Commission, April 4, 2017, No M.8254

EUROPEAN COMMISSION

Judgment

HP / PRINTER BUSINESS OF SAMSUNG ELECTRONICS

Subject: Case M. 8254 – HP / PRINTER BUSINESS OF SAMSUNG ELECTRONICS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 28 February 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking HP, Inc. ("HP", United States of America) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the printer business of Samsung Electronics Co., Ltd ("Samsung's Printer Business", Republic of Korea) by way of purchase of shares and assets (the "Proposed Transaction")3. HP is referred to as the "Notifying Party" and HP and Samsung's Printer Business are collectively referred to as "Parties".

1 THE PARTIES

(2) HP is a multinational technology company that manufactures and sells electronic devices, including PCs and printers. HP markets inkjet and laser printers geared towards a range of needs to consumers and businesses. HP's offerings include (a) personal computing and other access devices; (b) imaging and printer-related products and services.

(3) Samsung Electronics Co., Ltd is a multinational company that is a major supplier of consumer electronic devices (including televisions, monitors, air conditioners, refrigerators, washing machines, and printers), information technology and mobile communication systems (including mobile phones, smartphones, and tablets), and device solutions (such as semiconductors and mobile application processors).

(4) Samsung's Printer Business is a global supplier of printers and printer-related products and services for home office and business use.

2 THE OPERATION

(5) Pursuant to the master purchase agreement signed on 12 September 2016, HP will acquire sole control of the Samsung's Printer Business. Specifically, the Proposed Transaction will be carried out through an acquisition by HP of all of Samsung's direct and indirect rights, titles and interests in and to all of the issued and outstanding capital stock of a number of Samsung subsidiaries as well as other assets to be transferred, including contracts, products, permits, and IP and other rights related to Samsung's Printer Business. Upon completion of the Proposed Transaction, Samsung's Printer Business will be a wholly-owned subsidiary of HP.

(6) Therefore, the Proposed Transaction constitutes a change of control pursuant to Article 3(1)(b) of the Merger Regulation.

3 EU DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (HP: EUR 46 365 million; Samsung's Printer Business EUR […]; combined EUR […])4. Each of them has an EU-wide turnover in excess of EUR 250 million (HP: EUR […]; Samsung's Printer Business EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.

(8) The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4 RELEVANT MARKETS

4.1Relevant product markets

(9) HP and Samsung's Printer Business are both active in the supply of branded office automation equipment. While office automation equipement includes copiers,printers and fax machines, the Parties overlap only in printers (namely single function printers ("SFPs") and multi functional peripherals ("MFPs")). Furthermore, Samsung's Printer Business and HP are also active in the upstream market for supply of unbranded printers to other manufacturers.5

4.1.1 Supply of branded and unbranded office automation equipment

(10) In its previous decision Canon/Océ, the Commission concluded that the supply of unbranded office automation equipment should be distinguished from the supply of branded office automation equipment. The Commission considered that the supply of unbranded office automation equipment relates to the upstream supply market where original equipment manufacturers (OEM) sell office equipment directly to other manufacturers or wholesalers who then resell this equipment under their own brand to dealers or end customers, in competition with the original manufacturers. The supply of branded office automation equipment relates to the downstream supply of all equipment either manufactured and branded or purchased on an OEM basis and rebranded by the purchaser. This downstream supply encompasses sales of branded products, including direct sales to end-users and indirect sales through wholesale distributors or dealers.6

(11) The Notifying Party agrees with the deliniation made in Canon/Océ between the supply of (i) unbranded and (ii) branded printers.

(12) The market investigation in this case did not provide any new elements justifying a departure from Commission's previous decisions.

(13) In line with its previous decisional practice, for the purpose of this decision, the Commission considers that the supply of branded office automation equipment belongs to a separate relevant market than that of the supply of unbranded office automation equipment.

4.1.2 Large format printers and regular format printers

(14) The Commission in previous decisions distinguished the regular format printers which use A3 and A4 papers from the large format printers which function on A2 or larger papers and other supports.7

(15) The Notifying Party agrees that large format printers should be viewed as a separate market and submits that end applications in large format (printing signage and display items, computer aided design or graphic arts) are different from the ones in regular format (for use in home and office). Further, it submits that Samsung's Printer Business does not produce or sell any large format printers (A2 or larger).

(16) In line with its previous decisional practice, for the purpose of this decision, the Commission considers that the supply of large format printers should be distinguished from the supply of regular format printers.

4.1.3 Supply of regular format printers

(17) The Notifying Party submits that the relevant product market is the market for regular format printers, without a need for futher segmentation by functionality (SFPs vs MFPs), colour (mono vs colour) and speed. The Notifying Party claims that significant price and technology convergence has taken place between low, medium and high speed printers, SFPs and MFPs, and between mono and colour printers. The Notifying Party considers that parameters such as speed, colour and other functionalities are just elements of one market for regular format printers and that there are a number of supply-side considerations which make such potential segmentations irrelevant.

(18) The Notifying Party argues that from the demand side perspective, purchasers of one type of regular format printer regularly consider and switch to alternative printers from other segments in the market. The Notifying Party argues that customers view printers of different functionalities, colour or mono, or different speeds as interchangeable and that one of the reasons is that the difference of cost per page between different types of printers has progressively decreased due to technological developments and innovation in the industry. The Notifying Party claims that today the average cost per page is similar across printer types.

(19) From the supply side perspective, the Notifying Party argues that printer suppliers are able to switch production across the various segments of the regular format printers market in the short term and without incurring significant incremental costs. Finally, the Notifying Party claims that due to the commonality of assets, most of regular format printer manufacturers offer a wide range of printer models across all segments.

(20) The Commission has assessed during its investigation the various possible segmentations retained previously (SFPs vs MFPs; mono vs colour; slow, medium and fast printers) and whether a segmentation by paper size A3 vs A4 would be appropriate.

4.1.3.1 Single function vs. Multifunctional office equipment

(21) Within regular format office authomation equipment (A3/A4 paper size), the Commission found in previous decisions that a distinction could be made between single function office equipment (SFPs) and multifunctional peripherals (MFPs).8 With regard to single function devices, the Commission considered that photocopiers, printers and fax machines may constitue three distinct product markets.9 In the most recent decision Xerox/ Affiliated computer services the Commission noted that the market investigation indicated the customer needs in the printing business are rapidly evolving and, among other things, the increasing displacement of single function devices by multifunction peripherals.10 However, it ultimately left the market definition open.

(22) SFPs are products that are only able to execute one particular task, while MFPs combine at least two of the following functions: copy, scan, print and fax. The Notifying Party submits that the Parties do not supply single function fax machines. Only HP supplies single function copiers. The only single function device in which the Parties are both active is printers. The Parties both supply MFPs with a printing function.

Notifying Party's view

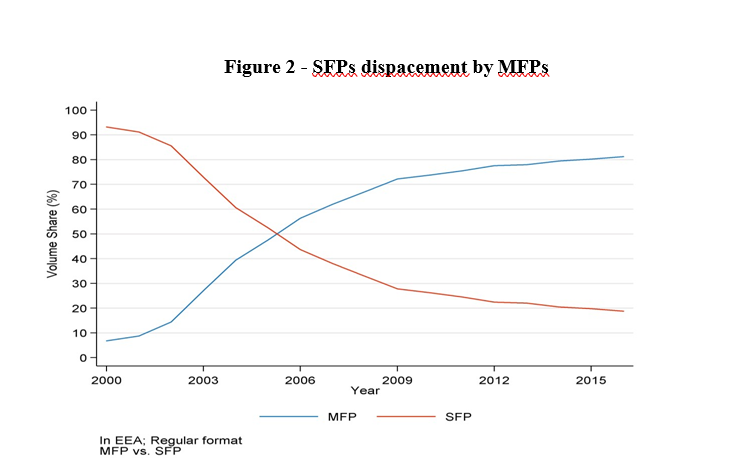

(23) The Notifying Party submits that today any segmentation between SFP and MFP printers would be without basis. The Notifying Party submits that between 2000 and 2016 SFPs have been gradually displaced by MFPs and that by 2016 the prices of MFPs and SFPs have effectively converged. The Notifying Party argues that one of the reasons for this convergence is that companies often use exactly the same engine for their SFPs and MFPs. The Notifying Party submits that according to the IDC11 market intelligence in the overall regular format printers market the ratio went from 7% vs 93% (MFPs vs SFPs) in 2000 to 81% vs 19% (MFPs vs SFPs) in 2016.

Commission's assessment

(24) Based on the results of the market investigation and the data provided by IDC, the Commission notes that, indeed, there has been a trend in the market of SFPs being displaced by MFPs and the distinction between these two types of printers appears to be losing its importance.

(25) From a demand side perspective, nearly all customers who responded to market investigation source both SFPs and MFPs, while a couple of customers source only MFPs.12 Furthermore, nearly all distributors, resellers and retailers that responded to market investigation currently distribute both SFPs and MFPs, while only a few stated that they distribute only MFPs.13 Business customers and distributors replying to market investigation confirmed that customers consider as important that the printers have additional functionalities beside printing, such as scanning.14 Some of the business customers indicated that some business processes require additional functionalities where MFPs enable the reduction of devices and leads to efficiencies.15 Furthermore, a few distributors, resellers and retailers observed a decline in SFPs with more demand being driven to MFPs as customers require greater functionality.16

(26) From a supply-side perspective, all competitors that responded to market investigation provide both SFPs and MFPs.17

(27) Based on the results of the market investigation, the Commission takes the view that the distinction between SFPs and MFPs is increasingly blurred, due in particular to the trend whereby SFPs are gradually replaced by MFPs.

(28) However, for the purpose of this decision, the exact product market definition can be left open, since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition

4.1.3.2 Mono (black & white) vs. colour regular format printers

(29) In past decisions, the Commission found that a distinction could be made between black and white and colour office automation equipment.18 In the most recent decision, the Commission also noted that the market investigation indicated that customer needs in the printing business are rapidly evolving and that there is an increasing displacement of Mono devices by Colour devices.19 As all colour devices have the capability to print in black and white, and costs of both types of devices converge, the distinction between the two is becoming increasingly blurred.20 The Commission however ultimately left the market definition open.

Notifying Party's view

(30) The Notifying Party submits that today any segmentation between Mono and Colour printers would be without basis in view of the significant technology and price convergence and the displacement of Mono by Colour printers. The Notifying Party submits that the price gap between Mono and Colour devices has reduced between 2000 and 2016 both in the overall regular format printers and in the low speed segment. In addition, the Notifying Party submits that according to IDC market intelligence colour printers represent 80% of sales of regular format printers and in the slow speed segment their proportion increased to 96% by 2016.

Commission's assessment

(31) Based on the results of the market investigation and the data provided by IDC, the Commission notes that indeed there has been a trend in the market of mono printers being gradually replaced by colour printers, in particular in the slow speed segments. As a result, the distinction between these two types of printers is losing its importance.

(32) Furthermore, from the demand side perspective, all customers that responded to market investigation currently source both colour and mono regular format printers.21 All distributors, resellers and retailers that responded to the market investigation currently distribute both colour and mono regular format printers, with exception of one who supplies only colour printers.22 Almost half of the respondents who provided meaningful response indicate that colour printers represent between 80 – 100 % of their sales of regular format printers.23 For the majority of business customers, colour printers represent an important percentage of their printers purchase (in general 30 to 50% and in some cases over 70% of their regular format printer purchases).24 The capability to use colour devices also to print in black and white is reflected in a sourcing policy of a customer which explains "New printer fleet with as low number of printers as possible is only having color printers in offices to fulfill the print policy."25

(33) The Commission also notes that from a demand side perspective the cost-per- page of mono and colour printers which used to be one of the major differences between mono and colour printers a few years ago is effectively converging, in particular in the slow printer segment as shown by Figure 1:

(34)

(35) From a supply-side perspective all competitors responding to the market investigation explained that they supply both mono and colour regular format printers.26 While the market investigation was mixed as to the question whether from a supply side perspective manufacturers could easily switch production from mono to colour printers, the Commission also notes that color printers are able to and may be used by customers to print also black and white.27

(36) For the above reasons and for the purpose of this decision, the Commission considers that the supply of mono (black and white) and of colour regular format printers belong to the same relevant product market.

4.1.3.3 Speed ranges

(37) In previous decisions, the Commission considered a further distinction into segments based on speed measured by the output of pages per minute (ppm) namely personal devices (speed up to 10 or 20 ppm for mono and up to 20 ppm for colour), office devices (speed between 11-20 and 90 ppm for mono and 20 – 50 ppm for colour) and commercial/production devices (speed over 90 ppm for mono and above 50 for colour).28 In Canon/Océ the Commission noted that due to demand and supply side substitutability the exact demarcation of the segmentation should not be applied rigidly. Customers responding to the market investigation in that case indicated that they could switch between different segments in case of a price increase, while competitors responded that an adjustment of the speed downwards would be possible, an increase however is limited to 10ppm.29 In the most recent case the Commission noted that the market investigation indicated that customer needs in the printing business are rapidly evolving which makes narrow segmentation difficult and limits its usefulness for a prospective analysis.30 The Commission ultimately left the product market definition open.

Notifying Party's views

(38) The Notifying Party submits that any segmentation based on speed would not be appropriate. The Notifying Party argues that suppliers offer various models of regular format printers that compete over a continuum of printers speeds. The Notifying Party claims that due to technological developments, speed has become a less relevant distinguishing factor. Speed is only one of the many determinants of printer prices. For a given printer speed, printer prices can vary depending on other characteristics of a model. Furthermore, it argues that the average speed of all regular format printers has increased in recent years.

(39) The Notifying Party further submits that there is no uniformly applicable industry standard for segmenting the regular format printers market in terms of speed. The Notifying Party argues that each manufacturer uses different criteria to segment their products offerings, measure performance and identify gaps vis-à-vis competitors's products. It also argues that due to technological development and evolution of the products, ranges are constantly adjusted and recalibrated.

Commission's assessment

(40) Based on the market investigation, the Commission considers that the boundaries of speed ranges of regular format printers are blurred.

(41) First, the market investigation confirmed that there is no uniform standard how different speed ranges are grouped together and no clear lines between segments based on speed. Competitors, customers, distributors, resellers and retailers have a different view of what the speed ranges are for each (slow, medium, fast) segment.31 IDC ranges represent just an indicative way for printer manufacturers to classify their printers for statistical purposes.

(42) The majority of customers, distributors, resellers and retailers indicated that printer speed is one criterion for a customer when selecting a printer, however, not among the most important ones .32

(43) Some competitors argued that an adjustment of the printer speed upwards or downwards would be possible.33 Moreover one competitor stated that it has already implemented such adjustments:"[] did it since years, first from higher to lower, then from lower to higher."34 Moreover, the majority of competitors and distributors indicated that printers can be programmed (via a software action) to print slower than originally designed.35

(44) However, for the purpose of this decision, the exact product market definition can be left open, since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.1.3.4 A3/A4 regular format printers

(45) The Commission also looked into the possible segmentation of printers by page format (that is to say, A3 printers and A4 printers), a segmentation that it had not analysed before.

The Notifying Party's views

(46) The Notifying Party argues that A3 and A4 printers are functionally interchangeable, with exception for A4 printers of not printing on A3 pages. The Notifying Party submits that A3 printers have certain features which traditionally distinguished them from A4 printers such as security, stapling/finishing, input/output tray capacity, duty cicle, service/intervention rates. However, the Notifying Party argues that there is increasing convergence between A3 and A4 printers features, particularly in terms of security features, printer speed, paper handling and finishing accessories and engine designs optimized for service based models (high duty cycle, lower intervention rate).

(47) The Notifying Party argues that interchangeability of A3 and A4 printers is particularly strong in the office environment. It argues that business customers typically operate a fleet of A3 and A4 printers and adjust their printing production by switching between the two formats. It also argues that in the context of an increasing trend for efficient fleet management and device consolidation, A3 and multiple A4 printers are viewed as substitutable. The Notifying Party also submits that there is a constant increase of A3 printer sales and decline of A4 printers which currently represent around 90% of all printers sold. It also argues that more than 90% of all pages printed by A3 printers is in A4 format.

Commission's assessment

(48) Based on the results of the market investigation, the Commission has indications that A3 and A4 printers appear to be rather complementary than substitutes.

(49) From the demand-side perspective, nearly all customers who responded to market investigation indicated that they consider A3 and A4 printers as complementary products.36 Some customers who responded to the market investigation indicated that both A3 and A4 are needed for different business needs. The majority of distributors, resellers and retailers which responded to market investigation indicated that their customers see A3 and A4 regular format printers as complementary products. However, some indicated that A3 and A4 could be considered as substitues as A3 regular format printers can print both formats.37

(50) From a supply side perspective, all the competitors who responded to market investigation supply both A3 and A4 regular format printers.

(51) However, for the purpose of this decision, the exact product market definition can be left open, since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2 Relevant geographic market

4.2.1 Branded Regular format printers.

(52) In previous decisions the Commission left the geographic market definition for branded regular format printers open.38 In the most recent decision Xerox/ Affiliated computer services the market investigation indicated that the markets for document production equipments is worldwide or at least EEA-wide scope.39

The Notifying Party's view

(53) The Notifying Party considers the relevant geographic market for regular format printers is at least EEA wide in scope for the following reasons:

(54) First, the Parties and other major equipment manufacturers are multinational corporations with manufacturing facilities in Asia and other countries from where they ship their products around the world. Second, manufacturers of regular format printers generally price on an EEA or even wider basis following standard price lists. Product characteristics do not vary significantly in the EEA or throughout the world. Third, there are no quota restraints or other material trade barriers. HP's top 10 distributors in the EEA resell regular format printers in multiple countries and some of them have one warehouse serving several countries.

Commission's assessment

(55) Based on the market investigation, the Commission considers that there are strong indications that the market for branded regular format printers is wider than national or even EEA-wide.

(56) From a demand-side perspective, business customers stated they source on EEA wide level with country specific conditions and specifications or at the national level.40 However, several customers indicated that they already procure regular format printers EEA wide with equal conditions across EEA.41 Business customers also indicated that there are no differences in customer requirements in the different countries within the EEA.42

(57) On the other hand, the replies of distributors, resellers and retailers received during the market investigation were mixed. A large number of distributors, resellers and retailers which responded to market investigation source regular format printers on a national level.43 However, several indicated that they source on EEA or worldwide level.44 In respect of their customers, while the majority of respondents indicate that their customers source on country by country level, some respondends indicate certain customers source on EEA level.45 The majority of respondents which provided meaningful responses consider that there are no differences in customer requirements for regular format printers in different countries within the EEA.46

(58) From a supply-side perspective, all the competitors that responded to market investigation indicated that they provide or are able to provide regular format printers throughout the EEA and do not observe restrictions or barriers for supply into any EEA country.47 They also indicated that there are no differences in customer requirements in the different countries within the EEA.48

(59) In conclusion, in spite of the fact that current sourcing patterns are usually at national level, there are clear indications that the relevant markets are wider than national or even EEA wide.

(60) However, for the purpose of this decision, the exact geographic market definition can be left open, since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.2 Unbranded regular format printers The Notifying Party's view

(61) The Notifying Party submits that the market for unbranded regular format printers is worldwide. Customers for unbranded OEM printers are large, multinational printer manufacturers with global procurement practices which source these products worldwide. In addition, suppliers of unbranded printers ship those globally from a few locations worldwide.

Commission's assessment

(62) The Commission, based on the market investigation, considers that there are indications that the market for unbranded regular format printers could be at least EEA-wide. Indeed, during the market investigation suppliers confirmed that they ship printers in all countries of the EEA.49

(63) However, for the purpose of this decision, the exact geographic market definition can be left open, since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

5 COMPETITIVE ASSESSMENT

(64) The activities of the Parties overlap horizontally on the market for the supply of branded regular format printers. Furthermore, as the Parties supply unbranded regular format printers to other manufacturers on an OEM basis and purchase unbranded regular format printers, the Proposed Transaction gives rise to vertical relationships between the downstream market for the supply of branded regular format printers and the upstream market for the supply of unbranded regular format printers.

5.1Horizontal non-coordinated effects

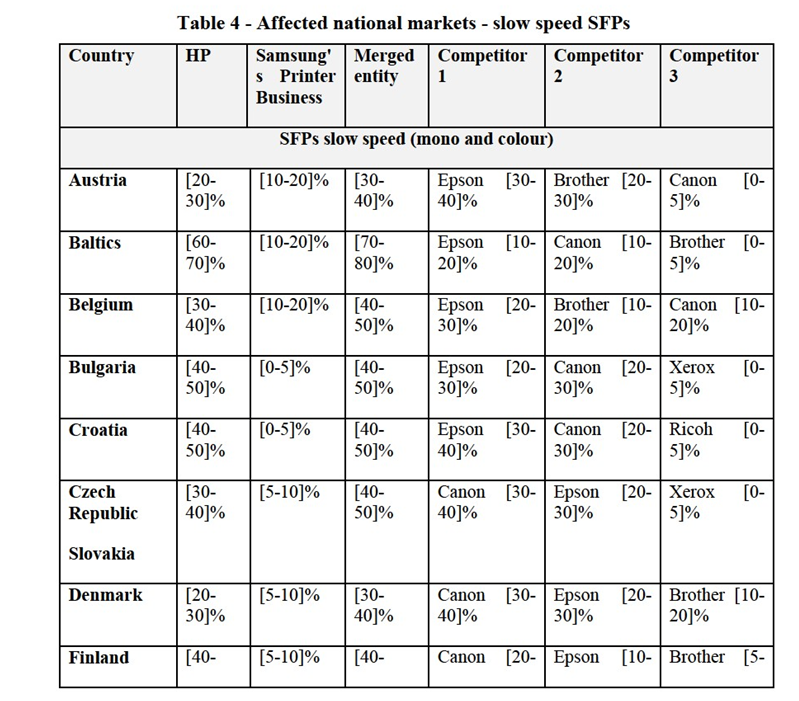

5.1.1 Supply of branded regular format printers

(65) On the overall market for the supply of branded regular format printers, the Proposed Transaction does not give rise to affected markets, either at worldwide level or at EEA level. At worldwide level, the Parties' combined market share in 2016 would be [10-20]% (HP: [10-20]%; Samsung's Printer Business: [0-5]%). At EEA level, the Parties' combined market share in 2016 would be [10-20]% (HP: [10-20]%; Samsung's Printer Business: [0-5]%). The market share data provided in this section is based on IDC data.

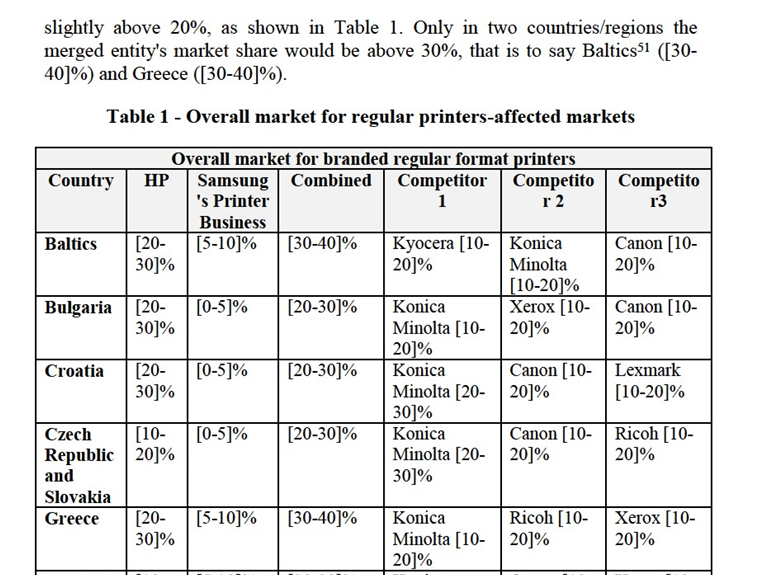

(66) Based on 2016 market shares50, on the overall market for branded regular format printers, the Proposed Transaction gives rise to 14 national affected markets. However, in most of these national markets, the merged entity's share would be

worldwide and EEA level. On the worldwide market, HP was only the fourth largest supplier and Samsung Printer Business ranked as the 11th largest supplier in 2016, while in the EEA, HP ranked as the third largest supplier and Samsung Printer Business as the 10th largest supplier.

(68) Second, the Notifying Party notes that Samsung Printer Business is not a significant competitive constraint to HP, as it is only one of the many competitors in branded regular format printers and that moreover, its position in the EEA has steadily declined both in terms of revenues and in terms of unit sales in the last few years.

(69) Third, the Notifying Party argues that due to the characteristics of these products, the way in which they are produced and sold, and the fact that many competitors already have a number of printer models sold in the various segments, barriers to entry and expansion in these markets are low. The Notifying Party also argues that the investments required to expand into adjacent segments (for example printers of different speeds) are limited and can be completed in a short time. Further, it claimes that any supplier can viably enter or expand into any segment of regular printers market by sourcing on OEM basis without incurring significant initial costs or risks.

(70) Furthermore, should the merged entity raise prices, companies such as Ricoh, Xerox or Konica Minolta would be well positioned to expand and reposition their product offering in response to a post-merger price increase. Furthermore, most regular format printer manufacturers are able and do offer a wide range of printer models across all possible segments (SFPs, MFPs, mono, colour, and different speed ranges).

(71) Fourth, the Notifying Party submits that due to low switching costs and strong countervailing buyer power, customers at various levels of the distribution chain can and do easily and timely switch to alternative sources of supply of branded regular format printers. In terms of buyer power, the Notifying Party notes that over […]% of the Parties' sales are made through large multinational distributors and/or retailers that have significant buyer power, which they will exert in the event of any increase by the merged entity. Companies such as […] and […], are sophisticated buyers that exert substantial countervailing bargaining power and can switch easily between competing products.

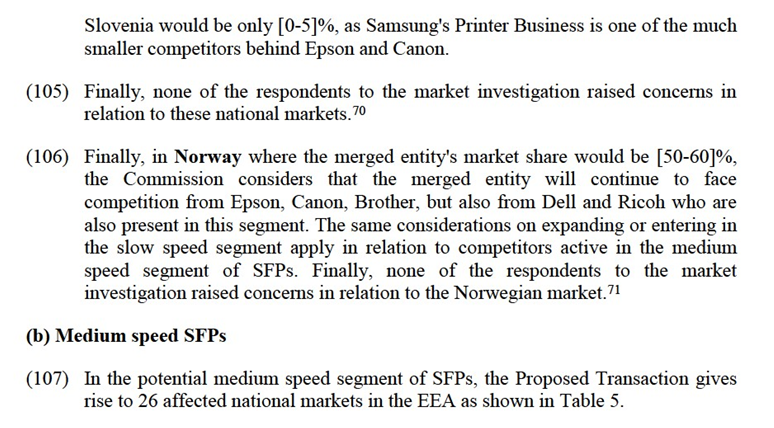

(72) Finally, in relation to the affected national markets, in particular Greece and the Baltics where the merged entity's market share would be higher than 30% on the overall regular format printers market, the Notifying Party submits that the merged entity will continue to face competition from the same suppliers as at EEA-level. Furthermore in the Baltics, Samsung's Printer Business share has decreased [as a result of a strategic decision on market positioning].

5.1.1.2 Commission's assessment

(73) The Commission considers that the Proposed Transaction is unlikely to raise doubts as to its compatibility with the internal market in the overall market for branded regular format printers for the following reasons:

(74) According to Commission's Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings (the "Horizontal Guidelines")52 , combined market shares below 25% may indicate that the concentration is not likely to impede effective competition. The Commission first notes that both at world-wide level, as well as at EEA-level, the Proposed Transaction will not give rise to affected markets: the merged entity's share at worldwide level was [10-20]% and at EEA-level [10- 20]% in 2016. Further, in 2016, on the overall worldwide market for branded regular format printers there were many suppliers present, such as Xerox ([10- 20]%); Canon ([10-20]%); Ricoh ([10-20]%); Konica Minolta ([10-20]%),Kyocera ([5-10]%), Epson ([0-5]%); Sharp ([0-5]%), Toshiba ([0-5]%), Brother ([0-5]%), Lexmark ([0-5]%), Oki ([0-5]%). The same suppliers were active in 2016 in the EEA: Xerox ([10-20]%); Canon ([10-20]%); Ricoh ([10-20]%);Konica Minolta ([10-20]%), Kyocera ([5-10]%), Epson ([0-5]%); Sharp ([0-5]%),Toshiba ([0-5]%), Brother ([0-5]%), Lexmark ([0-5]%), Oki ([0-5]%).

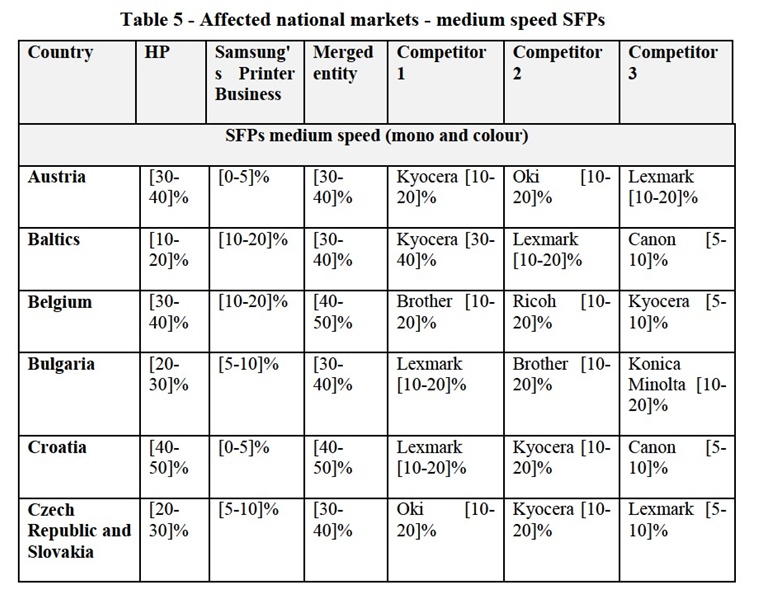

(75) Second, the majority of respondents to the market investigation do not consider HP and Samsung's Printer Business as particularly close competitors. In particular, business customers and distributors, resellers and retailers view other suppliers such as Canon, Xerox, Brother and Epson closer to HP than Samsung's Printer Business.53 In turn, only three of these respondents considered HP as the closest competitor to Samsung's Printer Business and only for some of the possible segments. Competitors' views on this issue were more mixed, but in general, HP is perceived as a rather high-end, more expensive product supplier, whose brand is widely recognised in the market, while Samsung's Printer Business is perceived more as a mass-market, consumer brand.54 The fact that Samsung's Printer Business products seem to address more consumers' segment, rather than large business customers is demonstrated by the fact that a non- negligible number of business customers indicating that they do not purchase printers from Samsung's Printer Business or that they have not yet evaluated Samsung's printers.55 Some customers pointed out that the product portfolios of the two companies are complementary, as HP is specialised more in A4 printers and Samsung in A3 printers and the two companies employ different technologies (HP mainly inkjet and Samsung's Printer Business mainly laser)56. Market investigation respondents did not consider that Samsung's printer portfolio, and in particular its line of A3 printers is in any way superior in terms of functionality and performance to those of other suppliers.57

(76) Third, the large majority of participants to the market investigation confirmed that a sufficient number of competitors will continue to compete in the overall market for branded regular format printers both at worldwide level, as well as at EEA- level.58 Furthermore, some respondents even signalled recent new entrants in the EEA such as Pantum, a Chinese manufacturer and Kodak.59

(77) Fourth, the vast majority of market participants did not consider that the Proposed Transaction will have a negative impact on the market for branded regular format printers or on prices of branded regular format printers.60

(78) For these reasons, the Commission takes the view that the Proposed Transaction does not raise serious doubts as regards its compatibility with the internal market in relation to the supply of branded regular format printers worldwide and in the EEA.

(79) Furthermore, in relation to the national affected markets identified in Table 1, the Commission first notes that in most of these markets, the merged entity's market share remains below 30%.

(80) Second, the Commission considers that the merged entity will continue to face strong competition from the same competitors active at EEA level. Indeed, suppliers such as Konica Minolta, Ricoh, Canon, Xerox, Kyocera, Brother, Epson, Lexmark, Sharp are present in each EEA country.

(81) In the Baltics, the Commission first notes that Samsung's Printer Business is a declining competitor, whose market share has indeed decreased from [10-20]% in 2013 to [5-10]% in 2016, while other competitors have expanded and increased their market share: Kyocera has increased its market share from [10-20]% in 2013 to [10-20]% in 2016, Canon from [5-10]% in 2013 to [10-20]% in 2016, and Konica Minolta from [10-20]% in 2013 to [10-20]% in 2016, which shows that other suppliers indeed have the capacity and willingness to expand. Furthermore, as explained in paragraph 58, competitors consider that they are able to supply in all countries in the EEA. Second, the Commission considers that in the Baltics the merged entity would continue to face strong competition from many competitors, such as Kyocera ([10-20]%), Canon ([10-20]%), Konica Minolta ([10-20]%), Lexmark ([0-5]%), Xerox ([0-5]%), Epson ([0-5]%) and Brother ([0-5]%) among others.

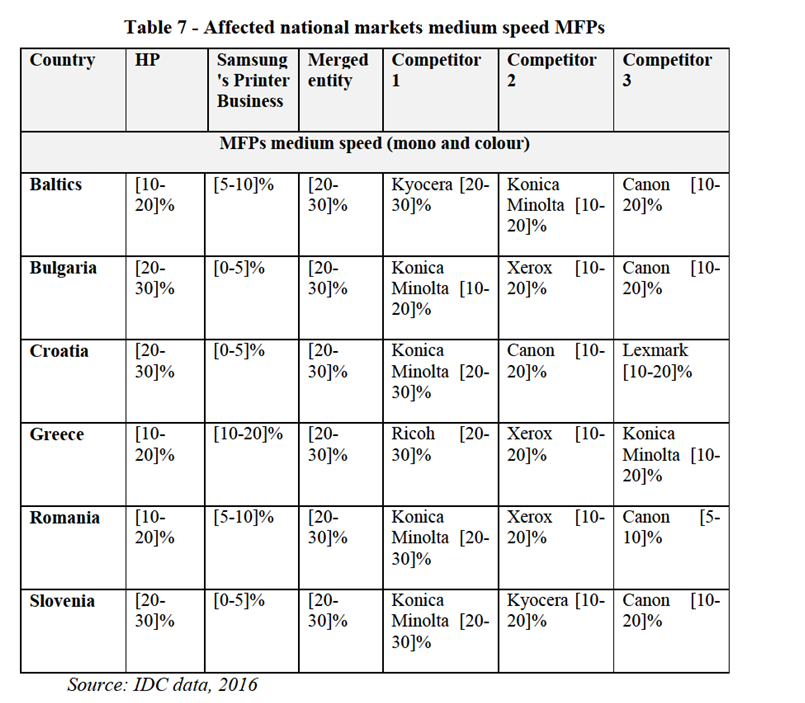

(82) As regards Greece, while Samsung's Printer Business share has remained stable over the last three years, the merged entity would continue to compete against a large number of competitors, including Ricoh ([10-20]%), Konica Minolta ([10- 20]%), Xerox ([10-20]%), Epson ([5-10]%), Canon ([5-10]%), Kyocera ([5- 10]%) among others. Some of these competitors have considerably increased their market share over the last few years, showing their ability and willingness to expand in the market. These include Ricoh (which has increased its market share from [0-5]% in 2013 to [10-20]% in 2016), Kyocera (from [0-5]% in 2013 to [0-5]% in 2016) and Epson (from [0-5]% in 2013 to [5-10]% in 2016). Furthermore, as explained in paragraph 58, competitors consider that they are able to supply in all countries in the EEA.

(83) Finally, participants to the market investigation did not raise any specific concerns in relation to the impact of the Proposed Transaction on branded regular format printers in these countries.61

(84) For all these reasons, the Commission takes the view that the Proposed Transaction does not raise serious doubts as regards its compatibility with the internal market in relation to overall branded regular format printers worldwide, in the EEA and in each of the Baltics, Bulgaria, Croatia, Czech Republic, Slovakia, Greece, Hungary, the Netherlands, Poland, Romania, Slovenia and Spain.

5.1.2 Supply of branded regular format printers by narrower product segments

(85) Under possible narrower markets for the supply of branded regular format printers, the Proposed Transaction gives rise to affected markets at worldwide, EEA-wide level and national level.

5.1.3 SFPs and MFPs

5.1.3.1 Worldwide and EEA-wide markets

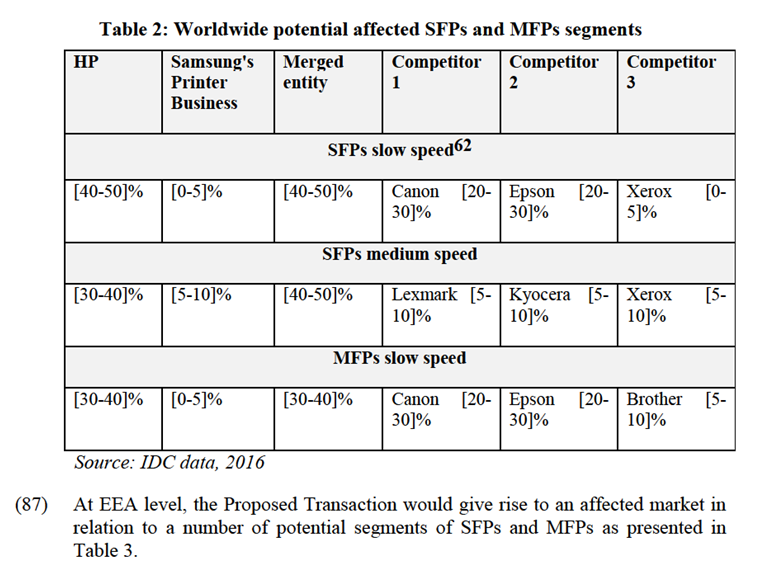

(86) At worldwide level, the Proposed Transaction would give rise to an affected market in relation to certain potential segments of SFPs and MFPs as presented in Table 2.

5.1.3.2 The Notifying Party's views

(88) Specifically in relation to SFPs and MFPs, the Notifying Party first submits that the Parties only overlap in colour SFPs and MFPs since Samsung's Printer business does not offer slow speed mono printers.

(89) Second, the Notifying Party argues that the Samsung's Printer Business does not exercise a significant competitive constraint on HP. In particular, in the low speed segment SFPs and MFPs, Samsung's Printer Business is a small and declining competitor, [as a result of a strategic decision on market positioning]. The Target's share in colour, low-speed SFPs in the EEA has declined significantly over the past few years (from [10-20]% in 2013 to [5-10]% in 2016). Its share has also dropped as regards colour, low speed MFPs (from [5-10]% in 2013 to [0-5]% in 2016). Similarly, in medium speed SFPs and MFPs, Samsung's Printer Business position is de minimis and declining.

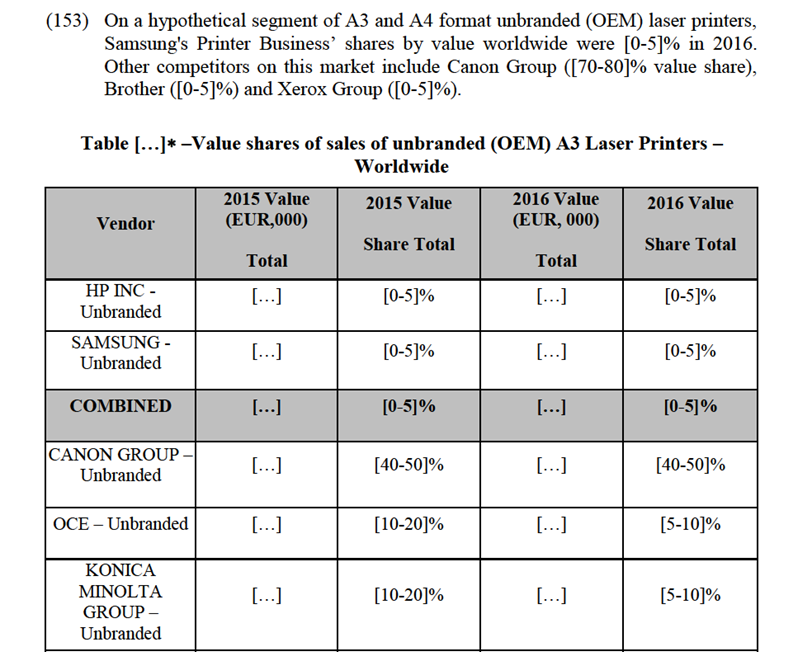

(90) Third, the Notifying Party argues that in all these hypothetical segments, the merged entity will continue to face competition from a number of well- established players, such as Canon, Epson and Brother, who have been growing significantly. Canon and Epson for instance are the strongest competitors in the EEA in the low and medium speed segments of SFPs and MFPs.

(91) Finally, the Notifying Party considers that printer suppliers can easily expand from the higher speed segments into the lower speed segments, as IP and know- how specific to those products are limited. The Notifying Party gives the example of "copier" players such as Ricoh, Konica Minolta, Toshiba or Xerox which are well-positioned to expand in the lower segments. Toshiba, Kyocera and Sharp have already introduced products to compete in these segments in the last 2-3 years. Similarly, suppliers can easily expand geographically to serve neighbouring countries, if they do not already have a presence in a specific country.

5.1.3.3 Commission's assesment

(92) The Commission considers that the Proposed Transaction will not raise serious doubts as regards its compatibility with the internal market in relation to these segments worldwide and in the EEA for the following reasons:

(93) The Commission first observes that the SFPs segment is today limited, both at world-wide level, as well as at EEA-level. According to the IDC market intelligence in the overall regular format printers market, the ratio of MFPs versus SFPs went from 7% vs 93% (MFPs v SFPs) in 2000 to 81% vs 19% (MFPs v SFPs) in 2016, as illustrated in Figure 2. The Commission had already observed this trend in previous decisions.63

(94) These figures support the assertions of the Notifying Party concerning the trend of SFPs being gradually displaced by MFPs. As indicated in paragraphs (23) and following, participants to the market investigation confirmed this displacement of SFPs. For instance, distributors confirmed that MFPs represent today 80 to 85% of the sales of printers and that customers (including end consumers) require more functionalities than just printing in the device they choose to purchase.64 Therefore, the SFPs segment appears to be shrinking and losing in importance, not only for business customers, but also with consumers.

(95) Second, the Commision notes that only the slow and medium speed segments of SFPs and MFPs are horizontally affected. The Parties' presence in fast SFPs and MFPs is limited.

(96) Third, the Commission observes that irrespective of the possible speed segmentation within SFPs and MFPs, the merged entity's market share would remain under 50%, and that other strong suppliers such as Canon, Epson, Brother, Kyocera, Lexmark or Xerox will continue to exercise competitive pressure on the merged entity in all these potential segments.

(97) Fourth, the majority of respondents to the market investigation did not indicate HP and Samsung’s Printer Business as particularly close competitors neither in SFPs, nor in MFPs.65

(98) Fifth, the vast majority of market participants did not consider that the Proposed Transaction will have any impact on the market for the supply of branded regular

| 50]% |

| 50]% | 30]% | 20]% | 10]% |

France | [30- 40]% | [0-5]% | [30- 40]% | Canon [30- 40]% | Epson [20- 30]% | Brother [0- 5]% |

Germany | [40- 50]% | [5-10]% | [40- 50]% | Canon [20- 30]% | Epson [10- 20]% | Brother [10- 20]% |

Greece | [40- 50]% | [0-5]% | [40- 50]% | Epson [40- 50]% | Canon [0- 5]% | Xerox [0- 5]% |

Hungary | [40- 50]% | [0-5]% | [40- 50]% | Epson [30- 40]% | Canon [20- 30]% | Xerox [0- 5]% |

Italy | [30- 40]% | [10-20]% | [40- 50]% | Epson [20- 30]% | Canon [10- 20]% | Brother [10- 20]% |

The Netherlands | [20- 30]% | [10-20]% | [30- 40]% | Canon [20- 30]% | Epson [20- 30]% | Brother [5- 10]% |

Norway | [30- 40]% | [10-20]% | [50- 60]% | Epson [30- 40]% | Canon [5- 10]% | Brother [5- 10]% |

Poland | [50- 60]% | [0-5]% | [50- 60]% | Canon [20- 30]% | Epson [10- 20]% | Ricoh [0- 5]% |

Portugal | [30- 40]% | [0-5]% | [30- 40]% | Epson [30- 40]% | Canon [10- 20]% | Brother [0- 5]% |

Romania | [40- 50]% | [0-5]% | [40- 50]% | Epson [20- 30]% | Canon [20- 30]% | Xerox [0- 5]% |

Slovenia | [60- 70]% | [0-5]% | [60- 70]% | Canon [10- 20]% | Epson [10- 20]% | Xerox [0- 5]% |

Spain | [60- 70]% | [5-10]% | [60- 70]% | Epson [10- 20]% | Canon [5- 10]% | Brother [5- 10]% |

Sweden | [20- 30]% | [10-20]% | [30- 40]% | Canon [40- 50]% | Epson [10- 20]% | Brother [0- 5]% |

UK and Ireland | [20- 30]% | [5-10]% | [20- 30]% | Epson [30- 40]% | Canon [20- 30]% | Brother [5- 10]% |

Source: IDC data, 2016

(102) However, the Commission considers that the Proposed Transaction will not raise serious doubts as regards its compatibility with the internal market in any of these countries/regions for the following reasons:

(103) First, the merged entity's market share in the majority of these countries (Austria, Belgium, Bulgaria, Croatia, Czech Republic, Slovakia, Denmark, Finland, France, Germany, Greece, Hungary, Italy, The Netherlands, Portugal, Romania, Sweden, UK and Ireland) remains under 50% and several strong competitors (among which Ricoh, Epson, Brother and Xerox) will continue to constrain the merged entity post-Proposed Transaction. Furthermore, in most of these countries Samsung's Printer Business is a small competitor, ranking behind the top three suppliers. Finally, none of the respondents to the market investigation raised concerns in relation to these national markets.67

(104) Second, in the Baltics68 where the market share of the merged entity is the highest for this segment (slightly over [70-80]%), the Commission first notes that Samsung's Printer Business is indeed a declining competitor in this possible segment, as it has lost significant market share over the last few years (from almost [20-30]% in 2013 to [10-20]% in 2016). Second, the Commission considers that the merged entity will continue to face three strong competitors (Epson, Canon and Brother) which will be able to react promptly in case of a price increase by the merged entity. For example, the evolution of the market shares of Canon and Brother in the Baltic region in this possible segment shows that these competitors would be able and willing to expand, as they have both almost doubled their share between 2013 and 2016. Furthermore, in the other speed segments of SFPs and MFPs there are eleven other global competitors present in the Baltics which could potentially expand or enter the slow speed segment as many of them have a complete portfolio of printers.69 Similarly in Spain where the market share of the merged entity would be [60-70]%, the Commission first notes that Samsung's Printer Business is a declining competitor (from [5-10]% share in 2013 to [5-10]% in 2016) in this possible segment. Second, the Commission considers that apart from the top three competitors (Epson, Canon and Brother) there are a few other competitors active in this segment (Ricoh, Dell and Xerox) which will continue to constrain the merged entity post-Transaction. In particular, Epson has significantly expanded over the last few years, its market share increasing from [5-10]% in 2013 to [10-15]% in 2016. Furthermore, the increment brought by the Proposed Transaction in Spain would be only [5-10]%, as Samsung's Printer Business is one of the smaller competitors behind Epson, Canon and Brother. The same considerations on expanding or entering in the slow speed segment apply in relation to competitors active in the medium speed segment of SFPs. Also, in Slovenia, where the market share of the merged entity would be [60-70]%, the Commission first notes that Samsung's Printer Business is a declining competitor (from [5-10]% market share in 2013 to [0-5]% in 2016) in this segment. Second, the Commission considers that there are four competitors (Epson, Canon, Xerox and Brother) which will continue to constrain the merged entity post-Transaction. In particular, not only Epson has significantly expanded in this possible segment over the last few years, its market share increasing from [0-5]% in 2013 to [10-20]% in 2016, but also Canon, which has increased its market share from [10-20]% in 2013 to [10-20]% in 2016. Furthermore, the increment brought by the Proposed Transaction in

Denmark | [30- 40]% | [0-5]% | [30- 40]% | Lexmark [10-20]% | Brother [10- 20]% | Oki [10- 20]% |

Finland | [30- 40]% | [5-10]% | [30- 40]% | Canon [10- 20]% | Toshiba [10- 20]% | Kyocera [10- 20]% |

France | [20- 30]% | [5-10]% | [30- 40]% | Brother [10- 20]% | Lexmark [10-20]% | Konica Minolta [5- 10]% |

Germany | [20- 30]% | [5-10]% | [20- 30]% | Kyocera [30- 40]% | Brother [10- 20]% | Lexmark [5- 10]% |

Greece | [20- 30]% | [20-30]% | [50- 60]% | Lexmark [10-20]% | Oki [10- 20]% | Brother [5- 10]% |

Hungary | [20- 30]% | [10-20]% | [30- 40]% | Kyocera [20- 30]% | Epson [10- 20]% | Oki [10- 20]% |

Italy | [10- 20]% | [10-20]% | [30- 40]% | Lexmark [20-30]% | Kyocera [10- 20]% | Oki [5-10]% |

The Netherlands | [30- 40]% | [5-10]% | [30- 40]% | Brother [10- 20]% | Lexmark [5- 10]% | Kyocera [5- 10]% |

Norway | [30- 40]% | [0-5]% | [40- 50]% | Oki [20- 30]% | Brother [20- 30]% | Ricoh [0- 5]% |

Poland | [20- 30]% | [0-5]% | [30- 40]% | Kyocera [10- 20]% | Lexmark [10-20]% | Oki [10- 20]% |

Portugal | [20- 30]% | [5-10]% | [20- 30]% | Oki [10- 20]% | Kyocera [10- 20]% | Konica Minolta [10- 20]% |

Romania | [30- 40]% | [5-10]% | [30- 40]% | Lexmark [10-20]% | Kyocera [10- 20]% | Xerox [10- 20]% |

Slovenia | [20- 30]% | [0-5]% | [30- 40]% | Lexmark [20-30]% | Kyocera [10- 20]% | Xerox [5- 10]% |

Spain | [30- 40]% | [5-10]% | [30- 40]% | Brother [10- 20]% | Kyocera [10- 20]% | Ricoh [10- 20]% |

Sweden | [30- 40]% | [10-20]% | [40- 50]% | Oki [10- 20]% | Ricoh [10- 20]% | Lexmark [5- 10]% |

UK and Ireland | [20- 30]% | [5-10]% | [30- 40]% | Brother [10- 20]% | Konica Minolta [5- 10]% | Kyocera [5- 10]% |

Source: IDC data 2016

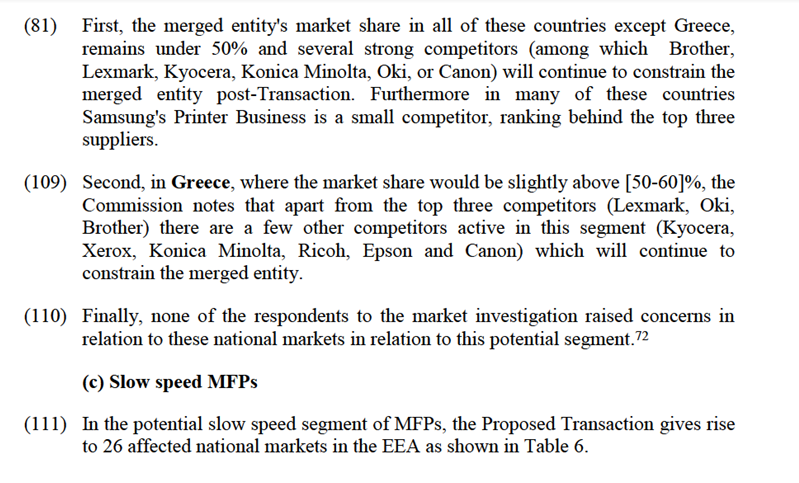

(108) However, the Commission considers that the Proposed Transaction will not raise serious doubts as regards its compatibility with the internal market in any of these countries for the following reasons:

Denmark | [60- 70]% | [0-5]% | [60- 70]% | Canon [20- 30]% | Brother [10- 20]% | Epson [5- 10]% |

Finland | [30- 40]% | [10-20]% | [40- 50]% | Canon [20- 30]% | Epson [10- 20]% | Brother [10- 20]% |

France | [40- 50]% | [0-5]% | [40- 50]% | Canon [30- 40]% | Epson [20- 30]% | Brother [0- 5]% |

Germany | [40- 50]% | [5-10]% | [40- 50]% | Canon [30- 40]% | Epson [10- 20]% | Brother [5- 10]% |

Greece | [60- 70]% | [0-5]% | [60- 70]% | Epson [10- 20]% | Canon [10- 20]% | Konica Minolta [0- 5]% |

Hungary | [40- 50]% | [0-5]% | [40- 50]% | Canon [20- 30]% | Epson [10- 20]% | Bother [0- 5]% |

Italy | [30- 40]% | [0-5]% | [40- 50]% | Epson [20- 30]% | Canon [20- 30]% | Brother [0- 5]% |

The Netherlan ds | [30- 40]% | [0-5]% | [30- 40]% | Canon [40- 50]% | Epson [10- 20]% | Brother [5- 10]% |

Norway | [30- 40]% | [0-5]% | [30- 40]% | Epson [30- 40]% | Brother [20- 30]% | Canon [5- 10]% |

Poland | [40- 50]% | [0-5]% | [40- 50]% | Brother [20- 30]% | Canon [20- 30]% | Epson [10- 20]% |

Portugal | [50- 60]% | [0-5]% | [50- 60]% | Canon [20- 30]% | Epson [10- 20]% | Brother [5- 10]% |

Romania | [20- 30]% | >[0-5]% | >[30- 40]% | Canon [40- 50]% | Epson [20- 30]% | Brother [5- 10]% |

Slovenia | [40- 50]% | [0-5]% | [40- 50]% | Canon [20- 30]% | Brother [10- 20]% | Epson [5- 10]% |

Spain | [50- 60]% | [0-5]% | [50- 60]% | Epson [10- 20]% | Canon [10- 20]% | Brother [10- 20]% |

Sweden | [30- 40]% | [5-10]% | [40- 50]% | Canon [40- 50]% | Brother [5- 10]% | Epson [5- 10]% |

UK and Ireland | [40- 50]% | >[0-5]% | >[50- 60]% | Canon [30- 40]% | Epson [10- 20]% | Brother [0- 5]% |

Source: IDC data, 2016

(112) However, the Commission considers that the Proposed Transaction will not raise serious doubts as regards its compatibility with the internal market in any of these countries for the following reasons:

(113) First, the merged entity's market share in the majority of these countries (Austria, Baltics, Bulgaria, Croatia, Czech Republic, Slovakia, Denmark, Finland, France, Germany, Hungary, Italy, The Netherlands, Norway, Poland, Romania, Slovenia, Sweden, UK and Ireland) remains under 50% and several strong competitors (among which Canon, Epson, Brother and Konica Minolta) will continue to constrain the merged entity post-Transaction. Furthermore, in most of these countries, Samsung's Printer Business is a small competitor, ranking behind the top three suppliers.

(114) Second, in Belgium, Greece, and Denmark where the market share of the merged entity is the highest for this segment (over 60%) the merged entity will continue to face three strong competitors (Epson, Canon, Brother or Konica Minolta) which will continue to constrain the merged entity. Additionally, some other suppliers are active in this segment in Belgium (Dell and Ricoh), Denmark (Xerox) and Greece (Ricoh, Kyocera and Xerox). Furthermore, the increment brought by the Proposed Transaction in those countries is very limited ([0-5]% or less).

(115) Third, in Spain and Portugal, where the merged entity's market share would be [50-60]% and [50-60]% respectively, the Commission considers that the merged entity will continue to face competition from Epson, Canon and Brother, but also from Dell and Ricoh in Spain and Xerox, Konica Minolta and Kyocera in Portugal (which are also present in this segment). Furthermore, the increment brought by the Proposed Transaction in Spain and Portugal is very limited.

(116) Finally, none of the respondents to the market investigation raised concerns in relation to these national markets.73

(d) Medium speed MFPs

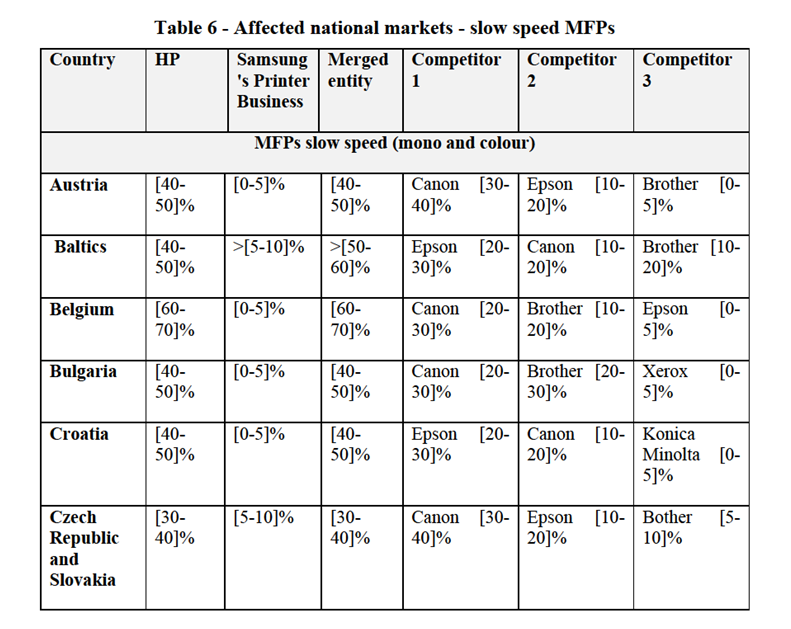

(117) In the potential medium speed segment of MFPs, the Proposed Transaction gives rise to 8 affected national markets in the EEA as shown in Table 7.

Transaction. Distributors and resellers multi-source and often stock 3 – 4 printer brands. Therefore, HP expects that the distributors and resellers that are currently stocking both HP and Samsung printers, will likely [business decision]. In addition, HP will not [transaction specific decision] and expects HP will not get access to or be able to retail all commercial relationsips of this sales force with its printer customers.

(126) The Notifying Party submits that in the potential A4 segment the merged entity will continue to face strong competition from at least seven well-established competitors with shares in the EEA between around [5-10]% and [10-20]% (Canon, Epson , Kyocera, Brother, Ricoh, Konica Minolta and Lexmark), the majority of which which have been increasing their EEA shares between 2013 and 2016. In the same period both HP and Samsung's Printer Business shares of sales declined on worldwide and EEA level.

(127) The Notifying Party further argues that barriers to entry and expansion into A4 printer segment are low. The ease of entry and expansion is demonstrated by the traditional copier manufacturers recent expansion into the A4 printer segment. As all major players are already active in both the A3 and A4 printer segments any price increase of A4 printers post-Transaction would increase the incentives of competitors to further expand in this segment and would result unprofitable.

(128) The Notifying Party also argues that the switching costs are low and the customers exert substantial countervailing bargaining power.

Commission's assesment

(129) The Commission first notes that both at world-wide level, as well as at EEA- level, the merged entity's share remains below 40% and several strong competitors (such as Canon, Epson, Brother, Lexmark, Ricoh, or Kyocera) will continue to constrain the merged entity post-Transaction. Furthermore Samsung Printer Business is a small competitor, ranking behind the top suppliers as 8th supplier worldwide and 9th supplier in the EEA.

(130) Second, the majority of respondents to the market investigation do not consider HP and Samsung's Printer Business as particularly close competitors. In particular, business customers and distributors, resellers and retailers view other suppliers such as Canon, Xerox, Brother, Epson and Lexmark closer to HP than Samsung's Printer Business.75

(131) Third, the large majority of participants to the market investigation confirmed that a sufficient number of suppliers of A4 format printers will continue to compete both at worldwide level, as well as at EEA-level.76

(132) Fourth, none of the respondents to the market investigation raised concerns in relation to this potential segment.77

Germany | [20- 30]% | [5-10]% | [30- 40]% | Kyocera [10- 20]% | Canon [10- 20]% | Brother [10- 20]% |

Greece | [40- 50]% | [10- 20]% | [60- 70]% | Epson [10- 20]% | Lexmark [5- 10]% | Canon [5- 10]% |

Hungary | [20- 30]% | [10- 20]% | [40- 50]% | Epson [10- 20]% | Canon [10- 20]% | Kyocera [10-20]% |

Italy | [20- 30]% | [10- 20]% | [30- 40]% | Epson[10- 20]% | Canon [10- 20]% | Brother [5- 10]% |

The Netherlands | [30- 40]% | [0-5]% | [30- 40]% | Canon [20- 30]% | Epson [5- 10]% | Brother [5- 10]% |

Norway | [20- 30]% | [0-5]% | [30- 40]% | Epson [10- 20]% | Canon [10- 20]% | Brother [10- 20]% |

Poland | [30- 40]% | [0-5]% | [30- 40]% | Brother [10- 20]% | Canon [10- 20]% | Lexmark [5- 10]% |

Portugal | [20- 30]% | [0-5]% | [20- 30]% | Canon [20- 30]% | Konica Minolta [5- 10]% | Epson [5- 10]% |

Romania | [30- 40]% | [5-10]% | [40- 50]% | Canon [10- 20]% | Xerox [5- 10]% | Epson [5- 10]% |

Slovenia | [40- 50]% | [0-5]% | [40- 50]% | Canon [10- 20]% | Kyocera [10- 20]% | Lexmark [5- 10]% |

Spain | [30- 40]% | [0-5]% | [30- 40]% | Kyocera [10- 20]% | Ricoh [10- 20]% | Brother [10- 20]% |

Sweden | [20- 30]% | [5-10]% | [30- 40]% | Canon [20- 30]% | Ricoh [10- 20]% | Brother [5- 10]% |

UK and Ireland | [30- 40]% | [0-5]% | [30- 40]% | Canon [10- 20]% | Epson [10- 20]% | Ricoh [5- 10]% |

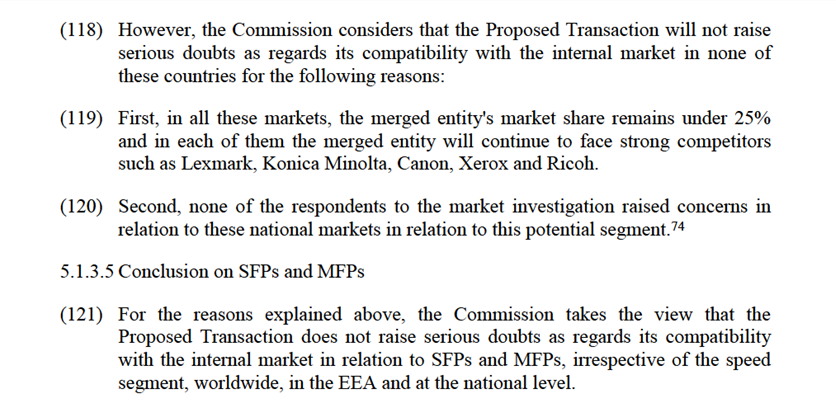

(135) The Commission considers that for the reasons set out below, the Proposed Transaction does not raise serious doubts as regards its compatibility with the internal market in relation to A4 regular format printers at the national level:

(136) First, in all countries considered, the combined market share of the Parties would remain below 50% and several strong competitors would remain in each of these countries post-Transaction, which will exert competitive pressure on the merged entity (including, depending on the country, Brother, Canon, Epson, Kyocera, Lexmark, Ricoh, Xerox and other players). Further, in most countries (Austria, Bulgaria, Czech Republic / Slovakia, Finland, France, Germany, Hungary, Italy, the Netherlands, Norway, Poland, Spain Sweden, and the UK / Ireland) the combined market shares of the Parties would remain below 40% and in Austria, France and Portugal below 30%.

(137) The only country where the combined market share of the Parties would exceed 50% is Greece. However, even in Greece, several competitors will remain post- Transcation which will continue to constrain the Parties, including Epson ([10- 20]%), Oki ([0-5]%) and Lexmark ([5-10]%). Other players on this potential market include Canon ([0-5]%), Ricoh ([0-5]%), Xerox ([0-5]%), Konica Minolta ([0-5]%), Kyocera ([0-5]%) and Brother ([0-5]%).

5.1.4.3 Conclusion on the potential segment of A4 regular format printers

(138) For all these reasons, the Commission considers that the Proposed Transaction does not raise serious doubts as regards its compatibility with the internal market in relation to A4 regular format printers world-wide, in the EEA and at national level.

5.2 Vertical effects

(139) The Proposed Transaction would give rise to several vertical relationships. In particular, the Parties are both active upstream as suppliers of unbranded (OEM) regular format printers and as suppliers of branded regular format printers.

(140) According to the Non-Horizontal Merger Guidelines, foreclosure occurs when actual or potential rivals’ access to supplies or markets is hampered, thereby reducing those companies’ ability and/or incentive to compete. Such foreclosure may discourage entry or expansion of rivals or encourage their exit.78

(141) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure: input foreclosure occurs where the merger is likely to raise the costs of downstream rivals by restricting their access to an important input and customer foreclosure occurs where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base.79

(142) In order for foreclosure to be a concern, three conditions need to be met post- merger: (i) the merged entity needs to have the ability to foreclose its rivals80; (ii) the merged entity needs to have the incentive to foreclose its rivals81; and (iii) the foreclosure strategy needs to have a significant detrimental effect on the parameters of competition on the downstream market (input foreclosure)82 or on consumers (customer foreclosure). In practice, these factors are often examined together since they are closely intertwined.83

(143) The Commission examined whether the Proposed Transaction could give rise to a possible risk of input foresclosure for the unbranded (OEM) regular format printers supplied by the Parties to the detriment of the Parties' competitors active downstream as suppliers of branded regular format printers. In addition, the Commission assessed the risk of a possible customer foreclosure for the Parties' competitors which are active as suppliers of unbranded (OEM) regular format printers which currently supply HP.

(144) The Commission's analysis focuses on the risk of foreclosure in relation to laser printers but does not cover inkjet printers. While HP supplies unbranded inkjet printers on an OEM basis to [customer] and to [customer], based on the Notifying Party's submission these sales are not EEA sales.8485

5.2.1 Input foreclosure

5.2.1.1 Notifying Party's views

(145) The Notifying Party submits that the Proposed Transaction would not give the merged entity the ability and incentive to engage in input foreclosure.

(146) First, the Notifying Party submits that the merged entity would not have the ability to foreclose the downstream customers of Samsung's Printer Business given that: (1) customers would be protected against any degradation in quality or interruption of supply through their contractual agreements with Samsung's Printer Business; (2) Samsung's Printer Business would lack market power in the upstream market for the supply of unbranded (OEM) laser printers; (3) customers could deploy counterstrategies in case the merged entity would adopt a foreclosure strategy, namely (i) turn to other suppliers of unbranded (OEM) regular format printers (including Canon and Sharp) or (ii) increase their internal production to the extent they are vertically integrated; and, (4) the absence of capacity constraints in the industry.

(147) Second, according to the Notifying Party, the merged entity would have no incentive to engage in any hypothetical input foreclosure strategy since: (1) contract manufacturing for unbranded (OEM) printers is typical in this industry, without evidence of such foreclosure attempts; and, (2) the merged entity would have an incentive post-Transaction to maintain large scale production and capacity utilization to maximize cost efficiency.

5.2.1.2 Commission's assessment

(148) Based on the Notifying Party's submission, Samsung's Printer Business supplies A4 laser printers86 on an OEM basis to [customers].87 However, the Notifying Party notes that Dell is gradually withdrawing from the regular format printer market.88 In addition, Samsung's Printer Business has supplied a small amount ([…] units) of A3 laser printers to [customer] in [country] and [country], and will supply further A3 laser printers on an OEM basis to [customer] pursuant to an agreement entered into in 2016.89

(149) During the market investigation, Konica Minolta stated that it had purchased a very small amount (less than [0-5]% of annual turnover) from each of the Parties in 2016.90

(150) The Commission considers that for the reasons set out below, the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to potential foreclosure of Samsung's Printer Business' (OEM) supplies of regular format printers, regardless of any segmentation.

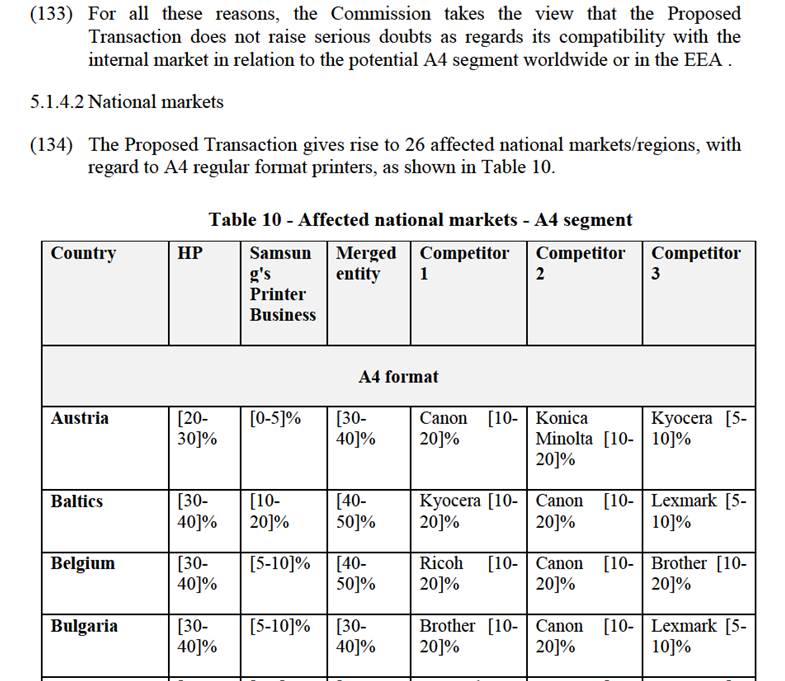

(151) First, with regard to the ability to engage in input foreclosure, the merged entity does not appear to have a significant degree of market power in the upstream market for the supply of unbranded (OEM) printers.

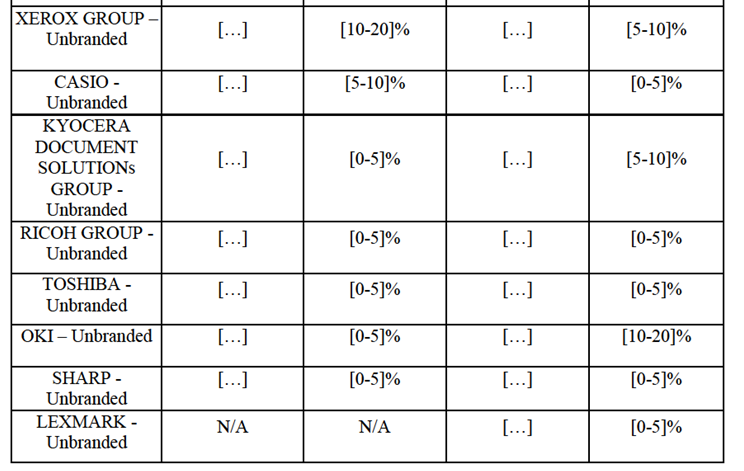

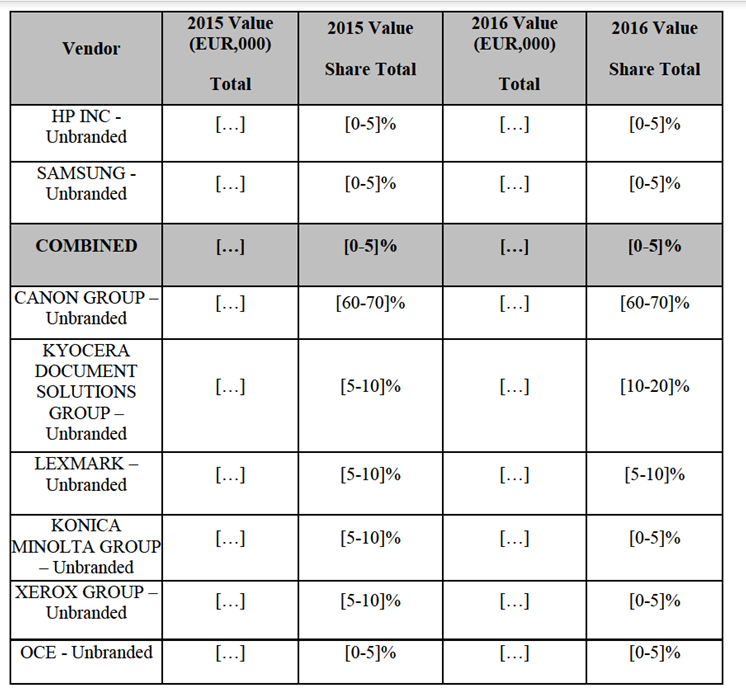

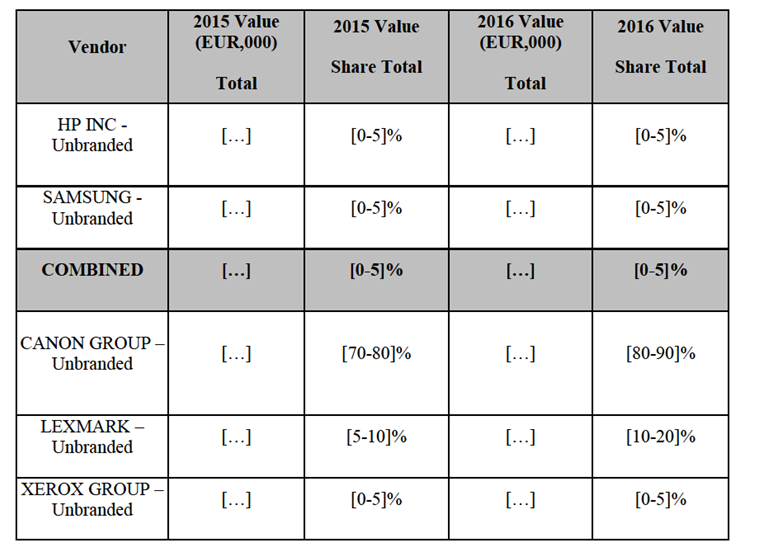

(152) Samsung's Printer Business' market shares for unbranded (OEM) Regular Format (Laser) Printers (overall for A3 and A4, A3 and A4 separately) are summarized in the Tables 11 to 15 below. As these tables show, Samsung's Printer Business did not sell any A3 format unbranded (OEM) laser printers worldwide to any significant degree. In fact Samsung's Printer Business did not sell any A3 format unbranded (OEM) laser printers in the EEA. Looking only at a hypothetical A4 format unbranded (OEM) printer segment, Samsung's Printer Business’ shares by value worldwide were [0-5]% in 2016, while in the EEA they were [0-5]%.

KYOCERA DOCUMENT SOLUTIONS GROUP – |

[…] |

[0-5]% |

[…] |

[0-5]% |

KONICA MINOLTA GROUP – Unbranded |

[…] |

[0-5]% |

[…] |

[0-5]% |

OKI – Unbranded | […] | [0-5]% | […] | [0-5]% |

OTHERS – Unbranded | […] | [0-5]% | […] | [0-5]% |

TOTAL |

[…] |

100% |

[…] |

100% |

Source: Form CO, based on IDC reports

(157) In a hypothetical segment of A4 format unbranded (OEM) laser printers on EEA- wide basis, Samsung's Printer Business’ shares by value were [0-5]% in 2016. Other competitors are Canon Group ([80-90]%), Lexmark ([10-20]%), Kyocera Document Solutions Group ([0-5]%), and others.

(158) Second, as discussed above, there appear to many competitors to the Samsung's Printer Business which could provide alternatives to the merged entity. Canon in particular has a large value share in all segments. Given that, based on the Notifying Party's submission, [post-Transaction supply strategy of the merged entity regarding unbranded (OEM) regular format printers].

(159) Third, based on the Notifying Party's submission, Xerox and Toshiba (as well as other players including Canon, Ricoh, and Konica Minolta) would be vertically integrated and therefore could expand their respective internal production as an effective counter-strategy. During the market investigation, Xerox indicated that it sourced regular format printers unbranded on an OEM basis from Fuji Xerox. 91

(160) Fourth, some of Samsung's Printer Business' customers for unbranded (OEM) regular format printers already source from other manufacturers. Based on the Notifying Party's submission, […] already sources unbranded (OEM) printers from Brother, Fuji-Xerox, Toshiba and Lexmark in addition to Samsung's Printer Business, while […] also sources unbranded (OEM) printers from Fuji-Xerox and Lexmark. Thus, even those customers which are not vertically integrated appear to have alternative sources of supply.

(161) Fifth, with regard to the incentive to engage in any input foreclosure, during the market investigation it appeared that contract manufacturing for unbranded (OEM) printers is well established. Around half of the competitors who replied to the market investigation, indicated that they currently fully or partially source on an OEM basis from another manufacturer, including for A3 laser printers (Oki, Konica Minolta and Xerox) and A4 laser printers (Konica Minolta and Xerox). Oki, for example, has indicated that it purchases A3 multifunction devices from Toshiba.

(162) One competitor which responded to the market investigation stated that post- Transaction the merged entity would not have an incentive to stop supplying unbranded regular format printers to other regular format printer manufacturers, while most competitors did not express a view on this question. 92

(163) Finally, with regard to the likely impact on prices and choice, during the market investigation, no competitor which responded to the market investigation stated that the Proposed Transaction would have an impact on the supply or the price of unbranded regular format printers in the EEA, while some competitors stated that the Proposed Transaction would have no impact and most competitors did not express any view.93 In addition, competitors did not raise any concerns with regard to input foreclosure during the market investigation.

5.2.2 Customer foreclosure

5.2.2.1 Notifying Party's views

(164) The Notifying Party submits that the Proposed Transaction would not give the merged entity the ability or incentive to engage in customer foreclosure strategies for the following reasons: (1) HP constitutes less than […] of the demand for unbranded (OEM) printers and therefore [supplier], HP's main supplier and a competitor of Samsung's Printer Business for the supply of unbranded (OEM) printers, would still have access to over […] of the unbranded (OEM) printer demand; (2) HP would have no intention of [post-Transaction strategic decision] but would hope to continue its supply relationship unbranded (OEM) A4 laser printers with [supplier]; (3) [information on Parties’ capacity] would prevent HP from [post-Transaction strategic decision] while continuing the current OEM business94; (4) since Canon, Toshiba and Sharp are all vertically integrated manufacturers of branded printers as well as unbranded (OEM) printers, they could brand the printers with their own mark and sell them directly into the market through their own sales channels.

5.2.2.2 The Commission's assessment

(165) HP purchases unbranded regular format printers on an OEM basis from [suppliers].95 HP has also recently concluded a new manufacturing arrangement with [supplier] by which it will purchase future volumes of unbranded (OEM) regular format laser printers.

(166) The Commission considers that for the reasons set out below, the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to potential foreclosure of […] (OEM) supplies of regular format printers, regardless of any possible segmentation.

(167) First, with regard to the ability to engage in a hypothetical customer foreclosure strategy, HP purchases approximately […] million units of unbranded (OEM) printers, which corresponds to [30-40]% of the volume of unbranded (OEM) printers ([…] million units) sold worldwide. Based on the Notifying Party's submission, while HP expects[post-Transaction strategic decision], HP does not appear to be able to.96 [information on the Parties’ capacity and post-Transaction strategic decision], HP would still need to [information on the Parties’ supply] unbranded (OEM) printers.

(168) Second, on the incentive to engage in customer foreclosure, most competitors which responded to the market investigation, […], did not express a view on whether post-Transaction the merged entity would have an incentive to stop sourcing unbranded regular format printers from other regular format printer manufacturers.97 Two competitors considered that the Proposed Transaction could have an impact on HP's current dependency on […]98, while another competitor responded that the merged entity would not have an incentive to stop sourcing unbranded regular format printers. 99

(169) Third, with regard to the likely impact on prices and choice, the market investigation did not reveal any impact that the Proposed Transaction would have on the supply or the price of unbranded regular format printers in the EEA.100 Furthermore, competitors which replied during the market investigation, […], have not raised any substantiated concerns with regard to customer foreclosure.

6 CONCLUSION

(170) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 71, 7.3.2017, p. 4.

4Turnover calculated in accordance with Article 5 of the Merger Regulation.

5 However, the Parties do not sell branded office automation equipment of third party manufacturers and therefore are not active in the wholesale distribution of branded printers.

6 Commission decision of 22 December 2009 in Case M.5672 Canon/Océ, paragraphs 9 and 11.

7 Commission decision of 22 December 2009 in Case M.5672 Canon/Océ, paragraphs 13 and 14.

8 Commission decision in Case M.5672 Canon/Océ, of 22 December 2009, paragraphs 16 – 19.

9 Commission decision in Case M.4434 Ricoh/Danka of 8 December 2006.

10 Commission decision of 19 January 2010 in Case COMP/M.5666 Xerox/ Affiliated computer services, paragraphs 20-29

11 International Data Corporation is a provider of market intelligence for the information technology, telecommunications and consumer technology markets.

12 Questionnaire Q2 to customers, question 13.

13 Questionnaire Q3 to distributors, resellers, retailers, question 16.

14 Questionnaire Q2 to customers, question 14; Questionnaire Q3 to distributors, resellers, retailers, question 17.

15 Questionnaire Q2 to customers, question 14.1.

16 Questionnaire Q3 to distributors, resellers, retailers, question 17.1.

17 Questionnaire Q1 to competitors question 18.

18 Commission decision in Case Konica/Minolta; Commission decision in Case M.5672 Canon/Océ.

19 Commission decision in Case M.5666 Xerox/ Affiliated computer services.

20 Commission decision in Case M.5666 Xerox/ Affiliated computer services.

21 Questionnaire Q2 to customers, question 15.

22 Questionnaire Q3 to distributors, resellers, retailers, question 18.

23 Questionnaire Q3 to distributors, resellers, retailers, question 18.2.

24 Questionnaire Q2 to customers, question 15.2.

25 Questionnaire Q2 to customers, question 15.1.

26 Questionnaire Q1 to competitors, question 20.

27 Questionnaire Q1 to competitors, question 21 and 21.1.

28 Commission decision in Case M.3091 Konica/Minolta; Commission decision in case M.5672 Canon/Océ.

29 Commission decision in Case M.5672 Canon/Océ.

30 Commission decision in case M.5666 Xerox/ Affiliated computer services, paragraph 27.

31 Questionnaire Q2 – to customers, question 11; replies to Q1 – questionnaire to competitors, question 14; replies to Q3 – questionnaire to distributors, resellers, retailers, question 11.

32 Questionnaire Q2 to customers, questions 12 and 19; Questionnaire Q3 to distributors, resellers, retailers, question 12 and 23.

33 Questionnaire Q1 to competitors, questions 15 – 17.

34 Konica Minolta's answer to Questionnaire Q1 to competitors, question 15.1.

35 Questionnaire Q1 to Competitors, question 17, and to Questionnaire Q3 to distributors, resellers and retailers, question 15.

36 Questionnaire Q2 to customers, question 7.

37 Questionnaire Q3 to distributors,resellers, retailers, question 7 and 7.1.

38 Commission decision of 22 December 2009 in Case M.5672 Canon/Océ, paragraphs 41 – 47; Commission decision of 19 January 2010 in Case M.5666 Xerox/ Affiliated computer services, paragraph 30 - 33.

39 Commission decision of 19 January 2010 in Case M.5666 Xerox/ Affiliated computer services,

paragraph 32.

40 Questionnaire Q2 to customers, question 17.

41 Questionnaire Q2 to customers, question 17.

42 Questionnaire Q2 to customers, question 18.

43 Questionnaire Q3 to distributors,resellers, retailers, question 20.

44 Questionnaire Q3 to distributors,resellers, retailers, question 20.

45 Questionnaire Q3 to distributors,resellers, retailers, question 21.

46 Questionnaire Q3 to distributors,resellers, retailers, question 22.

47 Questionnaire Q1 to competitors, questions 25 - 26.1.

48 Questionnaire Q1 to competitors, questions 24.

49 Questionnaire Q1 to competitors, question 25.

50 The Notifying Party was unable to provide separate data for the Baltic countries, Czech Republic, Slovakia and UK and Ireland, as IDC reports do not report separately for these countries.

51 IDC does not provide separate data for each of Latvia, Lithuania and Estonia , but only data for the whole Baltic region taken together. It also does not provide separate data for UK and Ireland and for Czech Republic and Slovakia.

52 OJ 2004/C 31/03.

53 Questionnaire Q2 to business customers, question 26 and Questionnaire Q3 to distributors, retailers and resellers, question 31.

54 Questionnaire Q1 to competitors, questions 28 and 32.

55 Questionnaire Q2 to business customers question 27.

56 Questionnaire Q3 to distributors, retailers and resellers, question 33.

57 Questionnaire Q1 to competitors, question 33, Questionnaire Q2 to business customers, question 30, and Questionnaire Q3 to distributors, retailers and resellers, question 35.

58 Questionnaire Q2 to business customers, question 23; Questionnaire Q3 to distributors, retailers and resellers, question 29.

59 Questionnaire Q1 to competitors, question 34; Questionnaire Q2 to business customers question 31 and Questionnaire Q3 to distributors, retailers and resellers, question 35.

60 Questionnaire Q1 to competitors, questions 41-42; Questionnaire Q2 to customers, questions 33-34; Questionnaire Q3 to distributors, retailers and resellers, questions 38-39.

61 Questionnaire Q1 to competitors, questions 40-45; Questionnaire Q2 to customers, questions 32-34; Questionnaire Q3 to distributors, retailers and resellers, questions 37-40.

62 As explained in paragraph (41), the speed ranges used by IDC are indicative standard for the manufacturers in order to classify their printers by speed. However, the actual speeds ranges offered by the manufacterers, as well as the customers views on what represents a slow, medium or fast speed printer may differ from the indicative speeds that IDC uses. Therefore the commission notes that the lines between the three speed segments used by IDC may be blurred.

63 See Commission Decision in case M 5672, Canon/Oce, of 22.12.2009, paragraph 17.

64 Questionnaire Q3 to distributors, resellers and retailers, Questions 16-17.

65 Questionnaire Q2 to business customers, question 26 and Questionnaire Q3 to distributors, retailers and resellers, question 31.