Commission, April 11, 2017, No M.8405

EUROPEAN COMMISSION

Judgment

LEAR / GRUPO ANTOLÍN ASSETS

Subject: Case M.8405 - LEAR / GRUPO ANTOLÍN ASSETS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 8 March 2017, the Commission received notification of a proposed concentration ("the Transaction"), pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking Lear Corporation, USA ("Lear" or “Notifying Party”) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the seat and metal business of Grupo Antolín-Irausa, S.A., Spain ("the Target") by way of purchase of shares and assets.3 (Lear and the Target are designated hereinafter as "the 'Parties".)

1.THE PARTIES

(2) Lear is active globally in the supply of complete automotive seating systems and components, as well as electrical distribution systems and electronic components. In particular, Lear’s activity in the seating segment includes the design, development, engineering, just-in-time ("JIT") assembly and delivery of complete seat systems to original equipment manufacturers ("OEMs"), and design, development, engineering and manufacture of all major seat components, including seat covers and surface materials such as leather and fabric, seat structures and mechanisms, seat foam and headrests.

(3) The Target constitutes a business unit comprising the complete seat assemblies, the metal seat structures, the recliners and the seat covers businesses of Grupo Antolín-Irausa, S.A. including all the companies and the assets pertaining to such businesses. The Target includes assets and companies being active across different stages of the seats production and marketing value chain, providing both components of car seats (steel and light alloy components, frames, mechanisms and seat covers), and complete seat assemblies.

2.THE TRANSACTION

(4) The Transaction will be carried out by transfer of shares and assets and will result in Lear acquiring sole control over the Target. Particularly, the Transaction will be carried out as follows: a. […]* b.Grupo Antolín will transfer to Lear its 70% participation in Antolín CIE Czech Republic SRO (“Antolín CIE”). The remaining 30% shares in Antolin CIE will be transferred to Lear by the remaining shareholder, CIE Berriz, S.L.. Antolin CIE's shareholders agreement provides for […]; c.Grupo Antolín will transfer to Lear the assets relating to the seat cover business. The seat cover business is a going concern composed of an independent industrial facility with […] employees belonging to Antolin- Tanger SARL. Only the assets and employees will be transferred; d.Grupo Antolín will transfer to Lear the assets relating to certain quality and testing equipment owned by Grupo Antolín-Ingeniería, S.A.U.; e. […]** f. Grupo Antolín will transfer to Lear the intellectual property rights relating to the purchased assets being owned by Grupo Antolín-Ingeniería, S.A.U., and the license contract with the Chinese company Fuzhou Lianhung Motor Parts Co. Ltd. to Grupo Antolín Ara, S.A.U..

(5) By means of the proposed Transaction Lear will own the entirety of the Target and therefore will have sole control over it within the meaning of Article 3(1)(b) of the Merger Regulation. 2

(6) The sale and purchase of the above-mentioned shares and assets included in the said businesses of Grupo Antolín will occur in pursuance of a single agreement between the same Parties. Therefore, the Transaction constitutes a single concentration, within the meaning of Article 3(1)(b) of the Merger Regulation.

3.EU DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million [Lear: EUR 16 765 million; Target: EUR […]]. Each of them has an EU-wide turnover in excess of EUR 250 million [Lear: EUR […]; Target: EUR […]], but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4.COMPETITIVE ASSESSMENT

(8) The Parties' activities horizontally overlap on the following markets: (i) Complete car seat assemblies; (ii) Metal seat structures; (iii) Recliners; and, (iv) Seat covers. The Transaction will give rise to the following horizontally affected markets: the market for the JIT supply of complete car seat assemblies, the market for the JIT supply of first row car seats, the market for the JIT supply of second row car seats, the market for the JIT supply of additional row car seats, the market for the supply of metal seat structures of second row car seats, the market for the supply of metal seat structures of additional row car seats and the market for the supply of seat covers.

(9) The Transaction also gives rise to vertically affected markets as the combined market share of the Parties in the (downstream) market for complete car seat assemblies is in excess of 30%. The upstream markets are the market for (i) metal seat structures, and plausible segmentations, (ii) recliners and (iii) seat covers, all input products to the assembled car seat.

4.1.Market definitions

4.1.1.Complete seat assemblies.

4.1.1.1.Product market definition.

(10) The Commission understands from the Parties submissions that OEMs generally purchase the seats installed on their vehicles from third parties. They do not only buy the seats, but also a service consisting of the JIT delivery, which requires that high volumes must be delivered on a very short notice (usually within less than 14 hours) directly to the production line of the customer to be immediately installed in a car, instead of being stored in a warehouse, with a view to reducing the OEMs' inventory levels and thus its costs. The business activity carried out by suppliers of complete seats essentially consists in the assembly of all the components (frame, mechanisms, foam and seat covers) and timely delivery of such components to the OEMs.

(11) In past decisions in the automotive sector the Commission has generally regarded each automotive component as a distinct product market. With reference to car seats, it has left open whether the JIT supply of complete car seat assemblies for OEMs, on the one hand, and the manufacturing of its individual components, on the other hand, constitute different relevant product markets.

(12) The Notifying Party does not contest the conclusions deriving from such past practice of the Commission. The Notifying Party also submits that it is inappropriate to further segment the market for complete seat assemblies according to the type of seat assembled, i.e. first row, second row and third or additional rows.

(13) With respect to the definition of a market encompassing the assembly and just in time supply of complete car seat only, respondents to the market investigation indicated that OEMs typically run separate tender procedures for the JIT assembly and delivery of complete seats and for the supply of the components thereof, based on requests for quotations ("RFQs"). Respondents also indicated that, although the vast majority of suppliers are vertically integrated along the automotive seats value chain, in a number of instances OEMs award the assembly and the supply of the components to different suppliers.

(14) Having regard to a possible segmentation of the product market in first row, second row and additional rows the Notifying Party claims that all suppliers are able to assemble all the seat rows as the know-how required to assemble subcomponents together into a complete car seat is quite similar for a front row, second row and third, fourth or further rows. Process methodology from row to row may vary but such variations depend on factors such as volumes, lead time, and number of features or complexity. Therefore, the row of the seat is not the key element for the assembly process.

(15) The market investigation was inconclusive as to whether such segmentation is appropriate or not. A customer responding to the market investigation indicated that the assembly of front seats is significantly more complex compared to the assembly of other rows and that it requires a more specific know how. That customer also indicated that not every seat supplier has the technical know-how to assemble front row seats and that generally separate RFQs are issued for the JIT supply of front and rear seats.

(16) Other customers responding to the market investigation, although confirming that the assembly of front seats is technically more complex, however indicated that all automotive seat suppliers are technically capable of assembling all rows. Contrary to the above indications, these customers also indicated that generally the JIT supply of front and rear seat is bundled in only one RFQ.4

(17) A competitor responding to the market investigation also indicated that generally OEMs bundle the JIT supply of front and rear seats in one tender, however indicated that this is specific to each customer.

(18) The market investigation also indicated that generally front seats are more expensive than rear seats. This is mainly because front seats have generally more content than rear seat (power adjusters, lumbar, massage, etc.).

(19) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact product market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the considered plausible market definitions.

4.1.1.2.Geographic market definition

(20) The Notifying Party claims that the geographic scope of the market for complete seat assemblies, irrespective of its precise segmentation is EEA wide. This is because, although the JIT assembly of complete car seats requires closeness to the car manufacturing site, competition for the award of contracts takes place in EEA-wide bidding or tender procedures. Further to the awarding of seat assembly contracts, a new supplier either builds a new site in the vicinity of the OEM's plants to serve or takes over the existing sites of a former supplier.

(21) Also, the Notifying Party claims that the investment costs needed to set up an assembly plant as well as the time of realisation of a new site are relatively contained and such costs are typically recouped within the duration of a single supply contract

(22) In a past decision,5 the Commission regarded the geographic scope of an assembly activity (the market for Front End Modules) as being EEA-wide in scope because of the low investment and limited time required to set up a new assembly facility in the vicinities of the OEMs' plants.

(23) The market investigation broadly confirmed that OEMs issue tenders at EEA level and suppliers do open JIT assembly facilities following the award of the supply contract.

(24) In the last 10 years, Lear opened […] new assembly plants and took over […] from a competitor and the Target opened […]. Competitors responding to the market investigation indicated that they participate in tenders for supplies also in regional clusters where they do not have a JIT facility in place and that they either open a new facility or take over an existing one if the contract is awarded to them.

(25) The vast majority of the customers responding to the market investigation also indicated that they do send RFQs also to suppliers not having a JIT assembly facility in the vicinity of the manufacturing site for which the tender is issued but rather invite all suppliers active in the EEA.

(26) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact geographic market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definitions considered.

4.1.2.Metal seat structures.

4.1.2.1.Product market definition.

(27) Seat structures are composed of the cushion assembly (i.e. the structure for the seating area into which the length, height and tilt adjusters are incorporated in the case of front seats) and the backrest assembly (i.e. the structure for the backrest into which the recliner is incorporated in the case of front seats).

(28) The Notifying Party claims that the relevant product market should encompass complete seat structures and should not be further segmented in cushion assembly and backrest assembly. This is because the long lead time between the award of a contract and start of serial production allows for timely switching of the production from one component to the other. Furthermore, the different types of seat structures are based on similar technology and equipment and those suppliers that provide one of them also provide the other.

(29) Customers responding to the market investigation indicated that they issue separate RFQs for the JIT supply of assembled seat and the supply of metal seat structures.

(30) Customers also indicated that when issuing RFQs for metal seat structures in the vast majority of cases they request the supply of the entire structure and not of the cushion assembly and backrest assembly separately.

(31) As for the market for complete seat assemblies, the market investigation was inconclusive as to the appropriateness of a further segmentation according to the seat row.

(32) All respondents to the market investigation in fact indicated that metal structures for front seat are technically more complex than metal structures for rear (second and eventually further) rows. Notwithstanding this grater complexity, some respondents – both customers and competitors – indicated that the majority of suppliers are able to manufacture metal structures for both the front and the rear seats.

(33) Also, the market investigation did not give univocal indication as to the sourcing preferences of OEMs. Some indicated that they tend to source frames for front and rear seat together, some others split the sourcing. A competitor responding to the market investigation confirmed this, however explaining that in its experience tenders for both front and rear seat structures are more common.

(34) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact product market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definition considered.

4.1.2.2.Geographic market definition

(35) The Notifying Party claims that the geographic scope of this market should be regarded as EEA-wide because: a.Closeness to a OEM's production plant is not necessary; b.Seat structures can be transported over long distances and transport throughout the EEA does not affect competiveness of the price (transport cost is estimated to be […]% to […]% of the final price); c.OEMs send RFQs to suppliers in the EEA; and, d.Seat structures are shipped throughout the EEA from a few production facilities.

(36) The market investigation supported the Parties' claims. All respondents to the market investigation indicated that tenders for the supply of metal seat structures takes place at EEA level and that vicinity to the OEM's plants is not relevant: suppliers can serve the entire EEA from a few plants and transport costs are low and do not materially impact the overall price of the goods.

(37) Finally, the analysis of the Parties' actual supply stream supports the above findings: the Parties supply metal seat structures in the EEA from only a few locations and deliver them to long-distance destinations, in some instances exceeding 2000 km.

(38) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact geographic market definition may be left open as the Transaction will not raise serious doubts as to its compatibility with the internal market under any of the plausible market definitions considered.

4.1.3.Recliners.

4.1.3.1.Product market definition.

(39) Recliners are used for adjusting the inclination of seats’ backrest. Recliners can be rotary (continuous) or lever (discontinuous), the former in turn being either manual or powered, and are present both in cars (accounting for the larger part of the demand) as well as in trucks.

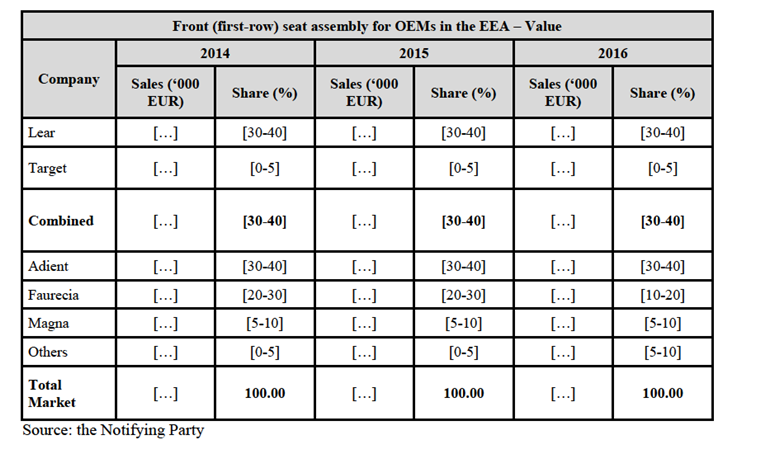

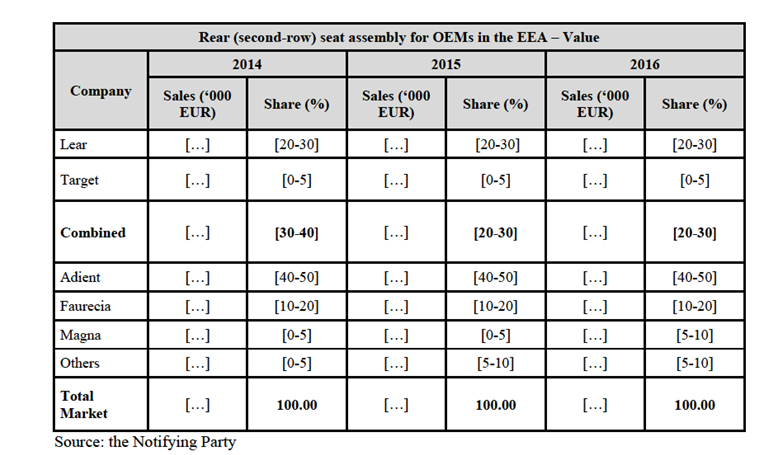

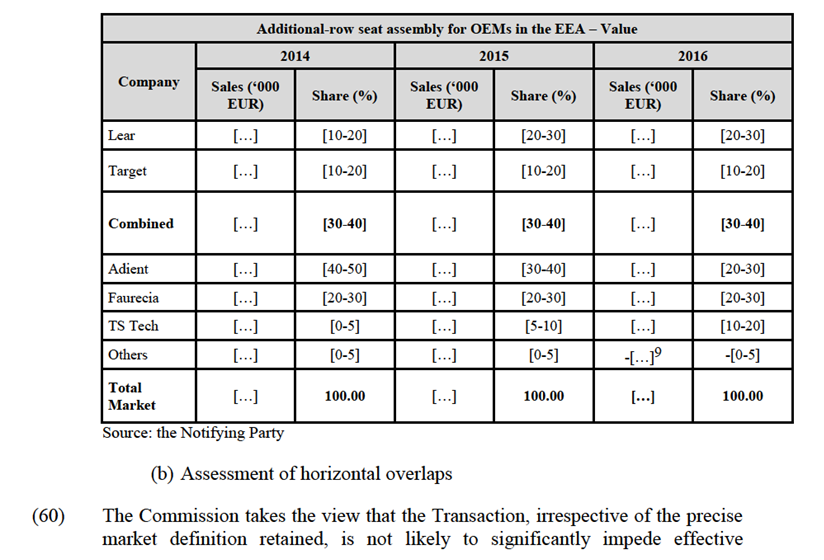

(40) The Notifying Party claims that all type of recliners should form part of a single product market and no further segmentation by type of recliner is appropriate because the main suppliers offer all types and shifting production capacity between them is not difficult for suppliers that already have the capabilities to supply all types of recliners.

(41) Production of rotary and lever recliners requires different assembly processes and components, however a switch of production between the two would take up to 3 years and an investment of up to Euro […]. In light of the above, it would be possible for a manufacturer to switch production between the award of a contract and the start of production ("SoP"). Also, the investment required does not appear a significant hurdle for a switch.

(42) Firstly, the Commission observes that the market investigation indicated that in the majority of cases recliners are sourced together with the metal structures. All the customers responding to the market investigation indicated that RFQs for metal seat structures include also the “mechanisms” (the recliners). It could therefore be argued, without the need to reach a definitive conclusion on the point, that recliners are part of the market for metal seat structures, as plausibly segmented.

(43) If recliners are regarded as forming part of a separate product market, the Notifying Party, as explained above, claims that a segmentation between rotary and lever recliner would be inappropriate.

(44) The market investigation supported the Notifying Party’s view in so far as OEMs responding to the market investigation explained that the choice between rotary and lever recliners is dictated mainly by the design of the car and the space between the seat and the door, to the extent they are concerned with the type of recliner proposed by the supplier. Other than that, OEMs consider that all suppliers are able to manufacture both types. A competitor contacted during the market investigation also confirmed this statement.

(45) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact product market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definitions considered.

4.1.3.2.Geographic market definition

(46) The Parties claim that the market for recliners can be defined as worldwide in scope as such goods use little space in packaging and are relatively lightweight, their transport costs are low6 even for shipments between different continents, thereby being tendered and purchased by car manufacturers at a global level.

(47) The market investigation did not entirely support the Notifying Party’s claim. As explained above, in fact, it emerged that recliners are usually sourced together with metal seat structures and therefore the geographic of the former market is most likely the same as the latter.

(48) This conclusion is also supported by the analysis of the actual supply streams. This analysis shows that recliners are shipped throughout the EEA from few production facilities in the EEA.

(49) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact geographic market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definitions considered.

4.1.4.Seat covers.

4.1.4.1.Product market definition.

(50) Seat covers are designed, engineered and manufactured for each unique vehicle model based on OEM customer specification. Seat covers utilise various combinations of leather, vinyl, and fabric which are cut based on precise measurements and assembled via sewing.

(51) In a recent case,7 seat covers (albeit not directly discussed) were regarded as an input market to complete car seat assemblies without further segmentation.

(52) The Notifying Party did not contest the conclusion of the above-mentioned past decisional practice of the Commission.

(53) Against the above considerations, the Commission concludes that, for the purposes of the present proceedings, the exact product market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definition.

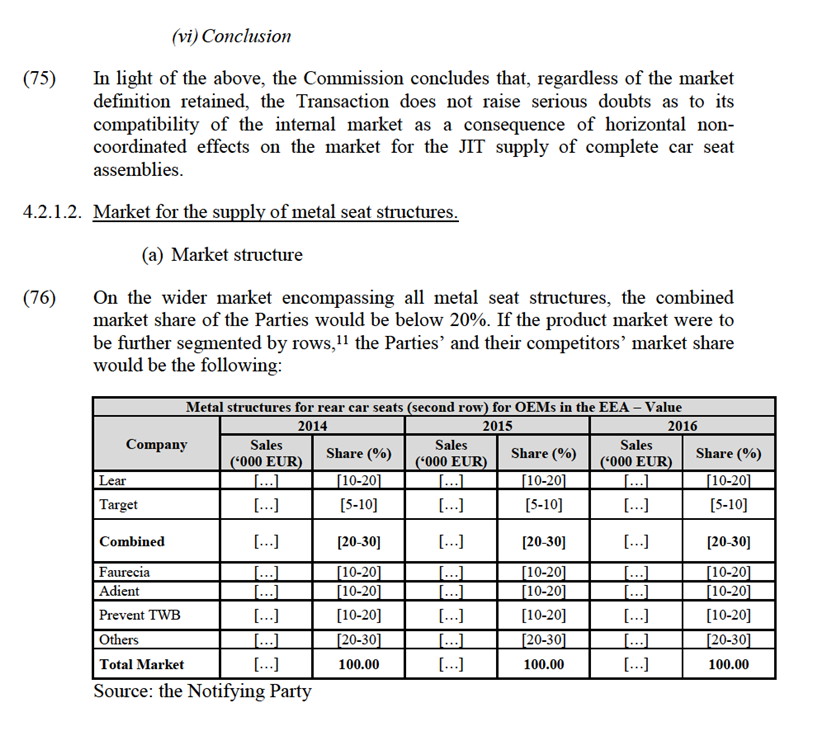

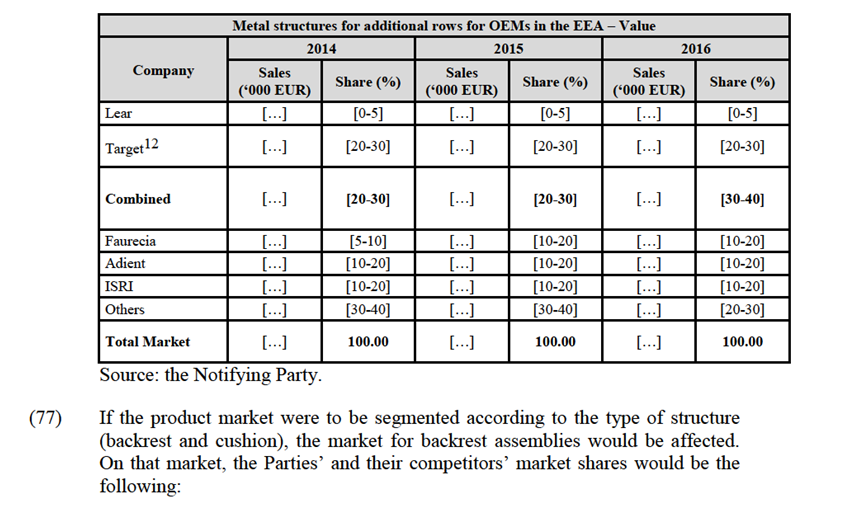

4.1.4.2.Geographic market definition

(54) The Parties claim that the geographic scope of this market should be regarded as being EEA-wide as opposed to more geographically limited, without providing further information.

(55) Against the above, the Commission concludes that, for the purposes of the present proceedings, the exact geographic market definition may be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the plausible market definitions.

4.2.Competitive assessment

4.2.1.Horizontal non-coordinated effects.

(56) The Parties activities horizontally overlap in the market for the JIT supply of complete car seat assemblies and in the supply market for seat covers.

(57) Further to that, if the market for metal seat structures was to be further segmented according to the seat row or the subcomponent (backrest assemblies and cushion assemblies) the following segments will be affected markets: (i) metal structures for car seats (second row), (ii) metal structures for additional rows and, (iii) backrest assemblies.

4.2.1.1.Market for the JIT supply of complete car seat assemblies

(a) Market structure

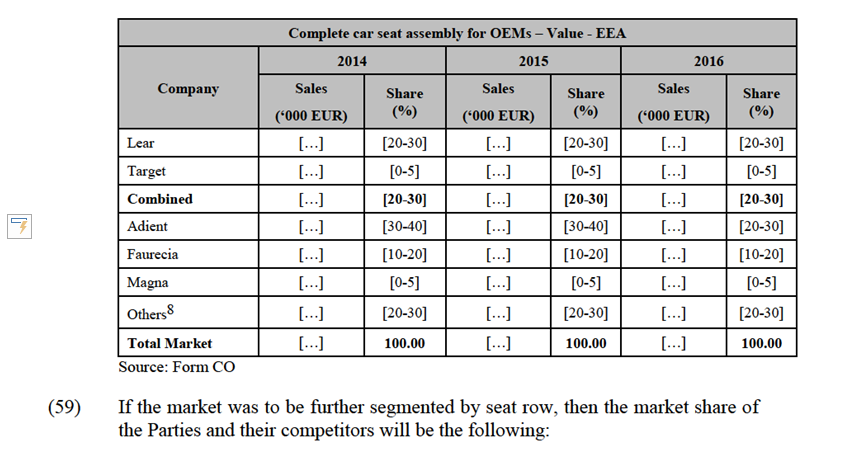

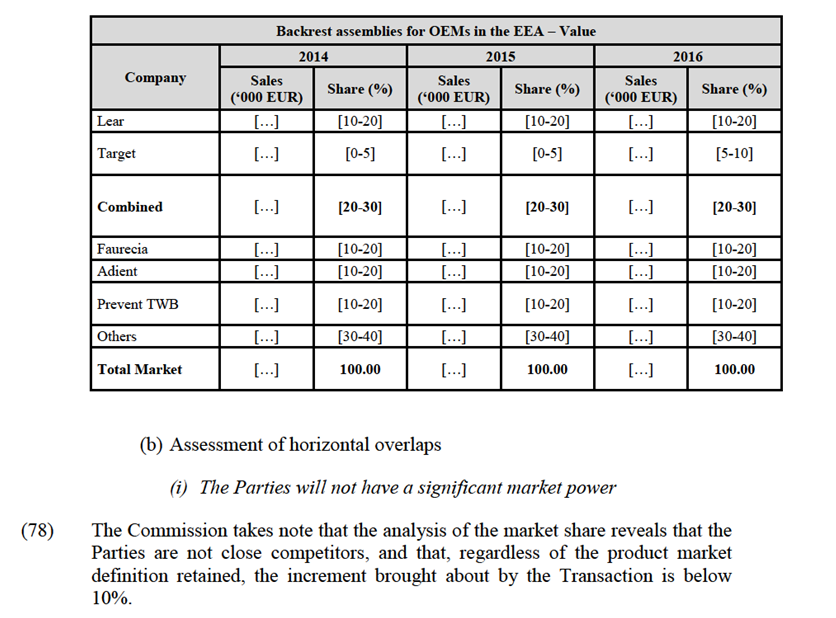

(58) On the EEA wide market for the JIT supply of complete car seat assemblies encompassing all rows, the Parties and their competitors market share will be the following:

competition on the market for the JIT supply of complete car seat assemblies, because of the following reasons.

(i) The Parties will not have a significant market power

(61) First, the Commission notes that although Lear has a significant market share and the Transaction would not entail an appreciable increase of that market share and the Parties combined market power after the Transaction would not be significantly accrued with respect to their current competitors. Under any of the plausible segmentations of the market, the Transaction would entail a combined market share not exceeding [30-40]% and in a minimal increment of market share: the only plausible market where the increment will exceed [0-5]% is the market for the JIT assembly of additional rows seats which is significantly smaller (in both value and volume) compared to all the other plausible segments.

(62) The combined entity will continue to face competition by Adient and Faurecia having larger or at least comparable market shares. Customers responding to the market investigation indicated that these latter two firms are considered as stronger than Lear and the Target and that they will continue to be stronger than the merged entity. Aside from Adient and Faurecia, the merged entity will also continue to face competition from Magna, which, albeit having a more limited market share, is an established and well-regarded supplier by the automotive industry and, in any event, has market shares larger than those of the increment brought about by the Transaction.10

(ii) The Parties are not close competitors

(63) Second, the Commission considers that Lear and the Target are not close competitors. On the one hand the analysis of the market shares indicates that the Target is a distant competitor from Lear, and, on the other hand, the Target is not a strong competitor on the market at all, excluding the market for the JIT assembly of additional rows seats where its market share is more prominent.

(64) The market investigation supported such findings: customers indicated that the Target is a regional player, focused mainly on the Iberic peninsula region. Some of the customers responding to the market investigation also indicated that the Target and Lear are regarded as competitive for only a limited number of simpler applications, especially light commercial vehicles. That same customer indicated that Lear is also competitive on the passenger cars segment.

(65) The above finding from the market investigation supports also the Notifying Party’s statement that Lear and the Target focus on different kind of vehicles. According to the Notifying Party the Target generally focuses on car seats for large cars, while Lear focuses on either compact, mid-size and full-size cars or light trucks.

(iii) Customers will maintain the possibility to switch suppliers

(66) The Commission finds that the Transaction is unlikely to hamper the OEMs’ ability to switch suppliers. As explained above in paragraphs 24 and 25, proximity to the OEM plant is not relevant in this market because suppliers can establish a new JIT plant timely, and without incurring significant costs.

(67) The Commission accordingly considers that the OEMs are not constrained in sourcing complete car seats only from suppliers already having an assembly facility in the vicinity of their plants, but are free to award contracts to suppliers not being yet established in the proximity, because of the relative certitude that such newcomers would open a JIT plant in the vicinity to secure a timely supply of their products.

(iv) The Target is not an important competitive force.

(68) As explained above in 58 and 59, the Commission considers that the Target is a rather small competitor on the market and, according to customers responding to the market investigation, not competitive on all type of vehicles. […].

(69) Also, all the customers responding to the market investigation indicated that Adient and Faurecia are significantly more competitive compared to the Target.

(70) In light of the above, the Commission takes the view that the Transaction does not eliminate an important competitive force from the market, regardless of the exact market definition.

(v) Regional analysis – Barcelona-Martorell cluster

(71) If the geographic scope of the market were regarded as regional, i.e. catchment areas of 100 km around the OEM plants, rather than EEA wide, the Parties would overlap only on the Barcelona-Martorell cluster (Spain). In that cluster there are two OEMs plants (Nissan Barcelona and Seat/VW Martorell) and 4 seat suppliers: the Target and Adient close to VW Martorell and Lear and Magna close to Nissan Barcelona.

(72) Further to the analysis carried out in the section (i) to (iv) above, which applies also to the competitive assessment for this cluster, the Commission finds that the review of the bidding data for the last 15 years would show that the Parties were invited to the same tender only […] times (out of […] tenders recorded). Of these […] times, […] both Parties were shortlisted but the contract was awarded to Adient.

(73) The analysis of the bidding data also shows that the majority of the contract in the last 15 years were awarded to Magna and JCI which had been awarded […] contracts and the remaining […] were awarded to the Parties ([…] Lear, […] the Target).

(74) From all the above, it can be concluded that on the Barcelona-Martorell cluster the Parties are only marginal competitors, and that accordingly the Transaction is unlikely to significantly change the competitive dynamics of the market. Such a limited impact would be further mitigated by the significant competitive pressure exerted by rival suppliers, which could easily open a JIT facility in the close proximity of each of the OEM plants.

(79) The Commission notes that, after the Transaction, the Parties will continue to face unaltered completive constraints from a number of their current competitors, including Adient and Faurecia. In this regard, several of the OEMs that responded to the market investigation indicated that they consider the latter two companies are able to exert more competitive constraints than either of the Parties. Furthermore, both the Parties' customers and competitors have indicated that certain specialised companies, like Brose are also able of imposing significant competitive constraints on the market.

(80) The market investigation has also shown that the market for metal seat structures is significantly more fragmented than the market for the JIT supply of complete car seat assemblies. As apparent from the market share tables above smaller but credible players such Magna, DAS, IRSI, Kirchhoff, Proma and Viza accrue for a significant proportion of the market. It follows that, after the Transaction, the Parties are unlikely to benefit from a considerable reduction in competitive constraints exercised by their current competitors.

(ii) The Parties are not close competitors

(81) Customers responding to the market investigation also indicated that the Parties are not able to exercise competitive constraints on each other in these markets because they have rather different product focuses. According to one customer, the Target is more competitive on specific low-volume seats, particularly for the light commercial vehicles ("LCV"), […].

(82) This last indication is also supported by the replies of another customer who indicated that the Target is considered only as a supplier of metal frames for LCV and Lear only for rear seats.

(83) A customer responding to the market investigation also indicated that it considers the Target as exercising less competitive constraints on Lear than other companies like Faurecia and Adient, because the Target's business lacks global footprint. According to that customer for OEMs it is important to have suppliers who can support a vehicle platform globally and the Target – being active only in Europe – is not able to do so. It follows that, after the Transaction, the Parties are unlikely to benefit from any elimination of competitive constraints exercised on each other.

(iii)Conclusion

(84) In light of the above, the Commission concludes that, regardless of the market definition retained, the Transaction does not raise serious doubts as to its compatibility with the internal market as a consequence of horizontal non- coordinated effects on the market for metal seat structures.

4.2.1.3.Market for seat covers

(a) Market structure

(85) The Commission considers that, on the EEA wide market for seat covers, the Parties’ and their competitors’ market share will be the following:

(91) Furthermore, against the above background, the Commission understands that: (i) On the upstream EEA-wide market for recliners, the combined market share of the Parties will be below [0-5]%, and below [0-5]% in any plausible segmentation of the market; (ii) On the upstream market for seat covers the combined market share of the Parties combined market share will be [20-30]%; (iii) On the downstream market the combined market share of the Parties will be between [20-30]% and [30-40]%, depending on the precise market definition retained

(92) The Commission considers it appropriate to assess the above circumstances in the light of the possible market foreclosure strategies that the Parties could be putting in place after the Transaction, as follows.

4.2.2.1.Customer foreclosure

(93) The Commission considers that an analysis of the likely effects of the Transaction as to customers' foreclosure would apply to all the vertical relationships arising from the Transaction, since the Parties' market power would be higher on the downstream market and therefore the Parties could engage in customer foreclosure practices to exclude competitors from their customer base downstream.

(94) The Commission takes the view that, post Transaction, the Parties are not likely to have the ability to foreclose their competitors from having access to their respective customer base downstream, for the reasons expressed below.

(95) First, the Commission notes that the strongest upstream competitors (Faurecia and Adient) are vertically integrated along the value chain and therefore cannot be foreclosed, and that a sufficient number of non-vertically integrated downstream customers are present on the market (roughly [10-20]% of the market, including Magna).

(96) Second, the market investigation indicated that in most of the cases the OEMs organise different tenders for the JIT supply of complete seats (assembling) and the individual components of the seats. Customers, i.e. OEMs, responding to the market investigation also indicated that it is not unusual to have components from different suppliers assembled by different suppliers.

(97) This sourcing strategy of the OEMs eliminates, or significantly hampers, the Parties' potential ability to foreclose its competitors' access to a sufficient customer's base downstream. In this respect, it is sufficient to note that should any of the OEMs so decide, a tender can be organised to source products from new suppliers.

(98) In light of the lack of ability to foreclose, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market as a result of non-horizontal effects.

5.CONCLUSION

(99) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 81, 16/03/2017, p. 12. * Should read: "Grupo Antolín will transfer to Lear its 100% participations indirectly held in the following companies: Grupo Antolín-Ara, S.A.U., (ii) Grupo Antolín-Ardasa, S.A.U., (iii) Grupo Antolín-Álava, S.A.U., (iv) Grupo Antolín-Martorell, S.A.U., (v) Grupo Antolín Magnesio, S.A.U.,(vi) Grupo Antolín-Vigo, S.A.U., and (vii) Grupo Antolín-PGA, S.A.U.(all of Spain), (viii)the Portuguese company Grupo Antolín Valença-Componentes Automóvel, Soc. Un. Lda, as well as the French companies (ix) Grupop Antolin Ingenierie Sieges SAS, (x) Grupo Antolin Jarny SAS and (xi) Grupo Antolin Loire SAS." **Should read: "certain equipment owned by Grupo Antolín-Martorell, S.A.U. devoted to nonseating activities, i.e. overhead and door sequencing and just-in-time supply, will be carved out between the date of signing of the SPA and that of closing of the Transaction"

4 These customers indicated that in the majority of the instances the same supplier is awarded the contract. However in some instances (depending on the type of seat and type of vehicle) they may issue separate RFQs or award the different rows to different suppliers.

5 M.7893 Plastic Omnium/Faurecia Exterior Automotive Business

6 The average transportation cost of recliners is estimated between […]% and […]% of their final price.

7 M.6136 JCI / Automotive Business of Keiper Recaro Group

8 The following categories of suppliers fall within the item ‘others » : (i) Internal OEM seating operations and subsidiaries (Daimler, BMW, VW-SITECH, and HYUNDAI-DYMAS) (ii) Japanese tier 1 suppliers focused ou their main « Keiretsu » customer (TS TECH-HONDA-, TOYOTA BOSHOKU-TOYOTA, TOYO SEATING – SUZUKI). Privately-held regional or local suppliers (CAB Automotive – United Kingdom, Prevent Group/Isri-Germany, Vanpro-joint venture between Johnson controls and Famecia limited to Portugal, Martur- Romania).

9 The total size of the market has been calculated on the basis of average CPVs for additional rocus. Homewer, CPVs can vary greatly depending on features and content and, as illustrated above by the example of firts row seats a set of premium front row seats for one customer can amont to more than eight times the CPV for a base seat for another customer.The Notifying Party submits that the Acquired Business is focussed […] (while Lear’s activity in this segment is concentrated on […]). Consequently, the negative value allocated to « others » can be explained by the fact that the market size in terms of value contained in this table has been underestimated and hence, the combined market Shares of the Parties must actually be lower than those provided.

10 The only exception being the market for the JIT assembly of additional rows seats.

11 On the plausible market for metal seat structures for firts row the combined market share of the parties will be below 20%.

12 The Target’s production of metal seat structures for additional rows is focused on vans, whereas Lear’s activity in this segment is concentrated on SUVs […].