Commission, June 4, 2019, No M.9239

EUROPEAN COMMISSION

Judgment

EVONIK / PEROXYCHEM

Subject: Case M.9239 – Evonik / PeroxyChem

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 24 April 2019, the European Commission received notification of a concentration pursuant to Article 4 of the Merger Regulation which would result from a proposed transaction by which Evonik Industries AG (“Evonik”, Germany), controlled by RAG Stiftung (Germany), intends to acquire sole control, within the meaning of Article 3(1)(b) of that regulation, over PeroxyChem Holdings L.P. (“PeroxyChem”, US), by way of a purchase of equity interests (the “Transaction”).3

(2) In this Decision, Evonik is also referred to as “the Notifying Party”. Evonik and PeroxyChem are collectively referred to as “the Parties”. The undertaking that would result from the Transaction is referred to as “the Merged Entity”.

1. THE PARTIES

(3) Evonik is headquartered in Germany and listed on the Frankfurt Stock Exchange. It is active in the production and marketing of specialty chemicals. Evonik has divided its activities into three business segments: Nutrition and Care, Resource Efficiency and Performance Materials.

(4) PeroxyChem is a globally active manufacturer of hydrogen peroxide (“H2O2”), peracetic acid (“PAA”) and persulfates. In addition, PeroxyChem is active in the resale of sulphur derivatives.

(5) In the EEA, PeroxyChem has one production plant in Spain (for H2O2 and PAA) and one in Germany (for persulfates). Outside the EEA, PeroxyChem operates four additional manufacturing facilities of which three are in the USA and one is in Canada.

2.THE OPERATION AND THE CONCENTRATION

(6) On 7 November 2018, the Parties signed an agreement and plan of merger pursuant to which Evonik will acquire sole control over PeroxyChem within the meaning of Article 3(1)(b) of the Merger Regulation.

(7) It follows that the Transaction would result in a concentration within the meaning of Article 3(1)(b) of the Merger Regulation

3. UNION DIMENSION

(8) The concentration does not have a Union dimension under Article 1 of the Merger Regulation, since in 2018, PeroxyChem achieved a turnover of EUR […] million worldwide and [less than EUR 100] million in the EEA. For the same year, Evonik achieved a turnover of EUR 14 383 million worldwide and EUR […] million in the EEA.4

(9) On 24 January 2019, the Commission received a referral request with respect to the Transaction, which was reviewable in Austria, Portugal and Spain.

(10) As no Member State disagreed with the Parties’ referral request, the concentration is deemed to have a Union dimension pursuant to Article 4(5) of the Merger Regulation.

4. MARKET DEFINITION

(11) The Transaction combines the Parties’ global businesses in active oxygen chemical products. In the EEA, the Transaction gives rise to horizontal overlaps and vertical links exclusively with respect to the Parties’ activities in the production and marketing of H2O2 and PAA products.

(12) The remainder of the present Decision will therefore exclusively focus on H2O2 and PAA products.

4.1.H2O2

4.1.1.Introduction

(13) H2O2, also known as oxygenated water, is a powerful oxidant sold as a bulk commodity in a broad range of concentrations and grades. It has a wide range of industrial and commercial applications in the manufacture of pulp and paper, textiles, electronics and semi-conductors, in the chemical synthesis or for metal extraction, disinfection, water and sewage treatment. H2O2 is also used as a raw material input product for the production of other peroxygen products, such as PAA products.

(14) In the EEA, each of Evonik and PeroxyChem is active in the production and sale of H2O2 products for use in the complete range of typical end-use applications.

(15) In the EEA, Evonik produces H2O2 in Antwerp (Belgium), Rheinfelden (Germany), Weissenstein (Austria) and Delfzijl (Netherlands). PeroxyChem produces its H2O2 products exclusively in La Zaida (Spain).

4.1.2.Relevant Product Market

(16) The Notifying Party submits that in its most recent decisional practice related to H2O2, the Commission concluded on a distinct product market for H2O2, without the need for any further segmentation.5 The Notifying Party agrees with that precedent and proposes to follow the same product market definition for the purpose of the present case.

(17) During its market investigation, the Commission investigated whether any further market segmentations of the product market for H2O2, on the basis of its concentration, purity levels and/or BPR6 product type would be appropriate.

(18) The results of the market investigation confirmed that H2O2 constitutes a distinct product market, without any need for further segmentations. In fact, competitors overall confirmed that they produce all typical concentration levels7 and purity levels8 of H2O2 and that their product portfolio covers the complete range of typical end-use applications.9 An exception to this was ultra-high concentrations (above 90%) for use in rocket propulsion purposes, for which none of the competitors confirmed its presence and for which some explicitly stated that their portfolio “does not include super high concentrations such as 90-99%”.10 In addition, in the EEA, none of the Parties has generated any sales relating to that specific end-use application. This Decision will therefore not assess the relevance of a potential sub-market with respect to H2O2 of ultra-high concentrations levels.

(19) In general, competitors active in the manufacture of H2O2 confirmed that they could easily and readily change production between H2O2 products for use in different applications.11 Customers, in general, did not recognize any specific end-use application of H2O2 for which products would only be manufactured or registered by fewer suppliers.12

(20) The Commission further notes that H2O2 is typically delivered in bulk, but may also, under particular circumstances and for particularly large volume orders, be supplied via pipeline. The Commission understands that the vast majority of merchant sales are realised in bulk, and only has knowledge of one instance in which H2O2 is delivered by pipeline, in Antwerp, Belgium13. While these two delivery modes could possibly seem to constitute separate product markets, the Commission does not need to conclude on this question for the purpose of the present case as, irrespective of whether the bulk supply and tonnage supply modes of H2O2 constitute separate product markets, the Transaction does not raise any competition concerns, given the low combined market shares of the Parties under either scenario, as will be demonstrated in section 5.2.1 below.

4.1.3.Relevant Geographic Market

(21) The Notifying Party also submits that in its prior decisional practice14, the Commission concluded that the relevant geographic market for H2O2 is EEA- wide in scope. The Notifying Party proposes to follow the same approach for the purpose of the present case.

(22) The results of the market investigation confirmed that the H2O2 market is EEA- wide in scope. In fact, while a majority of responding customers indicated that the location of a H2O2 supplier’s plants is an important criterion because of related lead times and transport costs15, they also confirmed their ability to source H2O2 from all over the EEA.16 More specifically, the majority of customers consider that a H2O2 supplier can serve them efficiently and at competitive terms within a radius of approximately 1 000 kilometers around a production plant.17 Several respondents indicated that the relevant geographic market would be EEA-wide in scope, with a maximum distance from a supplier’s plant of up to 3 000 kilometers.18 Similarly, competitors active in the production and sale of H2O2 confirmed that they do not tend to import H2O2 into the EEA19 and the Commission observes that H2O2 suppliers typically rely on a network of European production sites to cover the EEA demand.20

4.1.4.Conclusion

(23) In light of the above considerations and taking into account the result of the market investigation and all the evidence available to it, the Commission concludes that, for the purpose of the present case, the EEA market for H2O2 constitutes the relevant market, without the need for any further product or geographic market segmentation. In particular, given that the Transaction would not raise serious doubts as to its compatibility with the internal market even under the narrowest product market definition, the Commission leaves open the question whether separate product markets for H2O2 should be defined with respect to the bulk or pipeline delivery mode of H2O2.

4.2.PAA

4.2.1.Introduction

(24) PAA is manufactured following a chemical reaction between acetic acid and H2O2. It is sold in various concentrations for use in the paper industry, medicine, animal health, water treatment, disinfectant for the food and beverage industry. Concentrations of typically up to 15% are used as sanitizers, disinfectants and sterilants in the food and beverage industry, for water treatment, in laundries and for medical applications, while grades of concentrations of typically 35% or 40% can be used for oxidation reactions in chemical synthesis (for cosmetics, chemicals, fragrances and pharmaceutical end-use applications) and in the paper industry (for pulp bleaching).

(25) In the EEA, the Parties commercialize PAA products of various concentrations. More specifically, Evonik commercializes several grades of 11 different concentrations ranging from 0.4% to 40%, the bulk of which correspond to 15%-concentrated PAA ([…]% of Evonik’s 2018 sales in the EEA) and 5%-concentrated PAA ([…]% of sales). Similarly, PeroxyChem is active in the EEA with PAA products of 1.5%, 5%, 15% and 35% concentrations, the quasi- totality of which is represented, as for Evonik, by 5%-concentrated PAA ([…]%) and 15%-concentrated PAA ([…]% of sales) products.

(26) Consequently, the Parties’ activities in PAA products of higher concentrations and designed for oxidation purposes do not overlap in the production and sale of 40%-concentrated PAA products ([0-5]% of Evonik’s EEA sales in 2018) but only with respect to 35%-concentrated PAA products, which represent respectively [0-5]% and [0-5]% of Evonik’s and PeroxyChem’s sales in the EEA.

(27) Evonik produces all its PAA products in Weisenstein (Austria). PeroxyChem produces all its PAA products in La Zaida (Spain).

4.2.2.Relevant Product Market

(28) The Notifying Party submits that in previous cases21, the Commission considered that there is no need to further delineate the PAA market according to end-use applications, except for medical and animal health applications.22 It proposes to follow the same approach.

(29) During calls the Commission held with market participants, it was indicated that a separate product market may exist in relation to 35%-concentrated PAA products. Market participants indicated that PAA of such concentrations cannot be substituted by different materials, lower-concentration PAA or 40%-concentrated PAA products, and that they could recognise only Evonik and PeroxyChem as manufacturers of 35%-concentrated PAA products in the EEA.

(30) During the formal market investigation, both customers and competitors of the Parties overwhelmingly confirmed that the 35%-concentrated PAA products of Evonik and PeroxyChem cannot be substituted by PAA products of either lower concentrations23 or higher (40%) concentration.24

(31) Moreover, while the production process and necessary inputs remain overall the same for PAA products of different concentrations, the market investigation indicated that 35%-concentrated PAA products require the adoption of different handling and safety measures during the manufacturing and transport phases, compared to PAA products of lower concentration.25

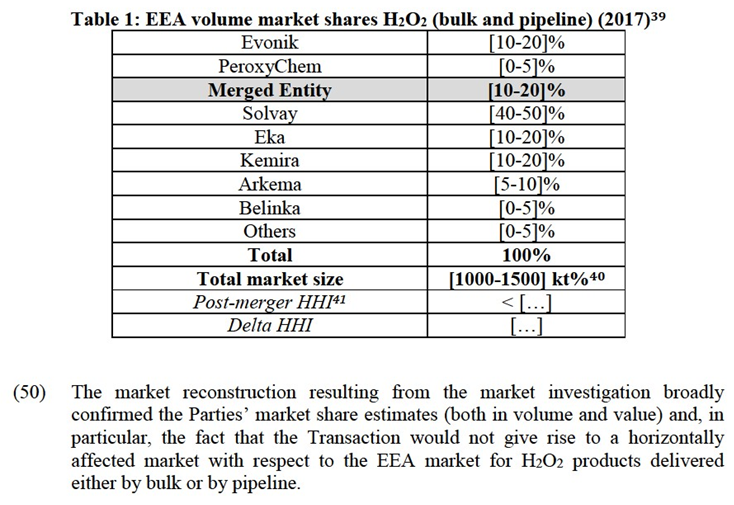

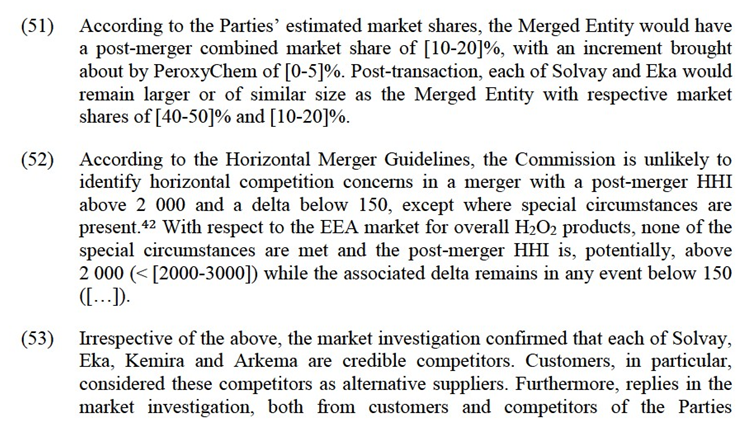

(32) For the purpose of the present case, however, the Commission does not need to conclude as to whether the product market definition for PAA needs to be further segmented with respect to 35%-concentrated PAA as, irrespective of whether the market for 35%-concentrated PAA products constitutes a separate relevant sub- market or belongs to the broader product market for overall PAA products, the Transaction would not raise serious doubts as to its compatibility with the internal market

4.2.3.Relevant Geographic Market

(33) The Notifying Party notes that in the pre-cited case26, the Commission concluded that the relevant geographic market for PAA was a collection of national or regional markets. At the time, the Commission noted a tendency towards an EEA-wide geographic market, which would be reinforced by the adoption of the European Biocide Products Directive27).

(34) In particular, the Notifying Party notes that the BPR enables PAA producers to seek one single regulatory approval to obtain a market authorisation for their products in the whole EEA. According to the Notifying Party, this has stimulated intra-EEA trade and removed regulatory barriers. The Notifying Party concludes that since the Parties each sell their PAA cross-border throughout the EAA, from one production plant in Austria (Evonik) and Spain (PeroxyChem), and as there are common standards for transportation of PAA, the geographic market is EEA- wide in scope.

(35) Customer replies to the Commission’s market investigation confirmed that PAA is transported within the EEA rather easily.28 The Commission also observes that Evonik supplies the market from its single plant in Austria to distances of more than 1 500 to 2 000 kilometers.

(36) Similarly, the Parties’ competitors indicated that transport distances do not constitute a barrier to commercial opportunities vis-à-vis potential PAA customers around the EEA, irrespective of the precise location of their PAA manufacturing plants.29

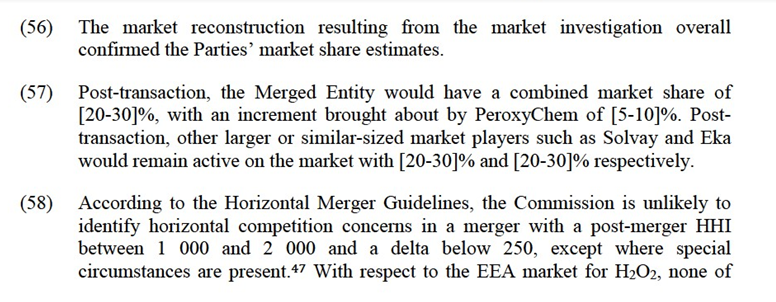

(37) The Commission therefore concludes that the geographic scope of the overall market for PAA products and of its potential sub-market restricted to 35%- concentrated PAA products is EEA-wide.

4.2.4.Conclusion

(38) In light of the above considerations and taking into account the result of the market investigation and all the evidence available to it, the Commission concludes that, for the purpose of the present case, the EEA market for overall PAA products and its potential, separate, sub-market for 35%-concentrated PAA products constitute the relevant markets. In particular, given that the Transaction would not raise serious doubts as to its compatibility with the internal market even under the narrowest product market definition, the Commission leaves open the question whether a separate market for PAA should be defined with respect to 35%-concentrated PAA products.

5.COMPETITIVE ASSESSMENT

(39) Within the EEA, the Transaction gives rise to two horizontally affected markets, first, with respect to H2O2 delivered in bulk (see section 5.2.1.2) and, second, with respect to PAA under the alternative of a narrower product market definition for 35%-concentrated PAA products (see section 5.2.2.2). Moreover, the existing link between this latter market and the overall market for H2O2 is vertically affected by the Transaction (see section 5.3).

(40) Conversely, the EEA market for H2O2 products in general (irrespective of the delivery mode) (see section 5.2.1.1) as well as the EEA market for overall PAA products (see section 5.2.2.1) are not affected markets.

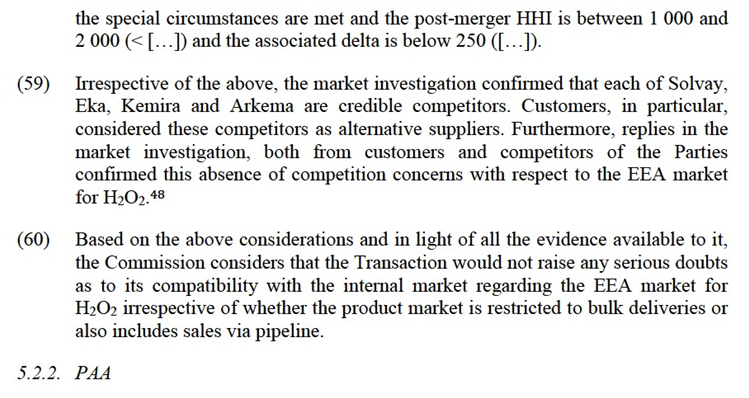

5.1.Legal Framework

(41) Article 2 of the Merger Regulation requires the Commission to examine whether notified concentrations are compatible with the internal market, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it.

(42) The Commission Guidelines on the assessment of horizontal mergers under the Merger Regulation (the "Horizontal Merger Guidelines") distinguish two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non- coordinated effects and coordinated effects.30

(43) Non-coordinated effects may significantly impede effective competition by eliminating the competitive constraint imposed by one merging party on the other, as a result of which the merged entity would have increased market power without resorting to coordinated behaviour. According to recital (25) of the preamble of the Merger Regulation, a significant impediment to effective competition can result from the anticompetitive effects of a concentration even if the merged entity would not have a dominant position on the market concerned. In this regard, the Horizontal Merger Guidelines consider not only the direct loss of competition between the merging firms, but also the reduction in competitive pressure on non-merging firms in the same market that could be brought about by the merger.31

(44) Indeed, the Horizontal Merger Guidelines list a number of factors which may influence whether or not significant non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that the merging firms are close competitors, the limited possibilities for customers to switch suppliers, or the fact that the merger would eliminate an important competitive force. Not all of these factors need to be present for significant non- coordinated effects to be likely. The list of factors, each of which is not necessarily decisive in its own right, is also not an exhaustive list.32

(45) In addition, the Commission Guidelines on the assessment of non-horizontal mergers under the Merger Regulation (the "Non-Horizontal Merger Guidelines") distinguish between two main ways in which vertical mergers may significantly impede effective competition, namely input foreclosure and customer foreclosure.33

(46) For a transaction to raise input foreclosure competition concerns, the merged entity must have a significant degree of market power upstream.34 In assessing the likelihood of an anticompetitive input foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to substantially foreclose access to inputs; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on competition downstream.35

(47) For a transaction to raise customer foreclosure competition concerns, the merged entity must be an important customer with a significant degree of market power in the downstream market.36 In assessing the likelihood of an anticompetitive customer foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from upstream rivals; (ii) whether it would have the incentive to do so and (iii) whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.37

5.2.Horizontal assessment

5.2.1.H2O2

5.2.1.1.Overall market for H2O2

(48) The Parties provided market shares by volume based on their own production and their best estimates for the competitors’ production. Regarding market shares in value, the Parties’ best estimate assumed that the average sales price of all market participants is equal to the Parties’ own average sales prices. This approach leads to value-based market shares that are very similar to the volume-based ones. In order to capture value market shares, the Commission carried out its own market reconstruction on the basis of the information it obtained during the market investigation.38

(49) Under the assumption that H2O2 deliveries via pipeline belong to the same product market as bulk H2O2 deliveries, the Transaction does not give rise to a horizontally affected market (see Table 1).

(63) The market reconstruction resulting from the market investigation broadly confirmed the Parties’ market share estimates and, in particular, the fact that the Transaction does not give rise to a horizontally affected market (both in terms of volume and value market shares) with respect to the EEA market for overall PAA products.

(64) According to the Parties’ estimated market shares, the Merged Entity would have a post-merger combined market share of [10-20]%, with an increment brought about by PeroxyChem of [0-5]%. Post-transaction, each of Solvay and Ecolab would remain larger than the Merged Entity with respective market shares of [30-40]% and [20-30]%.

(65) As explained in section 5.2.1.1, the Commission is unlikely to identify horizontal competition concerns in a merger with a post-merger HHI above 2 000 and a delta below 150, except where special circumstances are present.51 With respect to the EEA market for overall PAA products, none of the special circumstances are met and the post-merger HHI is, potentially, above 2 000 (< [2000-3000]) while the associated delta remains in any event below 150 ([…]).

(66) Moreover, the results of the market investigation did not indicate any concerns, neither from customers, nor from competitors.52

(67) Based on the above considerations and in light of all the evidence available to it, the Commission considers that the Transaction would not raise any serious doubts as to its compatibility with the internal market with regard to the Parties’ activities in the EEA market for overall PAA.

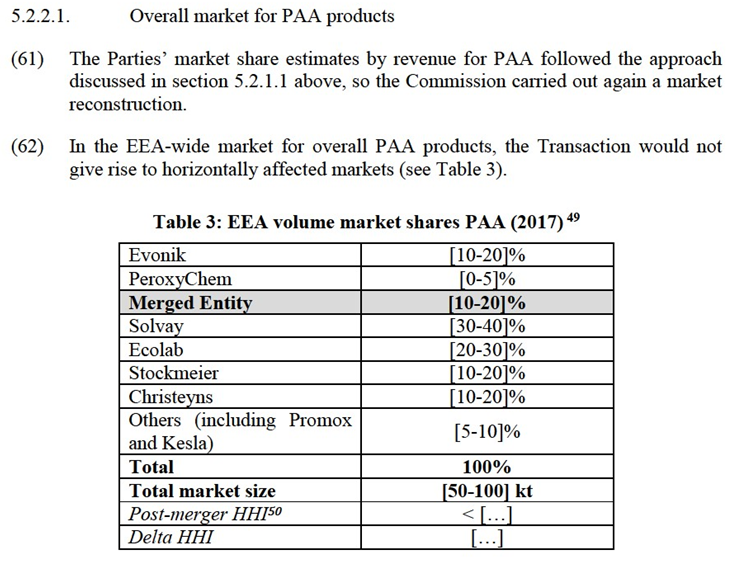

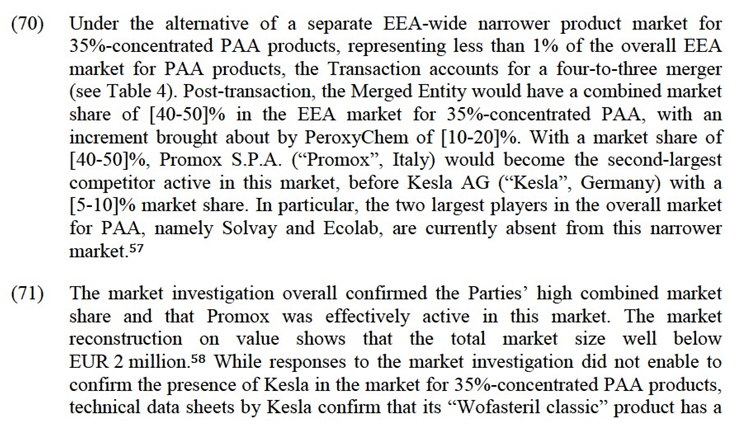

5.2.2.2.Narrower market for 35%-concentrated PAA products

(68) As a preliminary remark, the Commission notes that the Notifying Party provided market share figures in a hypothetical market for PAA products with concentration of 35% or above. Under this alternative, broader product market definition proposed by the Notifying Party and which would include any PAA products of concentration between 35% and 40%, Evonik’s volumes include […] t of its 40%-concentrated PAA products. PeroxyChem does not have any 40%-concentrated PAA products. Kemira would compete with […]t of distilled 40%-concentrated PAA products.53 Under this alternative, broader product market definition proposed by the Notifying Party, the Merged Entity’s market share would be reduced to [10-20]%, compared to Kemira’s leadership position with [70-80]%.

(69) However, as explained in section 4.2.2., the results of the market investigation casted doubts on whether 35%-concentrated PAA products can be substituted by

35% concentration59 and is appropriate for oxidation purposes in the pharmaceutical and cosmetic industries.60 Under the very conservative assumption that Kesla did not achieve any sales of 35%-concentrated PAA products in the EEA in 2018, the Merged Entity’s market share would increase, at most, to [50-60]% and Promox to [40-50]%. In any event, irrespective of whether Kesla achieved commercial sales of 35%-concentrated PAA products in the EEA in 2018, data sheets of Kesla confirm that it manufactures competing products and will therefore continue to exert a competitive pressure on the Merged Entity post-transaction.

(72) Some of the Parties’ customers of 35%-concentrated PAA products expressed concerns with respect to the Transaction, indicating that it would create a monopoly situation for the production and supply of 35%-concentrated PAA in the EEA. According to them, this could lead to price rises in the future.61 These replies are based, in particular on the premise that Evonik and Proxychem are the only two potential suppliers of 35%-concentrated PAA products in all of the EEA.62

(73) However, first, some customers of the Parties indicated the presence of at least one alternative supplier, Promox, for 35%-concentrated PAA products.63 More specifically, Promox confirmed its presence in the EEA market for 35%-concentrated PAA products.64 Moreover, as explained above, technical data sheets about Kesla’s PAA products further confirm the fact that Kesla manufactures 35%-concentrated PAA products in the EEA.

(74) Second, the production process, equipment and necessary inputs remain overall the same for PAA products of different concentrations. Apart from investment costs necessary to handle and transport 35%-concentrated PAA products65, there are no specific technical barriers to entry for any PAA manufacturer to start producing 35%-concentrated PAA products.66 Therefore, if a market opportunity were to materialise in this narrower market, established players in the markets for lower-concentration PAA products could enter the EEA market for 35%-concentrated PAA products.

(75) Consequently, while the Merged Entity would become the largest player in 35%-concentrated PAA products, other well-established players in the market for overall PAA will continue to constrain the Merged Entity post-transaction in the EEA market for 35%-concentrated PAA products. In fact, the Commission notes that Solvay confirmed that in the past it “manufactured PAA up to 40% in the UK but a commercial decision was taken to exit this business”.67 It can be assumed that with the appropriate market incentives, Solvay could likely consider to re- enter the EEA market for 35%-concentrated PAA products.

(76) Finally, the Commission observes that the Parties are unlikely to be close competitors from a geographic point of view, as PeroxyChem’s sales of 35%-concentrated PAA products exclusively occur in Spain, where Evonik does not have any sales of 35%-concentrated PAA products.

(77) In fact, Evonik supplies the Spanish market with [concentration levels] PAA products, but not 35%, through one single distributor68 for a de minimis value of approximately EUR [<15 000]. While, as explained in section 4.2.3, the relevant geographic market for PAA products is EEA-wide in scope, PeroxyChem’s local presence in Spain provides it with a certain competitive advantage to serve the Spanish market thanks to reduced transport costs.

(78) In conclusion, based on the above considerations and in light of all the evidence available to it, the Commission considers that the Transaction would not raise any serious doubts as to its compatibility with the internal market with regard to the Parties’ activities in the EEA market for 35%-concentrated PAA products, for the following reasons: (i) the presence of other alternative suppliers, Promox and Kesla, which exercise a competitive constraint on the Merged Entity in the EEA market for 35%-concentrated PAA products; (ii) the absence of technical entry barriers which enables the timely arrival of new entrants, such as Solvay, in case any commercial opportunity materialises and (iii) the fact that Evonik is not a close competitor of PeroxyChem in the EEA for 35%-concentrated PAA products.

5.3.Vertical assessment

(79) Given that H2O2 is an input product for the manufacture of PAA and that the Merged Entity would have an EEA-wide market share in 35%-concentrated PAA products of more than 30%, the Transaction gives rise to a vertically affected link between the upstream EEA market for H2O2 and the downstream market for 35%-concentration PAA products.

5.3.1.Input foreclosure

(80) Input foreclosure risks appear unlikely to arise in the present case as the Merged Entity would have a market share of only [10-20]% in the upstream EEA market for H2O2 and would therefore not enjoy any significant upstream market power so as to potentially deny access to H2O2 to its downstream competitors, Promox and Kesla, in the market for 35%-concentrated PAA products.

(81) While each of Evonik and PeroxyChem are suppliers of Promox69 for H2O2, alternative suppliers remain active in the upstream EEA market. More specifically, the particular H2O2 grades that Promox currently sources from the Parties correspond to 70%-concentrated H2O2 products70, which each of Solvay71 and Arkema72 also produce. Consequently, the Merged Entity will not have the ability to input foreclose Promox from getting access to the 70%-concentrated H2O2 products it needs for the manufacture of 35%-concentrated PAA products, as alternative producers of similar H2O2 grades remain active in the EEA. Moreover, the Merged Entity will not have any incentive to foreclose Promox, as the majority of input H2O2 products sold by the Parties are used in a variety of other chemicals produced by Promox73, in particular Promox’s range of PAA products of various concentrations (such as 0.1%, 0.2%, 2.5%, 5%, 10% or 15%).74

5.3.2.Customer foreclosure

(82) Customer foreclosure risks appear equally unlikely to arise in the present case, as the Parties are fully vertically integrated for their production of PAA and do not currently purchase H2O2 on the merchant market from any upstream competitor on the EEA market for H2O2.

(83) Furthermore, as PAA producers that are not vertically integrated upstream into the production of H2O2, represent only [<5]% of all H2O2 purchases in the EEA, the Merged Entity would, in any event, not have the ability to harm its upstream H2O2 competitors by denying them access to the downstream PAA market.

5.3.3.Conclusion

(84) Based on the above considerations and in light of all the evidence available to it, the Commission considers that the Transaction would not raise any serious doubts as to its compatibility with the internal market with regard to the vertically affected link between the upstream EEA market for H2O2 and the downstream EEA market for 35%-concentrated PAA products.

6.CONCLUSION

(85) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This Decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 154, 06/05/2019, p. 5.

4 Turnovers calculated in accordance with Article 5 of the Merger Regulation.

5 M.6230 Solvay/Rhodia, European Commission decision of 5 August 2011, paragraphs 20-23.

6 European Biocide Products Regulation (BPR). Regulation (EU) No 528/2012 of the European Parliament and of the Council of 22 May 2012 concerning the making available on the market and use of biocidal products, OJ L 167/1 [2012]. The BPR concerns the placing on the market and use of biocidal products, which are used to protect humans, animals, materials or articles against harmful organisms like pests or bacteria, by the action of the active substances contained in the biocidal product. According to the European Chemicals Agency (ECHA), this regulation aims to improve the functioning of the biocidal products market in the EU, while ensuring a high level of protection for humans and the environment.

7 See non-confidential replies to question 5 to Q4 Competitors – H2O2.

8 See non-confidential replies to question 6 to Q4 Competitors – H2O2.

9 See non-confidential replies to questions 4 and 8 to Q4 Competitors – H2O2.

10 See non-confidential replies to question 7 to Q4 Competitors – H2O2.

11 See non-confidential replies to question 9 to Q4 Competitors – H2O2.

12 See non-confidential replies to question 12 to Q4 Competitors – H2O2.

13 According to the Parties, this situation occurs in Antwerp where Solvay supplies H2O2 to BASF DOW HPPO Production B.V.B.A (“BASF/Dow joint venture”).

14 M.6230 Solvay/Rhodia, European Commission decision of 5 August 2011, paragraphs 24-25.

15 See non-confidential replies to question 14 and 14.1 to Q2 Customers – H2O2.

16 See non-confidential replies to question 6 to Q2 Customers – H2O2.

17 See non-confidential replies to question 13 to Q2 Customers – H2O2.

18 See non-confidential replies to question 13 to Q2 Customers – H2O2.

19 See non-confidential replies to question 12 to Q4 Competitors – H2O2.

20 See non-confidential replies to question 11 to Q4 Competitors – H2O2.

21 M.2690 -SOLVAY / MONTEDISON-AUSIMONT European Commission decision of 9 April 2002 paragraphs 101-105.

22 For the purpose of the present case, however, no horizontal overlap arises with respect to PAA products for use in medical and health applications.

23 See non-confidential replies to question 11 Q1 Customers – PAA, and non-confidential replies to questions 6, 7 & 8 Q3 Competitors – PAA.

24 See non-confidential replies to question 11 Q1 Customers – PAA and replies to question 7 Q3 Competitors PAA.

25 See non-confidential replies to questions 8 & 11 Q3 Competitors PAA.

26 M.2690 Solvay/Montedison-Ausimont, European Commission decision of 9 April 2002, par. 106-109.

27 Which has been adopted since 2012-2013 as the European Biocide Products Regulation (“BPR”).

28 See non-confidential replies to questions 12 & 13 Q1 - Customers PAA.

29 See non-confidential replies to questions 13, 14 & 15 Q3 - Competitors – PAA.

30 OJ C 31, 05.02.2004, p. 5. The remainder of this decision focuses on non-coordinated effects.

31 Horizontal Merger Guidelines, paragraphs 24-38.

32 Horizontal Merger Guidelines, paragraphs 24-38.

33 OJ L 24, 29.1.2004, p. 1.

34 Non-horizontal Merger Guidelines, paragraph 35.

35 Non-horizontal Merger Guidelines, paragraph 32.

36 Non-horizontal Merger Guidelines, paragraph 61.

37 Non-horizontal Merger Guidelines, paragraph 59.

38 During the market investigation, the Commission obtained information from each of the Parties’ major competitors about their own sales figures on a volume and value basis. The Commission was therefore able to obtain an overall picture of the market.

39 Paragraph 20 of the Horizontal Merger Guidelines.

40 See, in particular, non-confidential replies to questions 31 to 34 Q1 – Customers - PAA and questions 32 to 37 Q3 -competitors – PAA.

41 The Commission does not need to conclude as to whether Kemira’s distilled 40%-concentrated PAA is an alternative to Evonik’s 40%-concentrated PAA, since no competition concerns arise in this hypothetical sub-market, in particular given the absence of any 40%-concentrated product in PeroxyChem’s product portfolio.

42 Source : Table 2 of the Form CO.

43 Volumes for H2O2 are reported on a 100% concentration basis (Kt%)

44 Post-merger Herfindall Hirschman Index (« HHI ») has been estimated based on the conservative assumption that the category « Others » constitutes one single competitor with a market share of [0-5]%.

45 Paragraph 20 of the Horizontal Merger Guidelines.

46 See, in particular, non-confidential replies to questions 30 to 33, Q2-Customers-H2Q2 and question 26 to 29 Q4 – Competitors – H2O2.

47 Source : Based on Parties’ estimates. Compared to Table 2 of the Form CO, Solvay’s sales via pipeline to the BASF/Dow joint renture in Antwerp have been discounted.

48 Volumes for H2O2 are reported on a 100% concentration basis (Kt%).

49 Post-merger Herfindahl Hirschman Index (« HHI ») has been estimated based on the conservative assumption that the category « Others » constitutes one single competitor with a market share of [5-10]%.

50 Paragraph 20 of the Horizontal Merger Guidelines.

51 See, in particular, non-confidential replies to questions 30 to 33, Q2-Customers-H2Q2 and question 26 to 29 Q4 – Competitors – H2O2.

52 Source : Parties’ estimates. The Parties are unable to estimate market shares by revenue for PAA. However, the market investigation confirmed that market shares would not be materially different if based on revenue.

53 Post-merger HHI has been estimated based on the conservative assumption that the category « Others » constitutes one single competitor with a market share of [5-10]%.

54 See non-confidential replies to question 11 Q1 Customers -PAA and replies to Question 7 Q3 Competitors PAA.

55 Provided in Table 24 of the Form CO.

56 Source : Based on Parties’ estimates The Parties are unable to estimate market shares by revenue for 35%-concentrated PAA. However, The Market investigation confirmed that market shares would not be materially different if based an revenue.

57 In table 24 of the Form CO, the Partiess do not include Solvay or Ecolab in the list of competitors.

58 For confidentiality reasons, the Commissions cannot disclase the precise market size in value. However, since value market shares do not significantly differ from volume shares and given the Parties’ EEA-wide sales of EUR [<1] million (Evonik Sold products for EUR [0-0.5] million and Peroxy Cherm for EUR [<0-0.5] million in 2018), it can be roughly estimated that the total EEA-wide size of this narrower market is approximately EUR […] million on a value basis. The commission market investigation indicated that the actual market size is in the same order of magintude.

59 See technical data sheet for Kesla’s “Wofasteril classic” product, page 6: “Zusammensetzung: Enthält Acetylhydroperoxid (“Peressigsäure”) ca. 35% (entspircht 40% G/V bzw. 400 g/l).” (Source: https://www.kesla.de/wp-content/uploads/Wofasteril-classic 0916 klein.pdf consulted on 27 May 2019).

60 See safety sheet for Kesla’s “Wofasteril classic” product, page 1. (Source: https:// www.mqd.de/handel/dokumente/kesla/SDBWofasterilClassic.pdf consulted on 27 May 2019).

61 See non-confidential replies to questions 31 to 34 – Customers – PAA.

62 See non-confidential replies to question 32 of questionnaire Q1 to customers.

63 See non-confidential replies to question 8 – of questionnaire Q1 to Customers – PAA

64 Promox’s reply to Q3 to Competitors PAA.

65 See non-confidential minutes of 29 March 2019 with a PAA competitor.

66 See non-confidential minutes of 29 March 2019 with a PAA competitor.

67 Solvay’s non-confidential reply to question 6 of questionnaire Q3 to Competitors PAA,

68 See non-confidential replies to question 8 of questionnaire Q1 to customers PAA.

69 Non-confidential reply of question 28 to the questionnaire Q3 to PAA competitors.

70 Non-confidential reply of question 28 to the questionnaire Q3 to PAA competitors.

71 Non-confidential reply of question 5 to questionnaire Q4 to H2O2 competitors.

72 https://www.arkema.com/en/products/product-finder/range-viewer/Peroxal-hydrogen-peroxide-for- specialty-applications/ (consulted on 17 May 2019).

73 Non-confidential minutes of conference call with Promox of 14 May 2019.

74 Non-confidential reply to question 4 to questionnaire Q3 to PAA competitors.