Commission, October 31, 2018, No M.9099

EUROPEAN COMMISSION

Judgment

JIN JIANG / RADIS

Dear Sir or Madam,

Subject: Case M.9099 - Jin Jiang/Radisson

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

(1) On 28 September 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation, by which Jin Jiang International Holdings Co., Ltd ("Jin Jiang", China), a State-owned company, intends to acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of Radisson Holdings, Inc. (the United States) and Radisson Hospitality AB (Sweden) (together "Radisson"), by way of purchase of shares (the "Transaction"). (3) Jin Jiang and Radisson are designated hereinafter as the "Parties" or, in particular when assessing the post-Transaction scenario, the "merged entity").

1. THE PARTIES

(2) Jin Jiang is a leading Chinese hospitality and travel group that develops and manages hotels in China and the rest of the world. Jin Jiang operates a wide range of hotels, under the brands J.Hotel, Jin Jiang, Metropolo, Jin Jiang Inn, the series of brands under Groupe du Louvre, the series of brands under Plateno Group and the series of brands under Vienna Hotel. Groupe du Louvre consists in particular of the European brands Royal Tulip, Golden Tulip, Tulip Inn, Campanile, Première Classe and Kyriad and a suite of French independent hotels under Hôtels & Préférence. (4) The Plateno Group has 17 brands, including in particular the 7 Days Premium and H12 brands under which four hotels are operated in Austria. (5) As at the end of 2017, Jin Jiang owns or manages 6 794 hotels with a total of […] rooms located in 68 countries around the world, including […] hotels with a total of […] rooms located in 9 countries in Europe. (6)

(3) Jin Jiang is a wholly owned subsidiary of the Shanghai State-owned Assets Supervision and Administration Commission ("SASAC"), a subsidiary of the Shanghai municipal government. As such, Jin Jiang is a Chinese State-owned company. Jin Jiang submits that it is the ultimate parent company of the Jin Jiang group, and acts independently from all other entities owned by Shanghai SASAC and from all other Chinese State-owned enterprises, be they owned by central, regional or local authorities. (7)

(4) Nevertheless, Jin Jiang's Articles of Association confer on Shanghai SASAC (as the 100% shareholder of Jin Jiang) various rights including the right to appoint board members and approve significant investment decisions. (8) In addition, the Commission has not excluded in prior cases that certain Chinese State-owned enterprises lack an independent power of decision and should be considered to constitute a single economic unit whose turnover and activities should be combined. (9)

(5) In any case, for the purposes of the assessment of the Transaction, the question of whether Jin Jiang belongs to the same group as other Chinese State-owned enterprises can be left open, as the Transaction would not raise serious doubts even combining the activities of Jin Jiang and of all other Chinese State-owned enterprises active in the hotel industry. (10)

(6) Radisson, currently controlled by the Chinese conglomerate HNA Group, operates a range of hotel brands with a focus on the luxury, upper upscale, upscale and upper midscale segments. (11) In the EEA, these brands include Radisson Collection, Radisson Blu, Radisson, Radisson Red, Park Plaza, Park Inn by Radisson. As at the end of 2017, Radisson operates 369 hotels and resorts, […] rooms and has operations in 78 countries. (12) As at August 2018, Radisson's activities in the EEA included 224 hotels operating under the Radisson brands. (13)

2. THE OPERATION

(7) On 9 August 2018, a Jin Jiang-led consortium (14) and Radisson signed a series of agreements comprising three transactions pursuant to which Jin Jiang will acquire all the shares in, and therefore sole control over, Radisson. Under the first transaction, Jin Jiang will acquire a total of 51.15% of the outstanding shares and votes in Radisson AB. Following the closing of the first transaction, under Swedish takeover rules, Jin Jiang will be under an obligation to launch a mandatory public tender offer for the remaining outstanding shares in Radisson AB, within four weeks after the closing of the transaction, unless the ownership in Radisson AB is sold down below 30% (which, according to Jin Jiang, will not be the case). Under the second transaction, Jin Jiang will acquire up to an additional 18.50% of the shares and votes in Radisson AB from HNA Sweden. Under the third transaction, and following the closing of the shares in Radisson AB, Jin Jiang will acquire 100% of the shares in Radisson Holdings from HNA Hotel HK and HNA Sweden. (15)

(8) The first, second and third transactions will occur simultaneously. In addition, the closing of the third transaction is conditioned de jure upon the closing of the first transaction and the closing or termination of the second transaction. (16) Furthermore, the three transactions pursue the same economic aim, which is to bring about the sole control of the Radisson group in the hands of one single entity, Jin Jiang. (17) Therefore, the three transactions are interdependent and constitute a single concentration pursuant to paragraph 38 and following of the Commission Consolidated Jurisdictional Notice. (18)

(9) In light of the above, the operation pursuant to which Jin Jiang intends to acquire sole control over Radisson constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(10) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 2 500 million (19) (Jin Jang: 3 416 million; Radisson: EUR 1 257 million). In each of three Member States, the combined aggregate turnover of the undertakings concerned is more than EUR 100 million (France: […]; Germany: […]; United Kingdom: […]). The aggregate turnover of each of the undertakings concerned in each of those three Member States (France, Germany and United Kingdom) exceeds EUR 25 million. Each of the undertakings concerned has a Union-wide turnover in excess of EUR 100 million (Jin Jiang: […]; Radisson: […]), but they do not achieve more than two-thirds of their aggregate Union-wide turnover within one and the same Member State.

(11) The Transaction therefore has a Union dimension within the meaning of Article 1(3) of the Merger Regulation.

4. MARKET DEFINITION

4.1. Introduction

(12) The Parties are both active in the hotel industry.

(13) As pointed out by the Commission in Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide ("Marriott International"), (20) and as confirmed by the Parties (21), hotels may be operated under the following three main business models: (i) under the first model, hotels are owned or leased and managed by the same company under its own name or brand; (ii) under the second model, a company – either a hotel chain or a specialised management company ("white label management companies") – manages hotels, for a management fee, on behalf of their owner; (iii) under the third model, hotel chains franchise one of their brands to hotel owners, who either manage their hotels themselves or use a third management company.

(14) Moreover, the Commission defined in Marriott International three separate markets for: (i) the provision of hotel accommodation services, which is local in scope; (22) (ii) the provision of hotel management services, which may be EEA- or worldwide in scope; (23) and (iii) the provision of hotel franchising services, which may be EEA- or worldwide in scope. (24)

(15) Both Parties operate under the three business models described in the paragraph (13) in the EEA and worldwide. (25) In the EEA, Jin Jiang predominantly operates via Groupe du Louvre hotels, which are owned or leased, managed or franchised. (26) Radisson has an asset-light strategic goal, whereby it mainly licenses its brands. It also manages hotels and operates a few owned or leased hotels. (27)

(16) Therefore, the Parties' activities overlap in the markets for the provision of:

a. hotel accommodation services,

b. hotel management services, and

c. hotel franchising services.

(17) However, neither the market for hotel management services nor the market for hotel franchising services is affected at EEA-wide or worldwide levels, even if the market shares of other Chinese State-owned hotel managers or franchisors (28) are included in Jin Jiang's market shares. Indeed, according to Jin Jiang's estimates and based on the number of hotels rooms classified as "chain management" in the STR (29) database, the Parties' EEA-wide and worldwide combined shares in the market for the provision of hotel management services would remain below 5%. (30) Similarly, according to Jin Jiang's estimates and based on the number of hotels rooms classified as franchised in the STR database, the Parties' EEA-wide and worldwide combined shares in the market for the provision of hotel franchising services would remain below 20%. (31)

(18) In light of the above, the Commission will not further consider in this Decision the definition of the markets for the provision of hotel management and franchising services, and no competition assessment will be conducted in this Decision on those markets. For the purposes of this Decision, the Commission will only assess the effects of the Transaction in the market for the provision for hotel accommodation services.

4.2. Relevant product market for hotel accommodation services

(19) In decisions prior to Marriott International, the Commission considered a separate market for the provision of hotel accommodation services, (32) leaving open whether separate markets should be distinguished based on ownership type (chains vs. independent hotels), (33) comfort/price level (for instance star rating), (34) and the provision of services in short stay residences. (35)

(20) In Marriott International, the Commission carried out a detailed analysis of whether the market for hotel accommodation services should be segmented based on: (i) ownership type (chains vs. independent hotels); (ii) comfort/price level (star ratings vs. categories); (iii) short stay residences; and (iv) the provision of specific services. (36)

4.2.1. Distinction by ownership type

4.2.1.1. The Commission's precedents

(21) In its prior decision practice, the Commission considered a segmentation of the overall market for hotel accommodation services by ownership type. Specifically, the Commission distinguished between three types of hotels: (i) economically and legally independent hotels; (ii) voluntary chains consisting of groups of independent hotels which carry out their marketing, promotion, purchasing etc. under one and the same hotel brand; and (iii) integrated chains which operate hotels directly through subsidiaries or indirectly by a franchise or management contract. (37)

(22) In Marriott International, the Commission concluded that the market for hotel accommodation services comprised the services provided by both chain hotels and independent hotels. (38)

4.2.1.2. Jin Jiang's views

(23) Jin Jiang, first, considers that independent and chain hotels are entirely substitutable, particularly at a local level. The Parties' hotels competitive sets, that is to say the list of hotels against which Jin Jiang and Radisson benchmark themselves and the performance of which they monitor, consist of both chain and independent hotels. (39) Second, Jin Jiang argues that whether a hotel belongs to a chain or is independent is not among the main drivers of customers' choice between hotels. Third, Jin Jiang submits that on-line travel agencies ("OTAs") are increasingly used, enabling customers to compare the offerings of all chain and independent hotels, and their performance through users' reviews. Fourth, Jin Jiang maintains that independent hotels are continuing to improve their offering in the area of loyalty programmes and, as a result, any difference which may exist between independent and chain hotels in this area is being further eroded. Fifth, technological developments continue to enable independent hotels to raise awareness of their brands and access to customers on a global basis. Whilst chain hotels may potentially have greater brand awareness, customers, including corporate customers, purchase hotel accommodation services from both chain and independent hotels. (40)

4.2.1.3. The Commission's assessment

(24) The results of the market investigation confirmed the Commission's findings in Marriott International.

(25) First, most of the respondents to the market investigation confirmed that whether a hotel belongs to a chain or is independent is not among the main drivers of customer's choice between hotels. (41) In line with the results of the market investigation in Marriott International, (42) features such as price, comfort level and customers' rating are more important for the selection of a hotel in a given location than the ownership type. (43)

(26) Second, the majority of the respondents who expressed an opinion confirmed that customers purchase hotel accommodation services from both chain and independent hotels. (44) They also confirm that, in terms of price, customers consider chain and independent hotels as interchangeable. (45) Some of the respondents explain that the main, or only relevant, difference between chain and independent hotels is their offer of loyalty programmes. (46)

(27) Third, all the respondents to the market investigation indicated that intermediaries, such as travel agencies, on-line travel agencies and tour operators, have business relationships with both chain and independent hotels. (47) In this respect, some respondents clarified that it is in the intermediaries' interest to offer a broad portfolio. (48)

(28) Finally, according to the majority of the respondents having expressed an opinion, online travel agents prioritise offerings irrespective of whether the hotels belong to chains or are independent. (49)

4.2.1.4. Conclusion

(29) For the reasons set out in this section, including in light of the market investigation, the Commission concludes that, for the purposes of this Decision, the market for hotel accommodation services should not be segmented on the basis of ownership type, but rather comprises the services provided by both chain and independent hotels.

4.2.2. Distinction by comfort/price level

4.2.2.1. The Commission's precedents

(30) In its prior decision practice, the Commission has considered a possible segmentation of the market for hotel accommodation services by comfort/price level. (50)

(31) In Marriott International, the Commission left open the question of whether the market for hotel accommodation services should be segmented by comfort/price level on the basis of hotels' star rating. It nevertheless considered that the distinction by comfort/price level on the basis of comfort classes (for instance STR classes) (51) was not relevant for the purposes of that decision. (52)

4.2.2.2. Jin Jiang's views

(32) Jin Jiang submits that any further segmentation of the market for hotel accommodation services, based on comfort/price level, is not appropriate for the following main reasons. First, there is no established definition in the hotel industry for allocating star ratings to a particular hotel. As a result, individual hotel operators often use their own ratings. (53) Second, hotels with adjacent star ratings (for instance 4-star and 3-star hotels, 3-star and 2-star hotels) exert competitive pressure on one another. (54) Third, with respect to STR classes, customers are not familiar with this classification. (55)

4.2.2.3. The Commission's assessment

(33) The majority of the respondents to the market investigation who expressed an opinion confirmed that customers are familiar, or very familiar, with the classification of hotels on the basis of star rating. (56) Some of the competitors nonetheless recognised that the star rating classification has its limits; the absence of actual standards and the resulting differences among EEA countries make it difficult to rely fully on this classification. (57) In any event, as explained by some of the respondents to the market investigation, customer rating is growing in importance and online reputation websites are "becoming key" in the selection of hotels by customers. (58) In conformity with the above, and in particular the increasing importance of customer rating, the majority of respondents having ranked certain criteria for the choice of hotels in a given location by customers considered star rating as not so important. (59)

(34) As regards categories (for instance STR classes), the results of the market investigation supported the conclusion reached in Marriott International, according to which customers are not familiar with this type of classification, which is not widely communicated in all distribution channels. (60) The majority of the respondents to the market investigation considered comfort level (that is to say luxury, upper upscale, upscale, upper midscale, midscale and economy) as either important or very important for the choice of a hotel in a given location by final customers, (61) for which, subject to the national differences referred to in the previous paragraph, star rating should be a proxy. (62) However, the high importance given to comfort class seems to reflect the importance that customers give to the amenities and services offered by hotels and reflected by the hotel category, rather than the general level of awareness by customers of the meaning of hotel categories. Indeed, some of the respondents explained that comfort levels are part of "industry language" and that consumers are not familiar with this specific terminology. (63) The majority of respondents to the market investigation in fact confirmed that customers are not familiar, or not so familiar, with the classification of hotels on the basis of comfort level. (64)

4.2.2.4. Conclusion

(35) In any case, for the purposes of this Decision, the question of whether the market for hotel accommodation services should be segmented on the basis of star rating can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

(36) Furthermore, for the reasons set out in this section, including in light of the market investigation, the Commission concludes that, for the purposes of this Decision, the market for hotel accommodation services should not be segmented on the basis of categories (for instance STR classes), considering the general lack of awareness by customers of this type of classification.

4.2.3. Distinction between hotels and short stay residences

4.2.3.1. The Commission's precedents

(37) In its prior decision practice, the Commission assessed whether short stay residences are part of a broader hospitality market, also including hotel accommodation services, (65) ultimately leaving the question open. (66)

4.2.3.2. Jin Jiang's views

(38) The Parties submit that serviced apartments do not belong to a separate market as they compete with conventional hotels and also with short stay residences, including short-term lets. In their view, new entrants, such as Airbnb and FlipKey, by allowing the general public to rent out their own houses, represent an increasing threat to conventional hotels. (67)

4.2.3.3. The Commission's assessment

(39) The Parties have marginal serviced apartment offerings, corresponding to short stay residences. Jin Jiang does not offer serviced apartments. Radisson has one franchised hotel offering serviced apartments, namely, the Radisson Blu Mountain Resort & Residences, in Trysil, Norway, with 42 rooms. Radisson also has one managed hotel in development, which will offer serviced apartments, namely the Radisson Blu Hotel & Residences, in Zakopane, Poland, with 68 rooms. (68)

4.2.3.4. Conclusion

(40) In any case, for the purposes of this Decision, the question of whether short stay residences are part of the same market as hotel accommodation services can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.4. Distinction between hotel accommodation services and specific services

4.2.4.1. The Commission's precedents

(41) In Marriott International, the Commission concluded that the provision of additional services, for, for instance, conferences and events, fitness and spa, food & beverage, loyalty programmes etc. by hotel operators is ancillary to hotel accommodation services. (69)

4.2.4.2. Jin Jiang's views

(42) Jin Jiang submits that specific services offered by the Parties are ancillary to their primary offering and are intended to increase the hotels' occupancy rate. (70)

4.2.4.3. The Commission's assessment

(43) The market investigation has not produced evidence indicating that the Commission should depart from the approach it has recently taken in respect of the ancillary nature of specific services. In particular, respondents have not submitted material comments suggesting that there is any need to define a separate market for the provision of specific services for the purposes of assessing the effects of the Transaction on competition.

4.2.4.4. Conclusion

(44) In light of the above, the Commission concludes that, for the purposes of this Decision, the market for hotel accommodation services comprises additional services also offered by hotel operators.

4.2.5. Conclusion on the product market definition for hotel accommodation services

(45) For the reasons set out in this section, including in light of the market investigation and of all the evidence available to it, the Commission concludes that, for the purposes of this Decision, the relevant market is the market for the provision of hotel accommodation services, whether provided by chain or independent hotels, including the provision of additional services.

(46) Moreover, for the purposes of this Decision, the Commission considers that it is not necessary to conclude on the potential distinctions by star rating and between hotels and short stay residences, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.3. Relevant geographic market for hotel accommodation services

4.3.1. The Commission's precedents

(47) In decisions prior to Marriott International, the Commission left the exact geographic scope of the market for hotel accommodation services open. It had nonetheless observed that the relevant geographic market presented both national and local characteristics. (71)

(48) In Marriott International, the Commission concluded that the geographic market for hotel accommodation services appears to be local and that it should not be further segmented by city districts. (72) It nonetheless left the exact delineation of the local market open, notably the possibility of cities and their respective airport areas being part of the same geographic market. (73)

4.3.2. Jin Jiang's views

(49) Jin Jiang submits that the exact delineation of the local market for hotel accommodation services may be left open as in any case no competition concerns would arise from the Transaction. (74)

4.3.3. The Commission's assessment

(50) The market investigation has not revealed any indication that the Commission should depart from the approach it has recently taken in respect of the local scope of the market for hotel accommodation services. In particular, respondents have not submitted material comments suggesting that there is a need to assess the effects on competition on a broader market.

4.3.4. Conclusion on the geographic market definition for hotel accommodation services

(51) For the reasons set out in this section, including in light of the market investigation and of all the evidence available to it, the Commission concludes that, for the purposes of this Decision, the geographic market for hotel accommodation services is local.

(52) Moreover, for the purposes of this Decision, the Commission considers that it is not necessary to conclude on whether cities and their respective airport areas are part of the same geographic markets, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

5. COMPETITIVE ASSESSMENT

5.1. Legal framework for the competitive assessment

(53) Effective competition brings benefits to consumers, such as low prices, high quality products, a wide selection of goods and services, and innovation. Through its control of mergers, the Commission prevents mergers that would be likely to deprive customers of those benefits by significantly increasing the market power of firms. (75)

(54) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular as a result of the creation or strengthening of a dominant position. The notion of "significant impediment to effective competition" must be interpreted as extending, beyond the concept of dominance, to the anticompetitive effects of a concentration resulting from the non-coordinating behaviour of undertakings which do not have a dominant position on the market concerned. (76)

(55) As regards non-coordinated effects, a merger with horizontal effects may significantly impede effective competition in a market, even if it does not result in the creation or strengthening of a dominant position, by removing important competitive constraints and influencing parameters of competition. (77)

(56) The Horizontal Merger Guidelines list a number of factors which may influence whether or not significant non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that merging firms are close competitors, the limited possibilities for customers to access to the services provided by the parties and their competitors and the fact that the merger would eliminate an important competitive force.

(57) It is in the light of the principle set out above that the Commission must analyse whether and to what extent the Transaction may raise serious doubts as to its compatibility with the internal market.

5.2. Overview of the reportable markets

(58) As indicated in section 4.1 above, the Parties' activities overlap in the markets for: (i) hotel accommodation services; (ii) hotel management services; and (iii) hotel franchising services in the EEA and worldwide.

(59) However, as explained in paragraph (17), the Transaction does not give rise to affected markets for hotel management or franchising services at EEA-wide or worldwide levels. In addition, the majority of respondents to the market investigation consider that the Transaction will have no significant overall impact on hotel management services or on hotel franchising services in the EEA or worldwide. (78) In light of the above, the Commission considers that the Transaction is unlikely to give rise to any anti-competitive horizontal effects on the EEA or worldwide markets for hotel management or franchising services.

(60) In addition, Jin Jiang provides tour operating and travel agency services in China and is thus active in markets that are downstream from the market for hotel accommodation services. (79) However, the Commission has considered in its prior decision practice that these vertically related markets would generally be national or narrower in scope. (80) Jin Jiang is thus not active in a product market which is upstream or downstream from the hotel accommodation services provided by Radisson within the EEA territory or in a territory wider than the EEA. More generally, neither Jin Jiang nor any other State-owned enterprises are significantly active in a market which is upstream or downstream from the hotel services (accommodation, management or franchising) provided by Radisson. (81) In light of the above, the Commission considers that Transaction is unlikely to give rise to any anti-competitive vertical effects.

(61) Therefore, the assessment of the compatibility of the Transaction with the internal market will focus on the non-coordinated horizontal effects in the provision of hotel accommodation services, in relation to which the Transaction gives rise to affected markets.

5.3. Methodology for the estimation of market shares for hotel accommodation services

(62) As indicated in section 4.1 above, the Parties are active on the markets for hotel accommodation services in the EEA through owned or leased, managed and franchised hotels.

5.3.1. Inclusion of managed hotels in the calculation of market shares

(63) In its prior decision practice, the Commission considered that the provision of hotel management services to a hotel owner on a contractual basis may lead to a situation of joint control over the hotel by the hotel owner and the hotel manager. (82) In particular, in Marriott International, the Commission concluded that hotels managed by the parties are most likely jointly controlled by them. Therefore, the Commission included managed hotels in the calculation of the parties' market shares. (83)

(64) Jin Jiang submits that each of Jin Jiang and Radisson have a determining role on the operation of their respectively managed hotels and the development and implementation of their business. Therefore, Jin Jiang has included managed hotels in the calculation of the Parties' market shares in the EEA. (84)

(65) The Commission notes that, under the standardised management agreements of both Jin Jiang and Radisson, (85) the Parties in their function as hotel managers are granted a broad authority by the hotel owner to control all major aspects of the operation of the hotel, in particular setting rates, collecting revenues, preparing books and financial reporting, and performing repairs and maintenance. Furthermore, the Parties' management fees consist of a percentage of the hotel's gross annual revenues and a percentage of the hotel's annual operating profit. (86) Therefore, Jin Jiang and Radisson in their function as hotel managers exert significant influence over the hotels they manage.

(66) In light of the above, and in line with the conclusion reached in Marriott International, the Commission considers that the hotels managed by Jin Jiang or Radisson are most likely jointly controlled by them. Accordingly, these managed hotels should be taken into account for the purposes of identifying the local markets in the EEA where the Parties' activities overlap and the markets shares of these managed hotels should be attributed to the Parties, as this would more accurately reflect the Parties' relative market position. (87)

5.3.2. Non-inclusion of franchised hotels in the calculation of market shares

(67) According to the Commission Consolidated Jurisdictional Notice, "franchising agreements as such do not normally confer control over the franchisee's business on the franchisor." (88) In line with this, the Commission concluded in Marriott International that the parties did not control their franchised hotels. Therefore, the Commission did not include franchised hotels in the calculation of the parties' market shares in that case. (89)

(68) Jin Jiang submits that, in contrast to managed hotels, the franchise agreements do not confer upon Jin Jiang or Radisson in their function as hotel franchisors with any decision-making authority in relation to the operation of the hotel. (90)

(69) The Commission notes that, under the standardised franchise agreements of both Jin Jiang and Radisson, (91) the franchisee is responsible for the day-to-day operation of the hotel, which includes price setting, budget and business plan, employment and staffing issues, maintenance and investment of the hotel. Furthermore, the Parties are typically remunerated through a franchise application fee, a royalty fee, depending on the hotel's gross sales, and ancillary fees that cover miscellaneous expenses, such as the cost of the on-line reservations platform and property sales and marketing costs. (92) Therefore, hotels franchised by Jin Jiang and Radisson are operated independently by their hotel managers and not centrally by the hotel chain itself.

(70) This is confirmed by a majority of respondents to the market investigation, which considered that franchised hotels compete with other hotels belonging to the same chain within the same location (be they leased or owned, managed or franchised by the hotel chain). (93)

(71) In light of the above and taking account of the results of the market investigation and of all the evidence available to it, the Commission considers that the hotels franchised by Jin Jiang or Radisson are most likely not controlled by them. Accordingly, these franchised hotels should not be taken into account for the purposes of identifying the local markets in the EEA where the Parties' activities overlap and the markets shares of these franchised hotels should not be attributed to the Parties, as this would not accurately reflect their relative market position. (94)

5.3.3. Calculation of market shares

(72) Jin Jang has calculated the Parties' market shares in volume (room capacity expressed in number of rooms) on the basis of data from the STR database, supplemented by public record searches using major price comparison websites, such as TripAdvisor, Expedia or Booking.com. Hotels that did not have a star rating were excluded from the dataset. (95) Furthermore, Jin Jiang has included the Parties' pipeline hotels in its estimation of market shares, while excluding, on a conservative basis, pipeline projects from the Parties' competitors. (96)

(73) The calculation method adopted by Jin Jiang is in line with the one adopted by Marriott in Marriott International. In that decision, the Commission concluded that the market data provided by Marriott sufficed for assessing the impact of the transaction on the EEA markets for the provision of hotel accommodation services. (97)

5.4. Affected markets for hotel accommodation services

5.4.1. Introduction on hotel accommodation services in the EEA

(74) As indicated in Marriott International, the hotel sector in the EEA is highly fragmented and dynamic. (98) Jin Jiang notably indicates that the supply of hotel accommodation services grows by approximately 3% to 5% in the EEA on a yearly basis. This dynamism results in approximately 40 000 new hotel rooms available every year in the EEA, even excluding the additional capacity and growth of non- traditional lodging providers such as Airbnb. (99)

(75) In a Jin Jiang's internal document, the hospitality market in Europe is described as "relatively fragmental", with the top 5 hospitality market players accounting for less than 15% of the market by room number in 2017 (1. Accor: [5-10]%; 2. IHG: [0-5]%; 3. Marriott: [0-5]%; 4. Best Western: [0-5]%; and 5. Radisson: [0-5]%), and the top 10 hospitality market players accounting for about 20% (Jin Jiang ranking number […] according to the 2017 room number, with [0-5]%). (100)

5.4.2.Overview of the affected markets for hotel accommodation services

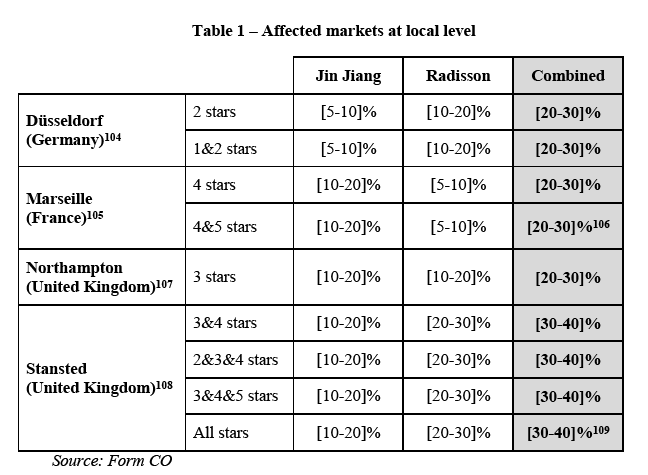

(76) Excluding their franchised hotels, the Parties' activities on the market for hotel accommodation services overlap in 34 cities in the EEA. (101) The Parties' combined market shares exceed 20% in only four of these cities, out of which three are only affected markets taking account of distinctions between hotels on the basis of their star rating. (102) The table below provides an overview of the affected markets (2018 data). (103)

5.4.3. Elements common to the assessment of markets for hotel accommodation services in the EEA

(77) The competitive assessment of the affected markets is carried out at local level in section 5.3.4 below. Nonetheless, certain elements which are common to all locations are briefly presented below: (i) closeness of competition, (110) (ii) consumer brand loyalty and loyalty programmes, and (iii) barriers to entry or expansion. (111)

5.4.3.1. Closeness of competition

(78) In Marriott International, the Commission assessed the extent to which the parties' hotel accommodation services are close substitutes on the basis of (i) their brand positioning, and (ii) the geographical proximity of their hotels. (112)

(79) Jin Jiang submits that the Parties are not close competitors in the EEA, in view of their different brand positioning and minimal geographical overlap. (113)

(80) In terms of brand positioning, both Parties own hotel brands which are present across the EEA. (114) The majority of respondents to the market investigation highlight that, in the EEA, the brand of the hotel is important for the choice of hotel in a given location by the final customer. (115)

(81) The Jin Jiang brands are predominantly categorised in the EEA in the lower end of the market (2-3 star hotels), while Radisson's brands are predominantly in the upper class categories (4-5 star hotels). (116) In that regard, Jin Jiang's internal document drafted in preparation of the Transaction refers to the […] between the Parties. (117)

(82) In light of the result of the market investigation and considering the evidence available to it, the Commission considers that the Parties' brands in the EEA are not particularly close to each other.

(83) In terms of geographical proximity, the Commission, in its assessment of the affected cities (see section 5.3.4 below) will include an assessment of whether the Parties' hotels are geographically particularly close to each other or whether competing hotels could be found at similar or shorter distance.

5.4.3.2. Consumer brand loyalty and loyalty programmes

(84) In Marriott International, the Commission found that brand loyalty of consumers, as well as loyalty programmes, did not play any material role in the competitive assessment of the transaction in the markets for hotel accommodation services in the EEA.

(85) Jin Jiang submits that the brand and the offering of loyalty programmes are not among customers' main selection criteria. (118)

(86) The majority of respondents to the market investigation confirmed that loyalty programmes, which are indicative of brand loyalty, are not among the strongest drivers of consumer decisions in the EEA. In particular, the importance of loyalty programmes for the choice of hotel in a given location by the final customer is ranked lower than, for instance, price or consumer rating. (119)

(87) Two respondents to the market investigation nevertheless indicated that the new Jin Jiang-Radisson entity will benefit from a more popular loyalty programme, which might contribute to redirecting part of the demand of Chinese travellers to its hotels. (120) Nevertheless, the Commission notes that Radisson already belonged pre- Transaction to a Chinese group active in the tourism sector (HNA Group). In addition, post-Transaction, Jin Jiang and Radisson combined will continue to face strong competition from other hotel chains active globally. As an example, one of the largest hotel companies indicates that it offers attractive loyalty programmes and that loyalty programme benefits are similar for all brands and networks. (121) Finally, the majority of respondents to the market investigation consider that the Transaction will have no significant impact on their company. (122)

(88) In light of the results of the market investigation and considering the evidence available to it, the Commission will not further consider consumer brand loyalty and loyalty programmes in its assessment of the competitive effects of the Transaction.

5.4.3.3. Barriers to entry or expansion

(89) In Marriott International, the Commission noted that there is a degree of dynamism in the EEA market with hotels changing brands and thus giving possibilities to competitors to enter the market. (123)

(90) Jin Jiang submits that there are no material legal or regulatory barriers to prevent market entry, and no intellectual property rights or other related rights that would prevent or make market entry more difficult, and that will remain the case post-Transaction. (124)

(91) The market investigation has not revealed any indication that the Transaction would have any significant impact on any existing barriers to entry or expansion in the hotel accommodation sector.

(92) In light of the results of the market investigation and considering the evidence available to it, the Commission considers that barriers to entry or expansion for the provision of hotel accommodation services in the EEA will not be materially impacted by the Transaction and do not change the competitive assessments at local level for each of the affected markets identified in paragraph (76) above.

5.4.4. Assessment at local level

5.4.4.1. Düsseldorf

The Parties' activities

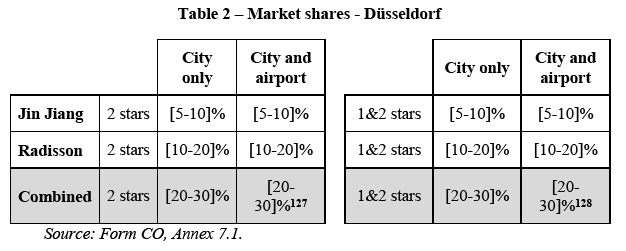

(93) There are 12 783 hotel rooms in Düsseldorf (city only), out of which 1 325 are in 2-star hotels (there is no 1-star hotel). Adding airport hotels, there are 14 251 hotel rooms in Düsseldorf, out of which 1 425 are in 2-star hotels (there is no 1-star hotel). (125)

(94) In Düsseldorf, Jin Jiang operates one 2-star hotel (Premiere Classe Düsseldorf City), with 84 rooms, which is located in the city centre. The overlap in the market for 2-star hotels in Düsseldorf only arises if a Radisson pipeline hotel, Prizeotel Düsseldorf City (250 rooms) due to open in 2021 in the city centre, is taken into account. (126)

The Commission's assessment

(95) The markets for 2-star and 1&2-star hotels would be affected with a combined market share of the Parties reaching [20-30]% on the narrowest product market and geographic scope. The table below sets out the Parties market shares (2018 data).

(96) Therefore, post-Transaction, (129) the market share of the merged entity would remain moderate, all the more so as, on a conservative basis, Jin Jiang has not included in the Parties' market share estimates data for pipeline projects of the Parties' competitors. (130)

(97) In addition, in Düsseldorf, a number of 2-star chain hotels compete actively in the market, including those operated by international chain operators such as Accor (with Ibis hotels) and B&B Hotels. Moreover, additional competition stems from independent 2-star hotels (for instance Hotel Terminus Garni and A&O Düsseldorf Hauptbahnhof). (131)

(98) Furthermore, on a geographical level, the Parties' 2-star hotels would not be particularly close competitors, since two 2-star Ibis hotels (Ibis Düsseldorf City and Ibis Düsseldorf Hauptbahnhof) are not more distant from the Radisson pipeline hotel than the Jin Jiang's hotels. (132)

(99) Finally, the majority of respondents to the market investigation having expressed an opinion indicated that there will be sufficient competition after the Transaction to prevent Jin Jiang and Radisson combined from raising the prices or degrading the quality of the hotel accommodation services they provide in Düsseldorf. (133)

(100) Overall, given the Parties' market shares, the presence of significant competitors and the fact that no material concern was expressed during the market investigation, the Commission considers that the Transaction is unlikely to lead to any significant competition concerns for the market for 2-star hotel accommodation services in Düsseldorf city.

Conclusion

(101) In light of the results of the market investigation and considering all evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for hotel accommodation services in Düsseldorf, under any plausible segmentation.

5.4.4.2. Marseille

The Parties' activities

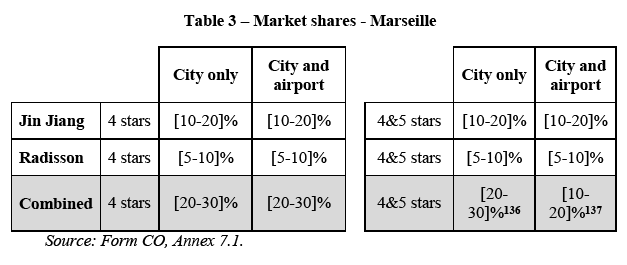

(102) There are 7 704 hotel rooms in Marseille (city only), out of which 2 266 are in 4- star hotels and 344 are in 5-star hotels. Adding airport hotels, there are 8 002 hotel rooms in Marseille, out of which 2 444 are in 4-star hotels and 344 are in 5-star hotels. (134)

(103) In Marseille, Jin Jiang operates two 4-star hotels (Golden Tulip Marseille Euromed and Golden Tulip Marseille Villa Massalia), with 350 rooms together (respectively 210 and 140 rooms), which are located in the city centre. Radisson operates one 4-star hotel (Radisson Blu Hotel Marseille Vieux Port), with 188 rooms, which is located in the city centre. (135)

The Commission's assessment

(104) The markets for 4-star and 4&5-star hotels would be affected with a combined market share of the Parties reaching [20-30]% on the narrowest product market and geographic scope. The table below sets out the Parties market shares (2018 data).

(105) Therefore, post-Transaction, the market share of the merged entity would remain below 25%, which, according to the Horizontal Merger Guidelines, is indicative of a non-problematic transaction. (138)

(106) In addition, in Marseille, a number of 4-star chain hotels compete actively in the market, including those operated by international chain operators such as Accor (with notably Novotel and Mercure hotels), NH Hotel and Best Western. Moreover, additional competition stems from independent 4-star hotels (for instance Grand Tonic Hôtel Marseille Vieux Port, La Résidence du Vieux Port). (139)

(107) Furthermore, on a geographical level, the Parties' 4-star hotels are not particularly close competitors, since a number of 4-star hotels operated notably by Accor and NH Hotel are not more distant from the Radisson hotel than the Jin Jiang's hotels. (140)

(108) Finally, the majority of respondents to the market investigation having expressed an opinion indicated that there will be sufficient competition after the Transaction to prevent Jin Jiang and Radisson combined from raising the prices or degrading the quality of the hotel accommodation services they provide in Marseille. (141)

(109) Overall, given the Parties' market shares, the presence of significant competitors and the fact that no material concern was expressed during the market investigation, the Commission considers that the Transaction is unlikely to lead to any significant competition concerns for the market for 4-star hotel accommodation services in Marseille city.

Conclusion

(110) In light of the results of the market investigation and considering all evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for hotel accommodation services in Marseille, under any plausible segmentation.

5.4.4.3. Northampton

The Parties' activities

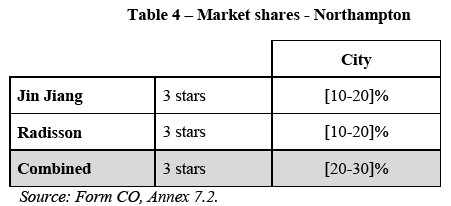

(111) There are 2 548 hotel rooms in Northampton, out of which 1 195 are in 3-star hotels. (142)

(112) In Northampton, Radisson operates one 3-star hotel (Park Inn by Radisson Northampton), with 146 rooms. Jin Jiang operates one 3-star hotel under one of its brands (Campanile Northampton), with 87 rooms. However, the 3-star market in Northampton is not affected taking account of these two hotels only. (143) The Transaction gives rise to an affected market in Northampton only if the activities of the 3-star hotel (Holiday Inn Northampton, 105 rooms) managed by Kew Green Hotels, controlled by another Chinese State-owned company, are attributed to Jin Jiang. (144)

The Commission's assessment

(113) The market for 3-star hotels would be affected with a combined market share of the Parties reaching [20-30]%. The table below sets out the Parties market shares (2018 data).

(114) Therefore, post-Transaction, the market share of the merged entity would remain moderate.

(115) In addition, in Northampton, a number of 3-star chain hotels compete actively in the market, including those operated by international chain operators such as IHG (which operates another Holiday Inn than the one managed by Kew Green Hotels) and Premier Inn. Moreover, additional competition stems from independent 3-star hotels (for instance The Westone Manor Hotel). (145)

(116) Furthermore, on a geographical level, the Parties' 3-star hotels would not be particularly close competitors, since they are not located in the same area (Park Inn by Radisson Northampton is in the very city centre, Campanile Northampton is in the Southern part of the city and Holiday Inn Northampton is in the Eastern part of the city). As an example, another 3-star Holiday Inn hotel, not managed by Kew Green Hotels (Holiday Inn Express Northampton – South), is located in the immediate vicinity of Campanile Northampton operated by Jin Jiang. (146)

(117) Finally, the majority of respondents to the market investigation having expressed an opinion indicated that there will be sufficient competition after the Transaction to prevent Jin Jiang and Radisson combined from raising the prices or degrading the quality of the hotel accommodation services they provide in Northampton. (147)

(118) Overall, given the Parties' market shares, the presence of significant competitors and the fact that no material concern was expressed during the market investigation, the Commission considers that the Transaction is unlikely to lead to any significant competition concerns for the market for 3-star hotel accommodation services in Northampton.

Conclusion

(119) In light of the results of the market investigation and considering all evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for hotel accommodation services in Northampton, under any plausible segmentation.

5.4.4.4. Stansted

The Parties' activities

(120) There are 2 176 hotel rooms in Stansted, out of which 1 350 are in 3-star hotels and 791 are in 4-star hotels. (148)

(121) In Stansted, Radisson operates one 4-star hotel (Radisson Blu Hotel London Stansted Airport), with 494 rooms. The Transaction gives rise to an overlap in Stansted and to affected markets only if the activities of the 3-star hotel (Holiday Inn Express London Stansted Airport, 254 rooms) managed by Kew Green Hotels, controlled by another Chinese State-owned company, are attributed to Jin Jiang. (149)

The Commission's assessment

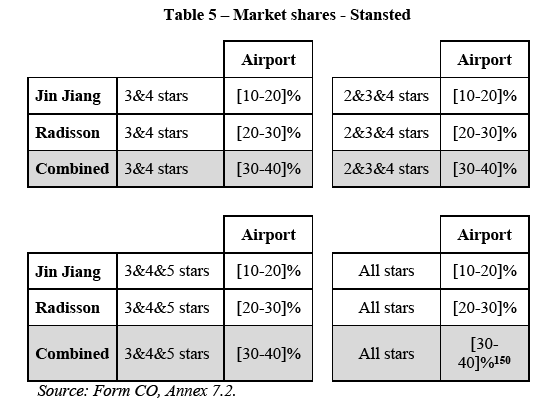

(122) The markets for 3&4-star, 2&3&4-star, 3&4&5-star, and all-star hotels would be affected with a combined market share of the Parties reaching [30-40]% on the narrowest product market (3&4-star hotels). The table below sets out the Parties market shares (2018 data).

(123) Therefore, post-Transaction, the market share of the merged entity would remain moderate.

(124) In addition, in Stansted, a number of 3-star and 4-star chain hotels compete actively in the market, including those operated by international chain operators such as Accor (with a Novotel hotel), Hilton and Premier Inn. Moreover, additional competition stems from independent 3-star and 4-star hotels (for instance Desalis Hotel London Stansted). (151)

(125) Moreover, Stansted airport has quick, frequent and multiple transportation links to London. Therefore, the Parties' market position considering Stansted does not necessarily provide a fair picture of the competition exerted by hotels located in cities connected by public transport to Stansted airport, in particular London.

(126) Furthermore, one of the hotels operated by a third party chain (Hampton by Hilton London Stansted airport) competes more closely with Jin Jiang's hotel (Holiday Inn Express London Stansted Airport) than Radisson's hotel (Radisson Blu Hotel London Stansted Airport), to the extent than both are 3-star hotels and the competing hotel is located closer to Jin Jiang's hotel than Radisson's hotel. Besides, the distance between Jin Jiang's 3-star hotel and Radisson's 4-star hotel is comparable to the distance between Jin Jiang's 3-star hotel and a 4-star hotel operated by a chain competitor (Novotel London Stansted Airport). (152)

(127) Finally, the majority of respondents to the market investigation having expressed an opinion indicated that there will be sufficient competition after the Transaction to prevent Jin Jiang and Radisson combined from raising the prices or degrading the quality of the hotel accommodation services they provide in Stansted. (153)

(128) Overall, given the Parties' market shares, the presence of significant competitors and the fact that no material concern was expressed during the market investigation, the Commission considers that the Transaction is unlikely to lead to any significant competition concerns for the market for 3&4-star hotel accommodation services in Stansted.

Conclusion

(129) In light of the results of the market investigation and considering all evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for hotel accommodation services in Stansted, under any plausible segmentation.

6. CONCLUSION

(130) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This Decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the "Merger Regulation"). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the "EEA Agreement").

3 Publication in the Official Journal of the European Union No C 359, 5.10.2018, p. 7.

4 The independent hotels operated under the Hôtels & Préférence brand are not owned by Jin Jiang, but operate under a distribution alliance via an affiliation model (that is to say no branding, no management, just a non-exclusive distribution relationship) (Form CO, footnotes 2, 19 and 40).

5 As of 30 June 2018, Jin Jiang owns an approximately 12.29% shareholding in the issued share capital of Accor Hotels. Other shareholders with more than 10% in Accor Hotels include Board members founders with 21.64%, QiA with 10.14% and a further 61.14% of shares which are floating. According to Jin Jiang, it does not hold a seat on Accor's Board of Directors and does not enjoy any special voting rights of any kind that would allow it to influence the strategic decisions of Accor Hotels (Form CO, paragraph 99). Therefore, Jin Jiang will not be considered as controlling Accor Hotels for the purposes of this Decision.

6 Form CO, paragraph 137.

7 Form CO, paragraph 70.

8 Form CO, paragraph 48.

9 See for instance Cases M.7850 – EDF/CGN/NNB Group of companies; M.7643 – CNRC/Pirelli; M.6113 – DSM/Sinochem/JV; M.6082 – China National Bluestar/Elkem.

10 These are in particular: BTG Homeinns Hotels (Group) Co., Jinling Hotels & Resorts Corp., HK CTS Hotels Co., Anhui Gujing Hotels Development Co., Huatian Hotel Group Co., Deefly Hotels & Resort Group, Yuehai (international) Hotel Group Co., Shenzhen Grand Skylight Hotel Management Co. Of these hotel groups, only HK CTS Hotels Co. ("HK CTS") has significant activities in the EEA. In 2015, HK CTS acquired "Kew Green Hotels", a hotel management company based in the United Kingdom. The Kew Green Hotels group provides hotel management services to 55 hotels, all situated in the United Kingdom.

11 Radisson AB operates the bulk of Radisson's European hotel portfolio. Radisson Holdings operates Radisson's portfolio in the Americas and Asia Pacific.

12 Form CO, paragraph 17.

13 Form CO, paragraph 144.

14 The consortium comprises Jin Jiang and SINO-CEE Fund, a private equity investment fund registered in Luxembourg. According to Jin Jiang, SINO-CEE Fund is only participating in the Transaction as a non-controlling minority shareholder of the Jin Jiang acquisition vehicle. It will not enjoy any form of right or power that would confer on it joint control under the EU Merger Regulation (Form CO, paragraphs 23-26). Therefore, SINO-CEE Fund will not be further considered for the purposes of this Decision.

15 Form CO, paragraphs 27-30 and paragraphs 84-88.

16 The closing of the third transaction is not a condition precedent for either of the first or the second transactions to avoid a situation of legal impossibility in which neither of the first two transactions could in fact close.

17 Form CO, paragraphs 30-37.

18 OJ C 95, 16.4.2008, p. 1.

19 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice. As indicated above, it is not excluded that Jin Jiang and other Chinese State-owned enterprises form part of the same economic unit and that their turnover should thus be combined. Nevertheless, there is no need to conclude on the question of the aggregate turnover of these undertakings for the purposes of establishing jurisdiction, since the EU turnover thresholds are reached even considering Jin Jiang alone and Radisson. Furthermore, Radisson does not achieve more than two-thirds of its aggregate EU-wide turnover within one Member State. Therefore, the Transaction has in any case an EU dimension.

20 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 12.

21 Form CO, paragraphs 138 and 141.

22 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, section 4.2.1, paragraphs 17-75 for the product market definition and section 4.3.1, paragraphs 110-120 for the geographic market definition.

23 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, section 4.2.2, paragraphs 76-101 for the product market definition and section 4.3.2, paragraphs 121-151 for the geographic market definition.

24 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, section 4.2.3, paragraphs 102-109 for the product market definition and section 4.3.3, paragraphs 152-180 for the geographic market definition.

25 Form CO, paragraphs 138 and 141.

26 Form CO, paragraph 138.

27 Form CO, paragraphs 141-145.

28 BTG Homeinns Hotels (Group) Co., Jinling Hotels & Resorts Corp., HK CTS Hotels Co., Anhui Gujing Hotels Development Co., Huatian Hotel Group Co., Deefly Hotels & Resort Group, Yuehai (international) Hotel Group Co., Shenzhen Grand Skylight Hotel Management Co.

29 STR Global ("STR") is a leading global provider of hotel market data and benchmarking.

30 Form CO, Annex 3.1(II), paragraphs 6-8.

31 Form CO, Annex 3.1(II), paragraphs 9-12.

32 Cases M. 6738 – Goldman Sachs/KKR/QMH, paragraph 14; M.6058 – Bank of Scotland/Barclays Bank/Kew Green Hotels, paragraph 13; M.1596 – Accor/Blackstone/Colony/Vivendi, paragraph 16; M.126 – Accor/Wagons-Lits, point V.

33 Cases M.6738 – Goldman Sachs/KKR/QMH, paragraph 14; M.6058 – Bank of Scotland/Barclays Bank/Kew Green Hotels, paragraphs 13 and 16; M.126 – Accor/Wagons-Lits, point V., paragraph 21.

34 Cases M.6738 – Goldman Sachs/KKR/QMH, paragraph 14; M.6058 – Bank of Scotland/Barclays Bank/Kew Green Hotels, paragraphs 13 and 16; Case M.1596 – Accor/Blackstone/Colony/Vivendi, paragraphs 23-26 and 28.

35 Cases M.4612 – Accor/Pierre et Vacances/NewCity JV, paragraphs 15-17; M.3068 – Ascott Group/Goldman Sachs/Oriville, paragraphs 13-17.

36 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 21-75.

37 Cases M.6058 – Bank of Scotland/Barclays Bank/Kew Green Hotels, paragraph 13; M.1596 – Accor/Blackstone/Colony/Vivendi, paragraphs 16-22.

38 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 47.

39 Form CO, Annexes 5.3.2.V(a) and 5.3.2.V(b).

40 Form CO, paragraphs 152-163.

41 Replies to Q1 – Questionnaire to competitors, question 3.

42 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 29.

43 Replies to Q1 – Questionnaire to competitors, question 3.

44 Replies to Q1 – Questionnaire to competitors, question 7.

45 Replies to Q1 – Questionnaire to competitors, question 6.

46 Replies to Q1 – Questionnaire to competitors, question 6.1.

47 Replies to Q1 – Questionnaire to competitors, question 8.

48 Replies to Q1 – Questionnaire to competitors, question 8.1.

49 Replies to Q1 – Questionnaire to competitors, question 10.

50 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 49-63; Case M. 6738 – Goldman Sachs/KKR/QMH, paragraph 14.

51 According to STR, there are six classes, namely luxury, upper upscale, upscale, upper midscale, midscale, and economy.

52 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 63.

53 Form CO, paragraph 170.

54 Form CO, paragraph 171.

55 Form CO, paragraph 172.

56 Replies to Q1 – Questionnaire to competitors, questions 3.1 and 5.

57 Replies to Q1 – Questionnaire to competitors, question 5.1.

58 Replies to Q1 – Questionnaire to competitors, questions 3.1, 5 and 5.1.

59 Replies to Q1 – Questionnaire to competitors, question 3.

60 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 62.

61 Replies to Q1 – Questionnaire to competitors, question 3.

62 In addition to the national differences in the star rating system, the approach to comfort level (for instance STR classification) deviates from the approach to star rating to the extent that a comfort level is attributed per brand (not per hotel), while star rating is attributed per hotel (not per brand) (see replies to Q1 – Questionnaire to competitors, question 5.1).

63 Replies to Q1 – Questionnaire to competitors, question 3.1.

64 Replies to Q1 – Questionnaire to competitors, question 4.

65 Cases M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 65, 67-68; M.4612 – Accor/Pierre et Vacances/NewCity JV, paragraphs 16-17; M.3068 – Ascott Group/Goldman Sachs/Oriville, paragraphs 14-16.

66 Cases M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 69; M.4612 – Accor/Pierre et Vacances/NewCity JV, paragraph 18; M.3068 – Ascott Group/Goldman Sachs/Oriville, paragraph 17.

67 Form CO, paragraph 182.

68 Form CO, paragraph 183, footnote 66.

69 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 72.

70 Form CO, paragraph 185.

71 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 110.

72 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 118 and 120.

73 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 119.

74 Form CO, paragraph 180.

75 Commission Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings (the "Horizontal Merger Guidelines"), OJ C 31, 5.2.2004, p. 5, paragraph 8.

76 Recital 25 of the Merger Regulation.

77 Horizontal Merger Guidelines, paragraph 8.

78 Replies to Q1 – Questionnaire to competitors, questions 14 and 15.

79 Jin Jiang operates the services "JinJiang Trip", Jin Jiang's own reservation platform, and "JinJiang Travel", a travel agency service. Since 2017, these services have allowed Chinese customers to book hotels in Europe, although to a marginal extent. In 2017, JinJiang Trip sold a total of […] nights in European hotels, with only […] nights sold in European hotels from January to June 2018. Since 2017, JinJiang Travel has […] (Form CO, paragraph 45).

80 For tour operating and travel agency services, see for instance Cases M.8046 – TUI/Transat France, paragraphs 65 and 106; M.6704 – REWE Touristik GmbH/ Ferid NASR/EXIM Holding SA, paragraph

28. For hotel accommodation services, see section XX above.

81 Form CO, paragraphs 46 and 69 and reply of Jin Jiang to RFI 2 of 17 October 2018.

82 See for instance Cases M.8718 – Starwood Capital Group/Accor/Sofitel Budapest Chain Bridge Hotel; M.5164 – MSREF/IHG/Crowne Plaza Wiesbaden.

83 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 192.

84 Form CO, paragraphs 225-229.

85 Jin Jiang indicates that, while each management agreement is negotiated and specific to each hotel, the final agreement remains closely aligned with the standard agreement, which may vary and be adjusted to a limited extent for brand differences (Form CO, paragraph 225).

86 Form CO, paragraphs 225-227 and Annexes 7.5.1(a), 7.5.1(b), 7.5.2(a) and 7.5.2(b).

87 Considering that the Chinese State-owned company HK CTS manages hotels in the EEA through the white-label management company Kew Green Hotels, the Commission consider that hotels managed by Kew Green Hotels should be considered as jointly controlled by Jin Jiang for the purposes of this Decision (see paragraph (5) above).

88 Commission Consolidated Jurisdictional Notice, paragraph 19.

89 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 199.

90 Form CO, paragraphs 230-239.

91 Jin Jiang indicates that, while each franchise agreement is negotiated and specific to each hotel, the final agreement remains closely aligned with the standard agreement (Form CO, paragraph 233).

92 Form CO, paragraphs 233-234 and 236 and Annexes 7.5.3(a), 7.5.3(b), 7.5.4(a) and 7.5.4(b).

93 Replies to Q1 – Questionnaire to competitors, question 11. For example: "As a franchise you own your own P&L and are doing business in the open market place amongst other hotels including other franchised and managed hotels associated with one chain" (reply to Q1 – Questionnaire to competitors, question 11.1).

94 Considering the relationship between Jin Jiang and the hotels operated under the Hôtels and Préférence brand, which simply consists in a non-exclusive distribution relationship (Form CO, footnotes 2, 19 and 40), the Commission also considers that Jin Jiang does not control the Hôtels and Préférence hotels and the latter's market shares are not attributed to Jin Jiang.

95 Form CO, footnote 31.

96 Form CO, paragraph 981.

97 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 200-203. With regard to serviced apartments, Marriott had included Marriott's and Starwood's serviced apartments and residential offerings in the parties' market shares for hotel accommodation services, while excluding the serviced apartments and residential offerings not operated by the parties from the estimation of the market size. In the present case, Jin Jiang does not offer serviced apartments in the EEA and Radisson is only marginally active (through one franchised hotel, the market share of which is not attributable to Radisson, and through one hotel in development, which is not in an overlap city). In this context, Jin Jiang has provided the two sets of data, including and excluding serviced apartments offered by third parties (Form CO, section 7 is based on the exclusion of serviced apartments from the competitor dataset, and Annex 7.1, City Tables Tool, provides market shares including and excluding serviced apartments).

98 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 204-205.

99 Form CO, paragraphs 1024-1025.

100 Form CO, Annex 5.4.2 – Project Camry_Business Plan Review, 30 July 2018, slide 28.

101 Including six cities in the United Kingdom for which the overlap only derives from the hotel management activities of Kew Green Hotels, controlled by another Chinese State-owned company, HK CTS Hotels Co. (Form CO, paragraphs 114-118 and Annex 7.2).

102 Form CO, paragraph 119 and Annex 7.2.

103 On a conservative basis, the Parties' market shares are presented below on the narrow market for hotel accommodation services excluding serviced apartments and short stay residences (only Radisson will offer serviced apartments in one non-overlap city).

104 Market shares on the basis of city-only hotels (excluding the airport area). The Parties' combined market share including airport hotels would be [20-30]%.

105 Market shares on the basis of city-only hotels (excluding the airport area). The Parties' combined market share for 4-star hotels including airport hotels would be [20-30]%. The market for 4&5-star hotels including airport hotels would not be affected.

106 Rounding effect.

107 All hotels in Northampton are considered as city hotels (no airport hotels).

108 All hotels in Stansted are considered as airport hotels (no city hotels).

109 Rounding effect.

110 Horizontal Merger Guidelines, paragraph 28.

111 Horizontal Merger Guidelines, paragraph 33.

112 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraphs 210-224.

113 Form CO, paragraph 213.

114 In the EEA, Jin Jiang is mainly present through the Groupe du Louvre brands (Form CO, paragraph 214).

115 Replies to Q1 – Questionnaire to competitors, question 3.

116 See Form CO, paragraphs 215-219 for the comparison of the marketing of the Parties' hotel brands.

117 Form CO, Annex 5.4.3 – Project Proposal by Shanghai Investment Consulting Corporation (SICC), 31 July 2018, p. 25.

118 Form CO, paragraphs 153, 160 and 1026.

119 Replies to Q1 – Questionnaire to competitors, question 3.

120 Replies of two competitors to Q1 – Questionnaire to competitors, question 12.

121 Replies of a competitor to Q1 – Questionnaire to competitors, questions 1 and 3.1.

122 Replies to Q1 – Questionnaire to competitors, question 12.

123 Case M.7902 – Marriott International/Starwood Hotels & Resorts Worldwide, paragraph 237.

124 Form CO, paragraph 1038.

125 Form CO, Annex 7.1.

126 Form CO, paragraphs 537, 552 and Annex 7.1.

127 Rounding effect.

128 Rounding effect.

129 After the opening of Radisson's 2-star hotel scheduled in 2021.

130 Form CO, paragraph 550.

131 Form CO, paragraph 560 and Annex 7.1.

132 Form CO, map in paragraph 555.

133 Replies to Q1 – Questionnaire to competitors, question 13.

134 Form CO, Annex 7.1.

135 Form CO, paragraph 389 and Annex 7.1.

136 Rounding effect.

137 Rounding effect.

138 Horizontal Merger Guidelines, paragraph 18.

139 Form CO, Annex 7.1.

140 Form CO, map in paragraph 391.

141 Replies to Q1 – Questionnaire to competitors, question 13.

142 Form CO, Annex 7.1.

143 The Parties' combined market share reaches [10-20]%.

144 Form CO, paragraphs 961, 966 and Annexes 7.1 and 7.2.

145 Form CO, paragraph 972 and Annex 7.1.

146 See map of hotels in Northampton on www.booking.com

147 Replies to Q1 – Questionnaire to competitors, question 13.

148 Form CO, Annexes 7.1 and 7.2.

149 Form CO, Annexes 7.1 and 7.2.

150 Rounding effect.

151 Form CO, Annex 7.1.

152 See map of hotels in the area Stansted airport on www.booking.com

153 Replies to Q1 – Questionnaire to competitors, question 13. In particular: "There is one Radisson Hotel in Stansted amongst other chains including Novotel, Hilton, Premier Inn, Holiday Inn plus independents – not convinced that the Stansted Airport market can sustain a massive increase in hotel supply so new development will need to be very considered" (reply of a competitor to Q1 – Questionnaire to competitors, question 13.1).