Commission, June 14, 2016, No M.7972

EUROPEAN COMMISSION

Judgment

ITW / EF&C

Dear Sir/Madam,

Subject:Case M.7972 – ITW / EF&C

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 10.05.2016, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Illinois Tool Works Inc. ("ITW", USA) will acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the Engineered Fasteners & Components ("EF&C") Business unit of ZF TRW Automotive Holdings Corp. ("TRW", Germany), a wholly owned subsidiary of ZF Friedrichshafen AG, Germany, by way of purchase of shares and assets. ITW is hereinafter referred to as the "Notifying Party", and ITW and EF&C are collectively referred to as the "Parties".

1.THE PARTIES

(2) ITW, headquartered in Illinois, USA, is a global manufacturer of a diversified range of industrial products and equipments. Its Automotive OEM business manufactures plastic and metal fasteners and other plastic components (pressure release valves, acoustic baffles and nozzle chains),3 as well as other body, powertrain and braking parts.

(3) EF&C, headquartered in Enkenbach, Germany, manufactures plastic fasteners and other plastic interior components, which it supplies globally to OEMs and Tier 1 customers.

2.THE CONCENTRATION

(4) The proposed transaction (the “Transaction”) involves the acquisition of sole control of EF&C by ITW by way of a series of asset disposals and equity sales among TRW's wholly-owned subsidiaries that comprise EF&C. The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3.EU DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million4 [ITW: EUR 12 082 million, EF&C: EUR […]]. However, they do not both have an EU-wide turnover in excess of EUR 250 million [ITW: EUR […], EF&C: EUR […]]. The notified operation therefore does not have Community dimension within the meaning of Article 1 of the Merger Regulation, but it was referred to the Commission pursuant to Article 4(5) of the Regulation.

4.RELEVANT MARKETS

(6) The Parties' activities overlap in relation to the manufacture and supply of plastic fasteners and pressure release valves (“PRVs”) for passenger and light commercial vehicles for Original Equipment Manufacturers (“OEMs”) and Tier 1 suppliers within the EEA. The Parties do not produce components for heavy vehicles and do not sell to the independent aftermarket.

4.1.Relevant product market

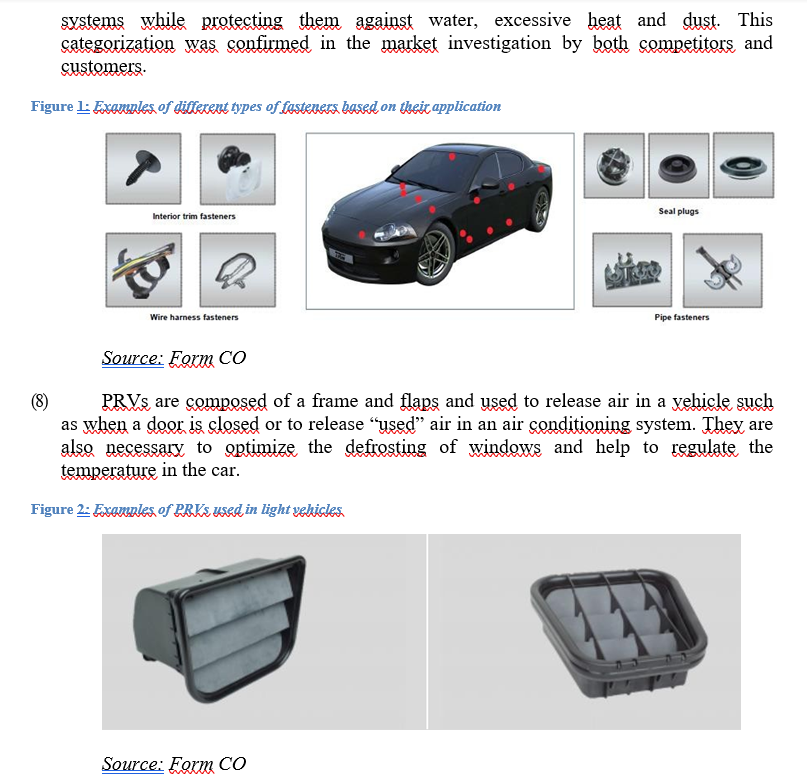

(7) Fasteners are diversified components designed to satisfy a fastening need. Metal fasteners are produced by either stamping or cold forming technology, while plastic fasteners are manufactured using injection moulding machines and tools. EF&C does not manufacture metal fasteners. With regard to their application, the Parties distinguish the following types of fasteners5: (i) plugs: used to close holes in the car body; (ii) trim fasteners: clips designed to join two pieces of fabric or material together; (iii) pipe fasteners: used to protect and fix pipes enabling them to remain safely in place; and (iv) wire harness fasteners: designed to secure routing and fastening of wire harness

systems while protecting them against water, excessive heat and dust. This categorization was confirmed in the market investigation by both competitors and customers.

Figure 1: Examples of different types of fasteners based on their application

Source: Form CO

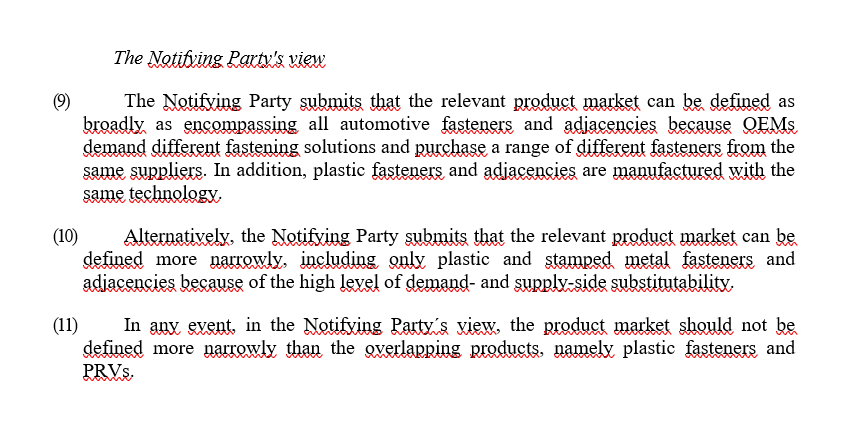

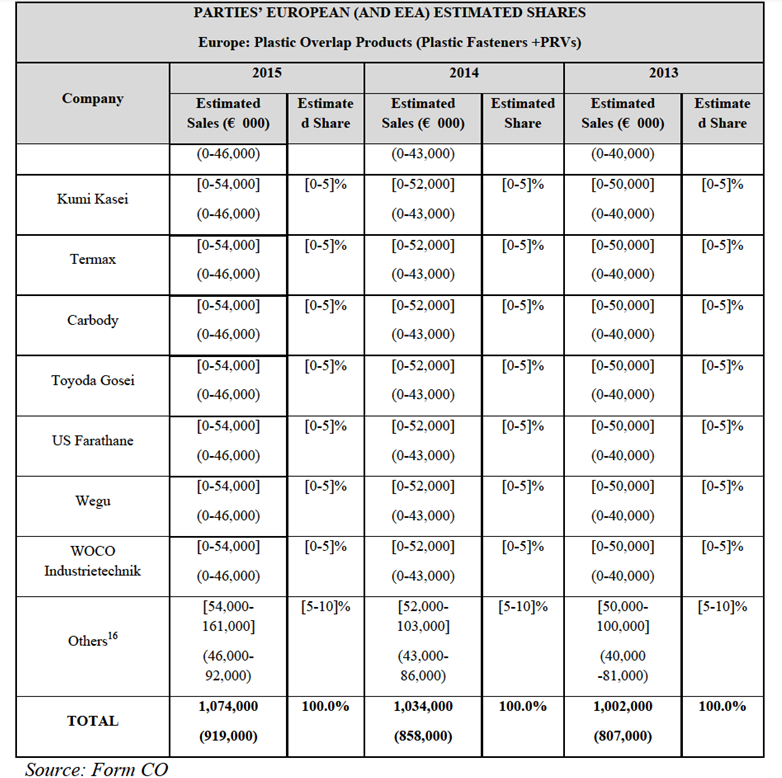

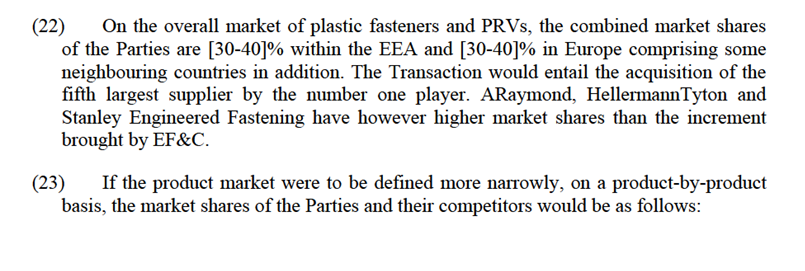

(8) PRVs are composed of a frame and flaps and used to release air in a vehicle such as when a door is closed or to release “used” air in an air conditioning system. They are also necessary to optimize the defrosting of windows and help to regulate the temperature in the car.

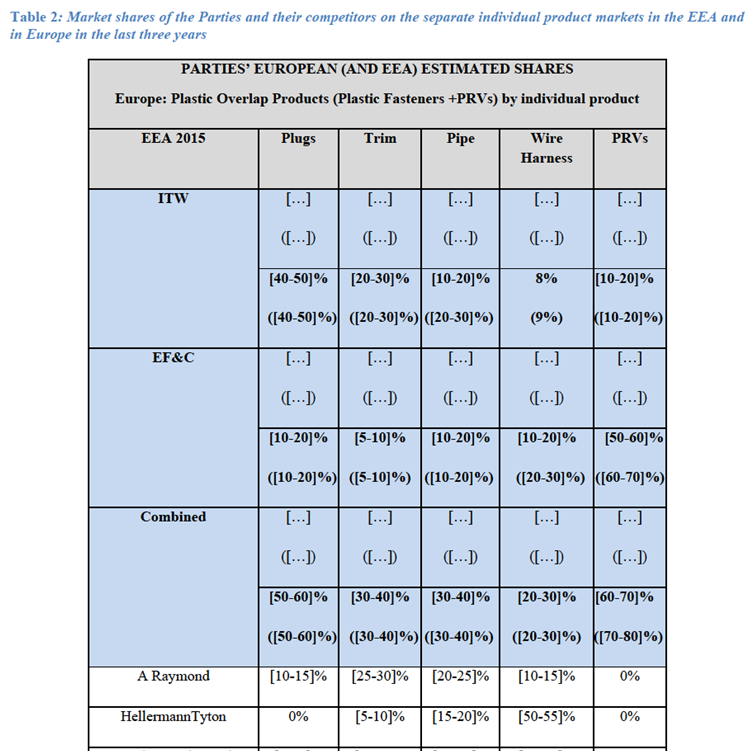

Figure 2: Examples of PRVs used in light vehicles

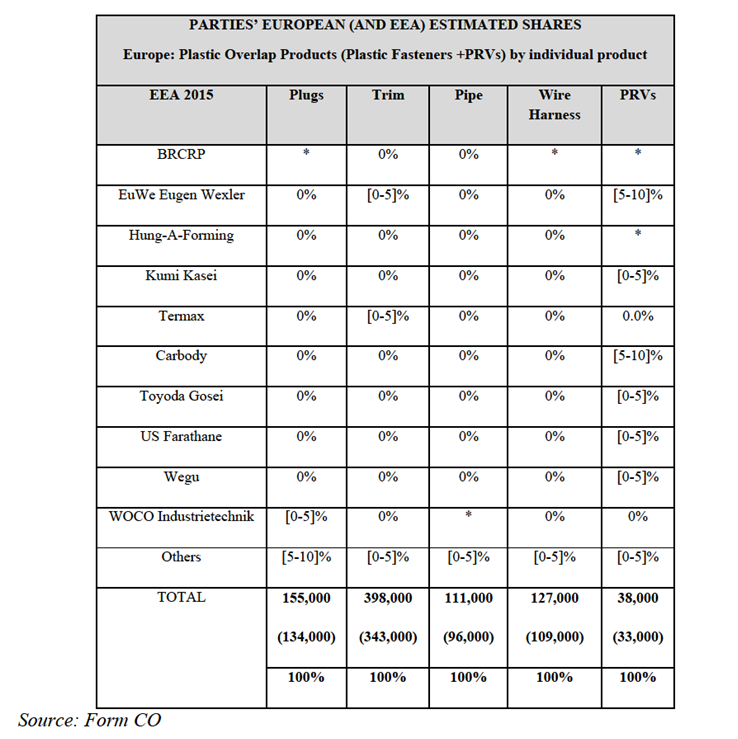

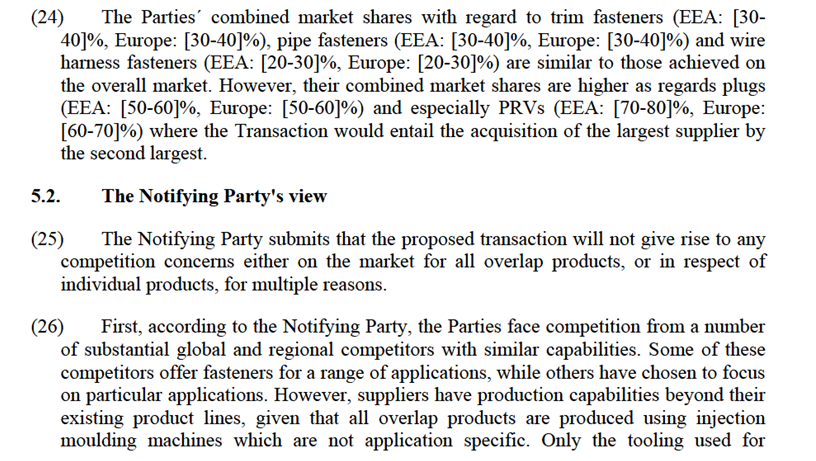

Source: Form CO

The Notifying Party's view

(9) The Notifying Party submits that the relevant product market can be defined as broadly as encompassing all automotive fasteners and adjacencies because OEMs demand different fastening solutions and purchase a range of different fasteners from the same suppliers. In addition, plastic fasteners and adjacencies are manufactured with the same technology.

(10) Alternatively, the Notifying Party submits that the relevant product market can be defined more narrowly, including only plastic and stamped metal fasteners and adjacencies because of the high level of demand- and supply-side substitutability.

(11) In any event, in the Notifying Party´s view, the product market should not be defined more narrowly than the overlapping products, namely plastic fasteners and PRVs.

The Commission's assessment

(12) According to the Commission's practice, separate relevant product markets exist for each individual automotive component.6 The Commission has previously identified separate relevant product markets depending on the channel into which the components are sold,7 as well as on the type of vehicle they are intended for.8 The Parties are not active on the independent aftermarket and manufacture components only for light vehicles.

(13) The Commission has previously considered that fasteners constitute a separate relevant product market,9 it has however not reached a conclusion on whether there is a separate product market for automotive fasteners.10

(14) In the present case, the Commission considers it inappropriate to define the market as broadly as to encompass all automotive fasteners and adjacencies or alternatively plastic and stamped metal fasteners and adjacencies. Indeed, plastic and metal components are manufactured not just with different materials but using different technologies. Therefore, there is no supply-side substitutability with regard to the two types of products. In addition, certain applications demand such technical requirements11 that cannot be fulfilled by plastic components, hence the material of the component is already determined in the request for quotation (“RFQ”).

(15) On the other hand, there are indications that plastic fasteners and PRVs may belong to the same relevant product market. First, there is some supply-side substitution as these components are manufactured with the same raw material, using the same technology. The injection moulding machines can be used for the production of a wide range of products, as only the tooling is specific, therefore the suppliers can easily expand their production from one type of plastic product to another. Competitors have confirmed that even if they do not currently manufacture all of the overlapping products, they would be technically able to do so.12 Second, OEMs invite the same suppliers to bid for the production of plastic components and sometimes issue tenders on a portfolio level.13

(16) The question however, whether the relevant product market should be defined even more narrowly, on a product by product basis, can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether this distinction is made.

4.2.Relevant geographic markets

The Notifying Party's view

(17) The Notifying Party submits that the relevant market is at least regional – encompassing the EEA and neighbouring countries (such as Turkey, Russia, Uzbekistan, Serbia, Kazakhstan, Belarus, and Ukraine) – but might be global in scope. This is due to low transportation costs, the lack of regulatory barriers, and the global presence of suppliers as well as customers.

The Commission's assessment

(18) In previous decisions, the Commission concluded that the relevant geographic market for sales to "OEMs" is at least EEA-wide.14

(19) In the present case the Commission considers that the relevant geographic market cannot be defined as broadly as worldwide in scope. Although the customers and suppliers are mostly global companies, and some OEMs have a global sourcing strategy, the market investigation confirmed that the demand has a local component. It is important that the supplier´s manufacturing facility is in the same region as the car production plant.15 However, due to the relatively low transportation costs of these small components and the fact that fasteners and PRVs do not have to be supplied just in sequence, the plants do not necessarily have to be in the close vicinity of each other.

(20) The question of whether the relevant geographic market should comprise only the EEA or the neighbouring countries as well can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether this distinction is made.

5.COMPETITIVE ASSESSMENT Non-Coordinated Horizontal Effects

5.1.Market structure

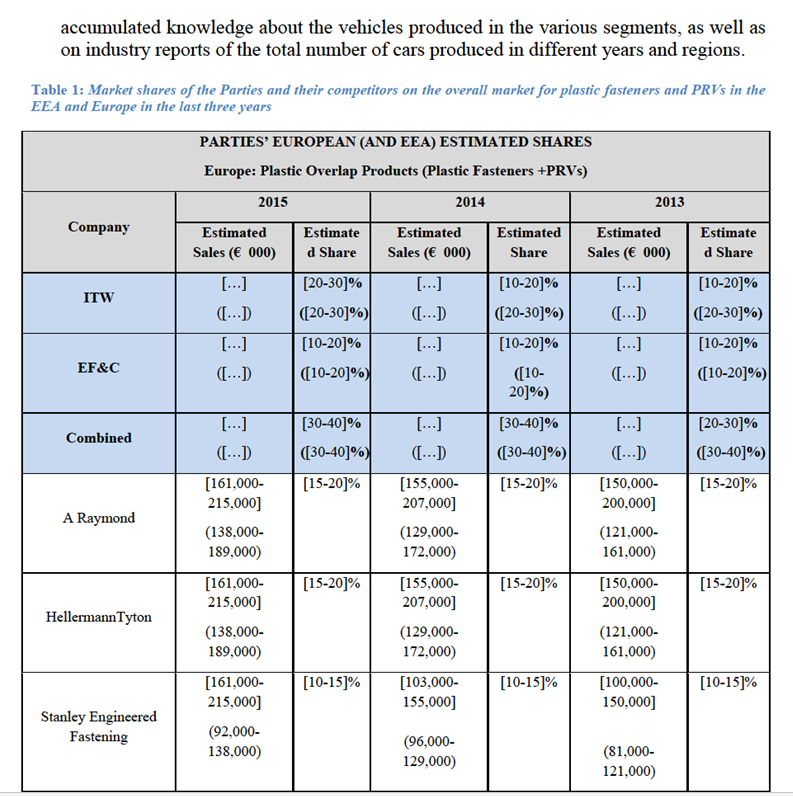

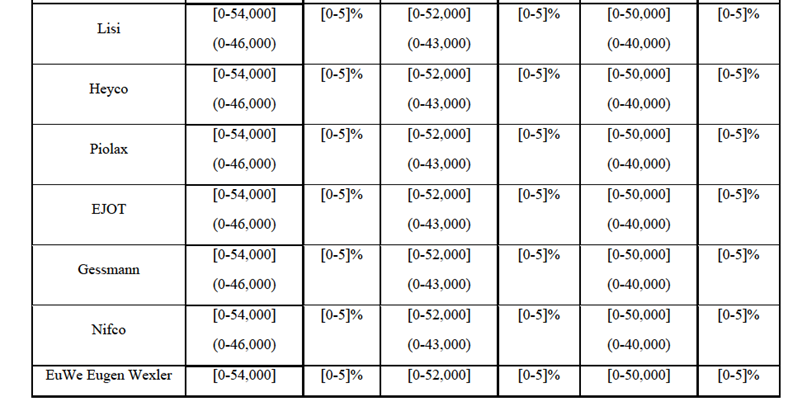

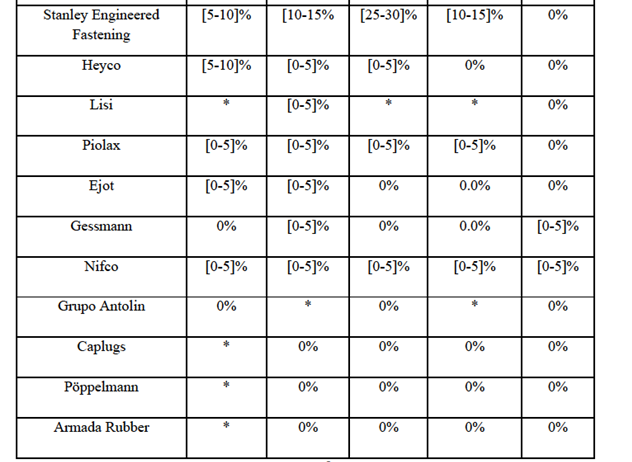

(21) The Notifying Party submits that there is no industry-wide standard or publicly available data to calculate the total size of the relevant product market and the market shares of the suppliers present. As a result, estimates are generated based on a number of factors. The Notifying Party relies in particular on its current real penetration in existing models; tear downs of models; analysis of RFQs; intelligence from customer visits and

moulding the product is by nature product specific, however the tools are not particularly costly and they are sometimes financed or owned by OEMs.

(27) Second, the Notifying Party submits that shares in terms of individual products are not reflective of market power: while the Parties have high shares in some products, penetration varies significantly across customers, which shows that alternatives are available to customers.

(28) Third, the market for the supply of overlap products is highly competitive: suppliers compete in tenders which are primarily organised on a product-by-product basis.

(29) Fourth, customers are sophisticated and have strong buyer power. They expect suppliers to make regular price decreases, they conduct market tests to find out whether better alternatives are available and threaten to switch suppliers or engage in other types of retaliatory conduct (e.g. by putting the supplier on a "new business hold") if they are faced with what they consider to be unjustified price increases.

5.3.The Commission's assessment

(30) The Commission has carried out a market investigation among customers and competitors to assess whether the Transaction would lead to the removal of an important competitive constraint, which would not be outweighed by the entry or expansion of other companies and by customers' buyer power. As the exact product market definition was left open, the Commission has assessed the conditions of competition with respect to the individual products and has found no significant differences between them in this respect.

(31) The Parties face competition from a number of other suppliers with respect to each of the overlap products. While indeed the various suppliers' share in a customer's total purchases of the products varied significantly across customers (in line with the Parties' argument regarding differences in the degree of penetration), the majority of customers surveyed indicated ARaymond, HellermannTyton, Stanley Engineered Fastening, Nifco, and Piolax as the main suppliers of the various categories of plastic fasteners, alongside ITW.17 In addition to the suppliers listed in Table 2, customers mentioned Springfix, Revifa, SBE, Gruppo Fontana, Gruppo Agrati, Da-Tor, Caillaou, Ahlberg, Voestalpine, Kemmerich, Grosshaus, Pöppelmann as suppliers of fasteners.18 As regards PRVs, the Parties' main competitors are Wegu, Carbody and US Farathane. Nifco, Denso and Sanden were also named by some customers among their suppliers.19

(32) In addition, the Parties are not seen as each other's closest competitors on the market. This is confirmed by the fact that their presence differs significantly not only with regard to their supply to each individual customer20 but also as regards their supply of different products. Furthermore, EF&C does not manufacture metal fasteners, which excludes it from tenders for fasteners for certain applications, as well as for portfolios including metal fastening solutions. In addition, EF&C is perceived by some customers and competitors as having become less competitive in recent years.21

(33) While their sales shares with respect to different customers or types of products differ, the suppliers mentioned in the paragraph 35 are similar in terms of technical capabilities and can produce both standardized products, purchased "off-the-shelf", and products that cater to an individual OEM's specific requirements.22

(34) Automotive OEMs differ in their approaches to the design of fasteners and PRVs. While some OEMs prefer to rely on standardized products and to carry products over to new platforms to the highest extent possible, others seek to use differentiated designs for new vehicle models. In the latter case, some OEMs undertake the development of a new design in-house, sometimes with the support of suppliers, while others entrust the development entirely to suppliers. The main suppliers surveyed by the Commission all have the engineering capabilities and requisite understanding of the automotive industry to develop solutions that cater to customers' individual needs with respect to the various categories of overlap products.

(35) Furthermore, just like the Parties, their main competitors have manufacturing facilities in multiple countries in Europe. As described in paragraph (19) above, while plastic fasteners and PRVs can easily be shipped across the world and certain OEMs indeed purchase centrally for their entire global operations, the majority of customers surveyed indicated that they prefer their supplier to be based in the same region, i.e. in Europe.

(36) With regard to each individual product, apart from their existing competitors, the Parties also face potential competition from suppliers of other overlap products produced using injection moulding technology.

(37) The injection moulding technology used to manufacture plastic fasteners and PRVs is used to produce a broad range of products, for both automotive and non-automotive uses. While there is a relationship between the size of the moulding tool and that of the machine, an injection machine can be utilized with many different moulding tools to produce parts of different shape and size. The customers and competitors surveyed unanimously confirmed that, from a technological point of view, any producer of one type of overlap product could relatively easily expand their production to another type of overlap product.

(38) The Commission has also analysed whether the existence of IP rights could prevent other competitors or potential competitors from supplying the products manufactured by the Parties. Indeed, a share of overlap products are patented. Both the Parties and their competitors (as well as customers) own large portfolios of patents for plastic fasteners and PRVs. However, this does not appear to be an industry where IP rights drive the competitive process. Patents typically relate to the development of a specific product design in response to particular RFQs; they do not cover broad concepts covering broad fields of exclusivity and in general they can be worked around. This is consistent with the fact that all of the main competitors of the Parties hold large portfolios of patents and with the fact that patent infringement suits are rare in this industry. Thus, rather than effectively preventing competition from other automotive suppliers of plastic fasteners or PRVs, patents appear to be a way of signalling the suppliers' capacity to innovate and to respond to customers' technical requirements and needs, and the Parties do not appear to have a distinct advantage over their main competitors in this respect.23

(39) To conclude, the Parties face competition from a number of suppliers having similar design and manufacturing capabilities. In addition to the competitive constraints exercised by other suppliers, the Parties are also faced with the pressure from their customers, who procure the fasteners and PRVs through competitive tenders and demand periodic price reductions.

(40) OEMs and their Tier 1 suppliers organise tenders to source plastic fasteners and PRVs. While customers sometimes group several products into a single tender, usually they are organised at the level of individual products, which means suppliers participate in numerous tenders every year.

(41) Following a tender, the contract is awarded for various lengths: some customers make use of open-ended contracts, others of contracts concluded for the lifetime of a car model, while others yet rely on yearly contracts. However, even in the case of longer term contracts, prices are reviewed and are expected to decrease periodically. Indeed, an annual reduction (in the range of 2-5%) is usually foreseen at the outset of the contract.24

(42) Ad-hoc negotiations of prices during the contract also take place: increases need to be justified by objective circumstances, e.g. changes in input prices or in volumes demanded, however negotiations usually result in price decreases. A number of customers indicated that they conduct periodic market tests and require their supplier to match the offers received if these are more competitive. While OEMs generally try to avoid actually switching suppliers, negotiations resulting in price decreases are relatively frequent in the industry.25

(43) In addition, although it is not common for customers to switch suppliers before the end of contract, all OEMs surveyed source their fasteners and PRVs from several suppliers, which facilitates switching and increases their power during negotiations. This is further enabled by the common practice among OEMs to own the moulding tools, in particular when they are used to produce OEM-specific parts.

(44) It thus appears that customers of the Parties and their competitors have significant buyer power which permits them to countervail attempts by suppliers to increase prices, unless objectively justified.

6.CONCLUSION

(45) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 ('the Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p.3 ("the EEA Agreement").

3 Within ITW’s Automotive business, PRVs, acoustic baffles and nozzle chains are referred to as “adjacencies” to fasteners. They are not fastening products but are plastic components made in the same facilities using the same technology and equipment and are purchased by the same group of customers.

4 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

5 EF&C categorizes its plastic fasteners in this way. By contrast, ITW does not use such categorization in its ordinary course of business.

6 See cases COMP/M.6714 U-Shin / Valeo CAM (2013); COMP/M.6083 Fiat / GM / VM Motori JV (2011); COMP/M.6045 JCI / CRH (2011); COMP/M.5930 JCI / Michel Thierry Group (2010); COMP/M.4524 Nemak / Hydro Castings (2007).

7 Sales through the OEM/OES channel and to the independent aftermarket constitute separate relevant product markets.

8 Components for passenger cars and light commercial vehicles (below 6 tonnes) and for heavy commercial vehicles constitute separate relevant product markets.

9 See case COMP/M.7593 Alcoa / RTI International Metals (2015).

10 See cases COMP/M.5570 Platinum Equity Group / Delphi Corporation (2009); IV/M.721 Textron / Valois (1996).

11 Plastic components cannot be used in some circumstances such as when subjected to high temperature (e.g. in the engine).

12 Minutes of conference calls with competitors from 12, 17, 19 and 20 May 2016.

13 Minutes of conference calls with customers from 17 and 20 May 2016 and with competitors from 12 and 19 May 2016.

14 See cases COMP/M.6640 Delphi/FCI MVL (2012); COMP/M.6470 TE/Deutsch (2012).

15 Minutes of conference calls with customers from 13,17, 19, 20 and 25 May and with competitors from 12, 17, 19 and 20 May 2016.

16 This includes competitors such as BRCRP, Grupo Antolin and Poeppelmann.

17 Minutes of conference calls with customers from 13, 17, 20 May 2016.

18 Minutes of conference calls with customers from 13, 17, 20 May 2016.

19 Minutes of conference call with a customer from 13 May 2016.

20 ITW's main customers of fasteners are, in decreasing order, FCA, Volkswagen, Renault and BMW. The majority of EF&C's fastener sales go to Volkswagen, BMW, Ford and Hyundai.

21 Minutes of conference call with a customer from 13 May 2016.

22 Minutes of conference calls with competitors from 12, 19, 20 May 2016.

23 Reply to Commission's request for information of 19 May 2016, minutes of conference calls with customers of 20 and 30 May 2016, and with competitors of 17, 20, 27 and 30 May 2016.

24 Minutes of conference calls with customers from 13, 17, 19, 20 May 2016.

25 Minutes of conference calls with customers from 13, 17, 19, 20 May 2016.