Commission, October 5, 2018, No M.8960

EUROPEAN COMMISSION

Judgment

DIENT / BOEING / JV (AIRCRAFT SEATS)

Subject: Case M.8960 – Adient/Boeing/JV (Aircraft seats) Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 31 August 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which The Boeing Company (“Boeing”, United States) and Adient plc (“Adient”, United States) via its subsidiary Adient US LLC acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of newly created joint-venture Adient Aerospace, LLC (the “Seats JV”) (3) (“the Transaction”). (Boeing and Adient are designated hereinafter as “the Parties”.)

1. THE PARTIES

(2) Boeing designs, manufactures and sells commercial jetliners and defence, space and security systems. Boeing also provides aftermarket services for the aerospace market. Its products and services include commercial and military aircraft, satellites, electronic and defence systems, launch systems, advanced information and communication systems.

(3) Adient designs, manufactures and markets seating systems and seating components for passenger cars, commercial vehicles and light trucks. In addition, Adient supplies seating systems to the commercial trucking and international motorsports industry. Adient's seating activities are limited to the automotive sector. It does not manufacture or sell aircraft seats.

2. THE OPERATION

(4) The purpose of the Seats JV will be to design, develop, manufacture and sell [description of the JV's scope] seats for both regional and large commercial aircraft. The Seats JV will [description of the JV's scope]. The Seats JV will sell its seats primarily directly to airlines and aircraft leasing companies in both line- fit and retro-fit (4) situations on regional and large commercial aircraft of Boeing and of other aircraft manufacturers.

(5) The Contribution Agreement between the Parties was signed on 11 January 2018 and the finalised Limited Liability Company (LLC) Agreement (5) will be signed upon fulfilment of the conditions required for “Initial Closing”, as laid down by the Contribution Agreement (6).

(6) Pursuant to the Contribution Agreement, the Seats JV will be jointly owned by Adient and Boeing with 50.01% and 49.99% of the shares in the Seats JV respectively. Adient and Boeing will contribute […].

(7) [Description of the JV's governance structure] (7), (8), (9), (10).

(8) Thus Adient and Boeing will have joint control of the Seats JV pursuant to Article 3(1)(b) of the Merger Regulation.

3. FULL FUNCTIONALITY OF THE JOINT VENTURE

(9) The parties will create a full-function joint venture within the meaning of Article 3(4) of the Merger Regulation.

a. As regards the Seat JV’s resources to operate independently on the market, the Seat JV will have its own financial resources, management and staff (transferred or seconded from Adient and Boeing as well as hired by the Seats JV), intellectual property rights, manufacturing plants, production tools and office premises.

b. As regards the scope of the Seat JV’s activities, the Seat JV will itself engage in product development, manufacturing, and marketing of aircraft seats and sell them on the market

c. As regards sales and purchase relations with the Parties, the seats JV will not make the majority of its sales or purchases to and from the Parties parents. It is currently envisaged that the Seats JV will purchase […] components from Adient at arms’ length conditions and the Seats JV will design and manufacture its own aircraft seats, thus adding considerable value to the components purchased from Adient. The JV’s main customers will be airlines and commercial aircraft leasing companies rather than aircraft manufacturers and the Seats JV will only occasionally sell to Boeing.

d. Finally, the Seats JV will be set up for an indefinite period of time. The Seats JV is, therefore, intended to operate on a lasting basis.

4. EU DIMENSION

(10) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (11) (Boeing EUR 82 670 million, Adient EUR 14 704 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Boeing EUR […], Adient EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

5. MARKET DEFINITION

(11) The Transaction concerns the manufacture of aircraft and of seating used on such aircraft.

5.1. Manufacture of aircraft

5.1.1. Product market

(12) Boeing is active in the manufacture of different types of aircraft. Commission precedents have generally differentiated the following main categories of aircraft: commercial aircraft (which include large commercial aircraft, regional aircraft, and business/corporate jets), military aircraft, helicopters and general aviation aircraft. (12)

(13) Within commercial aircraft the precedents differentiated three segments: (13)

a. Large commercial aircraft (i.e., aircraft with more than 100 seats, a range of greater than 2000 nautical miles and a cost in excess of USD 35 million). A distinction can be drawn between:

i. narrow-body (or single-aisle) aircraft, which have approx. 100-200 seats and travel medium distances (2000-4000 nautical miles); and

ii. wide-body (or twin-aisle) aircraft, which typically carry 200-850 passengers and can travel longer routes (4000 - 8000+ nautical miles).

b. Regional aircraft (i.e., aircraft with approx. 30-90 seats, a range of less than 2,000 nautical miles and a cost of up to USD 30 million);

c. Business/Corporate jets (i.e., aircraft designed for corporate activities and with a cost generally in the region of USD 3 - 70 million).

(14) Following those precedents, additional aircraft were introduced to the market that fall into the 90-120 seats range that may potentially blur the previous distinction between narrow-body large commercial aircraft and regional aircraft (14), such as the Embraer E190 or the Airbus A220-100 and A220-300 (formerly Bombardier CS100 and CS300). The Commission has therefore considered in a recent case a further split of the potential product market for narrow-body aircraft into (i) a segment for narrow-body aircraft with 90-120 seats and (ii) a segment for narrow-body aircraft with 120-200 seats (15). In any event, the sub-segmentation of the product market for commercial aircraft can be left open in this case as no serious doubts arise under either of the alternative market definitions.

5.1.2. Geographic market

(15) All markets, with the exception of military aircraft, have been considered to be worldwide in geographic scope. (16) The market investigation in this case has not provided any reasons to deviate from those precedents. The markets for the manufacture of aircraft relevant for this case, that is to say the markets for the manufacture of regional and large commercial aircraft and their potential sub- segments, are therefore considered to be worldwide in scope.

5.2. Manufacture of aircraft seating

5.2.1. Product markets

(16) A Commission precedent (17) examining aircraft seating found that aircraft seats constituted a separate market and considered several segmentations: First, the Commission found that aircraft seats could be differentiated according to the type of the aircraft, into seats for regional and large commercial aircraft on the one hand and seats for business aircraft on the other hand, due to the different size of the seats. Second, the Commission considered that within regional and large commercial aircraft, the differentiation between first, business and economy class can be made because of the differences in price, in market demand in number of seats for each class, in functionality and in comfort of seats. The Commission however left the ultimate market definition open.

(17) The Parties submit that that aircraft seats constitute a separate market. They also believe that, given the strong supply-side substitutability between the different categories of aircraft seats, all aircraft seating products should be considered part of the same product market. (18)

(18) As regards a sub-segmentation of the aircraft seating market by type of aircraft, responses (19) by market participants were mixed. Some held that business jet seating was significantly different from commercial aircraft, as they have some specificities in their appearance and design and need to encompass a broader range of functionalities if needed. Others noted that overall competitive conditions were however similar; such as negotiation processes and many of the same suppliers. At the same time, regional and large commercial aircraft were noted to differ in their procurement process; seating for regional is more often procured by the aircraft manufacturer while for large commercial it is more often procured by the airline.

(19) In any event, for the purposes of this decision, the question whether the product market for aircraft seating should be sub-segmented by type of aircraft can be left open, as no serious doubts arise under any alternative product market definition.

(20) As regards a sub-segmentation of the aircraft seating market by seat class, the market investigation in this case provided indications that there may indeed be a degree of substitutability between aircraft seating for different seat classes on a commercial aircraft: however, it pointed to some differences at the same time. Price levels of economy and "premium" (that is to say business and first class) seats were found to be significantly different. Also the sophistication of the seats and the skill required to produce premium seats was reported to be significantly higher such that a large number of suppliers was found to be active in economy seats only. The production volumes and also the production processes were also mentioned to differ, premium class seats requiring more manual labour while economy seat production was more automatized. Furthermore, certification was reported to be more challenging and to take longer for business class seats as opposed to economy. No such specific differentiators were mentioned between aircraft seats for first class and business class, as part of the premium segment. It was noted in addition that the boundary between business and first class seats was blurring and the number of first class seats decreasing as a result of business class products undergoing significant development and upgrade. (20) For the reasons above, it is conceivable that a separate product market for business class seating could exist.

(21) However, for the purposes of this decision, the question whether the product market for aircraft seating should be sub-segmented by seat class can be left open in this case as no serious doubts arise under any alternative product market definition.

(22) Furthermore, aircraft manufacturers such as Boeing act as resellers of aircraft seats in certain instances, (see also paragraph (24)). The Commission can leave open whether such resales fall into the same product market as the sales by aircraft seat manufacturer (see the assessment of a potential horizontal overlap assessed under section 6.1) or whether they fall into a product market downstream of the sale by aircraft manufacturers (see the assessment of the vertical links under section 6.2) as no serious doubts arise under any alternative product market definition.

5.2.2. Geographic markets

(23) The Commission has defined the markets for aircraft seating as global, finding that the competitive conditions for the purchase of aircraft seats do not differ between the EEA and the rest of the world. (21) The Parties share this view (22), which has been confirmed by the market investigation in this case as well. (23) The geographic market for the sale of aircraft seats and its potential sub-segments are therefore considered to be worldwide in scope.

6. COMPETITIVE ASSESSMENT

(24) The sale of aircraft seats usually occurs under the buyer furnished equipment (“BFE”) model where the final customers, such as airlines and aircraft leasing companies, purchase new seats directly from aircraft seat manufacturers to outfit their newly purchased aircraft or upgrade an existing aircraft. Alternatively, the sale may occur under the supplier furnished equipment (“SFE”) model where the final customers purchase the seats from the aircraft manufacturer.

(25) Under both models, the aircraft manufacturer installs the aircraft seats on the newly acquired aircraft (usually not, however, on existing aircraft), but the contractual relations differ: Under the BFE model, which according to Boeing accounts for [80-90]% of the sales of seats on large commercial aircraft in line- fit situations, (24) the final customer (i) chooses the type and number of seats; (ii) negotiates the price and other terms of supply directly with the seats manufacturer; (iii) enters into a direct supply agreement with the seat manufacturer; and (iv) is invoiced directly by the seat manufacturer. In line-fit situations, the supplier and equipment chosen must be approved by the aircraft manufacturer only with regard to performance requirements (quality, delivery, compliance, etc.). Under the SFE model, the final customer negotiates the supply of aircraft seats with the aircraft manufacturer and accordingly enters into a contract for the supply of aircraft seats with the aircraft manufacturer.

(26) Against that background, the Transaction creates

a. potential horizontal overlaps in the sale of aircraft seats where Boeing is active to a limited extent and where the Seats JV will be active,

b. a vertical relationship since the Seats JV will be active in the production of aircraft seats which are sold directly to aircraft manufacturers such as Boeing if the final customers decide to purchase aircraft seats under the SFE model in line-fit situations, and

c. a conglomerate relationship since the Seats JV will be active in the production of aircraft seats and Boeing is active in the production of aircraft and both products are sold directly to the final customer around the same time if the final customers decide to purchase aircraft seats under the BFE model in line-fit situations.

(27) In addition, the Commission has examined whether the Transaction could have adverse effects on the sale of aircraft seat in retro-fit situations, where the final customer decides to purchase new aircraft seats for an aircraft it already owns, since the Seats JV will be active in the production of aircraft seats for such retro- fit situations and Boeing has been alleged by some market participants to have influence over the choice of retro-fit seat suppliers.

6.1. Potential horizontal overlap (25)

(28) The Parties submit that Boeing merely re-sells aircraft seats that it purchases from third parties and does not manufacture the seats. They argue that, therefore, no horizontal overlap arises. (26)

(29) Boeing does not manufacture aircraft seats. However, it sells aircraft seats in connection with the modification or upgrade of aircraft interiors through its subsidiary Boeing Global Services (“BGS”) (27) and has a co-development arrangement with aircraft seat manufacturer LIFT/Encore for the design, manufacture and sale of seats for certain Boeing aircraft under the SFE model.

(30) If, on a conservative basis, those resale volumes of aircraft seats are attributed to Boeing (rather than to the seat manufacturer), Boeing achieved a market share of approximately [0-5]% in 2017, BGS included. (28) The Seat JV’s market share is currently 0%. Regarding future sales, the Parties expect (i) the Seats JV to achieve a market share of [5-10]% in aircraft seats by 2028 on an overall market for seats, with a market share of up to 10% in the sub-segments of business class seats and economy class seats for large commercial aircraft and (ii) Boeing to achieve a market share of less than 10% in the next ten years. (29)

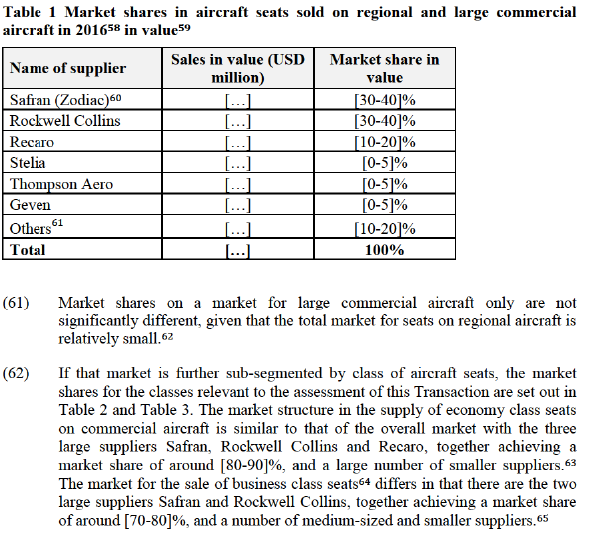

(31) The combined market shares of the Seats JV and Boeing are therefore likely to remain below 20% in the foreseeable future. The market is currently characterised by the presence of the three strong competitors Safran, Rockwell Collins and Recaro (30) and the presence of a large number of smaller suppliers, as set out below in Table 1, Table 2 and Table 3. This indicates that the Parties and the JV are unlikely to obtain market power in aircraft seats in the foreseeable future.

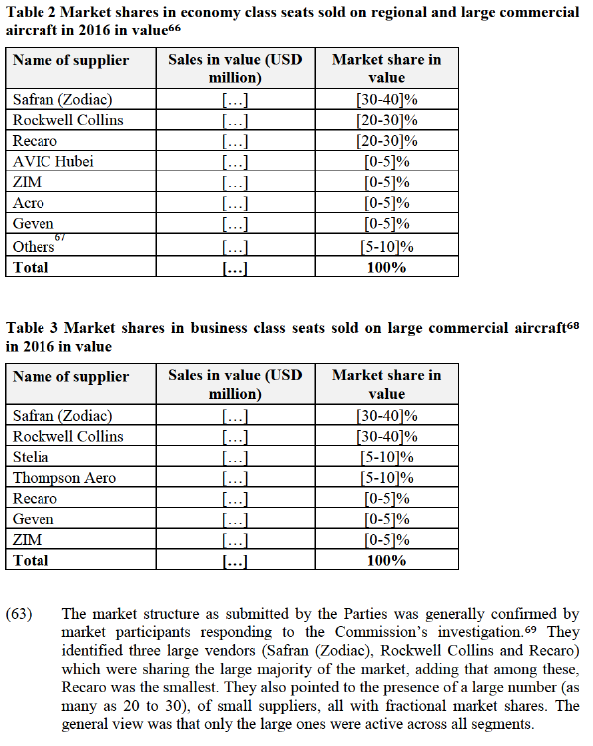

(32) Moreover, no concerns were raised in the market investigation as regards the potential overlap between the activities of Boeing and the Seats JV in selling aircraft seats.

(33) Based on the assessment in paragraphs (29) to (32), the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the horizontal overlaps brought about by the Transaction.

6.2. Vertical (31), (32) and conglomerate relationships

(34) The Seats JV will create future vertical and conglomerate relationships between the Seat JV’s manufacturing of aircraft seats and Boeing’s manufacturing of commercial aircraft as set out in paragraph (26).

(35) As a potential new entrant, the Seats JV currently has a market share of 0% and will be a new source of supply. None of the current aircraft manufacturers or final customers relies on the Seats JV for any of their aircraft seats purchases. If aircraft manufacturers and final customers were to purchase aircraft seats from the Seats JV in the future, this would mean that they would benefit from the existence of an additional source of aircraft seat supply, extending rather than limiting their choice of aircraft seat supplier. Therefore, no input foreclosure concerns will arise in this case.

(36) The Commission’s investigation therefore focussed on potential customer and conglomerate foreclosure concerns, as well as on concerns about the disclosure of commercially sensitive information raised during the market investigation as set out in sections 6.2.1 to 6.2.3.

6.2.1. Concerns raised during the investigation

Foreclosure effects

(37) Some aircraft seat producers expressed concerns during the market investigation of being excluded from future purchases of seats for Boeing aircraft, as Boeing would favour aircraft seat purchases from the Seats JV. They acknowledge that Boeing does not itself choose the aircraft seat supplier in the vast majority of cases. They submit, however, that Boeing will be able to influence the final customers’ choice of seats for all Boeing aircraft through different mechanisms, including: Boeing could decide to limit the number of aircraft seat suppliers available in line-fit situations on Boeing aircraft since Boeing decides which suppliers’ aircraft seats are offerable on its newly purchased aircraft. Boeing could grant the Seats JV more favourable conditions (such as granting the Seats JV reduced or waived IP royalty fees to be paid to Boeing or providing the Seats JV better or more rapid access to information relevant for obtaining regulatory approvals of its seats) while worsening simultaneously the conditions for the competing seats suppliers. All of those and similar mechanisms would result in loss of turnover of competing aircraft seat suppliers in sales of seats on Boeing aircraft. (33)

(38) Some of the complaining aircraft seat producers argue that such reduced or discontinued sales of aircraft seats on Boeing aircraft would have negative effects on the competitiveness of aircraft seat suppliers and on the markets for aircraft seats as a whole. Those seat producers argue principally that the reduced sales would lead to higher prices of aircraft seats as research and development costs would have to be spread across a smaller number of aircraft seats sold. Alternatively, the potential decrease of sales could lead to a reduction in innovation in order to keep costs down. They argue that the final customers and potentially also manufacturers of large commercial aircraft could be faced with higher prices and less innovation as a result of the Transaction. (34)

Access to commercially sensitive information

(39) Some aircraft seat producers raised concerns during the market investigation relating to the Seat JV’s potential access to competing seat suppliers’ commercially sensitive information. They explained that Boeing requires a large amount of confidential information to be transmitted to Boeing to become offerable on Boeing aircraft. (35)

(40) One of the seat producers in particular submits that the value of its confidential business information cannot be fully preserved through IP rights because assets such as know-how are not in the scope of IP rights. It further considers that non- disclosure agreements used in its business with Boeing are insufficient to ensure that its information will not be used by the Seats JV to gain market share to the detriment of competing suppliers. A major concern in this respect would be the announced transfer to the Seats JV of personnel handling Boeing's seat purchases until recently. (36)

(41) Such access to commercially sensitive information for the Seats JV through Boeing would put competitors at a disadvantage, dissuading them to expand and make investments in research and development, leading to negative effects mainly in terms of chilling innovation efforts. (37)

6.2.2. The Parties' views

(42) On a general note, the Parties submit that the rationale behind the creation of the Seats JV has been the ongoing frustration of airlines with the performance of the leading suppliers of aircraft seats and resulting repeated delivery delays since already a number of years. (38) Boeing argues that these issues are also well documented in the press (39) and notes that it recorded […] occurrences of seating delivered late to a scheduled due date between 2012 and 2017, out of which were […] occurrences where seat shipments were received more than 60 calendar days late, effectively delaying the delivery of the aircraft. (40)

Foreclosure effects

(43) The Parties note that Airbus, through its subsidiary Stelia Aerospace ("Stelia"), has already been vertically integrated into seats production for years. Stelia seats are deployed on more than 40 airlines and are mounted on both Airbus and Boeing aircraft. The Parties consider that the Airbus Stelia business model of competing against non-integrated seat suppliers in the supply of seats for use on both Airbus and Boeing aircraft is the same as the plan for the Seats JV.

(44) Further, Boeing argues that it does not have the ability to foreclose competing seat suppliers. Boeing explains (41) that it does not have the ability to drive customers' choice, as seats are an important competitive differentiator for airlines, and airlines are likely to push back against any hypothetical effort by Boeing to offer a single choice of seat supplier, stressing that the ultimate decision lies with the customer. (42)

(45) Boeing submits (43) that the purpose of the offerability process does not lend Boeing a "gatekeeper role". The purpose of the offerability process, Boeing explains, is to ensure that seats offered to customers for particular aircraft orders are technically suitable and available for that particular order. This is evaluated on a project-by-project basis. In Boeing's view, customers assume a significant role and can and do request seats that Boeing does not initially identify as offerable for a given project. Boeing needs to answer to the airlines and in the past has been required to justify to these airlines its decision not to make offerable a particular seat.

(46) Boeing acknowledges that it plans the Seats JV to become […] supplier for aircraft seats that Boeing sells under the SFE model. Boeing observes, however, that this represents only a small percentage of all aircraft seats sold (approx. 15% of all line-fit installations for large commercial aircraft globally while line- fit installations on Boeing aircraft represent around one third of all aircraft seats sold). (44)

(47) Boeing submits (45) that all Boeing demand for line-fit seats represents roughly only one third of the market, while Airbus line-fit is another third and retro-fit being the remaining third. Therefore, under all assumptions, the addressable market would remain sizable for competing aircraft seat suppliers.

(48) Boeing also adds that the Seats JV's business plan does not foresee a capacity planning that would enable it to become the supplier of choice for all demand of aircraft seats on Boeing aircraft. It targets to achieve a [5-10]% market share on an overall market for aircraft seats in 10 years, built up gradually. Boeing states that […]. (46)

(49) Boeing reasons that it does not have the incentive to limit airlines' choice on the selection of seats, as this could damage its relationship with its airline customers who prefer to have a large number of options and use interiors as an important differentiator against their rivals. Favouring its own Seats JV could potentially reduce the attractiveness of Boeing aircraft and thus ultimately harm aircraft sales. Boeing argues that its potential profits due to its ~50% share in the Seats JV is disproportionately small by comparison with the profits it makes from selling aircraft, in particular since the costs of the seats on an aircraft are only around [0-5]% of the price of an aircraft. (47)

(50) As concerns the impact of a potential reduction of demand that according to the concerned aircraft seat suppliers discourages innovation by incumbent suppliers and harms small suppliers that cannot achieve efficient scale to be competitive, Boeing notes that the presence of a number of small suppliers, such as Turkish Seat industries, Jamco, Encore or Toyota Bashoku provide evidence that new entry can take place successfully backed by orders from a single airline. (48)

Access to commercially sensitive information

(51) Boeing argues that it has no ability or incentive to share competing seating suppliers’ confidential information with the Seats JV for the following reasons:

(52) Boeing submits (49) that such misappropriation of confidential information would violate IT and trade secret law and Boeing’s contractual obligations. Boeing argues that it would be exposed to actions for damages and could suffer serious reputational harm if it is in breach of contract or in violation of the laws prohibiting trade secret misappropriation.

(53) Boeing enters into Proprietary Information Agreements (“PIAs”) with its aircraft seat suppliers which establish the parameters within which confidential information and materials relating to the design, development, certification, integration and installation of seating used on Boeing aircraft will be maintained, accessed and used. The PIAs [excerpt from PIA]. The PIAs require each party to [excerpt from PIA]. (50)

(54) In addition, Boeing describes that the specific aircraft seat information is only accessible to approved personnel, such as engineers. [description of information storage]. (51) Once the Seats JV is established, Boeing describes (52), it will be entirely distinct from its parents. It will have its own management and staff, IP rights, manufacturing plants, office premises and IT systems. As a result, Boeing considers that there is no case of true vertical integration and thus the Seats JV does not, nor will it have, access to confidential information of other seat suppliers.

(55) Boeing affirms (53) that it takes the protection of commercially sensitive information very seriously and has established procedural protections to prevent inadvertent disclosure: Boeing employs a strict internal process (“Company Policies”) to protect the confidential information of all third party manufacturers. These Company Policies are documented and made available to each Boeing employee who receives third party information. A current copy of its policies related to […]. (54)

(56) Boeing argues that the […] senior individuals, which are the only Boeing personnel who will be involved in the leadership or management of the Seats JV who have gained expertise in seat supply through their prior roles in Boeing's seat integration unit, have been firewalled off from Boeing - including the seat IT systems- since January 2018. Beyond this, Boeing also considers that the competing seat suppliers also overestimate the knowledge these individuals had accumulated about their business and products.

(57) The Parties argue that in any event, the use of confidential information from seat suppliers is not a part of the JV’s business model and recalls that numerous new entrants, such as LIFT, Mirus, Geven, have succeeded in offering innovative solutions and increase competition without access to confidential information of competing seat suppliers. Boeing adds (55) that the prototype the Parties have developed relied on Adient, which Boeing considers to be one of the most sophisticated and well-respected automotive seat manufacturers in the world, and the third party […].

(58) The Parties argue further (56) with respect to the alleged "quick entry" of the Seats JV on the basis of competing seat suppliers' confidential information, that the collaboration with Adient has already been ongoing for two years in order to develop prototype seats, leading to a total lead time of […] (with a targeted delivery schedule of […]). No JV seats have been certified or pre-certified by Boeing, and no JV seats were or currently are offerable by Boeing. Moreover, the Parties reiterate that their plan is to achieve only [5-10]% market share in 10 years' time.

(59) In any event, Boeing argues that it does not have the economic incentive to use confidential information of a third party in order to foreclose competitors or reduce competition. Boeing’s incentives both pre- and post- Transaction are to ensure that the seat supply market is as competitive, innovative and effective as possible in order to enhance product quality and delivery schedules and to provide the best possible customer service to airlines. In addition, the expected turnover from the JV’s supply of seats to airlines, well under [0-5]% of Boeing's total turnover, is not sufficient to risk damaging its relationships with customers and suppliers by engaging in prohibited use of seat supplier’s confidential information.

6.2.3. The Commission's assessment

Concentration levels

(60) The market for aircraft seats for regional and large commercial aircraft (57) is characterised by the presence of the three large suppliers Safran, Rockwell Collins and Recaro, together achieving a market share of around [80-90]% and a large number of small seat manufacturers, as reflected in Table 1.

(64) As regards the manufacture of large commercial aircraft above 90 seats, Airbus and Boeing held market shares of [40-50]% and [50-60]%, respectively in terms of number of aircraft deliveries in 2017.70 Embraer's market share amounted to [0-5]% while no other participants had a material market presence in this segment.

(65) If regional aircraft with less than 90 seats are included in the market definition, Boeing’s market share amounts to [40-50]%, in terms of number of aircraft deliveries in 2017 with Airbus, Embraer and Bombardier accounting for [40-50]%, [5-10]% and [0-5]% respectively. (71)

(66) In the segment of large commercial aircraft of more than 120 seats, Boeing's market share amounts to [50-60]%, with Airbus accounting for the remaining [40-50]% in terms of number of aircraft deliveries in 2017. Finally, in the sub- segment of wide-body commercial aircraft of 200 seats or more, Boeing held a market share of [50-60]% in terms of number of aircraft deliveries in 2017, with Airbus accounting for [40-50]% (72).

Customer and conglomerate foreclosure

(67) The Seats JV will create future vertical and conglomerate relationships between the Seat JV’s manufacturing of aircraft seats and Boeing’s manufacturing of commercial aircraft as set out in paragraph (26). The vertical relationship could lead to potential customer foreclosure concerns if the merged entity had the ability and incentives to foreclose access to a sufficient customer base from its rivals and if that had an overall negative impact on effective competition. The conglomerate relationship could lead to potential foreclosure concerns if the merged entity had the ability and incentives to foreclose its rivals by leveraging a strong market position from one market to another through means of tying or bundling or other exclusionary practices and if that had an overall negative impact on effective competition.

(68) The Commission will assess foreclosure concerns stemming from the vertical (linked to sales under the SFE model) and conglomerate (linked to sales under the BFE model) links together since they are intrinsically linked. Such assessment allows the Commission also to assess all potential foreclosure effects taken together.

(69) The Commission observes the following on Boeing's ability to foreclose competing aircraft seat manufacturers:

(70) First, Boeing has a market share of [50-60]% in the sale of large commercial aircraft above 90 seats and of [50-60]% in the sale of large commercial aircraft above 120 seats in terms of number of aircraft deliveries in 2017 and a market share of [0-5]% in the sale of regional aircraft, leaving around [50-60]% of demand for aircraft seats for large commercial aircraft and all of the demand for aircraft seats for regional aircraft unaffected by the Transaction. (73) Third party suppliers will thus continue to be able to sell their aircraft seats to a significant part of the market, including in the business and economy seat classes where the JV will be active.

(71) Second, the market investigation indicated that aircraft manufacturers' influence on the choice of aircraft seat supplier in the retro-fit market is minimal. (74) Furthermore, several respondents confirmed the Parties' estimates that retro-fit orders constituted ca. 30%-33% of the seats demand across seat classes. Therefore, in addition to demand for aircraft seats to be installed on Airbus aircraft, demand for retro-fit sales on Boeing aircraft is likely to remain available, leaving an overall addressable market of around 65% for competing aircraft seat suppliers.

(72) Third, […].

(73) Fourth, it is unlikely or at least uncertain that the Seats JV will be able to serve all or most of demand for aircraft seats on Boeing aircraft going forward, leaving also at least part of demand for aircraft seats on Boeing aircraft unaffected by the Transaction.

(74) In the first place, the market investigation confirmed that the airlines are in the driving seat when selecting the seat suppliers for their fleet under the BFE model. They choose the seats from the aircraft manufacturers'' “offerability list”, which contains a number of suppliers to choose from. If a certain supplier is not on the offerability list, the airlines reported being able to make a request to the aircraft manufacturer and negotiate the additional supplier’s inclusion. (75) Furthermore, market participants confirmed that the BFE model is prevalent for most large commercial aircraft and that the share of aircraft seats sold under the SFE model is minimal. (76)

(75) In the second place, the Seats JV has no sales of aircraft seats yet and is expected to develop its presence gradually. […]. Therefore, it is doubtful whether the Seats JV will have the ability to foreclose its rivals by winning significant market share at their expense in the foreseeable future. The future market share projections from its business plan are accordingly modest: [5-10]% after the first 10 years including line-fit and retro-fit, reaching at most [10-20]% in […] for large commercial aircraft. (77)

(76) In the third place, Rockwell Collins and Recaro are strong aircraft seat suppliers with established relationships with final customers. They may offer superior technology or quality and may have a price advantage over the products of the Seats JV. It is therefore uncertain whether final customers would be interested in foregoing purchases from those suppliers and whether Boeing would be able to prevent its customers from buying from these established competitors.

(77) Fifth, the market for aircraft has been growing rapidly in the past ten years and the growth is expected to continue (78). The Parties estimate (79) that this growth will translate into an increase from a USD […] aircraft seats market in 2017 to a USD […] aircraft seats market in 2026. Any reduction of the addressable merchant market could therefore be counterbalanced by general market growth.

(78) Sixth, the limited market presence of Airbus’s wholly-owned subsidiary Stelia argues against the ability for aircraft manufacturers to engage in foreclosure through vertical integration. Stelia designs and produces business and first class passenger seats among other products. Stelia's market share is well below the share of Airbus aircraft ([20-30]% in first class seats and less than [10-20]% in business class seats on large commercial aircraft (80)). Although Stelia is an Airbus subsidiary, [50-60]% of Stelia’s sales volumes for seats are made on Boeing aircraft. (81) No market participant has raised concerns about Airbus’ ability to foreclose other aircraft seat supplier to the benefit of Stelia in first class or business class seats.

(79) As concerns Boeing's incentive to foreclose alternative aircraft seat suppliers, the Commission finds the following:

(80) First, the market investigation confirmed that airlines value choice in aircraft seats supply. (82) Seat products are differentiated and allow the airlines to differentiate themselves from their competitors, thus airlines may have specific preferences for certain seat models/suppliers. The alternative seat suppliers are well-established and have long-standing relationships with the airlines who are the final customers. Limiting the choice of available aircraft seat suppliers is likely to result in customer dissatisfaction harming Boeing’s business relationship with its customers. Boeing has little incentive to upset its customers by limiting their choice and offering them a worse product than before the Transaction.

(81) Second, the strategies adopted by Airbus in the past argue against incentives for aircraft manufacturers to engage in foreclosure through vertical integration. Airbus' wholly-owned subsidiary Stelia’s market share is well below the share of Airbus aircraft as set out in paragraph (78). No market participant has raised any concerns about Airbus trying to foreclose other aircraft seat suppliers to the benefit of Stelia in first class or business class seats.

(82) Third, the revenue base on which Boeing could, though a foreclosure strategy, achieve higher prices and thus higher profits in the seat supply is disproportionately small compared to the profits it can achieve through the sale of aircraft. The benefit is even smaller considering Boeing's ~50% share in the Seats JV. Therefore, it is Boeing's interest to drive the sales of its aircraft rather than try to increase prices on the aircraft seat markets. Should Boeing endeavour to capture the entire market share of the seat JV's competitors on Boeing aircraft, the size of that market would not exceed [0-5]% of its annual turnover.

(83) Fourth, a further past example supporting the lack of incentives for Boeing to limit customer’s choice of aircraft seat is its collaboration with Lift/Encore. With that collaboration, Boeing introduced an additional economy seat choice under the SFE model for 737 aircraft without limiting the choice for alternative seats. (83)

(84) Fifth, as regards concerns about the unequal treatment of the Seats JV and competing aircraft seats suppliers in terms of royalty fees to be paid to Boeing (84), Boeing confirmed (85) that the Seats JV will […]. […].

(85) As concerns the impact of Boeing's potential foreclosure of alternative aircraft seat suppliers, the Commission finds the following:

(86) First, the creation of the Seats JV will result in adding a new seats supplier to the market. Final customers’ choice of seats suppliers available in the market will be enlarged, both on Boeing and on Airbus aircraft.

(87) Second, the Seats JV will develop its own R&D capabilities and is developing a new seats offer from scratch, which is likely to have positive effects on innovation in the market.

(88) Third, shifting purchases from a third party supplier to an in-house source does not in itself and automatically amount to foreclosure. Such shifts would only be anticompetitive if the move to the in-house source harms the ability or incentives of rivals to compete. Internal documents of Boeing corroborate its argument according to which the creation of the Seats JV is a response to customer dissatisfaction and an attempt to improve the situation. (86) A seat supplier replying to the Commission’s market investigation confirmed that timely deliveries and the quality of the products have been a concern in the past. (87)

(89) Fourth, aircraft seat customers (airlines and leasing companies) replying to the market investigation see the impact of the Transaction to be positive or neutral as long as Boeing does not impose the Seats JV products on them as sole choice on certain aircraft platforms. An aircraft manufacturer confirmed that it saw the impact of the Transaction as neutral or positive stating that "The proposed transaction is likely to lead to the entrant [sic] of a new market player and therefore to more choice and capacity in the market" (88) Most of the aircraft seat suppliers also acknowledge that while the impact of the Transaction on their business may be negative, primarily due to the potential loss of turnover, the impact on the market and final customers is expected to be positive as the creation of the Seats JV will increase choice and decrease price levels on the market for aircraft seats. (89)

(90) Fifth, there are a number of smaller competitors – including recent entrants – active in the seats markets, indicating that also competitors with smaller scale operations are viable and competitive.

(91) Sixth, Airbus’ integration into aircraft seats supply through its subsidiary Stelia has not led to negative effects on competition. None of the market participants raised concerns about foreclosure effects of Airbus’ integration into aircraft seats, in particular in first and business class seats. Furthermore, Airbus is a strong competitor in the downstream market for the sale of large commercial aircraft. Should a potential foreclosure strategy by Boeing negatively affect Airbus, it cannot be excluded that Airbus could decide to support third party aircraft seat suppliers in their business development or to rely to a larger extent on its own aircraft seats subsidiary Stelia.

(92) Seventh, aircraft seats represent a relatively small portion of the costs of the finished aircraft for the final customer, representing approximately [0-5]% of the list price of Boeing’s aircraft. (90) Therefore, it is doubtful whether foreclosure from the seats market could have appreciable effects on the downstream markets for the sale of aircraft.

(93) For the reasons set out in paragraphs (69)(67) to (92), the Commission considers that the Transaction does not raise customer or conglomerate foreclosure concerns.

Access to commercially sensitive information

(94) Paragraph 78 of the Commission’s Non-Horizontal Merger Guidelines notes the possibility that, by vertically integrating, the merged entity may gain access to commercially sensitive information on the upstream or downstream activities of non-integrated rivals. As a result, competitors may be put at a competitive disadvantage thereby dissuading them to enter or expand in the market.

(95) As regards the application of those principles to the present case, the Commission notes, first, that several of the arguments discussed in paragraphs (69)(67) to (92) also argue against significant adverse effects on the relevant markets of the sharing of confidential information. For instance, (i) significant demand for aircraft seats in a growing market is likely to remain available for third party seat manufacturers even if they reduce their sales of aircraft seats on Boeing aircraft due to the risk of disclosing confidential information to the Seats JV; (ii) Boeing is expecting to continue installing third party aircraft seats on its aircraft for years to come, driven among other reasons by the final customers’ preferences for the seats of certain suppliers, giving Boeing incentives to find mutually satisfactory agreements with the seat manufacturers regarding their confidential information; (iii) the Seats JV represents a new entrant, offering more choice and potentially boosting innovation also from incumbent seat manufacturers; and (iv) Airbus is likely to have means to react if adverse effects materialise or risk materialising on the seat markets.

(96) Second, business confidential information that is critical for the design, development and manufacture of aircraft seats can be protected under IP rights legislation. IP rights protection is enforceable in court and it confers a protection against any potential misappropriation of sensitive information. Third party aircraft seat suppliers can therefore have recourse to IP law to safeguard their IP rights and protect sensitive information.

(97) Third, the exchange of confidential information related to the certification and installation of aircraft seats by Boeing is covered by Proprietary Information Agreements as set out in paragraph (53). (91) Those agreements will prohibit the sharing of confidential information of competing aircraft seats suppliers with the Seats JV and can be enforced through litigation. Boeing has safeguards in place to limit the circulation of the confidential information and to implement the provisions of the non-disclosure agreements as outlined in paragraphs (54) and (55).

(98) Fourth, aircraft seat suppliers do not seem to be concerned about selling aircraft seats on Airbus aircraft although Airbus’ subsidiary Stelia manufactures and sells aircraft seats and there is the potential risk that Airbus may pass on confidential information to Stelia despite IP and contractual protections. This indicates that Airbus does not have the ability and incentives to pass on confidential information to Stelia, including that the market participants have been able to negotiate satisfactory solutions for the protection of commercially sensitive information with the large aircraft manufacturer Airbus.

(99) Fifth, insofar as one of the complaining aircraft seat suppliers refers to recent Commission precedents addressing concerns about the misappropriation of confidential information (92), the Commission notes that the Seats JV is a new market entrant and that the market is growing rapidly. Furthermore, Boeing will have to rely on third party aircraft seat suppliers going forward so that Boeing is unlikely to be in a position to negotiate confidentiality clauses in agreements with seats suppliers to their advantage in a disproportionate manner. This is the more so the case, as the Parties […]. By contrast, other aircraft seats suppliers offer approximately a dozen products that are either currently available or in development.

(100) Sixth, the Seat JV’s business model does not rely on the misappropriation of confidential information as alleged by one competing aircraft seat supplier. In particular, contrary to allegations raised during the market investigation, Adient has licensed in technology from a third party for the development of its seating product "Ascent" (93). In addition, the cooperation between Boeing and Adient (94) started as an R&D effort into seat development, which resulted in the creation of jointly owned intellectual property (95) that is going to be transferred to the Seats JV.

6.2.4. Conclusion regarding vertical and conglomerate relationships

(101) Based on the assessment in paragraphs (60) to (100), the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the vertical and conglomerate relationships brought about by the Transaction.

7. CONCLUSION

(102) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 322, 12.9.2018, p. 19.

4 The installation of aircraft seats prior to the initial delivery of a newly manufactured aircraft is called "line-fit". "Retrofit" refers to the replacement of aircraft seats by new seats at any time following the initial delivery of an aircraft.

5 Annexes 9 and 10 to the Form CO.

6 See Contribution Agreement Article VI, Annex 9 to the Form CO.

7 […].

8 […].

9 […].

10 Section 4.6 (h) to (kk) of the Form of LLC Agreement.

11 Turnover calculated in accordance with Article 5 of the Merger Regulation.

12 Case M.1601, Allied Signal/Honeywell, paragraph 11.

13 Case IV/M.877, Boeing/McDonnell Douglas, paragraphs 15 and 16; Case M.1601, Allied Signal/Honeywell, paragraph 13; Case M.2220, General Electric / Honeywell, paragraph 10.

14 See also page 65 and Chart 14 of the Industry report 'Commercial Aerospace Primer' by Bank of America/Merrill Lynch, 04 May 2016.

15 M.8858, Boeing/Safran/JV (Auxiliary power units), paragraph 14.

16 Case M.8858, Boeing/Safran/JV (Auxiliary power units), paragraph 15; M.2220, General Electric/Honeywell, paragraphs 10-34; Case M.1601, Allied Signal/Honeywell, paragraph 13; Case IV/M.877, Boeing/McDonnell Douglas, paragraphs 14-20.

17 Case M.8305, Rockwell Collins/BE Aerospace, paragraphs 14 and 16.

18 Form CO, paragraph 167.

19 See replies to question 11 of the Commission's questionnaire of 6 September 2018.

20 See replies to question 10 of the Commission's questionnaire of 6 September 2018.

21 Case M.8305, Rockwell Collins/BE Aerospace, paragraphs 15.

22 Form CO, paragraph 170.

23 See replies to question 12 of the Commission's questionnaire of 6 September 2018.

24 Boeing estimates that [80-90]% of its seats deliveries on new aircraft were under the BFE model and that this figures is the same for the entire market for seats on new large commercial aircraft, Form CO, paragraph 147.

25 An additional potential horizontal overlap in the sale of spare parts for aircraft seats does not lead to affected markets today or in the foreseeable future. Boeing’s subsidiary Aviall had a market share of less than [0-5]% in the distribution of spare parts for aircraft seats in 2017 while the Seat JV’s market share in the sale of spare parts is not expected to exceed its market share in aircraft seats (currently 0% and estimated to reach at most 10% in the segments of business class seats and economy class seats in the first 10 years of operation).

26 Form CO, paragraph 187.

27 BGS sells seats for retro-fit purposes only as part of a wider service, but not on a standalone basis. Typically, however, the seats are purchased and provided directly by the airline customer, Parties’ response to RFI1, part 1, question 1a.

28 Form CO, paragraphs 136 and Parties’ response to RFI1, question 1a on 7 September, 2018 and to RFI 4bis on 4 October, 2018: If the sub-segment of seating for large commercial and regional is considered, this share rises to [0-5]%.

29 Parties’ response to RFI1, question 1b on 7 September, 2018.

30 See replies to question 13 of the Commission's questionnaire of 6 September 2018.

31 An additional future vertical link between Adient and the Seats JV concerning components for aircraft seats does not lead to vertically affected markets today or in the foreseeable future. Adient does not currently sell components for aircraft seats with the exception of a one-time indirect supply […]. Adient’s market share is currently marginal in the supply of components for aircraft seats and the market share of the Seats JV is 0% (and expected to increase to [10-20]% in certain segments of the aircraft seats markets by […]). The market shares are therefore likely to remain below 30% in the upstream and downstream markets.

32 An additional potential vertical link between Adient and the Seats JV concerning the testing of aircraft seats is unlikely to lead to affected markets and ultimately competition concerns. Adient owns an aircraft testing facility in Germany which is used for the testing of aircraft seats of […]. Adient acquired the testing facility in 2012 […]. The vast majority of aircraft seat manufacturers have testing capabilities of their own and are thus unaffected by this link. Furthermore, […] is unlikely to be negatively affected by this link going forward: The testing facility has sufficient capacity to be used by both […] and the Seats JV. Furthermore, […] could use the crash testing facilities of alternative providers such as TASS International and Centre d’Essais Dynamiques. Moreover, […] has announced investment in new facilities, including […] (see Parties’ response to RFI1), question 2 and Annex 3. In addition, the Parties report in their reply to RFI3 on 3 October 2018 that the total cost of the aircraft seat testing services that Adient provides to […] at its testing facility in Kaiserslautern is […] which, according to the Parties’ estimates, amounts to [0-5]% of the variable and total production costs of […] in the EEA.

33 See replies to question 2 of the Commission's questionnaire of 6 September 2018 and the complainant's submissions on e.g. 3, 11 and 20 September, 2018.

34 See e.g. the complaint's submission on 3 September 2018.

35 See replies to questions 2 and 14 of the Commission's questionnaire of 6 September 2018 e.g. the complaint's submissions on 5 July and 11 September 2018.

36 See e.g. the complaint's submission on 24 July 2018.

37 Ibidem

38 Form CO, paragraph 7.

39 See e.g. Air Transport News, “787 Seat Supply Delays Continue But Solution Is Close” (22 Apr 2015), available at https://www.ainonline.com/aviation-news/air-transport/2015-04-22/787-seat- supply-delays-continue-solution-close; Skift, “United Is Mothballing Perfectly Good New Aircraft Thanks to Delayed Seats” (27 May 2017), available at https://skift.com/2017/03/27/united-is- mothballing-perfectly-good-new-aircraft-thanks-to-delayed-seats/; and Bloomberg, “United’s New 777s Struggle With Luxury Seat Delays” (30 Mar 2017), available at https://www.bloomberg.com/news/articles/2017-03-30/united-s-new-luxury-777-cabin-stumbles-on- zodiac-seat-delays.

40 Form CO, paragraph 80 and Annex 1 to Boeing's reply to the Commission's request for information on 09 August 2018 concerning internal records on delivery delays.

41 Form CO, paragraph 160 and the Parties' submission prepared by CRA, page 4, 11 September, 2018.

42 Form CO, paragraph 50.

43 See point 1.09-1.11 of the Parties' submission […] of 11 September 2018.

44 Form CO, paragraph 135.

45 See point 1.5 (a) of Boeing's submission […] of 9 August, 2018 and Form CO paragraph 213.

46 See point 1.5 (c) of Boeing's submission […] of 9 August, 2018 and 1.13 CRA Report, 11 September 2018.

47 See point 5.2 of Boeing's submission […] of 9 August, 2018 and 1.13 CRA Report, 11 September 2018.

48 Ibidem, point 4.2.

49 Form CO paragraph 216 and the Parties' submission […] of 11 September 2018.

50 Response of 24 September to the Commission’s request for information, question 9.

51 Ibidem, question 11.

52 Form CO, paragraph 219.

53 Form CO, paragraph 216.

54 See Annexes 4 and 5 to the Parties' reply to the Commission's pre-notification request for information on 11 July, 2018.

55 Form CO, paragraph 216.

56 See point 1.6 (b) of the Parties' submission […] of 11 September 2018.

57 The Commission will not present market shares or an assessment for markets defined more broadly, as for instance the market for all aircraft seats. Any effects of the Transaction on the overall aircraft seating market will be more limited than the effects assessed in this decision while the more pronounced links already do not lead to serious doubts for the reasons set out in this decision.

58 The market share data is based on the 2017 Counterpoint Market Intelligence Report on Aircraft Interiors which includes data for 2016. The 2018 Counterpoint Report with data for 2017 will not be available before November 2018

59 Response of the Parties of 7 September to the Commission's request for information, Annex 1.

60 Safran acquired aircraft seat supplier Zodiac Aerospace in 2018, see case M.8425. Safran/Zodiac Aerospace.

61 Others include suppliers such as Acro, AVIC Hubei. Avio Interiors. Expliseat, HAECO, Jamco. Optimares and ZIM.

62 Response of the Parties of 7 September to the Commission's request for information. Annex 1. market size for sets on regional aircraft according to the parties is ca. [...] USD.

63 The market structure does not differ significantly between the sale of economy class seats for widebody or narrow-body large commercial aircraft since Safran, Rockwell Collins and Recaro together achieve a market share of around [80-90]% in each of those segments. However, the identity of the other suppliers and their relative strength differ between those two market segments.

64 Business class seats constitute (90-100% of the market encompassing business and first class as the 'premium segment'. As concerns the sale of first class seats, Rockwell Collins and Safran share ca. [50-60]% of the market, while the Stelia is also present with [20-30]%. See response of the Parties of 7 September to the Commission's request for information. Annex 1.

65 Sales of business class seats for wide-body large commercial aircraft represent more than [80-90]% of those sales. The market structure does not differ significantly between the sale of business class seats for wide-body or narrow-body large commercial aircraft since Safran and Rockwell Collins together achieve a market share of around [70-80% in each of those segments. However, the identity of the other suppliers and their relative strength differ between those two market segments.

66 Response of the Parties of 7 September to the Commission's request for information, Annex 1.

67 Others includes suppliers such as Avio Interiors, HAECO, Stelia and Thompson Aero.

68 This takes into account that there are hardly any business class seats sold on regional aircraft.

69 See replies to question 13 of the Commission's questionnaire of 6 September 2018.

70 Response of the Parties of 7 September to the Commission’s request for information, Annex 2.

71 Ibid. The market share presented by Boeing does not account for 26 regional aircraft deliveries by COMAC and United Aircraft Corporation (Sukhoi) in 2017.

72 Ibid.

73 Boeing has announced its intention to acquire aircraft manufacturer Embraer which manufactures mainly regional aircraft: http://boeing mediaroom.com/2018-07-05-Boeing-and-Embraer-to-Establish- Strategic-Aerospace-Partnership-to-Accelerate-Global-Aerospace-Growth. Since no binding acquisition agreement has been signed and the regulatory approvals have not been received, the Commission will treat Boeing and Embraer as separate entities for the purposes of this decision.

74 See replies to question 5 of the Commission's questionnaire of 6 September, 2018.

75 See replies to question 5 of the Commission's questionnaire of 6 September, 2018

76 See replies to question 5 of the Commission's questionnaire of 6 September, 2018.

77 Parties’ response to RFI1, question 1b on 7 September, 2018. According to the business plan of the JV, the Seats JV will reach sales of USD […] in 2026, of which USD […] is expected to be generated from retro-fit and USD […] from production of new seats, while spare parts account for USD […].

78 See e.g. page 89 and Chart 28 of the Industry report 'Commercial Aerospace Primer' by Bank of America/Merrill Lynch, 04 May 2016, see also Form CO and see also forecasts of Airbus and Boeing, at Global Market Forecast 2018- https://www.airbus.com/aircraft/market/global-market-forecast.html and also transcript of a speak of Boeing CEO at Morgan Stanley Laguna Conference on 12 September, 2018, page 2.

79 Form CO, paragraph 84.

80 Response of the Parties of 7 September to the Commission’s request for information, Annex 1.

81 See […] reply to question 1 of the Commission's questionnaire of 6 September, 2018.

82 See replies to questions 2 and 3 of the Commission's questionnaire of 6 September, 2018.

83 Parties’ response to RFI1, question 12 on 7 September, 2018.

84 Boeing introduced a proposed IP licence in early 2015, along with a […].

85 Email of the Parties on 25 September 2018.

86 Form CO, paragraph 80; and internal presentation entitled […], submitted on 13 March 2018.

87 See a seat vendor's reply to question 3 of the Commission's questionnaire of 6 September, 2018.

88 See an aircraft manufacturer's reply to question 2 of the Commission's questionnaire of 6 September, 2018. […].

89 See replies to question 2 of the Commission's questionnaire of 6 September, 2018.

90 Response of the Parties of 10 September to the Commission’s request for information, question 7.

91 One aircraft seat supplier complained about the asymmetry in sanction mechanism in the agreements. However, such asymmetry appears to relate only to […] and does not appear to relate to […].

92 Case M.8314, Broadcom/Brocade, paragraphs 104-112, case M.7724, ASL/Arianespace, paragraphs 197-230.

93 […], see the Parties' reply to question 5 of RFI 4 on 3 October, 2018.

94 As per the Collaboration Agreement dated 7 July, 2016.

95 Form CO, paragraphs 64-66 and 262.