Commission, July 13, 2018, No M.8862

EUROPEAN COMMISSION

Judgment

GBT / HRG

Dear Sir or Madam,

Subject: Case M.8862 – GBT/HRG

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

(1) On 8 June 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 and following a referral pursuant to Article 4(5) of the Merger Regulation, by which GBT III B.V. ("GBT", the Netherlands) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Hogg Robinson Group plc ("HRG", the United Kingdom), by way of purchase of shares ("the Transaction"). GBT and HRG are subsequently collectively referred to as the "Parties".

1. THE PARTIES AND THE OPERATION

(2) GBT, trading as American Express Global Business Travel, is a global company primarily active in the provision of travel agency services to businesses. The services provided by GBT include traditional business travel agency services (e.g. online and offline reservation and booking services), business travel-related advisory/consultancy services, travel programme optimisation, and meetings and events arrangement in the context of business travel. GBT is jointly controlled by American Express Company ("Amex") and Qatar Holding LLC ("QH").

(3) HRG is a corporate services company specialising in business travel. HRG assists companies, governments and financial institutions in managing and controlling their travel expenditure.

(4) The Transaction is expected to be implemented by means of a recommended cash acquisition of the entire issued and to be issued ordinary share capital of HRG by GBT. A joint announcement in respect of the Transaction was published by GBT and HRG on 9 February 2018. Resolutions to approve the Transaction were passed by the requisite majorities of HRG's shareholders on 16 March 2018.

(5) Consequently, the Transaction, which results in the acquisition of sole control over HRG by GBT, constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(6) The Transaction does not have a Union dimension within the meaning of Article 1 of the Merger Regulation, as the Parties' turnover does not meet the thresholds of Article 1(2) or 1(3) of the Merger Regulation. However, it fulfilled the conditions set out in Article 4(5) of the Merger Regulation for the Parties to request referral of the case to the Commission, as it was reviewable under the merger control laws of at least three Member States ([…], […] and […]).

(7) Following notification of a reasoned submission by the Parties on 27 April 2018, the Transaction acquired a Union dimension on 28 May 2018, since none of these three Member States expressed their disagreement to a referral of the case to the Commission.

3. MARKET DEFINITION

3.1. Introduction

(8) GBT and HRG are both active in the travel industry, the value chain of which typically consists in three main levels:

(a) travel suppliers, which own or operate a travel service. Travel suppliers include airlines and rail companies, hotel operators, car rental companies, etc.;

(b) tour operators, which create tourism products by purchasing individual travel components from travel suppliers and combine them into package holidays;

(c) travel agencies, which distribute travel services to the end-customer (the corporate customer or the individual traveller).

(9) More specifically, GBT and HRG are both business travel agencies ("BTAs"), which (i) distribute, as retailers, travel services of upstream travel suppliers (such as airlines, hotels, car rental companies etc.), and (ii) provide travel booking and management services to downstream business customers. As BTAs, the Parties are remunerated by both suppliers and customers. Approximately […]% of GBT's worldwide revenue derives from fees charged to its corporate customers, while approximately […]% derives from travel suppliers or operators of global distribution systems (3) (GDSs). (4) In the EEA, the sources of GBT's revenue are […] between customers ([…]%) and suppliers ([…]%). As to HRG, it derives […]% of its global revenues from customers ([…]% in the EEA) and […]% from suppliers ([…]% in the EEA).

(10) As BTAs, the Parties are active in the provision of the following services: (i) travel booking and management services, i.e. the provision of online and offline travel booking and reservation services and support, and the design, assessment and management of travel programs to meet customers' needs; (ii) events and meeting management services, i.e. arranging events and meetings associated with customers' business travel; and (iii) travel consultancy services, i.e. advising customers on how to manage, track and predict their travel spend, and providing data analytics to inform customers about their travel programs and strategy. (5)

(11) Furthermore, GBT's parent company QH supplies travel services through its controlled companies Qatar Airways, which is active in the upstream market for passenger air transport services, as well as Katara Hospitality and […], which are active in the upstream market for hotel accommodation services.

3.2. Travel agency services

3.2.1. Product market

(12) In its prior decisional practice, the Commission has defined a separate market for the services provided by travel agencies, defined as retailers of travel services generally remunerated by the supplier of the service concerned. (6)

3.2.1.1. Distinction by type of customers (business vs. leisure)

GBT's views

(13) GBT submits that business travel services should be considered separately from the market for leisure travel services. In particular, GBT notes that the demand-side considerations in leisure travel services are different to those for business travel services, principally due to the fact that leisure travel is less frequent, specific to one individual (or one group), and does not typically require the same level of pre- trip support, advisory services, account management or other ancillary services. (7)

Commission's assessment

(14) Business travel agency services meet the needs of companies for business travel by management and employees in accordance with corporate travel budgets and plans, whereas leisure travel agencies provide services to individuals in connection with their non-business vacation and personal travel needs. (8)

(15) In its prior decisional practice, in view of the different needs of these two categories of customers, the Commission has distinguished between the provision of business travel agency services and leisure travel agency services. (9)

(16) A majority of respondents to the market investigation confirm that the distinction between the type of customers, i.e. between business and leisure travel agency services, is appropriate. (10) In particular, a majority of competitors indicates that, in general, the travel agency services required by corporate customers differ from those required by leisure customers. Competitors notably underline that business travel tends to be more complex than leisure travel, and the level of flexibility and support required by business travellers is typically higher. They also refer to other differentiating criteria, such as the level of fees, the payment conditions, and the booking channels. (11)

(17) In this context, a majority of the customers and of the suppliers of business travel services and GDSs that responded to the market investigation consider that leisure travel agencies do not compete strongly with GBT and HRG for the provision of business travel agency services to corporate customers. (12) The views of BTAs are nevertheless more nuanced, as the majority of them acknowledge that leisure travel agencies compete to some extent with them for the provision of business travel agency services to corporate customers. (13)

Conclusion

(18) In any case, for the purpose of this Decision, it is not necessary to decide on the distinction between business and leisure travel agency services, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible product market definition.

(19) GBT and HRG provide business travel agency services only. Amex, one of GBT's parent companies, also provides leisure travel agency services through its wholly- owned travel business American Express Travel and Lifestyle Services. (14) However, since HRG does not provide leisure travel agency services, the Parties' activities do not overlap with regard to leisure travel services.

(20) In addition, considering that the Transaction would not give rise to an affected market under any plausible geographic market definition (worldwide, EEA-wide or national) if business and leisure travel agency services were considered as belonging to the same product market, (15) for the purposes of this Decision, the Commission will further assess the competitive effects of the Transaction on business travel agency services only.

3.2.1.2. Distinction between business travel agency services and other business travel services

GBT's views

(21) GBT submits that booking business travel does not require the use of an external travel agent. According to GBT, companies can and do arrange their travel requirements themselves, through self-service tools, often taking advantage of a wide array of online travel agencies ("OTAs"). Therefore, business travel booking and management services provided by BTAs should not be distinguished from bookings of travel made directly by business travellers with travel suppliers or via an OTA. (16)

Commission's assessment

(22) In its prior decisional practice with regard to leisure travel services, the Commission has considered whether changes in the travel sector, notably through the development of online distribution and low-cost airlines, have led to the creation of a dynamic market consisting of the services provided by all suppliers in the travel industry's value chain. However, the Commission ultimately left this question open. (17)

(23) The majority of corporate customers that responded to the market investigation do not support the view expressed by GBT that the line between travel agency services and self-management of business travel is blurred. Indeed, most respondents indicate that, in general, they would not be willing to book their business travel through leisure-focused OTAs if the current prices of business travel agency services were to increase by 5%-10% on a permanent basis. They notably point to services that OTAs would not offer, notably in terms of duty of care, traveller tracking, data collection, and invoicing. (18) The views of corporate customers are more mixed with regard to direct bookings with suppliers of business travel services (e.g. airlines, train operators, hotels, car rental companies). (19) Nevertheless, some respondents indicate that large companies discourage direct bookings, at least for airlines and hotels, (20) in order to ensure transparency and consistency in their booking policies and note, more generally, that leisure-focused OTAs and direct travel suppliers are not (yet) able to offer the broad range of travel services required by large, global firms. (21)

(24) Similarly, the majority of suppliers of business travel services and GDSs that responded to the market investigation do not consider that GBT and HRG compete with them for the supply of business travel services to corporate customers. (22) Conversely, they do not see themselves, or online leisure travel agencies, as strong competitors of the Parties for the provision of business travel agency services. (23)

(25) Competitors do not express such a clear-cut opinion. When asked whether, in general, corporate customers using business travel agency services would be willing to book their business travel through leisure-focused OTAs or directly with suppliers of business travel services if the current prices of business travel agency services were to increase by 5%-10% on a permanent basis, the majority of respondents responded that it depends. (24)

Conclusion

(26) In any case, for the purpose of this Decision, it is not necessary to decide on the distinction between business travel agency services and business travel services provided directly by suppliers or via OTAs, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible product market definition.

(27) Considering that the Transaction would not give rise to an affected market under any plausible geographic market definition if all business travel services were considered as belonging to the same product market, (25) in this Decision, the Commission will further assess the competitive effects of the Transaction on business travel agency services only.

3.2.1.3. Distinction by distribution channel (online vs. offline)

GBT's views

(28) GBT considers that the market for business travel services should not be segmented by distribution channel (online or offline). The Parties notably note that they offer both offline and online services to their customers, such that customers are not committed to a single distribution channel but can choose either or both on a case- by-case basis. (26)

Commission's assessment

(29) In its prior decisional practice, the Commission has mainly assessed the question of whether online and offline travel agency services should be considered separate markets in relation to leisure travel agency services (27) or travel agencies serving the two customer categories. (28)

(30) The outcome of the market investigation is inconclusive as to whether online and offline business travel agency services form part of the same market. A minority of corporate customers using online services (i.e. booking through an online tool) that responded to the market investigation would, in general, be willing to switch to offline services (e.g. booking by phone, email, in brick-and-mortar agencies, etc.) if the current prices of online services were to increase by 5%-10% on a permanent basis (and vice versa would be willing to switch to online services in the event of a similar permanent increase in the current price of offline services). (29) To substantiate their views, corporate customers indicate that online solutions are not always available, in particular due to technical limitations, and may not be used for all types of services (in particular for complex travel arrangements). Nevertheless, a majority of corporate customers request in their contracts with BTAs both online and offline distribution channels. (30) In fact, a majority of the corporate customers that responded to the market investigation use both online and offline booking services, and the breakdown between the transactions ordered from their business travel agents through online tools or offline (e.g. by phone, by mail, in brick-and- mortar agencies, etc.) varies considerably between customers. (31) In addition, some corporate customers confirm that one of the advantages of BTAs compared to other booking solutions is that they offer both online and offline booking services. (32) Therefore, it appears that BTAs need to be able to offer the two booking channels to their corporate customers in order to compete effectively. This was confirmed by the response of corporate customers regarding the extent to which traditional BTAs and online BTAs compete with the Parties. Although a higher number of respondents consider that traditional BTAs compete very strongly with the Parties, the majority of them also consider that online BTAs compete very strongly with the Parties. (33)

(31) A majority of the competitors that responded to the market investigation also indicate that, with regard to the business travel agency services provided to their corporate customers, they generally offer both online and offline services. (34)

(32) Finally, the competitors that responded to the market investigation indicate that traditional and online BTAs compete almost equally with them. (35)

Conclusion

(33) In light of the above, considering that corporate customers generally require both online and offline booking solutions and it appears that BTAs need to be able to accommodate both distribution channels to compete, the Commission concludes that, for the purposes of this Decision, the market for the provision of business travel agency services includes both online and offline business travel agency services.

(34) In any case, the market investigation has not brought elements showing that the outcome of the competitive assessment would be materially affected if online and offline business travel agency services were considered as distinct markets.

3.2.1.4. Distinction by type of services (travel booking and management vs. events and meeting management vs. travel consultancy)

GBT's views

(35) GBT submits that the services provided by both GBT and HRG in relation to events and meeting management and travel consultancy are ancillary to their travel booking and management services. (36)

Commission's assessment

(36) The market investigation was inconclusive as regards the provision of the above- mentioned services as ancillary services to travel booking and management services. (37)

(37) As regards events and meeting management services, a number of competitors indicated that BTAs aim to provide these services to their clients, but that they require special skills and that corporate customers may handle them separately, as part of their marketing spend (rather than as part of their travel spend). (38) Corporate customers' responses to the market investigation indicate a diversity of purchasing patterns for events and meeting management services. About half of the responding customers indicated that they usually do not purchase events and meeting management services from their business travel agency, a minority said that they do, and the rest indicated that it depends. (39) The more qualitative answers reflect the divergence among customers, and even within the same customer group. As examples, one customer states that "[t]he needs of travel services and meeting services often coincide and synergies are significant", while another customer mentions that it "often use[s] specialized service providers" to manage meetings and events requests and a third customer that it "purchases most of its event and meeting management services from a TMC [travel management company], but that TMC is not the same TMC that [the customer] uses for most of its business travel services." (40)

(38) As regards travel consultancy services, the majority of competitors indicated that the supply of these services by a business travel agency is ancillary to its primary business and that "consulting and optimizing travel spending is required by many clients." (41) However, the responses of corporate customers to the market investigation are not sufficient to conclude that they usually acquire these services from their BTAs together with other services. (42) One respondent summarises the situation as follows: "Depending on the circumstances we may look to purchase consultancy services from a business travel agency. This service does not necessarily have to come from the incumbent business travel services provider." (43)

Conclusion

(39) In any case, for the purpose of this Decision, it is not necessary to decide on whether (i) events and meeting management services, and (ii) travel consultancy services constitute markets distinct from (iii) travel booking and management services, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible product market definition.

(40) Both GBT and HRG are […] active in the provision on a stand-alone basis of events and meeting management services (44) and travel consultancy services. (45) If (i) events and meeting management services and (ii) travel consultancy services were to be considered as separate markets, they would not be affected by the Transaction under any plausible geographic market definition. (46)

(41) Therefore, in this Decision, the Commission will further assess the competitive effects of the Transaction on travel booking and management services, defined as either including or excluding events and meeting management services and travel consultancy services.

3.2.1.5. Conclusion on product market

(42) In light of the above, for the purpose of this Decision, it is not necessary to decide whether the market for travel agency services should be segmented according to the type of customers (business or leisure). In view of the focus of the Parties' activities, the Commission will consider further the market for business travel agency services only.

(43) Furthermore, for the purpose of this Decision, the Commission concludes that it is not appropriate to segment the market for business travel agency services by distribution channel (online or offline).

(44) Lastly, for the purpose of this Decision, it is not necessary to decide on the delineation of the market for business travel agency services depending on the type of intermediary (or the absence thereof) or the type of agency services (travel booking and management or other services). In view of the focus of the Parties' activities, the Commission will carry out its competitive assessment based on the market for business travel agency services only, either including or excluding event and meeting management as well as travel consultancy services provided by BTAs.

3.2.2. Geographic market GBT's views

(45) GBT submits that the market for business travel services is at least EEA-wide and potentially worldwide in scope. (47)

Commission's assessment

(46) In its prior decisional practice, the Commission has generally considered that the market for travel agency services is national in scope, but has mainly reached that conclusion in respect of leisure travel agency services. For the supply of business travel agency services, the Commission has left open the question of whether the market is national or wider than national in scope. (48)

(47) A majority of the customers that responded to the market investigation indicate that (i) the types of services requested from BTAs, and (ii) the level of fees/commissions charged by BTAs do not vary significantly from one country to another within the EEA. They also consider that the types of services requested are homogeneous at worldwide level, while views are more mixed about the level of fees/commissions at worldwide level. (49) The contracts between large customers and BTAs tend to cover several countries and can even be worldwide in scope. (50)

(48) Similarly, a majority of the suppliers and GDSs that responded to the market investigation declare that the key terms of their contracts with BTAs do not vary significantly from one EEA country to another, or even worldwide. (51) The scope of their contracts with BTAs is generally global or regional (e.g. EMEA), but suppliers and GDSs may also enter into contracts with a narrower scope based on their points of sale. (52)

(49) The responses of competitors to the market investigation do not fully support the views expressed by customers and suppliers with regard to the homogeneity of the types of services provided by BTAs and the level of fees charged by BTAs within the EEA or at worldwide level. A number of competitors mention significant variations between countries, specifying for example that "[s]ervices are market/country dependant", and that "Fees/Costs are driven very much by the individual markets cost of doing business", notably labour costs. (53) In addition, the geographic scope of the network used by competitors to distribute business travel services to corporate customers ranges from one country to a global presence. (54) A competitor summarises the national and wider features of large BTAs as follows: "While a TMC may manage the business travel across EEA, in many cases, the agreement may be local in nature, with different local requirements and different pricing." (55)

(50) The results of the market investigation are more clear-cut as regards the importance of the BTA having a local presence in the countries where its customers have offices. A majority of the customers and competitors that responded to the market investigation consider that such a local presence is important or very important. (56)

(51) Moreover, the market shares of the Parties vary quite significantly between the different Member States, (57) which might be a preliminary indication of national markets. (58)

(52) Besides, a majority of the competitors that responded to the market investigation indicate that it is difficult or very difficult for a business travel agent to expand its activities from one EEA country to another, due notably to the need to gain knowledge about regulations and law, language and culture. (59)

3.2.2.1. Conclusion on geographic market

(53) In any case, for the purpose of this Decision, it is not necessary to decide on whether the market for business travel agency services is national, EEA-wide or worldwide, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible geographic market definition.

3.3. Passenger air transport services

(54) GBT's parent company QH is active, through Qatar Airways, in the market for passenger air transport services, which is upstream from business travel agency services.

GBT's views

(55) GBT only contemplates an overall market for passenger air transport services in the EEA. (60)

Commission's assessment

(56) In its prior decisional practice regarding the airline industry, the Commission has traditionally defined the relevant markets for passenger air transport services on the basis of the "point of origin/point of destination" (O&D) city-pair approach, (61) taking account of the substitutability between airports (particularly if the airports serve the same main city). (62) Under the O&D approach, it has considered distinguishing between, notably, (i) charter flights and scheduled flights, (ii) time sensitive and non-time sensitive passengers (in particular for long-haul flights), and (iii) direct and indirect flights. (63)

(57) For the purpose of assessing the possible vertical effects of the creation of the GBT joint venture, the Commission considered the provision of passenger air transport services by Qatar Airways on specific direct routes and at EEA level. (64)

Conclusion

(58) In any case, for the purpose of this Decision, it is not necessary to decide on the applicability of the O&D approach, or on the delineation of passenger air transport services by type of flights, customers or connection, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible market definition.

3.4. Hotel accommodation services

(59) GBT's parent company QH also provides hotel accommodation services through its subsidiaries Katara Hospitality and […].

GBT's views

(60) GBT submits that it is not necessary to decide on the precise product or geographic scope of the upstream market for hotel accommodation services. (65)

Commission's assessment

(61) In its prior decisional practice, the Commission has left open the question of whether the market for hotel accommodation services should be divided on the basis of (i) ownership type, or (ii) comfort/price level. (66) It has also found that the geographic market for hotel accommodation services appears to be local. (67)

Conclusion

(62) In any case, for the purpose of this Decision, it is neither necessary to decide on the distinction between hotel accommodation services according to the type of ownership or level of comfort/price nor on the precise geographic scope of the market for hotel accommodation services, since no serious doubts would arise as to the Transaction's compatibility with the internal market under any plausible market definition.

4. COMPETITIVE ASSESSMENT

4.1. Methodology for estimating market shares on worldwide, EEA-wide and national markets for business travel agency services

4.1.1. Non-inclusion of travel partners in the Parties' market shares

(63) GBT and HRG provide business travel agency services through a proprietary presence (i.e. by having an incorporated entity and/or office) or through their travel partner network. GBT has a proprietary presence in […] jurisdictions worldwide and has travel partners in […] jurisdictions. HRG has a proprietary presence in […] jurisdictions and travel partners in […] jurisdictions. (68)

(64) Travel partners are independent travel agents (typically with operations in a single jurisdiction), providing either leisure or business travel services or a combination of both. Travel partners use the branding of a global BTA in return for payment of a licence fee. The use of travel partners enables a BTA to facilitate business travel services for their international customers which have operations/employees based in jurisdictions where the BTA has no proprietary presence. (69)

(65) According to the information provided by GBT, the Parties do not have decision- making authority in relation to the operation of their travel partners, which operate autonomously. (70) In particular, the travel partner decides independently on its own pricing policy in its jurisdiction. As regards the tender processes in which the Parties intend to participate, the travel partner provides the Parties with a commercial offer, including a price range or fee structure, to address the customer's requirements in the travel partner's jurisdiction. The Parties then convey these commercial terms to the customer. At no point in time do the Parties negotiate with or direct the travel partner in respect of its commercial offer. (71) This information has not been contradicted by any evidence obtained from the market investigation. (72)

(66) Therefore, for the purpose of this Decision, and in line with paragraph 19 of the Commission's Consolidated Jurisdictional Notice according to which "franchising agreements as such do not normally confer control over the franchisee's business on the franchisor," travel partners are not considered as controlled by the Parties, which do not have a determining role in the operation of their travel partners and the development and implementation of the latter's business (including pricing) strategy.

(67) In addition, while the Parties are not precluded from establishing a proprietary presence in the jurisdiction of one of their travel partners, the Parties only exceptionally use this possibility. In particular, in the EEA, GBT has both a proprietary presence and a travel partner in […]. [Similar assessment for HRG]. (73)

(68) As a consequence, the turnover of the Parties' travel partners is not allocated to the Parties' turnover, as this would not accurately reflect their relative market position, and, in […] in which the Parties have both proprietary presence and travel partners ([…]), the travel partners' market shares are not included in the calculation of the Parties' market shares. (74)

4.1.2. Calculation of market shares

(69) According to the Parties, no reliable and comprehensive public source of market share data is available in the market for business travel agency services. The Parties have provided their best estimates of GBT's and HRG's market shares, on the basis of the total sales value of the travel services provided to corporate customers (e.g. the unit price of a ticket sold by a BTA multiplied by the number of tickets sold). (75)

(70) The methodology put forward by the Parties suffers from two flaws. First, it is not compliant with the definition of the turnover of intermediaries such as travel agencies set out in paragraph 159 of the Commission's Consolidated Jurisdictional Notice, (76) according to which turnover would consist of the commissions paid by the BTAs' suppliers and customers. Second, it was not supported by sufficient evidence that all BTAs apply comparable levels of fees to the sales volume they invoice to their customers (or at least comparable levels of fees per type of travel services), such that market shares calculated on the basis of total travel sales value would be comparable to market shares calculated on the basis of turnover (defined as total fees).

(71) The Commission has therefore undertaken a market reconstruction exercise to obtain a more precise overview of the competitive landscape at national, EEA-wide and worldwide levels. Within the framework of the market investigation, the Commission has asked the Parties and some of their key competitors for their 2017 turnover.

(72) Although the data gathered is reliable, the Commission did not request turnover data from the entirety of the competitors present at each level, and in each national market. Rather, the Commission focused mainly on competitors active in the countries where the Parties both have a proprietary presence. This means that the gathered turnover data does not cover the total turnover for each market. Hence, the market reconstruction exercise provides a reliable, yet conservative estimate of the Parties' combined shares at national level, and even more so at EEA-wide and worldwide levels.

4.1.3. Comparison of market shares including and excluding events and meeting management services and travel consultancy services

(73) Based on data collected from participants in the market reconstruction exercise, the Commission has calculated the Parties' market shares including and excluding turnover generated by (i) events and meeting management services, and (ii) travel consultancy services. On a conservative basis, the Commission has included the turnover of these services only for the Parties and for a limited number of competitors, the core business of which is the provision of travel booking and management services.

(74) As a result of this conservative approach, a comparison of the two sets of data shows that the Parties' market shares based on the outcome of the market reconstruction are systematically higher where turnover of events and meeting management services and travel consultancy services are included than where they are excluded, although to a non-significant extent.

(75) Therefore, the Commission will present below the Parties' estimated market shares including events and meeting management services and travel consultancy services. While the inclusion or exclusion of these services would not have an impact on the outcome of the competitive assessment, in this Decision the Commission's further analysis of the business travel agency services market encompasses (i) travel booking and management services, (ii) events and meeting management services, and (iii) travel consultancy services.

4.2. Horizontal effects

4.2.1. Legal framework

(76) According to the Horizontal Merger Guidelines, (77) a merger may significantly impede effective competition in a market by removing important competitive constraints on one or more sellers, who consequently have increased market power. The most direct effect of the merger will be the loss of competition between the merging firms.

(77) A number of factors, which taken separately are not necessarily decisive, may influence whether significant non-coordinated effects are likely to result from a merger, in particular whether merging firms have large market shares, merging firms are close competitors, customers have limited possibilities of switching supplier, competitors are unlikely to increase supply if prices increase, the merged entity would be able to hinder expansion by competitors, and the merger eliminates an important competitive force. (78)

4.2.2. Overview of the horizontally affected markets

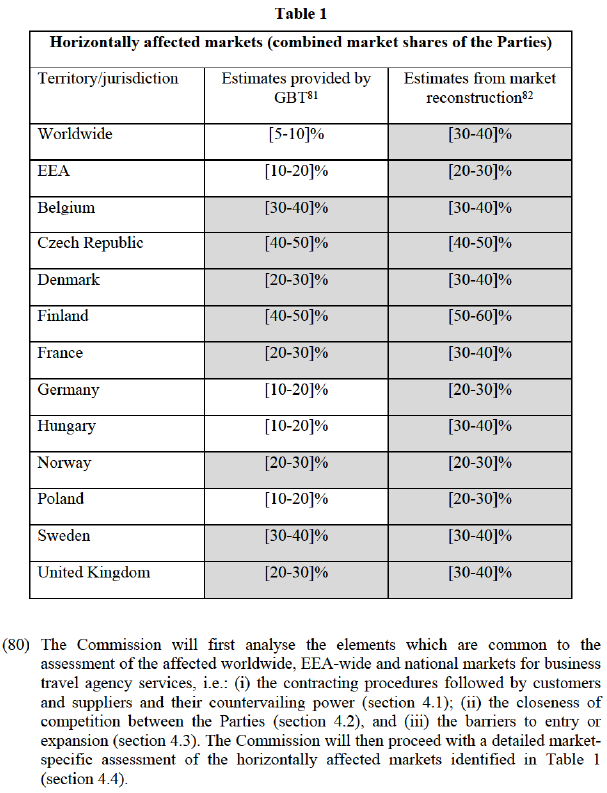

(78) Table 1 below provides an overview, based on the Parties' estimates and the market reconstruction results, (79) of the horizontally affected markets which would arise as a result of the Transaction.

(79) According to the market reconstruction results, as a result of the Transaction, the worldwide and EEA-wide markets for business travel agency services would be horizontally affected, as well as 11 national markets within the EEA. (80)

4.2.3. Elements common to the assessment of the markets for business travel agency services at worldwide, EEA-wide and national levels

4.2.3.1. Contracting procedures and countervailing power

Contracts with corporate customers

(81) According to GBT, procurement for business travel management services is conducted either by way of bilateral negotiations between customers and BTAs, or often through tender processes, with tenders coming to market on average every three to five years. (83) According to GBT, customers are sophisticated and experienced businesses, which exert considerable buyer power constraining the ability of the merged entity, and of BTAs in general, to increase prices.

(82) The majority of the respondents to the market investigation confirm that business travel agency services are procured by corporate customers (84) mostly by way of tendering and that BTAs have long-lasting relations with their customers and the duration of the contracts (which can be renewed) typically amounts to 3-5 years. (85) The main criteria for selection used by large corporate customers are the geographic footprint of the BTA, market knowledge, experience, service range and prices. (86) Prices and service levels are generally pre-agreed for the full duration of the contracts. (87) Therefore, the effect of the Transaction on prices and quality of services, if any, would only materialise at the expiry of the contracts. (88)

(83) While the Parties and a majority of their competitors that responded to the market investigation indicate a very high renewal rate of their existing contracts at the expiry of the initial contractual term, a majority of corporate customers that responded to the market investigation rather indicate that contracts are usually reviewed on their terms and that their renewal depends on a number of factors, notably the competitiveness of the services (compared with market conditions) and the customer's satisfaction. (89)

(84) Nevertheless, a majority of the corporate customers that responded to the market investigation indicate that they consider it relatively difficult to switch to another BTA than their current one, taking into account the administrative burden, costs and time involved. (90) Although a cumbersome process, a majority acknowledge that changing BTAs is feasible, and that the difficulty of the transition depends notably on whether the corporate customer switches a national, regional or global agent. (91)

(85) While the contracts are generally not exclusive, the practices of corporate customers with regard to multi-sourcing vary. (92) In any case, as will be demonstrated below, there will remain sufficient competition in the market post- Transaction to alleviate any negative impact on corporate customers, including those having a multi-sourcing strategy.

Contracts with travel service suppliers and GDSs

(86) GBT indicates, by way of background, that BTAs do not need to have a contract in place with a travel supplier to be able to book the supplier's travel service for a customer. According to GBT, market standard commissions from suppliers to BTAs on a per booking basis are not governed by contracts between the BTA and the supplier, but are instead an industry standard practice, which, in the case of many airlines in the EEA, has been eliminated. Nevertheless, both GBT and HRG have contracts with GDSs and preferred suppliers, which are negotiated bilaterally in a direct contracting process. (93)

(87) The majority of the suppliers and GDSs that responded to the market investigation indicate that the remuneration of BTAs distributing their services is generally negotiated regularly (every one to three years) and is governed by contracts directly entered into by the BTAs. (94) In addition, these contracts are usually renewed. (95) Furthermore, all the suppliers and GDSs that responded to the market investigation have contracts with multiple travel agents. In particular, one of the GDSs notes that "[a]s [it] operates in a two-sided market, [it] has an inherent interest in maximizing the number of travel agencies, including business travel agencies, subscribing to its GDS", while an airline indicates that it "seeks to have contracts with the largest and most relevant business travel agencies in the majority of the countries that [it] serve[s]." (96)

4.2.3.2. Market structure

(88) GBT claims that the business travel services market is highly fragmented, such that the combination of GBT and HRG would not negatively impact the level of choice for customers in the market. (97)

(89) Overall, customers, travel service suppliers and GDSs consider that the market for business travel agency services is competitive and that there will remain a sufficient number of competitors post-Transaction to mitigate any effects of the Transaction. (98) A minority of customers raise concerns about their reduced choice and the potential slowdown of innovation and product development due to the combination of GBT and HRG. (99) Similarly, a minority of travel service suppliers and GDSs raise concerns about an increase in fees and incentive payments, due to the alignment of GBT's and HRG's levels (HRG's fee and incentive levels were lower) and the reinforcement of GBT's negotiating power post-Transaction, as a result of the combination of their booking volumes. (100)

(90) However, the Commission finds that the merged entity will continue to be constrained by a number of major global BTAs with significant market shares post- merger, such as Carlson Wagonlit Travel (CWT), BCD Travel, Egencia, Lufthansa City Centre and FCM Travel Solutions. Hence, there is no indication that the merged entity would be able to profitably raise prices or lower the quality of its services when bidding for new contracts, at the expiry of its existing contracts with corporate customers, or when negotiating new contracts with travel suppliers and global distribution systems. The merged entity would also continue to be constrained, although to a lesser extent, by remaining smaller, regional and national BTAs.

(91) In addition to the strong competitive pressure exerted by rival BTAs, a majority of the competitors that responded to the market investigation also indicated that, although the competitive constraints from leisure-focused OTAs may be considered rather weak, suppliers of travel services (e.g. airlines) may be considered to constrain BTAs (101) to some extent and hence will continue to constrain the merged entity post-Transaction.

4.2.3.3. Closeness of competition

Outcome of the market investigation

(92) A majority of respondents to the market investigation indicate notably as close competitors to the Parties other global BTAs in the relevant markets such as Carlson Wagonlit Travel (CWT) and BCD Travel. FCM Travel Solutions and Egencia are also regularly mentioned. (102) A customer explains that "[m]ainly all global travel agency chains (American Express GBT, HRG, BCD, CWT, FCM) have a core business competency to deliver travel agency services in the above countries [the relevant markets]." (103) A majority of market investigation respondents indicated that HRG was not GBT's closest competitor (most often HRG was ranked as GBT's third closest competitor by corporate customers). However GBT was considered HRG's closest competitor. (104)

(93) In addition, internal documents provided by the Parties tend to show that the Parties consider their geographical footprints and their travel supplier content offerings to be complementary. (105)

Assessment of bidding data for corporate customers

(94) The bidding data provided by GBT for 2015-2017 show that, in the tender processes launched by companies across the EEA, GBT and HRG are not very close competitors, as HRG appears in materially fewer of the tenders in which GBT participated than CWT, BCD Travel or Egencia (i.e. HRG is reported as a competitor in a lesser proportion of all the tenders in which GBT participated and in a lesser proportion of all the tenders lost by GBT than the other players) and, in the case of competing bids, GBT loses more opportunities to CWT, Egencia and BCD than to HRG. (106)

(95) This would indicate that the competitive constraint imposed on GBT by HRG in such tenders would be lower than the competitive constraint imposed on GBT by other BTAs, such as CWT, BCD and Egencia.

4.2.3.4. Barriers to entry

(96) GBT submits that there are no substantial commercial or technical barriers to entry for potential new entrants in the market for business travel services. According to GBT, leisure-focused OTAs and direct suppliers can easily expand their offering to begin serving business customers. (107)

(97) The results of the market investigation do not support GBT's views. A majority of respondents to the market investigation indicated that it would be difficult for a corporate customer to internalise business travel agency services and that it would be difficult for a new entrant to start providing business travel agency services, taking into account the knowledge required, administration and information, and costs. (108) In addition, most of the competitors that responded to the market investigation consider it relatively difficult for a leisure travel agent to start providing business travel agency services. (109)

4.2.3.5. Conclusion

(98) Overall, based on information provided by GBT and on views expressed by customers, travel service suppliers and GDSs, and competitors on (i) the market structure, (ii) the closeness of competition between the Parties, and (iii) barriers to entry, it appears that, despite relatively high barriers to entry, there would remain post-Transaction a number of large BTAs which would closely compete with the merged entity.

4.2.4. Market-specific analysis of affected markets

4.2.4.1. Worldwide

(99) The market reconstruction results in a combined market share estimate for the Parties of [30-40]% (GBT: [20-30]%; HRG: [5-10]%) at worldwide level. The market share provided by the Parties, however, is considerably lower ([5-10]%) and does not give rise to an affected worldwide market for the provision of business travel agency services.

(100) According to a majority of respondents to the market investigation, there are major BTAs in the worldwide market, such as CWT and BCD Travel, which exert a stronger competitive pressure than HRG on GBT for the provision of business travel agency services. (110)

(101) Moreover, the majority of respondents to the market investigation confirm that there would be sufficient competition globally post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (111)

(102) Furthermore, the majority of respondents to the market investigation consider that the Transaction would not have any impact or would have a positive impact on the worldwide market for the distribution of business travel services. (112)

(103) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services at worldwide level.

4.2.4.2. EEA

(104) The market reconstruction results in a combined market share estimate for the Parties of [20-30]% (GBT: [10-20]%; HRG: [10-20]%) in the EEA. The market share provided by the Parties, however, is lower ([10-20]%) and does not give rise to an affected EEA-wide market for the provision of business travel agency services.

(105) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the EEA market, including CWT, BCD Travel, FCM Travel Solutions and Egencia.

(106) According to a majority of respondents to the market investigation, there are major BTAs in the EEA-wide market, such as CWT and BCD Travel, which exert a stronger competitive pressure than HRG on GBT for the provision of business travel agency services. (113)

(107) At EEA-wide level, based on the bidding data provided by GBT (relating to new contractual opportunities as well as renewals), GBT appears significantly more constrained by CWT, BCD Travel and Egencia than by HRG. (114)

(108) Moreover, the majority of respondents to the market investigation confirm that there would be sufficient competition in the EEA post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (115)

(109) Furthermore, the majority of the respondents consider that the Transaction would not have any impact or would have a positive impact on the EEA-wide market for the distribution of business travel services. (116)

(110) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services at EEA-wide level.

4.2.4.3. Belgium

(111) The market reconstruction results in a combined market share estimate for the Parties of [30-40]% (GBT: [20-30]%; HRG: [0-5]%) in Belgium.

(112) The increment of [0-5%] is indicative of the limited impact on the competitive situation in the Belgian market.

(113) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Belgian market, including several global or regional BTAs, such as CWT, Lufthansa City Centre, Egencia, Uniglobe Travel and BCD Travel, as well as national players such as BTS Travel. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Belgium.

(114) The majority of respondents to the market investigation name BCD Travel, CWT or Egencia as GBT's closest competitors in Belgium before HRG, and name the same three players as well as GBT as HRG's closest competitors in Belgium. (117)

(115) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Belgium, GBT is more constrained by CWT, BCD Travel and Egencia than by HRG. In addition, each of Egencia, BCD Travel, CWT and FCM Travel Solutions won more of the renewal tenders lost by GBT than HRG. (118)

(116) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Belgium post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (119)

(117) The majority of the respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Belgian market for the distribution of business travel services. (120)

(118) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Belgium.

4.2.4.4. Czech Republic

(119) The market reconstruction results in a combined market share estimate for the Parties of [40-50%] (GBT: [20-30]%; HRG: [20-30]%) in the Czech Republic.

(120) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Czech market, including several global or regional BTAs, such as BCD Travel, CWT, Lufthansa City Centre, Egencia, FCM Travel Solutions and Uniglobe Travel, as well as national players, such as Weco-Travel, (Radius), Asiana and Orbix. (121) These numerous competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in the Czech Republic.

(121) The majority of respondents to the market investigation name BCD Travel, CWT, Egencia or Orbix as GBT's closest competitors before HRG, and name BCD Travel, CWT and GBT as HRG's closest competitors in the Czech Republic. (122)

(122) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in the Czech Republic, GBT is significantly more constrained by BCD Travel and the constraint exercised by CWT and Egencia is equal to that exercised by HRG. Namely, BCD Travel won significantly more of the new opportunities lost by GBT ([…]%) than HRG ([…]%), which won […] CWT ([…]%) and Egencia ([…]%).

(123) With regard to participation rates, GBT is substantially less constrained by HRG than by CWT and BCD and no more than by Egencia, since CWT and BCD appear in significantly more of the tenders in which GBT participated (respectively […]% and […]%) than HRG ([…]%), which appears in only […]% more of the tenders in which GBT participated than Egencia ([…]%). (123) CWT and BCD also appear in significantly more of the tenders lost by GBT (respectively […]% and […]%) than HRG ([…]%).

(124) In addition, HRG […] of the renewal bids lost by GBT in Czech Republic, where CWT and BCD won the highest proportion of renewal bids lost by GBT. (124)

(125) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in the Czech Republic post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (125)

(126) The majority of respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Czech market for the distribution of business travel services. (126)

(127) Lastly, the market investigation has not provided any indication that BTAs competing with the Parties at worldwide or EEA levels do not try to expand or grow their presence in the Czech Republic, to the same extent as in other countries. In this context, the Parties' relatively high market shares understate the competitive pressure exerted on them by their close competitors.

(128) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in the Czech Republic.

4.2.4.5. Denmark

(129) The market reconstruction results in a combined market share estimate for the Parties in Denmark of [30-40]% (GBT: [20-30]%; HRG: [5-10]%).

(130) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Danish market, including several global or regional BTAs, such as FCM Travel Solutions, CWT, Egencia, ATPI and BCD Travel, as well as national players such as Vejle Rejser. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Denmark.

(131) The majority of respondents to the market investigation name BCD Travel, CWT or Egencia as GBT's closest competitors in Denmark before HRG, and name the same three players as well as GBT as HRG's closest competitors in Denmark. (127)

(132) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Denmark, GBT is more constrained by Egencia, CWT and BCD Travel with regard to new opportunities as well as participation rates. In addition, BCD Travel and CWT won significantly more of the renewal tenders lost by GBT than HRG. (128)

(133) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Denmark post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (129)

(134) The majority of respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Danish market for the distribution of business travel services. (130)

(135) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Denmark.

4.2.4.6. Finland

(136) The market reconstruction results in a combined market share estimate for the Parties of [50-60]% (GBT: [30-40]%; HRG: [10-20]%) in Finland. .

(137) Post-Transaction, in addition to several (smaller) national players, there would be several global BTAs left in the Finnish market, such as CWT, Egencia, FCM Travel Solutions and BCD Travel. These numerous competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Finland.

(138) The majority of the respondents to the market investigation name BCD Travel, CWT or Egencia as GBT's closest competitors in Finland, before HRG, and name the same three players as well as GBT as HRG's closest competitors. (131)

(139) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Finland, the constraint exercised by HRG on GBT is less than the constraint exercised by CWT, equal to the constraint exercised by BCD Travel and more than the constraint from Egencia. Namely, CWT won more of the new opportunities lost by GBT ([…]%) than HRG ([…]%), which won […] BCD Travel ([…]%) and […]% more than Egencia ([…]%).

(140) With regard to participation rates, GBT is substantially less constrained by HRG than by either of CWT and BCD Travel, since CWT and BCD appear in significantly more of the tenders in which GBT participated ([…]%) than HRG (…]%).132 CWT and BCD also appear in significantly more of the tenders lost by GBT (respectively […]% and […]%) than HRG ([…]%).

(141) In addition, CWT won significantly more of the renewal tenders lost by GBT than HRG, which won […] BCD and FCM Travel Solutions. (133)

(142) Furthermore, the majority of the respondents to the market investigation confirm that there would be sufficient competition in Finland post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (134)

(143) The majority of respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Finnish market for the distribution of business travel services. (135)

(144) Lastly, the market investigation has not provided any indication that BTAs competing with the Parties at worldwide or EEA levels do not try to expand or grow their presence in Finland, to the same extent as in other countries. In this context, the Parties' relatively high market shares understate the competitive pressure exerted on them by their close competitors.

(145) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Finland.

4.2.4.7. France

(146) The market reconstruction results in a combined market share estimate for the Parties of [30-40%] (GBT: [30-40]%; HRG: [0-5]%) in France.

(147) The increment of [0-5%] is indicative of the limited impact on the competitive situation in the French market.

(148) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the French market, including several global and regional BTAs, such as Egencia, BCD Travel and CWT, as well as Lufthansa City Centre, ATPI, Corporate Travel Management, FCM Travel Solutions and Uniglobe Travel. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in France.

(149) The majority of respondents to the market investigation name BCD Travel, CWT or Egencia as GBT's closest competitors in France before HRG, and name the same players as well as GBT as HRG's closest competitors in France. (136)

(150) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in France, GBT is significantly more constrained by CWT, BCD Travel and Egencia than by HRG (with regard to both new opportunities and participation rates). In addition, Egencia, BCD Travel, CWT and FCM Travel Solutions each won more of the renewal tenders lost by GBT than HRG. (137)

(151) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in France post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (138)

(152) Unlike the customers having responded to the market investigation, whose views were split, the majority of competitors, suppliers and GDSs having responded to the market investigation indicate that the Transaction would have no impact or would have a positive impact on the French market for the distribution of business travel services. (139)

(153) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in France.

4.2.4.8. Germany

(154) The market reconstruction results in a combined market share estimate for the Parties of [20-30%] (GBT: [10-20]%; HRG: [10-20]%) in Germany.

(155) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the German market, including several global or regional BTAs, such as CWT, BCD Travel, Lufthansa City Centre and Egencia, as well as national players, such as Der Touristik, Derpart and First Business Travel. These competitors would continue to constrain the merger entity's ability to profitably raise prices or lower the quality of its services in Germany.

(156) The majority of respondents to the market investigation name BCD Travel and CWT as GBT's closest competitors, and name the same two players together with GBT as HRG's closest competitors in Germany. (140)

(157) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Germany, GBT is significantly more constrained by BCD Travel, CWT and Egencia than by HRG. (141)

(158) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Germany post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (142)

(159) Unlike the customers having responded to the market investigation, whose views were split, the majority of the competitors, suppliers and GDSs that responded indicate that the Transaction would have no impact or would have a positive impact on the German market for the distribution of business travel services. (143)

(160) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Germany.

4.2.4.9. Hungary

(161) The market reconstruction results in a combined market share estimate for the Parties of [30-40]% (GBT: [10-20]%; HRG: [10-20]%) in Hungary.

(162) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Hungarian market, including several global or regional BTAs, such as CWT, Lufthansa City Centre and BCD Travel. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Hungary.

(163) The majority of respondents to the market investigation name BCD Travel and CWT as GBT's closest competitors, and name the same two players together with GBT as HRG's closest competitors in Hungary. (144)

(164) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, as regards new opportunities in Hungary, HRG does not exercise a greater constraint on GBT than do CWT or BCD Travel and, as regards participation rates, HRG exercises significantly less constraint on GBT than CWT and BCD. In addition, both BCD Travel and Egencia won significantly more renewal tenders lost by GBT than HRG in Hungary. (145)

(165) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Hungary post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (146)

(166) The majority of respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Hungarian market for the distribution of business travel services. (147)

(167) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Hungary.

4.2.4.10. Norway

(168) The market reconstruction results in a combined market share estimate for the Parties of [20-30]% (GBT: [5-10]%; HRG: [10-20]%) in Norway.

(169) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Norwegian market, including several global or regional BTAs, such as BCD Travel, ATPI, FCM Travel Solutions and Egencia, as well as a strong national player, Berg-Hansen. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Norway.

(170) Although the majority of respondents to the market investigation name GBT as HRG's closest competitor in Norway, the majority name BCD Travel, Egencia or CWT as GBT's closest competitors in Norway, before HRG. (148)

(171) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Norway, GBT is more constrained by CWT and Egencia than by HRG and that BCD exercises an equal constraint to HRG. (149)

(172) Furthermore, the majority of the respondents to the market investigation confirm that there would be sufficient competition in Norway post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (150)

(173) The majority of the respondents to the market investigation indicated that the Transaction would have no impact or would have a positive impact on the Norwegian market for the distribution of business travel services. (151)

(174) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Norway.

4.2.4.11. Poland

(175) The market reconstruction results in a combined market share estimate for the Parties of [20-30]% (GBT: [10-20]%; HRG: [10-20]%) in Poland.

(176) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Polish market, including several global or regional BTAs, such as CWT, BCD Travel, Uniglobe, FCM Travel Solutions and Egencia, as well as national players such as Weco-Travel and eTravel (a Lufhansa City Centre franchisee). These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Poland.

(177) Although the majority of respondents to the market investigation name GBT as HRG's closest competitor in Poland, the majority name BCD Travel, Egencia or CWT as GBT's closest competitors in Poland, before HRG. (152)

(178) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Poland, GBT is more competitively constrained by BCD Travel, CWT and Egencia than by HRG. (153) In addition, HRG […] of the renewal tenders lost by GBT in Poland, whereas CWT and BCD won the highest proportion of renewal tenders lost by GBT. (154)

(179) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Poland post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (155)

(180) The majority of respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Polish market for the distribution of business travel services. (156)

(181) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Poland.

4.2.4.12. Sweden

(182) The market reconstruction results in a combined market share estimate for the Parties of [30-40%] (GBT: [10-20]%; HRG: [10-20]%) in Sweden.

(183) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the Swedish market, including several global BTAs, such as CWT, Egencia, FCM Travel Solutions and BCD Travel, as well as a national player, Resia Travel. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in Sweden.

(184) The majority of the respondents to the market investigation name BCD Travel, CWT and Egencia as GBT's closest competitors in Sweden, before HRG, and name the same three players as well as GBT as HRG's closest competitors in Sweden. (157)

(185) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in Sweden, as regards new opportunities, the constraint exercised on GBT by Egencia and CWT is […] to that exercised by HRG, and, as regards participation rates, CWT and BCD Travel exercise a significantly greater constraint than HRG.. In addition, Egencia, CWT and BCD Travel won more renewal tenders […]*. (158)

(186) Furthermore, the majority of respondents to the market investigation confirm that there would be sufficient competition in Sweden post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (159)

(187) The majority of the respondents to the market investigation also indicate that the Transaction would have no impact or would have a positive impact on the Swedish market for the distribution of business travel services. (160)

(188) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in Sweden.

4.2.4.13. United Kingdom

(189) The market reconstruction results in a combined market share estimate for the Parties of [30-40]% (GBT: [10-20]%; HRG: [20-30]%) in the United Kingdom.

(190) Post-Transaction, there would be several large alternative suppliers of business travel agency services left in the United Kingdom market, including several global and regional BTAs, such as Capita Travel and Events, CWT, ATPI, Egencia, FCM Travel Solutions, Corporate Travel Management, Uniglobe, Lufthansa City Centre and BCD Travel. These competitors would continue to constrain the merged entity's ability to profitably raise prices or lower the quality of its services in the United Kingdom.

(191) In addition to the players identified in the market reconstruction, an annual survey by Buying Business Travel identifies: Redfern Travel, Portman Travel, Reed & Mackay, Hillgate Travel, Statesman Travel Group and various other market players. (161)

(192) The majority of the respondents to the market investigation name CWT as GBT's closest competitor in the United Kingdom, before HRG, also mentioning other major players such as BCD Travel, FCM Travel Solutions and Egencia. GBT is mostly named as HRG's closest competitor in the United Kingdom market, followed by CWT, Egencia, BCD Travel and FCM Travel Solutions. (162)

(193) Moreover, the bidding data provided by GBT for 2015-2017 tend to show that, in the United Kingdom, with regard to new opportunities, GBT is significantly more constrained by CWT and Egencia than by HRG (and that BCD Travel exercises a similar constraint to HRG), and that, with regard to participation rates, CWT, Egencia and BCD Travel exercise significantly more constraint on GBT in the United Kingdom than does HRG. In addition, CWT and Egencia won significantly more of the renewal tenders lost by GBT than HRG. (163)

(194) Furthermore, the majority of the respondents to the market investigation confirm that there would be sufficient competition in the United Kingdom post-Transaction to prevent the merged entity from raising the level of fees charged to customers for the provision of travel agency services or to suppliers and GDSs for the distribution of business travel services. (164)

(195) Customers that responded to the market investigation have split views as to the impact of the Transaction on the market for the distribution of business travel services in the UK. However, the majority of competitors, suppliers and GDSs that responded indicate that the Transaction would have no impact or would have a positive impact on the distribution of business travel services in the United Kingdom. (165)

(196) In view of the above, and considering all the evidence available to the Commission, the Commission concludes that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as concerns the market for business travel agency services in the United Kingdom.

4.3. Non-horizontal effects

(197) In this section, the Commission will examine whether the Transaction is likely to result in anti-competitive non-horizontal effects. Considering that no conglomerate effects have been identified in the present case, this section will focus on the assessment of the risks of foreclosure in any of the markets that are vertically affected by the Transaction. (166)

4.3.1. Legal framework

(198) According to the Non-Horizontal Merger Guidelines, (167) foreclosure occurs when actual or potential rivals' access to markets is hampered, thereby reducing those companies' ability and/or incentive to compete. (168) Such foreclosure can take two forms: (i) input foreclosure, when access of downstream rivals to supplies is hampered; (169) and (ii) customer foreclosure, when access of upstream rivals to a sufficient customer base is hampered. (170)

(199) For input or customer foreclosure to be a concern, three conditions need to be met post-transaction: (i) the merged entity needs to have the ability to foreclose its rivals; (ii) the merged entity needs to have the incentive to foreclose its rivals; and (iii) the foreclosure strategy needs to have a significant detrimental effect on competition on the downstream market (input foreclosure) or on customers (customer foreclosure). (171) In practice, these factors are often examined together since they are closely intertwined.

4.3.2. Overview of the vertically affected markets

(200) GBT and HRG, as BTAs, are retailers of travel services, while GBT's parent company QH supplies travel services (passenger air transport and hotel accommodation services). (172)

(201) Based on market share estimates resulting from the market reconstruction (see Table 1 above), the Parties' market shares exceed 30% on the market for business travel agency services worldwide, and in eight EEA countries: Belgium, Czech Republic, Denmark, Finland, France, Hungary, Sweden and the United Kingdom.

(202) QH provides upstream hotel accommodation services in Europe, Africa and Asia. In the EEA, it is only active in two countries where the Parties' market shares on the downstream market exceed 30%: France and the United Kingdom. (173)

(203) QH provides passenger air transport services through its portfolio company Qatar Airways, which is the only air carrier active on several direct routes between Doha and the EEA, notably to the following cities: Brussels, Prague, Copenhagen, Paris, Budapest, and Stockholm. On these O&Ds, QH would hold a share of [90-100]% of the market defined as direct scheduled flights. (174)

(204) GBT submits that these vertical links, which have been reviewed in detail at the time of the creation of the GBT joint venture by Amex and QH, (175) should be regarded as technical only. (176)

4.3.3. Hotel accommodation services (upstream) and business travel agency services (downstream)