Commission, September 5, 2019, No M.9416

EUROPEAN COMMISSION

Judgment

BOLLORE GROUP / M7 GROUP

Subject: Case M.9416 – Bolloré Group/M7 Group

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 31 July 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Groupe Canal + SA (“Canal +” or the “Notifying Party”, France) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of M7 Group SA (“M7”, Luxembourg) (the "Transaction"). Canal + and M7 are collectively referred to as the "Parties". (3)

1. THE PARTIES

(2) Canal + is a wholly-owned subsidiary of Vivendi SA and an indirectly solely controlled subsidiary of the Bolloré Group. (4) Canal + offers pay-TV subscriptions in a number of countries worldwide, including France and Poland within the EEA, produces and distributes audio-visual content, broadcasts over 60 channels worldwide, some of which are broadcast within the EEA in France, Belgium and Poland, and is active in selling online and offline advertising space on its channels and digital pay-TV offers. Through its subsidiary Thema, Canal + is active as a wholesaler of TV channels across the EEA and worldwide. Canal + also provides fixed internet and telephone access to residential customers in the French overseas territories and in Poland.

(3) M7 is a pay-TV retailer and has eleven pay-TV brands in eight EU Member States, namely in Austria, Belgium, Czechia, Germany, Hungary, the Netherlands, Romania and Slovakia. M7 is also active as a broadcaster of a TV channel in Czechia, Slovakia and Romania. M7 is also active as a wholesaler of TV channels in Germany. In addition, M7 resells some of the satellite transponder capacity that it purchases to TV broadcasters, the majority of which are suppliers of TV channels to M7. In Belgium, Hungary and the Netherlands, M7 also offers telephony and internet services alongside its retail pay-TV offering. M7 is solely controlled, through the holding company CDS Topco B.V., by the fund FPCI Astorg V, which is the indirect majority shareholder of M7.

2. THE CONCENTRATION

(4) On 7 June 2019, Canal + International SAS, a wholly owned subsidiary of Canal +, on one side, and FPCI Astorg V and the other indirect shareholders of M7, on the other side, entered into a Sale and Purchase Agreement pursuant to which Canal + International SAS will indirectly acquire 100% of the share capital of M7.

(5) The Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (5) (Canal + EUR […], M7 EUR […]). Each of them has an EU-wide turnover in excess of EUR 250 million (Canal + EUR […], M7 EUR […]), but they do not achieve more than two-thirds of their aggregate EU- wide turnover within one and the same Member State. The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

(7) The Transaction relates to all the levels of the TV value chain. Section 4.1 provides an overview of the TV value chain and the Parties' activities at each level of the value chain. The relevant product and geographic market definitions for each level of the TV value chain are subsequently discussed in Sections 4.2- 4.4.

4.1. Introduction: the TV value chain and the Parties’ activities

(8) Audiovisual content for television (“TV content”) comprises all products (films, sports, series, shows, live events, documentaries, etc.) that are broadcast via TV. (6) In previous decisions, the Commission has identified different activities in the TV value chain, namely: (i) the production, licensing and acquisition of TV content (including the supply of pre-produced TV content and commissioned TV content); (ii) the wholesale supply and acquisition of TV channels; and (iii) the retail provision of TV services to end customers. (7)

(9) Sections 4.1.1 to 4.1.3 further describe these levels of the TV value chain as well as provide an overview of the Parties' activities at each level in the EEA countries where they are active.

4.1.1. Production, licensing and acquisition of TV content

(10) This upstream level of the value chain comprises the production of new TV content as well as the licensing of broadcasting rights relating to pre-existing TV content. TV content is either (i) used internally on own TV channels or retail TV services if TV content suppliers are vertically integrated and also active in the wholesale supply of TV channels and/or in the retail provision of TV services (that is to say, captive TV production); or (ii) licensed to third-party customers (that is to say, non-captive TV production).

(11) Third-party customers are typically: (i) TV channel suppliers (TV broadcasters), which incorporate the TV content into linear TV channels, or (ii) content platform operators, which offer the TV content to end users on a non-linear basis (that is to say, Pay-Per-View ("PPV") or video on demand ("VOD")), including via non- traditional platforms, that is to say via internet or so-called Over-The-Top ("OTT") platforms. (8)

(12) TV broadcasters and TV distributors who source TV content for their TV channels or retail TV services generally have a choice between a number of sourcing models, which can be broadly categorised as follows:

a. Obtaining TV content produced on an ‘ad hoc’ basis (that is to say tailor- made), by:

i. Commissioning TV content from a TV production company (which owns the relevant TV format);

ii. Hiring a TV production company to provide the technical means and deliver the finished TV content based on a format owned by the broadcaster; or

iii. Producing the content themselves by relying on their in-house facilities (captive TV production); or

b. Acquiring broadcasting rights from TV production companies for pre- produced TV content (pre-produced TV content, sometimes referred to as off-the-shelf or tape sales).

(13) As regards commissioned TV content, in most cases, TV production companies produce TV content tailored to the needs of their customers on the basis of original TV formats (9) that they develop themselves or that they acquire from right holders (commissioned production). However, in some instances, TV production companies are hired by TV broadcasters or content platform operators to simply provide the technical production means and deliver the finished programme based on a TV format owned or acquired by the hiring company (production-for-hire or supply of TV production services).

(14) The production costs are usually borne entirely or almost entirely by the TV broadcasters or content platform operators. As regards ownership of the various rights relating to the TV content (for example, primary TV broadcast rights, ‘catch-up’, VOD, etc.), the extent to which those rights are retained by the production company – as opposed to the acquirer of TV content – may vary based on a number of factors, such as national regulation in the country concerned, the type of broadcasting, the outcome of the commercial negotiations between the parties, etc. Producers or the acquirers of TV content may then achieve secondary revenues by further licensing/distributing the TV content or the TV format to third parties. (10)

(15) As regards pre-produced TV content, this upstream level of the value chain concerns the licensing of broadcasting rights relating to pre-existing TV content – that is to say TV content that has been previously produced and is subsequently made available ‘off-the-shelf’ by the rights holder (so-called pre-produced TV content) – and broadcasting rights relating to sports events. (11)

(16) The broadcasting rights relating to TV content can belong to one or more of the following: (i) the holder of the rights to the TV format; (ii) the production company that produced the TV content; and (iii) the company that commissioned the production of the TV content. In addition, the broadcasting rights can belong to a third-party distributor, to which they were licensed by the original owner, with a right to sub-license. (12)

(17) As regards the supply-side of the market:

a. Canal +, mostly through its subsidiary StudioCanal, produces French and international movies and co-produces French and international TV series, as well as other TV content for the channels that it broadcasts. In addition, Canal + owns, through StudioCanal, the distribution rights for over 5 500 films and TV series, including French and international TV series, recent French and international motion pictures, as well as catalogue French and international motion pictures. These distribution rights vary in terms of their geographic scope;

b. M7 is not active in the supply-side of this market. (13)

(18) As regards the demand-side of the market:

a. Canal + acquires TV content from third party content owners and distributors to include in its own channels and for its content platforms;

b. M7 has a minor presence in the acquisition of TV content in the EEA to include in its own non-linear VOD offerings. (14)

4.1.2. Wholesale supply and acquisition of TV channels

(19) TV broadcasters use the TV content that they have acquired or produced in-house in order to package it into linear TV channels. (Linear) TV channels are broadcast to end users either on a free-to-air ("FTA") basis or on a pay-TV basis.

(20) At a very general level, FTA channels are TV channels that are available to viewers free of charge. Pay-TV channels are channels for which the viewer must pay a subscription fee in order to watch. Traditionally, FTA channels finance their operations via advertising revenues (with the exception of the publicly-owned TV channels in a number of Member States which are subject to advertising limitations), while pay-TV channels generate revenues through subscription fees.

(21) The Commission notes that TV broadcasters are increasingly complementing their traditional linear TV channel offering with non-linear services such as VOD services.

(22) Some TV broadcasters are vertically integrated as they are also active as retail TV operators (TV distributors) in the market for the retail provision of TV services to end users. Other TV broadcasters are not vertically integrated and rely on third party TV distributors to distribute their TV channels at the retail level.

(23) As regards the supply-side of the market:

a. Canal + is active as TV broadcaster in Belgium, France and Poland and, through its subsidiary, Thema, as a wholesale distributor of TV channels worldwide; (15)

b. M7 is present as a TV broadcaster, to [Information related to the extent of M7’s market presence], in Czechia, Romania and Slovakia and as a wholesale distributor of TV channels in Germany. (16)

(24) As regards the demand-side of the market:

a. Canal + enters into agreements with TV broadcasters for the distribution of TV channels in France and Poland;

b. M7 enters into agreements with TV broadcasters for the distribution of TV channels in Austria, Belgium, Czechia, Germany, Hungary, the Netherlands, Romania, and Slovakia. (17)

4.1.3. Retail provision of TV services to end users

(25) TV distributors either limit themselves to carrying TV channels and making them available to end users, or also act as channel aggregators, which ‘package’ TV channels. The TV services supplied by TV distributors to end users consist of: (i) packages of linear TV channels (which they have either acquired or produced themselves); and (ii) content aggregated in non-linear services, such as VOD, SVOD, TVOD and PPV. TV content can be delivered to end users through a number of technical means including cable, satellite and IPTV. (18) OTT players deliver channels and content in both a linear and non-linear fashion through the use of the internet.

(26) The content offered by a TV distributor is presented in an electronic programme guide ("EPG"), which is an application used on television sets to list current and scheduled programmes that are or will be available on each channel and a short summary or commentary for each programme. Each channel broadcast on the TV platform receives an EPG position, which is usually agreed between the TV broadcaster and the TV distributor. Traditional EPGs are not always used with regard to online content platforms and other non-linear methods of supplying content, or may form only part of a TV distributor's customer interface.

(27) In the retail provision of TV services to end users:

a. Canal + is active as a retail pay-TV services provider in France and Poland;

b. M7 is active as a retail pay-TV services provider in Austria, Belgium, Czechia, Germany, Hungary, the Netherlands, Romania and Slovakia. (19)

4.2. Production, licensing and acquisition of TV content

4.2.1. Product market definition

4.2.1.1. Commission precedents

(28) With regard to the production, licensing and acquisition of TV content, in previous decisions the Commission has concluded that there are separate markets for the: (i) production and supply of commissioned TV content; and (ii) licencing of pre-produced TV content. (20)

(29) With regard to the market for licencing of TV content, the Commission has considered that it could be subdivided by content type, in particular: (i) films; (ii) sports; and (iii) other TV content (i.e. all non-sport, non-film content); and potential sub-segments within these content types. Ultimately, the Commission left the exact scope of the product market open. (21)

(30) The Commission has also considered further sub-dividing the market for the licensing of TV content by exhibition window: (i) SVOD; (ii) TVOD; (iii) PPV; (iv) first pay-TV window; (v) second pay-TV window; and (vi) FTA; but left the market definition open. (22)

4.2.1.2. Notifying Party’s view

(31) The Notifying Party submits that it is not necessary to define the relevant market for the production, licensing and acquisition of TV content to assess the Transaction, as only Canal + is a supplier of both commissioned and original content, while the Target is not active at this level of the television value chain. Therefore, irrespective of the precise market definition, the Transaction would not give rise to any horizontal overlap between the Parties. As for the assessment of the vertical relationships, the Transaction would not give rise to any competition concerns, irrespective of the precise market definition adopted. (23)

4.2.1.3. The Commission’s assessment

(32) The results of the market investigation indicate that segmentations adopted in prior Commission decisions (by content type and exhibition window as indicated above) remain relevant. (24)

(33) In any event, for the purpose of this decision, the exact product market definition for the production, licensing and acquisition of TV content can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is segmented on the basis of content type or exhibition window.

4.2.2. Geographic market definition

4.2.2.1. Commission precedents

(34) In past decisions, the Commission has defined the possible markets for the production, licensing and acquisition of TV content to be either national or regional, based on linguistically homogeneous areas. (25)

4.2.2.2. Notifying Party’s view

(35) The Notifying Party submits that it is not necessary to define the relevant geographic market for the production, licensing and acquisition of TV content to assess the Transaction, as irrespective of the precise market definition, the Transaction would not give rise to competition concerns. (26)

4.2.2.3. The Commission’s assessment

(36) The results of the market investigation confirm that market definitions considered in prior Commission decisions, which delineate the markets for the production, licensing and acquisition of TV content as either national in scope or as potentially broader (or narrower) linguistically homogeneous area, remain relevant. (27)

(37) In any event, for the purpose of this decision, the exact geographic market definition for the production, licensing and acquisition of TV content can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered to be national or by linguistic region.

4.3. Wholesale supply and acquisition of TV channels

(38) TV broadcasters package the TV content that they have acquired or produced in- house into linear TV channels. Linear TV channels are broadcast to end users either on a FTA basis or on a pay-TV basis. This wholesale level is an intermediate activity between upstream production, licensing and acquisition of TV content, and the downstream retail provision of TV services to customers.

4.3.1. Product market definition

4.3.1.1. Commission precedents

(39) In previous decisions, the Commission has identified a wholesale market for the supply of TV channels. Within that market, the Commission has further identified two separate product markets for: (i) FTA TV channels; and (ii) pay-TV channels. (28) The Commission has further concluded that within the pay-TV channel market, there are separate markets for: (i) premium pay-TV channels; and (ii) basic pay-TV channels. For the purposes of its assessment, the Commission has considered FTA channels to be in the market for basic pay-TV channels. (29)

(40) In previous decisions, the Commission also examined a number of other potential segmentations, including: (i) genre or thematic content (such as films, sports, general entertainment, news, youth, and others); (30) (ii) linear channels vs non- linear services (VOD, PPV); (31) and (iii) the different means of infrastructure used for the delivery to the viewer (cable, satellite, terrestrial TV and IPTV). (32) It has usually left the market definition open in all these regards. (33)

4.3.1.2. Notifying Party’s view

(41) The Notifying Party submits that, for the assessment of the Transaction, it is not necessary to adopt a precise definition for the relevant market at the wholesale level of the television value chain, as the Transaction would give rise to no or minimal horizontal overlaps in the different Member States where the Parties are active, irrespective of the precise market definition adopted. Furthermore, no vertical concerns could arise from the Transaction, considering also the [Information related to Canal + business strategy] relevance of the Parties’ activity at the wholesale level in the Member States where they are active at the retail level, irrespective of any market definition. (34)

4.3.1.3. The Commission’s assessment

(42) Most respondents to the market investigation confirm that segmentations considered in prior Commission decisions (by FTA as well as basic and premium pay-TV, content type and distribution technology as indicated above) remain appropriate. (35) However, several respondents explain that such delineations are becoming increasingly blurred and hard to distinguish in practice as a wide variety of operating models are used in the market. A few respondents also point to country-specific peculiarities, such as the limited relevance of FTA TV in Belgium and the Netherlands.

(43) In any event, for the purpose of this decision, the exact product market definition in relation of the wholesale supply of TV channels can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is segmented on the basis of channel type, content, linearity or transmission infrastructure.

4.3.2. Geographic market definition

4.3.2.1. Commission precedents

(44) In previous decisions, the Commission found the market for the wholesale supply of TV channels to be either national in scope, (36) sub-national, (37) or to cover common linguistic regions encompassing more than one Member State. (38)

4.3.2.2. Notifying Party’s view

(45) The Notifying Party submits that it is not necessary to determine whether the relevant geographic market is limited to each relevant Member States or to narrower/larger linguistically homogenous regions, as the Transaction would not give rise to competition concerns irrespective of the precise geographic definition. (39)

4.3.2.3. The Commission’s assessment

(46) The results of the market investigation confirm that prior Commission decisions defining the market for the wholesale supply and acquisition of TV channels as either national in scope or to potentially comprise a broader (or narrower) linguistically homogeneous area remain relevant. (40)

(47) In any event, for the purpose of this decision, the exact geographic market definition for wholesale supply of TV channels can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered as national, sub-national or by linguistic region.

4.4. Retail provision of TV services

4.4.1. Product market definition

4.4.1.1. Commission precedents

(48) In previous cases the Commission split the retail supply of television services in two separate markets: (i) FTA and pay-TV. (41) The Commission also considered whether pay-TV can be segmented further according to: (ii) linear vs non-linear pay-TV services; (42) (iii) according to distribution technologies (e.g. cable, satellite, or terrestrial); (43) and (iv) premium vs basic pay-TV services. (44) In recent cases, the Commission has left open the market definition with regard to each of these potential sub-segments. (45)

4.4.1.2. Notifying Party’s view

(49) The Notifying Party submits that, for the assessment of the Transaction, the precise product market definition can be left open, as there are no Member States where both Parties are active at the retail level. The Notifying Party also submits that the question whether the various infrastructures through which pay-TV services are delivered are substitutable from the end-consumers’ or pay-TV suppliers’ perspective can be left open for the assessment of the Transaction. As for the assessment of the vertical relationships, the Transaction would not give rise to any competition concerns, irrespective of the precise market definition adopted. (46)

4.4.1.3. The Commission’s assessment

(50) Most respondents to the market investigation have indicated that the main segmentations considered in prior Commission decisions (by FTA and basic and premium pay-TV and linear and non-linear distribution as indicated above) remain appropriate. (47) Nevertheless, several respondents also explain that such distinctions have become blurred in practice. Most respondents do not consider that it would be relevant to distinguish markets by distribution technology because different infrastructures used for the access to retail TV services are substitutable. (48) A few respondents also point to country-specific peculiarities, such as the limited relevance of FTA TV in Belgium and the Netherlands.

(51) In any event, for the purpose of this decision, the exact product market definition in relation of the retail supply of TV services can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is further segmented or not.

4.4.2. Geographic market definition

4.4.2.1. Commission precedents

(52) The Commission has previously considered that the market for the retail provision of TV services is either national, or limited to the geographic coverage of a supplier's cable network. (49)

4.4.2.2. Notifying Party’s view

(53) The Notifying Party submits that, for the assessment of the Transaction, the precise geographic market definition can be left open, as there are no Member States or narrower regions where both Parties are active at the retail level. As regard vertical relationships, the market definition could be left open, as irrespective of the precise geographic market definition adopted, the Transaction would not give rise to any competition concerns. (50)

4.4.2.3. The Commission’s assessment

(54) The results of the market investigation are consistent with the Commission's previous findings that the market is either national, or limited to the geographic coverage of a supplier's cable network. (51)

(55) Therefore, for the purpose of this decision, the Commission considers that the relevant market for the retail provision of TV services is either national, or limited to the geographic coverage of a supplier's cable network.

5. COMPETITIVE ASSESSMENT

5.1. Affected Markets

(56) According to the information submitted by the Notifying Party, the Transaction does not give rise to any horizontally affected markets: (52)

(a) in the production, licensing and acquisition of TV content, only Canal + is active;

(b) in the wholesale supply and acquisition of TV channels, the only national markets or linguistic regions where both Parties are present are Czechia, Romania and Slovakia. However, M7’s activity in those countries is limited to the broadcasting of two channels aimed at promoting M7’s retail pay-TV offer. (53) Canal + is active in those countries as a wholesale distributor of TV channels through its subsidiary, Thema, but its market shares remain well below 20% in each possible sub-segmentation of the relevant product market in each of these Member States; (54)

(c) in the retail provision of TV services, there is no horizontal overlap as the Parties are active in different geographic markets: Canal + is active in France and Poland; M7 is active in Austria, Belgium, Czechia, Germany, Hungary, the Netherlands, Romania and Slovakia. (55)

(57) The Transaction results in a number of vertical relationships in connection with:

(a) Canal +’s activities in (i) the production, licensing and acquisition of TV content and (ii) the wholesale supply and acquisition of TV channels, and

(b) M7’s activities on the markets for the retail supply of pay-TV services.

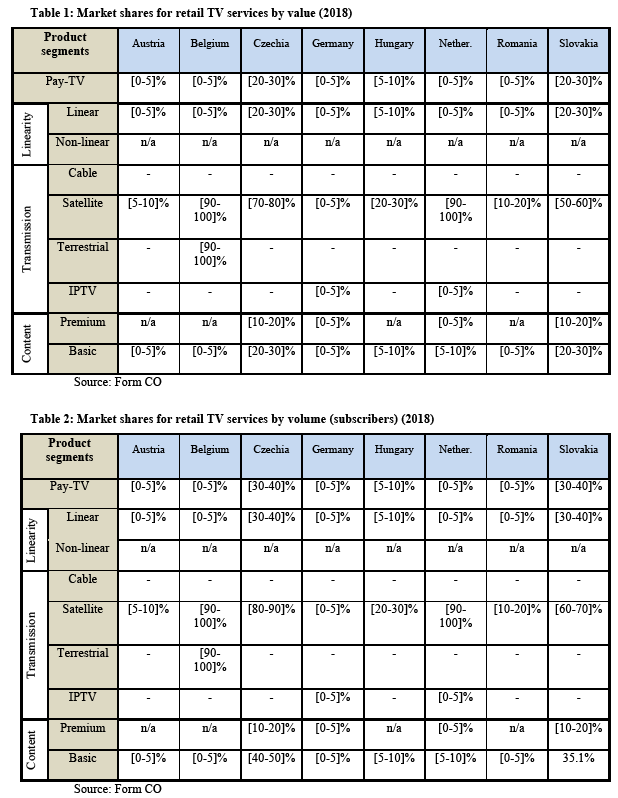

(58) The following tables provide M7’s market shares (56) in the retail pay-TV markets, in value and volume, in the different national markets in the EEA where the Target is active:

(59) On the basis of this data, M7’s market share exceeds 30% in retail pay-TV services in Czechia and Slovakia, in volume terms.

(60) Furthermore, M7’s market share exceeds 30% in the following segments of the retail pay-TV market:

(a) in Czechia and in Slovakia, in the possible segment of the provision of basic pay-TV services, in volume terms;

(b) in Belgium, Czechia, the Netherlands and Slovakia, in the possible segment of the retail provision of pay-TV services by satellite (in value and volume);

(c) in Belgium, in the possible segment of the retail provision of pay-TV services by terrestrial TV (in value and volume).

(61) The vertical link between the licencing of TV content upstream and the wholesale supply of television channels downstream does not give rise to any affected markets. (57) With regard to Canal +’s activities on the upstream market, the Notifying Party confirms that it has a market share [Information related to the extent of Canal+ market presence] below 30% in all plausible segments in all national markets or linguistic regions in which M7 is active on the downstream market. M7’s activities as a TV broadcaster in Czechia, Romania and Slovakia and as a wholesale distributor of TV channels in Germany are [Information related to the extent of M7’s market presence] limited and its market shares remain [Information related to the extent of M7’s market presence] below 20% in any plausible segments of these markets. (58)

(62) Therefore, the only markets vertically affected by the Transaction are the following:

(a) the upstream markets for the production, licensing and acquisition of TV content and the downstream markets for the retail provision of TV services, in Belgium, Czechia, the Netherlands and Slovakia (and corresponding linguistic regions);

(b) the upstream markets for the wholesale supply and acquisition of TV channels and the downstream markets for the retail provision of TV services, in Belgium, Czechia, the Netherlands and Slovakia (and corresponding linguistic regions).

(63) M7 is only active in the provision of retail pay-TV services. Moreover, in several of the relevant Member States, notably in Belgium and in the Netherlands, there is in any case a limited offer of FTA TV services. (59) Therefore, while the Transaction gives rise to an affected market for the retail provision of TV services, the Commission will assess the impact of the Transaction only on the narrower market for the retail provision of pay-TV services.

(64) M7’s activities in the downstream market for the provision of retail pay-TV services relate to at most nationally defined markets. Therefore, the Commission’s assessment of vertical effects focusses on the relevant Member States. In particular, the Commission notes that M7 is not active as a TV retailer in France and the Commission’s assessment covers Belgium and the Netherlands in any case. Nevertheless, where relevant, the Commission’s assessment takes into account evidence in relation to the linguistically homogenous regions.

(65) Where there are vertically affected markets, two possible forms of foreclosure may arise. The first is where the merger is likely to raise the costs of downstream rivals by restricting their access to an important input (input foreclosure). The second is where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base (customer foreclosure). (60)

(66) Section 5.2 assesses the possible input foreclosure concerns and Section 5.3 the possible customer foreclosure concerns arising from the Transaction.

5.2. Input foreclosure

5.2.1. Introduction

(67) The Transaction will bring about a vertical relationship with regard to the production, licensing and acquisition of TV content and the wholesale supply and acquisition of TV channels. M7 operates as a purchaser of TV channels (which it integrates in its TV retail offers) and, more marginally, of TV content (to provide non-linear services to its retail customers) while Canal + is active on the supply- side as a producer/licensor of TV content and wholesale provider of TV channels.

(68) In a merger between companies that operate at different levels of the supply chain, anti-competitive effects may arise when the merged entity’s behaviour could limit or eliminate competitor’s access to supplies – input foreclosure.

(69) In assessing the likelihood of an anticompetitive input foreclosure scenario, the Commission examines: (i) whether the merged entity would have post- Transaction the ability to substantially foreclose access to input; (ii) whether the merged entity would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental impact on effective competition downstream. (61)

5.2.2. Production, licensing and acquisition of TV content

(70) This section assesses the risk of input foreclosure with regard to TV content as a result of the Transaction, in the four affected national markets (Belgium, Czechia, the Netherlands and Slovakia) as well as the corresponding linguistic regions.

5.2.2.1. Notifying Party’s view

(71) The Notifying Party submits that it would not have the ability to engage in input foreclosure post-Transaction vis-à-vis providers of retail pay-TV services as it would not be typical for these operators, such as M7, to purchase content directly from content producers. In fact, mainly TV broadcasters purchase content in order to package them into TV channels, while retail pay-TV operators purchase TV channels (and not “unpackaged” TV content), which they then supply to consumers. It is even less typical for retail pay-TV providers to commission TV content. (62)

(72) Consistently, Canal +’s sales of TV content directly to the retail level of the television value chain are [Information related to Canal +’ content sales]. During the period 2016 to 2018 Canal + sold [Information related to Canal +’ content sales] to retail pay-TV operators in Czechia, the Netherlands and Slovakia, while Canal + sold [Information related to Canal +’ content sales and customers] in Belgium in [Information related to Canal +’ content sales]. (63) Canal+ also licenced [Information related to Canal +’ content sales and customers], for which the geographic scope of the licence covered some or all of the four Member States concerned. (64)

(73) Therefore, in the absence of any significant sales to retail pay-TV operators, the merged entity could not be considered to have any means to engage in input foreclosure regarding TV content with respect to its downstream retail pay-TV competitors. (65)

5.2.2.2. Commission’s assessment

(a) Ability to engage in input foreclosure

(74) In the market for the production, licensing and acquisition of TV content, Canal + is active both as a producer of original content and as an acquirer of broadcasting rights from other studios. As regards the potential segmentation according to content type, Canal + is active in the film segment (both with produced and acquired films and TV series) and to a more limited extent in the segment of other TV content (with acquired content), mostly with documentaries. As regards the segmentation according to the exhibition window, Canal + is present in each of the following relevant segments: (i) SVOD; (ii) TVOD; (iii) PPV; (iv) first pay- TV window; (v) second pay-TV window; and (vi) free-to-air (“FTA”). (66) In Belgium, Czechia, the Netherlands and Slovakia, Canal + licenses films [Information related to the modus operandi of Canal + with regard to content licensing] while it has generated [Information related to Canal +’ sales associated to the licensing of content] from other TV content in the period 2016-2018. (67)

(75) The Commission notes that the Notifying Party has not provided specific market shares, as Canal + does not track its market share in this sector in any geographic area outside of France, its home market. However, on the basis of market intelligence and internal estimates, the Notifying Party estimates that its market shares are [Information related to the extent of Canal +’ market presence] below 10% (in the last three calendar years of 2016, 2017 and 2018) in all plausible sub- segments in Belgium, Czechia, the Netherlands and Slovakia (including linguistically homogenous geographic areas encompassing several Member States, i.e., France and the French speaking parts of Belgium as well as the Netherlands and the Dutch speaking parts of Belgium). (68)

(76) Canal +’s competitors in the film segment and in all of the exhibition window segments are mostly the same across all EU Member States. Indeed, in Czechia, the Netherlands and Slovakia, Canal +’s main competitors are Disney/Fox, Warner, Sony, Universal and Paramount/Viacom, while in Belgium, Canal +’s main competitors are Gaumont, Pathé, Disney/Fox, Universal and Warner. (69), (70)

(77) Consistent with the description of the TV value chain in Section 4.1, the vast majority of Canal +’s sales of TV content are made to TV broadcasters, which are active on the market for the wholesale supply and acquisition of TV channels, and not directly to retail providers of TV services, such as M7. In fact, Canal +’s sales of TV content directly to retail providers of TV services have been [Information related to Canal +’ TV content sales] in Belgium and [Information related to Canal +’ TV content sales] in Czechia, the Netherlands and Slovakia in the last three years. Canal +’s role as provider of TV content to M7’s competitors at the retail level is therefore marginal.

(78) Finally, a large majority of respondents to the market investigation considers that the Transaction will have a neutral impact on competition in the TV value chain in Belgium, Czechia, the Netherlands and Slovakia. (71)

(79) Given the merged entity’s limited market position with regard to the production, licensing and acquisition of TV content in Belgium, Czechia, the Netherlands and Slovakia and the corresponding linguistic areas, in particular with respect to retail TV operators, the Commission considers that the merged entity would not have the ability to foreclose its downstream rivals.

(b) Incentive to engage in input foreclosure

(80) Very few respondents to the market investigation consider that the merged entity would have the incentive to exclusively supply some of its TV content to M7 and not to other providers of retail pay-TV services, or to otherwise degrade the terms and conditions on which it provides access. (72) Specifically, these respondents fear that the merged entity may try to impose licensing agreements covering several Member States, such as Belgium and France.

(81) The Commission notes that M7 plays a [Information related to M7’s business strategy] role as acquirer of TV content, limited to the acquisition of rights for catch-up services and VOD catalogues as add-ons to its linear pay-TV packages. M7’s VOD catalogue is not available to customers without a subscription to M7’s pay-TV service. (73) Therefore, Canal + is likely to continue to rely on licensing revenues from acquirers other than M7.

(82) Furthermore, considering the [Information related to Canal +’ business strategy] relevance of Canal +’s TV content offer in Belgium with a market share [Information related to the extent of Canal +’ market presence] below 10% in all plausible markets and segments and the significant position of alternative content suppliers (see paragraph (76)), foreclosing access to Canal +'s content would not significantly affect the merged entity's downstream revenues. Therefore, any additional retail revenues would not outweigh the likely upstream losses in the supply of TV content. Specifically with regard to France, the Commission notes that the merged entity's downstream footprint and thus incentives remain unchanged as M7 is not active as a retail provider of TV services in France.

(83) The territorial scope of the licence for TV content is determined on a case-by-case basis and depends on the requirements of the licensees. Both TV broadcasters and distributors of TV channels (as well as TV retailers) will generally licence the TV content for the territories in which they are active. (74) This is also evidenced by information provided by the Notifying Party which illustrates that licensing agreements can cover a single Member State, several Member states or can be worldwide in scope. In any event, the Transaction does not affect the merged entity's incentive to enter into single- or multi-territory licensing agreements with third parties in light of M7's marginal position as an acquirer of TV content. More generally, since Canal + does not generally sell TV content directly to TV retailers, whether for a single Member State or for several territories with the same agreement, the acquisition of M7’s retail TV operations will not have an impact on Canal + TV content licensing strategy. (75)

(84) The merged entity is therefore unlikely to have the incentive to foreclose competing TV services retailers from its TV content in Belgium, Czechia, the Netherlands and Slovakia and in the corresponding linguistic regions.

(c) Impact on effective competition

(85) Regardless of whether the merged entity has either the ability or the incentive to foreclose competing downstream rivals with regard to the supply of TV content, such strategy would not have an appreciable impact on competition.

(86) The role of Canal + as provider of TV content in each of Belgium, Czechia, the Netherlands and Slovakia is marginal, in particular with respect to sales to retail TV providers.

(87) Moreover, many alternative providers of TV content would remain active in the markets concerned (see paragraph (76)). Competing providers of TV retail services would therefore continue to have access to a large variety of TV content.

(d) Conclusion

(88) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects with regard to TV content to the detriment of competing providers of TV retail services in Belgium, Czechia, the Netherlands and Slovakia as well as in the corresponding linguistic regions.

5.2.3. Wholesale supply of TV channels

(89) This section assesses the risk of input foreclosure with regard to TV channels as a result of the Transaction, in the four affected national markets (Belgium, Czechia, the Netherlands and Slovakia) as well as the corresponding linguistic regions.

5.2.3.1. The Notifying Party's view

(90) The Notifying Party submits that the merged entity would not have the ability to foreclose downstream retail pay-TV competitors. It argues that none of the channels produced or distributed by Canal + are indispensable and could therefore be considered to confer the ability on the merged entity to engage in a vertical input foreclosure strategy. (76) As a TV broadcaster, Canal + sells only a limited number of its own pay-TV channels in Belgium. (77) As a wholesale supplier of third-party TV channels, Canal + is active via its subsidiary Thema worldwide, including in Belgium, Czechia, the Netherlands and Slovakia. Thema typically distributes TV channels outside their home market as well as [Information related to Canal +’ business strategy] thematic channels. (78)

(91) In addition, the merged entity would not have any incentive to engage in an input foreclosure strategy, as it would not be profitable for Canal + to refuse to supply its own channels to pay-TV retailers other than M7, because the potential increase in M7’s customer base could not compensate for the loss of actual or potential subscribers on other retail platforms.- (79)

5.2.3.2. The Commission's assessment

(a) Ability to engage in input foreclosure

Belgium

(92) In the market for the wholesale supply of pay-TV channels, Canal + is present both in basic pay-TV and premium pay-TV. (80) It is present in the following thematic categories: news, sports, youth, factual and general entertainment. The channels sold by Canal + are linear channels, some of which include catch-up services. In terms of the infrastructure used by the retail pay-TV operator, the customers of Canal + use all distribution technology (cable, satellite, terrestrial, IPTV and OTT). (81)

(93) The total revenues generated in Belgium in 2018 by Canal + as TV broadcaster and channel wholesale TV distributor are about [Information related to Canal +’ revenues]. On the basis of this [Information related to Canal +’ revenues] amount, the Notifying Party estimates that its share in the wholesale supply of TV channels and in each possible segment where it is present is [Information related to the extent of Canal +’ market presence] below 10% in the last three years (2016, 2017, 2018). (82)

(94) The Commission notes that Canal +’s limited market position at the wholesale level of the television value chain in Belgium is further demonstrated by the fact that the market report of the Belgian Conseil Supérieur de l’Audiovisuel does not cover any of the channels that Canal + broadcasts (or Thema distributes, see paragraph (96) below) in Belgium. (83) Even in the geographic area encompassing both Belgium and France, Canal + estimates that its market share in the market for the supply of TV channels remains below 30% in all plausible sub-segments. (84)

(95) The Notifying Party has also provided data on Canal +’s channels and channels’ packages that are available in the retail pay-TV operators’ premium packages. In Belgium, Canal + mainly sells its TV channels to [Information related to Canal +’ customers] and [Information related to Canal +’ customers], two TV retailers that offer the same channel package under the brand [Information related to Canal +’ customers], and [Information related to Canal +’ customers], a TV broadcaster and distributor that offers channel packages, consisting of its own and third-party channels, to subscribers of other retail pay-TV operators. (85), (86) Therefore, BeTV is not a direct competitor of M7. The data provided shows that the number of subscribers who opted for packages including Canal +’s channels are limited compared with the total subscriber base of these respective operators. (87) This suggests that those channels are not essential for providers of TV services to effectively compete in the downstream market.

(96) With particular regard to the TV channels distributed in Belgium by Canal +’s subsidiary Thema, the Commission notes that Thema has exclusive rights for only [Information related to Thema’s exclusive distribution rights] out of [Information related to Thema’s exclusive distribution rights] channels for which it has distribution rights in Belgium. Moreover, Thema sold a single channel (i.e., RTNC) that it distributes on an exclusive basis in Belgium. (88) In addition, Thema distributed two of Canal +'s channels, A+ and Nollywood TV, in Belgium. (89) The number of subscribers to the package including these channels is [Information related to the number of subscribers to the package including Canal +’ channels]. (90) Thema sold rights to [Information related to the number of subscribers to the package including Canal +’ channels] in Belgium, including distribution on exclusive and non-exclusive basis. The only channel currently sold to M7 is Stingray iConcerts, for which Thema [Information related to Thema’s distribution rights]. (91) Furthermore, the Commission notes that the TV channels for which Canal + has distribution rights in Belgium are mainly foreign TV channels and [Information related to Canal +’ business strategy] thematic channels with limited potential demand.

(97) Therefore, the channels broadcast by Canal + and Thema in Belgium are not essential for providers of TV services to effectively compete in the downstream market and thus do not allow the merged entity to engage in input foreclosure vis- à-vis M7’s competitors.

(98) Moreover, several important competitors would remain active and would continue to offer TV channels in each of the concerned segments, such as: Disney Cinema, beCiné, Movies & Series, TCM Cinéma, Action and Sundance TV for films; Comedy Central, RTL9, MTV, MCM and E Entertainment for entertainment; Eurosport, Zoom, Eleven Sports, Sport 10, Be Sport, Extreme Sports and Motorvision TV for sport; Nickelodeon, Disney Channel, Disney Junior, Disney XD, Disney Cinema HD, Cartoon Network, Studio 100, Baby TV, Boomerang for children; Discovery, National Geographic, National Geographic Wild, Viceland, Science et Vie TV, Histoire for documentaries; and Euronews, France 24, LCI, and BFM TV for news.

(99) Finally, a large majority of respondents to the market investigation considers that the Transaction will have a neutral impact on competition in the TV value chain in Belgium. (92)

Czechia

(100) In the market for the wholesale supply of pay-TV channels in Czechia, Canal + is present only as a wholesale distributor of TV channels through its subsidiary Thema. Thema has distribution rights in Czechia for about [Information related to Thema’s distribution rights] channels and has exclusive distribution rights for [Information related to Thema’s distribution rights] among them. (93) In the years 2016-2018, Thema sold [Information related to Thema’s sales] channels to Czech pay-TV operators, notably [Information related to Thema’s distribution rights], for which it [Information related to Thema’s distribution rights]. The only channel currently sold to M7 is Stingray iConcerts. (94) The total revenues generated by Thema in Czechia in 2018 amounted to about [Information related to revenues generated by Thema]. (95)

(101) The current activity of Canal + in Czechia in the wholesale TV market is therefore [Information related the extent of Canal +’market presence]. Furthermore, the TV channels for which Canal + has distribution rights in Czechia are mainly foreign TV channels and [Information related to Canal +’ business strategy] thematic channels with limited potential demand.

(102) Therefore, the channels broadcast by Canal + and Thema in Czechia are not essential for providers of TV services to effectively compete in the downstream market and thus do not allow the merged entity to engage in input foreclosure vis- à-vis M7’s competitors.

(103) Finally, a large majority of respondents to the market investigation considers that the Transaction will have a neutral impact on competition in the TV value chain in Czechia. (96)

Netherlands

(104) In the market for the wholesale supply of pay-TV channels in the Netherlands, Canal + is present only as a wholesale distributor of TV channels through its subsidiary Thema. Thema has distribution rights in the Netherlands for about [Information related to Thema’s distribution rights] channels and has exclusive distribution rights for [Information related to Thema’s distribution rights] among them. (97) In the years 2016-2018, Thema sold [Information related to Thema’s sales] channels to Dutch pay-TV operators and a foreign country package including 5-10 channels, depending on the year and the operator. Thema sold a single channel (i.e., Zen TV) [Information related to Thema’s distribution rights]. (98) The only channel currently sold to M7 is Stingray iConcerts. (99) The total revenues generated by Thema in the Netherlands in 2018 amounted to about EUR [Information related to Thema’s revenues]. (100)

(105) The current activity of Canal + in the Netherlands in the wholesale TV market is therefore [Information related the extent of Canal +’market presence]. Furthermore, the Commission notes that the TV channels for which Canal + has distribution rights in the Netherlands are mainly foreign TV channels and [Information related to Canal +’ business strategy] thematic channels with limited potential demand.

(106) Moreover, Zen TV competes with several channels, such as BBC Entertainment, Discovery, Travelxp, Voyage, Viceland, E!, Fashion TV, arte, My Cuisine and Science et Vie TV. (101)

(107) Therefore, the channels broadcast by Canal + and Thema in the Netherlands are not essential for providers of TV services to effectively compete in the downstream market and thus do not allow the merged entity to engage in input foreclosure vis-à-vis M7’s competitors.

(108) Finally, a large majority of respondents to the market investigation considers that the Transaction will have a neutral impact on competition in the TV value chain in the Netherlands. (102)

Slovakia

(109) In the market for the wholesale supply of pay-TV channels in Slovakia, Canal + is present only as a wholesale distributor of TV channels through its subsidiary Thema. Thema has distribution rights in Slovakia for about [Information related to Thema’s distribution rights] channels and has exclusive distribution rights for [Information related to Thema’s distribution rights] among them. (103) In the years 2016-2018, Thema sold [Information related to Thema’s sales] channels to Slovakian pay-TV operators. Thema sold only [Information related to Thema’s sales] (i.e., Zen TV and Luxe TV) [Information related to Thema’s distribution rights]. (104) The only channel currently sold to M7 is Stingray iConcerts. (105) The total revenues generated by Thema in Slovakia in 2018 amounted to about EUR [Information related to the revenues generated by Thema]. (106)

(110) The current activity of Canal + in Slovakia in the wholesale TV market is therefore [Information related the extent of Canal +’market presence]. Furthermore, the Commission notes that the TV channels for which Canal + has distribution rights in Slovakia are mainly foreign TV channels and [Information related to Canal +’ business strategy] thematic channels with limited potential demand.

(111) Moreover, like Zen TV, Luxe TV competes with several channels, such as Viceland, E! and Fashion TV. (107)

(112) Therefore, the channels broadcast by Canal + and Thema in Slovakia are not essential for providers of TV services to effectively compete in the downstream market and thus do not allow the merged entity to engage in input foreclosure vis- à-vis M7’s competitors.

(113) Finally, a large majority of respondents to the market investigation considers that the Transaction will have a neutral impact on competition in the TV value chain in Slovakia. (108)

Conclusion

(114) Based on the above, the Commission considers that the merged entity is unlikely to have the ability to foreclose competing pay-TV retailers in Belgium, Czechia, the Netherlands and Slovakia post-Transaction.

(b) Incentive to engage in input foreclosure

(115) The large majority of respondents to the market investigation consider that, post- Transaction, the merged entity would not have the incentive to exclusively supply its channels to M7 or to otherwise degrade the terms and conditions on which it provides access. (109) Nevertheless, a few respondents fear that the merged entity may try to impose licensing agreements covering several Member States, for instance Belgium and France. Several respondents refer to Canal +’s business strategy in France to accumulate exclusive distribution rights.

(116) The Commission notes that, at present, Canal +’s revenues from TV broadcasting are largely accounted for by acquirers other than M7 in each of the concerned Member States. M7 is projected to generate approximately [0-5]% of Canal +’s revenues from the licensing of its TV channels in Belgium in 2019 (taking into account the latest distribution agreements) and generated less than [0-5]% of Thema’s revenues from the distribution of TV channels in Belgium, Czechia, the Netherlands and Slovakia in 2018. (110) An input foreclosing strategy would seriously affect the vast majority of the merged entity’s revenues. Therefore, Canal + is likely to continue to rely on licensing revenues from acquirers other than M7.

(117) Thema’s business model is based on the distribution of third parties’ TV channels outside their home market as well as of [Information related to Thema’s business strategy] thematic channels. TV broadcasters rely on Thema to sell their channels in countries in which they are not present and have no in-depth knowledge of the market. The objective of the TV broadcasters distributed by Thema is therefore to ensure the widest possible distribution of their channels and [Information related to Thema’s business strategy] for their channels. It follows that [Information related to Thema’s business strategy on distribution agreements]. (111)

(118) Furthermore, considering the [Information related the extent of Canal +’market presence] relevance of Canal +’s TV channels offer in the concerned Member States and the significant position of alternative channel suppliers (see paragraphs

(92) and (114)), it is unlikely that input foreclosure would result in material diversion from rivals to M7 at the downstream level. Therefore, additional retail revenues could not outweigh the likely wholesale losses.

(119) Specifically with regard to France, the Commission notes that the merged entity's downstream footprint and thus incentives remain unchanged as M7 is not active as TV retailer in France.

(120) With regard to multi-territory licensing, the Commission notes that the Transaction does not affect the merged entity's incentive to enter into single- or multi-territory licensing agreements with third parties. Currently, it is common in the sector that negotiations take place separately for each Member State. (112) Specifically with regard to multi-territory agreements concerning the linguistic regions affected by the Transaction, the Commission notes the following:

(a) Belgium and the Netherlands: Canal + does not broadcast TV channels in the Netherlands or to a Dutch speaking audience, which could be subject to multi-territory agreements covering Belgium and the Netherlands;

(b) Belgium and France: While Canal + broadcasts TV channels in France and Belgium and, post-Transaction, Canal + will be present at the retail level of the television value chain in both France (Canal +) and Belgium (M7), the Transaction will not have an impact on Canal +’s incentive to enter into multi-territory agreements covering France and Belgium with competing TV retailers as no TV retailer is present in both France and Belgium. Therefore, there can be no demand for Canal +’s channels covering both territories. (113)

(121) As a result, the merged entity is unlikely to have the incentive to foreclose competing providers of TV retail services from its TV channels in the relevant Member States and corresponding linguistic regions.

(c) Impact on effective competition

(122) Even in the hypothetical situation that the merged entity were to have either the ability or the incentive to foreclose competing downstream rivals with regard to the wholesale supply of pay-TV channels, such a strategy would not have an appreciable impact on competition.

(123) As detailed above in paragraphs (92) to (114), Canal +’s activities on the market for the wholesale supply of TV channels as TV broadcaster and wholesale supplier of TV channels are limited in Belgium, and [Information related to the extent of Canal +’market presence] in Czechia, the Netherlands and Slovakia. In any case, there are several providers of pay-TV channels that compete with Canal +'s channels in all relevant segments will remain active post-Transaction. Therefore, even if the merged entity were to adopt a foreclosure strategy, downstream rivals would continue to have access to sufficient alternative inputs.

(d) Conclusion

(124) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects with regard to TV channels to the detriment of competing retail providers of TV retail services in Belgium, Czechia, the Netherlands and Slovakia as well as in the corresponding linguistic regions.

5.3. Customer foreclosure

5.3.1. Introduction

(125) The Transaction will bring about a vertical relationship with regard to the production, licensing and acquisition of TV content and the wholesale supply of TV channels. M7 operates as a purchaser of TV channels (which it integrates in its TV retail offers) and, more marginally, of TV content (to provide non-linear services to its retail customers) while Canal + is active as a producer/licensor of TV content and wholesale provider of TV channels.

(126) According to the Non-Horizontal Merger Guidelines a downstream firm being part of a vertical merger may refuse to buy inputs from its rivals input suppliers as a result of the Transaction. This incentive to foreclose access to customers downstream may result from the vertical integration of an upstream supplier with an important customer downstream. Due to their downstream presence, the merged entity may foreclose its upstream rivals' access to an important customer base. In turn this can inhibit upstream rivals to effectively compete. (114)

(127) In television markets, different forms of customer foreclosure may occur. First: (i) intermediate TV channel wholesalers; or (ii) downstream providers of retail TV services may cease to purchase TV content from upstream rivals in the market for the supply of TV content. Second, downstream providers of retail TV services may cease to buy TV channels from their rivals at the intermediate level for the wholesale supply of TV channels.

5.3.2. Supply of TV content

(128) This section assesses whether post-Transaction, the merged entity would have the ability and incentive to cease acquiring TV content from its upstream rivals to be sold by the merged entity directly to end users. It then assesses what the overall likely effect on competition would be.

5.3.2.1. Notifying Party's views

(129) The Notifying Party argues that, post-Transaction, it would neither have the ability nor the incentive to foreclose its upstream rivals in the market for the supply of TV content for the following reasons.

(130) First, the market share of the merged entity in the downstream market for the provision of retail TV services would fall below the level that could be considered to be sufficient for it to engage in a customer foreclosure strategy. In Czechia and Slovakia, M7’s market share would be above 30% in volume (subscribers) terms only, but below 30% in value terms. In Belgium and the Netherlands, market shares would be higher than 30% only in a hypothetical segmentation per distribution infrastructure. A market share higher than 30% in the segment of satellite retail pay-TV and terrestrial pay-TV bears no relevance regarding the merged entity’s ability to engage in customer foreclosure. (115)

(131) Second, the merged entity would not have the incentive to engage in customer foreclosure. M7’s commercial success is based on being able to offer a diversified package of TV content. The content supplied by the merged entity would by no means be sufficient to ensure that it could compete robustly at the downstream level. (116)

(132) Third, the value of M7’s purchases of TV content directly from suppliers at the content level of the television value chain is negligible and would not be sufficient to have any impact in the market, let alone to allow the merged entity to pursue customer foreclosure. (117)

(133) The merged entity’s inability to engage in customer foreclosure would be further confirmed by the presence of larger international online content retailers, such as Netflix, Amazon Prime or Apple, that represent an important outlet for original content at the retail level. (118)

5.3.2.2. The Commission’s assessment

(a) Ability to engage in customer foreclosure

(134) When considering whether the merged entity would have the ability to foreclose access to downstream markets, the Commission examines whether there are sufficient economic alternatives in the downstream market for upstream rivals to sell their output.

(135) In this respect and considering the position of the merged entity at the retail level, the Commission notes that:

(a) in Belgium, M7 is the only retail pay-TV provider offering satellite and terrestrial TV services. However, considering all technologies, M7 has a [Information related to the extent of Canal +’market presence] market share, lower than [5-10]% in all plausible sub-segments. There are other relevant retail pay-TV operators holding much higher market shares in the market for the provision of retail pay-TV services (Telenet 40-50%, Proximus 20-35% and Voo 10-20%, range by volume and value) which are active in all plausible sub-segments (by linearity and content);

(b) in Czechia, M7 has a market share of [20-30]% (value) and [30-40]% (volume) in the market for the provision of retail pay-TV services, which is slightly higher in the basic pay-TV segment and significantly higher in the satellite segment ([70-80]% (value) and [80-90]% (volume)). There are other relevant retail pay-TV operators with significant market shares both in value and volume terms: UPC Cable (20-30%), O2 (10-20%) and T- Mobile (0-10%). Moreover, M7’s market share has been declining in the period 2016-2018 while competitors’ shares have increased;

(c) in the Netherlands, M7 is the main operator in the satellite segment, with a market share of [90-100]% in value and volume terms. However, considering all technologies, M7 has a [Information related to the extent of M7’s market presence] market share, inferior to [5-10]% in all plausible sub-segments. There are other relevant retail pay-TV operators with much higher market shares in the market for the provision of retail pay-TV services (Ziggo 50-60%, KPN 20-35%) which are active in all plausible sub-segments (by linearity and content);

(d) in Slovakia, M7 has a market share of [20-30]% (value) and [30-40]% (volume) in the market for the provision of retail pay-TV services, which is slightly higher in the basic pay-TV segment and significantly higher in the satellite segment ([50-60]% (value) and [60-70]% (volume)). There are other relevant retail pay-TV operators with significant market shares: Slovak Telekom (30-50%,) and UPC Cable (10-20%). Moreover, M7’s market share has been declining in the period 2016-2018 while competitors’ shares have increased. (119)

(136) Therefore, the Commission considers that, post-Transaction, the merged entity will not have a significant degree of market power in the downstream market for the retail provision of TV services (or in any plausible sub-segment thereof) in the Member States concerned.

(137) In any case, the Commission notes that, irrespective of its position in the markets for the provision of retail TV services, the role of M7 as direct acquirer of TV content is [Information related to the extent of M7’s market presence and role as direct role as direct acquirer of TV content]. As already explained at paragraph (81), M7 offers catch-up services as well as a VOD library to its customers in the countries where it is active as a pay-TV retailer. With regard to its catch-up services, M7 does not purchase these rights from suppliers at the content level of the television supply chain but rather from TV broadcasters and wholesale TV distributors. With regard to its VOD library, the uptake of this offering is limited and thus M7’s licensing fees are marginal. In 2018, M7 paid licensing fees to (i) [Information related to the payment of licensing fees] for access to its film catalogue (EUR [Information related to the payment of licensing fees]) and (ii) content licensors for its customers’ TVOD purchases (EUR [Information related to the payment of licensing fees]). (120) Therefore, M7’s market shares mentioned above in the relevant retail TV markets are not an adequate indicator of M7’s role as direct purchaser of TV content.

(138) In general, the main acquirers of TV content are TV broadcasters and not traditional retail TV providers as M7. At the retail level, large international online content pay TV-retailers, such as Netflix, Amazon Prime or Apple, that are active mainly in the provision of non-linear services and normally directly acquire the TV content for their libraries play an increasing role as acquirers of TV content. These players, active worldwide, represent a new, important customer group of acquirers for TV content producers. (121)

(139) Finally, none of the respondents to the market investigation raised concerns related to risks of customer foreclosure with respect to competing providers of TV content in Belgium, Czechia, the Netherlands and Slovakia. (122)

(140) Given the merged entity’s marginal role as acquirer of TV content in Belgium, Czechia, the Netherlands and Slovakia, and the presence of relevant alternatives, the Commission considers that it would not have the ability to foreclose its upstream rivals in the market for the production, licensing and acquisition of TV content.

(b) Incentive to engage in customer foreclosure

(141) The Commission does not consider that the merged entity would have the incentive to foreclose access to downstream markets by reducing purchases from upstream rivals for the following reasons.

(142) The attractiveness of a pay-TV operator's offer to consumers is based on the richness of the bundle of content and channels broadcast through its platform. (123) On this basis, the merged entity would not have the incentive to cease purchasing TV content from upstream competitors. As mentioned above in paragraph (77), Canal +’s sales of TV content to TV retailers have been [Information related the extent of Canal +’ sales] in Belgium and [Information related the extent of Canal +’ sales] in Czechia, the Netherlands and Slovakia in the last three years. Canal +’s role as provider of TV content at the retail level is [Information related to the extent of Canal +’market presence] and the merged entity would not have an incentive to restrict its VOD offering to Canal +’s content.

(143) The merged entity will therefore not have the incentive to foreclose competing TV content providers in Belgium, the Netherlands, Czechia and Slovakia and corresponding linguistic regions.

(c) Impact on competition

(144) A broad range of alternative TV broadcasters and content platform operators compete to acquire TV content in each of the relevant Member States and linguistic regions, each of which will continue to be credible purchasers of TV content post-Transaction thus allowing rival upstream licensors to continue to operate efficiently. Moreover, considering the marginal role of M7 as acquirer of TV content, a customer foreclosure strategy would not have any appreciable impact on TV content providers. In light of this, the Commission does not consider that a potential customer foreclosure strategy for content would have a material effect on competition in Belgium, Czechia, the Netherlands and Slovakia and the corresponding linguistic regions.

(d) Conclusion

(145) In light of the above, the Commission concludes that the Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of customer foreclosure for the supply of TV content in Belgium, Czechia, the Netherlands and Slovakia as well as in the corresponding linguistic regions.

5.3.3. Wholesale supply of TV channels

(146) This section assesses whether post-Transaction, the merged entity would have the ability and incentive to cease acquiring TV channels from its upstream rivals and assesses what the overall likely effect on competition would be.

5.3.3.1. The Notifying Party's view

(147) The Notifying Party argues that, post-Transaction, there would not be any customer foreclosure concerns for the following reasons.

(148) First, the market share of the merged entity in the downstream market would fall below the level that could be considered to be sufficient for it to engage in a customer foreclosure strategy. In Czechia and Slovakia, M7’s market share would be above 30% in volume (subscribers) terms only, but below 30% in value terms. In Belgium and the Netherlands market shares would be higher than 30% only in a hypothetical segmentation per infrastructure. A market share of higher than 30% in the segment of satellite retail pay-TV and terrestrial pay-TV bears no relevance regarding the merged entity’s ability to engage in customer foreclosure. (124)

(149) Second, the merged entity would not have the incentive to engage in customer foreclosure. Such a strategy would be immediately defeated by the fact that the merged entity’s wholesale offering cannot replace the channels that M7 currently purchases from wholesalers in Belgium, the Czechia, the Netherlands and Slovakia. There are no local channels or particularly important channels in the merged entity’s offering. Thema, in particular, focuses on offering international and thematic channels. Without offering local channels, the merged entity would not be able to continue to compete in the downstream market. (125)

5.3.3.2. The Commission's assessment

(e) Ability to engage in input foreclosure

(150) At the outset, for customer foreclosure to be a concern, the Transaction must involve a company with a significant degree of market power as a customer in the downstream market. (126)

(151) As discussed in paragraphs (135) to (136), the merged entity will not have a significant degree of market power in the downstream market for the retail provision of TV services (or in any plausible sub-segments) in the Member States concerned. The Notifying Party confirms that its position with regard to the acquisition of TV channels is accurately reflected by its downstream market share in value terms. (127)

(152) With regard to Belgium and the Netherlands, M7’s market share in the market for the provision of pay-TV services is smaller than [5-10]% and [5-10]%, respectively, in all plausible segments and there are several significant competitors active on these markets: Telenet, Proximus and Voo in Belgium; Ziggo and KPN in the Netherlands. Therefore, the merged entity would not have the ability to harm upstream rivals based on partial (e.g., reduction of carriage fees) or total (e.g., termination of carriage agreements) foreclosure strategy. Even if the merged entity attempted to engage in a foreclosure strategy, such strategy would mainly concern the satellite and terrestrial segment and upstream rivals would have the ability to continue and potentially increase their sales with respect to other market segments (cable, IPTV) which represent the large majority of subscribers in Belgium and the Netherlands. Even if the market was segmented on the basis of distribution technology, sales in a different market segment would also qualify as economic alternative for upstream rivals to sell their output. (128)

(153) With respect to Czechia and Slovakia, the satellite segment represents a larger part of the market for the provision of pay-TV services and consequently M7’s overall market share is higher, in the range of 25-40% in Czechia and 20-30% in Slovakia. There are several significant competitors active on these markets: UPC Cable, O2 and T-Mobile in Czechia; Slovak Telekom and UPC Cable in Slovakia. Therefore, the merged entity would not have the ability to harm upstream rivals based on partial (e.g., reduction of carriage fees) or total (e.g., termination of carriage agreements) foreclosure strategy. Even if the merged entity attempted to engage in a foreclosure strategy, upstream rivals would have the ability to continue and potentially increase their sales with respect to other market segments (cable, IPTV, terrestrial) which represent more than half of the subscribers in Czechia and Slovakia.

(154) In any case, as discussed in Section 5.1.3, the TV channels supplied by Canal + and Thema do not constitute particularly important inputs for the provision of retail pay-TV services in Belgium, Czechia, the Netherlands and Slovakia and many of the distributed channels are niche products. Therefore, the merged entity is unlikely to be able to use the threat of switching to Canal +’s product offering in negotiations with competing upstream providers of TV channels.

(155) Finally, none of the respondents to the market investigation raised concerns related to risks of customer foreclosure with respect to competing providers of TV channels in Belgium, Czechia, the Netherlands and Slovakia. (129)

(156) In light of the above, the Commission considers that the merged entity would lack the ability to engage in total or partial customer foreclosure strategies.

(b) Incentive to engage in input foreclosure

(157) The Commission does not consider that the merged entity would have the incentive to foreclose access to downstream markets by reducing purchases from upstream for the following reasons.

(158) Retail pay-TV providers have to offer a diverse portfolio of channels in order to maximise their attractiveness for a large number of viewers. The risk of broad foreclosure strategy not targeting closely competing channels with Canal +'s channels, but foreclosing also channels that are not close competitors to Canal +'s channels can therefore be excluded at the outset. (130)

(159) The Commission notes that it is unlikely that the TV channels supplied by Canal + are particularly attractive (as discussed in Section 5.1.3) or close substitutes of the TV channels currently offered in Belgium, Czechia, the Netherlands and Slovakia.

(160) As confirmed by the Notifying Party, the merged entity could not replace M7’s current wholesale TV distributors with channels supplied by Canal + and Thema, as without offering the many local channels (none of which are supplied by the merged entity), it would not be able to continue to compete effectively in the downstream market. With regard to the channels distributed by Thema, the Commission notes that Thema’s business model is based on the distribution of third parties’ TV channels outside their home market as well as of [Information related to Canal +’ business strategy] thematic channels. Such channels are unlikely to replace significant parts of M7’s channel portfolio in Belgium, Czechia, the Netherlands and Slovakia. With regard to Canal +’s channels sold in Belgium, the Commission considers that these are also not suitable to replace a significant number of TV channels in M7’s current portfolio.

(161) In fact, in order to compete effectively in the downstream market with an attractive offering, M7 currently procures channels from [Information related to M7’s business strategy] different TV wholesalers in Belgium, [Information related to M7’s business strategy] different wholesalers in the Netherlands, [Information related to M7’s business strategy] wholesalers in the Czechia and [Information related to M7’s business strategy] wholesalers in Slovakia. (131) In light of the merged entity’s limited TV channel offering, the merged entity is unlikely to have an incentive to significantly reduce the number of carriage agreements with wholesalers in each of the concerned Member States.

(162) To the contrary, the merged entity faces possible costs if it were to stop procuring certain TV channels from upstream rivals as such strategy would risk to significantly reduce the attractiveness of the merged entity’s downstream offering. (132)

(163) The Commission therefore considers that the merged entity will not have the incentive to foreclose competing TV content providers in the relevant Member States.

(c) Impact on effective competition