Commission, September 5, 2019, No M.9406

EUROPEAN COMMISSION

Judgment

LONE STAR - STARK GROUP / SAINT-GOBAIN BDD

Subject: Case M.9406 – Lone Star – Stark Group/Saint-Gobain BDD Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 14 June 2019, the European Commission received a notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Lone Star (USA), through its subsidiary Stark Group A/S (Denmark, the “Notifying Party”), and ultimately through the Notifying Party’s subsidiary Stark Group Holding Germany GmbH (Germany) intends to acquire sole control over Saint-Gobain Building Distribution Deutschland GmbH (Germany; “SGBDD” or the “Target”) (the “Transaction”). Stark Group A/S and Stark Group Holding Germany GmbH are collectively referred to as “Stark”. Lone Star, Stark and SGBDD are collectively referred to as “the Parties”.

(2) On 27 June 2019, the notification was declared incomplete within the meaning of Article 5(2) of the Commission Regulation No 802/2004. (3)

(3) In subsequent submissions, (4) the Notifying Party provided further information necessary for the assessment of the concentration under the Merger Regulation and on 31 July 2019 filed a revised Form CO (“Form CO”). Therefore, based on this additional information and the Form CO, the notification became complete within the meaning of Article 10(1) of the Merger Regulation on 31 July 2019. (5)

1. THE PARTIES

(4) Lone Star is a private equity firm that invests globally in real estate, equity, credit and other financial assets. Among others, Lone Star controls Stark, a retailer of building and insulation materials active predominantly in the Nordic countries.

(5) SGBDD is a retailer of building materials that operates a network of physical retail outlets in Germany and sells mostly third-party products to small and medium-sized enterprises and larger construction companies and, to a smaller extent, private and “do-it-yourself” (“DIY”) consumers.

2. THE OPERATION AND CONCENTRATION

(6) On 20 May 2019, Compagnie de Saint-Gobain S.A. as the seller and Stark Group Holding Germany GmbH as the purchaser signed a share purchase agreement (“SPA”) according to which Stark would acquire all of the shares in SGBDD for a purchase price calculated on the basis of the assumed enterprise value of EUR 335 million, subject to various deductions and additions. Upon closing, Stark will be the sole owner of the shares in SGBDD. The completion of the proposed Transaction would thus result in Lone Star indirectly acquiring sole control over SGBDD within the meaning of Article 3(1)(b) of the Merger Regulation.

(7) The notified Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (6) in 2018 (Lone Star: EUR […] million; SGBDD: EUR […] million). Each of them has an EU-wide turnover in excess of EUR 250 million (Lone Star: EUR […] million; SGBDD: EUR […] million), but they do not each achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. (7) The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. MARKET DEFINITION

4.1. Introduction to the Transaction and the building materials markets

4.1.1. The Parties’ activities

(9) The proposed Transaction concerns the markets for the production and distribution of building and insulation materials in Germany.

(10) Lone Star’s portfolio company Stark is a distributor of building and insulation materials active in the Nordic countries.

(11) Lone Star’s portfolio company Xella International GmbH (Germany, “Xella”) manufactures and markets building and insulation materials. In particular, Xella sells the following products in Germany.

(a) Autoclaved aerated concrete (“AAC”) blocks, which are a lightweight, precast, foam concrete building material made of autoclaved aerated concrete. AAC blocks can be lifted by hand and do not require equipment for handling. Xella markets AAC blocks under the Ytong brand. (8)

(b) AAC large format prefabricated compound units (“AAC large format units”), which are made of the same material as AAC blocks, but require equipment such as cranes for handling. Xella markets AAC large format units under the Ytong and Hebel brands. The AAC large format units include aerated concrete ceiling and roofing panels, firewalls and outer walls and can roughly be divided into AAC large format units for residential construction (Ytong brand) and industrial/commercial construction (Hebel brand). (9)

(c) Calcium silicate units (“CSUs”), which are masonry products made from a mixture of lime and natural siliceous materials (sand, siliceous gravel or rock or mixtures thereof) that can typically be lifted by hand and which are used for the construction of walls. As a material, calcium silicate has a higher density, and is therefore heavier than AAC. Xella markets CSUs under the Silka brand. (10)

(d) Mineral insulation boards, which are niche insulation products suitable for special types of applications. Xella markets these products under the brand Multipor. (11) As regards the Multipor insulation products, the Commission notes that Xella’s market share does not exceed, under any plausible alternative product market definition, [0-5]% (12). Additionally, SGBDD’s sales of mineral insulation boards accounted for EUR [less than 5] million in 2018, thus accounting for a mere fraction of SGBDD’s overall sales turnover in Germany (13) . Therefore, the Commission abstained from investigating the Multipor insulation products.

(12) Moreover, URSA Insulation, S.A. (Spain, “URSA”), an insulation material producer, is a subsidiary of Xella. URSA’s main products include glass mineral wool and extruded polystyrene (“XPS”), which are used for the insulation of residential and non-residential buildings.(14) The Commission considered in precedent cases that the relevant geographic market on the wholesale sale to retailers market for building insulation products (15) is at least national (16), albeit leaving the exact geographic market definition open. In view of this, URSA’s market shares on the upstream market for the two building insulation products are below 30% under any plausible relevant product and geographic market definition (17). With respect to the relevant geographic market for building insulation products on the market of retail sales to professional customers, the Commission considered this market national in scope, although it left the exact market definition open (18) . Against this background, SGBDD’s market shares for the two products of glass mineral wool and XPS downstream are below 30% under any plausible relevant product and geographic market definition. (19) Therefore, the Commission refrained from further investigation of the products of glass mineral wool and XPS for the purpose of the assessment of the proposed Transaction.

(13) Furthermore, Lone Star owns Balta Finance S.à.r.l, the holding company of the Balta Group (Belgium, “Balta”), a producer of textile floor coverings in Europe. Balta has no sales to SGBDD. Moreover, SGBDD is not active in the distribution of carpets at all because carpets are not within its portfolio. Since SGBDD is not active downstream in the distribution of carpets at all, and Balta’s market share upstream in a potential overall market for floor coverings would be below 30% in Germany, there are no horizontal or vertical relationships between Balta and SGBDD. (20) Therefore, these products are not discussed further in this decision.

(14) Finally, Lone Star owns Edilians, a French producer of roofing products including clay-roofing products, i.e., clay tiles, clay roof accessories, non-clay pitched roof accessories and solar roofing solutions. (21) Edilians’ total sales to Germany are very limited and in 2018 amounted to EUR [less than 200,000]. SGBDD’s market shares are below 15% under any plausible product and geographic market definition. Therefore, the potential relationship between Edilians upstream and SGBDD downstream does not give rise to any vertically affected markets nor horizontal overlaps. (22) Therefore, these products are not discussed further in this decision.

(15) The Target is active in the field of retail distribution of building materials to professional customers, also called business-to-business (“B2B”), in Germany, operating via own branches and direct delivery. SGBDD has 216 branches in Germany and one branch in Luxembourg. SGBDD is present across the whole territory of Germany. (23)

(16) SGBDD operates through three business units: (i) “Generalists”, which includes products such as heavy building materials, dry walling and joinery, and also includes SGBDD’s leading brand Raab Karcher (120 branches out of a total of 150 branches for this business unit); (ii) “Tiles”, which includes tiles for all applications; and

(iii) “Civil Engineering”, which includes materials used for wastewater, fresh water supply and surface. (24)

(17) The Notifying Party estimates that more than 90% of SGBDD’s customers are buying from it in a predominantly professional capacity. (25)

(18) As SGBDD’s activities are geographically in essence (26) limited to Germany, the assessment focusses on impact of the proposed Transaction in Germany, at national as well as sub-national/local level.

4.1.2. Characteristics of the building materials markets

(19) In its precedents (27) , while leaving the question ultimately open, the Commission considered that the relevant product markets for the distribution of building materials in general can be divided into:

(a) wholesale sales to retailers;

(b) retail sales to professional customers (B2B); and

(c) retail sale to non-professional customers (B2C – primarily through do-it- yourself stores).

The ‘wholesale sales to retailers’ market is upstream of the ‘retail sales to professional customers’ market and the ‘retail sale to non-professional customers’ market.

(20) Furthermore, according to the Notifying Party, one characteristic of building material markets as regards products of the type sold by Xella is the distinction between “project sales”28 and “stock sales” (29).

(21) Stock sales, on the one hand, are sales from a manufacturer, who acts as a wholesaler in this regard, to retailers. The manufacturer delivers, or the retailer picks up, the products and stores them on the retailer’s premises. The retailer sells these products on to end-customers.

(22) According to the Notifying Party, in project sales, on the other hand, the two-step process of sale and delivery, which is characteristic for stock sales, is merged into one step. Manufacturers, retailers and end customer are involved in the sale/purchase of the products, which are shipped directly from the manufacturer to the end customer. Typically, project sales relate to a specific construction project. However, the retailer is always involved in project sales, even though the level of involvement varies from project to project. Regularly, the retailer is the contractual counterparty for the supply of these products, takes on the insolvency risk of the end-customers, provides certain logistic services and is responsible for the invoicing. The main reasons for the setup of project sales are the retailer’s local presence and hence his local industry contacts, his willingness to vet the end customers' financial strength and to take on the end customers' insolvency risks, the end-customer’s need for a variety of products and/or little volumes of products, which manufacturers are not able to provide, as well as the retailer’s logistic and other services.

(23) In addition to stock sales and project sales, the Notifying Party submits that manufacturers sell and deliver certain products directly to end-customers, without any involvement of a retailer (“direct sales”). In the case of direct sales, there are no vertical links between manufacturers and retailers.

(24) The Notifying Party submits that in the event that any of the manufacturers concerned by this Transaction, namely Xella, URSA, Balta and Edilians, distribute their products by way of direct sales, they distribute these products exclusively through this sales channel and not, in addition, through project sales or stock sales- (30). Therefore, for the purpose of the proposed Transaction, the Commission considers that direct sales do not lead to horizontal overlaps for the products sold through this sales channel. Market participants commonly do not distinguish between project sales and direct sales. (31) This distinction is, however, relevant for an assessment of the proposed Transaction under the Merger Regulation, because of the role of the Target who is not involved in direct sales.

(25) Xella as manufacturer/wholesaler engages in project sales, direct sales and stock sales. Xella’s project sales and stock sales are to be allocated to the ‘wholesale sales to retailers’ market. In view of the established Commission’s precedents (32) relating to markets for distribution of building materials, for the purpose of the proposed Transaction, direct sales are not part of the markets analysed for the purposes of the Transaction.

(26) SGBDD as a retailer engages in project sales and stock sales. SGBDD’s downstream activities are to be allocated to the ‘retail sales to professional customers’ market, as SGBDD does not operate DIY stores typically targeting DIY customers on the ‘retail sale to non-professional customers’ market. SGBDD’s sales to DIY customers are minor and a consequence of DIY customers occasionally purchasing products directly from SGBDD. SGBDD does not track the occasional purchases from DIY customers separately from its professional customers. (33)

4.2. Relevant product markets

4.2.1. Autoclaved aerated concrete (AAC) blocks on the market for wholesale sales to retailers

(27) AAC blocks are lightweight masonry products made of foam concrete that can typically be lifted by hand and are used for the construction of walls.

(28) In its previous decisions, the Commission noted that the relevant product market may comprise not only AAC blocks but also other products such as aggregate concrete blocks, but ultimately left the precise scope of the relevant product market open. (34) However, in one decision, by which the Commission partially referred a case for assessment to the German Bundeskartellamt, the Commission found that wall- building materials such as AAC blocks, CSUs, clay bricks and others are not fully substitutable in view of their characteristics, intended use and price (35), even though the Commission has not finally concluded on the relevant product market.

(29) The Notifying Party submits that there may be more than one plausible alternative for the definition of the relevant product markets including AAC blocks. The Notifying Party submits that the narrowest possible – although by no means most plausible – definition would consider AAC blocks as constituting a single relevant product market. However, the Notifying Party contends that the more plausible product market definition comprises AAC blocks, aggregate blocks and potentially also other wall-building materials, in particular bricks, sand-lime bricks/calcium silicate units and pumice blocks. (36)

(30) The Commission’s market investigation indicated that the relevant product market is not likely to comprise other products than AAC blocks, such as clay bricks, CSUs and pumice blocks. Even if different wall-building materials may be partially substitutable during the design stage of a construction project (37), this does not apply to a later stage of such project. Once a project is designed, the various materials are selected to work together and replacement by alternatives becomes more difficult. Some respondents explained that the architect determines the use of a particular building material. (38) Furthermore, market participants stressed the different characteristics of the materials, maintaining, for example that “AAC has entirely different physical characteristics than calcium silicate” (39), or that “calcium silicate has a very high bulk density and can hardly be substituted for certain areas of use. In the local market, there is no comparable product.” (40)

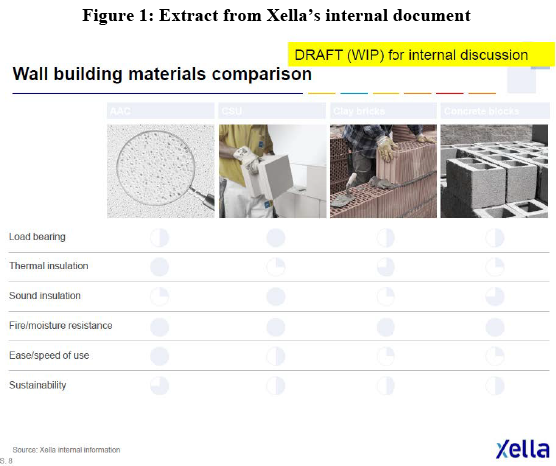

(31) Internal documents of the Notifying Party support these findings. When comparing different wall-building materials, Xella’s comparison between AAC blocks, CSUs, clay bricks and concrete blocks demonstrates the partially significant differences in characteristics, as shown in Figure 1 below. (41)

(32) Moreover, Xella’s statements in its internal documents point to product markets, which do not comprise several wall-building materials. When considering potential acquisitions, Xella commented as regards masonry bricks that such “market would probably not be considered competitive to Xella’s current business making potential acquisitions easy to get approval for by the authorities.” (42)

(33) However, for the purpose of this decision, the exact product market definition with respect to AAC blocks can be left open as the outcome of the competitive assessment would be the same under any plausible alternative product market definition.

4.2.2. AAC large format units on the market for wholesale sales to retailers

(34) AAC large format units are building materials made of foam concrete that cannot be lifted by hand and require equipment such as a crane for handling, and are used for the construction of walls, ceilings, floors and roofs. Xella offers such products both for industrial and residential construction. The products for the construction of industrial buildings, such as logistics centres, warehouses and manufacturing facilities, are sold under the Hebel brand. Xella’s large format units for the residential sector, together with floors, slabs or roofs are sold under the Ytong brand as a complete system.

(35) There are no relevant Commission precedents, which specifically concern AAC large format units.

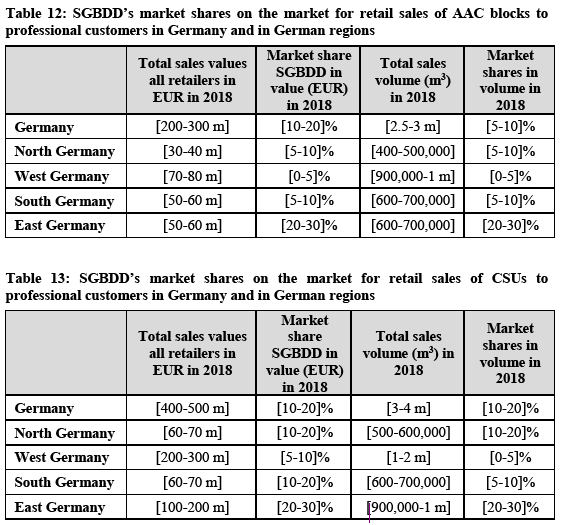

(36) The Notifying Party submits that the AAC large format wall and roof panels sold under the Hebel brand for industrial buildings on the one hand, and the Ytong complete systems, which include ceiling and roof large format units for single- family houses on the other, are part of two separate product markets. (43)

(37) In addition, the Notifying Party submits that from a demand side perspective, AAC large format units for industrial construction are part of a broader market, which includes concrete panels and steel elements, (44) while AAC large format units for residential construction belong to a broader market including concrete floor elements and full assembly floors. (45) However, the Notifying Party submits that from a supply side perspective, the product market definition is narrower, as producers cannot easily switch from one product to the other. (46)

(38) As regards the substitutability between AAC large format units for industrial and residential construction, the Commission’s market investigation indicated relevant differences between these products.

(39) Firstly, industrial buildings and residential buildings differ partially with respect to their relevant technical requirements. For example, on the one hand, a market participant explained that while for residential buildings the focus is on thermal insulation, this is less the case for industrial buildings. On the other hand, components for industrial buildings have to meet structural requirements for, among others, wind forces and snow loads. (47)

(40) Secondly, around half of the respondents active at the retail level considered AAC large format units for industrial and residential construction not to be substitutable products. However, roughly the same amount of respondents expressed the view that these two types of AAC large format units are substitutable. (48)

(41) With respect to substitutability of AAC large format units with other materials, whether for the residential or industrial sector, the majority of retailers responding to the Commission’s investigation did not consider AAC large format units to be substitutable with other materials. (49) One market participant expressed doubts whether AAC large format units could be substituted with other materials such as steel, mainly due to the different characteristics of the materials. (50)

(42) The Commission considers that the information obtained during its market investigation indicates that AAC large format units for industrial construction are not substitutable with those for residential construction, in particular due to the different technical requirements for residential and industrial constructions. As regards substitutability of AAC large format units with other materials, similar considerations apply.

(43) However, for the purpose of this decision, the exact product market definition with respect to AAC large format units whether for residential or industrial construction can be left open as the outcome of the competitive assessment would be the same under any plausible alternative product market definition.

(44) Finally, the Commission notes that AAC large format units for industrial construction under the Hebel brand are only sold via direct sales to end customers without any involvement of retailers. (51) Therefore, there are no horizontal overlaps or vertical links between the Notifying Party and SGBDD as regards AAC large format units for industrial construction. Therefore, these products are not discussed further in this decision.

4.2.3. Calcium silicate units (CSUs) on the market for wholesale sales to retailers

(45) CSUs are masonry products made from a mixture of lime and natural siliceous materials (sand, siliceous gravel or rock or mixtures thereof) that can typically be lifted by hand and which are used for the construction of walls. As a material, CSU has a higher density, and is therefore heavier than AAC.

(46) The Commission has not previously taken a definitive position on the relevant product market for CSUs, when it considered CSUs as being potentially part of the same market as AAC blocks (52).

(47) The Notifying Party contends that the more plausible market definition for CSUs is a product market comprising CSUs, AAC blocks, clay bricks and pumice bricks. (53)

(48) Feedback from the Commission’s market investigation as regards the substitutability of AAC blocks with other wall-building materials presented in section 4.2.1 of this decision applies also to the substitutability of CSUs with other wall-building materials. Therefore, there are credible indications that the relevant product market comprises only CSUs, and no other products such as AAC blocks, pumice blocks, and clay bricks.

(49) However, for the purpose of this decision, the exact product market definition with respect to CSUs can be left open, as the outcome of the competitive assessment would be the same under any plausible alternative product market definition.

4.2.4. Distribution of building materials on the market for retail sales to professional customers, in particular as regards AAC blocks and CSUs

(50) SGBDD’s operations are limited to distribution of building materials. More specifically, its activities in distribution of building materials are limited to the retail sales to professional customers (B2B). SGBDD is not active on the DIY market, or on the market for wholesale sales to retailers. As stated in paragraph (17), according to the Parties, more than 90% of SGBDD’s customers are estimated to be predominantly professional customers.

(51) In its previous decisions, the Commission has considered that the markets for the distribution of building materials in general can be divided into: (i) wholesale sales to retailers; (ii) retail sales to professional customers (B2B); and (iii) retail sales to non-professional customers (primarily through DIY stores), but has left the precise product market definition ultimately open. (54)

(52) As regards distribution on the retail level more specifically, in past decisions the Commission has also considered sub-segmentation by product groups, including the specific product group of building materials. (55)

(53) The Notifying Party submits that while further segmentation of the distribution markets by product category may be conceivable, it is extremely difficult to provide any reliable market share estimates on such a narrow product market basis. The Notifying Party also claims that distributors of building materials do no systematically track various product segments as distinct markets, as they are more interested in increasing their overall sales and offering as comprehensive a range of products as possible. (56)

(54) The Commission’s investigation indicated that Xella’s products represent only a minor part of the retailers’ portfolio based on their overall purchasing volumes. (57) The business model of retailers is based on having a large portfolio of building materials products and even other types of products such as insulation materials that they can offer to end customers for various types of construction projects, rather than specialising in a few types of building materials, such as AAC blocks, CSUs or AAC large format units. (58) For instance, in 2018, SGBDD generated revenues of only EUR [less than 50] million and EUR [less than 100] million in AAC blocks and CSUs respectively (stock sales and project sales combined), while the overall turnover generated from the distribution of building materials was EUR [1-2 billion]. (59)

(55) However, for the purpose of this decision, the exact product market definition with respect to the retail sales of building materials to professional customers can be left open as the outcome of the competitive assessment would be the same under any plausible alternative product market definition.

4.3. Relevant geographic markets

4.3.1. AAC blocks on the market for wholesale sales to retailers

(56) With regard to the relevant geographic market, the Commission has previously considered the wholesale sales to retailers market for AAC blocks as at most national level, but left the exact market definition open. (60) However, the Commission found in the referral decision Haniel/Fels (2001) and Haniel/Ytong (2001) that a local market appears to be appropriate, mainly because of the catchment areas of the production plants (61) and acknowledged local aspects of the supply of AAC in Germany in the Xella/H+H (2011) referral decision (62) . Moreover, Bundeskartellamt precedents from 2002 (Haniel/Ytong) and 2012 (Xella/H+H), both dealing with the supply of AAC blocks in Germany on the wholesale sales to retailers market, considered the geographical market to be subnational in scope, based on 200-km catchment areas around production plants, and North, West, South and East German regions respectively. (63)

(57) The Notifying Party submits that the geographic market for AAC products should be defined as (at least) national in scope. (64)

(58) In contrast, however, feedback from the market unambiguously indicates that the geographic market for AAC blocks is subnational in scope. A clear majority of retailers indicated that they purchase buildings materials, in particular, AAC blocks and CSUs, on a local level, whilst only a minority indicated a national scope for their purchases.(65) For the similar question, more than two-thirds of manufacturers stated that they sell their products on a local level (66) One manufacturer commented, “we sell exclusively through regional builders merchants” (67). As regards diverging wholesale prices, a clear majority of retailers confirmed that wholesale prices of building materials, in particular, AAC blocks and CSUs, differ significantly between different regions within Germany. (68) Respondents also confirmed that transport costs matter and that, therefore, the catchment areas around productions sites are between 150 and 300 kilometres. (69)

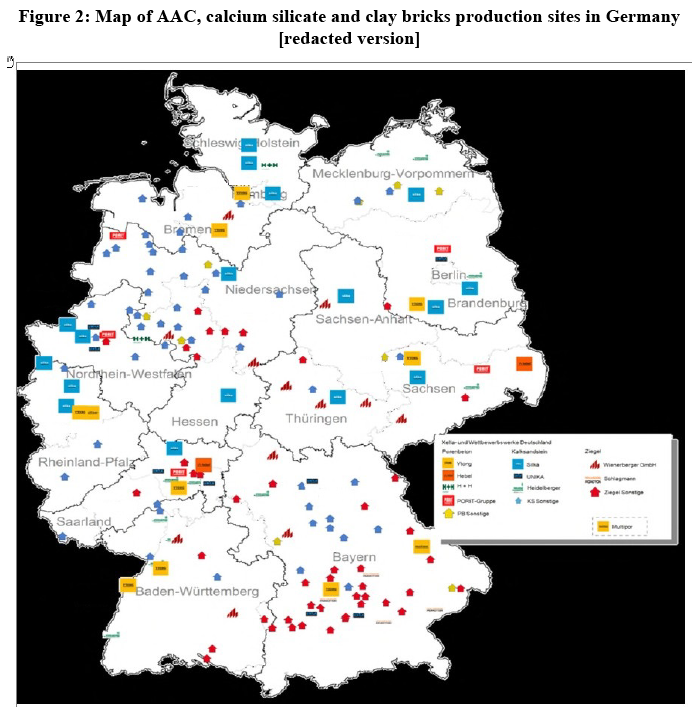

(59) The Commission notes that in particular because of the catchment areas around production facilities for AAC blocks, it is impossible to assume an economically reasonable national geographic market. Whereas this may be different for smaller countries, the size of Germany determines the local scope of the markets. This is even more so, as Xella appears to be the only AAC blocks manufacturer with production facilities across Germany, whilst in all German regions there are AAC blocks manufacturers that are active only locally, as can be seen from a map provided by the Notifying Party presented in Figure 2. (70)

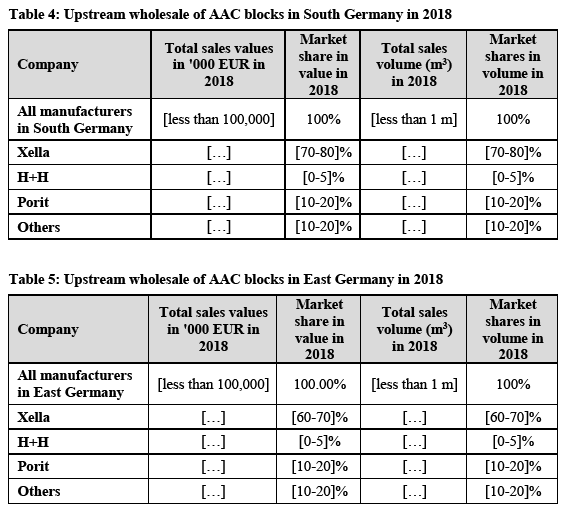

(60) Furthermore, the Commission takes note of strongly diverging market shares of AAC blocks manufacturers in different German regions (section 5.3.2.1 of this decision). For example, Xella’s market shares for the sale of AAC blocks on the wholesale to retailer market are as high as [70-80]% in South Germany, [60-70]% in East Germany but only [30-40]% in North and West Germany. H+H, Xella’s strongest competitor in AAC blocks, faces a similar diverging spread with [30-40]% in North Germany, [20-30]% in West Germany but only [0-5]% in East Germany and [0-5]% in South Germany.

(61) Therefore, the Commission considers that the relevant geographic markets for AAC blocks in Germany are local in scope and comprise certain areas within Germany. The Commission considers the delineation of four local markets established by the Bundeskartellamt to be the most suitable definition of the local markets. For this purpose, the Commission endorses this geographic market definition for AAC blocks within Germany.

4.3.2. AAC large format units for residential construction on the market for wholesale sales to retailers

(62) There are no precedents in the Commission's previous decisional practice as regards the relevant geographic market definition for AAC large format units for residential use.

(63) The Notifying Party contends that the geographic market for large format prefabricated compound units for residential use are national in scope, which is in line with the usual delivery radius of up to 600 kilometres. (71)

(64) In the market investigation, one market participant confirmed that manufacturers sell and deliver these products within the whole of Germany. (72)

(65) The Commission considers that, for the purposes of this decision, the precise scope of the relevant geographic market for AAC large format units for residential use products can be ultimately left open in the current case, since the Transaction does not give rise to serious doubts about its compatibility with the internal market under any plausible market definition.

4.3.3. CSUs on the market for wholesale sales to retailers

(66) As for the geographic scope, the Commission acknowledged the local aspect of the supply of CSUs in Germany in several referral decision. (73)

(67) The Notifying Party considers that CSUs are not different from other building materials in that respect and that the geographic market for the distribution of CSUs is therefore in all likelihood national. (74)

(68) However, as for AAC blocks, the market investigation demonstrated that the relevant geographic market is subnational in scope. (75) The arguments and considerations brought forward for AAC blocks apply in the same manner to CSUs: the production facilities for CSUs are spread over Germany in a similar manner as those of AAC blocks. Xella’s market shares are also strongly diverging with [70-80]% in North Germany, [40-50]% in East Germany, [20-30]% in West Germany and [5-10]% in South Germany, and so do they for H+H with [20-30]% in South Germany, [20-30]% in East Germany, [0-5]% in North Germany and [0-5]% in West Germany. One difference between AAC blocks and CSUs is that the catchment areas around production sites are smaller for CSUs due to the lower monetary value of these products (76), which even more supports the view that the relevant geographic markets are local in scope.

(69) Therefore, the Commission considers that the relevant geographic markets for CSUs in Germany are local in scope and comprise certain areas within Germany. The Commission considers the delineation of four local markets established by the Bundeskartellamt to be the most suitable definition of the local markets. For this purpose, the Commission endorses this geographic market definition for CSUs within Germany.

4.3.4. Distribution of building materials, in particular AAC and CSU products, on the market for retail sales to professional customers

(70) With regard to the relevant geographic market, the Commission has previously considered that the scope of the market of retail sales to professional customers for the distribution of building products is either national or potentially smaller than national. (77)

(71) The Notifying Party contends that the relevant geographic market for retail sales to professional customers is national. (78)

(72) The market investigation and the information submitted by the Notifying Party, however, point towards a local market of retail sales to professional customers for building materials. Firstly, some end-customers enter into supply contracts directly with manufacturers such as Xella. The delivery of the products and the invoicing, however, are carried out through a local retailer. (79) One respondent described the typical constellation as follows: “The planning and the technical agreements are done directly with the manufacturer. The purchase of the products is carried out through several retailers.” (80) Other end-customers source exclusively through retailers. Secondly, the geographic presence of the most of SGBDD’s competitors is limited to certain areas in Germany (81), with SGBDD’s competitors putting forward that they compete with SGBDD only locally. (82)

(73) In any event, the Commission considers that, for the purposes of this decision, the precise scope of the relevant geographic market for building materials distributed on the market of retail sales to professional customers can be left open in the current case, since the Transaction does not give rise to serious doubts about its compatibility with the internal market under any plausible market definition.

5. COMPETITIVE ASSESSMENT

5.1. Introduction

(74) Under Article 2(2) and (3) of the Merger Regulation and Annex XIV to the EEA Agreement, the Commission is required to examine whether notified concentrations are compatible with the internal market and the functioning of the EEA Agreement, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(75) In addition, Article 57(1) of the EEA Agreement requires the Commission to examine whether notified concentrations are compatible with the functioning of the EEA Agreement, by assessing whether they would create or strengthen a dominant position as a result of which effective competition would be significantly impeded within the EEA territory or a substantial part of it.

(76) In this respect, a proposed concentration may entail horizontal and/or non-horizontal effects.

5.2. Horizontal effects

5.2.1. Analytical framework

(77) As regards horizontal effects, the Horizontal Merger Guidelines (83) distinguish between two main ways in which concentrations concerning undertakings that are actual or potential competitors on the same relevant market (“horizontal mergers”) may significantly impede effective competition, namely non-coordinated and coordinated effects.

(78) Non-coordinated effects may significantly impede competition by eliminating important competitive constraints on one or more firms, which consequently would have increased market power, without resorting to coordinated behaviour. In that regard, the Horizontal Merger Guidelines consider not only the direct loss of competition between the undertakings involved in the horizontal merger, but also the reduction in competitive pressure on undertakings not involved in the horizontal merger in the same market that could be brought about by the horizontal merger.

(79) The Horizontal Merger Guidelines list a number of factors which may influence whether significant non-coordinated effects are likely to result from a horizontal merger, such as the large market shares of the undertakings involved in the horizontal merger, the fact that the undertakings involved in the horizontal merger are close competitors, the limited possibilities for customers to switch suppliers, or the fact that a horizontal merger would eliminate an important competitive force. That list of factors applies equally if a horizontal merger would create or strengthen a dominant position, or would otherwise significantly impede effective competition due to non-coordinated effects.

(80) Section 5.2.2 of this decision will analyse whether the proposed Transaction is likely to raise doubts as to its compatibility with the internal market due to non-coordinated effects.

5.2.2.The Commission’s assessment

(81) The Notifying Party contends that the proposed Transaction does not give rise to horizontal overlaps both between Stark and SGBDD on the one hand (84) and Xella and SGBDD on the other hand. (85)

(82) Horizontal overlaps on the markets of retail sales to professional customers and retail sale to non-professional customers between Stark and SGBDD, if any, are minimal. Stark has no operations in Germany and only very limited cross-border sales into Germany. SGBDD’s exports to Denmark (and its total exports to all Nordic countries in which Stark is present) represent [less than 1]% of its overall sales; and Stark’s exports to Germany are about [less than 1]% of its sales in Denmark. (86)

(83) As regards Xella’s production and sale of AAC blocks and CSUs, the Commission’s market investigation confirmed that Xella does not sell these products directly to end customers, but only through retailers such as SGBDD. (87)

(84) Xella distributes AAC large format units under the Ytong brand for residential construction by way of project sales through retailers, but not directly to end- customers. (88)

(85) Therefore, in light of the results of the market investigation and the evidence provided by the Notifying Party, the Commission considers that the proposed Transaction does not give rise to any, or only minimal, horizontal overlaps. Therefore, the Commission considers that the proposed Transaction does not raise any concerns as to its compatibility with internal market or the functioning of the EEA Agreement with respect to horizontal non-coordinated effects.

5.3. Vertical effects

5.3.1. Analytical framework

(86) As regards non-horizontal effects, the Non-Horizontal Merger Guidelines (89) distinguish between two broad types of concentrations that concern undertakings which are active on different relevant markets (“non-horizontal mergers”), namely vertical mergers and conglomerate mergers.

(87) A vertical merger may result in anti-competitive effects due to foreclosure. Foreclosure concerns a situation where actual or potential rivals’ access to supplies or markets is hampered or eliminated as a result of the vertical merger, thereby reducing these companies’ ability and/or incentive to compete. (90)

(88) Two forms of foreclosure can be distinguished in a vertical relationship: input and customer foreclosure. The first is where the vertical merger is likely to raise the costs of downstream rivals by restricting their access to an important input (input foreclosure). The second is where the vertical merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base (customer foreclosure). (91)

(89) Input foreclosure arises where, post-Transaction, the new entity would be likely to restrict access to the products or services that it would have otherwise supplied absent the vertical merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the vertical merger. (92)

(90) Customer foreclosure may occur when a supplier integrates with an important customer in the downstream market. Because of this downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (the input market) and reduce their ability or incentive to compete. In turn, this may raise downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the vertical merger. (93)

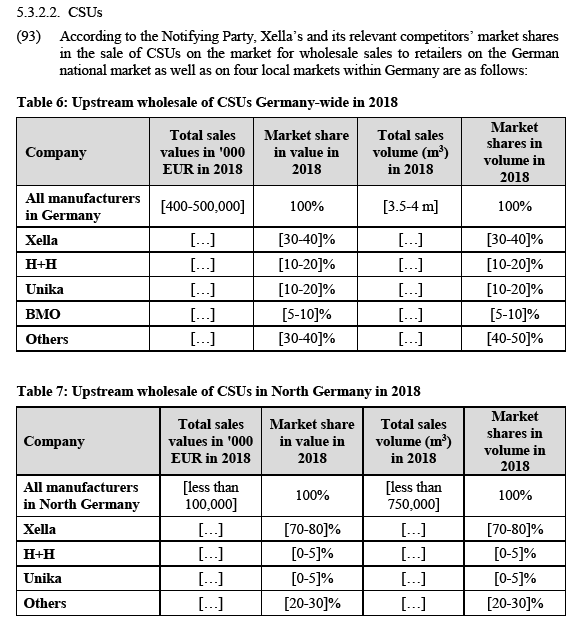

(91) For an input or customer foreclosure scenario to raise competition concerns, three cumulative factors need to be taken into account: (i) the ability of the merged entity to engage in foreclosure; (ii) the incentives of the merged entity to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on competition in the downstream market. (94)

5.3.2. Market structure of the upstream markets: wholesale sales of AAC blocks, CSUs and AAC large format unit for residential construction

5.3.2.1. AAC blocks

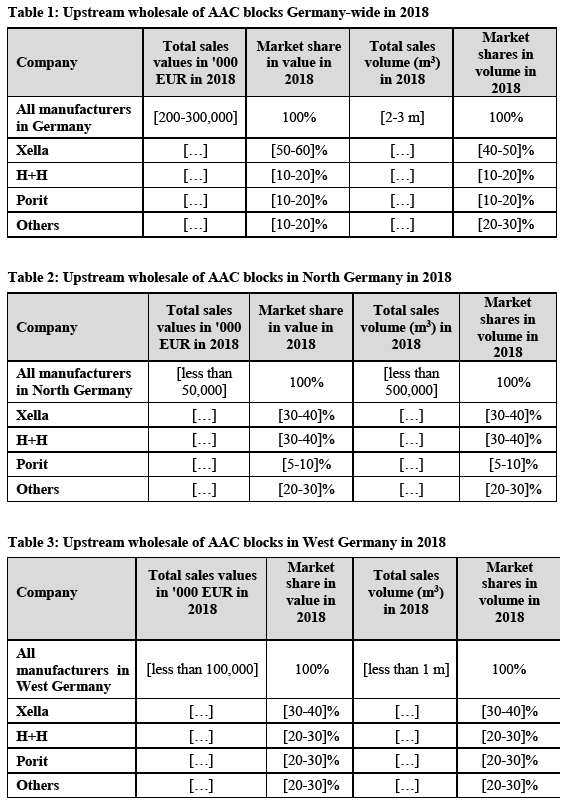

(92) According to the Notifying Party, Xella’s and its relevant competitors’ market shares in the sale of AAC blocks on the market for wholesale sales to retailers on the German national market as well as on four local markets within Germany are as follows:

5.3.2.3. AAC large format units for residential construction

(94) With respect to AAC large format units for the residential construction, the Notifying Party submits that it would have a market share of 100% on a plausible market, which only comprises this product, as it is the only manufacturer selling this product in Germany. (95)

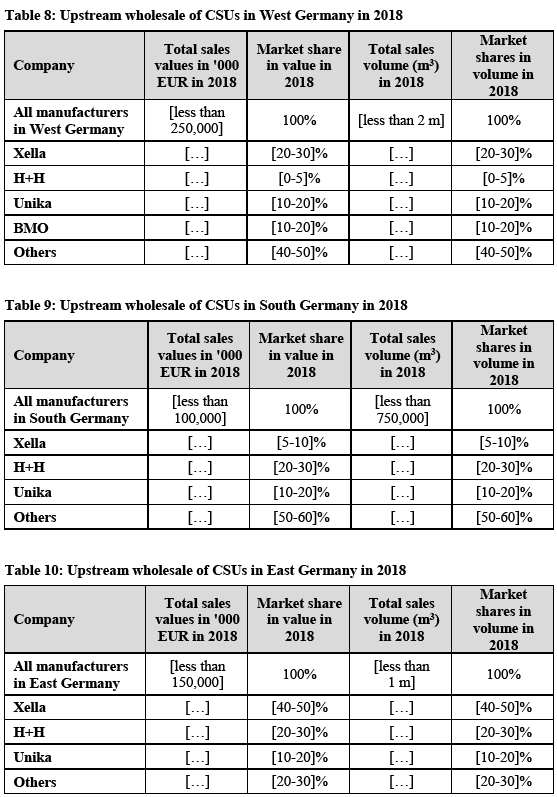

5.3.3. Market structure of the downstream markets: retail sales of building materials to professional customers

(95) For the downstream market, according to estimates of the Notifying Party, SGBDD’s market shares and the market shares of its competitors in distribution of building materials on the market for retail sales to professional customers are as follows:

(96) SGBDD’s market shares differ in different subnational regions of Germany. According to the Notifying Party, SGBDD’s market shares are between [0-5]% in North Germany and [20-30]% in the area of Berlin-Brandenburg, which roughly corresponds to the East German region. According to this data, SGBDD is market leader in the area of Berlin-Brandenburg followed by Bauking and Holz Possling with each [5-10]% market share, and in the area of Middle Germany with a market share of [10-20]%, followed by WeGO with [0-5]%. In other German regions, SGBDD does not command the highest market shares amongst its competitors. (98) In any case, the competitive assessment relates to narrowest plausible product markets on a subnational level, where the highest market shares exceed those on the national level.

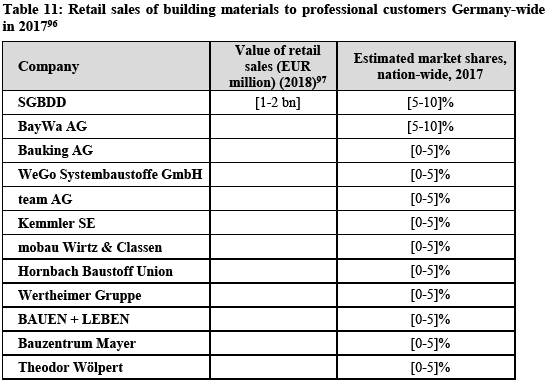

(97) As regards the Germany-wide and regional sale of AAC blocks and CSUs, the Notifying Party estimates the following market shares for SGBDD (99):

(98) With regard to SGBDD’s competitors in the sales of AAC blocks and CSUs on the Germany-wide and local level, the Notifying Party submitted only approximations of market shares, maintaining that no other data is available or known to the Notifying Party. (100) According to the Notifying Party, these approximations are based on several assumptions in relation to purchase and sales volumes of SGBDD’s competitors and therefore may deviate from market reality (101).

(99) The approximations indicate that in respect of AAC blocks, SGBDD commands the highest market shares on a Germany-wide level with [10-20]% (102) , followed by BayWa with [5-10]% and Bauking, Union Bauzentrum Hornbach and Raiffeisen Waren each with [0-5]%. SGBDD is also market leader in East Germany, with [20-30]% (103) , followed by Raiffeisen Waren with [5-10]% and BayWa holding [0-5]%. SGBDD is not, however, market leader in the sale of AAC blocks in North Germany, where, according to the market share approximation, it is the fifth largest retailer with [0-5]% (104), in West Germany as the third largest retailer with [5-10]% (105) and South Germany as the third largest retailer with [5-10]% (106).

(100) The same applies to SGBDD’s approximations of market shares of CSUs’ sales. On the national level it would hold the highest market share with [10-20]% (107), followed by Bauking with [5-10]% and Team baucenter, Henri Benthack and Krüger+Scharnberg each with [0-5]%. In East Germany, SGBDD would hold the highest market shares with [30-40]% (108) , with Bauking holding [5-10]% and Rothkelgel with [0-5]% being the second and third strongest competitor. SGBDD is fifths largest retailer with [5-10]% (109)in North Germany. In West Germany, it would hold [5-10]% (110) and be the third strongest retailer and in South Germany on fourth position with [5-10]% (111).

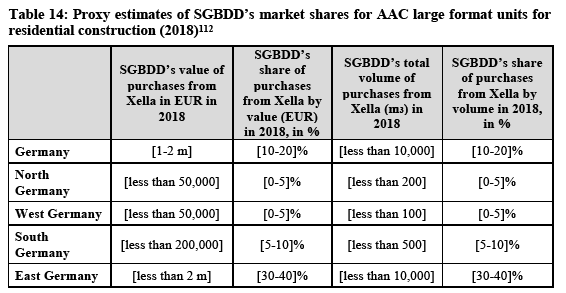

(101) With respect to AAC large format units for residential construction, according to the Notifying Party, proxy estimates of SGBDD’s market shares are presented in Table 14.

5.3.4. Vertically affected markets

(102) Based on the market shares submitted by the Notifying Party, as presented in sections 5.3.2 and 5.3.3 of this decision, and based on the methodology proposed and applied by the Notifying Party for the purpose of calculating the market shares, the Transaction gives rise to the following vertically affected markets.

(103) As regards AAC blocks:

(a) Upstream wholesale supply of AAC blocks by Xella and downstream retail distribution of AAC blocks to professional customers by SGBDD in Germany (upstream [50-60]% by value, [40-50]% by volume; downstream [10-20]% by value, [5-10]% by volume);

(b) Upstream wholesale supply of AAC blocks by Xella and downstream retail distribution of AAC blocks to professional customers by SGBDD in North Germany (upstream [30-40]% by volume, [30-40]% by value; downstream [5-10]% by value, [5-10]% by volume);

(c) Upstream wholesale supply of AAC blocks by Xella and downstream retail distribution of AAC blocks to professional customers by SGBDD in West Germany (upstream [30-40]% by volume, [30-40]% by value; downstream [0-5]% by value, [0-5]% by volume);

(d) Upstream wholesale supply of AAC blocks by Xella and downstream retail distribution of AAC blocks to professional customers by SGBDD in South Germany (upstream [70-80]% by volume, [70-80]% by value; downstream [5-10]% by value, [5-10]% by volume);

(e) Upstream wholesale supply of AAC blocks by Xella and downstream retail distribution of AAC blocks to professional customers by SGBDD in East Germany (upstream [60-70]% by volume, [60-70]% by value; downstream [20-30]% by value, [20-30]% by volume).

(104) As regards CSUs:

(a) Upstream wholesale supply of CSUs by Xella and downstream retail distribution of CSUs to professional customers by SGBDD in Germany (upstream [30-40]% by value, [30-40]% by volume; downstream [10-20]% by value, [10-20]% by volume);

(b) Upstream wholesale supply of CSUs by Xella and downstream retail distribution of CSUs to professional customers by SGBDD in North Germany (upstream [70-80]% by volume and value; downstream [10-20]% by value, [10-20]% by volume);

(c) Upstream wholesale supply of CSUs by Xella and downstream retail distribution of CSUs to professional customers by SGBDD in East Germany (upstream [40-50]% by volume and value; downstream [20-30]% by value, [20-30]% by volume).

(105) As regards AAC large format units for residential construction, upstream wholesale supply of AAC large format units for residential construction by Xella and downstream retail distribution of AAC large format units for residential construction to professional customers by SGBDD in:

(a) Germany (upstream [90-100]% by volume and value; downstream [10-20]% by volume, [10-20]% by value);

(b) North Germany (upstream [90-100]% by volume and value; downstream [0-5]% by volume and value);

(c) West Germany (upstream [90-100]% by volume and value; downstream [0-5]% by volume, [0-5]% by value);

(d) South Germany (upstream [90-100]% by volume and value; downstream [5-10]% by volume, [5-10]% by value);

(e) East Germany (upstream [90-100]% by volume and value; downstream [30-40]% by volume, [30-40]% by value).

(106) The Notifying Party submits that even if there were affected markets brought about by the proposed Transaction, it would not give rise to any significant impediment to effective competition by restricting downstream rivals’ access to an important input (input foreclosure) or by restricting upstream rivals’ access to a sufficient customer base (customer foreclosure). (113)

5.3.5. Input foreclosure

5.3.5.1. The Notifying Party’s arguments

(107) The Notifying Party submits that there is no risk that the proposed Transaction would lead to input foreclosure. Post-Transaction, Xella would have neither the ability nor the incentive to restrict access to its products vis-à-vis other distributors competing with SGBDD on the downstream level. (114)

(108) As regards ability, the Notifying Party submits that Xella would not have the ability to foreclose SGBDD’s downstream competitors from access to AAC blocks and CSUs as Xella’s products, and in particular AAC blocks, are not a ‘must have’ input for distributors of building materials. Moreover, any such attempt would be unsuccessful given that AAC blocks account for a very small share of both downstream costs as well as downstream revenues. More specifically, AAC blocks represented only [0-5]% and CSUs only [0-5]% of SGBDD’s overall procurement costs in 2018. At the same time, SGBDD only generated EUR [less than 50] million and EUR [less than 100] million worth of revenue with AAC and CSU blocks overall (stock sales and project sales combined), while the overall turnover of SGBDD’s activities in distribution of building materials amounted to EUR [1-2 billion]. (115) Therefore, the Notifying Party submits that AAC blocks and CSUs do not constitute an important input downstream.

(109) As regards incentive, the Notifying Party submits that an attempt to foreclose competitors of SGBDD would not be profitable against the background of SGBDD’s limited downstream market shares, because SGBDD is not an important wholesale customer for producers like Xella. Moreover, any potential benefits for SGBDD on the downstream market would be outweighed by the loss of profits for Xella on the upstream market, not only because SGBDD is one of Xella’s less important customers, but also because upstream margins are considerably larger than downstream margins. Therefore, the merged entity would not have any economic incentive to carry out input foreclosure.

(110) As regards AAC large format units for residential construction, the Notifying Party submits that Xella does not sell such products separately but only as part of a “complete Ytong system”, which includes other materials such as AAC blocks. (116) Therefore, the Notifying Party contends that Xella would have neither the ability nor the incentive to restrict access to its AAC large format units for residential construction vis-à-vis other distributors competing with SGBDD on a downstream level. Not only are the AAC large format units no “must have” inputs for the retailers, but also account for very limited sales volumes. With only [10-20]% of the sales of this product to SGBDD, the Notifying Party maintains that any attempt to rely only on SGBDD for the distribution of the AAC large format units would be unprofitable and hence without any incentive for Xella. Finally, Xella would face repercussions if such strategy alienates other retailers. (117)

5.3.5.2. The Commission’s assessment

(111) The Commission notes that certain retailers responding to the Commission’s market investigation raised concerns as regards the impact of the Transaction on their business, and in particular the impact if Xella were to stop supplying or raise prices for building materials for their company post-Transaction. (118) However, the majority of retailers responding to the Commission’s market investigation found it unlikely that Xella would stop supplying building materials to their company or raise prices of building materials for their company. (119) The Commission considers that the Transaction does not give rise to competition concerns related to input foreclosure with respect to AAC blocks, CSUs or AAC large format units for residential construction due to the following reasons.

(A) AAC blocks

(112) The Commission notes that the assessment presented in this section is applicable to all affected markets listed in paragraph (103) as the competitively relevant conditions are similar for all these geographic markets.

(113) The Commission notes that while Xella’s market shares in Germany nationwide and in several German regions are high on the upstream market of wholesale sale of AAC blocks to retailers, the shares of SGBDD downstream on the retail sale to professional customers are considerably lower.

(114) As shown in Table 1, Xella’s market share upstream in Germany is [40-50]% by volume and [50-60]% by value for AAC blocks. On a local level, Xella’s market share is higher in South Germany ([70-80]% by volume) and in East Germany ([60-70]% by volume), while Xella’s position is weaker in the North and West ([30-40]% by volume in both regions).

(115) As shown in Table 12, SGBDD’s market share downstream is significantly lower, accounting for [10-20]% (by value) of the distribution of AAC blocks to professional customers in Germany. On a local level SGBDD’s market shares are even lower (below 10% by value) in all regions except for East Germany, where its market share is higher ([20-30]% by value).

(116) However, even under the narrowest plausible market definition, under which AAC blocks constitute a separate product market and under which the geographic market is local with four regions in Germany, the Commission considers that Xella’s ability and incentive to engage in input foreclosure post-Transaction would be very limited. Therefore, the Transaction is unlikely to result in a significant impediment to effective competition due to input foreclosure.

(117) First, the Commission considers that it is not likely that Xella would have the ability to engage in an input foreclosure strategy post-Transaction.

(118) In the first place, the Commission’s market investigation indicated that Xella’s AAC blocks are not an important input for retailers of building materials. Retailers’ purchases from Xella do not constitute a significant proportion of their overall purchases of building materials, indicating that the portfolio of products distributed by the retailers is much wider than products offered by Xella. (120) AAC blocks are just one of Xella’s products, and therefore represent an even smaller proportion of the retailers’ overall purchases. This is also confirmed by SGBDD. For SGBDD, AAC blocks represented only [0-5]% of its overall procurement costs in 2018. At the same time, SGBDD only generated revenues of EUR [less than 50] million with AAC blocks overall (stock sales and project sales combined), while the overall turnover of its activities in distribution of building materials amounted to EUR [1-2 billion]. (121)

(119) In the second place, the large majority of retailers responding to the Commission’s market investigation did not consider a specific brand, such as Xella’s Ytong brand, a very important product for their business. (122)

(120) In the third place, the Commission’s market investigation clearly indicated that for retailers, Xella’s AAC blocks are substitutable in terms of product specifications, price and customer preferences with the same or similar types of products offered by competitors of Xella. (123) This was also confirmed by Xella’s competitors upstream (124) and a majority of end customers. (125) The Commission’s investigation did not indicate that there would be differences in the quality of the AAC blocks from different producers.

(121) In the fourth place, even in the areas where Xella achieves high market shares for AAC blocks, such as in East and South Germany, the Commission’s investigation indicated that there are smaller regional players present who could supply retailers if there were foreclosed by Xella. Many retailers indicated that in such a scenario, they would for instance focus on finding alternatives, start buying AAC blocks from Xella’s competitors and stop their business relationship with Xella. (126) Based on the Notifying Party’s submissions, Xella’s sales of AAC blocks in 2018 amounted to EUR [less than 200,000] out of its total sales of all products worth EUR [less than 500,000] (out of which EUR [less than 500,000] were sales made through retailers). (127) As such, AAC blocks account for ca. [30-40]% of Xella’s overall sales in Germany. Therefore, an input foreclosure strategy by Xella could put at risk a larger part of its revenues if retailers would stop their business relationship with Xella.

(122) Second, the Commission considers that it is not likely that Xella would have the incentive to engage in an input foreclosure strategy post-Transaction.

(123) In the first place, the Notifying Party’s submissions and feedback from the market indicated that the margins achieved by producers of AAC blocks are roughly twice that achieved by retailers, which would limit the incentive for input foreclosure practices. For instance, the screen margin of SGBDD for AAC blocks from projects sales in 2018 was [5-10]%, while Xella’s gross margin for AAC blocks from project sales in 2018 was [30-40]%. For stock sales of AAC blocks, Xella’s gross margin was [30-40]%, while SGBDD’s screen margin was [20-30]%. (128) Therefore, foreclosing competitors of SGBDD post-Transaction would not be profitable for Xella and thus the Notifying Party.

(124) In the second place, the Commission’s market investigation confirmed the fragmented nature of the distribution market on the level of retailers. Two large purchasing cooperatives that are present across Germany, namely Hagebau and Eurobaustoff, represent large number of smaller retailers in the procurement of building materials, including AAC blocks. Given that SGBDD accounts for only [10-20]% of the distribution of AAC blocks to professional customers in Germany, it is unlikely that Xella could rely only on SGBDD for the distribution of AAC blocks. As a result of such strategy, Xella would likely considerably reduce the sales of its AAC blocks, which given the higher margins upstream would be economically unprofitable. Moreover, half of the respondents to the Commission’s market investigation active on the upstream level indicated that they could expand capacity to satisfy additional demand for their products. (129) Therefore, it would seem that in all plausible markets SGBDD’s competitors would still have a choice of suppliers that would be able to supply the required quantities of AAC blocks. In addition, the purchasing cooperatives seem to have strong purchasing power, which allows them to negotiate prices with producer like Xella. Given their large presence and commercial importance, it is unlikely that Xella would have the incentive to foreclose their access to AAC blocks. (130)

(125) Third, the Commission considers that it is unlikely that the downstream rivals’ costs would increase as a result of the Transaction. In fact, SGBDD’s downstream rivals include purchasing cooperatives whose purchasing power on the market would likely counterbalance any attempt by Xella to pursue an input foreclosure strategy. Thus, they would be able to continue procuring AAC blocks without increased costs. Moreover, as reported in paragraph (111), majority of retailers that responded to the Commission’s market investigation found it unlikely that Xella foreclose input for their company. Therefore, the Transaction is unlikely to result in a significant impediment to effective competition due to input foreclosure.

(126) Therefore, taking into account the results of the Commission’s market investigation and the evidence provided by the Notifying Party, the Commission considers that it is not likely that the “merged entity” would have the ability and/or incentive to engage post-Transaction in an input foreclosure strategy in any of the plausible markets.

(B) CSUs

(127) The Commission notes that the assessment presented in this section is applicable to all affected markets listed in paragraph (104) as the competitively relevant conditions are similar for all these geographic markets.

(128) The Commission notes that while Xella’s market shares in Germany nationwide and in several German regions are high on the upstream market of wholesale sale of CSUs to retailers, the shares of SGBDD downstream on the retail sale to professional customers are considerably lower.

(129) As shown in Table 6, Xella’s market share upstream for CSUs in Germany is [30-40]% by volume and [30-40]% by value, which is considerably lower than its nationwide market share for AAC blocks. On a local level, Xella’s market share is higher in North Germany ([70-80]% by volume) and in East Germany ([40-50]% by volume), while Xella’s position is weaker in the West and South ([20-30]% and [5-10]% by volume respectively).

(130) As shown in Table 13, SGBDD’s market share downstream is significantly lower, accounting for [10-20]% (by value) of the distribution of CSUs to professional customers in Germany. On a local level SGBDD’s market shares are even lower (below [10-20]% by value) in all regions except for East Germany, where its market share is higher ([20-30]% by value).

(131) However, even under the narrowest plausible market definition, under which CSUs constitute a separate product market and under which the geographic market is local with four regions in Germany, the Commission considers that Xella’s ability and/or incentive to engage in input foreclosure post-Transaction would be very limited. Therefore, the Transaction is unlikely to result in a significant impediment to effective competition due to input foreclosure.

(132) First, the Commission considers that it is not likely that Xella would have the ability to engage in an input foreclosure strategy post-Transaction.

(133) In the first place, similarly as with regard to the AAC blocks, the Commission’s market investigation indicated that Xella’s CSUs are not an important input for retailers of building materials. Retailers’ purchases from Xella do not constitute a significant proportion of their overall purchases of building materials, indicating that the portfolio of products distributed by the retailers is much wider than products offered by Xella. (131) CSUs are just one of Xella’s products, and therefore represent an even smaller proportion of the retailers’ overall purchases. This is also confirmed by SGBDD. For SGBDD, CSUs represented only [0-5]% of SGBDD’s overall procurement costs in 2018. At the same time, SGBDD only generated EUR [less than 100] million worth of revenue with CSUs overall (stock sales and project sales combined), while the overall turnover of SGBDD’s activities in distribution of building materials amounted to EUR [1-2 billion]. (132)

(134) In the second place, the Commission’s market investigation did not indicate that Xella’s brand for CSUs (Silka) would be a very important product for retailers. (133)

(135) In the third place, as in the case of AAC blocks, the Commission’s market investigation clearly indicated that for retailers, Xella’s CSUs are substitutable in terms of product specifications, price and customer preferences with the same or similar types of products offered by competitors of Xella. (134) This was also confirmed by Xella’s competitors upstream (135) and a majority of end customers. (136) The Commission’s investigation did not indicate that there would be differences in the quality of the CSUs from different producers.

(136) In the fourth place, even in the areas where Xella achieves high market shares for CSUs, such as North and East Germany, the Commission’s investigation indicated that there are smaller regional players present who could supply retailers if there were foreclosed by Xella. As in the case of AAC blocks, many retailers indicated that in such scenario, they would for instance focus on finding alternatives, start buying CSUs from Xella’s competitors and stop their business relationship with Xella. (137)

(137) Second, the Commission considers that it is not likely that Xella would have the incentive to engage in an input foreclosure strategy post-Transaction.

(138) In the first place, the Notifying Party’s submissions and feedback from the market indicated that the margins achieved by producers of CSUs are roughly twice that achieved by retailers, which would limit the incentive for input foreclosure practices. For instance, the screen margin of SGBDD for CSUs from projects sales in 2018 was [5-10]%, while Xella’s gross margin for CSUs from project sales in 2018 was [20-30]%. For stock sales of CSUs, Xella’s gross margin was [30-40]%, while SGBDD’s screen margin was [30-40]%. (138) Therefore, foreclosing competitors of SGBDD post-Transaction would not be profitable for Xella and thus the Notifying Party.

(139) In the second place, the fragmentation of the retailers market and the role of the purchasing cooperatives is similar with regard to CSUs as in the case of AAC blocks, assessed in paragraph (124).

(140) Third, the Commission considers that it is unlikely that the downstream rivals’ costs would increase as a result of the Transaction. In fact, SGBDD’s downstream rivals include purchasing cooperatives whose purchasing power on the market would likely counterbalance any attempt by Xella to pursue an input foreclosure strategy. Thus, they would be able to continue procuring CSUs without increased costs. Moreover, as reported in paragraph (111), majority of retailers that responded to the Commission’s market investigation found it unlikely that Xella foreclose input for their company. Therefore, the Transaction is unlikely to result in a significant impediment to effective competition due to input foreclosure.

(141) Therefore, taking into account the results of the Commission’s market investigation and the evidence provided by the Notifying Party, the Commission considers that it is unlikely that the “merged entity” would have the ability and/or incentive to engage in an input foreclosure strategy post-Transaction in any of the plausible markets.

(C) AAC large format units for residential construction

(142) The Commission notes that AAC large format units for residential construction are indirectly sold through retailers. However, as regards Xella’s AAC large format units for residential construction, the Notifying Party submits that those are only sold as part of a “complete Ytong solution” and not as a separate product. Given that Xella’s market share in this hypothetical narrow product market in Germany amounts to 100% and the products are only sold as part of the “complete Ytong solution”, it follow that these products are not sold as a standalone products in general. The Commission’s market investigation indicated that Xella’s Ytong brand is indeed the only brand available for these products. (139)

(143) However, based on the submissions made by the Notifying Party and the Commission’s investigation, the Commission considers that these products constitute a niche product that can only be used for the construction of single-family houses and only if a customer chose to build a complete Ytong system single-family house. In 2018, such houses represented only [0-5]% of the total number of single- family houses built in that year in Germany. (140)

(144) In 2018, the value of Ytong AAC large format units represented only a market value of EUR [less than 20] million. In comparison, other elements that are available for a similar use such as concrete floor elements and full assembly floor made out of reinforced concrete, while arguably in different product markets, represented value of EUR 170 and 230 million respectively. (141) Moreover, the revenues from the Ytong system do not represent a considerable part of the retailers’ revenues and are not a very important product for retailers in general. This is due to the fact that retailers’ portfolio includes a large variety of building materials. (142) Moreover, only [0-5]% of single-family houses in 2018 in Germany were built with a complete Ytong system, which further indicates the limited application of this system. (143) As regards SGBDD, in 2018, Xella’s total sales to SGBDD of all products (that is including AAC blocks, CSUs, and large format units as well as any other ancillary products) amounted to EUR [less than 50] million. (144) While the Target did not provide information as to the amount of revenues achieved from the Ytong system, the Ytong system is unlikely to be of any significance to SGBDD’s revenues given its overall turnover of EUR [1-2 billion] achieved in building materials sold to professional customers. (145) Therefore, the lack of access to an Ytong system would not have an effect on the retailers’ business.

(145) Moreover, sales of the Ytong system through SGBDD are likely to represent only a part of the overall Ytong system sales. As can be seen from Table 14, SGBDD’s shares with regards to AAC large format units for residential construction do not indicate that SGBDD would be the only retailer selling such products. Given that these products are only sold as part of the Ytong system, it should therefore follow that also other retailers are active in the distribution on the retail level of Ytong systems. Therefore, the Notifying Party is unlikely to limit the sales just to SGBDD.

(146) Given the limited application of the Ytong AAC large format units and the fact that they are sold only as part of an Ytong system together with other Ytong products, such as AAC blocks, it can be considered that Xella’s revenues and thus any market power would be derived from these main products, for which there are competing products for customers, and not the “complementary” AAC large format units.

(147) Moreover, given that Xella’s AAC large format units for residential construction are sold as part of project sales, which can also be initiated by retailers, Xella and thus the Notifying Party would not have the incentive to foreclose competing retailers of SGBDD as it would lose sales to those retailers without having the possibility to recoup the lost sales. This is also due to the niche nature of the product and the limited use.

(148) Therefore, the merged entity is unlikely to have the ability and incentive to engage in input foreclosure strategy with regard to AAC large format units post-Transaction and it is also unlikely that the Transaction would result in a significant impediment to effective competition due to input foreclosure.

5.3.6. Customer foreclosure

5.3.6.1. The Notifying Party’s arguments

(149) The Notifying Party submits that there is no risk that the proposed Transaction would lead to customer foreclosure with regard to AAC blocks and CSUs. Post- Transaction, the merged entity would have neither the ability nor the incentive to impede or restrict access to a sufficient customer base for Xella’s actual or potential rivals on the upstream market. (146)

(150) As regards ability, the Notifying Party submits that the merged entity would not have the ability to foreclose competing upstream suppliers from access to customers. According to the Notifying Party, Xella’s AAC large format units for residential construction are in competition with a variety of substitutes, which have been chosen as the preferred technical solution in [90-100]% of the new single-family houses in Germany. As such, these upstream rivals would have a choice between a large number of major or smaller retailers in every region of Germany. (147) SGBDD’s presence downstream is limited. Even where SGBDD is the largest player downstream, as in the Berlin-Brandenburg region, it is not the most important customer, as purchasing cooperative such as Eurobaustoff and Hagebau are larger. (148)

(151) As regards incentive, the Notifying Party submits that Xella and SGBDD would have no incentive to engage in customer foreclosure. Excluding Xella’s competitors from its list of suppliers would not make economic sense for SGBDD as the downside of losing such alternative sources of supply would outweigh any potential benefits for SGBDD or Xella. AAC large format units for residential construction play an insignificant role in SGBDD’s portfolio. (149) The costs of not procuring from Xella’s upstream competitors would be high because SGBDD would lose a large number of downstream sales that are necessarily tied to a specific competitor brand. Thus, it would not be profitable for SGBDD to adopt a single-brand business strategy. (150)

(152) Eventually, the Notifying Party maintains that there would be no impact on effective competition on the market, mainly because of SGBDD’s small presence on the downstream market and high upstream margins of Xella’s competitors, who could easily allow them to maintain their sales levels. (151)

5.3.6.2. The Commission’s assessment

(153) The Commission notes that certain market participants active on the upstream level raised concerns as regards potential customer foreclosure in respect of AAC blocks and CSUs and the impact of the Transaction on their business. (152)

(154) However, the Commission considers that the proposed Transaction does not give rise to competition concerns related to customer foreclosure with respect to AAC blocks, CSUs and AAC large format units for residential construction due to the following reasons.

(155) The Commission notes that the assessment presented in this section is applicable to all affected markets listed in paragraphs (103) and (104) as the competitively relevant conditions are similar for all these geographic markets. For the sake of completeness, an assessment for the affected market listed in paragraph (105) is not developed further due to the fact that if the hypothetical product market was limited to constitute only AAC large format units for residential construction, no customer foreclosure could be undertaken by Xella as Xella is the only producer of such products in Germany (105). On the other hand, if the product market was broader and included other substitutable products, customer foreclosure would be unlikely given that alternatives would be available.

(156) First, the Commission considers that SGBDD does not have the ability to foreclose access for upstream suppliers other than Xella to customers active on the downstream markets. SGBDD is not an important customer for Xella and Xella’s competitors upstream. According to statements from market participants, the strongest players on the downstream market are purchasing cooperatives that represent hundreds of smaller retailers for the procurement of building materials and are present across the whole of Germany. (153)

(157) Second, although SGBDD is the largest retailer for building materials Germany- wide, its market share on the market for retail sales of building materials to professional customers in Germany is modest with [5-10]%. In addition, as can be seen from Table 11, the market for retailers of building materials is largely fragmented. Therefore, competitors of Xella should be able to sell their AAC blocks and CSUs to a range of alternative retailers even if Xella were to foreclose their access to SGBDD post-Transaction.

(158) Third, even when considering the sales of AAC blocks and CSUs specifically in East Germany, where SGBDD holds the strongest position amongst several regions within Germany, its market shares do not exceed [30-40]% (15)4. Therefore, SGBDD's importance for reaching end customers in Germany or in specific German regions is not significant and the Commission’s market investigation did not yield any indication to the contrary. (155) Therefore, the Commission does not consider SGBDD to have significant market power in the downstream market. As such, it is unlikely that the merged entity would be able to increase the cost of its upstream competitors to access downstream customers or by restricting access to a significant customer base.

(159) Fourth, given that margins on the upstream market are considerable, as presented in paragraphs (122) and (137), the Commission finds that even in the event that competitors such as H+H, Porit and Unika would initially incur sales losses because of a customer foreclosure strategy, they would be in the position to implement price- related counterstrategies in order to recover and to maintain their sales levels. Such strategies could include decreasing the price of their products in order to regain sales volumes. Given that the upstream producers enjoy a margin buffer, they could afford to implement such strategy and thus a customer foreclosure strategy would likely be unprofitable for Xella. Therefore, Xella is unlikely to have an incentive to engage in customer foreclosure post-Transaction.

(160) Fifth, it is unlikely that SGBDD’s rivals downstream would be at competitive disadvantage given SGBDD’s limited power downstream and the position of Xella’s rivals upstream. Therefore, the Transaction is unlikely to result in a significant impediment to effective competition due to customer foreclosure.

(161) Therefore, taking into account the results of the Commission’s market investigation and the evidence provided by the Notifying Party, the Commission considers that it is unlikely that the “merged entity” would have the ability and/or incentive to engage in a customer foreclosure strategy post-Transaction in any of the plausible markets.

5.3.7. Conclusion on vertical effects

(162) In light of the considerations in sections 5.3.5 and 5.3.6, the Commission concludes that the proposed Transaction does not give rise to serious doubts about its compatibility with the internal market or the functioning of the EEA Agreement due to input or customer foreclosure as regards the markets of AAC blocks, CSUs and AAC large format units for residential construction.

6. CONCLUSION