Commission, June 29, 2018, No M.8889

EUROPEAN COMMISSION

Judgment

TEVA / PGT OTC ASSETS

Subject: Case M.8889 – Teva/PGT OTC Assets

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 25 May 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Teva Pharmaceuticals Industries Ltd ("Teva", Israel) will acquire control within the meaning of Article 3.1(b) of the Merger Regulation over part of the over-the- counter ("OTC") business (the "Target business") of a joint venture (PGT Healthcare LLP, "PGT") controlled by The Procter & Gamble Company ("P&G", USA) ("the Transaction"). Teva is referred to as "the Notifying Party" and Teva and the Target collectively as "the Parties".

1.THE PARTIES

(2) Teva is a global pharmaceutical company involved in the development, production, and marketing of generic and proprietary pharmaceutical products; biopharmaceuticals; and active pharmaceutical ingredients.

(3) The Target business is comprised of a number of pharmaceutical products sold Over-the-Counter (OTC) previously contributed by Teva to PGT. The Target business also includes marginal sales in cosmetic products, medical devices, food supplements and general articles.

2.THE CONCENTRATION

(4) The Transaction will be structured as follows. Teva will withdraw from PGT, and Teva's 49% interests in this company will be cancelled, as a result of which P&G will own 100% of the interests. PGT and P&G will transfer to Teva all of the rights, titles, and interests in assets pertaining to the Target business.

(5) As a result, Teva will acquire parts of an undertaking within the meaning of 3(1)(b) of the Merger Regulation.

(6) The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million3. Each of them has an EU-wide turnover in excess of EUR 250 million, but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(8) The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4. COMPETITIVE ASSESSMENT

4.1.Introduction

(9) In 2011, Teva and P&G created a joint venture, PGT, in which they held 49% and 51% of equity interests respectively. Each of Teva and P&G contributed to PGT the entirety of their OTC drug business. PGT is solely controlled by P&G.4

(10) The Transaction results from the dissolution of PGT. After cancelling its participation in the joint venture, Teva will re-acquire control over the products it had contributed to PGT. The remaining PGT product will remain under the control of P&G.

(11) There is a number of pre-existing links between Teva and the Target business. Specifically, Teva manufactures all the Target business products and offers them to PGT on the basis of supply agreements. Teva also distributes and holds the marketing authorization for […] the Target business products in the EEA.5 As a distributor of those products, Teva is responsible for the "day-to-day" decisions related to the Target business products and sets the prices to wholesalers and customers.

(12) The potential overlaps between the Target business and Teva are limited and essentially concern Teva OTC products acquired after 2011, to the extent they were not contributed to PGT.6

(13) In view of these close relationships between Teva and the Target business pre- Transaction, the Commission also investigated the extent to which Teva and the Target business were perceived by competitors and customers as competing against each other.

(14) The results of the market investigation indicate that Teva and the Target business are generally perceived as two separate competitors.7 Pharmacies explained that they negotiate separately and with different sales teams the purchase terms for Teva and the Target business' products. On this basis, for the purposes of the competitive assessment, the Commission considered the Parties as separate players competing with each other in the market pre-Transaction.8

(15) Market participants also specified that they consider the two companies as being distant competitors.9 They emphasised that the Target business focuses on branded OTC products, while Teva focuses on prescription generic products, so that the two Parties' products generally target different patients groups. The Commission will analyse below more specifically the overlaps between Teva and the Target business' products resulting from the Transaction, taking into account the differences between the products.

4.2.General considerations on market definition

4.2.1.Relevant product market

4.2.1.1. General approach to product market definition in pharmaceutical cases

(16) When defining relevant markets in past decisions dealing with finished dose pharmaceutical products, the Commission based its assessment on the following,10 general approach.

(17) The Commission noted that medicines may be subdivided into therapeutic classes by reference to the "Anatomical Therapeutic Classification" (ATC), devised by 3 the European Pharmaceutical Marketing Research Association (EphMRA) and maintained by EphMRA and Intercontinental Medical Statistics (IMS).

(18) The ATC system is a hierarchical and coded four-level system which classifies medicinal products by class according to their indication, therapeutic use, composition, and mode of action. In the first and broadest level (ATC 1), medicinal products are divided into the 16 anatomical main groups. The second level (ATC 2) is either a pharmacological or therapeutic group. The third level (ATC 3) further groups medicinal products by their specific therapeutic indications. Finally, the ATC4 level is the most detailed one (not available for all ATC 3) and refers for instance to the mode of action (e.g. distinction of some ATC 3 classes into topical and systemic depending on their way of action) or any other subdivision of the group. Medicinal products are classified according to the ATC system in the IMS Midas data base.

(19) The Commission has referred to the third level (ATC 3) as the starting point for defining the relevant product market. However, in a number of cases, the Commission found that the ATC 3 level classification did not yield the appropriate market definition within the meaning of the Commission Notice on 11 the Definition of the Relevant Market. In particular in relation to originator and generic medicines, the Commission has considered in previous decision plausible product markets at the ATC4 level, at a level of a molecule or a group of molecules that are considered interchangeable so as to exercise competitive pressure on one another. However, it should be borne in mind that the overlap in therapeutic uses does not necessarily imply any particular economic substitution patterns between products.12

(20) In relation to generic medicines sold on prescription ("Rx"), the Commission has also considered in previous decisions that the most plausible product market is generally at the level of a molecule since generics are the closest substitutes to the originator product based on the same molecule. The Commission then assesses the potential for these products to enter into competition with other products by reference to their characteristics, intended therapeutic use, and expected 13 therapeutic and economic substitutability.

(21) In relation to OTC products sold in pharmacies, the active ingredient (molecule) appears to play a much more subordinated role, unless it is equivalent to a specific therapeutic/labelled indication (in situations where all products based on the same molecule and only those, have the same indication).14 The Commission has considered in previous decisions that the most plausible product market is generally at the level of the therapeutic indication, which may be a sub-division of the ATC 3 or even ATC 4 categories or may combine products belonging to different ATC 3 or ATC 4 categories.15 In view of these specificities, IMS has 4 developed a specific classification for OTC products, based on OTC 2 and OTC 3 levels.16 In previous decisions dealing with OTC products, the Commission has also referred to the OTC 3 level as the starting point for defining the relevant product market in OTC markets.17

4.2.1.2.Distinction between over-the-counter (OTC) and prescription (Rx) products

(22) The Commission has in the past defined separate markets for medicines which can be dispensed only against a prescription and those which can be sold OTC. Medical indications, side effects, regulatory framework, distribution and marketing tend to differ between these drug categories, even if the active ingredients may sometimes be identical.

(23) OTC products may be advertised to the public, as a result of which brands play a comparatively more significant role in the OTC industry, and advertising is a key feature in these markets. In addition, prescribers do not need to intervene in the purchase of OTC products. In most cases, consumers choose OTC pharmaceuticals themselves, possibly following the guidance of a pharmacist, and purchases are generally not reimbursed. In making purchasing decisions, consumers seem to predominately rely, aside from the brand, on therapeutic/labelled indication and price.

(24) By contrast, prescription pharmaceuticals (Rx) need to be prescribed by physicians. Their intervention is essential in the choice of the product. Pricing for prescription products is influenced by the public health care system, which pays (part of) the purchase price via reimbursement. Advertising is targeted at prescribers, namely, doctors and hospitals.

(25) However, in certain cases, products which are available OTC can still be reimbursable if bought on prescription.20 Furthermore, it cannot be excluded that OTC and prescription products compete with each other, especially in cases where the status of the drug is not clearly limited to either OTC or prescription.21

4.2.1.3.Other possible market segmentations

(26) As the Commission has acknowledged in its previous decisions,medicines are differentiated not only by their active ingredient(s) but also, in particular, as recognized by the European regulatory framework for medicines for human use, by their posology (or dosage), pharmaceutical form, method and route of administration (collectively referred to as "galenic form" in this decision) which may limit their substitutability. The galenic form of a medicine may in some cases influence the preferences of consumers or be targeted to specific patients groups (e.g. children), and therefore, two medicines with the same active ingredient and 23 indications may not be (fully) interchangeable for certain patient groups. Certain medicines can also be indicated only for a specific patient group (e.g. adults, children or babies), meaning that they have only been shown to be safe and effective when administered to that specific group of patients.

4.2.1.4.Conclusion

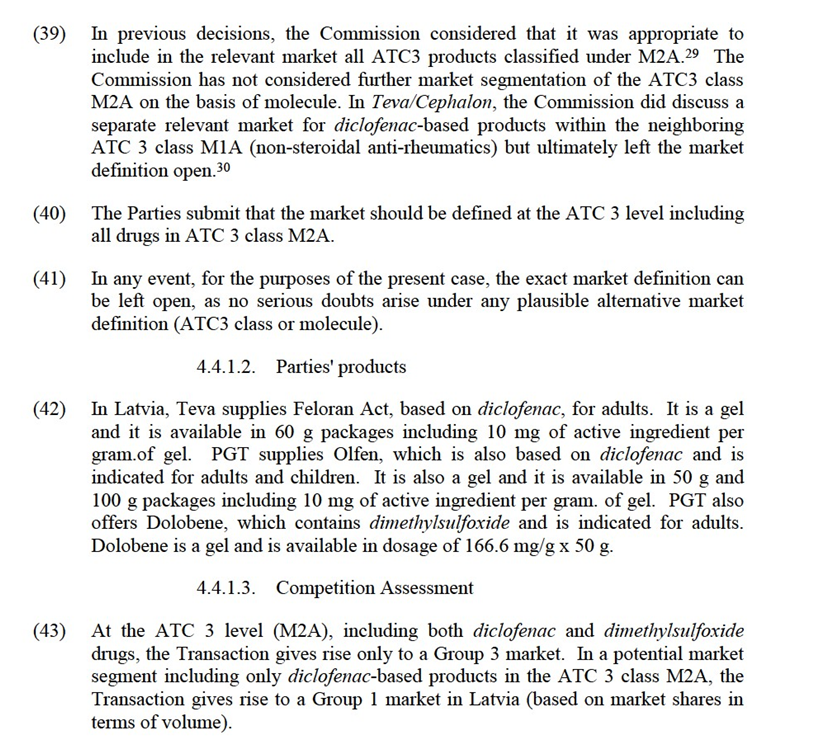

(27) The Commission's approach to market definition has been guided in the past pharmaceutical cases in particular by reference to ATC/OTC classes based on IMS; active ingredients; the distinction Rx versus OTC medicines; and different patients groups.

(28) The Commission will analyse below the relevance of these distinctions for the specific markets at stake.

4.2.2.Relevant geographic market

(29) The Commission has previously consistently defined the geographic markets for finished pharmaceutical products as being national in scope.

(30) The market investigation in this case did not provide any indications that such market definition should be revisited, in particular in view of the national regulatory and reimbursement schemes and the fact that competition between pharmaceutical firms still predominantly takes place at a national level.

(31) Therefore, for the purposes of this Decision, the Commission concludes that the scope of the geographic markets in relation to all assessed finished dose pharmaceutical products markets is national.

4.3.Methodology for the identification and the assessment of affected markets

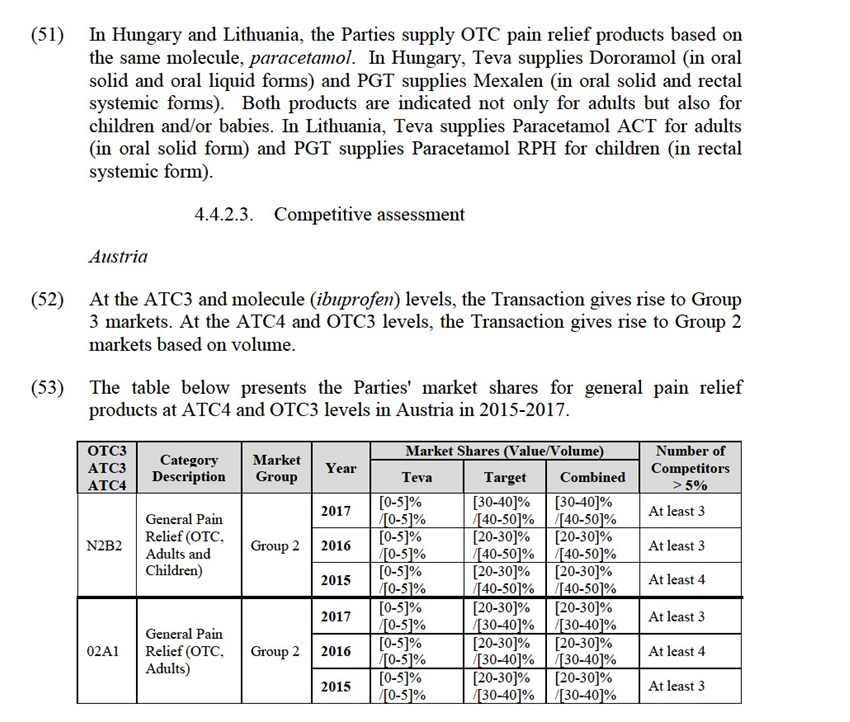

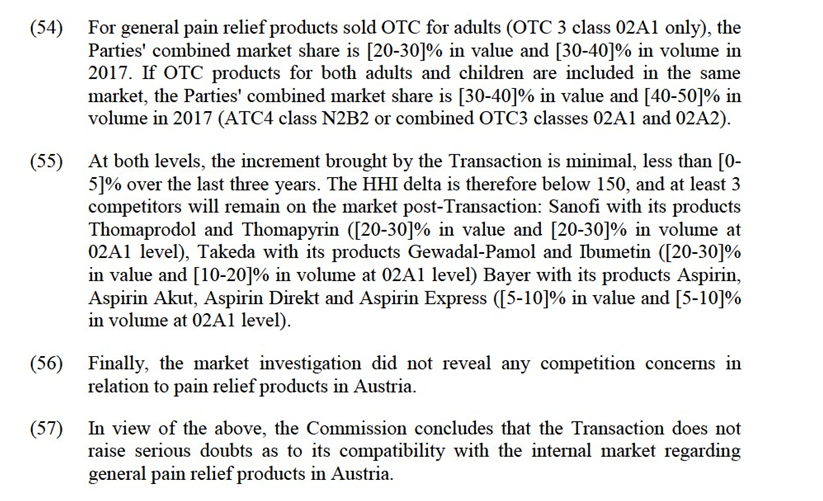

(32) To identify the markets affected by the Transaction, the methodology used is the following.

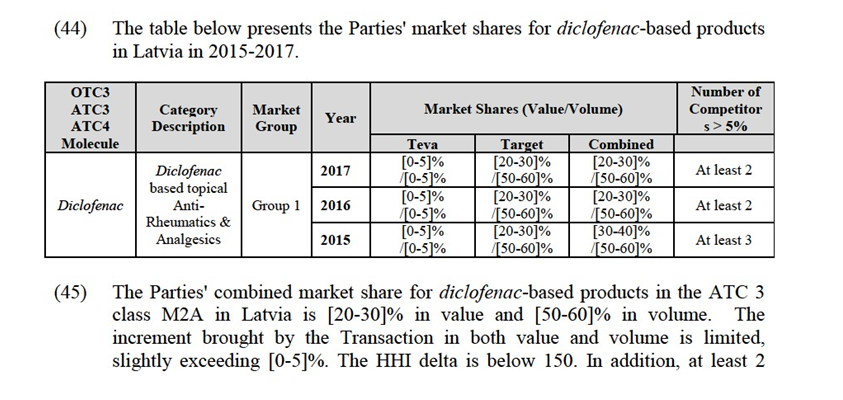

(33) First, the overlaps between OTC products of Teva and the products of the Target business (which are also OTC) have been identified on the basis of overlapping therapeutic indications, following in particular the OTC classification.25 To identify the affected markets, the Notifying Party provided market shares data based on the data of IMS for all plausible product market definition, including at OTC 3, ATC 3, ATC 4 and molecule level.26

(34) Second, the overlaps between Rx products of Teva and OTC products of the Target business were identified on the basis of overlapping therapeutic indications when the products included the same molecule and belonged to the same ATC3 class. To identify the affected markets, the Notifying Party calculated the market shares of the Parties based on the data of IMS.

(35) In line with precedents in the pharmaceutical industry,27 the markets affected by the Transaction have been grouped as follows: (a) Group 1 markets, where the Parties' combined market share exceeds 35% and the increment exceeds 1%; (b) Group 1+ markets, where (i) the combined market share is below 35% but only one other competitor remains on the market; or (ii) the combined market share exceeds 35% and the increment is below 1% but the party with the small increment is a recent entrant;(c) Group 2 markets, where the Parties' combined market share exceeds 35% but the increment is below 1%; (d) Group 3 markets, where the Parties' combined market share is between 20% and 35%.

(36) The Commission has analysed all markets affected by the Transaction for each of the two categories of overlaps (OTC vs OTC and Rx vs OTC). In line with previous decisions, Group 3 markets are however not individually considered in detail in this Decision. The Commission assessed the competitive situation on these markets analysing the nature and the number of existing competitors and considered that the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market in these markets.

4.4.OTC vs OTC Product Overlaps – Group 1/1+/2 markets

(37) The Transaction leads to Group 1 and Group 2 OTC markets in six product/geographic markets namely topical anti-rheumatics and analgesics in Latvia (more specifically diclofenac–based products) (4.4.1); general pain relief products in Austria, Hungary, and Lithuania (more specifically paracetamol- based general pain relief products in Hungary and Lithuania) (4.4.2); heart attack prevention products in Hungary (4.4.3) and proton pumps inhibitors in Bulgaria (4.4.4).

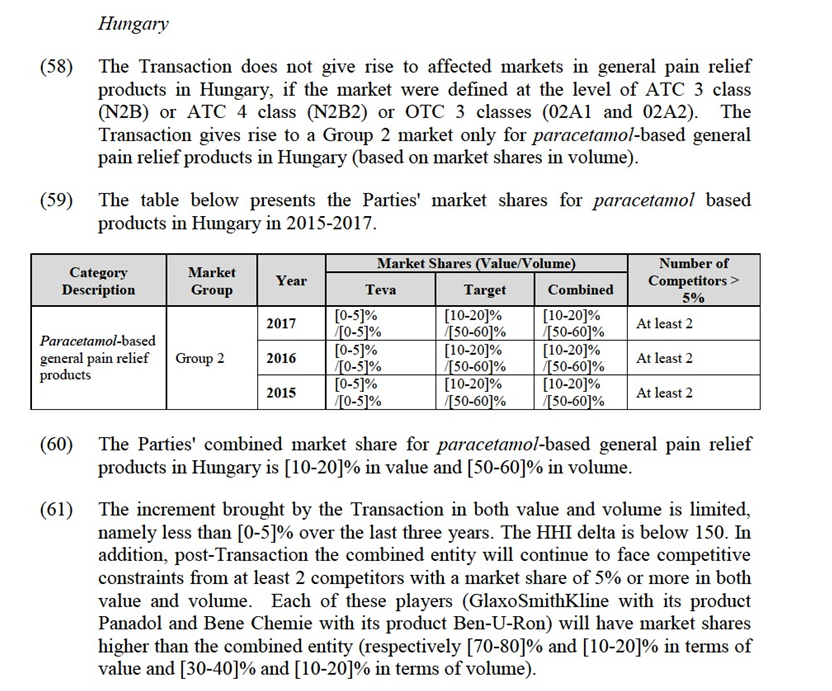

4.4.1.Topical Anti-Rheumatics and Analgesics in Latvia

4.4.1.1. Market Definition

(38) Topical anti-rheumatics and analgesics are categorized in ATC 3 class M2A (Topical Anti-rheumatic and Analgesics).28 This ATC 3 class includes ointments, creams and sprays for the treatment of injuries, sprains, muscular tension, etc. The ATC3 class M2A is not further divided into ATC4 classes.

competitors will remain in the market post-Transaction, holding a market share of 5% or more in both value and volume. These competitors are the market leader GlaxoSmithKline with its product Voltaren Emulgel ([40-50]% in value and [20- 30]% in volume) and Novartis with its product Diclac ([10-20]% in value and [10-20]% in volume).

(46) Finally, the market investigation did not reveal any competition concerns in the market for diclofenac-based topical anti-rheumatics and analgesics in Latvia.31

(47) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding diclofenac based products in Latvia.

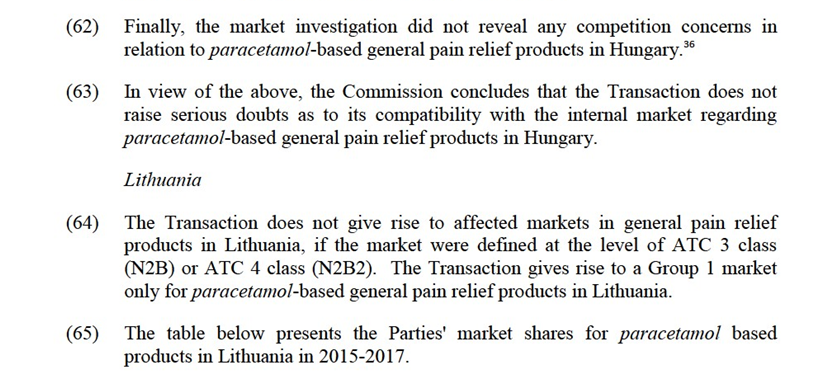

4.4.2. General pain relief products in Austria, Hungary, and Lithuania

4.4.2.1. Market definition

(48) In previous decisions, the Commission considered that the market for medicines to treat mild to moderate pain (non-narcotic analgesics) should be defined at the ATC 3 level of N2B (non-narcotics and anti-pyretics).32 The ATC 3 class N2B is further subdivided into two ATC 4 classes as follows: N2B1 (prescription non- narcotics and anti-pyretics) and N2B2 (non-prescription non-narcotics and anti- pyretics). In one past decision, the Commission assessed the effects of a concentration at the N2B2 level of the general pain relief product market.33 The Commission further considered that a distinction could be made between pain relief medicines for adults (which corresponds to the OTC 3 class 02A1) and for children (which corresponds to the OTC 3 class 02A2).34 Finally, the Commission previously considered molecule-based markets in general pain relief products in Teva/Ratiopharm (regarding the tramadol molecule).35

(49) In any event, for the purposes of the present case, the exact market definition can be left open as no serious doubts arise under any plausible alternative market definition (namely, at ATC3, ATC4, OTC3, or molecule level).

4.4.2.2.Parties' products

(50) In Austria, the Parties supply OTC pain relief products based on several molecules. PGT offers paracetamol under the brand name Mexalen (in oral solid, oral liquid and rectal systemic forms), ibuprofen under the brand name Ratiodolor (in oral solid form), combination drug including ascorbic acid and paracetamol under the brand name Mexavit.C (in oral solid form), and combination drug including acetylsalicylic acid, caffeine, and paracetamol under the brand name Influass (in oral solid form). Teva offers Ibunin (ibuprofen), in oral solid form. All products are indicated for adults and children.

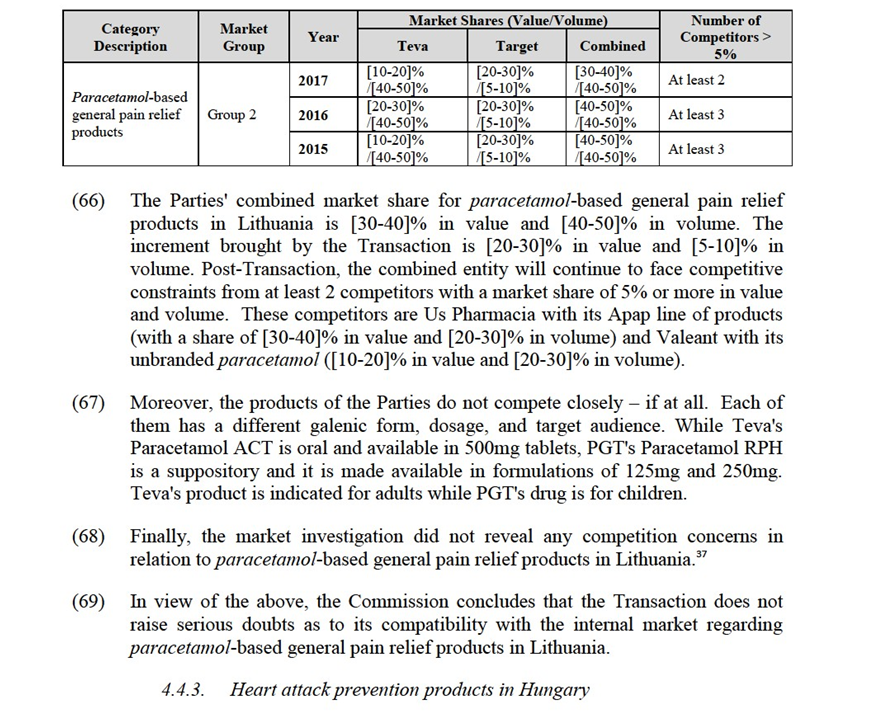

substitutability between ASA and dypiridamole on the one hand and clopidogrel on the other hand but eventually left the market open.40

(72) The Parties submit that the market should be determined at the OTC 3 level. The market would then include all drugs in OTC 3 class 10E1, irrespective of their molecule.

(73) The results of the market investigation were not conclusive as to whether the market should be defined at OTC 3 class level or at ATC 3 or ATC 4 class or molecule level.41 As explained below, almost all the products within the OTC 3 class 10E1 are based on acetylsalicylic acid (ASA).

(74) In any event, for the purposes of the present case, the exact market definition can be left open, as no serious doubts arise under any plausible alternative market definition (OTC3 class or ATC 3 or ATC 4 class or molecule).

4.4.3.2.Parties' products

(75) The Parties supply OTC products based on the same molecule, acetylsalicylic acid (ASA). Teva markets its product under the brand name Asactal and PGT's products are branded Asatrin and Astrix. All products are sold in oral sold form, for adults and children, with a dosage of 100 mg.

4.4.3.3.Competitive assessment

(76) The Transaction gives rise to a Group 3 market at ATC 3 level (B1C) in terms of volume and a non-affected market in terms of value. The Transaction gives rise to Group 1 markets at OTC 3 level (10E1), at ATC 4 level (B1C1) and molecule level (ASA), based on volume.

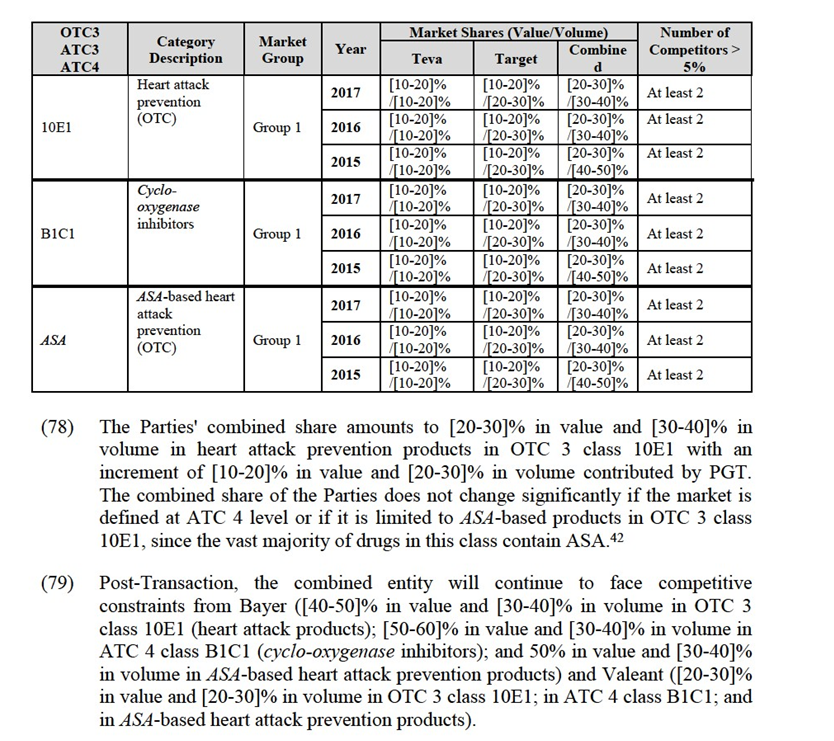

(77) The table below presents the Parties' market shares for heart attack prevention products and ASA based heart attack prevention products in Hungary in 2015- 2017.

(82) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding heart attack prevention products in Hungary.

4.4.4.Proton Pumps Inhibitors (PPIs) in Bulgaria

4.4.4.1.Market Definition

(83) Proton Pumps Inhibitors (PPIs) are drugs that proactively inhibit the acid secretion into the stomach. Acid is pumped into the stomach by a specific enzyme (the "proton pump") inside the parietal cells along the stomach's walls.

(84) PPIs that are sold over the counter are categorized in OTC 3 class 03G3 (PPIs) which corresponds to ATC 4 class A2B2.46 OTC 3 class 03G3 belongs to the OTC 2 class 03G (antiulcerants) which also includes OTC 3 class 03G2 (H2 blockers). The ATC 4 class A2B2 belongs to the ATC 3 class A2B (antiulcerants) which also includes ATC 4 class A2B1 (H2 blockers).47

(85) In previous decisions, the Commission has analysed PPIs both at the ATC 3 level (A2B - antiulcerants) and ATC4 level (A2B2 - PPIs).48 In AstraZeneca, the Commission considered separate relevant markets at the ATC 4 level for PPIs (A2B2).49 Most recently, in Sanofi/Boehringer-Ingelheim, the Commission's market investigation indicated that a distinction should be made between ATC 4 class A2B1 and ATC 4 class A2B2. As to a potential distinction of markets by molecule within PPIs, the market investigation in the same case suggested "pharmacists and patients substitute… OTC products across molecules with the same therapeutic/labelled indications…".50

(86) The Notifying Party submits that the relevant product market in relation to PPIs should be determined at the level of ATC 3 class (including both PPIs and H2 blockers).

(87) In any event, for the purposes of the present case, the exact market definition can be left open as no serious doubts arise under any plausible alternative market definition (namely, at ATC3 or ATC4/OTC3 level or molecule).

4.4.4.2.Parties' products

(88) Teva supplies the following PPI products that are sold OTC in Bulgaria: Panrazol (pantoprazole),51 Gastrocid (omeprazole), and Gastrocid Eso (esomprazole). PGT supplies Prazolpan, which includes pantoprazole. All products are sold in oral solid form and with a dosage of 20 mg.

based anti-herpes in Finland (4.5.1); ascorbic-acid based vitamin C products in Poland (4.5.2); beclometasone-based topical nasal preparations in Germany (4.5.3); clotrimazole-based dermatological antifungal products in Croatia (4.5.4); fluticasone-based topical nasal preparations in Sweden (4.5.5); furazidin-based urinary anti-infectives in Poland (4.5.6); ibuprofen-based non-steroidal anti- rheumatics in Luxembourg and the Netherlands (4.5.7); omeprazole-based PPIs in Estonia and Latvia (4.5.8); orlistat-based anti-obesity preparations in Portugal (4.5.9); and paracetamol-based non narcotics analgesics in Austria (4.5.10).

4.5.1.Aciclovir-based anti-herpes antivirals in Finland

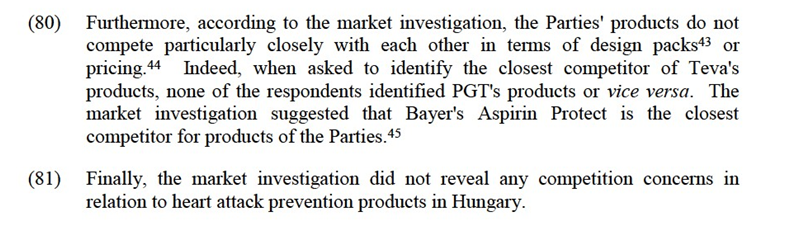

4.5.1.1.Market definition

(96) Antiviral products to treat herpes are classified in the ATC3 class J5B (antivirals, other). This ATC3 class includes systemic antivirals for herpes, influenza, viral respiratory conditions, etc. It excludes topical skin antivirals (D6D), topical ophthalmic antivirals (S1D), HIV antivirals (J5C), and hepatitis antivirals (J5D). More specifically, antivirals designed to treat herpes are part of the ATC4 class J5B3 (Herpes antivirals).

(97) In one previous decision,the Commission considered that the ATC3 class J5B should be considered as a starting point for the assessment. The Commission however added that drugs treating influenza and drugs treating herpes are not substitutable so that the relevant market could be limited to anti-herpes drugs. In this decision, there is no consideration on a possible segmentation of the market based on molecule.

(98) The Notifying Party submits that Rx and OTC anti-herpes drugs are not in the same market. More specifically, the Notifying Party considers that the indication for the Rx product is much broader than for OTC products. PGT OTC product is indicated only for the treatment of diagnosed recurrent herpes simplex labialis (or oral herpes, affecting the mouth), while Teva Rx product is indicated for the treatment of any infection of the skin and mucus membranes (including genital herpes), the treatment of varicella etc. The Notifying Party adds that Teva's Rx product is significantly cheaper than PGT's similar OTC product, respectively EUR 7.52 with a 40% reimbursement and EUR 10.90 with no reimbursement.

(99) The Notifying Party also considers that should Rx and OTC be part of the same market, the market should be defined at the ATC3 level J5B or at the very least at the ATC4 level J5B3.

(100) In any event, for the purposes of the present case, the exact market definition can be left open as no serious doubts arise under any plausible alternative market definition (namely, at ATC3 or ATC4/OTC3 level or molecule).

4.5.1.2.Parties' products

(101) In Finland, Teva and PGT supply aciclovir-based products branded Aclovir. Teva's is Rx (200 mg, 400 mg and 800 mg) and PGT's is OTC (200 mg). Both are sold in oral solid form.

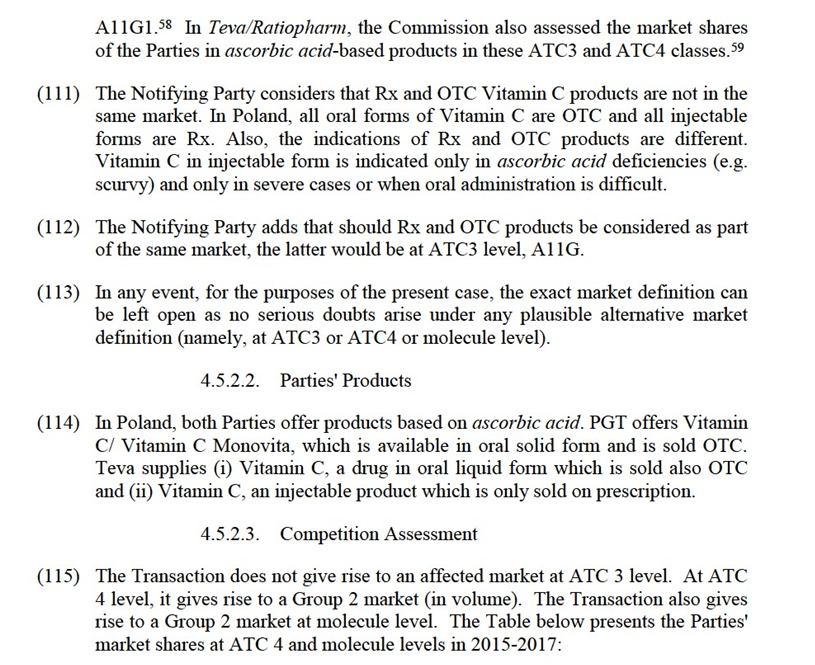

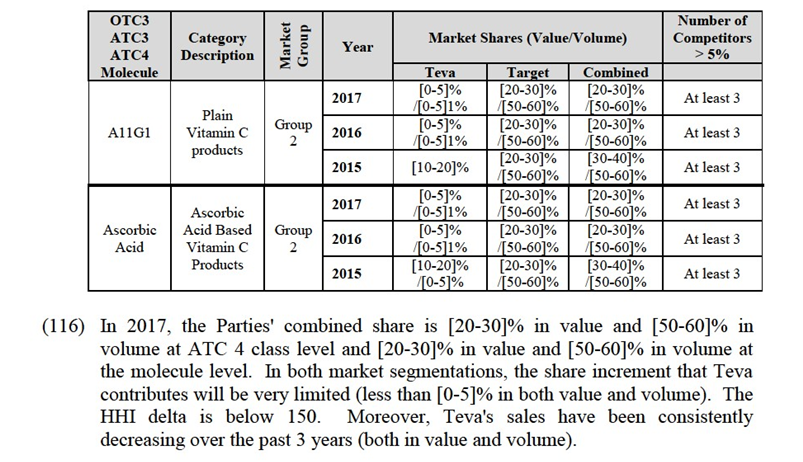

(117) Post-Transaction, the combined entity will continue to face competitive constraints from at least 3 competitors with a market share of 5% or more in both value and volume. These players are Merck ([30-40]% in value and [10-20]% in volume), Hasco ([20-30]% in value and [10-20]% in volume), and GlaxoSmithKline ([5-10]% in value and [0-5]% in volume). Menta Pharma, which entered the market in 2016 holds [0-5]% in value and [0-5]% in volume.

(118) In addition, as pointed out by the Notifying Party (see para. (111)), there seems to be differentiation between the Parties' products in terms of therapeutic indications and galenic forms.

(119) Finally, the market investigation did not reveal any competition concerns in relation to ascorbic acid-based Vitamin C products in Poland.60

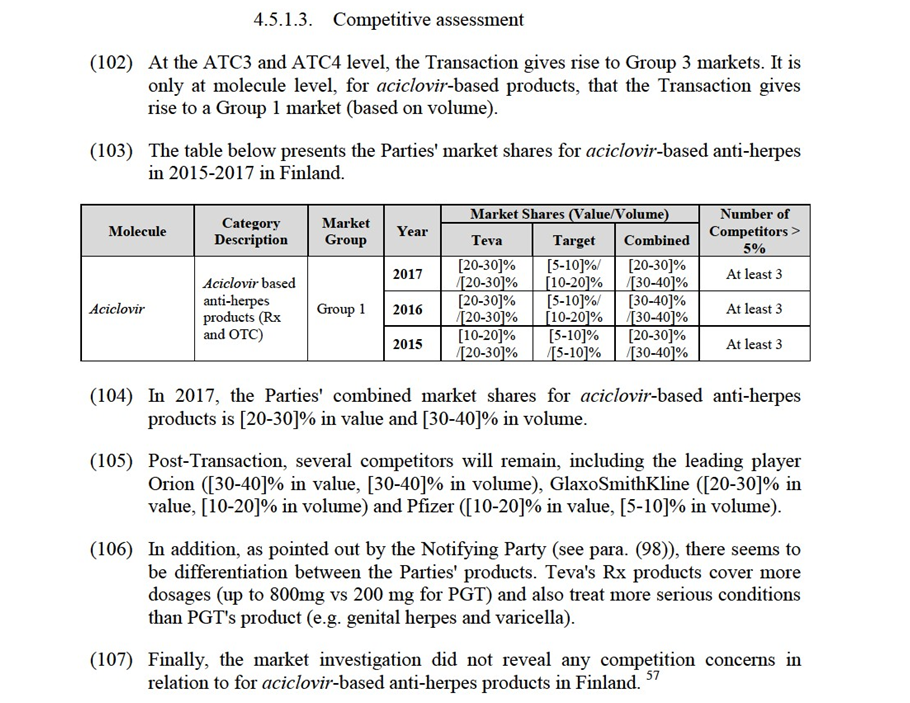

(120) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding ascorbic acid based Vitamin C products in Poland.

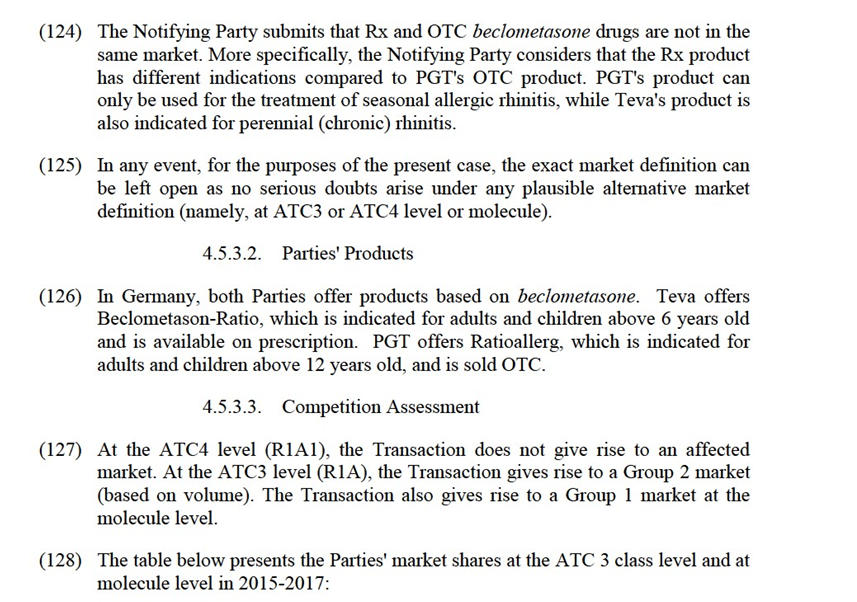

4.5.3. Beclometasone-based topical nasal preparations in Germany

4.5.3.1.Market Definition

(121) Topical nasal preparations are categorized in ATC 3 class R1A (topical nasal preparations). These products are used for the local treatment of nasal congestion (e.g., sympathomimetics) or for prophylaxis and treatment of allergic rhinitis (e.g., corticosteroids, cromoglicate preparations). The ATC3 class R1A is further subdivided into several ATC4 classes on the basis of the drug’s mode of action and composition as follows: R1A1 (Nasal corticosteroids without anti-infectives), R1A3 (Nasal corticosteroids with anti-infectives), R1A4 (Nasal anti-infectives without corticosteroids), R1A6 (Nasalantiallergic agents) and R1A7 (Nasal decongestants). All other topical nasal preparations are classified under ATC4 class R1A9.

(122) In previous decisions, the Commission considered but ultimately left open plausible market definitions based on ATC3 class R1A or based on one or several ATC 4 classes.61

(123) In Sanofi/Boehringer Ingelheim Consumer Healthcare Business, the Commission also contemplated a segmentation of the relevant product market(s) by molecule. The market investigation in that case indicated that such a market delineation would be inappropriate but the Commission eventually left the open the relevant product market.62 The market investigation in the present case also suggested that the relevant product market should not be segmented by molecule. Competitors identified several molecules as being substitutable to beclometasone for the management of nasal symptoms, such as mometasone.63

holds [5-10]% in value and [0-5]% in volume at molecule level.

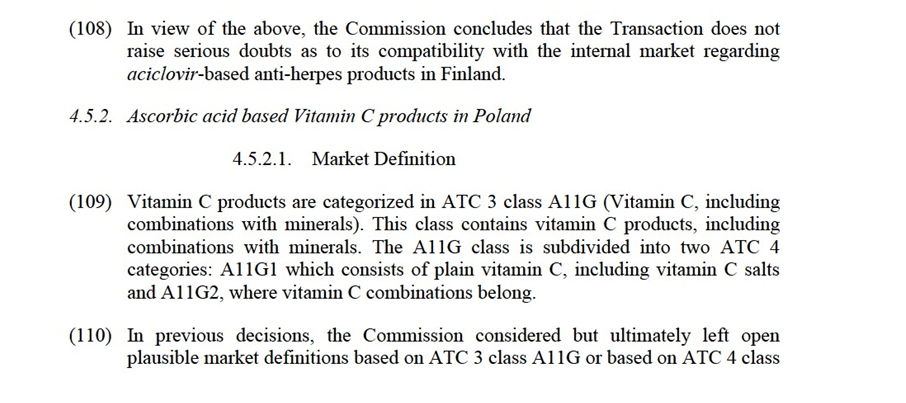

(131) All the respondents in the market investigation indicated that the Parties' products do not compete closely (if at all). None of them named PGT's product as the closest competitor for Teva's product or vice versa. Rather, the majority of respondents identified Novartis' Mometason Hexal as the closest competitor to the PGT's product because the two products have identical indications and their active ingredients belong to the same class of molecules. Respondents also identified two Rx products, Chiesi's Beclorhinol aquosum and Dermapharm's Rhinivict nasal, as the closest competitors to Teva's product.67 The market investigation also suggested that Teva's Rx product and PGT's OTC drugs are differentiated, in terms of pack design, brand and therapeutic indications.68

(132) Finally, the market investigation did not reveal any competition concerns in relation to topical nasal preparations in Germany.69

(133) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding beclometasone-based topical nasal preparations in Germany.

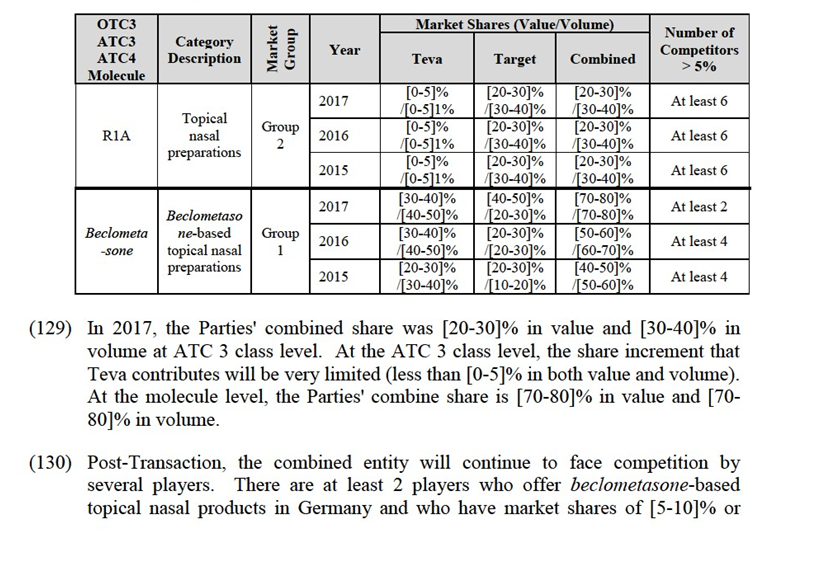

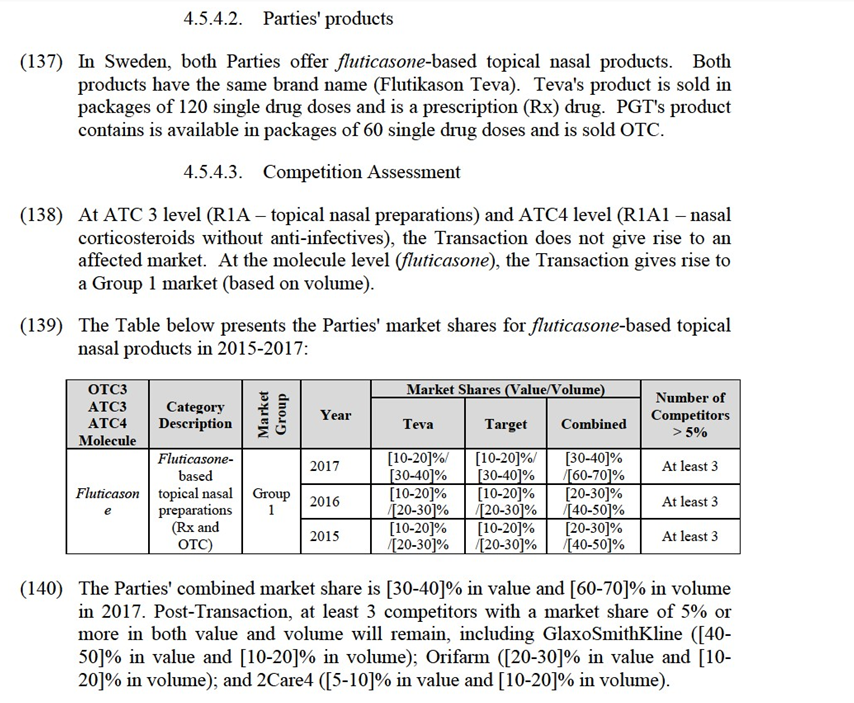

4.5.4. Fluticasone-based topical nasal preparations in Sweden

4.5.4.1. Market definition

(134) See paragraphs (121) to (123) above regarding market definition for topical nasal preparations.

(135) In this case, the market investigation provided indications that a market comprising only fluticasone-products would not be appropriate. Competitors identified several molecules as being substitutable to fluticasone for the management of nasal symptoms, such as mometasone, budesonide, triamcinolonacetonid, levocabastine, salmeterol, and xylometazoline.70 Customers suggested that there is no specific advantage in a patient using fluticasone-based products as opposed to other topical nasal drugs.71

(136) In any event, the exact market definition can be left open for the purposes of the present case. No serious doubts arise under any plausible alternative market definition (namely, at ATC3 or ATC 4 or molecule level).

4.5.5. Clotrimazole-based dermatological antifungal products in Croatia

4.5.5.1.Market definition

(144) Dermatological antifungals are categorized in ATC 3 class D1A (antifungals, dermatological). This ATC 3 class includes products that are mainly used for the treatment of skin infections caused by fungus.

(145) In previous decisions, the Commission has considered that the market for dermatological antifungals should be defined at the ATC 3 level of D1A.75 The Commission examined the relevant product market also at the ATC4 level (D1A1, namely topical dermatological antifungals) but finally left the market definition open.76

(146) The Notifying Party submits that OTC and Rx dermatological antifungals products are not in the same market. The Notifying Party submits that the average retail price for OTC products is significantly higher than the average price of Rx products in this ATC3 category, respectively EUR 2.71 versus EUR 1.15.

(147) The Notifying Party however adds that should the market comprise both OTC and Rx products, it is in any event broader than the molecule.

(148) The market investigation provided indications that the market would be broader than the molecule. Market respondents quoted a number of molecules competing with clotrimazole-based products, including miconazole, terbinafine and naftifin.77 Pharmacies also mentioned that if approached by a customer asking for advice regarding treatment of infections caused by dermatophytes, yeast, and molds, they would recommend substitutable products based on different molecules, such as clotrimazole, miconazole or naftifin.78

(149) In any event, for the purposes of the present case, the exact market definition can be left open, as no serious doubts arise under any plausible alternative market definition (ATC 3 or ATC 4 class or molecule).

a stronger brand that Teva Rx Klotrimazole.81 Market respondents also indicated that Teva and PGT products do not compete in terms of pricing.82 This has been confirmed by the average prices of OTC and Rx products provided by the Notifying Party, respectively EUR 2.71 versus EUR 1.15.

(156) None of the respondents identified PGT's products as being the closest competitor of Teva's product (and vice versa).83 Based on the replies to the market investigation, the closest substitute to PGT's Plimycol and Teva's Pliva appears to be Rojazol (Belupo), which is based on miconazole, a different molecule than the one included in the Parties' products (clotrimazole), which further supports the view that products based on different molecules compete against each other.

(157) Finally, all the customers considered that a sufficient number of credible competing alternatives will remain post-Transaction. The vast majority of competitors also indicated that the Transaction will most probably have no impact on this market.84

(158) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding antifungal dermatological products in Croatia.

4.5.6.Furazidin based urinary anti-infectives in Poland

4.5.6.1. Market definition

(159) Urinary anti-infectives are classified in the ATC3 class G4A (Urinary Anti- Infectives and Antiseptics). Urinary anti-infectives and antiseptics are used to prevent or treat urinary infections. The ATC3 class G4A is divided into three ATC4 classes: G4A1 (urinary antibacterials); G4A2 (urinary non-halogenated quinolones) and G4A9 (other urinary antiseptics).

(160) In previous decisions, the Commission identified a market at ATC3 level (G4A)85 and possibly including the ATC2 J1 (Systemic antibacterials).86 The Commission ultimately left the market definition open. It did not make any considerations on the ATC4 level or molecule level.

(161) The Notifying Party submits that Rx and OTC urinary anti-infectives products are not in the same market. OTC treatments would generally be used to relieve symptoms, while Rx treatments address the bacterial infections. The Notifying Party adds that OTC and Rx products have significant prices difference; Teva's Rx product being sold at 3.35 PLN with a 50% reimbursement and PGT OTC product being sold at 10.55 PLN with no reimbursement.

(162) The Notifying Party adds that should Rx and OTC products be part of the same market, the relevant market should be defined at ATC3 level, G4A.

(170) Finally, the market investigation did not reveal any competition concerns in relation to furazidin-based urinary anti-infectives in Poland. 88

(171) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding furazidin-based urinary anti-infectives in Poland.

4.5.7.Ibuprofen-based non-steroidal antirheumatics in Luxembourg and the Netherlands

4.5.7.1.Market Definition

(172) Non-steroidal antirheumatics are categorized in ATC 3 class M1A (anti- rheumatics, non-steroidal). This ATC 3 class comprises drugs prescribed against various arthroarthritic diseases such as back pain, joint disorders, osteoarthrosis and arthropathies.

(173) Ibuprofen is a non-steroidal anti-inflammatory drug derivative of propionic acid used for relieving pain and fever as well as reducing inflammation. Ibuprofen is classified in several ATC classes (e.g., M1A or N2B), depending on the indication of the specific ibuprofen-based product. Ibuprofen can be sold both as prescribed and OTC drug.

(174) In previous decisions, the Commission considered that the market for non- steroidal antirheumatics could be defined at ATC 3 level (M1A)89 or at ATC 4 level (e.g., M1A1 class which includes plain non-steroidal antirheumatics).90 As regards ibuprofen-based products, the Commission analysed them within the ATC 3 classes M1A or N2B.91 More recently, in Mylan/Perrigo, the market investigation suggested that ibuprofen-based products could compete against each other, irrespective of the ATC 3 class in which they are classified, depending on their reimbursement status, dosage, and galenic form.92 The relevant market definition was ultimately left open. 93

(175) As regards the distinction between Rx and OTC ibuprofen products, the Commission noted in Mylan/Perrigo that "it cannot be excluded that OTC ibuprofen and Rx ibuprofen exert some sort of competitive pressure on each other".94

(176) The Notifying Party submits that the indications for Rx and OTC products for ibuprofen are different. The OTC indication is typically limited to short term (less than one week) treatment of mild to moderate pain with single doses of maximum 400 mg. The Rx indication usually also includes long-term and high dose rheumatic treatment (inflammatory joint disorders, degenerative joint disorders etc.) and traumatology.

(177) The Notifying Party adds that should Rx and OTC be considered to be part of the same relevant market, the latter should be defined at ATC3 level.

(178) In any event, for the purposes of the present case, the exact market definition can be left open as no serious doubts arise under any plausible alternative market definition (namely, at ATC3 or ATC4 or molecule level (within M1A or across ATC 3 classes)).

4.5.7.2.Parties' products Luxembourg

(179) In Luxembourg, both Parties offer ibuprofen-based products under the same brand name. Teva offers IBU-Ratiopharm which is available in 400 mg, 600mg, and 800mg oral solid formulations and is indicated for adults and children above 15 years old. Teva's product is available only on prescription. PGT supplies IBU-Ratiopharm which is available in 200 mg and 400 mg oral solid formulations and a 20mg/ml liquid formulation. PGT's oral solid product is indicated for adults, children and babies above 6 months old. PGT's oral liquid product is indicated for babies above 6 months old and children below 12 years old. PGT's products are sold OTC.

Netherlands

(180) In the Netherlands, both Parties offer ibuprofen-based products with the same brand name. Teva offers Ibuprofen - PCH which is available in oral solid form (400 mg and 600 mg doses); oral liquid form (600 mg dose per sachet); and as a suppository (500 mg dose). Teva's Ibuprofen - PCH is available only on prescription.95 PGT supplies Ibuprofen - PCH which is available only in oral solid form (in 200 mg and 400 mg doses). PGT's product is sold OTC.

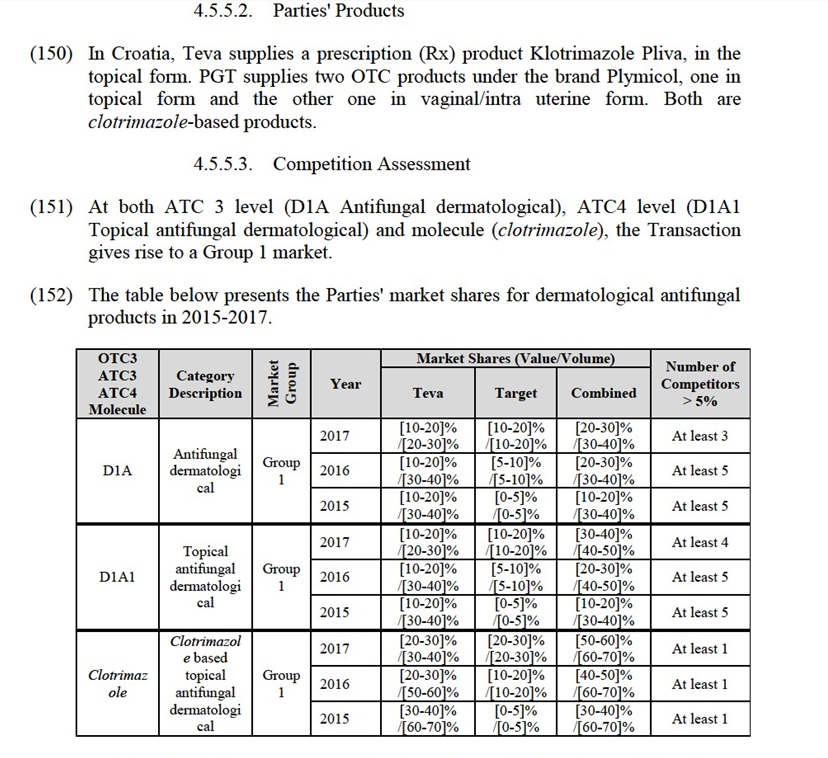

4.5.7.3.Competition Assessment

Luxembourg

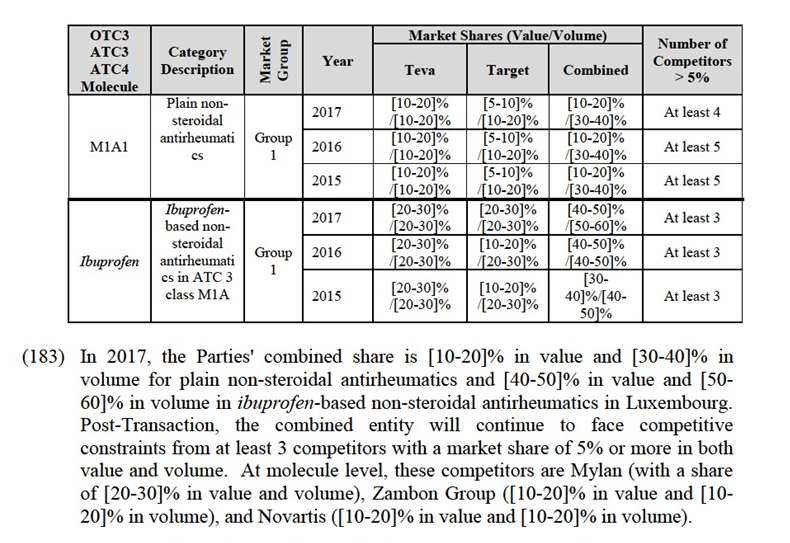

(181) At the ATC3 level (M1A), the Transaction gives rise to a Group 3 market. At the molecule level across ATC 3 classes, the Transaction gives rise to a Group 3 market. The Transaction gives rise to a Group 1 market at the ATC4 level (M1A1) and in ibuprofen-based products in the ATC 3 class M1A.

(182) The table below presents the Parties' market shares for non-steroidal antirheumatics at ATC4 and molecule levels in Luxembourg in 2015-2017:

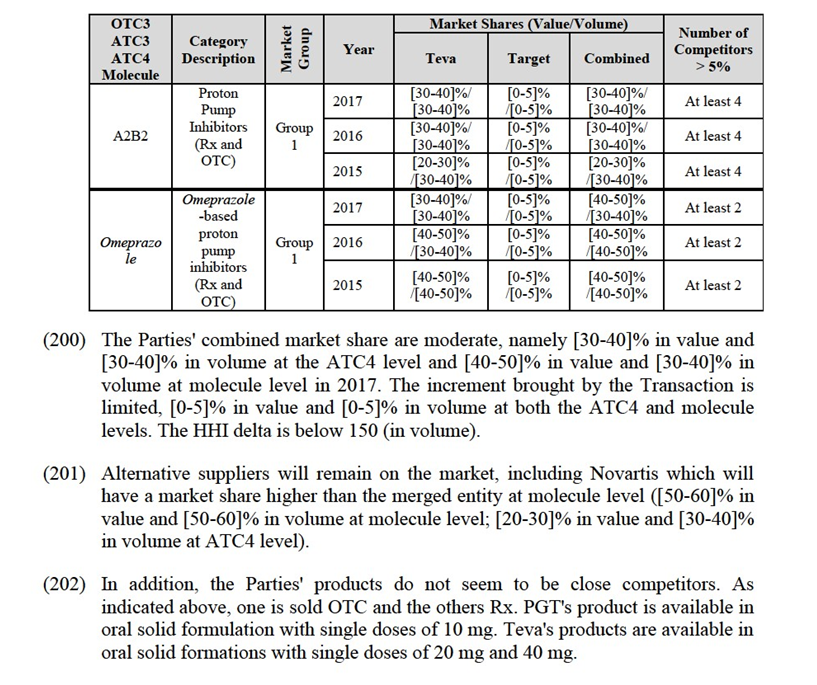

(209) In addition, the Parties' products do not seem to be close competitors. As indicated above, one is sold OTC and the others Rx. PGT's product is available in oral solid formulations with single doses of 10 mg or 20 mg. Teva's product is available in oral solid formations with single doses of 20 mg and 40 mg. The 20 mg product of PGT is sold in boxes of 14 tablets. The 20 mg product of Teva is sold in boxes of 28 or 56 tablets, which confirms that it is meant for mid- to long- term use unlike PGT's drug.

(210) Finally, during the market investigation, market respondents did not identify any impact of this Transaction on competition in the market for PPIs in Latvia. 99

(211) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding PPIs in Latvia.

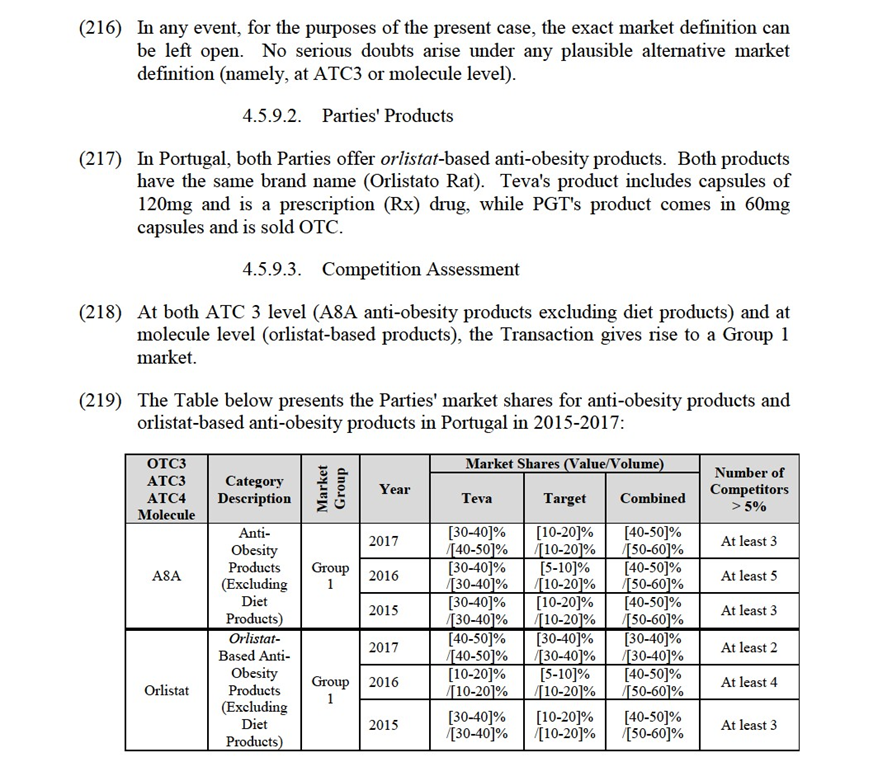

4.5.9.Orlistat-based Anti-Obesity Preparations in Portugal

4.5.9.1.Market definition

(212) Anti-obesity preparations are categorized in ATC 3 class A8A (anti-obesity preparations, excluding dietetics). This ATC 3 class covers products against obesity, acting either centrally or peripherally and including molecules such as orlistat or sibutramina.

(213) In previous decisions, the Commission has considered that the market for anti- obesity preparations should be defined at the ATC 3 level of A8A.100 In Teva/Allergan Generics, the Commission also considered a narrower relevant market segment within the ATC 3 class A8A, including only orlistat-based products.101

(214) The Notifying Party submits that OTC and Rx anti-obesity preparations products are not in the same market. The Notifying Party submits that the retail price of PGT OTC product is significantly higher than the retail price of Teva Rx product in this ATC3 category. The Notifying Party however adds that should the market comprise both OTC and Rx products, the molecule would not be the relevant market.

(215) The market investigation was not conclusive on the substitutability of orlistat based anti-obesity preparations and anti-obesity preparations based on other molecules. One market respondent mentioned that sibutramina may be an alternative molecule to orlistat. 102

prescription drug and PGT's product is sold OTC.103 The market investigation suggested that although the products have the same brand name and molecule, they are differentiated in terms of pack design, dosage and pricing.104 According to the market investigation, the therapeutic indications of the two products are different.105 PGT OTC product is indicated for overweight patients, while Teva Rx product is indicated for obese patients or overweight patients having associated risk factors.

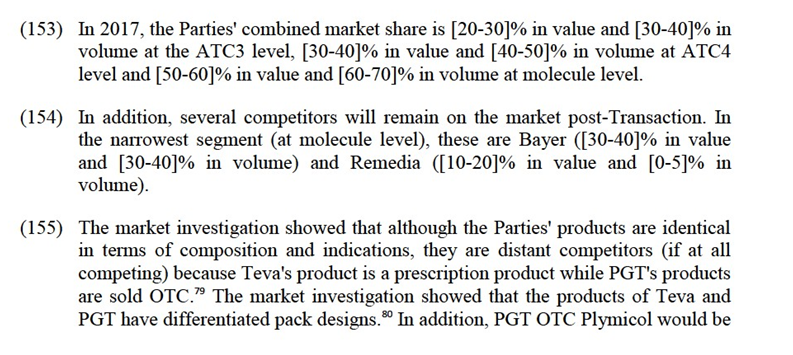

(223) Finally, the market investigation has not indicated that the Transaction will have an impact on the price or the availability of the products in the market.106

(224) In view of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding anti- obesity products in Portugal.

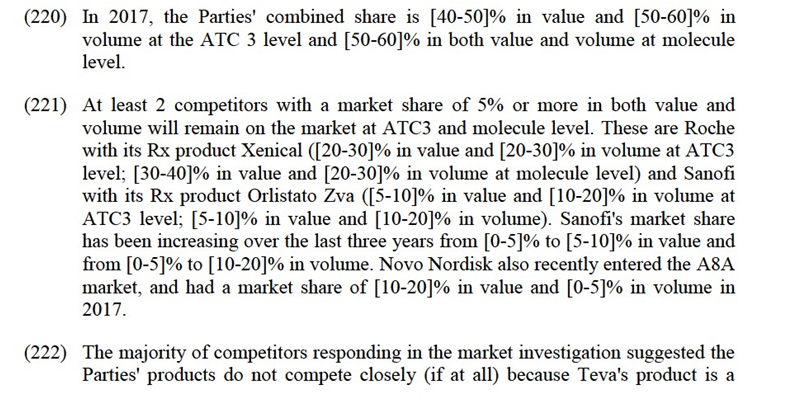

4.5.10.Paracetamol-based general pain relief in Austria

4.5.10.1. Market definition

(225) See paragraph (48) above regarding market definition for general pain relief products.

(226) For the purposes of the present case, the exact market definition can be left open. No serious doubts arise under any plausible alternative market definition (namely, at ATC3, ATC4, OTC3, or molecule level).

4.5.10.2.Parties' products

(227) For the Parties' OTC products, see section 4.4.2.2 above. Teva also supplies paracetamol based product Mexalen under prescription in Austria in rectal systemic form, for adults, children, and babies.

4.5.10.3.Competitive assessment

(228) For the assessment of the possible impact of the Transaction at the ATC3 and ATC4 level regarding OTC v. OTC overlaps, see section 4.4.2.3 above. At molecule level, the Transaction gives rise to a Group1 market for paracetamol based products, should OTC and Rx be part of the same relevant market.

(229) The Table below presents the Parties' market shares for paracetamol based products in Austria in 2015-2017:

5. CONCLUSION

(235) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Turnover calculated in accordance with Article 5 of the Merger Regulation.

4 See M.6280 Procter & Gamble/Teva OTC business, para. 6.

5 Teva distributes all the products of the Target, except Diastrolib, Vogalib and Vibivit which are distributed by P&G in France. These products are not overlapping with any Teva products.

6 Following Teva's acquisition of Cephalon in 2012, Cephalon's OTC business was contributed to PGT (M.6705 Procter & Gamble/Teva Pharmaceuticals OTC II). However, following the Teva's acquisition of Allergan Generics in 2016 (M.7746 Teva / Allergan Generics), the OTC business of Allergan was not contributed to PGT.

7 Replies to questions B.1. and B.2. of Q1 – Competitors; Replies to question 3 of Q2 – Customers (Croatia); Replies to questions 3 and 4 of Q4 – Customers (Hungary); Replies to question 3 of Q5 – Customers (Latvia); Replies to questions 3 and 4 of Q8 – Customers (Sweden); and Replies to questions 3 and 4 of Q3 – Customers (Germany).

8 Given that for the reasons explained below, the Transaction does not raise serious doubts, the Commission does not need to investigate further the existing links between Teva and the Target (which would be relevant for the merger specificity of any potential competition concerns).

9 Replies to questions B.1. and B.2. of Q1 – Competitors; Replies to question 3 of Q2 – Customers (Croatia); Replies to questions 3 and 4 of Q4 – Customers (Hungary); Replies to question 3 of Q5 – Customers (Latvia); Replies to questions 3 and 4 of Q8 – Customers (Sweden); and Replies to questions 3 and 4 of Q3 – Customers (Germany).

10 See for example M.7919 Sanofi/Boehringer Ingelheim Consumer healthcare Business, M.6969 Valeant Pharmaceuticals International/Bausch & Lomb Holdings, M.5778 Novartis/Alcon, and M.5865 Teva/Ratiopharm.

11 OJ C 372, 9.12.1997, p. 5–13.

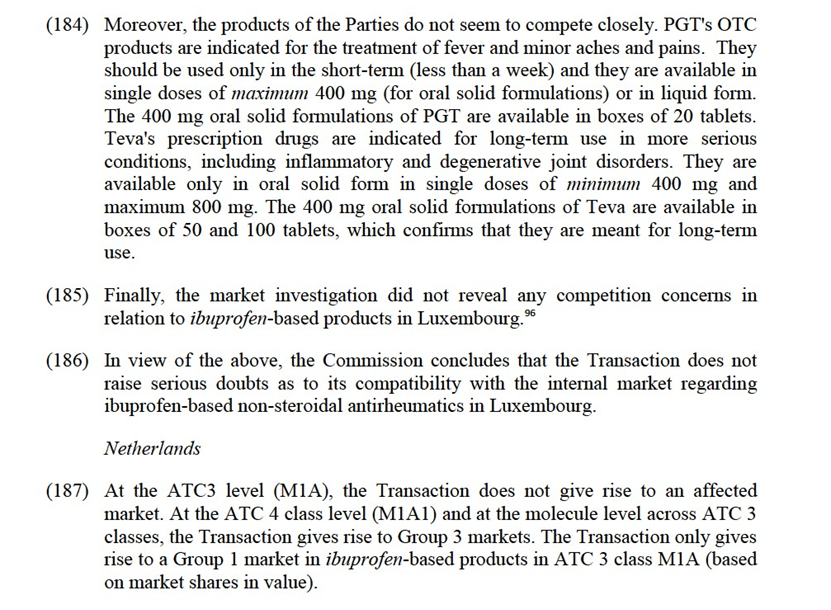

12 See for example M.7919, Sanofi/Boehringer Ingelheim Consumer Healthcare Business, M.7480 Actavis/Allergan; M.7279 Mylan/Abbott EPD-DM; M.7276 GlaxoSmithKline/Novartis vaccines business (excl. influenza)/Novartis Consumer Health business; M.7275 Novartis/GlaxoSmithKline Oncology Business and M.5253 Sanofi- Aventis/Zentiva.

13 See for example M.7746 Teva/Allergan Generics.

14 See for example M.7919, Sanofi/Boehringer Ingelheim Consumer Healthcare Business, para. 23.

15 See for example M.7919, Sanofi/Boehringer Ingelheim Consumer Healthcare Business.

16 The OTC3 level does not always correspond to the ATC3 level under the EphMRA classification. Depending on the country and on the OTC3, such categories may correspond to the equivalent ATC3 or ATC4 in the EphMRA classification, or may differ (although generically not significantly) from the ATC EphMRA classification.

17 M.7919, Sanofi/Boehringer Ingelheim Consumer Healthcare Business, para. 264 and 268, M.7276, GlaxoSmithKline/Novartis Vaccines Business (Excl. Influenza)/Novartis Consumer Health Business, para. 197, and M.6162, Pfizer/Ferrosan Consumer Healthcare Business, para. 37.

18 See for example M.6969 Valeant Pharmaceuticals International/Bausch & Lomb Holdings, M.5778 Novartis/Alcon, M.5865 Teva/Ratiopharm, and M.5295 Teva/Barr.

19 See M.5953 Reckitt Benckiser/SSL.

20 See for example M.5778 Novartis/Alcon, M.5253 Sanofi-Aventis/Zentiva, and M.3751 Novartis/Hexal.

21 See M.7645 Mylan/Perrigo of 29 July 2015, M.5778 Novartis/Alcon.

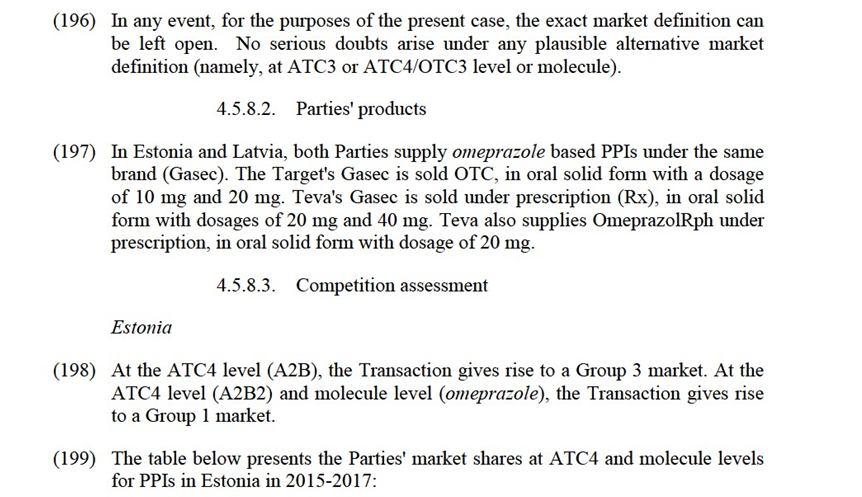

22 See for example M.5778 Novartis/Alcon, M.5865 Teva/Ratiopharm, and M.5253 Sanofi-Aventis/Zentiva.

23 See for example M.7919 Sanofi/Boehringer Ingelheim Consumer Healthcare Business, para. 24.

24 See most recently, M.8675, CVC/Teva's Women's Health Business, para. 20.

25 See para. (21) above.

26 The Notifying Party calculated the market shares at the molecule level where the Teva and the Target business product had the same molecule and belonged to the same OTC3 class.

27 See for example M.7919, Sanofi/Boehringer Ingelheim Consumer Healthcare Business, para. 35.

28 There is no separate OTC 3 class for these products. IMS Padds uses the ATC 3 classification.

29 M.6705, Procter & Gamble / Teva Pharmaceuticals OTC II (2012), para.16 ; M.3751 ; Novartis / Hexal, page10.

30 M.6258 Teva / Cephalon , paras. 50-52.

31 Replies to question K1 – Competitors, and to question 18 of Q5 – Customers (Latvia).

32 M.7276 GlaxoSmithKline/Novartis Vaccines (Excl.Influenza)/Novartis Consumer Healthcare, para. 313.

33 M.3544, Bayer Healthcare/Roche (OTC Business), paras. 20-23.

34 M.5953 Reckitt Benckiser/SSL, para. 18.

35 See M.5865 Teva/Ratiopharm, para. 278.

36 Replies to question K1 of Q1- Competitors

37 Replies to question K1 of Q1- Competitors

38 M.5865, Teva/Ratiopharm, para.386.

39 M.5253, Sanofi – Aventis/Zentiva, para.102.

40 M.5253, Sanofi-Aventis/Zentiva, para. 102.

41 Replies to question F.2 of Questionnaire Q1 – Competitors.

42 In OTC 3 class 10E1 (heart attack prevention products) in Hungary, there are only two products that do not contain ASA namely Pohl-Boskamp’s Notrolingual (introglycerin) and Oriental Herb’s Salvia which contains Salvia miltionhiza. The combined share of these two products in a relevent market for heart attack prevention products in Hungary has been less than 1% (in value and volume) in 2015/2017.

43 According to one competitor, Assectalis 10-12% more expensive than PGT’s products. See replies to question F.4.3 of Questionnaire Q1.Competitors.

44 According to one competitor, none of the two has particularity attractive packaging. See replies to question F.4.1 of Questionnaire Q1.Competitors.

45 Replies to question F.3 of Questionnaire Q1- competitors and replies to question 19 of Questionnaire Q4 – Customers – Hungary.

46 IMS Padds (which reports shares on the basis of OTC 3 class 03G3) contains more complete information than IMS Midas (which reports shares on the basis of ATC 4 class A2B2).

47 Similar to PPIs, H2 antagonists are used to suppress gastric acid secretion. PPIs and H2 antagonists work in different manners. While PPIs shut down the proton pump in the stomach, H2 antagonists block the so-called histamine receptors in the parietal cells.

48 See M.7645, Mylan/Perrigo, para. 50 and the cases cited therein.

49 See A.37507 – AstraZeneca, decision of 15 June 2005, para. 504.

50 M.7919 Sanofi/Boehringer Ingelheim Consumer healthcare Business, paras. 134-140.

51 Teva also offered Panrazol Control (pantoprazole) but the product is now discontinued.

52 In antiulcerants (including both PPIs and H2 products sold OTC) and in PPI products (based on ATC 4A2B2 in IMS Midas) the Transaction gives rise to Group 3 markets.

53 Replies to question K1 of Q1-Competitors.

54 See, in more detail, paras (22-25) above.

55 As explained below, for ascoric acid Vitamin C products Teva has both Rx and OTC products. However, the market limited to OTC products is not affected.

56 M.1846 Glaxo Wellcome/Smithkline Beecham, para. 25.

57 Replies to question K1-Competitors.

58 M.5965, Teva/Ratiopharm, paras, 105-110 and M.457/La roche/Syntex,para 35.

59 M.5965, Teva/Ratiopharm, para .108.

60 Replies to question K1 of Q1 - Competitors.

61 See M.7276 GlaxoSmithKline/Novartis Vaccines Business/Novartis Consumer Health Business, para. 284-285, M.5502 Merck/Schering-Plough, para. 43ff., and M.3354 Sanofi-Synthelabo/Aventis, para. 23.

62 See M.7919 Sanofi/Boehringer Ingelheim Consumer healthcare Business, paras. 43-46.

63 Replies to question D.2 and D.3 of Questionnaire Q1 – Competitors.

64 In 2017, Chiesi held [10-20]% in value and [10-20]% in volume at molecule level and [0-5]% in value and [0-5]% in volume at ATC 3 level.

65 In 2017, Dermapharm held [10-20]% in value and [5-10]% in volume at molecule level and [0-5]% in both value and volume at ATC 3 level.

66 In 2017, Orion held [0-5]% in both value and volume at ATC 3 level.

67 Replies to questions D.3.1 and D.3.2 of Questionnaire Q1 – Competitors.

68 Replies to question D.4 and D.5 of Questionnaire Q1 – Competitors.

69 Replies to question F.5.1 of Questionnaire Q1 – Competitors.

70 Replies to question I.2 of Questionnaire Q1 – Competitors.

71 Replies to questions 7-8 of Questionnaire Q8 – Customers (Sweden).

72 Replies to questions i.4 of Questionnaire Q1– Competitors and replies to question 11-12 of Questionnaire Q8-Customers (Sweden).

73 Replies to questions I.5 of Questionnaire Q1 – Competitors.

74 Replies to question I.6.1-I.6.3 of Questionnaire Q1- Competitors and Questions 14-16 of Questionnaire Q8-Customers (Sweden)

75 M.5330, GlaxoSmithKline/Stiefel Laboratories, para. 14.

76 M.7276, GlaxoSmithKline/Novartis Vaccines Business (Excl. Influenza)/Novartis Consumer Health Business, paras. 339, M.5253, Sanofi-Aventis / Zentiva, para. 104.

77 Replies to question C.2 of Q1 – Competitors.

78 Replies to questions 7 and 8 of Q2 – Croatia.

79 Replies to question C.4 of Q1 – Competitors ; and replis to question 16.1 of Q2 – Customers (Croatia).

80 Replies to question C.4 of Q1 – Competitors ; and replis to question 12 of Q2 – Customers (Croatia).

81 Replies to question C.4.2. of Q1 – Competitors.

82 Replies to question 10 of Q2 – Customers (Croatia).

83 Replies to question C.3 of Q1 – Competitors; Replies to question 14 of Q2 – Customers (Croatia).

84 Replies to questions 14 and 15 of Q2 – Customers (Croatia); Replies to question C.5 of Q1 – Competitors.

85 M.3354 Sanofi/Synthelabo/Aventis, para. 23.

86 M.3928 Teva/Ivax, para. 25-27.

87 More specifically, PGT OTC product Neofuragina treats infection of the lower urinary tract. Teva Rx Furaginum Teva is indicated for the treatment of acute and chronic non-complicated urinary tract infections caused by E.Coli (Escherichia Coli).

88 Replies to question K1 – Competitors.

89 M.5253, Sanofi-Aventis/Zentiva, paras. 135-136.

90 M.7379 Mylan/Abbott EPD-DM, para. 337.

91 M.5953 Reckitt Benckinser/SSL, paras. 17ff., M.6258 Teva/Cephalon, paras. 50ff., M.5865 Teva/Ratiopharm, paras. 250ff., and M.5253 Sanofi-Aventis/Zentiva, paras. 146ff.

92 M.7645, Mylan/Perrigo, para. 71.

93 M.7645, Mylan/Perrigo, para. 76.

94 M.7645, Mylan/Perrigo, para. 73.

95 Teva also offered an OTC ibuprofen product, Ibuprofen-RAT. but the product is now discontinued.

96 Replies to question K1 of Q1-Competitors.

97 Replies to question K1 of Q1-Competitors.

98 Replies to question K1-Competitors.

99 Replies to question K1 – Competitors and to question 18 of Q5 – Customers (Latvia).

100 M.457, La Roche/Syntex, para. 35.

101 M.7746 Teva / Allergan Generics, paras. 127-128. 102 Replies to question H.2. of Q1 – Competitors.

103 Replies to question H.4 of Questionnaire Q1 – Competitors. 104 Replies to question H.5 of Questionnaire Q1 – Competitors. 105 Reply to question H.4.1. of Questionnaire Q1 – Competitors. 106 Replies to question H.6 of Questionnaire Q1 – Competitors.

107 Replies to question K1– Competitors.