Commission, July 19, 2017, No M.8251

EUROPEAN COMMISSION

Judgment

BITE / TELE2 / TELIA LIETUVA / JV

Subject: Case M.8251 - Bite / Tele2 / Telia Lietuva / JV

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 15 June 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertakings UAB Bitė Lietuva ('Bitė'), controlled by Providence Equity, UAB Tele2 ('Tele2'), belonging to the Tele2 group and Telia Lietuva AB ('Telia'), belonging to Telia Company AB acquire within the meaning of Article 3(4) of the Merger Regulation joint control of a newly created full-function joint venture company (the 'JV') by way of a purchase of shares (hereinafter the 'Transaction'). (3) Bitė, Tele2 and Telia are collectively designated hereinafter as the 'Notifying Parties' and together with the JV as the 'Parties'.

1. THE PARTIES AND THE CONCENTRATION

(2) Bitė is a mobile network operator ('MNO') in Lithuania and a provider of wholesale and retail mobile telecommunications services and retail sales of mobile handsets, tablets and their accessories in Lithuania. Bitė also offers certain fixed telecommunications services. Bitė is ultimately controlled by the US investment firm Providence Equity Partners LLC.

(3) Tele2 is also an MNO and provides wholesale and retail mobile telecommunications services and retail sales of mobile handsets, tablets and their accessories in Lithuania. It belongs to the Tele2 group, a group of telecommunications companies with mobile and fixed telecommunications operations in multiple European countries. Tele2 group is de facto controlled by the Swedish investment company Kinnevik AB, ultimately controlled by Verdere S.à.r.l (Luxembourg).

(4) Telia is also an MNO and a provider of wholesale and retail mobile and fixed electronic communications services in Lithuania. Telia also provides a wide range of IT services (such as data centre (colocation) services). Telia belongs to the Swedish Telia Company AB which comprises fixed and mobile telecommunications companies in Europe and Asia.

(5) The JV is a newly established and currently empty company. After the Transaction, the JV will be engaged in the retail provision of payment services in Lithuania and will operate as an electronic money institution and as a payment services provider ('PSP'), subject to the regulatory supervision of the Bank of Lithuania. In particular, the JV will operate a new mobile payment ecosystem that will allow consumers (mobile telephony subscribers of the Notifying Parties) and merchants (who enter into an agreement with the JV) to carry out and receive mobile payments both within the JV's ecosystem (intra-PSP payments) and to and from accounts held at other PSPs (inter-PSP payments). The JV will therefore operate as a two-sided platform targeted at consumers on the on one side (by means of a mobile app) and merchants on the other side.

(6) The Transaction concerns the creation of the JV between Bitė, Tele2 and Telia. Pursuant to the Cooperation Agreement and the Share Sale and Purchase Agreement entered into by the Notifying Parties, respectively, on 18 and 27 April 2017, each of the Notifying Parties will acquire one third of the shares in the JV. The Notifying Parties' relationships regarding the management of the JV will be governed by a Shareholders Agreement entered into by the Notifying Parties on 18 April 2017.

1.1. Joint control

(7) As a result of the Transaction, each of the Notifying Parties will hold an equal amount of shares and voting rights in the JV and will be entitled to appoint one third of the members of the JV's supervisory board and management board. Commercially strategic decisions of the JV (including those concerning the JV's business plan, budget and investments) will be subject to unanimous approval by all members of the JV's management board. Accordingly, the Notifying Parties will exercise joint control over the JV.

1.2. Full-functionality

(8) The JV will be a joint venture performing on a lasting basis all the functions of an autonomous economic entity.

(9) First, the JV will have sufficient resources to operate independently on the market. In particular, the JV will have access to: (i) dedicated management, including a general manager, as well as technical, commercial, regulatory directors; (ii) staff, including around […] employees during the initial 2-3 years of the JV's operation; (iii) finance, including contributions from the Notifying Parties during the JV's initial start-up period, with around EUR […] to be contributed by each of the Notifying Parties during the JV's first year; and (iv) assets, including technical infrastructure and software solutions, also on the basis of […]. In addition, the JV will hold a license (already issued by the Bank of Lithuania) allowing it to conduct its activities as an e-money institution in Lithuania.

(10) Second, the JV will perform activities beyond one specific function for the parents and will have its own presence on the market as a retail PSP (a market in which the Notifying Parties are essentially not active). (4) The JV will be responsible for the overall management of its mobile payment ecosystem and for the execution of payment transactions. It will have direct customer-facing interactions (i) with merchants, […] (including the negotiation and conclusion of contracts and the provision of customer support services); and (ii) with consumers, on a shared basis with the Notifying Parties (by allowing them to subscribe through the JV's online subscription channel, download and install the JV's app and acquire user and IBAN e-money accounts with the JV, and by providing a customer service platform). While the Notifying Parties will also partly act as an interface vis-à-vis consumers, (5) […]. The services provided by the Notifying Parties will be remunerated […]. (6)

(11) Third, the JV will only have limited sales and purchase relationships with the Notifying Parties. The JV's purchases from the Notifying Parties (if any) will represent less than 5% of the JV's operational costs (in the case of mobile/fixed telecommunications services) or only take place in the initial period of the JV's operations (in the case of mobile devices to be installed at merchants' points of sale), and will in any event be conducted on an arm's length basis. Moreover, while each of the Notifying Parties will have an e-money account with the JV and use the JV's services as merchants, revenue from the Notifying Parties, which will be just a few of the many expected clients of the JV on the merchant side, will only account for a marginal proportion of the JV's revenues.

(12) Finally, the JV has been established for an indefinite period of time.

(13) In light of the above, the Transaction constitutes a concentration within the meaning of Article 3(4) of the Merger Regulation.

2. EU DIMENSION

(14) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (7) (Bitė: […] million; Tele2: 11 781 million; Telia: 8 897 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Bitė: […] million; Tele2: […] million; Telia: […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(15) The Transaction therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

3. RELEVANT MARKETS

3.1. Introduction

(16) The JV will provide mobile payment services in Lithuania.

(17) The Notifying Parties currently provide payment intermediation services in Lithuania. Moreover, the Notifying Parties all supply retail mobile telecommunications services, secure storage, mobile authentication services, and mobile communications devices in Lithuania. Only Telia is active in the market for the supply of colocation services, while Bite and Telia both provide fixed internet access services in Lithuania. These activities are relevant for the assessment of a number of vertical and conglomerate relationships between certain services provided by the Notifying Parties and the activities of the JV as discussed in Section 4.2.

(18) The Notifying Parties are also active in other markets vertically or otherwise related to the activities of the JV. Nonetheless, only the Parties' activities mentioned at paragraphs (16) and (17) give rise to potential affected markets as a result of the Transaction and therefore in the remainder of this section the relevant market definition will be discussed only for such activities.

3.2. Product market definition

3.2.1. Retail provision of mobile payment services

(19) Retail payments are payment transactions where at least one party to the transaction (i.e. the payer, the beneficiary or both) is not a financial institution. Hence, retail payments represent all payment transactions which do not take place between two banks. (8)

(20) Mobile payment services are retail payments for which the payment data and instructions are initiated, transmitted or confirmed via a mobile phone. Mobile payments can be classified by the location of the payee and the payer: (i) proximity/offline mobile payments when the payer and the payee are in the same location and (ii) remote/online payments when that is not the case. The JV will provide both offline/proximity and remote/online mobile payments.

(21) The market for mobile payments has been previously analysed by the Commission. (9) In the UK MCommerce decision, the Commission considered that online and offline mobile payments were not likely to be part of the same relevant product market. While the Commission concluded that the situation could evolve in the short to medium term, it ultimately left the product market definition open. (10) With regard to the substitutability of remote/online mobile payments and other types of remote/online payments, the Commission concluded that they may belong to different product markets, but ultimately also left the product market definition open in that respect. (11) The Commission reached a similar conclusion in relation to the mobile proximity/offline payments and existing proximity/offline payment solutions. (12) In Telefonica / Caixabank / Banco Santander / JV and in the Belgian MCommerce decision, the Commission reached similar conclusions. (13)

(22) The Notifying Parties consider that an overall market for retail payments transaction services, which comprises remote/online and proximity/offline mobile payment services, as well as other existing non-mobile remote/online and proximity/offline payment solutions, should be defined for the purposes of the Transaction. (14) Alternatively, they propose that proximity/offline payments (mobile and non-mobile) and remote/online payments (mobile and non-mobile) belong to separate product markets. (15)

(23) As mentioned, the Notifying Parties currently provide also payment intermediation services, which is a so-called 'payment over invoice' solution where customers can pay bus or parking tickets by sending an SMS that is then reflected in the customers' mobile invoice. In the Commission's precedent these services have been considered as part of the market for remote/online mobile payments. (16) The Notifying Parties submit that payment intermediation services are likely to belong to a separate relevant market because they are unlikely to be substitutable with the payment services provided by the JV and other players in the market from the merchants' perspective. (17)

(24) In the present case, the Commission investigated the exact scope of the relevant market for mobile payment services, as this is the only segment that the JV is active in and its position would be weaker in any potentially wider market. The results of its assessment are summarised in the following paragraphs.

(25) As regards the general distinction between proximity/offline and remote/online payment services, respondents to the market investigation provided mixed responses with regard to the demand side substitutability of these services. Among the respondents who expressed a view, some stated that consumers would not regard a remote payment as an alternative when wishing to make a proximity payment, while others considered both types of payments as part of the broader payment service market. (18) As regards supply side substitutability, most respondents expressed the view that a company offering proximity/offline payments would not be able to start offering online/remote payments in the short term and without significant investments. (19) Finally, the majority of respondents who expressed a view did not agree with the statement that proximity/offline and remote/online payments are equally safe in terms of data security and fraud prevention. (20)

(26) As regards the distinction between mobile and non-mobile proximity/offline payment services, the majority of the respondents to the market investigation considered that non-mobile proximity payment services (such as traditional or NFC-enabled payment cards or cash) and proximity/offline mobile payment services are substitutable from the demand side perspective. (21) For example, one respondent argued that "the service level (execution response time) is similar from consumer perspective – similar number of steps needs to be taken in order to complete the transaction". Respondents however considered that these services were not substitutes from the supply side perspective, as significant investments and time would be required for a company offering a non-mobile proximity payment solution to offer a mobile proximity solution. (22) In particular, several respondents commented that the infrastructure required to support mobile payments would be a significant part of those investments.

(27) As regards the distinction between mobile and non-mobile remote/online payment services, the results of the market investigation were not conclusive as regards demand side substitutability. (23) Among those respondents which considered substitutability to be limited, some cited the need for another device as one limiting factor. The market investigation also did not deliver conclusive results as regards the supply-side substitutability of mobile remote payments apps and non-mobile remote payment solutions. For example, a respondent mentioned that "development, launching, and marketing of a new payment method like a mobile remote payment app [is] a significant and time consuming endeavor. The process involves new integrations with existing systems and creation of completely new interface", while another considered that the feasibility of such development "[d]epends on concrete use case but should be relatively easy". (24)

(28) As regards the distinction between proximity/offline and remote/online mobile payment services, the results of the market investigation were not conclusive with respect to demand side substitutability. Among the respondents which considered substitutability limited, some cited as reasons limiting substitutability the time needed to complete the transaction. (25) Respondents were however of the view that both services are substitutes from the supply-side perspective. (26) For example, a respondent stated that "[m]inimal efforts in time and investment will be required since all major investments would have been made already".

(29) As regards the distinction between mobile online/remote payment apps and other mobile online/remote payment solutions (such as through a mobile internet browser), most respondents agreed that these two solutions were suitable alternatives from the demand side, despite a few indicating that the convenience of apps is greater. (27) The market investigation however delivered mixed results as regards the supply-side substitutability of both solutions. (28)

(30) As regards the distinction between mobile remote/online payment apps and payment intermediation services, the majority of respondents to the market investigation considered them as a suitable substitute from the demand side. (29) Regarding the supply side substitutability, the market investigation provided indications that a company already offering payment intermediation solutions would not be able to start offering mobile payment solutions in the short term and without significant investments. (30)

(31) For the purpose of this decision, the Commission considers that the exact product market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible product market definition. The Commission will undertake the assessment of the effects of the Transaction in the possible product markets for the retail provision of (i) mobile payment services overall, (ii) proximity/offline mobile payments and (iii) remote/online mobile payments (including or not payment intermediation services). Since the JV will only be active in mobile payment services, the JV's presence in any potentially wider market would be weaker.

3.2.2. Secure storage for mobile payment services

(32) Mobile payment solutions require access to a secure storage solution in order to ensure the secure functioning of the payments application. Secure storage is implemented by means of a Secure Element ('SE'), which is a piece of hardware and software (or only software where the SE is cloud-based) capable of securely hosting software applications and their confidential and cryptographic data. The SE can take the form of a variety of technological solutions including (i) in the SIM card, (ii) in the mobile device (embedded SE), (iii) in an external device (i.e. USB stick), (iv) on a (micro)Secure Digital (SD) card, and (v) on the cloud, which requires to a certain extent a secure environment in the mobile device to ensure the integrity of the transactions. (31)

(33) In the UK MCommerce decision, the Commission considered that the relevant market for secure storage included SIM-based SE solutions and at least embedded SEs placed within the mobile device. In that decision, the Commission left open the possibility that SEs on external devices (USB sticks) and cloud-based solutions belong to the same relevant product market. (32) The Commission found that, while SEs embedded in a mobile handset have shown to be a close substitute for a SIM-based SE, cloud-based secure storage and additional hardware containing SEs attached to the mobile handset were not perfect substitutes for SIM-based SE. (33)

(34) The Notifying Parties submit that if a separate relevant product market for secure storage was defined, it would comprise all the above-mentioned alternatives for storing secure information. (34)

(35) The market investigation provided indications that secure storage solutions other than SIM-cards may provide an alternative for the provision of mobile payment services. For example, one respondent highlighted that "[t]here can be security elements other than SIM-cards", while another respondent stated that "[t]here are alternative mobile payment technologies that fit these criteria and do not rely on the device’s SIM […]." Several other respondents confirmed the existence of such alternatives, naming in particular SE storage embedded in the mobile device. (35)

(36) For the purpose of this decision, the Commission considers that the exact product market definition, i.e. whether SIM-based SE and alternative SEs belong to the same product market, can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible product market definition.

3.2.3. Mobile authentication and signature services

(37) Mobile authentication and signature services are electronic trust services that can be used for mobile transactions, such as mobile payments. (36)

(38) A type of mobile authentication and signature services available in Lithuania is the "mobile signature" service or "mobile-ID" offered by the MNOs. (37) Other services available in Lithuania that provide electronic authentication and signature for mobile transactions include Smart ID (another mobile authentication and signature service recently launched in Lithuania), (38) authentication codes generators and secure passwords. Furthermore, biometric authentication tools, such as iris- and fingerprint-scanning, could be used for mobile payments. (39)

(39) The Commission has not previously defined a relevant product market for mobile authentication and signature services.

(40) The Notifying Parties argue that mobile signature (or mobile-IDs) services in Lithuania should be included within the relevant product market for retail mobile telecommunications services in Lithuania because they can be purchased jointly with other mobile telecommunications services and only mobile operators offer them. (40) If they were not considered to be part of the retail mobile telecommunications market, the Notifying Parties argue that alternative authentication solutions (such as Smart ID) could potentially be viewed as substitutable for mobile signatures, although only mobile signatures contain qualified certificates in the meaning of the eIDAS regulation. (41)

(41) The market investigation provided mixed results in relation to the substitutability of mobile signatures with other means of authentication for mobile payments. (42) Some respondents emphasised that mobile signatures are more convenient than other authentication solutions, while others pointed at the existence of alternatives. One respondent stated that "[m]obile signature implies that person’s identity has been verified: if a person uses it, one can be sure of it. Using alternative solutions will require the parties to rely on other means of establishing payers/payee identities before validating such payment.". However, another respondent argued that "[f]or both proximity and remote mobile payments, there are alternative cardholder / user authentication methods, ranging from biometrics (fingerprint, iris scanning) to passcode or PIN on the POS."

(42) The Commission notes that mobile signatures (or mobile-IDs) are not widely used today in Lithuania (in 2016 their uptake was less than […]% of active mobile subscribers and the expected uptake in 2017 is less than […]%) (43) and some players, such as banks, already offer mobile payment solutions that do not rely on the mobile signature services used by the Notifying Parties. (44) The Commission also notes that other means of authentication could in the future comply with the requirements of the eIDAS regulation for qualified certificates for electronic signatures. A respondent to the market investigation has indicated that, under the current draft law which transposes in Lithuania an EU anti-money laundering directive, it is foreseen that client identification by remote measures would not be limited only to the (so far not widely used) mobile signature services offered by the Lithuanian MNOs. (45)

(43) For the purpose of this decision, the Commission considers that the exact product market definition can be left open, i.e. whether mobile signature services are part of a wider market for mobile authentication and signature services, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible product market definition.

3.2.4. Colocation services

(44) Colocation services are building, power, cooling, connectivity and security services provided in data centres (dedicated facilities sometimes purpose-built) in which companies house and operate IT equipment that supports their business (such as servers and data storage). (46) Colocation services can be provided in- house, or by third-party providers.

(45) In Equinix / Telecity, the Commission concluded that the relevant product market comprises only colocation services provided by third party data centres (excluding in-house data centres) without further segmenting depending on the operator providing the services (carrier-neutral and carrier-owned data centres, wholesale and retail operators) or the type of customers. (47)

(46) The Notifying Parties agree with the Commission's precedent. (48)

(47) For the purpose of this decision, in line with Equinix / Telecity, the Commission considers that the relevant product market comprises colocation services provided by third party data centres without any further segmentation.

3.2.5. Retail mobile telecommunications services

(48) Mobile telecommunications services to end customers or 'retail mobile telecommunications services' include services for national and international mobile voice calls, SMS (including MMS and other messages), mobile Internet access, access to content via the mobile network and retail international roaming services. (49)

(49) In previous cases, the Commission defined the market for retail mobile telecommunications services as one overall market constituting a separate market from retail fixed telecommunication services, given that from a supply-side perspective all mobile operators are capable of providing the different types of mobile services to all types of customers. (50) The Commission did not further subdivide the overall market for retail mobile telecommunications services based on the type of service (voice calls, SMS, MMS, mobile Internet data services), or the type of network technology (such as 2G, 3G and 4G). The Commission reflected upon a possible segmentation of the overall market for retail mobile telecommunications services according to the type of contract (pre-paid or post- paid services) and the type of customer (residential customers or business customers) but ultimately took the view that these segmentations did not constitute separate product markets but represent rather market segments within an overall market. (51)

(50) The Notifying Parties agree with the Commission's precedents. (52)

(51) For the purpose of this decision, in line with its precedents, the Commission considers that the relevant product market is the overall market for retail mobile telecommunications services.

3.2.6. Retail sale of mobile communications devices

(52) In previous cases, the Commission has examined the market for the retail sale of electronic products and appliances and it has assessed whether such market could be further segmented into retail sale of computers and communication devices, and further sub-segments therein, but ultimately left the precise product market definition open. (53) The Commission did not consider a possible segmentation between residential and business customers.

(53) The Notifying Parties consider that the relevant product market may be defined as one overall product market for the retail sale of mobile communication devices (mobile phones, including smartphones, and tablets), without the need of further segmentations by type of product, distributional channel or type of retailer. (54)

(54) For the purpose of this decision, the Commission considers that the exact product market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible product market definition. Given that the JV will provide mobile payment services via a mobile app and the Notifying Parties are engaged in the retail sale of mobile communication devices, the Commission will undertake the assessment of the effects of the Transaction related to the Notifying Parties' presence in the potential market segment of the retail sale of smartphones and potential sub-segments, such as those analysed by the Commission in Carphone Warehouse/Dixons (such as by distribution channel, by the focus of the retailer's business), as the Notifying Parties' presence in any potentially wider market would be weaker. (55)

3.2.7. Retail market for fixed Internet access services

(55) Internet access services at the retail level consist of the provision of a fixed telecommunications link enabling customers to access the Internet.

(56) In previous cases, the Commission determined an overall market for the retail provision of fixed Internet access services without a further subdivision based on download speed or type of technology.56 In Altice / PT Portugal, the Commission left open the question whether the market should be further segmented between residential and business customers. (57) In other decisions, the Commission referred to retail broadband Internet access services for large business customers as the market for retail business connectivity services. (58)

(57) The Notifying Parties agree with the Commission's precedents. (59)

(58) For the purpose of this decision, the Commission considers that the relevant product market is the market for the provision of retail fixed Internet access services. (60)

3.3. Geographic market definition

3.3.1. Retail provision of mobile payment services

(59) Previous Commission precedents, while keeping the geographic market definition open, considered the market to be at least national in scope. (61)

(60) The Notifying Parties agree with the Commission's precedents and consider that the geographic scope of the relevant markets comprises the territory of Lithuania. (62) The JV's ecosystem will be offered to customers in Lithuania and other payment services providers also operate throughout the entire country. If anything, according to the Notifying Parties, the geographic market could be broader than national as some competitors operate across multiple countries. (63)

(61) The market investigation provided mixed views with regard to the geographic scope of the market for retail mobile payment services and most respondents did not express a view as to whether there are differences in customer demand and/or requirements for retail mobile payments in Lithuania compared to the rest of the EEA. (64) Some respondents highlighted that there exist different levels of uptake of these services across the European Union.

(62) For the purpose of this decision, the Commission considers that the exact geographic market definition, i.e. whether national or broader, can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition.

3.3.2. Secure storage for mobile payment services

(63) In the UK MCommerce decision, the Commission considered that the geographic scope of the market for secure storage for mobile payment services was at least national, while it left the exact geographic market definition open. The Commission noted that, while the provision of SIM-based SE secure storage seemed to be connected to the retail market for mobile telecommunications services (of national scope), other secure storage solutions (such as embedded SE) could have a wider scope, as most manufacturers are active globally. (65)

(64) The Notifying Parties did not provide any observation in this regard.

(65) The Commission considers, in line with the UK MCommerce decision, that the geographic scope of the market for secure storage could be wider than national, as suppliers of non-SIM-based SE solutions are usually active worldwide. On the other hand, the Commission acknowledges that SIM-based SEs are issued by mobile operators (who serve the national market of retail mobile telecommunications) and therefore the relevant market could have a national scope.

(66) For the purpose of this decision, the Commission considers that the exact geographic market definition, i.e. whether national or wider, can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition. Given that the Notifying Parties are active in the provision of SIM cards in Lithuania and their presence in a possible wider geographic market would be weaker, the Commission will undertake the assessment of the effects of the Transaction only at national level.

3.3.3. Mobile authentication and signature services

(67) The Notifying Parties argue that mobile signature services should be included in the market for retail mobile telecommunications services and would therefore have a national scope.66

(68) The Commission notes that mobile authentication and signature services are also provided by international players (such as Apple Pay) in several countries. Nonetheless, the Commission also notes that there are indications that mobile authentication and signature services would rather have a national scope because of national legislative or regulatory barriers. For example, the mobile signature services offered by the Notifying Parties are the result of an agreement with a national public authority at the national level and are provided nationally. (67)

(69) For the purpose of this decision, the exact geographic market definition, i.e. whether national or wider, can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition. Given that the Notifying Parties are active in the provision of mobile authentication and signature services only in Lithuania and their presence in a possible wider geographic market would be weaker, the Commission will undertake the assessment of the effects of the Transaction only at national level.

3.3.4. Colocation services

(70) In Equinix / Telecity, the Commission concluded that the relevant geographic market encompassed each relevant metropolitan area ('metro', corresponding to a radius of around 50 km from the city centre). This was in particular because most customers seemed to target very specific metros when seeking to source colocation services and that the different metros did not appear to be substitutable from the demand side. (68)

(71) The Notifying Parties agree with the Commission's precedent.

(72) For the purpose of this decision, in line with the findings of Equinix / Telecity, the Commission considers that the relevant geographic market encompasses each relevant metropolitan area (corresponding to a radius of around 50 km from the city centre). More precisely, since Telia's data centres are located in Vilnius, the relevant geographic market therefore comprises the territory corresponding to a radius of around 50 km from the city centre of Vilnius (the 'Vilnius metropolitan area'). (69)

3.3.5. Retail mobile telecommunications services

(73) In past cases, the Commission found that the market for retail mobile telecommunications services was national in scope. (70)

(74) The Notifying Parties agree with the Commission's precedents and submit that the scope of the relevant market for mobile communications services corresponds to the territory of Lithuania. (71)

(75) For the purpose of this decision, the Commission considers that the relevant geographic market consists of the territory of Lithuania.

3.3.6. Retail sale of mobile communications devices

(76) In Carphone Warehouse/Dixons, the Commission considered whether the retail market for the sale of mobile communication devices and accessories is national or local in scope, but ultimately left the question open. (72)

(77) The Notifying Parties consider that the relevant geographic market is at least national in scope and corresponds to the territory of Lithuania. In the Notifying Parties’ view, the definition of narrower, local geographic markets is not warranted because the Notifying Parties and their competitors operate on a national scale and nation-wide pricing policies apply. (73)

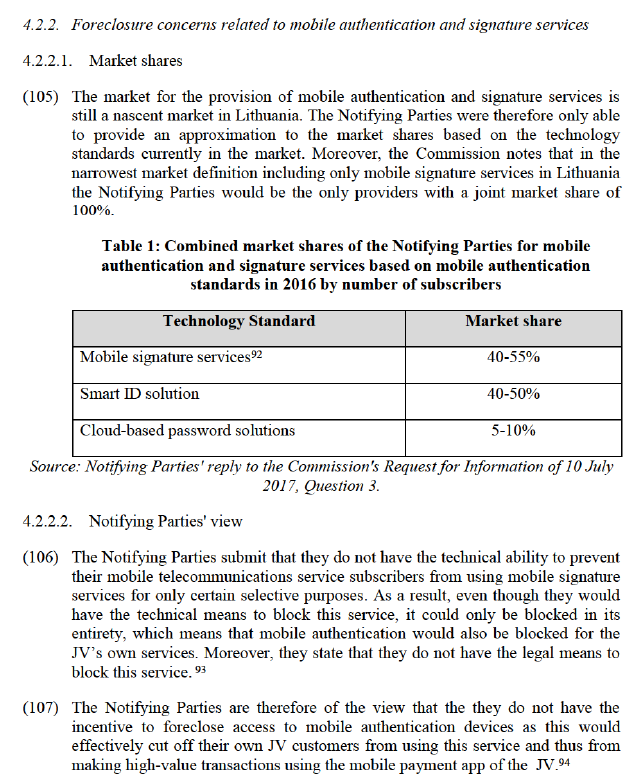

(78) For the purpose of this decision, the exact geographic market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition.

3.3.7. Retail market for fixed Internet access services

(79) In its previous decisions, the Commission found that the retail market for the provision of fixed Internet services is national in scope. (74)

(80) The Notifying Parties agree with the Commission's precedents and submit that the scope of the relevant market for fixed Internet access services corresponds to the territory of Lithuania. (75)

(81) In the light of the above, the Commission considers that the relevant geographic market consists of the territory of Lithuania.

4. COMPETITIVE ASSESSMENT

4.1. Introduction

(82) The markets for the provision of mobile payment services in Lithuania, especially mobile proximity services, are still nascent and in its early development. In this context the Commission notes that the Transaction, by introducing a new player, will allow for a faster development of these markets. In any event the market entry resulting from the Transaction will increase the competitiveness of the existing payment service markets in Lithuania, and is therefore likely to have pro- competitive effects. This is highlighted by evidence in the Commission's file demonstrating that absent the Transaction the Notifying Parties would not have made the investments to enter the market unilaterally.

(83) The Commission has nonetheless investigated whether as a result of the Transaction the Notifying Parties could have the ability and/or incentive to foreclose rival mobile payment providers in the markets for the provision of mobile payment services. It has further assessed what the overall likely impact on effective competition of any such potential foreclosure strategy would be. Indeed, the Transaction gives rise to a series of non-horizontally affected markets in view of the Notifying Parties' market positions in the provision of secure storage for mobile payment services, mobile authentication and signature services, colocation services, retail mobile telecommunication services and retail sale of mobile communications devices. (76)

(84) In addition, after the Transaction, the Notifying Parties will retain their activities in a number of markets that are either part of, upstream of or neighbouring to the market for the retail supply of mobile payment services in Lithuania, in which the JV will operate. In accordance with Article 2(4) of the Merger Regulation, the Commission has undertaken an assessment of whether the JV would create scope for coordination among the Notifying Parties on any of these markets (see Section 4.3).

(85) Finally, the Commission notes that the JV will collect data on its customers as part of its activities as a provider of mobile payment services. First, the data collected by the JV will include certain information that consumers and merchants will be required to provide when subscribing to the JV's services for purposes of identification and compliance with regulatory requirements. (77) Second, the JV will collect certain data on the usage of mobile payment services by its consumers and merchants, such as account top-up data, account balance data, as well as data on volume and value of transactions run via the JV's platform. The data collected by the JV will be stored in accordance with applicable regulations. (78)

(86) The Notifying Parties submit that they do not intend to monetise the data collected by the JV, including by means of advertising, and, indeed, no such monetisation projects are envisaged under the JV's business plan submitted to the Commission.

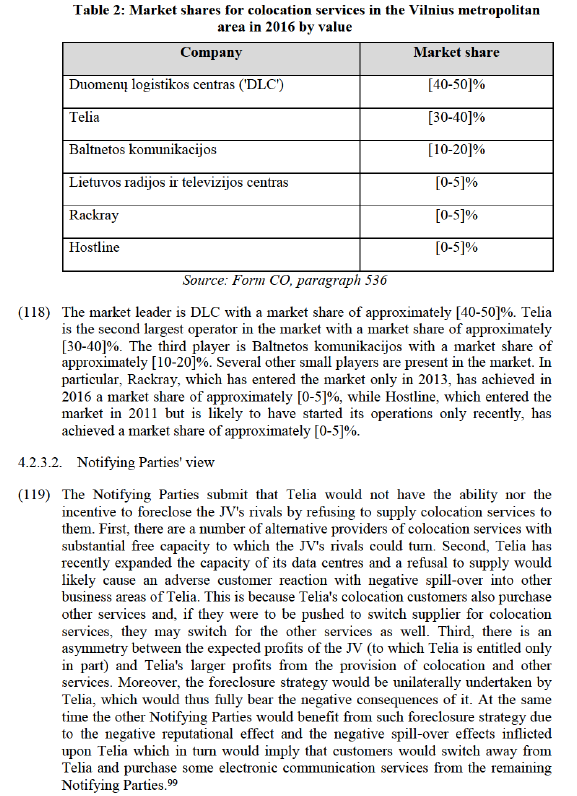

(87) In any event, the Commission notes that, post-Transaction, the JV and the Notifying Parties will be subject to the relevant national data protection rules (79) and, as of 25 May 2018, to the EU General Data Protection Regulation, (80) with respect to the collection, processing, storage and usage of personal data. These rules, subject to certain exceptions, limit companies' ability to process the datasets that they have access to. (81)

(88) Furthermore, even if the JV would start monetising the data it collects from its customers (for example, by providing advertising services based on those data), (82) it appears that competition concerns would be unlikely to arise from the Transaction as regards advertising or other products or services that rely on user data. Indeed, the input from the market investigation conducted in the present case indicates that other providers of payment services in Lithuania also collect data from their respective users. (83) As a result, after the Transaction, there will continue to be a large amount of user data that are valuable for monetisation purposes and that are not within the JV's exclusive control. Accordingly, the effects of the potential monetisation by the JV of the data it will collect from its users will not be discussed further in this decision.

(89) In the following sections, the Commission will, first, assess the potential non- horizontal effects arising from the Transaction (Section 4.2) and, subsequently, the potential cooperative effects of the JV (Section 4.3).

4.2. Non-horizontal effects on the market for mobile payment services in Lithuania

(90) The Transaction gives rise to a number of vertical and conglomerate relationships between certain services provided by the Notifying Parties and the activities of the JV.

(91) In particular, the Notifying Parties hold a market share above 30% under certain possible market definitions with respect to the provision of (i) secure storage for mobile payment services, (ii) mobile authentication and signature services, (iii) colocation services in the Vilnius area and (iv) retail mobile telecommunications services in Lithuania, which can be considered as important inputs for the provision of mobile payment services in Lithuania within the meaning of paragraphs 31 and 34 of the Non-Horizontal Guidelines.

(92) Likewise, the Notifying Parties hold a market position above 30% under certain possible market definitions with respect to the provision of (i) secure storage for mobile payment services, (ii) mobile authentication and signature services, and (iv) retail mobile telecommunications services in Lithuania, as well as with respect to (v) the retail sale of mobile communications devices in Lithuania, which can be considered complementary or at least closely related products to mobile payment services in Lithuania within the meaning of paragraph 91 of the Non-Horizontal Guidelines.

(93) The Commission has therefore assessed whether the Transaction could confer on the Notifying Parties the ability and the incentive to reduce competition in the markets for the provision of mobile payment services in Lithuania by (i) restricting access to an important input to the JV competitors and/or (ii) leveraging their market positions in any of the complementary or related markets to the provision of mobile payment services. (84)

4.2.1. Foreclosure concerns related to the supply of secure storage for mobile payment services

4.2.1.1. Market shares

(94) The market for the provision of secure storage for mobile payment services is still a nascent market in Lithuania. The Commission notes that in the narrowest market definition including only SIM based SE in Lithuania the Notifying Parties' would not be present as such (since they do not actually supply any secure storage solution themselves). However, given their market position in the retail market for mobile telecommunications services in Lithuania, for the provision of which they distribute SIM cards and which collectively amounts to a market share of close to 100%, they would be in the position to control access to (almost) all the SIM cards on which any SIM-based SE solution would be based.

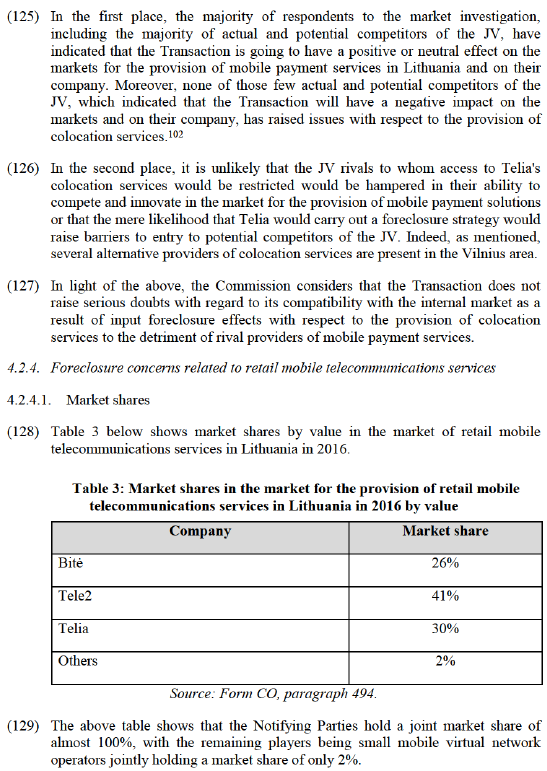

4.2.1.2. Notifying Parties' view

(95) The Notifying Parties admit that being issuers of the SIM cards, they do control access to them and, as a result, they would have the ability to foreclose access to SIM-based SEs. (85) At the same time, the Notifying Parties submit that they would not be in a position to substantially foreclose rival mobile payment service providers as these rivals could resort to using alternative SEs which cannot be blocked or degraded by the Notifying Parties. (86) The JV will not rely on an SE placed in the SIM card for the provision of mobile payment services. (87)

4.2.1.3. Commission's assessment

(96) The Commission considers that post-Transaction the Notifying Parties would not have the ability and the incentives to foreclose competing providers of mobile payment services in Lithuania through foreclosure strategies related to secure storage for the following reasons.

(97) First, while each of the Notifying Parties has the ability to foreclose access to SIM-based SE, and even if SIM-based SE were to be considered a separate market, the JV's rivals could rely on alternative technological solutions to securely store information, such as an embedded SE, which would exert an important constraint.

(98) In this regard, as mentioned in paragraph (95), the Commission notes that the Notifying Parties themselves do not plan that the JV will rely on a SIM-based SE.

(99) Moreover, the majority of the respondents to the market investigation stated that access to the SIM-based SE is not important and essential for the provision of mobile payment services, as the SE can be placed in other locations, such as embedded in the mobile device, and that these alternative technological solutions provide effective alternatives to SIM-based SE. A minority of respondents stated that access to the SIM-based SE is important for the provision of mobile payment services, but at the same time explained that there are alternatives to SIM-based SEs in order to enter the market for the provision of mobile payment services. (88)

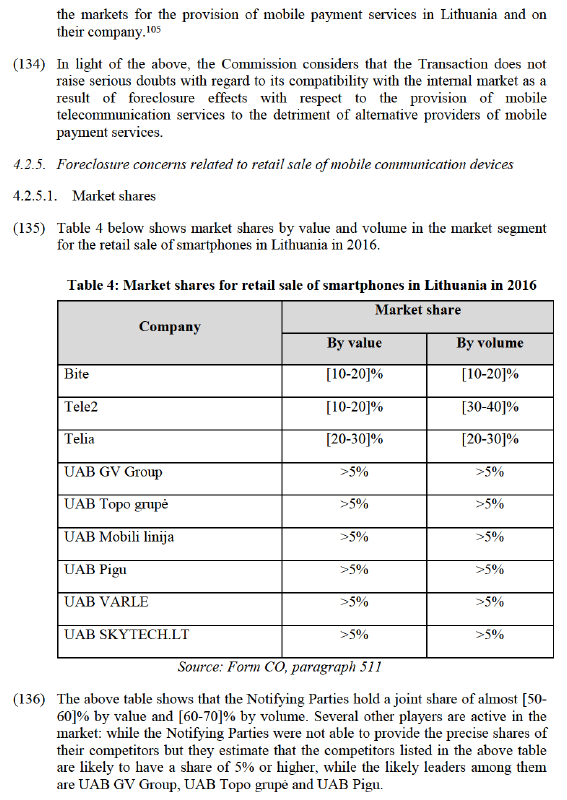

(100) Second, the Notifying Parties do not have the ability to technically or commercially foreclose the use of alternative SE solutions to the JV’s competitors. Indeed, the results of the market investigation univocally indicated that MNOs do not have the technical ability to disable or degrade the performance of alternative SE solutions, in particular embedded SEs. (89) Likewise, the results of the market investigation suggest that, despite their large market share in the market for the provision of mobile telecommunications services (see Table 3 below) as well as in the market for the retail sale of mobile communications devices (see Table 4 below), the Lithuanian MNOs have not succeeded in obtaining that OEMs design and manufacture specific version of handsets to be shipped to Lithuania (for instance without embedded SE) or disable SE embedded in the hardware of mobile handsets. (90)

(101) Finally, the Commission considers that, even if the Notifying Parties were to have ability and incentive to foreclose competing providers of mobile payment services in Lithuania through foreclosure strategies related to secure storage, their conduct is unlikely to have an overall negative impact on competition in the market for the provision of mobile payment services in Lithuania. Indeed, any such attempt could be circumvented by the JV’s rivals by opting to alternative solutions, such as embedded SEs, including, for example by entering in partnerships with OEMs.

(102) In any event, the Commission notes that for any foreclosure strategy to be effective it would have to be the result of a joint parallel behaviour of the Notifying Parties in the market for the provision of secure storage for mobile payment services where the Notifying Parties are gatekeepers and where their activities remain independent, and not of the behaviour of the JV. It would suffice for one of the Notifying Parties to defect from such joint parallel foreclosure strategy to severely limit the effectiveness of foreclosure as competitors of the JV would not be completely foreclosed anymore. As explained in Section 4.3.2, on the basis of the overall evidence in the file, the Commission considers that the Transaction is unlikely to give rise to coordination of the Notifying Parties' competitive behaviour in the market for secure storage for mobile payment services.

(103) In conclusion, the Commission notes that the majority of respondents to the market investigation, including the majority of actual and potential competitors of the JV, have indicated that the Transaction is going to have a positive or neutral effect on the markets for the provision of mobile payment services in Lithuania and on their company. (91)

(104) In light of the above, the Commission considers that the Transaction does not raise serious doubts with regard to its compatibility with the internal market as a result of foreclosure effects with respect to the provision of secure storage to the detriment of alternative providers of mobile payment services.

4.2.2.3. Commission's assessment

(108) The Commission considers that it is unlikely that the Notifying Parties would have the ability and the incentive to foreclose competing providers of mobile payment service using foreclosure strategies related to mobile authentication and signature services. The Commission concludes that this would be unlikely even if one were to consider the narrowest market including only the mobile signature services offered by the Notifying Parties. The reasons for this conclusion are as follows.

(109) First, on the basis of the information provided by the Notifying Parties, it appears that they cannot technically block the functioning of the mobile signature only for the use of specific services. Rather, the mobile signature is either "on" or "off" in its entirety. Therefore, should the Notifying Parties block the mobile signature for certain end users, they would jeopardise the viability of the JV itself, as it is envisaged that mobile signature services which will be used as a form of payment authentication for high value payments will form an integral part of the mobile payment system offered by the JV (95) The same argument would apply if the Notifying Parties were to stop registering end-users.

(110) Second, the Notifying Parties do not have a direct commercial relationship with trusting parties or service providers of mobile authentication and signature services, that is to say those that accept mobile signature in the context of their activities (e.g. banks which accept the mobile signature of their customers to access online banking facilities and authorise payment transactions). This implies that the Notifying Parties could not exert commercial pressure on those trusting parties in order to prevent a competing provider of mobile payment services from using the mobile signature for authentication of its customers and authorisation of their mobile payments. A commercial relationship only exists between the Notifying Parties and their mobile subscribers who conclude respective contracts with the MNOs for the provision of mobile signature services.

(111) A fortiori, the Commission considers that the Notifying Parties would not have the ability and the incentive to foreclose competing providers of mobile payment service through foreclosure strategies related to mobile authentication and signature services under a broader market definition. The results of the market investigation highlight that the mobile authentication and signature services provided by the Notifying Parties are not seen as an essential input for the provision of mobile payment services. Notably, the majority of respondents stated that there are alternatives in the market for mobile authentication and signature services. Such alternatives include biometrics solutions such as fingerprint or iris scanning, passcode or PIN code at the point of sale. (96)

(112) A minority of respondents stated that while alternatives exist they may not be as effective as the mobile signature services provided by the Notifying Parties. In this regard the Commission notes that today mobile payment services are already offered using those alternatives and that the use of mobile signature services is currently limited. Moreover, the Notifying Parties themselves do not plan that the JV will rely on their mobile signature services for low value transactions. Strong customer authentication on the basis of mobile signature services will only be used by the JV for transactions that have a value of EUR 150 or higher, therefore only for a subset of the JV's mobile payment transactions.

(113) Lastly, the Commission considers that, even if the Notifying Parties were to have the ability and the incentive to foreclose competing providers of mobile payment services in Lithuania through foreclosure strategies related to mobile authentication and signature services, the impact of any such foreclosure strategy would be very limited. Indeed, under the broader market definition, the JV's rivals would have several alternatives to the mobile authentication and signature services provided by the Notifying Parties. Under the narrowest market definition, limited to mobile signature services, the effectiveness of any foreclosure strategy would be restricted by the fact that the mobile signature services offered by the MNOs would only be necessary, if at all, for certain mobile payment transactions, i.e. high value payments, which implies that such foreclosure would only be partial. (97)

(114) In any event, the Commission notes that for any foreclosure strategy to be effective it would have to be the result of a joint parallel behaviour of the Notifying Parties in the market for the provision of mobile authentication and signature services where their activities remain independent and not of the behaviour of the JV. It would suffice for one of the Notifying Parties to defect from such joint parallel foreclosure strategy to severely limit the effectiveness of foreclosure as competitors of the JV would not be completely foreclosed anymore. As explained in Section 4.3.2, on the basis of the overall evidence in the file, the Commission consider that the Transaction is unlikely to give rise to coordination of the Notifying Parties' competitive behaviour in the market for mobile authentication and signature services.

(115) Finally, the Commission notes that the majority of respondents to the market investigation, including the majority of actual and potential competitors of the JV, have indicated that the Transaction is going to have a positive or neutral effect on the markets for the provision of mobile payment services in Lithuania and on their company. Moreover, none of those few actual and potential competitors of the JV, which indicated that the Transaction would have a negative impact on the markets and on their company, have raised issues with respect to the provision of mobile authentication and signature services. (98)

(116) In light of the above, the Commission considers that the Transaction does not raise serious doubts with regard to its compatibility with the internal market as a result of foreclosure effects with respect to the provision of mobile authentication and signature services to the detriment of alternative providers of mobile payment services.

4.2.3. Input foreclosure concerns related to colocation services

4.2.3.1. Market shares

(117) Table 2 below shows market shares by value of Telia and its main competitors in the market for the provision of colocation services in the Vilnius metropolitan area in 2016.

4.2.3.3. Commission's assessment

(120) The Commission considers that post-Transaction Telia would not have the ability and the incentives to foreclose competing providers of mobile payment services, by refusing, or making more onerous the terms for, access to its data centres for the following reasons.

(121) First, the Commission notes that while Telia would have the ability to foreclose access to its own colocation services, such a foreclosure strategy would only affect [30-40]% of the colocation market. Foreclosed customers could therefore resort to other alternative suppliers that are present in the market, which have sufficient spare capacity. One of those alternative colocation service providers is DLC, the current market leader with a market share of [40-50]%. Foreclosure would therefore remain partial which would in turn severely limit the effectiveness of such a strategy.

(122) Second, a big asymmetry in Telia's current revenues on colocation services and Telia's expected revenues from the provision of mobile payment services exists. Notably, the revenues achieved by Telia in 2016 from the provision of colocation services alone […] the revenues that all MNOs are estimated to receive, […]. By preventing access to its colocation services in order to foreclose a customer on the market for mobile payment services, Telia would forego more revenues on the colocation market than it could expect to gain on the mobile payment market. Such a foreclosure strategy would therefore not be profitable. (100) Moreover, the gains that Telia would achieve from the sales of mobile payment services by the JV are highly uncertain as they depend on the future expected uptake and usage of mobile payment services of the JV by Telia's mobile telecommunications subscribers compared to the losses that would take the form of foregone profits in colocation services. (101)

(123) Third, Telia has recently made investments to increase the capacity of its data centres which it is unlikely to recoup if it were to stop offering access or offering disadvantageous access conditions to new potential customers, including actual or potential providers of mobile payment services.

(124) Finally, the Commission considers that, even if Telia were to have the ability and the incentive to foreclose competing providers of mobile payment services, such conduct is unlikely to have an overall negative impact on competition in the market for the provision of mobile payment services in Lithuania.

4.2.4.2. Notifying Parties' view

(130) The Notifying Parties submit that they would neither have the ability nor the incentive to foreclose the JV's rivals by blocking competing mobile payment services in Lithuania from using mobile broadband services, so that relevant apps could not be downloaded, installed and updated or mobile payment services could not properly function on a mobile device. Among other arguments, in particular, they submit that they do not have the technical ability to prevent the downloading of the rival mobile payment applications without blocking service user's access to the entire online application store. Moreover, the Notifying Parties submit that any such behaviour would be prohibited by the Net Neutrality Regulation. (103)

4.2.4.3. Commission's assessment

(131) In view of the applicable legislation and in line with its precedents, (104) the Commission considers that post-Transaction the Notifying Parties would not have the ability to foreclose competing providers of mobile payment services, by blocking such services from using mobile broadband services. Indeed, it is not possible for MNOs to block a consumer broadband connection for specific uses (without prejudicing also the JV mobile payment services). Such behaviour would be in violation of Article 3(3), third paragraph, of the Net Neutrality Regulation pursuant to which "providers of internet access services shall not engage in traffic management measures going beyond those set out in the second subparagraph, and in particular shall not block, slow down, alter, restrict, interfere with, degrade or discriminate between specific content, applications or services, or specific categories thereof". The same article of the Net Neutrality Regulation envisages exceptions to this rule, but none of these exceptions would be applicable to the foreclosure strategy at stake.

(132) In any event, the Commission notes that for any foreclosure strategy to be effective it would have to be the result of a joint parallel behaviour of the Notifying Parties in the market for the provision of retail mobile telecommunications services in Lithuania where their activities remain independent, and not of the behaviour of the JV. It would suffice for one of the Notifying Parties to defect from such joint parallel foreclosure strategy to severely limit the effectiveness of foreclosure as competitors of the JV would not be completely foreclosed anymore. As explained in Section 4.3.2, on the basis of the overall evidence in the file, the Commission consider that the Transaction is unlikely to give rise to coordination of the Notifying Parties' competitive behaviour in the market for the provision of retail mobile telecommunications services in Lithuania.

(133) Finally, the Commission notes that the majority of respondents to the market investigation, including the majority of actual and potential competitors of the JV, have indicated that the Transaction is going to have a positive or neutral effect on

(137) The Notifying Parties were not able to provide precise shares for all possible product and geographic sub-segmentation, but submitted that their shares under these possible market definitions would not differ from those presented in the above table.

4.2.5.2. Notifying Parties' view

(138) The Notifying Parties state that they would not have the ability and the incentive to foreclose rivals by pressuring OEMs or operating system ('OS') providers not to install or to block the pre-installed embedded SEs. The reasons for this are in particular as follows: (i) the Lithuanian market is small and mobile devices are typically not customised for Lithuanian consumers; (ii) the Notifying Parties have limited bargaining power vis-à-vis OEMs and OS providers and (iii) OEMs such as Apple do not provide customised mobile devices at all.

(139) The Notifying Parties also assert that even in a scenario where they had such bargaining power, implementing commercial foreclosure by means of pressuring OEMs and OS providers not to pre-install or to block the pre-installed SEs, such a strategy would be largely ineffective. Among other things, such a strategy would only lead to partial foreclosure as mobile handsets are also sold by independent retail providers. Furthermore, OS providers and OEMs could engage in effective counterstrategies and also financial institutions could set up rival mobile payment solutions by partnering with 'over-the-top' providers, for instance. (106)

4.2.5.3. Commission's assessment

(140) The Commission considers that post-Transaction the Notifying Parties would not have the ability and the incentive to foreclose competing providers of mobile payment services in Lithuania by leveraging their market position in the retail sale of mobile communication devices and in particular smartphone for the following reasons. Indeed, the Notifying Parties do not have the ability to technically or commercially foreclose the use of alternative mobile payment services on the mobile devices they sell. In this regard, the majority of respondents to the market investigation stated that MNOs would not have the technical ability to pre-install the JV mobile payment apps on mobile devices. (107) Likewise, based on the results of the market investigation the Commission considers that, despite their large share in the retail sale of smartphones, the Lithuanian MNOs have not succeeded in obtaining from OEMs and OS providers the pre-installation of specific mobile apps on the devices shipped to Lithuania. (108)

(141) Finally, the Commission considers that, even if the Notifying Parties were to have the ability and the incentive to foreclose competing providers of mobile payment services in Lithuania by leveraging their market position in the retail sale of mobile communications devices in Lithuania, such a strategy is unlikely to have an overall negative impact on competition in the market for the provision of mobile payment services in Lithuania.

(142) First, over 40% of the sales of smartphones by value, and 30% of such sales by volume, are concluded by retailers which are independent from the Notifying Parties, so that the competitors of the JV could still sell to a significant share of customers. Such a foreclosure strategy would therefore be limited in effect.

(143) In addition, the Commission notes that for any foreclosure strategy to be effective it would have to be the result of a joint parallel behaviour of the Notifying Parties, and not of the behaviour of the JV, in the market for the retail sale of mobile communications devices in Lithuania where their activities remain independent. It would suffice for one of the Notifying Parties to defect from such joint parallel foreclosure strategy to severely limit the effectiveness of foreclosure as competitors of the JV would not be completely foreclosed anymore. As explained in Section 4.3.2, on the basis of the overall evidence in the file, the Commission consider that the Transaction is unlikely to give rise to coordination of the Notifying Parties' competitive behaviour in the market for the retail sale of mobile communications devices in Lithuania.

(144) Lastly, the Commission notes that the majority of respondents to the market investigation, including the majority of actual and potential competitors of the JV, have indicated that the Transaction is going to have a positive or neutral effect on the markets for the provision of mobile payment services in Lithuania and on their company. (109)

(145) In light of the above, the Commission considers that the Transaction does not raise serious doubts with regard to its compatibility with the internal market as a result of foreclosure effects with respect to the retail sale of mobile communications devices in Lithuania to the detriment of alternative providers of mobile payment services.

4.3. Cooperative effects of a joint venture

(146) After the Transaction, the Notifying Parties will retain their respective activities in the supply of payment intermediation services in Lithuania. Depending on the exact boundaries of the relevant product market, (110) these activities can be regarded either as part of the same market or as part of a neighbouring market closely related to the market for the provision of mobile payment services in Lithuania, in which the JV will operate.

(147) Moreover, after the Transaction, the Notifying Parties will retain their activities in the supply of secure storage, mobile authentication and signature services, retail mobile telecommunications services, retail mobile communication devices and retail fixed Internet access services in Lithuania. (111) Each of these activities could potentially be regarded as either upstream of, or neighbouring and closely related to, the market for the retail provision of mobile payment services in Lithuania, in which the JV will operate.

(148) In accordance with Articles 2(4) and 2(5) of the Merger Regulation, the Commission has assessed whether the Transaction would create scope for coordination among the Notifying Parties in the markets mentioned in paragraphs

(146) and (147) above, which is to be appraised under Article 101 TFEU. A restriction of competition under Article 101(1) TFEU is established when the coordination of the parent companies' competitive behaviour is likely and appreciable and results from the creation of the joint venture, be it as its object or effect.

4.3.1. Notifying Parties' view

(149) The Notifying Parties submit that the Transaction will not lead to anticompetitive coordination within the meaning of Article 101(1) TFEU. In particular, according to the Notifying Parties, post-Transaction, each of them will continue to decide on its own competitive strategy and actions individually, and competitively sensitive commercial information about their respective businesses will not be known or accessible to the other Notifying Parties or to the JV.

(150) In this respect, the Notifying Parties point out that they have entered into an agreement with each other to prevent any exchange of confidential information among them via the JV (the 'Confidentiality Agreement'). (112) In particular, according to the Notifying Parties, the Confidentiality Agreement provides that cooperation among them will be exclusively limited to the JV's activities and that the Notifying Parties will not deal with any issues, disclose any information (either directly or via the JV's management bodies or employees) or adopt any decisions not directly related to the JV's activities. Moreover, the Notifying Parties submit that the Confidentiality Agreement also establishes additional rules to ensure that any confidential information concerning one of the Notifying Parties that may potentially be disclosed to the JV for the purposes of its activities be appropriately protected and not forwarded to the two other Notifying Parties.

(151) Finally, with specific regard to the market for the supply of retail mobile telecommunications services in Lithuania, the Notifying Parties argue that, if anything, the Transaction may encourage more competition among the Notifying Parties in that market. This is because, given the revenue sharing model in place between them and the JV, (113) the more mobile subscribers each of the Notifying Parties has, the larger revenues it may be able to generate from the JV's mobile payment services activities.

4.3.2. Commission's assessment

(152) The Commission takes the view that the Transaction is unlikely to give rise to coordination of the Notifying Parties' competitive behaviour on any of the markets mentioned in paragraphs (146)-(147). No evidence in the Commission's file pointed to any risk in this regard.

(153) As explained in paragraph (150) above, the Confidentiality Agreement entered into by the Notifying Parties lays down a number of measures aimed at ensuring that commercially sensitive information concerning their respective activities will not be exchanged among them via the JV.

(154) Moreover, the activities of the JV are expected to be relatively limited in terms of value compared to the Notifying Parties' respective activities in their core markets in Lithuania, particularly in the supply of retail mobile telecommunications services, retail mobile communication devices and retail fixed Internet access services. (114) As a result, the Transaction in itself is unlikely to create a sufficiently strong incentive for the Notifying Parties to coordinate their competitive behaviour in the markets concerned.

(155) Finally, as regards the Notifying Parties' activities in the supply of payment intermediation services in Lithuania (which are expected to be less significant in economic terms than the JV's mobile payment activities), their combined market position within the overall retail provision of (remote) payment services in Lithuania is negligible. (115) As a consequence, any potential coordination between the Notifying Parties in this area would be unlikely to be appreciable.

(156) Accordingly, the Commission concludes that the Transaction is unlikely to have as its object or effect the coordination of the Notifying Parties' competitive behaviour in a manner contrary to Article 101 TFEU.

5. CONCLUSION

(157) For the above reasons, the Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 198, 22.6.2017, p. 9.

4 Save for a small presence as regards so-called payment intermediation services (see paragraphs (17) and (23) below).

5 Consumers will be able to subscribe to the JV's payment solution through the Notifying Parties' customer service branches. Moreover, […]. The more general brand support and promotion in the media of the JV's payment solution will be handled by the JV.

6 […].

7 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

8 See Commission’s Green Paper “Towards an integrated European market for card, internet and mobile payments”, footnote 1 and Section 2.

9 The main difference between mobile payments and mobile wallets is that, while mobile wallets are limited to hosting several means of payment provided by third parties, mobile payment services cover all the necessary steps to execute the payment transaction. See Commission decision of 4 September 2012 in case M.6314 – Telefónica UK / Vodafone UK / Everything Everywhere / JV (hereinafter the 'UK MCommerce decision'; see Commission decision of 14 August 2013 in case M.6956 – Telefonica / Caixabank / Banco Santander / JV, see Commission decision of 11 October 2013 in case M.6967 – BNP Paribas Fortis / Belgacom / Belgian Mobile Wallet (hereinafter the 'Belgian MCommerce decision').

10 See the UK MCommerce decision, recital 139.

11 See the UK MCommerce decision, recital 135.

12 See the UK MCommerce decision, recital 127;

13 See Commission decision of 14 August 2013 in case M.6956 – Telefonica / Caixabank / Banco Santander / JV, paragraphs 30-37; see the Belgian MCommerce decision, paragraphs 43-48. In the Belgian MCommerce decision, the market investigation provided mixed results with respect to the question whether mobile payment services constitute a separate market from existing offline payments.

14 Form CO, paragraph 361.

15 Form CO, paragraph 362.

16 See the Belgian MCommerce decision, paragraph 27.

17 Form CO, paragraph 364.

18 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 11.

19 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 18.

20 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 12.

21 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 7.

22 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 14.

23 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 8.

24 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 15.

25 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 6.

26 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 13.

27 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 9.

28 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 16.

29 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 10.

30 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 17.

31 See UK MCommerce decision, recital 54.

32 See UK MCommerce decision, recital 255.

33 See UK MCommerce decision, recitals 110-115.

34 Annex 30 to the Form CO, paragraph 7.

35 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 24.

36 See for example, "Security guidelines on the appropriate use of qualified electronic signatures. Guidance for users", European Union Agency for Network and Information Security (ENISA), December 2016. The functions that these services provide include, but are not limited to, user authentication (enabling the electronic identification), integrity (assurance that the data have not been altered) and confidentiality (by electronic encryption).

37 It constitutes a general purpose electronic authentication and signature tool for a natural person and is securely stored within a SIM card of a mobile device, see Form CO, paragraph 607.

38 See https://www.smart-id.com/about-smart-id/ and non-confidential minutes of the meeting with the Bank of Lithuania of 26 June 2017, questions 9 and 12.

39 For example, Apple Pay uses fingerprint scanning to authenticate the user (https://www.apple.com/apple-pay/). It has not yet launched in Lithuania (see Form CO, paragraph 588).

40 Form CO, paragraphs 380-383.

41 Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market and repealing Directive 1999/93/EC, OJ L 257, 28.8.2014, p. 73–114. See Annex 30 to the Form CO, paragraphs 23-24.

42 See replies to questionnaire Q1 of 16 June 2017 to financial players, question 25.

43 See Notifying Parties' reply to the Commission's Request for Information n.6 of 6 July 2017, question 2 and Form CO, paragraph 190.

44 See non-confidential minutes of the meeting with the Bank of Lithuania of 26 June 2017, question 9.

45 See replies to questionnaire Q5 of 16 June 2017 to associations.

46 See Commission decision of 13 November 2015 in Case M.7678 – Equinix / Telecity, paragraph 6.

47 See Commission decision of 13 November 2015 in Case M.7678 – Equinix / Telecity, paragraphs 11- 26.

48 Form CO, paragraph 425.

49 See for example Commission decision of 10 October 2014 in Case M.7000 – Liberty Global/Ziggo, recital 137; Commission decision of 3 August 2016 in Case M.7978 – Vodafone / Liberty Global/Dutch JV, paragraph 70.

50 See Commission decision of 11 May 2016 in Case M.7612 – Hutchison 3G UK/Telefónica UK, recital 252; Commission decision of 10 October 2014 in Case M.7000 – Liberty Global/Ziggo, recital 141 and Commission decision of 2 July 2014 in Case M.7018 – Telefónica Deutschland/E-Plus, recital 64.

51 See Commission decision of 3 August 2016 in Case M.7978 – Vodafone / Liberty Global/Dutch JV, paragraphs 73-74; Commission decision of 11 May 2016 in Case M.7612 – Hutchison 3G UK/Telefónica UK, recitals 255, 261, 270, 279, 287; Commission decision of 2 July 2014 in Case M.7018 – Telefónica Deutschland/E-Plus, recitals 31 to 55; Commission decision of 10 October 2014 in Case M.7000 – Liberty Global/Ziggo, recital 141; Commission decision of 28 May 2014 in Case M.6992 – Hutchison 3G UK/Telefónica Ireland, recital 141; Commission decision of 12 December 2012 in Case M.6497 – Hutchison 3G Austria/Orange Austria, recital 58.