Commission, April 3, 2020, No M.9679

EUROPEAN COMMISSION

Judgment

UNITED GROUP / BULGARIAN TELECOMMUNICATIONS COMPANY

Subject: Case M.9679 – United Group / Bulgarian Telecommunications Company

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 28 February 2020, the European Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043, by which United Group B.V. (“United Group” or the “Notifying Party”), through United Group Bulgaria (“UGB”, Bulgaria),4 will acquire within the meaning of Article 3(1)(b) sole control of Viva Telecom Bulgaria OOD (“Viva”) and its subsidiary, the Bulgarian Telecommunications Company EAD (Viva and BTC being collectively referred to as “BTC” or the “Target”),5 This operation is hereafter referred to as the “Transaction” and United Group and BTC are referred to as the “Parties”.

1. THE PARTIES

(2) United Group is active in the provision of telecoms and media in South East Europe, where it operates a multi-play cable and media platform. United Group’s activities focus on the production of Pay-TV channels and content, distribution of content, retail distribution of Pay-TV services, broadband internet and fixed and mobile telecommunication services. Within the EEA, United Group is active in Slovenia (through the “Telemach” brand) and Croatia (through the recently acquired telecommunication provider Tele2 Croatia). In Bulgaria, United Group is active only as a provider of Pay-TV services through Internet, via its wholly-owned subsidiary Solford Trading Limited ("Solford").

(3) BTC is a telecommunications operator, active in Bulgaria where it operates under the brand name “Vivacom”. BTC provides fixed and mobile telecommunication services, broadband internet and TV distribution services (via the Internet and satellite).

2. THE OPERATION

(4) The Transaction consists of an acquisition of shares. Pursuant to a share and purchase agreement of 7 November 2019, UGB will acquire all issued share capital of Viva from InterV Investment S.a.r.l.” (“InterV”, Luxembourg).

(5) Viva is a limited liability company which was previously held by InterV (51.27%) and BTC (48.73%).6 As a result of a cross-shareholding restructuring plan, InterV is the sole shareholder of Viva. Viva owns directly or indirectly 100% of the issued capital of the following undertakings: the Bulgarian Telecommunications Company EAD and its subsidiaries NURTS Bulgaria EAD, BTC Net EOOD, NURTS digital EAD, Net is Sat EOOD (together referred to as BTC, see paragraph 1).

(6) United Group is ultimately solely controlled by BC Partners LLP (“BC Partners”, United Kingdom), an international private equity firm, whose sole activity is to provide advisory services.7

(7) Upon completion of the Transaction, United Group will thus acquire, via UGB, sole control of the whole of BTC. The Transaction, therefore, constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(8) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 billion (EUR […]). Each United Group and BTC has an EU-wide turnover of more than EUR 250 million (United Group: EUR […] million, BTC: EUR […] million). Neither of the undertakings concerned achieves more than two thirds of their respective EU-wide turnover in one and the same Member State.

(9) Therefore, the Transaction has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

(10) The Transaction leads to a very limited horizontal overlap between the Parties’ activities in the retail supply of Pay-TV services (via Over-the-top services or “OTT”) in Bulgaria.

(11) The Transaction also gives rise to vertical relationships in connection with:

· at the upstream level: the supply of (i) wholesale international roaming and (ii) wholesale call terminations services on mobile and fixed networks in the countries where United Group and BTC operate

· at the downstream level: (i) retail fixed telephony services and (ii) retail mobile telecommunications services in the countries where United Group and BTC operate (see table 3).8

4.1. Retail supply of TV services

(12) In the market for the retail provision of TV services, TV distributors provide end users with TV services, which typically consist of: (i) linear TV channels or packages of linear TV channels (the latter either acquired or produced themselves) and (ii) content aggregated in non-linear services, such as Subscription Video on Demand (“SVOD”), Transactional VOD (“TVOD”) and Advertising VOD (“AVOD”). TV content can be delivered to end users through several platforms including cable, satellite (“direct-to-home” or “DTH”), IPTV and as OTT. OTT players deliver channels and content in both a linear and non-linear fashion through the use of internet.

(13) BTC (under the brand Vivacom) distributes Pay-TV services in Bulgaria through the Internet (both IPTV and OTT) and also through satellite. United Group offers TV services via cable, satellite (DTH) and Internet (OTT) in a number of countries, including Slovenia and Croatia.9 Its OTT services are offered internationally (including in Bulgaria) under the “Net.TV.Plus” brand.10

4.1.1. Relevant product markets

(14) In its previous decisions, the Commission has considered the retail provision of free- to-air (“FTA”) and Pay-TV services as separate product markets but ultimately left open the product market definition. In addition, the Commission has considered whether a further segmentation shall be made according to: (i) linear vs. non-linear TV services, (ii) distribution technologies (e.g. Cable, OTT, satellite, IPTV or terrestrial) and (iii) premium Pay-TV vs. basic Pay-TV services but has left the market open with regard to each of these potential sub-segments.11

(15) The Notifying Party submits that the relevant product market is the retail distribution of Pay TV, encompassing: (i) all distribution technologies, (ii) non-linear and linear content, and (iii) basic and premium Pay TV. In particular, the Notifying Party does not consider it necessary, for the purpose of the present notification, to segment the market for provision of TV services to end users according to distribution platform. In the Notifying Party’ view, the precise product market can be left open, since the Transaction does not give rise to any competitive concerns irrespective of the precise product market definition.

(16) The Commission considers that for the purpose of the present decision the question whether (i) FTA services and Pay TV services, (ii) linear Pay TV services and non- linear Pay TV services, (iii) different distribution technologies, and (iv) basic Pay TV services and premium Pay TV services belong to the same product markets can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of the narrowest- possible product market definitions set out in this paragraph.

4.1.2. Geographic market definition

(17) In previous decisions, the Commission has considered that the geographic scope of the market for the retail provision of TV services is national (since suppliers of retail TV services compete on a national level) or, at most, limited to the coverage area of each cable operator.12

(18) The Notifying Party submits that the precise geographic scope of the market can be left open, given that the Transaction does give rise to competitive concerns irrespective of the precise geographic market definition.

(19) For the purpose of the present decision, the Commission considers that the relevant market for the retail supply of TV services is national in scope. The Commissin considers that the competitive assessment in Section 5.3 would remain the same also on a geographic market comprising the coverage area of each cable operator.

4.2. Retail mobile communication services

(20) Mobile telecommunications services to end customers, or "retail mobile services", include services for national and international voice calls, SMS (including MMS and other messages), mobile internet with data services, access to content via the mobile network and retail international roaming services.

4.2.1. Product market definition

(21) In previous decisions, the Commission has not further segmented the overall retail mobile market based on the type of service (voice calls, SMS, MMS, mobile Internet data services), or the type of network technology. The Commission has considered possible segments of the overall retail market for mobile telecommunication services by distinguishing between pre-paid and post-paid services and between private customers and business customers, concluding that these did not constitute separate product markets but rather were market segments within an overall retail market.13

(22) The Notifying Party submits that, in the present case, the relevant product market should be defined in line with the Commission’s previous decisional practice, i.e. as the overall retail market for the mobile telecommunication services without further segmentation.

(23) For the purpose of the present decision, the Commission considers that the exact product market definition in relation to the provision of retail mobile telecommunications services (whether there is an overall market for retail mobile communication services or whether this market should be segmented between pre- paid and post-paid or between private and business customers) can be left open as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any such product market definition.

4.2.2. Geographic market definition

(24) In previous decisions, the Commission has consistently found the market for retail mobile communication services to be national in scope.14

(25) The Notifying Party considers that the market should be considered national in scope in line with previous Commission decisions.

(26) For the purpose of the present decision, the Commission considers the market for retail mobile services to be national in scope, notably taking into account the fact that licences to mobile operators are granted on a national basis.

4.3. Retail supply of fixed telephony services

(27) Fixed telephony services comprise the provision of connection services at a fixed location or access to the public telephone network, for the purpose of making and/or receiving calls and related services.

4.3.1. Product market definition

(28) In previous decisions, the Commission considered that managed Voice over Internet Protocol (“VoIP”) services and fixed voice services provided through fixed lines are interchangeable and therefore belong to the same market.15

(29) The Notifying Party submits that the relevant product market should be defined, in line with previous Commission decisions, as the overall retail market for fixed line telephony services, including VoIP services.

(30) For the purpose of the present decision, the Commission considers that the exact product market definition (whether there is an overall market for the retail supply of fixed telephony services or whether this market should be segmented into fixed voice services and VoIP services) can be left open as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any such possible product market definition.

4.3.2. Geographic market definition

(31) In previous decisions, the Commission has consistenly found the market for the supply of fixed telephony services to be national in scope, as this reflects the continuing importance of the role of national regulation in the telecommunications sector, the supply of upstream wholesale services on a national basis, as well as the fact that the pricing policies of telecommunications providers are predominantly national.16

(32) The Notifying Party considers the market to be national in scope, based on the Commission's precedents.

(33) For the purpose of the present decision, the Commission considers that the market for the supply of fixed telephony services is national in scope.

4.4. Wholesale market for mobile and fixed call termination services

(34) Call termination is the service provided by a network operator on the supply side to other network operators on the demand side, whereby a call originating in a demand side operator's network is delivered to a user in the supply side operator's network. This service is required by every originating operator, as it is necessary for its customers to be able to communicate with the customers of other networks. Call termination is therefore a wholesale service that is resold or used as an input for the provision of downstream retail telephony and mobile services. In previous decisions, the Commission has identified relevant markets for the provision of wholesale call termination on mobile and fixed networks.

4.4.1. Wholesale market for mobile call termination services

4.4.1.1. Product market definition

(35) In previous decisions, the Commission has found that there is no substitute for call termination on each individual network as the operator transmitting the call can reach the intended recipient only through the operator of the network to which the recipient is connected.17

(36) The Notifying Party, in accordance with Commission’s past practice, submits that the relevant product market is the market for wholesale call termination services.

(37) For the purpose of the present decision, the Commission considers that, as regards wholesale call termination services, termination on each individual mobile network constitutes a separate product market.

4.4.1.2. Geographic market definition

(38) In previous decision, the Commission considered that the market for wholesale mobile call termination services is national in scope, as each wholesale market for call termination corresponds to the dimensions of the operator’s network and therefore is limited to the national territory of the operator's network.18 This is primarily due to regulatory barriers as the geographic scope of a network licence is, in principle, limited to areas which do not extend beyond the borders of a Member State.

(39) In line with previous Commission decisions, the Notifying Party submits that the market for wholesale mobile call termination services should be considered national in scope.

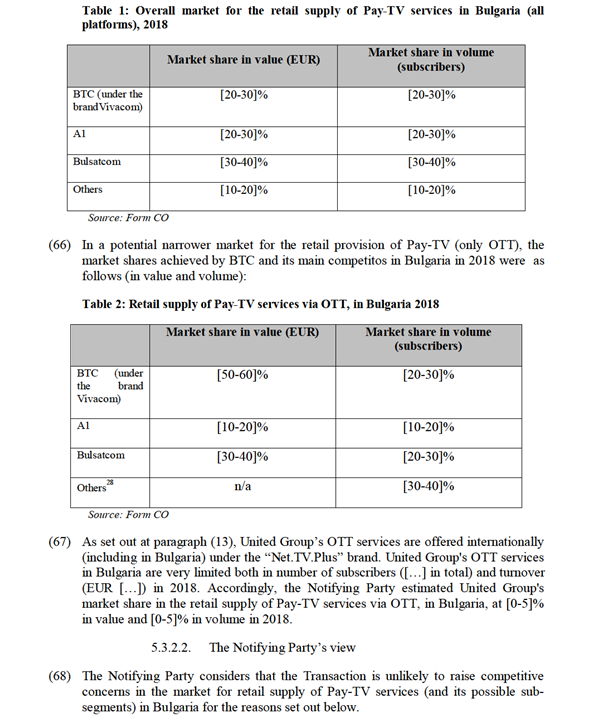

(40) For the purpose of the present decision, the Commission considers that the market for wholesale mobile call termination services is national in scope.

4.4.2. Wholesale market for fixed call termination services

4.4.2.1. Product market definition

(41) As in the case of wholesale mobile call termination services, in previous decisions the Commission has established that there are no potential substitutes for call termination on each fixed network since the operator transmitting the call can reach the intended recipient only through the operator of the network to which the recipient is connected.19

(42) The Notifying Party, in accordance with Commission’s decisional practice, submits that the relevant product market is the market for wholesale call termination services on fixed networks.

(43) For the purpose of the present decision, the Commission considers that, as regards wholesale call termination services, termination on each individual fixed network constitutes a separate product market.

4.4.2.2. Geographic market definition

(44) In previous decisions, the Commission has found that the market for wholesale fixed call termination services is national in scope, considering that the geographic scope of each wholesale market for call termination should correspond to the dimensions of the operator’s network, which is limited to national borders due to regulatory barriers.20

(45) The Notifying Party submits that, in line with previous Commission decisions, market for wholesale fixed call termination services is national.

(46) For the purpose of the present decision, the Commission considers that the market for wholesale fixed call termination services is national in scope.

4.5. Wholesale international roaming services

(47) International roaming services allow mobile telecommunication subscribers to make and receive calls and use other services such as text messages and data services, when abroad. To offer such services to their end-users, Mobile Network Operators (“MNOs”) conclude wholesale agreements with one another providing access and capacity on mobile networks in the foreign country. MNOs select their partner operators based on network coverage, price, network quality and reciprocity. Demand for wholesale international roaming services comes (i) from foreign mobile operators who wish to provide their own customers with mobile services outside their own network and also downstream (ii) from subscribers wishing to use their mobile telephones outside their own countries.

4.5.1. Product market definition

(48) In previous decisions, the Commission has considered a separate product market for wholesale international roaming services comprising both terminating calls and originating calls. 21

(49) In line with Commission’s decisional practice, the Notifying Party submits that the relevant product market is the wholesale market for international roaming. In particular, the Notifying Party considers that the wholesale international roaming market encompasses all mobile operators in a given country.

(50) For the purpose of the present decision, the Commission considers that the relevant product market is the wholesale market for international roaming services comprising both terminating and originating calls without distinguishing by mobile operator in a certain country.

4.5.2. Geographic market definition

(51) In previous decisions, the Commission found that the relevant geographic market is national in scope due to the existence of regulatory barriers to offering mobile services. 22

(52) The Notifying Party agrees with this approach and submits that the revelant geographic market is national.

(53) For the purpose of the present decision, the Commission considers that the market for wholesale international roaming services is national in scope.

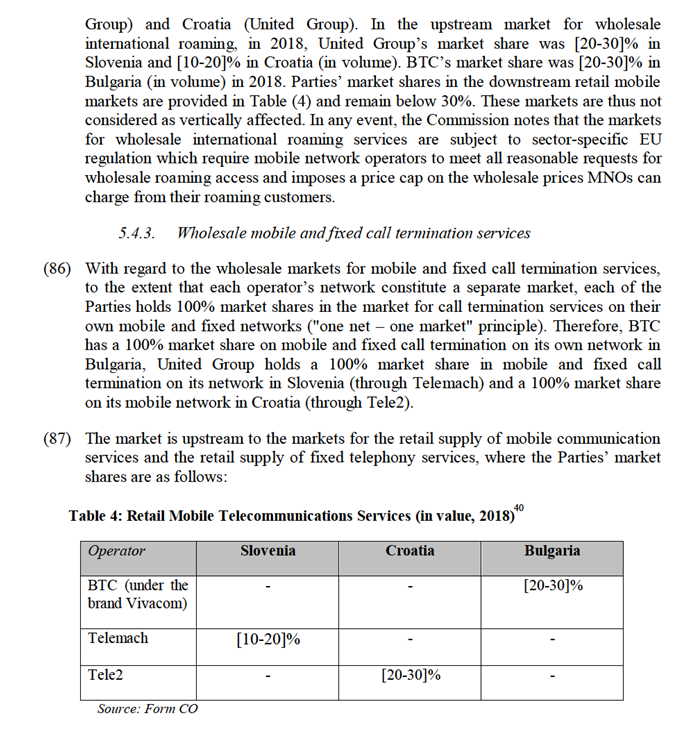

5. COMPETITIVE ASSESSMENT

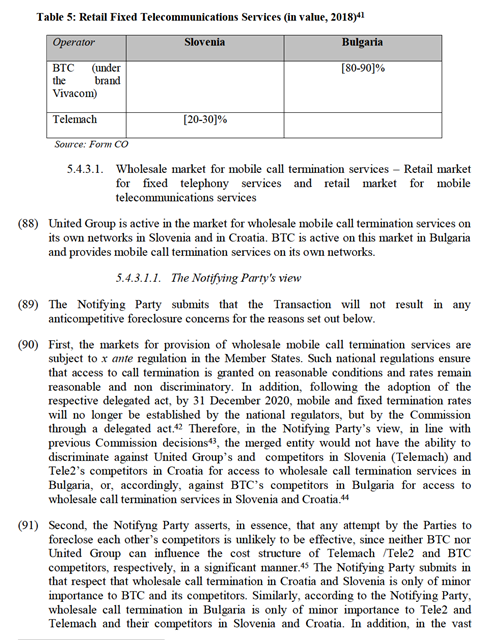

5.1. Analytical framework

(54) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(55) In this respect, a merger may entail horizontal and/or non-horizontal effects. Horizontal effects are those deriving from a concentration where the undertakings concerned are actual or potential competitors of each other in one or more of the relevant markets concerned. Non-horizontal effects are those deriving from a concentration where the undertakings concerned are active in different relevant markets.

(56) With regard to non-horizontal mergers, two broad types can be distinguished: vertical and conglomerate mergers. Vertical mergers involve companies operating at different supply chain levels.

(57) The Commission appraises horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Horizontal Merger Guidelines.23 Additionally, the Commission appraises non-horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Non-Horizontal Merger Guidelines. 24

5.2. Identification of affected markets

(58) The Transaction gives rise to horizontally affected market(s) in the retail supply of Pay-TV services (and possible segments) in Bulgaria.

(59) The Transaction also gives rise to vertically affected markets in relation to (i) the upstream provision of wholesale mobile call terminations services and the downstream provision of retail mobile telecommunication services in Bulgaria, Slovenia and Croatia and (ii) the upstream provision of wholesale fixed call termination services and the downstream provision of retail fixed telephony services in Bulgaria and Slovenia.

5.3. Horizontal non-coordinated effects

5.3.1. Introduction

(60) The Horizontal Merger Guidelines distinguish between two main ways in which a concentration between actual or potential competitors on the same relevant market may significantly impede effective competition, namely coordinated and non- coordinated effects.25

(61) Under the substantive test set out in Article 2(2) and (3) of the Merger Regulation, also mergers that do not lead to the creation or the strengthening of the dominant position of a single firm may be incompatible with the internal market.

(62) The Horizontal Merger Guidelines describe horizontal non-coordinated effects as follows: “A merger may significantly impede effective competition in a market by removing important competitive constraints on one or more sellers who consequently have increased market power. The most direct effect of the merger will be the loss of competition between the merging firms. For example, if prior to the merger one of the merging firms had raised its price, it would have lost some sales to the other merging firm. The merger removes this particular constraint. Non-merging firms in the same market can also benefit from the reduction of competitive pressure that results from the merger, since the merging firms’ price increase may switch some demand to the rival firms, which, in turn, may find it profitable to increase their prices. The reduction in these competitive constraints could lead to significant price increases in the relevant market.”26

(63) Therefore, a merger giving rise to such non-coordinated effects might significantly impede effective competition by creating or strengthening the dominant position of a single firm, one which, typically, would have an appreciably larger market share than the next competitor post-merger.

5.3.2. Retail supply of TV services

5.3.2.1. Horizontally affected markets

(64) The Parties’ activities overlap in the market(s) for the retail supply of TV services in Bulgaria, in particular, in a possible segment for the provision of OTT services. In this segment United Group is active globally, including in Bulgaria.

(65) The tables below illustrate BTC’s and its main competiors’ market shares in 2018 both in value and in volume (by number of subscribers) in Bulgaria.27

(69) First, the Transaction results in an increment of less than [0-5]% (even in the narrowest possible segment for retail supply of Pay-TV services distributed through OTT). In the Notifying Party’s view, [UG strategy regarding the Bulgarian market]. This is demonstrated by the very limited number of subscribers (amounted to […]) and revenues (EUR […]) generated from that activity in 2018. In addition, United Group’s OTT services provided under “Net.TV.Plus”, target the ex-Yugoslavian diaspora, with a focus on channels in Serbian/Croatian/Bosnian language, indicating further that [UG strategy regarding the Bulgarian market].

(70) Second, the Notifying Party submits that post-Transaction, the merged entity will continue to face strong competitive pressure from telecom operators providing such services, as well as from global or regional OTT platforms (such as Netflix and Amazon Prime).

5.3.2.3. The Commission’s assessment

(71) The Commission considers that the Transaction does not give rise to horizontal non- coordinated effects in the market(s) for retail supply of Pay-TV services (and its possible sub-segments) in Bulgaria for the reasons set out below.

(72) First, in the overall market for retail supply of Pay-TV services as demonstrated at Table 1, the Parties’ combined market share based on 2018 figures would be below 25% in volume and in value. In the plausible narrower market for retail supply of Pay-TV services via OTT, BTC’s market share is [20-30]% in volume and [50-60]% in value based on 2018 figures. However, the increment brought by the Transaction would be below [0-5]% in view of the limited revenues and number of subscribers of United Group as set out at paragraph (67), even in the narrowest plausible segment. Therefore, the Transaction, will not significantly affect the structure of the market.

(73) Second, post-Transaction there will remain a sufficient number of alternative suppliers in both the overall market for retail supply of Pay-TV services and the narrower market for the provision of OTT services to maintain a similar level of competition.

(74) Third, the results of the market investigation did not indicate any issues related to the horizontal overlap between the Parties’ activities in the market(s) for retail supply of Pay-TV services (even if we assumed a segmentation per distribution technology) in Bulgaria.29

(75) Based on the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to horizontal non-coordinated effects.

5.4. Vertical effects

5.4.1. Introduction

(76) A merger between companies which operate at different levels of the supply chain may significantly impede effective competition if such merger gives rise to foreclosure.30 Foreclosure occurs where actual or potential competitors' access to supplies or markets is hampered or eliminated as a result of the merger, thereby reducing those companies' ability and/or incentive to compete.31 Such foreclosure may discourage entry or expansion of competitors or encourage their exit.32

(77) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure. Input foreclosure occurs where the merger is likely to raise the costs of downstream competitors by restricting their access to an important input. Customer foreclosure occurs where the merger is likely to foreclose upstream competitors by restricting their access to a sufficient customer base.33

(78) Pursuant to the Non-Horizontal Merger Guidelines, input foreclosure arises where, post-merger, the new entity would be likely to restrict access to the products or services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger.34

(79) For input foreclosure to be a concern, the merged entity should have a significant degree of market power in the upstream market. Only when the merged entity has such a significant degree of market power, can it be expected that it will significantly influence the conditions of competition in the upstream market and thus, possibly, the prices and supply conditions in the downstream market.35.

(80) In assessing the likelihood of an anticompetitive input foreclosure scenario, the Commission examines, first, whether the merged entity would have, post-merger, the ability to substantially foreclose access to inputs, second, whether it would have the incentive to do so, and third, whether a foreclosure strategy would have a significant detrimental effect on competition downstream.36

(81) Pursuant to the Non-Horizontal Merger Guidelines, customer foreclosure may occur when a supplier integrates with an important customer in the downstream market and because of this downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (the input market) and reduce their ability or incentive to compete, which in turn, may raise downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger. This may allow the merged entity profitably to establish higher prices on the downstream market.37

(82) For customer foreclosure to be a concern, a vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground.38

(83) In assessing the likelihood of an anticompetitive customer foreclosure scenario, the Commission examines, first, whether the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals, second, whether it would have the incentive to reduce its purchases upstream, and third, whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.39

5.4.2. Vertically affected markets

(84) As set out at paragraph (34), call termination service is the wholesale service provided by network operators that allows users of different networks to communicate with each other. The market for wholesale termination of calls on mobile fixed networks is therefore vertically related to the retail markets for fixed and mobile telephony services.n this regard, the Transaction gives rise to the below vertically affected markets in the telecommunications sector.

(a) the upstream market for the wholesale provision of call termination services on United Group’smobile networks in Slovenia (Telemach) and Croatia (Tele2) in connection with the downstream maket for the retail provision of mobile and fixed telephony services in Bulgaria;

(b) the upstream market for the wholesale provision of call termination services on United Group’s fixed networks in Slovenia (Telemach) in connection with the downstream maket for the retail provision of mobile and fixed telephony services in Bulgaria (BTC);

(c) the upstream market for the wholesale provision of call termination services on BTC’s mobile network in Bulgaria, in connection with the downstream maket for the retail provision of mobile services in Slovenia and Croatia;

(d) the upstream market for the wholesale provision of call termination services on BTC’s fixed network in Bulgaria, in connection with the downstream maket for the retail provision of fixed telephony services in Slovenia and Croatia.

Table 3: Vertically affected markets in Bulgaria, Slovenia and Croatia

(1) Upstream markets | (2) Downstream markets |

Wholesale mobile call termination services in:

- United Group: 100% in Slovenia; 100% in Croatia | (i) Retail mobile telecommunications services in:

- BTC: [20-30]% in Bulgaria

(ii) Retail fixed telephony services in:

(3) - BTC: [80-90]% in Bulgaria |

Wholesale mobile call termination services in:

- BTC: 100% in Bulgaria | (i) Retail mobile telecommunications services in:

- United Group: [10-20%] in Slovenia; [20-30]% in Croatia

(ii) Retail fixed telephony services in:

- United Group: [20-30]% in Slovenia |

Wholesale fixed call termination in:

- United Group: 100% in Slovenia | (i) Retail mobile telecommunications services in:

- BTC [20-30]% in Bulgaria

(ii) Retail fixed telephony services in:

- BTC: [80-90]% in Bulgaria |

Wholesale fixed call termination in:

- BTC 100% in Bulgaria | (i) Retail mobile telecommunications services in:

- United Group: [10-20]% in Slovenia; [20-30]% in Croatia (ii) Retail fixed telephony services in:

- United Group [20-30]% in Slovenia |

(85) The Transaction gives rise to a vertical link in (i) the wholesale markets for international roaming services in Slovenia (United Group) and Croatia (United Group) in relation to the downstream markets for the retail provision of mobile communication services in Bulgaria (BTC); and (ii) the wholesale markets for international roaming services in Bulgaria (BTC), in relation to the downstream markets for the retail provision of mobile communication services in Slovenia (United

majority of cases, the identity of the customer purchasing termination services is not

known because international calls are mostly made over international carriers who act

as intermediaries between the telecommunication operators.46

5.4.3.1.2. The Commission's assessment

(92) The Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical link between the upstream market for wholesale mobile call termination services and the downstream markets for retail supply of fixed telephony services and retail supply of mobile telecommunication services, for the following reasons.

(93) First, the Commission notes that there are regulatory obligations applying to the wholesale mobile call termination markets.47 Those regulatory obligations include access to specific network facilities, transparency (including publication of draft interconnection agreements on the network operator’s website), non-discrimination and price control. Furthermore, as established by Article 75 of the European Electronic Communications Code, by 31 December 2020 the Commission shall adopt a delegated act setting the Eurorates (a single Union-wide mobile and a single Union- wide fixed termination rate). That means that termination rates, currently established by the Bulgarian, the Slovenian and the Croatian regulators, will be set by the European Commission through a delegated act.

(94) Second, the Commission notes that the majority of the respondents to the market investigation did not raise any concerns related to vertical issues arising from the Transaction in the market for wholesale mobile call termination services on the one hand, and the retail supply of fixed telephony services and retail mobile telecommunications services on the other hand.48

(95) Therefore, due to the existing regulatory obligations on wholesale suppliers of mobile call termination services, the Commission considers that the merged entity will not have the ability to discriminate against United Group’s competitors in Slovenia and Croatia for access to call termination services in Bulgaria. Similary, United Group will not have the ability to discriminate against BTC’s competitors in Bulgaria for access to call termination in Slovenia and Croatia. In view of such regulatory obligations, the Commission also considers that the merged entity will also not have the ability to otherwise degrade terms and conditions for the provision of wholesale mobile call termination services.

(96) In view of the limited importance of (i) wholesale mobile call termination services in Croatia and Slovenia to BTC to and its competitors and (ii) wholesale mobile termination services in Bulgaria to Tele2 and Telemach and their competitors, the Commission considers that the merged entity will not have an incentive to discriminate or otherwise degrade terms and conditions for the provision of such services.

(97) The Transaction will thus not have any appreciable negative impact on prices or other terms or conditions in the downstream markets for the retail supply of fixed telephony services and the retail supply of mobile telecommunications services in those countries.

(98) Based on the above, the Commission concludes that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical link between the upstream markets for wholesale mobile call termination services and the downstream markets for retail supply of fixed telephony services and retail mobile telecommunications services.

5.4.3.2. Wholesale market for fixed call termination services – Retail market for fixed telephony services and retail market for mobile telecommunications services

(99) United Group is active in the market for wholesale fixed call termination services on its own network in Slovenia. BTC is also active in this market in Bulgaria.

5.4.3.2.1. The Notifying Party's view

(100) The Notifying Party submits that the Transaction will not result in any anticompetitive foreclosure concerns for the reasons set out below.

(101) First, the markets for provision of wholesale fixed call termination services are subject to ex ante regulation in the Member States. Such national regulations ensure that access to call termination is granted on reasonable conditions and rates remain reasonable and non discriminatory. In addition, following the adoption of the respective delegated act, by 31 December 2020, mobile and fixed termination rates will no longer be established by the national regulators, but by the Commission through a delegated act.

(102) Second, the Notifying Party asserts that in essence, that any attempt by the Parties to foreclose each other’s competitors is unlikely to be effective, since neither BTC nor United Group can influence the cost structure of Telemach/Tele2 and BTC competitors, respectively, in a significant manner.49 The Notifying Party submits in that respect that wholesale call termination in Croatia and Slovenia is only of minor importance to BTC and its competitors. Similarly, according to the Notifying Party, wholesale call termination in Bulgaria is only of minor importance to Tele2 and Telemach and their competitors in Slovenia and Croatia. In addition, in the vast majority of cases, the identity of the customer purchasing termination services is not known because international calls are mostly made over international carriers who act as intermediaries between the telecommunication operators.50

5.4.3.2.2. The Commission's assessment

(103) The Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical link between the upstream market for wholesale fixed call termination services and the downstream markets for retail supply of fixed telephony services and retail supply of mobile telecommunication services, for the following reasons.

(104) First, the Commission notes that there are regulatory obligations applying to the wholesale mobile call termination markets.51 Those regulatory obligations include access to specific network facilities, transparency (including publication of draft interconnection agreements on the network operator’s website), non-discrimination and price control. Furthermore, as established by Article 75 of the European Electronic Communications Code, by 31 December 2020 the Commission shall adopt a delegated act setting the Eurorates (a single Union-wide mobile and a single Union- wide fixed termination rate). That means that termination rates, currently established by the Bulgarian and the Slovenian regulators, will be set by the European Commission through a delegated act.

(105) Second, the Commission notes that the majority of the respondents to the market investigation did not raise any concerns related to vertical issues arising from the Transaction in the market for wholesale fixed call termination services on the one hand, and the retail supply of fixed telephony services and retail mobile telecommunications services on the other hand.52

(106) Therefore, due to the existing regulatory obligations on wholesale suppliers of fixed call termination services, the Commission considers that the merged entity would not have the ability to discriminate against United Group’s competitors in Slovenia for access to call termination services in Bulgaria. Similary, United Group would not have the ability to discriminate against BTC’s competitors in Bulgaria for access to call termination in Slovenia. In view of such regulatory obligations, the Commission also considers that the merged entity will also not have the ability to otherwise degrade terms and conditions for the provision of wholesale fixed call termination services.

(107) In view of the limited importance of (i) wholesale fixed call termination services in Croatia and Slovenia to BTC to and its competitors and (ii) wholesale fixed termination services in Bulgaria to Tele2 and Telemach and their competitors, the Commission considers that the merged entity will not have an incentive to discriminate or otherwise degrade terms and conditions for the provision of such services.

(108) The Transaction will thus not have any appreciable negative impact on prices or other terms or conditions in the downstream markets for the retail supply of fixed telephony services (and all possible sub-segments set out at paragraph (30)) and the retail supply of mobile telecommunications services (and all possible sub-segments set out at paragraph (23)) in those countries.

(109) Based on the above, the Commission concludes that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical link between the upstream market for wholesale mobile call termination services and the downstream markets for retail supply of fixed telephony services and retail mobile telecommunications services.

6. CONCLUSION

(110) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’).

4 UGB is the special purpose vehicle created by United Group for the acquisition of BTC.

5 BTC’s subsidiaries include BTC, NURTS Bulgaria EAD, BTC Net EOOD, NURTS digital EAD, Net is Sat EOOD.

6 Pursuant to a cross-shareholding restructuring plan, the Bulgarian Telecommunications Company EAD surrendered its shareholding and thus ceased to be a shareholder of Viva.

7 BC Partners’ acquisition of United Group has been approved by the Commission in Case M.9152 of 17 December 2018.

8 At the time of notification of Case M.9152 (BC Partners/United Group), funds advised by BC Partners [Information on corporate governance] in Intelsat, which is active in the provision of satellite transponder of capacities. BTC is active in the provision of retail TV services through DTH and provides satellites services through its satellite station, Plana Teleport. BTC thus purchases transponder capacities from Intelsat. Following a block trade, BC Partners’ shareholding into Intelsat has been reduced [Information on corporate governance]. The Parties submit that […]See Form CO, paragraphs 64-70.

9 United Group offers cable Pay TV through its SBB/Telemach brand, and DTH Pay TV through its Total TV brand in Slovenia, Serbia, Montenegro, Bosnia and Herzegovina and North Macedonia (Total TV only). United Group owns three national TV stations which include Nova TV in Croatia, Nova BH in Bosna and Herzegovina, and Nova M in Montenegro.

10 In Bulgaria, United Group is active only as a provider of OTT services through its wholly-owned subsidiary Solford. “Net.TV.Plus” targets the ex-Yugoslavian diaspora, with a focus on channels in Serbian/Croatian/Bosnian language.

11 Commission decision of 7 April 2017 in case M.8354, Fox/Sky, paragraphs 80 and 81; Commission decision of 24 February 2015 in case M.7194, Liberty Global / Corelio / W&W / De Vijver Media, paragraph 90.

12 Commission decision of 8 December 2018 in case M.8842 – Tele2/Com Hem Holding paragraphs 37-38, Commission decision of 24 February 2015 in case M.7194, Liberty Global / Corelio / W&W / De Vijver Media, paragraphs 117-132; Commission decision of 15 April 2013 in case M.6880, Liberty Global/Virgin Media, paragraphs 44-50; Commission decision of 21 December 2010 in case M.5932, News Corp/BskyB, paragraphs 86–88.

13 Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraphs 40-42; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraphs 12-13; Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraphs 157-160; Commission decision of 4 April 2007 in Case M.4591, Weather Investments/Hellas Telecommunications, paragraph 10.

14 Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, para 44-46; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraphs 15-16; Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL.

15 Commission decision of 3 August 2016 in case M.7978, Vodafone/Liberty Global/Dutch JV, paragraphs 24-26; Commission decision of 4 February 2016 in case M.7637, Liberty Global/BASE Belgium, paragraphs 67-69.

16 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 274; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph 22; Commission decision of 3 August 2016 in case M.7978, Vodafone/Liberty Global/Dutch JV, paragraph 40; Commission decision of 4 February 2016 in case M.7637, Liberty Global/BASE Belgium, paragraph 73.

17 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 259; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraph 70; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph 26; Commission decision of 12 December 2012 in case M.6497, Hutchison 3G Austria/Orange Austria, paragraph 68.

18 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 263; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraph 73; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph28; Commission decision of 3 August 2016 in case M.7978, Vodafone/Liberty Global/Dutch JV, para 196.

19 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 259, Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraph78, Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph 32; Commission decision of 12 December 2012 in case M.6497, Hutchison 3G Austria/Orange Austria, paragraph 68.

20 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 263; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraph 81; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph 35; Commission decision of 3 August 2016 in case M.7978, Vodafone/Liberty Global/Dutch JV, paragraph 210.

21 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 250; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraphs 59-61; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph40; Commission decision of 1 March 2010 in case M.5650, T-Mobile/Orange, paragraphs 32-34.

22 Commission decision of 27 November 2018 in case M.8792, T-Mobile NL/Tele2 NL, paragraph 251; Commission decision of 15 July 2019 in case M.9370, Telenor/DNA, paragraph 65; Commission decision of 27 July 2018 in case M.8883, PPF/Telenor Target Companies, paragraph 43; Commission decision of 3 August 2016 in case M.7978 Vodafone/Liberty Global/Dutch JV, paragraph 202.

23 Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Horizontal Merger Guidelines"), OJ C 31, 05.02.2004.

24 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008.

25 The Commission has not found any indications that the present Transaction could give rise to coordinated effects in relation to the horizontally affected market identified in Section 5.2. No related complaints have been received during the market investigation.

26 Horizontal Merger Guidelines, paragraph 24.

27 Considering alternative segmentations of the market for retail supply of Pay-TV services, based on the Notifying Party’s submission, BTC's market shares in the possible segments for premium and basic Pay- TV services, in 2018 was [20-30]% in premium Pay-TV services and [20-30]% in basic Pay-TV services. According to the Notifying Party, market shares BTC and United Group achieved in the possible segment for linear and non-linear Pay-TV services are unlikely to be significantly different from the overall market including both linear and non-linear Pay-TV services. Therefore, BTC’s market share in alternative segments of the market for the retail supply of Pay-TV services does not materially differ from the market shares in the overall market for the retail supply of Pay-TV services.

28 HBO GO from Telenor, Voyo, Diema Xtra, Bubaplay etc.

29 See replies to questionnaire Q3 –Questionnaire to TV competitors, questions 5.1 and 5.2.

30 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008, p. 11, paragraphs. 17-18.

31 See Non-Horizontal Guidelines, paragraph 18.

32 See Non-Horizontal Guidelines, paragraph 29.

33 See Non-Horizontal Guidelines, paragraph 30.

34 See Non-Horizontal Guidelines, paragraph 31.

35 See Non-Horizontal Guidelines, paragraph 35.

36 See Non-Horizontal Guidelines, paragraph 32.

37 See Non-Horizontal Guidelines, paragraph 58.

38 See Non-Horizontal Guidelines, paragraph 61.

39 See Non-Horizontal Guidelines, paragraph 59.

40 In terms of suscribers, in 2018, United Group held a market share of [20-30]% in Slovenia and [10-20] in Croatia. BTC's market share was [20-30]% in Bulgaria.

41 In terms of suscribers, in 2018, United Group held a market share of [20-30]% in Slovenia while BTC's held a market share of [60-70]% in Bulgaria.

42 Form CO, paragraphs 243-244 and 251-252.

43 Commission decision of 15 July 2019 in case M.9270, Telenor/DNA, paragraph 136.

44 Form Co, paragraphs 245 and 253.

45 Form CO, paragraphs 247 and 255.

46 Reply to RFI 8 of 1 April 2020.

47 With respect to Bulgaria, see Commission Decision of 21 November, 2016 in case BG/2016/1924, Call termination on individual mobile telephone networks in Bulgaria and corresponding national market review performed by the national regulatory authority. With respect to Croatia, see Commission Decision of 13 February 2019 in case HR/2019/2140: Wholesale voice call termination on individual mobile networks in Croatia. With respect to Slovenia, see Commission decision of 8 March 2016, in case SI/2016/1841: Wholesale voice call termination on individual mobile networks in Slovenia – Remedies.

48 See replies to questionanaire Q1 – Questionnaire to competitors, questions 4.1, 4.2 and 4.4 and replies to questionnaire Q2 – Questionnaire to customers, questions 7.1 and 7.2.

49 Form CO, paragraphs 247 and 255.

50 Reply to RFI 8 of 1 April 2020.

51 With respect to Bulgaria, see Commission Decision of 26 May, 2016 in case BG/2016/1862, Call termination on individual public telephone provided at a fixed location in Bulgaria. With respect to Croatia, see Commission Decision of 12 February 2019 in case HR/2019/2139: Wholesale call termination on individual public telephone networks provided at a fixed location in Croatia. With respect to Slovenia see Commission Decision of 7 March 2016, in case SI/2016/1840, Wholesale call termination on individual public telephone networks provided at a fixed location in Slovenia – Remedies.

52 See replies to questionanaire Q1 – Questionnaire to competitors, questions 4.1, 4.2. and 4.5 and replies to questionnaire Q2 – Questionnaire to customers, questions 7.1 and 7.2