Commission, February 19, 2020, No M.9559

EUROPEAN COMMISSION

Judgment

TELEFONICA / PROSEGUR / PROSEGUR ALARMAS ESPAÑA

Subject: Case M.9559 – Telefónica/Prosegur/Prosegur Alarmas España

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 15 January 2020, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Telefónica EF S.A. ("TEF", Spain) and Prosegur Compañía de Seguridad, S.A. ("PCS", Spain) (together the “Notifying Parties”) will acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control over Prosegur Alarmas España, S.L.U. ("Prosegur Alarmas" or the "JV", Spain) (together with TEF and PCS, the “Parties”). Prosegur Alarmas currently belongs to the group of PCS.3

(2) The concentration had already been notified to the Commission on 27 November 2019, but was subsequently withdrawn on 20 December 2019.

1. THE PARTIES

(3) TEF is a global telecommunications operator and mobile network provider, operating under a number of brands, including Movistar, O2 and Vivo. TEF is a 100% publicly owned company listed on the Madrid, New York, Lima and Buenos Aires Stock Exchanges. In Spain, TEF mainly provides fixed and mobile telecommunication services, including machine-to-machine (“M2M”) SIM cards. It is also marginally active in the provision of security systems. Through its subsidiary Telefónica Ingeniería de Seguridad S.A.U. (“TIS”), TEF sells “Vivo Smart Security”, which is an alarm service mainly for small and medium-sized enterprises (“SMEs”).

(4) PCS is a provider of security systems to business customers, whose operations are divided in three business lines, namely alarms, security, and cash. The alarms business line offers (i) the installation and maintenance services to residential and SME customers; (ii) alarm monitoring by alarm reception centres services; and, (iii) alarm response services through immediate intervention and key holding services. The security business line provides comprehensive security systems, based on a combination of manned guarding and technological and analytical capabilities. The cash business line provides a range of services from basic valuables logistics and cash management to added-value outsourced services from financial institutions, retail establishments, government agencies, central banks, mints, jewellers and others.

(5) Prosegur Alarmas is a provider of alarm installation services and connection to alarm reception centres for both residential and SME customers in Spain.

2. THE CONCENTRATION

(6) Pursuant to a Stock Purchase Agreement signed on 17 September 2019, TEF and PCS will each own 50% of the stock in Prosegur Alarmas.

(7) After the concentration, under the Shareholders Agreement signed on 17 September 2019, […]. The board will be responsible for the operational and financial strategy of the JV. A board meeting will only be validly constituted […]. Furthermore, key decisions of the board, including the approval of the annual budget and of the business plan, will require the vote of at least one board member appointed by TEF and one board member appointed by PCS. As a result, both TEF and PCS will effectively have a veto right over such key decisions. Prosegur Alarmas will therefore be jointly controlled by TEF and PCS within the meaning of Article 3(1)(b) of the Merger Regulation.4

(8) The JV has sufficient own staff, financial resources and dedicated management for its operation and for the management of its portfolio and business interests. Furthermore, the JV will continue to have a market presence, does not have significant sale or purchase relationships with its parents and is intended to operate on a lasting basis. Therefore, the JV is full functional.

(9) Therefore, the Transaction consists of the acquisition of joint control by TEF and PCS over Prosegur Alarmas within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation.

3. UNION DIMENSION

(10) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (TEF: EUR 48 693 million, PCS: 3 939.2 million).5 Each of them has an EU-wide turnover in excess of EUR 250 million (TEF: EUR 26 816 million, PCS: 1 739.9 million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(11) The Transaction therefore has an Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

4.1. Introduction

(12) The Parties are both active in the market for security systems in Spain. PCS supplies the full spectrum of security systems to business customers. Prosegur Alarmas is active in the alarm installation and maintenance market as well as in the alarm monitoring and response market for both residential and SME customers whereas TEF, which is active through its subsidiary TIS, mainly supplies such services to SME customers.

(13) TEF’s main business focus is the retail supply of several telecommunications and TV services in Spain.

4.2. Market for security systems

4.2.1. Product market definition

4.2.1.1. Commission precedents

(14) In prior decisions, the Commission made a distinction, within the market for security systems, between (i) manned guarding services; (ii) alarm installation and maintenance (i.e. electronic guarding equipment); and (iii) alarm monitoring and response.6 Hereafter, segments (ii) and (iii) will be referred to as “alarm services”.

(15) Prosegur Alarmas and TEF, via its subsidiary TIS, are active in the supply of alarm services7, while they do not offer manned guarding services as PCS does. While Prosegur Alarms mainly supplies alarm services to residential and SME customers, TEF mainly supplies SME customers. Accordingly, the Transaction only concerns the markets for alarms services and not the wider market for security systems.

(16) Alarm installation and maintenance services consist in the installation and maintenance of alarm systems such as management of access control, fire, gas and/or flood alarm systems or systems based on video surveillance and telecare services.8

(17) Alarm monitoring and response services consist in receiving electronic data in an alarm receiving centre (“ARC”) connected to a site of a customers, and reacting to abnormal events detected by the alarm system of the site. The action to be taken by the provider of alarm monitoring services when an abnormal event is detected can either be (i) a phone call to the customer, to the police or another security company; or, (ii) an “outside response”, which involves sending staff on-site.9 In previous decisions, the Commission considered whether alarm monitoring and alarm response could belong to distinct market, but left the exact product market definition open.10

(18) The Commission has previously considered that alarm installation and maintenance and alarm monitoring and response could each be further divided into two sub- segments depending on the type of customers, i.e. residential and business customers, although it ultimately left the market definition open.11

4.2.1.2. The Notifying Parties’ view

(19) The Notifying Parties submit that there is a single overall market including all security systems or, at least, including all alarms services, but that the relevant product market can be left open.12 The Notifying Parties’ view is based on a precedent from the Spanish National Competition Authority (“CNMC”) where the CNMC retained a broader market definition covering all alarm services.13

(20) The Notifying Parties submit that so-called “Peace of Mind” solutions, which include electronic device-based security systems without connection to an ARC, should also be included into an overall market for security systems.14 Notably, the Notifying Parties identify a high degree of demand-side and supply-side substitutability. As regards the demand side, the Notifying Parties consider that Peace of Mind solutions cover the same need, i.e., detecting any abnormal event on the customer’s premise. The main difference is that Peace of Mind services are cheaper as customers “self-install” and “self-monitor” the solution with no technical support from professionals and as they have no connection to an ARC. However, they could always be upgraded to a professional alarm monitoring system at a later stage. As regards the supply side, the Notifying Parties submit that the underlying hardware and software for the supply of Peace of Mind solutions are very similar to those necessary for professional monitoring, albeit rendering a certification of the installation impossible as the alarm system would not be connected to an ARC.15

4.2.1.3. The Commission’s assessment

(21) The results of the market investigation conducted in the present case generally confirmed the market definition derived from the Commission’s past decisional practice. A majority of respondents agree that the market for security systems can be segmented between (i) manned guarding services; (ii) alarm installation and maintenance (i.e. electronic guarding equipment); and (iii) alarm monitoring and response services.16

(22) However, the Commission also takes note of the evidence from the CNMC’s precedent which followed the argument of the parties to that case that alarm installation and maintenance services are usually sold in conjunction with alarm monitoring and response services in Spain.17 Moreover, according to the Notifying Parties, all the main players in the alarm systems market in Spain offer installation and maintenance services together with alarm monitoring and response services and it is difficult from a customer perspective to identify in those offers the possibility of acquiring one service separate from the other.18

(23) A majority of respondents to the market investigation further confirmed that the market for alarm services could be segmented by type of customers, i.e. distinguishing between residential and business customers.19

(24) Peace of Mind solutions have different product characteristics and functionalities compared to traditional alarm services. In particular, they require self-installation and self-monitoring by the customer with no technical support from professionals. One respondent to the market investigation stressed that they exert competitive pressure on alarm services, without reaching a conclusion as to whether these services constitute a separate product market distinct from the market for alarm services.20 The Commission concludes that, for the purpose of this decision, Peace of Mind solutions do not form part of the market for security systems, even though they exert some competitive constraint on alarm services.

(25) With regard to the other above-mentioned segmentations, namely between (i) manned guarding services; (ii) alarm installation and maintenance (i.e. electronic guarding equipment); and (iii) alarm monitoring and response services and, for (ii) and (iii), a further potential sub-segmentation between residential and business customers, the Commission considers that, in any event, for the purposes of this decision, the exact product market definition with regard to the market for security systems can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible product market definition.

4.2.2. Geographic market definition

4.2.2.1. Commission precedents

(26) In its previous decisions, the Commission concluded that the market for security systems, under any plausible segmentation, is national in scope due to the existence of specific national regulations and standards, language differences and national preferences derived from the reputation of each of the players at the national level.21

4.2.2.2. The Notifying Parties’ view

(27) The Notifying Parties submit that, in accordance with the Commission’s practice, the geographic market is national in scope.22

4.2.2.3. The Commission’s assessment

(28) All respondents to the market investigation conducted in the present case supported the market definition derived from the Commission’s past decisional practice.23

(29) For the purpose of this decision, the Commission concludes that the market for security systems, including any plausible segmentation thereof, is national in scope.

4.3. Telecommunication markets

4.3.1. Retail supply of mobile telecommunication services

(30) Mobile telecommunication services to end customers include services for national and international voice calls, SMS (including MMS and other messages), mobile internet with data services, and retail international roaming services.24

(31) A segment of the market for retail mobile telecommunications services includes machine-to-machine (“M2M”) subscriptions. These allow machines, devices, appliances, etc., to connect wirelessly to the internet via mobile networks, or other technologies, permitting the transmission and receipt of data to a central server.25 M2M services are received through specific data-only M2M (SIM) cards, used for communication between machines (for instance, between different devices of an alarm system) and are mainly supplied to business customers.

(32) TEF is active as mobile network operator (“MNO”) in the supply of mobile telecommunication (and M2M services) in Spain whereas Prosegur Alarmas is not active in this market.

4.3.1.1. Product market definition

(A) Commission precedents

(33) The Commission has previously considered that there is an overall retail market for mobile telecommunication services constituting a separate market from retail fixed telecommunication services. In previous decisions, the Commission did not further segment the overall retail mobile market based on the type of service (e.g. voice calls, SMS, data services), or the type of network technology (e.g. 2G, 3G, 4G). The Commission considered possible segments of the overall retail market for mobile telecommunication services between pre-paid or post-paid services and private customers or business customers, concluding that these did not constitute separate product markets but rather represent market segments within an overall retail market.26

(34) In previous decisions, the Commission concluded that there is a separate market for M2M services.27

(B) The Notifying Parties’ view

(35) The Notifying Parties submit that there is a single overall market for the provision of retail mobile telecommunication services, including M2M services.28

(C) The Commission’s assessment

(36) The results of the market investigation conducted in the present case generally supported the market definition derived from the Commission’s past decisional practice.29 Notably, the respondents highlighted several demand-side and supply-side substitutability issues. In particular, one respondent stressed that not all retail telecommunication services providers offer M2M services, the reverse being also true. Furthermore, remote monitoring and control as well as predictive maintenance are key features for M2M services that are not necessary for traditional telecommunication services.30

(37) The Commission therefore concludes, for the purpose of this decision, that M2M services constitute a separate market. As for the remaining part of the market for the provision of retail mobile telecommunications services, the exact product market definition can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any possible market definition.

4.3.1.2. Geographic market definition

(A) Commission precedents

(38) The Commission has found that the overall market for retail mobile telecommunication services (except M2M services) is national in scope.31

(39) As for M2M services, the Commission assessed whether the geographic market was national or regional (e.g. including the Nordic countries in a specific case), but ultimately left the geographic market definition open.32

(B) The Notifying Parties’ view

(40) The Notifying Parties submit that the segment for M2M services is at least EEA- wide or global in scope as global M2M services are provided by all telecommunication companies, including international operators.33

(C) The Commission’s assessment

(41) With regard to the overall market for retail mobile telecommunication services (excluding M2M services), the market investigation in this case did not provide any new elements justifying a departure from Commission’s previous decisions.34

(42) As for the geographic scope of M2M services, the market investigation has yielded mixed results depending on the area of activity of the responding operator. The majority of operators active in Spain consider that a potential market for M2M services is national in scope35, whereas suppliers of M2M services mainly active outside of Spain have considered the geographic market to be wider in scope.36 However, the respondents that argued for a wider geographic scope referred to devices which cross borders (e.g., connected cars), for which a multi-national SIM card from a single connectivity provider would be required.37 This is not the case for alarm devices, which are installed at a fixed location.

(43) For the purpose of this decision, the Commission concludes that the market for retail mobile telecommunication services (excluding M2M services) is national in scope. As for the market for M2M services, the Commission considers that, for the purposes of this decision, the exact geographic market definition can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible geographic market definition.

4.3.2. Retail supply of fixed telephony services

(44) Fixed telephony services to end customers comprise the provision of subscriptions enabling access to public telephone networks at a fixed location for the purpose of making and/or receiving calls and related services.38

(45) TEF is the incumbent provider of fixed telephony services in Spain whereas Prosegur Alarmas is not active in this market.

4.3.2.1. Product market definition

(46) In previous decisions, the Commission considered whether a distinction between local/national and international calls as well as between residential and non- residential customers should be drawn, based on the distinctions in the Commission Recommendation 2003/311/EC,39 but ultimately left the exact product market definition open.40

(47) More recently, the Commission also considered that managed Voice over Internet Protocol (“VoIP”) services41 and traditional telephony are interchangeable and therefore belong to the same market. In recent decisions, the Commission considered that an overall retail market for fixed telephony services exists, which includes VoIP services.42

(48) The Notifying Parties agree with the Commission’s past decisional practice in relation to the market for the retail supply of fixed telephony services.43

(49) The Commission considers that, for the purposes of this decision, the exact product market definition with regard to the market for the retail supply of fixed telephony services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible product market definition.

4.3.2.2. Geographic market definition

(50) In previous decisions, the Commission concluded that the retail market for the provision of fixed telephony services was national in scope.44 This is due to the continuing importance of national regulation in the telecommunications sector, the supply of upstream wholesale services that work on a national basis, and the fact that the pricing policies of telecommunications providers are predominantly national.45 In Liberty Global/BASE Belgium and MEIF 6 Fiber/KCOM Group, the Commission assessed the possibility for the scope of the market for the retail provision of fixed telephony services to be narrower than national.46 More recently in Vodafone/Certain Liberty Global Assets, the Commission considered that the scope of the market for the retail provision of fixed telephony services was national.47

(51) The Notifying Parties agree with the Commission’s past decisional practice in relation to the market for the retail supply of fixed telephony services.48

(52) The Commission considers that, for the purposes of this decision, the exact geographic market definition with regard to the market for the retail supply of fixed telephony services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible geographic market definition.

4.3.3. Retail supply of fixed internet access services

(53) Fixed internet access services at the retail level consist of the provision of a fixed telecommunications link enabling customers to access the internet through a fixed telecommunications connection.

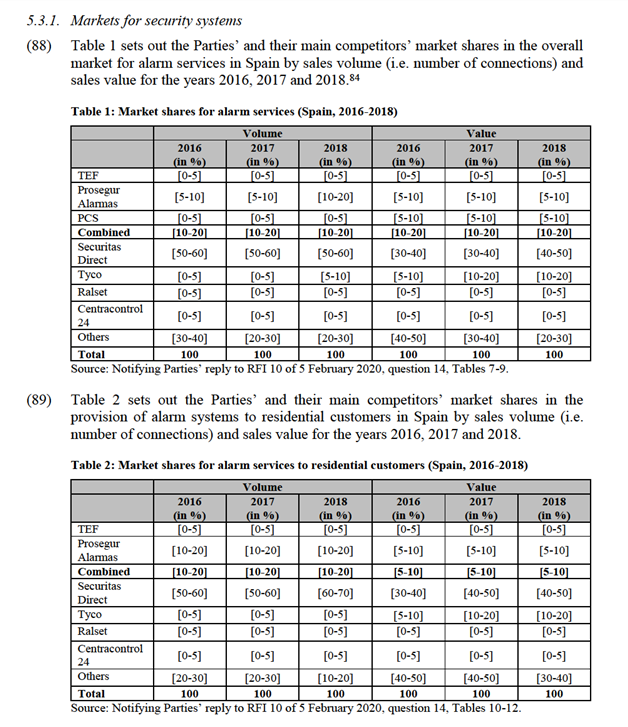

(54) TEF is the incumbent provider of fixed internet access services in Spain whereas Prosegur Alarmas is not active in this market.

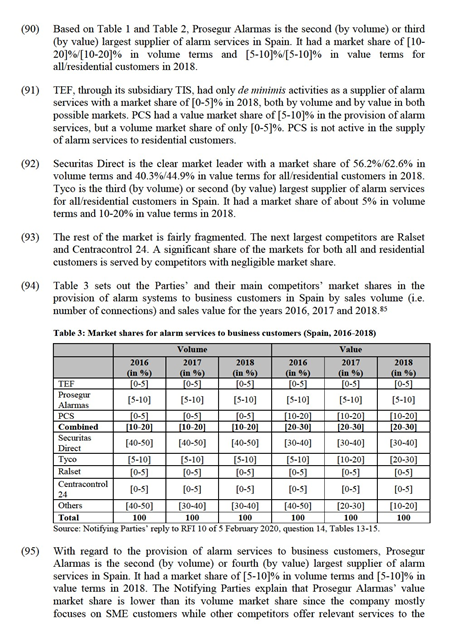

4.3.3.1. Product market definition

(55) In previous cases, the Commission considered, but ultimately left open, possible segmentations within the supply of retail fixed internet access services according to (i) product type, distinguishing between narrowband, broadband and dedicated access; (ii) distribution mode, distinguishing between xDSL, fibre, cable (fixed-only) and internet provided through the mobile network infrastructure (fixed-wireless); and (iii) customer type, distinguishing between residential and small business customers on the one hand, and larger business customers and public authorities on the other.49 At the same time, the Commission noted that the retail market for fixed internet access services should not be segmented according to download speed.50

(56) More recently, in Vodafone/Certain Liberty Global Assets, the Commission considered that the relevant product for the retail supply of fixed internet access services is the overall retail market for the provision of fixed internet access services, including all product types, distribution modes and speeds/bandwidths, to residential and small business customers, excluding the supply of fixed internet services provided through mobile network infrastructure.51

(57) The Notifying Parties submit that there is a single overall market for the retail provision of fixed internet access services, without further segmentations.52

(58) The Commission considers that, in any event, for the purposes of this decision, the exact product market definition with regard to the market for the retail supply of fixed internet access services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible product market definition.

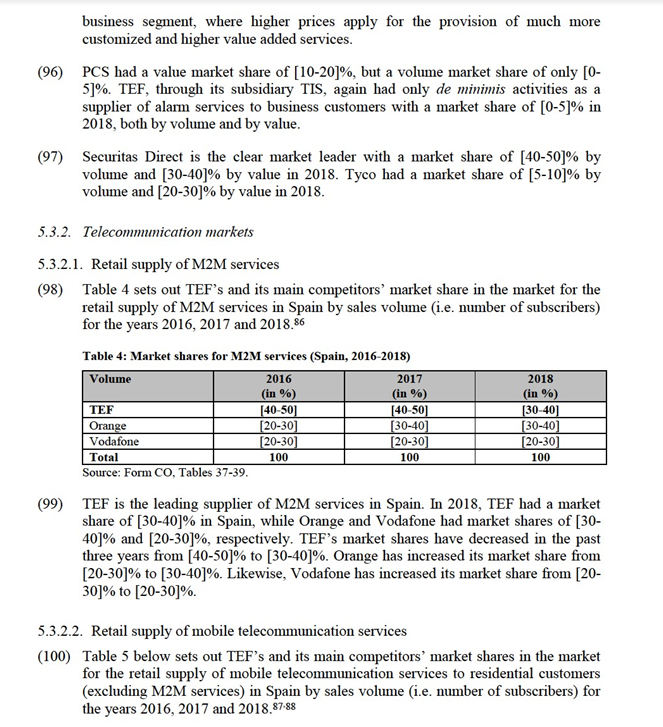

4.3.3.2. Geographic market definition

(59) In previous decisions, the Commission concluded that the retail market for the provision of fixed internet services was national in scope.53 In Liberty Global/BASE Belgium and MEIF 6 Fiber/KCOM Group, the Commission considered whether the geographic scope of the market should be defined on a national, regional basis or by reference to the footprint of the operators’ networks, but ultimately left the question open.54 More recently, in Vodafone/Certain Liberty Global Assets, the Commission considered the geographic scope of the retail market for the provision of fixed internet services was national in scope.55

(60) The Notifying Parties agree with the Commission’s assessment and submit that the relevant market for the retail provision of fixed internet services is national in scope.56

(61) The Commission considers that, in any event, for the purposes of this decision, the exact geographic market definition with regard to the market for the retail supply of fixed internet access services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible geographic market definition.

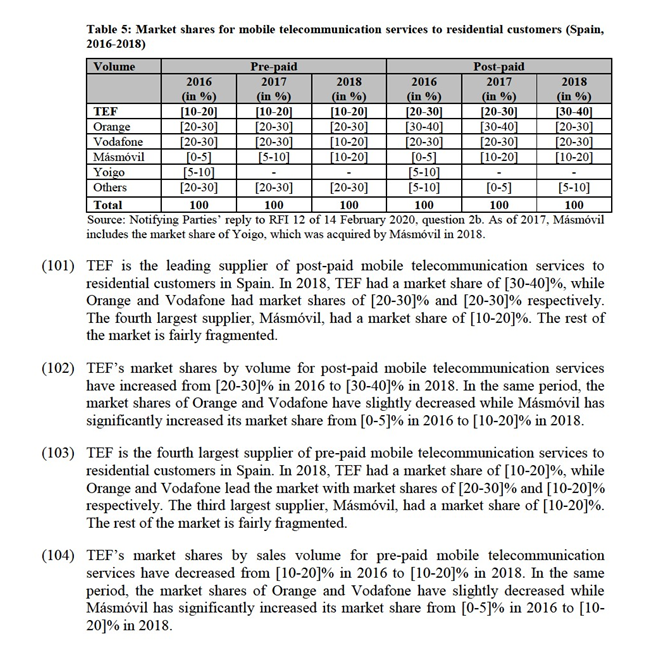

4.3.4. Retail supply of TV services

(62) TV distributors either limit themselves to carrying TV channels and making them available to end users, or also act as channel aggregators, which “package” TV channels into “bouquet” retail offers. The TV services supplied by TV distributors to end users consist of: (i) packages of linear TV channels (which they have either acquired or produced themselves); and (ii) content aggregated in non-linear services, such as video on demand (“VOD”), Subscription VOD (“SVOD”), Transactional VOD (“TVOD”) and Pay-Per-View (“PPV”). TV content can be delivered to end users through a number of technical platforms including terrestrial (“DTT”), cable, satellite and IPTV.57 Over-The-Top (“OTT”) players deliver channels and content in both a linear and non-linear fashion through the use of the internet.

(63) TEF is active in the retail supply of TV services in Spain whereas Prosegur Alarmas is not active in this market.

4.3.4.1. Product market definition

(64) In previous cases, the Commission distinguished two separate markets for the retail supply of television services: (i) Free-to-Air (“FTA”) TV and (ii) pay-TV.58 The Commission also considered whether pay-TV can be segmented further according to: (i) linear vs non-linear pay-TV services;59 (ii) distribution technologies (e.g. cable, satellite, or terrestrial);60 (ii) distribution technologies (e.g. cable, satellite, or terrestrial);61 and (iii) premium vs basic pay-TV services.62 In certain countries, due to the large penetration of pay-TV services and the fact that such services also carry the main FTA channels, the Commission has identified two separate product markets for: (i) basic pay-TV services (including FTA services) and (ii) premium pay-TV services. In previous cases, the Commission has left open the market definition with regard to each of these potential sub-segments.63

(65) The Notifying Parties submit that there is a single overall market for the retail provision of TV services.64

(66) The Commission considers that, in any event, for the purposes of this decision, the exact product market definition with regard to the market for the retail supply of TV services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible product market definition.

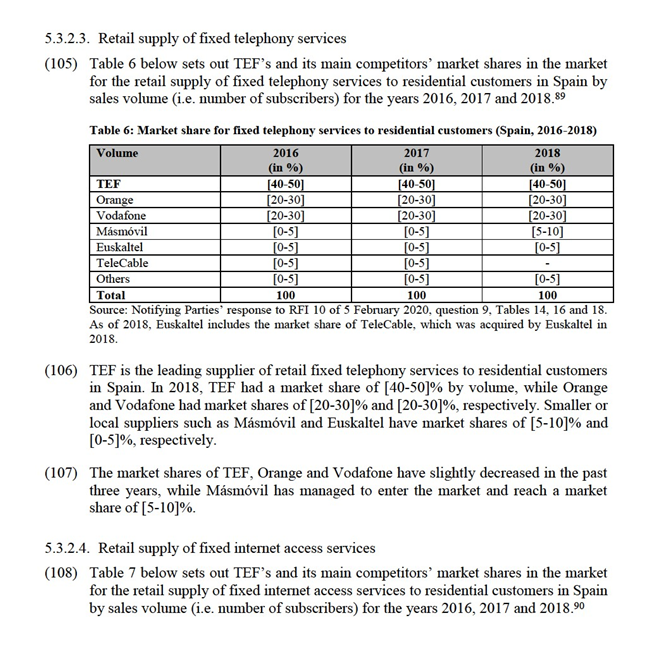

4.3.4.2. Geographic market definition

(67) The Commission has previously considered that the market for the retail provision of TV services is either national, or limited to the geographic coverage of a supplier’s cable network.65

(68) The Notifying Parties have not objected to the Commission’s past decisional practice in relation to the market for the retail supply of TV services.66

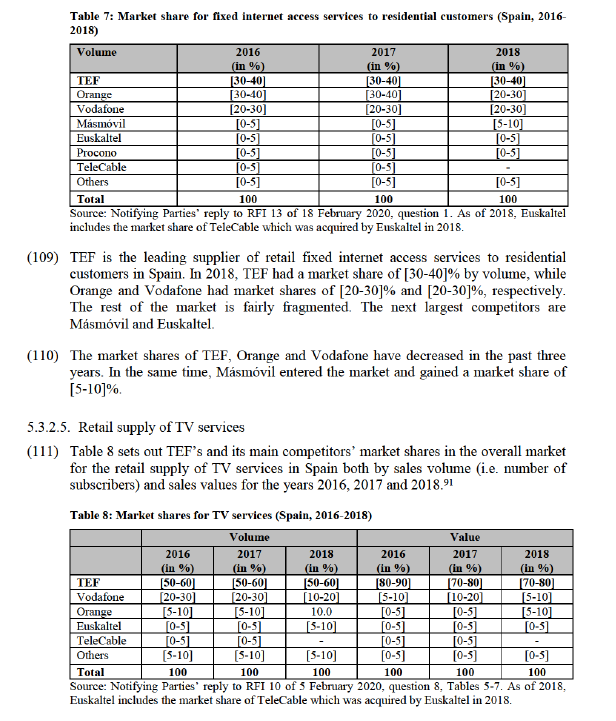

(69) The Commission considers that, in any event, for the purposes of this decision, the exact geographic market definition with regard to the market for the retail supply of TV services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible geographic market definition.

4.3.5. Retail supply of multiple play services

(70) The term “multiple play” relates to offers comprising two or more of the following services provided to retail consumers: fixed telephony, fixed internet access, TV and mobile telecommunications services. Multiple play comprising two, three or four of these services is referred to as dual play (“2P”), triple play (“3P”) and quadruple play (“4P”) respectively.

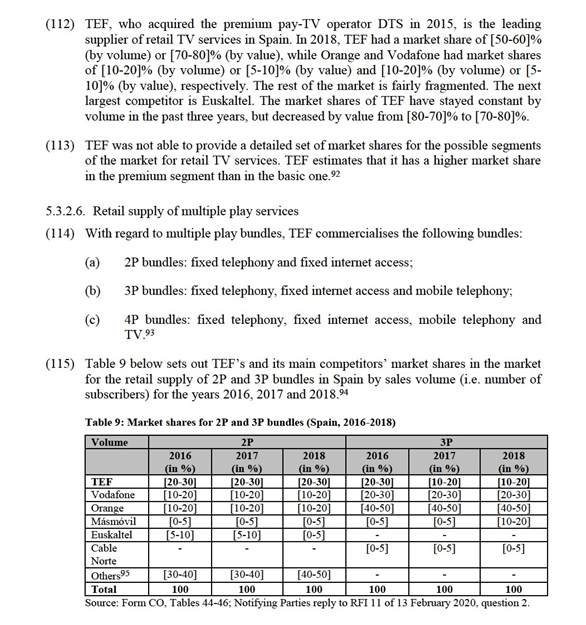

(71) TEF is a supplier of multiple play services in Spain whereas Prosegur Alarmas is not active in this market.

4.3.5.1. Product market definition

(A) Commission precedents

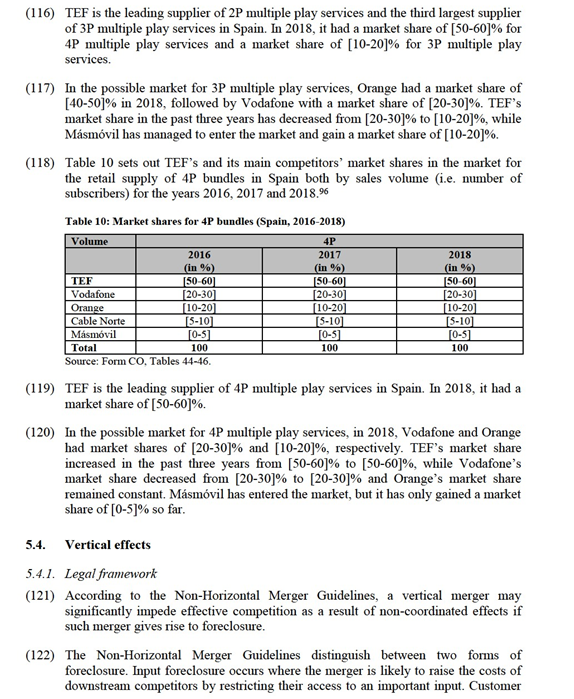

(72) In previous decisions, the Commission considered, but ultimately left open, the existence of distinct markets for the supply of multiple play offerings that comprise a bundle of two or more telecommunication (fixed internet access, fixed telephony, mobile) and TV services.67 In its previous analysis of this market,68 the Commission examined the factors associated with the rise in popularity of multiple play offers. In particular, customers choose multiple play bundles mainly because of the lower price, additional benefits and convenience of having one supplier/point of contact. From the supply-side, operators offer bundled services as a tool to increase customer loyalty and reduce customer churn.

(B) The Notifying Parties’ view

(73) The Notifying Parties consider that it is unlikely that there is a separate retail market for the provision of multiple play services due to potential demand-side substitutability between multi-play offerings and their separate component services.69

(C) The Commission’s assessment

(74) The results of the market investigation conducted in the present case generally supported the possibility of a potential separate market for the retail supply of multiple play services. In particular, most respondents considered that quadruple play (“4P”) offerings that comprise fixed internet access, fixed telephony, mobile and TV services have a high penetration in the Spanish residential market.70

(75) The Commission considers that, in any event, for the purposes of this decision, the exact product market definition with regard to the market for the retail supply of multiple play services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible product market definition.

4.3.5.2. Geographic market definition

(A) Commission precedents

(76) In previous decisions, the Commission considered that the geographic scope of any possible retail market for multiple play services would be national since the components of the multiple play offers are offered individually at national level and the bundling of the services would not change the geographic scope of the components. It nevertheless left the exact geographic delineation of the possible multiple play market open.71 However, in recent decisions, the Commission noted that bundles display their competitive effects on a national basis.72

(B) The Notifying Parties’ view

(77) The Notifying Parties agree that a possible market for the retail provision of multiple play services is national in scope.73

(C) The Commission’s assessment

(78) The market investigation in this case did not provide any new elements justifying a departure from the Commission's previous decisions.74

(79) The Commission considers that, for the purposes of this decision, the exact geographic market definition with regard to the market for the retail supply of multiple play services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any plausible geographic market definition.

5. COMPETITIVE ASSESSMENT

5.1. Analytical framework

(80) Under Article 2(2) and Article 2(3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(81) In this respect, a merger may entail horizontal and/or non-horizontal effects. Horizontal effects are those deriving from a concentration where the undertakings concerned are actual or potential competitors of each other in one or more of the relevant markets concerned. Non-horizontal effects are those deriving from a concentration where the undertakings concerned are active in different relevant markets.

(82) As regards non-horizontal mergers, two broad types of such mergers can be distinguished: vertical mergers and conglomerate mergers.75 Vertical mergers involve companies operating at different levels of the supply chain.76 Conglomerate mergers are mergers between firms that are in a relationship which is neither horizontal (as competitors in the same relevant market) nor vertical (as suppliers or customers).77

(83) The Commission appraises horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Horizontal Merger Guidelines.78 Additionally, the Commission appraises non-horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Non-Horizontal Merger Guidelines.

5.2. Affected markets

(84) The Transaction results in a limited horizontal overlap between the Parties’ activities in the provision of security systems, more precisely in the provision of (i) alarm installation and maintenance services and (ii) alarm monitoring and response services to all, residential and business, customers in Spain. However, a horizontally affected market could only arise in the potential segment for alarm services for business customers. In this segment, the Parties had a combined market share of [20- 30]% by value in Spain in 2018 (PCS [10-20]%, Prosegur Alarmas [5-10]% and TEF [0-5]%79). However, in light of TEF’s de minimis presence in this segment, the increment of the Herfindahl-Hirschman Index (“HHI”) of below 150 (i.e., 0.1) and the fact that sufficient credible competitors would remain (in particular Securitas Direct and Tyco with market shares of 34.9% and 23.1%, respectively), the Commission considers that the concentration does not raise serious doubts as to its compatibility with the common market in the potential segment for alarm services for business customers. As for the market for alarm services and the plausible segmentation for residential customers, in light of TEF’s de minimis presence in the supply of alarm services, amounting to a market share of [0-5]%, and the Parties’ combined market share of below 20%, there is no horizontally affected market. Therefore, the horizontal overlaps between the Parties will not be considered further.

(85) Moreover, TEF supplies M2M services, which are used as input for the provision of alarm services. Therefore, the Transaction gives rise to vertically affected markets in relation to TEF’s activities in the upstream market for the supply of M2M services and Prosegur Alarmas’ activities in the downstream market for the supply of alarm services (i.e., (i) alarm installation and maintenance services and (ii) alarm monitoring and response services to all, residential and business customers) in Spain.80

(86) The Transaction further results in a potential conglomerate relationship in relation to the potential bundling of TEF’s and Prosegur Alarmas’ services in the markets for telecommunication and TV services (i.e., (i) mobile telecommunication services, (ii) fixed telephony services, (iii) fixed internet access services, (iv) TV services and (v) multiple play services) and alarm services (i.e., (i) alarm installation and maintenance services and (ii) alarm monitoring and response services), which can be considered to be closely related markets for residential and SME customers81, in Spain.

5.3. Market shares

(87) According to the Non-Horizontal Merger Guidelines, market shares provide useful first indications of the market structure and of the competitive importance of both the merging parties and their competitors.82,83 foreclosure occurs where the merger is likely to foreclose upstream competitors by restricting their access to a sufficient customer base.

(123) In assessing the likelihood of an anticompetitive foreclosure scenario, the Commission examines, first, whether the merged entity would have, post-merger, the ability to substantially foreclose access to inputs or customers, second, whether it would have the incentive to do so, and third, whether a foreclosure strategy would have a significant detrimental effect on competition.97

(124) As regards ability to foreclose, under the Non-Horizontal Merger Guidelines, input foreclosure may lead to competition problems if the upstream input is important for the downstream product.98 For input foreclosure to be a concern, a vertically integrated merged entity must have a significant degree of market power in the upstream market. It is only in those circumstances that the merged entity can be expected to have significant influence on the conditions of competition in the upstream market and thus, possibly, on prices and supply conditions in the downstream market.99

(125) With respect to incentives to foreclose, paragraph 40 of the Non-Horizontal Merger Guidelines states that the incentive of the merged entity to foreclose depends on the degree to which foreclosure would be profitable. The vertically integrated firm will take into account how its supply of inputs to competitors downstream will affect not only the profits of its upstream division, but also of its downstream division. Essentially, the merged entity faces a trade-off between the profit lost in the upstream market due to a reduction of input sales to (actual or potential) rivals and the profit gain, in the short or longer term, from expanding sales downstream or, as the case may be, being able to raise prices for consumers.100 Additionally, paragraph 42 of the Non-Horizontal Merger Guidelines indicates that “[t]he incentive for the integrated firm to raise rivals' costs further depends on the extent to which downstream demand is likely to be diverted away from foreclosed rivals and the share of that diverted demand that the downstream division of the integrated firm can capture”.

(126) As regards the effects of input foreclosure, the Non-Horizontal Merger Guidelines explain that such conduct raises competition concerns when it leads to increased prices on the downstream market. First, anticompetitive foreclosure may occur when a vertical merger allows the merging parties to increase the costs of downstream rivals in the market thereby leading to upward pressure on their sales prices. Second, effective competition may be significantly impeded by raising barriers to entry to potential competitors.101 The Non-Horizontal Merger Guidelines further state that if there remain sufficient credible downstream competitors whose costs are not likely to be raised, for example because they are themselves vertically integrated or they are capable of switching to adequate alternative inputs, competition from those firms may constitute a sufficient constraint on the merged entity and therefore prevent output prices from rising above pre-merger levels.102

(127) For customer foreclosure to be a concern, a vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground.103

5.4.2. Assessment of potential input foreclosure

(128) This section assesses the risk of input foreclosure with regard to M2M services as M2M services are used as input in the provision of alarm services, i.e., concerning the possible markets for (i) alarm installation and maintenance and (ii) alarm monitoring and response services for all, residential and business customers in Spain.104 The possible segmentations by type of alarm service and type of customer do not have any impact on the competitive assessment and therefore the assessment focusses on the downstream market for the provision of alarm services to all customers.

5.4.2.1. The Notifying Parties’ views

(129) The Notifying Parties submit that TEF will not have the ability or the incentive to restrict access to M2M services or to raise prices to downstream competitors of Prosegur Alarmas post-Transaction.105

As regards ability

(130) First, the Notifying Parties submit that M2M services do not constitute an important input for the provision of alarm services. They note that M2M services are a pure commodity in the context of the provision of alarm services. Accordingly, there is no specific technology or differentiation among different telecommunication providers. M2M services would only represent about [0-5]% of the total cost of Prosegur Alarmas’ products and services. Moreover, the Notifying Parties argue that M2M services are mainly used as backup line, while the end customer’s fixed internet access connection would usually be used as primary source of connectivity. Nevertheless, the Notifying Parties acknowledge that it is advisable for alarm services providers to have more than one M2M services provider in order to ensure universal geographic coverage.106

(131) Second, the Notifying Parties submit that TEF would not have a significant degree of market power in the upstream market. On the one hand, the Notifying Parties point out that TEF’s market share in the provision of M2M services in Spain has decreased from [40-50]% in 2016 to [30-40]% in 2018 while TEF’s main competitors, Orange and Vodafone, were able to increase their market shares. On the other hand, they explain that TEF would continue to face substantial competition from international operators (e.g. AT&T, SFR, TIM, Telenor, T-Mobile), that provide M2M services in Spain based on roaming agreements and which would be credible alternative suppliers for alarm services providers.107

As regards incentives

(132) The Notifying Parties emphasise that TEF would never jeopardise its position in the telecommunication market, which is its core business, in favour of Prosegur Alarmas’ presence in alarm services. In 2018, TEF has more than […] subscribers to its Movistar Fusión multiple play product alone whereas Prosegur Alarmas has only […] subscribers to its alarm services.108

(133) Moreover, Prosegur Alarmas would have a moderate market share of about [10- 20]% in the downstream market for the provision of alarm services, which would limit the base of sales on which the JV could potentially enjoy increased margins following a foreclosure strategy.109

As regards effects

(134) The Notifying Parties argue that even if TEF tried to foreclose competing suppliers of alarm services, TEF would not be able to generate a competitive disadvantage to competitors given the low share that M2M services represent of the total costs for alarm services providers and the existence of credible alternative suppliers of M2M services.110

5.4.2.2. The Commission’s assessment

(135) For the reasons set out below, the Commission considers that TEF will not have the ability and incentive to foreclose non-integrated competitors by engaging in input foreclosure, e.g. by stopping the supply of M2M services to the JV’s rivals or to provide M2M services at less favourable terms and conditions than pre-Transaction. Furthermore, even if TEF tried to engage in input foreclosure, such a strategy would not have a significantly detrimental effect on competition.

As regards ability

(136) The Commission considers that TEF is unlikely to have the ability to engage in an input foreclosure strategy.

(137) As explained by the Notifying Parties, alarm services can and are often provided based on the fixed telecommunication service contracted by the end customer. In this case, there is no wholesale relationship between the telecommunication operators and alarm services providers, as the alarm systems use the fixed internet access already installed at the client’s property.111

(138) However, all alarm services providers responding to the market investigation confirmed that they also use M2M services in their alarm systems.112 While many alarm services providers use M2M services as primary source of connectivity, others employ M2M services only as a back-up line. There are mixed views as to whether a M2M connection is essential for the provision of alarm services, but the majority of respondents are of the view that a M2M connection, either as primary or back-up solution, is very important for the provision of alarm services. One respondent explains that M2M services deliver an essential component of its services, allowing for access control, alarm triggering, SOS requests and general communication with the ARC.113 Therefore, the Commission considers that it cannot be excluded that M2M services constitute an important input without which alarm services could not effectively be sold on the market.

(139) For input foreclosure to be a concern, the Parties must have a significant degree of market power and a significant influence on the conditions of competition in the upstream market. TEF is the market leader in the provision of M2M services with a share of [30-40]% in 2018, followed by Orange and Vodafone with market shares of [30-40] and [20-30]%, respectively.114 The three Spanish MNOs are the main providers of M2M services in an overall concentrated market. Each of the MNOs active on this market is likely to have some degree of market power but not a significant degree of market power in light of the existence of at least two alternative suppliers with strong positions.

(140) Moreover, the results of the market investigation provided further elements to support the view that TEF is unlikely have to a significant degree of market power in the upstream market, both in general and specifically with regard to providers of alarm services.

(141) First, respondents to the market investigation indicated that there are several credible alternative suppliers of M2M services for alarm services providers in Spain.115 Respondents mentioned Orange and Vodafone but also referred to Másmóvil and Euskaltel, for which the Notifying Parties have not provided market share estimates. Therefore, there are at least three main competitors and two smaller competitors active on the Spanish market for M2M services.

(142) Second, some alarm services providers indicated that international telecommunication operators and/or resellers offering M2M services in Spain based on roaming agreements can be considered as credible alternative suppliers.116 While the provision of M2M services by non-Spanish operators is not considered to be part of the relevant market (as explained in section 4.3.1.2), the results of the market investigation suggest that non-Spanish operators and/or resellers represent a certain competitive constraint for some alarm services providers. Nevertheless, other alarm services providers indicated that non-Spanish operators are not competitive in terms of price and service.117

(143) Third, respondents to the market investigation explained that alarm services providers do not have any special requirements in terms of price, quality or coverage. One Spanish MNO explained: “M2M services provided to security services providers are similar to M2M services offered to other customers, they do not have specific requirements in terms of price, quality or coverage. Services are based on mobile voice, data or SMS services to connect the alarm systems of end customers.”118

(144) Fourth, the results of the market investigation confirmed that there are generally no spots or wider geographic areas in Spain where TEF is the only viable operator with sufficient network coverage.119 This is also in line with the results of Umlaut’s 2019 study on data service network coverage for the main Spanish mobile telecommunication providers, in urban and non-urban areas.120 The results of this study show that the level of coverage is close to 100% for all providers. This is further corroborated by the fact that not all alarm services providers responding to the market investigation currently purchase M2M cards from TEF. Some rely exclusively on TEF’s competitors, such as Vodafone and Orange, which shows that TEF is dispensable.121

(145) In case mobile connectivity of one or several MNOs should be poor or unstable in a very specific location of the alarm device, respondents explain that alarm services providers can still ensure connectivity by relying either on roaming agreements between different MNOs or on a fixed internet access connection.122

(146) In the course of the market investigation, only one alarm services provider submitted a significantly different view and considered that TEF’s M2M services are an essential input which is not replicable by other suppliers in certain areas of Spain.123 This complainant itself acknowledges that “all these three telecoms operators [TEF, Vodafone, Orange] can grant coverage in more than 99% of Spain”124, however, it submits that the strength of the signal can vary between operators which could have an impact of the reliability of the alarm system. These concerns are inconsistent with the majority view expressed by other alarm services providers which explain that there are numerous alternative suppliers of M2M services with a sufficient level of service.

(147) Finally, as explained by the Notifying Parties, M2M services represent about […] of the total cost of Prosegur Alarmas’ products and services.125 Hence, any partial foreclosure strategy consisting in increasing the price of TEF’s M2M services would not result in a significant increase in rival alarm services providers’ costs. The market investigation did not provide any elements contesting the Notifying Parties’ argument that M2M services do not constitute an important cost factor for alarm services providers.126

(148) In light of the explanations given in paragraphs (136) to (147), and in particular given the existence of alternative credible suppliers of M2M services, which are able to satisfy the requirements of alarm services providers in terms of price, quality and coverage, the Commission considers that TEF would not have the ability to foreclose its downstream rivals with regard to M2M services.

As regards incentives

(149) The Commission considers that TEF is unlikely to have an incentive to engage in an input foreclosure strategy.

(150) First, the Commission notes that TEF’s main business focus are telecommunications rather than alarm services. Therefore, unless clearly profitable, it is unlikely that TEF would risk reputational damage by foreclosing its telecommunication customers from its M2M services.

(151) Second, the Notifying Parties’ submission evidences that a potential foreclosure strategy would not be profitable. If TEF stopped supplying Prosegur Alarmas’ main rivals, which are large corporate clients for TEF, this would lead to a certain and immediate loss of annual revenues which ranged between EUR […] and […] over the last four years.127 It is unlikely that this loss would be compensated by any potential gain of customers or revenues in the alarms business, which is an ancillary activity for TEF and where TEF only has a 50% shareholding in the JV. Such gain in terms of additional clients and revenues in the alarms business due to the input foreclosure strategy is particularly unlikely considering that alarm services providers have equally credible alternative suppliers to TEF.128

(152) Third, a partial foreclosure strategy consisting in increasing the price of TEF’s M2M services, would equally not be profitable. Considering that M2M services represent a very low proportion of alarm services providers’ costs ([…]), such a strategy would not significantly raise downstream rivals’ costs and hence would not divert a significant share of customers from rival alarm services providers to TEF.

(153) Finally, the vast majority of respondents to the market investigation, both telecommunication and alarm services providers, indicated that TEF would not have the incentive to foreclose downstream competitors with regard to the provision of M2M services, i.e. to stop supplying M2M services or to provide M2M services at less favourable terms and conditions than today.129

(154) The Commission therefore concludes that TEF is unlikely to have the incentive to foreclose competing alarm services providers from its M2M services in Spain.

As regards effects

(155) Regardless of whether TEF has either the ability or the incentive to foreclose competing downstream rivals with regard to the supply of M2M services, such strategy would be unlikely to have any material impact on competition.

(156) First, if TEF decided to increase the price of M2M services, as explained in paragraph (147), this would not significantly raise rivals’ costs and would hence not lead to increased prices in the downstream market.

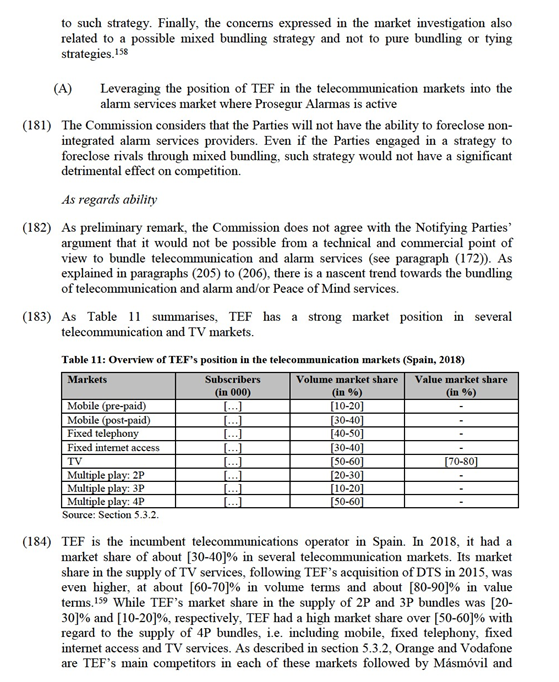

(157) Second, if TEF decided to discontinue the supply or reduce the quality of its M2M services, alarm services providers could switch to alternative telecommunication operators. As explained in paragraphs (139) to (146), there are sufficient alternative suppliers of M2M services active on the Spanish market.

(158) Switching M2M services provider for new end users is costless for alarm services providers. There are some costs associated to switching M2M services provider for the existing customer base. In particular, alarm operators would have to replace the SIM card installed in the alarm equipment located in the end user’s premises. According to internal estimates of Prosegur Alarmas, the costs of replacing the SIM card of an existing customer ranges between EUR […] and EUR […], comparable to […].130

(159) However, switching costs can be mitigated. First, most alarm services providers multi-source M2M services and hence would not have to replace all of their M2M cards. For instance, Prosegur Alarmas’ main provider is [COMPANY], with […]% of its installed SIM cards, followed by [COMPANY] with […]% and [COMPANY] with […]%. Based on the number of its supplied SIM cards, TEF estimates that it represents less than […]% of the installed SIM cards in Securitas Direct’s and Tyco’s alarm systems and even less for other competitors. Second, the main cost associated to SIM cards replacement is the cost of the personnel who visits the end user’s premises. The cost of switching can be reduced to EUR […], according to Prosegur Alarmas, if the SIM card is replaced during the alarm equipment maintenance operations that alarm operators need to carry out on an annual basis.131

5.4.2.3. Conclusion

(160) In light of the above considerations and based on the results of the market investigation, the Commission considers the Transaction does not give rise to serious doubts as to its compatibility with the internal market as a result of any input foreclosure strategy by the Parties with regard to M2M services.

5.5. Conglomerate effects

5.5.1. Legal framework

(161) According to the Non-Horizontal Merger Guidelines, in most circumstances, conglomerate mergers do not lead to competition problems.132

(162) However, foreclosure effects may arise when the combination of products in related markets may confer on the merged entity the ability and incentive to leverage a strong market position from one market to another closely related market by means of tying or bundling or other exclusionary practices. The Non-Horizontal Merger Guidelines distinguish between bundling, which usually refers to the way products are offered and priced by the merged entity133 and tying, usually referring to situations where customers that purchase one good (the tying good) are required to also purchase another good from the producer (the tied good).

(163) Tying and bundling as such are common practices that often have no anticompetitive consequences. Nevertheless, in certain circumstances, these practices may lead to a reduction in actual or potential rivals’ ability or incentive to compete. Foreclosure may also take more subtle forms, such as the degradation of the quality of the standalone product.134 This may reduce the competitive pressure on the merged entity allowing it to increase prices.135

(164) In assessing the likelihood of such a scenario, the Commission examines, first, whether the merged firm would have the ability to foreclose its rivals,136 second, whether it would have the economic incentive to do so137 and, third, whether a foreclosure strategy would have a significant detrimental effect on competition, thus causing harm to consumers.138 In practice, these factors are often examined together as they are closely intertwined.

(165) In order to be able to foreclose competitors, the merged entity must have a significant degree of market power, which does not necessarily amount to dominance, in one of the markets concerned. The effects of bundling or tying can only be expected to be substantial when at least one of the merging parties’ products is viewed by many customers as particularly important and there are few relevant alternatives for that product.139 Further, for foreclosure to be a potential concern, it must be the case that there is a large common pool of customers, which is more likely to be the case when the products are complementary.140 Finally, bundling is less likely to lead to foreclosure if rival firms are able to deploy effective and timely counter-strategies, such as single-product companies combining their offers.141

(166) The incentive to foreclose rivals through bundling or tying depends on the degree to which this strategy is profitable.142 Bundling and tying may entail losses or foregone revenues for the merged entity.143 However, they may also allow the merged entity to increase profits by gaining market power in the tied goods market, protecting market power in the tying good market, or a combination of the two.144

(167) It is only when a sufficiently large fraction of market output is affected by foreclosure resulting from the concentration that the concentration may significantly impede effective competition. If there remain effective single-product players in either market, competition is unlikely to deteriorate following a conglomerate concentration.145 The effect on competition needs to be assessed in light of countervailing factors such as the presence of countervailing buyer power or the likelihood that entry would maintain effective competition in the upstream or downstream markets.146

5.5.2. Assessment of potential conglomerate effects

(168) There are a number of recent examples of alliances between telecommunication operators and alarm services providers, as well as examples of telecommunication operators developing security solutions, both in Spain and worldwide. Some of them offer bundles of telecommunication and alarm services to residential and SME customers.147 In light of this development, TEF’s telecommunication offering can be seen as complementary to the alarm services supplied by Prosegur Alarmas, because some end customers may procure fixed telephony, fixed internet access, mobile, TV and alarm services from one and the same provider.

(169) This section therefore examines whether, given the conglomerate relationship identified above, the Transaction could lead to the foreclosure of alarm services providers that compete with Prosegur Alarmas, and/or the foreclosure of suppliers of telecommunication and TV services that compete with TEF, as a result of a bundling or tying strategy by the Parties.

5.5.2.1. The Notifying Parties’ views

(170) The Notifying Parties submit that the Parties will not have the ability or the incentive to adopt a bundling strategy aimed at foreclosing rivals post-Transaction.

As regards ability

(171) First, the Notifying Parties emphasise that the CNMC found TEF to have significant market power in the supply of fixed internet access (broadband) services. TEF is therefore subject to special rules including the replicability test (further discussed in paragraphs (187) to (193)). Should TEF bundle its fixed internet access services and the JV’s services, the replicability obligation would also apply in relation to alarm services and TEF would be required to guarantee the replicability of that offer in terms of price.148

(172) Second, according to the Notifying Parties, alarm services have very specific features and requirements which are well differentiated from telecommunication services. Therefore, it would not make sense from a commercial point of view to bundle these products.149 This would also be evidenced by TEF’s past […] a bundled product in cooperation with Securitas Direct, which was sold between 2015 and 2018, […].150

(173) Third, the Notifying Parties submit that they do not have a significant degree of market power neither with respect to multiple play services nor in any plausible market definition related to alarm services, the latter being dominated by Securitas Direct, which has a market share of at least over [40-50]%.151

(174) Fourth, according to the Notifying Parties, competitors have effective counter- strategies available. Telecoms operators have started to developed their own security systems and/or have alliances with alarm services providers.152 Besides such alliances, alarm services providers can find partners in other sectors, e.g. banks or insurance companies, to facilitate the commercialisation of their services.153

As regards incentives

(175) The Notifying Parties emphasise again that TEF would never jeopardize its position in the telecommunication market, which is its core business, in favour of Prosegur Alarmas’ presence in alarm services.154

As regards effects

(176) The Notifying Parties argue that even if TEF adopted a bundling strategy aimed at foreclosing rivals post-Transaction, the replicability test would prevent TEF from launching a non-replicable offer and hence there would be no material effect on the market.155

5.5.2.2. The Commission’s assessment

(177) The Commission carries out two assessments in relation to possible conglomerate effects between:

(a) The provision of telecommunication and TV services, i.e., concerning the markets for (i) mobile telecommunication services, (ii) fixed telephony services, (iii) fixed internet access services, (iv) TV services and (v) multiple play services for residential and SME customers in Spain; and

(b) The provision of alarm services, i.e., concerning the possible markets for (i) alarm installation and maintenance and (ii) alarm monitoring and response services for residential and SME customers in Spain.

(178) The first assessment consists in determining whether the Transaction would likely confer on the Parties the ability and incentive to leverage TEF’s strong market position in the telecommunication markets into the alarm services markets, and whether this would have a significant detrimental effect on competition in the alarm services markets, thus causing harm to customers.

(179) The second assessment consists in determining whether the Transaction would likely confer on the Parties the ability and incentive to leverage Prosegur Alarmas’ market position in the alarm services markets into any possible telecommunication markets, and whether this would have a significant detrimental effect on competition in the telecommunication markets, thus causing harm to customers.

(180) In relation to both assessments, the Commission focusses its analysis on the Parties’ ability and incentive to engage in a mixed bundling strategy, i.e. incentivising the joint purchase of the Parties’ own products by offering higher prices for the standalone products as compared to the price of the bundle of telecommunication and alarm services. In contrast, the Commission excludes from the outset the possibility that the Parties would have the incentive to engage in pure bundling or tying practices. Considering the relatively low penetration of alarm services in Spain and the existence of alternatives to TEF’s telecommunication services and Prosegur Alarmas’ alarm services, such strategy would have a significant cost in terms of loss of customers and revenues in TEF’s core telecommunication business. Indeed, less than […]% of Spanish households currently use alarm services.156 On the one hand, TEF, whose main business focus are telecommunication services, would never tie its services to the purchase of alarm services, which have a lower penetration. On the other hand, in order for the tying of alarm services to be profitable, the majority of telecommunication customers, which have not shown to effectively value or need alarm services in the past, would have to start purchasing alarm services.157 Therefore, the Commission considers that it is highly unlikely that TEF would agree

Euskaltel. The market share information suggests that TEF may have a significant degree of market power in several telecommunications and TV markets.

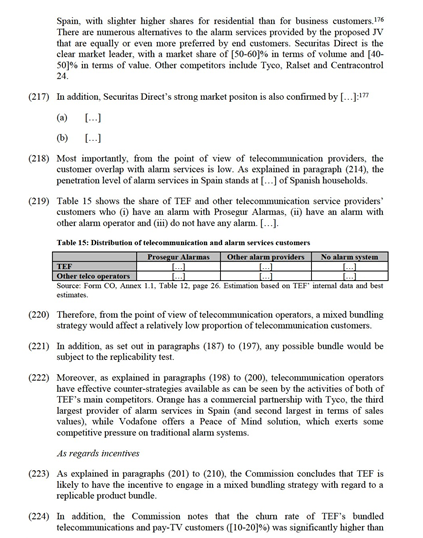

(185) On this basis, several respondents to the market investigation submitted that TEF would be able to leverage its strong market position in several telecommunication and TV markets into the market for alarm services.160 These respondents feared that TEF would, by offering a discounted bundled product consisting of telecommunication and alarm services, foreclose standalone providers of alarm services.

(186) The Commission considers that TEF would not be able to leverage its strong market position in the telecommunication markets into the market for alarm services.

(187) Importantly, TEF’s ability to provide discounted bundled products is constrained by the applicable regulation. In the context of ex-ante regulation in the telecommunication sector, the CNMC identified TEF as an operator with significant market power in 2016.161 Consequently, TEF is subject to specific obligations, including, amongst others, to guarantee that its conduct does not distort competition and infringe article 102 TFEU and to ensure replicability of TEF’s retail broadband offer in terms of price. The objective of the replicability test is to assess the possibility of an alternative operator to replicate the retail offer of the incumbent operator. In March 2018, the CNMC approved a detailed methodology for turning the replicability obligation into a concrete test, the economic replicability test (“ERT”), where all the relevant revenues and costs incurred in the broadband bundle provision are identified, as well as other relevant information needed for the margin calculation, the customer life period or the identification of the flagship broadband bundles.162

(188) Before explaining the functioning of the ERT, it is important to note that the ERT applies to any components bundled with TEF’s broadband product. This obligation would also apply in relation to alarm services as long as the alarm services are sold in a package with TEF’s broadband product. In this case, TEF would be compelled to consider the additional costs referred to this service in a manner comparable to other additional components in the past.163

(189) In practice, the ERT covers the majority of TEF’s fixed telecommunication and TV sales. In fact, besides TEF’s […] subscribers of standalone fixed telephony services and […] subscribers of standalone TV services, its remaining subscribers purchase 2P ([…]), 3P ([…]) or 4P ([…]) bundled products, which always contain a broadband component.164 In addition, TEF has […] subscribers of standalone mobile services. However, due to its product characteristics, the mobile component is less prone to be bundled with alarm services, which are more closely related to fixed telecommunication services. This was also confirmed by the market investigation. Respondents expect TEF to bundle Prosegur Alarmas’ alarm services with TEF’s existing bundles, in particular its 4P bundle consisting of fixed telephony, fixed internet access, TV and mobile services, but not with its standalone mobile telecommunication services.165 As for TEF’s TV services, as mentioned, TEF has […] standalone TV subscribers.

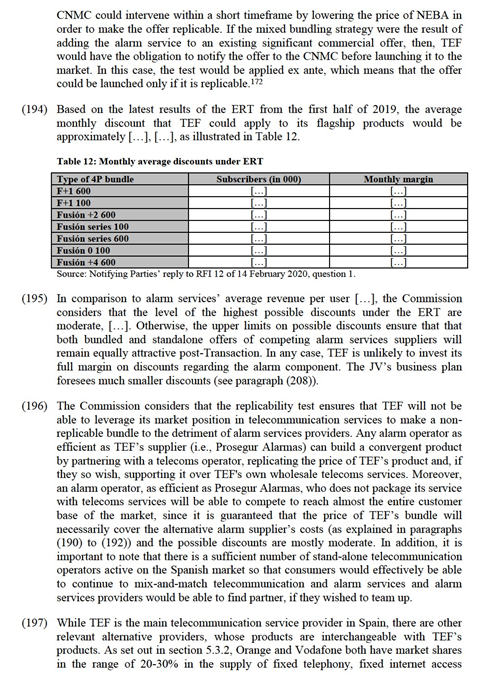

(190) As for the functioning of the ERT, the CNMC regularly arranges TEF’s fibre-based products by number of customers (from highest number of customers to lowest) until reaching 80% of TEF's fibre customer base.166 All of TEF’s current flagship products are 4P bundles.167 The margin of each of these flagship products is calculated as the Net Present Value (“NPV”) of all revenues generated and costs incurred in the provision of the flagship bundle during the customer life period with a discount rate equivalent to the last WACC168 approved by CNMC. If the NPV of the flagship bundle is greater or equal to zero, the flagship bundle is held to be replicable by an alternative operator, otherwise wholesale network access service (“NEBA”) charges must be reduced in order to restore the economic replicability of the flagship bundle.169

(191) For this analysis, the following cost categories are included: commercial costs, broadband (wholesale regulated) costs and internal network costs. In addition, depending on the product bundle, the following costs for the provision of additional components are included: fixed telephony costs (network access and traffic), mobile communication costs (voice, SMS and data), audio-visual costs (content rights and production) and any additional component costs. The last category includes any other components of the bundle such as software, online content (e.g., music, books, games) and any other value added services (e.g., parental control, antivirus, cloud storage or, in the future, alarm services). The value of the additional components is calculated according to the acquisition costs incurred by TEF.170

(192) The ERT ensures that any product which is offered in a bundle with a broadband product is replicable from TEF’s various wholesale products so that (i) each of the telecoms element in the bundle has an associated wholesale product that is technically and economically replicable; and (ii) the bundle’s overall margin (i.e., including telecoms elements and non-telecoms elements) is always positive.171 In this context, the replicability test ensures that the associated cost of the “non- telecoms elements” is covered by the bundle revenues. As a result of the methodology implemented for this replicability test, TEF would sacrifice its NEBA wholesale revenues if any of its offers were not replicable.

(193) The CNMC applies the test to TEF’s commercial offers at least every 6 months. This means that, in the hypothetical event that TEF launched a non-replicable offer, the

services and mobile telecommunication services. In the supply of TV services, they both have market shares in the range of 10-20%. While Orange is the market leader with respect to the supply of 3P bundles (about 50% market share), Vodafone and Orange are respectively the second (20-30%) and third largest (10-20%) suppliers of 4P bundles after TEF with a market share of about 50%. Moreover, TEF’s market share in the various telecommunication and TV markets has been decreasing over the last three years and has further decreased in the first three quarters of 2019.173 In the same period, Másmóvil has increased its market share from a de minimis position to [5-10]% in the supply of fixed telephony and [5-10]% in the supply of fixed internet access services in 2018 (and further to [5-10]% in the first three quarters of 2019).

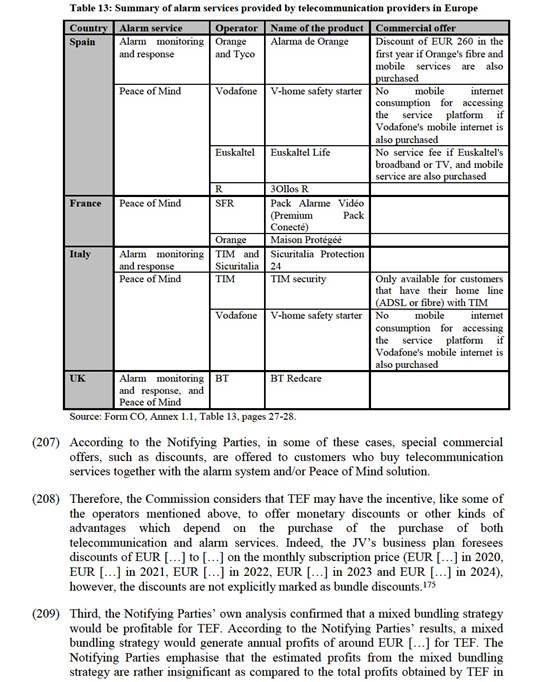

(198) Finally, it is important to mention that competing alarm services providers have effective counterstrategies available, such as entering into similar co-operations or proposing different kinds of bundles, if the offering of a bundled product became an important competitive advantage. Competitors are already employing such strategies today. For instance, Tyco, the third largest provider of alarm services in Spain (and second largest in terms of sales values), has entered into a commercial partnership with Orange (for more details see Table 13 below).

(199) In addition to alliances with telecommunication operators, alarm services providers have other alternatives to replicate any competitive advantage that the proposed JV may achieve thanks to a potential bundled offer. In particular, alarm operators could use companies from other sectors (for example, the financial sector) in order to increase their distribution channels and effectively compete. In fact, in June 2018, Securitas Direct made a commercial alliance with CaixaBank by virtue of which the financial entity distributes through its 4 743 distribution points of sales the alarm systems developed by Securitas Direct with advantageous financial conditions. According to the Notifying Parties, the number of distribution points owned by CaixaBank is significantly higher than the number of TEF’s distribution points ([…]). In addition, Securitas Direct has a commercial agreement with one of the main insurance companies in Spain, Mapfre, by virtue of which Mapfre distributes Securitas Direct’s alarm services.174

(200) Hence, competing alarm services providers have already started entering into partnerships and they can continue to team up, with telecommunication operators or other partners, if the provision of a bundled product should become an important competitive advantage.

As regards incentives

(201) The Commission distinguishes between TEF’s incentive to engage in a mixed bundling strategy offering a (i) non-replicable bundled product and (ii) a replicable bundled offer.

(202) With regard to a non-replicable offer, the Commission considers that it is highly unlikely that TEF would have incentives to launch a non-replicable offer to the market, considering that any significant commercial offer by TEF is subject to a replicability test and that if any of TEF’s offers does not pass the test this would automatically lead to a significant loss in terms of reduction of TEF’s wholesale NEBA prices and revenues.

(203) With regard to a replicable bundled product, the Commission considers that TEF has not only the technical ability to offer such a product but that it is likely to have the incentive to offer it.

(204) First, mixed bundling strategies do not generally involve substantial costs in terms of customer losses and thus companies will have the incentive to undertake them to the extent that products are sufficiently related and have a relevant common customer base.

(205) Second, the recent industry trend for co-operations between telecommunication and alarm services providers confirm that these products can be successfully bundled, are sufficiently related and have a relevant common customer base. In Spain, Orange and Tyco have entered into a commercial agreement. In addition, several Spanish telecommunication service providers, such as Vodafone, Euskaltel and R, have developed Peace of Mind solutions. Even if the latter are not considered to be part of the same product market as professional alarm services (as explained in section 4.2.1.3), bundles of telecommunication and Peace of Mind solution exert some competitive pressure on professional alarm services and more importantly point towards the same industry trend.

(206) Similar developments can be found in other European countries. Examples include the alarm and/or Peace of Mind solutions offered by SFR and Orange in France, British Telecom in the UK, and TIM in Italy. In particular, “Sicuritalia Protection 24” was developed by TIM and the alarm services provider Sicuritalia. There are further examples on a worldwide level, such as alarm services offered by AT&T in the US.

of Prosegur Alarmas’ customers ([5-10]%) in 2018.178 This could provide an additional incentive for TEF to bundle its telecommunication and TV services with alarm services.

As regards effects

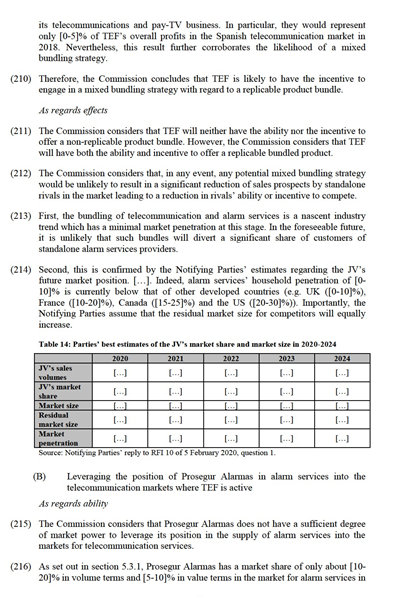

(225) The Commission considers that TEF will neither have the ability nor the incentive to offer a non-replicable product bundle. However, the Commission considers that TEF will have both the ability and incentive to offer a replicable bundled product.

(226) The Commission considers that a mixed bundling strategy would be unlikely to result in a significant reduction of sales prospects by standalone rivals in the market leading to a reduction in rivals’ ability or incentive to compete.

(227) In particular with regard to competing telecommunication operators, the vast majority of their customers, currently more than […], do not purchase any alarm services. Even if the Parties would manage to attract additional customers, as estimated in Table 14, there remains a sufficiently large fraction of the market that is unaffected.

5.5.3. Assessment of possible leakage/misuse of information

5.5.3.1. Potential concern

(228) One respondent to the market investigation explained that TEF currently has access to different types of confidential and commercially sensitive information: (i) confidential end customer data; (ii) information derived from the provision of corporate telecommunication services to alarm services providers; and (iii) commercially sensitive or confidential data shared in the framework of commercial and R&D cooperation projects. The respondent expressed concerns that, following the Transaction, TEF could misuse this information, in particular by sharing it with Prosegur Alarmas, giving it an anti-competitive advantage in the alarm services market.179

(229) In particular, the respondent pointed to the following strategies TEF could deploy. First, TEF already today has access to a significant amount of personal data of its own customers of telecommunication services. On the one hand, it could pass this data on to Prosegur Alarmas, allowing it to develop new products and services tailored to meet each customer’s specific needs. On the other hand, TEF could use this data to identify the customers of alarm services providers competing with Prosegur Alarmas and target them with advertising or promotional campaigns to make them switch to the security systems provided by Prosegur Alarmas.180

(230) Second, the respondent claimed that because TEF currently provides corporate telecommunication services to alarm services providers, it has access to their corporate communications with alarm service customers (even if these are not themselves TEF customers). TEF could use this information to target the end customers with advertising or promotional campaigns to make them switch to the security systems provided by Prosegur Alarmas.181