Commission, March 10, 2017, No M.7936

EUROPEAN COMMISSION

Judgment

PETROL / GEOPLIN

Subject: Case M.7936 – Petrol / Geoplin

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 3 February 2017, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which Petrol, Slovenian energy company d.d., Ljubljana ('Petrol', of Slovenia) will acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control over Geoplin d.o.o. Ljubljana, Družba za trgovanje in transport zemeljskega plina ('Geoplin', of Slovenia), by way of purchase of shares (the 'Proposed Transaction'). (3) Petrol is designated hereinafter as the 'Notifying Party'. Petrol and Geoplin are referred to together as the 'Parties'.

1. THE PARTIES

(2) Petrol (4) is a company active in the energy sector with a focus on the wholesale and retail distribution of petroleum products. It is also engaged in the supply of electricity and natural gas in Slovenia.

(3) Geoplin (5) is a company active in the energy sector with a focus on the wholesale and retail supply of natural gas in Slovenia.

2. THE CONCENTRATION

(4) On 14 July 2016, Petrol and the Republic of Slovenia entered into a binding agreement pursuant to which the Republic of Slovenia would sell to Petrol a controlling interest in Geoplin in exchange for a controlling interest in Plinovodi, the Slovenian gas transmission system operator ("TSO") currently 100% owned by Geoplin.

(5) Upon completion of this swap agreement, the Republic of Slovenia would acquire sole control over Plinovodi, thereby ensuring full ownership unbundling of the domestic TSO, and Petrol will increase its shareholding in Geoplin.

(6) Currently Geoplin shares are distributed among 21 shareholders. The major shareholders are the Republic of Slovenia – 41 %, Petrol – 33 %, Salnal – 7.8 % and Ekopur – 7.8 %. Other shareholders shares do not exceed 3 %. The decision in relation to the business, budget and investments are adopted at the level of Geoplin's Supervisory Board. The Board has 6 members – 2 appointed by Petrol, 2 by the Republic of Slovenia and 2 by the workers council. The decisions are adopted by simple majority if at least half of the Board members are present. According to the Notifying Party, there are no indications that any of Geoplin's shareholders have any agreements in place for the adoption of decisions at the Supervisory Board so that no shareholder is deemed to be currently controlling Geoplin.

(7) Post transaction Petrol will acquire 65% of shares in Geoplin, becoming the majority shareholder (6) of Geoplin, and as a result it will be able to appoint majority of the members of the Supervisory Board and therefore solely exercise decisive influence over Geoplin's strategic decisions.

(8) The Proposed Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(9) On the date of the conclusion of the binding legal agreement giving effect to the concentration, (7) the undertakings concerned had a combined aggregate world-wide turnover of more than EUR 5 000 million (Petrol: EUR 4 723 million; Geoplin: EUR 412 million). (8) In addition, each of them had an EU-wide turnover in excess of EUR 250 million (Petrol: EUR […] million; Geoplin: EUR […] million), but they did not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(10) The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4. BACKGROUND FACTS ON THE SLOVENIAN GAS INDUSTRY

(11) Total natural gas consumption in Slovenia amounted to approximately 0.8 bcm in 2015. (9) To meet domestic consumption, Slovenia relies almost entirely on imports from neighbouring countries given the lack of meaningful domestic production, (10) storage facilities and LNG terminals.

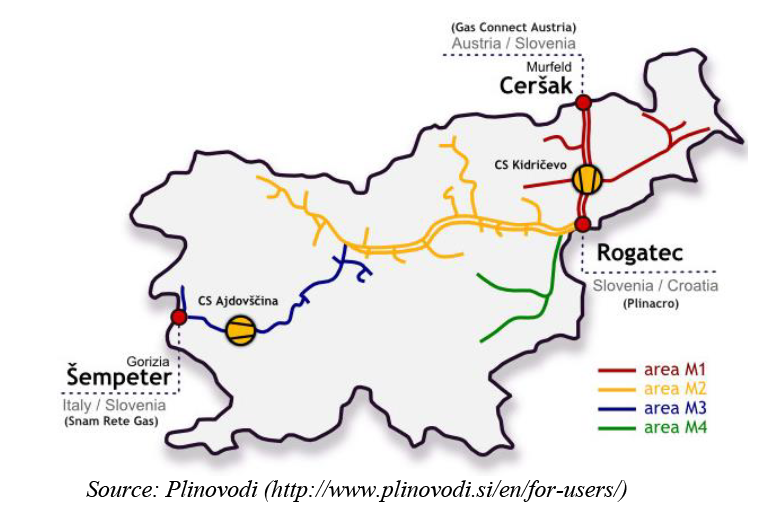

(12) The Slovenian gas transmission system is interconnected with the transmission systems of Austria (Ceršak – entry only), Italy (Šempeter – entry and exit) and Croatia (Rogatec – exit only). Most imports into Slovenia originate from Austria, and to a much lesser extent from Italy. (11) Generally, transmission capacities are auctioned online by the TSO on PRISMA, a platform for booking and trading gas capacities (www.prisma-capacity.eu).

(13) A large share of the natural gas imported into Slovenia (e.g., 46% in 2015) originates from the Central European Gas Hub ('CEGH') located in Austria (also known as 'Baumgarten'). CEGH is the main gas trading hub in Central and Eastern Europe (see www.cegh.at). As such, it operates online electronic gas auctions and provides related services such as the management of title transfer. Physical trading at the CEGH requires online membership registration, the payment of a registration fee and the lodging of a cash-deposit or bank guarantee of EUR 50 000 or less. There are approx. 100 members registered for physical trading with the CEGH, including several international gas suppliers as well as regional suppliers such as Geoplin and GEN-I. The total volume of natural gas physically traded at the CEGH in 2015 amounted to approx. 14 bcm. (12)

(14) To procure gas directly at the hub, suppliers must register as CEGH members and set up balancing groups in both Austria and Slovenia, (13) in addition to booking the required network and border point capacities. However, it is equally possible to source gas indirectly from the various traders active at the CEGH and to then organize the physical delivery of the requested volumes at the Ceršak border interconnection point between Austria and Slovenia.

(15) The distribution of natural gas in Slovenia is carried out by 15 distribution system operators ('DSOs'), most of the time by means of concession contracts entered into with municipalities. (14) Petrol acts as DSO on 24 out of 82 local distribution systems in Slovenia. Geoplin does not own or operate any distribution network.

5. MARKET DEFINITION

(16) The Parties are both active in the wholesale and retail supply of gas in Slovenia. In addition, Petrol is active in the distribution of natural gas and in the production and supply of electricity in Slovenia.

5.1. Downstream wholesale supply of gas

(17) In previous decisions, the Commission defined a separate market for the downstream wholesale supply of natural gas encompassing sales by suppliers with an upstream gas supply contract (as well as those with domestic production) to retailers or other wholesalers.(15) (16) The Notifying Party does not dispute this product market definition which is retained by the Commission for the purpose of the present case.

(18) The Commission usually defined the geographic scope of the downstream wholesale supply market as, at least, national in scope, possibly wider. (17) In the present case, the Notifying Party argues that that the market should be considered wider than Slovenia and should include the CEGH located in Austria. (18) This is due to the lack of any significant barriers for foreign gas suppliers to access domestic wholesale and retail suppliers as well as for Slovenian wholesalers to source gas at the CEGH. The Notifying Party also argues that there are no cross- border capacity constraints with the neighbouring Member States. (19)

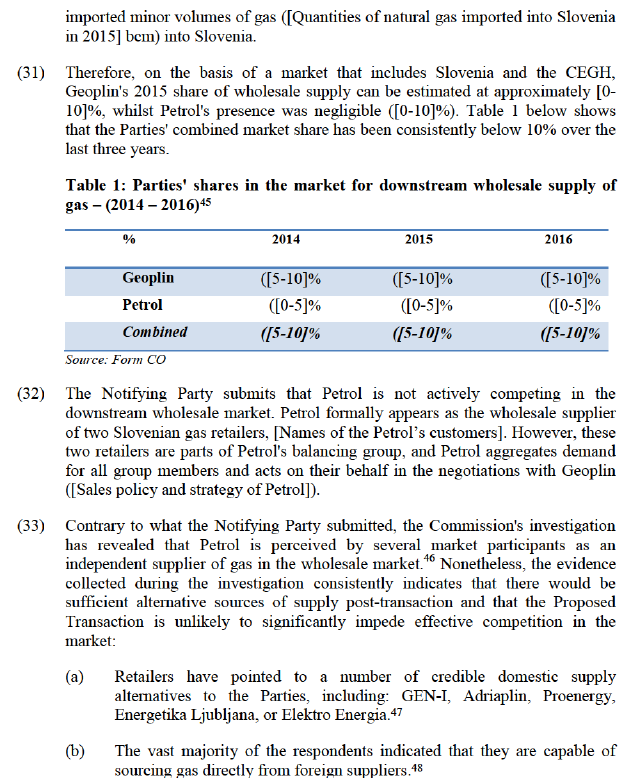

(19) The market investigation supported the view that the geographic market is wider than Slovenia and encompasses, at least, suppliers who operate on the CEGH.

(20) Firstly, most of the responding companies engaged in the purchase of gas at wholesale level in Slovenia confirmed that they can source gas from foreign suppliers. (20) Some domestic suppliers already procure gas from foreign traders, (21) and others have recently entered into negotiations with foreign traders for the supply of gas (or are considering doing so). (22)

(21) Some respondents indicated that in order to import gas into Slovenia via the CEGH, a supplier would have to establish and manage a balancing group at least in Slovenia (in case of delivery of gas at the border), and that small suppliers may lack the necessary know-how and (staff and financial) resources to operate an independent balancing group. (23) However, these difficulties do not appear particularly significant. First, companies purchasing gas at wholesale level in Slovenia, including relatively small suppliers, are increasingly looking into the opportunity to import gas directly or to procure gas at the border. (24) Second, the Commission has been told that Plinovodi, the Slovenian gas TSO, is developing a software that aims to generate gas consumption forecasts on a consistent basis, which should facilitate the management of balancing activities even for small quantities. (25) Finally, according to Plinovodi setting up a balancing group is not complex, it takes a relatively short period of time (approx. 1 month since the initial application) and in any case supplier can also import gas without creating and managing its own balancing group as the balancing activities can be outsourced to third-parties.

(22) Secondly, the majority of gas suppliers who responded to the market investigation took the view that gas trading on the CEGH is part of the Slovenian downstream wholesale market. (26)

(23) Thirdly, the majority of the respondents indicated that cross-border interconnection capacity is not constrained. Consistently with this view, the Slovenian Energy Regulator noted that in 2015 "there were no restriction of the access to border entry-exit points since the demand for capacity was within the available capacity". (27) Most of the gas imported to Slovenia comes from Austria and transits by the Ceršak interconnection point. The average annual utilisation of the maximum technical capacity (28) at the entry point with Austria was 38.8% in 2015. (29) Even in the month with the highest utilization rate (December 2015), a significant share of the available technical capacity at Ceršak remained unused (38.6%).- (30)

(24) Given the lack of any significant barriers to access the CEGH, the absence of cross-border capacity limitations and the large availability of gas on the CEGH, (31) the Commission is of the view that the downstream wholesale market relevant for the present case includes, at least, Slovenia and the CEGH. The Commission has also considered whether the geographic market may encompass other neighbouring countries (Croatia and Italy) but has not found conclusive evidence supporting such a finding. In any event, the exact delineation of the relevant market may be left open in this respect as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

5.2. Retail supply of gas

(25) In previous decisions, the Commission segmented the retail supply of gas into the following relevant markets of supply of gas to: (i) gas fired electricity plants; (ii) large industrial customers; (iii) small industrial and commercial customers; and (iv) households. (32) The Notifying Party agrees with this market segmentation which is retained by the Commission for the purpose of the present case.

(26) The Commission generally held that the geographic scope of retail markets was national in scope. (33) The Notifying Party does not dispute this market definition which is retained by the Commission for the purpose of the present case.

5.3. Distribution of natural gas

(27) The Commission has previously identified the distribution of natural gas through low- and medium-pressure pipeline networks as a relevant product market. (34) The geographic market has traditionally been defined as the territory covered by each distribution grid. (35) The distribution of gas constitutes a natural monopoly given that the distribution grid cannot be duplicated in any economically viable manner. The Notifying Party does not dispute this market delineation which is retained by the Commission for the purpose of the present case.

5.4. Production and wholesale supply of electricity

(28) In electricity markets, the Commission has in the past identified a separate market for the generation and wholesale supply of electricity, irrespective of the generation source, and this market has generally been defined as national in scope. (36) The Commission has also considered a number of alternative segmentations of the product and geographic market (e.g., peak vs off-peak (37), short-term and long-term contracts, (38) national vs supranational vs local, etc. (39)). However, for the purposes of the present case, the exact delineation of the relevant market can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

6. COMPETITIVE ASSESSMENT

6.1. Horizontal overlap in the downstream wholesale supply of gas

(29) The Notifying Party argues that the Proposed Transaction would not result in any material loss of competition because: (i) the downstream wholesale market is wider than Slovenia and the Parties have a limited position on this wider market; (ii) Petrol is not actively participating in the wholesale market; and (ii) there are no barriers for either foreign suppliers to serve Slovenian wholesalers/retailers or for the latter to source gas directly at CEGH therefore by-passing domestic wholesale suppliers, such as Geoplin and Petrol. (40)

(30) As discussed in section 5.1 above, the Commission considers that the downstream wholesale market relevant for the assessment of the Proposed Transaction includes, at least, Slovenia and the CEGH. The total volume of gas available for import into Slovenia (either at the CEGH or at the border with neighbouring countries (41)) amounted to 14.4 bcm in 2015. (42) Geoplin purchased 1.33 bcm of gas, (43) of which 0.64 bcm were imported and sold in Slovenia while the remaining 0.69 bcm were resold in countries other than Slovenia. Petrol purchased (44) and

(c) Domestic retailers and wholesalers have most commonly indicated GEN-I and Adriaplin as Geoplin's closest competitors for the wholesale supply of gas. (49)

(d) None of the respondents to the Commission's questionnaire considers itself as dependent on either Geoplin or Petrol for the procurement of gas at the wholesale level. (50)

(34) In addition, as discussed in paragraphs (20) to (23) above, the investigation has revealed that there are no significant barriers for domestic players (retailers or wholesalers) to source gas abroad, especially at the CEGH, or for foreign suppliers to import gas into Slovenia.

(35) In view of the above, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the market for the downstream wholesale supply of gas.

6.2. Horizontal overlap in the retail supply of gas

(36) The Parties' activities overlap on the markets for the retail supply of gas to: (i) large industrial customers; and (ii) small industrial and commercial customers.

(37) On the market for large industrial customers, the Parties' combined market share would be [70-80] % but the increment brought about by Petrol is very limited ([0- 5]%). Moreover, there are other competitors with a share larger than Petrol: Adriaplin ([10-20]%), GEN-I ([5-10]%) and Plinara Maribor ([0-5]%).

(38) On the market for small industrial and commercial customers, the Parties' combined market share would be [10-20] % (Petrol [10-20] % and Geoplin [5-10]%), so that the market would technically not be horizontally affected. (51) GEN-I ([20-30] %) and Adriaplin ([10-20] %) would have a share comparable to the Parties' post-merger, and the market investigation confirmed that these suppliers are perceived by retail customers as close competitors to the Parties. Other significant competitors include Energetika Ljubjana ([10-20] %), Plinarna Maribor ([10-20] %) and Domplan ([0-5] %).

(39) The Notifying Party argues that the overlaps between Geoplin and Petrol at retail level are unlikely to have a significant impact on competition because they are limited and a number of effective competitors would remain post-transaction.

(40) The outcome of the market investigation largely confirmed the Notifying Party's arguments. The majority of the responding retail customers indicated that they are not currently dependent for gas supplies on any of the Parties, (52) and that the Proposed Transaction would have limited (or no) competitive impact on the Slovenian retail gas markets. (53)

(41) The Commission also assessed the effects arising from Geoplin and Petrol's existing non-controlling minority shareholdings in their retail competitors Adriaplin and GEN-I, respectively. Geoplin has historically owned an interest in Adriaplian, currently at 11%. Petrol divested the majority of its 50% interest in GEN-I, but currently still retains an indirect 12.5 % stake in GEN-I's share capital. After considering the elements submitted by the Notifying Party and gathered in the course of the market investigation, the Commission considers that these minority shareholdings are unlikely to result in unilateral or coordinated effects in this case due to the following reasons:

(a) Firstly, the minority stakes in question do not entitle Geoplin or Petrol to exercise any specific influence over strategic decisions in Adriaplin or GEN-I.

(b) Secondly, the size of the minority stakes is limited and is unlikely to alter the Parties' incentives to compete to any material extent.

(c) Thirdly, while the Proposed Transaction would create a structural link between Petrol and Adriaplin as they compete in the retail supply to household customers (currently Geoplin is not active in the supply to households and therefore its activities do not overlap with Adriaplin's), there are numerous established suppliers in this market which would continue to exert a significant competitive constraint on the Parties and Adriaplin post-merger. (54)

(d) Finally, Petrol's remaining indirect minority stake in GEN-I is in the process of being divested. (55)

(42) In view of the above, the Commission considers that the Proposed Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the market for the retail supply of gas to large industrial customers and small industrial and commercial customers.

6.3.Vertical links between wholesale supply and retail supply of gas

(43) Based on the available evidence, the Commission considers that the Proposed Transaction is unlikely to result in any form of input or customer foreclosure.

(44) The Proposed Transaction does not create a new vertical link as the Parties are already active in the wholesale and retail supply of gas in Slovenia.

(45) With regard to input foreclosure, the Parties' individual positions in the downstream wholesale market are limited and the market investigation has confirmed that wholesale customers would be able to source gas from other reliable sources, including directly at the CEGH or from traders active at the CEGH in response to an increase in the domestic wholesale price.

(46) With regard to customer foreclosure, the Proposed Transaction would not materially strengthen the Parties' position in any of the retail markets where their activities overlap so that their ability to foreclose access to the downstream markets would remain largely unaltered. Moreover, the Commission notes that neither Petrol nor Geoplin currently purchases any volume of gas from third parties at wholesale level. (56)

(47) The Commission therefore concludes that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market as a result of the vertical relationship between the wholesale and retail supply of gas in Slovenia.

6.4. Vertical links between retail supply of gas to gas-fired power plants and electricity generation

(48) In addition to its activities in the gas sector, Petrol is also active in the generation and wholesale supply of electricity. The Proposed Transaction therefore creates a vertical link between the gas supply activities of Geoplin and the electricity generation and supply activities of Petrol, irrespective of the fact that Petrol does not operate any of the four gas-fired power plants located in Slovenia. The Commission has therefore considered whether, following the Proposed Transaction, the Parties may have the ability and incentive to restrict supply of gas to their competitors' gas-fired power plants.

(49) On the basis of the evidence collected during the investigation, the Commission considers that vertical foreclosure effects are unlikely to arise. Firstly, the Parties would have no (or limited) ability to foreclose access to gas. While Geoplin appears to be currently the sole supplier of natural gas to power plants in Slovenia, the respondents to the market investigation have indicated that: (i) there are alternative credible suppliers from which they could (or will) source gas in the future, including foreign traders active at CEGH, if Geoplin were to cease offering competitive supply conditions; and (ii) their gas-fired power plants operate on the basis of a dual fuel system allowing them to switch from one (gas) to the other (oil) in response to a change in the relative prices of gas and oil.

(50) Secondly, the Parties would have no (or limited) incentives to foreclose access to gas because: (i) Petrol's share of the electricity production in Slovenia is minimal ([0-5] %); (ii) electricity generated by gas-fired power plants in Slovenia accounts for a very small share of the total domestic production; and (iii) third parties' gas- fired power plants are used primarily for balancing purposes (as part of the tertiary/minute reserve) and therefore they compete with Petrol's generation units only to a limited extent.

(51) The Commission therefore concludes that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market as a result of the vertical relationship between the retail supply of gas to gas-fired power plants and the generation and wholesale supply of electricity in Slovenia.

6.5. Vertical links between retail supply of gas and gas distribution

(52) The Commission has also considered whether the Proposed Transaction may strengthen the existing vertical link between Petrol's retail supply and distribution activities. However, the Commission is of the view that Petrol's ability and incentives to engage in foreclosure strategies are unlikely to be materially affected by the Proposed Transaction.

(53) The Proposed Transaction would only marginally increase Petrol's position in the retail supply to customers connected to distribution networks since Geoplin has a small share ([5-10] %) in the retail supply to small industrial and commercial customers, and it does not serve household customers. (57) Therefore, the Proposed Transaction is unlikely to increase the incentives to foreclose the Parties' downstream (retail) competitors to any material extent. Also, no concerns were raised by market participants about the risk of Petrol carrying out discriminatory conducts in the provision of access to the distribution networks that it operates as a DSO.

(54) The Commission therefore concludes that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market as a result of the vertical relationship between the retail supply of gas to small industrial and commercial customers and the gas distribution in Slovenia.

7. CONCLUSION

(55) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 OJ L 24, 29.1.2004, p. 1

4 Geoplin is the ultimate parent company of the Geoplin group. None of the current shareholders exercise control over the company.

5 Petrol is the ultimate parent company of the Petrol group. None of the current shareholders exercise control over the company.

6 Republic of Slovenia will retain 25 % share in Geoplin. No veto or any other special rights providing control over Geoplin will be retained by the Republic of Slovenia.

7 See Commission Consolidated Jurisdictional Notice ([2008] O.J. C95/1), para. 156 and 172 et seq. The binding legal agreement between Petrol and the Republic of Slovenia was concluded on 14 July 2016, which is the relevant date for establishing jurisdiction. The relevant turnover of Petrol therefore includes the turnover of GEN-I, a company in which Petrol owned at the relevant date for establishing jurisdiction a 50% shareholding. No adjustment of the audited accounts was necessary as Petrol divested its interest in GEN-I only after the relevant date for establishing jurisdiction and the divestment of GEN-I was not a pre-condition for the operation.

8 Turnover calculated in accordance with Article 5(1) of the Merger Regulation.

9 Form CO, para. 172; Agencija za energijo, Key indicators of the electricity and natural gas markets in 2015, September 2015, p.3 (available at: https://www.agen-rs.si/).

10 In 2015 domestic production of gas in Slovenia amounted to [The quantities of natural gas produced in Slovenia in 2015] bcm, accounting for less than [The quantities of natural gas produced in Slovenia in 2015]% of the total domestic consumption (Form CO, para. 317).

11 Form CO, paragraph 173; Slovenian Energy Regulator, Key indicators of the electricity and natural gas markets in 2015, September 2015, p.10 (available at: https://www.agen-rs.si/).

12 See www.cegh.at/market-data-0.

13 A balancing group is a group of gas transmission system users for which the deviations ('imbalances') between the actual off-take and predicted (nominated) off-take of gas are jointly managed and balanced within every clearing interval (day). The TSO charges suppliers for any imbalance that they have generated, on the basis of the prices emerging in the balancing market.

14 Form CO, paragraphs 2015-225; Slovenian Energy Regulator, Report on the energy sector in Slovenia for 2015, pp. 80-81.

15 Case M.6984 EPH / Stredoslovenska Energetika (2014); Case 39.315 – ENI (2010).

16 In its decisional practice the Commission has generally distinguished between downstream and upstream wholesale market. On the latter market, upstream gas producers sell large volumes of gas to downstream wholesalers, typically under long-term gas supply agreements. See Case M.5585 Centrica/ Venture Production (2009).

17 Case M.6984 - EPH/Stredoslovenska Energetika (2014).

18 In the past, the Commission has considered whether gas trading on hubs should be included in the downstream wholesale market. For example, in Case M.4180 - GDF/Suez (2006), the Commission considered a separate market for the wholesale trading of gas on the Zeebrugge gas hub. In Case M.5467 - RWE/Essent (2009) and M.7228 – Centrica/Bord Gais Energy (2014), the Commission considered a number of evidence suggesting that trading at the hub (the Title Transfer Facility (TTF) in the Case M.5467 and the National Balancing point (NBP) in the Case M.7228) was part of the wholesale market although the market definition was ultimately left open.

19 Form CO, paragraph 300.

20 Non-confidential responses to Q26 of the Commission's questionnaire to suppliers.

21 For example, Energija plus, a Slovenia wholesaler, has an agreement in place with E.ON Energy Sales, a UK-based trader, to import natural gas from three neighbouring countries, Austria, Italy, and Croatia (see Form CO, paragraph 300). Similarly, one of the Parties' competitors has been importing all its gas requirements from abroad since 2012 (non-confidential minutes of the call with competitor, 28 September 2016).

22 See non-confidential minutes of the call with a customer, 28 September 2016 and minutes of the call with a customer,19 September 2016

23 See non-confidential minutes of the call with a customer, 28 September 2016, non-confidential minutes of the call with a customer, 12 October 2016; non-confidential minutes of the call with a customer, 3 October 2016.

24 See non-confidential minutes of the call with a supplier, 3 October 2016 and non-confidential minutes of the call with a supplier, 19 September 2016.

25 See non-confidential minutes of the call with a supplier, 28 September 2016.

26 See non-confidential responses to Q6 of the Commission's questionnaire to suppliers. The majority of the respondents also indicated that the CEGH price is typically taken as a reference point when negotiating the terms of supply with domestic wholesalers (non-confidential responses to Q12.6 of the Commission's questionnaire to suppliers).

27 See Slovenian Energy Agency, Report on the energy sector in Slovenia for 2015.

28 The 'maximum technical transmission capacity' is defined by Plinovodi d.o.o. as "the capacity, which is physically available for transmission of natural gas at analyzed entry or exit point. The definition of maximum technical capacity shall take into account the technical capacities of all components of the gas pipeline network involved in the transmission, the configuration and operational characteristics of the gas pipeline network as a whole and its operational boundary conditions." http://www.plinovodi.si/en/for-users/methodology-for-determination-of-maximum- technical-capacity/

29 Source: Plinovodi d.o.o.

30 The rate of technical capacity utilisation reached its peak on 11 December 2015 (66.8%).

31 The volume of gas traded on the CEGH was almost 17 times larger than the Slovenian total consumption in 2015.

32 COMP/M.5740 - Gazprom/ A2A / JV.

33 COMP/M.5740 - Gazprom / A2A / JV, COMP/M.6068 - ENI/ ACEGASAPS/ JV, COMP/M.3230 - Statoil / BP / Sonatrach / In Salah JV.

34 COMP/M.4180 - GDF/Suez, COMP/M.3696 - E.On/MOL, COMP/M.6302 -F2i/AXA Funds/ G6 Rete Gas, COMP/M.6068 - ENI/AcegasAps/JV, COMP/M.6698 – Cheung Kong Holdings / Cheung Kong Infrastructure Holdings / Power Assets Holdings / MGN Gas Networks.

35 See, e.g., COMP/M.3696 - E.On/MOL

36 COMP/M.3696 – E.ON / MOL; COMP/M.5512 – Electrabel / E.ON; COMP/M.5979 – KGHM / Tauron Wytwarzanie / JV; COMP/M.6984 – EPH / Stredoslovenska Energetika.

37 COMP/M.5467 RWE / Essent (June 2009).

38 COMP/M.5911 Tennet / Elia / Gasunie / APX-Endex (2010).

39 COMP/M.3868 DONG/Elsam/Energi E2 (2006), COMP/M.2947 Verbund / Energie Allianz (2003).

40 See Form CO, paragraphs 250 to 252.

41 Due to the lack of reliable data, the capacity available at the border with neighbouring countries is assumed to be equal to the amount of gas actually imported into Slovenia. As a result, it might underestimate the total volume potentially available for import into Slovenia.

42 The (physical) volume of gas traded on the CEGH was 13.9 bcm (of which 0.4 bcm were transported to Slovenia for domestic consumption) and the volume imported into Slovenia from sources other than the CEGH was 0.4 bcm.

43 Either at the CEGH or at the border with neighbouring countries.

44 Either at the CEGH or at the border with neighbouring countries.

45 Although information on the competitors’ shares in this market is not available, the Commission notes that, in addition to some domestic suppliers (see paragraph (20)), several international gas suppliersare active on the hub, including, for example, ENI, RWE and Uniper.

46 See non-confidential minutes of the call with a supplier, 12 October 2016 ; non-confidential minutes of the call with a supplier, 3 October 2016, and non-confidential minutes of the call with a supplier, 19 September 2016. See also non-confidential responses to Q12.3 and Q12.5 of the Commisions’ questionnaire to suppliers.

47 See non-confidential response to Q23.1 of the questionnaire to competitors, and also non-confidential minutes of the call with a supplier of 12 October 2016 and 3 Ocotober 2016

48 Non-confidential responses to Q26 of the Commissions' questionnaire to suppliers.

49 Non-confidential responses to Q12.5 of the Commissions' questionnaire to suppliers.

50 Non-confidential responses to Q18 and Q26 of the Commissions' questionnaire to suppliers.

51 Commission Regulation (EC) No 802/2004 implementing Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings, Annex 1, Section 6.3.

52 Non-confidential version of the Commission's questionnaire to customers, responses to Q.22.

53 Non-confidential version of the Commission's questionnaire to customers, responses to Q.30.

54 Including: Energetika Ljubljana (18 %), Plinarna Maribor (15 %), GEN-I (24 %)

55 Petrol's 50% interest in GEN-I was sold to a special purpose vehicle called GEN-EL. Upon closing of that transaction on 28 November 2016, Petrol still retained a non-controlling 25% interest in GEN-EL and, through GEN-EL, an indirect 12.5% stake in GEN-I. [Petrol’s intentions with the remaining stake in GEN-EL].

56 Form CO, paragraphs 291 and 296.

57 Form CO, paragraphs 279 and 284.