Commission, July 29, 2015, No M.7645

EUROPEAN COMMISSION

Judgment

MYLAN/ PERRIGO

Dear Sir/Madam,

Subject: Case M.7645 – Mylan/ Perrigo

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

1. On 23 June 2015, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Mylan N.V. ("Mylan" or "the Notifying Party", the Netherlands) intends to acquire within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking Perrigo Company plc ("Perrigo", Ireland) by way of an unsolicited public bid ("the Transaction")3.

1. THE PARTIES

2. Mylan is a global pharmaceutical company which develops, licenses, manufactures, markets and distributes generic, branded generic and specialty pharmaceuticals with a product portfolio of more than 1,400 marketed products (after completion of the acquisition of Abbott EPD-DM, cleared by the Commission in 2015). Mylan is active in approximately 145 countries and territories and operates approximately 40 manufacturing facilities world-wide.

3. Perrigo manufactures, markets and distributes proprietary pharmaceutical products as well as generics and over-the-counter ("OTC") products. In 2013, Perrigo was incorporated under the laws of Ireland following its acquisition of Elan Corporation plc. Perrigo also recently acquired Omega Pharma Invest N.V. ("Omega") (the transaction closed on 30 March 2015) and is in the process of acquiring GlaxoSmithKline (GSK)'s OTC business pursuant to the commitments accepted in the GSK/Novartis case4.

2. THE OPERATION

4. On 24 April 2015, Mylan issued a legally binding commitment under the Irish takeover rules to commence an offer for the entire issued and to be issued share capital of Perrigo.

5. If the bid is successful, Mylan will own the majority or the entirety of Perrigo's capital and voting rights and will acquire sole control over Perrigo.

6. Consequently, the proposed Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

7. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5,000 million (Mylan: EUR 7,247 million; Perrigo: above EUR 4,000 million)5. Each of them has an EU-wide turnover in excess of EUR 250 million (Mylan: EUR […] million; Perrigo: above EUR 1,000 million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

8. The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. COMPETITIVE ASSESSMENT

4.1. Context

9. The Parties' activities are by nature complementary. Indeed, the proposed Transaction involves an acquisition by Mylan, one of the main European producers of prescribed generics, of Perrigo, a producer specialised in OTC drugs which recently extended its portolio in Europe through its acquisition of Omega6. The rationale of the Transaction is for Mylan to diversify its pharmaceutical activities on a global basis and especially expand its portfolio of OTC drugs. Indeed, post-Transaction, Mylan's portfolio of OTC products will grow from 2% to 29% of its total sales.

10. In the area of finished dose pharmaceuticals ("FDPs"), the combination of activities of Mylan and Perrigo gives rise to horizontally affected markets in different therapeutic areas (section 4.2). In addition, both parties develop pipeline products, including some that overlap with the other Party's marketed FDPs (section 4.3). Finally, both parties are active in the production of APIs, giving rise to a limited number of vertically affected markets (section 4.4)7.

4.2. Finished dose pharmaceuticals (FDPs)

4.2.1. General approach to the product market definition

4.2.1.1. Analysis based on ATC classification

11. In previous decisions concerning the pharmaceutical sector, the Commission has referred to the third level of the Anatomical Therapeutic Classification (ATC)8 as the starting point for the purposes of defining the relevant product market. However, in a number of cases, especially concerning genericised products, the Commission found that the ATC3 level classification did not yield the appropriate market definition. As a result, in recent cases9, the Commission has defined the relevant product market at a narrower level, including at the ATC4 level or at the level of the "molecule" (i.e. active ingredient) or group of molecules that are considered interchangeable from a therapeutic perspective and between which there are proven economic substitution patterns so as to exercise competitive pressure on one another.

12. In the present case, the Commission has taken, where possible, as a starting point the molecule level and assessed, on a case-by case basis, whether the market should be expanded by including other molecules within the class having the same indication.

13. Given the complementarity between Mylan's and Perrigo's activities, some of their products giving rise to affected markets do not overlap at the level of the specific molecule but only at the level of the broader ATC3 category. This is due to the fact that Mylan offers pharmaceutical products based on specific active ingredients, whereas Perrigo focuses on the consumer goods segment with a number of products based for example on plant extracts which belong to the same ATC3 class due to the common indication they are intended to treat, but are not directly substitutable due to different therapeutic characteristics and consumer profile.

14. Pharmaceutical products may be further subdivided into various segments on the basis of a variety of criteria, and in particular demand-related criteria.

4.2.1.2. Prescription drugs v. OTC drugs

15. In some past cases, the Commission defined separate markets for medicines which can be sold on prescription and those which can be sold over the counter10. This is because the therapeutic indications, regulation and legal frameworks, prices, dosages, marketing, packaging and labelling tend to differ between these drug categories, even when the active ingredient is identical.

16. OTC products may be advertised to the public at large. Prescribers do not need to intervene in the purchase of these products. In most cases, consumers choose OTC pharmaceuticals themselves (possibly upon a recommendation from a pharmacist) and purchases are not reimbursed. By contract, prescription pharmaceuticals need to be prescribed by a physician, whose intervention is thus essential in the choice of the product. Pricing for prescription products is influenced by the public health care system, which pays the purchase price (or part of) via reimbursement. Marketing of prescription drugs, therefore, is targeted at prescribers, namely doctors and hospitals11. In certain cases, products which are available OTC may also be reimbursed if bought on prescription.

17. Furthermore, in some specific circumstances, OTC products and prescription drugs based on the same molecule may compete with each other, especially in cases where the status of the drugs is not clearly limited to either OTC or prescription12. It may occur in certain countries that some variations of a drug with the same brand name are classified as OTC, whilst others are classified as prescription-only, depending on the package size, dosage or galenic form.

18. The case at hand concerns both prescription and OTC drugs, due to the complementary profile of the two companies (Mylan focusing on prescription generic drugs and Perrigo specialising in the OTC and consumers good segment). Therefore, the Commission has, where necessary, tested the appropriateness of the OTC/prescription distinction in its assessment on a case-by case basis.

4.2.1.3. Galenic form

19. As the Commission has found in its previous decisions13, medicines are differentiated not only by their active ingredient(s), but also, in particular, as recognised by the European regulatory framework for medicines for human use, by their dosage, pharmaceutical form and route of administration which may limit their substitutability.

20. For the purposes of this decision, the Commission has looked at the "galenic form" of the FDPs with reference to the first letter of the typology of form codes (the so-called "New Form Code" or NFC) used by IMS/EphMRA. In general, the first letter differentiates between forms for systemic and topical effect, site of application, and also between long-acting and ordinary forms.

21. The market investigation in this case provided indications that, for some of the products considered, different routes of administration and the pharmaceutical form of a medicine may be designed to serve the needs of different patient groups and would therefore not be interchangeable. This was shown to be the case for the liquid form of certain drugs (such as syrups or oral solutions), which are mainly designed for a specific category of patients, such as patients with swallowing difficulties or paediatric patients.

22. In any event, as further detailed below in the Commission's product-specific assessments, the question of whether the relevant markets should be further subdivided according to the galenic form can be left open for the purpose of this decision.

4.2.2. Geographic market definition

23. The Commission has previously defined the geographic markets for pharmaceutical products as being national in scope14. The market investigation in this case did not provide any indications that such market definition should be revisited, in particular, in view of the national regulatory and reimbursement schemes and the fact that competition between pharmaceutical firms predominantly takes place at national level.

24. Therefore, for the purposes of this decision, the Commission's assessment of FDP markets is carried out on national basis.

4.2.3. Methodology used in the assessment of affected markets

25. In accordance with past Commission's practice in the pharmaceutical sector15, the Commission applied a system of filters aimed at determining the group of markets where concerns are most likely to arise and on which it focused its analysis.

26. Specifically, the markets were grouped in four groups:

· Group 1: where the Parties' combined market share exceeds 35% and the increment exceeds 1%.

· Group 2: where the Parties' combined market share exceeds 35% but the increment is below 1%.

· Group 3: where the Parties' combined market share is between 20%16 and 35%.

· Group 1 "plus"17: there are two scenarios of non-Group 1 markets, which deserve a closer attention: (1) the combined market share is below 35% but only one other competitor remains on the market, and (2) the combined market share exceeds 35% and the increment is below 1% but the party with the small increment is a recent entrant18.

27. The notified concentration gives rise to a limited number of affected markets in the area of FDPs, both at the ATC3 level (same therapeutic indication) and at the narrower molecule level. Some affected markets, the vast majority of which belonging to Group 3, arise only based on the sub-segments Rx/OTC or galenic form.

28. More specifically, in the area of FDPs, taking into account all possible alternative market definitions (including OTC/prescription segmentation, galenic form, etc.), the Transaction gives rise to eight Group 1 markets and nine Group 2 markets.

29. The Group 1 markets, which will be further analysed below, are the following:

· Two Group 1 affected markets at the ATC3 level in class A9A (digestives, including enzymes acting on the digestive tract): one in Belgium occurring at the ATC3 level and one in Hungary occurring at the ATC3 level, the latter only in the OTC segment. The overlaps occur for OTC products at the ATC3 level, but not at the molecule level because whilst the Parties sell products which are classified under the same therapeutic indication, these products do not have the same active ingredient.

· Three Group 1 affected markets in France in class A2B1 (H2 antagonists) (i) at the ATC4 level , (ii) at the ATC4 level and galenic form A (H2 antagonists, oral solid ordinary form) and (iii) at the level of the molecule cimetidine within such class.

· One Group 1 affected market in Portugal at the molecule level for ibuprofen sold OTC.

· Two Group 1 affected markets at the molecule level in the United Kingdom for the molecules procyclidine and lofepramine.

30. Besides, Group 2 and Group 3 affected markets were also analysed; the Commission assessed the competitive situation on these markets including the nature and the number of existing competitors. In this decision, these markets are not considered in detail individually and are covered by the general conclusions in relation to markets where the transaction does not give rise to serious doubts as to its compatibility with the internal market.

4.2.4. Product-specific assessment

31. The Commission analyses below in detail all the Group 1 markets resulting from the Transaction. Group 1 markets arise in the area of digestives in Hungary and Belgium (section 4.2.4.1), for cimetidine-based products in France (section 4.2.4.2), for ibuprofen-based products in Portugal (section 4.2.4.3) and for procyclidine and lofepramine-based products in the United Kingdom (section 4.2.4.4).

4.2.4.1. Digestives including enzymes (A9A) in Hungary and Belgium

32. The ATC3 class A9A covers digestives including enzymes, acting on the digestive tract.

33. In this case, one Group 1 affected market arises in Belgium at the ATC3 level and another Group 1 affected market arises in Hungary at the ATC3 level, but only in the OTC segment

The Parties' products

34. Mylan's A9A product (recently acquired from Abbott) is based on pancreatin and is sold under the trade name Creon in Belgium and Kreon in Hungary. Pancreatin is a biological product containing three enzymes: lipase, protease and amylase. Creon/Kreon is indicated for the treatment of exocrine pancreatic insufficiency due to cystic fibrosis, chronic pancreatitis or other conditions. It is protected by process and formulation patents and is sold OTC in Belgium and in Hungary in the oral solid ordinary form.

35. Unlike Creon/Kreon, Perrigo's A9A product, sold under the name Eau de Melisse Carmes in Belgium and Svedcsepp/Bittner in Hungary, is based on (non-enzyme) plant extracts. Eau de Melisse Carmes/Svedcsepp/Bittner is sold exclusively OTC in Belgium and in Hungary in the oral liquid form. It is used as a digestive and as an aid against stress, travel sickness and fatigue.

Product market definition

36. In the past cases dealing with molecules in the A9A class, the Commission examined the market at the ATC3 level19.

37. The exact product market definition for A9A products can be left open in this case as the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition, it being specified that Group 1 markets arise only at the ATC3 level and at the ATC3 level limited to OTC products.

Competitive assessment

Belgium

38. In Belgium, the Parties' combined market share in the A9A class was [90-100]% in value and [90-100]% in volume in 2014. However, the increment (Perrigo) is very small ([0-5]% in value and [0-5]% in volume, based on 2014 data). Moreover, there is no overlap at the molecule level because Creon is based on a biological product (pancreatin), which is a combination of three enzymes, whereas Eau de Melisse Carmes is based on extracts of various plants (Angelica Archangelica/Coriandrum Sativum/Melissa Officinalis).

39. The Notifying Party submits that, despite being classified in the same ATC3 class, there is no competitive relationship whatsoever between the Parties' products. Creon is a pharmaceutical product which treats a particularly serious condition, exocrine pancreatic insufficiency, whereby the body does not have enough enzymes produced by the pancreas to process nutriments from food. On the other hand, Perrigo's product is a consumer product composed of a blend of herbs and plant extracts, typically purchased by patients belonging to families in which the product has been traditionally used for the treatment of digestives disorders.

40. The market investigation indeed provided indications that due to these inherent different profiles, there is no competitive relationship between the two products. During the market investigation, respondents indicated that, due to the severity of the condition which Mylan's product is intended to treat, they would not consider Perrigo's plant extract-based product as an effective substitute for it20. The market investigation therefore supported the Notifying Party's view that Mylan and Perrigo's products are intended for different uses and that any patient migration from one product to the other in response to a price increase can be excluded.

41. Taking into consideration all of the above, the Commission considers that Mylan's and Perrigo's products in the ATC3 class A9A do not compete with each other.

Conclusion

42. In light of the above, the Commission concludes that the transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the ATC3 class A9A (digestives including enzyimes) in Belgium.

Hungary

43. In Hungary, a Group 1 affected market arises only in the OTC segment of the A9A class, where the Parties' combined market share was [30-40]% in value and [20-30]% in volume with an increment (Perrigo) of [5-10]% in value and [10-20]% in volume in 2014. As already indicated with respect to Belgium, there is no overlap at the molecule level because Kreon is based on pancreatin, which is a combination of three enzymes, whereas Svedcsepp/Bittner is based on plants extracts.

44. The Notifying Party submits that, despite being classified in the same ATC3 class, there is no competitive relationship whatsoever between the Parties' products. The underlying reasons are the same as explained for the Group 1 market in A9A class in Belgium (see paragraph 39 above). The market investigation confirmed that, similarly to Belgium, there is no competitive interaction between both products (see paragraph 40 above) in Hungary.

45. Moreover, regarding Hungary specifically, Kreon faces direct competition from various pancreatin-based products in the OTC segment sold by other suppliers, such as Menarini and Farmage (which sells products from Richter Gideon in Hungary) with market shares of [20-30]% and [20-30]% (value), respectively.

Conclusion

46. In light of the above, the Commission concludes that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the ATC3 class A9A (digestives including enzyimes) in Hungary.

4.2.4.2. Cimetidine (A2B) in France

47. Cimetidine belongs to the ATC3 class A2B which includes antiulcerants. The anti- peptic ulcer category encompasses a variety of drugs used to treat a range of common disorders considered to be related to acid secretion by the stomach. The ATC3 class A2B is further divided into several ATC4 classes depending on the mode of action. Cimetidine belongs to the ATC4 class A2B1 which contains H2 antagonists. Acid (or proton) pump inhibitors discussed below, also called PPIs, belong to the ATC4 class A2B2.

The Parties' products

48. In the ATC4 classes A2B1 and A2B2 in France, Mylan's primary products are acid pump inhibitors (A2B2) based on esomeprazole, lansoprazole and omeprazole. Mylan also markets the following H2 antagonists (A2B1): cimetidine, famotidine, pantoprazole, rabeprazole and ranitidine. Mylan's products are used for the treatment of a range of common disorders considered to be related to acid secretion by the stomach, such as dyspepsia, peptic and duodenal ulcer diseases as well as gastroesophageal reflux disease. As to cimetidine in particular, Mylan sells non- branded products which are marketed as prescription drugs in the oral solid ordinary form (from 10mg to 800mg) and in the parenteral form.

49. In the ATC4 classes A2B1 and A2B2 in France, Perrigo's product is a cimetidine- based product, sold under the brand Stomedine. Stomedine is also used for the treatment of a range of common disorders considered to be related to acid secretion by the stomach. Stomedine is marketed as an OTC drug in France and is available in the ordinary oral solid form (200mg).

Product market definition

50. In past decisions, the Commission has analysed this market both at the ATC3 (A2B – antiulcerants) and ATC4 level (A2B1 - H2 antagonists and A2B2 - acid pump inhibitors).21 In case 37.507 (AstraZeneca), the Commission defined a separate product market at the ATC4 level for prescription proton pump inhibitors which did not include H2 blockers.22

51. More recently, in case M.7379 (Mylan/Abbott EPD-DM)23, which concerned the H2 antagonist ranitidine, the market investigation indicated that various molecules within the category of H2 antagonists are substitutable, including ranitidine. In addition, the results of the market investigation in that case indicated that within the family of antiulcerants, acid pump inhibitors (A2B2), such as omeprazole, are a more recent and effective generation of products compared to H2 antagonists. Hence, acid pump inhibitors, appeared to be preferred by doctors24. Given the one-way substitutability of H2 antagonists by acid pump inhibitors, the Commission concluded in case M.7379 (Mylan/Abbott EPD-DM) that the relevant product market in relation to ranitidine- based products was wider than the molecule, but narrower than the ATC3 class, likely comprising ATC4 classes A2B1 and A2B2.

52. Mylan supports a market definition comprising ATC4 classes A2B1 and A2B2.

53. The market investigation in the present case confirmed this wider than the molecule approach. Specialists in the gastro therapeutic area explained that the official recommendations from the French National Gastroenterology Society advise to prescribe PPIs instead of H2 antagonists for patients with gastric problems in standard situations. This is due to the fact that PPIs are regarded as more efficient drugs and easier to administer to patients than H2 antagonists.

54. Given the one-way substitutability of H2 antagonists (including cimetidine) by PPIs, the relevant product market in relation to cimetidine-based products appears to be wider than the molecule. In any event the exact product market definition for cimetidine can be left open in this case as the transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition.

Competitive assessment

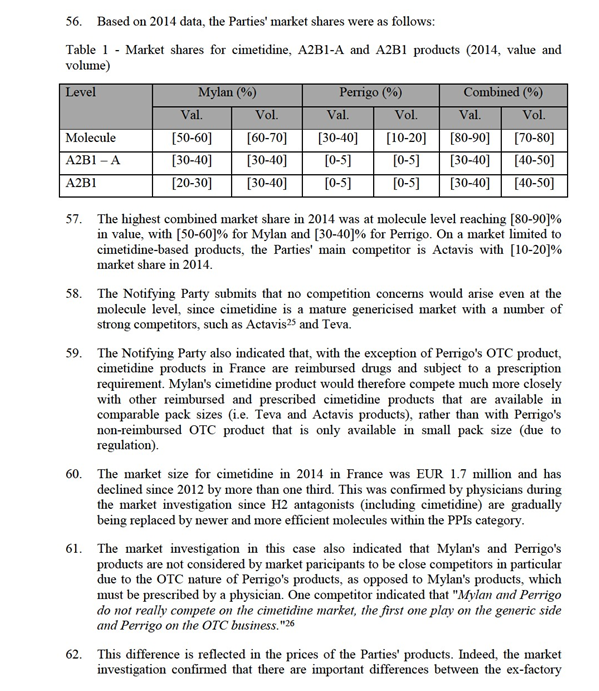

55. In France, the proposed transaction gives rise to Group 1 affected markets at the ATC4 level (A2B1), at the ATC4 level (A2B1) limited to OTC products and at the level of the molecule cimetidine, which is the only molecule sold by Perrigo in this ATC4 class.

price of Mylan's INN generic product and Perrigo's branded product for the same strength and dosage27.

63. Finally, the market investigation did not reveal any concerns in relation to cimetidine- based products in France.

Conclusion

64. In light of the above, the Commission concludes that the transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to cimetidine-based products in France, irrespective of the precise product market definition.

4.2.4.3. Ibuprofen (M1A, M2A and N2B) in Portugal

65. Ibuprofen is a non-steroidal anti-inflammatory drug derivative of propionic acid used for relieving pain and fever as well as reducing inflammation. Ibuprofen is classified in several ATC classes, depending on the indication of the specific ibuprofen-based product. Ibuprofen can be sold both as prescribed and OTC drug.

66. In Portugal, a Group 1 affected market arises at the level of the molecule ibuprofen, irrespective of the ATC classification, only for the OTC segment.

The Parties' products

67. In Portugal, Mylan's ibuprofen-based product is sold under the brand Brufen, recently acquired from Abbott. Brufen is classified under two different ATC classes, namely M1A1(anti-rheumatics, non-steroidal plain) where it is sold in oral solid form (from 200 mg to 600 mg) and in oral liquid form, and N2B0 (general purpose non-narcotic analgesics and antipyretics) where it is sold in oral liquid form only. Brufen is marketed as both prescription and OTC drug in Portugal. Its indications (under both ATC4 classes) range from the treatment of pain, to the treatment of inflammation and fever.

68. Perrigo's ibuprofen based product sold in Portugal is called Ozonol. Ozonol is classified under two ATC classes, namely M2A0 (topical anti-rheumatics and analgesics) where it is sold in a topical form and N2B0 where it is sold in the oral solid (200mg). Ozonol is sold as an OTC product only in Portugal. Its indications range from the treatment of pain (e.g. muscle pain, trauma pain, toothaches, headaches, menstrual pain, etc.) to symptoms associated with cold and flu.

Product market definition

69. In previous decisions28, the Commission analysed ibuprofen-based products within the respective ATC3 classes M1A and N2B. In one case, the Commission considered that the product market for ibuprofen could be defined at least at the ATC4 level, comprising all anti-rheumatic drugs belonging to the M1A1 class or wider29.

70. The Notifying Party submits that the relevant product market for ibuprofen in Portugal shall be defined on the basis of each applicable ATC code since the ibuprofen-based products marketed under each ATC class aim to treat different indications. Also, the Notifying Party considers that, within a specific ATC class, ibuprofen is widely substitutable by products based on other molecules belonging to the same class and therefore the market for ibuprofen should not be defined at the molecule level.

71. Responses to the market investigation in this case did not support the Notifying Party's view that the market for ibuprofen-based products shall be defined according to specific ATC classes. Respondents generally explained that although ibuprofen-based products belonging to different ATC classes may have different status (Rx or OTC), pack sizes, dosages and galenic forms30, they tend to compete against each other if they have the same reimbursement status, dosage and galenic form. In this context, one competitor explained that "even if ibuprofen products belong to different ATC classes, they might definitely compete in case of similar forms and dosages"31. Indeed, pharmaceutical companies typically cannot price discriminate between drugs based on the same molecule depending on the indication32, which was confirmed by one ibuprofen supplier stating that "no price and rebates differences are driven by different indications"33.

72. Furthermore, ibuprofen-based products may have very similar indications across ATC classes. The Notifying Party submits that ibuprofen belonging to three different ATC codes (M2A0, M1A1 and N2B0) treats "mild to moderate pain", including "fever" for M1A1 and N2B0. One competitor indeed indicated that, although "M2A is positioned for local pain", "M1A and N2B compete directly with each other"34.

73. As to the distinction between prescribed (Rx) and OTC ibuprofen, responses to the market investigation are varied. A number of market participants indicated that the reimbursement policy and dosages for Rx and OTC ibuprofen-based products sold in Portugal differ35. Indeed, 200mg ibuprofen-based products are not reimbursed and can be sold OTC, whereas 600mg ibuprofen-based products are reimbursed (up to 37% for Mylan's Brufen product) and can only be sold under prescription36. However, it cannot be excluded that OTC ibuprofen and Rx ibuprofen exert some sort of competitive pressure on each other. Some respondents indicated that when selling OTC products, pharmaceutical companies give strong rebates and discounts for promotion and placement purposes, which might lead to lower prices for OTC ibuprofen than the copayment level for Rx ibuprofen as a result of which competition can take place between OTC and Rx ibuprofen.

74. As to the distinction based on the galenic form, the market investigation gave indications that ibuprofen sold in the oral solid form may not be fully substitutable with ibuprofen sold in the topical form. One competitor indicated that "we don't consider that oral ibuprofen products compete directly with topic[al] ibuprofen products"37 and another that "topic[al] formulation […] don't compete with the oral ones"38.

75. Finally, respondents to the market investigation did not exclude the existence of competitive constraints on ibuprofen-based products from other molecules within the same ATC class. One competitor highlighted in particular the existence of "constraints [on ibuprofen] of other anti-inflammatory drugs"39.

76. In any event the exact product market definition for ibuprofen in Portugal can be left open in this case as the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition.

Competitive assessment

77. In Portugal, a Group 1 affected market arises at the molecule level irrespective of the ATC classification, but only in the OTC segment. The OTC ibuprofen segment represented EUR 3.4 million in 2014 in Portugal.

78. In 2014, Mylan's market share for OTC ibuprofen was [50-60]% in value and [70- 80]% in volume and Perrigo's market share was [0-5]% in value and [0-5]% in volume. The main competitors of Mylan in the OTC ibuprofen segment were Medinfar ([10-20]% in value), Bene Chemie ([5-10]% in value) and Reckitt Benckiser ([5-10]% in value).

79. Mylan's and Perrigo's products do not appear to be close competitors in Portugal. Besides the fact that Perrigo's overall position is small compared to Mylan's and its main competitors' positions, they compete only in the OTC 200 mg ibuprofen in oral solid form. Respondents to the market investigation presented Perrigo's Ozonol product as being particularly well known in its topical form – where Mylan is not active – but not in the oral solid form40.

80. Also, it must be noted that the OTC segment represents a relatively small proportion of the total sales of ibuprofen in Portugal (approximately EUR 3.4 million of a total of approximately EUR 19.2 million)41.

81. None of the market participant raised possible competitive concerns as to ibuprofen- based products in Portugal, Rx or OTC, as a result of the Transaction, but rather describe the market as being "high[ly] competitive"42.

Conclusion

82. Given the limited increment in market share (below 5%), the existence of strong competitors remaining even on a market limited to OTC products belonging to all ATC codes and the absence of closeness of competition between Mylan and Perrigo, the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to ibuprofen-based products in Portugal.

4.2.4.4. Group 1 markets in the United Kingdom

83. The Commission identified a number of affected markets in relation to FDPs sold by Mylan and Perrigo in the United Kingdom. Among these overlaps, the Commission identified only two Group 1 affected markets at the molecule level, namely for procyclidine and lofepramine in the United Kingdom.

4.2.4.4.1. Procyclidine (N4A) in the United Kingdom

84. Procyclidine belongs to the ATC3 class N4A which comprises anti-parkinson drugs that aim at restoring the balance between dopamine and acetylcholine in the brain. The ATC3 class N4A is not further subdivided into ATC4 classes.

The Parties' products

85. In the United Kingdom, Mylan sells non-branded procyclidine-based products, which are named after the active ingredient (Procyclidine). Mylan's procyclidine-based products are marketed as prescription drugs and are available in the oral solid ordinary form only.

86. Perrigo's procyclidine-based product is called Arpicolin (branded generic) and is also sold as a prescription drug. Arpicolin is available only in the oral liquid ordinary form.

Product market definition

87. In previous cases regarding the ATC3 class N4A, the Commission left open the question on whether the market shall be defined at the ATC3 level43.

88. The Notifying Party submits that the relevant product market is the ATC3 level N4A since the treatment of Parkinson is complicated and typically involves the use of multiple drugs. This would be further substantiated by the fact that most drugs in the N4A category can be used as a monotherapy or in combination with other drugs and are as such interchangeable. Moreover, the Notifying Party claims that the market should be further subdivided on the basis of the galenic forms in which the different prducts are available. In their view, Perrigo's products target a different category of patients than Mylan's, since they are desgined for patients with swallowing difficulties who are unable to confortably take the medication they are prescribed.

89. The market investigation in this case revealed that the role of procylidine in the treatment of Parkinson is in itself not very strong, as there are other better alternatives in the market. Procyclidine does not seem to be the first line of treatment for Parkinson, although it is considered a good option for some specific symptoms such as memory problems44.

90. As to the distinction between solid and liquid procyclidine-based products, specialists in the field indicated that in the United Kingdom there has traditionally been a preference for the solid form, although the liquid form could be useful for Parkinson patients (especially elderly) who have difficulties to swallow solid tablets.

91. In any event, the exact product market segmentation for procyclidine in the United Kingdom can be left open in this case as the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition for procyclidine.

Competitive assessment

92. In 2014, the Parties had a combined market share for procyclidine of [40-50]% in value. Mylan's market share in value was [30-40]% and Perrigo's market share was [10-20]%.

93. The Parties' main competitors in the United Kingdom are generic suppliers selling non-branded products, namely Aspen and Co-Pharma. Teva was also active in this market, but discontinued the supply of its proclydine-based products since April 2014. However, Teva still owns a dormant marketing authorisation.

94. The Notifying Party submits that, should the market be assessed at the level of the molecule, Mylan and Perrigo would not be close competitors, since both Parties are active with different galenic forms serving different groups of patients.

95. The market investigation provided indications that procyclidine-based products in the oral solid and oral liquid forms cannot be considered close competitors as they target different categories of patients45. This appears to be particularly relevant for Parkinson patients who are at an advanced stage of the disease, due to the gradual worsening of their physical condition and ability to swallow solid tablets. Specialists indicated that they would start the treatment with the solid form and would only consider switching the treatment to the liquid form once the patient's condition gets to it. At that point in time, there is typically no way back to the solid form.

96. The liquid form is thus a niche market. This seems to be confirmed by the size of the liquid form market which represents approximately 12% of the total market for procyclidine-based products. The Parties' competitors are all active in the solid form only. However, Perrigo positions itself as "specialist in liquid medicines" and only sells this product in the oral liquid form and devotes its marketing strategy for procyclidine to highlighting the features and advantages of liquids for patients with swallowing difficulties.

97. This is further confirmed by the substantial differences in pricing between Mylan's and Perrigo's products. Indeed, the average ex-factory actual selling price of Perrigo's products is significantly higher than Mylan's equivalent product (for a comparable dosage and strength).

98. Finally, the internal documents submitted by the Notifying party on this specific molecule confirm that Mylan does not consider Perrigo as a competitor in the procyclidine market while other competitors, Aspen, Co-Pharma and Teva, are clearly mentioned in its documents.

Conclusion

99. In light of the above and the fact that Mylan and Perrigo are not close competitors and important players will remain on the market, the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to procyclidine-based products in the United Kingdom.

4.2.4.4.2. Lofepramine (N6A) in the United Kingdom

100. Lofepramine belongs to the ATC3 class N6A which includes substances used in the treatment of depression and mood stabilisation. N6A can be subdivided into ATC4 classes N6A1 (herbal antidepressants), N6A3 (mood stabilizers), N64A (selective serotonin re-uptake inhibitor – SSRI – antidepressants), N6A5 (serotonin- noradrenaline re-uptake inhibitor – SNRI – antidepressants) and N6A9 (other antidepressants). Lofepramine, which belongs to the ATC4 class N6A9 (other antidepressants), is a tricyclic antidepressant, easing depression by affecting naturally occurring chemical messengers (neurotransmitters) used to communicate between brain cells.

The Parties' products

101. In the United Kingdom, Mylan's lofepramine product is named after the active ingredient upon which it is based (Lofepramine). Mylan's product is a prescribed drug and is sold in the oral sold ordinary form (70 mg).

102. Perrigo's product sold in the United Kingdom is Lomont. Lomont is a prescribed drug, sold only in the oral liquid ordinary form (70mg/5 ml, 150 ml per packsize).

Product market definition

103. In previous cases regarding the ATC3 class N6A, the Commission left open the question on whether the market shall be defined at the ATC3, ATC4 or molecule levels46.

104. The Notifying Party submits that tricyclic anti-depressants, such as lofepramine, are an older type of antidepressants than tetracyclic antidepressants and are no longer recommended as a first line of treatment for depression because they are more dangerous if an overdose is taken and may cause more unpleasant side effects than other newer treatments like SSRI and SNRI. Exceptions to the replacement of lofepramine based products by newer antidepressants may be people with severe depression that fails to respond to other treatments.

105. The Notifying Party considers that although various molecules within N6A9 class present differences in chemical structure, Mylan's product based on lofepramine competes with oral solid ordinary products based on other molecules within the N6A9 class which all share the characteristics of being anti-depressants. In the Notifying Party's view, certain molecules from other ATC4 categories (SSRI and SNRI) may also be regarded as interchangeable with lofepramine-based antidepressants, even though SSRI and SNRI are generally more expensive.

106. Moreover, the Notifying Party claims that the market should be further subdivided on the basis of the galenic forms in which the different prducts are available. In their view, Perrigo's products target a different category of patients than Mylan's, since they are designed for patients with swallowing difficulties who are unable to confortably take the medication they are prescribed.

107. The market investigation confirmed that lofepramine-based products are progressively replaced by newer antidepressants drugs in the United Kingdom, like SSRI (first line of treatment) and SNRI (second line of treatment). However, physicians indicated that lofepramine is still prescribed, in particular by general practitioners, for patients that may not tolerate the new antidepressants drugs, such as elderly patients.

108. As to the distinction between solid and liquid lofepramine-based products, physicians in the United Kingdom indicated that they are more familiar with the solid lofepramine product and usually prescribe this drug in the solid form. Liquid form may be prescribed in exceptional cases where patients cannot swallow.

109. In any event, the exact product market segmentation for lofepramine in the United Kingdom can be left open in this case as the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition for lofepramine.

Competitive assessment

110. The market size for lofepramine in the United Kingdom is GBP 2 million in 2014, having decreased from approximately GBP 6 million in 2012.

111. In the market for lofepramine in the United Kingdom, combining both solid and liquid forms, Mylan's market share was [40-50]% in value and [50-60]% in volume and Perrigo's market share was [5-10]% in value in 2014. The Parties' main competitors are Teva and Actavis. Both are selling lofepramine-based non branded generic in the oral solid form.

112. The Notifying Party submits that Mylan and Perrigo are not close competitors as their products have diverging galenic forms and target different patient groups. Indeed, Perrigo's liquid lofepramine product would specifically target patients with swallowing difficulties.

113. The market investigation in this case indicated that Mylan and Perrigo are not close competitors. Physicians indicated that, unless very specific circumstances where patients are not able to swallow, they always prescribe solid form lofepramine47. The liquid form was consistently presented by competitors and wholesalers as a niche market48. This is confirmed by the size of the market where solid form lofepramine based products represent almost 95% of the overall market. Also, the Parties' competitors, Teva, Actavis, Grey and Creo, are all active in solid form only, whereas Perrigo positions itself as "specialist in liquid medicines" and devotes its marketing strategy for lofepramine to highlighting the features and advantages of liquids for patients with swallowing difficulties.

114. Finally, Actavis' shortage as of November 2014 on the lofepramine market had a direct impact on Mylan's ex-factory prices, increasing from GBP […] in November 2014 to GBP […] in May 2015, which is an indication of the closeness of competition between oral solid dose providers. There is no evidence of such impact on Perrigo's liquid product. In addition, prices for Perrigo's liquid products are considerably higher than prices of Mylan's solid products.

Conclusion

115. In light of the above and in particular in view of the fact that Mylan and Perrigo are not close competitors and a number of important players will remain on the market, the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to lofepramine-based products in the United Kingdom.

4.3. Pipeline products

116. In addition to the marketed products, generic companies are developing pipeline generic FDPs. Pipeline generics may be the generic equilavent of originator drugs which come off-patent or new dosages or geographic markets for existing generic products.

117. In assessing generic pipeline competition, the Commission focused on instances where one party is planning to enter a market within a period of two years and the other party (or the Parties combined) has a market share of 35% or more on any plausible market definition where the pipeline products and marketed products overlap49.

118. In this case, the Form CO identified affected markets in some EEA countries in relation to Mylan's pipeline products in […] therapeutic areas, [confidential information on Mylan's pipeline products].

119. However, none of the FDP markets are affected at the molecule level, but always at the level of the ATC3/ATC4 class limited to the OTC segment. For all these markets, irrespective of the relevant market definition, Mylan would enter a market wider that the affected FDP markets. [confidential information on Mylan's pipeline products]. In light of this and the presence of other important competitors, the Commission concludes that sufficient competition is likely to remain post-Transaction on these markets.

120. The Commission also identified affected markets in relation to Mylan's pipeline products and [confidential information on Mylan's pipeline products]. However, strong competitors will remain post-Transaction in the countries where affected markets arise.

121. Finally, in relation to Perrigo's pipeline products, the Commission identified two pipeline products overlapping with Mylan's FDPs where its market share was above 35% in the FDP markets at the molecule level or at the galenic form level. However, strong competitors will also remain post-Transaction on these markets.

122. In view of the above, the Commission concludes that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to pipeline products.

4.4. Active pharmaceutical ingredients (API)

123. The API is the substance in an FDP that is pharmaceutically active, as opposed to the excipient (inert substance in which the API is suspended).

124. Both Mylan and Perrigo supply a number of APIs in the EEA and world-wide, however no horizontally affected markets arise. As both Parties are also active at the downstream level (FDPs), some vertical relationships arise as a result of the proposed Transaction.

Market definition

125. In previous decisions, the Commission considered that APIs form separate product markets upstream of the markets for FDPs. The Commission has looked at each individual API as potentially constituting a relevant market by itself, whilst noting that it was not excluded that certain APIs may be substitutable with each other for all, or for a range of, applications50.

126. Geographically, API markets were considered to be at least EEA-wide and possibly global in scope51.

127. The exact scope of the relevant product and geographic market can be left open as the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any plausible market definition.

Competitive assessment

128. The Commission analysed the markets for each individual API supplied by Mylan and/or Perrigo at EEA and global levels.

129. Downstream vertically affected markets are markets where either party has a market share of more than 30% in the upstream API market (world-wide and/or EEA) and the other party has a market share exceeding 5% in an ATC3, ATC4 or molecule class52 related to the FDP containing that particular API

130. Upstream vertically affected markets are those where either party has a market share of more than 30% in a downstream ATC3, ATC4 or molecule class53 and the other party has a market share of more than 5% in the corresponding upstream API market (world-wide and/or EEA) 54.

131. The transaction gives rise to vertically affected markets where Perrigo is active upstream (API) and Mylan is active downstream (FDP) in several EEA countries. The relevant APIs are fenofibrate, flumazenil, midazolam, moxonidine, pentoxifylline and tramadol. Also, based on the information provided by Perrigo, the Commission identified vertical links between Mylan's activities upstream (API) and Perrigo's FDPs in the United Kingdom relating to flucanozole, loratadine, dipyridamole, memantine, mirtazapine, acyclovir, losartan potassium, allopurinol, gabapentin and rivastigmine. Vertical links between Mylan's activities upstream (API) and Perrigo's FDPs were also identified in Malta for acyclovir.

132. However, in the instances where the Party active downstream has a significant market share in some FDP markets, the quantities of APIs sold in the relevant countries are small compared to the corresponding total world-wide API volumes, always below 15%. Since suppliers of these APIs are active globally, the Parties will not have the ability nor an incentive to engage in customer foreclosure.

133. Also, in the limited instances where the Party active upstream has a significant market share, the quantities of APIs needed by the other Party downstream is again very limited compared to the overall demand, so that an input foreclosure strategy is highly unlikely.

134. Finally, the market investigation did not reveal any concerns in relation to APIs. Conclusion

135. In light of the above, the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to APIs.

5. CONCLUSION

136. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p.3 ("the EEA Agreement").

3 Publication in the Official Journal of the European Union No C 215, 01.07.2015, p. 23.

4 M.7276 GlaxoSmithKline / Novartis Vaccines Business (ecl. Influenza) / Novartis Consumer Health Business.

5 Turnover calculated in accordance with Article 5 of the Merger Regulation.

6 In parallel to this Transaction, Perrigo is in the process of acquiring GSK's OTC business pursuant to the commitments accepted in the GSK/Novartis case. The Commission's competitive assessment of the Transaction takes into account this ongoing acquisition.

7 The Parties are also both active in outlicensing, contract manufacturing and distribution activities in the EEA. However, no affected market arises and, therefore, these activities will not be further discussed in this decision.

8 Classification devised by the European Pharmaceutical Marketing Research Association (EphMRA) and maintained by EphMRA and Intercontinental Medical Statistics (IMS).

9 M.5865 Teva/Ratiopharm, M.6613 Watson/Actavis and M.7379 Mylan/Abbott.

10 E.g. M.5865 Teva/Ratiopharm, paragraphs 22-24, M.5253 Sanofi-Aventis/Zentiva, paragraphs 21-24 and M.3751 Novartis/Hexal, paragraph 3. In many cases, this distinction was however left open (e.g. M.7480 Actavis/Allergan, paragraph 64 and M.6613 Watson/Actavis paragraphs 10 and 13).

11 M.5953 Reckitt Benckiser/SSL, paragraph 14.

12 M.5778 Novartis/Alcon, paragraph 14.

13 M.5778 Novartis/Alcon, M.5865 Teva/Ratiopharm, and M.5253 Sanofi-Aventis/Zentiva.

14 M.7379 Mylan/Abbott, paragraph 27.

15 M.5778 Novartis/Alcon, paragraph 25.

16 Initially, this group included markets where the combined market share ranges between 15% and 35%. However, in line with the new Notice on Simplified procedure (Commission Notice on a simplified procedure for treatment of certain concentrations under Council Regulation (EC)No 139/2004) this range was adapted from 20% to 35% to include only affected markets.

17 M.5778 Novartis/Alcon, paragraph 25.

18 No Group 1 "plus" markets were identified in this case (Form CO, footnote 48).

19 M.3853 Solvay/Fournier, paragraph 19.

20 Questionnaire Q1 – Pharmacies, Question 15, Questionnaire Q2 – Wholesalers and distributors, Question 14 and Questionnaire Q3 – Competitors – Question 28.

21 M.1846 Glaxo Wellcome/Smithkline Beecham and M.3354 Sanofi-Synthelabo/ Aventis.

22 A.37.507/F3 AstraZeneca.

23 M.7379 Mylan/Abbott EPD-DM, paragraph 194 and following.

24 In particular, in that case, it was submitted that in France doctors prescribe acid pump inhibitors instead of H2 antagonists in more than 95% of cases. Also, switching patients who are already taking H2 antagonists to acid pump inhibitors was not perceived as problematic. Therefore, in that case H2 antagonists were regarded as substitutable by acid pump inhibitors, which seem to be more effective (although the reverse substitution does not occur).

25 The originator brand Targamet developed by GlaxoSmithKline is currently marketed by Actavis in France

26 Questionnaire Q3 - Competitors, Question 27

27 Questionnaire Q3 – Competitors, Question 21.

28 M.5953 Reckitt Benckinser/SSL, paragraphs 17 and following, M.6258 Teva/Cephalon, paragraphs

50 and following, M.5865 Teva/Ratiopharm, paragraph 250 and following and M.5253 Sanofi- Aventis/Zentiva, paragraph 146 and following.

29 M.7379 Mylan/Abbott EPD-DM, paragraph.337.

30 Questionnaire Q1 – Pharmacies, Question 11 and Questionnaire Q3 – Competitors, Question 8.

31 Questionnaire Q3 – Competitors, Question 19.

32 Questionnaire Q3 – Competitors, Question 9.

33 Questionnaire Q3 – Competitors, Question 8.1.

34 Questionnaire Q3 – Competitors, Question 19.

35 Questionnaire Q3 – Competitors, Questions 8 and 11 and Questionnaire Q2 – wholesalers and distributors, Questions 16 and 19.

36 Questionnaire Q3 – Competitors, Question 11.

37 Questionnaire Q3 – Competitors, Question 18.

38 Questionnaire Q3 – Competitors, Question 19.

39 Questionnaire Q3 – Competitors, Question 14.

40 Questionnaire Q3 – Competitors, Questions 16 and 18.

41 When asked which companies are the main players for ibuprofen products in Portugal, respondents therefore identified companies active in the prescribed field: Mylan with its Brufen product, Ratiopharm (Teva) with its non-branded generic ibuprofeno ratiopharm and Zambon with its branded product Spidifen (Questionnaire Q3 – Competitors, Question 15).

42 Questionnaire Q3 – Competitors, Question 14.

43 M. 6258 Teva/Cephalon, paragraphs 69 and following.

44 Conference call with a neurologist on 15 July 2015.

45 Conference calls with a neurologist and with a competitor on 15 July 2015.

46 M. 5865 Teva/Ratiopharm, paragraphs 302 and following and M.6613 Watson/Actavis, pargraphs 29 and following.

47 Conference calls with a psychiatrist and neurologist on 15 July 2015

48 Conference call with a wholesaler on 16 July 2015 and with a competitor on 15 July 2015.

49 M.6258 Teva/Cephamon, paragraph 129 and M.6613 Watson/Actavis, paragraph 111.

50 M.5865 Teva/Rationpharm, paragraphs 393 to 395.

51 M.5865, Teva/Ratiopharm, paragraph 396.

52 Taking into account, at each level, further distinctions between Rx/OTC sales as well as galenic form.

53 Taking into account, at each level, further distinctions between Rx/OTC sales as well as galenic form.

54 M.5865 Teva/Ratiopharm, paragraph 399.