Commission, June 1, 2018, No M.8678

EUROPEAN COMMISSION

Judgment

ABB / GENERAL ELECTRIC INDUSTRIAL SOLUTIONS

Subject: Case M.8678 – ABB / GENERAL ELECTRIC INDUSTRIAL SOLUTIONS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 20 April 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Asea Brown Boveri Ltd ("ABB", Switzerland) acquires sole control over the whole of General Electric Industrial Solutions ("GEIS", USA), a division of the General Electric Company ("GE", USA). ABB is hereafter referred to as the "Notifying Party" and together with GEIS as the "Parties".

I. THE PARTIES

(2) ABB is active in power and automation technologies and serves customers in utilities, industry, and transport and infrastructure globally through four divisions: (i) Electrification Products, which is the relevant division for the present case; (ii) Robotics and Motion; (iii) Industrial Automation; and (iv) Power Grids.

(3) GEIS is a GE division active in the design, manufacture and sale of low- and medium-voltage electrical products and solutions for industrial, commercial and residential applications. GEIS is organised in four business units: (i) Engineered Solutions; (ii) Product Solutions; (iii) Configured Solutions; and (iv) Embedded Solutions.

II. THE CONCENTRATION

(4) ABB and GE entered into a Stock and Asset Purchase Agreement on 24 September 2017 by virtue of which ABB acquires the entirety of the GEIS division of GE by way of acquisition of equity interests in and the assets of the relevant GEIS entities (the "Proposed Transaction"). As a result, the Proposed Transaction qualifies as an acquisition of sole control by ABB over GEIS within the meaning of Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (3) [ABB: EUR 31 153 million; GEIS: EUR […] million]. Each of them has an EU-wide turnover in excess of EUR 250 million [ABB: EUR […] million; GEIS: EUR […] million], but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

IV. MARKET DEFINITION

(6) The Proposed Transaction involves the electrical equipment sector. Electrical equipment consists of components that are supplied individually or integrated into a system. In previous cases, the Commission has subdivided electrical components and systems according to their respective voltage levels, into three segments: (4)

· Low Voltage ("LV") products (<1 kV);

· Medium Voltage ("MV") products for distribution networks operating at voltages between 1 kV and 52 kV; and

· High Voltage ("HV") products for transmission networks operating at voltages between 52 kV and 800 kV (irrelevant for the Proposed Transaction).

(7) The results of the market investigation carried out in the present case indicate that this segmentation remains appropriate. (5)

(8) The Proposed Transaction primarily relates to the design, manufacture and marketing of LV and, to a lesser extent, MV products, as well as to Secured Power Products ("SPP") and transformers.

IV.1. Low voltage products

(9) LV products comprise equipment for electricity distribution and connection to the grid in residential, commercial and industrial buildings (such as electrical switchboards, cable ducts and junction boxes, sockets and switches), and are located downstream of the connection to the medium-voltage electricity supply, as well as communication and control components (for air conditioning, lighting, etc.) and other equipment such as security systems and fire or intruder detection and alarm systems.

(10) In practice, LV products comprise a range of different components and systems (i.e. combinations of integrated components) performing different functions in the distribution of low voltage electrical current as well as connecting and protecting electricity-powered items in residential, commercial and industrial settings. In this Decision, each LV component or system that fulfils a certain function will be referred to as an "LV product category". (6) An LV product category can encompass different variants of the component or system in question (e.g. for various LV product categories different versions exist depending on the number of poles that they include (7)).

(11) ABB and GEIS both manufacture and supply a broad assortment of LV product categories, so that the Proposed Transaction results in various horizontal overlaps. In addition, various LV product categories supplied by ABB and/or GEIS are used as inputs in a variety of electrical equipment, including other LV product categories, which may be manufactured and sold by ABB, GEIS or both. (8) Therefore, some vertical links also exist between some of the Parties' LV product categories.

IV.1.1. Product market definition

(12) In previous decisions, the Commission found that each LV product category is capable of giving rise to a separate product market due to the specific function thereof, which results in a lack of substitutability with other LV product categories. (9) No further sub-segmentations narrower than LV product categories relevant for this Decision have been envisaged in the past (10), nor have sub- segmentations per sales channel been considered for LV product categories.

(13) The Notifying Party observes that all LV product categories could be considered as belonging to one overall product market due to brand effects, i.e., the brand loyalty displayed by end-customers in sourcing LV products, but ultimately does not dispute the approach previously adopted by the Commission (i.e., product markets defined at the level of LV product categories) and provided data for different LV product categories in line with this approach. (11) Annex I describes the LV product categories in which the Parties' activities overlap, as identified and submitted by the Notifying Party on the basis of the Commission's decision- making practice. (12)

(14) Nevertheless, the Notifying Party also submits that two deviations should be made to the practice of defining product markets at the level of functionally- different LV product categories without further distinction. These deviations relate to LV Modular DIN-Rail Components and LV Contactors.

(15) With regard to LV Modular DIN-Rail Components, the Notifying Party submits that, in contrast to other LV product categories, these components should be assessed together as one market in spite of their different control, measurement or support functions. (13) This is because they are all mounted on a standardised modular platform/rail ensuring mechanical and/or electrical connectivity and all serve the same purpose which is to facilitate the function of the main electrical equipment to which they are mounted.

(16) With respect to LV Contactors, the Notifying Party contends that in the product category of LV Contactors (14), a distinction could be drawn between LV Industrial Contactors (i.e. contactors for industrial use) and LV Installation Contactors (i.e. contactors for residential use). It thereto submits that despite the fact that they both have the same basic function, they are used in different settings (industrial and non-industrial) and have a different capacity which prevents substitutability, but that ultimately the exact product market definition can be left open. (15)

(17) Apart from LV Contactors, the Notifying Party submits that, overall, a sub- segmentation of LV product categories between industrial applications and residential applications is not appropriate, because supply-side substitutability is high and their functionality differs only in a limited way. (16)

(18) The Commission conducted its market investigation on the basis and in respect of all LV product categories and sub-segments thereof as submitted by the Notifying Party. Although some respondents to the market investigation considered that technological advances justify the consideration of large groups of LV product categories as belonging to the same product market, (17) the results of the market investigation broadly supported the manner in which the Notifying Party identified separate markets, and thus supported a delineation into the LV product categories and sub-segments thereof as listed in Annex I, this in view of their respective technical characteristics, prices and intended use and the therefrom resulting lack of substitutability across LV product categories. (18)

(19) Regarding LV Modular DIN-Rail Components, a majority of respondents to the market investigation considered it indeed appropriate to identify the category of LV Modular DIN-Rail Components as one single market for the purpose of assessing supply and demand dynamics. (19)

(20) With regard to LV Contactors, the market investigation elicited mixed results as to whether LV Industrial Contactors and LV Installation Contactors are substitutable with each other or not; the majority of competitors viewed these products as non-substitutable whereas the majority of customers indicated the opposite. (20)

(21) In relation to a potential sub-segmentation of LV product categories (other than LV Contactors) between industrial and residential applications, the results of the market investigation are in line the Notifying Party view; customers considered it inappropriate to distinguish between residential and industrial applications for LV products, both when surveyed about a number of identified LV product categories and when asked generic questions to that effect. (21)

(22) With respect to potential sub-segmentations per sales channel, a majority of respondents to the market investigation considered it inappropriate to define separate markets for each customer segment, such as distributors, panel builders, system integrators or OEMs. (22) In particular, competitors explained that the technical characteristics, functionalities and intended use of the different LV product categories are the same across customer segments. (23) Likewise, customers indicated that "[t]here is no general differentiation from a customer segment point of view" and that "products are the same no matter which customer segments they are sold to". (24)

(23) With regard to any other possible alternative sub-segmentations of LV product categories, the market investigation overall did not elicit views shared by a sufficiently high number of respondents that would be capable of supporting any such alternative. (25) There is one exception, relating to the LV product category of Miniature Circuit Breakers ("MCB") (26) where the market investigation indicated that meter boards in Germany need to be equipped with a so-called Selective Miniature Circuit Breaker ("SMCB") which has a selective feature capable of de- energising only fault currents while leaving other circuits powered. (27) Regular MCBs do not provide that feature and are therefore not suitable for the German meter board application, (28) nor for other applications requiring selectivity performance (e.g., circuit feeding motors). The Notifying Party contended that SMCBs were "part of" MCBs and that other product categories (e.g., LV Fuses and LV Moulded Case Circuit Breakers) also offer the selective feature in question. (29) However, the Commission understands that SMCBs are the preferred and optimal solution to fulfil that selectivity requirement in German meter boards, for technical and cost-related reasons. (30) The Commission also understands that the main application for SMCBs in the EEA is to fulfil the selective feature required by meter boards in Germany. (31)

(24) In any case, taking into account the Notifying Party's arguments and the results of the market investigation, the Commission considers that, the precise scope of the product market definition can be left open since the Proposed Transaction does not raise serious doubts on the narrowest plausible segmentations, which is each separate LV product category with further sub-segmentations for MCBs between SMCBs and other MCBs and for LV Contactors between LV Industrial Contactors and LV Installation Contactors. Furthermore, the Commission considers that a plausible market exists for LV Modular DIN-Rail Components. (32)

IV.1.2. Geographic market definition

(25) In previous cases, the Commission generally considered the relevant geographic markets for LV product categories as being national due to prevalent local regulations, local customer bases and disparities in prices and suppliers' market positions across Member States. (33)

(26) The Notifying Party does not dispute that the relevant geographic scope is national in relation to the LV product categories with respect to sales to "downstream" customers, (34) i.e., wholesale distributors of electrical equipment, panel builders, system integrators, and original equipment manufacturers (OEMs). (35)

(27) With regard to sales to "upstream" customers, i.e., competitors buying LV products from each other to complement their portfolio or to use as input into other electrical systems, the Notifying Party however considers that the scope of LV markets should be viewed as EEA-wide. The rationale for such a differentiated geographic scope is that those competitors that supply and buy LV products to or from each other to complete their portfolio are large industrial players with a limited number of manufacturing plants throughout the EEA, which source components at least on an EEA-basis, without facing specific regulatory barriers or transportation costs. (36)

Sales to "downstream" customers

(28) The vast majority of sales of LV products are made to distributors of electrical equipment, panel builders, system integrators and industrial manufacturers (OEMs), defined together as "downstream" customers. When it comes to defining the geographic scope of the relevant markets for the sale of LV products to these downstream customers, the outcome of the market investigation has been ambivalent.

(29) On the one hand, the outcome of the market investigation points to the existence of national markets at the level of each EEA Member State. First, in terms of pricing, the market investigation revealed that prices for the same LV products vary significantly between Member States. (37) Second, local regulations relating to product design and installation procedures require LV products to be compliant with different specifications across Member States. (38) Third, the supplier base is not the same across EEA Member States. Smaller suppliers are generally locally based and differ across Member States, whereas large suppliers, such as the Parties, may be active in several Member States, though their respective market position may vary significantly from one EEA country to the other. (39)

(30) On the other hand, the outcome of the market investigation points to the possibility of cross-border markets. Both competitors and customers notably indicated that products to be used in one particular Member State could generally be sourced from a different Member State. (40) Moreover, most respondents to the market investigation appear to share the view that LV products for sale in the EEA can also be sold outside the EEA and, conversely, that LV products used outside the EEA can be marketed within the EEA, to the extent that they comply with IEC standards (excluding the United States and China, where different standards apply), thus potentially indicating that competition could even be wider than the EEA level. (41)

(31) In view of the outcome of the market investigation, the Commission considers that the relevant geographic market for LV product categories, and considered sub-segments thereof, can be left open with respect to sales to downstream customers given that the Proposed Transaction does not give rise to serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation, which is national in scope.

Sales to "upstream" customers

(32) In addition, the Commission has investigated the Notifying Party's arguments that a different geographic segmentation of LV product categories is warranted with regard to sales to upstream customers, in light of previous Commission decisions. (42)

(33) For the purposes of the market investigation, the Commission has defined "upstream customer" as the purchasing party to a brand label (or other supply) agreement located at the same level in the supply chain as the seller, in the sense that it procures products under an agreement to resell them downstream to the merchant market (typically) under its own brand, in competition with the selling party to that agreement.

(34) It is indeed common industry practice for manufacturers of LV products to engage in brand label agreements to source certain specific products from other manufacturers in order to fill gaps in their portfolio and be able to offer the widest range of products to downstream customers under their own brand(s). (43)

(35) The Parties have submitted that the brand label agreements to which they are a party are generally entered into at EEA-level. (44) A majority of respondents to the market investigation involved in purchasing from competitors has also indicated that their brand label agreements are global or EEA-wide in scope, thus not limited to the territory of a particular Member State, though they may pertain to different versions of particular products that need to be compliant with local regulations. (45) Similarly, the market investigation supported the Notifying Party's argument that, in brand label agreements, prices are negotiated centrally even though they may reflect specific market characteristics. (46)

(36) There are instances where LV product suppliers purchase certain products instead of manufacturing them with the aim of complying with local regulations and then source from a specific local producer. However, ABB submits that it does not source any product under brand label agreements for the purposes of ensuring compliance with local regulations, and only [5-10]% of brand label agreements are entered into by GEIS for this purpose. (47) Overall, the results of the market investigation indicate that the location of the supplier or the destination of the product does not appear to be a determinative criterion for the selection of suppliers by upstream customers. (48)

(37) In addition, competitors responding to the market investigation have indicated that transportation costs for LV products are limited (below 5%) within the EEA, which enables them to source centrally and ship throughout the EEA. (49)

(38) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission concludes that it is appropriate to consider a separate geographic market for sales of LV products to competitors or "upstream customers", in view of their different sourcing strategies, which is at least EEA- wide in scope. Whether the relevant market should be EEA-wide or wider can be left open since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation, which is EEA-wide in scope. IV.1.3. Conclusion on LV product and geographic market definition

(39) In light of the Notifying Party's arguments and the results to the market investigation, the Commission concludes that the precise scope of the product and geographic market definitions for LV product categories or considered sub- segments thereof can be left open for the purpose of this Decision, given that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even under the narrowest plausible segmentations.

(40) In view of the difference identified in terms of the geographic scope of the market, depending on whether the relevant products are sold to upstream or downstream customers, the assessment of the Proposed Transaction will be carried out at national level for each LV product category or considered sub- segment thereof with respect to sales to downstream customers; thus for the purposes of assessing horizontal overlaps between the Parties, as well as possible conglomerate effects. The assessment of the Proposed Transaction will be carried out at EEA level for each LV product category or considered sub-segment thereof with respect to sales between competitors; thus for the purposes of assessing vertical relationships. (50)

IV.2. Medium voltage products

(41) As noted in paragraph (6), MV electrical equipment is used in distribution networks operating at voltages between 1 kV and 52 kV. MV equipment includes a variety of switching and branching, measurement, control and protection devices, circuit breakers, disconnectors, lighting arresters, contactors and distribution transformers. In this Decision, each of the MV components or systems that have a certain application will, as for LV products, be referred to as "MV product categories".

(42) The Parties' activities overlap only in relation to two MV product categories: MV circuit breakers and MV switchgears. Multiple vertical relationships also arise between the Parties' activities in respect of different MV product categories, as various MV product categories supplied by ABB and/or GEIS are used as inputs in a variety of electrical equipment, including other MV product categories, which may be manufactured and sold by ABB, GEIS or both. (51)

IV.2.1. Product market definition

(43) In the past, the Commission has generally assessed individual MV product categories as constituting separate markets due to their specific functionalities. Alternative wider groupings have been considered but product market definitions have then generally been left open in the absence of competitive concerns. (52)

(44) The Notifying Party considers that all MV products could be defined as forming part of one overall product market due to the sourcing of MV products on a project or equipment basis, (53) but does not ultimately dispute the approach previously adopted by the Commission (i.e. products markets defined at the level of product categories) and provided data for different MV product categories in line with this approach. A description of those MV product categories where the Parties overlap, or where a vertical relationship between the Parties' activities in relation to MV product categories results in an affected market, as identified and submitted by the Notifying Party on the basis of the Commission's decision- making practice in relation to MV product categories, can be found in Annex I. (54) The Notifying Party ultimately suggests leaving the market definitions open given the limited overlaps between the Parties in relation to MV products.

(45) The Notifying Party does, however, consider that in respect of MV Circuit Breakers and MV Switchgears a further segmentation is appropriate. MV Circuit Breakers should be segmented into MV AC Circuit Breakers and MV DC Circuit Breakers due to the fact that the technology used in them differs. MV AC Circuit Breakers generally use a vacuum or gas to interrupt the current whereas MV DC Circuit Breakers use a magnetic blow out. Therefore, they are not interchangeable. (55) The same applies to MV Switchgears which can be further segmented into MV AC Switchgears and MV DC Switchgears. MV Switchgears can be used in AC or DC environments. MV AC Switchgears are used in transmission and distribution networks or industrial settings, whereas MV DC Switchgears are used in fixed substations which feed power to railway power lines or industrial setting operating on DC power. The Notifying Party submits that the exact definition of the relevant product market can in any case be left open as the Proposed Transaction does not raise any competition concerns irrespective of the segmentation upheld. (56)

(46) The market investigation has elicited mixed results as to the appropriateness of defining separate markets at the level of each different MV product category on account of technical characteristics, prices and intended use. (57) However, no alternative segmentation appears to be widely used within the industry and, (58) notably, a distinction between MV products used in primary distribution and in secondary distribution (59) does not appear appropriate in the view of the majority of customers responding to the market investigation. (60) Moreover, a majority of respondents found it inappropriate to define separate markets for each customer segment such as distributors or utilities. (61)

(47) As regards MV Circuit Breakers and MV Switchgears, in line with the Notifying Party's views, respondents to the market investigation consider that whereas they generally perform the same function, MV AC and MV DC Circuit Breakers behave differently and have different performance characteristics, with the result that they are not interchangeable. (62) The same conclusion applies to the distinction between MV AC Switchgears and MV DC Switchgears. (63)

(48) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission considers that, in any case, the precise scope of the product market definition can be left open since the Proposed Transaction does not raise serious doubts on the narrowest plausible segmentation, which is each separate MV product category and the further sub-segmentation for MV Circuit Breakers between MV AC Circuit Breakers and MV DC Circuit Breakers, as well as for MV Switchgears, between MV AC Switchgears and MV DC Switchgears. (64)

IV.2.2. Geographic market definition

(49) In previous decisions, the Commission has considered that the geographic market in relation to MV product categories was likely to be at least EEA-wide. (65)

(50) The Notifying Party submits that the geographic market for MV product categories, irrespective of their segmentation, should be defined as at least EEA- wide in scope, given that customers of MV products primarily include large utilities sourcing on a cross-border level and that major manufacturers are generally able to supply worldwide according to various standards and that transportation costs represent an insignificant percentage of MV product sales prices. (66) However, the exact definition of the relevant geographic market could be left open given the insignificant overlaps caused by the Proposed Transaction. (67)

(51) Most customers responding to the market investigation indicated that they are able to source MV products from different locations for use in different EEA Member States. (68) In particular, customers have indicated that the same IEC standards generally apply to MV products across all Member States. (69) Conversely, customers consider that product specifications do not differ significantly across Member States, at least for a broad range of MV products. (70) In contrast, because different standards are applicable outside the EEA, the geographic scope of MV product markets may be limited to the EEA.

(52) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission concludes that the geographic scope of the MV product categories, and considered sub-segments thereof, is likely to be at least EEA-wide in scope. However, the precise market definition can be left open since the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation, which is EEA- wide in scope.

IV.2.3. Conclusion on MV product and geographic market definition

(53) In light of the Notifying Party's arguments and the results of the market investigation, the Commission concludes that the precise product and geographic market definitions for MV product categories and considered sub-segments thereof can be left open for the purposes of this Decision given that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under the narrowest plausible segmentations.

IV.3. Secured power products

(54) The Parties' EEA activities overlap to a limited extent in relation to Secured Power Products ("SPP"). These products are designed to provide critical loads (e.g. servers) with an alternative power source in case of a power outage. One such SPP is Uninterruptible Power Supply ("UPS") solutions, which is where the Parties' product portfolios overlap. The Proposed Transaction also involves a vertical link, with respect to Embedded Power Supplies and Custom Power Solutions.

IV.3.1. Product market definition

(55) In previous cases, the Commission segmented the market for UPS devices between: (i) low UPS devices below 10 kVA and (ii) medium-high UPS devices above 10 kVA (for which a distinct servicing market may also exist). (71)

(56) The Commission has previously defined a market for Embedded Power Supplies describing that this included both AC/DC and DC/DC power converters but did not assess whether AC/DC and DC/DC power converters could constitute different segments. (72) The Commission has not previously assessed Custom Power Solutions.

(57) With respect to UPS devices, the Notifying Party does not dispute the Commission's decision-making practice, and also additionally explains that a distinction could be made for UPS devices above 10 kVA, by end-use, between industrial and non-industrial uses. However, the Notifying Party argues that UPS manufacturers typically offer both industrial and non-industrial UPS and can easily and rapidly shift production from industrial to non-industrial UPS and vice versa so that there is high supply side substitutability between the two.(73) The Notifying Party ultimately submits that the precise market definition in relation to UPS can in any even be left open given the limited overlaps arising from the Proposed Transaction. (74)

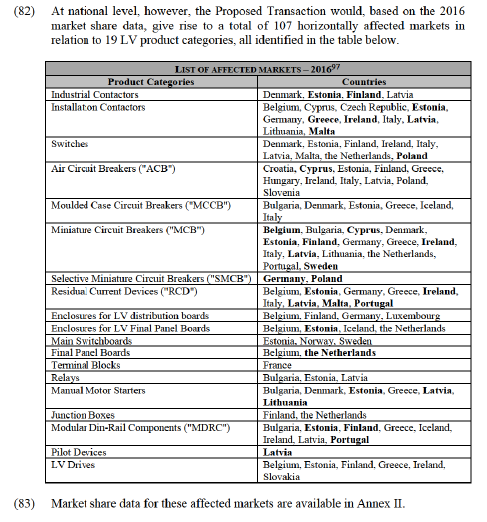

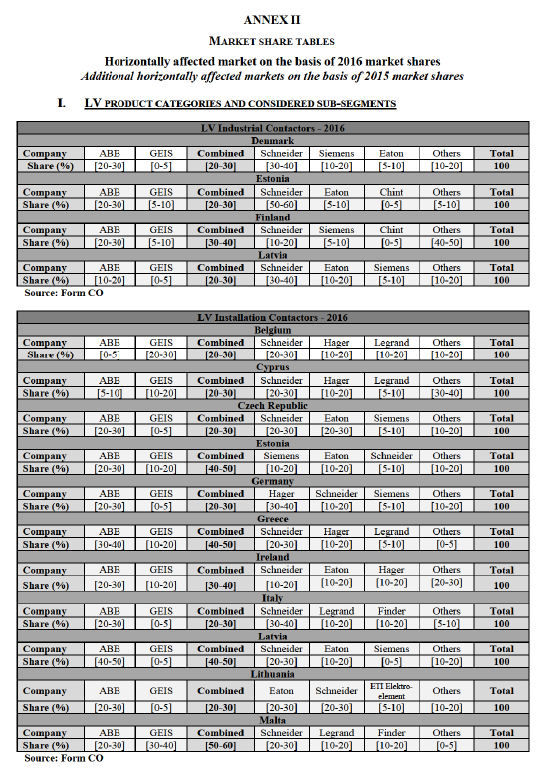

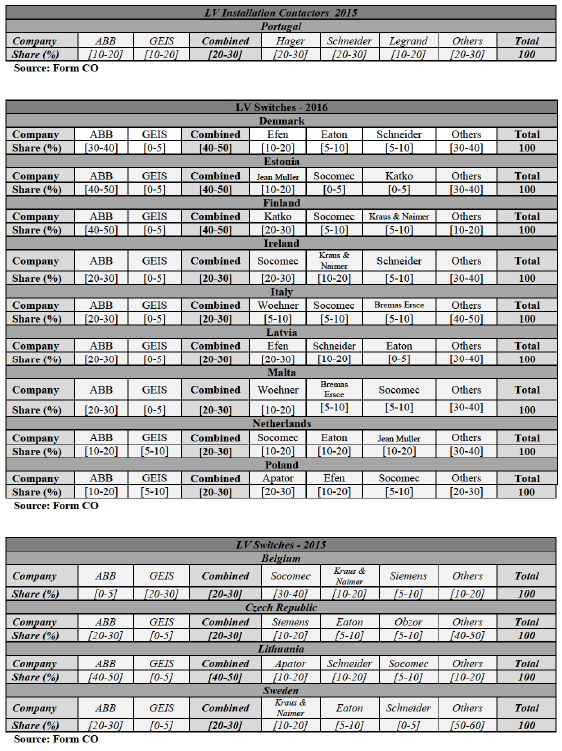

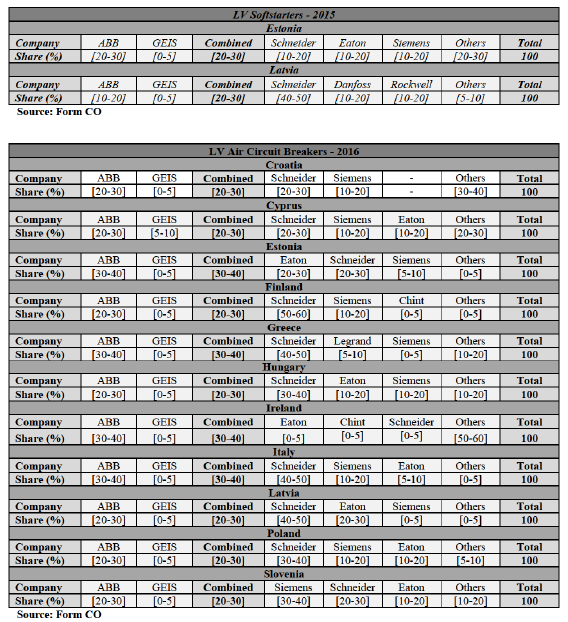

(58) With regard to Embedded Power Supplies and Custom Power Solutions, the Notifying Party submits that the exact product market definitions can be left open. (75) However, it has submitted data segmented into AC/DC power converters, DC/DC power converters and Custom Power Solutions. (76)

(59) A description of those SPPs for which the Parties' activities overlap, or where a vertical relationship between the Parties' activities results in an affected market, as identified and submitted by the Notifying Party on the basis of the Commission's decision-making practice, can be found in Annex I.

(60) The market investigation broadly supports the appropriateness of segmenting UPS devices between low UPS devices below 10 kVA and medium-high UPS devices above 10 kVA, thus between applications powered by either single-phase or three-phase input voltages, for the purpose of assessing supply and demand dynamics. (77) Likewise, the majority of respondents supported the Notifying Party's view that segmenting UPS devices for industrial and non-industrial uses was not necessary. (78) Regarding Embedded Power Supplies and Custom Power Solutions, the market investigation has not brought to light any indication that would contradict the Commission's earlier findings nor the Notifying Party's submission. (79)

(61) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission concludes that for UPS devices and Embedded Power Supplies and Custom Power Solutions the precise product market definition can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under the narrowest plausible market definition, namely a segmentation between AC/AC and AC/DC power converters within Embedded Product Supplies and Custom Power Solutions.

IV.3.2. Geographic market definition

(62) For UPS devices, the Commission has in previous decisions left open whether product markets for UPS devices were national or EEA-wide in scope. (80)

(63) In relation to Embedded Power Supplies and Custom Power Solutions, the Commission, in previous decisions, has considered the relevant markets to be at least EEA-wide in scope, and possibly worldwide, but ultimately left the exact geographic market definition open. (81)

(64) For UPS devices, the Notifying Party argues that the geographic scope is at least EEA-wide in view of customers' procurement patterns but that no affected markets arise irrespective of the definition considered because the Parties' combined share under any plausible segmentation would remain well below 10% at the level of the EEA or any individual EEA Member State. (82)

(65) With respect to Embedded Power Supplies and Custom Power Solutions, the Notifying Party submits that the exact geographic market definitions can in any event be left open in the present case. (83)

(66) In relation to both UPS devices and Embedded Power Supplies and Custom Power Solutions, the market investigation has not brought to light any indication that would contradict the Commission's earlier findings nor the Notifying Party's submission. (84)

(67) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission concludes that for the purpose of this Decision, the precise geographic market definition for both UPS devices and Embedded Power Supplies and Custom Power Solutions can be left open as no serious doubts arise under any plausible segmentation. Given that no affected product markets arise from the Proposed Transaction with regard to UPS devices, these will not be further assessed in this Decision. With respect to Embedded Power Supplies and Custom Power Solutions, the assessment of the Proposed Transaction will for the purpose of the present Decision be conducted at the narrowest plausible level, which is EEA-wide.

IV.3.3. Conclusion on SPP product and geographic market definition

(68) In light of the Notifying Party's arguments and the results to the market investigation, the Commission concludes that the precise product and geographic market definitions for UPS devices can be left open for the purpose of this Decision given that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even under the narrowest plausible segmentations. As regards Embedded Power Supplies and Custom Power Solutions, the Commission will assess Proposed Transaction on the basis of the narrowest plausible market definition, namely for AC/DC and DC/DC power converters separately and at the narrowest plausible geographic level, which is EEA-wide.

IV.4. Transformers

(69) The Parties' activities narrowly overlap in relation to Transformers. A Transformer is the electromagnetic piece of equipment that transfers electricity from one electrical circuit to another through the coupling of a magnetic core. The Parties' activities only overlap in relation to Dry-type Distribution Transformers, which are generally used for MV applications connecting medium- to low-voltage networks. (85)

IV.4.1. Product market definition

(70) In previous decisions, the Commission has left open whether the relevant market was to include both Power and Distribution Transformers or whether Distribution Transformers constituted a separate relevant product market, possibly as an MV product category. (86) Likewise, the Commission has not in the past considered whether a segmentation between Dry-type and Liquid-filled Distribution Transformers was appropriate.

(71) According to the Notifying Party, the precise market definition in relation to Transformers can be left open given that the Parties' activities only overlap in relation to Dry-type Distribution Transformers, and that the Proposed Transaction only gives rise to a negligible increment in this regard. (87)

(72) The market investigation generally supported the appropriateness of distinguishing separate markets for Power Transformers and Distribution Transformers on account of technical characteristics, prices and intended use. (88) However, results were inconclusive with regard to a possible segmentation between Liquid-filled and Dry-type Distribution Transformers. (89)

(73) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission considers that the precise product market definition in relation to Transformers can be left open due to the lack of serious doubts arising under any alternative segmentation. Given that no affected product markets arise from the Proposed Transaction, Transformers will not be further discussed in this Decision.

IV.4.2. Geographic market definition

(74) The Commission has previously considered that the relevant geographic market for Transformers was EEA-wide in scope, possibly even worldwide, although the precise definition was left open. (90)

(75) The Notifying Party therefore submits that the relevant geographic market in relation to Transformers should be considered as at least EEA-wide in scope. (91) It also notes that the increment brought about by the Proposed Transaction on the narrow segment of Dry-type Distribution Transformers is [0-5]% at EEA level, and would remain below [0-5]% on any hypothetical national market within the EEA. (92)

(76) In relation to Transformers, the market investigation has not brought to light any indication that would contradict the Notifying Party's submission nor the Commission's earlier findings. (93)

(77) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission concludes that the precise geographic market definition of Transformers, and Distribution Transformers in particular, can be left open for the purpose of the Proposed Transaction as no serious doubts arise under any plausible segmentation.

IV.4.3. Conclusion on Transformers product and geographic market definition

(78) In light of the Notifying Party's arguments and the results to the market investigation, the Commission concludes that the precise product and geographic market definitions for Transformers can be left open for the purposes of this Decision given that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market under the narrowest plausible segmentations. Given that no affected product markets arise from the Proposed Transaction, Transformers will not be further discussed in this decision.

V. COMPETITIVE ASSESSMENT

(79) In the EEA, the activities of the Parties overlap in relation to LV products, MV products, Secured Power Products and Transformers. Specifically, the overlaps relate to: (i) 26 LV product categories (including considered sub-segments thereof); (94) (ii) 2 MV product categories (including considered sub-segments thereof); (95) (iii) SPP; and (iv) Distribution Transformers. However, the combined activities of the Parties in relation to UPS devices and Distribution Transformers do not give rise to any affected markets. They will therefore not be dealt with further in this Decision. Similarly, the overlap arising in respect of MV AC Switchgears does not lead to an affected market and as such, will not be discussed further in this Decision. Hence, the competitive assessment below only addresses the potential horizontal, vertical and conglomerate effects derived from the Proposed Transaction in the remaining affected LV and MV markets. (96)

V.1. LV Products

V.1.1. Horizontal non-coordinated effects

(80) Both Parties are active in the manufacture and supply of LV products, and their activities overlap in relation to the 26 LV product categories and considered sub- segments thereof listed in Annex I.

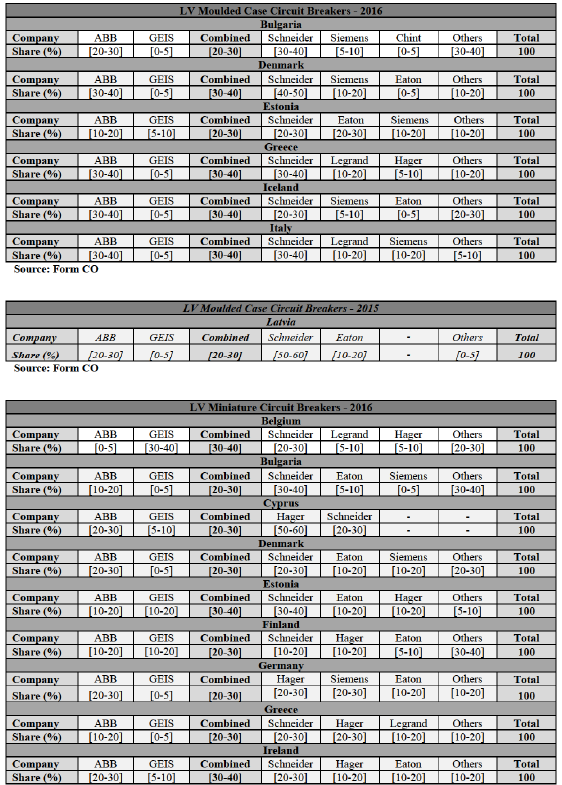

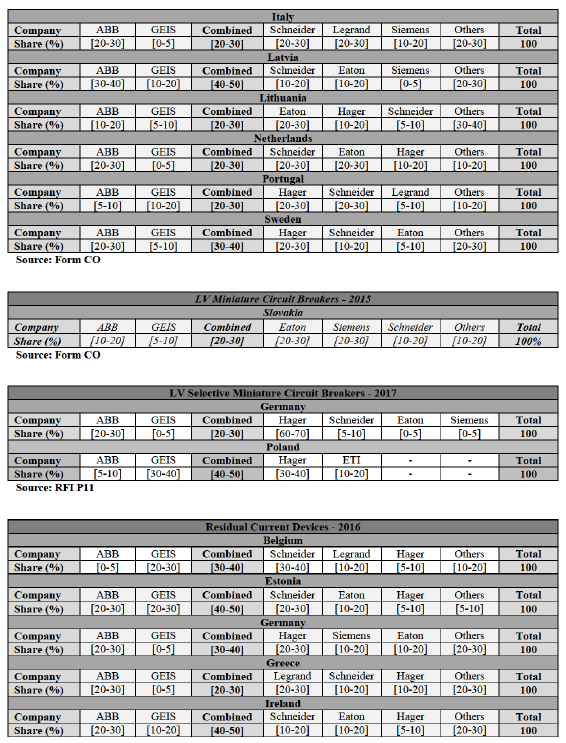

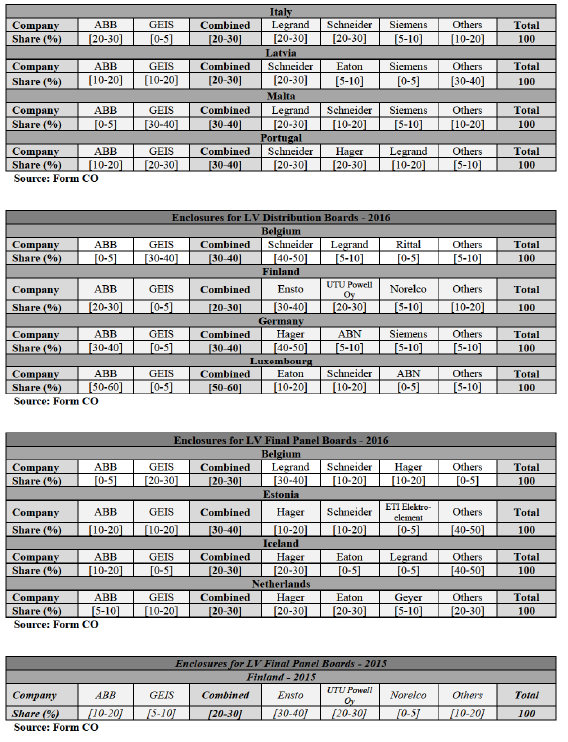

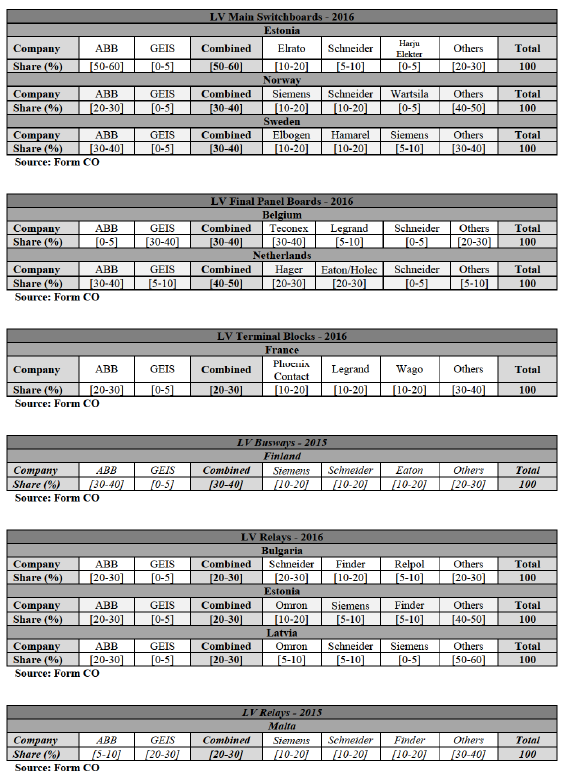

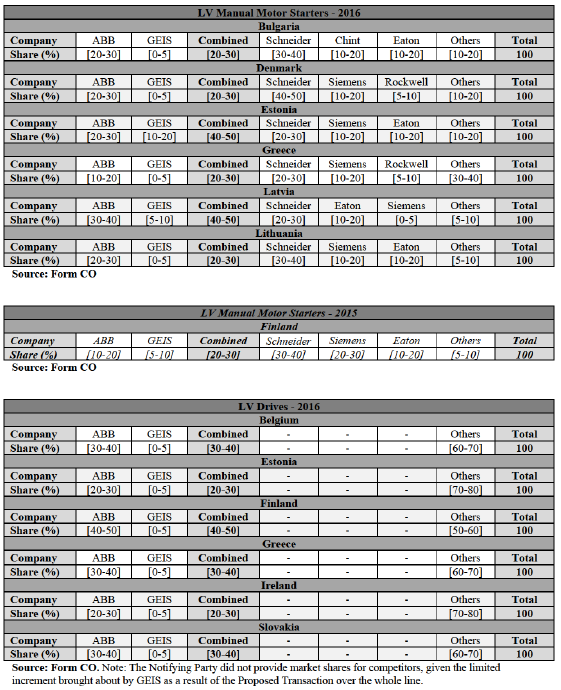

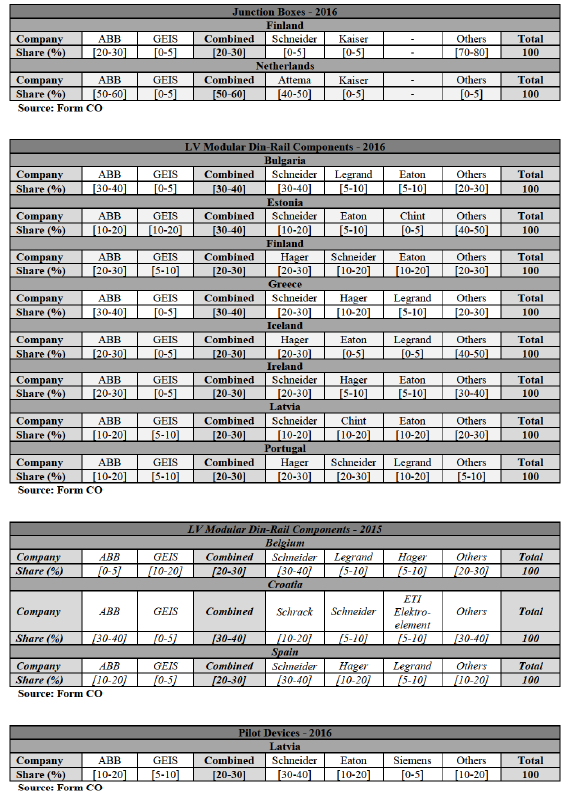

(81) On an EEA-wide level, all LV product categories combined, the Proposed Transaction would result in a sales increment of less than [0-5]%, resulting in a post-Transaction combined market share of approximately [5-10]%. According to the Notifying Party, the Parties' combined market share would also remain under 20% for each LV product category, so that the Proposed Transaction would not give rise to any horizontally affected markets.

(84) When it comes to the competitive landscape with regard to LV product categories and considered sub-segments thereof, the data in Annex II shows that in addition to the Parties, the main EEA competitors active on all or most affected LV product categories are Schneider, Siemens, Eaton, Hager and Legrand. In addition, depending on the specific LV product category or EEA Member State, certain other smaller players are also present.

(85) Additionally, these data reveal that for 75 of those horizontally affected markets (98), either the Parties' combined market share is so low that those markets are only marginally affected, or only a minor increment is brought about by GEIS so that the Proposed Transaction results in an insignificant increase in market concentration. As such, competition concerns arising from the Proposed Transaction appear unlikely in relation to these markets. (99) In addition, in all of these markets, the merging parties do not appear to be particularly close competitors and the merged entity will generally continue to face a large number of competitors active on each of these markets post-Transaction.

(86) Furthermore, according to the information available to the Commission, the merger involves no potential or recent entrant in any of these markets, none of the merging parties could be considered an important innovator in any of these markets, the Commission is not aware of any significant cross-shareholdings of the participants in any of these markets, none of the Parties can be considered a maverick firm with a high likelihood of disrupting coordination in any of these markets and the Commission is not aware of any past or ongoing coordination or facilitating practicing in any of these markets. In addition, respondents to the market investigation have not raised any concerns in relation to any of these markets. For these reasons, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market based on the likely effects in relation to these 75 markets.

(87) As regards the other 32 affected markets, (100) the Notifying Party submits that the Proposed Transaction does not give rise to any significant impediment to effective competition because: (i) GEIS' offering, in relation to many of the product categories, is wholly or partially dependent on brand label agreements; (ii) of the presence of a number of large well-established competitors from whom the merged entity will continue to face competitive pressure such as Schneider, Eaton and Siemens, as well as others who contribute to guaranteeing alternative supply sources; and (iii) the products concerned are largely commoditised and customers for these products often multi-source and have sophisticated market knowledge, which enables them to switch between the wide range of suppliers available.

(88) Taking account of the results of the market investigation, the Commission considers that the Proposed Transaction does not raise serious doubts as a result of horizontal non-coordinated effects with respect to any LV product category, as well as in respect of LV Industrial Contactors and LV Installation Contactors and Modular Din-Rail Components, for the reasons set out below.

(89) First, the market investigation indicated that overall the Parties are not perceived as particularly close competitors. Whereas a large majority of respondents to the market investigation, competitors and customers alike, consider ABB to be an important supplier of LV products in the EEA, GEIS is considered to be mainly active in the USA and is only viewed as an important EEA-supplier by a minority of respondents. (101) Additionally, when asked about the five closest competitors of ABB, only one of the competitors that responded to the market investigation considered GEIS to be one of ABB's main competitors in the EEA. (102) As regards customers, only a minority indicated that they consider GEIS to be among ABB's main competitors, and none ranked GEIS as ABB's closest competitor. (103) Therefore, it appears that the Parties are not close competitors pre-Transaction.

(90) Second, the majority of both competitors and customers stated that within each LV product category (or sub-segment thereof), there is homogeneity across suppliers and technical and functional interchangeability across brands and suppliers, (104) regardless of any product differentiations related to, inter alia, country-specific regulations or product designs. (105) All large competitors, such as Schneider, Siemens and Eaton, have a comparable portfolio and are generally able to and do supply all individual LV products in all or most EEA countries. The fact that the market shares of the various large market players may differ, in particular between the different EEA countries within the LV product categories, does not contradict these findings. Indeed, the market investigation clearly indicated that the relative market positions of the various players are predominantly historically determined and the result of customer loyalty, (106) rather than being linked to any product specificities. (107)

(91) Third, the merged entity will not only continue to face competition from large competitors for all LV product categories (i.e. Schneider, Siemens, Eaton, Hager and others), but also from specialised and local market players.

(92) Indeed, it appears from the market investigation that smaller suppliers do exert a competitive constraint on large suppliers, including the Parties. (108) Admittedly, a small majority of respondents to the market investigation, both competitors and customers, indicated that the material scope of their own supply/procurement agreements generally covers a broad portfolio of LV products, (109) and a large majority considers it a competitive advantage to be able to offer a broad portfolio of LV products, inter alia for reasons of cost efficiency. (110) However, the market investigation also indicated that while having a wide portfolio is competitively advantageous, it is neither the key factor in determining competitiveness nor the first criterion customers take into account. (111)

(93) Ultimately, a vast majority of respondents to the market investigation indicated that specialised or local suppliers of LV products, in spite of their smaller portfolio, generally compete with large-scale suppliers, such as the Parties. (112) Furthermore, various respondents, among which several large distributors, explained that they procure both from large suppliers as well as from smaller suppliers, the latter often having more specialised or niche product portfolios, (113) and that sourcing is mainly driven by end-customers' demand. (114) Furthermore, some respondents indicated that local or specialised suppliers often have better knowledge of the local market concerned, can benefit from more tightly established customer relationships and are able to offer (especially specialised, customised) products at competitive prices. (115) Overall, respondents indicated that as such they are confident that sufficient alternative sources of supply would remain in all EEA countries for these products after the implementation of the Proposed Transaction. (116)

(94) In addition, the market investigation revealed that customers generally multi- source within each LV product category (and considered sub-segments thereof), (117) that contracts are typically concluded for a period of one year (though this could also be slightly longer), (118) and that rebates are generally customer- and contract-specific so that there are, for example, no typical assortment rebates related to sourcing the complete portfolio of a certain supplier. (119) As such, and in view of the homogeneity of individual LV products within each LV product category across suppliers, the results of the market investigation indicate that switching between the various suppliers available for these products is relatively easy.

(95) Therefore, taking into account the Notifying Party's arguments and the results to the market investigation, the Commission concludes that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with regard to horizontal non-coordinated effects in relation to any of the 19 affected LV product categories and sub-segments thereof identified in paragraph (82).

V.1.2. Vertical non-coordinated effects

(96) Due to the large number of LV product categories involved and the fact that they may be used as inputs in a variety of electrical equipment, including other LV or MV systems, which may be manufactured and sold by ABB, GEIS or both, the Proposed Transaction gives rise to multiple actual or potential vertical relations. However, according to the Notifying Party, none of the vertical relations involving LV product categories are affected by the Proposed Transaction given the limited market position of the Parties at the relevant EEA-wide level. (120) This implies that, for the components and systems in question, a sufficient supplier and customer base will remain post-merger.

(97) However, over the course of the market investigation, a specific potential input foreclosure concern was raised by a third party in relation to the supply of a particular component known as a Selective Miniature Circuit Breakers (SMCB) (a sub-segment of the LV product category MCBs), inasmuch as it is used as a main incomer (121) for meter boards in Germany. (122) As discussed in section IV.1.1., SMCBs constitute a necessary input for meter boards in Germany, as no alternative component appears to be reasonably substitutable for it, including other MCBs. The concerns raised by the third party stem from the fact that the Parties and Hager are the only manufacturers of that particular SMCB in the EEA and that the Proposed Transaction could limit the sources of supply for SMCBs, in particular for non-integrated suppliers of meter boards in Germany. (123) Indeed, the Parties appear to be currently the only suppliers of SMCBs to non-integrated suppliers of meter boards in Germany. (124) Furthermore, whereas ABB is currently one of the main suppliers of meter boards in Germany, GEIS is not active on that downstream market, which means that the Proposed Transaction could in theory affect the merged entity's incentives to continue supplying downstream competitors in the future.

(98) For the reasons set out below, however, the Commission considers that the merged entity would not have the ability to implement an input foreclosure strategy post-merger, within the meaning of the Guidelines on the assessment of non-horizontal mergers. (125)

(99) First, the market investigation has revealed that the third party raising the input foreclosure concerns is currently engaged in a supply relationship with both Parties for the procurement of SMCBs and that the applicable agreement with ABB has a duration of […]. In principle, the risk of termination of supply in the short- to medium-term appears therefore limited. Moreover, under that agreement, price increases are governed and limited by a specific contractually-set formula.

(100) Second, the remaining duration of the supply agreement with ABB appears to extend beyond the time required to implement an effective and timely counter- strategy, (126) including the (co-)development of an alternative component design, which could take between one and three years according to both the third party and the Parties. (127) In that regard, the third party raising concerns has indicated that, as a supplier of other LV components and systems, it would have the ability of engaging in such development project and in the subsequent manufacturing of the component in question. (128) Moreover, the other main SMCB customer of the Parties indicated that it could equally consider engaging in its own development efforts for meter board incomers in the future, depending on the evolution of market conditions. (129) Furthermore, the range of possible investment costs submitted by the third party does not seem excessively high considering the economic and financial data obtained by the Commission over the course of the market investigation in relation to the supply of both SMCBs and meter boards in Germany. (130)

(101) As a result, in view of the outcome of the investigation carried out on the basis of the concerns expressed by a third party including in relation to other third-party SMCB customers, the Commission concludes that it is unlikely that the merged entity will have the ability to successfully engage in a foreclosure strategy in relation to the supply of SMCBs in the future, in particular as an input for meter boards in Germany.

(102) Consequently, in view of the lack of other affected vertical relations involving LV components and systems, the Commission concludes that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with regard to vertical non-coordinated effects in relation to any LV product category.

V.1.3. Conglomerate effects

(103) In addition to the overlapping activities of the Parties in LV products, their portfolios are also complementary.

(104) However, the Notifying Party submits that the Proposed Transaction will not give rise to conglomerate concerns for the following reasons: (i) the majority of LV products offered by GEIS in the EEA are already part of ABB's product offering prior to the Proposed Transaction; (ii) the merged entity will continue to face competition from a large number of strong competitors, such as Schneider, Siemens and Eaton, who are able to offer a comparable, or even broader, range of products; (iii) other competitors can also enter into teaming arrangements, such as brand label agreements, in order to expand their product portfolio; and (iv) the merged entity will have no "must-have" products that it could leverage to increase sales of other products in its portfolio. (131)

(105) The Commission has investigated whether the Proposed Transaction could give rise to conglomerate effects in the sale of LV products and has reached the conclusion that it will not raise serious doubts in this regard for the following reasons.

(106) First, it does not appear that GEIS' portfolio would materially enhance the portfolio of products marketed by ABB in the EEA countries prior to the Proposed Transaction. Only a few additional product categories that amount to a limited proportion of the LV portfolio will be contributed by GEIS. (132)

(107) Second, the market investigation has indicated that other large competitors on the market (133) typically supply all or most LV product categories in competition with the Parties. (134) As a result, ABB will still face competition from strong competitors capable of offering similar portfolios as the merged entity post- Transaction.

(108) Third, the responses to the market investigation supported the Notifying Party's view that it is common in the industry to enter into brand label agreements to complete ones product portfolio. The majority of competitors responding to the market investigation stated that they enter into brand label agreements, as buyers, sellers or both, in order to fill gaps in their product portfolio. (135) In fact, GEIS is also itself active in a number of product markets by way of brand label agreements.

(109) Fourth, while most customers stated that it is an advantage for a supplier to be able to offer a wide portfolio of products, the vast majority of respondents also indicated that specialised or local suppliers can compete with large-scale suppliers. (136) In fact, the portfolio is not among the most important criteria driving customers' purchase decisions. (137)

(110) Fifth, the majority of respondents to the market investigation stated that GEIS does not hold any key LV product (that would be "must have"). This is line also with the fact that GEIS is not seen as an important supplier of LV products in the EEA. (138)

(111) Finally, customers have indicated that LV products are not generally sold in bundles (although discounts may apply for procuring assortments). (139) The Notifying Party will thus not be able to exercise any leverage from the breadth of its portfolio.

(112) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission takes the view that, with respect to LV product categories and considered sub-segments thereof, the Proposed Transaction is unlikely to raise serious doubts as to its compatibility with the internal market as a result of conglomerate effects.

V.1.4. Conclusion on LV Products

(113) In light of the Notifying Party's arguments and the results to the market investigation, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to LV product categories or considered sub-segments thereof as set out in Section V.1. as a result of horizontal, vertical or conglomerate effects.

V.2. MV Products

V.2.1. Horizontal non-coordinated effects

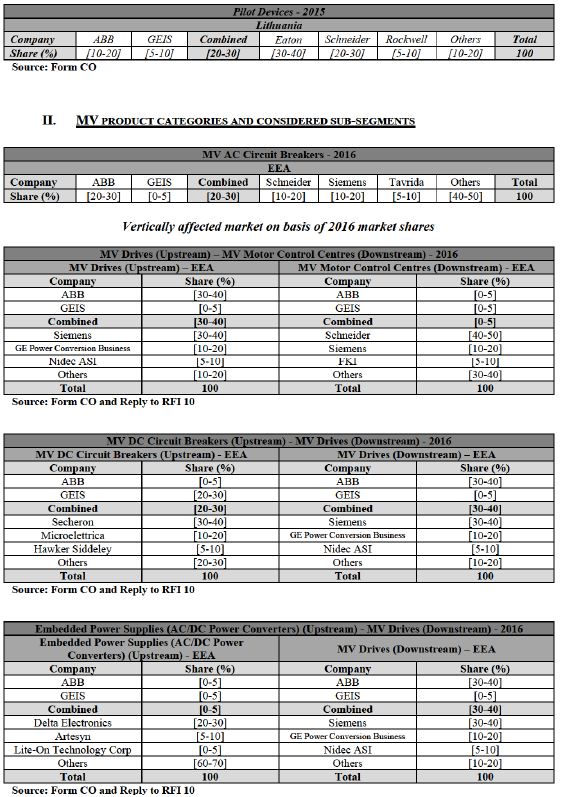

(114) The activities of the Parties overlap in the EEA in relation to MV AC Circuit Breakers and MV AC Switchgear, but only give rise to an affected market with regard to the sale of MV AC Circuit Breakers in the EEA, where ABB holds a market share of [20-30]% and GEIS of [0-5]%. (140)

(115) The Notifying Party argues that in view of the limited presence of GEIS on this market the Proposed Transaction will not raise any concerns.

(116) The Commission notes that GEIS will contribute a de minimis increment to ABB's share so that it will not have any significant impact on the market for MV AC Circuit Breakers. Moreover, the Notifying Party will still face competition from a number of strong competitors such as Schneider, with a market share of [10-20]% and Siemens with [10-20]%, among others. (141)

(117) As a result, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market as a result of horizontal non-coordinated effects with respect to MV AC Circuit Breakers.

V.2.2. Vertical non-coordinated effects (142)

(118) Due to the large number of MV product categories involved and the fact that they may be used as inputs in a variety of electrical equipment, including other MV systems, which may be manufactured and sold by ABB, GEIS or both, the Proposed Transaction gives rise to multiple actual or potential vertical relations between different MV product categories. However, according to the Notifying Party, none of the vertical relations involving MV product categories result in vertically affected markets in the EEA (implying that, for the components and systems in question, a sufficient supplier and customer base will remain post- merger) with the exception of the following EEA-wide product categories and considered sub-segments thereof: (143)

(a) The upstream market for MV Drives where ABB is active and the downstream market for the sale of MV Motor Control Centres (MV MCCs) where GEIS is active;

(b) The upstream market for MV DC Circuit Breakers where GEIS is active and the downstream market for MV Drives where ABB is active; and

(c) The upstream market for Embedded Power Supplies and Custom Power Solutions where GEIS is active and the downstream market for MV Drives where ABB is active. (144)

(119) The Notifying Party submits that in any case the Proposed Transaction will not lead to any potential foreclosure given the limited presence of the Parties and the presence of numerous strong competitors on each market.

(120) In light of the market investigation and in accordance with the Notifying Party's arguments, the Commission considers that the Proposed Transaction does not raise serious doubts with regard to vertically affected markets in relation to the product categories (and sub-segments thereof) identified in paragraph (118) for the reasons set out below.

V.2.2.1. MV Drives (upstream) and MV Motor Control Centres (downstream)

(121) In the EEA, ABB has an estimated market share of [30-40]% (145) on the upstream market for MV Drives while GEIS has a market share of [0-5]% on the downstream market for MV MCCs. (146)

(122) The merged entity will not have the ability to engage in input foreclosure given the presence of strong competitors such as Siemens, which is the market leader on the market for MV Drives with a market share of [30-40]%, as well as GE, (147) Nidec ASI or Rockwell. Similarly, in view of the limited position of GEIS downstream, on the market for MV MCCs, the merged entity will not have the ability to restrict access of upstream rivals to a sufficient customer base so as to engage in customer foreclose.

(123) Moreover, the market investigation did not reveal any concerns with regard to the availability of MV Drives upstream or to access to a sufficient customer base downstream post-Transaction.

(124) Therefore, the Commission concludes that the Proposed Transaction does not raise serious doubts in respect of input or customer foreclosure with regard to the vertical relation between the upstream market for MV Drives and the downstream market for MV MCCs.

V.2.2.2. MV DC Circuit Breakers (upstream) and MV Drives (downstream)

(125) In the EEA, GEIS has a market share of [20-30]% in the upstream market for MV DC Circuit Breakers and ABB has an estimated [30-40]% market share on the downstream market for MV Drives. (148)

(126) The merged entity will not have the ability post-Transaction to engage in input foreclosure given the presence of strong competitors such as Secheron, which will remain the market leader in the market for MV DC Circuit Breakers with [30- 40]%, as well as Microelettrica with [10-20]% and Hawker Siddeley with [5- 10]%.

(127) Similarly, the merged entity will not have the ability to engage in customer foreclosure due to the presence of strong downstream competitors such as GE, Siemens, Nidec ASI or Rockwell that account for a significant amount of demand.

(128) Moreover, the market investigation did not reveal any concerns with regard to the availability of MV DC Circuit Breakers upstream or to access to a sufficient customer base downstream post-Transaction.

(129) Therefore, the Commission concludes that the Proposed Transaction does not raise serious doubts in respect of input or customer foreclosure with regard to the vertical relation between the upstream market for MV DC Circuit Breakers and the downstream market for MV Drives.

V.2.2.3. Embedded Power Supplies and Custom Power Solutions (upstream) and MV Drives (downstream)

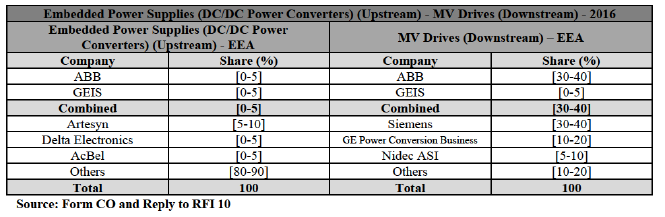

(130) In the EEA, GEIS' market in the upstream market for Embedded Power Supplies and Custom Power Solutions is below [0-5]% and ABB has an estimated [30- 40]% market share on the downstream market for MV Drives. (149)

(131) In view of the very limited position of GEIS upstream on the market for Embedded Power Supplies and Custom Power Solutions or any possible sub- segment thereof, the merged entity will not have the ability to engage in input foreclosure. Similarly, the merged entity will not have the ability to engage in customer foreclosure given the presence of strong downstream MV Drives competitors such as Siemens (the market leader with [30-40]%), GE, Nidec ASI and Rockwell.

(132) Moreover, the market investigation did not reveal any concerns with regard to the availability of Embedded Power Supplies and Custom Power Solutions upstream or to access to a sufficient customer base downstream post-Transaction.

(133) Therefore, the Commission concludes that the Proposed Transaction does not raise serious doubts in respect of input or customer foreclosure with regard to the vertical relation between the upstream market for Embedded Power Supplies and Custom Power Solutions and the downstream market for MV Drives.

V.2.3. Conglomerate effects

(134) The Notifying Party submits that the Proposed Transaction will not give rise to conglomerate concerns in relation to MV product categories. They argue that due to the moderate shares of GEIS both on an overall MV market as well as in all relevant narrow market segments, and the existence of a large number of strong competitors in each of the MV segments, foreclosure effects due to leveraging or other exclusionary practices can be excluded. (150)

(135) The Commission investigated whether the Proposed Transaction could give rise to conglomerate effects in the sale of MV products and has reached the conclusion that no serious doubts arise in this regard for the same reasons as set out in the assessment of potential conglomerate effects with regard to LV products (see Section V.1.3.).

(136) GEIS is not considered an important supplier of MV products (151) and its contribution to ABB's MV product portfolio is de minimis. Furthermore, there are many other suppliers in the industry, such as Schneider, Eaton, Siemens, Legrand and Hager with a similar offering. (152) Also, competitors have the possibility to enter into brand label agreements to widen their portfolio.

(137) Taking into account the Notifying Party's arguments and the results of the market investigation, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market as a result of conglomerate effects in respect of MV products.

V.2.4. Conclusion on MV Products

(138) In light of the Notifying Party's arguments and the results to the market investigation, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the MV product categories and sub-segments discussed in Section V.2. as a result of horizontal, vertical or conglomerate effects.

VI. CONCLUSION

(139) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This Decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

ANNEX I

RELEVANT PRODUCT CATEGORIES (153)

I. LV PRODUCT CATEGORIES AND CONSIDERED SUB-SEGMENTS

- LV Overload Relays are protective devices designed to assess conditions on an electric circuit by monitoring current flowing through the power conductors of the circuit. When a fault is found (such as overload or phase failure), the LV Overload Relay de-energises the related LV Industrial Contactors, thus interrupting the circuit and protecting it against damage that would result from overheating due to excessive current.

- LV Switches are mechanical devices that can carry out the isolation, control and (overcurrent) protection tasks needed to protect (part of) an electrical circuit or a specific piece of electrical equipment and is typically used in coordination with an overload and short circuit protection device, such as LV Fuses and/or LV Circuit Breakers.

- LV Automatic Transfer Switches are used to switch the input of an electrical circuit (e.g., of a hospital) from the commercial grid to a back-up or stand-by source, often a generator system, in case of a failure in the primary energy source, such that the back-up or stand-by source provides temporary electrical power.

- LV Softstarters are devices used with AC electric motors to temporarily reduce the load (i.e., resistance acting against the motor) and torque (twisting force that causes rotation) in the power train of the motor, especially during start-up.

- LV Circuit breakers are devices that ensure the control and protection of an electrical network allowing the user to safely close and open an electrical circuit.

- LV Air Circuit Breakers ("ACBs") are used in circuits with currents up to 6,300 A and use compressed or displaced air to quench the electric arc. They can, for example, be integrated into LV Main Switchboards.

- LV Moulded Case Circuit Breakers ("MCCBs") are used in circuits with currents typically up to 2,500 A and use air alone to quench the electric arc. They are often integrated into LV Distribution Boards and are used as an input product for UPS devices.

- LV Miniature Circuit Breakers ("MCBs") are used in circuits with a current typically below 125 A and use air alone to extinguish the electric arc and are particularly prevalent in residential settings. They are standard DIN-Rail mounted products and are often integrated into Final Distribution Boards and used as an input product for UPS devices.

- LV Residual Current Devices are protection devices that switch off electricity in a fraction of a second, by breaking the circuit when the system leaks a significant current to earth.

- Enclosures are cabinets for electrical equipment and panels onto which switches, knobs, displays and other components are mounted. They are metal or plastic boxes used to house and protect electrical components incorporated into LV Switchgear.

- Enclosures for final panel boards are standard products typically made of plastic and mounted on DIN-Rails.

- Enclosures for distribution boards are usually metal, standardised products, generally based on assembly "kits".

- Enclosures for main switchboards are typically made of metal and tend to incorporate specific components and meet stricter technical requirements, relating to electromechanical constraints and short circuit levels.

- LV Surge Protection Devices are used to protect electrical equipment from damage caused by transient overvoltage or surges (high magnitude voltage 'spikes' which can occur due to lightning or as a result of electrical switching operations), by attempting to limit the surge voltage to a safe threshold. Surge Protective Devices are also used to prevent dangerous sparking or flashover within an electrical installation thus preventing a risk of fire.

- LV Main Switchboards are situated downstream of the connection to the medium- voltage electricity supply, generally just after a Distribution substation (i.e., MV Substation). LV Main Switchboards are used to control electricity distribution mainly in large commercial buildings (more than 5000 m2).

- LV Distribution Boards are used to control electricity distribution on a floor of a large commercial building and are therefore, within an electricity distribution system, situated downstream from the LV Main Switchboard.

- LV Final Panel Boards are the last stage in an electricity distribution protection and handling system. They are generally situated at the level of an individual dwelling or small group of offices.

- LV Terminal Blocks are modular and insulated connectors, which allow more than one electrical circuit to connect to another electrical circuit by fastening two or more wires together. They consists of an insulating frame and a clamping component, and often contains two long aluminium or copper strips that are designed to connect different components.

- LV Busway Systems are electrical power supply distribution systems that seamlessly distribute power from one end of a building, facility or piece of equipment to another. The most commonly used LV Busways correspond to two other specific functions: supplying power for lighting systems and low-power electricity distribution.

- LV Relays are electrically controlled switches that are used to signal and control the operation of electrical equipment and systems.

- LV Manual Motor Starters ("MMS") are the heart of a combination motor control unit. The MMS is a full electromechanical protection device for the main circuit. The contact parts of an MMS are used mainly to switch motors manually ON/OFF, and the trip units provide fuse-less protection against overload.

- LV Junction Boxes are boxes made out of metal or plastic used in the electrical wiring of buildings for the protection of cable connections. They can be mounted on the wall, on the ceiling or on the floor. Within these boxes, wires are joined together and in some cases a switch or an electrical fixture could be mounted on the box.

- Pilot Devices are mechanical control equipment designed to provide an interface for the man-machine dialogue, thereby allowing for the operation of apparatus.

- LV Drives are electronic devices used to adjust the rotating speed or torque of a standard electric motor by controlling the frequency of the electricity exiting the Drive and entering the motor. The threshold between LV and MV Drives is 690V.

- LV Modular DIN-Rail Components ("MDRC") are electrical devices serving facilitative functions such as command and control, measurement or support functions and include, e.g., modular fuseholders, timers, twilight switches, insulation monitoring devices, socket outlets, modular measuring instruments. They are designed to be mounted on a standardised modular platform (in essence a metal bar, the DIN-Rail) used to establish mechanical and/or electrical connectivity. LV MDRCs are functional when installed in a system that services independent functions or in conjunction with other components (e.g., LV Circuit Breakers, LV RCDs).

- LV Contactors are electrically controlled switches used for the repeated establishing and interrupting of an electrical power circuit. Unlike Switches, which have to be manually operated at the location, contactors can be controlled remotely (or manually) or by automatic devices such as timers. Unlike Circuit Breakers, contactors cannot break fault current.

- LV Installation Contactors are used to switch and control lighting, heating, ventilation, motors and pumps, and are most commonly used to control lighting installations in smaller buildings.

- LV Industrial Contactors are used for starting and stopping electrical machinery (especially motors).

- LV Selective Miniature Circuit Breakers ("SMCBs") are used for their current- limiting selectivity functions downstream ensuring that only the protection device of faulty circuit trips while other circuits remain powered.

II. MV PRODUCT CATEGORIES AND CONSIDERED SUB-SEGMENTS

- MV Circuit Breakers are devices that ensure the control and protection of an electrical network allowing the user to safely close and open an electrical circuit and are available for both DC environments and AC environments. MV AC Circuit Breakers are used in distribution networks, power plants, industrial settings or railway networks. MV DC Circuit Breakers are in contrast used in fixed substations, which feed power to railway power lines (so-called Traction Substations), as part of traction chains on rolling stock (e.g. trains) or in industrial settings, which operate on DC power (e.g. mines or cranes).

- MV Switchgears are electrical equipment used to control, protect, and regulate the flow of electrical power in a transmission or distribution network. MV Switchgears are available for both AC environments and DC environments. MV AC Switchgears are used in Transmission and Distribution networks or industrial settings. MV DC Switchgears are used in fixed Substations which feed power to railway power lines (so-called Traction Substations) or in industrial settings which operate on DC power (e.g., mines or cranes).

- MV Drives are electronic devices used to adjust the rotating speed or torque of a standard electric motor by controlling the frequency of the electricity exiting the drive and entering the motor. The electric motor, in turn, drives a load such as a fan, pump, or conveyor. MV drives, as opposed to LV drives, are used in motors operating at a higher voltage.

- MV Motor Control Centres ("MCC") are generally used to provide power to motors, not general loads. The function of an MCC is to provide a centralised point of control, but also to protect motors to extend the life of the equipment. MV Motor Control Centres are destined to operate above 1 kV whereas LV Motor Control Centres are destined to operate below 1 kV.

III. SECURED POWER PRODUCTS

- UPS devices protect critical loads (i.e., sensitive electronic gear such as servers) by providing an AC power source as back-up in case utility power fails (e.g., a power cut).

- Embedded Power Supplies and Custom Power Solutions are embedded into other electrical products or systems and are used to convert and manage/control an external power source.

IV. TRANSFORMERS

- A Transformer is the electromagnetic piece of equipment that transfers the electricity (characterised by a certain voltage and electric current level) from one electrical circuit to another (often, but not necessarily, of another voltage and electric current level) through the coupling of a magnetic core. Transformers therefore are used to transfer energy from one AC power circuit to another and to increase ("step-up") or reduce ("step-down") voltage as required.

Whereas Power Transformers are generally used in transmission networks, Distribution Transformers provide the final voltage transformation in the electricity distribution system, stepping down the voltage used in the distribution lines to the level used by residential premises, factories, and similar.

- Liquid-filled Distribution Transformers contain liquid (usually oil) and are used to insulate the windings or copper/aluminium conductors of the Transformer and to keep the Transformer cool.

- Dry-type Distribution Transformers do not require a liquid such as oil or any other liquid to cool down the electrical core and coils; the coils of Dry-type Distribution Transformers are simply cooled by normal air ventilation.

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Turnover calculated in accordance with Article 5 of the Merger Regulation.

4 Case COMP/M.6945 – ABB/Power-One paragraphs 19-21; Case COMP/M.6642 – Eaton Corporation/Cooper Industries, paragraphs 10-13; Case COMP/M.6529 – ABB/Thomas & Betts, paragraph 19; Case COMP/M.5755 – Schneider Electric/Areva T&D, paragraph 8 et seq.

5 Replies to question 8 of eQuestionnaire 1 – Competitors; replies to question 7 of eQuestionnaire 2 – Customers (and national variants).