Commission, August 7, 2015, No M.7669

EUROPEAN COMMISSION

Judgment

LION CAPITAL/ ARYZTA/ PICARD GROUPE

Dear Sir/Madam,

Subject: Case M.7669 Lion Capital/Aryzta /Picard Groupe

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 8 July 2015, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertakings Aryzta AG ("Aryzta", Switzerland) and Lion Capital LLP ("Lion Capital", United Kingdom) intend to acquire within the meaning of Article 3(1)(b) of the Merger Regulation joint control of the whole of the undertaking Picard Groupe SAS ("Picard", France) by way of purchase of securities ("the proposed Transaction")3. Aryzta and Lion Capital are hereinafter referred to as the "Notifying Parties" and together with Picard as "the Parties".

1. THE PARTIES

(2) Aryzta is a Swiss-based holding company active in various food businesses and, through the Aryzta Food Group and its subsidiaries, in the manufacture and supply of bakery products to the retail and food services sectors.

(3) Lion Capital LLP is a private equity manager investing in businesses engaged in the production and/or sale of consumer-branded goods.

(4) Picard is active in the retail distribution of frozen food through its own distribution network of specialised shops operating under the Picard brand.

2. THE OPERATION AND THE CONCENTRATION

(5) Lion Capital LLP is the ultimate management entity of Lion Capital Fund II L.P., Lion Capital Fund II B L.P., Lion Capital Fund II SBS L.P., Lion/Polaris Investors L.P., Lion Capital Fund III L.P., Lion Capital Fund III (USD) L.P., Lion Capital Fund III SBS L.P., Lion Capital Fund III (USD) SBS L.P. and Lion/Polaris Cayman Ltd (together the "Sellers" or the “Lion Capital”). Lion Capital LLP is acting, for the purpose of the proposed Transaction, as the Sellers' representative.

(6) Prior to the completion of the proposed Transaction, Lion Capital exerts ownership and sole control over its direct and indirect subsidiaries, including Picard.

(7) Pursuant to the Securities Transfer Agreement ("STA"), signed on 30 March […]* between the Sellers, on the one hand, and Aryzta, as the purchaser on the other hand, the Sellers shall contribute, prior to the completion of the proposed Transaction, 100% of the Class A shares and 100% (less three) of the Class B shares issued by Lion/Polaris Lux Topco S.a.r.l., ("LP Lux Topco") a company incorporated under the laws of Luxembourg to Lion/Polaris Lux Holdco ("Holdco") a holding which is the process of being incorporated. As a consequence, Holdco shall own direct or indirect shareholdings in several companies, including Picard.

(8) Pursuant to clause 5.2 of the STA, Aryzta will acquire […]% of the class A shares and […]% of the class B shares (less three) of LP held by the Sellers through the acquisition of […]%4 of the securities of Holdco.

(9) Also, pursuant to the Securities Holders' Agreement attached to the STA, Aryzta will be granted with veto rights over certain strategic decisions of Holdco, including Picard, such as the approval and amendment of the annual budget or the business plan, the appointment or removal of the CEO or CFO, the appointment or dismissal of a member of the management board, any chairman (president) or managing director. Such veto rights are sufficient to confer joint control to the Sellers and Aryzta over Holdco, and indirectly over Picard.

(10) The proposed Transaction therefore results in a change of control on a lasting basis over Picard with the sole control of the Sellers being converted into joint control between the Sellers and Aryzta. The proposed Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(11) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million5 [Lion Capital: EUR […] million; Aryzta: EUR 3,393.8 million]. Each of them has a Union-wide turnover in excess of EUR 250 million [Lion Capital: EUR […] million; Aryzta: EUR […] million, Picard: EUR […] million] but only one of them achieves more than two-thirds of its aggregate Union-wide turnover within one and the same Member State.6 The notified operation therefore has a Union dimension.

4. RELEVANT MARKETS AND COMPETITIVE ASSESSMENT

(12) The proposed Transaction concerns i) upstream markets for the manufacture and the supply of frozen food to the retail sector as well as ii) downstream markets for retail distribution of frozen foods to end consumers.

(13) Arytza is active in the manufacture and supply of bakery food, in particular bread, savoury, pastries and cakes (fresh, industrial or frozen ready-to-bake) to the retail and food service sector.

(14) Picard is active on the procurement market for frozen food products; it purchases these products and resells them to the end consumer mostly under its own brand through its specialised shops. Picard's product range covers all frozen food types from starters to desserts and from ingredients to prepared meals.

4.1. Relevant markets

4.1.1. Upstream markets: Manufacture and supply of frozen food to the retail secto

4.1.1.1. Product market definition

(15) In previous decisions, the Commission considered a potential distinction between the production and sale of food products dedicated to the retail sector and the production and sale of food products dedicated to the food service sector (the supply of out-of- home eating, institutional catering and the quick service restaurants sectors)7.

(16) The Notifying Parties submit that this distinction should be applied. The market investigation has confirmed this analysis: a large majority of market participants consider that wholesale sales of food to the retail sector and the food sector differ in terms of price, packaging, innovation and distribution.8

(17) With particular regard to the retail sector, the Commission has investigated a potential segmentation between (i) multiple grocers (hyper and supermarket stores, convenience stores and small village shops) (ii) specialised retailers which solely sell a wide variety of frozen food products and are perceived by customers as "cold chain experts" on the market of retail distribution. Given the strong substitutability between the demand by multiple grocers and by specialised retailers, this distinction does not however appear to be relevant on this upstream market for the following reasons: (i) the sector involves sale of commoditised products: all categories of retailers can easily source equivalent products; (ii) processes, equipment and facilities are standard and widely available - any retailer can purchase a store, freezers and products from global suppliers; and (iii) the purchase of frozen food does not require specialist IP or know-how that could potentially constitute a barrier to entry.

(18) From a demand-side perspective, the Commission has previously considered within the retail sector a division between (i) frozen foods, (ii) chilled foods and (iii) fresh foods.9 In Orkla/Chips10 the Commission considered a potential further segmentation of the frozen foods into: (i) frozen pizzas, (ii) potato-based frozen food dishes and (iii) frozen fish without closing the market definition.11 Similarly, in Lion Capital/Picard Groupe, a potential segmentation of frozen food into (i) frozen starters, (ii) frozen ready meals, (iii) frozen vegetables and (iv) frozen sea products had been also considered, but it was ultimately left open.

(19) In line with the Commission, the Notifying Parties submit that the market for the manufacture and supply of food products to the retail sector could be further segmented into the manufacture and supply of (i) frozen foods, (ii) chilled foods, and (iii) fresh foods.

(20) Moreover, with respect to the market for manufacture and supply market for bakery where Arytza is active, the Commission previously considered the following main product groups: (i) bread12, (ii) bread substitutes13 and (iii) cake products14. A further distinction for cakes was also taken into account, namely (i) cakes, mini cakes and other pastries and (ii) morning goods, which include bagels, croissants, scones and similar products that are normally eaten for breakfast.15

(21) As regards the hypothetical market of frozen bakery food, the Notifying Parties submit that the traditional definition of frozen bakery shall be viewed as including frozen bread, frozen morning goods, frozen pastries and cakes, which constitute the core of this market but that this definition tends to progressively integrate frozen savoury snacks as complements of product ranges.

(22) The market investigation has confirmed the specificity of frozen bakery food: a very large majority of market participants consider that wholesale sales of frozen food and frozen bakery food constitute different markets both in terms of demand- and supply- side substitutability16 (even though frozen bakery products may be distributed along with other frozen food).17

(23) The Commission has also investigated the distinction between retailer- and supplier-branded products in the past. It considered they may belong to the same market as there is a tendency for the customers to switch from one group of the products to another but left the question ultimately open.18

(24) In any event, the Commission considers that for the purposes of the present case the exact definition of the upstream product market for the manufacture and supply of frozen food to the retail sector can be left open as it does not ultimately influence the competitive assessment of the proposed Transaction.

4.1.1.2. Geographic market definition

(25) The Commission has consistently held that the market for the manufacture and supply of food products is national in scope due to (i) the existence of the national sales channels, (ii) national distribution and logistics, (iii) different brands and brand reputations across different countries and (iv) national sales contracts.19

(26) Moreover, in Orkla/Chips, the market investigation confirmed that the logistics of frozen food supply require a continuous refrigeration chain, which would complicate any attempt to arbitrage price differences between national markets.

(27) In line with the Commission's previous finding, the Notifying Parties submit that the market for the manufacture and supply of frozen food to the retail sector is national in scope.

(28) The market investigation has confirmed the Commission's past analysis. All suppliers and customers submit that there are national differences relative to frozen food among others in terms of consumption habits, taste, brands, quality and size.20 Almost a majority of suppliers submitted that wholesale prices for similar frozen food varied more than by 10% between Member States and a very large majority indicated that it negotiated prices on a national level.21 Additionally, all customers of wholesale frozen food submitted that their suppliers were located in the same Member state.22

(29) In any event, the Commission considers that for the purposes of the present case, the exact definition of the geographic upstream market for the manufacture and supply of frozen food to the retail sector can be left open as it does not ultimately influence the competitive assessment of the proposed Transaction.

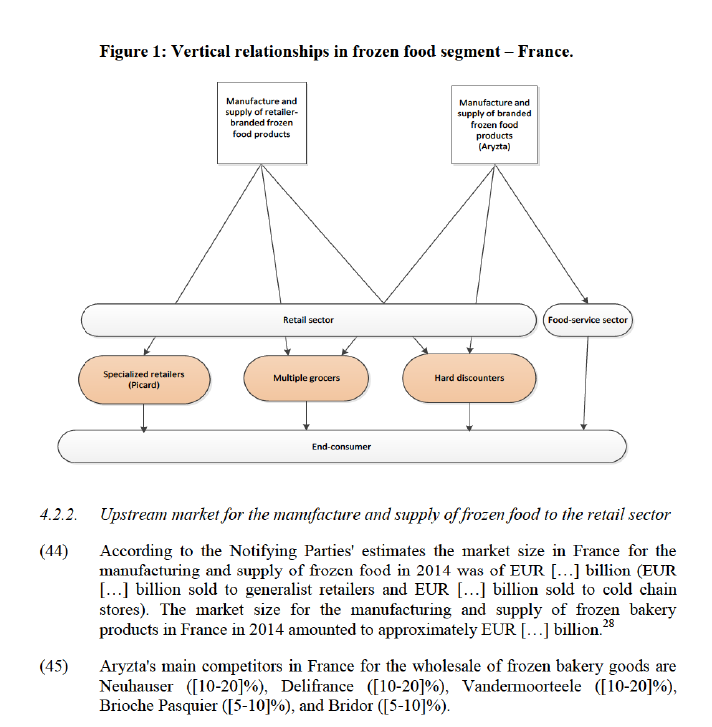

4.1.2. Downstream markets: Retail distribution of frozen food to end customers

4.1.2.1. Product market definition

(30) Food retail is a downstream market where retailers, and possibly other actors, compete for the procurement of the products they will resell on the market for the supply of food products by retailers.

(31) In previous cases, the Commission found that there is little substitutability between categories of products on this market. Therefore, each different product or group of products constitutes a different product market. 23

(32) The Notifying Parties submit that the procurement market for alimentary goods should be at least further segmented into the market for the procurement of frozen goods.

(33) With respect to retail distribution of frozen food products, the Commission previously considered a segmentation among (i) multiple grocers, (ii) specialised retailers and (iii) hard discounters, characterized by a competitive price of the products, low number of in-store lines and a limited number of frozen food lines. The exact market definition was however left open. 24

(34) The Notifying Parties submit the market for the retail distribution of frozen food products shall encompass the three distribution channels described above.

(35) In any event, the Commission considers for the purpose of the present case that the exact definition of the product market for the retail distribution of frozen products to end customers can be left open as it does not ultimately influence the competitive assessment of the proposed Transaction.

4.1.2.2. Geographic market definition

(36) The Commission concluded in the past that the market for the distribution of alimentary goods to end costumer was to be delineated on the basis of the geographic area in which the companies actively sell their goods.

(37) However, when analysing the procurement market for alimentary goods (the market on which retailers purchase goods for the distribution to end customers), the Commission also pointed out that such a market is probably national in scope due to a number of factors like publicity, national preferences, cooperation with suppliers, launching of new products and promotion activities. In any event, the Commission left in previous decisions the exact geographic market definition open.25

(38) The Notifying Parties submit that that the relevant geographic market is national in scope.

(39) In any event, the Commission considers that for the purposes of the present case, the exact definition of the relevant geographic market for the retail distribution of frozen foods to end customers can be left open as it does not ultimately influence the competitive assessment of the proposed Transaction.

4.2. Competitive assessment

(40) The proposed Transaction does not lead to any horizontal overlaps.26

(41) The proposed Transaction gives rise to a potential vertical link between Aryzta's upstream market for frozen bakery to the retail sector and Picard's downstream activities as a retail distributor of frozen food through specialised shops in France and to a much lesser extent in Sweden.27

4.2.1. General considerations

(42) Picard is present in France through […] specialist stores or "freezer centres". Paris and Ile-de-France are the most important sales areas, with […] and […] stores respectively. Picard procures and almost exclusively sells products under the Picard brand or under brands owned by Picard (around […]% of Picard’s total sales).

(43) […].

Table 1. Market shares by value (2014) in vertically affected markets in relation to frozen food in frozen food market in France

| Aryzta | Picard | |

| Sales to the retail sector | Sales to end- consumer | Retail distribution to end consumers29 |

Frozen food products | [0-5]% | NA30 | [10-20]% |

Frozen bakery | [5-10]% | NA | [5-10]% |

Ø Frozen bread and bread substitutes | [0-5]% | NA | [0-5]% |

Ø Frozen morning goods | [5-10]% | NA | [0-5]% |

Ø Frozen pastries and cakes | [5-10]% | NA | [20-30]% |

Ø Frozen savoury snacks | [5-10]%31 | NA | [10-20]% (estimate) |

4.2.3. Downstream market for the retail distribution of frozen food by specialised retailers to end customers

(46) According to the Notifying Parties' estimates, the market for retail distribution of frozen food by specialized retailers in France amounted to EUR […] billion, while the one for frozen bakery amounted to EUR […] million.

(47) Picard faces competition in retail distribution by specialized retailers from Thiriet ([10-20]%), Toupargel ([10-20]%), Maximo ([5-10]%), and others ([10-20]%). When looking at the retail distribution of frozen food by generalist and specialized retailers, Picard's main competitors are Leclerc ([10-20]%), Carrefour ([10-20]%), Intermarché ([5-10]%), Auchan ([5-10]%), and many others with market shares from 3% to 6%.

4.2.4. Competitive assessment of vertical link

(48) Overall, market participants did not raise concerns about the proposed Transaction. A very large majority of suppliers submitted that the proposed Transaction would have a neutral impact on competition on the market for the manufacture and supply of frozen food in France, both for retailers as a whole and for specialized frozen food retailers. A large majority also considered the impact of the proposed Transaction to be neutral on the market for the supply of frozen bakery food to retailers and to specialized frozen food retailers in particular.32 On the wholesale markets for the supply of frozen food or frozen bakery food, none of the suppliers or of the customers expect prices to rise as a result of the Transaction.33

(49) With respect to input foreclosure, Aryzta will not have the ability to restrict the access of Picard's competitors to its frozen food products. On all potential subsegments in the sales of frozen food to the retail sector, Aryzta's market share falls below [5-10]% (It is of [0-5]% on the general market for the manufacture of supply of frozen food products to the retail sector, of [5-10]% for frozen bakery food products, of [0-5]% for frozen breads, of [5-10]% for frozen morning goods, of [5-10]% for frozen pastries and cakes and of [5-10]% for frozen savoury snacks). Furthermore, Arytza's sales to the retail sector in France represent […]% of its total sales in France (the other […]% is sold to the food industry) and Arytza does not make sales of frozen foods to specialised retailers such as cold chain stores.

(50) With respect to customer foreclosure, Picard's market share is of [10-20]% on the market of retail distribution of frozen food products34. However, any foreclosure strategy on the upstream market for the procurement of frozen food product by retailers is unlikely for the following reasons: (i) Picard's market share is not large enough to implement such a strategy, (ii) in terms of product, Aryzta's current sale to the retail sector in France essentially consist in frozen bakery products and would therefore not fulfil all of Picard's need for frozen food in general (iii) in terms of volume, Aryzta only represents [0-5]% of sales of frozen food products to the retail sector (EUR […] million) and could not fulfil Picard's much larger total demand (Picard's sales of frozen food to end consumers is of EUR […] billion) (iv) as explained in paragraph (47), there exists numerous customers on the retail sector which competitors of Aryzta could turn to in the event of an attempted customer foreclosure.

(51) As regards the market for the procurement of frozen bakery products by retailers, Picard's total demand for frozen bakery products in France amounted to EUR […] million in 2014, representing [5-10]% of the market for the manufacturing and supply of frozen bakery food (EUR […] billion) and [0-5]% of the total sales to end customers in France (approx. EUR […] billion). Moreover, Picard does not currently purchase from Aryzta. Therefore, the Transaction is equally unlikely to give rise to any foreclosure strategy by Picard on the market for the procurement of frozen bakery products in France.

(52) Only if a hypothetical narrower market for the procurement of frozen pastries and cakes by retailers is taken into account within the market for the procurement of frozen bakery products, could Picard be considered a potentially significant customer with sales to end consumers of EUR […] million, representing [20-30] % of the total market for sales to end consumers of frozen cakes and pastries in France (EUR […] million).35 However, Picard procures and almost exclusively sells products under the Picard brand or under brands owned by Picard (around […]% of Picard’s total sales) whereas Aryzta does not produce retailer branded products. Moreover, under the current market conditions, Picard would not be able to shift its entire demand for frozen pastries and cakes; Aryzta currently sells only EUR […] million's worth of frozen pastries and cakes in France. This is well below Picard's level of sales (EUR […] million). Therefore, the proposed Transaction is

unlikely to give rise to any foreclosure strategy by Picard on the market for the procurement of frozen pastries and cakes.

(53) As regards a hypothetical market for savoury snacks, insofar as it could be considered a subsegment of frozen bakery products, the Notifying Parties estimate that Picards' market share on the market for the procurement of savoury snack comparable to what Aryzta manufactures is approximately of [10-20]%. The Notifying Parties submit the market for frozen savoury snacks or any other subsegment does not lead to any new affected market. Given Picard's low market share, the proposed Transaction is unlikely to give rise to any foreclosure strategy by Picard on this market.

(54) Furthermore, the proposed Transaction consists in a move from sole control by Lion Capital to joint control by Lion capital and Aryzta and will thus further constrain any foreclosure strategy which would be implemented to the advantage of a single Party.

(55) Additionally, in the light of the outcome of the market investigation and of the information available, the Commission considers that the proposed Transaction is not likely to entail any conglomerate effects.

5. CONCLUSION

(56) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p.3 ("the EEA Agreement").

3 Publication in the Official Journal of the European Union No C 232, 16.07.2015, p.17.

* Should read 2015.

4 Under the terms of the deal, Aryzta would maintain an option to acquire […]% stake in the business in […].

5 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

6 Picard (France: EUR […] million).

7 M.3658–Orkla/Chips (2005); M.2302 – Heinz/CSM (2001); M.1990–Unilever/Bestfoods (2000).

8 Questionnnaire Q2 to suppliers - replies to questions 4,4.1 and questionnaire Q1 to Customers - replies to questions 4,4.1

9 .6813-McCain Foods Group/Luthosa Business (2013), M. 4216 – CVC/Bocchi/De Weide Blik

(2006), M.1740 – Heinz/United Biscuits Frozen and Chilled Foods (1999).

10 M.3658–Orkla/Chips (2005).

11 M.3658–Orkla/Chips (2005).

12 Including fresh and pre-packaged bread.

13 Including crisp bread, extruded bread, crisp rolls, bread sticks, crackers and rusks.

14 Including two main segments: the segment for cakes, mini cakes and other pastries produced by craft pastries as well as industrial producers and the segment for morning goods which include bagels, croissants, scones and similar products normally eaten for breakfast)

15 M.2817 – Barilla/BPL/Kamps, M.5286 – Lion Capital/Foodvest, M.6143 – Princes/Premier Foods Cannes Grocery Operations.

16 Questionnnaire Q2 to suppliers - replies to questions 6 and questionnaire Q1 to Customers - replies to questions 6.

17 Questionnnaire Q2 to suppliers - replies to questions 7 and questionnaire Q1 to Customers - replies to questions 7.

18 M.1740 – Heinz/United Biscuits Frozen and chilled foods (1999).

19 M.6753 – Orkla/Rieber & Son (2012), M.5975-Lion Capital/Picard Group (2010) and M.3658–

Orkla/Chips (2005).

20 Questionnnaire Q2 to suppliers - replies to question 10 and questionnaire Q1 to Customers - replies to question 10.

21 Questionnnaire Q2 to suppliers - replies to questions 11 and 12.

22 Questionnnaire Q1 to Customers - replies to question 13.

23 M.1684 - Carrefour/Promodès, and M.2115-Carrefour/GB.

24 M.5975 - Lion Capital / Picard Groupe (2010).

25 M.5975 – Lion Capital/Picard Groupe (2010) and M.5047-Rewe/Adeg.

26 As regards the manufacture and supply of food to the retail sector and to the food service sector, both Aryzta and Lion Capital are temporarily active on this market. […]. Lion Capital also owns a […]% shareholding in Findus but this is a non-controlling minority shareholding. As a result, Aryzta will be the only concerned undertaking to manufacture and supply frozen foods once all ongoing transactions are finalized.

27 In Sweden, Arytza's market shares are of less than [0-5]% in any market or sub-segment that we might consider, including respectively the frozen products and the frozen bakery segments. As regards Picard, its presence in this country is minimal (12 shops in the country).

28 This includes EUR […] millions of frozen savoury snacks.

29 Picard's market share on the market for the distribution of frozen food to end costumers by specialised retailers is significantly higher. However, as explained in paragraph (16), this subsegmentation is not relevant. For reference, Picard's market share would be of [50-60]% for frozen food products, [10- 20]% for frozen bakery products, [0-5]% for frozen bread and substitutes, [10-20]% for frozen morning goods and [70-80]% for frozen savoury snacks.

30 Not active.

31 The possible subsegment of frozen starters and frozen pizzas correspond to a complement of Aryzta’s core range of products (which are traditional bakery products) and Aryzta is not able to provide the breakdown of these sales by type of product. However, as a whole, Aryzta considers its market share on those complementary products to be of approximately [5-10]%.

32 Questionnnaire Q2 to suppliers - replies to question 14.1, 14.2, 14.3 and 14.4.

33 Questionnnaire Q2 to suppliers - replies to questions 15 and 16 and questionnaire Q1 to Customers - replies to questions 15 and 16.

34 Picard's market share is of [50-60]% on the market for the retail distribution of frozen food products to ends consumers by specialized retailers. However, this market share is not relevant on the market for the procurement of frozen food by retailers where demand is made up of large retailers and specialised retailers.

35 The figure was estimated by the Parties as […]% of the market for frozen bakery in France.