(98) The market investigation did not show that Parties are considered as particular aggressive or innovative competitors.59

(99) Some respondents to the market investigation submitted that entry has occurred in the past three years60, namely by Virbac with its product Filarive in 201161 and also provided indications that there will be future potential entry from Merck and Merial.62

(100) As mentioned above in paragraph (90), Elanco will soon launch Trifexis, a patented product which also treats heartworm. The Commission considers that even after the launch of Trifexis the above mentioned competitive conditions apply, namely that there will be sufficient competitors post-merger to which customers could switch, and that entry has occurred and will occur in the future.

(101) In addition, some respondents to the market investigation submitted that generics are not very important and customers prefer branded products.63 However, some other respondents provided indications that customers currently purchase generics.64Taking into account the results of the market investigation above, and in particular taking into account that, despite Parties' products being close competitors and that there might be some barriers to entry such as brand loyalty, product credibility, marketing investment and regulatory issues, Merial is the market leader and that there are several competitors remaining post-merger, there are alternative suppliers for heartworm products, customers multisource and would switch to other competitors' products in case of a price increase, generics exist and have been indicated as a source of supply for some respondents to the market investigation, entry has occurred in recent past years and it is expected to take place also in the future, the Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for heartworm parasiticides for companion animals in Italy.

4.4.2.5. Conclusion

(102) On this basis, the Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for heartworm parasiticides in Italy, Spain and Portugal.

4.4.3. Otitis externa antimicrobials in Germany, Austria and the Czech Republic

(103) Regarding the segment for otitis externa antimicrobials, the Parties' products are Panolog (NAH) and Surolan (Elanco). NAH has also a product in the pipeline, expected to be launched in […].

(104) The Commission notes that in this market, the importance and success of an otitis externa product is based on the combination of different active ingredients. The Parties' products contain different active ingredients. NAH's Panalog contains nystatin, neomycin sulfate, thiostrepton and triamcinolone acetonide, while Elanco's

Canaural (Dechra), Prisulfan (Norbrook) and Otimectin (Richter) and many of these same products are also available in Germany, including Canaural (Dechra) and Otimectin (La Vet).

(112) The Notifying Party also claims that there is no evidence that the parties are particularly close competitors. NAH’s Panalog is available in cream and ointment while Elanco’s Surolan is available only in drops. The products also contain different active ingredients, as Panalog contains nystatin, neomycin sulfate, thiostrepton and triamcinolone acetonide, while Surolan contains miconazole nitrate, polymyxin B sulfate and prednisolone acetate.

(113) Furthermore, the Notifying Party claims that both Parties' products (Panolog and Surolan) are also indicated for dermatitis (a skin condition), which was the single most common medical condition in dogs in 2012. Dermatitis covers a wide range of skin diseases with various causes. The Notifying Party estimates that the total demand for dermatitis products for dogs is EUR […] in the EEA in 2013. Surolan’s and Panolog’s total sales in the EEA were EUR […], which includes also the sales for the treatment of otitis conditions. They therefore represent only a small part of the EEA dermatitis demand and must be priced to compete not only against the many other otitis products but against the dermatitis products as well.

(114) As to NAH's pipeline product, the Notifying Party claims that despite it overlapping with Elanco’s Surolan, this raises no new issues since (i) the parties already overlap in this area; (ii) over ten firms compete in the EEA this highly fragmented space, including such major players as Bayer, Merck, Merial, Vétoquinol, Virbac and others; (iii) Elanco’s Surolan would not compete closely with NAH’ new product as they contain different active ingredients ([…]) and have different modes of administration ([…]).

4.4.3.2. The results of the market investigation and the Commission's assessment

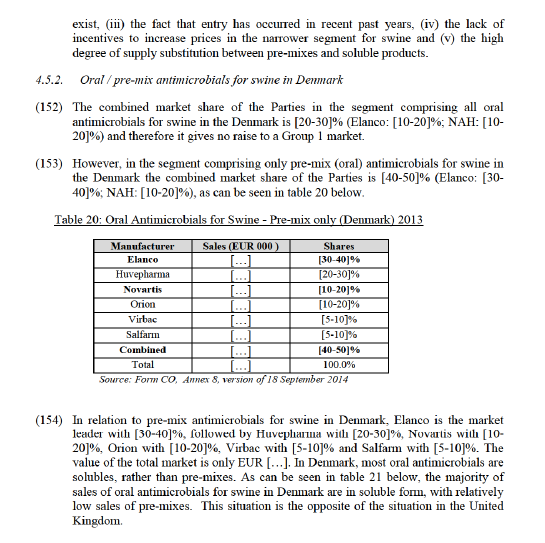

Germany and Austria

(115) The respondents to the market investigation in Germany and Austria submitted that Elanco is the market leader followed by Vétoquinol, Virbac and Novartis66 and that it benefits from a competitive advantage.67

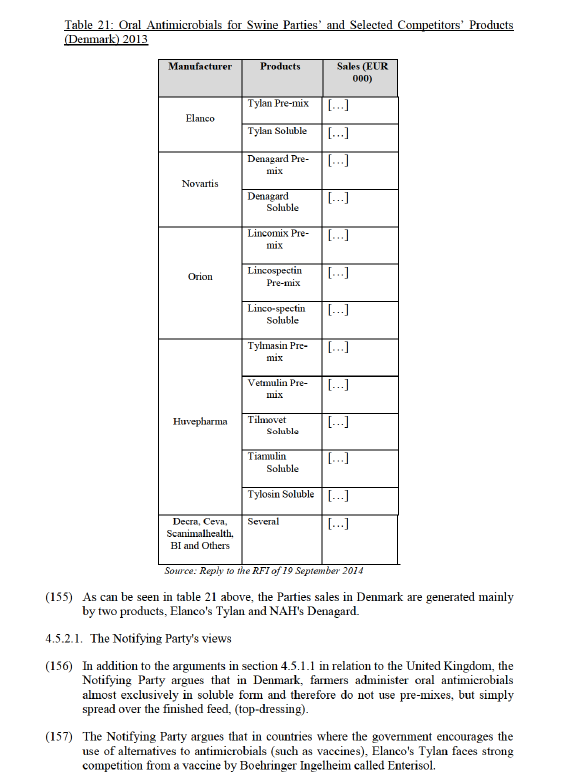

(116) One respondent to the market investigation expressed concerns that with the limited supply of Panolog (NAH) and with Elanco having access to all commercial data from Novartis, the Parties would have a major competitive advantage. 68 In addition, some respondents to the market investigation expressed concerns that the transaction would have an impact on the availability and prices of otitis externa products in Austria and Germany.69

(117) Contrary to the Notifying Party's claims, the majority of respondents to the market investigation submitted that the Parties are close competitors70 and also that the fact that NAH's Panalog is a cream and Elanco's Surolan a drop does affect the closeness of the products.71

(118) The Commission notes that there are sufficient competitors in this market. The majority of respondents to the market investigation submitted that there are alternative suppliers for otitis externa products in Germany and Austria, such as Vétoquinol, Merck and Virbac72 and that customers could easily switch suppliers in case of a price increase and that they would further use generics.73

(119) The Commission further notes that Parties' products are off-patent, which enables generic manufacturers to enter and expand in the market. Indeed, entry is feasible between six months and one year.74 In addition, the large majority of respondents confirmed that entry has occurred in Germany and Austria in the last three years. By means of example, Merck has introduced its product Posatex and a number of generic products have also been introduced.75 In addition, they expect new entry in the next two to three years, including new products on the pipeline by generic manufacturers.76

(120) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for otitis externa in Germany and in Austria, based on the above, and particularly on the fact that (i) the competitive structure will not be significantly modified by the transaction because Elanco is already the market leader in both Germany and Austria, the increment is limited, (particularly in Austria, [0-5]%) and significant competitors remain post-merger with market shares higher than those of NAH to which customers can easily switch; and, (ii) the Parties’ products are off-patent, generics exist, entry has occurred in the past in both Germany and Austria and it is expected to take place in the and future, in spite of entry barriers, such as registration and product development, the need to have a superior product profile and facing competition form generics.

The Czech Republic

(121) The replies from the market investigation did not indicate the Parties as market leaders77 nor as particularly aggressive or innovative competitors.78 As regards the question of whether Parties are close competitors79 the market investigation was not conclusive. The majority of respondents to the market investigation submitted that alternative suppliers for otitis externa products exist in the Czech Republic80 and that customers easily switch suppliers in case of a price increase.81 In addition, generics are important and pose a competitive constraint on the branded products. 82

(122) Entry is feasible within six months to one year.83 The majority of respondents to the market investigation submitted that there has been entry in the last three years, including from generic companies84 and that new entry is expected in the next two to three years.85 In addition, one respondent submitted that the distribution companies have strong market position and pressure suppliers to offer discounts. 86

(123) In addition, respondents to the market investigation confirmed that the merger will have little or no impact in the market for otitis externa in the Czech Republic. 87

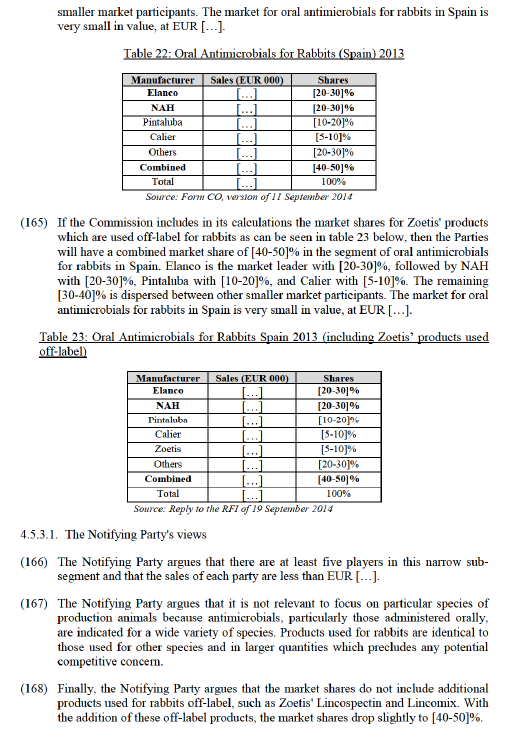

(124) The Commission notes that in the last few years, the main competitors have grown significantly. Namely, Merck from [5-10]% in 2011 to [20-30]% in 2013 and Virbac expanded from [0-5]% to [10-20]% during the same two years. The fact that such an increase of market shares (and the correspondent decrease of NAH's shares) occurred during the period in which NAH's product was not available due to licensing problems, and such high fluctuation of market shares clearly illustrate the ability of competitors to become a competitive constraints to the Parties. The Commission considers that such ability of competitors to fill in a gap in the market is a natural event which demonstrates the degree of competitive pressures in the market for otitis externa in the Czech Republic.

(125) The Commission considers that, even when NAH's Surolan becomes available again, it would be difficult for the merging Parties to regain its market shares to the level of 2012. This is particularly so taking into account that: (i) the Parties’ products are off-closely by Ceva with [5-10]%. Zoetis and Huvepharma are both larger players, with [20-30]% and [10-20]% respectively.

closely by Ceva with [5-10]%. Zoetis and Huvepharma are both larger players, with [20-30]% and [10-20]% respectively.

(135) In addition, all of the Parties' antimicrobials are off-patent and face strong competition from companies supplying antimicrobials based on the Parties' respective active ingredients.

(136) The Notifying Party also argues that the Parties' products are not close competitors. The Notifying Party argues that Tylan is no longer being indicated for dysentery, where Denagard is mainly used. Similarly, Denagard, though still indicated, is no longer materially used for ileitits, where Tylan is mainly used.

(137) Finally, the Notifying Party argues that it is not relevant to focus on particular species of production animals because antimicrobials, in particular those administered orally, are indicated for a wide variety of species.

(138) Thus, the combined firm's share in this narrow segment could not translate into a price increase. Not only is there strong competition even within this segment, farmers choose among alternative modes of administration which exert still additional competition. Moreover, because Parties' products are used for other species than swine and in different forms of administration (such as injectables), there is no reason to believe the combined firm could raise price without losing sales in those other areas.

4.5.1.2. The results of the market investigation and the Commission's assessment

(139) The respondents to the market investigation submit that both Parties are considered among the market leaders in the market for oral / pre-mix antimicrobials for swine in the United Kingdom together with other suppliers such as Zoetis, Huvepharma, and ECO.89 Additionally, the respondents to the market investigation submit that these represent alternative suppliers to the merged entity, together with Virbac, Univet KRKA, Lavet and MSD.90

(140) One respondent to the market investigation submits that the transaction would generate a dominant position in the market for pre-mixes, where the combined market share goes close to [50-60]% in volume and higher in value.91 In addition, another respondent to the market investigation argued that Elanco is the leader of the macrolides molecules, whereas NAH is the leader of pleuromutilins molecules. On this basis, both are the major alternatives to treat most swine enteric diseases.92

(141) In relation to NAH's competitive position, the respondents to the market investigation submit that NAH is not widely considered as innovative or aggressive and […].

(142) The Commission notes that the Parties face competition from a number of competitors, including generics manufacturers such as Huvepharma and that barriers to entry are relatively low as the Parties' products are off-patent.

(143) In relation to closeness of competition, the responses to the market investigation were inconclusive in relation to whether Tylan and Denagard are both used for ileitis and / or dysentery. Some respondents consider that they are used for "similar diseases" whereas others consider that they are used for different diseases. 93

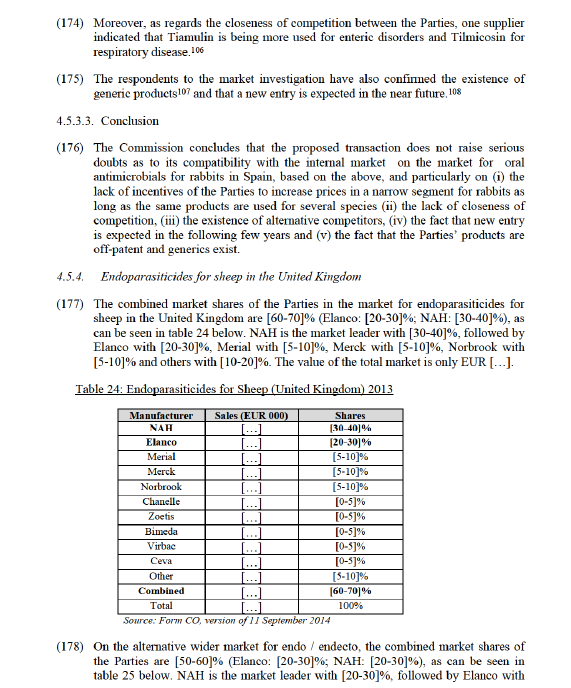

(144) The Commission notes that NAH has pleuromutilin based drugs (Denagard and Econor), whereas Elanco has macrolites based drugs (Tylan and Pulmotil).

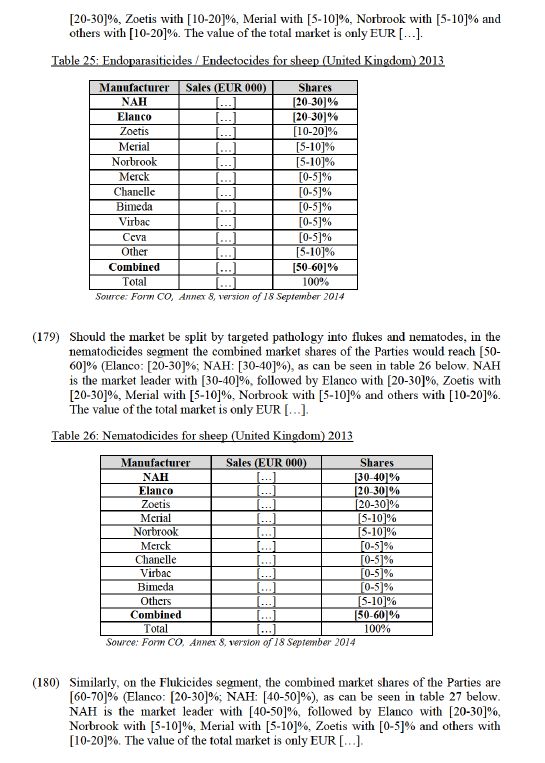

(145) Denagard is primarily marketed, sold and used to treat dysentery and mixed enteric infections (colitis) that include dysentery.94 Denagard is within the class of pleuromutilin drugs which have become "the only potentially effective choice among antimicrobials with swine dysentery as authorized indication".95

(146) Tylan is not effective against dysentery. The European Medicines Agency’s Committee for Medicinal Products for Veterinary Use (EMA CVMP) recently ordered the deletion of swine dysentery from the label of all tylosin products such as Tylan.96 In contrast, Tylan is primarily marketed, purchased and used to prevent and treat ileitis (also known as porcine enteropathy), a different intestinal disease.97 Denagard is indicated for treatment but, unlike Tylan, not prevention. Yet, even its use for treatment is limited and decreasing because customers need it for dysentery.98 Using it for the more common ileitis would cause swine to become resistant to the active ingredient tiamulin and thus preclude its effectiveness when needed for dysentery. If resistance was developed, pig farmers would have no way to treat swine dysentery because there are no alternatives to pleuromutilins to treat it.

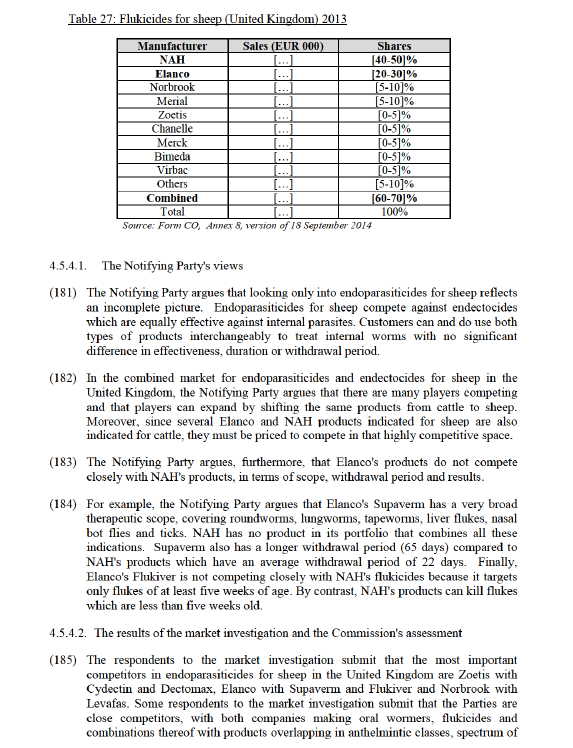

(147) These concerns lead the EMA CVMP to adopt a Reflection Paper in February 2014,99 recommending that tiamulin be restricted to the treatment of animals already diagnosed with a disease or for metaphylaxis (a mass medication for an imminent outbreak). According to the CVMP, tiamulin should only exceptionally be used as a prophylactic (i.e. for prevention) as part of well-defined and restricted in time eradication programs for swine dysentery. These limitations preclude general use of Denagard to prevent recurring diseases like ileitis. In contrast, ileitis is Tylan’s primary indication and main field of use.

(148) In addition, the Commission considers that the Parties face competitive constraints from generic products which use the same active ingredients. These generic products are closer to each Party than the Parties are with each other, as discussed in paragraphs (143) to (147) above.

(149) Moreover, the Commission considers that the post-merger, the combined entity will not have the ability to raise prices. The Parties' products can be used for several species beside swine. In particular, a number of oral antimicrobials are sold in pre- mix and soluble forms. The pre-mix forms are mainly used for swine, whereas the soluble forms are mainly used for poultry. There is a high degree of supply substitution between pre-mix and soluble. Almost all companies supply both modes of administration, including but not limited to Elanco, NAH, Zoetis, Huvepharma, Vétoquinol and Dechra. The same active ingredient can, and is often, used on both modes of administration. For instance, all of Elanco's active ingredients are sold as both premix and solubles (i.e. Tylan, Pulmotil and Apralan). The same is true for NAH's Denagard, Zoetis' Lincospectin and Lincosin and Huvepharma's Tylosin, Vetmulin and Tilmovet. In addition, Zoetis' pre-mix product, Aurofac, is used about equally for both swine and poultry. Aurofac, one of the most successful pre-mix antimicrobial for swine with very high sales, is priced to compete for poultry customers as well as swine. This would eliminate the incentive for Parties to raise prices in the narrower segment for swine, as this would mean losing sales to Zoetis and to other competitors in soluble antimicrobials.

(150) Finally, the Commission notices that the active ingredient is off-patent and generics exist in this market. Moreover, Huvepharma is an example of successful generic entry, which has achieved a current market share of [10-20]% on the basis of active ingredients which are the same as Denagard and Tylan. It is notable that Huvepharma has consistently grown by [0-5]% per year, from [10-20]% in 2011 to [10-20]% in 2013 while both Elanco and NAH have lost market shares. Ceva has grown even more dramatically, from [0-5]% in 2011 to [5-10]% in 2013.

4.5.1.3. Conclusion

(151) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for oral antimicrobials, or on an alternative segment of pre-mix only antimicrobials, for swine in the United Kingdom, based on the above, and particularly on (i) the recent decision of EMA CVMP as regards the use of tiamulin products, which make the main products of the Parties no longer substitutable, (ii) fact that there are various alternative competitors which will continue to exercise competitive constraint on the merged entity post-merger and that the Parties’ products are off-patent and generics

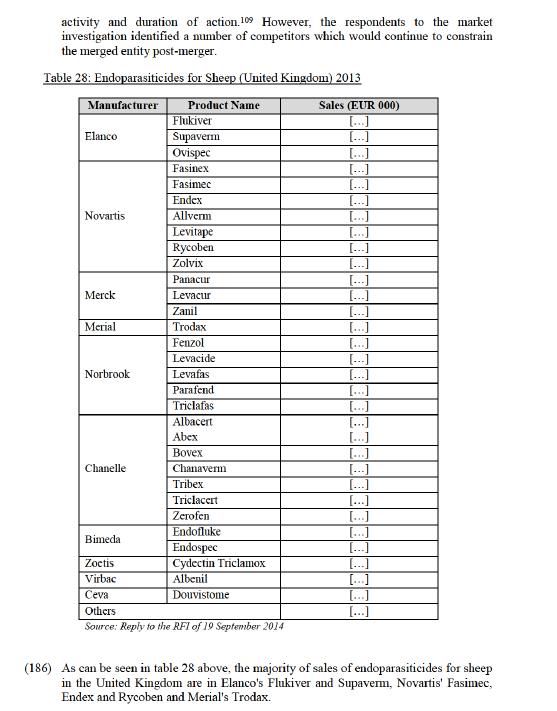

4.5.2.2. The results of the market investigation and the Commission's assessment

(158) In order to reverse the trend of the constantly increasing antibiotic consumption in the pig production and the risk posed by increasing antibiotic resistance, the Danish Veterinary and Food Administration has issues some special provisions in order to decrease the consumption of antibiotics in swine.100

(159) The respondents to the market investigation confirm that the market for pre-mix antimicrobials in Denmark is almost non-existent due to these regulatory restrictions. According to the respondents to the market investigation, competition is wider than in other countries.101

(160) One respondent to the market investigation argued that the merger would generate a dominant position in the market for oral antimicrobials in Denmark. Another competitor expressed the concern that the merged entity would control the two most widely used feed additives (Denagard and Tylan), which also represent the two largest and best regarded brands in the market.102

(161) The Commission considers that post-merger, five competitors will continue to compete in oral antimicrobials for swine. This includes large multinational companies such as Zoetis, Huvepharma and Orion. In addition, the Parties products are off-patent and face competitive constraint from generics manufacturers with the same active ingredient as Tylan and Denagard, such as Huvepharma.

(162) Moreover, as discussed above in paragraphs (143) to (147) the Parties main products, Tylan and Denagard focus on different diseases and are not close competitors.

4.5.2.3. Conclusion

(163) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the market for oral / pre- mix antimicrobials for swine in Denmark, based on the above, and particularly on (i) the fact the Parties are not close competitors, (ii) the legal limitation for the usage of antimicrobials for swine in Denmark and therefore the limited size of the market,

(iii) the existence of other competitors that shall continue to exercise a competitive constraint the merged entity, (iv) the fact that other competitors are active on this market and that the Parties’ products are off-patent and generics exist.

4.5.3. Oral antimicrobials for rabbits in Spain

(164) As can be seen in table 22 below, The Parties will have a combined market share of [40-50]% in the segment of oral antimicrobials for rabbits in Spain. Elanco is the market leader with [20-30]%, followed by NAH with [20-30]%, Pintaluba with [10- 20]%, and Calier with [5-10]%. The remaining [20-30]% is dispersed between other

4.5.3.2. The results of the market investigation and the Commission's assessment

(169) One respondent to the market investigation expressed the concern that the merger would generate a dominant position in the market for oral antimicrobials for rabbits in Spain, with the combination of Tilmovet, Apralan and Vetmulin. However, other respondents to the market investigation submitted that there are other competitors in the market for oral antimicrobials for rabbits in Spain, such as Karizoo, Esteve, Ceva and Calier.103

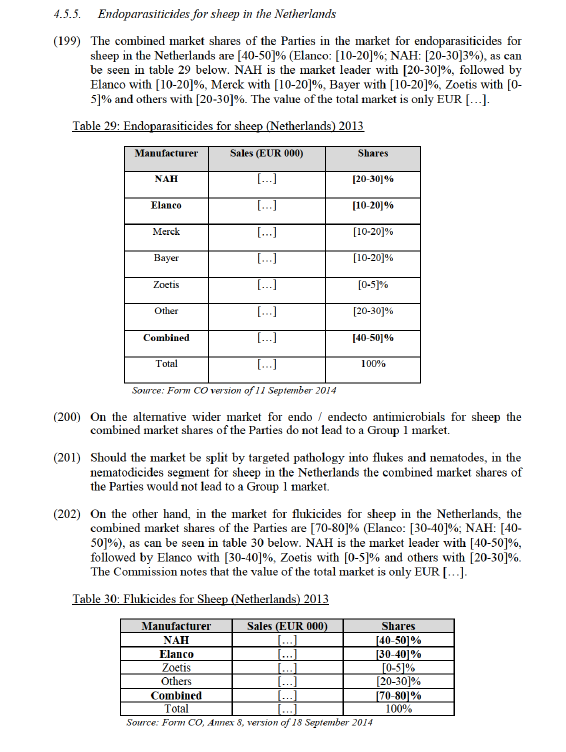

(170) In Schering Plough / Organon Biosciences104 the Commission mentioned that there is insufficient demand for economical mass-production of animal health products aimed at other individual species than the main production animal and companion animal species (such as rabbits). Where demand for animal health products for such species is not met by local production (often by veterinarians themselves or local laboratories) vaccines or pharmaceutical products developed for other species are often used (with dosage adapted to the mass of the animal).

(171) The Commission notes that most oral antimicrobials used in rabbits are indicated for several species. For example, this is the case for NAH's Denagard (which is indicated for swine, poultry and rabbits) and Econor (swine and rabbits). It is also true for Elanco’s Pulmotil (swine and rabbits) as well as competitors’ products, such as Oxiteve (swine and rabbits), Ganamix Colistin (swine, poultry and rabbits) and Caliermutin (swine and rabbits).

(172) The Commission notes that all oral antimicrobials which are indicated for rabbits are also indicated for other species, mainly swine. For example, Elanco's Pulmotil and Apralan are also indicated for swine. For example, only [20-30]% of Pulmotil (pre- mix) and [30-40]% of Apralan (pre-mix) is sold for rabbit, with the remaining [80- 90]% and [70-80]% respecively sold for swine. Similarly, only [10-20]% of Denagard (pre-mix) is sold for rabbit, with [90-100]% sold for swine. Other competitors also have cross-species products, such as Pintaluba's Apsamix Tiamulina and Apsamix Colistina, Calier's Caliermutin and Tilmovet and Zoetis' Lincospectin (soluble and pre-mix) and Lincomix (pre-mix). On this basis, the combined firm could not increase the prices of these products in rabbits because it would lose sales from customers that use these products for swine.

(173) The respondents suppliers to the market investigation submit that they do not track data specific for rabbits and that neither Party is reporting sales in relation to antimicrobials for rabbits.105 The reporting organisation CEESA also does not report data by species. For example, Tylan pre-mix is categorised under "Other large ruminants" while Tylan soluble and Pulmotil are allocated under "other food producing animals". Nor, does CEESA attempt to allocate sales of multi-species products to individual species. When narrower species categories exist, the entire product sales are allocated into a single category.

(187) In addition, most active substances contained in endoparasiticides for sheep are off- patent, which enables generic manufacturers to enter and expand in the market. By way of example, generic competitors Norbrook, Channelle and Bimeda account for over [10-20]% of the market in the United Kingdom. One competitor submits that in the United Kingdom there is a large number of generic entrants which has driven margins low.110 The respondents to the market investigation submit that generics in this market are important and place a competitive constraint on the branded products.

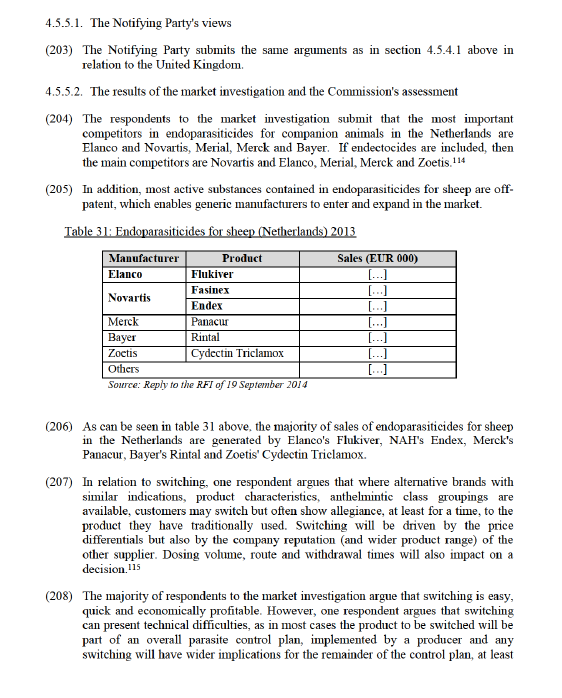

(188) In relation to switching, one respondent argues that where alternative brands with similar indications, product characteristics, anthelmintic class groupings are available, customers may switch but often show allegiance, at least for a time, to the product they have traditionally used. Switching will be driven by the price differentials but also by the company reputation (and wider product range) of the other supplier. Dosing volume, route and withdrawal times will also impact on a decision.111

(189) In relation to buyer power, some respondents to the market investigation argue that the customers are strong and have the ability to influence prices. At the retail level a small number of retailers control the majority of purchases. The largest of these have some influence on their purchasing price but critically a huge influence on price at farm level, due to improved pricing and ability to maintain smaller margins due to the scale of their operation.112

(190) The Commission notes that several of the Parties' products, including products that treat flukes and nematodes are indicated for both sheep and cattle. For example, Elanco's Flukiver and NAH's Fasinex and Endex are all indicated for sheep and cattle. For example, only [20-30]% of Fasinex is sold for sheep, with the remaining [70-80]% sold for cattle. Similarly, other competitors also have cross-species products, such as Merck's Panacur and Zanil, Merial's Trodax, Norbrook's Fenzol, Lavacide, Levafas and Parafend and Chanelle's Abex, Bovex, Chanaverm, Tribex, Triclacert and Zerofen. On this basis, the combined firm could not increase the prices of these products because it would lose sales from customers that use these products for cattle.

(191) All of these products are indicated for a number of worms, including liver flukes and (with the exception of Fasinex) nematodes (i.e. roundworms). In fact, all of the Parties products are indicated for a combination of worms, such as round, gape, lung, tape, caecal, liver flukes, nasal bot flies (and to some limited extent external ticks). The only exception is Fasinex which is only indicated for liver flukes.

(192) For example, only [20-30]% of Supaverm are in relation to the treatment of flukes, with the remaining [80-90]% estimated for the treatment of other worms. Similarly, for almost all of NAH's products, Endex, Allverm, Rycoben and Fasimec, the estimated sales attributed to the treatment of flukes range between 10-20%, with the remaining sales allocated to other worms. Similarly, [50-60]% of Zoetis' Cydectin Triclamox and Norbrook's Levafas are allocated for the treatment of flukes, with the remaining [50-60]% estimated for the treatment of other worms.

(193) In relation to the narrower segments of flukicides and nematodicides, there are other competitors, such as Norbrook, Merial, Zoetis, Chanelle, Merck, Bimeda and Virbac. These competitors have products with the same active ingredients as NAH and Elanco's respective products and are closer substitutes. For example, Norbrook's Triclafas Drench competes more closely with NAH, while Norbrook's Closamectin injection competes more closely with Elanco.

(194) In relation to barriers to entry, at the broader market level, there have been many entrants using ivermectin based products, the active ingredient which is the base of NAH's Fasimec.113 In the last three years Zoetis has introduced Startect, an oral endoparasiticides active against worms only. Other recent entrants have been Epizero by Norbrook, Robonex (Dawnland) by Norbrook and the relaunch of Zanil by Ceva. Market respondents expect that several generic products shall be launched in the future.

(195) One respondent to the market investigation argues that flukicides have seen little generic activity because of the scarcity of the active ingredient and because the relative cost of making a generic product for sheep is greater than for cattle or multi- species products.

(196) The Commission notes that the Parties flukicides do not overlap in active ingredients. Also, all of the active ingredients for fluke in the UK are off-patent and there are many generic suppliers (such as Channelle, Norbrook, Tulivin Laboratories, Bimeda, Eco).

(197) In nematodicides, the Parties only overlapping active ingredient is ivermectin, which is used by a number of competing products, such as Chanelle's Animec, Chanimec and Topimec, Norbrook's Closamectin and Closiver, Bimeda's Bimectin, Eco's Econmectin, Merial's Ivomec Classic, Norbrook's Noromectin drench and Noromectin injection. With the exception of monepantel, all of the active ingredients used to treat nematodicides are off-patent. A number of generic manufacturers have entered the United Kingdom market in recent years (Chanelle, Norbrook, Bimeda, Eco etc).

4.5.4.3. Conclusion

(198) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the endoparasiticides for sheep in the United Kingdom, based on the above, and particularly on (i) the lack of incentives of the Parties to increase prices only in this segment as long as the same products are used for several species (ii) the lack of closeness of competition, (iii) the existence of alternative competitors, (iv) the fact new entry has occurred in past years, and (v) the fact that the Parties’ products are off-patent and generics exist.

for that production cycle. Finding alternative products with the exact critical profile (spectrum, duration, withdrawal period) is not simple.116

(209) In relation to entry, Zoetis introduced Startect, as discussed above in paragraph (194). The respondents to the market investigation indicate that they expect entry by generic companies. The respondents to the market investigation consider that the generics companies are important and place a competitive constraint to the branded products.117

(210) Finally, some products are indicated for a number of species, in particular sheep and cattle. For example, only [5-10]% of NAH's Fasinex is sold for sheep, with the remaining [90-100]% sold for cattle. Similarly, Bayer's Rintal, Zoetis' Cydectin Triclamox and Merck's Panacur are sold both to cattle and sheep. On this basis, the combined firm could not increase the prices of these products because it would lose sales from customers that use these products for cattle.

(211) All of these products are indicated for a number of worms, including liver flukes and (with the exception of Fasinex) nematodes (i.e. roundworms). For example, only [20-30]% of and NAH's Endex is allocated in relation to the treatment of flukes, with the remaining [80-90]% estimated for the treatment of other worms. Similarly, [50- 60]% of Zoetis' Cydectin Triclamox is allocated for the treatment of flukes, with the remaining [50-60]% estimated for the treatment of other worms.

4.5.5.3. Conclusion

(212) The Commission concludes that the proposed transaction does not raise serious doubts as to its compatibility with the internal market on the endoparasiticides for sheep in n the Netherlands, based on the above, and particularly on (i) the lack of incentives of the Parties to increase prices only in this segment, as the same products are used for several species, (ii) the fact that alternative competitors operate on thie market and (iii) the fact that new entry of generics is expected in the next years.

5. CONCLUSION

(213) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 Publication in the Official Journal of the European Union No C 299, 05.09.2014, p. 19.

3 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009.

4 Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007; Commission Decision 2003/C110/EU in case COMP/M.2922 - Pfizer/Pharmacia, OJ C110, 08 May 2003 and Commission Decision 2000/C111/EU in case COMP/M.1681 - Akzo Nobel/Hoechst, OJ C111, 14 January 2000.

5 Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007, Case COMP/M.1681 – Akzo Nobel/Hoechst Roussel Vet, 22 November 1999, paragraph 13.

6 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009; Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007.

7 In its decision in case COMP/M.4691- Schering Plough/Organon Biosciences, (Commission Decision of 11 October 2007), the Commission mentioned that there is insufficient demand for economical mass-production of animal health products aimed at other individual species. Where demand for animal health products for such species is not met by local production (often by veterinarians themselves or local laboratories) vaccines or pharmaceutical products developed for other species are often used (with dosage adapted to the mass of the animal).

8 Commission Decision in case COMP/M.4691- Schering Plough/Organon Biosciences, Commission Decision of 11 October 2007.

9 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009; Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007.

10 Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007.

11 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009.

12 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009.

13 Questionnaire Q1, Questionnaire to Competitors, questions 7 and 8.

14 Questionnaire Q2, Questionnaire to Customers, questions 10 and 11.

15 Questionnaire Q2, Questionnaire to Customers, questions 12 and 13.

16 Questionnaire Q2, Questionnaire to Customers, question 15 and Questionnaire Q1, Questionnaire to Competitors, question 18.

17 Agreed minutes of conference call with Boehringer Ingelheim of 31 July 2014.

18 Zoetis Memorandum of 10 August 2014.

19 Questionnaire Q2, Questionnaire to Customers, questions 16 and 17 and Questionnaire Q1, Questionnaire to Competitors, questions 19 and 20.

20 Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007.

21 Questionnaire Q1, Questionnaire to Competitors, question 26.

22 Questionnaire Q1, Questionnaire to Competitors, question 27.2 and Questionnaire Q2, Questionnaire to Customers, question 24.2.

23 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009; Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007; Commission Decision 2003/C110/EU in case COMP/M.2922 - Pfizer/Pharmacia, OJ C110, 08 May 2003; Commission Decision 2000/C111/EU in case COMP/M.1681 - Akzo Nobel/Hoechst, OJ C111, 14 January 2000.

24 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009, recital 339.

25 Commission Decision 2009/C262/EU in case COMP/M.5476 - Pfizer/Wyeth, OJ C262, 17 July 2009; Commission Decision 2008/C80/EU in case COMP/M.4691- Schering Plough/Organon Biosciences, OJ C80, 11 October 2007; Commission Decision 2003/C110/EU in case COMP/M.2922 - Pfizer/Pharmacia, OJ C110, 08 May 2003; Commission Decision 2000/C111/EU in case COMP/M.1681 - Akzo Nobel/Hoechst, OJ C111, 14 January 2000.

26 As the Parties do not overlap at the level of active ingredient, this segmentation shall not be further analysed.

27 Questionnaire Q1, Questionnaire to Competitors, question 30 and Questionnaire Q2, Questionnaire to Customers, question 27.

28 Questionnaire Q2, Questionnaire to Customers, question 32.

29 Questionnaire Q2, Questionnaire to Customers, question 31.

30 Questionnaire Q1, Questionnaire to Competitors, question 36.

31 A non-profit international association that collects sales data from reporting companies in 16 EEA Member States.

32 Questionnaire Q1, Questionnaire to Competitors, question 38.

33 Questionnaire Q1, Questionnaire to Competitors, question 38.

34 Questionnaire Q1, Questionnaire to Competitors, question 40.

35 Questionnaire Q1, Questionnaire to Competitors, question 41 and Questionnaire Q2, Questionnaire to Customers, question 39.

36 Questionnaire Q1, Questionnaire to Competitors, question 43.5.