Commission, February 21, 2011, No M.5950

EUROPEAN COMMISSION

Judgment

MUNKSJO / ARJOWIGGINS (DECOR AND ABRASIVE BUSINESSES)

Dear Sir/Madam,

Subject: Case No M.5950 - MUNKSJO / ARJOWIGGINS (DECOR AND ABRASIVE BUSINESSES)

Notification of […]* pursuant to Article 4 of Council Regulation No 139/20041

1. On 17 January 2011, the Commission received a notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Munksjö AB ("Munksjö") acquires within the meaning of Article 3(1)(b) of the Merger Regulation control over Arjowiggins' decor paper, thin paper, fine art paper and abrasive paper businesses (the "Target Business").

I. THE PARTIES

2. Munksjö is a Swedish-based manufacturer of high value-added paper products in six product areas: decor paper, pulp, electro-technical paper, Spantex, thin paper and Inpak. Decor paper is the single most important product area and accounts for around […] % of

Munksjö's total turnover. Munksjö is controlled by EQT III Limited, an investment fund2.

3. The Target Business comprises Arjowiggins' decor paper, thin paper, fine art paper and abrasive paper businesses. Decor paper is the most important product area of the Target Business and accounts for around […] % of the total turnover generated by the Target Business. The assets comprised by the transaction include two paper mills located in Arches, France, and Dettingen, Germany. The seller of the assets, Arjowiggins, is a manufacturer of creative and technical paper (graphic paper, coated US, creative paper, industrial solutions, security).

II. THE CONCENTRATION

4. Pursuant to a letter dated 13 December 2010 and the related draft share sale and purchase agreement, Arjowiggins shall transfer all the shares of Arjowiggins Arches SAS and Arjo Wiggins Deutschland GmbH, which hold two paper mills in Arches and Dettingen respectively, to Munksjö or one or more of its subsidiaries. As a result of the proposed transaction, Arjowiggins' decor paper, thin paper, fine art paper and abrasive paper businesses will be solely controlled by Munksjö. The operation therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

5. The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (Munksjö: EUR […]; the Target Business […]million)3. However, the Target Businesss does not have an EU-wide turnover in excess of EUR 250 million (EUR […]). The notified operation therefore does not have an EU dimension within the meaning of Article 1 of the Merger Regulation.

6. According to the notifying party, the operation is reviewable under the national merger control laws of five Member States, namely Austria, Germany, Poland, Portugal and Spain.

7. Following the filing of a referral request pursuant to Article 4(5) of the Merger Regulation on 18 August 2010 and none of the Member States that were competent to examine the concentration having expressed its disagreement with the request for referral within the 15 day deadline, the concentration is deemed to have an EU dimension according to Article 4(5) of the Merger Regulation.

IV. RELEVANT MARKETS

1. Product market definition

8. Both parties produce paper products in various segments. However, their activities in the EEA only overlap horizontally in decor paper.

9. Decor paper is a type of surface material for decorative applications ("decorative surface materials"). Other decorative surface materials are veneer, varnish, lacquer and decorative laminates (thermoplastic foils). Following several further processing steps, decor paper is mainly used in the furniture, interior-design and construction and renovation industries both for technical purposes (surface resistance) and esthetical purposes (colours and patterns). There are different types of decor paper, such as high and low pressure laminate paper ("HPL"/"LPL") (also referred to as "unicolour"), print base paper ("PBP"), balance paper and pre-impregnated paper and other papers.

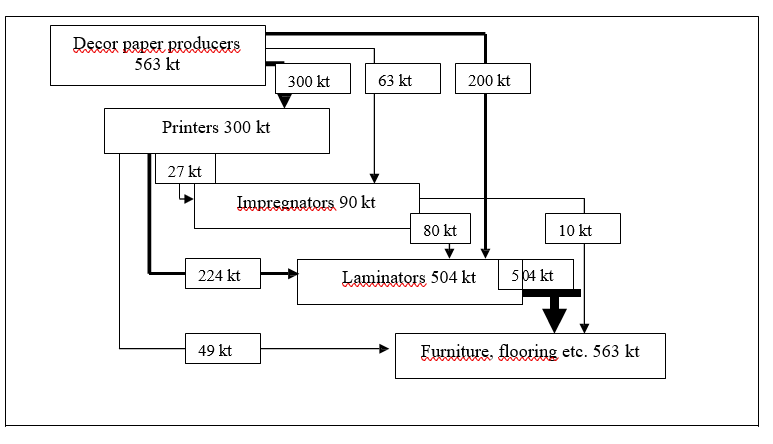

10. Decor paper is the first step in a complex conversion chain (see graph below). In further processing stages, decor paper is often printed by the decor paper producers' customers with decors such as wood, stone or coloured patterns (more than 50% of decor paper is printed). In further stages, both printed and non-printed decor paper is impregnated with melamine resin (pre-impregnated paper4 needs a lacquered surface instead)5. After impregnation, the resulting intermediate product is laminated onto a wood-based substrate such as medium density fibreboards ("MDF") or particleboard. Pre- impregnated decor paper is not laminated, but glued onto the wood-based substrate.

Decor paper value chain for the worldwide market of decor paper (excl. China), 20096

Decor paper value chain for the worldwide market of decor paper (excl. China), 20096

11. In a previous decision, the Commission's market investigation indicated at the time that decorative laminates and decor paper may be regarded as substitutes7. However the Commission left open whether they belong to a single or separate markets.

12. Decorative laminate consists of several layers of resin- or melamine-impregnated craft paper (for the core) and decor paper (for the surface) sealed together. It is used, for example, in shower cabins, facades and balconies. In a previous decision, the Commission's market investigation indicated that all types of decorative laminate belong to a single product market, which is separate from the product market for coated particle board or components8. However, the question of whether the market of "decorative laminate" should be further segmented according to different types of decorative laminates or different decor papers was left open.

13. The notifying party considers that the relevant product market is the market for decor paper or the market for decor paper excluding pre-impregnated decor paper.

14. The market investigation strongly indicated that from a demand perspective decorative laminates are not a substitute for decor paper.

15. The Commission therefore considers that for the purpose of the present transaction the relevant product market should not include decorative laminates.

16. The different types of decor paper referred to in paragraph 9 above are all supplied in rolls to decor paper customers. The width of rolls, the weight, and other properties and characteristics of the paper vary depending on the type of decor paper and the customer's requirements.

17. HPL paper is sold almost exclusively to laminators, who impregnate the papers with melamine resin and then laminate them with high temperature and high pressure. An important customer requirement is that the paper matches exactly the required colour and that deliveries are consistent in this respect. The weight of HPL paper is 80-120 grams.

18. LPL paper is sold almost exclusively to laminators. As for HPL, it is crucial that the paper matches exactly the required colour and that deliveries are consistent in this respect. The weight of LPL paper is usually 80 grams.

19. PBP is sold mainly to printers, who print the decor paper for panel and laminate flooring producers. The core competence of the printers is in design, i.e. in creating different decorative prints decor such as wood, stone or coloured patterns. The paper weight of PBP is 70 grams or lower.

20. Balance paper is sold mainly to impregnators and laminators, and is used to prevent tension and warping of the panel during one-sided absorption of moisture. Balance paper is made from waste paper in the production of other decor papers. The exactness and consistency of the colour is not as important for balance paper as for other decor papers. The weight of balance paper is usually 70 grams.

21. Pre-impregnated decor paper is sold to printers. Pre-impregnated decor paper is impregnated by the decor paper manufacturer (in the decor paper machine). The weight of pre-impregnated decor paper is 60 grams or less.

22. The prices of different types of decor paper vary, with the highest prices generally in HPL and pre-impregnated decor paper. The notifying party explains that the differences in price are mainly due to the fact that orders and lot sizes of such decor papers are generally smaller as compared with other types of decor paper.

23. The notifying party points out that there is a high supply-side substitutability for the different types of decor paper (HPL/LPL, PBP, balance paper) except for pre- impregnated paper for which the supply-side substitutability is lower as switching production involves some investments in machinery. According to the parties, switching between HPL/LPL, PBP and balance paper is an ordinary activity which does not involve any particular costs.

24. The market investigation confirmed the existence of a high degree of supply-side substitutability as regards HPL/LPL, PBP and balance paper.

25. As regards pre-impregnated decor paper, its production requires a special device ("size press"). Some investments are thus needed to equip a decor paper machine to produce pre-impregnated paper. Furthermore, while suppliers of pre-impregnated decor paper can also switch production to also supply (non pre-impregnated) decor paper, the converse is not true.

26. The Commission therefore considers that decor paper should not be segmented between HPL, LPL, print base paper and balance paper. As regards pre-impregnated decor paper, the supply-side substitutability is more limited as there is only one-way substitutability.

27. The Commission therefore considers that, for the purpose of the proposed transaction, the relevant product market is the overall market for the production of decor paper (including the different types of decor paper HPL, LPL, print base paper and balance paper). The question of whether there is a separate product market for pre-impregnated decor paper can be left open as it has no impact on the outcome of the competitive assessment of the proposed transaction.

2. Geographic market definition

28. The notifying party considers that the relevant geographic market for decor paper is global (excluding China9) or at least EEA-wide in scope.

29. In past decisions, the Commission considered that the relevant geographic market for decorative laminates, a close product of the decor paper, is EEA-wide in scope10. It has reached the same conclusion in previous decisions concerning other paper products (fine paper, magazine paper)11.

30. On the one hand, about half of the respondents to the market investigation claim that the geographic market for decor paper is worldwide, in particular with regards to the very low transport cost. On the other hand, a majority of customers indicate that the share of decor paper they source from manufacturers outside the EEA is very limited. In any event, the outcome of the assessment would not change if the relevant geographic market was defined as worldwide.

31. The Commission considers that, for the purpose of the proposed transaction, the geographic market definition is at least EEA-wide in scope.

V. ASSESSMENT

1. Market characteristics

Activities of the parties and their competitors

32. The notifying party estimates the total size of the decor paper market (including pre- impregnated paper) to be EUR 571 million in 2009 in the EEA and EUR 844 million worldwide (excluding China).

33. The total market volume of decor paper sales (including pre-impregnated paper) in the EEA was 377 045 tonnes in 200912, a decline by 19% compared to 2008 in the wake of the financial crisis13. The total market volume of decor paper (including pre-impregnated paper) worldwide (excluding China) was 548 000 tonnes in 200914, a decline by 17% compared to 2008. Precise figures for 2010 are not yet available, but the market investigation indicated that sales for decor paper increased significantly in 2010.

34. In 2009, the EEA and worldwide (excluding China) market shares of the parties and their main competitors based on volume sales in the market for decor paper (including pre-impregnated paper) were as follows:

Table 1 – 2009 market shares (based on volume)

| EEA | Worldwide (excl. China) | ||

| Volume sales (in tonnes) | Market share | Volume sales (in tonnes) | Market share |

Munksjö | […] | [10-20]% | […] | [10-20]% |

Arjowiggins | […] | [10-20]% | […] | [10-20]% |

Combined | […] | [20-30]% | […] | [20-30]% |

Technocell | n.a. | [20-30]% | n.a. | [30-40]% |

Malta Decor | n.a. | [10-20]% | n.a. | [10-20]% |

Koehler | n.a. | [10-20]% | n.a. | [5-10]% |

Ahlström Kämmerer | n.a. | [5-10]% | n.a. | n.a. |

Hoffsümmer | n.a. | [5-10]% | n.a. | n.a. |

Others | n.a. | [5-10]% | n.a. | n.a. |

Total | 377 045 | 100% | 548 000 | 100% |

Source: Estimates by the notifying party

35. Post-transaction the merged entity would have an EEA market share of [20-30]% with Technocell still remaining the market leader in terms of sales with a share of [20-30]%.

36. Munksjö produces decor paper in two paper mills, located in Unterkochen, Germany, and Tolosa, Spain. It is currently the second largest supplier of decor paper. Munksjö produces all kinds of decor paper apart from pre-impregnated decor paper. Munskjö does not produce so-called "intense colours"15.

37. Arjowiggins produces decor paper in two production mills, located in Dettingen, Germany, and Arches, France. It is a major supplier of pre-impregnated decor paper, which accounted for […]% of Arjowiggins decor paper production in 2010. It also produces other types of decor paper (HPL, LPL, including intense colours, PBP and balance paper).

38. Technocell is currently the market leader in decor paper. It produces all types of decor paper including pre-impregnated paper.

39. Malta Decor is a decor paper producer that is part of the Kronospan/Kaindl group. This group also includes a laminator, which purchases decor paper for its production. Malta Decor is thus a vertically integrated decor paper producer.

40. Koehler and Hoffsümmer produce different types of decor paper, while Ahlström Kämmerer is specialized in pre-impregnated decor paper.

41. Other small decor paper producers not mentioned in the above table include the two Italian companies Cartiere di Guarcino and Cartiere di Panigada.

42. As noted above, decor paper includes a number of different types of papers. Pre- impregnated papers are only supplied by few suppliers given that they require special equipment and constitute a relatively small market ([10-20]% of total EEA sales16 in 2009). Ahlström Kämmerer is specialised in pre-impregnated papers. Arjowiggins and Technocell also compete in this segment while Munksjö is not active in this segment.

43. Most EEA-based competitors with notable production capacities produce all other types of decor papers, that is PBP, balancing paper, and unicolour papers (for LPL/ HPL). However, within the segment of unicolour papers, some companies choose not to produce intense colours or white colours.

44. While there is immediate supply-side substitution for the production of these papers (as noted above), the choice of decor papers being produced appears to be driven by commercial and efficiency considerations. Amongst others, these considerations include the size of ordered lots, the number and characteristics (e.g. speed, cleaning time) of the paper machine(s) available as well as the know-how of a company (e.g. in matching colours). For instance, intense colours typically are smaller orders that require longer and more frequent cleaning times (during which the machine cannot be used) so they tend to be produced on smaller, slower machines. The market investigation revealed that suppliers operating only one large decor paper machine may find it uneconomical to produce intense colour decor paper or to accept orders below a certain minimum purchase volume.

Capacity

45. The total capacity of the EEA decor paper market (including pre-impregnated decor paper) amounted to at least 698 400 tonnes in 2010, 684 600 tonnes in 2009 and 742 700 tonnes in 2008 according to data collected in the market investigation . The notifying party estimates total EEA decor paper production capacities to amount to 789 000 tonnes in 2010 compared to an estimated 729 000 tonnes in 2009 and 789 000 tonnes in 2008.

46. The notifying party submitted the following estimates for the production capacities of the respective EEA decor paper producers in 201017. The percentage share is calculated in relation to an estimated total capacity of 698 400 tonnes based on the results of the market investigation and not on the estimates on total capacity provided by the notifying party.

Table 2 - EEA production capacity

| 2010 | |

| tonnes | % |

Munksjö | […] | [10-20] |

Arjowiggins | […] | [10-20] |

Combined | […] | [30-40] |

Technocell (1) | […] | [30-40] |

Malta Decor | […] | [20-30] |

Koehler | […] | [5-10] |

Hoffsümmer | […] | [5-10] |

Cartiere di Guarcino | […] | [0-5] |

Source: Estimates by the notifying party

(1) The estimate for Technocell appears to include the full capacity of its new paper machine, which however is expected to be become gradually operational over the coming years and fully operational by […]. Therefore, this table overstates Technocell's capacity share for 2010.

47. On this basis, the parties' combined share of EEA production capacities would amount to [30-40]%. The reduction in capacity in 2009 compared to 2008 is mainly because of restructuring measures undertaken by Munksjö, Koehler and, to a lesser extent, Technocell.

48. The notifying party submits that the market is characterised by substantial overcapacity as the available production capacity would exceed demand considerably. The Commission however notes that demand has picked up strongly in 2010 while at the same time capacity has been reduced. The market investigation also showed that EEA utilisation rates improved significantly in 2010.

49. Two companies have committed to increase capacity in 2011 and one competitor may do so in the coming years. Cartiere di Guarcino (Italy) will start operating a second paper machine (that had been idle since 2001) in April 201118. In mid-2010, Technocell (Germany) had started to operate a rebuilt image paper machine for decor paper production. The machine is currently in a ramp-up phase and will gradually add new capacity of up to 60 000 tonnes for decor paper production19. According to the notifying party, Malta Decor (Poland) recently gained approval from the relevant Polish authorities to install a sixth machine with a planned capacity of […] tonnes. However, the decision for the investment has not yet been taken and the earliest possible start-up would be in 2012.

Future demand trends

50. The notifying party estimates that the worldwide demand for decor paper (excluding China) will increase by 4-6% in 2010-2011, 4% in 2011-2012, and 3-4% in 2013. On this basis, the notifying party forecasts the EEA market for decor paper20 to grow from […] tonnes in 2010 to […] tonnes in 2013 (worldwide excluding China: […] tonnes in 2010 to […] tonnes in 2013).

Customers

51. As noted above, decor paper customers are mainly printers, laminators and impregnators. The notifying party estimates that around 50% of the production is sold to printers and around 50% is sold to laminators and impregnators. According to the notifying party, demand for decor paper is driven by furniture sales for roughly 75%, whereas interior design accounts for the remaining 25%.

52. The notifying party submits that a significant degree of buyer power is concentrated in the hands of a small group of customers. Munksjö’s top five customers account for […] % of Munksjö’s total sales on the worldwide decor paper market (excluding China) and […] % at the EEA level. Arjowiggins’ top five customers account for […] % of the Target Business’ total sales on the worldwide decor paper market (excluding China) and […] % at the EEA level.

53. Major printers purchasing PBP and pre-impregnated decor paper (and to some extent edge-banding decor paper) include Schattdecor, Süddekor and Interprint. Major laminators/impregnators are Kronospan, Coveright, Egger, Surteco, Lamigraf, Kronoswiss, Chiyoda, Pfleiderer, and Finsa. These 13 companies represent nearly […] % of the total demand for decor paper at the worldwide level (excluding China).

Raw material markets

54. Pulp (made up of wood pulp) and titanium dioxide are essential raw materials for decor paper. Titanium dioxide is a chemical powder used in paints, plastic and cosmetics. According to the notifying party, decor paper manufacturers account for only about 5% of worldwide titanium dioxide demand. The share of costs (at 2010 price levels) accounted for by titanium dioxide is highly dependent on whether the relevant decor paper is white (between […] % and […] % for white unicolours) or coloured (around […] % for unicolour and […] % for PBP).

55. All market participants agree that there was a shortage of titanium dioxide in 2010. This shortage led to an prices increases for decor paper in 2010. While, over the next three years, demand for titanium dioxide is expected to grow at an annual rate of 2-3%, the notifying party takes the view that no capacity shortages will occur within the coming years as the supply is expected to increase due to production capacity increases21 and the improved quality of supplies from emerging markets such as Ukraine and China. Finally, titanium dioxide users have learnt to employ "extenders" amplifying the effect of titanium dioxide, which permits a substitution of up to 10% of all titanium dioxide.

2. Non-coordinated effects

56. The merger will remove Arjowiggins as an independent supplier of decor paper. The new entity's 2009 market share would be [20-30] % in volume based on total EEA sales of decor paper. When considering EEA production capacity, the new entity will hold approximately a market share of [30-40] %, on the basis of 2010 data.

57. The second largest competitor active on the market, as mentioned above, will be Technocell: on the basis of 2010 EEA sales figures, it would hold a market share of [20- 30] %, and a market share of [30-40] % in terms of production capacity. Malta Decor, the third player, would have a market share of [10-20] % based on 2010 EEA sales (excluding intra-group sales) and [20-30] % in terms of production capacity (including all capacity). Koehler's share would be [10-20] % in terms of sales and [5-10] % in terms of production capacity. Cartiere di Guarcino would hold a share of less than [5-10] % in terms of sales and [0-5] % in terms of production capacity22. Another small player, like Hofsümmer would hold a share of around [5-10] % in terms of sales and [5-10] % in terms of production capacity.

58. The market investigation revealed some concerns of customers related to possible non- coordinated anticompetitive effects of the proposed transaction. According to some customers belonging mainly to the category of impregnators and laminators, their choice of potential suppliers of decor paper would be reduced from three to two (namely the merged entity and Technocell) as a result of the proposed transaction and prices would increase.

59. Many customers (both printers and laminators) respondents to the market investigation claim that they consider only Munksjö, Arjowiggins and Technocell as potential suppliers for decor paper. Malta Decor is considered special because of its vertical integration. The other competitors, such as Koehler, Hoffsümmer, Cartiere di Guarcino or Cartiere di Panigada are considered as belonging to a different tier because (i) the quality would be different; (ii) the reliability of the deliveries would not be comparable; (iii) the flexibility in relation to orders placement would be different; (iv) there would be some production capacity constraints, both in terms of colour and sizes of papers produced. A few respondents consider that Munksjö and Arjowiggins are the closest or very close competitors in the decor paper market.

60. The Commission therefore investigated the type of competitive constraints exercised by the different competitors (other than Technocell) on the merging parties along these dimensions.

61. As regards Malta Decor, the company is perceived by some respondents to be a special player due to its integration in the Kaindl/Kronospan group. Mostly laminators (and to a smaller extent printers) place importance on the fact that Malta Decor could always privilege its commercial relationship with Kronospan at the expense of other customers, and therefore choose not to rely on Malta Decor as their supplier.

62. Malta Decor's perceived preference for intra-group sales has not been confirmed by the Commission investigation and by internal production and sales data supplied by Malta Decor itself. The market investigation revealed that the production capacity of Malta is superior to that of each of the merging parties. The notifying party submitted that the Kaindl/Kronospan group is organized as "separate profit centres", whereby a customer not belonging to the group would not be treated differently than companies belonging to the group. This information was confirmed by the investigation.

63. With five installed printing machines in two different sites, Malta Decor has a significant flexibility in terms of product mix and quantities that it can supply to any customer. The Commission therefore concludes that Malta Decor is a significant competitor which could exercise a competitive constraint on the merged entity and Technocell in the market for the supply of decor paper in the EEA.

64. In addition, the other smaller competitors (Koehler, Hoffsümmer and Cartiere di Guarcino) cannot be considered as secondary players. The decor paper products they supply do not significantly differ from the product range of the other four main competitors. The purchase data supplied by the customers show that both printers and laminators/impregnators regularly purchase part of their decor paper needs also from one or several of these other suppliers. The Commission therefore concludes that these players have the quality, flexibility and reliability to act as a competitive constraint on the larger players.

65. Moreover, the expansion plans of Technocell and Cartiere di Guarcino – as mentioned above – will shortly increase the capacity available on the market, thereby offering credible alternatives for customers looking for different suppliers than the merged entity.

66. The Commission also analyzed the purchase data submitted by customers for the years 2008, 2009 and 2010 in order to verify to what extent customers have limited sources of supply in the existing market conditions. Generally, both printers and laminators/impregnators tend to have different suppliers. For high volume grades, they typically rely on two or more suppliers because they value reliability of supply very highly: no customer is willing to face the serious risk of disruption of its own production because of lack of decor paper. For small volume grades, they typically purchase from one supplier but by having active commercial relationships with several suppliers they are able to play suppliers against each other in order to get the best deal.

67. When looking at the decor paper market as a whole, it seems clear that the overwhelming majority of the customers who replied to the questionnaire multisource from more than three or four suppliers. The Commission also considered the different types of decor paper offered by each of the merging parties. As regards their current product mix, the parties mostly compete in the sub-segments of (i) unicolours excluding intense colours (Munksjö: […] % of its 2010 production volume; Arjowiggins: […] %) and (ii) PBP (Munksjö: […] % of its 2010 production volume; Arjowiggins: […] %). Munksjö does not currently produce intense colour decor paper, whereas […] % of Arjowiggin's unicolour production volume ([…] % of its decor paper sales in value) relate to intense colours.

68. When looking at the two main segments where the parties' activities overlap, it can be observed that the majority of printers (companies who purchase PBP) buy from four or even five different suppliers: these are Munksjö, Arjowiggins, Koehler, Malta Decor, Hoffsümmer, Technocell and Cartiere di Guarcino. The information provided to the Commission also shows that the quantities of PBP bought by the customers do not reflect the alleged "two tier" structure of the market (three top players versus a few fringe players) as suggested by certain replies. Rather, printers purchase large volumes also from suppliers such as Hoffsümmer, Guarcino, Koehler and Malta Decor (sometimes in quantities greater or equivalent to those purchased from Munksjö, Arjowiggins or Technocell).

69. In relation to unicolour (HPL/LPL) paper, half of the respondents source paper from more than three suppliers (four or five), while only one out of five sources exclusively from Munksjö, Arjowiggins or Technocell. Of the three respondents who declared they buy unicolour paper only from two suppliers, two respondents purchase from the merging parties. Of these, only one expressed some concern about a future risk loss of negotiating power versus suppliers, while the second one did not express any concern. The third customer buys from Munksjö and from Cartiere di Panigada.

70. The investigation does not therefore support the complaint according to which the merger would lead to the restriction of suppliers from three to two either in the overall decor paper market or in the sub-segments of print base paper and unicolour paper (HPL/LPL). Each customer has different specifications and different proportions of purchased volume from one or the other suppliers.

71. The market investigation also revealed that switching suppliers is not an exceptional event in this market. On the one hand, customers (especially impregnators and laminators) have a preference for remaining with the same supplier, especially for specific colours, in order to avoid problems of colour mismatch with previous production. On the other hand, they tend to be very sensitive to prices. The respondents to the investigation consistently reported that a price increase by one supplier triggers a negotiation phase and, if the negotiation is not satisfactory, the evaluation of alternative competing offers by other suppliers. Switching suppliers – at least for part of the overall demand of each customer – is therefore customary in this market.

72. It should be noted that the shortage of titanium dioxide currently experienced in the market generates strong concerns of customers on the reliability of supply and future market developments. The suppliers of decor paper have reportedly refused to supply some customers because of the specific problems connected to the lack of raw material. It cannot be excluded that these concerns influenced the customers' replies to the market investigation.

73. In view of the above, the Commission concludes that the proposed transaction does not raise concerns of a non-coordinated nature in relation to the market for the supply of decor paper in the EEA.

3. Coordinated effects

74. According to the Horizontal Merger Guidelines in assessing the likelihood of coordinated effects, the Commission should take into account the structural features of the market and past behaviour of the firms. According to case law and the Horizontal Merger Guidelines, coordination is more likely to emerge in markets where:

(i) it is relatively simple to reach a common understanding on the terms of coordination;

(ii) markets are sufficiently transparent to allow the coordinating firms to monitor deviations of participating firms;

(iii) there is some form of credible deterrent mechanism and future retaliation;

(iv) reactions of outsiders (such as competitors and customers) are not able to jeopardise the results expected from the coordination.

75. The notifying party submits that the market characteristics in the decor paper market are not such that they would raise coordinated effects concerns.

76. In 2008 the German Bundeskartellamt fined three manufacturers of decor paper, i.e. Munksjö, Felix Schoeller/Technocell and Arjowiggins, on account of concerted practices concerning price increases and capacity reductions.

77. The proposed transaction will lead to the existence of three large players in the decor paper market (the new entity, Technocell and Malta Decor) with some other small players ("fringe players"). The top three suppliers will control more than [80 -90] % of the capacity available in the market (the merged entity [30-40] %, Technocell [30-40] %, and Malta Decor [20-30] %).

78. The fact that a large share of the capacity would be controlled by three players gives rise to possible concerns about coordinated effects resulting from the proposed transaction. The Commission therefore investigated the likelihood that, as a result of the transaction, decor paper suppliers would attempt to keep capacity tight in the industry in a coordinated manner across companies (with the leaders being either the new entity or Technocell) and to charge supra-competitive prices by means of coordinated price increases.

79. From an economic perspective, coordination in capacity is typically more difficult than coordination on prices. Investments in capacity grant an advantage to suppliers due to the irreversibility characteristic (i.e., by investing in capacity a supplier commits to use as much as possible such production capacity in a persistent manner over time) that such investments carry. Therefore, suppliers might find it difficult to coordinate on capacity (thus believing that other suppliers will not invest in capacity) for the fear of ending up in a weaker position in case another supplier would cheat (thus investing). As a result, suppliers find it difficult to trust each other on their willingness to stick to a capacity agreement. The weakness of an agreement on capacity depends crucially on the extent to which capacity investments are irreversible. The notifying party argues that the paper machines in the market are fully dedicated to the production of decor paper and it would be uneconomical to switch to the production of other types of paper.

80. The market investigation confirmed that the majority of paper machines are indeed fully dedicated to decor paper production. However, the investigation revealed also limited examples of suppliers producing other types of paper on the same machines with which they produce decor paper, which limits the costs of having capacity idle. Furthermore, it seems that the suppliers could also consider it economical to leave a complete decor paper machine idle for long period of time (so-called "mothballing"). The disrupting element of coordination in capacity due to the irreversibility is thus alleviated in the decor paper market.

81. As regards the proposed transaction, an essential aspect for the assessment is to investigate to what extent the market conditions are prone to coordination and to what extent the three main suppliers, as a result of the transaction, will have aligned incentives which would make it easy for them to conclude an agreement and to effectively enforce this agreement.

82. A further essential aspect is the expected behaviour of the small players (the "fringe players") in terms of their ability to disrupt the collusion among the large players. If these companies are pure "followers" which makes them not interested in investing in capacity (or makes them refrain for fear of retaliation) but, on the contrary, makes them willing to accept passively the behaviour of the big companies to cooperatively control the overall capacity in the market and to follow the prices (and price increases) imposed by the three big players, any coordination would be more stable and not be disrupted by outsiders.

83. As regard market conditions, the market shows some characteristics that are consistent with an environment that can potentially favour coordination. First, historic players populate this market and have enjoyed for the last two decades a positive trend in the demand for decor paper (with shocks limited in time) which, according to the industry, is likely to persist in the future.

84. Second, the notifying party argues that decor paper is a rather differentiated product and there is a large variety of decor paper grades that also translates in a large dispersion of prices. However, the market investigation and the price analyses conducted on data provided by the parties on customers' orders in the last five years provide a more nuanced picture. The different prices for the respective grades can to a large extend be explained by a different composition of the respective grades with respect to the various input factors and consequently by different input costs. The composition of the grades is likely not to be different across different suppliers due to very similar production technologies. Furthermore, price dispersion can be traced back and reduced if observable characteristics of the different grades are taken into account. Different colours, different widths and different weights trigger different prices but this is understood in the industry as well as the direction of the price differentials. Altogether this implies that the difference in prices can be anticipated by supplier and customers due to their common knowledge about the product and the input factors and related prices.

85. Third, in such markets reversion to competition is typically a credible deterrent mechanism. The fear of losing high margins (supra-competitive prices derived by coordination) compared to competitive margins is a sufficient punishment in order to discipline companies to stick to a coordinative equilibrium. The quarterly orders of customers, as observed in this market, can offer the possibility for timely punishments threats and the current situation in term of capacity utilization where large players have some idle capacity can be consistent with a post-merger credible threat to punish deviators.

86. Fourth, the EEA market currently shows high barriers to entry from companies located outside the EEA. The market investigation confirmed that the current production in China is not yet a competitive and feasible alternative for the majority of the EEA customers due to unsatisfactory quality levels. Furthermore, within the EEA the investigation did not confirm the possibility of greenfield expansions. The market investigation showed possibilities only for brownfield expansion. This evidence is consistent with a specific know-how necessary for the production of such large variety of decor paper grades and large fixed investment costs.

87. As regards aligned incentives, the Commission comes to the conclusion that the fact that Malta is vertically integrated in the Kaindl/Kronospan group means that the company is less likely to have an incentive to maintain high margins and high prices for decor paper to its customers who are laminators/impregnators.

88. Malta Decor's mother company, Kronospan, also purchases decor paper (unicolour as well as printed paper) from other players (decor paper producers and printers) than Malta Decor. Therefore, high prices charged by Malta Decor's competitors to laminators/impregnators following an agreement among the three big players would also negatively affect Kronospan. A strategy leading to price increases for decor paper would thus be detrimental to Kronospan and consequently the group.

89. As regards the behaviour of the fringe players, the Commission considers that these players are not pure "followers". This can be illustrated for example by the fact that Cartiere di Guarcino is currently increasing its production capacity by reactivating its second decor paper producing machine and by the fact that according to the evidence in the file at least some of the smaller companies seem to independently set their prices (with evidence of undercutting the three big suppliers) and not just adopt the price levels of their large competitors.

90. The Commission therefore comes to the conclusion that in the current situation there do not seem to be aligned incentives among the three large players. This makes reaching a common understanding on the terms of coordination more difficult and makes any agreement unstable. Furthermore, the presence of fringe players with such characteristics as explained above can contribute to increase the difficulties to keep internal stability of the common understanding.

91. As regards transparency directly linked with the ability to monitor and discipline the behaviour of the coordinating players, the investigation showed that there is a very high level of transparency on capacity in the market, and to a lesser extent a good grasp of the suppliers' capacity utilizations rates. Furthermore, the market investigation also showed a certain transparency on the identity of suppliers for given customers. The use of retroactive rebates is also limited. This transparency favours the reaching of a common understanding on the terms of coordination and it allows the participating companies to monitor deviations of participating firms by knowing in advance whether suppliers are sticking to the tacit agreement.

92. However, the market investigation also showed that the level of price transparency is limited as price negotiations are strictly bilateral and the final price is normally not known to the competitors. On balance, the Commission can conclude that the monitoring of any deviations is likely to be difficult and the transaction does not increase the overall transparency in the industry.

93. The market investigation showed that most customers tend to multisource and can shift orders – in particular of large batches of white paper – from one order to the next among suppliers. The market investigation indicated that, while there are some costs related to switching and customers prefer to keep a current supplier if it offers good terms, switching costs are generally comparatively low and thus customers can impose on suppliers a credible threat to switch. This is supported by the absence of formal quantity commitments to suppliers: there are no framework contracts and purchases of decor paper are done through typically quarterly orders. Low switching costs increase the risk for a supplier to lose a customer when trying to implement a price increase in case that the supplier's competitors does not stick to the agreement to increase prices.

94. Customers furthermore are typically informed about the evolution of input costs for decor paper production. Furthermore, decor paper represents a large part of the costs for printers and still seems to be an important factor in the production costs and consequently margins for laminators, although decor paper has a more limited impact in their costs. Thus, both types of customers seem to be able to exercise effective actions in order to disrupt a possible coordination agreement among suppliers.

95. On the basis of the above, in particular as regards the incentives of the major suppliers and the behaviour of the fringe suppliers, the Commission comes to the conclusion that although the market shows some characteristics prone to coordination post-transaction, some necessary conditions for a post-transaction sustainability of a coordination agreement are unlikely to be present. The proposed transaction therefore does not raise competition concerns because it is not likely to enable decor paper producers to coordinate their behaviour.

VI. CONCLUSION

96. For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation.

* "Should read 17 January 2011*

1 OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on

the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 COMP/M.3699 – EQT/Smurfit/Munksjö, 16 February 2005. None of EQT Limited's other portfolio companies nor its main investor, Investor AB, is active within the same markets as the parties to the operation.

3 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.04.2008, p. 1).

4 Pre-impregnated paper is impregnated by the decor paper manufacturer already in the paper machine.

5 The impregnation step is either carried out by impregnators, or by laminators (which are often vertically integrated and carry out both impregnation and lamination).

6 Data include intra-group sales of one decor paper producer.

7 COMP/M.3946 – Renolit/Solvay, 22 February 2006, para 22.

8 COMP/M.4525 – Kronospan/Constantia, 19 September 2007, paras 18-19.

9 According to the parties, the Chinese market is characterised by important market barriers such as import duties. Moreover Chinese customers are mainly supplied by domestic decor paper producers, which explains that imports of decor paper account for less than 3% of total Chinese demand.

10 COMP/M.3946 – Renolit/Solvay, 22 February 2006, para 33, and COMP/M.4525 – Kronospan/Constantia, 19 September 2007, para 37.

11 COMP/M.5283 – Sappi/M-REAL, 31 October 2008, paras 28-29, and COMP/M.2245 – Metsä- Serla/Zanders, 15 December 2000, para 11.

12 Excluding Malta Decor's estimated direct sales to Kronospan.

13 The figures are Munksjö's best estimates. Market share data are provided in terms of volume and not in terms of value, since volume figures – albeit uncertain – are not as uncertain as value figures.

14 Excluding Malta Decor's estimated direct sales to Kronospan.

15 The market investigation revealed that the demand for unicolour paper can be distinguished between intense colours as opposed to basic colours (white, beige, grey, etc..) which are bought in larger quantities by the downstream industries.

16 Excluding Malta Decor's estimated direct sales to Kronospan.

17 Note that these are estimates of the parties and omit the capacity of competitors Ahlström Kämmerer and Cartiere Panigada.

18 EUWID, 5/2011, p. 1. Press release by Technocell, 30 September 2010, http://www.felix-schoeller.com/en/nc/press/press- releases/press-release/article/felix-schoeller-reorganizes.html?tx_ttnews[backPid]=80&cHash=db32467e 19558d8b57379a159f7fc496

19 Including pre-impregnated paper and Malta decor's internal sales to Kronospan.

20 The notifying party notes that capacity increases are in progress in Australia (Christal, 40 000 tonnes), the Netherlands (Tronox, 10 000 tonnes), China (Lomon, 80 000 tonnes) and India (KMML, 60 000 tonnes).

21 These figures do not take into account Cartiere di Guarcino's increased capacity due to the re-activation of a second paper mill in March 2011.