Commission, June 7, 2017, No M.8399

EUROPEAN COMMISSION

Judgment

CWS-BOCO / RENTOKIL INITIAL TARGET BUSINESSES

Subject: Case M.8399 - CWS-BOCO / RENTOKIL INITIAL TARGET BUSINESSES

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 26 April 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking CWS-boco International GmbH ("CWS-boco", Germany), a wholly owned subsidiary of Franz Haniel & Cie. GmbH ("Haniel", Germany), acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the textile, washroom, cleanroom and dust mats businesses of Rentokil Initial plc, ("Rentokil Initial", United Kingdom) in a number of EU Member States ("the Rentokil Initial Target Businesses") by way of a purchase of shares. (3) CWS-boco, Haniel and the Rentokil Initial Target Businesses are hereinafter together designated as "the Parties".

1. THE PARTIES

(2) CWS-boco provides textile, cleanroom, washroom and dust mats services, mainly in the EU. Haniel is a diversified German holding company.

(3) The Rentokil Initial Target Businesses provide textile, cleanroom, washroom and dust mats services in Austria, Belgium, Czech Republic, Germany, Luxembourg, Netherlands, Poland, Slovakia, Sweden and Switzerland.

2. THE OPERATION

(4) The Transaction concerns the purchase by CWS-boco of the Rentokil Initial Target Businesses, currently owned by Rentokil Initial, in exchange of cash and a 17.8% shareholding in CWS-boco. Haniel will own the remaining 82.2%.

(5) The 17.8% shareholding in CWS-boco to be held by Rentokil Initial upon completion will not confer decisive influence leading to control over CWS-boco. The approval of CWS-boco's strategic commercial decisions will be done by a simple majority vote of the Shareholder Committee, of which Haniel appoints [the majority of the] members. The Joint Venture Agreement ("JVA") to be entered into by the Parties provides that the annual business plan, which includes

the annual budget, has to be approved by […]. (4) The appointment and dismissal of directors and senior management is […]. Therefore, Rentokil Initial cannot veto any strategic decision, […]. Unanimous approval of the Shareholder Committee is only required for reserved matters that do not go beyond the veto rights normally accorded to minority shareholders in order to protect their financial interests as investors. (5)

(6) In light of the above, CWS-boco will acquire sole control over the Rentokil Initial Target Businesses. Therefore, the Transaction constitutes a concentration within the meaning of Article 3(1)b of the Merger Regulation.

3. EU DIMENSION

(7) The notified operation has an EU dimension pursuant to Article 1(3) of the Merger Regulation.

(8) Haniel and the Rentokil Initial Target Businesses have a combined aggregate world-wide turnover of more than EUR 2 500 million [Haniel: EUR […] million; the Rentokil Initial Target Businesses: EUR […] million] and their aggregate EU- wide turnover is in excess of EUR 100 million [Haniel: EUR […] million; the Rentokil Initial Target Businesses: EUR […] million]. (6)

(9) The combined aggregate turnover of Haniel and the Rentokil Initial Target Businesses exceeds EUR 100 million in three Member States (Belgium, Germany and the Netherlands), and each of them has a turnover in excess of EUR 25 million in each of these three Member States.

(10) None of the undertakings concerned achieves more than two-thirds of its aggregate Union-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

4. MARKET DEFINITION

(11) The Parties' activities overlap in (i) the market for the provision of textile solution services (in Belgium, Czech Republic, Germany, Luxembourg, Slovakia and Austria); (ii) the market for the provision of cleanroom solution services (in Belgium, Germany, Luxembourg and Austria); (iii) the market for the provision of washroom solution services (in Belgium, Czech Republic, Germany, Luxembourg, Netherlands, Poland, Sweden and Austria); and (iv) the market for the provision of mats solution services (in Belgium, Czech Republic, Germany, Luxembourg, Netherlands, Poland, Sweden and Austria).

(12) Out of the aforementioned 26 reportable markets, the Transaction leads to 9 horizontally affected plausible markets, as set out below. The Transaction would not lead to any vertically affected market under any plausible market definition, as the Parties are not vertically integrated. (7)

4.1. RELEVANT PRODUCT MARKETS

4.1.1. Textile solution services

(13) Textile solution services refer to the provision of textile products, such as garments for work (workwear) and flat linen, and their maintenance.

(14) In its previous decision practice, the Commission considered a market for the sale of workwear which might be subdivided according to sales channels (direct sales by manufacturers vs. retailer sales), ultimately leaving the market definition open. (8) The Commission also assessed the production and sale of personal protection equipment and defined separate markets for the supply of inter alia protective footwear, protective clothing, fall protection, hand protection and other protective equipment. (9) These markets did not address however the combination of supply and maintenance of textile products together as one full service solution for customers, while the vast majority of textile solution contracts by the Parties include both the supply and the maintenance of textile products, as this is the business model and core value proposition of both Parties. (10)

(15) CWS-boco takes the view that the textile products covered by the provision of textile solutions include (i) flat linen, (ii) standard workwear, and (iii) protective workwear. Flat linen textiles are typically used in hospitals, nursing and care home facilities, commercial kitchens and horeca (hotels, restaurants, and catering facilities). Products range from table linen, table skirting, napkins, placemats and kitchen towels, to bedspreads, sheets, pillowcases, mattress pads, blankets, towels and shower curtains. Standard workwear comprises working clothes supplied by businesses (e.g. hospitals, hotels) to their employees. Protective workwear includes textile products and technical products (protective glasses, gloves, helmets, etc.) designed to protect the worker's body from injury. According to CWS-boco, for hospital and horeca customers in particular, workwear is often supplied together with flat linen. (11) Flat linen and workwear (both standard and protective) would therefore all make part of one and the same product market. (12)

(16) Further, CWS-boco submits that a differentiation between standard workwear and protective workwear would not be appropriate. According to CWS-boco, almost all suppliers of standard workwear also provide protective workwear. Neither CWS-boco nor the Rentokil Initial Target Businesses supply protective workwear separately. Moreover, CWS-boco is not aware of any textile solutions provider that supplies protective workwear on a stand-alone basis.

(17) CWS-boco also submits that the provision of textile solutions comprises the rental and sale of textile products, and the provision of textile maintenance services to public-sector and business customers. (13) In its notification, CWS-boco considers that the term 'maintenance' includes the laundering, conditioning, repair and collection and delivery of the textile products.

(18) The Commission's market investigation did not support CWS-boco's proposal of a single product market. As regards the distinction between flat linen and workwear products, competitors were split in equal numbers between those that consider the two products as belonging to the same product market and those that did not. The latter consider that the provision of flat linen and workwear products differ in terms of production techniques/equipment, providers, customers or distribution channels. (14) One competitor further stated that "flat linen is rented mainly to hotels and hospitals and this group of customers is different to the customers of standard workwear and protective workwear". (15) A majority of the customers that procure both flat linen and workwear indicated that there is no synergy in procuring flat linen and workwear together. (16)

(19) Furthermore, all the competitors active in the provision of textile solutions that participated in the Commission's market investigation provide standard workwear, while not all of them provide flat linen and/or protective workwear. Lastly, very few customers of the Parties that participated in the market investigation procure both flat linen and standard workwear from the Parties, and only one customer procures (mostly or entirely) also protective workwear from them. (17)

(20) On the basis of the above, a segmentation of the market for the provision of textile solution services between flat linen and workwear (both standard and protective) seems plausible. However, there is no need to conclude on this point for the purpose of this decision as the Transaction would not lead to serious doubts as to its compatibility with the common market under either definition.

(21) With regard to a possible distinction between the rental and the purchase of textile solutions, all the competitors that participated in the market investigation indicated that the majority of their customers rent the textile products rather than purchasing them. (18) Customers however would be open to both renting and acquiring the textile products, with their final choice depending mostly on their particular needs (number of garments, required quality, etc.) and total cost involved. (19)

(22) With regards to the provision of the textile products and the subsequent maintenance service, a large majority of both competitors and customers indicated that their supply agreements include both the supply of the textile products and their maintenance. (20) One competitor indicated that "the majority of the customers of textiles solutions procure the rental as well as maintenance of garments from the same vendor/supplier". (21) However, in case of a 5-10% increase in the price for the maintenance of the textile products, a majority of customers indicated that they would consider taking care of the maintenance of all or part of the textile products themselves, for instance by switching to a laundry service company different than the provider of the textile products. (22)

(23) Although the purchase of the textile products or the maintenance of the products separately from their rental remain a valid option for some customers, in the vast majority of cases customers opt for a package solution including rental and maintenance of their textiles. This full service model is also the main product offering of both parties and their competitors. Based on the results of the market investigation, it appears that textile solutions are mostly offered as a full service solution comprising both the rental of the textile products and their maintenance. The Commission will therefore consider that the market for textile solution services comprises both the rental and the maintenance of the textile products for the purpose of this Decision.

4.1.2. Cleanroom solution services

(24) Cleanroom products and services are provided to customers that operate within environments controlled for particular contaminants, such as dust, airborne microbes, aerosol particles and chemical vapours.

(25) Cleanroom products and services are classified according to standards, principally the ISO14644 classifications, which specify the maximum number of particles per cubic metre of space within the controlled environment and classify them from ISO class 1 (the most clean) to ISO class 9 (the least clean). Other cleanroom standards also exist, such as the EU’s Good Manufacturing Practice (GMP) guidelines for the pharmaceutical industry.

(26) Customers that require full cleanroom services operate primarily in regulated sectors (e.g. pharmaceuticals), the microelectronics, aerospace, automotive and healthcare industries. The class of cleanroom service a customer requires will depend on the sector in which it operates and the regulations applicable to that sector. The most common classes for cleanroom purposes are ISO 5 to 8. (23)

(27) CWS-boco actually provides ISO class 4 to 8 services only. As far as customers request ISO class 9 services, they receive services compliant to ISO class 8. The Rentokil Initial Target Businesses offers ISO class 5 to 9 services but actually provides, for the same reason as described in relation to CWS-boco, ISO class 5 or ISO class 7 services only. Neither of the Parties provides ISO class 1 to 3 certified services (24). Cleanroom solution providers principally offer services with regard to the most common ISO classes 4 to 9 (only one competitor – Alsco – offers ISO class 3 services).

(28) The Commission has not yet defined a product market for the provision of cleanroom solutions.

(29) CWS-boco submits that a sub-segmentation of the cleanroom services according to different ISO classes is not appropriate. (25)

(30) CWS-boco also submits that the provision of cleanroom solution services include (i) the supply and maintenance of reusable cleanroom garments, and (ii) the supply of disposable cleanroom garments and other items used by cleanroom operators (cleanroom consumables). (26) CWS-boco claims that re-usable garments as well as disposables form part of the cleanroom solutions services market since both types of garments satisfy the same customer needs (27) and the products are therefore in competition with each other.

(31) As regards a possible separate product market for disposable garments/consumables, the market investigation revealed that many of the suppliers of cleanroom solutions that participated in the market investigation offer both disposable and reusable items. (28) However, on the demand side, twice as many customers of the Parties' reusable cleanroom garments buy disposables from third party suppliers as those customers who buy both product types from the Parties (29). Some customers indicated that disposable garments/consumables is a separate product from reusable cleanroom solutions, and procure disposables from third parties such as "from wholesalers because is more efficient (process-, time-, cost-view)". (30) Thus, the possibility of the supply of disposable cleanroom garments/ consumables as a separate market cannot be excluded. Nonetheless, the Parties do not offer disposable garments/consumables to their customers on a stand-alone basis but, in the rather rare cases these products are requested from the Parties by the customer, they are offered under their existing supply contracts with the customers together with the reusable cleanroom garments and their maintenance. (31) In any event, it can be left open whether reusable and disposable cleanroom garments are part of the same product market or belong to separate product markets, as the proposed Transaction would not result in serious doubts under either definition.

(32) The Commission's market investigation revealed that not all the competitors active in the provision of cleanroom solutions provide these services across all the classification standards. (32) Moreover, very few customers of the Parties that participated in the market investigation require cleanroom solutions across all the classification standards. (33) This indicates that both from demand side and supply side, a segmentation of the market for the provision of cleanroom solutions on the basis of the classification standards seems plausible.

(33) With regards to a single overall product market including both rental and purchase of cleanroom garment solutions, all the competitors who responded stated that the majority of their customers rent rather than purchase their cleanroom garments. (34) Equally, a majority of customers, who expressed an opinion, would not consider purchasing cleanroom garments instead of renting them. (35) At the same time, a minority of customers considered that this would depend on factors such as their particular needs (number of garments, required quality, etc.) and total cost involved. (36)

(34) With regard to separate markets for the provision of the cleanroom garments and the subsequent maintenance service, a majority of both competitors and customers that participated in the market investigation indicated that their contracts include both the supply of the cleanroom garments and their maintenance by the same supplier. (37) Particularly, a majority of the responding customers indicated that they would not consider having their cleanroom garments maintained by a laundry company different from the provider of the garments. (38) The main reasons listed were that in some countries, such as in particular in Germany, having a different maintenance provider would increase regulatory risks, raise issues of liability, is more costly, or internally more difficult to organise. (39)

(35) Based on the results of the market investigation, it appears that the cleanroom solutions are mostly offered as a full service solution comprising the rental of the cleanroom garments and their maintenance, and the sale of disposable garments. The Commission will therefore consider that the market for cleanroom solution services comprises both the rental and the maintenance of the cleanroom garments for the purpose of this Decision. As to the potential segmentation of the market according to the respective classification standards as well as to the existence of a potential separate market for disposable cleanroom garments/consumables, for the purpose of this Decision, the precise product market definition can be left open as the proposed Transaction would not result in serious doubts under either definition, as will be analysed below.

4.1.3. Washroom solution services

(36) Washroom solutions concern the provision and distribution of a wide variety of washroom equipment and consumables that enable the operation of washrooms in public and commercial premises. They include the installation of equipment and the servicing/restocking of consumables (e.g. toilet paper, paper towels, soap) for customers that need to maintain washrooms.

(37) The Commission has not yet defined a product market for the provision of cleanroom solutions.

(38) CWS-boco submits that the supply of washroom solutions comprises a selection of products and services including hand washing, hand drying, toilet cubicle requirements, sanitisers, waste disposal and odour remediation. (40) According to CWS-boco, out of the whole spectrum of products and services that washroom solution suppliers may offer, toilet paper, hand washing and hand drying solutions would be essential products provided by almost all suppliers active on the market. (41)

(39) Hand drying solutions can take various forms. There are disposable paper towels, reusable cotton towels and cotton towels on reels, as well as electrical hand dryers. Reusable cotton solutions require a cleaning facility and a different infrastructure on the supply side. Customers choose their preferred option depending on their needs. As most suppliers are able to offer all of these solutions (42) a distinction according to the various hand drying solutions is not warranted.

(40) All the competitors that participated in the market investigation offer a wide variety of products for washroom solutions, with the most common products (offered by at least 75% of the competitors) being toilet paper and toilet paper dispensers, soap and soap dispensers, paper towels and dispensers, and air fresheners. (43) Similarly, the most demanded washroom products by customers are toilet paper and toilet paper dispensers, soap and soap dispensers, paper towels and dispensers, cotton towel rolls and dispensers, air fresheners, and feminine hygiene products. (44)

(41) Competitors indicated that the products which are essential for a provider of washroom solutions to be competitive are mostly toilet paper and toilet paper dispensers, soap and soap dispensers, paper towels and dispensers, and air fresheners. (45) On the other hand, customers took the view that the essential washroom products are the aforementioned (but excluding air fresheners) and additionally cotton towel rolls and dispensers and feminine hygiene products. (46)

(42) Both a majority of customers and competitors submitted that their supply agreements comprise both the equipment and the servicing and restocking of consumables, such as toilet paper, paper towels or soap. (47)

(43) In light of the above, the market for the provision of washroom solutions would therefore comprise the supply of a wide variety of washroom equipment and consumables, together with their subsequent servicing and restocking.

4.1.4. Mats solution services

(44) Mats solutions refer to the supply of indoor and outdoor floor mats used in commercial, industrial, and public premises by staff, customers and/or the general public to prevent slips and trips, keep floors more hygienic, minimise the wear of flooring and enhance the image of the premises.

(45) The Commission has not yet defined a product market for the provision of mats solutions.

(46) CWS-boco submits that the provision of mats solutions comprises the supply of mats solutions through the rental and sale of mats as well as the provision of the subsequent maintenance services (48). In its notification, CWS-boco considers that the term 'maintenance' refers to the laundering, conditioning, repair and collection and delivery of the mats.

(47) According to CWS-boco, from the point of view of the customer, there is little difference between the various suppliers of mats solutions, because the service obtained and the end result are identical in all cases. Consequently, the Parties compete against specialist mats-only service providers, FM companies that supply and maintain the mats themselves, FM companies that supply mats and sub- contract the maintenance to laundry service specialists, and other hygiene/textile specialists that also supply and maintain mats. (49)

(48) Moreover, CWS-boco submits that the sale of standard mats by cash & carry or retailers constitutes a significant competitive constraint on providers of mats solutions. (50)

(49) CWS-boco also submits that, in addition to contracting a full service solution including the rental and maintenance of the mats, customers may either rent the mats and have them serviced by a third party, or purchase the mats and have them serviced by a third party. (51)

(50) In the Commission's market investigation, a large majority of both customers and competitors indicated that their agreements for the supply of mats include the delivery, laundering and replacement of the dust mats; and in most cases, also the repair of the mats. (52) Moreover, all the competitors that participated in the market investigation submitted that their supply agreements include both the provision of the mats and their maintenance in all or most cases. (53)

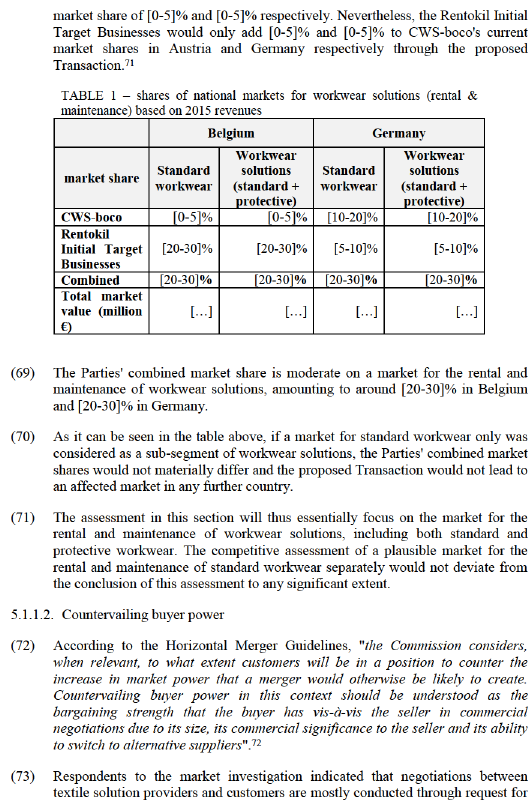

(51) With regard to the possibility of purchasing the dust mats instead of renting them, a large majority of customers indicated that they would not consider purchasing the mats, since it is easier and more effective to have their mats serviced by an external provider (54). This extent was confirmed by the competitors of the Parties, since they all indicated that a majority of their customers (above 80%) rent the mats rather than purchasing them. (55)

(52) With regard to the possibility of having the dust mats maintained by a third party different from the supplier, a majority of the customers indicated that they would not consider this option, since it is easier to deal with one single provider for both the provision and the maintenance of the mats. (56) This statement was confirmed by the competitors of the Parties, since they never or very rarely offer the maintenance of mats that have been supplied by a third party provider. (57)

(53) On the basis of the above, it appears evident that mats solutions are mostly offered as a full service solution comprising the rental of the mats and their maintenance.

4.2. RELEVANT GEOGRAPHIC MARKETS

4.2.1.Textile solutions

(54) CWS-boco submits that the relevant geographic market for textile solutions is national. According to CWS-boco, customers' taste differs from country to country and they tend to contract these services on a national basis. In addition, although customers require regular on-time services and individual customer support, suppliers of textile solutions typically install depots across the country that serve as hubs to service their customers' needs. (58)

(55) In the Commission's market investigation, a majority of both customers and competitors have indicated that the geographic coverage of their supply agreements for textile solutions is national. (59) Although both customers and competitors submit that servicing the textile products from facilities located in the vicinity of the customers' premises would imply a strong competitive advantage, they also acknowledge that the distance is not a barrier as long as the service is offered on a regular basis and providers are able to adapt quickly to the customers' needs. (60)

(56) In view of the above, and considering all evidence available to it, the Commission considers that, for the purpose of this Decision, the market for textile solutions is national in scope.

4.2.2. Cleanroom solutions

(57) CWS-boco submits that the relevant geographic market with regard to a plausible market for cleanroom services is at least national, and possibly even wider in scope. According to CWS-boco, customers of cleanroom solutions mainly focus on quality of service and reliability. Customers would therefore be less sensitive to higher transportation costs. (61)

(58) The Commission's market investigation did not support a geographic scope wider than national. (62) As for competitors, a majority considered the geographic scope of the cleanroom solutions market to be clearly narrower than EEA, with a majority considering it to be national. (63) A majority of customers also considered the market to be national in scope. (64)

(59) In view of the above, and considering all evidence available to it, the Commission considers that, for the purpose of this Decision, the market for cleanroom solutions is national in scope.

4.2.3. Washroom solutions

(60) CWS-boco submits that the relevant geographic market for the provision of washroom solutions is national. According to CWS-boco, customers require regular and prompt service availability and a reliable point of contact. In addition, while there are national differences with regard to the market structure, the respective national markets are homogeneous without any regional differences. (65)

(61) In the Commission's market investigation, a large majority of customers and a majority of competitors indicated that the market for the provision of washroom solutions is national in scope. (66) In addition, while the responses by both customers and competitors yielded mixed results as to the competitive advantage of a supplier for having its facilities located near its customers' premises, many customers pointed out that what matters to them are mostly the price and the service provided. In this line, a competitor pointed out that "whilst there can be some benefits to having a local facility, proximity to the customer is not critical as [it] has depots which contain consumable stock and allow for efficient distribution". (67)

(62) In view of the above, and considering all evidence available to it, the Commission considers that, for the purpose of this Decision, the market for washroom solutions is national in scope.

4.2.4. Mats solutions

(63) CWS-boco submits that the relevant geographic market for textile solutions is national. According to CWS-boco, conditions of competition are homogeneous on a national basis, and closeness to customers is a key element to be able to service equipment efficiently at regular intervals. (68)

(64) In the Commission's market investigation, a large majority of both customers and competitors indicated that the geographic coverage of their supply agreements for mats solutions in national. (69) Further, a majority of competitors submit that servicing dust mats from facilities located in the vicinity of their customers' premises would not necessarily imply a strong competitive advantage against other competing mats solution providers. (70)

(65) In view of the above, and considering all evidence available to it, the Commission considers that, for the purpose of this Decision, the market for mats solutions is national in scope.

5. COMPETITIVE ASSESSMENT

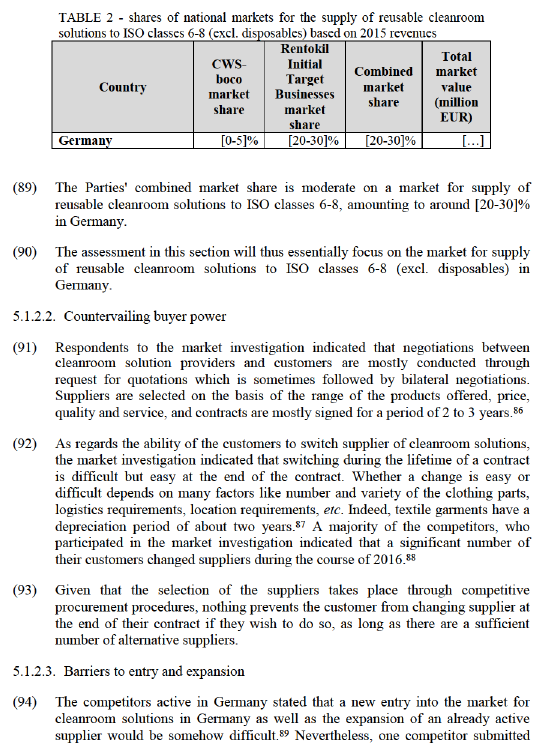

(66) The Transaction would lead to affected markets for textile solutions in Belgium and Germany, for cleanroom solutions in Germany, for washroom solutions in Belgium and the Netherlands and mats solutions in Austria, Belgium, Germany and the Netherlands.

5.1.1.Textile solution services

5.1.1.1. Overview of the Parties' market shares

(67) The proposed Transaction would give rise to horizontally affected markets for the provision of textile solution services in Belgium and Germany in a market including the rental and maintenance of workwear solutions (flat linen excluded), as indicated in the table below.

(68) If a market for the rental and maintenance of flat linen is considered, the Parties' activities would overlap in Austria and Germany, with an estimated combined

quotations. Suppliers are selected on the basis of the price, quality and service, and contracts are mostly signed for a period of 3 years. (73)

(74) A majority of the customers that participated in the market investigation indicated that changing the supplier of textile solution services is somehow difficult or very difficult during a running contract. Indeed, textile garments have a depreciation period of about two to three years. If a customer decides to terminate the contract for the rental of the workwear within the depreciation period, it has to pay for the residual value of the garment, which can lead to a considerable amount of money if the customer has a significant quantity of garments under lease. (74)

(75) However, it is easy to switch suppliers at the end of the contract period. Given that the selection of the suppliers takes place through competitive procurement procedures every two to three years, nothing prevents the customer from changing supplier at the end of their contract. Customers confirmed that there are enough alternative suppliers in the affected markets.

5.1.1.3. Barriers to entry and expansion

(76) The competitors that are active in the affected markets and expressed an opinion in the market investigation indicated that a new entry into the market for workwear solutions in Belgium and Germany would be somehow difficult, whereas the expansion of an already active supplier would be significantly easier. (75)

(77) Several competitors submitted that they currently have plans to enter or expand their activities into a new product or geographic market for textile solutions in the EEA in the coming 2-3 years. (76) Therefore, should CWS-boco significantly increase prices post-Transaction in Belgium for textile solutions, other providers would be in the position of expanding their activities in order to compete.

5.1.1.4. Workwear solutions in Belgium

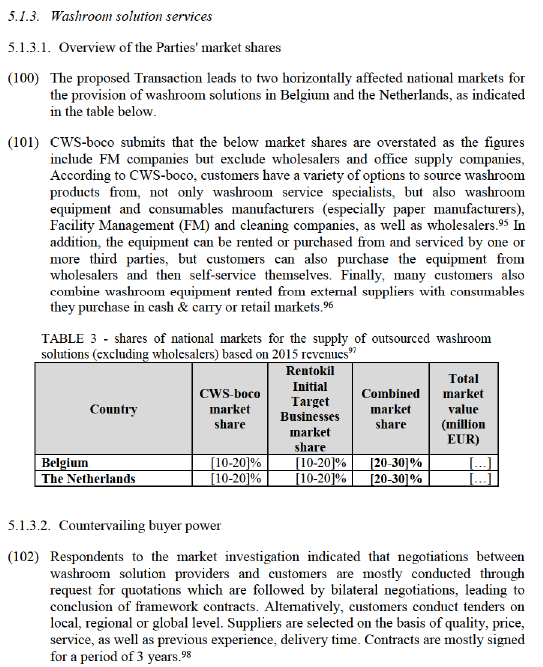

(78) CWS-boco is active in the market for textile solutions in Belgium only to a very limited extent. Indeed, CWS-boco does not offer flat linen solutions in Belgium, and it only adds [0-5]% to the Rentokil Initial Target Businesses' current market share for the rental and maintenance of workwear solutions in Belgium.

(79) Moreover, a number of other providers are active in the Belgian market, such as Mewa, Elis, Cleanlease, Depairon and Mireille, with estimated market shares ranging between [5-10]% and [5-10]%. Mewa and Elis are large competitors and active across several EU Member States. All these firms are credible competitors in Belgium and would continue to constrain CWS-boco to a significant extent post-Transaction.

(80) Furthermore, the merging entities are not each other's closest competitors. The majority of competitors indicated that the closest competitors of CWS-boco for workwear solutions in Belgium are Cleanlease, Depairon and Elis; while the closest competitors of the Rentokil Initial Target Businesses, according to competitors, would be Cleanlease, followed by CWS-boco and Depairon. (77) Customers shared this opinion on the closest competitors of each of the Parties. (78)

(81) A large majority of both customers and competitors that expressed an opinion during the market investigation considered that there will be sufficient competitive alternatives to prevent CWS-boco from raising prices for workwear solutions in Belgium post-Transaction (79), and, consequently, the Transaction would have either positive or no effects at all for the rental and maintenance of workwear solutions in Belgium. (80)

Conclusion

(82) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the small increment brought about by CWS-boco, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction would not raise serious doubts as to its compatibility with the internal market in respect of the market for textile solutions in Belgium under any plausible product market definition.

5.1.1.5. Workwear solutions in Germany

(83) Both CWS-boco and the Rentokil Initial Target Businesses are active in the market for textile solutions in Germany, where the proposed Transaction would lead to a combined market share of [20-30]% for the rental and maintenance of workwear solutions (with an estimated market share of [10-20]% and [5-10]% respectively).

(84) A number of other strong and credible providers are active in the German market, such as Mewa (with an estimated market share of [20-30]%), DBL ([10-20]%), Bardusch ([5-10]%), Berendsen ([0-5]%) and Elis ([0-5]%). Some of these competitors such as Mewa, Berendsen and Elis are large internationally active firms. All of these competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(85) Furthermore, the merging entities are not each other's closest competitors. Competitors have identified other close competitors of the Parties for workwear solutions in Germany, such as DBL, Bardusch, Berendsen and Alsco. (81) In addition, one competitor has indicated that "Rentokil Initial is not very strong in the market for textile solutions in Germany". (82) Customers shared the same opinion on the closest competitors of each of the Parties. (83)

(86) All the customers and a majority of competitors that expressed an opinion during the course of the market investigation considered that there will be sufficient competitive alternatives to prevent CWS-boco from raising prices for workwear solutions in Germany post-Transaction, (84) and a majority of both customers and competitors considered that the Transaction would have either positive or no effects at all for the rental and maintenance of workwear solutions. (85)

Conclusion

(87) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for textile solutions in Germany under any plausible product market definition.

5.1.2. Cleanroom solutions services

5.1.2.1. Overview of the Parties' market shares

(88) The proposed Transaction would not give rise to any national affected market for the provision of overall cleanroom solutions including ISO classes 4 to 8, regardless of whether disposable cleanroom garments and consumables are included or not. However, the proposed Transaction would lead to a horizontally affected market in Germany if a narrower product market for reusable cleanroom solutions ISO classes 6 to 8 only is considered (excluding disposable garments and consumables).

that it currently has plans to enter or expand its activities into a new product or geographic market for cleanroom solutions in the EEA in the coming 2-3 years. (90)

5.1.2.4. Cleanroom solutions in Germany

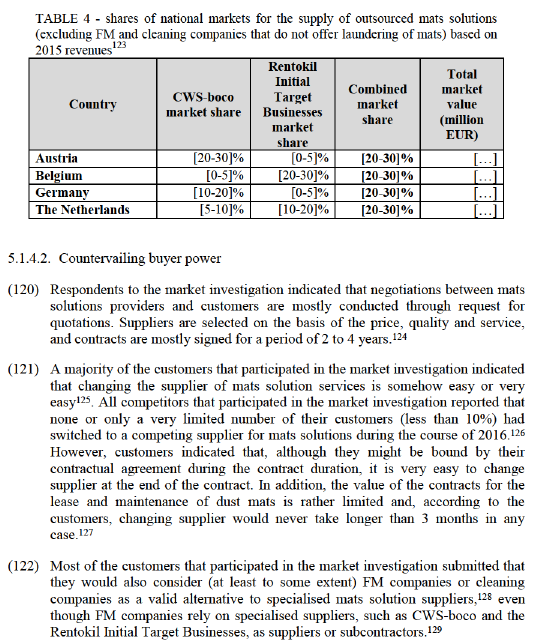

(95) CWS-boco is active in the market for reusable cleanroom solutions to ISO classes 6-8 (excl. disposables) in Germany only to a very limited extent, since it only adds [0-5]% to the Rentokil Initial Target Businesses' current market share for the supply of reusable cleanroom solutions to ISO classes 6-8 in Germany.

(96) Moreover, a number of other providers are active in the German market, such as Decontam, Bardusch and Alsco, with estimated market shares ranging between [5-10]% and [5-10]%. These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(97) Furthermore, a majority of respondents to the market investigation stated that CWS-boco and the Rentokil Initial Target Businesses are not the closest competitors of each other in the market for the supply of reusable cleanroom solutions to ISO classes 6-8 in Germany. (91) The majority of customers indicated that the closest competitor of CWS-boco is Alsco followed by Bardusch and Decontam, whereas the closest competitors of the Rentokil Initial Target Businesses, would be Alsco, followed by Bardusch and CWS-boco (92). One of the competitor stated that " in the German cleanroom market, CWS-Boco focuses on customers requiring ISO 5 services, and does not seek to serve ISO 6 to 8 (albeit they are able to from their existing facilities).We therefore do not consider CWS- boco and Rentokil Initial to be competitors in the German cleanroom market for ISO 6 to 8 services." (93)

(98) The market investigation revealed that a majority of both competitors and customers expressing an opinion considered there will be sufficient competitive alternatives to prevent CWS-boco from raising prices for cleanroom solutions in Germany post-Transaction. This equally applied to the narrowest plausible market, i.e. the segment of ISO-classes 6-8, where all customers expressing a view considered that the Transaction would leave enough competitive alternatives. (94)

Conclusion

(99) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties and the presence of strong competitors the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for cleanroom solutions in Germany under any plausible segmentation, in particular for a potential product market for reysable cleanroom solutions to ISO classes 6-8 in Germany.

(103) As regards the ability of the customers to switch supplier of washroom solutions, whether a change is easy or difficult depends on many factors like the site requirements, the washroom solution product in question (a customer considered that the only difficult task would be to change dispensers, but that this should be done by the supplier). (99) For example, "For dispensers and other systems, switching is more difficult since consumables are often adapted to the dispenser systems. Thus, a change of suppliers often also requires changing these systems" (100). In addition, a significant proportion of customers considered the switch of a provider to be somehow easy to very easy given that it would only take between 6 weeks and 2 months for the new supplier to install its equipment at the customer premises and for products not requiring installation the time would be significantly shortened; no extra quality controls are needed for washroom solutions products and services; and since, in general, the products can be exchanged without any training or work instructions (only in case of provided service, the new supplier needs to be trained on the location's requirement). (101) A majority of the competitors participating in the market investigation indicated that a significant number (i.e. representing more than 10% in terms of their revenue) of their customers changed suppliers during the course of 2016. (102)

(104) In any event, given that the selection of the suppliers takes place through regularly held competitive procurement procedures, nothing prevents the customer from changing supplier at the end of their contract if they wish to do so or in response to a threatened price increase by the Parties, as long as there are a sufficient number of alternative suppliers. Whilst switching during contract period is relatively difficult and rare, the ease of switching increases significantly and, indeed, switching commonly occurs after the end of the contract period.

(105) Moreover, a non-negligible proportion of customers considered other suppliers than washroom solution specialists a credible alternative, such as Facility Management companies, (103) even though most FM companies "outsource these services to specialised companies such as CWS-boco and Rentokil Initial". (104) Some customers indicated that they would not only consider switching their outsourced washroom solution services to FM companies, but also to office supply companies or wholesalers in case of a 5-10% increase in the current price. (105) On the basis of the aforementioned, there is clearly a certain degree of demand side substitutability for the washroom services provided by the FM companies, and maybe also by wholesalers and office supply companies. This is also supported by a majority of competitors which submitted that some of their customers have switched to FM companies or office supply companies and wholesalers during the course of 2016. (106)

5.1.3.3. Barriers to entry and expansion

(106) The competitors that are active in the affected markets and expressed an opinion in the market investigation indicated that a new entry into the market for washroom solutions in Belgium and in the Netherlands would be somehow difficult, whereas the expansion of an already active supplier would be significantly easier. (107)

(107) Nevertheless, some competitors submitted that they currently have plans to enter or expand their activities into a new product or geographic market for washroom solutions in the EEA in the coming 2-3 years. (108) Therefore, should CWS-boco significantly increase prices post-Transaction in Belgium or the Netherlands for textile solutions, other providers would be in the position of expanding their activities in order to compete.

5.1.3.4. Washroom solutions in Belgium

(108) Both CWS-boco and the Rentokil Initial Target Businesses are active in the market for washroom solutions in Belgium, with an estimated market share of [10-20]% and [10-20]% respectively, resulting on a moderate combined market share of [20-30]%.

(109) Moreover, a number of other providers are active in the Belgian market, such as SCA Tork (with an estimated market share of [10-20]%), Kimberly Clark ([10- 20]%) and Boma ([5-10]%). (109) In addition, a competitor indicated that Vendor is also a close competitor of the Parties. (110) These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(110) All the competitors and a majority of the customers active in Belgium that responded to the market investigation indicated that CWS-boco and the Rentokil Initial Target Businesses are particularly close competitors of each other. (111) In their explanation, some customers submitted that CWS-boco and the Rentokil Initial Target Businesses offer very similar services at a comparable price level in Belgium. (112) Also a significant proportion of competitors considered that there would not to be enough competitive alternatives post-Transaction in the Belgian market for washroom solutions. However, none of these competitors substantiated their negative view. (113) Also, two significant multinational competitors, SCA Tork and Kimberly Clark, will remain in the market for washroom solutions in Belgium. More importantly, a clear majority of customers indicated that there will be sufficient competitive alternatives to prevent CWS-boco from raising prices for washroom solutions in Belgium post-Transaction. (114)

(111) Finally, a majority of customers that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the provision of washroom solutions in Belgium. (115)

Conclusion

(112) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of customers considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for washroom solutions in Belgium.

5.1.3.5. Washroom solutions in the Netherlands

(113) Both CWS-boco and the Rentokil Initial Target Businesses are active in the market for washroom solutions in the Netherlands, with an estimated market share of [10-20]% and [10-20]% respectively, resulting on a moderate combined market share of [20-30]%.

(114) Moreover, a number of other providers are active in the Dutch market, such as SCA Tork (with an estimated market share of [10-20]%), Kimberly Clark ([10- 20]%) Vendor ([5-10]%) and Berendsen ([5-10]%). (116) These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(115) All the competitors and customers active in the Netherlands and that responded to the market investigation indicated that CWS-boco and the Rentokil Initial Target Businesses are particularly close competitors of each other. (117) In their explanation, some customers submitted that CWS-boco and the Rentokil Initial Target Businesses offer very similar services at a comparable price level in the Netherlands. (118) Also a significant proportion of competitors considered that there would not to be enough competitive alternatives post-Transaction in the Dutch washroom solutions market. However, none of these competitors substantiated their negative view. (119) Also, a number of relatively strong multinational competitors will remain on the Dutch washroom solutions market. More importantly, a clear majority of customers indicated that there will be sufficient competitive alternatives to prevent CWS-boco from raising prices for washroom solutions in the Netherlands post-Transaction. (120) In fact, none of the customers considered that there would not be sufficient alternatives on the Dutch market post Transaction.

(116) Finally, a majority of respondents that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the provision of washroom solutions in the Netherlands. (121)

Conclusion

(117) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of customers considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for washroom solutions in the Netherlands.

5.1.4. Mats solution services

5.1.4.1. Overview of the Parties' market shares

(118) The proposed Transaction leads to four horizontally affected markets for the provision of mats solutions in Austria, Belgium, Germany and the Netherlands, as follows.

(119) CWS-boco submits that the below market shares are overstated as the figures do not include FM companies. According to CWS-boco however, FM companies constitute a significant competitive constraint on suppliers of mats solutions because the majority is able to provide the same service as "full service" mats solutions suppliers. FM companies provide mats services often as part of the general provision of facilities management services. The majority of FM companies provide mats to their clients and take care of laundering of those mats by co-operating with local laundries. (122) From a customer's perspective, these supply alternatives are substitutable since they all cover "full service" mats solutions. By contrast, wholesalers and retailers are not included in the relevant market. Due to the homogeneity of mats solutions, switching is easy between the providers of these solutions.

(123) The market investigation also revealed that customers would not consider switching to office supply companies, cash & carry or retailers for their service contracts as a valid option. (130) Although customers are in general open to study the price difference, they highlight the importance of having a specialised maintenance service. (131)

5.1.4.3. Barriers to entry and expansion

(124) The competitors that are active in the affected markets and expressed an opinion in the market investigation indicated that a new entry into the market for mats solutions in Austria, Belgium, Germany or the Netherlands would be moderately or somehow difficult, while the expansion of the activities by an already existing supplier would be easier. (132)

(125) In addition, one competitor submitted that it currently has plans to enter or expand its activities into a new product or geographic market for textile solutions in the EEA in the coming 2-3 years. (133) Therefore, should CWS-boco significantly increase prices post-Transaction in a given country for mats solutions, at least another provider would be in the position of expanding its activities in order to compete.

5.1.4.4. Mats solutions in Austria

(126) The Rentokil Initial Target Businesses are active in the market for the provision of mats solutions in Austria only to a very limited extent, since it only adds [0- 5]% to CWS-boco's current market share ([20-30]%) for the rental and maintenance of dust mats in Austria.

(127) Moreover, a number of other providers are active in the Austrian market, such as Eder (with an estimated market share of [20-30]%), Scheybal ([10-20]%) and Salsianer ([5-10]%). These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(128) Although most customers and competitors considered CWS-boco and the Rentokil Initial Target Businesses to be particularly close competitors for the provision of mats solutions in Austria, (134) all customers and all competitors indicated that there will be a sufficient number of competitive alternatives to prevent CWS-boco from raising prices for mats solutions in Austria post- Transaction. (135)

(129) Finally, a majority of both competitors and customers that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the rental and maintenance of dust mats in Austria. (136)

Conclusion

(130) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the very small increment brought about by the Rentokil Initial Target Businesses, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for mats solutions in Austria.

5.1.4.5. Mats solutions in Belgium

(131) CWS-boco is active in the market for the provision of mats solutions in Belgium only to a very limited extent, since it only adds [0-5]% to the Rentokil Initial Target Businesses' current market share ([20-30]%) for the rental and maintenance of dust mats in Belgium.

(132) Moreover, a number of other providers are active in the Belgian market, such as Mireille (with an estimated market share of [10-20]%), Aneca ([10-20]%), Depairon ([5-10]%), Mewa ([5-10]%) and Elis ([5-10]%). These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(133) Although all customers and competitors considered CWS-boco and the Rentokil Initial Target Businesses to be particularly close competitors for the provision of mats solutions in Belgium, (137) all customers and all competitors indicated that there will be a sufficient number of competitive alternatives to prevent CWS-boco from raising prices for mats solutions in Belgium post-Transaction. (138)

(134) Finally, a majority of both customers and competitors that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the rental and maintenance of dust mats in Belgium. (139)

Conclusion

(135) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for mats solutions in Belgium.

5.1.4.6. Mats solutions in Germany

(136) Both CWS-boco and the Rentokil Initial Target Businesses are active in the market for the provision of mats solutions in Germany, with market shares of [10- 20]% and [0-5]% respectively for the rental and maintenance of dust mats in Germany.

(137) Moreover, a number of other providers are active in the German market, such as City Clean (with an estimated market share of [10-20]%), DBL ([5-10]%), Bardusch ([5-10]%), and Alsco ([5-10]%). These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(138) Although most customers and all the competitors considered CWS-boco and the Rentokil Initial Target Businesses to be particularly close competitors for the provision of mats solutions in Germany (140), all customers and all competitors indicated that there will be a sufficient number of competitive alternatives to prevent CWS-boco from raising prices for mats solutions in Germany post-Transaction. (141)

(139) Finally, a majority of the respondents that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the rental and maintenance of dust mats in Germany. (142)

Conclusion

(140) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for mats solutions in Germany.

5.1.4.7. Mats solutions in the Netherlands

(141) Both CWS-boco and the Rentokil Initial Target Businesses are active in the market for the provision of mats solutions in the Netherlands, with market shares of [5-10]% and [20-30]% respectively for the rental and maintenance of dust mats in the Netherlands.

(142) Moreover, a number of other providers are active in the Dutch market, such as Berendsen (with an estimated market share of [10-20]%), Lavans ([5-10]%) and Vendor ([5-10]%). Moreover, a competitor pointed out that, in addition to Berendsen, Lavans is also a close competitor of the Parties in the Netherlands. (143) These competitors would continue to constrain CWS-boco to a significant extent post-Transaction.

(143) Although all the customers and the competitors considered CWS-boco and the Rentokil Initial Target Businesses to be particularly close competitors for the provision of mats solutions in the Netherlands, (144) all customers and all competitors also indicated that there will be a sufficient number of competitive alternatives to prevent CWS-boco from raising prices for mats solutions in the Netherlands post-Transaction. (145)

(144) Finally, a majority of both the customers and the competitors that expressed an opinion during the course of the market investigation considered that the Transaction would have either positive or no effects at all for the rental and maintenance of dust mats in the Netherlands. (146)

Conclusion

(145) In view of the above, and considering all evidence available to it, in particular the moderate combined market shares of the Parties, the presence of strong competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for mats solutions in the Netherlands.

6. CONCLUSION

(146) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 139, 04.05.2017, p. 31.

4 See [reference to Transaction agreements].

5 See [reference to Transaction agreements].

6 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

7 Subject to the exception of Rentokil Initial ultimately controlling a seller of workwear, Cawe FTB Group ([…] gradually ceasing to sell workwear to third parties); to a very limited supply of soap and dispensers manufactured by Rentokil Initial to third parties (but such manufacturing businesses of Rentokil Initial will not be transferred to CWS-boco); to running contracts […] for the provision with replacements of damaged items to existing customers (washroom and workwear) and with garments for additional personnel (workwear). However, any such vertical relationships would not lead to vertically affected markets.

8 See Case M.4920 – Haniel/Schmidt-Ruthenbeck/Metro, of 9 October 2008.

9 See Case M.5908 – Honeywell/Sperian, of 4 August 2008.

10 See Form CO, paragraph 100.

11 See Form CO, paragraph 76.

12 See Form CO, paragraphs 109 & 112.

13 See Form CO, paragraph 117.

14 See responses to question 5 of the Questionnaire to Competitors.

15 Non-confidential reply of [a competitor] to question 5.1 of the Questionnaire to Competitors.

16 See responses to question 5 of the Questionnaire to Customers.

17 See responses to questions 1&4 of the Questionnaire to Customers.

18 See responses to question 8 of the Questionnaire to Competitors

19 See responses to question 7 of the Questionnaire to Customers.

20 See responses to question 7 of the Questionnaire to Competitors and question 6 of the Questionnaire to Customers.

21 See agreed minutes of a call with a competitor of 30 March 2017, paragraph 10.

22 See responses to question 8 of the Questionnaire to Customers.

23 Since the parties do not provide ISO class 9 services, the following sections refer to ISO classes 4 to 8 only. See Form CO, paragraph 156.

24 See Form CO, paragraphs 148-151.

25 See Form CO, paragraph 156.

26 See Form CO, paragraph 138.

27 See Form CO, paragraph 177.

28 See responses to question 24 of the Questionnaire to Competitors.

29 See responses to question 21 of the Questionnaire to Customers.

30 Non-confidential reply of [a customer] to Q.21.2.1 of Questionnaire 1 to Customers.

31 See Parties' reply to RFI of 30 May 2017, paragraphs 8-11.

32 See responses to question 25.2 of the Questionnaire to Competitors.

33 See responses to question 22.2 of the Questionnaire to Customers.

34 See responses to question 27 of the Questionnaire to Competitors.

35 See responses to question 23 of the Questionnaire to Customers.

36 See responses to question 23 of the Questionnaire to Customers.

37 See responses to question 26 of the Questionnaire to Competitors and question 21 of the Questionnaire to Customers.

38 See responses to question 24 of the Questionnaire to Customers.

39 See responses to question 24.1 of the Questionnaire to Customers.

40 See Form CO, paragraph 202.

41 See Form CO, paragraph 185.

42 See responses to question 44 of the Questionnaire to Competitors.

43 See responses to question 44 of the Questionnaire to Competitors.

44 See responses to question 38 of the Questionnaire to Customers.

45 See responses to question 45 of the Questionnaire to Competitors.

46 See responses to question 39 of the Questionnaire to Customers.

47 See responses to question 47 of the Questionnaire to Competitors and to question 40 the Questionnaire to Customers.

48 See Form CO, paragraph 255.

49 See Form CO, paragraph 252.

50 See Form CO, paragraph 253.

51 See Form CO, paragraph 239.

52 See responses to question 66 of the Questionnaire to Competitors and questions 54 & 55 of the Questionnaire to Customers.

53 See responses to question 72 of the Questionnaire to Competitors

54 See responses to question 56 of the Questionnaire to Customers.

55 See responses to question 67 of the Questionnaire to Competitors.

56 See responses to question 57 of the Questionnaire to Customers.

57 See responses to question 66.1 of the Questionnaire to Competitors.

58 See Form CO, paragraphs 68 & 122.

59 See responses to question 9 of the Questionnaire to Competitors and question 9 of the Questionnaire to Customers.

60 See responses to question 10 of the Questionnaire to Competitors and question 10 & 10.1 of the Questionnaire to Customers.

61 See Form CO, paragraphs 168 & 172.

62 See responses to question 29 of the Questionnaire to Competitors and question 26 of the Questionnaire to Customers.

63 See responses to question 48 of the Questionnaire to Competitors.

64 See responses to question 41 of the Questionnaire to Customers.

65 See Form CO, paragraphs 220 & 223.

66 See responses to question 48 of the Questionnaire to Competitors and question 41 of the Questionnaire to Customers.

67 Reply to Q2 – Questionnaire to competitors, question 49.1.

68 See Form CO, paragraphs 256 & 257.

69 See responses to question 68 of the Questionnaire to Competitors and question 58 of the Questionnaire to Customers.

70 See responses to question 69 of the Questionnaire to Competitors and question 68 of the Questionnaire to Customers.

71 See Form CO, table 6(e).

72 Horizontal Merger Guidelines, paragraphs 64-65.

73 See responses to question 12 of the Questionnaire to Customers.

74 See responses to questions 17 & 17.1 of the Questionnaire to Customers.

75 The average difficulty to enter the market for standard and protective workwear solutions in Belgium was ranked 3.67 and 4.14 respectively on a scale from 1 to 5; while the average difficulty to enter the market for standard and protective workwear solutions in Germany was ranked 3.71 and 4.14 respectively on a scale from 1 to 5. The average difficulty for an existing supplier to expand its activities for standard and protective workwear solutions in Belgium was ranked 3.33 and 3.29 respectively on a scale from 1 to 5; while the average difficulty for an existing supplier to expand its activities for standard and protective workwear solutions in Germany was ranked 3.43 and 3.43 respectively on a scale from 1 to 5. See reply to Q2 – Questionnaire to competitors, questions 18 and 19.

76 See responses to question 21 of the Questionnaire to Competitors.

77 See responses to question 14 & 15 of the Questionnaire to Competitors.

78 See responses to question 14 & 15 of the Questionnaire to Customers.

79 See responses to question 22 of the Questionnaire to Competitors and to question 18 of the Questionnaire to Customers.

80 See responses to question 23 of the Questionnaire to Competitors and to question 19 of the Questionnaire to Customers.

81 See responses to question 14 & 15 of the Questionnaire to Competitors and to questions 14 & 15 of the Questionnaire to Customers.

82 See agreed minutes of a call with a competitor of 28 March 2017, paragraph 23.

83 See responses to question 14 & 15 of the Questionnaire to Customers.

84 See responses to question 22 of the Questionnaire to Competitors and to question 18 of the Questionnaire to Customers.

85 See responses to question 23 of the Questionnaire to Competitors and to question 19 of the Questionnaire to Customers.

86 See responses to question 31 of the Questionnaire to Competitors and to question 28 of the Questionnaire to Customers.

87 See responses to question 34 of the Questionnaire to Customers.

88 See responses to question 37 of the Questionnaire to Competitors.

89 The average difficulty to enter the market for cleanroon solutions to ISO classes 6-8 (excl. disposables) in Germany was ranked 4.14 on a scale from 1 to 5 ; while average difficulty for an existing supplier to expand its activities for cleanroom solutions to ISO classes 6-8 (excl. disposables) in Germany was ranked 3.43 on a scale from 1 to 5. See reply to Q2 – Questionnaire to competitors, question 38 and 39.

90 See responses to question 41 of the Questionnaire to Competitors.

91 See responses to question 55 of the Questionnaire to Competitors.

92 See responses to question 31 and 32 of the Questionnaire to Customers.

93 See responses to question 36 of the Questionnaire to Competitors.

94 See responses to question 42 of the Questionnaire to Competitors and to question 35 of the Questionnaire to Customers

95 See Form CO, paragraphs 200.

96 See Form CO, paragraphs 218.

97 If the provision of washroom solutions by wholesalers is included in the overall market size, as claimed by the Parties, their combined market shares would not materially differ, leading to an affected market in Belgium and in the Netherlands (with combined market share of (20-30)% and (20-30)% respectively).

98 See responses to question 44 of the Questionnaire to Customers

99 See responses to question 51 of the Questionnaire to Customers. See also the Non-confidential reply of [a customer] to question 51.1 of the Questionnaire to Customers.

100 See Non-confidential reply of [a customer] to question 51.1 of the Questionnaire to Customers.

101 See also the Non-confidential reply of [a customer] to question 51.1 of the Questionnaire to Customers.

102 See responses to question 57 of the Questionnaire to Competitors.

103 See responses to question 49 of the Questionnaire to Customers.

104 See Non-confidential reply of [a customer] to question 49.1 of the Questionnaire to Customers.

105 See responses to question 50.1 of the Questionnaire to Customers.

106 See responses to question 58.1 of the Questionnaire to Competitors.

107 The average difficulty to enter the market for washroom solutions in Belgium and in the Netherlands was ranked 3.43 and 3.30 respectively on a scale from 1 to 5; while the average difficulty for an existing supplier to expand its activities for washroom solutions in Belgium and in the Netherlands was ranked 2.71 and 2.70 respectively on a scale from 1 to 5. See reply to Q2 – Questionnaire to competitors, questions 59 and 60.

108 See responses to question 62 of the Questionnaire to Competitors.

109 Estimated market shares for Belgium and Luxembourg on the basis of the information provided in the Form CO, tables 12(b) and 33.

110 See responses to question 63.1 of the Questionnaire to Competitors.

111 See responses to question 55 of the Questionnaire to Competitors and to question 48 of the Questionnaire to Customers.

112 See responses to question 48.1 of the Questionnaire to Customers.

113 See responses to question 63 of the Questionnaire to Competitors.

114 See responses to question 52 of the Questionnaire to Customers.

115 See responses to question 64 of the Questionnaire to Competitors and to question 53 of the Questionnaire to Customers.

116 Estimated market shares for the Netherlands on the basis of the information provided in the Form CO, tables 12(b) and 34.

117 See responses to question 55 of the Questionnaire to Competitors and to question 48 of the Questionnaire to Customers.

118 See responses to question 48.1 of the Questionnaire to Customers.

119 See responses to question 63 of the Questionnaire to Competitors.

120 See responses to question 52 of the Questionnaire to Customers.

121 See responses to question 64 of the Questionnaire to Competitors and to question 53 of the Questionnaire to Customers.

122 The proportion of FM companies and cleaning companies that do not offer laundry services for the mats provided by them is very low though. In fact, according to the parties' estimate which is based on internal market intelligence, the FM and cleaning companies not offering mats laundering services account for only 5% of "other suppliers" since the competitors identified by the parties provide combined rental and laundry services.

123 If the provision of mats solutions by FM companies and cleaning companies is included overall market size, as claimed by the Parties, their combined market shares would not materially differ, leading to an affected market in Austria, Belgium, Germany and the Netherlands (with a combined market share of (20-30)%, (20-30)% and (20-30)% respectively).

124 See responses to question 71 of the Questionnaire to Competitors and to question 60 of the Questionnaire to Customers.

125 See responses to question 67 of the Questionnaire to Customers.

126 See responses to question 77 of the Questionnaire to Competitors.

127 See responses to question 67.1 of the Questionnaire to Customers

128 See responses to question 65 of the Questionnaire to Customers.

129 See responses to question 76.1 of the Questionnaire to Competitors. See also agreed minutes of a call with a competitor of 30 March 2017, paragraph 7of the addendum : « Competitor’s identity) views facility managers primarily as customers ».

130 See responses to question 66.2 of the Questionnaire to Competitors.

131 See responses to question 66.3 of the Questionnaire to Competitors.

132 The average difficulty to enter the market for mats solutions in Austria, Belgium, Germany and the Netherlands was ranked 2.67, 3.00, 3.50 and 3.00 respectively on a scale from 1 to 5; while the average difficulty for an existing supplier to expand its activities for mats solutions in Austria, Belgium, Germany and the Netherlands was ranked 2.67, 3.00, 3.25 and 2.50 respectively on a scale from 1 to 5. See reply to Q2 – Questionnaire to competitors, questions 79 and 80.

133 See responses to question 82 of the Questionnaire to Competitors.

134 See responses to question 64 of the Questionnaire to Customers.

135 See responses to question 83 of the Questionnaire to Competitors and to question 69 of the Questionnaire to Customers.

136 See responses to question 84 of the Questionnaire to Competitors and to question 70 of the Questionnaire to Customers.

137 See responses to question 64 of the Questionnaire to Customers.

138 See responses to question 83 of the Questionnaire to Competitors and to question 69 of the Questionnaire to Customers.

139 See responses to question 84 of the Questionnaire to Competitors and to question 70 of the Questionnaire to Customers.

140 See responses to question 64 of the Questionnaire to Customers.

141 See responses to question 83 of the Questionnaire to Competitors and to question 69 of the Questionnaire to Customers.

142 See responses to question 84 of the Questionnaire to Competitors and to question 70 of the Questionnaire to Customers.

143 See responses to question 73.5 of the Questionnaire to Competitors.

144 See responses to question 64 of the Questionnaire to Customers.

145 See responses to question 83 of the Questionnaire to Competitors and to question 69 of the Questionnaire to Customers.

146 See responses to question 84 of the Questionnaire to Competitors and to question 70 of the Questionnaire to Customers.