Commission, January 30, 2020, No M.9503

EUROPEAN COMMISSION

Judgment

GARDNER DENVER / INGERSOLL INDUSTRIALS

Subject: Case M.9503 – Gardner Denver/Ingersoll Industrials

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 16 December 2019, the European Commission received the notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which Gardner Denver Holdings, Inc. ("GDI") acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Ingersoll-Rand U.S. HoldCo, Inc. ("IR Industrials") (the "Transaction").3 IR Industrials is referred to as the "Target" and together with GDI as the "Parties".

1. THE PARTIES AND THE OPERATION

(2) GDI (US-based) is a provider of air and gas compression equipment and aftermarket parts and services for industrial, energy and medical industries. GDI designs, manufactures and markets compressors, vacuum pumps and blowers for a range of industrial applications.

(3) IR Industrials (US-based) is the industrial business of Ingersoll-Rand (Ireland), active in air and gas compressors, blowers, vacuum pumps, gas systems and services, power tools and material handling systems, as well as utility and consumer low-speed vehicles.

(4) Pursuant to a Separation and Distribution Agreement dated 30 April 2019, Ingersoll- Rand will spin off IR Industrials by either (i) causing Ingersoll-Rand shareholders to receive all of the shares of IR Industrials, or (ii) consummating an offer to exchange shares of IR Industrials for shares of Ingersoll-Rand.

(5) IR Industrials will then be merged with Merger Sub, a corporation wholly-owned by GDI and newly created for the purpose of consummating the Transaction. IR Industrials will continue as the surviving corporation and become a wholly-owned subsidiary of GDI. The separate existence of Merger Sub will cease.

(6) The post-Transaction GDI board will consist of ten members, including seven current GDI directors selected by the GDI board, and three directors selected by Ingersoll Rand. Voting rights will be exercised within the Board of Directors by a simple majority, and Ingersoll Rand will not retain any consent or veto rights. As a result, immediately following closing, IR Industrials will be owned by and solely controlled by GDI, within the meaning of Article 3(1) of the EUMR.

2. UNION DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million.4 Each of them has an EU-wide turnover in excess of EUR 250 million, but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

3. COMPETITIVE ANALYSIS

3.1. Market definition

3.1.1. Air compressors

3.1.1.1. Product market definition

(8) Air compressors are mechanical devices used to increase the pressure of air and reduce its volume. Industrial air compressors are able to release the compressed air at a high velocity and pressure and can be used to drive other machines. Air compressors are used in a wide range of applications including industrial, manufacturing and domestic use.5

(A) The Commission's decisional practice

(9) In Ingersoll-Rand / MAN, the Commission distinguished between (i) air compressors, (ii) process gas compressors, and (iii) air ends.6 The Transaction does not result in reportable markets for process gas compressors, therefore this potential sub-segment will not be further discussed.

(10) The Commission stated in Alchemy / CompAir that air compressors can be segmented in the following categories: (i) portable vs. stationary, (ii) oil-injected vs. oil-free, (iii) by type of technology used and (iv) by capacity, but ultimately left the product market definition open.7

(11) The segmentation based on capacity the Commission used in Ingersoll-Rand / MAN defines (i) large stationary air compressors as having a pressure range from 15 to up to 200 bar, (ii) standard air compressors (mobile and stationary) as covering 4-14 bar and (iii) low pressure machines as covering a range of less than 4 bar.8

(B) The Notifying Party's view

(12) The Notifying Party agrees that air compressors constitute a relevant product market distinct from gas compressors. In any case, the Parties do not overlap in gas compressors in the EEA based on technology.9

(13) The Notifying Party considers that the further segmentation discussed by the Commission in paragraph (10) is appropriate.

(14) The Notifying Party states that segmentation by technology would be relevant. Technologies used in air compressors include rotary screw, water injected screw, dry screw, scroll, rotary vane, rotary lobe, liquid ring, reciprocating piston, and centrifugal.10

(15) The Notifying Party argues that a segmentation by application is unnecessary, as they consider air compressors general purpose products.11

(C) The Commission’s assessment

(16) The Commission considers that air compressors and gas compressors constitute separate markets.12

(17) As will be explained, the Commission considers there can be a further potential sub- segmentation (i) between low, medium and high output pressure air compressors, (ii) between oil-free and oil-lubricated air compressors, (iii) between stationary and portable air compressors and (iv) between air compressors based on different technologies.

(18) First, the results of the market investigation support a distinction between air and gas compressors according to the majority of both competitors and customers, “[b]ecause it is not the same process and […] a different compressor technology. Gas compressor [sic] can convey different type of gas (sometimes including Air) whereas air compressor [sic] can ONLY convey Air.”13 The Commission therefore distinguishes between air and gas compressors. However, only in air compressors is there an overlap resulting in an affected market. Therefore the present Decision will focus on air compressors.

(19) Second, the results of the market investigation confirmed a plausible distinction of types of air compressors by output pressure. A majority of respondents agreed on the main distinction being between low pressure air compressors, called "blowers" (< 2 bar) and other types of air compressors (2 bar or more). There appears to be a “common understanding that the definition of compressor is applicable for the system able to provide a discharge pressure over 2 bar g”. As a competitor explained, “[t]o distinguish air blowers and air compressors is reasonable due to different product types, applications, engineering requirements and mostly different competitive dynamics as well as market channels. Further distinction between medium and high pressure air compressors is necessary.”14

(20) As for this further distinction, suggested by a limited number of competitors and customers, the definition seems to be less clear-cut. For instance, one customer suggests a distinction “between Blower (<2 bar), industrial air compressor (<15 bar) and high pressure compressor (>15 bar)”15. A competitor distinguishes between “standard pressure air compressors 2 - 15 bar g, medium pressure air compressors 16 - 100 bar g, high pressure air compressors above 100 bar g”.16 The Commission considers that the exact split between the markets based on their output pressure can be left open. However, the Parties’ activities in the low and high pressure segments of air compressors do not lead to affected markets. Therefore the present Decision will focus on the medium pressure segment for air compressors.

(21)Third, oil-free and oil-lubricated air compressors can also be regarded as two separate product markets, according to the vast majority of the respondents to the market investigation, as “technology, production costs and prices, health and environment and security aspects etc. are different”.17 Whereas for some applications, oil-free and oil-injected air compressors are substitutes, “[f]or some application field [sic] like Pharma environment, oil-free air compressor is mandatory to avoid contamination by oil”. In addition, “oil-free technology is much more expensive than the oil-injected technology”.18 The Commission considers that a further sub-segmentation based on whether air compressors are oil-free or oil- lubricated can be left open.

(22) Fourth, a small majority of respondents of the market investigation supported a segmentation between stationary and portable air compressors. Respondents noted that in some cases, portable air compressors can substitute stationary air compressors and are “used as a backup compressor in cases when a stationary compressor fails”.19 However, generally applications and customer groups are different as “stationary compressors go mainly into [sic] manufacturing industry, portable compressors mainly into the construction industry”20 and “the cost of ownership is lower for the stationary compressors.”21 The Commission considers that a further sub-segmentation based on whether air compressors are portable or stationary can be left open. The Transaction does not result in reportable markets for portable air compressors, therefore this potential sub-segment will not be further discussed. The present Decision will therefore focus on stationary compressors.22

(23) Fifth, the results of the market investigation also suggested a segmentation by type of technology used. Types of technology that have been mentioned both by the Notifying Party and respondents of the market investigation are piston, rotary vane, screw, centrifugal, etc. Respondents explained that certain technologies are close substitutes and can be interchanged from a technical point of view, but depending on the application, each technology has certain advantages and disadvantages: “the one or the other compressor technology has some specific advantages or disadvantages such as long life time, heat, maintenance, air quality, basically price. So mostly one Technology is leading in a certain application or you have 2 leading technologies.”23 The Commission considers that a further sub-segmentation by type of air compressor technology can be left open.

(24) Sixth, the results of the market investigation show that an additional segmentation by application would not be pertinent. A vast majority of competitors and a majority of customers who responded to the market investigation confirmed this. Most respondents noted that the categories outlined in recitals (18) to (23) would be sufficient, explaining that different technologies could be used for the same application and a specific technology could be used for different applications.24 As a competitor explained, “[c]ompressed air is a very neutral type of energy, comparable to electricity, so the market should not be further sub segmented by application or industry.”25 Therefore, the Commission considers that a further sub- segmentation by application should not be warranted as it was clearly rejected by the market investigation. A further sub-segmentation by application will therefore not be further discussed.

(25) In conclusion, the Commission will analyse the Transaction on the basis of all plausible product markets and combinations of them (as listed below), but will leave the market definition open (except on a potential segmentation by application that will not be discussed as explained in paragraph (24)) as the Transaction does not raise concerns on any plausible market.

3.1.1.2. Geographic market definition

(A) The Commission's decisional practice

(26) The Commission has previously considered the markets for air compressors to be at least EEA-wide, and maybe even global, given the large trade flows and low transportation costs, but has left the definition open.26

(B) The Notifying Party's view

(27) The Notifying Party considers the market for the manufacture and supply of air compressors to be EEA-wide because (i) the competitive landscape and dynamics differ substantially between EEA and the rest of the world, (ii) consumer preferences vary across regions as customers in the EEA have a distinct demand profile from many non-EEA customers, (iii) the Parties organise their sales and marketing organisations by region and (iv) products sold in the EEA must meet EEA specific standards.27

(C) The Commission’s assessment

(28) The market investigation has shown mixed results, according to which the market for air compressors could be EEA-wide or worldwide. A majority of competitors and customers considers the market as worldwide, as “[a]ll main competitors of air compressor deliver worldwide and are in competition in all countries”28 and “[o]nly some smaller compressor packagers supply mainly in their home country.”29 Respondents generally considered regulatory requirements (like for instance the CE- approval) as not constituting entry barriers within or to the EEA.30

(29) Several customers and competitors also note that “[w]ithout nationwide distribution, engineering, maintenance and service network the success of market penetration would be not possible.”31 Nevertheless, the Commission finds that national markets are not appropriate in this case. A majority of competitors who responded to the market investigation stated they would be able to use an existing distributor in order to supply air compressors in a new Member State in the EEA, or use other means. Several competitors argue that other options exist, such as “import by the final customer”32, sale through an independent distributor “as well as sale through online channels.”33

(30) Indeed, none of the competitors who participated in the market investigation are active at national level only, but most of them have activities at a global level (with a focus on developed countries). Even smaller competitors who do not export worldwide confirm that the “same compressors producers are on the whole EU market.”34

(31) In any case, the exact definition of the air compressor market can be left open between the EEA and worldwide, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement even on the narrowest plausible markets on any of the two plausible geographic market definitions.

3.1.2. Vacuum pumps

3.1.2.1. Product market definition

(32) Vacuum pumps remove air or gas to reduce the pressure below atmospheric levels. They have a wide range of applications from domestic to industrial use. Vacuum pumps rely on the same technologies as compressors, but employ them in reverse.35

(A) The Commission's decisional practice

(33) The Commission has not analysed the market for vacuum pumps previously.36

(B) The Notifying Party's view

(34) The Notifying Party considers that vacuum pumps constitute a distinct product from compressors. This is because instead of creating positive air displacement, vacuum pumps create a reduction in pressure. The use of the two products is therefore quite different.

(35) While proposing to leave the market definition open, the Notifying Party argues that, similarly to compressors, vacuum pumps may need to be distinguished for (i) oil- injected vs. oil-free, and (ii) by type of technology used. Indeed, vacuum pumps, similarly to compressors, rely on a range of technologies such as, rotary vane, dry claw, dry screw, rotary lobe, liquid ring, and centrifugal.

(36) The Notifying Party notes that vacuum pumps have a wide range of applications. They are integral to manufacturing processes in applications for packaging, pneumatic conveying, drying, holding / lifting, distillation, evacuation, forming / pressing, removal and coating. Vacuums may also be used for domestic applications such as on automobiles or for draining water in dishwashers.

(37) The Notifying Party argues that a segmentation by application is unnecessary for the reasons outlined in paragraph (24).

(C) The Commission’s assessment

(38) The Commission considers that whether the vacuum pump market must be further segmented can be left open but will consider plausible market distinctions (i) between oil-injected and oil-free vacuum pumps and (ii) by type of technology.

(39) First, the Commission considers that insofar as compressors and vacuum pumps are different in terms of their end use, i.e. one removes air or gas, while the other releases it, compressors and vacuum pumps constitute distinct product markets.

(40) Second, the results of the market investigation support a distinction between oil- injected and oil-free vacuum pumps according to the majority of both competitors and customers that responded. Differences mentioned were the "production costs and prices, health and environment and security aspects etc. […]."37 Respondents also raised the fact that "regulation may require pumps to be oil-free in an increasing number of applications. As a result, production of oil-free products is steadily increasing. This means that rotary lobe pumps are becoming more common than rotary vane pumps which require oil-lubrication."38

(41) Third, the results of the market investigation support a distinction by type of technology used according to the majority of both competitors and customers that responded. Types of technologies for vacuum pumps mentioned by the Notifying Party and respondents to the market investigation were rotary lobe, claw, screw, side channel, radial, etc. Different technologies are not necessarily substitutable with one another. As explained by a competitor: "[g]enerally vacuum pumps cannot easily be substituted. There are three criteria for the choice of a specific technology:

(a) Compatibility with the application (e.g. for certain applications, pumps have to be robust against corrosion, aggressive gases, explosive gases, humid gases etc.);

(b) The price; (c) The cost of ownership (such as price, maintenance, service and utilities needed to operate the pumps, like energy and water); (d) [Potentially, environmental aspects could constitute a fourth factor]".39

(42) Finally, regarding a possible segmentation by application, the results of the market investigation show that a distinction by technology is sufficient and that an additional segmentation by application would therefore not be pertinent. Moreover, a competitor explained that vacuum pumps "usually do not serve only one final application, but many different."40 Another added that there "is no link between the application and the design or type of vacuum pumps."41 Customers were particularly not in favour of a distinction by application, also emphasising that the same vacuum pump could serve different applications.42 Therefore, the Commission considers that a further sub-segmentation by application should not be warranted as it was clearly rejected by the market investigation. A further sub-segmentation by application will therefore not be further discussed.

(43) In conclusion, the Commission will analyse the Transaction on the basis of the plausible product markets, but will leave the market definition open (except for a potential split by application, which has been rejected and will not be further discussed) as the Transaction does not raise concerns on any plausible market.43

3.1.2.2. Geographic market definition

(A) The Commission's decisional practice

(44) As explained in paragraph (33), the Commission has not previously analysed a vacuum pumps market.

(B) The Notifying Party's view

(45) The Notifying Party considers the market for the manufacture and supply of vacuum pumps to be EEA-wide because (i) the competitive landscape and dynamics differ substantially between EEA and the rest of the world, (ii) consumer preferences vary across regions as customers in the EEA have a distinct demand profile from many non-EEA customers, (iii) the Parties organise their sales and marketing organisations by region and (iv) products sold in the EEA must meet EEA specific standards.44

(C) The Commission’s assessment

(46) The results of the market investigation point to a worldwide market.45 The majority of competitors do not consider technical specifications or regulatory requirements as limiting the number of competitors in the EEA.46 The vast majority of customers also consider this market global, due to the fact that vacuum pumps are a mature technology, market players have a global footprint and production and delivery is global.47

(47) In any case, the exact product and geographic market definition can be left open between the EEA and worldwide, as the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement even on any of the two plausible geographic market definitions.

3.1.3. Air ends

3.1.3.1. Product market definition

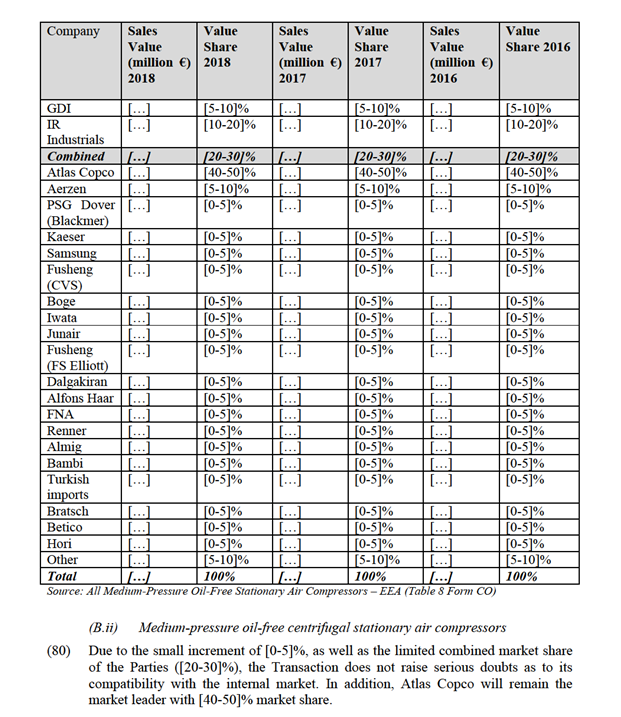

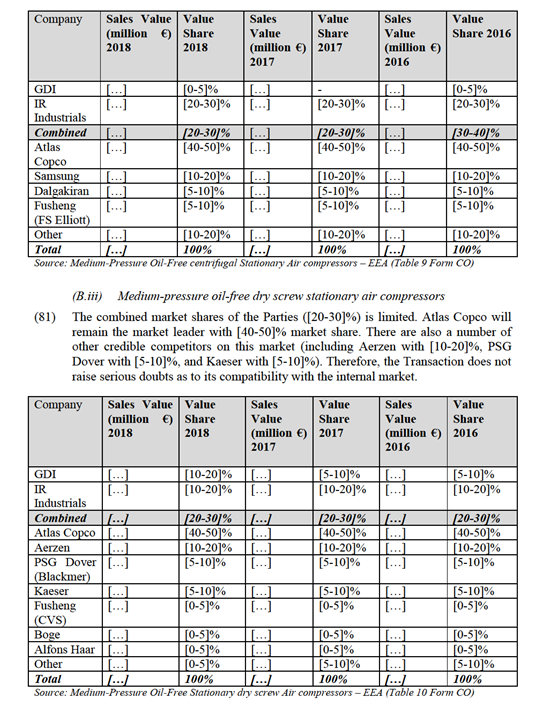

(A) The Commission's decisional practice

(48) Air ends refer to the mechanism within the device that mechanically compresses the air or gas in air compressors (i.e. excluding motors, filters, etc.). Many compressor manufacturers, including the Parties, sell air ends as replacement parts following an initial equipment sale. They also sell air ends on the open market to third party compressor manufacturers or to OEMs to be incorporated as inputs into other products which require compressed air to operate such as for pneumatic conveying machinery, snow blowers or agricultural machinery.

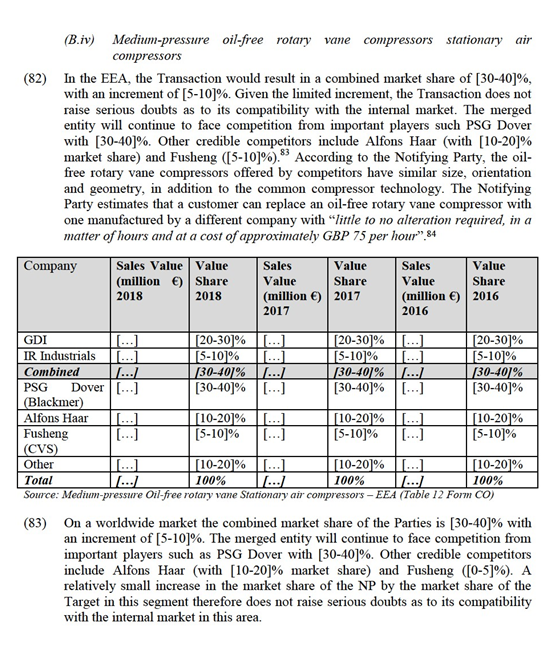

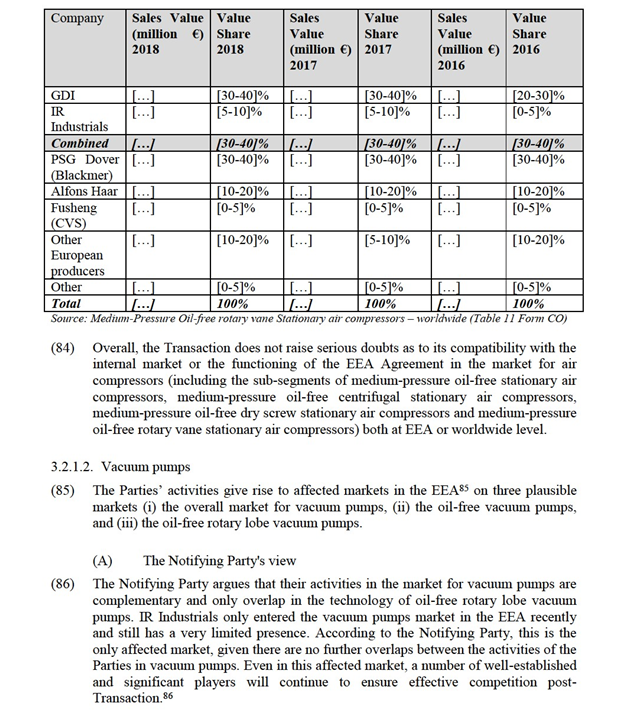

(49) In Ingersoll-Rand / Man, the Commission considered a relevant product market for air ends, which the Commission described as “the central components of compressors which actually compress air or gas”. The Commission also considered a plausible segmentation for the air ends product markets to be between oil-free on the one hand and oil-lubricated on the other hand. Moreover, it defined a plausible product market for “oil-free air ends/screws”.48

(B) The Notifying Party's view

(50) The Notifying Party does not contest the product market definition in the Commission’s past practice.

(C) The Commission’s assessment

(51) The market investigation suggested a plausible segmentation between (i) oil-injected vs. oil-free and (ii) by output pressure and potentially also by (iii) technology.

(52) First, a majority of customers and competitors that participated in the market investigation found a segmentation of the product market into oil-injected vs. oil-free appropriate,49 given their “[d]ifferent technology, production price and different application.”50

(53) Second, a majority of customers and competitors that participated in the market investigation also found a segmentation of the product market by output pressure appropriate.51 This refers mainly to the distinction between air ends for compressors and air ends for blowers along the lines of paragraph (19). A competitor also noted that “some air ends […] are only used in specific applications such as gas (not air) applications or high pressure (above 40 bar) applications.”52

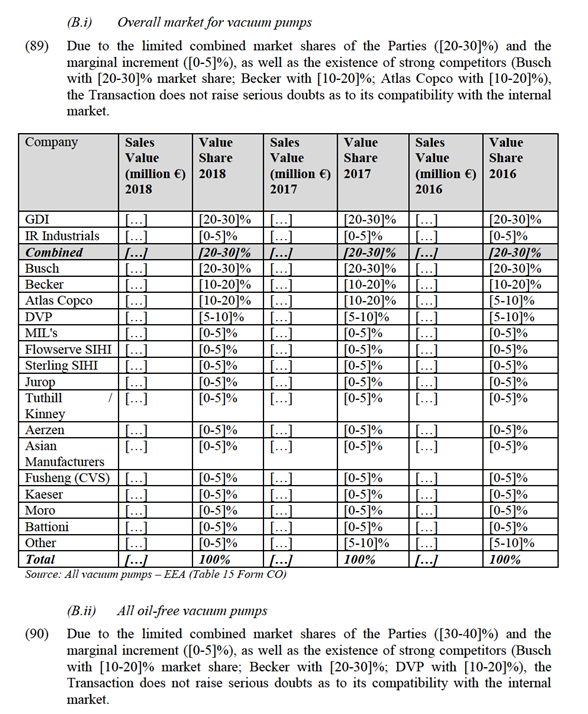

(54) In relation to the output pressure, oil-free air ends require different technologies, as explained by a competitor: “Distinctions of […] air ends are one-stage blower or screw compressor oil-free (low pressure) for transport of material and two-stage oil- free air end (middle pressure 5-12 bar) for industrial applications.”53 However, the Transaction only results in affected markets for medium pressure air ends segments, therefore low and high pressure air ends will not be further discussed. The present Decision will therefore focus on medium pressure air ends.

(55) Third, as for segmentation by technology, a majority of customers and competitors that participated in the market investigation considered it not necessary.54 A customer explained that supply substitutability is high: “You don't find different Technologies in air Ends, that can't be provided from similar manufacturing Technology.”55 However, both the Notifying Party and some respondents to the market investigation note that “[e]ach type of blower and compressor require a specific type of air end.”56 The Commission therefore takes note that compressors must use an air end with the same technology they are based on.

(56) Fourth, a vast majority of respondents also rejected a segmentation according to the application or intended use of the air end.57 As a customer explained, the “[s]ame air ends can be used for many applications and it is up to user to decide.”58 Therefore, the Commission considers that a further sub-segmentation by application should not be warranted as it was clearly rejected by the market investigation. A further sub- segmentation by application will therefore not be further discussed.

(57) Finally, the Commission notes that the Parties overlap only in oil-lubricated compressor air ends for rotary screw air compressors.59

(58) In conclusion, the Commission will analyse the Transaction on the basis of the following plausible product markets, but will leave the market definition open (except for a potential split by application, which is not warranted) as the Transaction does not raise concerns on any plausible market.

3.1.3.2. Geographic market definition

(A) The Commission's decisional practice

(59) In Ingersoll-Rand / Man, the Commission left open whether these are national or EEA-wide markets. The Commission acknowledged that there are nearly no trade barriers between the European countries concerned, however it took account of (i) existing strong national preferences in the market relations between compressor and air end suppliers and users, and (ii) the importance for customers of the reliability of products and good after-sales service.60 However, in the subsequent case Alchemy / Compare, the Commission considered that the market for compressor air ends is at least EEA-wide.

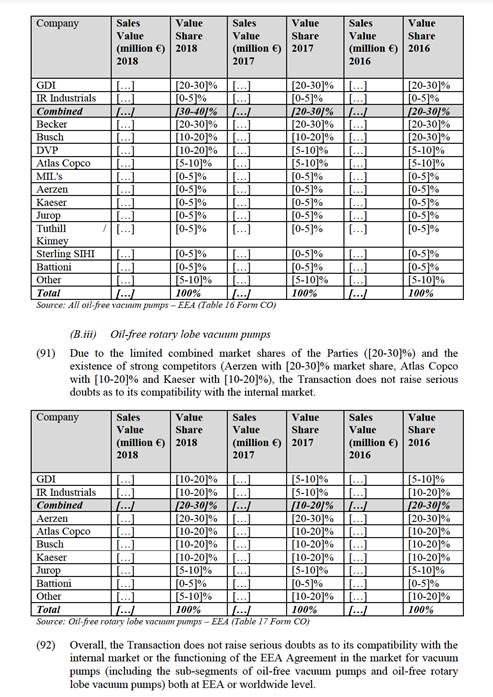

(B) The Notifying Party's view

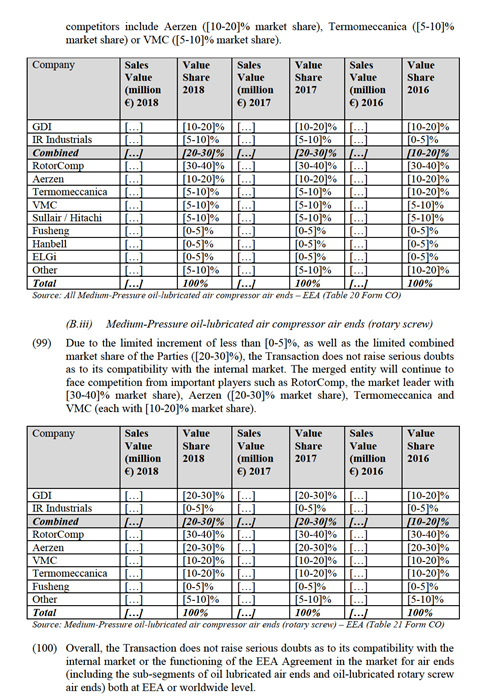

(60) Concerning the geographic market definition, the Parties argue that the market for air compressor air ends is at least EEA-wide as: (i) all major manufacturers are active in all EEA member States, (ii) air end products, like compressors, are frequently sold across country lines and (iii) IR Industrial’s air end manufacturing now takes place exclusively in China and the United States, as IR Industrials discontinued its EEA air end production in 2018. In addition, the Parties argue that there are no barriers to enter local, national or supra-national distribution networks, as all that is necessary to partner with a distributor is a commercial agreement.

(C) The Commission’s assessment

(61) The replies of the majority of competitors and customers of the market investigation point to a worldwide market,61 because market players have a global footprint and production and delivery are global.62

(62) The majority of customers do not consider technical specifications or regulatory requirements as limiting the number of competitors in the EEA while the replies of competitors are inconclusive.63 Requirements such as “[c]ertified components”, “CE Certification” and “ISO standard testing”64 are seen as limiting the number of competitors in the EEA by some competitors, while others state that these are easy to comply with.

(63) The results of the market investigation confirm that no regulatory barriers or equivalent barriers exist within the EEA. The Commission therefore considers that with regard to the geographic definition, the market for air ends is at least EEA-wide and probably worldwide.

(64) In any case, the exact geographic scope of the air ends market can be left open between the EEA and worldwide, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement on any of the two plausible geographic market definitions.

3.2. Competitive assessment

(65) With regard to any of the plausible relevant markets as defined or left open in Section 3.1, the Parties activities only give rise to ten plausible horizontally affected markets in the EEA:

(a) Overall medium-pressure oil-free stationary air compressors;

(b) Oil-free medium-pressure centrifugal stationary air compressors;

(c) Oil-free medium-pressure dry screw stationary air compressors;

(d) Oil-free medium-pressure rotary vane stationary air compressors;

(e) All vacuum pumps;

(f) All oil-free vacuum pumps;

(g) Oil-free rotary lobe vacuum pumps;

(h) All medium-pressure air compressor air ends;

(i) All medium-pressure oil-lubricated air compressor air ends;

(j) Medium-pressure oil-lubricated air compressor air ends (rotary screw).

(66) The Transaction also gives rise to one potential vertically affected market between medium-pressure two-stage oil-free dry screw compressor air ends (upstream) and the corresponding market for this type of compressor (downstream).

3.2.1. Horizontal overlaps

(67) The Notifying Party argues that the Transaction will not affect competition in the EEA or at a worldwide level and is therefore compatible with the internal market. Overlaps resulting in affected markets only occur in the market for medium-pressure oil-free stationary dry screw air compressors, medium-pressure oil-free stationary rotary vane air compressors, oil-free rotary lobe vacuum pumps and medium- pressure oil-lubricated air compressor air ends (rotary screw).

(68) The Notifying Party argues that in the markets where overlaps occur post- Transaction, a sufficient number of viable alternative suppliers will ensure effective competition. Furthermore, post-Transaction, the Parties will be better able to compete with market leader Atlas Copco, as well as with other strong competitors that are expected to remain active in all affected markets.65

(69) The Notifying Party also argues that barriers to entry in the EEA are low, so that suppliers from the United States or Asia have recently started entering the EEA market. Examples are US-based Sullair, Turkey-based Dalgakiran, India-based Elgi and Taiwan-based Fusheng which either export their products to the EEA (in the case of Sullair and Dalgakiran) and/or have bought brands and production facilities in the EEA (in the case of Elgi and Fusheng).66

(70) Finally, according to the Notifying Party, distribution channels are available to facilitate the entry to the EEA market: the Parties estimate that instead of having to set up an entire distribution and service network, a new entrant would only need approximately six employees per EUR 2 million sales.67

3.2.1.1. Air compressors

(71) The Parties’ activities give rise to affected markets in the EEA68 on four plausible markets (i) the market for all medium-pressure oil-free stationary air compressors, (ii) the market for medium-pressure oil-free centrifugal air stationary air compressors, (iii) the market for medium-pressure oil-free dry screw stationary air compressors, (iv) the market for medium-pressure oil-free rotary vane stationary air compressors.

(A) The Notifying Party's view

(72) The Notifying Party argues that their activities in the market for medium-pressure stationary air compressors will face competitive constraints from the high number of competitors present in all plausible market segments post-Transaction.

(73) According to the Notifying Party, both for oil-lubricated and oil-free compressors, Atlas Copco is and will remain the market leader across most technology types, followed by Kaeser. Other strong competitors active in the EEA include Boge, Renner, Parker, FNA, Fusheng, Sullair and Kobelco.69

(74) The Notifying Party describes the market for medium-pressure stationary air compressors as being characterised by aggressive competition on price, [confidential information regarding competitive strategy and pricing model].70

(75) In the unlikely scenario that the Parties would be able to raise prices post- Transaction, competitors would not only retaliate but could additionally expand their production capacity, as Kaeser did in 2019 and Renner in 2014, or their warehousing capacity as Boge did recently.71

(76) Finally, the Notifying Party notes that competitive constraints in practice do not only come from competitors in the same technology segment, but from alternative technologies that act as close substitutes for many end-uses.72

(B) The Commission's assessment

(77) The market investigation confirmed that the Transaction is unlikely to substantially change the competitive dynamics in the market for air compressors, mainly given the presence of strong competitors, low barriers to entry and the competitive pressure exercised on specific types of air compressors (even in a narrow product market) by other types of air compressors.

(a) The market investigation confirmed that a high number of competitors is active in the air compressor market. Competitors named various alternative suppliers for air compressors in addition to those listed in paragraph (81), such as CVS, Rhiwo Star and Mouvex Blackmer.73 Competitors also mentioned a number of recent entrants and potential future entrants (SCC Tolpac, Dalgakiran, Comprag, Hanbell and Shanghai Screw).74 This suggests that the presence of established competitors and market entry by new competitors poses significant competitive constraints on any attempt by the Parties to raise prices, or lower quality, post-Transaction.

(b) Replies by competitors to the market investigation suggest that market entry is difficult due to the high number of players and the intense competition.75 As explained in the follow-up explanations, this does not suggest that entry barriers are high but rather that the market is highly competitive, so that profit margins are too low to attract new entrants.76 In the words of a competitor, the “mature compressor market in EEA is already highly competitive with strong European suppliers like Atlas Copco, Kaeser, Aerzen, Boge etc.”.77 This confirms the argument made by the Notifying Party in paragraph (82). A majority of customers in the market investigation also confirmed they would have sufficient alternatives to switch in the event that the Parties raised prices post-Transaction.

(c) The results of the market investigation are well represented by the words of this competitor: “qualified sales and [reliable]/fast service is very important and has a strong influence on the decision for the supplier.” The market investigation confirmed that the Parties have a strong sales and installation, as well as maintenance and repair network. However, these aspects are only one among many that appear decisive in the choice of a supplier. In the market investigation, customers ranked “good maintenance and repair network” third and “good sales and installation network” fourth, after “reliable supplier” and “high quality products”. They are closely followed by “low prices” and “innovative products”. 78 Whereas the Parties might have a competitive advantage given their sales and installation and maintenance and repair network, competitors with weaker networks would still be able to compete on other aspects. Furthermore, as discussed in recitals (29)-(30), the market players consider that suppliers of compressors do not need their own distribution network as there are alternatives that can be used.

(d) A majority of competitors who responded to the market investigation consider that switching can be considered difficult.79 However, almost half of the customers who replied have switched supplier in the past,80 in particular “to increase cost competitiveness.”81 This suggests that the Parties would not be able to raise prices post-Transaction without losing at least some of their customers.

(e) Overall, the combination of competitive constraints from the supply side, such as strong competitors, and from the demand side, such as switching, are overall sufficiently strong to limit any ability to increase prices or any impacts on competition arising from the Transaction.

(f) In any case, the overall view among the respondents of the market investigation suggests that the Transaction will not have an impact on the air compressor market. 82

(78) For the reasons set out in paragraph (85), the Transaction does not give rise to concerns in the air compressor market. Below the Commission examines the specific market position of the Parties in all affected markets.

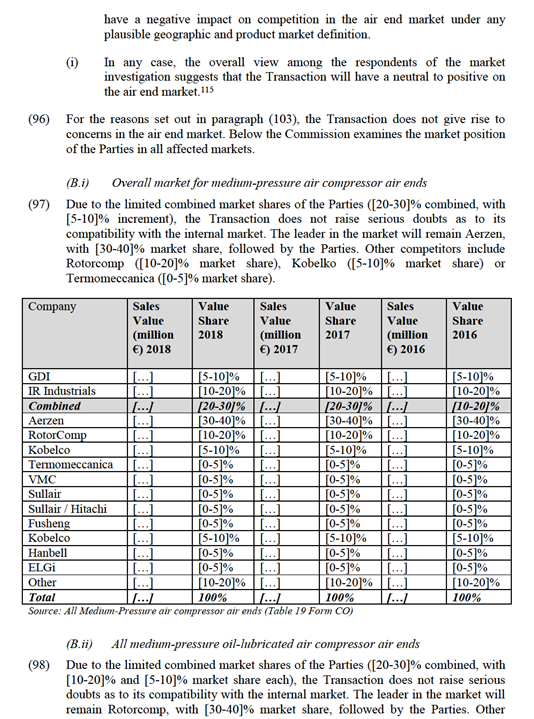

(B.i) Medium-pressure oil-free stationary air compressors

(79) Due to the limited combined market shares of the Parties ([20-30]%), the Transaction does not give rise to raise serious doubts as to its compatibility with the internal market. The leader in the market will be Atlas Copco, with [40-50]% market share, followed by the Parties. Other competitors include Aerzen ([5-10]% market share), PSG Dover ([0-5]% market share), Fusheng, Kaeser, Samsung, Boge and Iwata (each with [0-5]% market share), as well as a large number of smaller competitors, such as Junair, Dalgakiran, Alfons Haar, FNA, Renner, Almig and Bambi which each have [0-5]% market share.

(B) The Commission's assessment

(87) The market investigation confirmed that the Transaction is unlikely to substantially change the competitive dynamics in the vacuum pumps market, given IR’s limited activities in the EEA and the presence of strong competitors.

(a) The market investigation confirms that a number of strong competitors is present in the EEA market for vacuum pumps. In addition to the competitors mentioned by the Notifying Party, competitors who replied to the market investigation also named various alternative suppliers for vacuum pumps, such as Becker, Aerzen, Rietschle, Leybold, Atlas Copco, Jurop, Moro Kaiser, CVS, Hertell S. coop, Pedro Gil, Edwards, TMC, and VMC.87 According to most customers, these alternative suppliers, in particular Atlas Copco, Aerzen, Busch, and Kaeser, also offer high quality products, large product range, known brands, are considered reliable suppliers, and offer a good sales and installation networks.88 In the words of a competitor, “[t]he competitive arena in Europe is quite wide. There are many competitors in the European market for vacuum pumps.”89 This suggests that competition in the market for vacuum pumps will not be affected by the Transaction.

(b) Some replies to the market investigation suggest that market entry could be rather difficult, due to the high competition and the number of competitors.90 Similarly to the air compressor market, potential new entrants seem to be discouraged by the high degree of competition in the EEA market for vacuum pumps. In the market investigation, several competitors noted that the EEA market for vacuum pumps is saturated. This appears to explain why manufacturers from outside the EEA have not entered the market, according to a competitor. In case the Parties tried to raise prices, there would already be enough competitors in the market to compete for lower prices, while in addition, new entrants might be attracted.

(c) Indeed, market entry does occur. A recent entrant in the market for vacuum pumps is German firm CVS Engineering.91

(d) The market investigation confirmed the importance of brand loyalty and of a sales and maintenance network. While this might provide the Parties with an advantage over competitors without sales and maintenance networks, the market investigation showed that the Parties are not stronger than other players in these aspects. According to competitors, the Parties are not considered as having a “good maintenance and repair network” nor a “good sales and installation network”92, and according to customers, other suppliers seem to provide better maintenance and repair as well as sales and installation networks.93

(e) A competitor also added that as an alternative to service networks by the vacuum pump suppliers themselves, “[t]here are a few companies acting as freelancers providing aftermarket services next to the product manufacturers. They are usually only active at regional or local level, providing 24h maintenance and repair services to customers within a radius of 50km.”94 Therefore sufficient alternatives exist and even competitors without distribution and maintenance networks are able to compete in the vacuum pump market.

(f) Indeed, a majority of competitors who responded to the market investigation consider that switching is easy.95 The market investigation has shown that a majority of competitors have had experience of their customers' sometimes switching supplier.96 Almost half of customers have switched supplier in the past, “due to price and quality reasons”97 or because a competitor offered more “[i]nnovative products”.98 One customer that never switched gave the explanation that it was satisfied with the current supplier. This illustrate that switching seems possible, if some customers have not had this experience, it is likely that they have not needed to switch so far.

(g) In addition, a majority of customers has been able to negotiate price concessions from their suppliers99 and both customers and competitors consider that “[p]rice negotiations and price concessions are part of the daily business.”100

(h) This shows that competitive constraints from the supply side, such as entry of new competitors, and from the demand side, such as switching, are overall sufficiently strong to limit any impacts on competition arising from the Transaction.

(i) In any case, the overall view among the respondents of the market investigation suggests that the Transaction will not have an impact on the vacuum pumps market.101

(88) For the reasons set out in paragraph (95), the Transaction does not give rise to concerns in the vacuum pumps market. Below the Commission examines the market position of the Parties in all affected markets.

3.2.1.3. Air ends

(93) The Parties’ activities give rise to affected markets in the EEA102 on three plausible market segments (i) the overall market for air compressor air ends, (ii) the overall market for medium-pressure oil-lubricated air compressor air ends, (iii) the market for medium-pressure oil-lubricated air ends for rotary screw compressors.

(A) The Notifying Party's view

(94) The Notifying Party argues that their activities in the market for air ends only give rise to an overlap in the market for medium-pressure oil-lubricated air ends for compressors. [Confidential information related to internal sales strategy].103 IR Industrials has only a small market share in medium-pressure oil-lubricated compressor air ends in the EEA ([5-10]% in 2018). If further segmenting the air end market by technologies, the only overlap would occur in medium-pressure oil- lubricated air ends for rotary screw air compressors with an increment of under [0- 5]% in 2018. The Notifying Party also confirms that the combined entity will not be the market leader.104

(B) The Commission's assessment

(95) The market investigation confirmed that the Transaction is unlikely to substantially change the competitive dynamics in the market for air ends given the limited market shares of the Parties and the presence of strong competitors in the EEA and potential entrants facing low entry barriers.

(a) Competitors who replied to the market investigation also named various alternative suppliers for air ends: Atlas Copco, Aerzen, Kaeser, Termomeccanica, Kobe, Fusheng, Boge, Cobelco, Iwata, Sullair Hitachi, Pedro Gil, Rotorcomp, TMC, VMC and CVS.105 Similar to the market for compressors, market participants consider the air end market a “mature market, with destructive competition.”106 Therefore, if the Parties tried to raise prices post-Transaction, competitors could retaliate and extend their market share.

(b) Replies to the market investigation regarding the ease of market entry are inconclusive. As in the case for air compressors and vacuum pumps, some see market saturation as the reason: “The mature air end market in EEA is already highly competitive with strong European suppliers.”107 While currently incentives seem to be low given the level of competition, new entrants could find it interesting to enter the market in case the Parties increased prices.

(c) In such a scenario, there are a number of new suppliers that might enter the EEA market or have done so recently. Competitors named several recent entrants that include Fusheng, Hanbell (both from Taiwan) and Elgi (from India) and potential future entrants Baosi and Torin Drive (both from China).108

(d) Conditions for market entry seem favourable. As the market investigation confirmed, there seem to be no regulatory requirements constituting entry barriers to the EEA (“For air ends, CE mark is the only purposeful requirement”109).

(e) An additional advantage facilitating entry of the air end market is the fact that sales and maintenance network seems to be less relevant than in the markets for air compressors. The market investigation confirmed that a local presence for sales is less important as a compressor air end “is a part that can easily be imported.”110 As for the importance of a “maintenance repair network or sales organisation, [these are] less important because disfunctions are not covered by the supplier but by the assembler of compressor packages.” Rather, “high quality of products and reliability of supplier is important.”111 The market investigation confirmed this: the most important selection criteria for a supplier are high quality products, reliability, low prices, a large product range, innovation, followed by a good maintenance and repair network and a good sales and installation network.112 It can thus be concluded that market entry is easy and that the possibility of entry by new competitors poses a considerable competitive constraint.

(f) The market investigation was inconclusive as to whether switching to another air end producer is common and easy. A majority of competitors who responded to the market investigation consider that switching is easy, and a minority of customers confirmed it has actually switched supplier for air ends.113

(g) In comparison to the air compressor and vacuum pump market, price concessions are less common in the air end market. Only half of the customers who participated in the market investigation have negotiated lower prices, as competition is less fierce in this smaller market.114

(h) Nevertheless, although the competitive constraints on the demand side are weaker than in the markets for air compressors and vacuum pumps, competitive constraints on the supply side are particularly strong. The Commission considers them sufficient to ensure that the Transaction will not

3.2.2. Vertical relationships

3.2.2.1. Air ends (upstream) for air compressors (downstream)

(101) The Parties’ activities result in vertical links between the upstream production of air ends of a specific technology and the downstream compressors of the corresponding technology. This is the case for oil-lubricated rotary screw air compressor, oil-free dry screw air compressor, and rotary lobe blowers.116 In the case of oil-lubricated rotary screw air compressor and rotary lobe blowers, the market shares of the Parties remain below 30% in both upstream and downstream markets.117

(102) It should be noted that neither party purchases air ends (the input) from the other one, so there is no actual vertical link between them currently.118 Moreover, an air end from a specific technology should fit the same technology of air compressors, as a mix of technologies between the upstream and downstream levels is not possible technically. In short, this means that the only vertically affected market is the plausible market for medium-pressure two-stage119 oil-free dry screw air ends (upstream) and the plausible market for medium-pressure oil-free dry screw air compressors (downstream).

(103) Upstream, only IR Industrials is active in the air end market for medium-pressure two-stage oil-free dry screw compressor air ends, with an EEA market share of roughly [50-60]%.120 Competitors in this market in the EEA are Aerzen with [20- 30]%, Kobelco with [10-20]% and Sullair with [10-20]%.121

(104) Downstream, both Parties are active in the market for medium-pressure air dry screw compressors, but their combined market share remains below 30% (at [20-30]% in 2018 and [20-30]% in 2016 and 2017 respectively).

(A) No input foreclosure

(105) The "Non-horizontal Guidelines"122 provide that input foreclosure "arises where, post-merger, the new entity would be likely to restrict access to the products and services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under the similar prices and conditions absent the merger".123

(106) The Commission has assessed whether post-Transaction, the merged entity is likely to successfully restrict access to IR's medium-pressure two-stage oil-free dry screw compressor air ends to the Parties' competitors in the medium-pressure oil-free dry screw air compressors downstream in an anti-competitive manner.

(107) The Notifying Party argues that the presence of credible competitors on the upstream market, as described in paragraph (103), provides sufficient competitive constraints, so that the Parties would therefore have no ability to foreclose access to air ends for its customers.124

(a) Atlas Copco would remain the market leader downstream, with 43% market share. Both Atlas Copco and Aerzen, the Parties’ main competitors, are vertically integrated and self-supply air ends for their production of medium- pressure dry screw air compressors. Therefore, there exists no ability from the merged entity post-Transaction to foreclose input to these downstream rivals that are self-sufficient. This means that [50-60]% of the downstream market, the Parties competitors on that level, would still be able to maintain competition conditions as they are before the Transaction, effectively defeating any attempt from the merged entity to recoup any potential gains from foreclosure.

(b) Second, IR Industrials supplies [number] downstream customers: [name of customers], who together account for only [proportion]% of the downstream market. These two downstream rivals are the only one that could be foreclosed post-Transaction as other downstream rivals already source their input from alternative upstream competitors from the Parties.

(c) Third, this shows that in practice, the merged entity could only have the ability to foreclose [5-10]% of the market. This is not sufficient to lead to significant gains that would make such a strategy profitable.

(d) Finally, as shown by the fact that the merged entity would only supply the inputs to [5-10]% of the downstream customers, there are enough alternative suppliers, used by other downstream rivals that would readily defeat any such attempt by providing an alternative source of supply to the merged entity.

(108) The Commission agrees with this reasoning. It notes, in particular, that on top of the facts which the Notifying Party relies on, its analysis is further supported by the replies to the market investigation.

(a) A majority of customers who responded to the market investigation explained that the Parties would not have an incentive to stop selling air ends to third parties and only to sell compressors and blowers with an integrated air end.125

(b) As a customer explained, “[t]here is market potential. Both parties know, if they will not sell air ends separately, there will be other/new manufacturers focussing on this market [s]egment. The entry barriers are not high enough to [k]eep other manufacturers out.”126

(c) Another customer found that the competitors present in the market would act as a sufficient constraint so that selling only compressors with integrated air ends would not “make sense. Too much competitors on a market for them.”127

(109) Therefore, the Commission considers that the merged entity will not have the ability to engage in a foreclosure attempt and that any such attempt by the merged entity would not be successful.

(B) No customer foreclosure

(110) The "Non-horizontal Guidelines"128 provide that customer foreclosure "may occur when a supplier integrates with an important customer in the downstream market. Because of the downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (input market) and reduce their ability or incentive to compete".129

(111) The Commission has assessed whether post-Transaction, the merged entity would be able to stop or reduce its sourcing from other upstream suppliers, therefore denying them the customer base that the merged entity was representing.

(112) It should be noted that both GDI and IR source from their upstream divisions. Therefore, even absent the merger, the Parties cannot be considered as "an important customer" on the downstream market.

(113) Moreover, as the Parties only represent a small share of the customer base in any case (only [20-30]% of the downstream market), denying access to the merged entity as a potential customer for upstream rivals is unlikely to deprive upstream rivals from a significant customer base.

(114) Therefore, the Commission considers that the merged entity will not have the ability to engage in a foreclosure attempt and that any such attempt by the merged entity would not be successful.

4. CONCLUSION

(115) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Publication in the Official Journal of the European Union No C 428, 20.12.2019, p. 41.

4 Turnover calculated in accordance with Article 5 of the Merger Regulation.

5 Form CO, paragraph 148.

6 Commission decision of 28 July 1994 in Case No. COMP/M.479 – Ingersoll Rand / Man, paragraph 17.

7 Commission decision of 17 June 2002 in Case No. COMP/M.2834 – Alchemy / CompAir, paragraph 5. For completeness, in this Decision it was found that low pressure compressors might constitute a separate market named blowers but the Parties' activities in the segment do not lead to horizontally affected markets. Form CO, paragraph 248.

8 Commission decision of 28 July 1994 in Case No. COMP/M.479 – Ingersoll Rand / Man, paragraph 17.

9 Form CO, paragraph 345.

10 Form CO, paragraph 170.

11 Form CO, paragraph 409.

12 As, in any case, the Transaction does not result in affected markets on the market for gas compressors, this market will not be further discussed in this Decision. Form CO, paragraph 234.

13 Reply to question 3 of Questionnaire to customers.

14 Reply to question 3.1 of Questionnaire to competitors.

15 Reply to question 4.1 of Questionnaire to customers.

16 Reply to question 4.1 of Questionnaire to competitors.

17 Reply to question 5 of Questionnaire to customers.

18 Reply to question 5 of Questionnaire to customers.

19 Reply to question 6.1 of Questionnaire to customers.

20 Reply to question 6.1 of Questionnaire to customers.

21 Reply to question 6.1 of Questionnaire to customers.

22 The Commission had been made aware that in the lower pressure segment of compressors (also called blowers), the Parties may have a non-negligible presence for specific applications (such as trucks). However, since this market segmentation is not warranted, as the Commission found there exist alternative suppliers of similar products and as the lower pressure segment of compressors does not lead to any affected market under the plausible market definition discussed in Section 3.1.1.1.(C), this will not be further discussed.

23 Reply to question 7.1. of Questionnaire to competitors.

24 Replies to questions 8 and 8.1 of Questionnaires to customers. Replies to questions 8 and 8.1 of Questionnaires to competitors.

25 Minutes of a call with a competitor of 12 November 2019.

26 Commission decision of 17 June 2002 in Case No. COMP/M.2834 – Alchemy / CompAir, paragraph 7-8.

27 Form CO, paragraph 370.

28 Reply to question 9.1 of Questionnaire to competitors.

29 Replies to question 9.1 of Questionnaire to competitors.

30 Minutes of a call with a customer of 4 November 2019 (paragraph 5), see in particular: “there are no specific constraints (of a regulatory nature, or other) to source at EEA or world-wide level”.

31 Reply to question 10.1 of Questionnaire to competitors.

32 Reply to question 10.2 of Questionnaire to competitors.

33 Reply to question 10.2 of Questionnaire to competitors.

34 Reply to question 9.1 of Questionnaire to competitors.

35 Form CO, paragraph 106.

36 This is with the exception of one precedent that exclusively focused on vacuum pumps for cars as relevant markets. The market for the manufacture and supply of vacuum pumps was analysed in a similar way as a car component. In the precedent at hand, only this very specific type of pumps was relevant for the decision, i.e. as an input installed in a car. The Commission considers that this precedent is not relevant for the present decision considering the present Transaction is much wider in terms of diversity of types of vacuum pumps manufactured by one Party of the other; see Commission decision of 28 November 2012 in Case No. COMP/M.6748 – MAGNA/ IXETIC.

37 Replies to question 12.1 of Questionnaire to customers.

38 Minutes of a call with a competitor on 5 November 2019, paragraph 4.

39 Minutes of a call with a competitor on 22 November 2019, paragraph 9.

40 Reply to question 16 and 16.1 of Questionnaire to competitors.

41 Reply to question 16.1 of Questionnaire to competitors.

42 Replies to question 15 and 15.1 of Questionnaire to customers.

43 A potential additional sub-segmentation in vacuum pumps mirroring the compressors' split (between low, medium and high pressure vacuum pumps, and/or between portable and stationary vacuum pumps) was not argued by the Notifying Party, nor was it clearly established in response to the market investigation. However, since such potential additional segmentations would not lead to further affected markets, these potential segmentations are not further discussed in this Decision.

44 Form CO, paragraph 370.

45 Replies to question 18 and 18.1 of Questionnaire to competitors.

46 Replies to question 19 and 19.1 of Questionnaire to competitors.

47 Replies to question 16 and 16.1 of Questionnaire to customers.

48 Commission decision of 28 July 1994 in Case No. COMP/M.479 – Ingersoll Rand / Man, paragraphs 17- 19.

49 Replies to question 18 of Questionnaire to customers. Replies to question 20 of Questionnaire to competitors.

50 Reply to question 18.1 of Questionnaire to customers.

51 Replies to question 21 of Questionnaire to customers. Replies to question 23 of Questionnaire to competitors.

52 Reply to question 23.1 of Questionnaire to competitors.

53 Reply to question 23.1 of Questionnaire to competitors.

54 Replies to question 19 of Questionnaire to customers. Replies to question 21 of Questionnaire to competitors.

55 Reply to question 19.1 of Questionnaire to customers.

56 Reply to question 25 of Questionnaire to competitors.

57 Replies to question 20 of Questionnaire to customers. Replies to question 22 of Questionnaire to competitors.

58 Reply to question 2.1 of Questionnaire to customers.

59 Form CO, paragraph 362.

60 Case COMP/M.479 – Ingersoll Rand / Man, paragraph 20.

61 Replies to question 24 of Questionnaire to customers. Replies to question 26 of Questionnaire to competitors.

62 Replies to question 24.1 of Questionnaire to customers. Replies to question 26.1 of Questionnaire to competitors.

63 Replies to question 25 of Questionnaire to customers. Replies to question 28 of Questionnaire to competitors.

64 Replies to question 28.1 of Questionnaire to competitors.

65 Form CO, paragraph 397.

66 Form CO, paragraph 403.

67 Form CO, paragraph 403: “including a manager, 2-3 commercial and sales employees, 1-2 back office and support employees sales people, and 1-2 service employees including engineers and field support”.

68 For compressors, the Notifying Party confirms that the market shares of the Parties at global level do not exceed the market shares at EEA level with the exception of oil-free rotary vane air compressors. In the latter case, the analysis will be conducted on both the EEA and the worldwide markets. In the other few instances, where the worldwide market is affected but less than the EEA one, the Commission considers that the market conditions at worldwide and EEA level are sufficiently similar that the analysis conducted at EEA level (i.e. the narrowest plausible market) also covers the worldwide market definition. Therefore, since at EEA level, the Transaction does not raise serious doubts, it should be considered that the worldwide corresponding market segment that is less affected and where the competition conditions are similar, will also not raise serious doubts.

69 Form CO, paragraph 412.

70 Form CO, paragraph 414.

71 Form CO, paragraph 402.

72 Form CO, paragraph 415.

73 Replies to question 28-29 of Questionnaire to customers. Replies to question 30 of Questionnaire to competitors.

74 Replies to question 38 of Questionnaire to competitors.

75 Replies to question 31 of Questionnaire to customers. Replies to question 34-39 of Questionnaire to competitors.

76 Replies to question 35.1 to Questionnaire to competitors.

77 Reply to question 35.1 of Questionnaire to competitors.

78 Replies to question 30 of Questionnaire to customers.

79 Replies to question 33 of Questionnaire to customers. Replies to question 40 of Questionnaire to competitors.

80 Replies to question 32 of Questionnaire to customers.

81 Reply to question 32 of Questionnaire to customers.

82 Replies to question 55 of Questionnaire to customers. Replies to question 71 of Questionnaire to competitors. The Commission did not receive any substantiated complaint.

83 See Form CO, paragraph 451 : "Fusheng has been actively growing its presence in the EEA, including throught the acquisition of Alming Compressor Systems and the establishment of an Alming compressor manufacturing plant in Kongen, Germany."

84 Form CO, paragraph 602.

85 Reply to RFI 10, question 1: the Notifying Party confirmed that worldwide market shares for the vacuum pumps markets, including any potential sub-segments, world remain below 20%. Therefore, as any potential markets for vacuum pumps remains not affected at worldwide level, this geographic market segmentation will not be further discussed in the Decision.

86 Form CO, paragraph 400.

87 Replies to question 47 of Questionnaire to customers. Question 44 of Questionnaire to competitors.

88 Replies to question 38 of Questionnaire to customers. Question 45 of Questionnaire to competitors.

89 Minutes of a call with a customer, on 26 November 2019, paragraph 13.

90 Minutes of a call with a competitor, on 5 November 2019, paragraph 7.

91 Minutes of a call with a customer, on 26 November 2019, paragraph 16; minutes of a call with a competitor, on 5 November 2019, paragraph 9.

92 Replies to question 45 of Questionnaire to competitors.

93 Replies to question 42.1 of Questionnaire to costumers.

94 Minutes of a call with a competitor, on 22 November 2019, paragraph 12.

95 Replies to question 55 of Questionnaire to competitors.

96 Replies to question 54 of Questionnaire to competitors.

97 Reply to question 41.1 of Questionnaire to costumers.

98 Reply to question 41.1 of Questionnaire to costumers.

99 Replies to question 34 of Questionnaire to costumers.

100 Reply to question 56.1 of Questionnaire to competitors.

101 Replies to question 58 to 60 of Questionnaire to costumers. Replies to question 73 to 74.1 of Questionnaire to competitors. The Commission did not receive any substantiated complaint.

102 Reply to RFI 10, question 2: the Notifying Party confirmed that worldwide market shares for the air-ends markets, including any potential sub-segments, would remain below 20%. Therefore, as any potential market for air-ends remains not affected at worldwide level, this geographic market segmentation will not be further discussed in the Decision.

103 Form CO, paragraph 488.

104 Form CO, paragraph 32.

105 Replies to question 47 of Questionnaire to customers. Replies to question 58 of Questionnaire to competitors.

106 Reply to question 62 of Questionnaire to competitors.

107 Reply to question 63.1 of Questionnaire to competitors.

108 Replies to question 66 of Questionnaire to competitors.

109 Reply to question 28.1 of Questionnaire to competitors.

110 Reply to question 64.1 of Questionnaire to competitors.

111 Reply to question 50.1 of Questionnaire to customers.

112 Replies to question 50 of Questionnaire to customers. Replies to question 60 of Questionnaire to competitors.

113 Replies to questionnaire 52 of Questionnaire to customers. Replies to question 68 of Questionnaire to competitors.

114 Replies to question 54 of Questionnaire to customers.

115 Replies to questionnaire 62 of Questionnaire to customers. Reply to question 77 to Questionnaire to competitors. The Commission did not received any substantiated complaint.

116 As explained in paragraph (55), compressors must use an air end with the same technology they are based on.

117 Form CO, paragraph 515.

118 Form CO, paragraph 508.

119 As explained in paragraph (54), the so-called two-stage technology is used in medium pressure oil-free dry screw air ends.

120 At a worldwide level, IR Industrials has an approximate market share of [30-40]% along with Sullair, followed by Kobelco with [20-30]%, Aerzen with [10-20]% and Elgi with [10-20]%.

121 [Confidential information related to internal sales strategy].

122 The Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings, (2008/C 265/07).

123 Non-horizontal Guidelines, paragraph 31.

124 Reply to question 1 of RFI 9 of 16 January 2020.

125 Replies to question 46 of Questionnaire to customers. Minutes of a call with a competitor, on 12 November 2019, paragraph 23. GDI does not sell compressor air ends to third parties, but IR sells both oil-lubricated and oil-free compressor air ends to third parties under its brand GHH (based in China).

126 Reply to question 46.1 of Questionnaire to customers.

127 Reply to question 46.1 of Questionnaire to customers.

128 The Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings, (2008/C 265/07).

129 Non-horizontal Guidelines, paragraph 158.