Commission, July 23, 2019, No M.9389

EUROPEAN COMMISSION

Judgment

PORSCHE HOLDING SALZBURG / SIVA / SOAUTO

Subject: Case M.9389 – Porsche Holding Salzburg/SIVA/Soauto

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 20 June 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Porsche Holding Gesellschaft m.b.H. (“Porsche Holding Salzburg”, Austria) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of SIVA – Sociedade de Importação de Veículos Automóveis, S.A. (“SIVA”, Portugal) and Soauto – SGPS, S.A. (“Soauto”, Portugal), by way of purchase of shares (the “Transaction”). (3) Porsche Holding Salzburg is designated hereinafter as the “Notifying Party”. SIVA and Soauto are referred to together as the “Target Companies”. Porsche Holding Salzburg, SIVA and Soauto are collectively referred to as the “Parties”.

1. THE PARTIES & THE OPERATION

(2) Porsche Holding Salzburg is active in the wholesale and retail distribution of passenger cars, light commercial vehicles (“LCVs”) and related spare parts as well as repair services and certain financial services in a number of European countries and in Columbia, Chile, China, Malaysia, Singapur, Brunei and Japan. Porsche Holding Salzburg is an indirect subsidiary of Volkswagen AG (“VW AG”). The latter is a publicly traded company being the parent company of the Volkswagen Group (“VW Group”). The VW Group is active worldwide in the development, manufacture, marketing and sale of passenger cars, light commercial vehicles, trucks, buses, coaches, chassis for buses, diesel engines, motor bikes, each including spare parts and accessories, and in vehicle distribution. The VW Group includes the vehicles brands Volkswagen Passenger Cars, Volkswagen Light Commercial Vehicles, Porsche, Audi, Škoda, SEAT, Bentley, Bugatti, Lamborghini, MAN, Scania and Ducati (“VW Group Brands”). In Portugal, the VW Group is active on:

(a) the wholesale distribution of new and used passenger cars, light commercial vehicles and OE spare parts with regard to its SEAT, Porsche and Bentley brands, and

(b) the retail distribution of new and used passenger cars, light commercial vehicles, and OE spare parts (as well as maintenance and repair services) via a single SEAT dealer in the district of Setúbal.

(3) The Target Companies are active in the wholesale and retail distribution of new and used passenger cars, light commercial vehicles and OE spare parts of certain brands of the VW Group in Portugal.

(a) SIVA is active on the wholesale level as importer of the vehicles and OE spare parts of passenger cars and light commercial vehicles and OE spare parts for VW, Audi, Škoda and Lamborghini brands. SIVA further distributes these vehicles to Soauto and other independent VW dealers throughout Portugal.

(b) Soauto is active in the retail distribution of new and used passenger cars and light commercial vehicles, and OE spare parts for VW, Audi, Škoda, Lamborghini and Bentley brands. Soauto also provides car repair and maintenance services. Soauto has a physical presence in the districts of Lisboa, Porto and Setúbal.

(4) Due to the Target Companies’ financial distress, [Porsche Holding Salzburg intends to acquire the Target Companies].

(5) Pursuant to a share and purchase agreement of 30 April 2019, Porsche Holding Salzburg will acquire the total share capital of the Target Companies, which will therefore be solely controlled by Porsche Holding Salzburg post-Transaction. The Operation therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million. (4) Each of them has an EU-wide turnover in excess of EUR 250 million, but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

3. MARKET DEFINITION

(7) The Parties’ activities horizontally overlap in a number of markets, namely: (i) wholesale distribution of new passengers cars and light commercial vehicles ("LCVs") at EEA-wide level and in Portugal or regions thereof; (5) (ii) retail distribution of new passengers cars and LCVs at EEA-wide level and in Portugal or regions/cities thereof; (6) (iii) wholesale distribution of used motor vehicles at EEA- wide level and in Portugal; (7) (iv) retail distribution of used motor vehicles in Portugal or regions thereof; (8) (v) retail distribution of OE spare parts for passenger cars and LCVs at EEA-wide level and in Portugal or cities thereof; (9) and (vi) car repair and maintenance of automotive vehicles in Portugal. (10)

(8) Only one of the horizontal overlaps involve affected markets: wholesale distribution of new passenger cars and LCVs at EEA-wide level.

(9) The Transaction also gives rise to four vertical relationships through the activity of PHS’s parent company VW, namely: (i) Manufacture of new passenger cars and LCVs (11) and wholesale distribution of new passenger cars and LCVs in Portugal and at EEA-wide level; (ii) Wholesale and retail distribution of new passenger cars and LCVs in Portugal and at EEA-wide level; (iii) Manufacture of OE spare parts for passenger cars and LCVs (12) and wholesale distribution of OE spare parts for passenger cars and LCVs in Portugal; and (iv) Wholesale and retail distribution of OE spare parts for passenger cars and LCVs in Portugal.

(10) Only the last two vertical relationships involve affected markets: VW is active on the upstream markets for the manufacture and wholesale distribution of OE spare parts for passenger cars, and Siva and Soauto are active on the downstream markets for the wholesale and retail distribution of those parts in Portugal.

3.1. Product market definition

3.1.1. Wholesale distribution of new passenger cars and LCVs

(11) In its previous decisional practice, the Commission has distinguished between the wholesale and retail distribution of vehicles. At the wholesale level, distributors or importers distribute vehicles to dealers operating at retail level. (13) Furthermore, the Commission has concluded that the wholesale distribution of passenger cars and the wholesale distribution of LCVs are considered separate relevant product markets.

(12) The Notifying Party does not contest the above market definition, which will be retained for the purposes of this case. In any event, there is no need to close the market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.1.2. Manufacture of OE spare parts for passenger cars and LCV

(13) In previous cases, (14) the Commission has defined the market for the manufacture and supply of spare parts for passenger cars or LCVs. The narrowest plausible product market definition would comprise brand specific OE spare parts.

(14) In any event, there is no need to close the market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.1.3. Wholesale distribution of OE spare parts for passenger cars and LCVs

(15) In its previous decisional practice, the Commission found that there are separate markets for the wholesale distribution of OE spare parts for passenger cars and LCVs and the non-OE spare parts. (15) According to the Commission, the wholesale distribution of OE spare parts is brand-specific. (16) The Commission also considered a segmentation of the market between categories of vehicles, i.e. light vehicles (passenger cars and LCVs) and heavy vehicles, (17) but without any sub-segmentation by product. (18)

(16) The Notifying Party does not contest the above market definition, which will be retained for the purposes of this case. In any event, there is no need to close the market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.1.4. Retail distribution of OE spare parts for passenger cars and LCV

(17) In previous decisions, (19) the Commission has distinguished between the retail distribution of OE spare parts and non-OE spare parts. The Commission found that the retail distribution of OE spare parts is also brand-specific, thus defining the market according to the brand of a given spare part, and distinguished between light and heavy vehicles. (20)

(18) The Notifying Party does not contest the above market definition, which will be retained for the purposes of this case. In any event, there is no need to close the market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.2. Geographic market definition

3.2.1. Wholesale distribution of new passenger cars and LCVs

(19) In its previous decisional practice, the Commission has left open whether the geographic market for the wholesale distribution of new passenger cars and LCVs is to be considered EEA-wide, national or regional. (21)

(20) The Notifying Party submits that the Portuguese Competition Authority has considered the geographic scope of the wholesale distribution markets for new and used vehicles to be national in scope. (22) However, the Notifying Party submits that the market definition can be left open as no competition concerns arise under any alternative market definition.

(21) In any event, there is no need to close the geographic market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.2.2. Manufacture of OE spare parts for passenger cars and LCV

(22) In previous decisions, (23) the Commission has left open whether the scope of the market for the manufacture and supply of spare parts for passenger cars and LCVs is EEA-wide or national. The Notifying Party submits that the market definition can be left open as no competition concerns arise under any alternative market definition.

(23) In any event, there is no need to close the geographic market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.2.3. Wholesale distribution of OE spare parts for passenger cars and LCV

(24) In its past decisional practice, the Commission has left open whether the scope of the wholesale distribution market of OE spare parts for passenger cars and LCV is EEA-wide or national. (24) The Notifying Party submits that the market definition can be left open.

(25) In any event, there is no need to close the geographic market definition as the Transaction will not lead to serious doubts under any alternative market definition.

3.2.4. Retail distribution of OE spare parts for passenger cars and LCV

(26) In previous decisions, (25) the Commission has left open whether the scope of the market for the retail distribution of OE spare parts is national or sub-national. The Notifying Party submits that the market definition can be left open.

(27) In any event, there is no need to close the geographic market definition as the Transaction will not lead to serious doubts under any alternative market definition.

4. COMPETITIVE ASSESSMENT

4.1. Horizontal non-coordinated effects

4.1.1. Introduction

(28) As explained in paragraph (8) the Transaction leads to horizontally affected market in relation to the wholesale distribution of new passenger cars and LCVs at EEA- wide level.

(29) Concerning the wholesale distribution of VW-branded OE spare parts, prior to the Transaction, SIVA was the sole wholesale distributor of the spare parts of the VW, Audi, Škoda and Lamborghini brands in Portugal, whereas SEAT Spain, Porsche Ibérica and Bentley Limited have been the sole wholesale distributors of spare parts of their respective brands. Post-Transaction, the VW Group will fully integrate the wholesale distribution of all its different brands in Portugal. Given that each brand constitutes a separate product market, the vertical integration of those brands does not lead to any horizontal overlap.

4.1.2. Wholesale distribution of new passenger cars and LCV

(30) The combined market share of the Parties on the market for wholesale distribution of new passenger cars and LCV amounts to [20-30]% at EEA-wide level. However, the Target Companies are only active in Portugal and the increment brought about by the Transaction is below [0-5]%. (26)

(31) In view of the small combined market share of the Parties and the small increment, the Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the market for the wholesale distribution of new passenger cars and LCV at EEA-wide level.

4.2. Non-horizontal overlaps

4.2.1. Introduction

(32) The Transaction gives rise to vertically affected relationships as follows: (i) between the upstream market for the manufacture of OE spare parts for passenger cars and LCV, where VW Group is active, and the downstream market for the wholesale distribution of those parts where the Target Companies are active (as well as VW); and (ii) between the upstream market for the wholesale distribution of VW-branded OE spare parts for passenger cars and LCV, where VW Group is active (as well as the Target Companies), and the downstream market for the retail distribution of those parts, where the Target Companies are active.

4.2.2. Market structure

(33) On the upstream market for the manufacture of VW-branded OE spare parts for passenger cars and LCVs VW Group – the ultimate controlling entity of Porsche Holding Salzburg – has a monopoly for all brands. On the market for the wholesale distribution of VW-branded OE spare parts for passenger cars and LCVs in Portugal, VW Group is the exclusive general importer and wholesale distributor in Portugal for each of the SEAT, Porsche and Bentley brands, and will integrate these functions for the VW, Audi, Škoda and Lamborghini brands post-transaction.

(34) On the downstream market for the retail distribution of VW-branded OE spare parts in Portugal, the VW Group is active via a single SEAT dealer in Setúbal. In respect of the Target Companies, Soauto is active in the retail distribution of VW-branded OE spare parts at its premises in Lisboa, Setúbal and Porto.

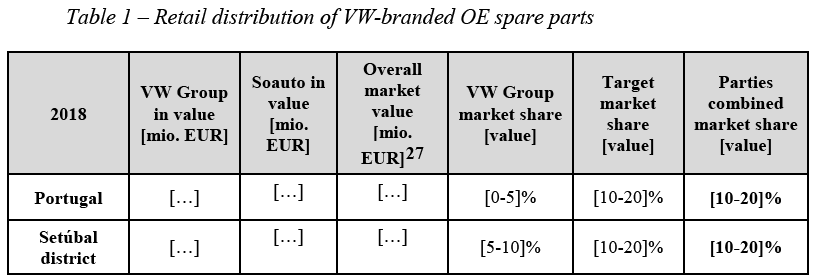

(35) The combined market share of the Parties in Portugal and in Setúbal are the following:

4.2.3. Customer Foreclosure

(36) In light of the monopolistic position of VW on the upstream market for the manufacture of VW-branded OE spare parts for passenger cars and LCVs, inherent to the fact that it is the manufacturer of VW vehicles, there is no scope for customer foreclosure in this market.

4.2.4. Input Foreclosure

4.2.4.1. The manufacture and the wholesale distribution of VW-branded OE spare parts for passenger cars and LCVs

(37) In terms of input foreclosure, the Target has previously been the exclusive general importer and wholesale distributor of VW Group for the VW, Audi, Škoda and Lamborghini brands in Portugal (while also operating its own dealership outlets). With the Transaction Porsche Holding Salzburg takes on the role of the Target as the exclusive general importer and wholesale distributor in Portugal for these brands (as well as the brands for which it already acts as exclusive general importer and wholesale distributor). The competitive landscape at the wholesale level will therefore not change post-Transaction.

(38) Thus, the Commission considers that, in relation to the vertical link between the manufacture and the wholesale distribution of VW-branded OE spare parts for passenger cars and LCVs, the Transaction is unlikely to give rise to input foreclosure or to reduce effective competition.

4.2.4.2. Wholesale and the retail distribution of VW-branded OE spare parts for passenger cars and LCVs

(39) In light of the structure of the market, the concern is that the merged entity may foreclose other dealers operating at the retail level, namely VW service partners and independent repairers, which both currently source VW-branded OE spare parts from the Parties for their own services in the aftermarket.

Ability to foreclose

(40) As the merged entity enjoys a monopoly on the market for the manufacture of OE spare parts and will be the exclusive general importer for wholesale distribution of all VW-branded OE spare parts in Portugal, it appears to have the ability to foreclose.

(41) However, the Commission understands that the contracts in force between VW and each of its service partners provides for their right to cross-supply VW-branded spare parts across the (European-wide) network. This is also compliant with the Commission Regulation (EU) No 330/2010 of 20 April 2010 on the application of Article 101(3) of the Treaty on the Functioning of the European Union to categories of vertical agreements and concerted practices. Hence, downstream competitors of the merged entity will continue to have access to spare parts from other service partners located in regions where the merged entity is not active.

(42) The market investigation also supported this conclusion. Downstream competitors indicated that they have no difficulties in obtaining VW-branded OE spare and that they are not prevented from obtaining VW-branded OE spare parts from other dealers in any European country. They also confirmed that they have cross-supplied VW-branded OE spare parts with other VW dealers and independent car repairers. The respondents did not expect any difficulties in obtaining VW-branded OE spare parts following the Transaction. (28)

(43) In conclusion, the merged entity would not appear to have the ability to foreclose these markets in Portugal, despite their activities as the exclusive general importer into Portugal. This conclusion is reinforced by the fact, discussed further below, that any foreclosure would necessarily be limited to the part of Portugal where the Parties are active, which at the moment is very limited.

Incentive to foreclose

(44) The Notifying Party claims that the merged entity will lack the incentive to foreclose its downstream competitors:

(a) [VW’s distribution system is set up in such a way that customers have the possibility to source from different suppliers, also located in different geographic areas].

(b) It would not constitute a commercially viable or sensible strategy if the merged entity were to put VW service partners, or independent car repair shops that are using VW-branded OE parts, at a disadvantage post- Transaction. [Customers have the possibility to source VW-branded OE spare parts from different suppliers]. Moreover, VW service partners and independent car repair shops could still buy, inter alia, from any other VW service partner in other districts or EU-countries, which is their free choice ([…]).

(45) The Commission considers that the merged entity is unlikely to have an incentive to foreclose downstream competitors of the Target Companies given its limited market share in the downstream market, the limited geographic presence of the Target Companies (and the merged entity post-Transaction) in Portugal, and the nature of VW’s distribution strategy.

(46) The Commission takes the view that given the limited market presence of the merged entity both at national level ([10-20]%), and at district level (Setúbal, [10- 20]%, Lisboa [20-30]%, Porto [5-10]%), it would probably not be profitable for the merged entity to engage in a foreclosure strategy.

(47) In light of the limited geographic presence of the merged entity in the downstream market, the Parties will have to rely on VW service partners and independent car repair shops in other regions in order to maintain its distribution in all of Portugal. VW will therefore in any event have an incentive to continue to supply VW-branded parts to its service partners in regions where the Target Companies are not active (including in neighbouring Portuguese districts). VW would therefore not have any incentive to engage in a foreclosure strategy in the rest of Portugal.

(48) [VW’s distribution system is set up in such a way that customers have the possibility to source from different suppliers, also located in different geographic areas], VW would not appear to have the incentive to foreclose their activities in Portugal.

(49) Therefore, the Commission takes the view that a foreclosure strategy limited to Portugal or to a limited part of Portugal (Lisboa, Porto, Setúbal) would probably fail: competitors of the merged entity will retain the ability to source OE spare parts from service partners located in other (neighbouring) regions. In more detail, downstream competitors will continue to have access to a significant number of other suppliers (notably, the remaining [80-90]% of the national market, [80-90]% of Setúbal, [70- 80]% of Lisboa and [90-100]% of Porto), as other service partners can also cross- sell). Hence, if the merged entity were to engage in foreclosure, it would not be able to recoup the lost sales at downstream level, and therefore the merged entity will not have the incentive to foreclose access to input.

Overall likely impact on effective competition

(50) Thus, in view of the merged entity’s lack of incentive to foreclose downstream competitors, downstream competitors of the merged entity will continue to have access to spare parts from other service partners located in regions where the merged entity is not active. The Commission therefore considers that the Transaction is unlikely to reduce competition in the market for the retail distribution of VW- branded OE spare parts for passenger cars and LCVs in Portugal or the Setúbal district.

4.2.5. Conclusion

(51) Given the lack of ability or incentive to foreclose downstream competitors in any market, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market as a result of non-horizontal effects.

5. CONCLUSION

(52) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 217, 28.06.2019, p. 18.

4 Turnover calculated in accordance with Article 5 of the Merger Regulation.

5 COMP/M.6403 - VOLKSWAGEN/ KPI POLSKA/ SKODA AUTO POLSKA/ VW BANK POLSKA/ VW LEASING POLSKA.

6 Cases COMP/M.7747 – PGA/MSA; COMP/M.5061 – Renault/Russian Technologies/AvtoVaz; COMP/M.2832 – General Motors/Daewoo Motors.

7 Case COMP/M.6958 – Cd&R/We Buy Any Car.

8 Case COMP/M.6958 – Cd&R/We Buy Any Car.

9 Cases COMP/M.5709 – Volkswagen/MAHAG; COMP/M.5250 – Porsche/Volkswagen; COMP/M.3198 – VW-Audi/VW-Audi Sales Centres.

10 Cases COMP/M.6063 – Itochu/Speedy; COMP/M.2948 – CVC/Kwik-Fit; COMP/M.2087 – Feu Vert/Carrefour/Autocenter Delauto.

11 COMP/M.6403 - VOLKSWAGEN/ KPI POLSKA/ SKODA AUTO POLSKA/ VW BANK POLSKA/ VW LEASING POLSKA; COMP/M.5709 – Volkswagen / Mahag.

12 COMP/M.5219 – VWAG / OFH / VWGI.

13 COMP/M.6403 - Volkswagen/ KPI Polska/ Skoda Auto Polska/ VW Bank Polska/ VW Leasing Polska; Commission decision of 23 July 2008, COMP/M.5250 – Porsche / Volkswagen.

14 Case COMP/M.5219 – VWAG / OFH / VWGI; COMP/M.5250 – Porsche/Volkswagen; COMP/M.2832 –General Motors/Daewoo Motors.

15 Case COMP/M.7401 – Blackstone/Alliance BV/Alliance Automotive Group.

16 Case COMP/9070 – Eurocar/Vicentini; Case COMP/M.6063 – Itochu/Speedy.

17 Case COMP/9070 – Eurocar/Vicentini, COMP/M.7401 – Blackstone/Alliance BV/Alliance Automotive Group.

18 Case COMP/9070 – Eurocar/Vicentini; COMP/M.8198 – Alliance Automotive Group/FPS Distribution; Case COMP/M.6319 – Triton/Europart; Case COMP/M.7401 – Blackstone/Alliance BV/Alliance Automotive Group.

19 Case COMP/M.9070 – Eurocar/Vicentin; Case COMP/M.5709 – VW/MAHAG.

20 Case COMP/9070 – Eurocar/Vicentini; Case COMP/M.6063 – Itochu/Speedy.

21 Commission decision of 26 March 1999, No. IV/1452 – Ford / Volvo; Commission decision of 22 July 2002, COMP/M.2832 – General Motors / Daewoo Motors.

22 Case Ccent. 6/2017, Sózó / Negócio Honda.

23 Case COMP/M.5219 – VWAG / OFH / VWGI; COMP/M.5250 – Porsche/Volkswagen; COMP/M.2832 –General Motors/Daewoo Motors.

24 Case COMP/M.7401 – Blackstone/Alliance BV/Alliance Automotive Group; COMP/9070 – Eurocar/Vicentini.

25 Case COMP/M.9070 – Eurocar/Vicentini; COMP/M.6718 – Toyota Tsusho Corporation/CFAO; COMP/M.5250 – Porsche/Volkswagen.

26 At national level, the combined market share of the Parties does not give rise to an affected market in Portugual.

27 Source: The overall market volume provided in this table is a “best estimate” of the Parties, based on their sales to retailers on the wholesale level and an estimation on an average resale margin (based on Target’s own sales). However, this estimate does not take into account “cross-supplies” of VW-branded OE spare parts within the VW network (and to independent repairers), which are then resold to end customers (the Parties do not possess a reliable factual basis to estimate these “cross-supplies”). Accordingly, this estimate of the overall market value overestimates the actual market shares.

28 E-mails of customers of 28 June 2019.