Commission, April 7, 2016, No M.7849

EUROPEAN COMMISSION

Judgment

MOL HUNGARIAN OIL AND GAS / ENI HUNGARIA / ENI SLOVENIJA

Dear Sir/Madam,

Subject: Case M.7849 – MOL / ENI Hungaria / ENI Slovenija

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

(1) On 29.02.2016, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking MOL Hungarian Oil and Gas Plc. ("MOL", Hungary) will acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of ENI Hungaria Zrt. ("ENI Hungaria", Hungary) and ENI Slovenija druzba za trzenje z naftnimi derivati, d.o.o. ("ENI Slovenija", Slovenia) by way of purchase of shares. MOL is hereinafter referred to as the "Notifying Party", and MOL, ENI Hungaria and ENI Slovenija are collectively referred to as the "Parties".

1. THE PARTIES

(2) MOL is an integrated international oil and gas company active across the entire crude oil and natural gas value chain. MOL’s principal activities are: (i) the exploration, production and refining of crude oil, the distribution of refined oil products both at (ii) wholesale and (iii) retail level, (iv) the production and sale of petrochemicals, (v) the exploration and production of natural gas and (vi) the transmission of natural gas in Hungary.

(3) With regards to the retail sales of motor fuels, MOL has a network of more than 1,750 filling stations under eight brands in Central and South-Eastern Europe as well as Northern Italy. In Hungary and Slovenia, MOL operates 364 and 34 stations, respectively.

(4) ENI Hungaria is a 100% subsidiary of ENI International B.V., which in turn is wholly owned by ENI S.p.A. The in Hungary incorporated limited liability company is active on the markets for ex-refinery and non-retail supply of gasoline and diesel, the non-retail markets of bitumen, base oils and lubricants and the retail supply of motor fuels, lubricants and convenience goods operating 180 filling stations in Hungary.

(5) ENI Slovenija is incorporated in Slovenia and is also a wholly-owned subsidiary of ENI International B.V. It is active on the markets for non-retail supply of various refined oil products (3) and the retail supply of motor fuels, heating oil, lubricants and convenience goods via its 17 filling stations in Slovenia.

2. THE CONCENTRATION

(6) The proposed transaction (the “Transaction”) involves the acquisition of sole control of ENI Hungaria and ENI Slovenija by MOL by way of purchase of 100% of the shares. The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

(7) The Transaction will be implemented by way of two share sale and share purchase agreements ("SPAs"). The consummation of the ENI Hungaria transaction is de jure linked to the signing of the ENI Slovenija SPA. (4) The ENI Slovenija transaction is on the other hand de facto conditional on the ENI Hungaria transaction. This interdependence is indicated by the fact that the two SPAs were negotiated together and that it has been the mutual understanding of the Notifying Party and ENI S.p.A. (the Seller) from the beginning to acquire/sell the two undertakings together. (5) The Transaction therefore constitutes a single concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (6) [MOL: EUR 15 765 million; ENI Hungaria: EUR […] million; ENI Slovenija: EUR […] million]. Two of them have an EU-wide turnover in excess of EUR 250 million [MOL: EUR […] million; ENI Hungaria: […] million], but they do not achieve more than two-thirds of their aggregate EU- wide turnover within one and the same Member State. The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

(9) The Parties' activities overlap in relation to the (i) non-retail supply of refined oil products (gasoline and diesel) in Hungary and (ii) retail supply of motor fuels in Hungary. The Transaction will also give rise to horizontal overlaps in relation to the non-retail supply of bitumen (iii) in Hungary and (iv) in Slovenia. Furthermore, vertical overlaps arise between (v) the ex-refinery sales of diesel and gasoline (upstream) and the Hungarian non-retail sales of the same refined oil products, as well as between (vi) the upstream market for non-retail supply of refined oil products and the downstream market for the retail supply of motor fuels in Hungary.

4.1. Relevant product markets

4.1.1. Non-retail supply of refined oil products The Notifying Party's view

(10) The Notifying Party submits that in line with the Commission's decision making practice the non-retail supply of each refined oil product constitutes a separate relevant product market. (7) In the present case the non-retail markets of gasoline and diesel would need to be considered. However, the Notifying Party questions whether the ex-refinery sales – in the meaning of sales of high volume by refiners directly at the refinery gate or delivered by primary transport to customers' terminals or storage facilities – qualify as a distinct wholesale market due to the high supply-side substitutability and the fact that the Parties do not distinguish their sales on this basis. The Notifying Party also submits that the distinction between (i) B7 diesel, (ii) uncoloured B0 diesel and (iii) coloured B0 diesel is not relevant in the present case as the required amount of bio blending is reached in Hungary on the basis of a pooling system, not on a litre-by-litre basis.

The Commission's assessment

(11) The non-retail sales of refined fuels products consist of wholesales to independent resellers and retailers not integrated upstream (for example unbranded service station operators such as hypermarkets) as well as to large industrial and commercial consumers (such as hospitals, car rental fleets, factories). In line with previous cases (8) the Commission considers that the ex-refinery sales are distinct from non-retail sales which involve value-added services such as smaller delivery sizes, multiple delivery locations, infrastructure of storage and terminals and often payment term flexibility.

(12) The Commission however considers that distinction between the different types of diesels (9) is not relevant in the present case due to the method of bio-compliance in Hungary. Indeed, according to national law (10) the required amount of bio-blending has to be reached at the end of the year as a total requirement, thus B7 or coloured/uncoloured B0 diesel is not distinguished.

4.1.2. Non-retail supply of bitumen The Notifying Party's view

(13) The Notifying Party submits that in line with the Commission's decision making practice the non-retail supply of bitumen is distinct from the non-retail sale of fuels, as it has a distinct set of uses (e.g. road construction) and a small number of customers (independent resellers). (11) The Notifying Party however submits that the non-retail bitumen market should be sub-segmented into sales to resellers/retailers (supply side of the market) and sales to end-customers (demand side of the market).

The Commission's assessment

(14) The Commission considers the non-retail supply of bitumen as a separate product market. In line with its previous decision (12) it takes the view that the different types of bitumen (standard bitumen, bitumen emulsions and modified bitumen) belong to one single market due to the high supply-side substitutability. This finding was also confirmed by the market investigation in the present case. (13)

(15) In the present case, the Commission considers that the question of further sub- segmentation of the market for non-retail supply of bitumen can be left open as the Transaction does not raise serious doubts with regard to the only overlapping sub- market, i.e. the market for non-retail supply of bitumen to resellers/retailers.

4.1.3. Retail supply of motor fuels The Notifying Party's view

(16) The Notifying Party submits that the retail market of diesel, gasoline and automotive LPG are part of the same relevant market. It further explains that the segmentation of the market based on location (on- and off-motorway stations) is not relevant as there are no physical or economic barriers in Hungary that impede or discourage motorists from exiting the motorways network and no significant price difference exists between the filling stations on- and off-motorway. The Notifying Party also submits that no distinction should be made on the basis of type of customer (sales via fuel cards to business/public customers ("B2B customers") and sales to private customers (14) ("B2C customers") as the products between the two segments are fully substitutable from both the demand and the supply side. In addition, it takes the view that fuel cards are simply a means of payment, that is ancillary to the retail activities. According to the Notifying Party, the relevant product market therefore comprises retail sales of all motor fuels through all forms of service stations.

The Commission's assessment

(17) The Commission has previously defined the market for the retail sales of motor fuels as sales of motor fuels at service stations, (15) both branded and unbranded, in- and outside an integrated network. (16) The relevant product market encompasses all types of motor fuels available at service stations. The Commission previously noted that, although no demand-side substitutability exists between the different types of fuels (as customers must use the type of fuel appropriate to their vehicle), these are always available at the distribution level at the same point of sales and therefore substitutable from a supply-side perspective. (17)

(18) Moreover, the Commission has in the past considered, but left open, the possibility to segment the retail sales of motor fuels between sales at motorway and at non- motorway stations (18). It also considered, but left open, the possibility to distinguish between sales from regular stations and from dedicated truck stops. (19)

(19) Finally, the Commission has also considered in the present case the possibility to segment the retail sales of motor fuels between sales to B2B customers and to B2C customers. (20)

(20) These various possible segmentations are assessed further below with regard to the affected Hungarian market.

On-motorway and off-motorway stations

(21) The Commission considers that the relevant market for retail sales of motor fuels should not be further subdivided between on-and off-motorway filling stations. First, although motorways can be used against payment of a toll, the e-vignettes are valid for a certain period of time (10 days, 1 month or 1 year), therefore the motorists can freely switch between on-and off-motorway stations. Second, there are generally a large number of easily accessible off-motorway stations in the close vicinity of the motorways. Finally, given the actual traffic flow, a lot of motorists pass by off-motorway stations while commuting.

Regular stations and dedicated truck stops

(22) The Commission considers that the distinction between regular stations and dedicated truck stops is not relevant in the present case as the Parties do not operate any dedicated truck stops.

B2B and B2C customers

(23) The Commission considers that the market for retail supply of motor fuels may be further sub-segmented between the sales to B2B and to B2C customers based on the different competitive landscape of these segments.

(24) First, the price setting and thus the price level on the two possible sub-segments are different. On the one hand, the B2B customers negotiate a national price, […]. On the other hand, B2C customers always pay the local pump price which is determined by the local competition, as it is adjusted several times a day according to the monitoring of the fuel station in question.

(25) Second, B2B customers have different requirements as for the network of their suppliers. The market investigation confirmed (21) that B2B customers consider other characteristics apart from the competitive price and good credit terms, the most important being the nationwide coverage. The necessity to offer pan-European fuels card or an international brand, as well as having on-motorway stations was also mentioned by the market participants.

(26) For the above-mentioned reasons the Commission considers that there is limited demand-side substitutability between the two segments, and that B2B customers are unlikely to switch to stations without fuel card offerings in case of a hypothetical price increase.

(27) In addition, the Commission takes the view that the supply-side substitutability is also limited because competitors on the B2C sub-segment (such as white pumpers) could not compete effectively for B2C customers in lack of a nationwide coverage.

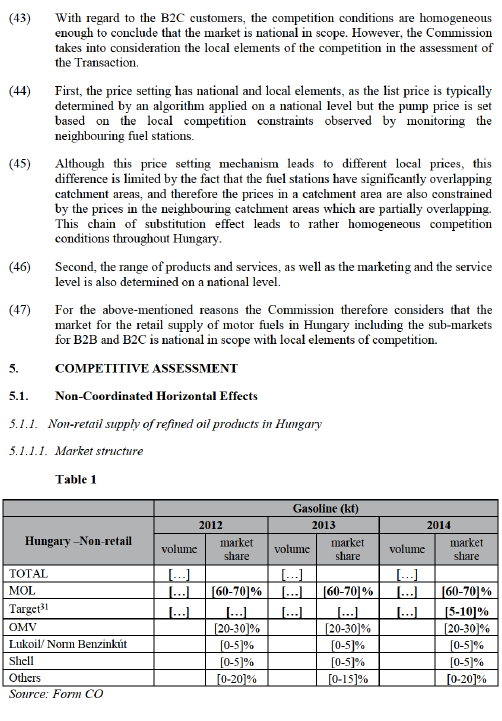

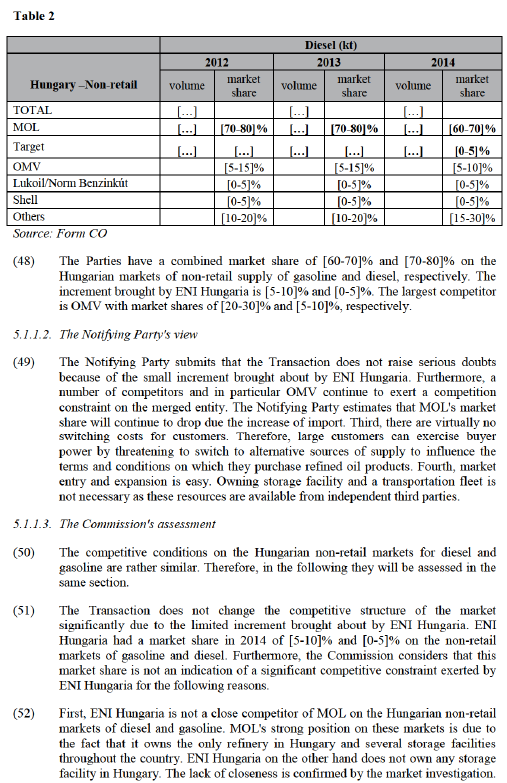

(28) However, the precise market definition can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the retail market for the supply of motor fuels is further sub-segmented into B2B and B2C.

4.2. Relevant geographic markets

4.2.1. Non-retail supply of refined oil products The Notifying Party's view

(29) The Notifying Party submits that for the purpose of the assessment of the Transaction the market for non-retail sales of refined oil products should be defined as at least regional in scope, comprising of CEE, plus Italy and Germany.

The Commission's assessment

(30) The recent decision-making practice of the Commission found that that the various markets for non-retail supply of refined oil products are likely to be national in scope. (22) However, the Commission has considered whether this scope could both be wider (Scandinavia-wide for Sweden, Finland, Denmark and Norway (23)) as well as – exceptionally – narrower (macro-regional for Italy (24), local for France (25), and the border region of Poland and the Czech Republic (26)) – depending on the Member State concerned.

(31) In the present case, the Commission does not consider it appropriate to define the market narrower than national as the competitive conditions are homogeneous throughout the whole territory of Hungary which can be explained inter alia with the relatively small geographic size of the country. Indeed, the market investigation confirmed that the same suppliers are present in the whole of the Member State and that there are no local price differences.

(32) Although imports play an important role on the Hungarian non-retail markets and there seems to be no significant barriers to cross-border trade, the wholesalers typically are not supplied directly from the refineries. The need to own or rent storage capacity in terminals/depots across Hungary indicates that competition does not take place on a wider than national scope.

(33) The Commission therefore considers it appropriate to examine the competitive impact of the Transaction on the non-retail markets for gasoline and diesel on the basis of a national market.

4.2.2. Non-retail supply of bitumen The Notifying Party's view

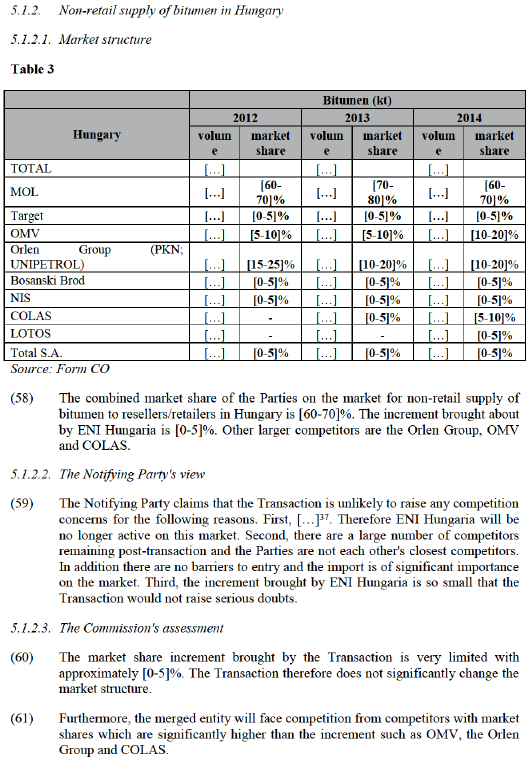

(34) The Notifying Party submits that the market for non-retail supply of bitumen is regional in scope. In the present case, it defines the relevant geographic market as the CEE region plus Italy and Germany.

The Commission's assessment

(35) The Commission has in previous decisions considered the geographic market for the non-retail sales of bitumen to be national in scope. (27) However, given the high cost of transportation (bitumen needs to be transported at temperatures above 130C°), the Commission also considered that bitumen is generally used within a 200- 300 km radius of where it is sourced, pointing to the existence of a market that is regional in scope. (28)

(36) The Commission does not consider it to be appropriate to define the market as narrower than national as the competition conditions are homogeneous throughout the territory of Hungary and Slovenia. Indeed, the same players are active in the whole of the Member States concerned and there are no local price differences.

(37) Despite the high transportation costs however, import plays a significant role in Hungary and in Slovenia as well, and the barriers to enter these markets seem to be low.

(38) Thus, the Commission considers for the purpose of this case that the market for bitumen in Hungary and Slovenia is national, however leaving open whether it could be considered wider in scope.

4.2.3. Retail supply of motor fuels The Notifying Party's view

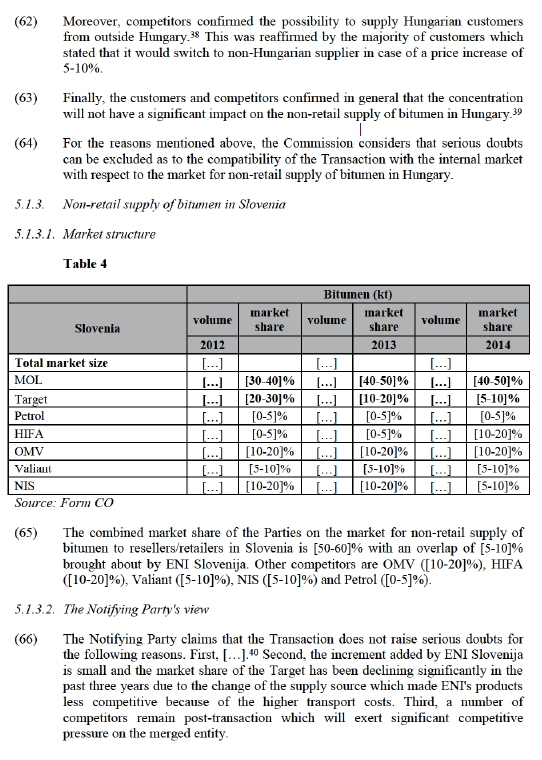

(39) The Notifying Party submits that the market for retail supply of motor fuels is national in scope for the following reasons. First, the prices are set mainly at a national level and are homogeneous across the country. Second, the fuel stations have overlapping catchment areas, which results in a chain of substitution. Third, the market is regulated on a national level and there are no local differences with regard to the range, quality and promotion of the products or the service.

The Commission's assessment

(40) The Commission has previously considered the market mostly to be national in scope. (29) However, narrower geographic market definitions have also been adopted taken into consideration the strong local element of the retail motor fuel markets, as vehicle owners usually resort to service stations in their vicinity. (30)

(41) In the present case the Commission considers that the market for retail supply of motor fuels is national in scope with local elements.

(42) The competition for B2B customers takes place on a national level, and the conditions of competition are the same throughout the whole territory of Hungary. Competitors and customers do not generally view ENI Hungaria as a major player ranking it as 4th or 5th competitor on the non-retail markets in Hungary. (32)

(53) Second, the merged entity will continue to face competition in particular from OMV which has a market share which is larger than ENI Hungaria's market share on each of the non-retail markets. The fact that OMV's own refinery is located very close, about 60 kilometres from the Hungarian border and that it owns a storage depot in Hungary, strengthens its position on the non-retail markets and makes OMV a strong competitor not only with regard to its market share but also its characteristics. The market investigation also confirmed that the competitors and customers consider OMV as a company exerting a significant competitive constraint on MOL. (33)

(54) Third, the market investigation confirmed that competitors can compete effectively on the Hungarian non-retail markets without owning storage capacity in Hungary and that there is sufficient transport capacity available from third parties. (34) Indeed ENI Hungaria was supplied [90-100]% from refineries outside of Hungary via rented (35) depots in 2015, namely depots of […]. The Commission therefore considers that the availability of third party storage capacities enables other competitors to achieve a market position which is comparable to ENI Hungaria.

(55) Fourth, in the last three years (2013-2015) imports increased significantly from 19% to 27% with regard to gasoline and from 11% to 25% with regard to diesel. Based on the above the Commission considers that imports will likely continue to play an important role and will continue to pose a competitive constraint on the merged entity. In 2015 ENI Hungaria got all of its supplies from third party refineries […]. Other competitors also get a significant amount, if not all of their supplies from outside Hungary.

(56) Finally, the market investigation confirmed that the price level would not increase due to the Transaction on the non-retail markets of diesel and gasoline. (36)

(57) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the markets for non-retail supply of diesel and gasoline in Hungary.

5.1.3.3. The Commission's assessment

(67) The Commission considers that the increment brought by the Transaction is relatively small and therefore does not significantly change the competitive structure of the market for non-retail supply of bitumen in Slovenia.

(68) There are a sufficient number of competitors remaining post-transaction, of which at least three (OMV, HIFA and Valiant) have higher market shares than ENI Slovenija. The Commission considers that these competitors would be able to exercise a competitive constraint on the merged entity. Respondents to the market investigation also confirmed that the intensity of competition would not decrease post-transaction. (41)

(69) Furthermore, competitors stated that a company involved in the supply of refined oil products may be able to enter the market. (42)

(70) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the market for non-retail supply of bitumen in Slovenia.

5.1.4. Retail supply of motor fuels in Hungary

5.1.4.1. Market structure

(71) This section presents the market structure on the Hungarian markets for (i) the overall retail supply of motor fuels, (ii) the retail supply of motor fuels to B2C customers, and (iii) the retail supply of motor fuels to B2B customers.

(i) Overall market for retail supply of motor fuels in Hungary

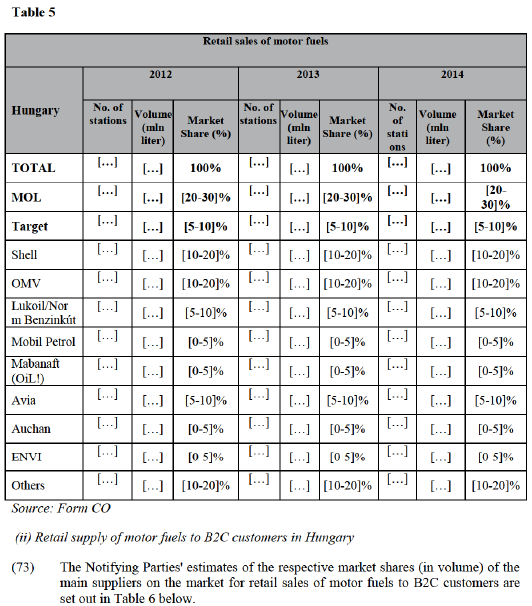

(72) The Notifying Parties' estimates of the respective market shares (in volume) of the main suppliers in the overall Hungarian market for retail sales of motor fuels are set out in Table 5 below. The Parties stated that a calculation of the market shares based on value would lead to similar results.

post-transaction two competitors (OMV, Shell) with market shares higher than the increment and one competitor (Lukoil) with a market share comparable to the increment. This indicates that the Transaction would lead to a limited change of the competitive structure of the market.

(77) Second, the market investigation confirmed that the Parties are not close competitors (44) which also indicates that the customers would be able to switch away from the merged entity to other competitors which are currently effectively competing with MOL. The vast majority of the customers and competitors states that MOL and ENI Hungaria do not have a comparable market presence with regard to several factors such as pricing, network coverage, types of stations, branding and fuel card offers. Indeed although ENI Hungaria is present throughout Hungary, its strong position in the Budapest area is rather complementary to MOL's geographic footprint. Also, MOL is a significantly stronger player with regard to the size of its network (363 fuels stations compared to 185) but also concerning its on-motorway presence.

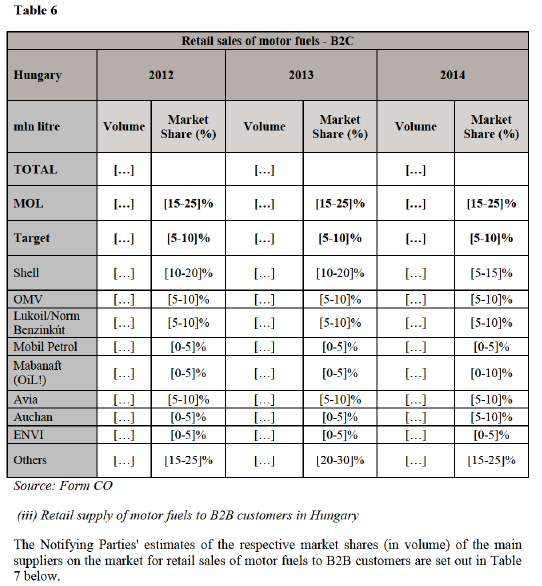

(ii) Retail supply of motor fuels to B2C customers in Hungary

(78) The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market on the Hungarian market for the retail supply of motor fuels to B2C customers.

(79) First, even if the Notifying Party will further re-inforce its leading market position, the combined market share remains at approximately [20-30]% and the increment brought about by ENI Hungaria is not more than [5-10]%. Furthermore, there are post-transaction two competitors (Shell, Lukoil) with market shares higher than the increment and another two competitors (OMV, Avia) with a market share comparable to the increment. This indicates that the Transaction would lead to a limited change of the competitive structure of the market.

(80) Second, the Commission takes the view that the Transaction would not lead to the removal of a significant competitive constraint on a local level. In all local areas in Hungary a sufficient number of competitors remain active.

(81) In order to assess the local elements of the competition, the Commission has used the following monitoring and presence-based approach. (45) As a first step the Parties identified those MOL stations which monitored one or more ENI stations and those ENI stations which monitored one or more MOL stations. This approach takes into account that oil companies monitor each other on the retail market and determine the actual pump price by modifying the national list price accordingly. Then, the Parties identified those local areas where the merger would lead to a fascia reduction of 4 to 3 or lower.

(82) The monitoring approach has the benefit of reflecting the day-to-day business decisions of the Parties in terms of which sites are most relevant for informing local pricing decisions. However, the monitoring approach does not account for indirect constraints from other competing sites in direct proximity or further away which are not directly monitored, but which are monitored by competitors’ sites which the Parties monitor. This indirect competition is conservatively taken into account by adding an additional filter in the form of isochrones/catchment areas of the 2.5 Km for stations located in Budapest, 5 Km for stations located in Budapest' suburbs and larger cities other than Budapest and 20 Km for stations located in rural areas.

(83) Following the above analysis only five stations – out of the 180 acquired - were identified as potentially problematic within the meaning that less than three competitors would remain post-transaction in the identified local area. The total volume of motor fuels sold at these stations are low, amounting to less than [0-5]% for ENI (46) and less than [0-5]% for MOL (47). On a national market these clusters can therefore be considered as de minimis.

(84) Second, the analysis of the local elements as well as the fact that the Parties are not close competitors with regard to their geographic footprint and network characteristics indicate that the customers could easily switch to other competitors post-transaction.

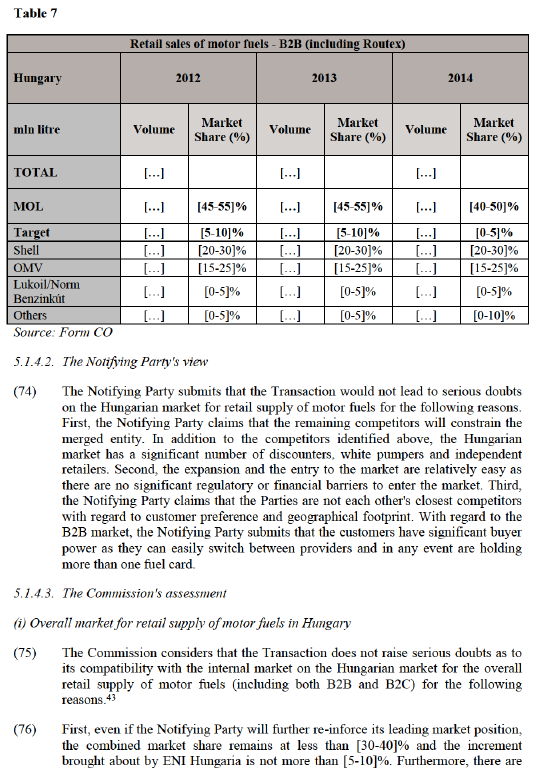

(iii) Retail supply of motor fuels to B2B customers in Hungary

(85) The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market on the Hungarian market for the retail supply of motor fuels to B2B customers.

(86) First, ENI's Routex card business, which represents the vast majority of ENI Hungaria's B2B customers, does not form part of the Transaction. Excluding Routex business ENI would bring an increment of less than [0-5]%. However, even taken into consideration the whole of the overlap (48), the increment brought by the Transaction is still limited, [0-5]%.

(87) Second, other competitors such as OMV and Shell with market shares of [15-25]% and [20-30]% respectively would continue to exert significant competition constraints on the merged entity.

5.2. Vertical effects

(88) The Transaction gives rise to vertically affected markets with regard to (1) the ex- refinery sales of diesel and gasoline (upstream) and (2) the non-retail supply of the corresponding products in Hungary.

(89) The Transaction also gives rise to vertically affected markets in Hungary with regard to (1) the non-retail sale of each diesel and gasoline (upstream) and (2) the retail sale of motor fuels (downstream).

5.2.1. Ex-refinery supply of refined oil products – non-retail supply of refined oil products in Hungary

(90) The Parties are both active on the market for ex-refinery sales of diesel and gasoline, with a combined market share of [0-5]% and [0-5]% (49) respectively with a minimal overlap. (50)

(91) With regard to the non-retail supply of diesel and gasoline, the Parties have a combined market share of [70-80]% and [60-70]% respectively.

5.2.1.1. The Notifying Party's view

(92) The Notifying Party claims that the merged entity would not have the ability to foreclose its downstream competitors because the inputs to supply wholesalers are available from a number of other suppliers. Furthermore, the Notifying Party submits that the merged entity would also have no incentive to foreclose inputs from downstream rivals as MOL disposes sufficient refinery capacities and the upstream sales form part of its business model.

5.2.1.2. The Commission's assessment

(93) The Commission considers that the merged entity would not have the ability to foreclose its competitors given its limited market share on the upstream markets of ex-refinery sales of refined oil products. MOL's market shares of [60-70]% with regard to the ex-refinery sales of gasoline and diesel in Hungary and the small geographic size of the country indicates that there are available supply sources in Hungary other than the MOL refinery.

(94) Furthermore, in the light of the small increment brought about by ENI Hungaria on the downstream market for non-retail supply of refined oil products, the Commission considers that the Transaction would not change the incentive to engage in foreclosure behaviour. ENI Hungaria's market share on the market for non-retail supply of diesel and gasoline is only [0-5]% and [5-10]% respectively.

(95) Based on the above, the Commission concluded that the Transaction does not raise serious doubts with regard to the vertical relationship of the Parties' activities on the ex-refinery sales of diesel and gasoline (upstream) and the non-retail sales of the same refined products (downstream).

5.2.2. Non-retail supply of refined oil products – retail supply of motor fuels in Hungary

(96) The Parties have a combined market share of [70-80]% and [60-70]% on the Hungarian non-retail markets of diesel and gasoline and a combined market share of [30-40]% on the overall retail market of motor fuels in Hungary.

5.2.2.1. Input foreclosure

5.2.2.1.1. The Notifying Party's view

(97) The Notifying Party submits that the merged entity would not have the ability to foreclose its downstream competitors as there are sufficient alternative supplies available. In addition, imports constitute such a competition constraint that the merged entity would not be able to increase its prices. Furthermore, the Notifying Party submits that the merged entity would also have no incentive to foreclose inputs from downstream rivals as the upstream sales are part of its profitable business strategy.

5.2.2.1.2. The Commission's assessment

(98) The Commission considers that the merged entity would not have the ability to foreclose its competitors despite the Parties' relatively high combined market shares as there are other suppliers to whom the downstream competitors could easily switch. Strong competitors such as OMV would remain on the upstream market; furthermore the increasing significance of imports combined with the availability of third party storage and transport infrastructure shows that they constitute a viable alternative supply source. (51)

(99) In addition, the Commission considers that the Transaction would not lead to a changed incentive given the rather limited increment of [5-10]% brought by ENI Hungaria on the downstream market.

(100) Based on the above, the Commission considers that input foreclosure can be excluded with regard to the vertical relationship for non-retail sales of refined oil products to retailers and the market for retail supply of motor fuel.

5.2.2.2. Customer foreclosure

5.2.2.2.1. The Notifying Party's view

(101) The Notifying Party submits that the Transaction would not lead to customer foreclosure as there would be a sufficient customer base on the downstream retail market post-transaction, since there are numerous other filling station operators and ENI Hungaria's market share amounts only to [5-10]%.

5.2.2.2.2. The Commission's assessment

(102) The Commission considers that customer foreclosure can be excluded based on the small increment brought by ENI Hungaria on the Hungarian retail market of motor fuels and the fact that the Target is currently supplied by ENI S.p.A, hence is not an available customer for MOL's competitors pre-transaction.

6. CONCLUSION

(103) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p.3 ("the EEA Agreement").

3 ENI Slovenija is active on the markets for non-retail supply of diesel, gasoline, LPG, heating oil, bitumen, base oils and lubricants.

4 See Clause 3.1 (b) of the ENI Hungaria SPA.

5 See recital 43 of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings.

6 Turnover calculated in accordance with Article 5 of the Merger Regulation.

7 See cases COMP/M.3291 – Preem/Skandinaviska Raffinaderi (2003); COMP/M.3375 – Statoil/SDS (2004); COMP/M.3543 – PKN Orlen/Unipetrol (2005); COMP/M.3516 – Repsol/Shell Portugal (2004); COMP/M.4208 – Petroplus/European Petroleum Holdings (2006); COMP/M.4545 – Statoil/Hydro (2007); COMP/M.5005 – Galp Energia/Exxonmobil Iberia (2008); COMP/M.5169 – Galp Energia Espana/Agip Espana (2008).

8 See COMP/M.4348 PKN / Mazeikiu (2006).

9 See COMP/M.7616 DCC / DLG (2015).

10 2010. évi CXVII. törvény a megújuló energia közlekedési célú felhasználásának előmozdításáról és a közlekedésben felhasznált energia üvegházhatású gázkibocsátásának csökkentéséről; 36/2010. (XII.31.) NFM rendelet a bioüzemanyag fenntarthatósági követelményeknek való megfelelésével kapcsolatos üvegházhatású-gázkibocsátás elkerülés kiszámításának szabályairól; 138/2009. (VI.30.) Kormányrendelet a bioüzemanyagok közlekedési célú felhasználásának előmozdítására vonatkozó egyes rendelkezések végrehajtásának szabályairól; 343/2010. (XII.28.) Kormányrendelet a fenntartható bioüzemanyag-termelés követelményeiről és igazolásáról.

11 See cases COMP/M. 727 BP / MOBIL (1996); COMP/M.5005 Galp Energia / ExxonMobil Iberia (2008); COMP/M.5637 Motor Oil (Hellas) Corinth Refineries / Shell Overseas Holdings (2010).

12 See COMP/M.5005 Galp Energia / ExxonMobil Iberia (2008).

13 See question No 5 of the questionnaires Q3 and Q4.

14 With or without fuel cards.

15 See cases COMP/M.4919 – StatoilHydro / ConocoPhillips (2009); COMP/M.4532 – Lukoil / ConocoPhillips (2007); COMP/M.4348 – PKN / Mazeikiu (2006); COMP/M.3516 – Repsol YPF / Shell Portugal (2004); COMP/M.3291 – Preem/Skandinaviska Raffinaderi (2003).

16 See cases COMP/M.6167 – RWA / OMV Warme (2011); COMP/M.5637 – Motor Oil (Hellas) Corinth Refineries / Shell Overseas Holdings (2010); COMP/M.5781 – Total Holdings Europe SAS / ERG SpA / JV (2010); COMP/M.5629 – Normeston / MOL / Met JV (2010).

17 See COMP/M.3291 – Preem / Skandinaviska Raffinaderi (2003).

18 See cases COMP/M.5637 Motor Oil (Hellas) Corinth Refineries / Shell Overseas Holdings (2010); COMP/M.5005 Galp Energia / Exxonmobil Iberia (2008); COMP/M.1383 Exxon/Mobil, COMP/M.1628 – TotalFina/Elf.

19 See cases COMP/M.4919 StatoilHydro / ConocoPhillips (2009); COMP/M.4545 Statoil / Hydro (2007); COMP/M.4532 Lukoil / ConocoPhillips (2007); COMP/M.3516 Repsol YPF / Shell Portugal (2004).

20 Sales to business or public customer without fuel card are considered as B2C sales.

21 See question No 9 of the questionnaire Q5.

22 See cases COMP/M.3291 Preem / Skandinaviska Raffinaderi (2003); COMP/M.3375 Statoil / SDS (2004); COMP/M.3516 Repsol / Shell Portugal (2004); COMP/M.3543 PKN Orlen / Unipetrol (2005); COMP/M.4208 Petroplus / European Petroleum Holdings (2006); COMP/M.4545 Statoil / Hydro (2007); COMP/M.5005 Galp Energia / ExxonMobil Iberia (2008); COMP/M.5846 Shell / Cosan / JV (2011)

23 COMP/M.3291 Preem/Skandinaviska Raffinaderi (2003); COMP/M.3730 Lukoil / Teboil / Suomen Petrooli (2005); COMP/M.4532 Lukoil / ConocoPhillips (2007).

24 Although some competitors pointed out that the use of local terminals does not necessarily prevent the existence of national markets: COMP/M.5781 Total Holdings Europe SAS / ERG SPA / JV (2010).

25 The possibility of a national market was however left open: COMP/M.1628 TotalFina / Elf (2000); COMP/M.6935 Argos / Sopetral (2013).

26 Although the markets concerned appeared to be national in scope, the Commission also assessed the impact of the transaction in this particular border region: COMP/M.3543 PKN Orlen / Unipetrol (2005), para. 19.

27 COMP/M.727 BP/MOBIL (1996), COMP/M.3543 PKN Orlen/Unipetrol (2005).

28 COMP/M.1464 Total/Petrofina (1999), COMP/M.3516 Repsol YPF/Shell Portugal (2004); COMP/ M.5781 - TOTAL HOLDINGS EUROPE SAS/ ERG SPA/ JV (2010).

29 See cases COMP/M.1383 Exxon / Mobil (1999); COMP/M.3291 Preem / Skandinaviska Raffinaderi (2003); COMP/M.3375 Statoil / SDS (2004); COMP/M.5796 Eni / Mobil Oil Austria (2010).

30 See cases COMP/M.1013 Shell UK / Gulf Oil (1997); COMP/M.5781 Total Holdings Europe Sas / ERG Spa / JV (2010).

31 In 2012-2013 ENI Hungaria acted as an agent of MOL. MOL has included its sales to ENI Hungaria for that period in its ex-refinery sales. ENI is not able to provide sales for diesel and gasoline for the years 2012 and 2013 since it can only calculate the overall volume sold by MOL based on the commission invoiced to ENI for the agency period.

32 See questions No.23 of questionnaire Q2 and No. 13 and No.15 of questionnaire Q6.

33 See questions No. 24 of questionnaire Q2 and No. 13 of questionnaire Q6.

34 See questions No. 20 and 21 of questionnaire Q2.

35 ENI Hungaria gets [20-30]% of its supplies from the […]. According to the supply agreement this volume is delivered from the […] depot in Hungary which ENI Hungaria does not rent.

36 See questions No. 20 of questionnaire Q6 and No.27 of questionnaire Q2.

37 See Clause 6.10 of the ENI Hungaria SPA.

38 See questions No 9-12 and 18 of questionnaire Q3.

39 See questions No 24-27 of questionnaire Q3 and question No 17-20 of questionnaire Q7.

40 See Clause 6.10 of the ENI Slovenija SPA.

41 See question 18 of questionnaire Q8 and question 24 of questionnaire Q4.

42 See questions 17 and 19 of questionnaire Q4.

43 Some elements of the competition are assesed with regards to the subsegments of retail sales to B2C and B2B customers in the section below.

44 See questions No 13 and 15 of questionnaire Q5 and question No 17 of questionnaire Q1.

45 This approach is in line with the method followed in case COMP/M.4919 Statoil / ConocoPhilips.

46 Fuel station […]: [0-5]% fuel station […]:[0-5]%; fuel station […]:[0-5]% of ENI's total sales volume.

47 Fuel station […]:[0-5]%; fuel station […]:[0-5]% of MOL's total sales volume.

48 […].

49 In line with the Commission's previous decision making practice (see cases COMP/M.727 BP / MOBIL (1996), COMP/M.7318 Rosneft / Morgan Stanley Global Oil Merchanting Unit (2014)) the market for refining and ex-refinery sales of refined oil products was assessed as EEA-wide in scope.

50 ENI has a market share of [0-5]% and [0-5]% on the market for ex-refinery sales of diesel and gasoline.

51 Please see paragraph 54.