Commission, June 15, 2018, No M.8861

EUROPEAN COMMISSION

Judgment

COMCAST / SKY

Subject: Case M.8861 - Comcast/Sky

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 7 May 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Comcast Corporation ("Comcast" or the "Notifying Party", United States) proposes to acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Sky plc ("Sky", United Kingdom and the "Proposed Transaction"). Comcast and Sky are collectively referred to as the "Parties". (3)

1. THE OPERATION

(2) Comcast is a US listed global media, technology and entertainment company, with two primary businesses: Comcast Cable and NBCUniversal ("NBCU"). Comcast is present in Europe almost entirely through NBCU, which is active in Europe in: (i) production, sales and distribution of film and television content; (ii) wholesale supply of TV channels and on-demand services; (iii) CNBC, a business news service, as well as NBC News; (iv) the provision of television content to end users through NBCU’s video on demand service; (v) the licensing of its intellectual property to manufacturers and distributors of consumer products; (vi) minor golf-related digital businesses; and (vii) minor direct to consumer DVD, Blu-ray and music disk sales. (4)

(3) Sky is a UK public company whose shares are listed on the London Stock Exchange. Sky is the holding company of a number of subsidiaries carrying on business in a variety of sectors predominantly in the UK, Ireland, Germany, Austria and Italy, including: (i) licensing/acquisition of audiovisual programming; (ii) TV channel wholesale supply in the UK and Ireland; (iii) retailing of audiovisual programming to subscribers; (iv) provision of technical platform services to broadcasters on Sky’s DTH platforms in the UK, Ireland, Germany and Austria; (v) sale of TV advertising; (vi) in the UK and Ireland, the provision of fixed-line retail telephony and broadband services; (vii) in the UK, the provision of mobile communications services; and (viii) in the UK, provision of access to public Wi-Fi hotspots. Sky also recently launched its over-the-top ("OTT") subscription service ("Now TV") in Spain.

2. THE CONCENTRATION

(4) On 25 April 2018, Comcast published its announcement for a pre-conditional cash offer for the entire issued and to be issued share capital of Sky, under Rule 2.7 of the UK City Code on Takeovers and Mergers. This constitutes the announcement of the intention to launch a public bid in terms of Article 4(1) of the EUMR.

(5) Comcast intends to implement its offer to acquire the entire issued and to be issued share capital of Sky by way of a takeover offer pursuant to the relevant provisions of Part 28 of the UK Companies Act 2006. Whilst Comcast’s objective is to achieve 100% ownership in Sky, under these circumstances, the offer will be conditional upon the receipt of valid acceptances in respect of Sky shares which, together with Sky shares that Comcast has acquired or may agree to acquire (pursuant to the offer or otherwise), carry in aggregate more than 50% of the voting rights normally exercisable at a general meeting of Sky. The offer will thus be conditional on a minimum acceptance condition of 50 per cent, plus one share. The Proposed Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

(6) The Commission notes that, by decision of 7 April 2017 in case M.8354 – Fox/Sky, it unconditionally approved the proposed acquisition by Twenty-First Century Fox, Inc. of the remaining shares that it does not currently own in Sky. That transaction has not been completed yet. The current transaction in case M.8861 - Comcast/ Sky constitutes a competing bid for Sky.

3. EU DIMENSION

(7) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (5) (Comcast: EUR 74 437 million; Sky: EUR 15 186 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Comcast: EUR [turnover]; Sky: EUR [turnover]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

(8) The Proposed Transaction relates to all the levels of the TV value chain. Section

4.1 first provides an overview of the TV value chain and the Parties activities at each level of the chain. Section 4.2 onward then discusses the product and geographic market definition for each level of the TV value chain.

4.1. Introduction: the TV value chain and the Parties’ activities

(9) Audiovisual ("AV") content for television (TV content) comprises all products (films, sports, series, shows, live events, documentaries, etc.) that are broadcast via TV. (6) In previous decisions, the Commission has identified different activities in the TV value chain, namely: (i) the production and supply of TV content (including the supply of pre-produced TV content and commissioned TV content); (ii) the wholesale supply of TV channels; and (iii) the retail provision of TV services to end customers. (7) As a part of its analysis of the Parties' activities, the Commission also considers the Parties’ activities in the area of advertising (section 4.1.4).

(10) Sections 4.1.1 to 4.1.3 further describe these levels of the TV value chain as well as provide an overview of the Parties' activities at each level in the UK, Ireland, Germany, Austria, Italy and Spain.

4.1.1. Production, supply and acquisition of TV content

(11) This upstream level of the value chain concerns the production of new TV content. TV production companies produce TV content for either: (i) internal use on their own TV channels or retail TV services if they are vertically integrated in the wholesale supply of TV channels and/or in the retail provision of TV services (that is to say, captive TV production); or (ii) supply to third-party customers (that is to say, non-captive TV production).

(12) Third-party customers are typically: (i) TV channel suppliers (TV broadcasters), which then incorporate the TV content into linear TV channels, or (ii) content platform operators, which then retail the TV content to end users on a non-linear basis (that is to say, Pay-Per-View ("PPV") or video on demand ("VOD")), including non-traditional platforms, that is to say internet or so-called Over-The- Top ("OTT") platforms.

(13) TV broadcasters and TV distributors who source TV content for their TV channels or retail TV services generally have a choice between a number of sourcing models, which can be broadly categorised as follows:

a. Obtaining TV content produced on an ‘ad hoc’ basis (that is to say tailor- made), by:

i. Commissioning TV content from a TV production company (which owns the relevant TV format);

ii. Hiring a TV production company to provide the technical means and deliver the finished TV content based on a format owned by the broadcaster; or

iii. Producing the content themselves by relying on their in-house facilities (captive TV production); or

b. Acquiring broadcasting rights from TV production companies for pre- produced TV content (pre-produced TV content, sometimes referred to as off-the-shelf or tape sales).

(14) As regards commissioned TV content, in most cases, TV production companies produce TV content tailored to the needs of their customers on the basis of original TV formats (8) that they develop themselves or that they acquire from right holders (commissioned production). However, in some instances, TV production companies are hired by TV broadcasters or content platform operators to simply provide the technical production means and deliver the finished programme based on a TV format owned or acquired by the hiring company (production-for-hire or supply of TV production services).

(15) The production costs are usually borne entirely or almost entirely by the TV broadcasters or content platform operators. As regards ownership of the various rights relating to the TV content (for example, primary TV broadcast rights, ‘catch-up’, VOD, etc.), the extent to which those rights are retained by the production company – as opposed to the acquirer of TV content – may vary based on a number of factors, such as national regulation in the country concerned, the type of broadcasting, the outcome of the commercial negotiations between the parties, etc. Producers or the acquirers of TV content may then achieve secondary revenues by further licensing/distributing the TV content or the TV format to third parties.

(16) As regards pre-produced TV content, this upstream level of the value chain concerns the licensing of broadcasting rights relating to pre-existing TV content – that is to say TV content that has been previously produced and is subsequently made available ‘off-the-shelf’ by the rights holder (so-called pre-produced TV content) – and broadcasting rights relating to sports events.

(17) The broadcasting rights relating to TV content can belong to one or more of the following: (i) the holder of the rights to the TV format; (ii) the production company that produced the TV content; and (iii) the company that commissioned the production of the TV content. In addition, the broadcasting rights can belong to a third-party distributor, to which they were licensed by the original owner, with a right to sub-license.

(18) As regards the supply-side of the market:

a. Sky licenses small amounts of both commissioned and pre-produced TV content through its distribution arm, Sky Vision. It has also minimal activities through its Vision Distribution joint venture (9) and Sky Cinema Original Films initiative (10).

b. Comcast licenses both commissioned and pre-produced TV content via several NBCU companies (e.g. Universal Studios, Carnival Films and others).

(19) As regards the demand-side of the market:

a. Sky acquires some TV content from third party content owners and distributors to include in its own channels and for its content platforms;

b. Comcast has a minor presence in acquisition of TV content in the EEA to include in its own channels.

4.1.2. Wholesale supply and acquisition of TV channels

(20) TV broadcasters use the TV content that they have acquired or produced in-house in order to package it into linear TV channels. (Linear) TV channels are broadcast to end users either on a free-to-air ("FTA") basis or on a pay-TV basis.

(21) At a very general level, FTA channels are TV channels that are available to viewers free of charge. Pay-TV channels are channels for which the viewer must pay a subscription fee in order to watch. Traditionally, FTA channels finance their operations via advertising revenues (with the exception of the publicly-owned TV channels in a number of Member States which are subject to advertising limitations), while pay-TV channels generate revenues through subscription fees.

(22) The Commission notes that TV broadcasters are increasingly complementing their traditional linear TV channel offering with non-linear services such as VOD services. (11)

(23) Some TV broadcasters are vertically integrated as they are also active as retail TV operators (TV distributors) in the market for the retail provision of TV services to end users. Other TV broadcasters are not vertically integrated and rely on third party TV distributors to distribute their TV channels at the retail level.

(24) As regards the supply-side of the market:

a. Sky supplies channels to TV distributors and also holds a 50% stake in channel provider A&E Networks UK, a joint venture with A&E Networks. Sky does not supply channels on a wholesale basis in Italy and Austria, and only to very limited extent in Germany;

b. NBCU supplies a range of basic pay-TV channels on a wholesale basis, including 13th Street, Universal Channel, SyFy, E!, CNBC and Movies24.

(25) As regards the demand-side of the market:

a. Sky enters into agreements with TV broadcasters for the distribution of TV channels in the UK, Ireland, Germany, Austria and Italy;

b. Comcast does not acquire TV channels.

4.1.3. Retail provision of TV services to end users

(26) TV distributors either limit themselves to carrying TV channels and making them available to end users, or also act as channel aggregators, which ‘package’ TV channels. The TV services supplied by TV distributors to end users consist of: (i) packages of linear TV channels (which they have either acquired or produced themselves); and (ii) content aggregated in non-linear services, such as VOD, SVOD, TVOD and PPV. TV content can be delivered to end users through a number of technical means including cable, satellite and IPTV. (12) OTT players deliver channels and content in both a linear and non-linear fashion through the use of the internet.

(27) The content offered by the TV distributor is presented in an electronic programme guide ("EPG"), which is an application used on television sets to list current and scheduled programmes that are or will be available on each channel and a short summary or commentary for each programme. Each channel broadcast on the TV platform receives an EPG position, which is usually agreed between the TV broadcaster and the TV distributor. Traditional EPGs are not always used with regard to online content platforms and other non-linear methods of supplying content, or may form only part of a TV distributor's customer interface.

(28) In the retail provision of TV services to end users:

(a) Sky offers retail services in the UK, Ireland, Germany, Austria and Italy, retailing its own and third party linear pay-TV channels and VOD programming via DTH satellite, OTT and mobile technologies to end customers. Sky also broadcasts a limited number of FTA channels: Sky News International (available across much of Europe); in the UK and Ireland, Sky News, Sky News Arabia, Challenge, Pick and the Sky Intro channel; and in Italy, Cielo and TV8. Sky’s TV services on an OTT basis include NowTV in the UK, Ireland (13) and Italy, “Sky Ticket” in Germany and Austria, Sky Go (which is an OTT service available to DTH subscribers) and services operated under the Sky brand in Spain, which enable the end user to access Sky TV content in a linear and/or non-linear manner on big screen and small screen mobile devices without requiring a cable or satellite connection with Sky.

(b) NBCU supplies on demand service hayu in the UK and Ireland. It also offers limited direct sales to clients from licensing the CNBC linear channel in the UK, Ireland, Germany, Austria and Italy.

4.1.4. Advertising

(29) Advertising space can be provided through various media, including newspapers, TV airtime, radio or online advertising.

(30) When it comes to online advertising, the online advertising value chain has, on the supply side, ad publishers (including broadcasters and website owners); and on the demand side, advertisers, media buyers and advertising agencies. The ad publishers have advertising inventory available (i.e. “spaces” on their websites, videos or other digital assets) that they seek to monetise. The demand-side players seek these spaces on which to display their advertisements. Intermediaries, ad networks and ad exchanges sometimes operate in between those two markets.

(31) Once advertising space has been sold by a publisher to an advertiser, either directly or through an intermediary, both parties need to ensure that the correct ad actually appears (i.e. is served) onto the publisher website space at the right place at the right time. This step is undertaken by the ad serving tools.

(32) Both Parties are active in the supply of TV advertising airtime. Sky is also active in selling online advertising space, including targeted advertising (through Sky AdSmart) and multiplatform advertising (through Sky Advance). Apart from that, Comcast provides online display ad serving technology (through FreeWheel).

4.2. Production, supply and acquisition of TV content

4.2.1. Product market definition

4.2.1.1. Commission precedents

(33) With regard to the market for the supply of TV content, in previous decisions the Commission has concluded that there are separate markets for the: (i) production and supply of commissioned TV content; and (ii) licencing of broadcasting rights for pre-produced TV content. (14)

(34) With regard to the market for licencing of broadcasting rights for TV content, the Commission has considered that it could be subdivided by content type, in particular: (i) films; (ii) sports; and (iii) other TV content (i.e. all non-sport, non- film content); and potential sub-segments within these content types. Ultimately, the Commission left the exact scope of the product market open. (15)

(35) The Commission has also considered further sub-dividing the market for the licensing of broadcasting rights for TV content by exhibition window: (i) subscription video on demand ("SVOD"); (ii) transactional video on demand ("TVOD"); (iii) pay-per-view ("PPV"); (iv) first pay-TV window; (v) second pay- TV window; and (vi) FTA; but left the market definition open. (16)

4.2.1.2. Notifying Party’s view

(36) The Notifying party submits that, notwithstanding potential sub-divisions of TV content, if a company is only active in the production of one type of content (in particular, film content) it would be able to start producing sports content and/or other TV content within a short timeframe and without incurring significant additional costs. Moreover, there is no material difference from a demand-side perspective between US films and non-US films since both types compete to attract the same viewing audience in the EEA. Accordingly, it is the Notifying Party’s view that the distinction in the Commission’s decisional practice by content type may not necessarily reflect conditions of competition from a supply or demand side perspective.

(37) Moreover, the Notifying Party does not believe that it is necessary formally to distinguish the licensing of broadcasting rights by exhibition window (SVOD, TVOD, PPV, first pay-TV window, second pay-TV window or FTA) for the purpose of market definition since suppliers of TV content do not produce different types of TV content designed for different exhibition windows, and the content licensed in each window is broadly substitutable from a demand side perspective.

4.2.1.3. The Commission’s assessment

(38) The results of the market investigation indicate that, although content providers did not provide definitive views, most broadcasters and retail providers of audiovisual services consider the segmentations adopted in prior Commission decisions (by content type and exhibition window as indicated above) still relevant. (17)

(39) In any event, for the purpose of this decision, the exact product market definition for the production and supply of TV content can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is segmented on the basis of content type or exhibition window.

4.2.2. Geographic market definition

4.2.2.1. Commission precedents

(40) In past decisions, the Commission has defined the market for the production and supply of TV content, including production of TV content and the licensing of broadcasting rights for TV content to be either national or regional, based on linguistically homogeneous areas. (18)

4.2.2.2. Notifying Party’s view

(41) Comcast submits that the relevant geographic market for the production and supply of TV content, including any narrower segmentation thereof, is national in scope. This delineation reflects the nature of the typical licensing relationship between the supplier of the TV content and the licensee. In particular, Comcast considers that the majority of licensing relationships are concluded at the national level, with some exceptions in which the licensee obtains broadcasting rights to multiple countries/regions with a common language. Moreover, in many cases, supranational considerations are not relevant given many broadcasters (particularly FTA broadcasters) are only active in one Member State. Accordingly, it is more appropriate to delineate the geographic scope of the market based on national, rather than linguistic, boundaries.

4.2.2.3. The Commission’s assessment

(42) The results of the market investigation show that most of the respondents among TV broadcasters and distributors purchase content nationally or for certain linguistic regions. Broadcasters sometimes also purchase content on an EEA or worldwide basis. (19)

(43) In any event, for the purpose of this decision, the exact geographic market definition for the production and supply of TV content can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered to be national or by linguistic region.

4.3. Wholesale supply and acquisition of TV channels

(44) TV broadcasters package the TV content that they have acquired or produced in- house into linear TV channels. Linear TV channels are broadcast to end users either on a FTA basis or on a pay-TV basis. This wholesale level is an intermediate activity between upstream production and licensing of content, and the downstream retail provision of TV services to customers.

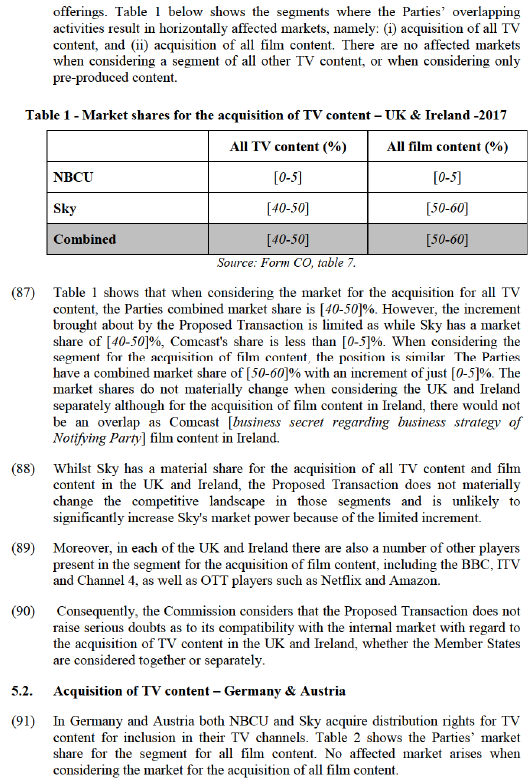

4.3.1. Product market definition

4.3.1.1. Commission precedents

(45) In previous decisions, the Commission has identified a wholesale market for the supply of TV channels. Within that market, the Commission has further identified two separate product markets for: (i) FTA TV channels; and (ii) pay-TV channels. (20) The Commission has further concluded that within the pay-TV channel market, there are separate markets for: (i) premium pay-TV channels; and (ii) basic pay-TV channels. For the purposes of its assessment, the Commission has considered FTA channels to be in the market for basic pay-TV channels. (21)

(46) In previous decisions, the Commission also examined a number of other potential segmentations, including: (i) genre or thematic content (such as films, sports, general entertainment, news, youth, and others); (22) (ii) linear channels vs non-linear services (VOD, PPV); (23) and (iii) the different means of infrastructure used for the delivery to the viewer (cable, satellite, terrestrial TV and IPTV). (24) It has ultimately left the market definition open in all these regards.

4.3.1.2. Notifying Party’s view

(47) The Notifying Party considers that basic pay-TV channels and FTA TV channels are broadly substitutable, since any differences in terms of content, pricing and licensing rights are insufficient to create a meaningful distinction. In this respect, Comcast notes that a programme produced for pay-TV could just as easily play on a FTA platform, and is not inherently of a different type. Within basic pay-TV channels, as mentioned above, Comcast considers that it is not necessary to distinguish between channels on the basis of genres for the purposes of product market definition, since each of the above mentioned genres are broadly substitutable with one another from the consumer’s perspective.

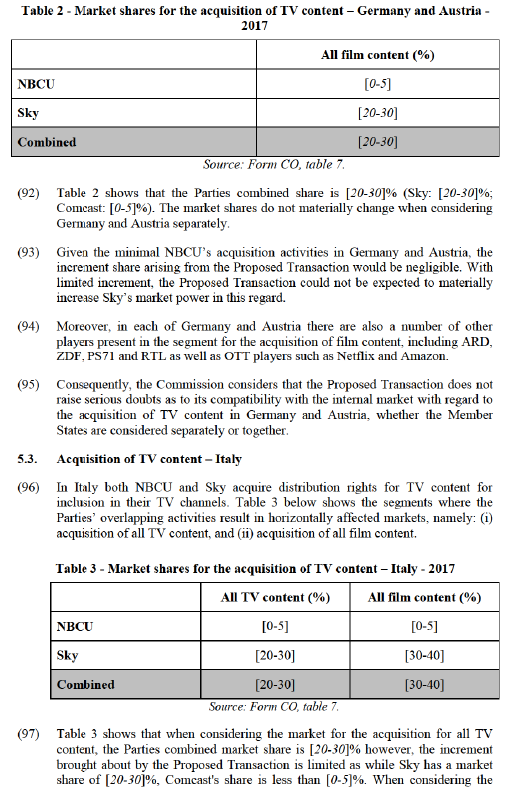

(48) In particular, the Notifying Party considers that a distinction between FTA and pay-TV does not make sense with respect to news channels. Several channels providing news content, for example the BBC and Sky News in the UK and Ireland, are available on both a FTA basis and through the EPG for retail pay-TV services in the five Member States where Sky is primarily active. Further, within these Member States, the majority of news viewing tends to be undertaken on channels available on a FTA basis, even on pay-TV platforms. Consequently, FTA news channels (such as the BBC and Sky News in the UK) are in direct competition with the (generally much smaller) news channels which are only available on a pay-TV basis (e.g. Euronews in the UK). The lack of any practical distinction between FTA and pay-TV news channels is also demonstrated by the fact that many news channels – including CNBC in the UK, Ireland and Italy – are available both FTA and via pay-TV platforms. The lack of relevance of a distinction between FTA and pay-TV in the news genre is further illustrated through the choice of several media regulatory agencies to analyse news consumption at the level of “all TV” when reporting on news consumption and competitive dynamics within their Member State.

4.3.1.3. The Commission’s assessment

(49) According to broadcasters, the distinctions drawn between FTA and pay-TV channels as well as between basic and premium pay-TV are still relevant in the UK, Ireland, Germany, Austria and Italy. However, the market investigation did not provide definitive views on whether thematic channels are only substitutable with other channels that broadcast the same specific content. (25)

(50) In any event, for the purpose of this decision, the exact product market definition in relation of the wholesale supply of TV channels can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is segmented on the basis of channel type or exhibition window.

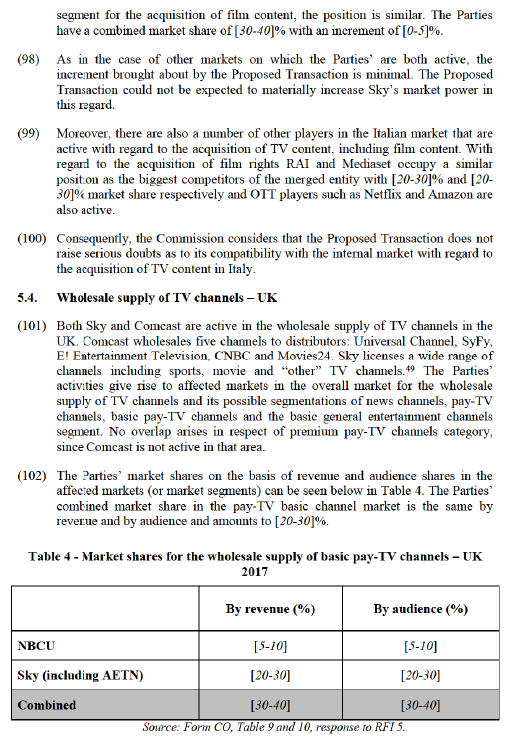

4.3.2. Geographic market definition

4.3.2.1. Commission precedents

(51) In previous decisions, the Commission found the market for the wholesale supply of TV channels to be either national in scope, (26) sub-national, (27) or by linguistic region encompassing more than one Member State. (28)

4.3.2.2. Notifying Party’s view

(52) Comcast considers that the appropriate geographic market is national in scope, given that the majority of wholesale supply relationships are concluded at the national level, with some exceptions in which the retailer obtains broadcasting rights to multiple countries/regions with a common language.

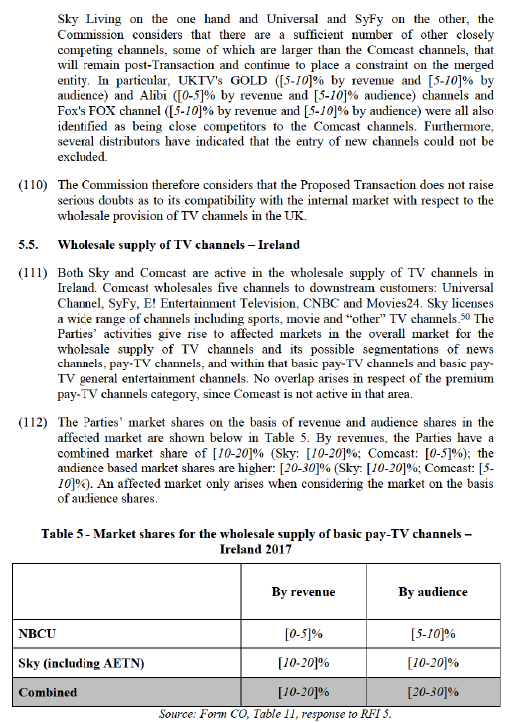

4.3.2.3. The Commission’s assessment

(53) The results of the market investigation show that the majority of agreements between TV broadcasters and retail TV distributors for the wholesale supply of TV channels are negotiated on either a national basis, although they are also sometimes negotiated on a linguistic basis. Exceptionally, agreements are also made on a sub-national or worldwide basis. (29)

(54) In any event, for the purpose of this decision, the exact geographic market definition for wholesale supply of TV channels can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered as national, sub-national or by linguistic region.

4.4. Retail provision of TV services

4.4.1. Product market definition

4.4.1.1. Commission precedents

(55) In previous cases the Commission has split the retail supply of television services in two separate markets: (i) FTA and pay-TV. (30) The Commission also considered whether pay-TV can be segmented further according to: (ii) linear vs non-linear pay-TV services; (31) (iii) according to distribution technologies (e.g. cable, satellite, or terrestrial); (32) and (iv) premium vs basic pay-TV services. (33) In recent cases, the Commission has left open the market definition with regard to each of these potential sub-segments. (34)

4.4.1.2. Notifying Party’s view

(56) Sky considers that there is a single, albeit differentiated, market for the provision of all audiovisual services (comprising pay and FTA, basic and premium) to end users.

4.4.1.3. The Commission’s assessment

(57) A number of respondents to the market investigation doubted the relevance of the distinction between basic and premium pay-TV. In addition, respondents were divided as to whether the provision of retail services could be segmented by genre. (35)

(58) The results of the market investigation indicated that most distributors provide both linear and non-linear services. However, they did not provide definitive views as to whether the broadcasting rights for linear and non-linear services are always acquired separately or together. A majority of distributors did not consider VOD services offered by OTT providers substitutable to pay-TV services. (36)

(59) In any event, for the purpose of this decision, the exact product market definition in relation of the retail supply of TV services can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is further segmented or not.

4.4.2. Geographic market definition

4.4.2.1. Commission precedents

(60) The Commission has previously considered that the market for the retail provision of TV services is either national, or limited to the geographic coverage of a supplier's cable network. (37)

4.4.2.2. Notifying Party’s view

(61) Comcast considers that the geographic scope of the market for the retail provision of TV services is national, but submits that the analysis would not be materially different if the markets were combined into linguistic regions (or considered on a sub-national basis).

4.4.2.3. The Commission’s assessment

(62) Nothing in the market investigation contradicts the Commission's previous findings that the market is either national, or limited to the geographic coverage of a supplier's cable network.

(63) In any event, the Commission considers the exact geographic market definition for the retail provision of TV services can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market on any geographic basis.

4.5. Advertising

4.5.1. Product market definition

4.5.1.1. Commission precedents

(64) The Commission has previously defined separate product markets for the sale of advertising space in national newspapers and TV broadcasting. (38) The Commission has also drawn a distinction between online and offline advertising, due to each channel’s specificity and different pricing mechanisms. (39)

(65) With respect to TV advertising, the Commission has not previously distinguished between advertising space on FTA channels and pay-TV channels. (40)

(66) With respect to online advertising, the Commission has previously distinguished between the market from the provision of advertising space and the market for the provision of online display ad technology. (41) Within the market for the provision of advertising space, the Commission has considered that: (i) there may be different markets for search and non-search advertising but left the market open; (42) and (ii) intermediation is likely part of the market. (43)

4.5.1.2. Notifying Party’s view

(67) The Notifying Party notes that advertisers typically use TV advertising airtime to reach a mass audience, while also seeking to reach particular audience demographics that might be delivered by advertising on particular channels or programmes. Moreover, in view of the increasing consumption of TV services (particularly non-linear services) online, online advertising exercises an increasing competitive constraint on TV advertising. Comcast considers that the precise definition of the relevant market can be left open, as the Proposed Transaction does not raise any competition concerns under any plausible product market definition.

(68) The Notifying Party considers that the relevant market comprises the supply of online display ad serving technology, in line with previous Commission precedent.

4.5.1.3. The Commission’s assessment

(69) Nothing in the market investigation contradicts the Commission's previous findings regarding the advertising markets.

(70) In any event, the Commission considers that the precise definition of the relevant market can be left open, as the Proposed Transaction does not raise any competition concerns under any plausible product market definition.

4.5.2. Geographic market definition

4.5.2.1. Commission precedents

(71) Previous Commission decisions have taken the view that the markets for TV advertising are national in scope. (44)

(72) As regards the geographic market definition for online display ad serving technology services, the Commission has previously considered the geographic market for these services to be at least EEA-wide in scope. (45)

4.5.2.2. Notifying Party’s view

(73) The Notifying Party considers that there is no need to precisely delineate the scope of these markets as the Proposed Transaction does not raise concerns under any approach to geographic market definition. It does not offer a position on the geographic scope of online display ad serving technology services market.

4.5.2.3. The Commission’s assessment

(74) Nothing in the market investigation contradicts the Commission's previous findings that the markets for TV advertising are national in scope and that the market for online display ad serving technology services is at least EEA in scope.

(75) Accordingly, in line with previous decisions, the Commission takes the view that the markets for advertising TV space and newspaper advertising are national in scope. The Commission also considers the geographic market for online display ad serving technology services to be at least EEA-wide but leaves the precise geographic market definition open.

5. COMPETITIVE ASSESSMENT – HORIZONTALLY AFFECTED MARKETS

(76) The Proposed Transaction results in a number of horizontal overlaps at different levels of the distribution chain.

(77) Upstream, the Parties' activities overlap with regard to the supply of TV content. Comcast is active with regard to the production and supply of commissioned TV content, as well as licensing pre-produced film and other TV content. (46) While Sky has some marginal activities with regard to licensing pre-produced and commissioned TV content and sports content, its presence upstream is negligible, leading to no horizontally affected markets in relation to the production or supply of TV content.

(78) The Parties' activities also overlap with regard to the acquisition of TV content which: (i) Sky includes in its TV channels (which are incorporated into its retail TV offering and/or wholesales to third parties) as well as for supply via its PPV/TVOD services; and (ii) Comcast includes in its TV channels which are wholesaled to third parties. This overlap results in a number of horizontally affected markets in the UK, Ireland, Germany, Austria and Italy, which are discussed further below in Sections 5.1, 5.2 and 5.3.

(79) Both Parties supply TV channels on a wholesale basis to third parties in a number of Member States. Sky supplies a range of channels including sports, movie and other channels to third parties, in particular those under the Sky brand. Comcast has a more limited number of TV channels, including 13th Street, Universal Channel, Syfy, E!, CNBC and Movies24. Horizontally affected markets arise in the UK and Ireland which are discussed further below in Sections 5.4 and 5.5 respectively.

(80) In Germany, Austria and Italy, Sky’s has a “self-retail” business model: in addition to retailing TV channels on its own platform, Sky's service is available on the platform of cable network and IPTV providers who transmit the programs' signal to end customers and perform certain marketing and distribution services for Sky. Sky, however, enters into direct contractual relationships with subscribers, controls subscriber data, deploys its own subscriber management system and retains the rights to determine the service packaging and pricing. Sky is therefore not active with regard to the wholesale distribution of TV channels in Germany, Austria and Italy and no affected markets arise.

(81) Sky is active as a retail supplier of TV services in the UK, Ireland, Germany, Austria and Italy. Comcast is also active in those Member States with the overlap resulting in an affected market in United Kingdom, Ireland, and Italy which is discussed further below in Section 5.6.

(82) For the sake of completeness, the Commission notes that Sky also expanded its OTT offering by launching a retail TV service in Spain on 11 September 2017 under the Sky brand via NOW TV. (47) Sky’s retail offering in Spain does not currently include any of Sky’s own TV channels, but rather broadcasts third party TV channels supplied by wholesale TV channel suppliers such as Twenty First Century Fox ("21CF"), Turner, NBCU and Viacom. However, no horizontally affected markets arise.

(83) Finally, the Parties' activities also overlap with regard to the supply of TV advertising airtime on their TV channels. However no horizontally affected markets arise on any plausible market definition.

(84) In the course of the market investigation the Commission received a third party submission alleging possible adverse effects on competition arising from the Proposed Transaction in the market for premium video advertising technology services. Comcast is active in the provision of online display ad serving technology services (FreeWheel), while Sky provides targeted and multi-platform advertising services (Sky AdSmart and Sky AdVance).

(85) While reserving an opinion on the precise delineation of the product market, the Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market in relation to video advertising technology services. Sky’s services are not an online ad serving technology, (48) and Sky requires ad serving technology from third-party providers for its on demand adverts. The Transaction therefore does not lead to any overlap in this respect. In addition, Comcast's position in the relevant market is limited (even on the narrowest market definition, Comcast's market share will amount to [5-10] – [10-20]%) and there are other competitors present, for example Google DoubleClick, Ooyala, AppNexus or SpotX.

5.1. Acquisition of TV content - UK & Ireland

(86) In the UK and Ireland, both NBCU and Sky acquire distribution rights for TV content for inclusion in their TV channels and in their non-linear service

(103) The Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market in this market in for the following reasons: (i) the limited increment brought about by the Proposed Transaction; (ii) the presence of multiple competing TV channel providers that will continue to constrain the merged entity post-transaction; and (iii) the fact that generally the Parties are not close competitors.

(104) First, the overall increment brought about by the Proposed Transaction is limited or does not lead to significant market shares. When looking at the segment of news channels, Comcast’s presence on that market is minimal, so the increment brought about by the transaction is negligible. On the basic pay-TV channels market, Sky has a wide range of pay-TV channels but Comcast only wholesales five channels in the UK and does not license any sports channels. While Sky may already have a material market position, given the limited extent of NBCU’s offering, the Commission does not consider that the Proposed Transaction will have a significant effect on the competitive landscape in the UK or materially increase Sky’s existing market power with regard to the wholesale supply of TV channels.

(105) Second, a large number of TV channel suppliers will continue to compete with the merged entity post-Transaction, in particular UKTV ([10-20]% by revenue and [10-20]% by audience), Discovery ([5-10]% by revenue, [5-10]% by audience), Fox ([5-10]% by revenue and [5-10]% by audience), Viacom ([10- 20]% by revenue, [10-20]% by audience), Disney ([5-10]% by revenue, [5-10]% by audience) and Time Warner ([0-5]% by revenue, [0-5]% by audience). These broadcasters each supply a range of basic pay-TV channels to third parties and will continue to place a competitive constraint on the merged entity.

(106) Third, the results of the market investigation indicate that Sky and Comcast's channels do not closely compete. The majority of respondents to the market investigation noted the wide range of channels offered by the Parties and the limited overlapping content of the channels, considering each of the Parties' portfolios to be complementary given Sky's focus on sports and premium channels and Comcast's more limited portfolio focussed on general entertainment non-premium movie content.

(107) There were however a number of respondents to the market investigation that indicated that certain channels offered by the Parties’ do compete closely in the general entertainment segment, in particular Sky 1, Sky Atlantic and Sky Living were identified by some respondents as close competitors to Comcast's Universal and SyFy channels.

(108) When considering the narrower general entertainment segment of basic pay-TV channels, the Parties have a combined market share of [50-60]% by revenue and [30-40]% by audience share (Sky, including AETN: [40-50]% by revenue, and [20-30]% by audience; Comcast: [5-10]% by revenue, and [10-20]% by audience). By channel, Comcast's Universal channel has a [5-10]% share by revenue and [5-10]% by audience and SyFy has a share of [0-5]% by revenue and by audience.

(109) The Commission notes that Sky Atlantic is exclusive to Sky and not currently wholesaled to third parties. It therefore does not contribute to Sky's position on the wholesale market. With regard to the reported closeness between Sky One and

(113) The Commission considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market in this market for the following reasons: (i) the limited increment brought about by the Proposed Transaction; (ii) the presence of multiple competing TV channel providers that will continue to constrain the merged entity post-transaction; and (iii) the fact that generally the Parties are not close competitors.

(114) First, the overall increment brought about by the Proposed Transaction is limited. When looking at the segment of news channels, Comcast’s presence on that market is minimal, so the increment brought about by the transaction is negligible. On the basic pay-TV channels market, the Parties' combined market share ([20-30]%) does not give rise to competition concerns.

(115) Second, a large number of TV channel suppliers will continue to compete with the merged entity post-Transaction, in particular Viacom ([10-20]% by revenue, [20-30]% by audience), Discovery ([5-10]% by revenue, [10-20]% by audience), UKTV ([10-20]% by revenue, [5-10]% by audience), Disney ([5-10]% by revenue and by audience), and Fox ([5-10]% by revenue, [5-10]% by audience). These broadcasters each supply a range of basic pay-TV channels to third parties and will continue to place a competitive constraint on the merged entity.

(116) Third, as described above in paragraph (106) in relation to the UK, the results of the market investigation indicate that Sky and Comcast's channels do not closely compete in the UK and Ireland. The majority of respondents to the market investigation noted the wide range of channels offered by the Parties and the limited overlapping content of the channels, considering each of the Parties' portfolios to be complementary given Sky's focus on sports and premium channels and Comcast's more limited portfolio focussed on general entertainment non-premium movie content.

(117) There were however a number of respondents to the market investigation that indicated that certain channels offered by the Parties’ do compete closely in the general entertainment segment, in particular Sky 1, Sky Atlantic and Sky Living were identified by some respondents as close competitors to Comcast's Universal and SyFy channels.

(118) When considering the narrower general entertainment segment of basic pay-TV channels in Ireland, the Parties have a combined market share of [20-30]% by revenue and [40-50]% by audience share (Sky, including AETN: [20-30]% by revenue, and [30-40]% by audience; Comcast: [0-5]% by revenue, and [10-20]% by audience). By channel, Comcast's Universal channel has a [0-5]% share by revenue and [5-10]% by audience and SyFy has a share of [0-5]% by revenue and [0-5]% by audience.

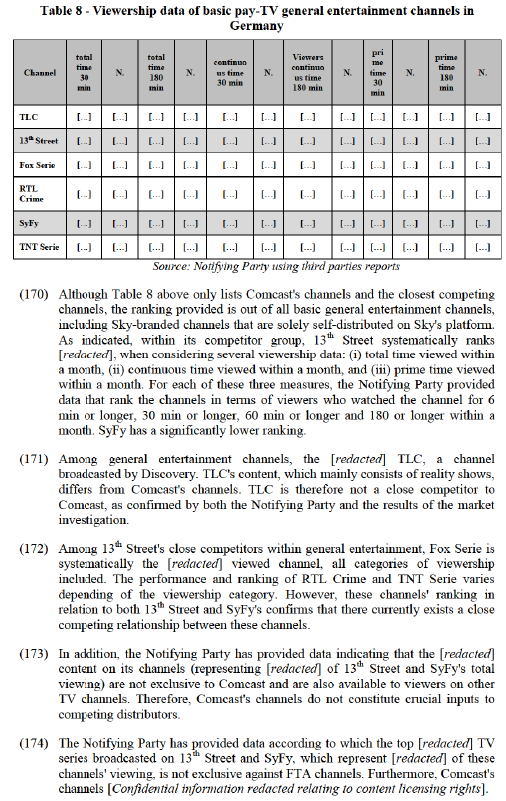

(119) The Commission notes that Sky Atlantic is exclusive to Sky and not currently wholesaled to third parties. With regard to the reported closeness between Sky One and Sky Living on the one hand and Universal and SyFy on the other, the Commission considers that there are a sufficient number of other closely competing channels, some of which are larger than the Comcast channels, that will remain post-Transaction and continue to place a constraint on the merged entity. In particular, UKTV's GOLD ([5-10]% by revenue and [5-10]% by audience) and Alibi ([5-10]% by revenue and [0-5]% audience) channels and Fox's FOX channel ([5-10]% by revenue and [5-10]% by audience) were all also identified as being close competitors to the Comcast channels. Furthermore, several distributors have indicated that the entry of new channels could not be excluded.

(120) The Commission therefore considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the wholesale provision of TV channels in Ireland.

5.6. Retail provision of TV services

(121) In the UK and Ireland, Comcast offers one non-linear service, hayu, direct to end- users, and licenses the CNBC linear channel to hotels and financial services firms. In Italy, Comcast's retail activities are limited to licensing the CNBC linear channel to hotels and financial services firms. In these countries, the overlap with Sky's own retail TV services leads to technically affected markets given Sky's retail market shares. (51)

(122) However, Comcast's retail activities are de minimis. As of 5 April 2018, hayu has [redacted] direct subscribers in the UK and [redacted] direct subscribers in Ireland and Comcast's share does not exceed [0-5]% of the potential sub-segment for the retail provision of non-linear pay TV services. Similarly, Comcast's position resulting from direct sales of CNBC account for a negligible share of the retail market for pay TV services or potential linear pay TV sub-segment.

(123) Accordingly, the Proposed Transaction will not lead to a material increment in the merged entity's market share in the retail provision of pay TV services.

(124) The Commission therefore considers that the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the retail provision of TV services in the UK, Ireland and Italy given the negligible overlap and Comcast’s minimal presence on these markets.

6. COMPETITIVE ASSESSMENT – VERTICALLY AFFECTED MARKETS.

(125) As noted above: (i) both Parties are active with regard to the supply of TV content; (ii) both Parties supply TV channels on a wholesale basis to third parties in the UK and Ireland; and (iii) Sky is active as a TV distributor for retail TV services in the UK, Ireland, Germany, Austria and Italy and Comcast is active in the UK, Ireland and Italy. The Proposed Transaction therefore results in a number of vertical relationships.

(126) These activities at various levels of the value chain give rise to the following vertically affected markets in various Member States:

(a) Comcast’s and Sky’s upstream activities as suppliers of TV content and their respective downstream activities in the wholesale supply of TV channels; and,

(b) Comcast’s and Sky’s upstream activities as wholesale suppliers of TV channels and Sky’s downstream activities as a TV retailer.

(127) Where there are vertically affected markets, two possible forms of foreclosure arise. The first is where the merger is likely to raise the costs of downstream rivals by restricting their access to an important input (input foreclosure). The second is where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base (customer foreclosure).

(128) Section 6.1 discusses the possible input foreclosure concerns arising from the Proposed Transaction with regard to TV markets; Section 6.2 discusses the possible customer foreclosure concerns arising from the Proposed Transaction with regard to TV markets.

(129) For the sake of completeness, the Commission notes that it found no vertically affected markets in relation to advertising markets.

6.1. Input foreclosure – TV markets

6.1.1. Introduction

(130) The Proposed Transaction will bring about a vertical relationship with regard to the licensing of broadcasting rights. Sky operates as a purchaser of broadcasting rights (to assemble TV channels to be provided to TV retailers or to use in a self- retail model) and TV channels (which it integrates in its TV retail offers) while Comcast is active at the wholesale level as a licensor of TV content (such as films and TV series) and provider of TV channels (such as 13th Street or SyFy).

(131) In a merger between companies which operate at different levels of the supply chain, anti-competitive effects may arise when the merged entity’s behaviour could limit or eliminate competitor’s access to supplies – input foreclosure.

(132) In assessing the likelihood of an anticompetitive input foreclosure scenario, the Commission examines: (i) whether the merged entity would have post-merger the ability to substantially foreclose access to input; (ii) whether the merged entity would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental impact on effective competition downstream. (52)

(133) In the course of the market investigation the Commission received a third party submission with regards to a possible input foreclosure strategy in relation to video ad technology services. (53) The Commission does not consider that the Proposed Transaction gives rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects in relation to online display/video ad technology services for lack of ability to foreclose access to input. Even on the narrowest market definition, Comcast's limited market shares ([5-10] – [10-20]%) do not give rise to a significant degree of market power. The merged entity's share in the acquisition of online display ad serving technology services is estimated well below 30%, such that there are not vertically affected markets in relation to these services. Regardless, on both the advertiser-side and publisher-side there exist other significant competitors, including Google, Ooyala, AppNexus, and SpotX. In addition, video ad serving technology services are not a necessary input into the supply of digital advertising, either for publishers or advertising sales houses.

(134) The following sections examine any possible input foreclosure with respect to the supply of TV content and TV channels in the UK, Ireland, Germany, Austria and Italy.

6.1.2.Supply of TV content

6.1.2.1. Notifying Party’s view

(135) The Notifying Party submits that it would not have the ability to engage in input foreclosure post-merger as: (i) it does not have market power in any product or geographic segment of the upstream market for licensing of TV content; (ii) multi-year contractual relationships with downstream customers would hamper the merged entity’s ability to restrict the supply of TV content or otherwise degrade the terms on which it supplies content to third parties; (iii) Sky already licenses content from NBCU on an exclusive basis.

(136) The Notifying Party submits that it would equally have no incentive to engage in input foreclosure given: (i) its strategy to license its content [Business Secrets redacted regarding sales strategy], (ii) that using NBCU content exclusively or otherwise to degrade the conditions on which it provides access to NBCU content would result in significant lost licensing revenues that the merged entity would have no prospect of recovering downstream.

(137) Finally, it submits that in any event, such strategy would not have any impact on competition as there would be no change in the current position with regard to access to NBCU content for third parties ([Confidential information redacted regarding Comcast’s current licensing arrangements]), and the existence of several other providers of film content which would continue to be accessible by competing channel suppliers.

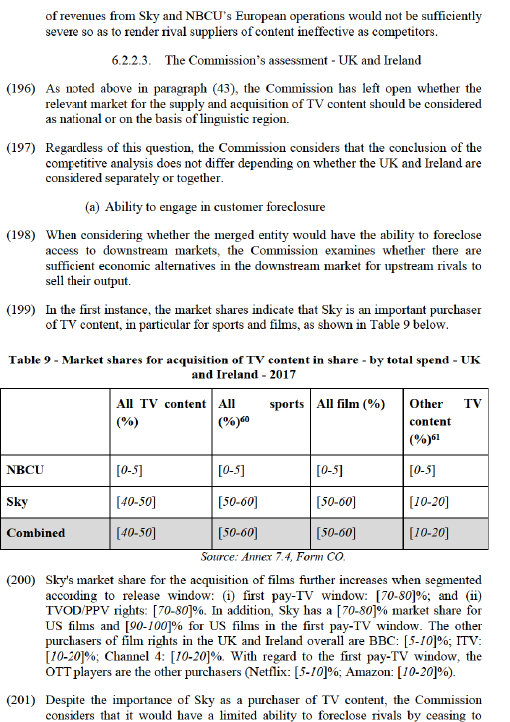

6.1.2.2. Commission’s assessment

(a) Ability to engage in input foreclosure

(138) In the UK and Ireland, the merged entity’s share in the upstream market is between [10-20]% and [20-30]% in all market segments, except for the narrower segment of licensing of US film content in the first pay-TV window in which NBCU has a [20-30]% market share in 2017. Post-transaction the other major Hollywood studios will also have significant market shares licensing of US film content in the first pay-TV window: Disney ([20-30]%), Fox ([10-20]%), Warner ([10-20]%), Sony ([10-20]%), Paramount ([0-5]%) and will continue to place a competitive constraint on the merged entity.

(139) In Germany and Austria, the merged entity’s market shares are below 20% in all vertically affected segments. (54)

(140) In Italy, merged entity’s market shares in the upstream market are below [10- 20]% in the TVOD/PPV and first pay-TV window segments and [20-30]% in the overall all film content category. In the US film first pay-TV window Comcast held a [20-30]% market share in 2016, but its share fell to [10-20]% in 2017. Post-transaction the other major Hollywood studios will have superior to similar market shares: Warner ([30-40]%), Disney ([20-30]%), Fox ([10-20]%) and will continue to place a competitive constraint on the merged entity.

(141) Given the merged entity’s limited market position with regard to the licensing of content, the Commission considers that it would not have the ability to foreclose its downstream rivals.

(b) Incentive to engage in input foreclosure

(142) Several respondents to the market investigation consider that the merged entity may have the incentive to exclusively supply some of its TV content to Sky and not to other TV channel suppliers/TV services retailers, or to otherwise degrade the terms and conditions on which it provides access. (55)

(143) On the other hand, the Commission notes that [redacted] of Comcast’s licensing revenue is accounted for acquirers other than Sky. Existing contractual arrangements for the provision of content could also disincentive the merged entity from foreclosing its inputs. Furthermore, given the significant position of alternative content suppliers, foreclosing access to Comcast's content would not significantly impact the merged entity's downstream revenues.

(144) In any event, given the lack of ability to foreclose, it is not necessary to conclude as to whether the merged entity will have the incentive to foreclose competing TV channel suppliers and/or TV services retailers from its content in the relevant Member States.

(c) Impact on effective competition

(145) Regardless of whether the merged entity has either the ability or the incentive to foreclose competing downstream rivals with regard to the supply of TV content, the Commission does not consider that such strategy would have an impact on competition.

(146) The market shares presented above indicate that several providers of TV content would remain active in the market in each of the UK, Ireland, Germany, Austria and Italy and so competing TV channel suppliers and providers of TV retail services would continue to have access to TV content that competes with the content supplied by Comcast today.

(d) Conclusion

(147) In light of the above, the Commission considers that the Proposed Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects to the detriment of either competing TV broadcasters or providers of TV retail services in the UK, Ireland, Germany, Austria or Italy.

6.1.3. Wholesale supply of TV channels

6.1.3.1. Introduction

(148) The Proposed Transaction increases Sky’s pre-existing vertical integration by adding Comcast’s channels to Sky’s existing portfolio. The Commission has therefore assessed the risk of input foreclosure with regard to TV channels as a result of the transaction. The Commission notes, in this regard, that Comcast broadcasts general entertainment channels and CNBC, a business news channel. CNBC is available on an FTA basis in the UK, Ireland and Italy. In Germany and Austria, CNBC's audience share is negligible (56), such that input foreclosure can be excluded at the outset. The below analysis will therefore focus on input foreclosure in relation to general entertainment channels.

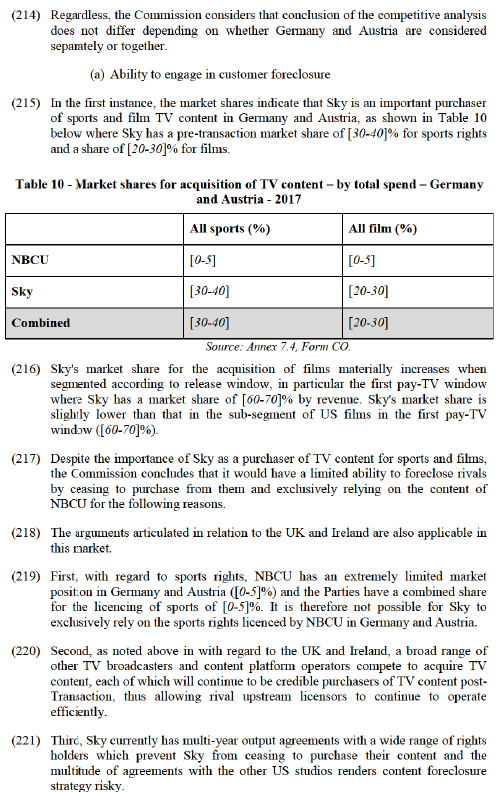

6.1.3.2. The Notifying Party's view

(149) The Notifying Party submits that the merged entity would lack the ability to engage in input foreclosure. It argues that the Parties’ combined share is limited in all Member States where Sky is active and considers that none of Comcast's channels can be considered to constitute important inputs to downstream competitors. The Notifying Party also indicates that there will remain a sufficient number of wholesale competitors for downstream rivals to have access to alternative inputs, especially in the general entertainment segment where major broadcasters like Fox, Time Warner, UKTV, Viacom ad Discovery will continue to compete after the Transaction.

(150) In addition, the Notifying Party indicates that the merged entity would lack the incentive to cease making Comcast’s channels available to downstream competitors. It argues that the limited increment brought about by the Transaction would not suffice to modify the merged entity's incentives. The Notifying Party indicates that Comcast's current incentive to [Business secret redacted regarding Comcast’s sales policy] will remain unchanged by the Transaction. Moreover, it notes that, despite already being vertically integrated, Sky has not foreclosed its downstream rivals' access to its wholesale TV channels in the UK and Ireland, and its incentive in that regard will not change as a result of the Proposed Transaction.

(151) Finally, the Notifying Party considers that Comcast's channels do not just compete with other general entertainment channels, but also with channels broadcasting different thematic content. Because the merged entity's position in other genres would remain unaffected by the Transaction, the Notifying Party argues that any hypothetical customer diversion as a result of input foreclosure can be expected to be very limited. As a result, according to the Notifying Party, the merged entity's incentives would not be changed by the Transaction and any putative impact on competition would be immaterial.

6.1.3.3. The Commission's assessment - UK and Ireland

(a) Ability to engage in input foreclosure

(152) As set out above in Tables 4 and 5, with regard to the wholesale supply of basic pay TV channels:

(a) in the UK, the Parties have a combined market share of [30-40]% by revenue (Sky: [20-30]%; Comcast: [5-10]%) and [30-40]% by audience share (Sky: [20-30]%; Comcast: [5-10]%);

(b) in Ireland, the Parties have a combined market share of [10-20]% by revenue (Sky: [10-20]%; Comcast: [0-5]%) and [20-30]% by audience share (Sky: [10-20]%; Comcast: [5-10]%).

(153) As Comcast does not wholesale any premium pay-TV channels there is no overlap in this regard.

(154) In respect of the merged entity's ability to engage in input foreclosure, respondents to the market investigation consider that Sky holds a leading market position and "must have" channels. As concerns the Notifying Party, although a number of respondents consider that Comcast does have bargaining power, there is no indication that there would remain insufficient substitutes to its channels in the market after the Transaction.

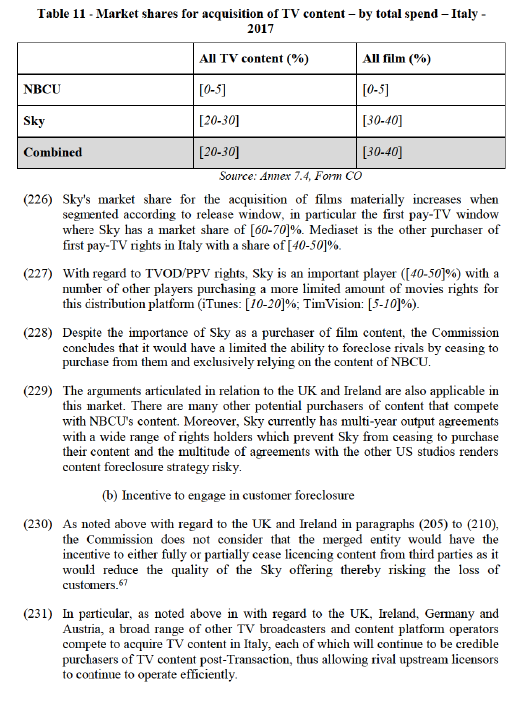

(155) When considering a potential sub-segment for general entertainment pay-TV channels, the Parties market shares are higher, as indicated in Tables 4 and 5 above. However, close competitors with audience shares higher or similar to Comcast's channels would remain active in the market in both the UK and Ireland (UKTV, with [20-30]% in the UK and [10-20]% in Ireland, Fox with [10-20]% in the UK and [5-10]% in Ireland).

(156) The availability of alternatives is further supported by the market investigation which showed that several TV channels, which will remain available post- transaction, are close competitors to Comcast's main channels, Universal Channel and SyFy. Close competitors to Universal Channel and SyFy include Fox (21CF), W and Alibi (both UKTV). This result confirms the Parties' own assessment of closeness of competition and singles out channels whose audience is either higher or on par with Comcast's.

(157) Based on the above, the Commission considers that the merged entity is unlikely to have the ability to foreclose competing TV distributors in the UK and Ireland post-transaction.

(b) Incentive to engage in input foreclosure

(158) Several respondents to the market investigation consider that post-transaction the merged entity would have the incentive to exclusively supply its channels to Sky and not to other providers of TV retail services, or to degrade the terms and conditions to which it provides access. (57)

(159) However, Sky is already vertically integrated with regard to the upstream supply of TV channels and the downstream supply of retail TV services; the increment brought about by the Transaction is therefore limited to Comcast's channels. As noted above, Comcast's market share in the wholesale supply of TV channels is limited and the merged entity's incentives will therefore not be significantly changed as a result of the Transaction.

(160) Moreover, despite being vertically integrated, Sky currently licenses basic general entertainment channels to competing distributors. There is no evidence on file to suggest that the change brought about by the Transaction would modify its overall incentive in this respect.

(161) In any event, given the lack of ability to foreclose, it is not necessary to conclude as to whether the merged entity will have the incentive to foreclose competing TV distributors in the UK and Ireland post-transaction.

(c) Impact on effective competition

(162) Regardless of whether the merged entity has either the ability or the incentive to foreclose competing downstream rivals with regard to the wholesale supply of basic pay-TV channels, the Commission does not consider that such a strategy would have an impact on competition.

(163) As detailed above in paragraph (156) there are several providers of basic pay-TV channels that closely compete with Comcast's channels and will remain active post-transaction. Therefore even if the merged entity were to adopt a foreclosure strategy, downstream rivals would continue to have access to sufficient alternative inputs.

(d) Conclusion

(164) In light of the above, the Commission considers that the Proposed Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects of TV channels to the detriment of competing retail providers of TV retail services in the UK or Ireland.

6.1.3.4. Germany and Austria

(a) Ability to engage in input foreclosure

(165) As noted above in paragraph (80), Sky does not supply channels on a wholesale basis to retail TV distributors in Germany and Austria as it has adopted a self- retail model. Therefore, Sky’s channels do not generate wholesale carriage revenues and revenue-based market share estimates are unavailable. The present assessment will thus rely on audience shares. However, due to Sky’s lack of wholesale activity, the audience of Sky’s channels has been excluded from wholesale market share calculations. Finally, the Notifying Party has been unable to provide market share estimates for Austria alone, but considers that its position in that country is not materially different than its position in Germany, such that market share data provided for Germany provide an adequate proxy for its market share in Austria. On this basis, Comcast holds a [10-20]% audience share in basic pay-TV channels, and [20-30]% of the general entertainment segment in Germany and Austria.

(166) Several respondents to the market investigation indicate that Comcast’s channels are important inputs to compete. This is particularly true with respect to 13th Street, the channel generating the most audience out of Comcast’s portfolio, with an [10-20]% audience share among all basic pay-TV channels. Several respondents thus claim that Comcast's channels constitute important inputs and indicate that their thematic content (general entertainment) is among the most popular in basic pay TV.

(167) According to respondents to the market investigation, 13th Street and SyFy, which make up the bulk of Comcast's market share, compete most closely with Fox (21CF), RTL Crime (RTL), TNT Serie and TNT Film (both Time Warner). This assessment is consistent with the Notifying Party's views. According to the Notifying Party's analysis in terms of content and on the basis of customer surveys, in both Germany and Austria [channel names] are 13th Street closest competing channels and [channel names] are SyFy's closest competitors.

(168) On the wholesale basic pay TV market, Fox Serie's audience share amounts to [5- 10]%, TNT Serie [0-5]% and RTL Crime [5-10]%. Taken individually, these channels have lower audience shares than 13th Street ([10-20]%) but have higher to equivalent audience shares as SyFy ([5-10]%). However, the combined audience share of Fox Serie, TNT Serie and RTL Crime ([10-20]%) is slightly higher than the combined audience share of 13th Street and SyFy ([10-20]%). Other TV channels providing access to general entertainment content and TV series include: TNT Film, Romance TV and RTL Crime.

(169) In order to assess whether 13th Street and SyFy should be considered as particularly important for TV distributors, more than their audience share could suggest, the Commission requested the Parties to provide viewer shares based on different parameters. (58) Table 8 summarizes such information in relation to the total viewing, continuous viewing and prime time viewing of Comcast's channels and their closest competitors in Germany and Austria.

(175) Based on the above, despite their strong position in basic pay TV, the audience and viewership of Comcast's channels is at least matched by the combined audience and viewership of the three closest competitors. Given that these competitors will remain available post-Transaction, the Commission considers that the merged entity would not have the ability to foreclose its downstream rivals.

(a) Incentive to engage in input foreclosure

(176) The Notifying Party argues that it would lack the incentive to foreclose access to its channels in Germany and Austria as this would adversely impact the revenues generated from Comcast's carriage agreements. In this regard, the Notifying Party notes that Sky accounts for only [redacted]% of its carriage revenues in Germany and Austria and argues that input foreclosure would not result in material diversion from rivals to Sky at the downstream level. The Notifying Party concludes that additional retail revenues would not outweigh wholesale losses and that input foreclosure would therefore be unprofitable.

(177) The Notifying Party provides no relevant data to support its arguments. In the absence of diversion and margin evidence and given the disproportionate importance of Sky's downstream revenues in relation to Comcast's carriage revenues, it cannot be assumed that reserving Comcast's channels to Sky's platform would be unprofitable for the merged entity.

(178) In addition, although, as indicated above in paragraphs (165) to (175) the merged entity will lack the ability to foreclose downstream rivals given that significant competitors will remain active at the wholesale level, Comcast's market shares both in relation to all basic pay TV and in general entertainment are material. It therefore cannot be excluded that the Transaction will have an impact on the merged entity's incentives.

(179) The Notifying Party also emphasizes that, as the Commission observed in its decision in case M.8354 – Fox/Sky, Sky Deutschland was previously controlled by 21CF which did not refuse to supply its TV channels to third parties despite being vertically integrated. The Notifying Party thus considers that, under the Commission's Non-Horizontal Merger Guidelines, 21CF's prior strategy constitute evidence that the merged entity's incentives would be no different.

(180) However, as explained in recital 45 (footnote 7) of the Commission's Non- Horizontal Merger Guidelines, past strategies adopted by competitors in relation to input foreclosure may be taken into account for the purpose of the competitive assessment in situations where these competitors held "a similar market position". This is not the case in the present instance as the Notifying Party's market share is twice as important as 21CF's market share.

(181) In any event, given the lack of ability to foreclose, it is not necessary to conclude as to whether the merged entity will have the incentive to foreclose competing TV distributors in the Germany and Austria.

(b) Impact on effective competition

(182) Regardless of whether the merged entity has either the ability or the incentive to foreclose competing downstream rivals with regard to the supply of TV channels, the Commission does not consider that such a strategy would have an impact on competition.

(183) As detailed above in paragraphs (165) to (175), the number of competing channels that will continue to be available to downstream competitors post- Transaction is sufficient to enable them to compete. The combined audience and viewership of channels that compete most directly with Comcast's main channels, 13th Street and SyFy, equate or exceed Comcast's audience and viewership.

(184) Given the continued availability of channels that compete closely with Comcast's and represent significant viewership within the narrow segment of basic general entertainment pay TV channels, even in the event of input foreclosure, it is unlikely that downstream rivals would be significantly impacted and unable to compete effectively post-merger.

(c) Conclusion

(185) In light of the above, the Commission considers that the Proposed Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects of TV channels to the detriment of competing retail providers of TV retail services in Germany or Austria.

6.1.3.5. Italy

(186) In respect of the merged entity's ability to engage in input foreclosure, as explained above in paragraph (80), Sky does not supply channels on a wholesale basis to retail TV distributors in Italy whereas Comcast supplies Studio Universal and CNBC. With respect to Studio Universal, the Notifying Party estimates that it has a negligible market share in Italy, both out of all basic pay TV channels and within the general entertainment segment.

(187) As a result of Comcast's negligible market share, the Transaction will bring no material change to the merged entity's incentives. In any event, for the same reason, were the merged entity to distribute Studio Universal exclusively on Sky's platform, this would have no appreciable impact on competition.

(188) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts with regard to its compatibility with the internal market as a result of input foreclosure effects of TV channels to the detriment of competing retail providers of TV retail services in Italy.

6.2. Customer foreclosure – TV markets

6.2.1. Introduction

(189) The Proposed Transaction combines Comcast’s and Sky’s content with their respective downstream activities as acquirers of content for their TV channels and Sky’s downstream activities as a pay-TV retailer.

(190) According to the Non-Horizontal Merger Guidelines a downstream firm being part of a vertical merger may refuse to buy inputs from its rivals input suppliers as a result of the Proposed Transaction. This incentive to foreclose access to customers downstream may result from the vertical integration of an upstream supplier with an important customer downstream. Due to their downstream presence, the merged entity may foreclose its upstream rivals' access to an important customer base. In turn this can inhibit upstream rivals to effectively compete. (59)

(191) In television markets, different forms of customer foreclosure may occur. First: (i) intermediate TV channel wholesalers; or (ii) downstream TV distributors; cease purchasing TV content from upstream rivals. Second, downstream TV distributors cease buying TV channels from their rivals at the intermediate level for the wholesale supply of TV channels.

6.2.2. Supply of TV content

6.2.2.1. Introduction

(192) The following section assesses whether post-transaction, the merged entity would have the ability and incentive to cease acquiring TV content from its upstream rivals either: (i) for incorporation into TV channels to be wholesaled to third parties; or (ii) to be sold by the merged entity directly to end users. It then assesses what the overall likely effect on competition would be.

6.2.2.2. Notifying Party's views

(193) The Notifying Party argues that post-Transaction, it would not have the ability to foreclose its upstream rivals for the following reasons: (i) there are multiple other downstream outlets to which upstream rivals could licence their content, including TV channels and OTT platforms such as Netflix and Amazon; (ii) Sky's multi-year output and other licencing agreements with suppliers would prevent the merged entity from ceasing to acquire content from its upstream rivals. Specifically as regards the downstream markets for the acquisition of sports content, the Notifying Party argues that there can be no prospect of customer foreclosure: although Sky is a significant acquirer of sports content in each of the vertically affected markets, it would not be possible for Sky to pursue a strategy of exclusively sourcing its sports content from NBCU, given NBCU’s activity as a licensor in the EEA is negligible and only includes [Business secret redacted relating to scope of Comcast’s sports content licensing activities].

(194) The Notifying Party further submits that the merged entity would not have the incentive to stop acquiring content from other suppliers of TV content as its commercial success is based on the richness of the bundle of content and channels broadcast through its platform. In addition, while Sky could be considered as an important acquirer of film content, Comcast acquires very limited amounts of content.

(195) It submits that such a customer foreclosure strategy would have a limited impact on competition given: (i) the existence of multi-year output agreements; (ii) the existence of a sufficient number of credible alternative content acquirers which will remain post-merger; and (iii) the fact that the impact of the hypothetical loss

purchase from them and exclusively relying on the content of NBCU post- transaction, for the following reasons.

(202) First, NBCU has an extremely limited market position in the UK and Ireland with regard to the supply of sports rights (less than [0-5]% share by revenue in 2017 and the Parties together do not have more than [0-5]% under any other sub- segment considered). It is therefore not possible for Sky to exclusively rely on the sports rights licenced by NBCU in the UK and Ireland.

(203) Second, the results of the market investigation indicate that a majority of rights holders consider that there are other players to which they could licence their content as an alternative to the merged entity in the event that the merged entity ceased acquiring their TV content or otherwise degraded the terms on which it acquires their TV content. (62) Therefore, the merged entity would have no ability to restrict the access of rival upstream licensors to downstream purchasers of those rights given the multiple other outlets available to TV content licensors. A broad range of other TV broadcasters and content platform operators compete to acquire TV content, each of which will continue to be credible purchasers of TV content post-Transaction, thus allowing rival upstream licensors to continue to operate efficiently.

(204) Third, Sky has multi-year output agreements and other licensing agreements in place with a wide range of rights holders. Accordingly, Sky cannot unilaterally cease to licence such content from these third parties or otherwise degrade the terms of supply until their expiry without being in breach of these agreements.

(b) Incentive to engage in customer foreclosure

(205) The Commission does not consider that the merged entity would have the incentive to foreclose access to downstream markets by reducing purchases from upstream competing rivals for the following reasons.

(206) The attractiveness of a pay-TV operator's offer to consumers is based on the richness of the bundle of content and channels broadcast through its platform. (63) On this basis, the merged entity would not have the incentive to cease purchasing content from upstream competitors. Sky does not limit its offering to NBCU film content, including its entire output of new films but it purchases similar premium film content also from NBCU's competitors.