Commission, November 23, 2015, No M.7686

EUROPEAN COMMISSION

Judgment

AVAGO / BROADCOM

Dear Sir/Madam,

Subject:Case M.7686 - Avago / Broadcom

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 2 October 2015, the European Commission ("Commission") received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Avago Technologies Limited ("Avago" or the "Notifying Party", Singapore) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of the undertaking Broadcom Corporation ("Broadcom", the USA) by way of acquisition of shares (the "Transaction").3 Avago and Broadcom together are referred as the "Parties".

1.THE PARTIES

(2) Avago is active globally in the design, manufacture, marketing and sales of a range of semiconductor devices for use in wireless and wireline communications, storage applications and industrial applications.

(3) Avago is the successor of the Semiconductor Products Group (“SPG”). SPG, until 2005, was part of Agilent Technologies, Inc., which, in turn, was originally spun off from HP’s semiconductor division. Avago is dual-headquartered in San Jose, California (United States) and Singapore. Avago is listed on the NASDAQ Global Select Market under the symbol “AVGO”.

(4) Broadcom is a global provider of semiconductor solutions for wireless and wireline communications; it is incorporated in California and its principal executive offices are in Irvine, California (United States). Broadcom is listed on the NASDAQ Global Select Market under the symbol “BRCM”.

2.THE OPERATION

(5) Avago is not controlled by any company or natural person. Its capital share is fragmented and the main shareholders are Capital World Investor with 11.1%, JP Morgan Chase & Co. with 7.8% and Capital Research Global Investors with 7.5%.

(6) Similarly also Broadcom is not controlled by any company or natural person. Its capital share is fragmented and the main shareholders are FMR LLC with 7.7% of Class A shares, Blackrock Inc. with 5.5% and Vanguard Group Inc. with 5.1%.

(7) Pursuant to an Agreement and Plan of Merger of 28 May 2015, the Parties will undertake several steps including the transfer of shares and mergers between different companies. First, shares of Avago will be transferred to a subsidiary of a holding company ("HoldCo") in exchange for an equivalent number of shares of that holding company. Next, Broadcom will merge with two subsidiaries of HoldCo, providing shareholders of Broadcom with the ability to receive shares of HoldCo in exchange. Ultimately, as a result of these steps Avago will acquire control of Broadcom through HoldCo.

(8) The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3.EU DIMENSION

(9) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million4 (Avago: EUR 3 495 million; Broadcom: EUR 6 344 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Avago: EUR […] million; Broadcom: EUR […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(10) The notified operation therefore has an EU dimension under Article 1(2) of the Merger Regulation.

4.RELEVANT MARKETS

(11) The Transaction concerns semiconductor devices.

4.1.Overview of the semiconductor industry

(12) Semiconductors are materials that conduct electricity more easily than insulators (like glass) but less easily than conductors (like copper), which makes them ideal for manipulating electronic signals (reversing, amplifying). Semiconductor materials, most typically silicon, are used in semiconductor devices like microchips and their components (for example diodes and transistors) Semiconductor devices can be found in virtually every electronic device today. The end-products that contain semiconductor devices range from base stations, mobile phones, computers, domestic appliances and cars to medical equipment, identification systems, large-scale industry electronics and aerospace equipment. Semiconductor devices are rarely bought as end-products by consumers. They are mainly bought by equipment manufacturers in virtually all sectors within the electronic equipment industry.

(13) According to a classification of semiconductor devices based on various industry reports (Gartner, Strategy Analytics and ABI Research), there are four main categories of semiconductor devices: (i) integrated circuits (“ICs”), commonly referred to as "chips", or "microchips" (ii) discretes, (iii) optical semiconductors, and (iv) sensors and actuators. In a recent decision the Commission concluded that it is appropriate to distinguish semiconductor devices within these four categories.5

(14) Moreover, ICs can be distinguished according to their purpose between “general purpose” ICs on the one hand and ICs used for specific application on the other hand, the latter comprising the following three main sub-segments: (i) Application Specific Integrated Circuits ("ASICs"), that are custom-made ICs created by and for a specific Original Equipment Manufacturer ("OEM"), (ii) Application Specific Standard Products ("ASSPs") which may be described as “off-the-shelf” or “merchant” ICs, which can be purchased in identical form by a number of different customers, and (iii) Field Programmable Gate Arrays, which can be configured and re-configured by customers after fabrication to perform desired logic and processing functions.

(15) In addition, ASICs on one hand and ASSPs on the other hand, can each also be distinguished according to product categories such as consumer, data processing, automotive, industrial, military/aerospace, and communications. The segments of ASICs for communications and ASSPs for communications can each be sub- divided in wireline communications and wireless communications.

(16) Lastly, within the category of wireline ASICs and ASSPs it is possible to distinguish between the following products: (i) ASICs/ASSPs for Ethernet switches (electronic devices that connect the nodes on a network, by receiving, processing and forwarding data to the destination; (ii) ASICs/ASSPs for Ethernet controllers (found at the transmitting and receiving ends of an Ethernet network and enabling devices to interact with each other by implementing Ethernet connectivity protocols); and (iii) ASIC/ASSP Physical layer devices ("PHYs", which connect the physical medium of an Ethernet network and the digital processing functions of the network, and perform "signal conditioning").6

(17) A number of different ICs as well as other components are used within data centers (so called "IT stacks", also referred to as the "data center stack"). As data centers use many different types of equipment, for instance for networking, computing or for storage of data, the ICs in the data center stack could belong to very different product markets.7

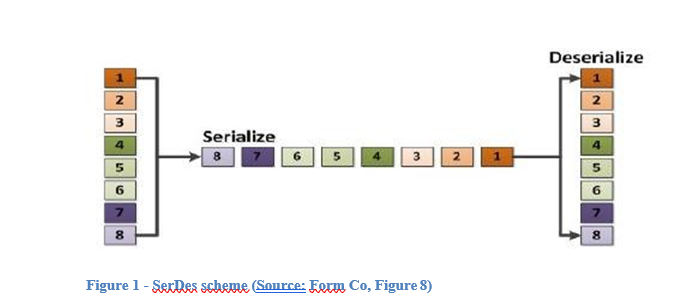

(18) Of relevance to the case are also so-called “SerDes” ("Serializers/Deserializers"), that is to say IC components that allow fast data transmission between ICs.

(19) The Parties have overlapping activities in relation to (i) wireline communication ASICs, including, in particular, Ethernet switch ASICs8, (ii) wireline communication ASSPs,9 and (iii) SerDes IP.

4.2.Wireline communication ASICs

4.2.1.Introduction

(20) Wireline communication ASICs are manufactured according to individual specifications of the customer. In an ASIC development, the IC vendor provides its IP blocks10 to the customer, and the customer combines this vendor IP with its own IP to create a so-called "logical design" of the chip. In further cooperation with the ASIC vendor a "physical design" is defined. The ASIC vendor then defines the place of all electronic components of the chip ("placing") and defines the exact design of all the wires needed to connect the components of the chip ("routing"). The ASIC vendor then undertakes the so-called “physical verification” process to make sure that the chip works and has the frequency and other performance requirements that the OEM requested. Finally, unless the ASIC vendor has its own foundry it outsources the manufacturing to a third-party foundry.

(21) Within the broad segment of wireline communication ASICs, the Parties activities overlap in particular in the specific sub-segment of Ethernet switch ASICs.

(22) An Ethernet switch is an electronic device that connects the nodes on a network, by receiving, processing and forwarding data to the destination via the Ethernet protocol. Ethernet switches are used in almost any Local Area Network (“LAN”), which is a network that may include servers, computers, peripherals, and other devices (each of them a “node”), operating in a limited area, generally a building.

(23) The functions of an Ethernet switch can be performed both by ASSPs and by ASICs depending on the process used to reach the final design of the IC.

4.2.2.Product market definition

4.2.2.1.Notifying Party's view

(24) The Notifying Party submits that ASICs are a separate product market from ASSPs and that wireline communication ASICs are a separate product market from ASICs used in other product categories (e.g. from ASICs used in wireless communications or consumer electronics, see paragraph (15).)

(25) According to the Notifying Party, on the demand-side ASICs are an option only for OEMs that have a relevant in-house development team and such a team requires significant resources which can be justified only for OEMs with sufficient large scale volumes in the final products for which the IC is used. A customer without such in-house development team would not be in a position to purchase ASICs.

(26) On the supply-side, the Notifying Party submits that the provision of ASIC design support to OEMs focuses on the provision of specialized, and high quality, IP blocks and thus requires a different skill set from that required to sell ASSPs. From a vendor perspective, each ASIC can be sold only to the one customer with whom it was developed.

(27) Moreover the Notifying Party submits that wireline communication ASICs are a separate product market from ICs used in other product areas mainly because of a lack of demand-side substitutability; for instance ASICs designed for wireline communication cannot be substituted with ASICs designed for wireless communication without incurring significant re-design cost of the final product by the customers.

(28) Therefore the Notifying Party submits that there is a separate product market for wireline communication ASICs.

(29) When considering the potential market for Ethernet switch ASICs, Avago submits that from a supply-side perspective there is no need to define a separate relevant market for Ethernet switch ASICs within the broader market for wireline communication ASICs.

(30) The Notifying Party argues that within Avago, the same division that is working on Ethernet switches is also working on several other wireline communication ASICs such as PHYs ASICs, ASICs for routers and host adapters.

4.2.2.2.Results of the market investigation and Commission's assessment

(31) When considering different functionalities, the majority of customers and competitors which responded to the market investigation replied that ICs used for wireline communication can be distinguished from ICs used in other product areas (for instance wireless communication, automotive and data processing).11

(32) The market investigation results also suggest that separate relevant markets exist for ASSPs, on the one hand, and ASICs, on the other hand.12 More specifically, market participants indicated that they treat ASICs and ASSPs separately.13 In addition, ASICs and ASSPs have different characteristics in terms of size and technology, different design, need different know-how, have different costs and are produced in different production lines.14 Further, the respondents to the market investigation indicated that there is a certain degree of supply-side substitutability between wireline communication ASSPs and wireline communication ASICs, but that there is less demand-side substitutability between those two products.15

(33) In sum, the results of the market investigation indicate that it may be appropriate to distinguish between markets for ICs according to product areas, and that separate relevant markets exist for ASSPs and ASICs within each product area.

(34) As regards the potential market for Ethernet switch ASICs, despite some respondents pointing out that Ethernet switch ASICs are substitutable with Ethernet switch ASSPs, the responses of the majority of customers and competitors suggest the existence of a separate relevant product market for Ethernet switch ASICs within the broader market for wireline communication ASICs mainly due to lack of demand side substitutability. The respondents pointed out that the functionalities of an Ethernet switch are specific to a switch and cannot be performed by any other wireline communication IC.16

(35) Based on the above, the Commission concludes that, for the purpose of this decision, ASICs for wireline communication are in a separate product market than ASSPs used for wireline communication. Other elements of the product market definition, including the definition of further, narrower markets within wireline communication ASICs, can be left open for the purpose of this decision as the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to wireline communication ASICs, and any possible segments thereof, under any plausible product market definition.

4.2.3.Geographic market definition

(36) In previous cases, the Commission considered that the geographic scope of semiconductor markets may be at least EEA-wide, if not worldwide, although the precise scope of the geographic market was ultimately left open.17

4.2.3.1.Notifying Party's view

(37) The Notifying Party submits that the different product markets for semiconductor devices and IP blocks, including the potential market for Ethernet switch ASICs, are all worldwide in scope, because (i) transport costs are null or very low; (ii) location is not a factor for a supplier selection; (iii) price differences among regions are insignificant; (iii) customers are global players and typically source globally; and (v) there are no quotas, tariffs or technical specifications limiting trade.

4.2.3.2.Results of the market investigation and Commission's assessment

(38) All the respondents to the market investigation considered that the geographic scope of the markets for all the relevant products is worldwide.18

(39) In light of the results of the market investigation, for the purposes of this decision, the Commission concludes that the relevant geographic market for wireline communication ASICs, including the potential market of Ethernet switch ASICs, should be considered worldwide in scope.

4.3.Wireline communication ASSPs

4.3.1.Introduction

(40) ASSPs for wireline communications can be purchased in identical form by a number of different customers. In an ASSP development, the vendor uses its own IP to develop an IC that performs a particular function, and this IC can be used by multiple customers.

(41) Just like in the case of wireline communication ASICs it may be possible to distinguish narrower segments such as Ethernet switch ASSPs (see paragraph (23), and wireline PHY ASSPs.

4.3.2.Product market definition

4.3.2.1.Notifying Party's view

(42) The Notifying Party submits that ASSPs are a separate product market from ASICs and that wireline communication ASSPs are a separate product market from ASSPs used in other product areas.

(43) According to the Notifying Party on the demand-side, ASSPs are "off-the-shelf" solutions which do not require the customer to have a dedicated in-house development team to work on the specific design of the IC.

(44) In the Notifying Party's view, the supply of ASSPs involves the sale of a product which is already fully designed and manufactured by the vendor, as opposed to the design phase with the customer required to supply an ASIC. It follows that the same ASSP can be sold to several customers at the same time.

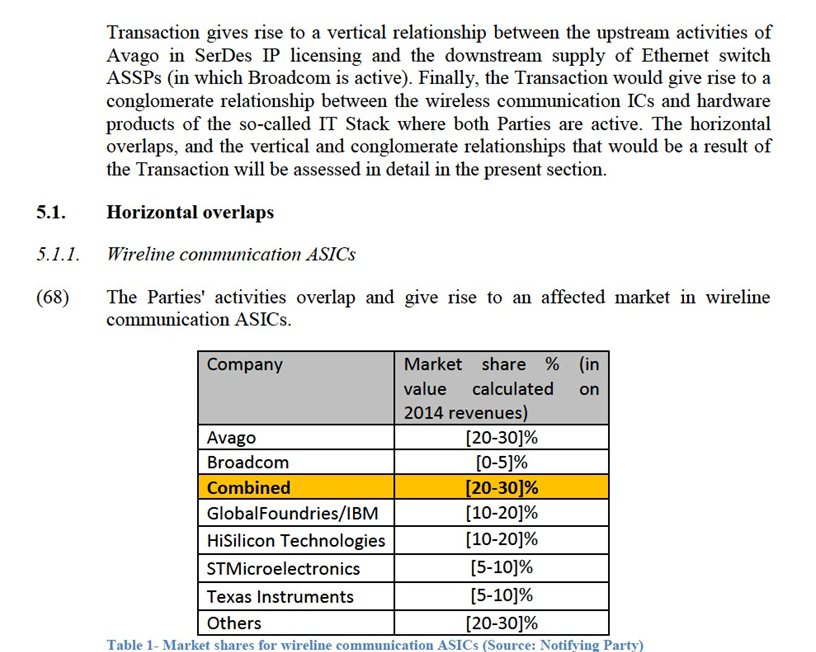

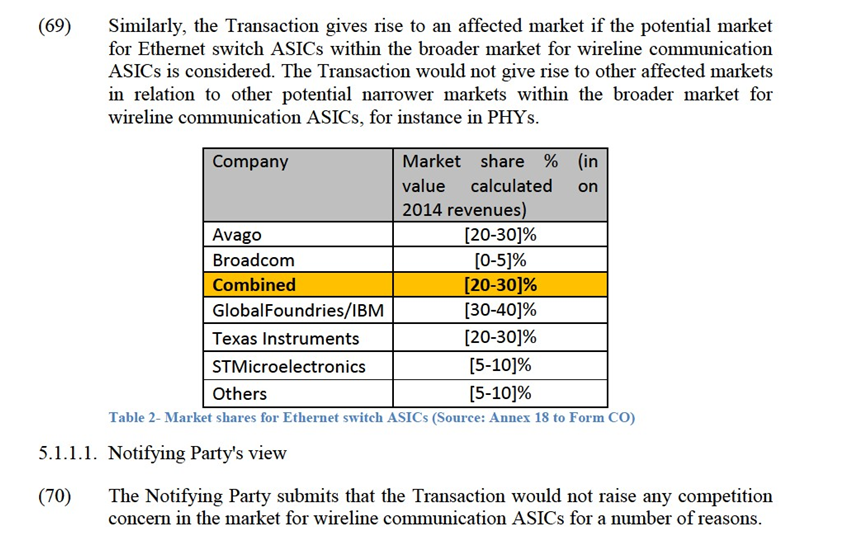

(45) Moreover, just like in the case of ASICs (see paragraph (27)) the Notifying Party submits that wireline communication ASSPs are a separate market from ASSPs used in different product areas, for instance wireless communication ASSPs.

4.3.2.2.Results of the market investigation and Commission's assessment

(46) As already noted in paragraphs (31) and (32), the market investigation indicated that it may be appropriate to distinguish between markets for ICs according to product areas,19 and that separate relevant product markets exist for wireline communication ASSPs and ASICs.20

(47) As regards the potential market for Ethernet switch ASSPs, as discussed in paragraph (34) the market investigation results indicated that there might be a separate relevant product market for Ethernet switch ASSPs within the broader market for wireline communication ASSPs.21

(48) Based on the above, the Commission concludes that, for the purposes of this decision, ASSPs for wireline communication are in a separate product market than ASICs used for wireline communication. Other elements of the product market definition, including the definition of further, narrower markets within wireline communication ASSPs, can be left open for the purpose of this decision as the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to wireline communication ASSPs, and any possible segments thereof, under any plausible product market definition.

4.3.3.Geographic market definition

(49) In previous cases, the Commission considered that the geographic scope of semiconductor markets may be at least EEA-wide, if not worldwide, although the precise scope of the geographic market was ultimately left open.22

4.3.3.1.Notifying Party's view

(50) The Notifying Party submits that the different product markets for semiconductor devices and IP blocks are all worldwide in scope, because (i) transport costs are null or very low; (ii) location is not a factor for a supplier selection; (iii) price differences among regions are insignificant; (iv) customers are global players and typically source globally; and (v) there are no quotas, tariffs or technical specifications limiting trade.

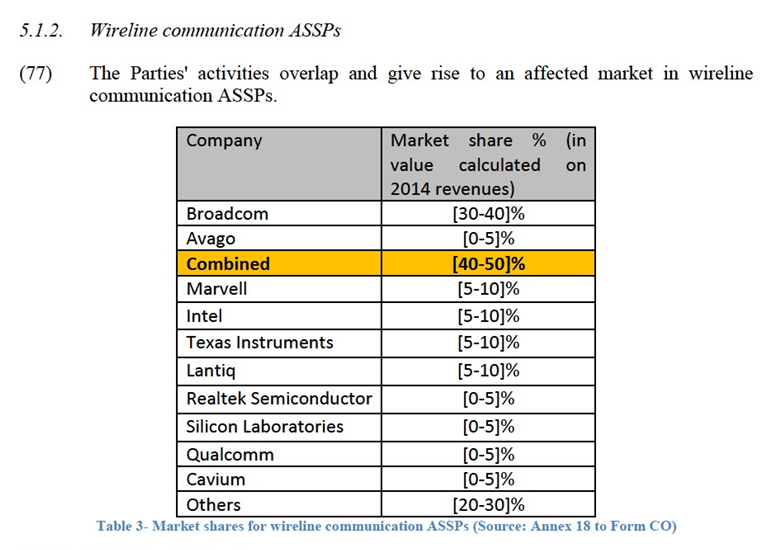

4.3.3.2.Results of the market investigation and Commission's assessment

(51) All the respondents to the market investigation considered that the geographic scope of the markets for the relevant products is worldwide.23

(52) In light of the results of the market investigation, for the purposes of this decision, the Commission concludes that the relevant geographic market for wireline communication ASSPs should be considered worldwide in scope.

4.4.SerDes IP licensing

4.4.1.Introduction

(53) Fast data transmission between chips often requires converting the parallel data into serial form. As a result, ICs often include a SerDes that converts the data stream from parallel to serial, consolidating multiple parallel series of bits into a single data stream. Once the data reaches the destination, it is de-consolidated again from serial to parallel. SerDes are found in various wireline ICs such as Ethernet switch ICs and PHYs.

(54) As SerDes constitute a separate block within a chip and require specialized know- how; the IP for SerDes is often licensed separately.

(55) SerDes IP can be further distinguished by the speeds in which they perform their tasks. Different SerDes speeds include 1G24, 10G, 25G, 50G and 100G. Those speeds are indicative and referred to as standard speeds. There are SerDes with similar speeds, for instance 28G and 56G, which will be considered 25G and 50G respectively for the purposes of this decision.

4.4.2.Product market definition

4.4.2.1.Notifying Party's view

(56) The Notifying Party submits that it is not necessary to consider a separate market for each different speed of SerDes IP.

(57) In this regard, the Notifying Party submits that from demand-side the customer can achieve a certain speed using a combination of SerDes, for instance it can reach 25G using two 10G SerDes together with five 1G SerDes or alternatively by using one 25G SerDes, the two solutions being equivalent.25 As such the IPs of different speed SerDes do not form separate markets.

(58) The Notifying Party also argues that SerDes IPs for different speeds are substitutable from the supply side in that SerDes of 1G and upwards require the same kind of know-how and R&D effort with only limited additional investment and time.26

4.4.2.2.Results of the market investigation and Commission's assessment

(59) The majority of respondents to the market investigation indicated that SerDes IP is a separate product market from other IP blocks used in ICs and that some market participants have an in-house solution, while others license it from third parties.27

(60) When considering the possible different speed SerDes, the majority of respondents considered that within SerDes IP separate markets should be distinguished for each standard speed (1G, 10G, 25G, 50G and the future 100G).28

(61) Further contacts with market participants highlighted the importance of the production technology node for SerDes IP (for instance 32nm, 28nm and 16nm) but the Commission considers that the evidence is not conclusive as to whether separate markets should be distinguished along these lines.29

(62) In any event, for the purpose of this decision the precise product market definition can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to IP blocks, and any relevant segments therein, under any plausible product market definition.

4.4.3.Geographic market definition

(63) In previous cases, the Commission considered that the geographic scope of semiconductor markets may be at least EEA-wide, if not worldwide, although the precise scope of the geographic market was ultimately left open.30

4.4.3.1.Notifying Party's view

(64) The Notifying Party submits that the different product markets for semiconductor devices and IP blocks are all worldwide in scope, because (i) transport costs are null or very low; (ii) location is not a factor for a supplier selection; (iii) price differences among regions are insignificant; (iv) customers are global players and typically source globally; and (v) there are no quotas, tariffs or technical specifications limiting trade.

4.4.3.2.Results of the market investigation and Commission's assessment

(65) All the respondents to the market investigation considered that the geographic scope of the markets for the relevant products is worldwide.31

(66) In light of the results of the market investigation, for the purposes of this decision, the Commission concludes that the relevant geographic markets for SerDes IP licensing should be considered worldwide in scope.

5.COMPETITIVE ASSESSMENT

(67) As set out in paragraph (19) above, the Transaction gives rise to horizontal overlaps in relation to potential markets for wireline communication ASSPs, wireline communication ASICs and Ethernet switch ASICs. In addition, the

(71) Firstly, the presence of Avago is not very strong, with a market share of [20-30]% and the addition of Broadcom's [0-5]% hardly changes the competitive landscape. Secondly, the market is fragmented with an HHI of [1,500-1,550] post-Transaction and a delta brought about by the Transaction of [50-100]. Thirdly, there are, according to the Notifying Party, strong competitors such as GlobalFoundries/IBM, Huawei (via HiSilicon) and STMicroelectronics, which will subject the merged entity to competitive constraints. Fourthly, when developing new ASICs switching costs are minimal and there are no capacity constraints for competitors to increase their productions. Fifthly, customers, which are typically well-established and large companies such as […],[…],[…],[…] and […], would have a significant degree of buyer power.

(72) Moreover, the Notifying Party submits that Avago and Broadcom are not close competitors in this market.

(73) The Notifying Party further claims that, on top of the arguments presented for the broader wireline communication ASICs market, specifically in the potential market for Ethernet switch ASICs, the presence of strong competitors such as GlobalFoundries/IBM and Texas Instruments with higher or comparable market shares to the merged entity, poses significant competitive constraints.

5.1.1.2. Results of the market investigation and Commission's assessment

(74) On the basis of the results of the market investigation and the information provided by the Notifying Party, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards wireline communication ASICs including the potential market for Ethernet switch ASICs for several reasons.

(75) First of all, the Parties do not hold a significant combined market share. Moreover, the market share increment that would arise from the Transaction is minimal ([0- 5]% for wireline communication ASICs and [0-5]% for Ethernet switch ASICs). In addition, respondents to the market investigation indicated that there will be a sufficient number of suppliers post-Transaction.32 The results of the market investigation also indicated that Broadcom is not a significant player in this market.33

(76) In light of the above and of the fact that market participants expressed no concerns in relation to the impact of the Transaction on wireline communication ASICs, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the market for wireline communication ASICs including the potential market for Ethernet switch ASICs.

raise serious doubts as to its compatibility with the internal market as regards wireline communication ASSPs.

(83) First of all, the increment brought about by the Transaction is very limited. Moreover, the respondents to the market investigation indicated that there will be a sufficient number of suppliers post-Transaction.34 The results of the market investigation also support the view that Avago is not a significant player as regards wireline communication ASSPs.

(84) In light of the above and of the fact that market participants expressed no concerns in relation to the impact of the Transaction on this market, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the market for wireline communication ASSPs.

5.2.Vertical relationships

(85) As explained in paragraph (67), Avago, apart from including SerDes in its own ASICs, is also active in the licensing of SerDes IP to third parties. Namely, it licenses SerDes IP to […] IC vendors35 that use it to produce wireline communication ASSPs in competition with Broadcom. These agreements are as follows: [Agreements with Broadcom competitors on licensing 25G/50G SerDes].

(86) Currently Avago has a clear incentive to license SerDes IP to ASSPs manufacturers as it is not producing own ASSPs. Post-Transaction, however, this incentive may change as the merged entity will become the competitor of Avago's current licensees. The question arises therefore whether the Transaction creates the risk that Avago will foreclose its future competitors by withdrawing this input (input foreclosure).

5.2.1.Ability to foreclose

5.2.1.1.Notifying Party's view

(87) The Notifying Party submits that Avago will not have the ability to engage in an input foreclosure strategy. While exact market shares in SerDes IP licensing are not available, the Notifying Party estimates the market for interface IP in both wireline and wireless communication ICs, which includes SerDes IP, to be worth approximately USD 500-600 million in 2014. Avago's revenues from SerDes IP licensing amounted to USD [10-15] million in the last four quarters, which would correspond to [0-5]%36 of this IP licensing market if the lower end of the range is used to calculate the market share.

(88) In addition, there are, according to the Notifying Party, a number of licensors of SerDes IP at all speeds.

(89) 1G and 10G SerDes technology is mature, widely available and the majority of the production market is based on these technologies. Licensors would include Cadence, Synopsys, Semtech, Inphi, Credo, STMicroelectronics, ClariPHY and GlobalFoundries/IBM.

(90) The current SerDes technology is 25G. Chips with this technology will go in production in about a year. According to the Notifying Party, this technology can be sourced from Mellanox, Cadence, ClariPHY, Credo, Intel, Open Silicon, Semtech, Inphi, STMicroelectronics and GlobalFoundries/IBM. Some of these players are licensing this technology to third parties, and all of them would have the ability and incentive to license their solutions to third parties in case prices for SerDes technology at the 25G standard were to increase.

(91) The next generation of SerDes will be based on the 50G SerDes technology. This technology itself is still in development and chips based on this technology are expected to go in production in about three years. While Avago […] SerDes 50G IP, the Notifying Party claims that several other companies […] 50G SerDes IP as well. The Notifying Party expects Intel to launch its 50G SerDes product in the course of the year of this decision, and claims that Credo has demonstrated a 50G product. Inphi has recently announced availability of 40G/50G/100G solutions and ClariPHY also has a 50G SerDes product.

(92) As regards a future SerDes IP with speeds of 100G and more, the Notifying Party claims that all the firms mentioned previously are investing to develop their own 100G technology. There are strong indications that as for the currently available technologies, competition will be lively.

(93) The Notifying Party furthermore points out that the existing Avago licensees are protected under long-term licensing agreements, [Details about confidential license agreements].

(94) Lastly, the Notifying Party submits that it is possible to replace higher speed SerDes with more than one lower speed SerDes (e.g. reach the 50G speed by using two 25G SerDes), which means that any speed can be achieved with the widely available lower speed SerDes.

5.2.1.2.Results of the market investigation and Commission's assessment

(95) The Commission recalls, first, that as mentioned in paragraph (60) the majority of respondents to the market investigation indicated that the market for SerDes IP should be further segmented for each standard speed (1G, 10G, 25G, 50G and the future 100G).37

(96) Several market participants considered that high speed SerDes (25G and above) are critical in areas where high amounts of data need to be handled with high speed, such as networking equipment in data centers.38 An OEM that uses chips with high speed SerDes noted that due to the limited physical space available in the device to place components it is not possible to replace higher speed SerDes with two lower speed SerDes.39 Numerous market participants explained that it is very challenging to design good quality high speed SerDes because higher speeds need to be achieved without compromising on signal quality, power consumption, size and reach (i.e. how far the data can travel).40 This also strongly suggests that two 10G SerDes would not substitute a 25G SerDes as such a configuration would increase the space and power consumption of the IC, both of which appear to be important criteria in the eyes of customers.

(97) Consequently, even though the market investigation supported the Notifying Party's view that lower speed SerDes is available from multiple sources41, this fact cannot dispel concerns relating to higher speed SerDes.

(98) With regard to high speed SerDes (25G and above), the Commission notes that such SerDes appear to be critical for high performing chips. Almost all market participants agreed that SerDes is a critical function of a chip42, especially in light of the current trend to move to higher speeds in network equipment and data center applications.43 Market participants agreed that if the SerDes is slow, error prone (too much noise or "jitter" in the data transmission), consumes too much power, does not have enough reach (does not send the data far enough), or takes up too much space, then the same will be true for the chip that incorporates it.44 Consequently in areas where high performing chips are required (such as network equipment, data centers) high speed and high quality SerDes appear to be a must have.

(99) Not only high speed SerDes are critical, but once a certain SerDes is chosen for a new chip design, the chip vendor cannot switch to another SerDes without redesigning the whole chip, which would involve losing years of development work and substantial development costs.45 Choosing a SerDes is, therefore, a critical business decision and the chip vendor is locked in with the chosen SerDes for the lifecycle of the chip, including its upgrades and newer generation variants.

(100) All market participants agreed that designing a high performing high speed SerDes is extremely challenging46 even by the standards of the high-tech world of the semiconductor industry. Multiple sources estimate that developing a high speed SerDes requires several years of development work as well as significant human and financial resources.47 A supplier of SerDes IP held that there are only a few engineers in the world who have a good understanding of the mathematics involved.48

(101) Such advanced technology that is at the same time critical to the performance of the final product is unlikely, by its nature, to be widely available. In addition, given the important business implications in choosing a SerDes technology, chip vendors who have a trusted solution are unlikely to switch easily to alternative suppliers.

(102) Indeed, when it comes to high speed SerDes, the market investigation did not confirm the Notifying Party's view. A large majority of market participants agreed that Avago is the clear leader in SerDes technology and has the best and most advanced SerDes.49 Several market participants that use Avago's high speed SerDes reported that currently there is no alternative on the market that would meet their technical requirements.50 A licensor of SerDes IP submitted that in high speed SerDes Avago is superior and the other SerDes technologies are generally behind.51

(103) More specifically, with regard to the sources the Notifying Party mentions, the SerDes of Credo, a start-up, and Inphi were regarded as having potential but not yet accepted in the market52 Intel was viewed as being in the process of catching up with the market in SerDes.53 Cadence and Synopsis are focused on lower speed SerDes.54 STMicroelectronics and Mellanox do not license out their SerDes (but only use it for their own ASICs).55 Open Silicon, ClariPHY and Semtech were not mentioned as potential alternatives by any market participant for high speed SerDes.56 Globalfoundries/IBM was regarded as one of the best by an IC vendor57; however other market participants regarded it as inferior to Avago.58

(104) Several market participants noted that reputation is an important element in SerDes licensing in a sense that a leading SerDes supplier would have an edge even against a technically equivalent solution.59 As explained above, the choice of SerDes is a critical business decision: chip vendors are likely to be reluctant in switching away from a trusted source with a reputation of being a market leader. It is therefore likely that Avago's SerDes is critical for the licensees and that there is a lack of suitable alternatives.

(105) On the other hand, a few respondents to the Commission's questionnaire considered that there is sufficient choice in SerDes licensing.60 Furthermore, an OEM submitted that SerDes other than Avago's also comply with its performance criteria for ASSPs.61 However, even this OEM considered that Avago clearly has the best SerDes.

(106) Taking into account all replies, the Commission therefore considers that the withdrawal of Avago's SerDes license could create difficulties in the downstream competition in wireline communications ASSPs.

(107) The Commission notes that several firms are developing high speed SerDes. A number of market participants noted that the tendency of data centre and network applications to move to higher speeds, coupled with the lack of adequate alternatives in high quality SerDes, create a market opportunity for developing such SerDes, which several firms are trying to capture.62 While the existence of such development work does not mean that at present there are sufficient credible alternatives to Avago's SerDes IP, the Commission will take this fact into account in the overall assessment of this concern.

(108) With regard to […]. Therefore, contrary to the Notifying Party's view, not all licensees are protected by the current contractual arrangements.

(109) In view of the above the Commission considers that post-Transaction Avago will have the ability to engage in input foreclosure. The Commission notes at the same time that several firms are developing high speed SerDes in an attempt to catch up with Avago.

5.2.2.Incentive to foreclose

5.2.2.1.Notifying Party's view

(110) […] It did so because it represented an incremental, highly profitable revenue stream for Avago’s ASIC Product Division (“APD”). According to the Notifying Party, Avago has a natural and strong incentive to continue capturing that revenue going forward.

(117) As the market for such switches is already concentrated and Broadcom is a very strong player on this market, a possible input foreclosure conduct by Avago post- Transaction could lead to anti-competitive effects on this market, especially in light of the fact that one of the licensees of Avago’s 25G and 50 G SerDes is [Information regarding confidential license agreement], Broadcom’s [Information regarding confidential license agreement] competitor on this market.

5.2.3.3.Overall conclusion on the vertical concern linked to SerDes IP licensing

(118) Based on the above, and contrary to the Notifying Party's view, following the results of the phase I market investigation, the Commission considered that the Transaction raised a concern as regards its compatibility with the internal market in respect of the licensing of Avago’s 25G and 50G SerDes IP.

5.2.4.Commitment offered

(119) On 30 October 2015 Avago offered remedies in response to the Commission's concern.

(120) Under the proposed remedies, Avago commits to make a firm, irrevocable and legally binding offer to extend the duration of [Confidential details on Avago’s offered remedy] licensing agreements currently in place with [Confidential details on Avago’s offered remedy].

(121) Avago also committed [Confidential details on Avago’s offered remedy]. The scope of the license includes [Confidential details on Avago’s offered remedy].

5.2.5.Agreements entered into after the notification of the Transaction

(122) Parallel to offering these remedies, Avago also attempted to address the Commission's competition concerns by entering into agreements with certain licensees of its SerDes IP.

(123) On 2 November 2015, the Notifying Party submitted that it reached an agreement with [Licensee] in Ethernet switch ASSPs. Specifically, Avago granted [Licensee] the option of extending the duration of the existing licensing agreement [Details about confidential license agreement]. Avago and [Licensee] also concluded a new licensing agreement on the 56G SerDes [Details about confidential license agreement].

(124) On 9 November 2015, the Notifying Party submitted that it entered into a legally binding arrangement with [Licensees], [Details about confidential license agreement]. Specifically, Avago agreed to extend the duration of the existing licenses [Details about confidential license agreement]. This provision is meant to ensure that [Licensees] will not be restricted in their ability to compete in Ethernet switch ASSPs [Details about confidential license agreement]. Further, Avago committed to negotiate and execute with [Licensees] a license agreement on the new generation 56G SerDes. [Details about confidential license agreement].

(125) Avago acknowledged that [Licensees] rely on Avago's commitment in their development plans and that, if Avago failed to fulfil its obligation, such failure would likely have detrimental effect on [Licensees] businesses. The Notifying Party [Details about confidential license agreement] undertakings vis-à-vis [Licensees] became legally binding.

5.2.6.The Commission's assessment

(126) The agreement Avago concluded with [Licensee] protects [Licensee] in ASSP Ethernet switch chips, against a foreclosure strategy in the medium term. [Details about confidential license agreement]. More importantly, [Licensee] will have the ability to compete in Ethernet switch ASSPs in the medium term as it will be able to use Avago's SerDes in its new generation chips. The contract duration was [Licensee] preference, which further supports the Commission's view that the arrangement allows [Licensee] to compete effectively. [Details about confidential license agreement].In other words, the merged entity will not be able to engage in a foreclosure strategy […].

(127) Moreover, the agreement allows [Licensee] to [Details about confidential license agreement]. The consideration payable [Details about confidential license agreement] can be regarded as a true market rate. The slightly higher rate reflects the fact that [Details about confidential license agreement] it will have access to the most modern technology.

(128) [Licensees] will also be able to continue producing their current chips [Details about confidential license agreement]. The agreement that Avago committed to execute on 50 G SerDes [Details about confidential license agreement] guaranteeing [Licensees] ability to compete in newer generation Ethernet switch ASSPs. Importantly, Avago's commitment [Details about confidential license agreement].

(129) The license agreements and arrangements do not cover [Licensee]. However, [Licensee] is not yet present today on the Ethernet switch ASSP market. Moreover, as it will take some time for [Licensee] to enter the market and then to develop a new ASSP Ethernet switch, it is plausible that other licensors of high quality SerDes IP will by that time have developed credible alternatives to Avago's SerDes technology.

(130) Accordingly, the agreements and arrangements Avago entered into address the Commission's initial competition concern. Taking the new agreements and arrangements into account, the Commission considers that Avago no longer has the ability to distort competition in Ethernet switch ASSPs. The Commission also considers therefore that the remedies offered by Avago are not necessary to address the Commission's initial input foreclosure concern.

5.3.Conglomerate relationships

(131) The Transaction gives rise to a conglomerate relationship between the Parties’ activities in two areas, namely ICs that are used in wireless applications (mobile phones and tablets) and in the so-called data center stack.

(132) With regard to wireless communication ICs, the Parties offer ICs and devices for wireless communications devices that are purchased by the same customers for the same end use. Broadcom’s wireless division produces connectivity chips for, e.g., WiFi, GPS or Bluetooth, while Avago’s Wireless Semiconductor Division produces Radio Frequency ("RF") semiconductor devices. However, as the Commission received no feedback specifically on wireless ICs in its market investigation, it will focus on the data center stack.

(133) The notion of data center stack is based on the concept of IT stack that the Commission used in the past to refer to the hardware and software components necessary for companies to ultimately use their business software applications.67 An IT stack includes the following layers: (i) physical infrastructure products, including, for instance, servers, storage units, client PCs and networking equipment, constituting the first layer, (ii) operating systems, (iii) databases, (iv) middleware, and (v) enterprise application software (EAS).68 Accordingly, data center stack refers to the set of hardware and software components used in data centers. Within the data center stack the Parties are only active in hardware components (the first layer of a hypothetical data center “IT stack”). The hardware layer of the data center stack can be further subdivided into storage, compute (server) and networking sublayers. Both Parties offer a range of products that are used in the hardware layer of the data center IT stack.

5.3.1.Notifying Party's view

(134) As regards the hardware components within the storage sublayer of data centers, the Notifying Party claims that Broadcom is […] as a result the Transaction will not bring about any change of suppliers within such sublayer.

(135) The Notifying Party further submits that Avago is only marginally active in the computing sublayer providing computing ASICs and ASSPs for data center applications. Avago has [sales of […] EUR] in the EEA in this sublayer. Broadcom […] in the data center stack […]. Transaction will not, therefore, bring about any change in this sublayer.

(136) According to the Notifying Party, both Broadcom and Avago are active in the networking infrastructure sublayer.

(137) Namely, Avago provides wireline communication ASICs for networking equipment including Ethernet switches, in particular Ethernet switch ASICs, wireline communications ASSPs (Ethernet controllers) as well as optical products (“Optics”)69 for data center infrastructure. Avago’s switch ASICs and Optics are generally found in Ethernet switches while Avago’s Ethernet controllers are generally found in servers.

(138) Broadcom, on the other hand, provides wireline communications ASSPs, in particular Ethernet controllers, which are generally found in servers, and Ethernet switch and PHY ASSPs, which are generally found in Ethernet switches. To a much more limited extent, Broadcom is also active in wireline communication ASICs, in particular Ethernet switch ASICs and PHY ASICs, which are found in networking equipment.

(139) In the Notifying Party's view, the merged entity does not have the ability to profitably bundle the Parties' respective products within the networking sublayer. Avago’s offer focuses on ASICs, whereas Broadcom specializes in ASSPs. ASICs and ASSPs follow very different product cycles, and reflect different fundamental choices by the OEM to build a customized IC or rely on an off-the-shelf product.

(140) The Notifying Party submits that tying and bundling would not be feasible or practicable across sublayers either. Technology and procurement for the data center compute sublayer is driven by Intel and its product roadmap for processors. The Notifying Party further submits that OEMs have to follow Intel given that it is the de facto prevailing technological solution. The typical product cycle in the compute sub layer is approximately 2 years, is driven by Intel’s innovations and the product cycle in the storage sublayer tracks closely that of the compute sublayer.

(141) In the view of the Notifying Party, the networking sublayer is, however, independent from the compute and storage sublayers as it requires different expertise and is run by different procurement teams. The Notifying Party argues that products in this sublayer follow different product cycles than products in other sublayer and differ even within the sublayer. Optics are commodities, and new products are launched every 6 months whereas product cycles for ASICs and ASSPs in the networking layer range from 18 months to 3 years, depending on the product. An IC producer would not delay product introductions in order to synchronize product cycles between layers because time-to-market is a key competitive parameter in ICs. The Notifying Party concludes that for these reasons, in areas where the Transaction brings about a change bundling and tying across sublayers would not be practicable.

5.3.2.Results of the market investigation and Commission's assessment

(142) As a preliminary remark the Commission notes that its assessment is restricted to potential exclusionary tying and bundling practices that could result from the Transaction. In the context of this Decision, the Commission cannot and does not take a view on potential bundling and tying practices within the existing product sets of Avago or Broadcom.

(143) In response to the Commission's questionnaire a number of market participants submitted that the Transaction could increase the ability and incentive of the merged entity to tie and/or bundle some of its products, especially in light of the Parties' complementary product portfolios.70

(144) These comments were not, however, substantiated as to the mechanics and the likely success of a bundling or tying strategy. The investigation did not point to a specific product set and customer group in respect of which a bundling or tying strategy could be successfully applied.71

(145) In this regard, the Commission notes that, in line with the Non-Horizontal Merger Guidelines, the mere fact that the merged entity will have a broader range of products is insufficient to conclude that the Transaction will significantly increase the risk of abusive tying and bundling.72

(146) The Commission requested detailed data on the Parties’ respective sales and market shares within each sublayer of the hardware layer of the data center stack.

(147) According to this data, in the computing (server) sublayer both Parties' presence is minimal73 as Avago has a [0-5]% share in ASICs, less than [0-5]% in ASSPs, while Broadcom […] and has a [0-5]% share in ASSPs. Accordingly the risk of tying and bundling could be excluded within the computing (server) sublayer. In the storage sublayer Broadcom […]74, so the Transaction would have no effect within this sublayer either.

(148) Both Parties are present, however, in the networking sublayer.

(149) Broadcom has a strong portfolio in the networking layer, with products such as Ethernet Switch ASSPs (a worldwide market share of [70-80]%), and PHY ASSPs (a worldwide market share of [60-70]%). Avago also has a presence in Ethernet Switch ASICs, where it holds a [20-30]% share on a worldwide basis. In addition, Avago competes in PHY ASICs, where it is holds a [20-30]% share on a worldwide basis. The Parties have a number of overlapping customers in the storage and the networking layer, such as [Confidential information on customers].

(150) In this sublayer therefore the potential risk of exclusionary tying and bundling needs to be further examined.

(151) In this regard, the Commission's market investigation results indicated that ASICs and ASSPs are treated separately within the OEMs.75 ASICs and ASSPs have different characteristics in terms of size and technology, different design, need different know-how, have different costs and are produced in different production lines.76

(152) ASICs are based on the cooperation between the ASIC vendor and the OEM and take several years to develop. Such development work, which is tailored to the needs of the OEM, is costly and due to their custom nature ASICs benefit much less from economies of scale than ASSPs. As a result, not all OEMs can afford to employ ASICs. The OEMs that can afford it embark on these costly ASIC projects to differentiate their products from those of their competitors.

(153) Due to the fundamental difference between and the separate treatment of ASICs and ASSPs, they are procured separately by OEMs.77 Even if such separate procurement may not prevent tying and bundling between ASSP and ASIC products, it would make it considerably more difficult for the merged entity to force such a strategy on its customers.

(154) Another element that might make tying and bundling more difficult is the fact that customers in this area are large technology companies. [Confidential information on customers]. These customers made up [40-50]% of Avago's ASIC revenues and [20-30]% of Broadcom's revenues in the networking sublayer in 2014. These customers are sophisticated market participants that will closely evaluate other options in case the merged entity would try to impose tying or bundling upon them, including the possible option to start in-house production of certain chips or to support entry.78

(155) Furthermore, due to the distinct nature of ASICs and ASSPs, their development cycle is also different.79 As time to market is important for IC vendors, it would be impractical to delay the offer in either product type in an attempt to bundle them together. While this aspect also does not eliminate the risk of tying and bundling entirely (in principle the merged entity could tie or bundle products that reach the market at different times) it does make the implementation of such practices more difficult.

(156) It is therefore unlikely that the Transaction would give rise to an increased risk of exclusionary tying or bundling across ASICs and ASSPs. As the only bundling and tying possibilities that are specific to the Transaction arise from the combination of ASSPs and ASICs, this means that it is unlikely that the Transaction would meaningfully increase the risk of tying and bundling in the networking sublayer.

(157) With regard to the potential risk of tying and bundling across (and not within) the different sublayers, the merger specific theoretical possibilities include i) leveraging either party's strong position in the networking sublayer to the markets in other sublayers where the other party has a meaningful presence and ii) leveraging Avago's strong position in the storage sublayer to the markets in the other sublayers where Broadcom has a meaningful presence.

(158) Both Parties' presence in the computing sublayer is minimal (Avago has a [0-5]% share in compute ASICs and Broadcom has a [0-5]% share on a worldwide basis in compute ASSPs) and some of the computing sublayer segments are dominated by Intel. Accordingly, bundling combinations involving the compute sublayer are very unlikely.

(159) It follows that both potential bundling and tying possibilities would involve combinations across the networking and the storage sublayers.

(160) In this regard the bundling possibilities are restricted to the customers with a presence in both sublayers. On the basis of information requested by the Commission, the most important customers that fit this description are [Confidential information on customers].80 As explained in paragraph (154), these are large and sophisticated customers.

(161) Further, storage and networking products require different expertise and thus are unlikely to be procured together at OEMs. In addition, even across sublayers most of the merger specific possible bundling possibilities involve the bundling of ASICs with ASSPs, which, as explained in paragraphs (151) to (156) are unlikely to be bundled. In addition, the product cycle in the networking sublayer is different with the storage sublayer as the product cycle in the storage sublayer follows closely the compute sublayer and is decoupled from the networking sublayer. Thus differences in time-to-market make it unlikely that bundling and tying across these layers would be practicable.

(162) On the basis of the market investigation results and the other evidence available to it, the Commission therefore considers that tying and bundling across sublayers is unlikely and accordingly, the Transaction is unlikely to lead to a significant impediment of effective competition.

6.CONCLUSION

(163) For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 ("the EEA Agreement").

3 Publication in the Official Journal of the European Union No C 336, 10.10.2015, p. 2.

4 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

5 Commission decision of 17 September 2015 in Case M.7585 - NXP Semiconductors / Freescale Semiconductor, para. 14.

6 They may, for instance, repeat and strengthen the signal, which may have deteriorated due to distance (so-called “channel loss”), equalize it, convert it between analogue and digital form, serialize or de- serialize it, increase or reduce its speed, or reduce the deviation from its original frequency (so-called “jitter”).

7 For more details on data center stacks, see paragraph (133).

8 As mentioned in paragraph (69), other than Ethernet switch ASICs, the Transaction would not give rise to an affected market under any narrower market definition within the broader market for wireline communication ASICs.

9 The Commission notes that, in relation to another type of ASSPs, namely PHY ASSPs, the Parties’ activities used to overlap until November 2014, when Avago discontinued its activities. Therefore there is no longer any overlap between the Parties’ activities in relation to PHYs ASSPs while minor overlaps still exists in the broader market for wireline communication ASSPs, see Section 5.1.2.

10 IP blocks are designs which perform a specific function, for instance computation, memory access and SerDes. Such blocks can be developed in-house or licensed and the IC vendors will assemble several blocks in order to have the final design of their ICs.

11 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 6; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 6.

12 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 5 and 5.1; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 5.

13 Replies to Commission questionnaire to customers Q2 of 5 October 2015, question 5.

14 Replies to Commission questionnaire to customers Q2 of 5 October 2015, question 10.

15 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 10; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 10.

16 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 7.1 and 7.1.1; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 7.1 and 7.1.1.

17 Commission decision of 24 June 2002 in Case M.2820 - STMicroelectronics/AlcatelMicroelectronics; Commission decision of 3 July 2001 in Case M.2439 - Hitachi/STMicroelectronics/SuperH JV; Commission decision of 10 August 2007 in Case M.4751- STM/Intel/JV; Commission decision of 27 June 2008 in Case M. 5173 - STM/NXP/JV; Commission decision of 25 November 2008 in Case M. 5332 - Ericson/STM/JV; and Commission decision of 2 December 2009 in Case M.5535 - Renesas Technology/NEC Electronics.

18 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 13; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 13.

19 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 6; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 6.

20 See paragraph (32).

21 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 7.1 and 7.1.1; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 7.1 and 7.1.1.

22 Commission decision of 24 June 2002 in Case M.2820 - STMicroelectronics/AlcatelMicroelectronics; Commission decision of 3 July 2001 in Case M.2439 - Hitachi/STMicroelectronics/SuperH JV; Commission decision of 10 August 2007 in Case M.4751 - STM/Intel/JV; Commission decision of 27 June 2008 in Case M. 5173 - STM/NXP/JV; Commission decision of 25 November 2008 in Case • 5332 - Ericson/STM/JV; and Commission decision of 2 December 2009 in Case M.5535 - Renesas Technology/NEC Electronics.

23 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 13; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 13.

24 "G" stands for gigabit per second.

25 See replies to RFI 4 question 2.

26 See replies to RFI 4 question 2.

27 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 11 and 11.1; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 11 and 11.1.

28 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 12; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 12.

29 See for instance the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET.

30 Commission decision of 24 June 2002 in Case M.2820 - STMicroelectronics/AlcatelMicroelectronics; Commission decision of 3 July 2001 in Case M.2439 - Hitachi/STMicroelectronics/SuperH JV; Commission decision of 10 August 2007 in Case M.4751- STM/Intel/JV; Commission decision of 27 June 2008 in Case M. 5173 - STM/NXP/JV; Commission decision of 25 November 2008 in Case • 5332 - Ericson/STM/JV; and Commission decision of 2 December 2009 in Case M.5535 - Renesas Technology/NEC Electronics.

31 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 13; replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 13.

32 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 18; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 18.

33 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 14; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 14.

34 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 18; replies to Commission questionnaire to customers Q2 of 5 October 2015, question 18.

35 […].

36 Form CO paragraph 193.

37 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 12; replies To Commission questionnaire to customers Q2 of 5 October 2015, questions 12.

38 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET.

39 See the non-confidential minutes of a conference call with a market participant dated 14 October 2015 at 18.00 CET.

40 See for instance the replies to Commission questionnaire to customers Q2 of 5 October 2015, question 24.1, 24.3, the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET, the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET.

41 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 24, replies to Commission questionnaire to customers Q2 of 5 October 2015, question 25.

42 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 23, the replies to Commission questionnaire to customers Q2 of 5 October 2015, question 24 and 24.3, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET.

43 See the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET.

44 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET. the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET.

45 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 26 and 26.1, replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 27 and 27.1, the non-confidential minutes of a conference call with a market participant dated 14 October 2015 at 18.00 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET.

46 See for instance the non-confidential minutes of a conference call with a competitor dated 4 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET, the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, replies to Commission questionnaire to customers Q2 of 5 October 2015, question 24.3.

47 the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a customer dated 5 November 2015 at 16.15 CET, the non-confidential minutes of a conference call with a competitor dated 4 November 2015 at 18.00 CET.

48 See the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET.

49 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET; the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET; the non-confidential minutes of a conference call with a customer dated 5 November 2015 at 16.15 CET, the non-confidential minutes of a conference call with a market participant dated 14 October 2015 at 18.00 CET, the non-confidential minutes of a conference call with a competitor dated 4 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET. Even those market participants that did not consider Avago's SerDes as the best referred to it as one of the best out of the top two.

50 See the non-confidential minutes of a conference call with a market participant dated 14 October 2015 at 18.00 CET; the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET; reply of a market participant to Commission questionnaire to customers Q2 of 5 October, question 24.2.

51 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET.

52 See the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a customer dated 5 November 2015 at 16.15 CET,the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET.

53 See for instance the non-confidential minutes of a conference call with a competitor dated 9 November 2015 at 16.00 CET.

54 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a competitor dated 9 November 2015 at 16.00 CET, the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET.

55 See the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET, the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 18.00 CET.

56 See the non-confidential minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a customer dated 5 November 2015 at 16.15 CET, the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET, the non-confidential minutes of a conference call with a competitor dated 4 November 2015 at 18.00 CET, the non-confidential minutes of a conference call with a competitor dated 9 November 2015 at 16.00 CET, the non-confidential minutes of a conference call with a market participant dated 14 October 2015 at 18.00 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET.

57 See the non-confidential minutes of a conference call with a competitor dated 6 November 2015 at 12.00 CET.

58 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, the non-confidential minutes of a conference call with a competitor dated 26 October 2015 at 17.00 CET, the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET.

59 See for instance the non-confidential minutes of a conference call with a customer dated 29 October 2015 at 17.00 CET.

60 Replies to Commission questionnaire to customers Q2 of 5 October 2015, questions 24.2 and 28.

61 See the non-confidential minutes of a conference call with a customer dated 5 November 2015 at 16.15 CET.

62 See for instance the non-confidential minutes of a conference call with a competitor dated 28 October 2015 at 16.30 CET, See the non-confidential minutes of a conference call with a customer dated 26 October 2015 at 17.00 CET.

63 See paragraph (87)

64 See Form CO, paragraph 115, 151 and 172 the non-confidencial minutes of a conference call with a customer dated 6 November 2015 at 18.00 CET the non-confidential minutes or a conference call with a customer dated 29 Octobre 2015 at 17.00 CET.

65 Form CO, annex 18.

66 Form CO, paragraph 172.

67 Case COMP/M.7334 - Oracle / Micros, recital 30.

68 Case COMP/M.5529 - Oracle / Sun Microsystems, recitals 24 and following.

69 Avago supplies optical transceivers, which are classified as optical semiconductors. Those products are modules that enable computer systems to use fiber optic technology to communicate between system components. Avago represents only [5-10]% of the segment. Broadcom does not supply Optics.

70 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, questions 20-22.

71 See replies to Commission questionnaire to competitors Q1 of 5 October 2015, question 20.1.

72 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008, p. 6–25, paragraph 104.

73 Form CO, Annex 18.

74 Form CO, Annex 18.

75 Replies to Commission questionnaire to customers Q2 of 5 October 2015, question 5.

76 Replies to Commission questionnaire to customers Q2 of 5 October 2015, question 10.

77 See for example the reply of a customer in Replies to Commission questionnaire to customers Q2 of 5 October 2015, question 10.

78 See for example Cisco's support for a chip start-up that would compete with Broadcom http://www.wsj.com/articles/chip-startup-backed-by-cisco-systems-lands-eighth-funding-round- 1444017602.

79 See for example Marvell's non-confidential reply to Commission questionnaire to customers Q2 of 5 October 2015, question 10.1.

80 Form CO, Annex 18.