Commission, May 18, 2017, No M.8431

EUROPEAN COMMISSION

Judgment

OMERS / AIMCO / VUE / DALIAN WANDA GROUP / UCI ITALIA / JV

Subject: Case M.8431 - OMERS/AIMCo/Vue/Dalian Wanda Group/UCI Italia/JV

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 7 April 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertakings The Space Cinema 1 SpA ("TSC", Italy), indirectly controlled by Vue International Holdco Limited ("Vue", United Kingdom, in turn jointly controlled by Alberta Investment Management Corporations, "AIMCo", Canada, and OCP Investment Corporation, "OMERS", Canada), and UCI Italia SpA ("UCI Italia", Italy), controlled by the Dalian Wanda Group (China) via AMC Entertainment Holdings Inc. ("AMC", United States) acquire within the meaning of Article 3(4) of the Merger Regulation joint control of a newly created and fully-functional joint venture ("JV").3 TSC and UCI Italia are designated hereinafter as the "Notifying Parties".

1.THE PARTIES

(2) TSC provides cinema exhibition services in Italy where it operates 36 cinemas, under the brand “The Space”, which are located in the following provinces: Bari, Bologna, Cagliari, Catania, Catanzaro, Firenze, Genova, Grosseto, Lecce, Livorno, Milano, Monza Brianza, Napoli, Padova, Parma, Pavia, Perugia, Roma, Salerno, Terni, Torino, Treviso, Trieste, Udine, Verona and Vicenza.

(3) Vue is the ultimate holding company of Vue International group, an operator of cinemas across the United Kingdom, Italy, Germany, the Netherlands, Poland, Denmark, Ireland, Latvia, Lithuania and Taiwan. Vue currently operates a total of 211 cinemas.4

(4) AIMCo is an institutional investment fund manager, investing globally on behalf of its clients, various pension, endowment and government funds in the Province of Alberta (Canada).

(5) OMERS is active in the administration of one of Canada’s leading pension funds, providing retirement benefits, management of a diversified global portfolio of stocks and bonds as well as real estate, infrastructure and private equity investments.

(6) UCI Italia provides cinema exhibition services in Italy where it operates 48 cinemas under the brand “UCI Cinemas” located in the following provinces: Alessandria, Ancona, Arezzo, Ascoli Piceno, Bari, Bergamo, Bologna, Bolzano, Cagliari, Caserta, Catania, Como, Fermo, Ferrara, Firenze, Genova, Gorizia, Matera, Messina, Milano, Napoli, Palermo, Perugia, Pesaro Urbino, Piacenza, Pordenone, Reggio Emilia, Rimini, Roma, Siena, Torino, Venezia and Verona.

(7) AMC provides cinema exhibition services in the United States and parts of Europe. AMC operates 885 cinemas, the majority of which are located in the US. In Europe AMC operates some cinemas under the Odeon, UCI, UCI Kinowelt and Cinesa brands in the United Kingdom, Ireland, Spain, Portugal, Italy, Germany and Austria. Odeon also has a number of joint ventures in areas ancillary to film exhibition services, including a cinema screen advertising company and a film distribution joint venture both based in the United Kingdom and an online ticket sales platform in Germany. AMC also controls Nordic Cinema Group Holding AB which is active in the provision of cinema exhibition services, cinema screen advertising and film distribution services in Sweden, Finland, Norway, Estonia, Latvia and Lithuania.

(8) The Dalian Wanda Group is engaged in three principal business activities: investment and operations of commercial properties, culture and finance. It also provides cinema exhibition services in Australia and in China, and film production and distribution services in China.

(9) The JV will provide cinema advertising services in Italy.

2.THE OPERATION AND THE CONCENTRATION

2.1.The operation

(10) On 13 March 2017, TSC and UCI Italia signed a shareholders’ agreement (the "SHA") pursuant to which they will create a 50/50 joint venture with the company name “Digital Cinema Advertising – DCA S.r.l.” over which each of the Notifying Parties will exercise joint control.

(11) The Notifying Parties will contribute the following assets to the JV: EUR […] of credit that will be granted by TSC and UCI Italia.5 In addition, the Notifying Parties will provide to the JV EUR […] as equity capital, as well as a further EUR […] as share premium.6 The SHA also provides that the JV will enter with each of the Notifying Parties into the Service Agreements, so that their cinema advertising services will be undertaken by the JV.7 Pre-Transaction International Cinemamedia UCI S.r.l. ("ICU"), a wholly owned subsidiary of UCI Italia, sells part of UCI Italia's advertising spaces to advertisers.8 TSC has a contract with PRS Mediagroup S.r.l. ("PRS"), so that PRS sells cinema advertising space in TSC's cinemas. Post-Transaction, this contract will be terminated and TSC will enter into a contract with the JV.9 PRS is a third-party active in the provision of advertising services in Italy across different media (TV, radio, cinema) and is also a publishing company. Therefore, UCI Italia will transfer its cinema advertising business to the JV, whereas TSC will transfer its demand to the JV and become a customer of the JV.

(12) The Notifying Parties intend to create the JV through the incorporation of a newly established company. The shareholding of the JV following the notified operation (also referred to as the "Transaction") would be: (i) TSC: 50%; (ii) UCI Italia: 50%.

(13) Pursuant to the SHA, TSC and UCI Italia will have the right to nominate three directors each to the board of the JV. A quorum at any board of directors meeting is only obtained if the meeting is attended by at least four directors. Any approval of the board of directors requires the unanimity of the votes of the directors attending the meeting. The matters reserved to the board of directors include the approval/amendment of the business plan and the appointment/dismissal of the senior management. Therefore, the JV will be jointly controlled by TSC and UCI Italia.

2.2.Full-functionality

(14) The Commission considers that the JV will have sufficient resources to operate independently on the market (both in terms of financial resources, staff and assets), will play an active autonomous role on the market, and will operate on a lasting basis, for the following reasons.10

(15) First, the JV will have a General Manager and another [Number of employees] to carry out its day-to-day activities, who will be directly employed by the JV.11 Second, the JV will have an initial equity capital and additional financing up to EUR […] provided by the Notifying Parties.12 Third, the JV will play an active role in the market since it will offer its services to all interested Italian cinemas, which the JV will treat in the same commercial way as the Notifying Parties.13 Fourth, the JV will be created for an indefinite period of time, for an initial period of […] years, tacitly renewable for further periods of […] years, as per the SHA.14

2.3.Conclusion

(16) The Transaction consists in the creation of a jointly controlled and fully functional JV by TSC and UCI Italia and, therefore, constitutes a concentration within the meaning of Article 3(4) of the Merger Regulation.

3.EU DIMENSION

(17) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million15 (TSC: EUR […]; UCI Italia: EUR […]). Each of them has an EU-wide turnover in excess of EUR 250 million (TSC: EUR […]; UCI Italia: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

4.RELEVANT MARKETS

(18) The Transaction concerns the markets for (i) the supply of cinema exhibition services and (ii) the provision of cinema advertising services in Italy.

4.1.Cinema exhibition services

4.1.1.Product market

(19) The cinema exhibition market comprises all business activities of public performance of films for paying audiences.16 In previous decisions concerning cinema exhibition services, the Commission left the precise product market definition open.17

(20) In OMERS/AIMCo/Vue, while leaving open the product market definition, the Commission observed, that in relation to the United Kingdom the Office of Fair Trading (OFT) had considered that: (i) film exhibition services constitute a separate market of film distribution; (ii) the closest constraint on a multiplex cinema is another multiplex cinema, and that other cinemas should be considered on a case-by-case basis; and (iii) 2D and 3D formats might be considered as separate frames of reference. 18

(21) In Odeon/Cineworld/CSA JV, the Commission noted that the cinema exhibition market comprises all business activities of public performance of films for paying audiences. The Commission also observed that the UK Competition Commission considered four possible definitions of the cinema exhibition market, namely (i) all ways of using discretionary spend; (ii) all ways of watching films; (iii) all cinemas; and (iv) separate markets for multiplex cinemas and traditional cinemas, ultimately concluding that the relevant product market is no wider than all cinemas, but within this market the closest constraint on multiplex cinemas appear to be other multiplex cinemas.19

(22) The Notifying Parties submit that the precise product scope can be left open in this case, as the Transaction would not give rise to competition concerns on any plausible definition of the market.

(23) For the purpose of this decision, the exact product market definition, whether including all cinemas or only multiplex cinemas with a minimum number of screens,20 can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

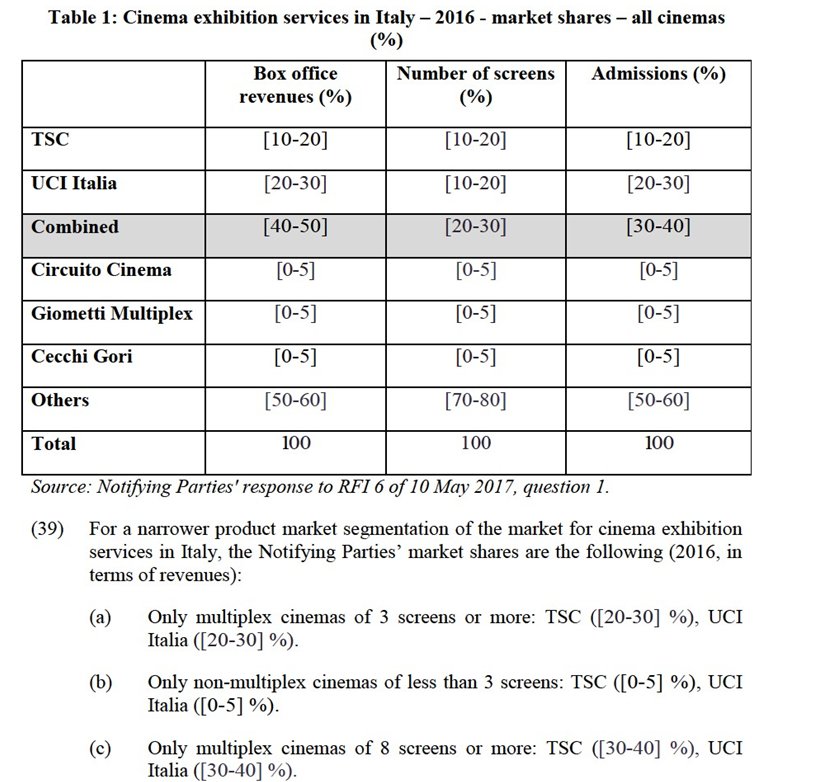

4.1.2.Geographic market

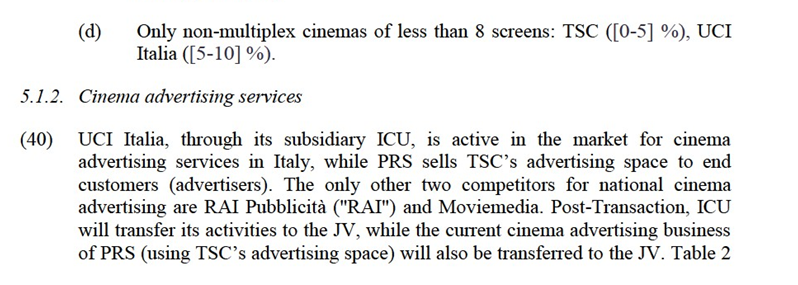

(24) In past decisions, the Commission considered that the geographic market for cinema exhibition services is national and that there could be a series of local markets since some cinemas are geographically isolated from other cinemas and do not face much competition from other exhibitors.21 The Commission ultimately left the geographic market definition open.

(25) The Notifying Parties submit that the market for cinema exhibition services is no wider than national. According to the Notifying Parties, from a supply side perspective, ticket prices, service levels (i.e. opening times) and amenities are generally set at a national level, whereas, from a demand side perspective end consumers are not likely to travel outside of their locality to attend a cinema. In any event, the Notifying Parties submit that the precise geographic scope of the market can be left open in this case, as the Transaction would not give rise to competition concerns on any plausible definition of the market.

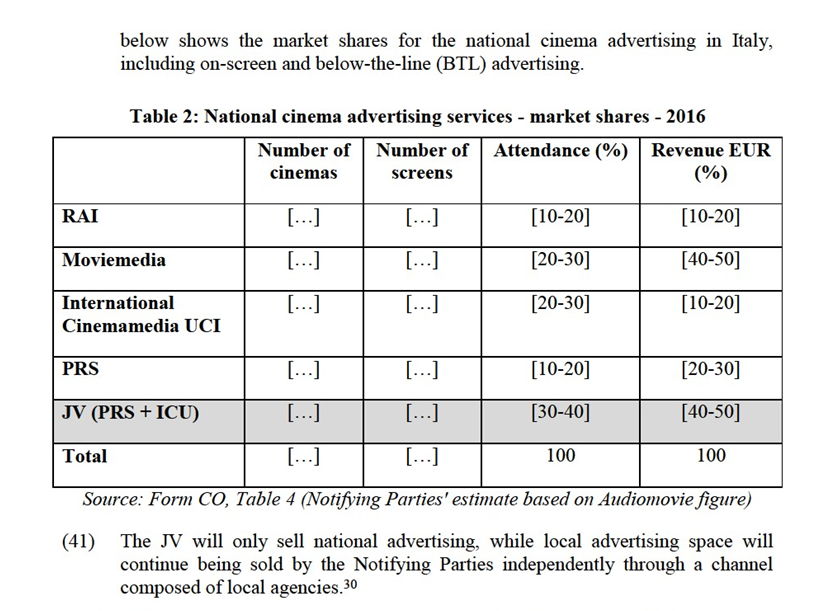

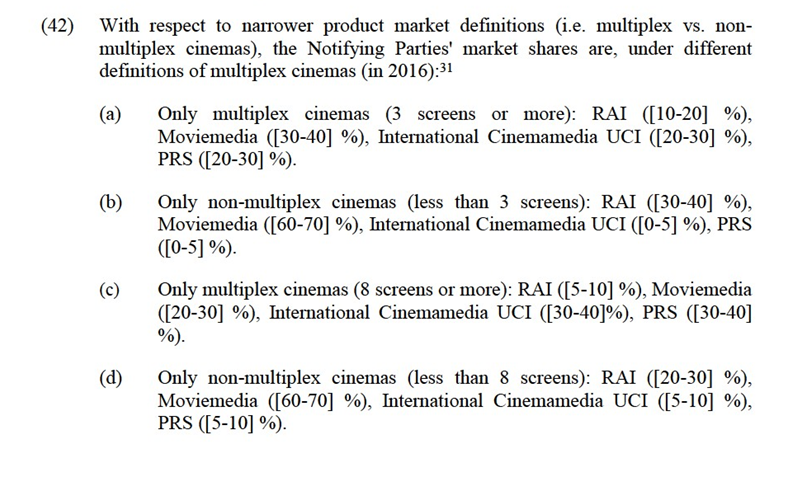

(26) For the purpose of this decision, the exact geographic market definition, and in particular the question whether the market is national or local in scope, can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.Cinema screen advertising

4.2.1.Product market

(27) Cinema screen advertisers acquire from cinema exhibitors the right to show advertising films prior to the feature film and then sell this screen time either directly to advertisers or to advertising agencies. Cinema screen advertisers may also have the right to advertise in other communal areas of the cinema e.g. at the ticket desks and in the lobby of the cinema (known as 'below the line' cinema advertising).

(28) In previous decisions, the Commission considered, but ultimately left open, whether cinema screen advertising constitutes a separate market or whether it is part of a wider market for display advertising, as it does not offer any unique characteristics that cannot be replicated by other media, such as television and the internet.22

(29) The Notifying Parties submit that cinema screen advertising does not offer any unique characteristics that cannot be replicated by other media (e.g. television, internet, smartphone) and should be considered as part of a wider market for display advertising. In any event, the Notifying Parties submit that the precise product scope can be left open in this case, as the Transaction does not give rise to competition concerns under any plausible definition of the product market.

(30) For the purpose of this decision, the exact product market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.2.Geographic market

(31) In relation to the geographic market definition, in previous decisions, the Commission considered that the market for cinema screen advertising is national, if not local in scope, similar to the related market for cinema exhibition services.23

(32) The Notifying Parties submit that the precise geographic scope of the market can be left open in this case, as the Transaction does not give rise to competition concerns under any plausible definition of the geographic market.

(33) For the purpose of this decision, the exact geographic market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

5.COMPETITIVE ASSESSMENT

(34) The Notifying Parties are both active in the provision of cinema exhibition services across Italy.

(35) UCI Italia, through its subsidiary ICU, is also active in the provision of national cinema advertising services in Italy but exclusively to UCI cinemas,24 while TSC currently sells its national cinema advertising space through PRS.

(36) Post-Transaction, the JV will be active in the market for national cinema advertising services and will offer cinema advertising services to the Notifying Parties as well as third party cinemas.25 According to the JV's business plan included in the SHA, the total turnover expected to be achieved by the JV will be EUR […] in 2018.26 The JV will only sell national cinema advertising (typically covering the entire Italian territory or several administrative regions) but not local advertising (typically relating to small businesses active in the city or area where the cinema facility is located), which will remain independently managed by the Notifying Parties. Nothing will change with respect to the Notifying Parties' provision of cinema exhibition services. In turn, as per the Advertising Service Agreements,27 TSC will terminate its current agreement with PRS (a third party company, independent of TSC) and will start selling its national cinema advertising space through the JV. As a result, PRS will lose its only source of cinema advertising space, but will maintain its other advertising activities.28

(37) Therefore, the Transaction gives rise to vertically affected markets in relation to the upstream supply of cinema exhibition services in Italy and the downstream provision of cinema advertising in Italy. There are no horizontally affected markets because pre-Transaction UCI Italia, through its subsidiary ICU, is active in the market for cinema advertising services exclusively to its own cinemas and TSC is not active at all in that market (as it relies entirely on PRS).

5.1.Introduction and market shares

5.1.1.Cinema exhibition services

(38) The Notifying Parties are active in the market for cinema exhibition services in Italy, including all cinemas or only multiplex cinemas with a minimum number of screens. Table 1 shows the Notifying Parties' and their competitors' market shares in 2016 for cinema exhibition services in Italy, including all cinemas, by a number of measures (revenues, number of screens and number of admissions).29

(43) Therefore, the JV's market presence (currently through ICU and PRS) in the market for cinema advertising is more important for large multiplex cinemas of 8 screens or more than for multiplex cinemas of 3 screens or more or the overall market for multiplex cinemas and non-multiplex cinemas (up to about a market share of [60-70] % for multiplex cinemas of 8 screens or more).

(44) These market shares have been calculated for the market of national cinema advertising services in Italy. Under a wider product market definition, i.e. display advertising services in Italy, the Notifying Parties' market shares would be very low, as they are only active in cinema advertising, which only constitutes less than 0.5 %.of the overall display advertising market in Italy.32

(45) Post-Transaction, PRS' market share will decrease to [0-5] %, because TSC will start commercialising its cinema advertising space through the JV. Accordingly, the JV's market share in national cinema advertising services in Italy will be [40- 50] % post-Transaction, as per Table 2 above, for all cinemas, [40-50] % for multiplex cinemas of 3 screens or more, and [60-70] % for multiplex cinemas of 8 screens or more (see paragraph (42) above).

5.2.Vertical effects

5.2.1. Introduction

(46) The Transaction gives rise to vertically affected markets between the possible national Italian market for cinema exhibition services33, including all cinemas, or the possible narrower market including multiplex cinemas only (upstream, where TSC and UCI Italia are active) and the possible national Italian market for cinema advertising services (downstream, through the JV).34

(47) The Commission assessed whether, post-Transaction, the merged entity would have the ability and incentive to (i) engage in input foreclosure of competing cinema advertising providers and/or (ii) engage in customer foreclosure of competing cinema exhibitors.

5.2.2.Input foreclosure of competing cinema advertising providers

5.2.2.1.The Notifying Parties' view

(48) The Notifying Parties submit that the Transaction will not lead to input foreclosure of competing cinema advertising providers because: (i) the JV will continue to face strong competition from the market leader Moviemedia ([40-50] %) and RAI ([10-20] %), (ii) PRS's revenues earned from cinema advertising represent less than […] % of the revenues it achieves in the display advertising market, (iii) PRS has developed the necessary know-how to remain as a credible operator of cinema advertising, and (iv) market surveys show that there is a contestable customer base with cinemas ready to switch advertising companies (for example RAI increased the number of screens it serves by 31% between 2016 and 2017).

5.2.2.2.The Commission's assessment

(49) Input foreclosure concerns would arise if the JV would have the ability and incentive to foreclose downstream competitors in the cinema advertising market from cinema advertising space provided by the Notifying Parties and if such foreclosure strategy would have a significant detrimental effect on effective competition in the downstream market.35

(50) The Commission considers that it is unlikely that the JV would have the ability or the incentive to engage in an input foreclosure strategy for the following reasons.

(51) First, the Parties’ ability and incentive to engage in input foreclosure of competing cinema advertising providers other than PRS would not change post- Transaction, since UCI Italia currently sells its advertising space through ICU (hence the space in those cinemas is currently not available to competitors), and TSC sells advertising space through PRS.

(52) Second, even though PRS would lose its only cinema advertising customer (TSC), cinema advertising only represents about […] % of the advertising business of PRS and would not compromise its continuity on the market. Moreover, even if after the transaction PRS would lose its only current customer in the cinema sector, it could leverage its advertising business in other platforms (TV, radio) together with its know-how of the cinema advertising business to remain as a strong competitive constraint and regain market shares.36 In this respect, it should be noted that some market participants underlined that certain advertisers buy advertising space on different channels (TV, Internet, cinema), which would allow PRS to bundle cinema advertising with other forms of advertising.

(53) Third, [60-70] % of Italian cinema screens offering advertising space (currently contracting with RAI and Moviemedia)37 are addressable by PRS. Moreover, as pointed out by the GfK report published by RAI, the Italian cinema advertising market is generally a contestable market. This is also reflected by RAI's recent success.38 Therefore, the Notifying Parties would lack the ability to foreclose PRS post-Transaction.

(54) Fourth, the majority of advertisers and media agencies (customers of cinema advertising providers) responding to the market investigation did not express concerns in relation to the Transaction. Furthermore, all advertisers/media agencies responding to the market investigation stated that they consider other advertising channels, such as TV, newspapers, Internet, as an alternative to cinema screen advertising.

(55) Fifth, the Commission's assessment as outlined in paragraphs (51) to (54) above, would not change in case possible narrower markets for cinema exhibition services were considered, such as multiplex cinemas only, except for the fact that the share of Italian cinema screen still addressable by the JV's competitors would be [50-60] % for multiplex cinemas of 3 screens or more and [30-40] % for multiplex cinemas of 8 screens or more.

(56) During the market investigation, a market participant raised concerns that the JV would have the ability and incentive, post-Transaction, to increase the amount of advertising minutes it sells because the Notifying Parties are also active upstream in the market of cinema exhibition services. As a result of this behaviour, the number of screen advertising minutes offered by the JV would significantly increase, which would likely compromise the competitive position of the JV's competitors, as it would reduce the unit price paid for cinema advertising (per minute).39

(57) The Commission considers that it is unlikely that the JV would have the ability or incentive to engage in such behaviour, taking into account that: (i) it is contractually bound by the Services Agreements to limit the number of advertising minutes before a movie, (ii) [Quantity of advertising space sold] 40 and (iii) other cinemas could follow this strategy and also increase the number of advertising minutes, which would jeopardise such a foreclosure strategy by the JV.

5.2.2.3.Conclusion

(58) For all these reasons, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to input foreclosure of competing cinema advertising providers.

5.2.3.Customer foreclosure of competing cinema exhibition providers

5.2.3.1.The Notifying Parties' view

(59) The Notifying Parties submit that the Transaction will not lead to customer foreclosure of competing third-party cinemas because (i) those cinemas already have agreements in place with the JV's competitors, (ii) the JV will represent an additional alternative for those cinemas as it would have the incentive to provide its services to the widest possible customer base,41 (iii) the JV's anticipated market share would be well below [0-5] % under any market segmentation so it would not have the ability to foreclose independent cinemas, and (iv) advertising revenues typically represent less than […] % of a cinema's total revenues and are not therefore a material source of revenue.42

5.2.3.2.The Commission's assessment

(60) In assessing the likelihood of an anticompetitive customer foreclosure scenario, the Commission examines, first, whether the JV would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals, second, whether it would have the incentive to reduce its purchases upstream, and third, whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.43

(61) The Commission considers that it is unlikely that the JV would have the ability or the incentive to engage in a customer foreclosure strategy to the downstream market of competing cinema exhibition providers for the following reasons.

(62) First, competing providers of cinema advertising services will remain active post- Transaction and independent cinemas would be able to sell their advertising space (Moviemedia, PRS and RAI) to them. In particular, independent cinemas could sell their advertising space to PRS, who will need to find alternative providers of advertising space after it will lose its only customer in the cinema sector after the Transaction. Moreover, Moviemedia's market share [40-50] % will remain higher than the JV's for the possible market comprising all cinemas in Italy. Therefore, the JV would lack the ability to foreclose third-party cinemas.

(63) Second, the JV would remain open to selling cinema advertising space from third- party cinema exhibitors, as it would have the incentive to offer its services to a wide customer base of cinemas. This would mean, in practice, that an additional cinema advertising provider would enter the market for cinema advertising services following the Transaction (as ICU was not open to third-party exhibitors). This view is further supported by the fact that the JV's General Manager and not the Notifying Parties would be responsible for deciding the terms and conditions applicable to those cinemas.44 As a result, the JV would lack the incentive to foreclose third-party cinemas.

(64) Third, even in the event that independent cinemas would not have alternative providers of cinema advertising services, cinema advertising only represents less than […] % of the revenues of cinemas, which would not compromise their viability going forward.45

(65) Fourth, the reasons outlined in paragraphs (62)-(64) would apply to the possible narrower markets for cinema exhibition services, such as multiplex cinemas only, except for the fact that the share of Italian cinema screen still addressable by the JV's competitors would be [50-60] % for multiplex cinemas of 3 screens or more and [30-40] % for multiplex cinemas of 8 screens or more.

5.2.3.3.Conclusion

(66) For all these reasons, the Commission concludes that the Transaction does not raise serious doubts as regards its compatibility with the internal market in relation to customer foreclosure of competing cinema exhibition providers.

5.3.Spill-over effects

5.3.1.Cooperative effects of the joint venture in relation to the upstream market for cinema exhibition services

5.3.1.1.The Notifying Parties' view

(67) The Notifying Parties submit that the JV has not as its object or effect the coordination of their competitive behaviours. In particular, there is no risk that the JV may have the effect of coordination of that behaviour in the supply of cinema exhibition services because: (i) the forecasted revenue for the JV is very low in comparison with the Notifying Parties' revenue from cinema exhibition (less than […]%), (ii) the Notifying Parties have committed in the SHA to introduce a firewall mechanism to prevent any flow of commercially sensitive information, (iii) third-party cinemas will not be discriminated against, as the General Manager of the JV will be empowered to decide the terms and conditions of the relationship with third-party cinemas independently and, (iv) cinema screen advertising services are not closely related to cinema exhibition services, being both two different and independent sources of revenues for the Notifying Parties.46

5.3.1.2.Commission's assessment

(68) With regard to the potential existence of cooperative effects47 of the JV arising from the fact that the parents will retain significant activities in the upstream market for cinema exhibition services,48 the Commission excludes that the JV has as its object or effect the coordination of the Notifying Parties' activities in that market, for the following reasons.

(69) First, the JV's expected revenues will be much smaller than those earned by the JV's parents in the market for cinema exhibition services in Italy. For example, in 2016 the Notifying Parties' revenues from cinema advertising services were less than […] % of their revenues from cinema exhibition services in Italy.49 This would reduce the incentives of the Notifying Parties to coordinate their behaviour in the neighbouring market of cinema exhibition services in Italy through the JV.50

(70) Second, the Notifying Parties have implemented firewall mechanisms, such as the provision included in the SHA through which the Notifying Parties commit to preventing access to each other's commercially sensitive information. The Commission considers that these mechanisms alleviate the theoretical risk that the JV facilitates that the Notifying Parties coordinate their behaviour by sharing commercially sensitive information. Therefore there would be no practical scope for the Notifying Parties to coordinate their behaviour in the neighbouring market of cinema exhibition services in Italy through the JV.51

(71) Third, pursuant to the SHA,52 the General Manager of the JV will be responsible for deciding the terms and conditions for third-party cinema exhibitors, which would prevent a theoretical coordination of the Notifying Parties in that market.

5.3.1.3.Conclusion

(72) Based on the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market due to cooperative effects of the joint venture in relation to the upstream market for cinema exhibition services.

6.CONCLUSION

(73) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 123, 20.04.2017, p. 11.

4 Of these, 84 cinemas are located in the United Kingdom, 36 in Italy, 33 in Poland, 30 in Germany, 21 in the Netherlands, 3 in Denmark, and 1 in each of Ireland, Latvia, Lithuania and Taiwan.

5 Pursuant to the Financing Agreements attached as Annex 1.3 (o) to the SHA.

6 Form CO, paragraph 45.

7 Annexes 1.3(g) and 1.3(h) to the SHA. See Form CO, paragraph 46.

8 Form CO, paragraph 14.

9 Annexes 1.3(g) and 1.3(h) to the SHA. See Form CO, paragraph 46.

10 Consolidated Jurisdictional Notice, paragraphs 91-105.

11 Form CO, paragraph 44.

12 Form CO, paragraph 45.

13 Form CO, paragraphs 46-47.

14 Form CO, paragraph 51.

15 Turnover calculated in accordance with Article 5 of the Merger Regulation.

16 Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV, paragraph 10.

17 Commission decision of 12 May 1997 in case IV/M.902 – Warner Bros/Lusomando/Sogecable; Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV; Commission decision of 25 July 2013 in case M.6977 – Omers/Aimco/Vue.

18 Commission decision of 25 July 2013 in case M.6977 – Omers/Aimco/Vue, paragraph 9.

19 Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV, paragraph 10.

20 As further described in paragraph (39) of this decision, there are alternative ways of defining a "multiplex cinema", including cinemas with at least 3 screens, 8 screens, etc.

21 Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV, paragraphs 12-13; Commission decision of 25 July 2013 in case M.6977 – Omers/Aimco/Vue, paragraph 10.

22 Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV, paragraph 11; Commission decision of 25 July 2013 in case M.6977 – Omers/Aimco/Vue, paragraphs 12 and 14. See also Commission decision of 21 June 2002 in case M.2813 – Carlton+Thomson/Circuit A, RMBI, RMBC, paragraph 16. See also Commission decision of 9 January 2014 in case M.7023 – Publicis/Omnicom, paragraph 92.

23 Commission decision of 23 April 2008 in case M.5076 – Odeon/Cineworld/CSA JV, paragraphs 12-13; Commission decision of 25 July 2013 in case M.6977 – Omers/Aimco/Vue, paragraphs 13-14. See also Commission decision of 21 June 2002 in case M.2813 – Carlton+Thomson/Circuit A, RMBI, RMBC, paragraphs 17-18. See also Commission decision of 9 January 2014 in case M.7023 – Publicis/Omnicom, paragraph 95.

24 See Annex 14 to the Form CO, page 15.

25 Form CO, paragraph 119.

26 Form CO, paragraph 28 and Annex 1.3(d) to the SHA.

27 Article 2.2 of the Advertising Service Agreements (Annex 1.3(g) of the SHA).

28 Both RAI and PRS are active in other type of display advertising, such as TV. See Form CO, Annex 14, page 16 and responses to the market investigation of 7 April 2017, questions 1-3.

29 If narrower geographic markets for cinema exhibition services are considered, for example, at the province level, the aggregate share of TSC and UCI Italia exceeds [40-50]% (the estimated share at national level) in the following Provinces: (i) Bari [40-50]%; (ii) Bologna [50-60]%; (iii) Cagliari [90-100]%; (iv) Firenze [40-50]%; (v) Genova [50-60]%; (vi) Milano [50-60]%; (vii) Napoli [40- 50]%; (viii) Perugia [70-80]%; (ix) Torino [40-50]%; (x) Verona [60-70]%, Form CO, paragraph

120 However, the JV will only sell national cinema advertising services while local advertising space will continue being sold by the Notifying Parties independently through a channel composed of local agencies. Therefore, the Commission’s analysis of possible vertical effects stemming from the merger will consider the Notifying Partie’s market shares in cinema exhibition services at the national level.

30 According to the Notifying Parties, national cinema adverting consists of adverting compaing that will be transmitted on screen of cinemas located at least in 3 different regions or if BTL advertising.

31 Notifying Partie’s reply to the Commission’s RFI 5 of 3 May 2017, question 3.

32 Form CO, Table 2 (Notifying Parties' best estimate based on Nielsen data). Cinema advertising revenue in Italy was EUR 18.649 million in 2015, while the Italian display advertising market was worth EUR 4.241 billion.

33 With regard to possible geographic markets for cinema exhibition services at local level, the Commission has not assessed a possible vertical relationship given that the JV will only be active in national cinema advertising. In any event, the assessment set out in Sections 5.2.2 and 5.2.3 would not significantly change if local markets were considered.

34 Providers of cinema advertising services acquire cinema advertising space from cinema exhibitors, which they in turn sell to advertisers.

35 See Guidelines on the assessment of non-horizontal merger under the Council Regulation on the control of concentrations between undertakings, OJ C 262 of 18/10/2008, p. 6-25 ("Non-Horizontal Merger Guidelines"), paragraph 32.

36 With regard to the joint selling of advertising services across different platforms (TV, Internet, cinema, etc.), some competitors have indicated that certain advertisers have a preference for purchasing cinema advertising jointly with other types of advertising such as TV or Internet advertising. In that respect, both PRS and RAI are active in other types of display advertising and could therefore offer these services, while Moviemedia and the JV only offer cinema advertising (see responses to the market investigation of 7 April 2017, question 3).

37 And [70-80] % of all cinema screens in Italy.

38 Notifying Parties' response to the Commission's RFI 5 of 3 May 2017, question 2. A recent GfK market study published by RAI (http://www raipubblicita.it/download/cinema10aprile per-sito.pdf) shows that there is a contestable customer base, as shows RAI's increase in the number of screen advertised (425 to 557 in 2016 to 2017).

39 Response to the market investigation of 7 April 2017, questions 4 and 5.

40 Notifying Parties' response to the Commission's RFI 5 of 3 May 2017, question 4, and Annexes 1.3(g) and 1.3(h) to the SHA.

41 The JV would only control [40-50]% (around […] screens) of the total number of screens currently offering screen advertising space (around […] screens) or [20-30] % of the total number of cinema screen in Italy (around […] screens).

42 Form CO, paragraphs 108-111 and Annex 1 of the Notifying Parties' response to the Commission's RFI 5 of 3 May 2017. The share of national advertising in the cinemas' total revenues varies from [0-5] % to [0-5] %.

43 See Non-Horizontal Merger Guidelines, paragraph 59.

44 See paragraph (71), Form CO, paragraphs 105-107 and 119 and Notifying Parties' response to the Commission's RFI 5 of 3 May 2017, questions 2 and 4.

45 Notifying Parties' response to the Commission's RFI 5 of 3 May 2017, question 5. For cinemas having entered into agreements with RAI and Moviemedia, cinema advertising represents […] % and […] % of their total revenues, respectively.

46 Form CO, paragraphs 116-121.

47 Article 2(4) of the Merger Regulation: "To the extent that the creation of a joint venture constituting a concentration pursuant to Article 3 has as its object or effect the coordination of the competitive behaviour of undertakings that remain independent, such coordination shall be appraised in accordance with the criteria of Article 101(1) and (3) of the Treaty, with a view to establishing whether or not the operation is compatible with the common market."

48 See market shares under all possible market definitions for cinema exhibition services in Italy in Section 5.1.1.

49 The Notifying Parties' combined revenues from cinema exhibition services in 2015 were EUR […] million, while revenues from cinema advertising services amounted to less than […] million (less than [0-5] %).

50 See Commission decision of 3 May 2005 in case M.3178 – Bertelsman Springer JV, paragraph 168.

51 See Commission decision of 4 September 2012 in case M.6314 - Telefónica UK/Vodafone UK/ Everything Everywhere/ JV, paragraphs 585 and 586.

52 See paragraph 7.8 of the SHA and Form CO, paragraph 119. [Independence of the JV and faculty of the General Manager to decide terms and conditions applicable to third party cinemas]