Commission, July 14, 2016, No M.7946

EUROPEAN COMMISSION

Judgment

PAI / NESTLE / FRONERI

Dear Sir/Madam,

Subject: Case M.7946 - PAI / NESTLE / FRONERI

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 10 June 2016, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043 by which PAI Partners S.A.S ("PAI", France) and Nestlé S.A. ("Nestlé", Switzerland) acquire within the meaning of Article 3(4) of the Merger Regulation joint control over the newly created joint venture Froneri ("Froneri", United Kingdom), by way of purchase of shares and transfer of assets ("the Transaction").4

(2) PAI and Nestlé will also be referred to below as the "Parties".

1.THE PARTIES

(3) PAI is a France-based private equity investor active in a broad range of industries across the EEA. R&R Ice Cream Plc. ("R&R") is a UK industrial ice cream manufacturer, controlled by PAI's private equity funds. R&R manufactures and markets a range of private label ice cream products in the retail and Out-of-Home markets and has limited sales of ice cream under its own and licensed brands e.g.

Mondelez, Disney.5

(4) Nestlé is a Swiss company mainly active across the EEA in the production, marketing, and sale of food and beverage products, including ice cream. Nestlé's ice cream business is almost exclusively limited to manufacturing and marketing branded ice cream. Its portfolio includes brands such as Extreme, Maxibon, and Mövenpick.6

2.THE OPERATION

(5) The Transaction concerns the creation of the full-function JV Froneri by Nestlé and PAI. Froneri will be headquartered in the UK and comprise the entirety of R&R's business, which is mainly active in the manufacturing of ice cream in Europe, South Africa, and Australia along with Nestlé's ice cream business in Europe and other geographic areas, and with Nestlé's frozen food business in Europe.

(6) PAI and Nestlé will each hold 50% of the shares in Froneri and will share equal voting rights.[Certain details about the governance structure of Froneri]. PAI and Nestlé will therefore exercise joint control over Froneri.

(7) Froneri will have its own presence on the market, conducting a broad range of business activities and notably the Parties' ice cream business in Europe and beyond. The Parties expect Froneri to achieve EUR […] turnover in financial year 2016 in the EEA.

(8) To conclude, the Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(9) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million7 (Nestlé: EUR 83 153 million; PAI: EUR […]). Each of them has an EU-wide turnover in excess of EUR 250 million (Nestlé: EUR […]; PAI: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

(10) Therefore, the notified operation has a Union dimension under Article 1(2) of the Merger Regulation.

4. MARKET DEFINITION

(11) Introduction

(12) Froneri will be principally active in the production, distribution and sale of ice cream products and to a limited extent in the production and sale of other frozen food products.

4.1.Relevant Product Markets

(13) The Commission's decisional practice concerning the frozen food sector distinguishes between ice cream products and other frozen food products.8

4.1.1. Ice cream products

(14) Ice cream varies in flavour, shape, size, additional ingredients (e.g., nuts, chocolate, sauce, etc.) and other characteristics. Ice cream products also vary significantly in perceived quality. The ice cream market is therefore a differentiated market.

(15) In particular, the Commission has considered in its prior decision practice that industrial ice cream is distinct from artisanal ice cream.9 Artisanal ice cream manufacturers can be defined in accordance with the widespread understanding in the industry, as street vendors or bakers who produce themselves their ice cream, as well as ice cream parlours and small companies generally with less than 10 employees, which offer their ice cream products at local level. Artisanal ice cream is generally offered on the production site. Conversely, industrial ice cream is usually manufactured in specialised facilities and its consumption site is independent of the production site. Industrial ice cream comprises a broad range of sweetened frozen desserts consisting of a number of major components, all of which are mixed according to different recipes, packaged and stored before delivery to downstream customers.10

(16) Both Parties are active only in the manufacturing of industrial ice cream.

(17) The Parties consider that artisanal ice cream exercises a firm competitive constraint both on the industrial Catering and Impulse markets, especially because artisanal ice cream would represent a significant part of the overall ice cream consumption in several countries.11 In particular the Impulse segment is characterised by the competitive pressure of market players, such as artisanal ice cream manufacturers (see Section 4.1.2 for a presentation of the Take-Home, Impulse and Catering markets).12

(18) In the Commission's market investigation, the majority of respondents across all categories submit that artisanal ice cream does not compete with industrial ice cream products, or does so only to a limited extent.13 This is true for all of Impulse, Take-Home and Catering ice cream.

(19) Moreover, there are various differences in terms of packaging, prices and modes of distribution between artisanal and industrial ice cream, showing that only limited competitive pressure would be exercised by the former on the latter. One competitor argues: "The small, local ice cream manufacturers which typically produce artisanal ice cream do not have the scale to effectively compete on price or promote their products, nor the ability to distribute their products over any significant distance. Furthermore, the majority of artisanal ice cream is distributed by specialised stores or ice cream cafés. It is purchased by a relatively limited range of impulse and catering ice cream consumers which have access to these outlets."14

(20) In light of the above, and considering all evidence available to it, the Commission concludes that for the purposes of this Decision, the relevant product market is that for industrial ice cream.

4.1.2.Industrial ice cream

(21) The Commission has in prior decisions identified distinct product markets for each of (i) Take-Home ice cream, (ii) Impulse ice cream, and (iii) Catering ice cream.15 i.Take-Home ice cream has been defined as ice cream purchased to be consumed at home. Take-Home ice cream is usually purchased by consumers in supermarkets, smaller stores, and other retail outlets, and is intended to be consumed at a later time or date. It is available in a broad range of formats, including tubs, cones, wrapped bars, sticks, and sandwiches. ii. Impulse ice cream has been defined as ice cream for the consumption on the street or in public areas, such as swimming pools and recreation areas. Impulse ice cream products are sold to players operating various types of points of sale, such as bakeries, ice cream kiosks, ice cream trucks, etc. The Impulse market is characterised by the fact that the final consumer purchases the product for immediate consumption, in small quantity and at a higher price than Take-Home products. iii.The Commission has defined in its prior decision practice the market for Catering ice cream as consisting of ice cream products purchased in the gastronomy sector, i.e. in restaurants, cafes, hotels, etc. Ice cream sold through this channel is mainly sold and delivered in bulk form either directly to the customer or to their wholesalers to be consumed at the catering place but also in single wrapped formats.

(22) The Parties submit that there is evidence that the Take-Home market is part of a broader retail market also including Impulse sales, as these two relevant markets seem to be interrelated and the majority of Impulse products are indistinguishable from Take-Home products in terms of marketing and manufacturing process. Moreover, they argue that at the wholesale level, it is difficult to disaggregate Catering from Impulse ice cream products, as they are substitutable. Impulse ice cream would therefore exert competitive pressure on the Catering ice cream market. Ultimately however, the Parties believe that the segmentation between three separate product markets for Take-Home, Impulse and Catering is an appropriate method to assess the competitive effects of the Transaction.16

(23) In the Commission's market investigation, both a majority of competitors of the Parties and a majority of customers consider that within industrial ice cream, the distinction between Take-Home and Out-of-Home ice cream is appropriate for the assessment of the current Transaction.17 Moreover, a majority of customers and a majority of competitors confirm that a distinction between Impulse and Catering is appropriate within the Out-of-Home market.18

(24) The Commission notes in particular that there are various differences in terms of packaging, formats and modes of consumption between Impulse and Catering ice cream. One customer notes: "Impulse ice cream is a product, usually individually wrapped, which the retailer does not handle and which the consumer consumes there and then. Catering ice cream requires some added value: like being scooped in a container before being served to the consumer."19 One competitor also states: "The distinction is appropriate because Impulse ice cream and Catering ice cream are different ways of consumption."20 Furthermore, in the Impulse market, the Commission observes that branding is generally perceived as playing a more important role than in the Catering market, as one customer states for instance: "We think that in the area of "Impulse ice cream" the brand determines the buying decision a lot more than in restaurants, leisure venues or other public venues because it is more obvious."21

(25) In its prior decision practice, the Commission has not considered any other segmentation of the market for industrial ice cream.

(26) The Parties submit that frozen yoghurt exercises a competitive constraint on industrial ice cream, in particular on ice cream products distributed through the Impulse channel.22

(27) The Commission has not previously assessed whether the manufacturing and marketing of frozen yoghurt would constitute a separate market. As the Transaction does not raise serious doubts irrespective of whether frozen yoghurt is seen as part of the overall market for ice cream products or not, the market definition may in this regards be left open, for the purposes of this Decision.23

(28) In light of the above, and considering all evidence available to it, the Commission concludes that for the purposes of this Decision the market for industrial ice cream is further segmented into Take-Home, Impulse and Catering.

4.1.2.1.Take-Home ice cream

(29) In a prior decision, the Commission also considered a distinction between branded ice cream (i.e. products that are produced and sold under the manufacturers own or licensed brands) and private label (i.e. products that are produced under contract for another brand-owner, or for a supermarket or other retailer).24

(30) The Parties take the view that branded and private label products cannot be clearly distinguished due to the competitive constraint they exercise on one another. They submit that, from the supply side, raw materials are the same and the production lines and processes can be adapted. From the demand side, the Parties submit that branded and private label products compete against each other in all channels, not only in Take-Home, but that within the Impulse and Catering markets, the differentiation between private label and branded ice cream products is less pronounced.25

(31) During the Commission's market investigation, on the one hand a majority of competitors indicate that branded and private label ice cream products and vice versa compete to a significant extent26. Manufacturers also state that they could easily (i.e. without incurring significant additional costs or risks, and in the short term) switch production between branded and private label (and vice-versa) if necessary for commercial reasons.27 On the other hand, customers are mostly split. While the majority considers that branded and private label ice cream products compete to only a limited extent or not at all, an important minority consider that branded and private label products compete to a significant extent.28

(32) Moreover, most of the competitors and customers do not consider that customers (both at the wholesale and retail level) would likely switch from buying branded ice cream to private label ice cream in case of a price increase of 5-10% of branded ice creams (and vice versa). A majority of respondents submit that from a final consumers' perspective, branded and private label ice cream products are substitutable only to a limited extent.29 As to the reasons for this limited substitutability, significant differences in terms of end consumers' price or of margins on sale, etc. are mentioned.30

(33) Furthermore, the majority of both customers and competitors also state that negotiations between manufacturers and their customers are handled separately and not together for each of branded and private label ice cream products31 and that the supplying/sourcing of private label ice cream products differs from supplying/sourcing of branded ice cream products (for instance in terms of tendering processes, lengths of contract, sharing of risks and responsibilities, quality requirements etc.).32 Therefore, even if there is some degree of supply-side substitutability, customers appear to purchase branded and private label products separately and to thus have a separate product assortment for both branded and private label ice cream products. In its competitive assessment, the Commission has analysed in more detail the effects of the Transaction on the negotiation process between the Parties and their customers and specifically on the possibility of negotiating jointly the supply of branded and private label ice cream (see Section 5.2.1).

(34) In any event, and in light of the fact that the results of the market investigation are not conclusive as there are indications favouring a broader market comprising both branded and private label ice cream, as well as indications towards a separation of the two types of ice cream products, the question whether the Take-Home market should be further segmented between branded and private label ice cream products can be left open for the purposes of the present Decision, as the Transaction does not raise serious doubts under any plausible market definition.

(35) The Commission has not considered any other segmentation of the market for Take-Home ice cream in its previous practice.

(36) According to the Parties, it is not necessary to consider any narrower segments by format as (i) on the supply side, the cost of switching from one format to another is limited, since using several formats (e.g. tubs and cartons) […]* require any additional plant and since the majority of the Parties' competitors already produce ice cream in a variety of formats, and (ii) the demand is relatively homogenous, i.e. from the consumers’ point of view, all Take-Home ice cream formats are substitutable.33 The Parties also submit that a further distinction of Take-Home ice cream by the level of quality or the age demographic would be neither appropriate nor economically meaningful.34

(37) Furthermore, a majority of respondents indicate that no other distinction between the various categories of ice cream products (e.g. by other physical or marketing criteria, formats, ingredients, etc.) is relevant within the Take-Home market.35

(38) To conclude, the Commission will assess in Section 5.3 the impact of the Transaction on both the markets for branded Take-Home ice-cream and the broader markets for the overall Take-Home ice cream, as the Parties' activities do not overlap in the private label segment.36

4.1.2.2.Impulse ice cream

(39) In the Unilever/Miko37 decision, the Commission assessed a further segmentation within the Impulse segment according to the type of ice cream consumed: (i) wrapped ice cream, sold in the form of cones, sticks or bars; (ii) scooped ice cream, sold to the final consumer as a scoop of ice cream, usually in a cone; (iii) soft-ice or “Italian ice cream,” which is a type of ice cream that is softer than regular ice creams as a result of air being introduced during freezing. Soft-ice is usually consumed in a cone. Whilst the degree of retailers' involvement varies depending on the category, the Commission ultimately considered that wrapped, scooped and soft-ice are substitutable from the final consumer’s point of view.

(40) In the present case, in the Commission's market investigation, a majority of respondents indicate that no other distinction between the various categories of ice cream products (e.g. by other physical or marketing criteria, formats, ingredients, etc.) is relevant within the Impulse market.38

(41) As to the specific question of whether the distinction between branded and private label ice cream products is of relevance in the Impulse market, answers are mixed.39 Several respondents however reason their answers in more detail and explain that: "It is only relevant locally in the [Take-Home] trade and not in all outlets - only where there is an own label brand present"40, and that "In reality, the private label ice cream in the impulse market (Germany) is not existent."41

(42) The Parties take the view that branded and private label products also compete against each other in the Impulse market, with private label products generating "impulse" demand mainly through scooped ice cream. However, the branding, on- site marketing, freezer arrangements and consumers' media impressions are much more significant for capturing demand in the Impulse market. Even though some private label products exist in the Impulse market, their presence is much more limited. Illustratively, R&R's 2014 sales of private label Impulse products only represent [10-20%] of its total sales on the Impulse market, even though it has an overall much greater focus on the manufacturing of private label products.42 Therefore, there is no clear demand from consumers for private label products in the Impulse market.

(43) In light of the above, and considering all evidence available to it, the Commission concludes that for the purposes of this Decision the market for Impulse ice cream should not be further segmented.

4.1.2.3.Catering Ice Cream

(44) The Commission has not considered any further segmentation of the Catering market in its prior decision practice.

(45) Furthermore, a majority of respondents indicate that no other distinction between the various categories of ice cream products (e.g. by other physical or marketing criteria, formats, ingredients, etc.) is relevant within the Catering market.43

(46) As to the specific question of whether the distinction between branded and private label ice cream products is of relevance in the Catering market, answers are mixed.44 Several respondents however reason their answers in more detail and point out that in the Catering market, customers usually are not aware of the brand of the ice cream they purchase or whether it is branded or private label. Customers indicate that "Distinction is of less relevance in catering as the end consumer doesn't necessarily know what brand of ice cream he or she is served", "This might happened in retail level, but in restaurants they sell more branded or even local ice creams", "they compete the most at take-home category".45 Responding competitors also indicate that "private label has a relatively limited presence in […] and catering ice cream", "it is of relevance mainly in the market for Take- home", and "mostly in take-home ice creams".46 Therefore, there is no clear demand from consumers for private label ice cream in the Catering market.

(47) In light of the above, and considering all evidence available to it, the Commission concludes that for the purposes of this Decision the market for Catering ice cream should not be further segmented.

4.1.3.Conclusion

(48) In light of the above and all evidence available to it, the Commission concludes that, for the purposes of this Decision, it is appropriate to assess the competitive effects of the Transaction on distinct product markets, for each of (i) Take-Home ice cream, (ii) Impulse ice cream, and (iii) Catering ice cream.

(49) Furthermore, whether a further distinction between branded and private label ice cream should be made in the Take-Home market can be left open, as the Transaction does not raise serious doubts under any plausible product market definition. The Commission will therefore assess the impact of the Transaction on both the market for branded Take-Home ice-cream and a broader market for the overall Take-Home ice cream market, as the Parties' activities do not overlap in the private label segment (Section 5.3).

(50) For each of the overall Impulse and overall Catering markets, the Commission concludes that for the purposes of this Decision, no further segmentation is necessary.

4.1.4.Other frozen food products

(51) In prior decisions, the Commission considered a distinction between the production and sale of food products dedicated to the retail sector and the production and sale of food products to the food service sector47. Within the retail sector and from a demand-side perspective, the Commission has considered a further division into (i) frozen food, (ii) chilled food and (iii) fresh food48.

(52) Further, the Commission segmented the market according to the categories of products and their role in the meal (e.g. starter, main course). 49 More specifically, with respect to the market for manufacture and supply for frozen bakery, in which both Parties are present, the Commission analysed the market for manufacture and supply for frozen bakery by segmenting it per category of products (i) frozen bread, (ii) frozen morning goods, (iii) frozen pastries and cakes, and (iv) frozen savoury snacks), while ultimately leaving open the exact market definition50.

(53) In this context, the Parties define frozen cakes as including all type of tarts or cakes, mini cakes (e.g. single portion cakes) as well as other types of pastries (e.g. eclairs, dessert miniatures) that are to be consumed as a dessert. The Parties argue that frozen appetizers should be distinguished from frozen starters or frozen main courses and cover types of finger food that is to be consumed prior to the meal. The Parties submit that four relevant product markets where both Nestlé and PAI are both active may thus be considered: (i) the market for the production and sale of frozen pastries and cakes to the retail sector, (ii) the market for the production and sale of frozen pastries and cakes to the food service sector (iii) the market for the production and sale of frozen appetizers to the retail sector and (iv) the market for the production and sale of frozen appetizers to the food service sector.51

(54) In light of the above and all evidence available to it, the Commission concludes that the precise market definition concerning those markets may be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.Relevant geographic markets

4.2.1. Industrial ice cream

(55) In a previous decision,52 the Commission considered that the relevant geographic markets for all ice cream product markets are national in scope due to legislative differences, national and sub-national trends in sales and distribution, and differences in consumers’ habits, products recipes and packaging.

(56) The Parties' view is that the relevant geographic market is wider than national and potentially as wide as the entire EEA. The Parties consider that the precise geographic dimension of the relevant markets could be left open as no competition concerns would exist irrespective of the precise geographic scope of the markets.53

(57) In the Commission's market investigation, majorities of both competitors and customers, indicate that the geographic coverage of the distribution or retail agreements they enter into for ice cream products is national.54

(58) While a majority of both competitors and customers state that the same ice cream products (i.e. without any change in recipe, taste, appearance) are sold irrespective of the EEA country of destination55, respondents are rather divided, when asked whether the structure, importance, etc. of retail or distribution channels vary significantly from a country to another in the EEA.56

(59) The majority of suppliers state that wholesale prices in the contracts they negotiate with retailers and other distributors are country-specific.57 Furthermore, retail prices for ice cream products vary significantly from one country to another, according to the majority of all categories of respondents.58

(60) In view of the above results, the Commission considers that, in addition to the other factors identified in its prior practice such as differences in consumers' habits, product recipes and packaging, the organisation of sales and purchasing along national lines suggests that these ice cream markets would be national.59 Therefore, the Commission considers that the evidence available to it does not lend support to the conclusion that the geographic scope of the ice cream markets may extend to wider than national markets, as proposed by the Parties.

(61) In view of the above, and considering all evidence available to it, the Commission considers that, for the purpose of this Decision, the markets for each of (i) Take- Home ice cream, (ii) Impulse ice cream, and (iii) Catering ice cream are national.

4.2.2.Other frozen food products

(62) The Commission has previously considered that the relevant geographic markets for frozen food are national in scope due to legislative differences, national and sub-national trends in sales distribution and brands and the differences in market structure60.

(63) The Parties take the view that the relevant geographic market is most probably wider than national in scope, and potentially as wide as the entire EEA.61

(64) In light of the above and all evidence available to it, the Commission concludes that for the purposes of this Decision, the precise geographic market definition concerning other frozen food can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

5.COMPETITIVE ASSESSMENT

(65) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular as a result of the creation or strengthening of a dominant position.

(66) The Horizontal Merger Guidelines62 distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non-coordinated and coordinated effects.

(67) As the Parties' activities on a market for frozen food products do not give rise to an affected market under any plausible market definition, they will not be further analysed in this Decision.63

(68) The assessment of the compatibility of the Transaction with the internal market will thus essentially focus on non-coordinated horizontal effects in the ice cream market, including the Take-Home, Impulse and Catering markets where the Parties' activities overlap.

(69) Non-coordinated effects may significantly impede effective competition by eliminating important competitive constraints on one or more firms, which consequently would have increased market power, without resorting to coordinated behaviour. The factors listed in paragraphs 27 onwards of the Horizontal Merger Guidelines may influence whether or not significant horizontal non-coordinated effects are likely to result from a merger, but not all of these factors need to be present to make significant non-coordinated effects likely and the list is not exhaustive.64 The presence of these factors may though have an impact on the degree of horizontal non-coordinated effects arising from the transaction.

(70) The Commission will first present a sectorial overview of the ice cream sector (Section 5.1) and elements common to the assessment of the Transaction that cut across the different EEA countries (Section 5.2), before undertaking a more detailed analysis on a country per country basis (Section 5.3). Finally, the Commission will also assess coordinated effects that the Transaction might bring about (Section 5.4).

5.1.Sectorial overview

(71) In 2014, the EEA ice cream market had an estimated value of around EUR 9 billion65 and the market is generally growing across the EEA.

(72) The Parties are active in different segments of the ice cream market. While Nestlé’s focus is on branded ice-creams, R&R specialises more on private label ice creams and offers some licensed branded products.

(73) In addition to the Parties, other ice cream manufacturers include (i) large global players, such as Unilever, which leads the EEA market, having a material presence in several EEA States and a comprehensive product offering, and General Mills, with its strong brand Häagen Dazs, (ii) pan-European players, such as DMK, YSCO, Sammontana, and ICFC, which compete in targeted markets with a portfolio of own- and/or licensed-brands, and private label offerings, and (iii) regional and national players such as Thiriet (France), Granarolo (Italy), Deny (Bulgaria), and a large number of private label producers.

(74) On an EEA-wide market, the Parties estimate their combined market share to be around [20-30]% with Nestlé and R&R respectively having circa [10-20]% and circa [5-10]%. Their combined market share in the Take-Home market at the EEA level would approximately be [10-20]%, with Nestlé and R&R respectively having circa [5-10]% and circa [10-20]% market shares. For the Impulse and Catering markets, the Parties have very limited visibility of their respective positions at the EEA level, given that those figures are not systematically recorded by third-parties. In any event, the Parties believe that for the Out-of-Home channel (i.e. Impulse and Catering) R&R accounts for a limited increment of less than [0-5]%, as outside of the U.K. R&R has a very limited presence in this channel across the EEA.66

5.2.Elements common to the assessment of the EEA ice cream markets

(75) The Commission has considered several elements, which are relevant for the assessment of the effects of the Transaction across the EEA countries. These elements include how the Parties negotiate commercial terms with customers (Section 5.2.1), closeness of competition between the Parties (Section 5.2.2), and the barriers to entry or expansion (Section 5.2.3).

5.2.1.Negotiation with customers

(76) According to the Horizontal Merger Guidelines, ‘the Commission considers, when relevant, to what extent customers will be in a position to counter the increase in market power that a merger would otherwise be likely to create. Countervailing buyer power in this context should be understood as the bargaining strength that the buyer has vis-à-vis the seller in commercial negotiations due to its size, its commercial significance to the seller and its ability to switch to alternative suppliers.67

(77) Respondents to the market investigation indicate that negotiations and distribution agreements between suppliers and retailers are conducted in different ways, namely through tender procedures, bilateral negotiations or request for quotations. Suppliers are selected on the basis of the (i) quality of the product, (ii) production capacity of the supplier, and (iii) price. While suppliers conclude annual framework agreements setting the general terms and conditions of their relationship with their customer, prices are negotiated separately and subject to changes during the year being influenced by the price of the raw material. The agreement will typically be national in scope and its duration may vary between 1 to 5 years.68

(78) The rebate/bonus/discount/incentive systems represent also an important element in the negotiations between suppliers and retailers, notably for Take-Home branded ice cream products. Suppliers use them to incentivise retailers to list, promote and market their products. Respondents to the market investigations indicate that rebate/bonus/discount/incentive schemes may include performance rebates based on value and volume targets or promotional rebates linked to shelf-space allocation and visibility.69

(79) As regards countervailing buyer power,70 retailers have the possibility to delist certain products, should a manufacturer decide to increase its price […]. Similarly, in 2016 […].71

(80) […] notably in [an EEA Member State] by retailers such as […] and others, when their cost or relative performance did not satisfy the customer.72 Moreover, for private label ice cream, retailers usually enter into contracts with more than one manufacturer; they can therefore also adjust the volume of their purchases from each supplier. Retailers may also decide to start their own production facilities should prices significantly increase. Certain retailers, such as Thiriet and Intermarché, are already vertically integrated, producing their own private label ice cream in France. Also, Lidl is constructing its own ice cream factory in Germany, scheduled to begin operation in 2017.73

(81) Among respondents to the market investigation, a majority of competitors acknowledge the power of retailers, notably due to the concentrated retail structures, the availability of a broad range of ice cream products, the customers' ability to easily switch between suppliers and the consumers' limited brand loyalty.74 Conversely, the majority of customers indicate that they do not enjoy significant buyer power. In particular when faced with important brands, which are requested by customers, retailers' countervailing power appears more limited.75

(82) As a result, although large retailers may have some degree of buyer power, it has not been demonstrated to a sufficient degree that retailers would have the ability to exercise significant buyer power to counter potential price increases.

(83) Moreover, the Transaction would not significantly impact the negotiating power currently held by Parties vis-à-vis their customers.

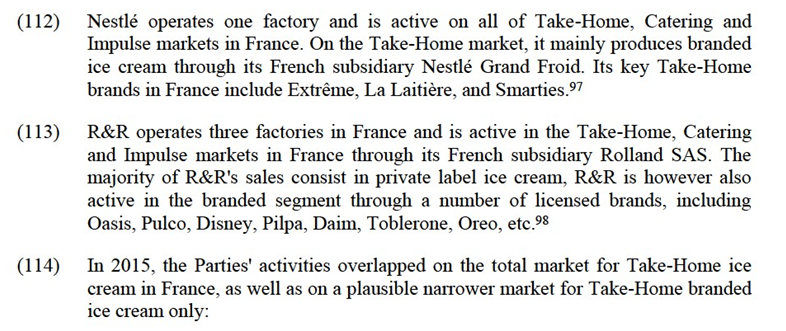

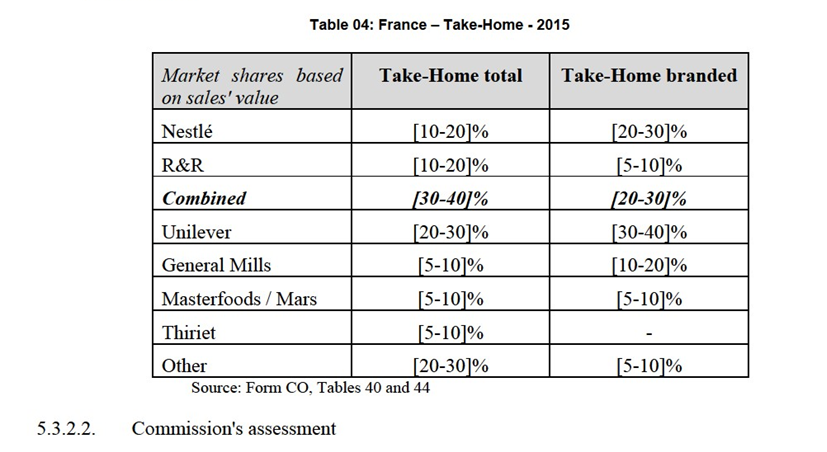

(84) With regard to the purchase of branded and private label ice creams in the Take- Home market, the majority of customers and competitors indicate that negotiations with suppliers are conducted separately and through different procedures: while negotiations for branded products are generally conducted directly with the supplier and across its entire portfolio, sales negotiations for private label are typically carried out through tenders.76

(85) Moreover, it appears unlikely that the Transaction will have an impact on the way customers negotiate the purchase of branded and private label ice cream products.

(86) First, the terms and conditions, which apply to the purchase and supply of branded and private label products are significantly different. In the case of branded products, the negotiations focus on the assortment of products to be purchased, prices, marketing activities, etc. Conversely, in the case of private label ice cream,retailers issue calls for tenders, in view of determining the type, ingredients and format of the ice cream produced.77

(87) Second, in many instances manufacturers negotiate with different entities. In the case of branded ice cream, negotiations are often conducted with alliances of retailers. In the case of private label products, retailers issue calls for tender and enter into direct discussions with manufacturers, in view of determining the type, ingredients and format of the ice cream produced.78

(88) Third, the majority of respondents to the market investigation also submit that it is unlikely that the current negotiation process for branded and private label ice cream will be materially affected post Transaction.79

(89) Fourth, even though R&R has a strong presence in the private label segment, as well as a portfolio of licensed brands, some of which widely known, it currently does not negotiate jointly its sales of branded and private label ice cream products.

(90) In light of these considerations and as it will remain confronted with different negotiating parties and negotiation processes, Froneri would most likely not be in a position of negotiating the supply of branded and private label ice cream jointly.

(91) Therefore, considering all evidence available to the Commission, even if Froneri combined Nestlé's brands with R&R's position in the private label segment, this is not likely to significantly increase its negotiating power in Take-Home markets. Subsequently, any countervailing buying power of the Parties' customers is not likely to be materially affected by the Transaction.

5.2.2.Closeness of competition

(92) According to the Horizontal Merger Guidelines, a merger between close competitors is more likely to have anticompetitive effects and lead to a significant increase in price. The higher the degree of substitutability between the merging firms' products, the more likely it is that the merging firms will raise prices significantly. The purpose of assessing the closeness of competition between the Parties is therefore to determine whether they currently exert a significant competitive constraint on each other which would be removed post-Transaction and whether other suppliers would be able to sufficiently constrain the Merged Entity.80

(93) As explained in Section 4.1.1 above, the industrial ice cream market comprises differentiated products. It is therefore relevant to assess whether Nestlé's and R&R's products are close substitutes.

(94) The Parties do not see each other as close competitors within the EEA, notably as they are active in different segments of the ice cream market: while Nestlé’s focus is on branded ice-creams, R&R specialises more on private label ice creams and only offers some licensed branded products.81

(95) The majority of respondents to the market investigation confirms that the Parties are not close competitors and that the activities of Nestlé and R&R are rather complementary.82

(96) The Commission considers that Nestlé competes more closely with Unilever, rather than with R&R, as they both offer similar ice cream products. In this respect, when asked to identify the closest competitor to Nestlé with regards to the ice cream market in the EEA, the majority of the respondents points to Unilever. R&R is not mentioned in any of the affected markets.83

(97) Unilever is identified as the closest competitor to R&R by the majority of respondents to the market investigation, followed by Nestlé, Ysco and other private label suppliers; DMK, les Délices du Valplessis, and General Mills are also mentioned by some respondents.84

(98) The Commission further notes that internal documents submitted by the Parties also confirm the views of the majority of market participants, notably that Nestlé's and R&R's products are not close substitutes. They refer to Unilever as the market leader in the ice cream market in the EEA and to the opportunity for the Parties, through the creation of Froneri, to combine their complementary activities and become a compelling alternative. In particular, they "believe that a partnership between Nestlé and R&R would create a very strong number 2 in the European ice- cream market behind Unilever with the scale to compete effectively […] combining complimentary brand portfolios with private label scale efficiencies".85

(99) In light of the above, and considering all evidence available to it, the Commission concludes that the Parties brands in the EEA are not closely competing with each other.

5.2.3.Barriers to entry or expansion

(100) When entering a market is sufficiently easy, a merger is unlikely to pose any significant anti-competitive risk. For entry to be considered a sufficient competitive constraint on the merging parties however, it must be shown to be likely, timely and sufficient to deter or defeat any potential anti-competitive effects of the merger.86 As some mergers could significantly impede competition by enabling the merged entity to make the expansion of smaller firms and potential competitors more difficult, the impact of the Transaction on the Parties' competitors' ability to enter or expand will be assessed.87

(101) The Parties put forward that there are no significant barriers to entry for a new ice cream manufacturer. Other than the initial costs of a plant, a new player would be able to readily enter the market through private label sales or local boutique sales to smaller retailers.88

(102) The entry of new players in a market as well as the expansion of existing ones acts as a competitive constraint on the merged entity. However, for entry to be considered a sufficient competitive constraint on the merging parties, it must be shown that entry is likely, timely and sufficient to deter or defeat any potential anti- competitive effects of the merger.89

(103) A majority of respondents to the market investigations indicate that, in general, barriers to enter in the ice cream market seem to be not insignificant, notably when referred to entry with branded products. Critical factors for success in the ice cream sector, as identified by some competitors and customers, include having a well- known brand, financial strength to sustain investments and effective marketing strategy as well as brand awareness for suppliers to have access to retail shelf space.90

(104) Some respondents to the market investigation also indicate that entry with private label products, while significantly easier than with branded products, still requires high investments, notably in relation to setting up production facilities capable of producing large amounts on short notice.91

(105) There are however examples of recent market entry in the ice cream market, including Lidl (a German retailer which will start its own ice cream plant in 2017), Bruno Gelato (an artisanal ice cream manufacturer, which expanded into the industrial Take-Home market in Germany) as well as other players entering in France, Italy and Bulgaria.92

(106) Similarly, respondents to the market investigation also consider that barriers to expansion are lower than barriers to entry given and that suppliers will likely be able to use their existing manufacturing facilities and distribution system. In this respect, the market investigation also revealed that a number of expansion projects would take place in the EEA in the coming 2–3 years by competitors including in the affected markets such as Bulgaria, Germany, Italy and France.93

Conclusion

(107) Considering all evidence available to it, the Commission notes that a number of entries in the cream market occurred in the EEA over the past years. This indicates that, while barriers to entry and expansion in the ice cream market may be relatively high, it remains attractive for potential and expanding players. As a result, entry is still likely, as confirmed by the market investigation, and potential entrants and expanding players are likely to exercise a competitive constraint on the JV post-merger.

5.3.Market-specific analysis

5.3.1.Affected markets (description of the Parties' overlaps and identification of affected markets)

(108) According to the Horizontal Merger Guidelines, "the larger the market share, the more likely a firm is to possess market power. And the larger the addition of market share, the more likely it is that a merger will lead to a significant increase in market power... Although market shares and additions of market shares only provide first indications of market power and increases in market power, they are normally important factors in the assessment."94

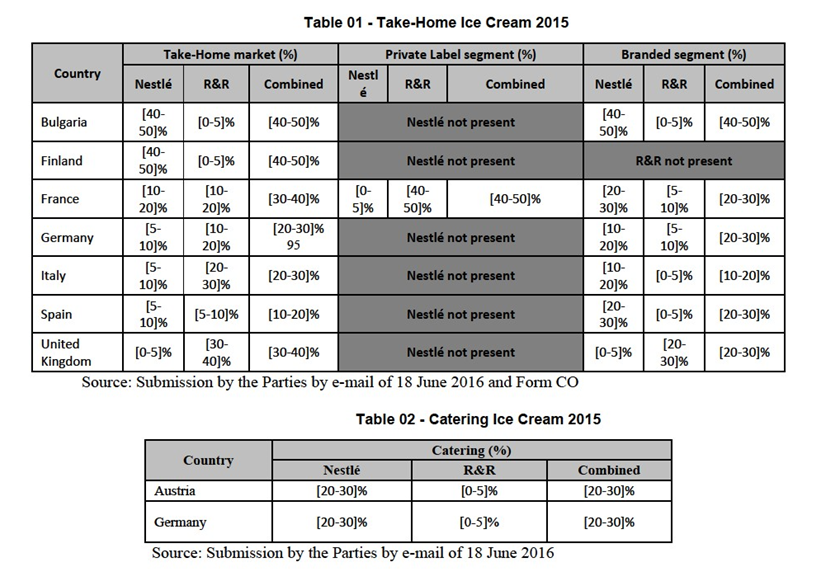

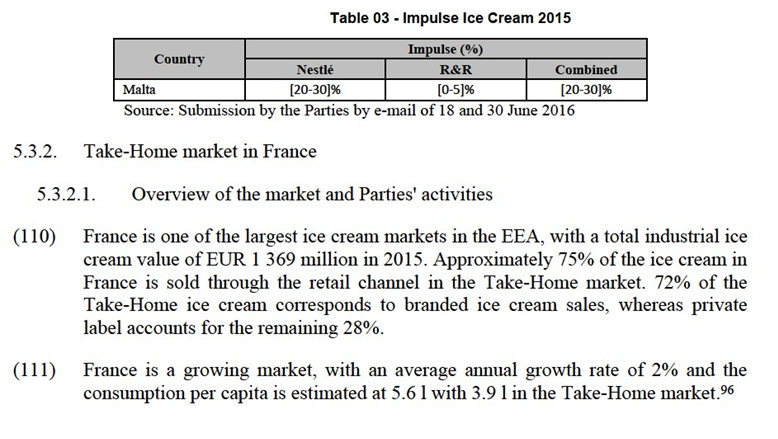

(109) Tables 01,02, and 03 below provide an overview of the Parties' individual and combined shares in the affected markets:

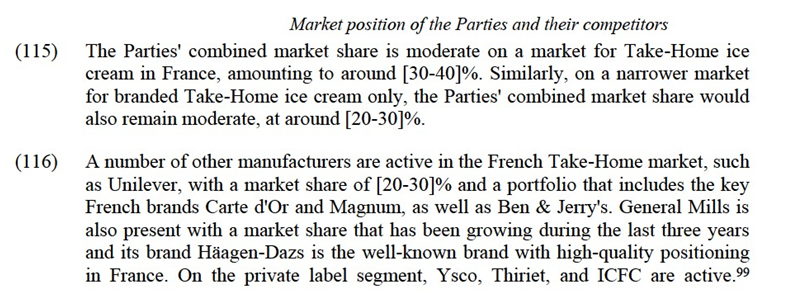

These competitors will continue to constrain Froneri to a significant extent post- Transaction.

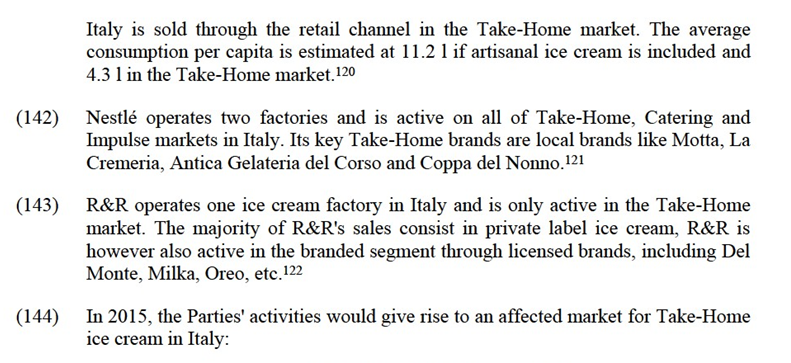

(117) On a narrower market for branded Take-Home ice cream only, Froneri will be significantly constrained by the same main players, namely the market leader, Unilever, Häagen-Dazs and Masterfoods/Mars.

Brands in the French Take-Home market

(118) According to a market study, when comparing the awareness of various ice cream brands among French customers, […].100

(119) The majority of respondents to the market investigation, which are active in France and expressed an opinion, submit that there are "must-have" brands in the French Take-Home market, such as Unilever's Magnum and Cornetto. Nestlé's brands and General Mills' Häagen Dazs were also referenced as "must have" by a number of respondents.101

(120) Large competitors active in France that responded to the market investigation, however, specify that "Some brands or products may be more important, or 'core' compared to others. But retailers and other distributors are able to sell ice cream without necessarily including any specific brands in their portfolio. In fact, there is no single ice cream brand that would be sold in all points of sale" and that "retailers will be keen to stock at least a limited range of the market's stronger selling brands in order to attract customers to the ice cream freezer. While they are not all necessary "must-have" brands, the more popular brands include Magnum, Häagen Dazs, Extrême, Ben & Jerry's, Cornetto, Pirulo, Smarties, Oasis, Mars and Snickers."102

(121) Moreover, final consumers do not have to bear any switching costs and it is estimated that approximately 30% of them regularly switch between brands in the French Take-Home market.103 Also, on average [30-40]% of Nestlé's, R&R's, Unilever's and General Mills products are promoted throughout the year and there is a correlation between the promotions run and the volumes sold by each manufacturer; consumers therefore appear to be quite price-sensitive and willing to switch among brands in case of promotions.104

(122) Respondents to the market investigation, which are active in France and expressed an opinion, were split between those considering that consumers have a medium degree of brand loyalty in the French Take-Home market and those considering that the degree of brand loyalty is high. Several of the latter, however, specify that only certain products, notably those considered "must-have" enjoy a high degree of brand loyalty.105

(123) In light of the above, it can be concluded that, even though certain brands may be well known in the French Take-Home market, this is not necessarily determinative of consumers' choice. Moreover, as R&R's brands are not among the best-known, their addition to the brands of Nestlé would not lead to Froneri enjoying a significantly stronger brand positioning in the French Take-Home market.

Closeness of competition

(124) As already indicated in Section 4.1.2.1 above, Nestlé is only active on the branded segment of the French Take-Home market, where it competes more closely with Unilever, General Mills and Masterfoods/Mars.

(125) Conversely, R&R derives [70-80]% of its revenues in France through the private label segment, whereas on the branded segment, it is only active through ice cream sold under licensed brands, on the basis of licensing agreements concluded with Mondelez, Disney, Oasis, Del Monte and others;106 its market position in branded is therefore dependent on the continuation of such licensing agreements. R&R competes thus primarily with other private label manufacturers, such as Ysco or ICFC.

(126) The majority of respondents to the market investigation, which are active in France and expressed an opinion, indicate that Nestlé's closest competitor on the French Take-Home market is Unilever, followed by R&R. General Mills, Masterfoods/Mars, Ysco, as well as private label suppliers more broadly are also mentioned by some of the respondents.107

(127) Similarly, Unilever is identified as the closest competitor to R&R by the majority of respondents to the market investigation, followed by Nestlé, Ysco and other private label suppliers referenced collectively; les Délices du Valplessis, ICFC,DMK and General Mills, are also referenced by some respondents.108

(128) The Parties are therefore not close competitors in the Take-Home market in France.

(129) The same conclusion would apply also on a narrower market for branded Take- Home ice cream, as Nestlé's closest competitor would be Unilever, followed by General Mills and Masterfoods/Mars. On that market, R&R would only be present through licensed brands. Such licenses may however be revoked by the licensor, internalised or transferred to another ice cream manufacturer, if [certain commercial targets] are not met. Therefore, R&R's ability to compete with Nestlé in the French branded Take-Home market depends on the continuation of its licensing contracts.109

Entry and expansion

(130) Following the analysis in Section 5.2.3 above, even if there are some barriers to entry or expansion in ice cream markets, new manufacturers have recently entered the French Take-Home market. Thiriet, a French freezer centre has started commercialising its private label ice creams in Monoprix' points of sale.110 Other providers, such as the Spanish ICFC which is active in both the private label and the branded segment, continuously strive to strengthen their position in the French market.111

(131) In the private label segment, retailers active in the French market have already or are considering starting to produce their own ice cream.112 Moreover, a number of private label manufacturers active in other EEA markets indicated during the market investigation that they intend to expand their activities with –among others- a focus on the French Take-Home market.113

(132) Respondents to the market investigation, which are active in France and expressed an opinion, also indicate that entry into the French Take-Home market would be rather difficult, whereas the expansion of an already active manufacturer would be significantly easier.114 Moreover, all competitors responding to the market investigation submit that if there were an increase in demand, they would be able to increase their deliveries in France in the short term, i.e. within one or two years.115

(133) Some respondents to the market investigation, which are active in France and expressed an opinion, indicate that the Transaction would increase the existing barriers to entry, notably due to Froneri's increased know-how in both the branded and private label segment and the breadth of its product portfolio. Other respondents, however, indicate that the Transaction could thus bring about more innovation in the sector or that entry and expansion decisions are taken independently of the other competitors.116

(134) Therefore, should Froneri significantly increase prices post-Transaction in the French Take-Home, other manufacturers active in the branded and the private label segments would be in the position of expanding their activities into that market in order to compete.

Other aspects

(135) In France, retailers negotiate purchasing conditions for branded ice cream on an annual basis, through a process regulated by the French Commercial Code. For private label however, retailers usually select their supplier through tenders, following which they enter into annual or biannual contracts.117

(136) The limitations imposed by the French legal framework regarding the purchase of branded ice cream confirm the conclusion of Section 5.2.1 above, namely that negotiations for private label and for branded Take-Home ice cream are conducted separately and that Froneri will not have significantly greater negotiating power than each of Nestlé and R&R have today.

(137) Moreover, the majority of respondents to the market investigation, which are active in France and expressed an opinion, indicate that they consider that there will be sufficient competition to prevent Froneri from raising prices post-Transaction in the French Take-Home market; no respondent indicates that the situation would be different in the French branded Take-Home market.118

(138) As to the likely impact of the Transaction on the French Take-Home market, the majority of respondents, which are active in France and expressed an opinion, submit that it will be neutral. No respondent indicates that the impact of the Transaction would be different on the French branded Take-Home market.119

5.3.2.3.Conclusion

(139) Overall, the Commission considers that the moderate combined market shares of the Parties, the presence of strong competitors, the fact that the Parties are not close competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, support the conclusion that the Transaction would not lead to any significant competition concerns in the markets for Take-Home ice cream and for Take-Home branded ice cream in France.

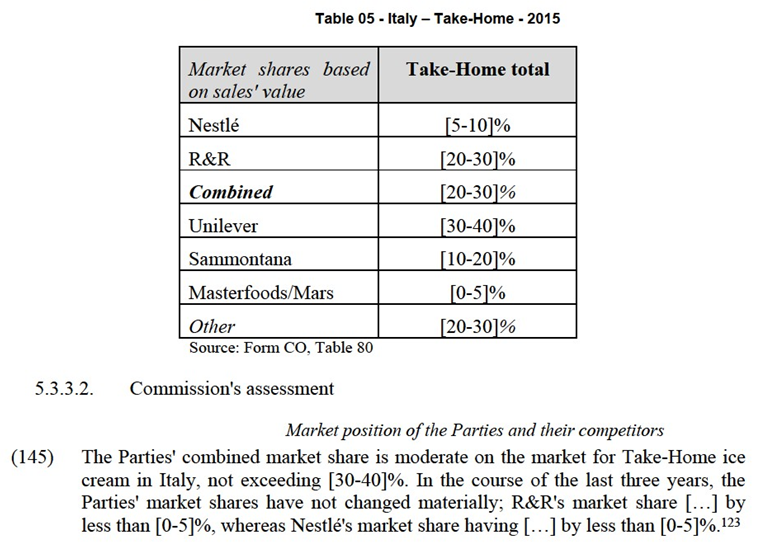

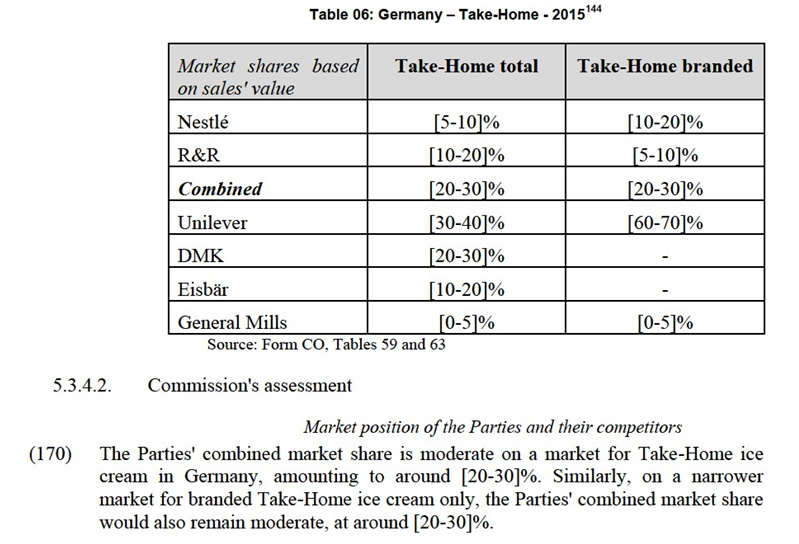

(140) In view of the above, and considering all evidence available to the Commission, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take-Home ice cream in France, under any plausible segmentation.

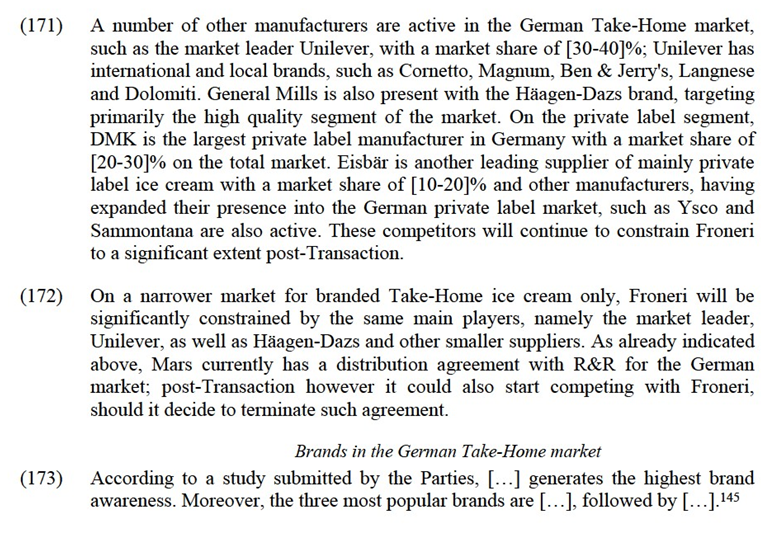

5.3.3.Take-Home market in Italy

5.3.3.1 Overview of the market and Parties' activities

(141) Italy is one of the largest ice cream markets in the EEA, with a total industrial ice cream value of EUR 1 776 million in 2015. Approximately 55% of the ice cream in

(146) A number of other ice cream manufacturers are active in the Italian Take-Home market. Unilever (in particular with its Algida brand) is the market leader with a share of [30-40]%. The Italian manufacturer Sammontana is also active with branded products. On the private label segment, ICFC, Sammontana and Eisbär are active.124 These competitors will continue to constrain Froneri to a significant extent post-Transaction.

Brands in the Italian Take-Home market

(147) Even though broadly known, the Parties consider that Nestlé’s brands would attract lower repurchase and loyalty rates than Unilever's Algida in the Italian market.125 Similarly, R&R’s licensed brands (Milka, Oreo, Toblerone, Philadelphia, Daim, Del Monte and Fruitini) would have lower loyalty rates as R&R’s branded presence in Italy is limited.

(148) The majority of respondents to the market investigation, which are active in Italy and expressed an opinion, submit that there are "must-have" brands in the Italian Take-Home market, notably of Unilever, such as the Cornetto and Magnum brands,Nestlé, such as the Maxibon and the Coppa del nonno brands, and Sammontana.126

(149) Moreover, final consumers can easily switch and a marketing study provided by the Parties indicates that [20-30]% of them switch to other brands when promotions are run; it is also estimated that [40-50]% of the customers in Italy visit the promotions aisle before going to the standard ice cream aisle.127 Promotions correspond to [50-60]% of Nestlé's volumes. Such promotions consist mainly of price reductions, which are usually around [30-40]% of the end price.128

(150) R&R's branded presence in the Italian Take-Home market is small (with a market share of [0-5]% in 2015); discounting is carried out on an ad hoc basis to encourage the take-up of a particular product.129

(151) The majority of respondents to the market investigation, which are active in Italy and expressed an opinion, indicate that consumers have a medium degree of brand loyalty in the Italian Take-Home market.130

(152) In light of the above, it can be concluded that, even though certain brands may be well known in the Italian Take-Home market, this is not necessarily determinative of consumers' choice. Moreover, as R&R's presence in the branded ice-cream market is very limited, their addition to the brands of Nestlé would not lead to Froneri enjoying a significantly stronger brand positioning in the Italian Take- Home market.

Closeness of competition

(153) Nestlé is only active on the branded segment of the Italian Take-Home market, where it competes more closely with Unilever, Sammontana and Masterfoods/Mars. Conversely, R&R has a very limited presence in the branded segment and competes instead with numerous other suppliers, such as Ysco and ICFC in the private label segment of the Take-Home market.131

(154) The majority of respondents to the market investigation, which are active in Italy and who expressed an opinion, indicate that Nestlé's closest competitor on the Italian Take-Home market is Unilever, followed by Sammontana. R&R and other private label manufacturers more generally are mentioned subsequently as somewhat more distant competitors.132

(155) Similarly, Unilever is identified as the closest competitor to R&R by the majority of respondents to the market investigation, followed by Sammontana. Nestlé and other private label manufacturers more generally are mentioned subsequently as somewhat more distant competitors.133

(156) The Parties are therefore not close competitors on the Take-Home market in Italy.

Entry and expansion

(157) Following the analysis in Section 5.2.3 above, even if there are some barriers to entry or expansion in ice cream markets, new manufacturers have recently entered or expanded their activities in the Italian Take-Home market. Granarolo, an Italian milk production chain has entered the Italian branded Take-Home segment in 2012. Moreover, a private label manufacturer active in other EEA markets indicated its intention to expand its activities with –among others– a focus on the Italian Take-Home market.134

(158) A majority of respondents to the market investigation, which are active in Italy and who expressed an opinion, indicate that entry into the Italian Take-Home market would be rather difficult, whereas the expansion of an already active manufacturer would be significantly easier.135 Moreover, all competitors responding to the market investigation submit that if there were an increase in demand, they would be able to increase their deliveries in Italy in the short term, i.e. within one or two years.136

(159) Therefore, should Froneri significantly increase prices post-Transaction in the […]*Take-Home, other manufacturers active in the branded and the private label segments would be in the position of expanding their activities into that market in order to compete.

Other aspects

(160) Take-Home ice cream products in Italy are typically sold to supermarkets, hypermarkets, convenient stores and discounters, which all have low switching costs. Moreover, retailers multisource their supplies from two or three manufacturers.137

(161) As R&R's activity in the Italian branded Take-Home market is limited and negotiations for private label and for branded Take-Home ice cream are conducted separately, Froneri will not have significantly greater negotiating power than each of Nestlé and R&R have today. The majority of the customers responding to the market investigation also indicate that they expect the negotiations on the purchase of branded and private label ice creams by Froneri will be conducted separately.138

(162) The majority of respondents to the market investigation, which are active in Italy and expressed an opinion, indicate that they consider that there will be sufficient competition to prevent Froneri from raising prices post-Transaction in the Italian Take-Home market.139

(163) As to the likely impact of the Transaction on the Italian Take-Home market, the majority of respondents, which are active in Italy and expressed an opinion, submit that it will be neutral.140

5.3.3.3.Conclusion

(164) Overall, the Commission considers that the moderate combined market shares of the Parties, the presence of strong competitors, the fact that the Parties are not close competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, support the conclusion that the Transaction would not lead to any significant competition concerns in the market for Take-Home ice cream in Italy.

(165) In view of the above, and considering all evidence available to the Commission, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take-Home ice cream in Italy, under any plausible segmentation.

5.3.4.Take-Home market in Germany

5.3.4.1.Parties' activities

(166) Germany is the largest ice cream market in the EEA, with a total value of approximately EUR 2 billion generated through the sale of industrial ice cream and EUR 1 billion for artisanal ice cream. In addition, there is an overall yearly growth of 2%. About 70% of the total industrial ice cream is sold through the retail channel in the Take-Home market and approximately 50% thereof corresponds to sales of private label ice cream.141

(167) Nestlé operates one factory in Germany, where it produces [70-80]% of the ice cream sold in Germany. It is active in all of the Take-Home, Impulse and Catering. Key Take-Home brands include Mövenpick, Nestlé Schöller, Himbi, Macao, Big Sandwich, Cactus and Bum Bum.142

(168) R&R operates one factory in Germany and generates the majority of its revenues through the sale of private label ice cream to large retailers such as [three retailers]. R&R's presence in the branded segment is limited to licensed brands, such as Milka, Oreo, Toblerone, Landliebe, Botterbloom. R&R also has a distribution agreement with Mars for the distribution of some of Mars' ice cream products to retailers; these sales however correspond to less than 1% of the total Take-Home market and less than 2% of the branded Take-Home market.143

(169) In 2015, the Parties' activities overlapped on the total market for Take-Home ice cream in Germany, as well as on a plausible narrower market for Take-Home branded ice cream only:

(174) The majority of respondents to the market investigation, which are active in Germany and expressed an opinion, submit that there are "must-have" brands in the German Take-Home market, notably from the portfolios of Unilever and Nestlé.146

(175) Final consumers do not have to bear any switching costs and are rather price- sensitive in the German Take-Home market. On average 22% of all ice cream in the Take-Home market is sold through promotions; Nestlé and Unilever being particularly aggressive in this regard, as [60-70]% and [50-60]% of their respective bulk sales and [20-30]% and [40-50]% of their multipacks sales are made through promotions. R&R also offers promotions in [20-30]% of its total bulk and [10- 20]% of its multipacks sales.147

(176) The majority of respondents to the market investigation, which are active in Germany and expressed an opinion, indicate that consumers have a medium degree of brand loyalty in the German Take-Home market.148

(177) In light of the above, it can be concluded that, even though certain brands may be well known in the German Take-Home market, this is not necessarily determinative of consumers' choice. Moreover, as R&R's brands are not among the most well-known, their addition to the brands of Nestlé would not lead to Froneri enjoying a significantly stronger brand positioning in the German Take-Home market.

Closeness of competition

(178) Nestlé is only active on the branded segment of the German Take-Home market, where it competes more closely with Unilever and General Mills.

(179) Conversely, R&R derives [70-80]% of its revenues in Germany through the private label segment, whereas on the branded segment, it is only active through ice cream sold under licensed brands, on the basis of licensing agreements concluded with Mondelez, Landliebe, Oasis, Del Monte and others;149 its market position in branded is therefore dependent on the continuation of such licensing agreements. R&R competes thus primarily with other private label manufacturers, such as DMK and Eisbär.

(180) The majority of respondents to the market investigation, which are active in Germany and expressed an opinion, indicate that Nestlé's closest competitor on the German Take-Home market is Unilever, followed by notably R&R, as well as other private label manufacturers. General Mills is also mentioned as somewhat less close competitor.150

(181) Similarly, Unilever is identified as the closest competitor of R&R by the majority of respondents to the market investigation, closely followed by DMK and other private label manufacturers. Nestlé is mentioned subsequently as somewhat less close competitor.151

(182) The Parties are therefore not close competitors on the Take-Home market in Germany.

(183) The same conclusion would apply also on a narrower market for branded Take- Home ice cream, as Nestlé's closest competitor would again be Unilever, followed by R&R and General Mills. On that market, R&R would only be present through licensed brands, which may be revoked by the licensor, internalised or transferred to another ice cream manufacturer, if [certain commercial targets] are not met. Therefore, R&R's ability to compete with Nestlé in the German branded Take- Home market depends on the continuation of its licensing contracts.

Entry and expansion

(184) Following the analysis in Section 5.2.3 above, even if there are some barriers to entry or expansion in ice cream markets, new manufacturers have recently entered the German Take-Home market. The Italian manufacturer Sammontana has launched new products in the last two years in both branded and private label products in the Take-Home market. Bruno Gelato is also an example of a smaller boutique branded competitor that has in 2013 expanded its activity by supplying branded ice cream products to supermarkets. Gelato Classico, a private label manufacturer has also recently started producing branded ice cream under the newly created "Belnatura" brand. In the private label sector, Lidl is in the process of creating a new ice cream plant, which will start operation in 2017.152

(185) Respondents to the market investigation, which are active in Germany and expressed an opinion, indicate that entry into the German Take-Home market would be rather difficult, whereas the expansion of an already active manufacturer would be significantly easier.153 Some respondents to the market investigation indicate that the Transaction would increase the existing barriers to entry, notably due to Froneri's portfolio breadth.154

(186) However, all competitors responding to the market investigation submit that if there were an increase in demand, they would be able to increase their deliveries in Germany in the short term, i.e. within one or two years.155 Moreover, respondents point out that there is sufficient manufacturing capacity in the German market, expected to increase even further, when the Lidl facility becomes operational.156

(187) Therefore, should Froneri significantly increase prices post-Transaction in the German Take-Home, other manufacturers active in the branded and the private label segments would be in the position of expanding their activities into that market in order to compete.157

Other aspects

(188) Take-Home ice cream products in Germany are typically sold to supermarkets, hypermarkets and discounters. Retailers negotiate purchasing conditions for branded ice cream on an annual basis. For private label however, retailers usually select their supplier through tenders, following which they enter into annual or biannual contracts. Retailers multisource their supplies from several manufacturers and have low switching costs.158

(189) As negotiations for private label and for branded Take-Home ice cream are conducted separately, Froneri will not have significantly greater negotiating power than each of Nestlé and R&R have today. The majority of the customers responding to the market investigation also indicate that they expect the negotiations on the purchase of branded and private label ice creams by Froneri will be conducted separately.159

(190) Moreover, the majority of respondents to the market investigation, which are active in Germany and expressed an opinion, indicate that they consider that there will be sufficient competition to prevent Froneri from raising prices post-Transaction in the German Take-Home market; no respondent indicates that the situation would be different in the German branded Take-Home market.160

(191) As to the likely impact of the Transaction on the German Take-Home market, the majority of respondents, which are active in Germany and expressed an opinion, submit that it will be neutral. No respondent indicates that the impact of the Transaction would be different on the German branded Take-Home market.161

5.3.4.3. Conclusion

(192) Overall, the Commission considers that the moderate combined market shares of the Parties, the presence of strong competitors, the fact that the Parties are not close competitors, and the fact that a majority of market participants considers that there would be sufficient competitive pressure post-Transaction, support the conclusion that the Transaction would not lead to any significant competition concerns in the markets for Take-Home ice cream and for Take-Home branded ice cream in Germany.

(193) In view of the above, and considering all evidence available to the Commission, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take-Home ice cream in Germany, under any plausible segmentation.

5.3.5.Take-Home market in Bulgaria

5.3.5.1. Parties' activities

(194) Both the markets for Take-Home ice cream and for Take-Home branded ice-cream are affected, with Parties combined market shares of respectively [40-50]% and [40-50]% in 2015.

(195) The increments brought about by the Transaction are for each market at most [0- 5]%.

5.3.5.2. Commission's assessment

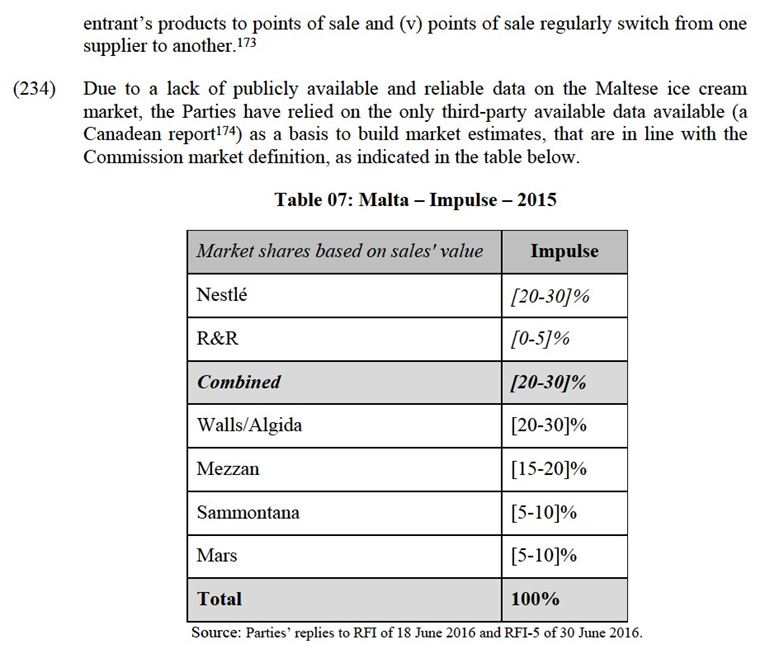

(196) Multiple competitors remain such as Unilever, with a market share of [20-30]%, Izida, with a market share of [10-20]% and Deni, with a market share of [0-5]%.

(197) The increments brought upon by the Transaction in the markets for Take-Home ice cream and for Take-Home branded ice cream in Bulgaria would be very limited, so that there would be no material Transaction-specific effect in these markets.

(198) Customers and competitors did not raise any concerns during the market investigation with respect to the market for Take-Home ice cream and for Take- Home branded ice cream in Bulgaria.

5.3.5.3.Conclusion

(199) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take- Home in Bulgaria, under any plausible segmentation.

5.3.6.Take-Home market in Finland

5.3.6.1. Parties' activities

(200) While Nestlé is not present in the private label segment, R&R is not present in the Take-Home branded ice-cream segment in Finland. The only affected market in Finland is the market for Take-Home ice cream, where the combined market share of the Parties reached [40-50]% in 2015.

5.3.6.2.Commission's assessment

(201) The increment brought about by the Transaction is only [0-5]% due to R&R's limited presence in Finland. Moreover, multiple competitors remain such as Unilever, Kesko, SOK and Kolme Kaveria.

(202) The increment brought upon by the Transaction in the market for Take-Home ice cream in Finland would be very limited, so that so that there would be no material Transaction-specific effect in this market.

(203) Customers and competitors did not raise any concerns during the market investigation with respect to the market for Take-Home in Finland. 162

5.3.6.3. Conclusion

(204) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take- Home in Finland, under any plausible segmentation.

5.3.7. Take-Home market in Spain

5.3.7.1. Parties' activities

(205) […]. The only affected market in Spain is the market for Take-Home branded ice cream, where the combined market share of the Parties reached [20-30]% in 2015, with an increment brought about by the Transaction of only [0-5]%.

5.3.7.2. Commission's assessment

(206) Strong competitors remain such as Unilever's Frigo, with a market share of [50- 60]% and General Mills' Häagen Dazs, with a market share of [10-20]%.

(207) Moreover, the increment brought about by the Transaction in the market for Take- Home branded ice cream in Spain would be very limited, so that so that there would be no material Transaction-specific effect in this market.

(208) Finally, customers and competitors did not raise any concerns during the market investigation with respect to the market for Take-Home branded ice cream in Spain. 163

5.3.7.3. Conclusion

(209) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the market for Take- Home branded in Spain.

5.3.8. Take-Home market in the UK

5.3.8.1.Parties' activities

(210) Nestlé is not present in the private label segment in the UK and only to a minor extent in the Take-Home branded segment.

(211) Both the markets for Take-Home ice cream and for Take-Home branded ice-cream are affected, with Parties combined market shares of respectively [30-40]% and [20-30]% in 2015.

(212) The increments brought about by the Transaction are for each market below [0- 5]%.

5.3.8.2. Commission's assessment

(213) The Parties' combined market shares in the Take-Home ice cream and Take-Home branded ice cream markets remain moderate.

(214) Multiple competitors remain both in the markets for Take-Home and Take-Home branded such as Unilever (market shares are Take-Home: [40-50]% and Take- Home branded: [50-60]%), General Mills (Take-Home: [5-10]% and Take-Home branded: [5-10]%), and Mars (Take-Home: [0-5]% and Take-Home branded: [0- 5]%).

(215) Moreover, the increments brought upon by the Transaction in the markets for Take- Home ice cream and for Take-Home branded ice-cream in the UK would be very limited, so that so that there would be no material Transaction-specific effect in these markets.

(216) Customers and competitors did not raise any concerns during the market investigation with respect to the markets for Take-Home ice cream and Take-Home branded ice cream in the UK. 164

5.3.8.3.Conclusion

(217) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the markets for Take- Home and Take-Home branded in the UK.

5.3.9.Catering market in Germany

5.3.9.1.Parties' activities

(218) The Catering market in Germany is affected, with a combined market share of the Parties of [20-30]% in 2015, with an increment brought about by the Transaction of only [0-5]%.

5.3.9.2.Commission's assessment

(219) The Parties' combined market share in the German Catering market remains moderate.

(220) Other competitors remain such as Unilever ([10-20]%), DMK ([0-10]%) and Belgium Ice cream Group ([0-10]%)

(221) Moreover, the increment brought upon by the Transaction in the Catering market in Germany would be very limited, so that so that there would be no material Transaction-specific effect in this market.

(222) Finally, customers and competitors did not raise any concerns during the market investigation with respect to the Catering market in Germany.165

5.3.9.3.Conclusion

(223) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the Catering market in Germany.

5.3.10. Catering market in Austria

5.3.10.1.Parties' activities

(224) The Catering market in Austria is affected, with a combined market share of the Parties of [20-30]% in 2015, with an increment brought about by the Transaction of only [0-5]%.

5.3.10.2.Commission's assessment

(225) The Parties' combined market share in the Austrian Catering market remains moderate.

(226) Moreover, the increment brought upon by the Transaction in the Catering market in Austria would be very limited, so that so that there would be no material Transaction-specific effect in this market.

(227) Finally, customers and competitors did not raise any concerns during the market investigation with respect to the Catering market in Austria. 166

5.3.10.3.Conclusion

(228) The Commission thus concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of the Catering market in Austria.

5.3.11.Impulse market in Malta

5.3.11.1.Overview of the market and Parties' activities

(229) Malta is a dynamic ice cream market in the EEA, with approximately 4% growth rate in volume in 2015 and the overall ice cream consumption would be close to 4.8 litres per capita according to the Parties' estimates.167

(230) Approximately 75% of the ice cream in Malta is sold through the Out-of-Home channel, i.e. Impulse and Catering ice cream markets, due to the trading seasonality on the island as a result of tourism, while 25% is sold in the Take-Home market.168