Commission, October 31, 2019, No M.9450

EUROPEAN COMMISSION

Judgment

PPG / TIL / JV

Subject: Case M.9450 – PPG/TIL/JV

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 26 September 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Peel Ports Group Limited (United Kingdom, ‘PPG’) and Terminal Investments Limited S.a.r.l (Switzerland, ‘TIL’) acquire, within the meaning of Articles 3(1)(b) and 3(4) of the Merger Regulation, joint control of The Mersey Docks and Harbour Company (L2) Limited (United Kingdom, ‘MDHCL2’) (‘Transaction’)3. PPG and TIL are designated hereinafter as the 'Notifying Parties'.

1.THE PARTIES

(2) PPG is a port group that provides ports, shipping and marine support services. PPG operates in various locations in the United Kingdom, Ireland, the Netherlands and Australia. PPG is jointly controlled by The Peel Group (UK) and Deutsche Bank AG (Germany). PPG owns and operates the two container terminals in the Port of Liverpool, namely the Royal Seaforth Container Terminal (‘RSCT’)4 and the L2 Terminal. In the United Kingdom and Ireland, PPG also owns the Greenock Ocean Terminal in Clydeport, Scotland; the Marine Terminals Ltd. (South Quays Container Terminal), Dublin, Ireland; and the Irlam Container Terminal in Manchester, England.

(3) TIL is a terminal operating company jointly controlled by MSC Mediterranean Shipping Company S.A. (Switzerland, ‘MSC’) and by certain equity funds managed by Global Infrastructure Management, LLC, and associated with Global Infrastructure Partners (USA). TIL invests in, develops and manages container terminals in various parts of the world, for example terminals in Antwerp and Rotterdam, but operates pre-Transaction no terminal in the United Kingdom or Ireland. MSC provides worldwide container transport services and terminal services, and is also active as a cruise operator and in maritime ancillary activities.

(4) MDHCL2 is a newly established entity that currently does not have operating business activities. PPG established MDHCL2 for the purpose of this Transaction and will transfer the operation of the L2 Terminal to MDHCL2. Post-Transaction, MDHCL2 will become the operating entity of the L2 Terminal in the port of Liverpool.

2.THE CONCENTRATION

(5) TIL will acquire 50% of the shares in MDHCL2 from PPG. The Transaction comprises of the acquisition of joint control over MDHCL2, the future operating entity of the L2 Terminal in the port of Liverpool.

(6) TIL and PPG will have the right to appoint an equal number of members to the Board of Directors of MDHCL2, which, amongst others, will have the right to adopt strategic decisions such as the annual business plan and budget. Decisions will be taken by simple majority and neither TIL nor PPG has a casting vote. The deadlock resolution mechanism provides that PPG and TIL shall meet and seek to resolve in good faith the dispute underlying the deadlock situation. No shareholder has a casting vote. This demonstrates that TIL and PPG must reach a common understanding in determining the commercial policy including strategic decisions of MDHCL2 and are required to cooperate.5

(7) As a result, TIL and PPG will be jointly controlling MCHCL2 post-Transaction. Therefore, the Transaction constitutes a concentration within the meaning of Article 3 (1)(b) of the Merger Regulation.

(8) Post-Transaction, MDHCL2 will be a full-function joint venture in the meaning of Article 3 (4) of the Merger Regulation since it has sufficient resources, activities beyond one specific function for the parents,6 access to the market and operates on a lasting basis.7

3.EU DIMENSION

(9) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million8 (PPG: […] EUR million, TIL: […] million). Each of them has an EU-wide turnover in excess of EUR 250 million (PPG: […] million, TIL: […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

4.MARKET DEFINITION

4.1.Introduction

(10) TIL operates terminals in Northern Europe, but not in the United Kingdom or Ireland. PPG only operates terminals in the United Kingdom and Ireland. The Transaction therefore gives rise to a horizontal overlap on the market for container terminal services in Northern Europe.

(11) TIL is vertically integrated with the containerised shipping company MSC. MSC provides short-sea container liner shipping services via its subsidiary W.E.C.Lines. W.E.C. Lines operates schedules between Belgium, Germany, the Netherlands, Portugal, Spain and the United Kingdom. W.E.C. Lines calls at the Liverpool RSCT terminal with its British Isles-Iberia trade.9 MSC also provides deep-sea container liner shipping services on various trades to and from Northern Europe.10

(12) The Transaction therefore gives rise to vertical links between MSC’s activities in the market for containerised liner shipping services and the market for container terminal services.

4.2.Container terminal services

4.2.1.Relevant product market

(13) In its prior decisional practice, the Commission has defined a separate market for container terminal services, and has considered a possible distinction between hinterland traffic (containers transported directly onto/from a container vessel from/to the hinterland via barge, truck or train) and transhipment traffic (containers destined for the onward transportation to other ports or other vessels).11

(14) The Notifying Parties do not dispute the above mentioned market definition or its plausible segmentations.12

(15) For the purpose of this Decision, the question of whether the market for container terminal services should be segmented between hinterland and transhipment traffic can be left open, as the Transaction would not raise serious doubts as to the Transaction’s compatibility with the internal market under any such product market definition.

4.2.2.Relevant geographic market

(16) The Commission has considered in its prior decisional practice that the geographic market for container terminal services is determined by the geographic scope of the container terminal services (catchment area).13

(17) For container terminal services for transhipment traffic, the Commission has considered in its prior decisional practice that the relevant geographic dimension is, in its broadest scope, regional, such as Northern Europe including the United Kingdom and Ireland.14

(18) The Notifying Parties agree with the Commission’s market definition for container terminal services for transhipment traffic.15

(19) The Commission therefore considers that, for the purpose of this case, the geographic scope of the market for container terminal services for transhipment traffic is Northern Europe including the United Kingdom and Ireland.

(20) For hinterland traffic, the Commission has considered in previous cases the catchment area of the ports in a certain range, such as Hamburg-Antwerp, and possibly an even narrower geographic market, comprising the ports of a single Member State only.16

(21) The Notifying Parties submit that the geographic range of container terminal services for hinterland traffic should comprise at least all container ports in mainland Great Britain and claim that a narrower range would “ignore the commercial and logistical reality of the existing hinterland connections, which connect mainland Great Britain quickly and efficiently”.17 In any event, the Notifying Parties consider that at least the ports of Southampton, Felixstowe, London Gateway and Liverpool are substitutable and that all four ports could handle large containerships with more than 20 000 TEUs.18, 19

(22) The majority of respondents to the Commission’s market investigation in this case confirmed that from a demand-side perspective, the ports of Southampton, London Gateway and Felixstowe could be considered as substitutable with the port of Liverpool.20 However, the majority of respondents to the market investigation indicated that other ports in mainland Great Britain such as Bristol, Clydeport (Glasgow and surroundings), Manchester, Newport or Cardiff would not be an alternative to the port of Liverpool, because these ports would either not have the facilities for larger containerships or because they lack the required hinterland connections.21

(23) For the purpose of this Decision, the exact geographic scope of the market for container terminal services for hinterland traffic can be left open, as no serious doubts would arise as to the Transaction’s compatibility with the internal market also under the narrower plausible geographic market definition comprising only the four ports of Southampton, Felixstowe, London Gateway and Liverpool.

(24) The Commission will assess the effects of the Transaction on the markets for container terminal services in its broadest scope (Northern Europe including the United Kingdom and Ireland) and in its narrowest possible scope (the ports of Liverpool, Southampton, London and Felixstowe as well as ports in mainland Great Britain for hinterland traffic).

4.3.Deep-sea container liner shipping services

4.3.1.Relevant product market

(25) In its prior decisional practice, the Commission has defined separate product markets for deep-sea container liner shipping services and short-sea container liner shipping services.22

(26) Deep-sea container liner shipping services comprise the offer of regular, scheduled services for the sea transportation of containerised cargo.23

(27) A possible narrower product market for deep-sea container liner shipping services is that for the transport of refrigerated goods, which could be limited to refrigerated (reefer) containers only or could include transport in conventional reefer vessels. In past cases, the Commission looked separately at the plausible narrower markets for reefer containers and non-refrigerated (warm) containers only when the share of the reefer containers in relation to all containerised cargo was 10% or more on both legs of trade.24 In the present Transaction, this is the case for three trades on which MSC is providing deep-sea container liner shipping services, namely the Northern Europe – Australia/New Zealand, the Northern Europe – West Africa and the Northern Europe – Caribbean & Central America trade.25

(28) While the Notifying Parties do not dispute the above mentioned market definition, they argue that a reefer market would not be relevant for the purpose of assessing the Transaction.26 The Notifying Parties have nonetheless provided the Commission with the information necessary to assess the effects of the Transaction.

(29) The Commission notes that the volume of reefer cargo shipped to and from the port of Liverpool on the legs of trade of the three trades mentioned above is basically non-existent and amounts to at most 0.007% of the overall reefer cargo volume on each leg of trade.27 This Decision assesses the competitive effects of the acquisition of joint control over the L2 Terminal in the port of Liverpool. Therefore, for the purpose of assessing the vertical link between container terminal services and deep- sea container shipping services created by the Transaction, the Commission considers it not meaningful to assess a narrower market segment for reefer containers only.

(30) The Commission will therefore, for the purpose of this Decision, assess only the overall market for deep-sea container liner shipping services.

4.3.2.Relevant geographic market

(31) While the Commission has in its prior decisional practice left open whether the geographic scope should comprise trades, defined as the range of ports which are served at both ends of the service (e.g. Northern Europe – North America) or each leg of trade (each direction of the route separately, e.g. westbound and eastbound within a given trade), in its more recent practice, the Commission concluded that container liner shipping services are geographically defined on the basis of the legs of trade (e.g. Northern Europe-North America eastbound and Northern Europe-North America westbound).28(32) The Notifying Parties do not dispute the above mentioned market definition,29 and submit that the following ranges of ports constitute distinct ends of legs of trade:30

· Northern Europe;

· Australia and New Zealand;

· West Africa;

· South Africa;

· East Africa;

· Central America and Caribbean;

· South America East Coast;

· South America West Coast;

· Far East;

· Indian Subcontinent;

· Middle East;

· North America.

(33) In line with the Commission’s prior decisional practice, the geographic market for deep-sea container liner shipping services is defined on the basis of legs of trades as set out in the previous paragraph.

4.4.Short-sea container liner shipping services

4.4.1.Relevant product market

(34) Short-sea container liner shipping services involve the provision of regular, scheduled intra-continental (usually costal trade) services for the carriage of cargo by container liner shipping companies.31

(35) In its prior decisional practice related to the short-sea shipping services, the Commission concluded as regards the type of cargo transported, that short-sea container liner shipping services should be distinguished from non-containerised shipping, such as bulk shipping, but it has ultimately left open whether wheeled cargo and short-sea container liner shipping services should be considered as belonging to the same product market.32 The Commission considered in its prior decisional practice in short-sea container liner shipping, in trades with a share of reefer containers in relation to all containerized cargo below 10% in both directions, transport in reefer containers is not assessed separately, but as part of the overall market for container liner shipping services.33

(36) The Notifying Parties do not dispute the above mentioned market definition and submit that the precise market definition can be left open.34 Concerning reefer container transport, the Notifying Parties submit that MSC’s short-sea container liner shipping company W.E.C. Lines does not have any reefers in its container fleet and that an analysis of the reefer segment would not be relevant.35

(37) Considering that the L2 Terminal is a container terminal36 and W.E.C. Lines does not have reefers in its container fleet, for the purposes of this Decision, the Commission will assess the effects of the Transaction on the market for short-sea container shipping services and will not assess a market for the transport of reefer containers only.

4.4.2.Relevant geographic market

(38) In its prior decisional practice, the Commission considered that the relevant geographic market for short-sea container liner shipping services should be defined on the basis of (i) either single trades or corridors, defined by the range of ports which are served at both ends of the service;37 or (ii) single legs of trade.38 In a prior decision concerning a horizontal overlap in short-sea container liner shipping services on the trade between the British Isles and the Iberian Peninsula, the Commission, while ultimately leaving the market definition open, also considered Spain and Portugal as well as Ireland and the United Kingdom separately.39

(39) The Notifying Parties consider that the geographic market for short-sea container liner shipping services should be defined on the basis of single trades. The Notifying Parties submit that considering Spain and Portugal as well as the United Kingdom alone would be too narrow.40 The Notifying Parties have nonetheless provided the Commission with the necessary information to assess the effects of the Transaction.

(40) Given that the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition, the exact scope of the geographic market for the purposes of this Decision can be left open.

5.COMPETITIVE ASSESSMENT

(41) The Transaction gives rise to both a horizontal overlap in the market for container terminal services and vertical links between MSC’s activities in the market for containerised liner shipping services and the market for container terminal services.

5.1.Horizontal overlap: container terminal services

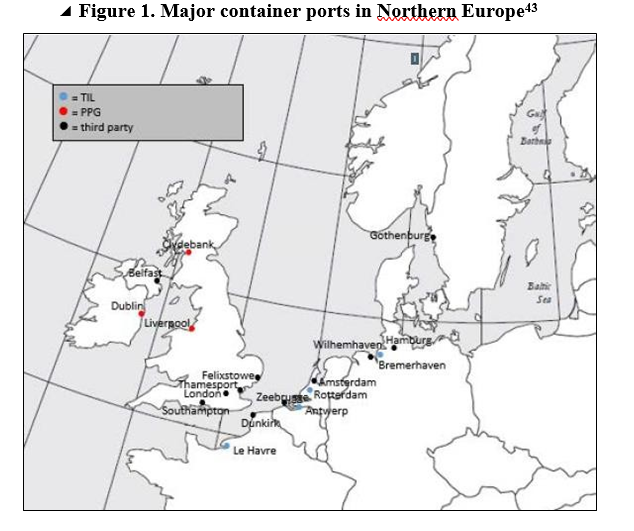

(42) In addition to the L2 Terminal and the RSCT in the port of Liverpool, at the time of this Decision, PPG owns and operates the following terminals: Greenock Ocean Terminal at the Clyde river in Glasgow (part of PPG’s Clydeport subsidiary, Scotland), the Marine Terminals Ltd. (South Quays Container Terminal) in Dublin, Ireland, and the Irlam Container Terminal in Manchester, England.41 (see Figure 1 below)

(43) TIL currently operates several container terminals in Northern Europe, namely Terminals Normandie MSC and Porte Océane S.A. in Le Havre, France, MSC Gate in Bremerhaven, Germany, DMT B.V. terminal in Rotterdam, the Netherlands, and MSC PSA European Terminal N.V. in Antwerp, Belgium.42 (see Figure 1 below)

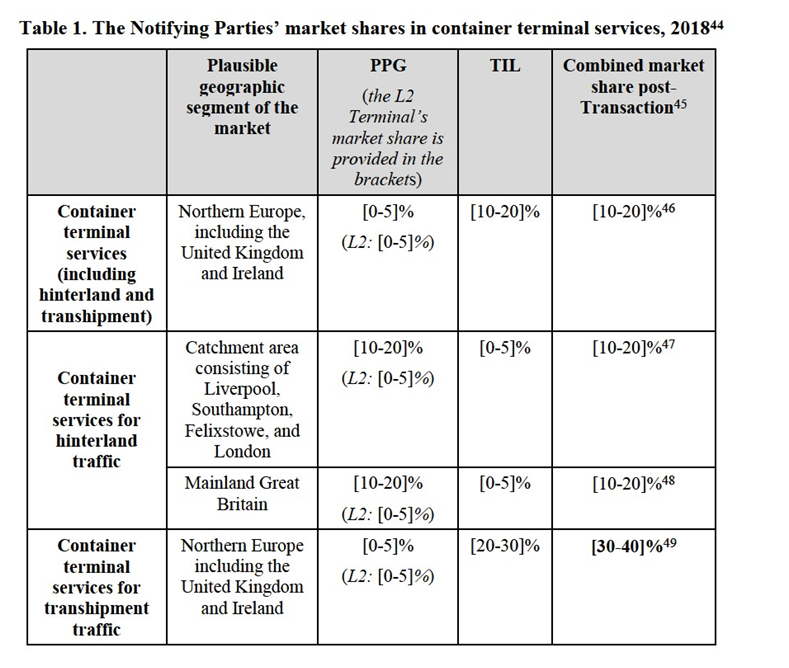

(44) The market shares of PPG and TIL on the market for container terminal services and its plausible segments are shown in Table 1 below.

Commission considers that the Transaction only has an immaterial effect on this market.

(46) Therefore, in this this Decision, the Commission will further assess only the vertical links between the container terminal services and containerised liner shipping services.

5.2.Vertical links between the container terminal services and container liner shipping services

5.2.1.Legal framework

(47) The Commission will examine whether the Transaction is likely to result in foreclosure in any of the markets that are vertically affected by the Transaction.

(48) According to the Non-Horizontal Merger Guidelines,50 foreclosure occurs when actual or potential rivals' access to markets is hampered, thereby reducing those companies' ability and/or incentive to compete.51 Such foreclosure can take two forms: (i) input foreclosure, when access of downstream rivals to supplies is hampered;52 and (ii) customer foreclosure, when access of upstream rivals to a sufficient customer base is hampered.53

(49) For input or customer foreclosure to be a concern, three conditions need to be met post-transaction: (i) the merged entity needs to have the ability to foreclose its rivals; (ii) the merged entity needs to have the incentive to foreclose its rivals; and (iii) the foreclosure strategy needs to have a significant detrimental effect on competition on the downstream market (input foreclosure) or on customers (customer foreclosure).54 In practice, these factors are often examined together since they are closely intertwined.

5.2.2.Analytical framework

(50) Shipping companies provide their services either individually with their own vessels (owned or charted) or through co-operation agreements with third party shipping companies.55

(51) Under a slot charter agreement, a shipping company “rents” a predetermined number of container slots on a vessel of another shipping company in exchange for cash (normal or regular slot charter) or slots on its own vessels (slot-exchange). Slot charter agreements do not normally involve joint decision making concerning marketing, ports of call, schedule or the use of the same port terminals.56

(52) Consortia are operational agreements between shipping companies established on individual trades for the provision of a joint service. Alliances are matrices of vessel sharing agreements that cover multiple trades rather than one trade, as opposed to consortia. In its prior decisions relating to container liner shipping services, the Commission considered that shipping companies that are members of alliances/consortia (the latter are also called vessel sharing agreements, “VSAs”) jointly agree on the capacity that will be offered by the service, on its schedule and ports of call. Generally, each party provides a number of vessels for operating the joint service and in exchange receives a number of container slots across all vessels deployed in the joint service based on the total vessel capacity that it contributes. The allocation of containers is usually predetermined and shipping companies are not compensated if the slots attributed to them are not used. The costs for the operation of the service are generally borne by the vessel providers individually so that there is limited to no sharing of costs between the participants in a consortium.57

(53) In previous cases, the Commission also considered that it is not appropriate to assess the effects of the concentration only on the basis of the parties’ individual market shares. Such an approach would not adequately take into account the fact that a member of an alliance/consortium can have a significant influence on operational decisions determining service characteristics. This influence can have a dampening effect on competition on the trade/s serviced by the alliances/consortia in question. Hence, the competitive assessment should also be based on the aggregate shares of the parties’ alliances/consortia.58

(54) The Notifying Parties argue that the competitive analysis of the vertical links created by the Transaction should be based only on MSC’s market shares and should not include the market shares of MSC’s consortia partners.59

(55) In line with its prior decisional practice,60 the Commission will assess the effects of the Transaction by taking into account the aggregate market shares of MSC and of its partners in the respective consortia.

5.2.3.Vertical link – market for container terminal services and deep-sea container liner shipping services

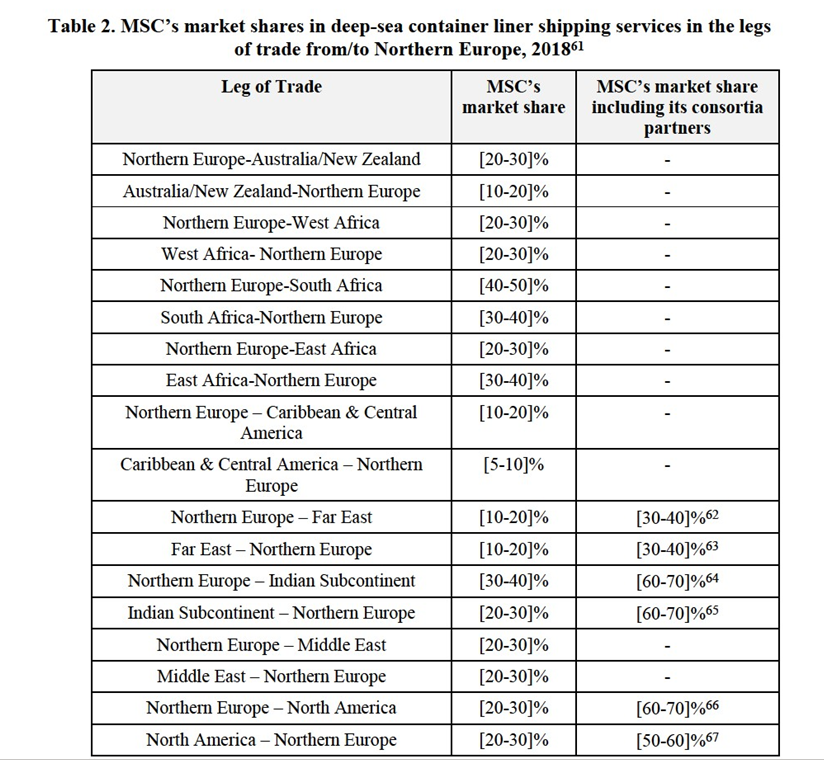

(56) MSC is providing deep-sea container liner shipping services on various trades to and from Northern Europe. MSC’s market share (including its consortia partners) is shown in Table 2 below.

Northern Europe – South America East Coast | [20-30]% | [40-50]%68 |

South America East Coast – Northern Europe | [20-30]% | [30-40]%69 |

Northern Europe – South America West Coast | [20-30]% | - |

South America West Coast – Northern Europe | [30-40]% | - |

(57) As shown in Table 2 above, MSC (including its consortia partners) has a market share of above 30% on the following 13 legs of trade: Northern Europe – South Africa, South Africa – Northern Europe, East Africa – Northern Europe, Northern Europe – Far East, Far East – Northern Europe, Northern Europe – Indian Subcontinent, Indian Subcontinent – Northern Europe, Northern Europe – North America, North America – Northern Europe, Northern Europe – South America East Coast, South America East Coast – Northern Europe, Northern Europe-South America West Coast, South America West Coast – Northern Europe.

(58) If an overall market for container terminal services or a market for container terminal services for hinterland traffic are considered on which the Notifying Parties’ market shares are below 30%, these legs of trade are vertically affected by the Transaction.

(59) If a market for container terminal services for transhipment traffic is considered, on which the Notifying Parties’ combined market share is above 30%, all legs of trade mentioned in the table above are vertically affected markets.

(60) Therefore, the Commission will assess in the following all of the above legs of trade as vertically affected markets. 5.2.3.1.Foreclosure of competing container liner shipping companies from procuring container terminal services

(61) The Commission considers that the Transaction would not lead to any foreclosure strategy, aimed at foreclosure of competing container liner shipping companies from procuring container terminal services.

(62) The Notifying Parties would not have the ability to engage in such a strategy. The vertical link between different legs of trades and container terminal services based on the established geographic market definitions does not seem to reflect the business reality, as no terminal, let alone a single harbour, is specific to any individual trade in this Transaction. Every container terminal serves vessels sailing on a variety of trades. The relevant end of trade in this Transaction for the deep-sea container liner shipping services, Northern Europe, encompasses the full range of harbours from the Atlantic coast of the Iberian Peninsula to the Baltic Sea. Any high market share of MSC, including its consortia partners as the case may be, on an affected leg of trade does not mean that it can foreclose the remaining container liner shipping companies active on that trade because it has also a substantial market share in the market for terminal services in a given harbour, here the L2 Terminal in the port of Liverpool. Instead, competing container liner shipping companies serving Northern Europe as one relevant end of a trade could procure port terminal services from several alternative providers. Following the Transaction, the competing container liner shipping companies will continue to be able to source container terminal services from alternative providers in the ports belonging to the same catchment area as the port of Liverpool. In England alone, deep-sea container liner shipping companies have the ports of London, Southampton and Felixstowe which are not controlled by any of the Notifying Parties as an alternative, which seem to be the closest competitors to the port of Liverpool.70

(63) Moreover, in the Commission’s view, the Notifying Parties will not have the incentive to discontinue providing container terminal services to competing liner shipping companies in the L2 Terminal due to the following reasons.71 First, as the Commission has found in previous cases, the profit margins that terminal operators obtain from the provision of container terminal services are usually higher than those that vessels operators derive from their liner shipping activities.72 Therefore, the Commission considers that the Notifying Parties post-Transaction do not have an incentive to foreclose container liner shipping companies competing with MSC from procuring container terminal services at L2 Terminal. Second, while it is intended that MSC increases its throughput at the L2 Terminal, following expansion of the L2 Terminal in 2021, MSC’s throughput at the L2 Terminal would amount to [<50]% at most.73 It is therefore intended to achieve the vast majority of the throughput at the L2 Terminal with third-party shipping lines. Moreover, Global Infrastructure Management (‘GIP’), the other shareholder in TIL, is an institutional investor, with no activities in the container liner shipping business in the EEA. GIP will not have an incentive to block access of MSC's rivals or to give preferential treatment to MSC, but would insist on arm's length dealings.

(64) During the Commission’s market investigation, one liner shipping company currently calling at the RSCT in the port of Liverpool voiced concerns that PPG post-Transaction could potentially discontinue or reduce investments in the RSCT or its maintenance which would negatively affect the quality of services.74 However, on the basis of the evidence submitted by the Notifying Parties and the Commission’s market investigation, the Commission is of the view that these concerns are not substantiated.

(65) In particular, the majority of respondents to the Commission’s market investigation expressing an opinion on this question considered it unlikely that the Transaction would have a negative impact on the operation at the RSCT. For example, one respondent considered that the quality of service would remain the same post-Transaction at the RSCT. Another respondent explained that the L2 Terminal would rather be a supplement for deep-sea services than a replacement for the RSCT.75

(66) PPG explained that the RSCT has been a profitable terminal with steady volumes which should continue post-Transaction.76 PPG submitted that it expects its customers (with the exception of MSC) to continue calling at the RSCT and that it had not made any proposal to its RSCT customers to switch volumes to the L2 Terminal (with the exception of MSC).77 In addition, PPG’s five year business plan for the RSCT shows that [details about future investment plans].78 Furthermore, PPG has a management team responsible for the development and growth of the RSCT.79

(67) The RSCT is solely controlled by PPG. Post-Transaction, the L2 Terminal will be jointly controlled by PPG and TIL. Considering that PPG will achieve the profit from the RSCT alone, whereas the profit from the L2 will be split between PPG and TIL, the Commission considers that PPG would not have any incentive to discontinue its investments in the RSCT.

5.2.3.2.Foreclosure of other terminal operators’ access to MSC’s demand of container terminal services

(68) In the Commission’s view, the Notifying Parties would not have the ability or the incentive to foreclose access of the L2 Terminal’s competitors to MSC’s demand of container terminal services for deep-sea container liner shipping.

(69) First, neither the market investigation nor the evidence submitted by the Notifying Parties provide any indication that post-Transaction the Notifying Parties would have the ability or incentive to engage in foreclosure strategies.80

(70) Second, as regards ability, it is an industry practice that as a member of consortia, MSC cannot unilaterally choose to divert its deep-sea trade volume to the terminal in which it has an equity stake, because its consortia partners have a say and may have preferences for other ports.81 This is even less plausible to achieve at the entire consortia level which would require even more compromises. The Transaction is therefore unlikely to lead to any significant changes in the competitive environment in this area.

(71) Third, the Commission’s market investigation showed that liner shipping companies typically procure port terminal services from several alternative providers which are chosen on the basis of various practical considerations, including commercial conditions82 and transfer times.83 There is therefore also no incentive for MSC, as such a potential foreclosure strategy of competing terminals by concentrating its deep-sea services at the L2 Terminal would defeat the purpose of having access to various ports which is necessary in order to make sure that MSC is able to reach its customers at optimal transfer times.

(72) Last, even if it were to engage in a foreclosure strategy, MSC’s deep-sea trade volume is not sufficiently large on the overall Northern European market in order to harm the other terminal operators competing with the L2 Terminal. Indeed, MSC’s volume on all Northern European trade legs combined was approximately […] million TEUs in 2018 (out of the estimated total of […] million TEUs), which amounted to less than [<40]%.84

(73) The Commission therefore considers that following the Transaction, the competing container terminal services providers will continue to have economic alternatives to avoid being foreclosed.

5.2.3.3.Conclusion

(74) In light of the above considerations, the Commission concludes that the Transaction would not raise serious doubts as to its compatibility with the internal market as a result of (input or customer) foreclosure concerns on the markets for container terminal services and deep-sea container liner shipping services.

5.2.4. Vertical link – market for container terminal services and short-sea container liner services

(75) The L2 Terminal can accommodate the short-sea container vessels.85 The Notifying Parties submit that for short sea service, MSC calls at the RSCT through its subsidiary W.E.C. Lines that operates in short-sea container liner shipping service with its British Isles-Iberia trade.86 At present, MSC has no plans to transfer the W.E.C. Lines’ short-sea volumes from the RSCT to the L2 Terminal, however, there remains a possibility that it might switch to the L2 Terminal in the future.87

(76) Given the market share data provided in Table 3 below, the Transaction gives rise to a vertically affected market between the container terminal services and the short-sea container liner services on the Portugal-United Kingdom leg of trade.

Table 3. MSC’s market shares for various short-sea trades, 201888

Leg of Trade | MSC’s market share89 |

British Isles-Iberia trade | [5-10]% |

British Isles-Iberia leg of trade | [0-5]% |

Iberia-British Isles leg of trade | [10-20]% |

Spain – United Kingdom leg of trade | [0-5]% |

United Kingdom – Spain leg of trade | [0-5]% |

Portugal – United Kingdom leg of trade | [50-60]% |

United Kingdom – Portugal leg of trade | [20-30]% |

(77) In the Commission’s view, the Notifying Parties would not have the ability or the incentive to engage in foreclosure due to the following reasons.

(78) First, the Transaction would not lead to any foreclosure strategy aimed at foreclosure of competing container liner shipping companies from procuring container terminal services as no terminal, let alone a single harbour, is specific for any individual trade, including the Portugal – United Kingdom leg of trade, in this Transaction. Indeed, there are many other ports in the mainland Great Britain, which provide container terminal services to short-sea vessels, including the RSCT. Therefore, following the Transaction, the competing container liner shipping companies will continue to be able to source container terminal services for short-sea services from alternative providers.

(79) Moreover, the L2 Terminal is only jointly-controlled by TIL which is then in turn jointly controlled by MSC and GIP, an institutional investor, with no activities in the container liner shipping business in the EEA. GIP will not have an incentive to block access of MSC's rivals or to give preferential treatment to MSC, but would insist on arm's length dealings. In addition, the other parent company of the L2 Terminal’s operating entity, PPG, would also not benefit from any foreclosure strategy as it operates other terminals in the mainland Great Britain.90 Therefore, PPG would be likely to block any such foreclosure strategy.

(80) In addition, the Commission’s market investigation confirmed that the L2 Terminal might not be a preferred option to some customers due to big tidal swings, and strong current,91 therefore for such customers the RSCT or other competing terminals will remain a more viable option. Indeed, the L2 Terminal is directly at the riverside outside the lock and is made for larger vessels which are above 2 000 TEUs,92 whereas the RSCT is inside the lock. In addition, the L2 Terminal is equipped with bigger cranes, which are less suitable for smaller intra-regional vessels.93

(81) The market investigation also showed that for certain customers, the L2 Terminal will not be a viable option due to its technical specifications. The L2 Terminal has a straight berth, therefore it cannot accommodate vessels with stern ramps which need a pontoon or berth at the rear of the vessel in order to drop the ramp to load and discharge cargo.94 This technical incompatibility may prohibit certain short-sea customers from calling at the L2 Terminal for technical reasons.95

(82) Second, in the Commission’s view, the Transaction would not lead to any strategy aimed at foreclosure of other terminal operators’ access to W.E.C. Lines’ demand of container terminal services for short-sea container liner shipping. The Commission considers that there is close to no possibility that the Notifying Parties could benefit from a potential foreclosure strategy of competing terminals by concentrating its short-sea services at the L2 Terminal, because it would defeat the purpose of the short-sea shipping operations. Indeed, short-sea container liner shipping is the provision of regular, scheduled costal trade services linking various ports located at different costal locations. Given this, it would not make economic sense for W.E.C. Lines to seek concentrating its business at a single port.

(83) In light of the above considerations, the Commission concludes that the Transaction would not raise serious doubts as to its compatibility with the internal market as a result of (input or customer) foreclosure concerns in the markets for container terminal services and short-sea container liner services.

6.CONCLUSION

(84) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Publication in the Official Journal of the European Union No C 332, 3.10.2019, p.18.

4 Also known as the “L1 Terminal”.

5 Form CO, para. 69 et seq., Annex 3.1.4 Shareholders’ Agreement of 5 September 2019.

6 MSC’s current throughput at the port of Liverpool container terminals accounts for [<40]% of the current capacity of the L2 Terminal. The L2 Terminal will be expanded in the next 18 months. All permits and regulatory approvals for the expansion were obtained, the additional land is owned, the necessary cranes have been purchased and are partly already shipped to the United Kingdom, see Form CO paragraph 21 et seq. and reply to RFI 3, question 4. The Notifying Parties therefore expect the expansion of the L2 Terminal to be completed in [early] 2021. Following completion of this expansion, MSC will occupy around [<50]% of the L2 Terminal’s capacity. All terminal services for MSC will remain at arm’s length. Therefore, the turnover achieved with third parties is sufficient to conclude that MDHCL2 is geared to play an active role on the market and can be considered economically autonomous from an operational viewpoint in the meaning of para. 98 of the Consolidated Jurisdictional Notice.

7 Form CO, para. 74 et seq.

8 Turnover calculated in accordance with Article 5 of the Merger Regulation.

9 Form CO, para. 260 et seq.

10 Form CO, para. 247.

11 See e.g. Cases M.9093 – DP World Investments/Unifeeder, para. 12; M.9016 – CMA CGM/Container Finance, para. 51.

12 Form CO, para. 157.

13 See e.g. Case M. 8120 – Hapag-Lloyd / United Arab Shipping Company, para. 22.

14 See e.g. Cases M.9093 – DP World Investments/Unifeeder, para. 15; M.9016 – CMA CGM/Container Finance, para. 54; M.5066 – Eurogate/APMM, para. 16.

15 Form CO, para. 240.

16 See e.g. Cases M.9093 – DP World Investments/Unifeeder, para. 15; M.9016 – CMA CGM/Container Finance, para. 54; M.5066 – Eurogate/APMM, para. 16.

17 Form CO, para. 233.

18 See the Notifying Parties’ reply to RFI 1 of 30 September 2019, question 4.

19 TEU refers to twenty-foot equivalent unit.

20 See agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer A, para. 7 and 8; agreed non-confidential minutes of a conference call of 2 October 2019 with a terminal customer, para. 5; agreed non-confidential minutes of a conference call of 10 October 2019 with a terminal customer, para. 5.

21 See agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer A, para. 8; agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer B, paras. 4 and 6; agreed non-confidential minutes of a conference call of 2 October 2019 with a terminal customer, para. 6.

22 See e.g. Case M. 8330 – Maersk Line/HSDG, para. 19.

23 See e.g. Case M.8330 – Maersk Line/HSDG, para. 10.

24 See e.g. Cases M.8594 – COSCO Shipping/OOIL, para. 13; M.8120 – Hapag-Lloyd/United Arab Shipping Company, para. 11.

25 Form CO, para. 376, table 64.

26 Form CO, para. 172 et seq.

27 See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 3.

28 See e.g. Cases M.8594 – COSCO Shipping/OOIL, para. 14; M.8330 – Maersk Line/HSDG, para. 15.

29 Form CO, para. 252.

30 Form CO, para. 245 and 249.

31 See e.g. Case M.9016 – CMA CGM/Container Finance, para. 29.

32 See e.g. Cases M. 9016 – CMA CGM/Container Finance, para. 31 et seq.; M.8330 – Maersk Line/HSDG, para. 19.

33 See e.g. Case M.9016 – CMA CGM/Container Finance, para. 33; M.7523 – CMA CGM/OPDR, para. 40; M.3829 – Maersk/PONL, para. 10; M.3973 – CMA CGM/Delmas, para. 7.

34 Form CO, para. 193.

35 See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 1.

36 Form CO, para. 2.

37 See e.g. Cases M.9016 – CMA CGM/Container Finance, para. 40 et seq.; M.7523 – CMA CGM/OPDR, para. 59.

38 See e.g. Case M. 9016 – CMA CGM/Container Finance, para. 44 et seq.; M.8330 - Maersk Line/HSDG, para. 20; M.7523 – CMA CGM/OPDR, para. 60.

39 See Case M.7523 – CMA CGM/OPDR, paras. 61 and 88 et seq.

40 See the Notifying Parties’ reply to QP2 of 24 September, question 8; reply to RFI 2 of 2 October, question 1c.

41 Form CO, para. 9.

42 Form CO, para. 39.

43 A significant number of smaller container ports are not included, as this map shows only the most significant container ports in Northern Europe. Source: Form CO, Figure 5.

44 Market shares are provided on the basis of volume throughput (TEUs) and are based, where available, on the industry analyst Drewry Consultants Limited data and the Notifying Parties’ best estimates (non-equity allocated). See Form CO para.296 and the Notifying Parties’ replies to Qp2 of 1 October 2019, question 10 ; RFI 1 of 30 september 2019, question 5 and RFI 3 of 11 October 2019.

45 The Market shares are rounded. If the market share of PPG and TIL does not add up to the combined market share stated in the table, this is due to rounding effects.

46 Form CO, para.302, Table 1 ; the combined market share amounted to [10-20]% in 2017 and 10-20]% in 2016.

47 See the Notifying Parties’ reply to RFI 1 of 30 September 2019, question 5.

48 Form CO, para.305, Table 19.

49 In 2017 and 2016, the combined market share was [20-30]% and [20-30]% respectively, with an increment of [0-5]% Form CO, para.316, Table 28.

50 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings, OJ C 265, 18.10.2008, p. 7.

51 Non-Horizontal Merger Guidelines, para. 29.

52 Non-Horizontal Merger Guidelines, para. 31.

53 Non-Horizontal Merger Guidelines, para. 58.

54 Non-Horizontal Merger Guidelines, paras. 32 and 59.

55 See e.g. Case M.8594 – COSCO Shipping/OOIL, para. 26.

56 See e.g. Case M.8594 – COSCO Shipping/OOIL, para. 27.

57 See e.g. Case M.8594 – COSCO Shipping/OOIL, paras. 28-29.

58 See e.g. Cases M.8594 – COSCO Shipping/OOIL, paras. 32-33; M.8330 – Maersk Line/HSDG, para. 60.

59 Form CO, paras. 173; 283; 330 et seq.

60 See also Case M.8459 – TIL/PSA/PSA DGD, para. 52.

61 See form CO, para.333, Table 38 and the Notifying Parties’ reply to RFI 3 of 11 October, question 2. The market shares are by volume (TEUs) and are based on data from Container Trades Statistics Ltd. (« CTS »), see Form CO, para.328. The Commission has used CTS data as an appropriate proxy for market share estimates in previous decisions, see e.g.M.8120-Hapag Lloyd/United Arab Shipping Company, para.52.

62 2M USA with Maerk and MSC/Maerk/Hyundai Merchant Marine Strategic Cooperation, See Form CO, para 352, Table 51.

63 2M USA with Maerk and MSC/Maerk/Hyundai Merchant Marine Strategic Cooperation, See Form CO, para 352, Table 51.

64 USA with the shipping Corporation of India Ltd and USA with CMA CGM and United Arab shipping Company and Hapag Lloyd, See Form Co, para.352, Table 51.

65 USA with the shipping Corporation of India Ltd and USA with CMA CGM and United Arab shipping Company and Hapag Lloyd, See Form Co, para.352, Table 51.

66 USA with Hapag Lloyd ; SCA with Hapag Lloyd, 2M USA with Maersk ; MSC/ Maersk/Hyundai Merchant Marine Strategic Cooperation ; SCA with Maersk. )The market Shares of MSC including its consortia partners on this leg of trade are overstated since they include also the SCAs ; See the Notifyng Parties’ reply to RFI 4 of 24 October 2019.

67 USA with Hapag Lloyd ; SCA with Hapag Lloyd ; 2M USA with Maersk ; MSC/ Maersk/ Hyundai Merchant Marine Startegic Cooperation ; SCA with Maersk. The Market shares of MSC including its consortia. partners on this leg of trade are overstated since they include also the SCAs; see the Notifying Parties’ reply to RFI 4 of 24 October 2019.

68 VSA with Hapag Lloyd.

69 VSA with Hapag Lloyd.

70 See Section 4.1.2 of the Decision.

71 As explained above in paragraph 49 of this Decision, for input or customer foreclosure to be a concern, three conditions need to be met: (i) the merged entity needs to have the ability to foreclose its rivals; (ii) the merged entity needs to have the incentive to foreclose its rivals; and (iii) the foreclosure strategy needs to have a significant detrimental effect on competition. These three conditions are cumulative. Therefore, the conclusion that the merged entity lacks the ability to foreclose is already sufficient for the Commission to conclude that the transaction would not lead to a foreclosure strategy.

72 See e.g. Case M.9093 – DP World Investments/Unifeeder, para. 64.

73 See also footnote 6.

74 See agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer A, para. 14.

75 See agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer B, paras. 11-12; agreed non-confidential minutes of a conference call of 10 October 2019 with a terminal customer, para. 10.

76 See the Notifying Parties’ reply to RFI 1 of 30 September 2019, question 3b.

77 See the Notifing Parties’ reply to RFI 1 of 30 September 2019, question 3d.

78 See the Notifying Parties’ reply to RFI 1 of 30 September 2019, question 3c and RFI 3 of 11 October 2019, question 4.

79 See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 4.

80 See, for example, agreed non-confidential minutes of a conference call of 10 October 2019 with a terminal customer, para. 14 and agreed non-confidential minutes of a conference call of 2 October 2019 with a terminal customer, para. 8.

81 See Drewry Annual Report 2018, Drewry Global Container Terminal Operations – Annual Review and Forecasts, Form CO, Annex 7.4.a, p. 20.

82 Agreed non-confidential minutes of a conference call of 2 October 2019 with a terminal customer, para. 7.

83 Agreed non-confidential minutes of a conference call of 10 October 2019 with a terminal customer, para. 5.

84 Based on the information submitted by the Notifying Parties in Form CO, Table 38 and the Notifying Parties’ reply to RFI 3 of 11 October, question 2.

85 As explained by the Notifying Parties, the L2 Terminal can accommodate short-sea container vessels that are greater than approximately 2 000 TEUs. Smaller vessels cannot be accommodated at the L2 Terminal due to the tidal range of the river Mersey. See the Notifying Parties’ reply to RFI 2 of 2 October 2019, question 1. At present, approximately [20-30]% of the RSCT’s volumes are handled from vessels that are greater than 2 000 TEUs. See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 6b.

86 See Form CO, paras. 260-262.

87 See the Notifying Parties’ reply to RFI 2 of 2 October, question 1b.

88 These market shares are W.E.C. Lines’ own estimates and are based on volume in TEUs, see the Notifying Parties’ reply to QP2 of 24 September, question 8 and reply to RFI 2 of 2 October 2019, question 1c.

89 W.E.C. Lines is not a member of any consortia or vessel sharing agreement, see Form CO, para. 271.

90 For example, Greenock Ocean Terminal in Clydeport, Scotland and the Irlam Container Terminal in Manchester, England.

91 Agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer A, para. 11.

92 Agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer B, para. 7; the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 6a.

93 Agreed non-confidential minutes of a conference call of 30 September 2019 with a terminal customer B, para. 7.

94 See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 6a.

95 See the Notifying Parties’ reply to RFI 3 of 11 October 2019, question 6a.